Crypto World

Why is the crypto market down today? (Feb. 19)

The crypto market remained in a downtrend on Thursday, dropping nearly 3% to $2.35 trillion due to a confluence of macroeconomic uncertainty and geopolitical tensions that spooked investors.

Summary

- The latest FOMC minutes report has cast uncertainty regarding rate cuts hurting risk-on sentiment.

- Fears of a full-blown US-Iran war have pushed investors to the sidelines.

- Crypto ETFs recorded billions in outflows over the past weeks.

Bitcoin (BTC), the world’s largest crypto asset, fell 3.5% to around $65,900 before experiencing a partial recovery back above $66,700 at press time. Ethereum (ETH) was down 1.6% after losing the $2,000 key support level, while other major cryptos such as XRP (XRP), BNB (BNB), Solana (SOL), and Dogecoin (DOGE) were also in the red, posting losses between 1% and 4%.

Some of the top laggards of the day were Provenance Blockchain (HASH), Zcash (ZEC), and Memecore (M).

The latest slide triggered a liquidation wave, with the open interest of the total market falling by 0.71%. Data from SoSoValue show that in the past 24 hours, over $224 million worth of positions were liquidated from the futures market, with roughly $164 million coming from long positions.

At the same time, the crypto fear and greed index, a metric investors use to gauge the general sentiment of the market, remained in the extreme fear thresholds.

The crypto market tanked on Thursday after the FOMC minutes report on Feb. 19, which revealed uncertainty over more rate cuts moving into the coming months. This shifting stance could set the Federal Reserve on a direct collision course with President Donald Trump, who has consistently pressured for aggressive rate cuts. It also complicates the path for Trump’s nominee for Fed chair, Kevin Warsh.

According to market predictions platform Polymarket, the odds of no changes in rate cuts for the next FOMC meeting in March have increased to 93% at the time of writing. Cryptocurrency prices have historically fallen back or remained suppressed when the Fed sets a hawkish tone surrounding interest rate policies.

U.S.-Iran war tensions

Investors also remain wary of a potential full-scale war between the United States and Iran. According to recent reports, the United States and Israel are planning a potential joint campaign to target Iran’s nuclear and missile facilities, which could escalate into a weeks-long conflict. Meanwhile, Iran has vowed to retaliate against any strikes on its territory.

When markets enter a period of geopolitical stress, such as an armed conflict, investors often rotate capital to cash and traditional safe-haven assets and, in turn, dump volatile crypto assets. Bitcoin has so far failed to establish a credible safe-haven narrative as it continues to trade as a high-beta risk asset rather than digital gold.

During this latest escalation, the premier cryptocurrency has mirrored the declines seen in tech stocks, struggling to absorb the stress bid that has instead bolstered physical gold and crude oil prices.

Bitcoin ETFs outflows hit 5-week streak

Another layer eroding retail confidence in the crypto market is the lackluster interest shown by institutional investors towards crypto ETFs, specifically majors like Bitcoin and Ethereum ETFs.

Data from SoSoValue shows that the 12 spot Bitcoin ETFs have recorded 5 straight weeks of outflows so far, with the total tally of these net withdrawals standing at over $3.6 billion within the period. Meanwhile, their Ethereum counterparts have posted outflows of over $1.2 billion.

As investor demand in these investment vehicles continues to be sluggish, it removes a key safety net of consistent institutional buying pressure that has historically stabilized prices during periods of high volatility. Without this reliable influx of capital, the market remains more vulnerable to sudden selloffs and the prevailing negative sentiment.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Parsec shuts down after 5 years as crypto volatility claims another platform

Decentralized finance analytics platform Parsec is shutting down after five years, marking the latest casualty in a volatile crypto market that continues to reshape the industry.

Summary

- Parsec shuts down after five years, with its CEO citing shifting market dynamics and declining DeFi leverage following the 2022 crypto collapse and FTX fallout.

- The platform rose to prominence during the 2020–2021 DeFi boom, helping traders navigate major unwind events including Terra, OHM, Wonderland and the 3AC/stETH crisis.

- Parsec’s closure reflects broader strain in the crypto sector, following recent shutdowns of smaller platforms such as Arkham’s exchange and ZeroLend amid persistent volatility and thinning liquidity.

Parsec calls it quits after 5 years

In a post on X, the company said: “After 5 years, Parsec is shutting down. Not how we wanted our story to end, but we are proud of what we built and the value we provided along the way.” The team thanked users who “traversed the ups and downs onchain” with them, calling the journey “quite the ride.”

Parsec’s CEO described the closure as “the end of the road,” adding that “the market zigged while we zagged a few too many times.” The platform began in early 2020 as a side project charting Uniswap v1 activity before evolving into a full DeFi terminal during the 2020 “DeFi summer” and the bull market frenzy of 2021.

The company gained traction during the 2022 market collapse, when major protocols and firms, including Wonderland, OlympusDAO, Terra, and the 3AC/stETH unwind, imploded under extreme leverage. According to the CEO, traders and firms relied on Parsec’s dashboards to navigate cascading liquidations.

However, after the collapse of FTX, on-chain activity shifted. “DeFi spot lending leverage never really came back in the same way,” the CEO wrote, noting that crypto activity “changed hugely” in ways the team struggled to fully anticipate.

While Parsec saw brief spikes of engagement, including during the Friend.tech boom and a high-traffic Polymarket election dashboard, sustained growth proved elusive.

The shutdown reflects a broader trend. Smaller crypto venues and projects have been winding down amid thinning liquidity, shifting user behavior and persistent volatility. Recent examples include Arkham’s exchange closure and ZeroLend’s decision to cease operations after three years, underscoring the harsh operating environment for niche platforms.

Despite Parsec’s closure, its CEO said he remains committed to DeFi’s long-term vision of reinventing finance. “I’m not going anywhere,” he wrote. “Onwards.”

Crypto World

Growth, Challenges, and What’s Ahead

Despite notable advancements, PI has collapsed by almost 95% from its ATH.

The controversial cryptocurrency project Pi Network has been around since 2019, but users had to wait until February 2025 before they could finally trade the native token PI.

Over the past 12 months, the Core Team has rolled out multiple upgrades as the ecosystem has continued to develop. Yet, PI’s price has suffered a steep decline, the project is still grappling with several challenges, and some Pioneers have voiced growing criticism. The key question now is whether the upcoming advancements can trigger a decisive comeback for PI or whether the bears will remain in charge.

Happy First Birthday, PI

Exactly one year ago, Pi Network launched its Open Network. The initiative made PI publicly accessible and enabled exchanges to list it as the first to hop on the bandwagon were Bitget, OKX, and MEXC.

On the debut day, the asset’s valuation varied across platforms, ranging from $1.68 to $1.72. Interest from traders and investors was high over the following days, and PI reached a historical peak of approximately $3 by the end of February last year. Meanwhile, its market capitalization exploded above $18 billion, placing the coin among the 15 largest cryptocurrencies.

However, the peak was short-lived, and PI headed straight south in the following months. Some reasons potentially suppressing the price include ongoing token unlocks, fading interest from market participants, accusations that the project could be a scam, and Binance’s inaction.

The world’s largest crypto exchange was rumored to follow Bitget, OKX, and MEX in listing PI: a move that could lift the token’s value by increasing its liquidity, visibility, and overall legitimacy. It even held a community vote to ask its clients whether they wanted the asset available on the platform. While more than 86% of the participants selected the “yes” option, Binance has yet to honor their wish.

PI has seen sporadic price revivals over the last several months, driven by upgrades announced by Pi Network’s team, but currently trades at around $0.17, representing a staggering 94% decline from the all-time high.

You may also like:

Some of the updates targeted the verification process, which has long been a source of frustration for many users. In September 2025, for instance, the team unveiled Fast Track KYC – a feature that allows Pioneers to participate in the Mainnet ecosystem “earlier than ever before.”

In October, it was revealed that more than 3.36 million additional users had successfully completed the required verification procedures following the release of a system process that conducts vital checks on Tentative KYC cases. Just a few weeks ago, the team unveiled a technical upgrade that should allow multiple Pioneers to pass the Miannet migration. Specifically, they claimed the roughly 2.5 million users who were previously unable to migrate will be unblocked.

Other standout developments over the past 12 months include the launch of Pi Network Ventures (a Pi-related fund targeting $100 millin in investments in innovative startups), the project’s entry into the AI space through Pi App Studio, the introduction of the first Hackathon, and a partnership with CiDi Games to accelerate Web3 gaming engagement.

Most recently, the Core Team disclosed that migration to Protocol v19.6 was successfully completed. “Next up is v19.9 – the final step before v20. Node operators should make sure they’re upgraded and stay tuned for further instructions,” the X post read.

What Lies Ahead?

Many members of Pi Network’s community believe that 2026 could be successful, claiming that something “big” is on the horizon. Some have pointed out March 12 as a key date, as a major upgrade related to the Pi DEX activation is expected to go live then. If confirmed, the launch could play an important role in strengthening user trust and increasing real-world use of PI.

Meanwhile, rumors have circulated that leading exchanges, such as Kraken, may soon offer trading services for the token.

Pioneers are also closely watching March 14 – a date, known across the community as Pi Day due to its symbolic resemblance to the mathematical constant π (3.14). Pi Network expanded its ecosystem on that day in 2025, and it remains to be seen whether a similar move will occur this year.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

‘Bitcoin Going to Zero’ Google Searches Hit Highest Level Since FTX

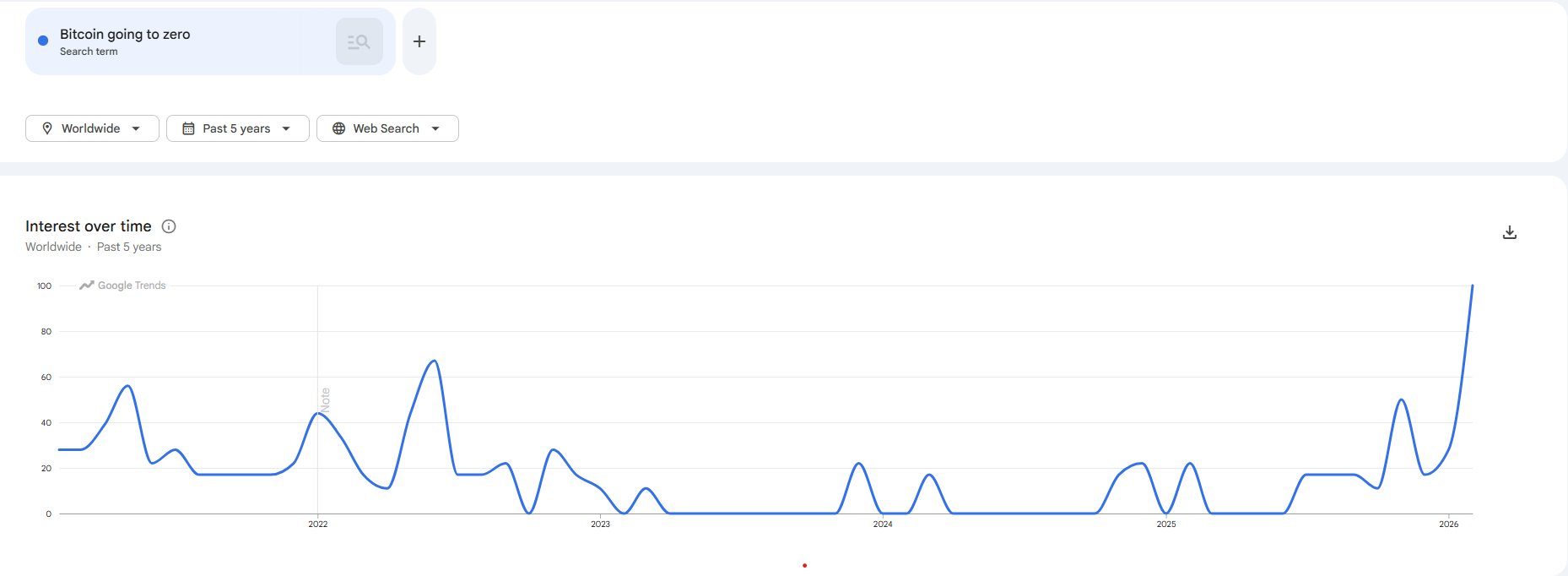

Google searches for “Bitcoin going to zero” have surged to their highest level since the post‑FTX panic in November 2022, according to Google Trends data for the past five years.

The spike aligns with Bitcoin’s latest drawdown from its Oct. 6, 2025, all‑time high near $126,000 to about $66,500 at the time of writing on Thursday, according to data from CoinGecko, leaving the asset almost 50% below its peak.

At the same time, the Bitcoin Fear and Greed Index has plunged into extreme fear around 9, levels previously seen during the Terra ecosystem collapse and the FTX fallout in 2022.

Google Trends shows that worldwide interest in the phrase “Bitcoin going to zero” last hit comparable levels in early November 2022, when FTX froze withdrawals, and Bitcoin (BTC) crashed to around $15,000.

Today’s Bitcoin fears different from 2022

Crypto intelligence platform Perception analyzed narrative intelligence across 650+ crypto media sources and shared its findings with Cointelegraph.

Founder Fernando Nikolic said that fear in 2022 was driven by internal events, such as cascading failures of centralized lenders and one of the industry’s largest exchanges, while today’s fear is “driven by macro fears and being amplified by a single bearish voice.”

Related: Bitcoin passes $69K on slower US CPI print, but Fed rate-cut odds stay low

Nikolic said that Bloomberg’s Mike McGlone has been the loudest single voice driving the “Bitcoin could go to zero (or near-zero)” narrative, and that he has been a “one-man content machine this cycle,” calling Bitcoin to $10,000 on Feb. 3, saying markets were headed for a 2008-style crash and continuously calling for Bitcoin’s decline throughout the past month.

He told Cointelegraph that McGlone is repeatedly amplified by crypto media sites and has “essentially been the go-to bearish quote for the past three weeks.” “This media saturation likely contributes directly to the Google search spike,” he said.

Retail fear lags professional media sentiment

Nikolic said that the actual counterpoint that “nobody is synthesizing” is that, while “Bitcoin to zero” searches are spiking, institutional buyers are accumulating more BTC, pointing to the fact that sovereign wealth funds, such as Abu Dhabi, are increasing their Bitcoin exchange-traded fund holdings, and large corporations like Strategy continue to stack BTC.

According to Perception data, he said, media sentiment bottomed on Feb. 5, but has been recovering for two weeks, while Google “Bitcoin going to zero” searches are peaking now in mid-February.

Related: Willy Woo warns quantum risk is eroding Bitcoin’s edge over gold

Retail fear lags professional media sentiment by about 10-14 days, he said. “By the time the public is most scared, the professional narrative has already started to stabilize. The retail narrative and institutional behavior are moving in opposite directions.”

Macro fears and quantum angst

The surge in “Bitcoin going to zero” searches is also unfolding against a backdrop of record‑high macro anxiety.

The World Uncertainty Index, which counts references to “uncertainty” in Economist Intelligence Unit country reports, is sitting at its highest level in the Federal Reserve Bank of St. Louis (FRED) time series, exceeding the peaks seen around the 2008 global financial crisis and the 2020 COVID‑19 shock.

Research underpinning the index finds that spikes in global uncertainty tend to precede weaker output and slower growth as companies delay investment and hiring.

Quantum fears have also been a persistent background narrative since October 2025, according to Nikolic, but he said that quantum fear spikes alongside price drops, not independently.

“Bitcoin quantum” searches peaked in November 2025 and have been falling steadily since, according to Google Trends.

“It’s an amplifier of existing bearish sentiment, not a standalone driver. The “Bitcoin going to zero” search trend is likely a composite of price-crash fear + quantum existential fear + McGlone-style macro doom, all converging in the same window.”

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

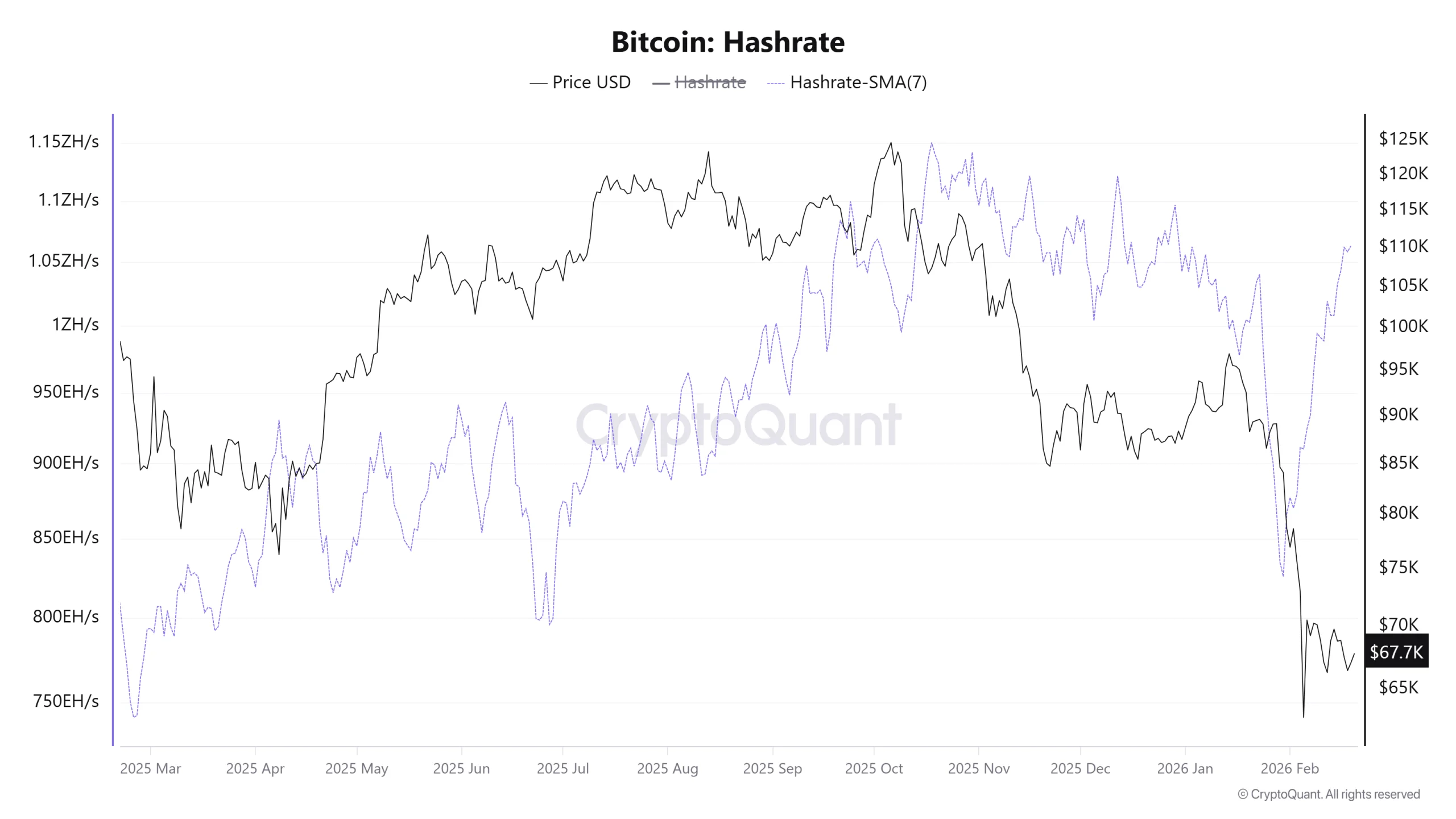

How Bitcoin Hashrate Recovery Mirrors 2021 Rebound Pattern

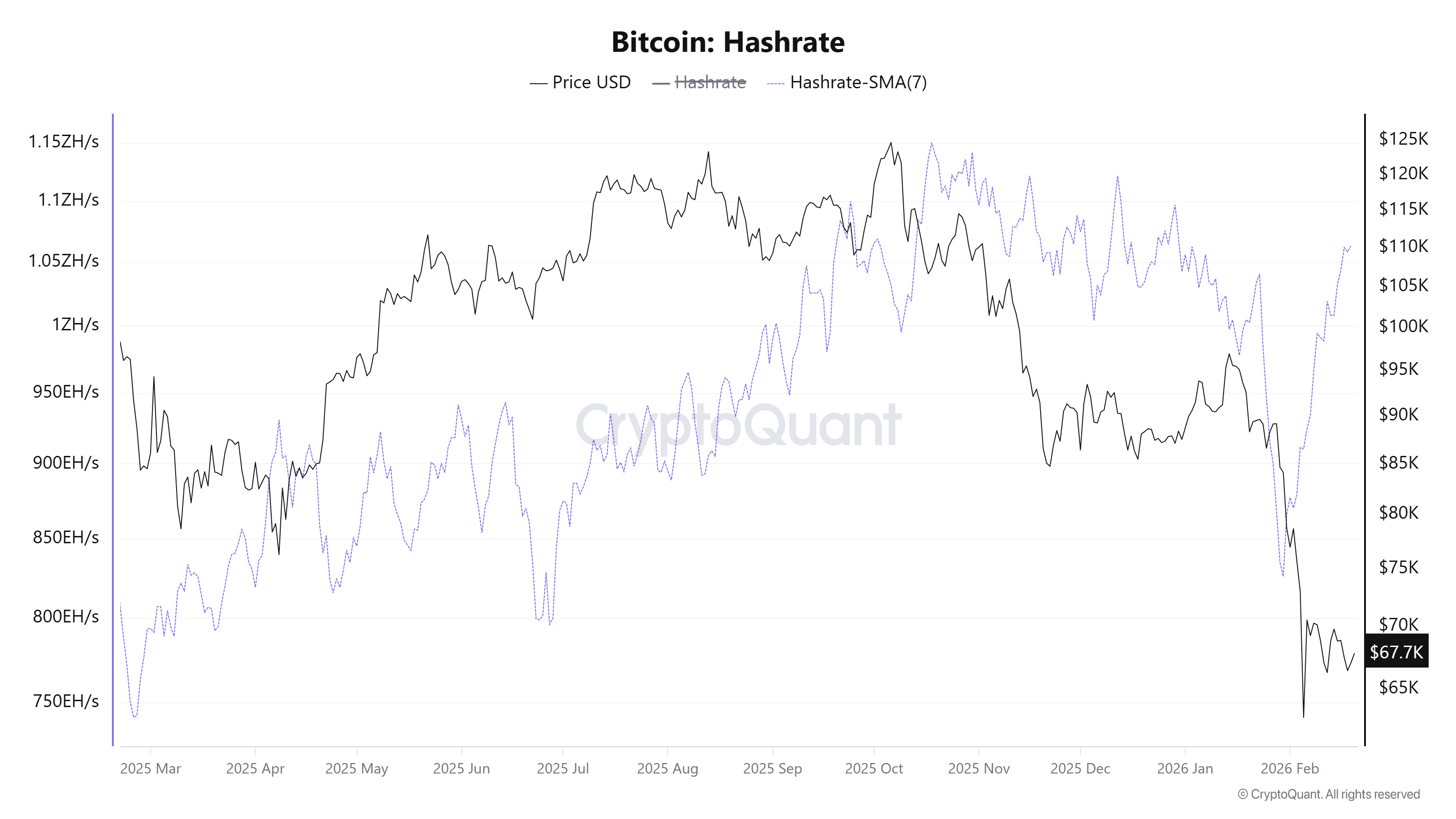

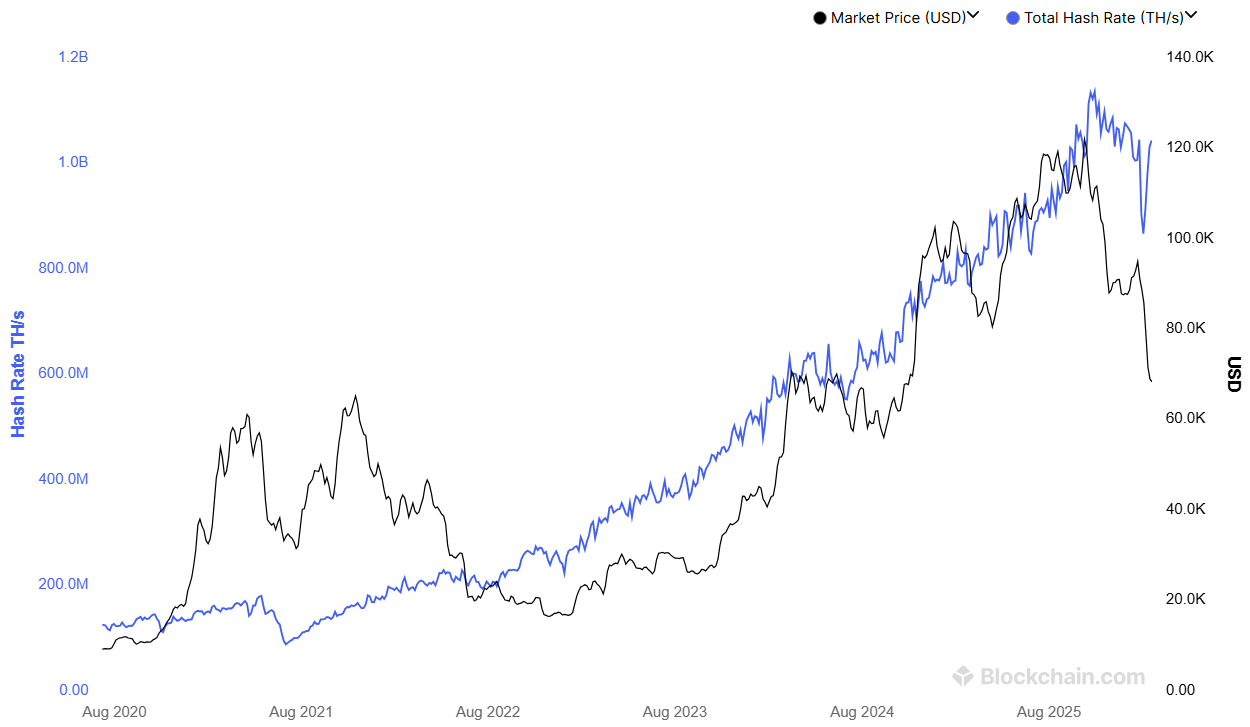

Bitcoin’s hashrate — a key metric that measures the network’s total computational power — recorded a sharp V-shaped recovery in February.

This sudden turnaround has raised hopes that Bitcoin may end its five-month losing streak and make a strong recovery.

Hashrate–Price Correlation Points to a Potential Upside Scenario

A previous report by BeInCrypto noted that Bitcoin’s hashrate suffered a major shock in early 2026. An extreme Arctic cold wave swept across the United States.

Freezing temperatures, heavy snowfall, and surging heating demand strained the national power grid. Authorities issued energy-saving requests, and several regions experienced localized blackouts.

As a result, the network’s hashrate dropped by roughly 30%. Around 1.3 million mining machines went offline, slowing block production.

By February, however, data showed a swift turnaround. Hashrate rebounded from below 850 EH/s to over 1 ZH/s, recovering nearly all of the previous large downward adjustment.

“Bitcoin mining just got ~15% harder, with the largest ever increase in absolute difficulty, completely erasing last epoch’s huge downwards adjustment,” commented Mononaut, a developer at Mempool.

Despite the recovery in hashrate, Bitcoin’s price continues to fluctuate below $70,000 and has not mirrored the same strength. According to the market analytics platform Hedgeye, the cost to mine one Bitcoin in February is approximately $84,000. This suggests that many miners are still operating at a loss.

The rise in hashrate reflects the return of computational capacity. Miners have powered machines back on and appear more optimistic about Bitcoin’s long-term profitability.

Historical data shows that V-shaped recoveries in hashrate often coincide with strong price rebounds.

A notable example occurred in mid-2021. After China imposed a sweeping ban on Bitcoin mining, hashrate plunged by more than 50%, falling from 166 EH/s to 95 EH/s in July. Months later, a V-shaped recovery in hashrate paralleled a powerful price rebound. Bitcoin surged from around $30,000 to above $60,000 by the end of the year.

“Bitcoin network hashrate has sharply recovered after the recent dip, a strong signal that miner confidence remains intact and they are coming back online. Historically, hashrate is a leading indicator during recoveries. Price tends to follow hashrate,” said Satoxis, a Bitcoin OG.

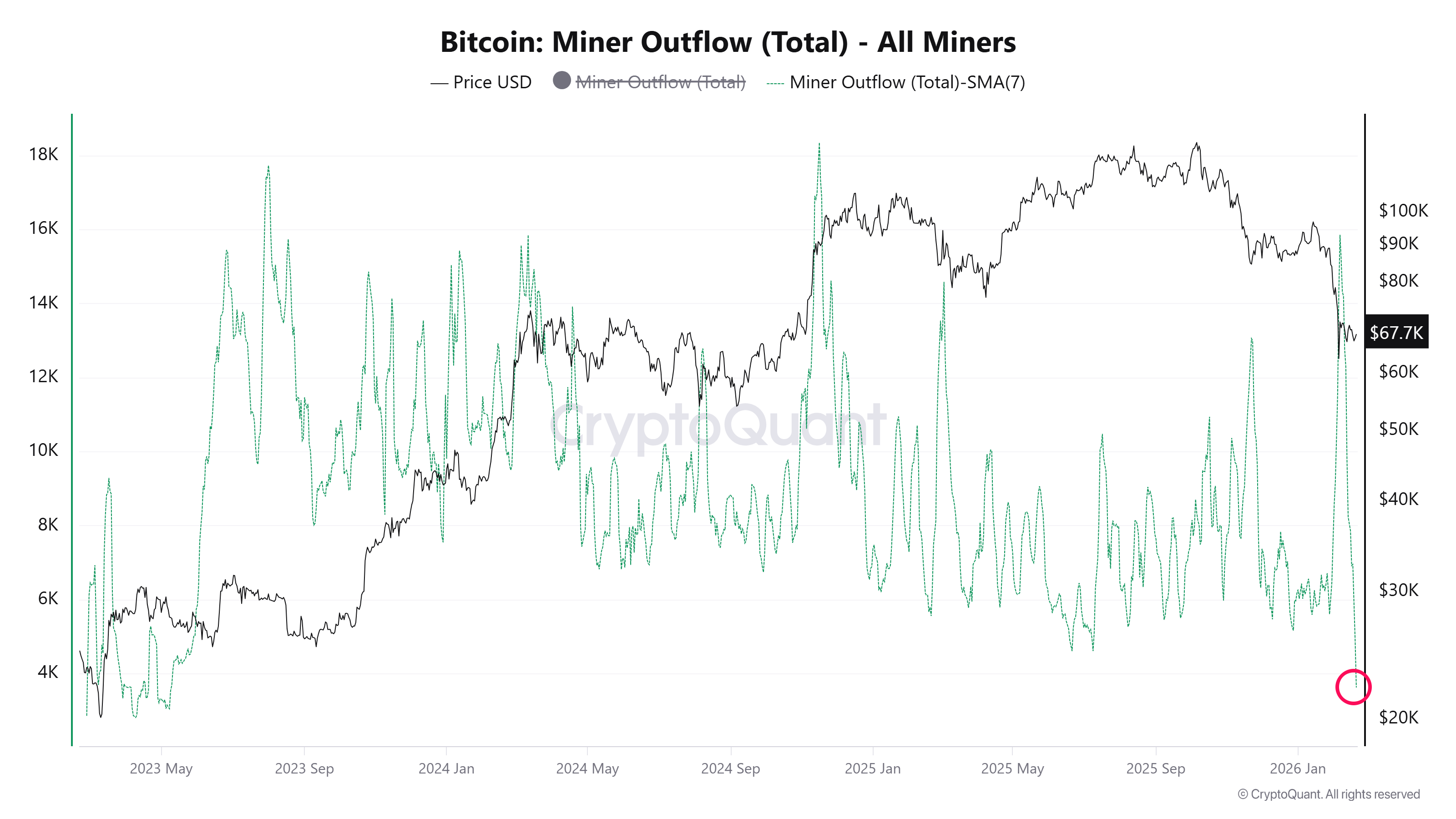

Data from CryptoQuant on Bitcoin Miner Outflow further supports the view that miners expect a price recovery. The 7-day average outflow from miner wallets has fallen to its lowest level since May 2023.

This trend indicates that miners are no longer aggressively selling their holdings. Instead, they appear to be holding in anticipation of a potential rebound.

Additional analysis from BeInCrypto emphasizes that any sustained recovery at this stage requires confirmation through a breakout above $71,693.

Crypto World

Voltage Unveils USD Credit Line Over Bitcoin Rails

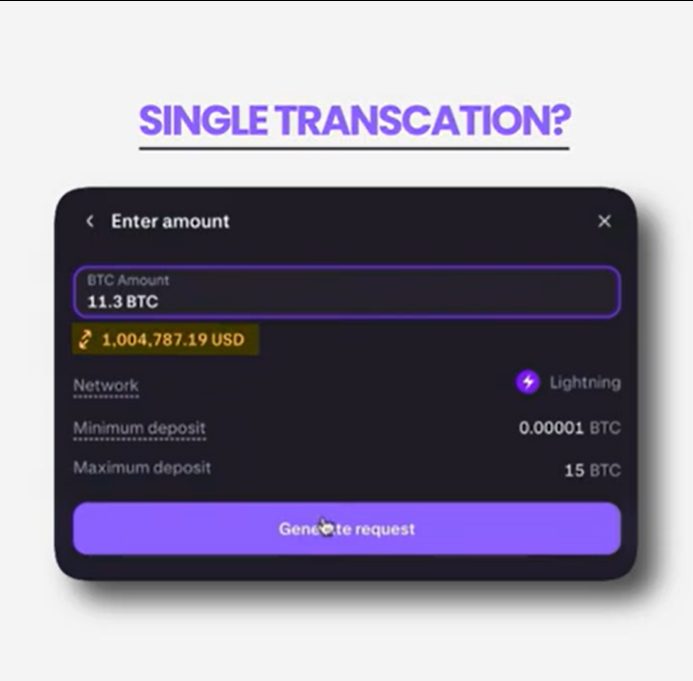

Bitcoin infrastructure company Voltage has announced the launch of Voltage Credit, a programmatic revolving line of credit designed to let businesses send payments with Lightning-style instant finality while still repaying the credit line in US dollars from a standard bank account or in Bitcoin.

In a Thursday release shared with Cointelegraph, the company, which provides enterprise-grade solutions for regulated businesses, said it was targeting chief financial officers and treasurers who wanted “send now, pay later” flexibility on the fastest payment rails available, without having to hold crypto on their balance sheet.

Rather than positioning it as just another Lightning-backed loan, Voltage pitched the product as an embedded piece of the payment flow, and the “first revolving line of credit that delivers instant payment finality and the capability to settle entirely in USD.”

CEO Graham Krizek told Cointelegraph that while players like Stripe and Block blended faster payments with working capital, they didn’t embed a revolving credit facility directly into Lightning payments in the way Voltage does, adding that Stripe did not support Lightning at all.

Related: Stripe-owned Bridge gets OCC conditional approval for national bank charter

In the Block model, he said, Lightning and credit remain separate workflows, whereas Voltage lets businesses originate credit and immediately use it to send or receive Lightning and stablecoin payments in real time, without pre-funding or manual treasury movements.

Underwriting against payment flows, not static BTC collateral

Voltage said it departs from traditional crypto lending by underwriting against payment flows rather than static Bitcoin (BTC) collateral.

Because Voltage already powers the underlying Bitcoin and Lightning infrastructure, it can size and adjust credit limits based on the volume a business processes through its platform.

“Voltage Credit is the lender of record in our platform,” Krizek said, noting that the company originated all loans itself and was not relying on a bank, card network or third-party fintech to fund the lines.

Krizek said the platform carries a 12% annual percentage yield (APY) that accrues daily on outstanding balances, with a flat platform fee design intended to avoid transaction-based pricing that gets more expensive as volumes scale.

Related: Inside the Swiss city where you can pay for almost everything in Bitcoin

He said that revolving lines of credit themselves are not new, but what is new is bringing that “familiar financial construct” into an environment where Bitcoin and Lightning move money instantly and globally.

“We are effectively modernizing the revolving credit model so it operates at internet speed, rather than at the pace of legacy banking and card networks,” he said.

From $1 million pilot to institutional Lightning rails

The launch builds on Voltage’s recent role supporting a $1 million Lightning Network payment between Secure Digital Markets and Kraken on Feb. 5, a pilot that was framed as the biggest publicly reported transaction on the network.

Krizek said that episode was meant to test Lightning’s suitability for institutional-sized flows and that the network “is capable of handling massive payment volumes and is ready for institutional-scale use.”

Voltage Credit is initially available to qualified US‑headquartered businesses, Krizek said, saying the company can currently serve all US states except California, Nevada, North Dakota, Vermont and Washington, D.C., as a registered commercial lender.

Early traction, he added, has come from exchanges, Bitcoin miners, gaming platforms and payment processors looking to reduce idle working capital, avoid forced BTC liquidations and bridge Bitcoin‑denominated revenue with US dollar‑denominated expenses without relying on unpredictable off‑ramps.

The Lightning Network reached an all-time capacity high in December 2025 of 5,606 BTC amid increased adoption from major crypto exchanges and functionality improvements. Demand has stalled somewhat since then, falling to 5,121 BTC as of Monday.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation — Santiment founder

Crypto World

Metaplanet CEO Fires Back at Critics as $1.2 Billion Bitcoin Paper Losses Mount

Metaplanet CEO Simon Gerovich fired back at critics, accusing the Japanese Bitcoin-holding firm of misusing shareholder funds and hiding key disclosures.

Why it matters:

- Metaplanet holds over $1.2 billion in unrealized Bitcoin losses, making transparency around fund use a direct concern for shareholders.

- Allegations of undisclosed borrowing against BTC holdings raise governance red flags for public-company crypto investors.

The details:

- Critics alleged Metaplanet bought BTC at a market top, stayed silent during the drawdown, and borrowed against those holdings without disclosing interest rates or counterparties.

- Gerovich confirmed Bitcoin wallet addresses are publicly listed, with a live shareholder dashboard tracking holdings in real time.

- Gerovich called September’s purchase price a “local top” but defended a long-term, non-market-timed strategy.

- The company reported 6.2 billion yen in operating profit — up 1,694% year-over-year.

- Gerovich attributed reported accounting losses solely to unrealized mark-to-market BTC fluctuations on unsold holdings.

- Meanwhile, CoinGecko currently tracks Metaplanet’s unrealized BTC losses at over $1.2 billion.

The big picture:

- Metaplanet follows the MicroStrategy playbook — using equity and debt to accumulate Bitcoin as a primary treasury asset.

- Corporate BTC holders now face growing pressure to meet traditional disclosure standards as unrealized losses mount across the sector.

- The allegations expose a structural tension: Bitcoin’s on-chain transparency does not automatically satisfy securities law disclosure requirements.

The post Metaplanet CEO Fires Back at Critics as $1.2 Billion Bitcoin Paper Losses Mount appeared first on BeInCrypto.

Crypto World

Parsec Closes as Crypto Market Remains Volatile

Bitcoin (CRYPTO: BTC) and broader on-chain activity are entering a period of recalibration as Parsec, a five-year-old analytics firm focused on DeFi and NFTs, announces its winding down. Launched in January 2021, Parsec grew alongside a nascent wave of on-chain research and funding from notable industry players, only to find the current market environment diverging from the original playbook. In its X post, Parsec framed the closure as a strategic retreat from a market that “zigged while we zagged a few too many times,” underscoring a misalignment between its niche focus and where the ecosystem has since progressed. The company’s exit comes amid a pronounced shift in on-chain dynamics, with NFT volumes and DeFi activity not repeating the patterns seen during the prior cycle.

Key takeaways

- Parsec—the five-year analytics firm backed by Uniswap, Polychain Capital, and Galaxy Digital—will shut down as it pivots away from DeFi and NFT-centric tracking.

- NFT market data shows a 2025 decline to about $5.63 billion in sales, down 37% from 2024’s $8.9 billion, while average sale prices slid from $124 to $96 per unit (CryptoSlam data).

- The wider crypto sector is watching consolidation unfold, with Entropy also closing and returning capital to investors, signaling a shift in how startups scale in a crowded landscape.

- Bitcoin’s price action remains critical context, having fallen roughly 46% from its October peak to around $67,246, amid evolving risk sentiment and macro headwinds.

- Industry voices, including Nansen’s Alex Svanevik, reflect on a period of transformation as the market recalibrates, with a focus on sustainability and product-market fit rather than rapid expansion.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Negative. BTC’s extended drawdown in 2025 reflects broader risk-off dynamics that accompany sector consolidation and shifting on-chain activity.

Market context: The downturn in specialized on-chain analytics and the push toward consolidation align with a broader transition in crypto markets, where venture-backed experimentation is giving way to more measured, winner-take-more dynamics amid tightening liquidity and cautious investor sentiment.

Why it matters

Parsec’s closure marks a notable inflection for a segment of the crypto ecosystem that has long relied on on-chain signals to interpret market health, DeFi leverage trends, and NFT activity. The firm’s exit signals more than just a single business story; it points to a shift in how participants measure value in a landscape that has undergone seismic changes since 2022. Parsec’s avatar—once backed by industry heavyweights such as Uniswap, Polychain Capital, and Galaxy Digital—illustrates how capital and talent have redistributed as the market evolves. The decision to close underscores the reality that post-FTX market dynamics altered leverage structures in DeFi, making it harder for a highly specialized analytics company to sustain a product-market fit built around a subset of the ecosystem.

From a broader market perspective, NFT volumes and average selling prices have cooled. CryptoSlam’s data for 2025 show sales of approximately $5.63 billion, a notable drop from 2024’s $8.9 billion, while average prices slipped from about $124 to $96. This shift compounds the pressure on firms whose value proposition rested on analyzing a thriving NFT market and high-velocity NFT trades. The collision of shrinking volumes with a more selective investor appetite for specialized analytics platforms helps explain why Parsec chose to exit now rather than pursue a protracted pivot.

Industry observers view Parsec’s shutdown through a consolidation lens. A related thread in the sector notes Entropy’s closure and the return of funds to investors, a move often framed as a pragmatic recentering rather than a collapse. The narrative of consolidation gained further traction when a prominent crypto executive predicted that the space would see more M&A activity, with larger players acquiring smaller projects in the months ahead. This theme—fewer, larger, better-capitalized entities—stands in contrast to the earlier cycle’s fragmentation and rapid experimentation. It’s a shift that could influence who becomes a dominant source of on-chain insights and market data in the next phase of the market cycle.

Price dynamics provide a practical backdrop to these structural shifts. Bitcoin’s drawdown—from an October all-time high near $126,100 to roughly $67,246—frames the risk-off mood permeating markets. Such price action often correlates with reduced appetite for experimental or niche analytics services, especially those tied to discretionary sectors like DeFi lending or NFT markets. In parallel, search interest around Bitcoin’s prospects—“Bitcoin going to zero”—has surged to levels not seen since the post-FTX panic in late 2022, underscoring the fragility of investor confidence when prices retreat and headlines crowd the narrative. These macro and on-chain signals together illuminate why Parsec’s departure feels consequential beyond a single corporate exit.

As the industry recalibrates, voices from within the space emphasize a pragmatic pivot toward sustainability and broader product-market fit. Alex Svanevik, the CEO of on-chain analytics platform Nansen, described Parsec as having “a great run,” signaling respect for the team’s contributions even as the market moves in a different direction. The liquidity and talent reallocation that typically accompany consolidation can seed new, more resilient offerings in the analytics arena, but the transition is unlikely to be seamless or immediate for any single player. In the near term, investors and builders will watch for how competing firms adapt—whether through product diversification, partnerships, or strategic acquisitions that promise more scalable data insights than what was historically possible in a market with highly idiosyncratic cycles.

What to watch next

- Follow any formal wind-down announcements or final reports from Parsec to understand remaining liabilities, data access terms, and customer transitions.

- Monitor announcements of consolidation among on-chain analytics and data firms, including potential acquisitions or fundraisings by rivals seeking scale.

- Track NFT market metrics and DeFi activity in early 2026 to gauge the pace of recovery or further slowdown in the segments Parsec focused on.

- Observe Bitcoin price action and macro risk sentiment for signals about market-wide demand for research and data services.

- Stay attentive to ETF inflows/outflows and regulatory developments that could influence institutional demand for crypto data and analytics tools.

Sources & verification

- Parsec X post announcing the shutdown and its remark about market dynamics.

- CryptoSlam NFT market data showing 2025 sales and average sale prices.

- Entropy shutdown announcement and refund details.

- CNBC interview with a crypto industry executive discussing consolidation and M&A expectations.

- Bitcoin price data from CoinMarketCap for context on the 2025 price trajectory.

Market reaction and implications for on-chain analytics

Bitcoin (CRYPTO: BTC) has traded amid a broader re-pricing of risk as analysts weigh the implications of Parsec’s exit and the shifting demand for specialized on-chain insights. The closure of a five-year analytics firm highlights a market recalibration where niche services tied closely to NFT and DeFi activity face a tougher environment than during the early expansion phase. Parsec’s investors—Uniswap, Polychain Capital, and Galaxy Digital—were early testaments to the crypto market’s willingness to fund data-centric ventures that promised deeper market clarity. Their involvement underscored a belief that on-chain metrics could shape investment and risk decisions in a highly volatile domain, but the current cycle’s transformation has altered the economics of those bets.

The NFT space, once a robust growth engine for on-chain signals, has cooled considerably. CryptoSlam’s figures for 2025 illustrate a market maturing past its frenetic growth phase, with sales down and average prices eroding. That reality, in turn, compresses the value proposition of analytics platforms whose strengths rested on measuring and interpreting rapid shifts in NFT demand and liquidity. Parsec’s exit reflects the market’s demand for flexibility and resilience—an emphasis on broader data products and sustainable business models rather than a singular focus on a high-volatility segment.

At the same time, the crypto industry’s consolidation thesis is gaining more empirical ballast. The Entropy shutdown and similar moves paint a portrait of a sector moving away from the diffuse, experimental setup of the last cycle toward a more concentrated ecosystem dominated by fewer, larger participants. This trend does not guarantee immediate profitability for survivors, but it does shape the kind of partnerships and products that can scale in a market characterized by tighter liquidity and more selective investor scrutiny. The market context, including price trajectory and investor sentiment, will continue to influence which firms succeed in delivering credible, actionable on-chain intelligence in a rapidly evolving landscape.

Ultimately, Parsec’s departure underscores a broader truth about crypto analytics: success increasingly hinges on being able to deliver durable, product-market fit across multiple market regimes. The coming months will reveal whether the remaining players can fill the void left by Parsec by expanding their data pipelines, strengthening distribution channels, and coordinating more closely with institutional stakeholders seeking clear signals in a market defined by swift regime shifts.

https://platform.twitter.com/widgets.js

Crypto World

Sharplink refreshes brand as ETH staking reaches $1.7 billion

Sharplink, a leading advocate for Ethereum-focused digital asset treasuries, announced a series of major milestones on Thursday that signify its rapid ascent in the institutional finance space.

Summary

- Sharplink now holds 867,798 ETH (valued at $1.72B), making it one of the largest corporate Ethereum holders in the world.

- The company stakes nearly 100% of its holdings, having already generated 13,615 ETH in rewards that accrue directly to stockholder value.

- The appointment of Steven Ehrlich (formerly of Forbes) is designed to amplify Sharplink’s mission as the primary “productive treasury” vehicle for Ethereum exposure.

The company revealed that institutional ownership has surged to 46%, a record level that CEO Joseph Chalom attributes to the firm’s disciplined, “productivity-first” approach to Ethereum.

As of February 15, 2026, Sharplink’s treasury holds 867,798 ETH, valued at approximately $1.72 billion. Unlike many digital asset holders that keep assets in “cold storage,” Sharplink has distinguished itself by staking nearly 100% of its holdings.

This strategy has generated over 13,000 ETH in staking rewards since June 2025 alone. “Institutions know they can trust us to keep generating long-term value,” Chalom stated, emphasizing that the firm continues to grow its ETH concentration per share regardless of market volatility.

“Ethereum with an edge”: Sharplink rebrands

To match its growing institutional profile, the company launched a comprehensive brand refresh under the tagline “Ethereum with an Edge.”

The rebrand includes a redesigned investor platform and a dedicated Ethereum treasury dashboard, aiming to provide total transparency for stockholders tracking yield and network growth.

Parallel to the visual update, Sharplink is bolstering its intellectual capital with the appointment of Steven Ehrlich as Head of Research and Communications. Ehrlich, a heavyweight in crypto journalism with a pedigree at Forbes and Unchained, will be tasked with clarifying the “Ethereum opportunity” for a broader audience.

By combining massive ETH accumulation with institutional-grade risk management and high-level communications, Sharplink is positioning itself as the primary vehicle for public market investors seeking productive exposure to the decentralized finance (DeFi) backbone.

As the Ethereum ecosystem continues to host the majority of tokenized real-world assets, Sharplink’s “staked treasury” model may become the new blueprint for digital asset corporations.

Crypto World

What Is the PUNCH Meme Coin and Why Is It Surging?

PUNCH, a Solana-based meme coin, has surged more than 80,000% since its launch earlier this month, capturing traders’ attention across the ecosystem.

As its market cap expands and accumulation intensifies, concerns are also mounting. Amid the token’s explosive rally, analysts are highlighting red flags surrounding this new market entrant.

What Is PUNCH Token?

PUNCH is a token inspired by the story of a baby Japanese macaque named Punch and his inseparable plush companion. The token positions itself as a community-driven cryptocurrency built around emotion, comfort, and companionship.

According to details provided on the website, the token has a fixed total supply of 1 billion. The project states that its liquidity has been locked and burned.

It also claims that ownership has been renounced. In addition, the token operates with a 0% tax.

“PUNCH is gearing up to be the MOODENG of 2026,” an analyst wrote.

Solana Meme Coin PUNCH Skyrockets to $30 Million Market Cap

Data from GeckoTerminal showed that the token began trading earlier this month. Momentum accelerated as the story of the baby macaque gained traction across media outlets and social platforms. Over the past week alone, the meme coin has surged 22,290.8%.

During early Asian trading hours today, PUNCH hit an all-time high, with its market cap climbing above $30 million. On CoinGecko, the token emerged as the top daily gainer, posting a 260% increase. It also ranks third among the platform’s top trending cryptocurrencies.

The rally has attracted substantial investor interest. Blockchain tracker Stalkchain highlighted one wallet that accumulated approximately $226,000 worth of PUNCH.

Data from Nansen also revealed that over the past seven days, public figure holdings in PUNCH surged 89.69%. However, smart money and whale holdings have declined.

Crypto Watchers Raise Red Flags Over PUNCH

Several market watchers have raised concerns about the token. Crypto analyst StarPlatinum has alleged that the token shows “multiple signs of coordinated insider control.”

In a post on X, the analyst claimed that the creator wallet, identified as A8Z1ejQGk45EJibBPJviWnM3UvwKSuYun53nSCkWKM52, distributed approximately 100 billion PUNCH tokens, equivalent to 10% of the total supply, soon after the token went live.

According to the analysis, the wallet (A8Z1e) sent 48.2 billion tokens directly to another wallet, CgR8tggfcM8Re5agDY5fsT4pKmqQTzF8vQ7jQknM6iBj. This entity allegedly acted as an intermediary between the creator and several large holders.

Blockchain traces shared in the thread suggest a flow pattern from the creator wallet to the intermediary address, then to large wallets. Among the top linked holders identified:

- Wallet Hbx5PturLVp9F7YYG18jZZSWFTNp9TTSXEJepq6pvSi3 reportedly holds 35 billion PUNCH, or 3.5% of the total supply, and was funded from the intermediary wallet.

- Wallet H8GLvJ89DwoeBTY3YhepLTf3VmKR44qVnskNdEZHQVDPK holds 25.1 billion tokens, representing 2.5% of supply, and was allegedly funded by the largest holder.

- Wallet DXU65912VjiPUhKR37TLiHCrbp4uNHVNNZiBdLv1uAx1 controls 17.5 billion tokens, or 1.75% of supply, and is said to be connected within the same funding cluster.

Combined, these three wallets account for approximately 7.75% of the total supply, with all allocations allegedly traceable back to the initial creator distribution, according to the claims.

“This is how controlled memecoins are structured. Stay careful,” StarPlatinum wrote.

Here, it’s worth noting that the website specifies that PUNCH’s total supply stands at 1 billion. Meanwhile, the White Whale also identified two “red flags” related to the PUNCH token.

“1. Bubble maps is too perfect. Too clean. Real life is messy. 2. Liquidity does NOT look like this. In fact it simply cannot look like this due to how distribution takes place on the idiotic constant product pools,” he noted. “Almost 6x “support” in equal distance below than resistance above? It’s fake, guys. No coin gets that much support organically with liquidity just sitting around on the books in case of a dip. It’s all done through Meteora.”

However, the White Whale clarified that he is not directly accusing the project team or developers of orchestrating the activity. He stated that the project itself “may or may not be good.”

“I didn’t warn people when I saw the warning signs on Penguin because I didn’t want to be accused of having a conflict of interest. Those same warning signs are now presenting themselves on Punch. Trade carefully. We never know when the cabal is going to pull the rug,” he wrote in another post.

Thus, while PUNCH’s rally has attracted significant interest, analysts’ concerns raise questions about the sustainability of its momentum. As with many sharply appreciating meme coins, heightened volatility and structural risks remain key factors for traders to monitor.

Crypto World

Crypto Liquidations Steal The Show With Bitcoin Stuck Below $70,000

Bitcoin fed into “extreme bearish sentiment” as a tight BTC price range fueled daily crypto liquidations of over $200 million.

Bitcoin (BTC) faced fresh downside predictions on Thursday as BTC price action kept long liquidations high.

Key points:

-

Bitcoin price analysis sees lower levels coming amid a lack of a “strong bounce.”

-

High liquidations contrast with the tightly rangebound BTC price behavior.

-

Crypto funds seal a fourth week of net outflows amid “extreme” bearish sentiment.

Analyst expects Bitcoin to “test lower”

Data from TradingView showed BTC/USD acting within an increasingly narrow range, with the day’s lows at $65,620.

A modest improvement in US jobless claims prior to the Wall Street open had little impact on the mood, and market participants expected lower levels to come into focus next.

“This looks to me as if we’re going to test lower on the markets to see whether there’s some support on Bitcoin,” crypto trader, analyst and entrepreneur Michaël van de Poppe said about the four-hour chart in a post on X.

“Not a strong bounce, and constant lower highs.”

CryptoReviewing, the pseudonymous cofounder of trading community Wealth Capital, drew attention to ongoing large liquidation numbers despite the relative lack of BTC price volatility.

“Now, below us at $64,000 – $66,000 we still have a sizable amount of liquidity,” he told X followers alongside data from CoinGlass.

“However, $68,000 – $71,000 has around 3x more liquidations built up ready to be taken, making this a higher probability zone to visit in the next days. Bulls really need to respond soon.”

CoinGlass put 24-hour cross-crypto liquidations at $210 million at the time of writing.

Trader Daan Crypto Trades nonetheless described nearby liquidity as “nothing major.”

“This current ~$66K area has held as support for the past 2 weeks with ~$71K capping price. Will see if we get a decisive break by the end of the week because as of now there’s not much action going on,” he wrote.

Institutions underscore ”extreme bearish levels”

Institutional investor flight from crypto instruments, meanwhile, caught the attention of mainstream commentator The Kobeissi Letter.

Related: Bitcoin 2024 buyers steady BTC price as trader sees $52K ‘next week or so’

In an X post on the day, Kobeissi flagged last week’s outflows of $173 million from crypto funds, their fourth consecutive negative weekly performance.

“This brings 4-week cumulative outflows to -$3.74 billion. Bitcoin led the selling with -$133 million in outflows last week, while Ethereum saw -$85 million. Crypto funds have now seen withdrawals in 11 out of the last 16 weeks,” it continued.

As Cointelegraph reported, the US spot Bitcoin exchange-traded funds (ETFs) form one part of the institutional sector experiencing long-term pressure under current conditions.

Kobeissi described sentiment as “reaching extreme bearish levels.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Video4 days ago

Video4 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech5 days ago

Tech5 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World3 days ago

Crypto World3 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports3 days ago

Sports3 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 hours ago

Video6 hours agoXRP News: XRP Just Entered a New Phase (Almost Nobody Noticed)

-

Video7 days ago

Video7 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech3 days ago

Tech3 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business2 days ago

Business2 days agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Entertainment2 days ago

Entertainment2 days agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Video3 days ago

Video3 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Tech2 days ago

Tech2 days agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Crypto World6 days ago

Crypto World6 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Sports1 day ago

Sports1 day agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Crypto World7 days ago

Crypto World7 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Entertainment1 day ago

Entertainment1 day agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

Business2 days ago

Business2 days agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

NewsBeat5 days ago

NewsBeat5 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Crypto World2 days ago

Crypto World2 days agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

NewsBeat5 days ago

NewsBeat5 days agoMan dies after entering floodwater during police pursuit

-

Crypto World11 hours ago

Crypto World11 hours ago83% of Altcoins Enter Bear Trend as Liquidity Crunch Tightens Grip on Crypto Market