Crypto World

Why Latency Is the Silent DeFi Killer

In DeFi, speed isn’t a luxury — it’s survival.

And yet, latency remains the most underestimated risk in the entire stack.

Users obsess over yields, tokenomics, and narratives. Protocols brag about TVL and UI polish. But beneath all of it lies a brutal truth: latency decides who wins and who gets liquidated.

While no one is watching, latency is draining alpha, widening spreads, and turning “automated” strategies into expensive mistakes.

Let’s talk about why.

Latency: The Invisible Tax on DeFi

Latency is the delay between intent and execution.

In DeFi, that delay happens everywhere:

Each step adds milliseconds or seconds. In fast-moving markets, that delay is effectively a hidden tax on every action you take.

You don’t see it in the UI.

You feel it when the result is worse than expected.

When Seconds = Slippage, Losses, and Liquidations

In TradFi, low-latency infrastructure is a table-stakes requirement.

In DeFi, many protocols still behave as markets move once per block.

They don’t.

Here’s how latency quietly wrecks users:

1. Slippage Becomes Structural

By the time your transaction lands:

You didn’t get unlucky.

You were late.

2. MEV Loves Slow Transactions

The longer your transaction sits in the mempool, the more visible — and exploitable — it becomes.

Latency turns your trade into:

-

A sandwich

-

A backrun

-

Someone else’s profit

MEV doesn’t punish bad strategies.

It punishes slow ones.

3. Automated Strategies Stop Being Smart

“Set and forget” strategies break under latency.

Rebalancers, liquidators, and yield optimizers:

At scale, this turns automation into systematic underperformance.

The UI Is Lying to You

Most DeFi dashboards operate on delayed or aggregated data.

By the time you see:

-

A liquidation threshold

-

A yield spike

-

A funding imbalance

The window is already closing — or closed.

This creates a dangerous illusion:

“I’m early.”

You’re not.

You’re reacting to the past.

Latency Compounds Across the Stack

Latency isn’t one problem. It’s a stack of them.

Individually tolerable.

Collectively devastating.

In composable systems, latency compounds, and every hop increases execution risk.

Why This Gets Worse as DeFi Scales

More users don’t just mean more liquidity.

They mean more contention.

As DeFi grows:

Latency stops being an edge case and becomes a core risk parameter.

Protocols that ignore this eventually see:

The Shift: From Passive DeFi to Reactive Infrastructure

The next phase of DeFi isn’t about prettier dashboards.

It’s about:

-

Continuous execution, not manual transactions

-

Event-driven agents, not user clicks

-

Proximity to execution, not abstracted UIs

-

Outcomes, not intentions

AI agents, co-located execution, private order flow, and latency-aware systems aren’t “nice to have.”

They’re survival tools.

Final Thought

Latency doesn’t announce itself.

It doesn’t show up as an error.

It just quietly makes your results worse.

If DeFi is going to compete with global financial markets, it can’t afford to treat speed as optional.

Because in open markets:

The fastest system wins — and everyone else pays for being slow.

REQUEST AN ARTICLE

Crypto World

NYSE Owner ICE Invests In OKX At $25B To Expand Tokenized Stock Trading

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange (NYSE), has invested in crypto exchange OKX at a $25 billion valuation and will take a seat on the company’s board, according to a Thursday announcement.

ICE has invested an undisclosed amount in OKX as part of its push into blockchain technology and tokenized stocks, the announcement said.

OKX will provide ICE with a live price feed of crypto assets listed on its platform. OKX will also provide access to ICE’s US futures and NYSE tokenized equities markets to its customer base of about 120 million accounts. The integration is expected to roll out in the second half of 2026.

Haider Rafique, global managing partner at OKX, said the two companies shared a strong strategic alignment in their vision for tokenization and traditional finance (TradFi).

“There was great chemistry in how we looked at the world and the future of tokenized securities, how derivatives should make it to the global stage, how TradFi [and] digital assets should merge together,” Rafique said.

A new chapter for OKX in the US

OKX CEO Star Xu took to X to say the investment is “not an endpoint” but rather the beginning of a deeper collaboration.

He highlighted the partnership’s impact on the exchange’s approach to the US, noting that the company views its presence in the country as a “blank sheet of paper.”

The move comes nearly a year after OKX reentered the US in April 2025, along with the appointment of former Barclays director Roshan Robert as its US CEO.

The collaboration with ICE is an “opportunity to build thoughtfully, engage constructively with regulators and institutions, and contribute to the development of market infrastructure that meets the standards of the world’s most sophisticated capital markets,” Xu said.

Related: TD Securities sees NYSE tokenization as institutional turning point

ICE’s investment in OKX is the latest move by the company into the crypto industry. In January, ICE said that it was developing its own blockchain-based trading infrastructure for tokenized securities.

In November 2025, the stock exchange announced plans to invest $2 billion into the prediction market platform Polymarket in a deal valuing the startup at $9 billion. One of the world’s largest prediction marketplaces, Polymarket has faced mounting scrutiny for alleged insider trading.

OKX did not respond to Cointelegraph’s request to comment.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Zilliqa Launches zUSDC via XBridge as Network Takes Full Control of Stablecoin Infrastructure

TLDR:

- Zilliqa launches zUSDC via XBridge, shifting USDC liquidity from third-party bridges to native network infrastructure.

- The zUSDC contract is live at 0xe59f97Fac09ee00AEEF320485ee45D5CcfbBC1E9, supporting DEX pools and stablecoin trading pairs.

- Debridge support on Zilliqa permanently ends March 31, 2026, requiring all legacy USDC holders to act immediately.

- XBridge receives a full UI overhaul as Zilliqa works toward automated, seamless cross-chain token transfer processing.

zUSDC is now live on Zilliqa through the network’s native XBridge system. This change moves USDC liquidity away from third-party bridging toward Zilliqa-operated infrastructure.

The transition is designed to improve long-term reliability and give Zilliqa direct control over stablecoin operations.

Users currently holding USDC on Zilliqa must act before March 31, 2026. After that date, Debridge support on the network will permanently end, affecting all remaining legacy USDC holders.

Zilliqa Transitions USDC Liquidity to Its Own XBridge Infrastructure

zUSDC is a USDC representation bridged to Zilliqa through the network’s own XBridge system. Its contract address is 0xe59f97Fac09ee00AEEF320485ee45D5CcfbBC1E9.

The token supports stablecoin trading, DEX liquidity pool participation, and arbitrage across pairs such as kUSDC and zUSDT. Zilliqa now holds direct operational control over this stablecoin liquidity within its ecosystem.

Previously, USDC liquidity on Zilliqa depended on external bridging infrastructure from third-party operators. Most of that liquidity was concentrated in DEX pools supporting trading and arbitrage activity.

Running external infrastructure under those conditions created an operational dependency. That dependency came without proportional benefit to the broader network, making this transition a practical move for the ecosystem.

The migration followed a phased process. Existing USDC was first bridged back to Ethereum as the starting point. It was then minted as zUSDC under Zilliqa-managed infrastructure and re-bridged through XBridge.

From there, funds were redeployed into ecosystem trading pools, with each phase structured to keep disruption low throughout.

Zilliqa shared the update on its official channel, stating it was “introducing zUSDC via XBridge on Zilliqa” and that the move improves reliability while keeping “stablecoin liquidity flowing across the ecosystem.”

As part of the Phase 3 ecosystem rollout, a zUSDC trading pair also launched on Plunderswap. Additionally, XBridge received a full UI overhaul, with the refreshed interface now available at xbridge.zilliqa.com.

Users Face March 31 Deadline as Debridge Support on Zilliqa Ends

Users holding USDC on Zilliqa must bridge their assets out through Debridge before March 31, 2026. Two options are currently available for doing so.

The Plunderswap bridge widget is accessible at plunderswap.com/bridge, while the StakeZIL bridge is available at stakezil.com. Both remain operational until the sunset date arrives.

After March 31, Debridge will no longer function on Zilliqa. Users who still hold legacy USDC beyond that point will need to reach out to Zilliqa directly for assistance. The team can be contacted at enquiry@zilliqa.com for support with any remaining holdings.

This transition does not remove stablecoin liquidity from the Zilliqa ecosystem. Rather, that liquidity is being moved to infrastructure that Zilliqa directly owns and operates.

The network frames this as a long-term step toward institutional-grade financial rails that the network itself controls.

Alongside the zUSDC launch, Zilliqa is also improving XBridge’s processing efficiency. The team is actively developing automation for bridge transaction processing.

This effort is aimed at making token transfers faster and more seamless across all chains that XBridge supports.

Crypto World

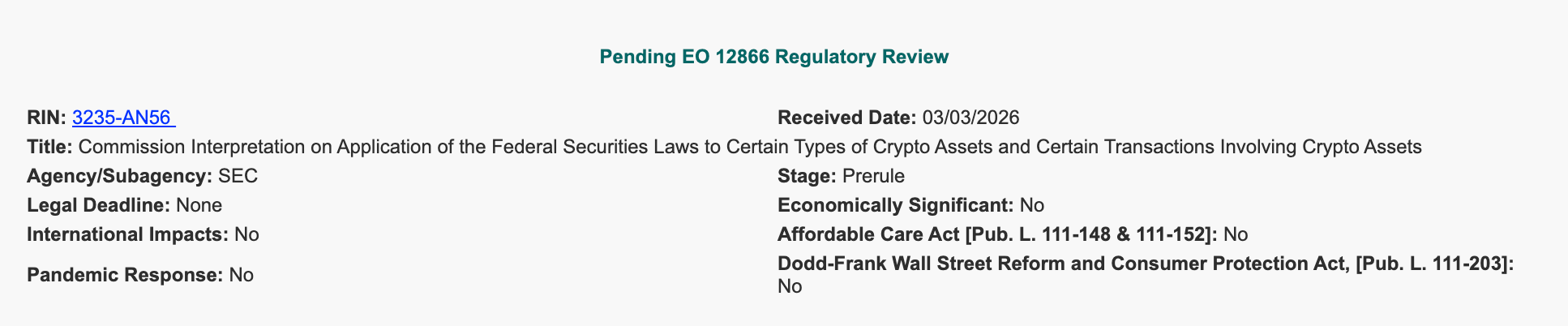

SEC Submits Proposal on Interpreting Crypto under Securities Laws

The proposed interpretative application of federal securities laws on digital assets by the SEC reportedly carries more weight than staff-level statements.

Officials at the US Securities and Exchange Commission (SEC) submitted a regulatory proposal to the White House with the potential to change how the government handles enforcement of federal securities laws over cryptocurrencies.

In a Tuesday submission to the White House’s Office of Information and Regulatory Affairs, the SEC sent a “commission interpretation on application of the federal securities laws to certain types of crypto assets and certain transactions involving crypto assets.”

The move reportedly marked interpretative guidance around “token taxonomy” for cryptocurrencies, determining which tokens may be considered securities under the SEC’s purview.

In contrast with rulemaking that requires notice to the public and comment periods, the proposed interpretative application of federal securities laws reportedly carries more weight than staff-level statements. SEC Chair Paul Atkins and Commissioner Hester Peirce said at ETHDenver in February that the agency sought to clarify how tokenized securities fit within existing federal securities laws.

As of Thursday, the proposal was under review by the White House office. Trump administration officials have also held three meetings in 2026 related to passage of the crypto market structure bill moving through the US Senate. The legislation, if passed, is expected to significantly affect how the SEC and Commodity Futures Trading Commission (CFTC) oversee digital assets.

Related: Ex-OpenAI researcher’s hedge fund reveals big Bitcoin miner bets in new SEC filing

Separately, the CFTC on Monday sent its own guidance on prediction markets to the White House. Michael Selig, who chairs the regulator, has claimed that the agency has “exclusive jurisdiction” in overseeing such markets.

SEC and CFTC still lack commissioner appointees

As of Thursday, the SEC is being led by three commissioners and the CFTC by one, in bodies normally consisting of a bipartisan group of five. The commissioners — Selig at the CFTC, and Atkins, Peirce and Mark Uyeda at the SEC — are all Republican members, with no leaders representing Democrats.

US President Donald Trump has not made any public statement signaling that he plans to nominate additional commissioners to either agency.

Magazine: What’s a ‘Network State’ and are there real-life examples? Big Questions

Crypto World

Aave price tests key resistance as Monad vote nears approval

Aave price is approaching a key technical resistance level as the community prepares to vote on a potential deployment on Monad.

Summary

- AAVE trades near $118 as price approaches mid-Bollinger Band resistance around $120.

- The Aave DAO vote to deploy the protocol on Monad has strong community backing.

- A breakout above the 20-day moving average could open a move toward $130

Aave (AAVE) traded at $118.23 at press time, up 3.1% in the last 24 hours and close to the upper end of its weekly range between $105.64 and $124.89. The token has gained about 12% over the past week, though it is still 7% lower over the past month and 45% down year-over-year.

Derivatives activity has slowed slightly. Data from CoinGlass shows trading volume fell 28% to $373 million, while open interest sits at $194 million, down 0.09%.

Aave DAO votes to launch on Monad

The price movement comes as a governance vote by the Aave DAO on deploying the protocol to Monad, which approaches approval. With about 21 hours left, more than 873,000 participants have backed the proposal, while no votes have been cast against it.

The proposal, created on Feb. 24, suggests deploying Aave v3 on Monad, a network built for high-throughput DeFi applications. Its architecture processes transactions in parallel and pipelines execution with consensus, allowing faster processing and lower latency while keeping full compatibility with Ethereum tools.

Supporters say this design could help fintech platforms and on-chain neobanks that require fast settlement, predictable costs, and deep liquidity. If deployed, Aave would act as a core lending layer supporting savings products, credit lines, stablecoin liquidity, and treasury management tools for fintech applications.

If the proposal proceeds, a mid-to-late March launch is being considered. In order to support network liquidity, the plan also calls for the purchase of 10 million GHO units and $15 million in ecosystem incentives from the Monad Foundation.

Market sentiment may be affected by the deployment. Increased user activity and liquidity flows are often the outcome of network expansion. If more users adopt Monad, there may be a greater need for Aave’s lending infrastructure, which could boost the token’s value.

Aave price technical analysis

AAVE is trying to stabilize after weeks of selling pressure. The token is now testing the mid-band, which aligns with the 20-day moving average near $118–$120.

Earlier in February, the price dropped toward the $100 support zone, touching the lower Bollinger Band. Buyers stepped in and a rebound followed, pushing the token back to the mid-band. This level now acts as dynamic resistance.

A move toward the upper Bollinger Band near $130 could be initiated by a break above $120, which would indicate increasing momentum. The price may decline and trade between $108 and $110, which is near the lower band, if the level remains as resistance.

Momentum is steadily increasing. When the relative strength index was near 30, the market was about to be oversold, but it has since risen. It is now approaching the neutral 50 level, suggesting that selling pressure has decreased even though significant bullish momentum has not yet emerged.

Volatility is also tightening as the Bollinger Bands narrow. Such compression often comes before a larger price move. If volatility expands upward, the next resistance zone could appear near $130 to $135. A downside expansion may push the token back toward $100 to $105.

For now, price action is at a decision point. A clean break above the 20-day moving average could trigger a stronger recovery. Failure to hold above the level may lead to another pullback toward the $100 support area.

Crypto World

Construction Begins at 1M Qubit Quantum Facility

The quantum computing company PsiQuantum is a step closer to its goal of building the world’s first useful quantum computer, breaking ground on the construction of a 1 million-qubit quantum facility, a size that scientists say is powerful enough to crack Bitcoin’s cryptography.

PsiQuantum co-founder Peter Shadbolt shared a photo of its Chicago site in a post to X on Thursday, saying that 500 tons of steel had been erected in six days, which will house the computer.

PsiQuantum said in September that it raised $1 billion to build the facility in collaboration with chip maker Nvidia, designed to house quantum computers capable of functioning even if they have errors.

PsiQuantum added that the facility would house 1 million qubits of quantum computing power, the equivalent of tens of billions of typical computers, with the aim of making quantum computing commercially useful to support “next-generation AI supercomputers.”

Some in the Bitcoin community have warned that the advent of quantum computing could potentially compromise Bitcoin’s cryptography.

Some Bitcoiners have argued that such a compromise could put the network, which currently secures $1.4 trillion, at risk, while others, such as Blockstream CEO Adam Back, have said quantum computers won’t post a real threat to Bitcoin for at least a decade.

Bitcoin developers are currently discussing whether to take immediate action against quantum threats via a hard fork, and if so, what that would entail.

The Bitcoin (BTC) most vulnerable to a quantum attack are unspent transaction output (UTXO) wallets, or coins tied to wallet addresses that have never been spent, many of which date back to when the cryptocurrency was first invented.

The amount of qubits needed to crack Bitcoin keys is debated, but estimates are dropping as quantum research advances.

Related: Vitalik Buterin outlines quantum resistance roadmap for Ethereum

A preprint scientific paper released last month argued that around 100,000 qubits are needed to break 2048-bit keys, while Bitcoin’s encryption uses 256-bit keys.

The largest quantum computer, from the California Institute of Technology, is 6,100 qubits in size.

PsiQuantum has no plans to attack Bitcoin

In July, PsiQuantum co-founder Terry Rudolph said the company has no plans to use quantum computers to derive private keys from public keys.

“We do not have plans,” Rudolph said at the Presidio Bitcoin-hosted Quantum Bitcoin Summit. “You can’t hide this stuff as well; it’s a company of hundreds of people.”

Only 10,000 BTC at legitimate risk: CoinShares

Even if quantum computers can break Bitcoin, research from crypto asset manager CoinShares in February found that only 10,230 Bitcoin is both quantum-vulnerable and sitting in wallet addresses with publicly visible cryptographic keys.

CoinShares said a selloff of 10,230 Bitcoin, equal to $728.2 million at current market prices, would “resemble a routine trade.”

Magazine: Bitcoin may take 7 years to upgrade to post-quantum: BIP-360 co-author

Crypto World

SEC Schedules April 16 Roundtable to Review Listed Options Market Structure Reform

TLDR:

- The SEC roundtable on listed options market structure is scheduled for April 16, 2026, in Washington, D.C.

- Commissioner Hester M. Peirce praised retail investor growth and called for continued options market reflection.

- Public comments referencing File Number 4-887 can be submitted electronically or on paper through one method.

- The roundtable will be live-streamed on SEC.gov, with a full recording made available at a later date.

The SEC roundtable on listed options market structure is set for April 16, 2026, in Washington, D.C. The Securities and Exchange Commission officially announced the event on March 5, 2026.

It will be held at the agency’s headquarters at 100 F Street, N.E. The discussion will also be streamed live on SEC.gov for audiences unable to attend in person.

Core topics include facilitating competition in quote-driven markets, evaluating the customer experience, and identifying growth opportunities in listed options.

What the SEC Roundtable Will Cover

The roundtable is designed to foster open public dialogue on the listed options market structure reform. The SEC aims to examine how competition can be better supported within quote-driven market environments.

Along with that, evaluating the overall customer experience remains a key focus for the discussion.

Commissioner Hester M. Peirce commented publicly on the growth of the U.S.-listed options market. She pointed out that retail investor participation has grown remarkably in recent years.

The roundtable, she noted, will celebrate the market’s achievements while considering areas that may need further reflection.

The SEC posted on X, formerly Twitter, confirming the date and format of the event:

“The SEC is hosting a roundtable on April 16 to discuss listed options market structure. The event will be in-person and live-streamed on SEC.gov. Agenda, panelists, and registration info will be available soon.” — @SECGov

The SEC will release agenda details and speaker information before the roundtable takes place. In-person participation will be open to the public, though space may be limited. All visitors attending in person will be subject to standard security checks at the SEC’s headquarters.

Public Comment Submissions for the Roundtable

Members of the public who wish to share views on the listed options market structure may submit comments. Submissions can be made electronically or on paper, but only through one method at a time. All comments submitted will be entered into the official public record of the roundtable.

The SEC has clarified that personal identifying information will not be removed or edited from any submission. Therefore, submitters are cautioned to include only information they are willing to make publicly available. This applies to both electronic and paper submissions equally.

All submissions must reference File Number 4-887 in the text of the comment. For those submitting via email, the file number should appear in the subject line. The SEC will publish all received comments on its official website without modification.

A recording of the SEC roundtable will be made available on SEC.gov at a later date. This allows those unable to attend or watch the livestream to still access the full discussion.

The agency remains committed to keeping the options market reform conversation open and accessible to all.

Crypto World

Mantle’s stablecoin surges 75% in 30 days as liquidity flywheel kicks in

Mantle’s ecosystem stablecoin has added roughly 375 million dollars in market value over the past month, climbing from about 494 million to nearly 870 million and cementing the network’s push to become a full‑stack on‑chain liquidity and banking layer built around ETH staking and restaking primitives.

Summary

- Stablecoin market cap jumps 75% in 30 days, approaching 870 million dollars as Mantle’s liquidity products gain traction across DeFi.

- Growth rides on Mantle’s mETH staking and cmETH restaking stack, which channels yield and demand back into the broader ecosystem.

- Mantle’s deep treasury and “fortress” balance sheet reinforce confidence in its stablecoin and DeFi rails despite wider market volatility.

Mantle’s stablecoin engine is firing on all cylinders. Over the past 30 days, the total market value of the Mantle ecosystem stablecoin has risen from roughly 494 million dollars to around 870 million, a gain of more than 75% that sharply outperforms the broader market and highlights the chain’s emerging role as an on‑chain liquidity hub.

The move comes as Mantle doubles down on an integrated strategy: pair an Ethereum Layer 2 with native liquid staking and restaking, then plug that liquidity into DeFi. At the base layer sits mETH, Mantle’s liquid staking token for Ethereum, which has already attracted more than 1 billion dollars in total value locked by letting users earn staking rewards while keeping their assets liquid. On top of that, cmETH extends those positions into restaking, unlocking additional yield and incentives without forcing users to unwind core ETH exposure.

This composable stack is now bleeding directly into stablecoin demand. As traders and protocols seek dollar liquidity backed by yield‑bearing collateral, Mantle’s stablecoin becomes a natural settlement and liquidity layer inside the ecosystem, tightening the feedback loop between ETH staking flows, DeFi usage and dollar‑denominated volume. Campaigns such as “Methamorphosis” and ecosystem incentive seasons have further accelerated user onboarding and capital rotation into Mantle’s products.

Underpinning the growth is a balance sheet that rivals mid‑tier centralized players. Mantle controls a multi‑billion‑dollar treasury, including more than 270,000 ETH, giving the DAO ample capacity to backstop liquidity, co‑invest in protocols and defend key pegs or markets when needed. Research firms have already labeled Mantle a “fortress” protocol for its ability to withstand severe price shocks in its native token while maintaining solvency. If current growth persists, Mantle’s stablecoin could become one of the core dollar rails for restaking‑centric DeFi over the coming cycle.

Crypto World

Chainlink price confirms bearish SFP as $8.33 support comes

Chainlink price has confirmed a bearish swing failure pattern at a key resistance zone, signaling a potential downside rotation. The rejection near $9.72 increases the probability of a corrective move toward the $8.33 high-timeframe support.

Summary

- Bearish SFP confirmed: Rejection at the $9.72 resistance signals weakening bullish momentum.

- Value Area High lost: Indicates a shift in market structure toward downside pressure.

- $8.33 support in focus: Confluence with value area low makes it the next major downside target.

Chainlink (LINK) price is showing clear signs of technical weakness after failing to sustain momentum above a critical resistance level. Recent price action formed a bearish swing failure pattern (SFP) at the $9.72 high-timeframe resistance, a signal that often indicates exhaustion in bullish momentum.

With this rejection now confirmed, traders are closely watching the $8.33 region as the next significant support level.

Chainlink price key technical points

- High-timeframe resistance rejection: Price rejected the $9.72 resistance with a bearish SFP formation.

- Value Area High lost: Loss of this key level signals weakening bullish momentum.

- Downside target: $8.33 aligns with the value area low and major high-timeframe support.

Chainlink recently attempted to break above the $9.72 resistance level, which has historically acted as a major barrier in price action. However, the breakout attempt was short-lived. The market briefly traded above the previous swing high but quickly reversed, leaving a wick above the level before closing back below it. This structure forms a classic swing failure pattern, which is widely recognized by traders as a signal that liquidity above the highs has been taken before the market rotates lower.

The confirmation of this SFP highlights a shift in short-term market control. When price fails to sustain above a key resistance and closes back within the previous range, it often indicates that buyers have lost momentum. In Chainlink’s case, the inability to hold above $9.72 suggests that the move was primarily driven by liquidity collection rather than genuine bullish continuation. This increases the probability of a retracement as the market seeks lower levels of support.

Another important technical development is the loss of the value area high. This level previously acted as a key pivot within the current trading range, providing support during earlier pullbacks. Once price loses this level, it often signals a structural shift where sellers begin to gain greater control of the market.

The breakdown from this region reinforces the bearish outlook and suggests that Chainlink may continue rotating within the broader range. On the regulatory front, Chainlink’s deputy general counsel, Taylor Lindman, has also joined the Securities and Exchange Commission’s Crypto Task Force, stepping in to replace Michael Selig.

The next major level of interest is the point of control, which represents the price level with the highest traded volume within the range. This area typically acts as a magnet for price due to the high concentration of market activity. If Chainlink continues to show weakness and fails to reclaim the value area high, price is likely to gravitate toward this zone as traders reposition within the range structure.

Below the point of control lies the value area low, which sits in direct confluence with the $8.33 high-timeframe support level. This region represents a critical area where buyers may attempt to step in and defend price. Historically, high-timeframe supports combined with volume-profile levels tend to attract significant market interest, making $8.33 an important level to monitor in the coming sessions.

Meanwhile, on the fundamental side, Chainlink has recently enabled Coinbase’s cbBTC bridging to Monad, unlocking over $5 billion in Bitcoin-backed liquidity for decentralized finance applications and further expanding its ecosystem utility.

While short-term bounces can occur during corrective phases, the broader structure currently favors downside continuation. As long as price remains below the rejected resistance at $9.72 and fails to reclaim the value area high, the bearish market structure remains intact. This keeps the probability tilted toward a deeper rotation within the current range.

What to expect in the coming price action

From a technical and structural perspective, Chainlink remains under bearish pressure following the confirmed SFP rejection at $9.72. If the value area high continues to act as resistance, price is likely to rotate lower toward the $8.33 support zone.

A strong reclaim of the lost resistance would invalidate the bearish outlook, but until then, the path of least resistance remains to the downside.

Crypto World

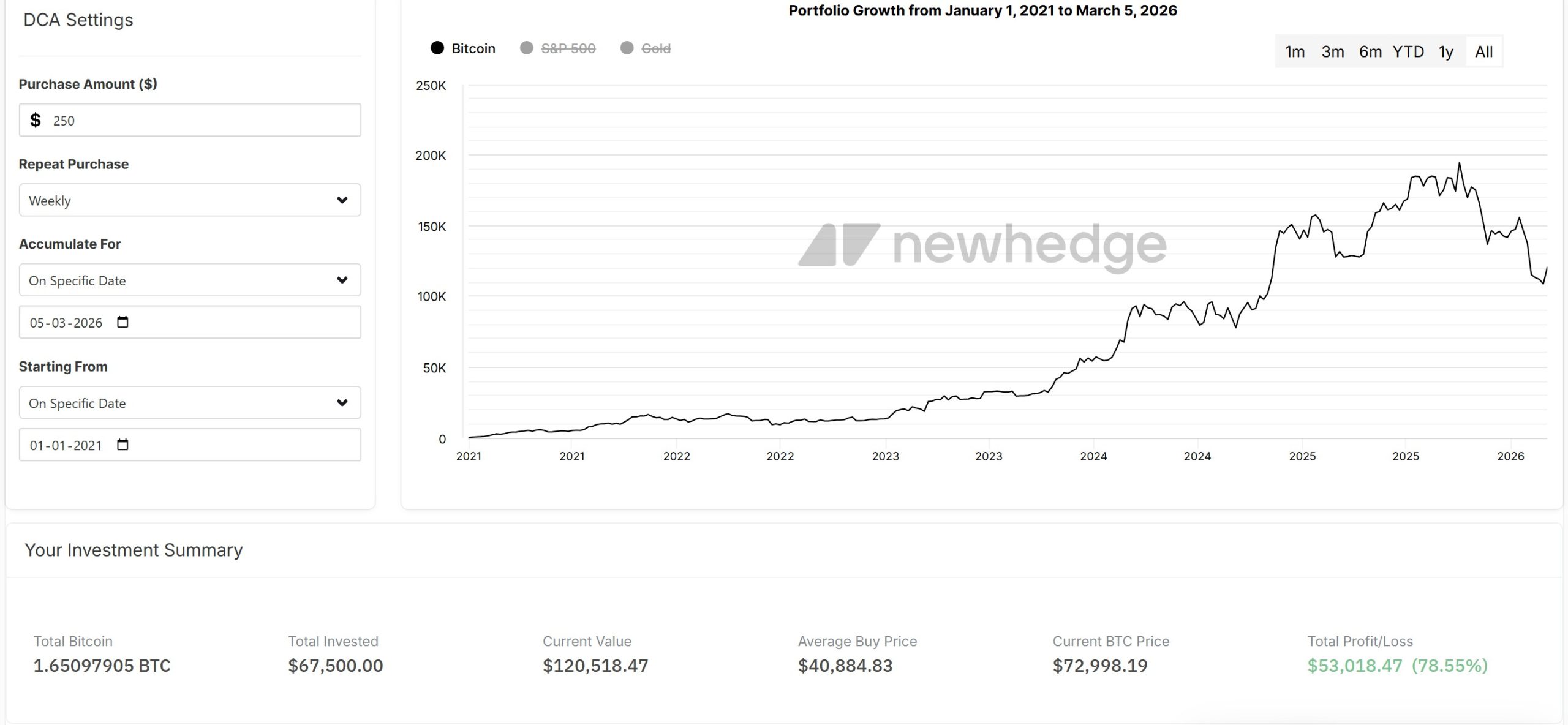

Weekly Bitcoin Buys Produce The Best Returns Across Bull And Bear Markets

Smart investors adjust their strategy during bear markets and 50% drawdowns like the one seen in Bitcoin (BTC) over the last five months. The strategy, known as dollar-cost averaging (DCA), involves investing the same amount at regular intervals regardless of market conditions.

Historical market cycle data and forward-looking BTC price simulations provide a clearer view of how these steady investment patterns develop across different entry periods and time horizons.

A five-year Bitcoin DCA stack shows strong net gains

A $250 weekly Bitcoin purchase starting in January 2021 resulted in $67,500 invested over a five-year period. Based on DCA simulation data, the strategy accumulated 1.65097905 BTC at an average purchase price of $40,884.

At the current Bitcoin price near $71,000, that 1.65097905 BTC is valued at roughly $120,518, representing a $53,018 gain (76%) on the invested capital. When Bitcoin traded for $100,000, the holdings were worth about $165,098, while at the cycle peak near $126,000 in October 2025, the same amount reached $208,023.

A shorter accumulation window illustrates how entry timing changes the early outcome while the strategy continues building exposure. A $250 weekly DCA beginning January 2024 results in $28,500 invested, accumulating 0.36863166 BTC with an average purchase price of $77,312.

At the current price of $71000, the amount is valued at about $26,909, a –6% unrealized loss. At $100,000, the holdings had risen to $36,863, while a $126,000 cycle high valued the Bitcoin at $46,448.

In a February X post, Swan Bitcoin analyst Adam Livingston compared a similar DCA approach against equities over the past five years. A $100 weekly allocation produced $42,508 in Bitcoin versus $37,470 in S&P 500 (SPX), representing 62.9% and 43.6% returns, respectively.

Livingston noted that purchasing Bitcoin consistently during drawdowns has historically produced stronger cumulative returns despite the price volatility.

Related: Bitcoin’s bullish momentum accelerates but topping $78K remains a challenge

Long-term models emphasize the time horizon

Forward-looking simulations examine how the DCA strategy could work from 2026 onward. A $250 weekly DCA beginning January 2026 allocates about $54,250 by March 2030.

The price assumptions come from Bitcoin’s long-term power-law growth curve, which tracks Bitcoin’s historical price relative to time on a logarithmic scale. The model produces a rising support band and median trend that have broadly aligned with previous market cycles.

Using this framework, analysts estimate that by 2028, the long-term trend support may move above $100,000, forming the base assumption for future DCA modeling. Simulations from Bitcoin Well place the median price near $430,278 by March 2030.

To capture the wider range around that path, the model also considers deviation bands of the power-law channel, producing a lower projection near $274,000 and an upper expansion scenario near $900,000.

Under those assumptions, the weekly strategy accumulates about 0.30 BTC over four years.

-

At $274,000, the holdings are worth about $82,200.

-

At the $430,278 median estimate, the investment value reaches $129,000.

-

At a $900,000 BTC price, the investment is worth nearly $270,000.

A November 2025 study by Bitcoin researcher Sminston With tested how the entry timing affects the long-term outcomes using similar projections. Even buying 20% above $94,000 (the price of BTC at that time) and exiting 20% below the projected 2035 median still produced nearly 300% gains on the remaining holdings after a decade.

The total savings reached 7.7 times the initial capital in the simulation.

The study concluded that entry timing adjusts the range of outcomes, while long holding periods drive the majority of the results.

Related: A sucker’s rally? Why Bitcoin analysts say BTC price must hold $70K

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Hyperliquid price eyes $35 as Bollinger Bands tighten

Hyperliquid price is approaching a key resistance level, and shrinking volatility suggests a possible breakout toward $35.

Summary

- HYPE trades near $31 after slipping 5.7% in 24 hours but remains up 80% over the past year.

- Bollinger Bands are tightening, signaling a volatility squeeze that often precedes a major move.

- A breakout above $34 could push price toward $35, while losing $29 may expose the $26 support zone.

At press time, Hyperliquid (HYPE) was trading at $31.24, down 5.7% in the past 24 hours. Over the last week, it moved between $26.22 and $33.33, ending roughly 7% higher. However, the token has decreased by roughly 10% per month.

HYPE continues to be one of the better-performing altcoins despite the recent decline. Over the past year, the token has increased by about 80%, despite difficulties in the larger cryptocurrency market.

Derivatives activity has cooled slightly. CoinGlass data shows that trading volume dropped 18% to about $1.25 billion, while open interest fell 7.5% to $1.21 billion, showing some traders closing their positions.

HYPE token fundamentals

HYPE’s price is influenced by several structural factors. The core of Hyperliquid’s ecosystem is perpetual futures trading, and the Assistance Fund for token buybacks receives about 97% of platform fees.

Increases in trading are directly correlated with increases in buybacks. For example, when trading volumes averaged $29 billion daily, $5.82 million in buybacks were generated, demonstrating a direct correlation between trading demand and token support.

Market sentiment has also been influenced by protocol upgrades. Permissionless perpetual markets were introduced by HIP-3, which produced a total volume of about $83 billion.

HIP-4 proposal aims to launch outcome trading products, combining prediction markets, options, and binary-style contracts. These additions could expand platform activity if more retail or institutional traders participate.

Hyperliquid price technical analysis

HYPE appears to be entering a compressed volatility phase. Bollinger Bands have tightened on the daily chart, which is frequently an indication of an impending big move.

The upper band, which has caused pullbacks in recent sessions, is being tested by the price.

The structure of the market has improved. HYPE has formed a string of higher lows around $26 and $29 since late January, indicating that buyers are intervening earlier on dips. This outlook is also supported by momentum indicators.

There is potential for more gains as the relative strength index is in the mid-50s and trending upward. Meanwhile, the mid-Bollinger Band has been offering dynamic support around $29.

A move toward $35 could ensue if HYPE breaks above $33–$34, with a possible extension to $38 if buying pressure increases. Deeper losses could retest the $26 base, and rejection at resistance could push the token back toward $29 on the downside.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech19 hours ago

Tech19 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports8 hours ago

Sports8 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker