Crypto World

Vitalik Buterin Donates to Shielded Labs for Zcash Crosslink Security Upgrade

TLDR:

- Buterin’s donation funds Crosslink development from prototype to incentivized testnet and production phase.

- Crosslink adds finality layer to Zcash’s PoW chain, preventing reversals and strengthening settlement guarantees.

- The upgrade enables shorter exchange confirmations and improves cross-chain integration reliability for Zcash.

- Shielded Labs operates independently from Zcash Dev Fund, relying on donations from network supporters.

Ethereum co-founder Vitalik Buterin has donated to Shielded Labs to advance Crosslink development for Zcash. The contribution will fund progression from prototype to incentivized testnet and production readiness.

Crosslink adds a finality layer to Zcash’s proof-of-work consensus, protecting against chain reorganizations and rollback attacks. This marks Buterin’s second donation to the organization.

Crosslink Enhances Zcash Security Architecture

Shielded Labs announced the donation will support Crosslink’s continued development. The upgrade strengthens Zcash’s existing proof-of-work consensus through a parallel finality layer.

Block production and economic activity remain on the proof-of-work chain. Meanwhile, the finality gadget anchors blocks and provides stronger settlement guarantees.

The architecture prevents confirmed transactions from being reversed. This reduction in double-spend risk increases confidence in transaction settlement across the network.

Exchanges can implement shorter confirmation requirements as a result. Cross-chain integrations gain improved reliability through the enhanced security model.

Applications requiring predictable settlement benefit from the increased consistency. The improvements facilitate easier integration into the broader crypto ecosystem.

Zcash maintains its existing security properties throughout the upgrade process. The design preserves the network’s core characteristics while adding protective measures.

Commenting on the donation, Buterin stated that Zcash is one of the most honorable crypto projects. He praised the network’s steadfast focus on privacy as a defining characteristic.

According to Buterin, Shielded Labs’ Crosslink work will allow Zcash to be more secure. The upgrade will enable operation on a lower security budget, supporting long-term sustainability.

Production Phase Will Focus on Technical Readiness

The donation will fund the productization of the existing Crosslink prototype. Shielded Labs plans to launch a persistent, incentivized testnet where participants can earn ZEC.

The transition into productionization involves multiple technical components. Design specifications require completion before mainnet consideration.

Security analysis will form a critical component of the development process. Audits will verify the robustness of the finality layer implementation.

Coordination with wallets and infrastructure providers ensures smooth integration. Proactive engagement with the Zcash community maintains transparency throughout development.

Progress toward mainnet activation depends on several factors. Technical readiness must meet established standards before deployment.

Security review processes need completion to validate the upgrade’s safety. Broad community support remains essential for major protocol changes.

Shielded Labs operates as a Swiss-based Zcash support organization. The team focuses on protocol development projects that strengthen network security.

Funding comes from donations by Zcash holders and supporters. The organization maintains independence from the Dev Fund and block rewards.

Buterin’s first contribution in 2023 supported formation of a dedicated Crosslink team. He has contributed to discussions around protocol design and security for years.

Shielded Labs acknowledged his continued engagement with the Zcash ecosystem. The organization expressed appreciation for his support in advancing network resilience.

Crypto World

U.S. inflation, Polkadot upgrade, Solstice-Kamino announcement: Crypto Week Ahead

U.S. inflation data is the major catalyst to watch this week, as it could move the needle on market sentiment and Federal Reserve interest-rate expectations.

The war in the Middle East and other geopolitical risks have kept commodity markets volatile, with bitcoin last week failing to remain above the $70,000 mark.

The U.S.-Israel conflict with Iran is escalating, and the odds of a near-term ceasefire on prediction markets appear slim. Traders will be monitoring the price of crude oil for potential signs of its impact on inflation.

Against that background, there are some specific crypto events to catch the eye. Solstice and Kamino have teased a new product announcement, without giving any details, and Succinct also said it will make an announcement.

What to Watch

(All times ET)

- Crypto

- March 9: Solstice and Kamino to announce a new product or feature. No details were provided.

- March 10: Succint will make an announcement. No details were provided.

- March 12: Polakdot’s economic upgrade to start rolling out, featuring a DOT supply cap, an emissions cut and unbonding reduction.

- March 12: BOB mainnet to undergo its Jovian hardfork.

- Macro

- March 9, 6:50 p.m.: Japan GDP growth annualized final for Q4 est. 1.2% (Prev. -2.6%)

- March 9, 10:00 p.m.: China balance of trade for January-February (Prev. $114.1B)

- March 11, 7:30 a.m.: U.S. inflation rate YoY for February (Prev. 2.4%); core rate YoY (Prev. 2.5%)

- March 11: OPEC monthly report

- March 12, 7:30 a.m.: U.S. initial jobless claims for week ending March 7 (Prev. 213K)

- March 12, 7:30 a.m.: U.S. balance of trade for January (Prev. -$70.3B)

- March 12, 3:30 p.m.: Fed balance sheet for week ending March 11 (Prev. $6.63T)

- March 13, 7:30 a.m.: U.S. GDP growth rate QoQ second estimate for Q4 (Prev. 4.4%)

- March 13, 7:30 a.m.: U.S. core PCE price index MoM for January (Prev. 0.4%)

- March 13, 9:00 a.m.: U.S. JOLTS job openings for January (Prev. 6.542M)

- March 13, 9:00 a.m.: U.S. Michigan consumer sentiment preliminary for March (Prev. 56.6;)

- Earnings (Estimates based on FactSet data)

- March 9: Sharplink (SBET), pre-market, $0.31

- March 11: Exodus Movement (EXOD), pre-market, $0.14

- March 12: Cango (CANG), post-market, -$0.34

- March 13: Bit Digital (BTBT), pre-market, -$0.01

Token Events

- Governance votes & calls

- Convex Finance is voting on Curve Ownership DAO Vote ID: 1358, which would onboard GHO as a Pegkeeper with a 3 million crvUSD debt ceiling. Voting ends March 9.

- Lido DAO is voting to make the delegate incentivization program (DIP 2.0) a permanent governance mechanism. Voting ends March 9.

- Lido DAO is voting to authorize a one-time $5 million DAO Treasury allocation into the Lido Earn ETH and USD vaults. Voting ends March 9.

- Lido DAO is voting on whether Stakin (recently acquired by The Tie) should continue operating as a node operator and whether to approve updating Stakin’s onchain name and reward address. Voting ends March 9.

- Aavegotchi DAO is conducting ballots 1 and 2 of a multi-sig signer election, asking token holders to choose one signer from among the nominees. Voting ends March 10.

- Ssv.network DAO is voting to cancel DIP-46 and reallocate the originally approved $15 million development budget, splitting it into $14.9 million for DVT and $100,000 as a retroactive research grant. Voting ends March 10.

- Realtoken Ecosystem Governance DAO is voting to temporarily drop interest rates on the RMM (Real Estate Monetary Fund) to zero for 15 days. Voting ends March 10.

- Unlock DAO is voting to approve the Unlock Protocol DAO budget for Q1–Q2 2026, totaling approximately $30,768. Voting ends March 11.

- Arbitrum DAO is voting to establish an operational directive that automatically consolidates idle and surplus non-ARB funds from DAO initiatives directly into the Arbitrum Treasury Management Company (ATMC) portfolio. Voting ends March 12.

- CoW DAO is voting on a CoW Swap Affiliate Program to reward affiliates who refer new retail traders and those traders upon reaching qualifying volume milestones, with up to 500,000 USDC allocated over a six-month pilot. Voting ends March 12.

- World Liberty Financial DAO is voting to introduce a WLFI governance staking system requiring unlocked token holders to stake (minimum 180-day lock) to participate in governance. Voting ends March 12.

- Arbitrum DAO is voting to implement a delegated voting power (DVP) quorum model, update its constitution, and enable onchain proposal cancellation. Voting ends March 12.

- Unlocks

- Token Launches

- March 9: Nexira’s (NEXI) token generation event occurs. Token to be listed on KuCoin.

- March 12: ForU AI’s (FORU) token generation event occurs.

Conferences

Crypto World

Anthropic Sues US Over Supply Chain Risk Blacklist

TLDR

- Anthropic filed a lawsuit against the US Department of Defense over a supply chain risk designation.

- The designation restricts Anthropic from working with defense contractors on federal projects.

- Federal officials labeled the company after talks failed over surveillance and weapons use.

- Anthropic refused to allow its systems for mass surveillance of Americans or autonomous weapons.

- The Pentagon paused a contract valued at up to 200 million dollars following the dispute.

Anthropic has filed a lawsuit against the US Department of Defense and other federal agencies over a supply chain risk designation. The company challenges the Trump administration’s decision that restricts its work with defense contractors. The dispute centers on failed talks about surveillance use and a Pentagon contract valued at up to $200 million.

Anthropic Challenges Federal Supply Chain Risk Designation

Anthropic filed the lawsuit after federal agencies labeled the company a supply chain risk and restricted defense partnerships. The designation followed collapsed talks between the company and defense officials over permitted uses of its systems. Federal officials insisted the technology must support all lawful purposes, including surveillance and weapons programs.

However, Anthropic refused to allow its systems for mass surveillance of Americans or autonomous weapons. As talks ended, the government halted adoption plans and jeopardized a Pentagon deal worth up to $200 million. The company argues the classification lacks legal basis and seeks judicial review to protect its operations.

An Anthropic spokesperson told CNN, “Seeking judicial review does not change our longstanding commitment to harnessing AI to protect our national security.” The spokesperson added that the lawsuit protects its business, customers, and partners. Meanwhile, the Pentagon maintained that lawful use requirements remain essential for defense technology.

Defense Contract Dispute and Corporate Responses

The Financial Times reported that Chief Executive Dario Amodei sought last-minute negotiations with defense leaders. He attempted to de-escalate tensions and prevent a formal blacklist. However, the effort failed to stop the supply chain risk classification.

Following the designation, federal agencies limited cooperation with Anthropic in defense projects. The Pentagon stated that contractors must ensure full lawful access to deployed systems. Officials maintained that defense technology providers must meet comprehensive operational requirements.

Despite the government dispute, Anthropic’s consumer business showed resilience. The company’s Claude application surpassed OpenAI’s ChatGPT in Apple App Store rankings after news of the contract termination. By early March, Anthropic reported that more than one million users signed up for Claude daily.

Major technology companies responded to the federal classification with public statements. Google confirmed it would continue providing Anthropic technology to cloud customers for non-defense purposes. Microsoft issued a similar statement, and Amazon said it would maintain access outside defense work.

Anthropic continues discussions with government officials while pursuing its lawsuit in federal court. The company maintains that the designation lacks a clear statutory foundation. As of early March, more than one million users join Claude daily, according to company data

Crypto World

Nasdaq partners with Kraken to distribute tokenized stocks globally

Nasdaq said it will work with crypto exchange Kraken to develop a system for issuing and trading tokenized versions of stocks and other exchange-traded products, according to a press release.

Under the plan, tokenized shares would give investors the same corporate governance rights as ordinary stockholders, including voting in proxy ballots and receiving dividends. Nasdaq said the initiative will focus heavily on making corporate actions, such as dividend payments and proxy voting, more efficient by automating parts of the process through blockchain technology. The platform is expected to launch in early 2027.

Kraken will act as a distribution partner for the project. Through the arrangement, one-to-one tokenized versions of public company shares would be made available to Kraken’s customers outside the United States, particularly in Europe and other international markets.

The effort builds on a proposal Nasdaq submitted to the U.S. Securities and Exchange Commission in September seeking approval to allow tokenized versions of its listed stocks and exchange-traded products to trade alongside traditional shares on the exchange.

In that proposal, both the tokenized and conventional versions would be settled through the Depository Trust to ensure they remain interchangeable.

Last week exchange operator ICE made a strategic investment in OKX, valuing the exchange at $25 billion as it signed a deal to offer new tokenized stocks and crypto futures products.

Separately, Nasdaq also announced a partnership with Boerse Stuttgart Group’s tokenized settlement platform Seturion to connect its European trading venues to infrastructure designed to support trading and settlement of tokenized securities.

UPDATE: (March 9, 11:41 UTC) Adds the final paragraph on Nasdaq’s partnership with the Boerese Stuttgart Group.

UPDATE: (March 9, 13:18 UTC) Changes citation to Kraken press release.

Crypto World

Bitcoin hits one-month high as CLARITY Act optimism grows

Editor’s note: The latest market commentary centers on renewed optimism around US crypto regulation as lawmakers push the CLARITY Act. Bitcoin briefly rose to a one-month high on that tone, while major altcoins moved modestly higher before retracing. The report also highlights Kazakhstan’s plan to invest in cryptoassets, with fresh allocations signaling growing interest from a national regulator in digital assets. As CPI and PCE data loom and geopolitical tensions influence energy prices, crypto markets could be particularly sensitive to policy signals and macro data.

“Prices were boosted earlier in the week following reports of a private meeting between Coinbase CEO Brian Armstrong and President Donald Trump regarding the CLARITY Act,” Peters said.

Key points

- Bitcoin touched a one-month high on CLARITY Act optimism.

- Kazakhstan central bank plans to invest in cryptoassets, with initial $350m from reserves and $350m from the National Fund planned later.

- The CLARITY Act faces resistance from banks; final decision rests with the Senate Banking Committee.

- Markets are watching US inflation data and oil prices for potential crypto moves.

Why this matters

The evolving regulatory landscape around the CLARITY Act could shape how crypto markets price risk and admit new participants. A Kazakhstan central bank move toward direct exposure to digital assets marks a notable shift in state involvement, potentially influencing policy debates and industry strategies. With central banks, regulators and investors weighing stability, innovation and governance, the next rounds of data and negotiations will help define the parity between markets and policy.

What to watch next

- Senate Banking Committee debates and votes on the CLARITY Act.

- Upcoming CPI and PCE data releases and the Federal Reserve decision on March 18.

- Kazakhstan’s crypto investments expected to begin in April or May.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Bitcoin touches one-month high on CLARITY Act optimism; Kazakhstan central bank to invest in crypto

Abu Dhabi, United Arab Emirates – March 09, 2026: Bitcoin briefly touched a one-month high of $74,000 last week, supported by renewed optimism around potential US crypto market regulation, according to the latest market commentary from Simon Peters, Crypto Analyst at eToro.

Despite the temporary rally, the leading cryptocurrency ended the week roughly where it started, while major altcoins including Ethereum, BNB and Solana also recorded modest gains earlier in the week before retracing.

Commenting on the market movements, Peters said speculation around progress on the proposed CLARITY Act helped lift sentiment across crypto markets.

“Prices were boosted earlier in the week following reports of a private meeting between Coinbase CEO Brian Armstrong and President Donald Trump regarding the CLARITY Act,” Peters said.

President Trump also publicly weighed in on the issue via Truth Social, criticising banks and urging progress on US crypto market structure legislation. In his comments, Trump said the US needs to “get Market Structure done” and that policymakers should “make a good deal with the Crypto Industry.”

However, the proposed legislation has faced resistance from the banking sector. Banks have argued that allowing stablecoins to offer yields could encourage depositors to move funds away from traditional bank accounts, potentially creating liquidity pressures and broader instability within the financial system.

Crypto firms, on the other hand, argue that restricting yields on stablecoins would stifle innovation and weaken the competitiveness of the US digital asset industry, while protecting the interests of traditional financial institutions.

Although the CLARITY Act appears to have support from the President and the White House, the final decision will rest with lawmakers in the Senate Banking Committee, who must debate and vote on the bill before it can progress.

Looking ahead, investors are closely watching upcoming US inflation data releases, including CPI and PCE figures, which could influence the Federal Reserve’s interest rate decision at its next policy meeting on March 18.

“At the same time, escalating tensions in the Middle East are raising concerns about rising oil prices and their potential impact on global inflation, which could also spill over into crypto markets,” Peters added.

Biggest movers

Chiliz (CHZ) was among the strongest performers over the past week, rising 11%, including a 6% gain in the last 24 hours.

The move followed Chiliz announcing that it will buy back and burn CHZ tokens for the first time since its launch in 2018. The initiative will be funded using 10% of revenue generated from fan token sales.

Chiliz is the company behind Socios.com, a blockchain-based sports fan engagement and rewards platform. Built on Chiliz blockchain technology, CHZ serves as the platform’s exclusive on-platform currency.

Eye-catching story

Kazakhstan central bank to invest in crypto

The National Bank of Kazakhstan has announced plans to add cryptoassets to its national reserves, marking a notable step by a central bank toward direct exposure to digital assets.

According to reports, the central bank has allocated $350 million from its gold and foreign exchange reserves for an initial investment. An additional $350 million from the National Fund — the country’s sovereign wealth fund — is expected to be allocated later this month.

Aliya Moldabekova, Deputy Governor of the National Bank of Kazakhstan, said the investments are expected to begin in April or May.

In addition to direct cryptoasset exposure, the central bank plans to invest in high-tech companies linked to digital assets, index funds, and other instruments that exhibit similar performance dynamics to cryptocurrencies.

As of February 1, the National Bank of Kazakhstan’s gold and foreign exchange reserves stood at $69.40 billion, while the National Fund held assets valued at $65.23 billion.

Media Contact:

PR@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Crypto World

Why bitcoin is rising even as the S&P 500 and tech stocks stumble

The outbreak of war in the Middle East has rattled global markets, yet bitcoin has been doing something unexpected: outperforming stocks.

Bitcoin has risen about 3.5% to $68,000 since the conflict between Iran, Israel and the U.S. began just over a week ago, according to CoinDesk data. Over the same period it has outperformed most major assets. Gold has fallen roughly 5%, silver is down 12%, the Nasdaq 100 has declined about 1% and the S&P 500 is lower by around 1.5%.

The divergence has widened over the past 24 hours, with bitcoin up more than 2.5% while U.S. equity futures remain in the red. WTI crude briefly surged to around $116 per barrel early on Monday, at one stage up about 60% since the conflict began. However, comments from G7 leaders about potentially releasing oil reserves helped cool the rally, with crude retreating to roughly $100 per barrel.

Meanwhile, the U..S dollar has strengthened, with the DXY index rising more than 1% to just above 99. Treasury yields have also climbed, with the US 10 year yield moving from just below 4% before the conflict to around 4.2%.

Bitcoin’s outperformance comes after weeks of a brutal sell-off that saw prices nearly halve to around $60,000 from the record high above $126,000 in October. With sentiment already fragile when the conflict began, many expected the downturn to deepen rather than reverse. Instead, the market has done what it often does best: catch the consensus off guard.

Tracking tech stocks

Despite bitcoin’s relative strength, it still shows correlation with technology stocks. The iShares Expanded Tech Software ETF (IGV), a widely followed software sector benchmark, has gained about 7% since the conflict began after rebounding from roughly $76 to close Friday near $88.

Derivative market signals may point to stabilization. Open interest in coin margined futures, which measures the total value of outstanding contracts settled in bitcoin rather than dollars, has declined, indicating leverage is being flushed from the system. Funding rates, periodic payments between long and short traders in perpetual futures, remain negative at around -3.5%, meaning short sellers are paying longs, a sign bearish positioning remains crowded.

At the same time, the Coinbase premium has returned. This measures the price difference between bitcoin on Coinbase and offshore exchanges and is often used as a proxy for US institutional demand. Its reappearance, alongside spot ETF inflows, suggests institutional buyers may be returning to the market and finding demand at these oversold levels.

Crypto World

Stablecoin Depegs and the DeFi Chain Reaction

Stablecoins are often described as the foundation of decentralized finance (DeFi). They provide price stability in a volatile crypto market and act as the primary medium for trading, lending, liquidity provisioning, and yield farming. From decentralized exchanges to lending platforms, stablecoins power a large portion of on-chain financial activity.

However, this deep integration also introduces systemic risk. When a stablecoin loses its peg, the impact rarely remains isolated. Instead, the instability can ripple through the entire DeFi ecosystem, causing liquidation cascades, liquidity imbalances, and cross-protocol failures.

This phenomenon is known as stablecoin contagion—a chain reaction where instability in one stablecoin spreads across interconnected DeFi systems.

What Is Stablecoin Contagion?

Stablecoin contagion refers to the spread of financial instability triggered by a stablecoin losing its price peg. Because stablecoins are deeply embedded in DeFi infrastructure, their failure can impact multiple protocols simultaneously.

When a depeg occurs, several events can unfold:

-

Lending positions become undercollateralized

-

Automated liquidations trigger across multiple protocols

-

Liquidity pools become imbalanced

-

Arbitrage traders drain stable assets from pools

-

Cross-chain markets transmit instability to other ecosystems

The result is a network-wide stress event that can rapidly escalate if not contained.

Why Stablecoins Are Systemically Important in DeFi

Stablecoins serve several essential roles in decentralized finance:

Trading pairs

Most decentralized exchanges use stablecoins as the base trading asset.

Collateral assets

Lending protocols allow users to borrow funds against stablecoin deposits.

Liquidity provision

Stablecoins form the backbone of many automated market maker (AMM) pools.

Yield farming incentives

Many protocols distribute rewards based on stablecoin liquidity participation.

Because these roles overlap across multiple platforms, a single stablecoin can become deeply embedded across dozens of DeFi protocols simultaneously.

The Four Core Contagion Mechanisms

1. Liquidation Cascades

One of the fastest ways contagion spreads is through collateral liquidations.

Many lending platforms require overcollateralized positions. When a stablecoin depegs below $1:

-

Collateral value suddenly drops

-

Borrowers fall below the required collateral ratios

-

Smart contracts trigger automatic liquidations

-

Liquidated assets flood the market

These forced sales can push asset prices down further, triggering additional liquidations across other protocols.

Callout:

⚠️ Liquidation cascades can propagate across multiple DeFi platforms within minutes.

2. Liquidity Pool Imbalances

Decentralized exchanges rely heavily on stablecoin liquidity pools.

When a stablecoin loses its peg:

-

Traders rush to swap the unstable asset

-

Arbitrageurs drain stable assets from the pool

-

Liquidity providers are left holding mostly the depegged asset

This imbalance causes massive impermanent loss for liquidity providers and weakens overall market liquidity.

Callout:

💡 AMM pools amplify contagion because they automatically rebalance toward the failing asset.

3. DeFi Composability Risk

DeFi is built on composability, often called “money legos.” Assets from one protocol are frequently reused in others.

For example:

-

Deposit Stablecoin A into a lending protocol

-

Borrow Stablecoin B

-

Use B to provide liquidity on a DEX

-

Stake LP tokens in a yield farm

If Stablecoin A depegs, the user’s entire stack becomes unstable. This layered exposure allows contagion to spread across multiple platforms simultaneously.

Callout:

🔗 Composability multiplies risk because a single asset can support multiple financial layers.

4. Cross-Chain Transmission

Stablecoins often exist across multiple blockchains via bridges.

When instability begins on one chain:

-

Arbitrage spreads price imbalances across chains

-

Bridged liquidity pools become unstable

-

Protocols using wrapped versions of the stablecoin inherit the risk

This allows contagion to spread beyond a single blockchain ecosystem.

Callout:

🌐 Cross-chain liquidity turns local stablecoin failures into global DeFi risks.

Stablecoin Types and Their Contagion Risk

Not all stablecoins carry the same systemic risk.

Fiat-Backed Stablecoins

These stablecoins are backed by real-world reserves such as cash or treasury bonds.

Advantages

Risks

Crypto-Collateralized Stablecoins

These stablecoins are backed by crypto assets locked in smart contracts.

Advantages

Risks

Algorithmic Stablecoins

Algorithmic stablecoins rely on supply adjustments rather than collateral reserves.

Advantages

-

Capital efficient

-

Fully on-chain

Risks

Historically, this model has produced the largest contagion events in DeFi history.

Case Study: The Terra Collapse

One of the most dramatic examples of stablecoin contagion occurred during the collapse of the Terra ecosystem.

The algorithmic stablecoin UST lost its peg, triggering a massive chain reaction:

-

Billions withdrawn from Anchor Protocol

-

Large-scale liquidations across DeFi markets

-

Liquidity pools drained across multiple blockchains

-

Over $40 billion in value was wiped out

This event highlighted how one stablecoin failure can destabilize an entire ecosystem.

How Researchers Model Stablecoin Contagion

As DeFi grows more complex, researchers are developing frameworks to measure systemic risk.

Network Dependency Models

These models map relationships between stablecoins, protocols, and liquidity pools to identify systemic exposure.

Spillover Volatility Models

Statistical models estimate how volatility from one stablecoin spreads to others during extreme market conditions.

Systemic Risk Metrics

Composite indicators track:

These tools help analysts detect potential contagion risks before they escalate into full market crises.

Strategies to Reduce Stablecoin Contagion

DeFi protocols are beginning to implement safeguards to limit systemic risk.

Diversified Collateral

Using multiple asset types instead of relying on a single stablecoin.

Emergency Shutdown Mechanisms

Protocols can temporarily halt liquidations or trading during extreme volatility.

Liquidity Backstops

Reserve funds or insurance pools can stabilize markets during stress events.

Cross-Protocol Risk Monitoring

Shared analytics systems help track exposure across the broader DeFi ecosystem.

The Future of Stablecoin Risk Management

Stablecoins are essential to the growth of decentralized finance, but their interconnected nature means instability can spread quickly. As the ecosystem evolves, stronger risk models and protocol safeguards will be critical for preventing systemic failures.

Understanding stablecoin contagion models helps developers, investors, and researchers anticipate vulnerabilities and build more resilient financial systems.

In a highly composable financial network like DeFi, the stability of one asset can influence the stability of the entire ecosystem.

REQUEST AN ARTICLE

Crypto World

Global insurance broker Aon tests stablecoin payments on Ethereum, Solana with Coinbase, Paxos

Aon (AON), which advises on $5 trillion in assets as one of the world’s largest insurance brokers, said it carried out a proof-of-concept using stablecoins to settle insurance premium payments, an early sign that dollar-pegged tokens may start moving deeper into corporate finance.

The London-based company worked with crypto exchange Coinbase (COIN) and blockchain infrastructure firm Paxos to complete the transactions using Circle Internet’s (CRCL) USDC token on Ethereum and on Solana, according to a press release Monday.

Aon said the initiative marked the first known example of a major global insurance broker accepting stablecoins for premium settlement, even if only in a controlled demonstration.

While limited in scope, the exercise shows how stablecoins could simplify how large financial payments move through the insurance industry. Premiums today often pass through banks, whose clearing systems can take days to settle, especially across borders. Blockchain-based payments, proponents say, can move funds in minutes and leave a transparent record of the transaction.

The timing also underscores how the $300 billion stablecoin asset class is becoming increasingly embedded into traditional finance as the regulatory backdrop improves. The U.S. Genius Act, passed in 2025, established a federal framework for stablecoin issuers and set rules around reserves and oversight. That clarity has encouraged banks, fintech firms and large companies to test how tokenized dollars might fit into existing financial plumbing.

“While broader adoption of stablecoins across corporate payments is still emerging, the long-term potential is significant,” John King, head of corporate portfolio strategy and treasurer for Aon, said in the statement.

“This work allows us to understand how these mechanisms operate within established systems and frameworks, so we are prepared to evaluate efficiency and cost-savings opportunities over time as the technology matures.”

Read more: Circle moves $68 million in just 30 minutes by using its own stablecoin for internal payments

Crypto World

Bitcoin Slumps to $66K as Oil Breakout Adds Macro Pressure

Today’s Bitcoin (BTC) sell-off coincides with a massive breakout in crude oil prices, which surged past $110 per barrel on escalating Middle East tensions.

The original cryptocurrency briefly dropped down to $66,010 on Monday, marking a 10% slide from its March 5 peak of $73,670.

That energy shock is rattling risk assets globally. As oil costs climb 30% on the day, traders fear renewed inflation will force the Federal Reserve to keep interest rates elevated, draining liquidity from speculative markets.

Discover: The best pre-launch token sales

Bitcoin and Stocks: Oil Prices are Recoupling Them

The correlation between Bitcoin and equities has tightened significantly, leaving the asset vulnerable to broader market panic.

The oil spike triggered immediate losses in Asia, where Japan’s Nikkei plunged 7% and South Korea’s KOSPI dropped 6% Monday. This risk-off shift has already impacted institutional flows. Bitcoin ETFs saw $576.6 million in net outflows late last week, adding sell-side pressure to the spot price.

That heavy selling aligns with broader cross-asset weakness. As Bitcoin price and stocks stabilize, the bond market continues to signal ongoing macro risk, suggesting the path of least resistance remains lower for now.

If risk assets continue to sell off, Bitcoin’s high correlation suggests it will struggle to find a floor independent of the stock market.

Technical Price Analysis: The Levels That Change Everything

The technical picture shows Bitcoin testing critical support levels after losing the $70,000 handle. The price is currently hovering near $66,000.

The slide has brought Bitcoin back to levels seen before the recent surge.

If sellers push the price below $62,300, the chart structure risks a breakdown toward Fibonacci support levels at $56,800 or even $52,300.

Bearish momentum is supported by the 50-day SMA at $77,200, which is currently acting as overhead resistance.

However, on-chain data offers a counter-narrative. Bitcoin is vanishing from exchanges, suggesting a potential supply shock could cushion the downside if long-term holders refuse to sell at these levels.

To invalidate the bearish structure, buyers need to reclaim the $72,600 level. Anything below that keeps the bears in control.

Bitcoin Fears: Rising Oil Prices Drive a Hawkish Fed

The surge in oil is the primary headwind. Crude prices rose 72% in the past month, sparking fears that input costs will drive inflation higher across industries.

Former President Donald Trump commented that the spike is a “very small price to pay,” but for markets, the cost is liquidity. If energy prices bleed into CPI data, the Fed may be forced to hold rates higher for longer.

That policy risk puts a cap on upside volatility. Traders monitoring options expiry and max pain levels should expect continued chop as the market prices in a more hawkish Fed.

Key Levels Summary

Resistance stands at $72,600. Bulls need to reclaim this level and the 50-day SMA to restart momentum.

The macro trigger remains crude oil at $110. Continued upside here exerts heavy pressure on risk assets and inflation expectations.

Support sits at $60,000 to $62,300. A loss of this zone opens the door to $52,000 as the next major demand area.

The post Bitcoin Slumps to $66K as Oil Breakout Adds Macro Pressure appeared first on Cryptonews.

Crypto World

Can v20.2 Protocol Update Push PI to $0.30?

Check out what suggests that a major sell-off could be on the horizon.

The past several days have been quite successful for Pi Network’s PI, whose price spiked to a three-month high.

While some market observers believe the asset could post additional gains in the short term, certain indicators suggest it might be time for a sharp pullback.

Back to Red Territory?

PI is the best-performing cryptocurrency (at least in the top 100) over the past week, with its valuation rising 30% during the period. A few days ago, it surpassed $0.23 for the first time since December last year, while it currently trades at around $0.21 (per CoinGecko’s data).

Its rally follows the latest updates announced by the Core Team. Recently, the protocol v19.9 migration was successfully completed, while the next version, v20.2, is scheduled for release around March 12 (just two days before Pi Day 2026). Another catalyst might have been the newly revealed case study showing that Pi Nodes could be used for distributed AI computing and model training.

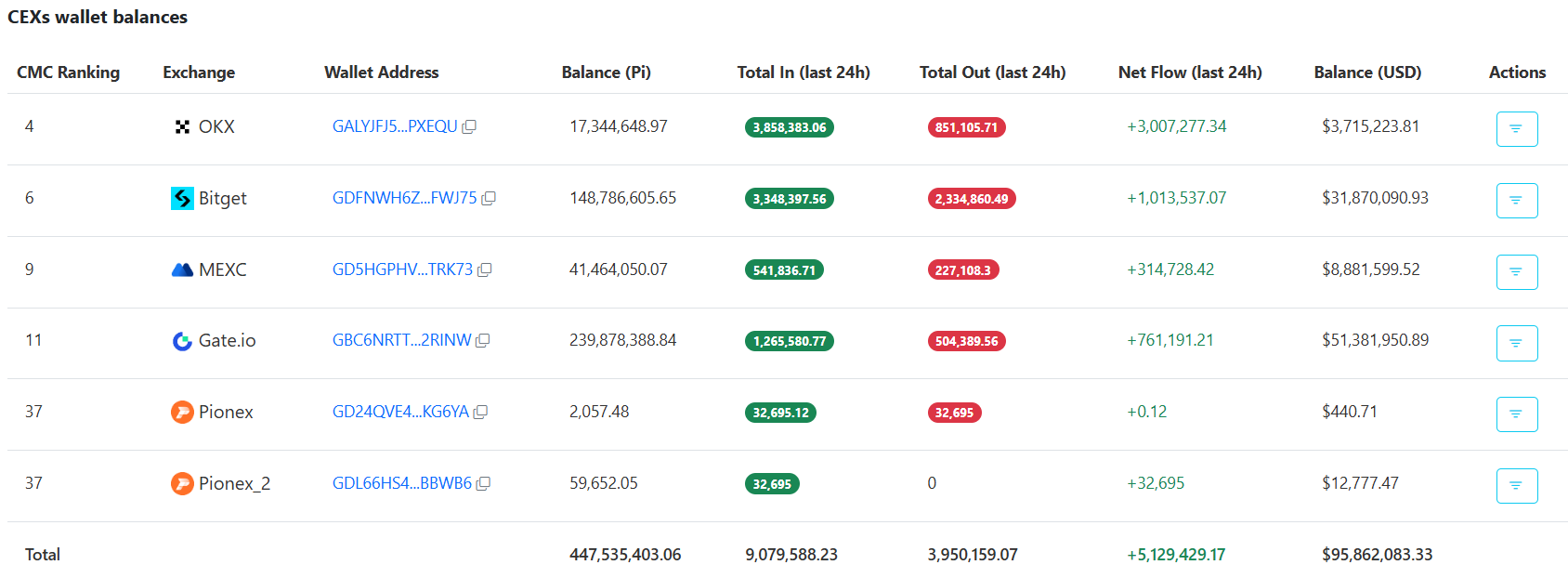

However, two important factors suggest that the ascent may soon be replaced by a correction. Data shows that more than 6.2 million PI have been transferred to exchanges in the past 24 hours alone, thus bringing the total figure to almost 450 million. The majority of the coins (53%) are stored on Gate.io, whereas Bitget ranks second with approximately 148.8 million. This development doesn’t guarantee a short-term price decline but is often considered a pre-sale step.

Next on the list is PI’s Relative Strength Index (RSI). It measures the speed and magnitude of recent price changes to help traders gauge whether the asset is on the verge of a turning point. The tool ranges from 0 to 100, with ratios above 70 indicating that PI has entered overbought territory and could be due for a pullback. Currently, the index stands at around 71.

More Gains Ahead?

Contrary to the worrying factors mentioned above, some X users remain optimistic that PI could be gearing up for an additional rally in the near future. The analyst, who goes by the moniker Vuori Trading, predicted a potential increase to $0.64, while ALTS GEMS Alert forecasted an ascent to as high as $0.30.

You may also like:

The upcoming protocol update scheduled for later this week may give PI another boost, though there’s always the risk of a classic “sell-the-news” reaction, which investors should keep in mind.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

The 20 Millionth BTC Has Been Mined

Bitcoin’s network achieved one of the most significant milestones today.

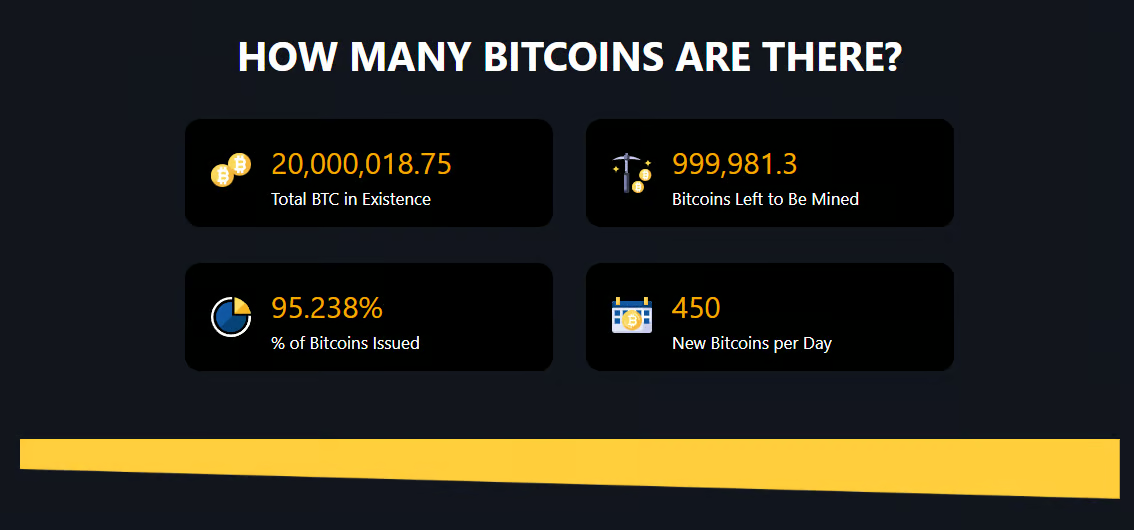

The Bitcoin network has reached a massive milestone: the 20 millionth BTC has been officially mined. With its total supply permanently capped at 21 million, this moment marks a monumental step toward its permanent scarcity.

Moreover, the event highlights one of the network’s defining features: its transparency and predictability. Unlike traditional fiat currencies, which can be pretty much printed at will and indefinitely, BTC follows a very strict issuance schedule, hardcoded into its protocol. With Bitcoin, code is law, and this code cannot be changed (at least not without massive market turbulence and seismic shifts in the entire industry), and can be publicly verified by anyone interested.

Digital Scarcity, but at a New Level

Data from BiTBO shows that 95.2% of Bitcoin’s total supply, representing exactly 20,000,018.75 BTC, has been mined at the time of this writing.

The remaining one million coins will be increasingly difficult to mine because of how the network is structured to function. Halvings take place roughly every four years, which slashes the rewards miners receive for adding new blocks to the network by 50%. In essence, this reduces the fresh supply by half, hence the name. In other words, the more time passes, the harder it will become to mine BTC. In fact, some estimates predict that the last BTC will be mined in 2140.

All of this highlights one of Bitcoin’s core concepts – digital scarcity. That’s why many investors have been comparing it to gold – because of its limited and ever-decreasing supply.

But one thing that many tend to forget is that millions of BTC are believed to be permanently lost due to forgotten phrases, lost wallets, and more. this makes the situation even more constrained, putting the effective circulating supply significantly lower than 21,000,000.

What the Final Million Means

The last Bitcoin halving occurred in 2024, reducing the block reward from 6.25 to 3.125 BTC. The next one should take place in two years, effectively making BTC even scarcer.

You may also like:

To put matters in perspective, only about 450 BTC (roughly) is mined daily, meaning that by 2030, only a tiny fraction of the remaining BTC will be in circulation.

This also means that miners, who secure the network and validate blocks, will be relying increasingly on the fees as the block reward continues to decline.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

-

Politics6 days ago

Politics6 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business3 days ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Fashion3 days ago

Fashion3 days agoWeekend Open Thread: Ann Taylor

-

Tech4 days ago

Tech4 days agoBitwarden adds support for passkey login on Windows 11

-

Sports4 days ago

Sports4 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

News Videos6 hours ago

News Videos6 hours ago10th Algebra | Financial Planning | Question Bank Solution | Board Exam 2026

-

Sports2 days ago

Sports2 days agoThree share 2-shot lead entering final round in Hong Kong

-

Sports2 days ago

Sports2 days agoBraveheart Lakshya downs Lai in epic battle to enter All England Open final | Other Sports News

-

Tech7 days ago

Tech7 days agoCynus Chess Robot: A Chess Board With A Robotic Arm

-

Business6 days ago

Business6 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat4 days ago

NewsBeat4 days agoPiccadilly Circus just unveiled ‘London’s newest tourist attraction’ and it only costs 80p to enter

-

Business24 hours ago

Business24 hours agoSearch for Nancy Guthrie Enters 37th Day as FBI Probes Wi-Fi Jammer Theory

-

Politics3 days ago

Politics3 days agoTop Mamdani aide takes progressive project to the UK

-

Entertainment3 days ago

Entertainment3 days agoHailey Bieber Poses For Sexy Selfies In New Luscious Lip Thirst Traps

-

Crypto World2 hours ago

Crypto World2 hours agoParadigm, a16z, Winklevoss Capital, Balaji Srinivasan among investors in ZODL

-

Sports6 days ago

Sports6 days agoJack Grealish posts new injury update as Man City star enters crucial period

-

Crypto World5 days ago

Crypto World5 days agoNew Crypto Mutuum Finance (MUTM) Reports V1 Protocol Progress as Roadmap Enters Phase 3

-

Tech3 hours ago

Tech3 hours agoDespite challenges, Ireland sixth in EU for board gender diversity

-

Tech4 days ago

Tech4 days agoACIP To Discuss COVID ‘Vaccine Injuries’ Next Month, Despite That Not Being In Its Purview

-

Entertainment5 days ago

Harry Styles Has ‘Struggled’ to Discuss Liam Payne’s Death