Crypto World

Why Coinbase Users Haven’t Got Super Bowl Payouts

Coinbase is facing mounting criticism from users after many participants in its Super Bowl “Big Game Challenge” prediction market contest reported delayed or missing payouts, even after qualifying for shares of the advertised Bitcoin prize pool.

Community complaints and technical issues highlight the growing pains of prediction markets as they surge in popularity while confronting regulatory, operational, and infrastructure challenges.

Sponsored

Sponsored

Coinbase Payout Issues Highlight Prediction Markets’ Growing Pains

On Reddit and other forums, users described confusing and frustrating experiences with the payout process. Reportedly, some users correctly predicted outcomes in the Big Game but “still haven’t been paid.

Others reported winnings showing briefly in their account balances before disappearing without explanation, or payouts reflected in USD without transferability or access.

Amidst these frustrations, some are calling the situation a “rug pull,” claiming Coinbase’s app initially confirmed a win after five correct picks, the threshold for eligibility, only for a later email to declare they had not won.

“According to the Coinbase app, I had won the Big Game Predictions with 5 correct predictions with $5 bet on each prediction. It told await my payout. However, I just received an email from Coinbase stating that I did not win. Does anyone else feel like this was a rug pull or a scam in some way? They said.

However, support responses seen in some threads indicate that rewards are being held until all prediction markets and mail‑in entries are settled, in line with the contest’s official rules.

Coinbase has previously said winners will receive Bitcoin rewards directly into their accounts by February 23, 2026.

Sponsored

Sponsored

However, the lack of transparency and account migrations has frustrated users trying to confirm settlement status.

“We completely understand how important this is to you. Verified winners will receive their prize directly into their Coinbase account. The prize amount will be a share of $1,000,000 in Bitcoin, divided equally among all winners. Prizes are expected to be fulfilled no later than February 23, 2026,” Coinbase explained.

Infrastructure Strains, Regulatory Hurdles, and the Rising Stakes for Crypto Prediction Markets

The timing of these complaints coincides with broader strains in crypto-linked prediction markets. Partner platform Kalshi, which provides the backend for Coinbase’s event contracts, suffered deposit and transaction delays during the Super Bowl due to overwhelming traffic.

“Kalshi does all this ad investment just for their app, not to let you deposit on Super Bowl Day, sounds about right,” one user lamented.

Sponsored

Sponsored

Kalshi co-founder Luana Lopes Lara acknowledged slowdowns but assured users that funds were “safe and on the way.

These operational stretches highlight how infrastructure designed for everyday trading may struggle with spikes tied to major events.

Similar technical pressure was observed across the industry on prediction markets during the championship. This suggests systemic scalability challenges for platforms offering event contracts under high demand.

The Coinbase backlash arrives amid a broader regulatory and legal battleground. State gaming regulators, such as the Nevada Gaming Control Board, have sued Coinbase to block its prediction markets. They argue that they constitute unlicensed sports wagering.

These legal actions fuel uncertainty around the regulatory status of event contracts, complicating rollout and user experiences.

Sponsored

Sponsored

Meanwhile, critics from within the crypto community note that prediction markets must mature beyond short-term speculative betting.

Voices like Ethereum co-founder Vitalik Buterin have warned that over-reliance on speculative contracts may create products lacking deeper utility, urging a focus on hedging and risk‑management applications.

The current Coinbase backlash highlights the operational and communication gaps that can accompany rapid product expansion.

Crypto World

Solana Price Prediction: Standard Chartered Cuts 2026 Target, Sees $2,000 by 2030

Standard Chartered just dropped a fear signal on Solana. They cut their 2026 target to $250. But then they doubled down on a bold $2,000 call by 2030.

That is a sharp contrast. Near term pressure. Long term conviction.

The bank sees Solana shifting away from pure speculation toward real utility. That kind of transition is rarely smooth. It can mean volatility now and growth later.

- Target Adjustment: 2026 prediction cut from $310 to $250, citing transitional risks.

- Long-Term Bull: 2030 target set at $2,000, driven by dominance in micropayments.

- Market Signal: Analysts see the shift from memecoins to stablecoins as a key utility driver.

What Standard Chartered’s Revised Targets Mean for Solana

Standard Chartered sees Solana at a turning point. Geoffrey Kendrick, who leads digital asset research at the bank, says SOL is shifting away from its memecoin casino image and moving toward something more serious. More infrastructure. More real finance.

That shift is not frictionless. The revised $250 target for 2026 reflects that transition. Growth is still there, but it may not look like the explosive runs from past cycles.

For retail investors, it is a trade off. The near term upside could be more measured. But the long term foundation looks stronger if real utility keeps building.

Solana Price Prediction: Breaking Down the New SOL Valuations

The roadmap is detailed. Standard Chartered trimmed the 2026 target to $250 from $310, expecting a period of consolidation as activity shifts.

But after that, the projections accelerates. $400 by 2027. $700 in 2028. $1,200 in 2029. And $2,000 by the end of 2030.

The thesis centers on network velocity. Stablecoin turnover on Solana is reportedly 2 to 3 times higher than on Ethereum, which makes it well suited for fast, low value transactions. That kind of throughput is what long term valuation models are leaning on.

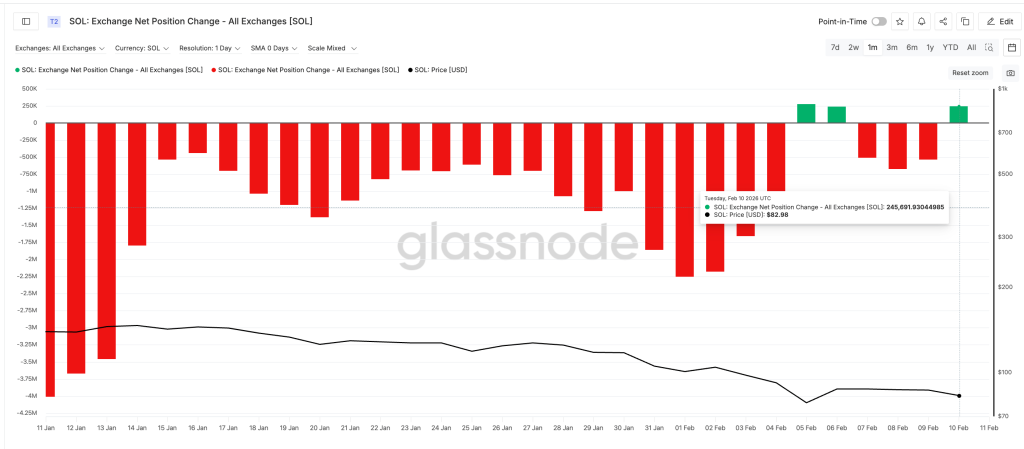

Solana coins have continued to leave exchanges. Historically, that kind of outflow points to accumulation. So even with a short-term downgrade, some players appear to be positioning for the bigger picture.

The post Solana Price Prediction: Standard Chartered Cuts 2026 Target, Sees $2,000 by 2030 appeared first on Cryptonews.

Crypto World

How Quantum Computing May Be Impacting Bitcoin’s Valuation

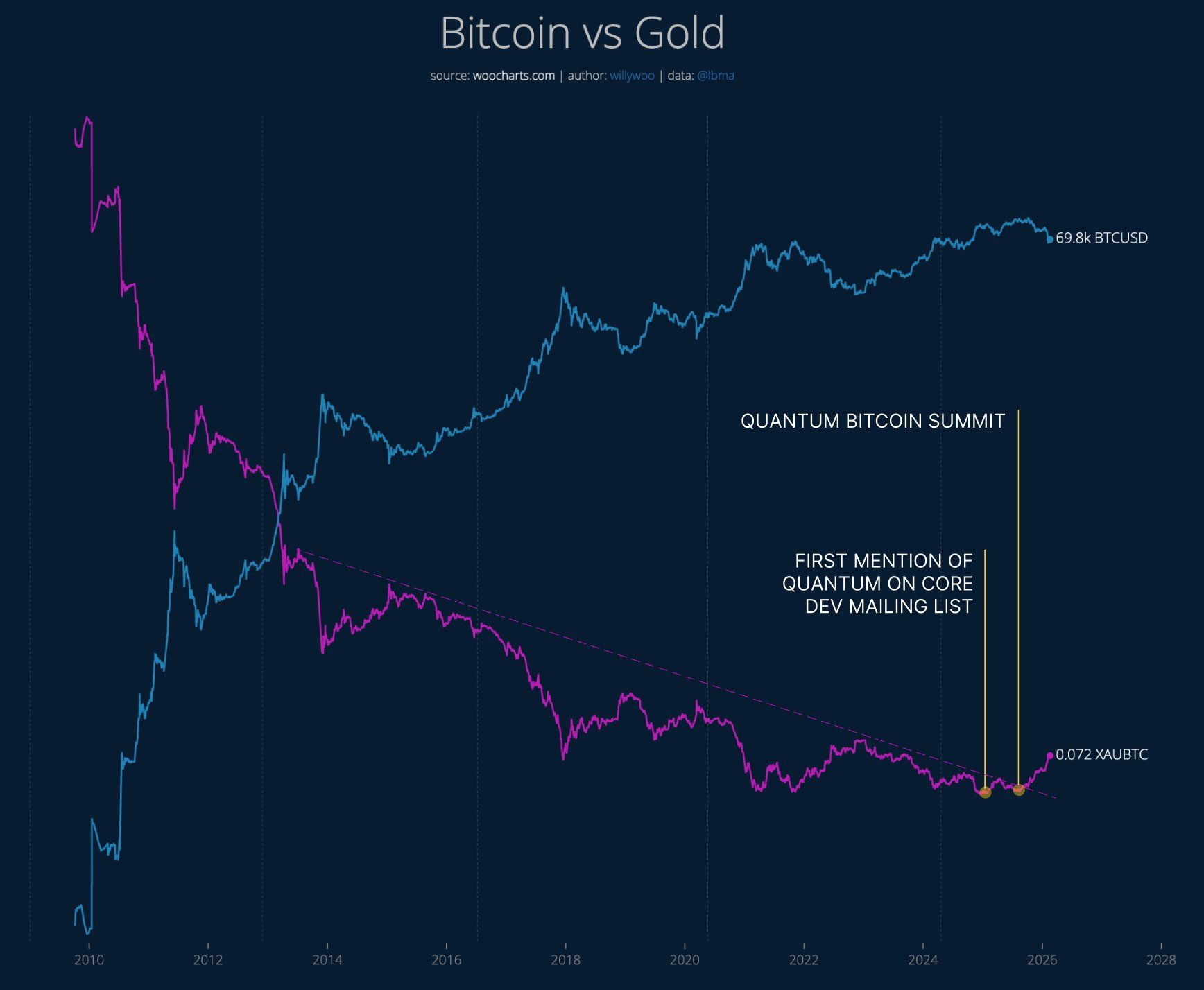

Quantum computing risks are weighing on Bitcoin’s (BTC) relative valuation against gold, according to analyst Willy Woo.

The development of quantum computing has spread concerns across the tech and financial sectors, as future breakthroughs could potentially undermine current encryption standards. Although such capabilities are not considered imminent, the long-term threat has raised questions about Bitcoin’s security model and how markets price that uncertainty.

Sponsored

Sponsored

Has Quantum Computing Entered the Bitcoin Valuation Equation?

Woo argued that Bitcoin’s 12-year outperformance relative to gold has broken, marking a significant structural shift. He pointed to the rising market awareness of quantum computing risks as a reason behind this shift.

“12 YR TREND BROKEN. BTC should be a valued a LOT HIGHER relative to gold. Should be. IT’S NOT. The valuation trend broke down once QUANTUM came into awareness,” Woo said.

Bitcoin’s security relies on elliptic curve cryptography (ECDSA over secp256k1). A sufficiently advanced, fault-tolerant quantum computer running Shor’s algorithm could theoretically derive private keys from exposed public keys and compromise funds associated with those on-chain addresses.

Such technology is not yet capable of breaking Bitcoin’s encryption. Nonetheless, a key concern, Woo argues, is the potential reactivation of an estimated 4 million “lost” BTC. If quantum breakthroughs made those coins accessible, they could re-enter circulation, effectively increasing supply.

Sponsored

Sponsored

To illustrate the scale, Woo explained that corporations following MicroStrategy’s 2020 playbook and spot Bitcoin ETFs have accumulated approximately 2.8 million BTC. The possible return of 4 million lost coins would exceed that total, equivalent to roughly eight years of enterprise-level accumulation at recent rates.

“The market has started pricing in the return of these lost coins ahead of time. This process completes once the Q-Day risk is off the table. Until then, BTCUSD will price in this risk. Q-Day is 5 to 15 years away… that’s a long time trading with a cloud over its head,” he emphasized.

He acknowledged that Bitcoin would likely adopt quantum-resistant signatures before any credible attack becomes feasible. However, upgrading cryptography would not automatically resolve the status of these coins.

“I’d say it’s 75% chance that lost coins will not be frozen by a protocol hard fork,” the analyst remarked. “Unfortunately the next 10 years is when BTC is most needed. It’s the end of the long term debt cycle, it’s where macro investors and sovereigns run to hard assets like gold to shelter from global debt deleveraging. Hence gold moons without BTC.”

Woo’s analysis does not suggest that quantum attacks are imminent. Instead, it positions quantum computing as a long-term variable factored into Bitcoin’s relative valuation, particularly in comparison to gold.

Meanwhile, Charles Edwards, founder of Capriole Investments, offered a complementary perspective on how quantum risk may be influencing market behavior. According to Edwards, concerns surrounding the quantum threat were likely a key factor that drove Bitcoin’s price lower.

The quantum threat is also shaping real portfolio moves. Jefferies strategist Christopher Wood reduced a 10% Bitcoin allocation in favor of gold and mining stocks, citing quantum concerns. This highlights that institutional investors see quantum computing as a significant risk, not a remote one.

Crypto World

Ether steadies after $540 million sell wave while altcoins lag: Crypto Markets Today

The crypto market remains under pressure on Monday despite U.S. equity futures rising by around 0.25% since midnight UTC.

Bitcoin trades at $68,710, having lost 0.1%. Altcoins such as HYPE, ZEC and XMR are down by more than 3%.

Ether is one of Monday’s outliers, rising by 0.43% since midnight as it claws its way back to $2,000 after a grueling weekend selloff was spurred by selling pressure from trader Garrett Jin.

Onchain data shows a wallet attributed to Jin deposited more than $540 million worth of ether to Binance over the weekend, leading to a disproportionate rise in sell volume compared with other exchanges.

That pressure translated into oversold conditions that ultimately set the scene for Monday’s recovery.

Gold is changing hands at $5,000 on Monday, down from its Jan. 29 peak of $5,600 but outperforming silver and crypto, which are down by 36% and 21% respectively over the same period.

U.S. markets are closed on Monday due to a public holiday.

Derivatives positioning

- The crypto futures market continues to see capital outflows, with notional open interest (OI), or the dollar value of total open or active contracts, dropping to $98 billion.

- De-risking is seen across the board, with OI falling 1% and 2.7% in bitcoin and ether futures, respectively, over 24 hours. XRP, DOGE, SUI and ADA saw declines of 6% or more.

- OI in futures tied to gold token XAUT rose 8% as traders continued to deploy capital in traditional assets.

- BTC and ETH’s 30-day implied volatility has reversed the massive pop from annualized 50% to nearly 100% earlier this month, when prices crashed. The reversal indicates a massive pricing out of volatility risks, supporting the case for price recovery.

- The spread between ether and bitcoin implied volatility indexes is beginning to widen, indicating expectations for bigger swings in ether.

- Funding rates for several alternative tokens, such as XRP, TRX, DOGE and SOL, remain negative, indicating a trader preference for bearish, short positions. If the market remains resilient, these bears may feel compelled to square off their bets, potentially leading to a “short squeeze” higher.

- SOL futures on CME show an annualized premium near zero, a sign of buy-side pressure fading fast. BTC and ETH futures are trading with slight premiums.

- On Deribit, someone paid $3 million in premium for the $75,000 strike bitcoin call option. The massive flow likely represents a bullish bet on the market.

- Still, put options tied to BTC and ETH remain pricier than calls across all time frames, a sign of lingering downside concerns.

Token talk

- The altcoin market experienced a familiar, low-liquidity drift lower on Sunday before a slight recovery on Monday morning.

- Popular memecoin is down by more than 10% in the past 24 hours but has steadied since midnight UTC, while XRP has risen by 1% by midnight despite losing 8% of its value since Sunday morning.

- Layer zero (ZRO) continues to lose momentum after its early February rally, falling by more than 34% over the past five days including a 10% drawdown in the past 24 hours. The plummet comes after the introduction of a native blockchain in collaboration with Wall Street veterans Citadel Securities and DTCC.

- The heavily bitcoin-weighted CoinDesk 5 (CD5) Index rose by 0.38% since midnight UTC while the altcoin-dominated CoinDesk 80 (CD80) lost 0.17% over the same period, demonstrating relative altcoin weakness.

Crypto World

4 Economic Triggers That Could Shake Bitcoin in Days

Bitcoin is entering a pivotal macro week as it hovers near $68,600 on February 16, 2026. After a volatile start to the year, including a sharp retracement from 2025 highs above $126,000, markets remain highly sensitive to US economic data.

Tariff tensions, sticky inflation, and the Federal Reserve’s decision to pause rate cuts have kept risk assets on edge. With US markets closed Monday for Presidents’ Day, liquidity is thinner than usual, a factor that could amplify volatility once major data begins midweek.

US Economic Data Crypto Traders Must Watch This Week

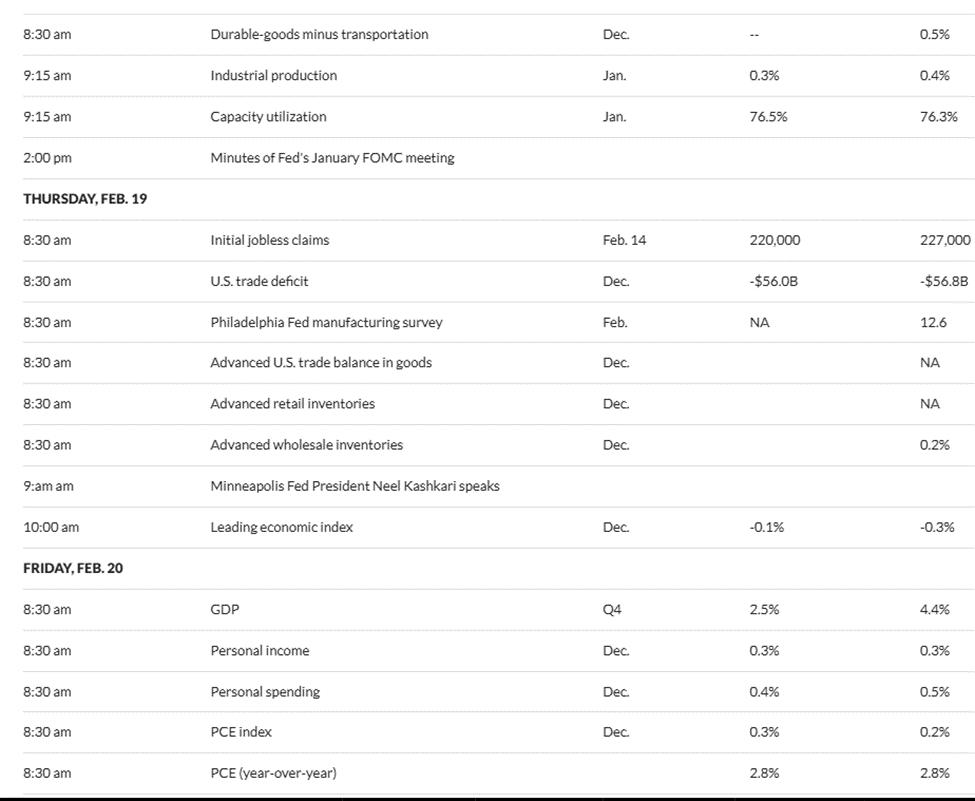

Traders are focused on four key releases: the January FOMC minutes on Wednesday, initial jobless claims on Thursday, and Friday’s Q4 GDP revision alongside December PCE inflation.

Sponsored

Sponsored

According to CME FedWatch data, markets are pricing just 9.8% odds of a March rate cut, reflecting skepticism that easing is imminent.

In this environment, even modest surprises could determine whether Bitcoin tests $70,000 resistance or revisits the $60,000 support zone.

FOMC Minutes

The release of the January FOMC (Federal Open Market Committee)minutes will likely set the week’s tone.

The Fed held rates steady at 3.50%–3.75% during its last meeting, signaling caution amid resilient growth and persistent services inflation.

FOMC minutes on Wednesday will provide deeper insight into policymakers’ internal debates, particularly around inflation risks, labor strength, and tariff-related pressures.

A hawkish tone emphasizing sticky inflation or upside risks could reinforce “higher for longer” expectations. Historically, similar signals have triggered 3–5% Bitcoin pullbacks within 24 hours as Treasury yields rise and liquidity expectations tighten.

Conversely, any language suggesting balanced risks or growing concern over slowing growth could revive rate-cut speculation.

Sponsored

Sponsored

In holiday-thinned trading conditions, even subtle dovish cues may be enough to push Bitcoin toward $70,000.

Initial Jobless Claims

Thursday’s jobless claims report offers a real-time snapshot of labor market health, a core pillar of the Fed’s dual mandate.

Consensus expects roughly 220,000 new filings for the week ending February 14, down from 227,000 previously.

A reading below 210,000 would reinforce labor resilience and reduce the likelihood of near-term easing. That outcome could pressure Bitcoin 1–3% lower as markets recalibrate rate-cut expectations.

On the other hand, claims above 230,000 would raise concerns about softening employment conditions. In past cycles, weaker labor prints have boosted risk assets on the assumption that the Fed may pivot sooner. Such a scenario could lift Bitcoin 2–4% as easing bets increase.

With BTC consolidating between $68,000 and $69,000, this release may serve as a bridge between Wednesday’s Fed insight and Friday’s inflation data.

Sponsored

Sponsored

Q4 2025 GDP (Final Revision)

Friday’s final Q4 GDP revision is expected to show +2.5% annualized growth, a significant step down from the initial +4.4% estimate.

A downside surprise below 2.3% would reinforce slowdown narratives and potentially boost Bitcoin 3–6% as markets price in earlier policy relief. Softer consumer spending, which accounts for roughly 70% of GDP, would be closely watched.

However, a print above 2.7% could complicate the outlook. Strong growth may delay easing, reinforcing “higher for longer” expectations and weighing on crypto markets.

Bitcoin remains highly correlated with equities during major macro releases. Strong growth combined with persistent inflation has historically triggered short-term BTC pullbacks.

PCE & Core PCE

The week’s most important catalyst arrives with December’s PCE inflation report, the Fed’s preferred inflation gauge.

Expectations call for +0.3% month-over-month increases in both headline and core PCE, with year-over-year readings around 2.8–2.9%.

Sponsored

Sponsored

A cooler-than-expected 0.2% MoM print would signal further disinflation progress. That outcome could meaningfully increase the probability of a rate cut and spark a 4–8% Bitcoin rally, potentially pushing prices decisively above $70,000.

But a hotter print above 0.3% would reinforce sticky inflation concerns, likely triggering 3–5% downside pressure as yields climb and easing hopes fade.

Core PCE, which strips out food and energy, will carry particular weight for policymakers and traders alike.

From Fed messaging to labor resilience, growth revisions, and inflation data, each release feeds directly into expectations for 2026 monetary policy.

With Bitcoin stabilizing near $68,600 but still well below its 2025 highs, the market remains acutely sensitive to liquidity signals.

Dovish surprises across the board could reignite risk appetite and drive a breakout toward $70,000 and beyond. Hawkish data, however, may deepen the correction toward $60,000–$65,000.

Crypto World

How Has X Money Helped DOGE Regain Momentum in February?

By mid-February, discussions about Dogecoin (DOGE) had become noticeably more active. DOGE holders expect the meme coin to stage a strong recovery after losing more than 75% of its value since last year.

Several catalysts have fueled this renewed optimism. The key question remains whether these factors are strong enough to drive a sustained price rebound.

Sponsored

Elon Musk’s Influence Over DOGE Is Making a Comeback

Data from LunarCrush, a social intelligence platform for crypto investors, show that mentions of Dogecoin increased by 33.19% over the past month compared with the previous month.

This unusually strong rise indicates that community interest in the meme coin has returned in force.

LunarCrush reports that discussions have focused on DOGE’s technical analysis, Elon Musk’s influence on the token, and the possibility of deeper integration of DOGE into X’s ecosystem.

Charts show that DOGE-related topics began trending upward after February 12. On that same day, Elon Musk revealed that X Money had entered internal testing with X employees. The company expects a limited rollout to users within the next one to two months.

Sponsored

DOGE holders expect X Money to accept DOGE for payments. Their expectations stem from Musk’s previous references to DOGE as an example for micropayments.

On February 14, Nikita Bier, Head of Product at X, announced that the platform will soon allow users to trade cryptocurrencies directly from their timelines through clickable “Smart Cashtags.”

“X is reportedly in internal testing for stock and crypto trading, sparking speculation about Dogecoin and $XRP integration. Analysts suggest Dogecoin could reach $1 or $2 quickly, with recent social posts highlighting potential price pumps and Elon Musk’s influence.” LunarCrush reported.

Price Rebounds

Although these arguments remain speculative and lack any official confirmation, DOGE’s price rebounded following these developments.

Sponsored

Data from TradingView shows that DOGE climbed from $0.09 to above $0.11 before correcting to around $0.10.

Analyst Daan Crypto Trades predicts that DOGE could reclaim the $0.16–$0.17 range in the short term. This level aligns with the 200-day moving average (MA200).

Sponsored

The recent recovery has strengthened short-term bullish sentiment. However, several structural concerns continue to cloud the long-term outlook.

Recent ETF data highlights ongoing weakness in institutional demand. The DOGE Spot ETF has recorded zero net inflows since the beginning of February. This stagnation reflects limited interest from institutional investors.

Since the launch of DOGE ETFs in the United States, total net assets across these funds have reached only $8.69 million. This figure remains modest compared to other major crypto ETFs.

Dogecoin’s unlimited supply model also presents a structural challenge. The network mints approximately 5 billion new DOGE each year. This continuous issuance raises concerns about the preservation of long-term value.

Crypto World

How to Spot and Avoid Cyber Scams During the 2026 Winter Games

Editor’s note: As the 2026 Winter Olympics attract millions of fans worldwide, cyber crooks look to exploit hype and distraction. This editorial spotlights practical, action‑or‑action guidance from Kaspersky to recognize and avoid scam attempts around tickets, merchandise and streaming. The aim is to empower readers to verify sources, keep personal data secure, and rely on official channels during the events. The content below complements the press release by summarizing key takeaways and security best practices for attending, watching or engaging with the Games online.

Key points

- Buy tickets only from official channels and confirm via the official Olympics platform.

- Stick to legitimate streaming services and trusted broadcasters; verify HTTPS and avoid unverified sites.

- Avoid counterfeit merchandise by purchasing only from official stores or partner retailers.

- Don’t click unsolicited emails, posts, texts, or ads offering free tickets or cheap streams.

- Rely on a trusted security tool such as Kaspersky Premium to block dangerous sites and card-skimming scripts.

Why this matters

During a global event that unites fans from around the world, the risk of cyber fraud rises in tandem. This guidance helps fans protect personal and payment information, avoid losing money on fake tickets, fake merch, and bogus streams, and enjoy the Games with greater confidence. By sticking to official sources and trusted channels, readers reduce exposure to fraud and support a safer online fan experience.

What to watch next

- Monitor official Olympics channels for ticket availability and official merchandise.

- Verify streaming sources and ensure secure payments on trusted platforms.

- Be cautious of unknown shops; buy only from confirmed official stores or partner retailers.

- Stay alert for phishing attempts and rely on security advisories from trusted providers.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

How to spot and avoid cyber scams during the 2026 Winter Competitions

The 2026 Winter Olympic Games are in full swing, captivating sports fans worldwide. However, the Games also serve as an opportunity for scammers to strike with different kinds of cyber fraud. Kaspersky has identified some of the key scams targeting fans right now – these are centered on fake tickets, merchandise and streaming access.

Ticket fraud

Fake ticket schemes rank among the most damaging scams hitting sports fans. With sports venues drawing huge crowds, attackers push bogus “tickets” through phishing sites that mimic official sellers to harvest payment info. Official sources stress that tickets are sold exclusively through the authorized Olympics platform, and third-party brokers or resale sites (outside any official resale channel) are fraudulent.

A fake ticket website

Bogus merchandise traps

Fans rushing to buy authentic sports competition items – clothes, souvenirs or event-specific collectibles – are prime targets. Attackers launch multiple counterfeit online shops that may use official logos, post convincing photos and fabricate glowing reviews to appear legitimate. Victims pay, then get nothing – or have their card details stolen for later fraud.

Fake streaming offers

Attackers create deceptive websites imitating broadcasters, promising “cheap,” “exclusive,” or even “free” ways to catch winter competition events live – from snowboard cross to curling finals. Users pay input card details expecting instant access, only to lose their money and expose financial data for theft or redirects to more scams when they hit “play.”

Scam page of “free” streaming service

“While global competitions bring together people from different countries for the ultimate sports festival, they also draw fraudsters eager to cash in on the hype. Whether through phony ticket portals, imitation merchandise sites or bogus streaming links, these schemes are designed to look completely genuine. The best defense for sports fans is to pause, double-check every source and stick strictly to official, trusted channels before entering any personal or payment information,” notes Anton Yatsenko, web content expert at Kaspersky.

Here are the key ways to protect yourself during sports competitions:

- Purchase tickets exclusively from official channels. Skip any third-party sellers and always confirm via the official competition website.

- Stick to legitimate streaming services and trusted broadcasters. Verify HTTPS security, check reviews and never submit payment info on unverified or pop-up sites.

- Be cautious with merchandise vendors, avoid deals on “exclusive” or heavily discounted competition-branded items from unknown shops – they often deliver fakes, nothing at all or steal your details. Buy only from confirmed official stores or partner retailers.

- Don’t click on unsolicited emails, social media posts, texts or ads offering free tickets, cheap streams, special giveaways, or “urgent” competition updates.

- Rely on a trusted security tool like Kaspersky Premium, which actively blocks dangerous websites, phishing attempts, malicious ads and card-skimming scripts in real time to safeguard your information.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com

Crypto World

Solana Price Analysis Flags Big Risk After 20% DEX Volume Drop

The Solana price is under pressure after failing to break a key resistance level. Over the past 24 hours, SOL has dropped 5.4%, extending its rejection near the $89 zone. But the price rejection did not happen in isolation.

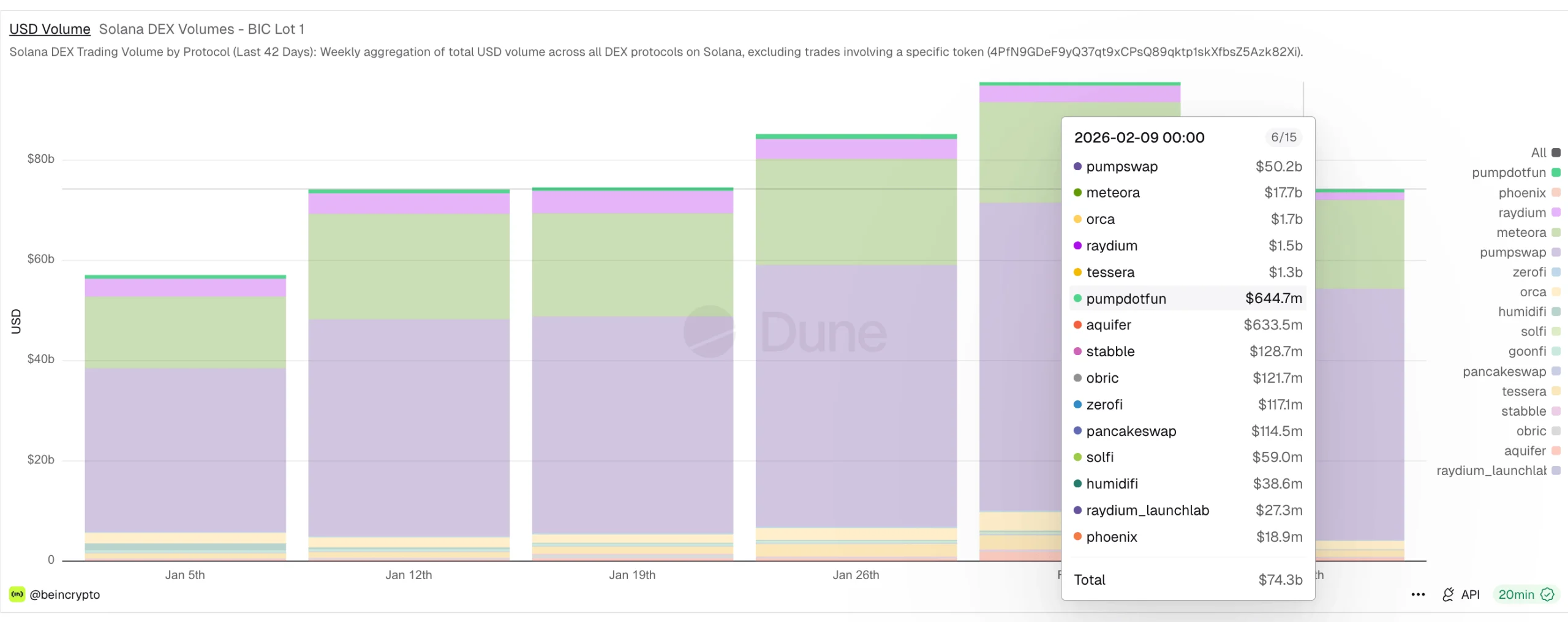

Exclusive Dune dashboard data shows Solana’s DEX volume fell sharply last week, possibly weakening buyer conviction and triggering selling from some of the network’s strongest holders. This combination could now play a decisive role in Solana price prediction over the coming weeks.

Sponsored

Sponsored

Solana DEX Volume Drops Over 20% as RSI Confirms Price Weakness

BeInCrypto’s exclusive Dune dashboard data shows Solana’s weekly DEX trading volume dropped from $95.6 billion in the week ending February 2 to $74.3 billion in the week ending February 9. This marks a sharp decline of $21.3 billion, or over 20%, in just one week.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

DEX volume measures how much actual trading activity is happening on Solana’s decentralized exchanges. When volume rises, it signals strong participation and demand. This drop happened at a critical time.

On the 12-hour chart, Solana’s price attempted to break above the $89 resistance level highlighted last week but failed. At the same time, the Relative Strength Index (RSI), which measures buying and selling momentum, formed a higher high while price formed a lower high between February 2 and February 15.

This is called a hidden bearish divergence. It signals that although momentum appears to improve, the underlying price strength is weakening. The divergence confirmed exactly when Solana failed to clear $89. The weak DEX participation helps explain why. With fewer traders entering the market, the bounce lacked the strength needed to break resistance.

This is an important signal for Solana price prediction. Without strong trading activity, rallies become harder to sustain.

Sponsored

Sponsored

Long-Term Holders Begin Selling as Conviction Weakens

The drop in DEX activity coincided with a major shift in holder behavior. Some of Solana’s most important investor groups began reducing their holdings, per the HODL Waves metric, which partitions holders by time held. The biggest warning comes from long-term holders who held SOL for three to five years.

Their share of supply dropped from 9.77% on February 8 to 7.28% now. This represents a decline of 2.49 percentage points, or about 25.5%.

These holders are considered the strongest hands in the market. They usually sell only when confidence weakens significantly. Their selling adds meaningful supply and reduces market stability. At the same time, mid-term holders who held SOL for three to six months also reduced their positions.

Sponsored

Sponsored

Their share fell from 24.21% on February 3 to 20.78% now. This marks a decline of 3.43 percentage points, or roughly 14.2%. The timing is critical. Most of this selling happened between February 3 and February 9, the same period when DEX volume collapsed.

This shows a clear connection. As trading activity weakened, conviction holders began exiting. This behavior plays a major role in Solana’s price prediction going forward. When long-term holders sell, recoveries often slow down or fail completely.

It also explains why the Solana price failed to sustain its recent bounce that started on February 6. The overlap between falling DEX participation and long-term holder selling also explains why the Solana price failed to break above $89.

Solana Price Now Tests Critical $84 Support Level

The Solana price is now approaching one of its most important support zones. The key level to watch is $84.

Sponsored

Sponsored

Cost basis heatmap data shows that between $83 and $84, more than 6.44 million SOL were accumulated. This makes it one of the strongest near-term support zones because many investors may try to defend their positions.

If Solana price holds this level, stabilization could follow. But if SOL breaks below $84, the outlook changes quickly.

The first downside target sits at $79. Below that, the next major support appears at $59, which aligns with the 0.618 Fibonacci retracement level. This would represent a potential 30% decline from recent highs. This makes the current zone critical for Solana price prediction.

On the upside, recovery requires reclaiming the $89 resistance level. A confirmed breakout above $91 would strengthen bullish momentum and open the path toward $106. Until then, the price remains vulnerable.

The recent drop in Solana DEX volume, combined with long-term holder selling and resistance rejection, shows weakening conviction. Unless long-term buying activity returns and key resistance levels are reclaimed, Solana price prediction remains heavily dependent on whether the $84 support can hold or fails in the coming sessions.

Crypto World

Crypto Funds See $173M Outflows As Altcoins Gain Momentum

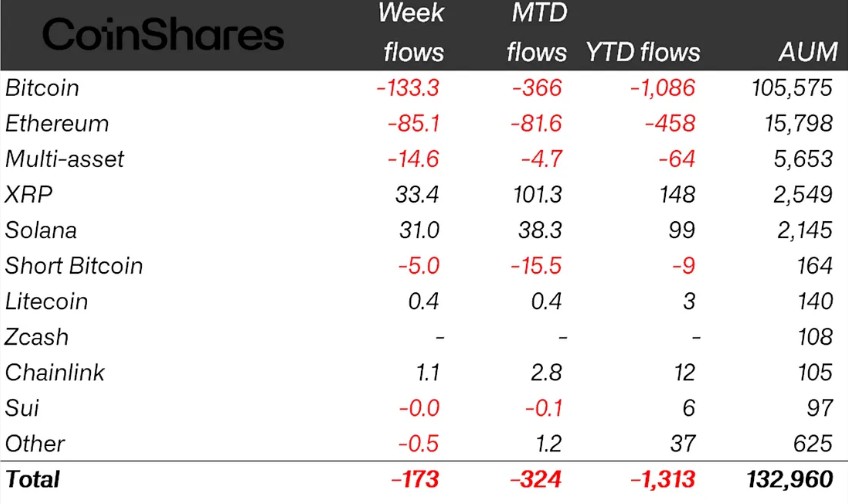

Crypto investment products failed to attract enough inflows last week to reverse negative sentiment and clocked a fourth consecutive week of outflows.

Crypto exchange-traded products (ETPs) recorded $173 million in outflows, following the previous week’s $187 million, according to a CoinShares update on Monday.

Although the last two weeks brought relatively minor losses, total outflows over the past four weeks now amount to about $3.8 billion, while total assets under management (AUM) sit near $133 billion, the lowest since April 2025.

CoinShares’ head of research, James Butterfill, attributed last week’s outflows to broad market negativity and ongoing price weakness. After starting last week at $70,000, Bitcoin (BTC) briefly dropped as low as $65,000 on Thursday, according to Coinbase data.

Bitcoin leads outflows, while XRP and Solana buck the trend

Bitcoin ETPs drove last week’s negative sentiment, with outflows totaling $133.3 million and AUM declining to about $106 billion.

US spot Bitcoin exchange-traded funds (ETFs) painted an even bleaker picture, with outflows approaching $360 million last week, according to SoSoValue data.

Echoing Bitcoin’s trend, Ether (ETH) funds recorded $85 million in outflows, though US spot Ether ETFs saw modest inflows of $10 million.

Related: Trump Media files for two new crypto ETFs tied to Bitcoin, Ether, Cronos

XRP (XRP) and Solana (SOL) ETPs bucked the trend, emerging as the top performers with inflows of $33.4 million and $31 million, respectively.

US crypto products saw more than $400 million in outflows

Butterfill highlighted a significant divergence in sentiment between the US and other regions.

While US crypto investment products saw $403 million in outflows, all other regions recorded sizable inflows totaling $230 million.

Germany, Canada and Switzerland saw the largest gains, with inflows of $115 million, $46 million and $37 million, respectively.

The outflows came amid Standard Chartered analysts officially lowering their 2026 Bitcoin target from $150,000 to $100,000 last week, while forecasting the crypto asset to drop to $50,000 before recovering.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

SOL price prediction as Solana RWA Tokenization value breaks $1.66B record

Solana price is catching its breath after a ferocious multi‑month rally, slipping back toward the mid‑$80s as traders reassess how much upside is left in one of this cycle’s most aggressive beta plays. The pullback is sharp, but it is not disorderly; it looks like a market that simply ran too far, too fast.

Summary

- Solana price slips toward the mid-$80s after an aggressive multi-month run, with YCharts showing a near 56% drawdown from a year ago.

- Polymarket contracts still price meaningful odds of SOL above $160 and even new all-time highs by end-2026, highlighting a wide distribution of outcomes.

- Bitcoin and Ethereum prices frame Solana inside a broader macro risk-on tape, with high Solana volumes keeping liquidity conditions supportive.

Solana price cools, prediction markets stay bold

As of early U.S. trading, Solana (SOL) changes hands around $86.07, down 4.4% on the session, after trading near $90.03 24 hours ago. Perplexity Finance data show a 24‑hour range between roughly $84.41 and $86.57, with spot market cap hovering near $48.55B and volumes around $57.32M. YCharts puts Solana’s daily reference price at $85.94 for February 16, down from $88.16 yesterday and dramatically below roughly $194.43 a year ago, a drawdown of about 55.8%.

Despite that drawdown, prediction markets have not written Solana off. A Polymarket market asking whether Solana will hit a fresh all‑time high by December 31, 2026, prices that probability near 16%, while a separate contract on “What price will Solana hit in 2026?” shows traders assigning roughly 32% odds to SOL trading above $160 before year‑end 2026. In that market, downside brackets such as “↓ 60” and “↓ 40” still command substantial probability, underscoring that “the path to new highs is anything but linear.”

Macro risk lens and wider crypto tape

This recalibration comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $68,000–$69,000, with 24‑hour highs just above $69,000 and lows near $68,150, on roughly $37.8B in trading volume across major BTC/USD venues. Ethereum (ETH) changes hands close to $1,970–$1,975, after printing a 24‑hour high near $2,095.87 and a low around $1,933.97, with market cap near $237B. Solana (SOL) itself trades in the mid‑$80s, with Metamask data putting spot near $85.43 and 24‑hour volumes approaching $9.75B, a sign that “high 24h volume… improves liquidity and reduces slippage for traders.

Solana RWA tokenization efforts intensify

Solana’s RWA tokenization value smashing the 1.66 billion dollar mark reinforces the chain’s narrative as real financial infrastructure, not just a speculative L1, and that matters for SOL’s future pricing power. As more real-world assets settle and trade on Solana, fee revenue, demand for blockspace, and (crucially) the incentive to hold SOL for staking and governance all scale with it, giving fundamentals a chance to catch up with and eventually justify higher valuations in the next risk-on phase.

Crypto World

Can Pi Network price reclaim $0.20 after breaking a key resistance trendline?

Pi Network’s price shot up more than 50% to $0.20 earlier last week before parting with some of its gains and settling lower. Can it reclaim the key psychological figure now that it has confirmed a breakout from a multi-month trendline resistance?

Summary

- Pi Network price briefly rallied to a four-week high of $0.20 last week.

- Pi price action has confirmed a breakout from a multi-week descending trendline support on the daily chart.

According to data from crypto.news, Pi Network (PI) price rose nearly 54% to a four-week high of $0.20 on February 15 before profit taking stirred it back to $0.17 at the time of writing, though it still retains 20% gains over a seven-day period.

The PI network rally came amid investor hype surrounding the project’s upcoming key upgrades for the following months, aimed at building the ecosystem towards a more decentralized network. Notably, the upgrades for its mainnet node operators are part of its transition from version 19 to 22 of the Stellar network to accelerate its vision of decentralization while seeking to optimize performance, better security, and scalability to support long-term network growth for the project.

Another catalyst fueling this uptick is the hype surrounding the first anniversary of its mainnet launch on Feb. 20. Investors often tend to celebrate such milestones by buying more tokens, which can often drive speculative rallies.

Against this backdrop, derivatives data show that the Pi Network token’s funding rate has shifted from negative to positive at press time. This reversal suggests that traders are rotating from bearish to bullish positioning, which typically tends to uplift market sentiment surrounding the associated token.

Additionally, there is a lot of community chatter that the token could be listed on crypto exchange Kraken later this year. Getting listed on a major exchange like Kraken, which has a customer base of millions, could provide a significant boost to its price and overall liquidity.

On the daily chart, Pi Network price has confirmed a breakout of a descending trendline that had been acting as dynamic resistance since late November last year. Breaking above this long-standing pattern indicates that bulls are reclaiming market dominance and appear positioned to drive prices higher in the short term.

Evidence of a burgeoning uptrend is visible across several oscillators, with the MACD lines turning upward to indicate a positive crossover in momentum. This is typically interpreted as a sign that the period of distribution is ending and accumulation has begun.

Validating this transition, the Aroon Up at 92.86% vastly outpaces the 28.5% Down reading, confirming that the bulls have successfully seized control of the price discovery process.

Hence, Pi Network is well-positioned to see a potential rebound to its Feb. 15 high of $0.20. If bullish momentum persists, the rally could extend to its Nov. 28 high of $0.28, which lies 64% above the current price level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

-

Sports4 days ago

Sports4 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

NewsBeat7 days ago

NewsBeat7 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech5 days ago

Tech5 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World6 days ago

Crypto World6 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Tech1 day ago

Tech1 day agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World2 days ago

Crypto World2 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World4 days ago

Crypto World4 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video4 days ago

Video4 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World6 days ago

Crypto World6 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat18 hours ago

NewsBeat18 hours agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World5 days ago

Crypto World5 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat20 hours ago

NewsBeat20 hours agoMan dies after entering floodwater during police pursuit

-

Crypto World2 days ago

Crypto World2 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show