Crypto World

Why AI Needs Sovereign Data Integrity

AI agents dominated ETHDenver 2026, from autonomous finance to on-chain robotics. But as enthusiasm around “agentic economies” builds, a harder question is emerging: can institutions prove what their AI systems were trained on?

Among the startups targeting that problem is Perle Labs, which argues that AI systems require a verifiable chain of custody for their training data, particularly in regulated and high-risk environments. With a focus on building an auditable, credentialed data infrastructure for institutions, Perle has raised $17.5 million to date, with its latest funding round led by Framework Ventures. Other investors include CoinFund, Protagonist, HashKey, and Peer VC. The company reports more than one million annotators contributing over a billion scored data points on its platform.

BeInCrypto spoke with Ahmed Rashad, CEO of Perle Labs, on the sidelines of ETHDenver 2026. Rashad previously held an operational leadership role at Scale AI during its hypergrowth phase. In the conversation, he discussed data provenance, model collapse, adversarial risks and why he believes sovereign intelligence will become a prerequisite for deploying AI in critical systems.

BeInCrypto: You describe Perle Labs as the “sovereign intelligence layer for AI.” For readers who are not inside the data infrastructure debate, what does that actually mean in practical terms?

Ahmed Rashad: “The word sovereign is deliberate, and it carries a few layers.

The most literal meaning is control. If you’re a government, a hospital, a defense contractor, or a large enterprise deploying AI in a high-stakes environment, you need to own the intelligence behind that system, not outsource it to a black box you can’t inspect or audit. Sovereign means you know what your AI was trained on, who validated it, and you can prove it. Most of the industry today cannot say that.

The second meaning is independence. Acting without outside interference. This is exactly what institutions like the DoD, or an enterprise require when they’re deploying AI in sensitive environments. You cannot have your critical AI infrastructure dependent on data pipelines you don’t control, can’t verify, and can’t defend against tampering. That’s not a theoretical risk. NSA and CISA have both issued operational guidance on data supply chain vulnerabilities as a national security issue.

The third meaning is accountability. When AI moves from generating content into making decisions, medical, financial, military, someone has to be able to answer: where did the intelligence come from? Who verified it? Is that record permanent? On Perle, our goal is to have every contribution from every expert annotator is recorded on-chain. It can’t be rewritten. That immutability is what makes the word sovereign accurate rather than just aspirational.

In practical terms, we are building a verification and credentialing layer. If a hospital deploys an AI diagnostic system, it should be able to trace each data point in the training set back to a credentialed professional who validated it. That is sovereign intelligence. That’s what we mean.”

BeInCrypto: You were part of Scale AI during its hypergrowth phase, including major defense contracts and the Meta investment. What did that experience teach you about where traditional AI data pipelines break?

Ahmed Rashad: “Scale was an incredible company. I was there during the period when it went from $90M and now it’s $29B, all of that was taking shape, and I had a front-row seat to where the cracks form.

The fundamental problem is that data quality and scale pull in opposite directions. When you’re growing 100x, the pressure is always to move fast: more data, faster annotation, lower cost per label. And the casualties are precision and accountability. You end up with opaque pipelines: you know roughly what went in, you have some quality metrics on what came out, but the middle is a black box. Who validated this? Were they actually qualified? Was the annotation consistent? Those questions become almost impossible to answer at scale with traditional models.

The second thing I learned is that the human element is almost always treated as a cost to be minimized rather than a capability to be developed. The transactional model: pay per task then optimize for throughput just degrades quality over time. It burns through the best contributors. The people who can give you genuinely high-quality, expert-level annotations are not the same people who will sit through a gamified micro-task system for pennies. You have to build differently if you want that caliber of input.

That realization is what Perle is built on. The data problem isn’t solved by throwing more labor at it. It’s solved by treating contributors as professionals, building verifiable credentialing into the system, and making the entire process auditable end to end.”

BeInCrypto: You’ve reached a million annotators and scored over a billion data points. Most data labeling platforms rely on anonymous crowd labor. What’s structurally different about your reputation model?

Ahmed Rashad: “The core difference is that on Perle, your work history is yours, and it’s permanent. When you complete a task, the record of that contribution, the quality tier it hit, how it compared to expert consensus, is written on-chain. It can’t be edited, can’t be deleted, can’t be reassigned. Over time, that becomes a professional credential that compounds.

Compare that to anonymous crowd labor, where a person is essentially fungible. They have no stake in quality because their reputation doesn’t exist, each task is disconnected from the last. The incentive structure produces exactly what you’d expect: minimum viable effort.

Our model inverts that. Contributors build verifiable track records. The platform recognizes domain expertise. For example, a radiologist who consistently produces high-quality medical image annotations builds a profile that reflects that. That reputation drives access to higher-value tasks, better compensation, and more meaningful work. It’s a flywheel: quality compounds because the incentives reward it.

We’ve crossed a billion points scored across our annotator network. That’s not just a volume number, it’s a billion traceable, attributed data contributions from verified humans. That’s the foundation of trustworthy AI training data, and it’s structurally impossible to replicate with anonymous crowd labor.”

BeInCrypto: Model collapse gets discussed a lot in research circles but rarely makes it into mainstream AI conversations. Why do you think that is, and should more people be worried?

Ahmed Rashad: “It doesn’t make mainstream conversations because it’s a slow-moving crisis, not a dramatic one. Model collapse, where AI systems trained increasingly on AI-generated data start to degrade, lose nuance, and compress toward the mean, doesn’t produce a headline event. It produces a gradual erosion of quality that’s easy to miss until it’s severe.

The mechanism is straightforward: the internet is filling up with AI-generated content. Models trained on that content are learning from their own outputs rather than genuine human knowledge and experience. Each generation of training amplifies the distortions of the last. It’s a feedback loop with no natural correction.

Should more people be worried? Yes, particularly in high-stakes domains. When model collapse affects a content recommendation algorithm, you get worse recommendations. When it affects a medical diagnostic model, a legal reasoning system, or a defense intelligence tool, the consequences are categorically different. The margin for degradation disappears.

This is why the human-verified data layer isn’t optional as AI moves into critical infrastructure. You need a continuous source of genuine, diverse human intelligence to train against; not AI outputs laundered through another model. We have over a million annotators representing genuine domain expertise across dozens of fields. That diversity is the antidote to model collapse. You can’t fix it with synthetic data or more compute.”

BeInCrypto: When AI expands from digital environments into physical systems, what fundamentally changes about risk, responsibility, and the standards applied to its development?

Ahmed Rashad: The irreversibility changes. That’s the core of it. A language model that hallucinates produces a wrong answer. You can correct it, flag it, move on. A robotic surgical system operating on a wrong inference, an autonomous vehicle making a bad classification, a drone acting on a misidentified target, those errors don’t have undo buttons. The cost of failure shifts from embarrassing to catastrophic.

That changes everything about what standards should apply. In digital environments, AI development has largely been allowed to move fast and self-correct. In physical systems, that model is untenable. You need the training data behind these systems to be verified before deployment, not audited after an incident.

It also changes accountability. In a digital context, it’s relatively easy to diffuse responsibility, was it the model? The data? The deployment? In physical systems, particularly where humans are harmed, regulators and courts will demand clear answers. Who trained this? On what data? Who validated that data and under what standards? The companies and governments that can answer those questions will be the ones allowed to operate. The ones that can’t will face liability they didn’t anticipate.

We built Perle for exactly this transition. Human-verified, expert-sourced, on-chain auditable. When AI starts operating in warehouses, operating rooms, and on the battlefield, the intelligence layer underneath it needs to meet a different standard. That standard is what we’re building toward.

BeInCrypto: How real is the threat of data poisoning or adversarial manipulation in AI systems today, particularly at the national level?

Ahmed Rashad: “It’s real, it’s documented, and it’s already being treated as a national security priority by people who have access to classified information about it.

DARPA’s GARD program (Guaranteeing AI Robustness Against Deception) spent years specifically developing defenses against adversarial attacks on AI systems, including data poisoning. The NSA and CISA issued joint guidance in 2025 explicitly warning that data supply chain vulnerabilities and maliciously modified training data represent credible threats to AI system integrity. These aren’t theoretical white papers. They’re operational guidance from agencies that don’t publish warnings about hypothetical risks.

The attack surface is significant. If you can compromise the training data of an AI system used for threat detection, medical diagnosis, or logistics optimization, you don’t need to hack the system itself. You’ve already shaped how it sees the world. That’s a much more elegant and harder-to-detect attack vector than traditional cybersecurity intrusions.

The $300 million contract Scale AI holds with the Department of Defense’s CDAO, to deploy AI on classified networks, exists in part because the government understands it cannot use AI trained on unverified public data in sensitive environments. The data provenance question is not academic at that level. It’s operational.

What’s missing from the mainstream conversation is that this isn’t just a government problem. Any enterprise deploying AI in a competitive environment, financial services, pharmaceuticals, critical infrastructure, has an adversarial data exposure they’ve probably not fully mapped. The threat is real. The defenses are still being built.”

BeInCrypto: Why can’t a government or a large enterprise just build this verification layer themselves? What’s the real answer when someone pushes back on that?

Ahmed Rashad: “Some try. And the ones who try learn quickly what the actual problem is.

Building the technology is the easy part. The hard part is the network. Verified, credentialed domain experts, radiologists, linguists, legal specialists, engineers, scientists, don’t just appear because you built a platform for them. You have to recruit them, credential them, build the incentive structures that keep them engaged, and develop the quality consensus mechanisms that make their contributions meaningful at scale. That takes years and it requires expertise that most government agencies and enterprises simply don’t have in-house.

The second problem is diversity. A government agency building its own verification layer will, by definition, draw from a limited and relatively homogeneous pool. The value of a global expert network isn’t just credentialing; it’s the range of perspective, language, cultural context, and domain specialization that you can only get by operating at real scale across real geographies. We have over a million annotators. That’s not something you replicate internally.

The third problem is incentive design. Keeping high-quality contributors engaged over time requires transparent, fair, programmable compensation. Blockchain infrastructure makes that possible in a way that internal systems typically can’t replicate: immutable contribution records, direct attribution, and verifiable payment. A government procurement system is not built to do that efficiently.

The honest answer to the pushback is: you’re not just buying a tool. You’re accessing a network and a credentialing system that took years to build. The alternative isn’t ‘build it yourself’, it’s ‘use what already exists or accept the data quality risk that comes with not having it.’”

BeInCrypto: If AI becomes core national infrastructure, where does a sovereign intelligence layer sit in that stack five years from now?

Ahmed Rashad: “Five years from now, I think it looks like what the financial audit function looks like today, a non-negotiable layer of verification that sits between data and deployment, with regulatory backing and professional standards attached to it.

Right now, AI development operates without anything equivalent to financial auditing. Companies self-report on their training data. There’s no independent verification, no professional credentialing of the process, no third-party attestation that the intelligence behind a model meets a defined standard. We’re in the early equivalent of pre-Sarbanes-Oxley finance, operating largely on trust and self-certification.

As AI becomes critical infrastructure, running power grids, healthcare systems, financial markets, defense networks, that model becomes untenable. Governments will mandate auditability. Procurement processes will require verified data provenance as a condition of contract. Liability frameworks will attach consequences to failures that could have been prevented by proper verification.

Where Perle sits in that stack is as the verification and credentialing layer, the entity that can produce an immutable, auditable record of what a model was trained on, by whom, under what standards. That’s not a feature of AI development five years from now. It’s a prerequisite.

The broader point is that sovereign intelligence isn’t a niche concern for defense contractors. It’s the foundation that makes AI deployable in any context where failure has real consequences. And as AI expands into more of those contexts, the foundation becomes the most valuable part of the stack.”

Crypto World

ARB price prediction as $56.9 million in capital exits Arbitrum network

- $56.9M have exited Arbitrum, pressuring ARB near key support levels.

- Arbitrum Network activity remains steady despite the token price decline.

- Critical levels to watch are the support around $0.093–$0.095 and the resistance around $0.100–$0.105.

Arbitrum has found itself under renewed pressure after a sharp wave of capital outflows unsettled market confidence.

In the last 24 hours, roughly $56.9 million exited the Arbitrum ecosystem, according to Artemis, raising concerns about whether the recent attempt at a price rebound can survive.

Arbitrum capital outflow against ARB’s price decline

The outflow comes at a time when ARB was already trading near historical lows, leaving little room for error.

The token is hovering around the $0.096 region, a level that now carries heavy psychological weight for traders and long-term holders alike.

Despite the sell pressure, Arbitrum’s broader network activity has not collapsed.

According to data from Artemis, daily transactions and active addresses have shown resilience, suggesting that users are still interacting with the chain even as capital flows out.

This disconnect between network usage and token price has become one of the most talked-about themes around ARB.

It reflects a market where sentiment and liquidity matter more in the short term than raw on-chain activity.

The outflows appear to be driven more by capital rotation than by a fundamental rejection of Arbitrum itself.

A portion of the existing funds moved back into Ethereum, while some flowed into newer or more speculative ecosystems.

This behaviour signals caution rather than panic, as traders look for short-term safety or higher volatility elsewhere.

Still, the impact on ARB’s price has been hard to ignore.

Over the past month, the token has lost nearly half of its value, underperforming many comparable assets.

The decline has also been accompanied by weakening market sentiment, with bullish conviction fading quickly.

Derivatives data adds another layer of concern.

Funding rates have slipped into negative territory, showing that short positions are gaining dominance.

When combined with heavy outflows, this setup often leads to choppy price action rather than a clean recovery.

At the same time, selling pressure appears to be slowing near the current lows.

ARB recently printed a fresh all-time low around $0.093, only to bounce modestly afterwards, suggesting that buyers are willing to defend this zone, at least for now.

However, confidence remains fragile.

Any further surge in capital exiting the network could push ARB back toward that low with little resistance in between.

On the other hand, if outflows ease and market conditions stabilise, ARB could attempt to build a short-term base.

Such a base would not guarantee a strong rally, but it could reduce downside risk.

ARN price prediction

For now, Arbitrum (ARB) sits at a crossroads between stabilisation and continuation of its broader downtrend.

Much will depend on whether sentiment improves or deteriorates further in the coming days.

From a technical perspective, the $0.093 to $0.095 zone stands out as the most critical support area.

A clear daily close below this range would expose ARB to deeper losses, with little historical structure to slow the fall.

On the upside, the $0.100 to $0.105 region acts as the first meaningful resistance.

This area aligns with prior breakdown levels and could attract selling from traders looking to exit on relief rallies.

On the upside, a recovery would require ARB to reclaim the $0.12 level, which previously acted as short-term support.

Until that happens, rallies are likely to be viewed as corrective rather than trend-changing.

And while momentum indicators remain weak, early signs of seller exhaustion are starting to appear.

For traders, patience is key, as volatility around these levels can be deceptive.

A sustained hold above $0.10 could improve short-term outlooks, while a breakdown below $0.093 would likely reinforce bearish control.

Crypto World

SCOTUS Strikes Down Trump Tariffs as Alternative Plans Brew

The Supreme Court’s decision on Friday sharply curtailed the executive branch’s authority to deploy tariffs under the International Emergency Economic Powers Act (IEEPA). In a 6-3 ruling, the justices concluded that the President lacks inherent power to impose broad tariffs under peacetime conditions, signaling a significant check on executive power in U.S. trade policy. The majority’s view was clear: IEEPA does not authorize tariffs at the scale seen in recent years, and the presidential interpretation of the statute extended beyond its legitimate reach. The ruling hinges on historical precedent and the breadth of authority claimed by the administration, suggesting a reevaluation of the tariff policy framework used during peacetime emergencies. The decision was issued on Friday, February 20, 2026, with the court emphasizing the statute’s limited scope.

“In IEEPA’s half-century of existence, no president has invoked the statute to impose any tariffs, let alone tariffs of this magnitude and scope. That ‘lack of historical precedent,’ coupled with the breadth of authority that the President now claims, suggests that the tariffs extend beyond the President’s ‘legitimate reach.’”

At issue was whether tariffs imposed as a means of addressing perceived national emergencies could be sustained under IEEPA. The court’s opinion rejected that premise, noting that the administration had not demonstrated a statutory basis strong enough to justify the breadth and scale of the measures in question. The decision, while narrow in its focus on statutory interpretation, carries broad implications for how future administrations might leverage tariff tools in times of perceived distress. The ruling’s central thrust is that IEEPA does not authorize sweeping tariff regimes, and the absence of a sustained, historically grounded precedent undermines the President’s justification for such measures.

Trump criticizes court, says he’ll get tariffs reinstated

Following the ruling, former President Donald Trump blasted the justices who voted to strike down the tariffs and signaled that the policy would persist through alternative channels. A report noted that he pledged to pursue reinstatement via other avenues, raising questions about what policy instruments could replace tariffs as a means to influence trade dynamics. The courtroom decision, contrasted with Trump’s rhetoric, underscores a broader political debate over how the United States should calibrate its use of trade tools in pursuit of fiscal and industrial goals.

Trump asserted that tariffs were a lever to address perceived imbalances with Canada, China, and Mexico, and he framed the decision as a setback for U.S. economic strategy. Critics argued that tariff policy risks provoking retaliatory actions, disrupting supply chains, and injecting volatility into already fragile macro conditions. The clash between judicial limits and executive ambitions has intensified scrutiny over the federal policy toolkit available to safeguard domestic industries while maintaining competitive leverage on the global stage.

Historically, the tariff discourse has had tangible spillovers across asset markets. In 2025, for example, the prospect or announcement of new tariffs sent shockwaves through equities and cryptocurrencies alike, amplifying uncertainty at a moment when investors were already grappling with a shifting macro backdrop. The prevailing narrative suggested that aggressive tariff posturing tended to compress risk sentiment and tilt asset pricing toward risk-off dynamics, a trend that reverberated across multiple sectors of the market.

As policy discourse continues, observers will watch for how the administration retools its approach. The White House has indicated it may pursue alternate mechanisms to achieve similar objectives, but the legal and economic costs of doing so remain a focal point for lawmakers, market participants, and international partners alike.

Trump claims tariffs could replace income tax, but crypto markets are paying the price

Earlier in the campaign cycle, Trump floated a controversial idea that tariff revenue could be used to replace federal income taxes, a proposition he described as potentially lowering the budget deficit. He argued that tariffs would substantially reduce taxes for many households, a claim that fed into a broader debate about the role of tariffs in fiscal policy. The implications for tax structures, consumer prices, and corporate planning were hotly contested among economists and policymakers, but the idea underscored how tariff revenue could be framed as a substitute for conventional taxation in certain scenarios.

Public disclosures and posts on social platforms reflected a broader narrative that tariff policy could be a transformative fiscal tool. While supporters argued that tariffs might boost domestic production and protect strategic industries, skeptics warned of distortions, higher consumer costs, and diminished global competitiveness. The policy rhetoric matched a volatile market environment where crypto assets, equities, and risk assets had shown sensitivity to tariff-related headlines and policy signals.

In practical terms, the tariff episode left crypto markets exposed to policy-driven risk. When tariffs targeted China in 2025, investors watched liquidity and volatility as leading indicators of how risk assets would respond. In that episode, Bitcoin (BTC) traded with noticeable swings, reflecting the broader interplay between regulatory expectations and appetite for alternative stores of value during periods of uncertainty. The price action mirrored the tension between policy risk, macro fundamentals, and the evolving sentiment around decentralized finance as a potential hedge against traditional financial channels.

Market commentators pointed to a combination of leverage, liquidity constraints, and sentiment factors as drivers of the crypto drawdown observed during tariff episodes. A notable pattern emerged: traders frequently viewed tariff announcements as catalysts for broader risk-off moves, reinforcing the idea that policy shocks can function as macro triggers for price movements across digital assets. In the wake of the latest ruling, traders and investors are parsing how policy space will evolve and what that means for risk parity, hedging strategies, and the resilience of crypto markets to regulatory shocks.

Market context

Market context: The ruling arrives amid a broader phase of regulatory scrutiny and ongoing debate about the role of tariffs in U.S. economic policy, which continues to ripple through crypto markets and risk assets as investors reassess policy risk and liquidity conditions.

Why it matters

The Supreme Court’s decision narrows the executive branch’s tariff toolkit, potentially altering the trajectory of U.S. trade policy in an era of rapid technological change and global supply-chain disruption. For investors, the ruling clarifies what authorities the administration can credibly rely on to shape market dynamics, reducing the likelihood of ad hoc tariff shocks that could surprise markets. For crypto market participants, the episode underscores the sensitivity of digital assets to macro policy developments and the need for resilience in volatile environments. Firms building in this space must consider how shifting tariff and regulatory landscapes could affect cross-border operations, energy pricing, and financial infrastructure decisions. Finally, the ruling adds to the ongoing discourse about the balance between national policy interventions and market-based mechanisms, a debate that will continue to influence capital flows and innovation in the crypto ecosystem.

In the near term, traders will be watching how the administration navigates alternatives to tariffs and whether Congress steps in to provide clearer statutory guardrails. The decision may also spur renewed attention on how the U.S. coordinates with its trading partners to establish a more predictable policy environment, an outcome that could stabilize investor expectations and reduce speculative volatility in volatile assets like cryptocurrencies.

What to watch next

- Clarification on any alternative measures the executive branch may pursue to influence trade, including potential regulatory or administrative actions.

- Legislative responses or bipartisan discussions that could shape the future use of tariffs or trade tools.

- Crypto market reactions to future tariff-related headlines and potential policy shifts, with attention to liquidity and volatility metrics.

- Ongoing court considerations or challenges related to the scope of executive powers in economic policy.

- Further official statements or documentation detailing the scope and limits of IEEPA in modern policy applications.

Sources & verification

- Official Supreme Court ruling: The ruling PDF provides the Court’s reasoning and the formal holding on IEEPA’s authority (https://www.supremecourt.gov/opinions/25pdf/24-1287_4gcj.pdf).

- Politico coverage of Trump’s reaction to the ruling (https://www.politico.com/news/2026/02/20/donald-trump-tariff-supreme-court-reaction-00791245?utm_medium=twitter&utm_source=dlvr.it).

- Cointelegraph reporting on tariff-related market dynamics and related policy debates (https://cointelegraph.com/news/trump-liberation-day-tariffs-markets-recession).

- Truth Social posts by Donald Trump referenced in coverage (https://truthsocial.com/@realDonaldTrump/posts/114410073592204291 and https://truthsocial.com/@realDonaldTrump/posts/115351840469973590).

- Market analysis linking tariff news to crypto sentiment (https://cointelegraph.com/news/crypto-traders-us-donald-trump-tariffs-market-decline-santiment).

Key details and implications for markets

Introduction to the core finding: The Supreme Court has curtailed the scope of presidential tariff powers under IEEPA, reinforcing a constitutional check on executive actions in times of economic strain. The ruling, while focused on statutory interpretation, triggers a broader recalibration of policy risk and how market participants price macro surprises. In the immediate aftermath, the president’s reception of the decision and his stated intention to pursue tariffs through other channels raised questions about the timing and nature of any forthcoming policy shifts. Investors will be watching for any formal policy proposals or regulatory steps that could reintroduce tariff pressures, particularly around cross-border trade with major partners.

What to watch next

- Dates for any anticipated policy proposals or regulatory actions outlining alternative tariff mechanisms.

- Potential shifts in congressional discussions that could frame future tariff authority or trade policy instruments.

- Monitoring of crypto market liquidity and volatility around new tariff-related announcements or debates.

Endnotes

Note: The coverage reflects developments reported across multiple outlets, including legal filings, political reporting, and market analysis linked above. The information should be verified against primary documents and official releases as policy positions evolve.

Crypto World

Crypto Market News Today: Pepeto Presale Hits $7.2M as 300X Forecasts Grow and Michael Saylor Says Bitcoin Is Going to a Million

What if the biggest crypto opportunity of 2026 isn’t buying Bitcoin at $67,000? What if it’s finding the one altcoin set to explode the hardest when Bitcoin starts its next leg up? Because every crypto cycle has proven the same thing. When Bitcoin recovers, altcoins don’t just follow. They multiply. And the altcoin positioned to make the most people rich this year is Pepeto.

Geoffrey Kendrick from Standard Chartered told DL News that Bitcoin could fall to $50,000 in the coming months. According to CNBC, Bitcoin dropped below $61,000 earlier this month before recovering to $67,000. The total market has shed over $2 trillion since October.

But Michael Saylor just put it plainly. Bitcoin is not going to zero. It’s going to a million. Wall Street institutions keep accumulating. ETF inflows are still positive yearly. Every major dip in Bitcoin’s history has been followed by a bigger rally. The fear is temporary. The trajectory is not.

Given how this is where the real opportunity opens up. Every time Bitcoin rebounds, altcoins do 5x, 10x, even 100x what Bitcoin does. That pattern repeated in 2017, 2021, and it’s about to repeat again. The question is which altcoin you’re in before it happens.

Best crypto presale: Why Pepeto is the altcoin set to explode this year

Forget about scrolling through lists of coins hoping one moons. Pepeto is the one to watch.

Pepeto built the tools the meme coin economy is missing. PepetoSwap for instant trades. A cross chain bridge for moving assets between blockchains. An upcoming exchange that only lists verified projects. These aren’t concepts. They’re working demos that presale holders can test at pepeto.io. While other altcoins promise roadmaps for 2027, Pepeto already delivered.

This clear infrastructure has pushed Pepeto into crypto media headlines. Recent talk suggests 300X projections could play out once trading opens on Binance. Some longtime traders say missing Pepeto at this stage is like missing Bitcoin back when nobody cared. That might sound extreme. But when SHIB hit $40 billion with zero products, and PEPE reached $7 billion on memes alone, a project with actual working tools at $0.000000184 doesn’t need much imagination to see where it goes.

Pepeto is priced at $0.000000184 with $7.2M raised during one of the worst markets in years. Founded by a Pepe cofounder. Dual audits by SolidProof and Coinsult. Zero transaction tax. Put $5,000 in at this price. If Pepeto reaches just 200X after listing, that’s $1,000,000. On top of that, the 214% staking APY generates $10,700 a year on that same $5,000 while you wait. Staking is just the holding bonus. The real play is what Bitcoin’s recovery does to an altcoin with real products at a micro cap price. 70% already filled.

More people in crypto media are starting to notice

A crypto news site recently wrote that Pepeto could be a strong presale for 2026 given its live products and ground floor pricing. According to The Motley Fool, the CLARITY Act and GENIUS Act could bring billions in institutional capital this summer. When that capital arrives, it flows into projects with real utility at early valuations. Pepeto checks every box.

Conclusion

Standard Chartered sees short term pain. Michael Saylor sees a million dollar Bitcoin. History sides with Saylor. And when Bitcoin climbs, altcoins fly harder. Pepeto at $0.000000184 with working demos, dual audits, a Pepe cofounder, and a Binance listing ahead is built to capture that wave. 70% filled. This is the opportunity crypto was designed to create.

Click To Visit Official Website To Buy Pepeto: https://pepeto.io

FAQs

Why is the crypto market down today?

Standard Chartered predicts Bitcoin could fall to $50K due to macro headwinds. But Michael Saylor and institutions see long term upside to $1 million. Presale tokens like Pepeto are shielded from daily swings because the entry price stays fixed until listing.

Can Pepeto really reach 300X?

SHIB hit $40 billion with no utility. PEPE hit $7 billion with no products. Pepeto has swap, bridge, exchange demos holders can test, dual audits, and a Pepe cofounder at $0.000000184. When Bitcoin recovers, altcoins multiply harder. The 300X math is grounded in real cycle patterns.

Is it worth buying presale crypto during a crash?

Presale prices don’t drop when Bitcoin drops. $5,000 in Pepeto at 200X becomes $1,000,000. The 214% staking APY adds $10,700 a year on top. Every major Bitcoin dip has led to an even bigger rally, and altcoins with utility benefit the most.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

BTC unfazed by Trump tariff news; DOGE, SOL, ADA lead modest bounce

Bitcoin brushed aside a volatile round of U.S. tariff headlines on Friday, inching toward $68,000 and altcoins modestly bouncing.

The day began with the U.S. Supreme Court ruling President Donald Trump’s global tariff rollout illegal. The decision did not clarify what should happen to tariff revenue already collected, and it doesn’t necessarily spell the end of Trump’s trade agenda, with multiple legal and executive avenues still available.

By the afternoon, President Trump announced an additional 10% global tariff to be rolled out under Section 122 for roughly five months, effective in three days.

The fresh levy, imposed on top of existing tariffs, barely dented sentiment.

Risk assets, including crypto, pushed modestly higher through the session. The broad-market CoinDesk 20 Index gained 2.5% over the past 24 hours, with BNB, , and Solana (SOL) outperforming with 3%-4% advances. Bitcoin was recently trading just below $68,000.

Meanwhile, the S&P 500 and Nasdaq 100 climbed 0.9% and 0.7%, respectively. Among crypto-linked stocks, exchange Coinbase (COIN), stablecoin issuer Circle (CRCL) and bitcoin treasury firm Strategy (MSTR) rose more than 2%. Bitcoin miners tied to AI infrastructure buildouts underperformed, with Riot Platforms (RIOT), Cipher Mining (CIFR), IREN and TeraWulf (WULF) falling 3%-6%.

Cryptos to stay rangebound

“We have seen a small rally for risk assets post-tariffs news as it leads into a narrative that tariffs are damaging for the macro environment,” said Paul Howard, director at trading firm Wincent.

Still, conviction remains light that prices could break out to the upside from the current tight range. “Volumes, however, remain muted and we can expect crypto to maintain range bound trading for the time being” barring any “macro or geopolitical shocks coming,” Howard added.

A key potential macro risk could be Trump ordering strikes against Iran over the next few days, following the significant military buildup in the region for weeks now.

Crypto World

Crypto Markets Tick Up Following Supreme Court Tariff Ruling

Bitcoin holds near $67,700 while investors assess Trump’s new 10% global tariff plan.

Crypto markets traded slightly higher on Friday, Feb. 20, as traders reacted to the U.S. Supreme Court ruling that struck down President Donald Trump’s emergency tariffs.

Bitcoin (BTC) is trading at $67,728, up 1.2% over the past 24 hours, while Ethereum (ETH) is at $1,970, up 1.5%. Other large-cap tokens were also mostly higher, with XRP up 1.5% to $1.43, BNB rising 3.2% to $625, and Solana (SOL) gaining 4% to $85.

Meanwhile, the total cryptocurrency market capitalization is hovering near $2.4 trillion, up 1.3% on the day. Daily trading volume stood at around $114.5 billion, according to CoinGecko.

Among top gainers, Morpho (MORPHO) climbed 11%, Ethereum Classic (ETC) rose 5.3%, and Official Trump (TRUMP) added about 5%. On the downside, Aave (AAVE) fell roughly 4.6%, Pi Network (PI) dropped about 3%, and Rain (RAIN) slipped around 2%.

Liquidations and ETF Flows

About $180 million in leveraged crypto positions were liquidated in the past 24 hours, according to CoinGlass. Long liquidations accounted for roughly $71.9 million, while shorts made up about $108 million.

Bitcoin led liquidations with $67.9 million, followed by Ethereum at around $38.3 million. More than 78,600 traders were liquidated during the period.

In the ETF space, Bitcoin spot ETFs recorded $165.76 million in outflows, while Ethereum spot ETFs experienced $130 million in outflows. In contrast, XRP spot ETFs recorded around $4 million in inflows, while Solana spot ETFs posted $5.94 million in inflows, per SoSoValue data.

Supreme Court Strikes Down Tariffs

The market uptick came amid intensifying macroeconomic uncertainty after President Donald Trump announced plans to impose a 10% global tariff. Trump’s announcement immediately followed a Supreme Court ruling that deemed his emergency tariffs illegal.

Notably, President Trump’s new tariffs could only take effect for up to 150 days unless Congress approves an extension, CNN reported.

Investors also reacted to increased geopolitical tensions after Trump said he is considering a limited military strike on Iran if nuclear negotiations do not progress soon.

In traditional markets, safe-haven assets have continued to hold steady. Gold traded at $5,092, up 1.46%, while silver climbed 6% to $84.

Meanwhile, Paul Howard, Senior Director, Wincent, said in comments shared with The Defiant that there has been a “mix of developments” over the past two days impacting price action independently of larger macro trends.

“These include speculation around the U.S. stablecoin bill, the launch of a SUI ETF on Nasdaq, and several DATs marking down their books,” Howard said. “Given the noticeable thinning of liquidity over the past month, volatility risk is currently elevated relative to levels observed over the past 12 months.”

Crypto World

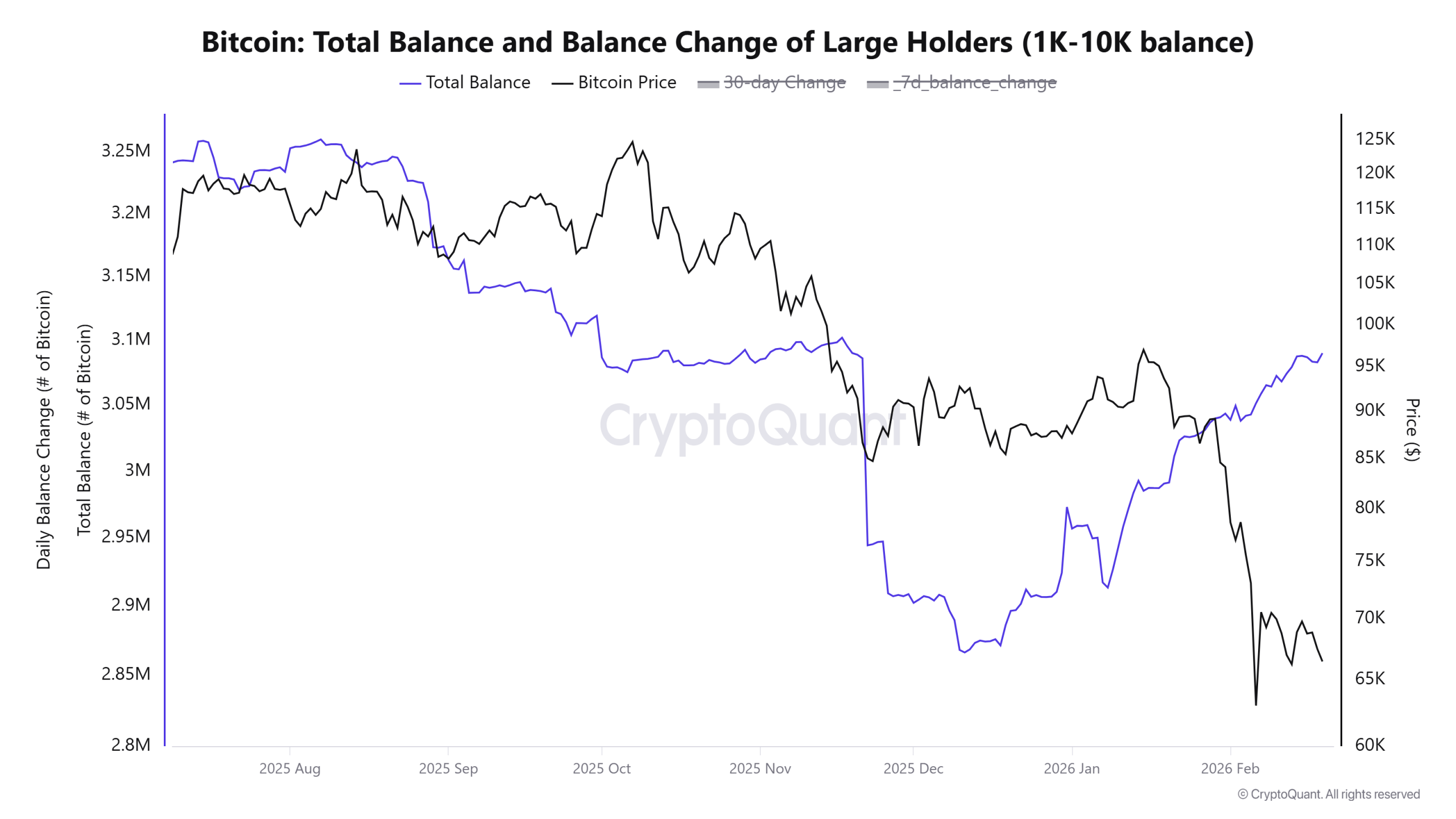

Bitcoin Whales Rebuild Reserves With 236K BTC in 90-days

Large Bitcoin (BTC) holders have steadily increased their holdings in recent months, with the total balance climbing back to levels last seen before the October 10, 2025, market crash.

At the same time, crypto exchange data shows whale-related outflows averaging 3.5% of exchange-held BTC over a 30-day rolling period, the highest since late 2024.

BTC whale reserves return to pre-October peak

Bitcoin wallets or “whales”, holding between 1,000 and 10,000 BTC, have rebuilt reserves over the past three months. The cohorts increased their total balance to 3.09 million, from 2.86 million BTC on Dec. 10, 2025, a 230,000 BTC addition that restores their balance to pre-October 2025 levels.

Crypto analyst ‘Caueconomy’ said the full drawdown in whale reserves has been reversed over the past 30 days with the accumulation of 98,000 BTC. The broader distribution phase began in August 2025 (after BTC hit $124,000), after which Bitcoin struggled to sustain a rally significantly higher.

BTC spot market data supports the recovery. Throughout 2026, the average BTC order size has ranged between 950 BTC and 1,100 BTC, the most consistent stretch of large-ticket activity since September 2024.

Similar clusters appeared during the February–March 2025 correction. During that phase, retail orders accounted for the majority of activity, while large blocks appeared more intermittently and in smaller clusters.

Related: ‘Resilient’ Bitcoin holders defend BTC, but bear floor sits 20% lower: Glassnode

BTC exchange flows spike to 14-month highs

CryptoQuant analyst Maartunn reported $8.24 billion in whale BTC exchange flows moved into Binance over the past 30 days, marking a 14-month high. Retail flows reached $11.91 billion and have flattened over the same period. The retail-to-whale ratio now sits at 1.45, and it continues to drop as the larger-size deposits increase.

Parallel to these inflows, Glassnode data shows gross exchange whale withdrawals averaging 3.5% of total exchange-held BTC supply over a 30-day period, the strongest pace since November 2024.

Based on current exchange balances, that translates to roughly 60,000–100,000 BTC in withdrawals over the past month.

While gross inflows into exchanges have also increased, the elevated withdrawal ratio suggests that much of that incoming BTC is being offset by strong outbound transfers, leaving net exchange balances relatively stable.

Related: Quantum fears aren’t behind Bitcoin’s 46% drop, says developer

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

BTC volatility spikes as price slides from $85k to $60k

Summary

- BTC fell from about $85k to $60k before stabilizing near $66k, while March 2026 options IV spiked from just above 40% to nearly 65% then eased back toward 50%.

- Matrixport flags extreme pessimism, shrinking open interest, and persistent outflows as traders cut “tail risk” hedges and overall positioning, leaving liquidity and participation thin.

- The firm notes that high volatility, muted price sensitivity, and low liquidity have historically preceded strong upside moves in crypto, especially when macro conditions are quietly improving.

Crypto asset management company Matrixport stated in its latest research note that cryptocurrency markets are approaching a critical turning point, according to a report released by the firm.

The report indicated that a sharp decline in Bitcoin (BTC) led to a rapid increase in implied volatility in the options market, followed by a partial pullback. Bitcoin’s price briefly dropped sharply before stabilizing at a lower level, according to Matrixport’s analysis.

During the same period, the implied volatility of March 2026 expiry options climbed from approximately 40 percent to 65 percent, the report stated. The rebound indicated strong investor demand for hedging against downside risks during the decline, Matrixport noted. The subsequent drop in volatility to around 50 percent suggested that excessive “tail risk” hedges were gradually unwinding and short-term pressure had eased somewhat, according to the firm.

Matrixport stated that the market remains in a high-volatility environment. The report noted that investor sentiment is extremely pessimistic and liquidity continues to flow out of the market. Total position size has significantly decreased as traders reduce their hedging positions against collapse scenarios, weakening market participation, according to the analysis.

The report highlighted that historically, this type of combination—high volatility, low sensitivity, and decreased liquidity—has often preceded strong upward movements in cryptocurrency markets. Matrixport also noted that while there are signs of partial improvement in macroeconomic conditions, the lack of a clear reaction from cryptocurrency prices may not continue for long, according to the firm’s assessment.

Crypto World

Specialized AI detects 92% of real-world DeFi exploits

A purpose-built AI security agent detected vulnerabilities in 92% of exploited DeFi smart contracts in a new open-source benchmark.

The study, released Thursday by AI security firm Cecuro, evaluated 90 real-world smart contracts exploited between October 2024 and early 2026, representing $228 million in verified losses. The specialized system flagged vulnerabilities tied to $96.8 million in exploit value, compared with just 34% detection and $7.5 million in coverage from a baseline GPT-5.1-based coding agent.

Both systems ran on the same frontier model. The difference, according to the report, was the application layer: domain-specific methodology, structured review phases and DeFi-focused security heuristics layered on top of the model.

The findings arrive amid growing concern that AI is accelerating crypto crime. Separate research from Anthropic and OpenAI has shown that AI agents can now execute end-to-end exploits on most known vulnerable smart contracts, with exploit capability reportedly doubling roughly every 1.3 months. The average cost of an AI-powered exploit attempt is about $1.22 per contract, sharply lowering the barrier to large-scale scanning.

Previous CoinDesk coverage outlined how bad actors such as North Korea have begun using AI to scale hacking operations and automate parts of the exploit process, underscoring the widening gap between offensive and defensive capabilities.

Cecuro argues that many teams rely on general-purpose AI tools or one-off audits for security, an approach the benchmark suggests may miss high-value, complex vulnerabilities. Several contracts in the dataset had previously undergone professional audits before being exploited.

The benchmark dataset, evaluation framework and baseline agent have been open-sourced on GitHub. The company said it has not released its full security agent due to concerns that similar tooling could be repurposed for offensive use.

Crypto World

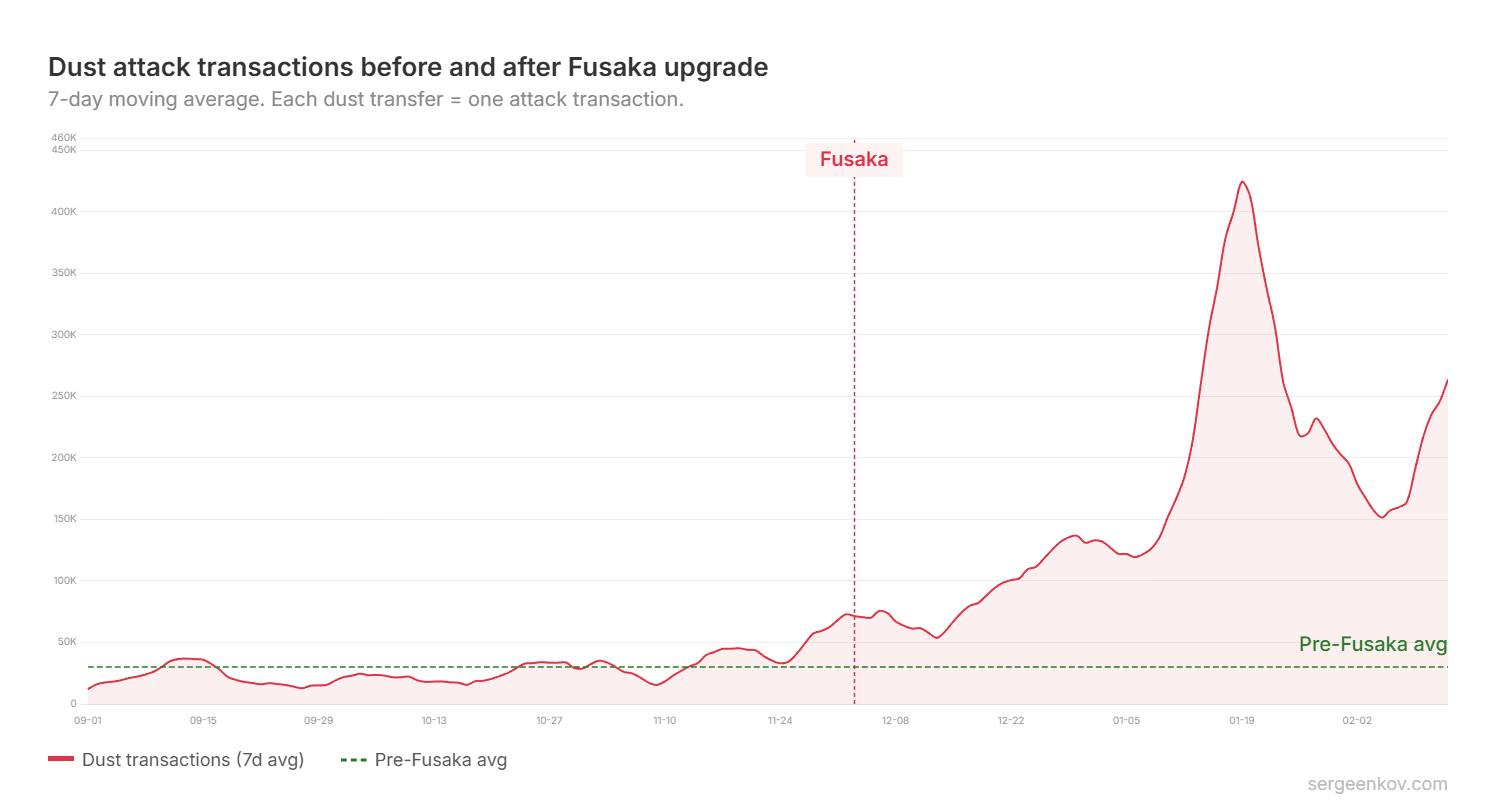

Fusaka Upgrade Fuels Record Address Poisoning on Ethereum

Lower gas costs have turned Ethereum into a playground for mass address poisoning, with scammers hitting thousands of wallets daily.

Ethereum has spent years trying to fix high fees, and recent upgrades finally made transactions cheaper. But while they solved one problem, they may have opened the door to another.

Leon Waidmann, head of research at Lisk, noted in an X post on Wednesday, Feb. 18, that network activity is booming, with stablecoin volume hitting $7.5 trillion in a single quarter while transaction fees stayed under a dollar.

“Record usage. Record cheap. At the same time. The biggest divergence between fundamentals and price in all of crypto right now,” he noted.

But the growth may hide a more alarming reality. A recent study by blockchain researcher Andrey Sergeenkov finds address poisoning attacks surged significantly after the December Fusaka upgrade, which cut gas fees sixfold and made spam attacks cheap enough to scale.

Address poisoning works by sending tiny transfers from addresses that look like the victim’s real contacts. If the victim copies the wrong address from their history, funds get stolen. Sergeenkov says attackers treat this like a lottery, sending millions of cheap transactions in the hope of a few big payoffs.

Unintended Consequences

Before Fusaka, attackers were sending roughly 30,000 dust transactions per day, according to Sergeenkov’s analysis of 101 tokens between Sept. 1, 2025, and Feb. 13 this year.

But after the upgrade, lower fees made mass poisoning viable in a way that wasn’t possible before, and daily dust transactions jumped to 167,000, peaking at about 510,000 in one day in January.

In just over two months after Fusaka, victims lost more than $63 million, 13 times the $4.9 million lost in a comparable prior period, the data shows.

“There is nothing wrong with lowering fees, but the security problems that cheap transactions amplify should have been addressed before the upgrade. When the Ethereum Foundation claims it is building trillion-dollar security, user safety must be the strictest priority over growth metrics,” Sergeenkov writes.

Sergeenkov noted that a single transfer accounted for a large share of the post-Fusaka losses, when attackers stole $50 million in USDT on Dec. 19, 2025. Even leaving that out, total losses still came to $13.3 million, 2.7 times higher than the pre-Fusaka period, he concluded.

Crypto World

Dutch Authorities Call on Polymarket Arm to Cease Activities

The prediction market’s Dutch arm, Adventure One, allegedly offered illegal bets, including on elections in the Netherlands.

The Netherlands Gambling Authority said it imposed a penalty on prediction markets platform Polymarket’s Dutch arm, Adventure One, for offering gambling to residents without a license.

In a Tuesday notice, Dutch authorities ordered the Polymarket company to “cease its activities immediately,” or face up to $990,000 in fines. According to authorities, Adventure One was in violation of Dutch law for offering illegal bets, including those on local elections, and the company had not responded to requests to address these activities.

”Prediction markets are on the rise, including in the Netherlands,” said the Netherlands Gambling Authority’s director of licensing and supervision, Ella Seijsener. “These types of companies offer bets that are not permitted in our market under any circumstances, not even by license holders.”

Polymarket and other platforms offering event contracts on prediction market platforms face similar scrutiny in the United States, where many individual state authorities have filed lawsuits over sports gambling. However, the chair of one of the federal financial regulators, the Commodity Futures Trading Commission, said on Tuesday that he would defend the agency’s “exclusive jurisdiction” over prediction markets, criticizing state-level action.

Related: Polymarket’s lawsuit could decide who regulates US prediction markets

Cointelegraph reached out to Polymarket for comment, but had not received a response at the time of publication. The company’s chief legal officer, Neal Kumar, said on Feb. 9 that Polymarket “welcome[s] dialogue with other states while the federal courts” consider the issue of jurisdiction in the US.

Dutch tax on crypto passes House of Representatives

The Polymarket crackdown in the Netherlands came within a week of the country’s House of Representatives advancing a proposal to introduce a 36% capital gains tax on investments that would likely include cryptocurrencies. If passed by the Dutch Senate and signed into law, it could take effect as early as 2028.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech6 days ago

Tech6 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports4 days ago

Sports4 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video19 hours ago

Video19 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Tech4 days ago

Tech4 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 days ago

Business3 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video4 days ago

Video4 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech3 days ago

Tech3 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World7 days ago

Crypto World7 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports2 days ago

Sports2 days agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment2 days ago

Entertainment2 days agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business3 days ago

Business3 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World24 hours ago

Crypto World24 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market

-

NewsBeat6 days ago

NewsBeat6 days agoUK construction company enters administration, records show

-

Politics4 days ago

Politics4 days agoEurovision Announces UK Act For 2026 Song Contest