Crypto World

Why XRP, DOGE, TAO Could Pose Liquidation Risks This Week

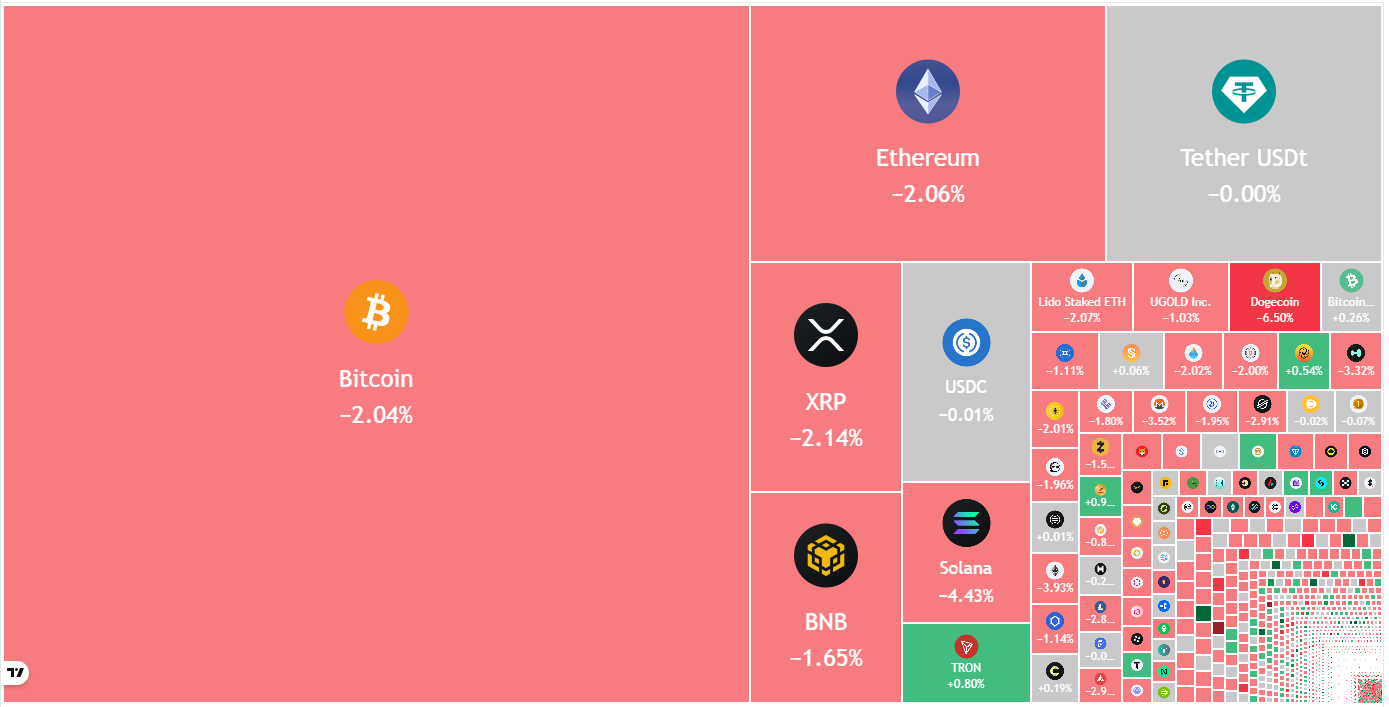

The crypto market entered the third week of February with notable recoveries across several altcoins. However, overall negative sentiment has yet to improve, creating conditions for potential liquidations among overly optimistic traders.

Altcoins such as XRP, DOGE, and TAO are drawing attention this week due to significant developments, but they also carry the following risks.

Sponsored

1. XRP

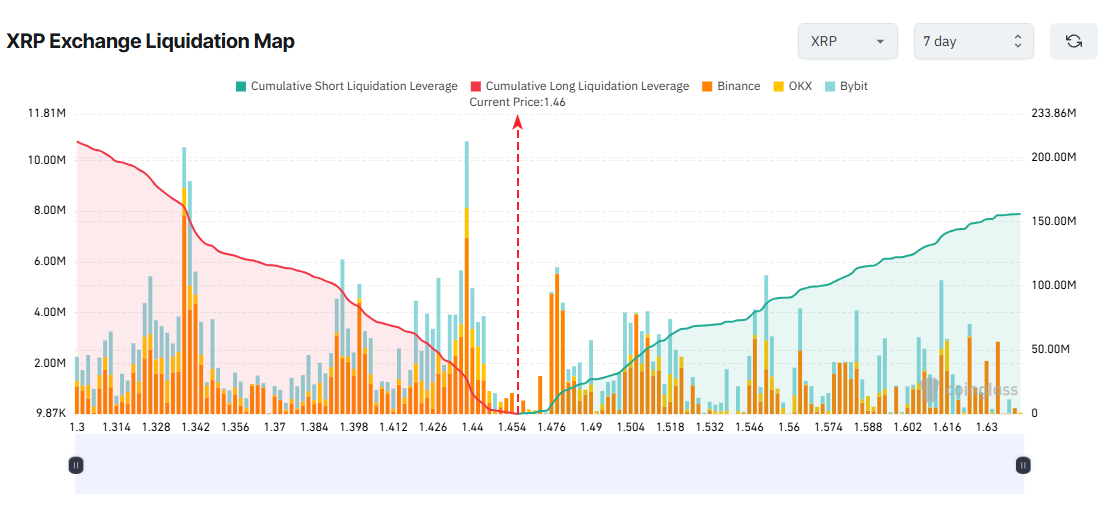

XRP’s liquidation map shows that the cumulative liquidation volume of Long positions slightly exceeds that of Short positions.

This week, if XRP declines to $1.30, cumulative Long liquidations could surpass $200 million. Conversely, if XRP rises above $1.63, cumulative Short liquidations could reach $150 million.

On Sunday, XRP briefly climbed to $1.66 before quickly falling back below $1.50 on Monday. Analyst Dom identified selling pressure originating from the Upbit exchange through the XRP Spot Cumulative Volume Delta indicator.

The data shows that approximately 50 million XRP were net sold on Upbit within 15 hours, generating strong selling pressure. This pressure emerged ahead of the Lunar New Year’s Eve, a holiday period in many Asian countries that often raises concerns about declining liquidity.

Sponsored

Meanwhile, XRP accounts for a significant share of trading volume on both Upbit and Bithumb in South Korea. As a result, selling pressure from Asian investors could put Long positions at risk this week.

2. Dogecoin (DOGE)

Recent bullish discussions within the community have encouraged traders to allocate capital to Long DOGE positions this week.

If DOGE falls to $0.091, cumulative Long liquidations could approach $90 million. Meanwhile, if DOGE rises to $0.114, cumulative Short liquidations could total around $53 million.

Sponsored

Why should DOGE Long traders remain cautious? Data from Nansen shows that DOGE exchange balances (yellow line) surged abruptly from February 12, when DOGE began its recovery driven by rumors surrounding the upcoming launch of X Money.

Many DOGE investors appear to be using the recovery as an opportunity to exit positions by transferring tokens onto exchanges. If this trend continues this week, DOGE could correct and move toward liquidation levels for Long positions.

3. Bittensor (TAO)

The listing of TAO on South Korea’s Upbit exchange on February 16 could provide fresh momentum to support a price recovery.

Sponsored

The liquidation map shows that if TAO climbs above $283 this week, Short liquidations could exceed $13 million. Conversely, if TAO declines to $160, Long liquidations could reach $11.5 million.

As crypto community discussions around AI continue to capture a high share of overall market attention and Bittensor (TAO) corrects toward a long-term support zone, analyst Michaël van de Poppe expects a strong recovery.

“I think that protocols working on AI <> Crypto are a must have in every portfolio and I’m glad I’ve added funds into this position. I think that we’re going to see more strength going forward from here. At least a mean reversion to ~$300,” Michaël van de Poppe stated.

New liquidity from Upbit, combined with Michaël van de Poppe’s assessment, could place TAO Short positions at risk.

Crypto World

$321 Million in Crypto Tokens Unlock This Week: What to Watch

The crypto market will welcome tokens worth more than $321 million in the third week of February 2025. Major projects, including LayerZero (ZRO), YZY (YZY), and KAITO (KAITO), will release significant new token supplies.

These unlocks could introduce market volatility and influence short-term price movements. So, here’s a breakdown of what to watch.

Sponsored

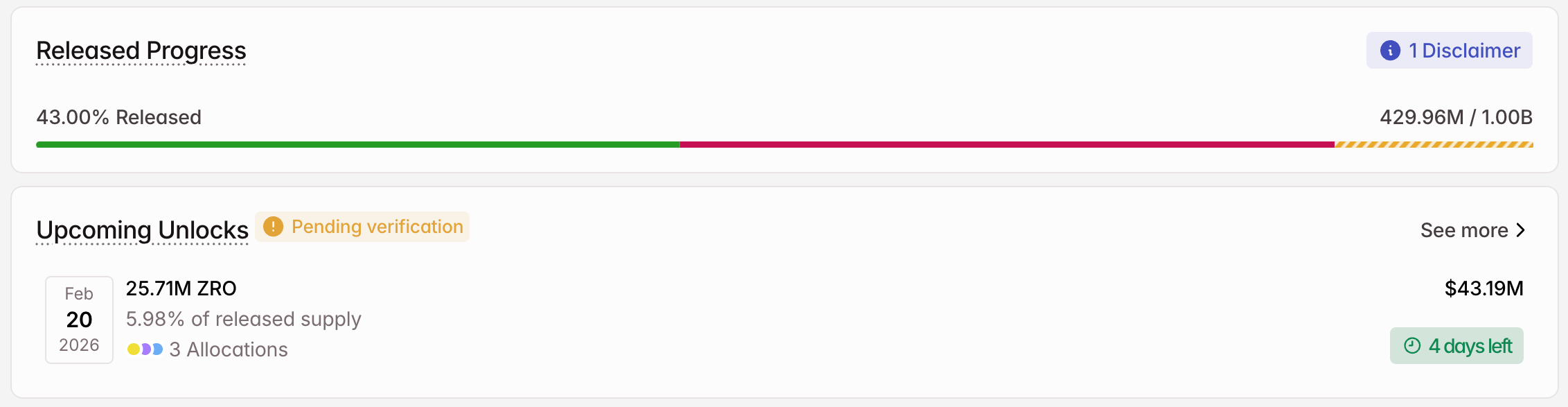

1. LayerZero (ZRO)

- Unlock Date: February 20

- Number of Tokens to be Unlocked: 25.71 million ZRO

- Released Supply: 429.96 million ZRO

- Total Supply: 1 billion ZRO

LayerZero is an interoperability protocol that connects different blockchains. Its primary goal is to facilitate seamless cross-chain communication. Thus, it enables decentralized applications (dApps) to interact across multiple blockchains without relying on traditional bridging models.

The team will unlock 25.71 million tokens on February 20, representing 5.98% of the released supply. Moreover, the supply is worth approximately $43.19 million.

LayerZero will award 13.42 million altcoins to strategic partners. Core contributors will get 10.63 million ZRO. Lastly, 1.67 million ZRO are for tokens repurchased by the team.

Sponsored

2. YZY (YZY)

- Unlock Date: February 17

- Number of Tokens to be Unlocked: 62.5 million YZY

- Released Supply: 362.5 million YZY

- Total supply: 1 billion YZY

YZY is a cryptocurrency token associated with the rapper Ye (formerly known as Kanye West). It is positioned as part of the broader “YZY MONEY” ecosystem, which includes the YZY token, a payment platform called Ye Pay, and a physical YZY Card.

On February 17, YZY will unlock 62.5 million tokens worth around $20.34 million. The tokens represent 17.24% of the released supply.

Sponsored

The team will allocate 50 million altcoins to Yeezy Investments LLC, Vesting 2. Moreover, it will direct 12.5 million tokens to Yeezy Investments LLC, Vesting 1.

3. Kaito (KAITO)

- Unlock Date: February 20

- Number of Tokens to be Unlocked: 32.6 million KAITO

- Released Supply: 306.49 million KAITO

- Total Supply: 1 billion KAITO

Kaito is an artificial intelligence (AI)-powered Web3 information platform that aggregates and analyzes cryptocurrency market data from diverse sources like social media, governance forums, news, and more. The KAITO token serves as a medium of exchange, governance tool, and incentive mechanism within the platform.

Sponsored

On February 20, the team will unlock 32.6 million tokens, representing 10.64% of the current released supply. The supply is worth approximately $10.08 million.

The team will split the unlocked tokens five ways. The foundation will receive 1.19 million tokens. Core contributions will get 6.94 million tokens. Furthermore, early backers will receive 2.31 million KAITO.

Finally, the team will direct 7.16 million KAITO for ecosystem and network growth and 15 million tokens for long-term creator incentives.

In addition to these, other prominent unlocks that investors can look out for in the third week of February include ZKsync (ZK), Solv Protocol (SOLV), ApeCoin (APE), and more, contributing to the overall market-wide releases.

Crypto World

Bitcoin Holds Key Level, Altcoins Aim To Follow: Will Bears Relent?

Key points:

-

Bitcoin remains under pressure as bears are selling on rallies near the $74,508 resistance

-

The bears are mounting a solid defense in several major altcoins at higher levels, indicating a negative sentiment.

Bitcoin (BTC) has started the new week on a cautious note as bulls attempt to maintain the price above $67,500. Investors are not rushing in to buy the dip, as seen from the $133.3 million in outflows from BTC exchange-traded products last week. The total outflows from crypto investment products have risen to $3.8 billion over the past four weeks, according to a CoinShares update on Monday.

If BTC ends the month below $79,500, it will record its first-ever consecutive negative monthly closing in January and February. With more than 22% loss, BTC is staring at its worst first-quarter performance since the 49.7% loss in 2018, per CoinGlass data.

Despite BTC’s weak performance and uncertain near-term direction, Strategy co-founder Michael Saylor indicated in a post on X that the company is buying more BTC. That will be Strategy’s 99th BTC transaction, showing their long-term bullish view remains intact.

Could BTC and the major altcoins defend the support levels and start a strong relief rally? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

S&P 500 Index price prediction

The S&P 500 Index (SPX) is witnessing a tough battle between the bulls and the bears at the support line of the ascending channel pattern.

The moving averages are on the verge of a bearish crossover, and the relative strength index (RSI) is in the negative territory, indicating that the bears are making a comeback. The index may start a deeper correction to 6,720 and then to solid support at 6,550 if the price breaks below the 6,780 level.

Buyers will have to propel the price above the 7,002 level to retain control. If they manage to do that, the index may resume its uptrend and surge toward the 7,290 level.

US Dollar Index price prediction

The US Dollar Index (DXY) has been trading below the moving averages, but the bears have failed to challenge the 96.21 to 95.55 support zone.

The bulls will try to strengthen their position by pushing the price above the moving averages. If they can pull it off, the index may rally to 99.49 and then to the overhead resistance at 100.54.

Contrarily, if the price turns down sharply from the moving averages, it suggests that the bears continue to sell on rallies. The index may the next leg of the downtrend on a close below the 95.55 support.

Bitcoin price prediction

Sellers are attempting to halt BTC’s recovery near $71,000, indicating that the bears remain sellers on rallies.

The sellers will have to pull the price below the $65,000 level to remain in command. The BTC/USDT pair may then retest the critical $60,000 level. If the $60,000 support cracks, the next stop is likely to be $52,500.

Buyers will have to drive the Bitcoin price above the breakdown level of $74,508 to signal that the bearish momentum is weakening. The pair may then surge toward the 50-day SMA ($83,910), where the bears are expected to mount a strong defense.

Ether price prediction

Ether (ETH) once again turned down from the $2,111 level on Sunday, indicating that the bears are fiercely defending the level.

Sellers will attempt to pull the price below the immediate support at $1,897. If they do that, the ETH/USDT pair may drop to the $1,750 level. Buyers are expected to defend the $1,750 level with all their might, as a close below it may sink the pair to $1,537.

Instead, if the Ether price turns up and breaks above the 20-day EMA ($2,221), it signals that the selling pressure is reducing. The pair may then rally to the 50-day SMA ($2,744).

BNB price prediction

BNB’s (BNB) relief rally fizzled out at $642 on Sunday, indicating that the bears are selling on every minor rise.

The bears will attempt to increase their hold by pulling the BNB price below the $570 level. If they manage to do that, the BNB/USDT pair may extend its decline to psychological support at $500.

The bulls will have to drive the price above the 20-day EMA ($686) to suggest that the bears are losing their grip. The pair may then climb to $730 and subsequently to the 50-day SMA ($817).

XRP price prediction

XRP (XRP) turned up from the support line of the descending channel pattern on Friday and pierced the 20-day EMA ($1.53) on Sunday.

However, the bears successfully defended the breakdown level of $1.61 and pulled the XRP price back below the 20-day EMA. The bulls are unlikely to give up easily and will make another attempt to clear the $1.61 level.

If they succeed, the XRP/USDT pair may rise to the 50-day SMA ($1.81). Such a move suggests that the pair may remain inside the channel for some more time.

Sellers will have to tug the price below the support line to gain the upper hand. The pair may then retest the Feb. 6 low of $1.11.

Solana price prediction

Buyers are attempting to push Solana (SOL) back above the breakdown level of $95, but the bears have held their ground.

The Solana price may trade inside the $76 to $95 range for some time. Such a move increases the likelihood of an upside breakout. The SOL/USDT pair may then rally toward $117.

This positive view will be negated in the near term if the price turns down and breaks below the $76 support. The pair may then retest the Feb. 6 low of $67, where the buyers are expected to step in.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

Dogecoin price prediction

Dogecoin (DOGE) turned down from the breakdown level of $0.12 on Sunday, indicating that the bears are defending the level.

The 20-day EMA ($0.10) is flattening out, and the RSI is just below the midpoint, signaling a possible range-bound action in the near term. The DOGE/USDT pair may swing between $0.08 and $0.12 for a few days.

Buyers will gain the upper hand on a close above the $0.12 resistance. That opens the doors for a rally to $0.16. Alternatively, the advantage will tilt in favor of the bears on a close below $0.08. The Dogecoin price may then slump to $0.06.

Cardano price prediction

Cardano’s (ADA) relief rally reached the 20-day EMA ($0.29) on Saturday, which is expected to act as a stiff hurdle.

If the bulls do not give up much ground to the bears, the possibility of a break above the 20-day EMA increases. That suggests the ADA/USDT pair may remain inside the descending channel for some more time. A break and close above the downtrend line signals a potential short-term trend change.

Sellers will have to pull the Cardano price below the support line to extend the downward move toward the next support at $0.20.

Bitcoin Cash price prediction

Bitcoin Cash (BCH) surged above the 20-day EMA ($544) on Friday, indicating that the bears are losing their grip.

The recovery is facing resistance at the 50-day SMA ($578), but a positive sign is that the bulls have not allowed the Bitcoin Cash price to slip back below the 20-day EMA. That increases the likelihood of the continuation of the relief rally. If buyers pierce the 50-day SMA, the BCH/USDT pair may reach $600.

Sellers will have to swiftly yank the price below the 20-day EMA to apply pressure on the bulls. The pair may then skid to the $500 support.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin Weekly RSI Echoes Mid-2022 Bear Market as BTC Plays Liquidity

Bitcoin (CRYPTO: BTC) briefly surged toward the $70,000 level on a U.S. bank holiday before retreating, underscoring how thin liquidity can amplify price moves in markets with limited participants. The session featured swift reversals as major venues saw shallow order books, allowing large players to push the price in sharp, short-lived bursts and then pull back just as quickly. Traders described a day of both dramatic squeezes and measured pauses, with liquidity gaps creating a backdrop where price action could swing without a clear directional trend. While the move rekindled talk of potential bottoming signals, observers cautioned that a single holiday-driven spike is not a proof point for a durable trend, particularly given the broader context of a market accustomed to volatile cross-currents.

Key takeaways

- Holiday-thinned liquidity on a U.S. trading day amplified both upside and downside moves, with BTC briefly touching $70,000 before a pullback.

- Price action occurred in a tight range, described by analysts as a pattern of “breakouts and shakeouts” that failed to establish a decisive breakout.

- CoinGlass tracked roughly $120 million in crypto liquidations across four hours, highlighting the reflexive nature of order-book dynamics during low-volume sessions.

- Weekly RSI readings dipped to 27.8, the lowest since June 2022, fueling discussions about potential cycle lows and macro bottoming patterns.

- Market commentary emphasized ongoing liquidity-driven reversals, with notable divergence in activity on different exchanges and persistent bullish-bias signals outside of a handful of venues.

- A sequence of social posts from traders highlighted mixed sentiment, with some noting net buying pressure overall while exceptions persisted on certain platforms such as OKX.

Tickers mentioned: $BTC

Price impact: Neutral. The episode demonstrated how thin liquidity can drive rapid intraday reversals without signaling a sustained directional shift.

Trading idea (Not Financial Advice): Hold. Given the absence of a clear breakout and the sensitivity to depth on holiday sessions, traders may prefer to wait for a more decisive move backed by stronger liquidity and higher-volume participation.

Market context: The latest price activity reflects a broader pattern in crypto markets where liquidity constraints during holidays or low-volume sessions can magnify swings. It also sits amid ongoing debates about macro risk sentiment, ETF-related flows, and the persistence of risk-on versus risk-off dynamics that shape digital-asset price formation.

Why it matters

The episode matters because it exercises a fundamental risk for traders: price discovery in environments where liquidity is not consistently deep. Thin order books can magnify both hopeful breakouts and fear-driven reversals, making risk management and position sizing more critical than in normal trading conditions. For market participants, the contrast between a swift move to the multi-year high vicinity and a rapid retracement underscores how much of Bitcoin’s price action still depends on the availability of buyers and sellers at key price levels rather than on a sustained flow of capital. The event also provides a practical test bed for risk controls, as exchanges and liquidity providers calibrate their resilience to sudden, liquidity-driven shocks.

From a technical perspective, weekly RSI readings toward oversold territory suggest potential patience is warranted before drawing conclusions about a longer-term bottom. Yet the narrative is not binary: the same chart readings were cited in past cycles as precursors to stalled consolidations or gradual basing patterns rather than immediate recoveries. Analysts emphasized that while the current RSI dip resembles patterns seen in previous bear markets, it does not guarantee a repeat of those outcomes. The broader takeaway is a need to monitor how price, momentum, and volume evolve together in the weeks ahead, particularly as markets digest macro inputs and any incremental developments in crypto regulation or product approvals that could influence risk appetite.

On-chain and on-exchange observations further enrich the story. Market participants noted blocks of liquidity getting reconfigured as bids and offers were removed and re-placed at new levels, reinforcing the sense that order-book dynamics played a leading role in the day’s action. The interplay between short-term liquidations, bid-ask wall reformation, and whale activity suggested a tug-of-war between buyers aiming for a breakout and sellers defending certain price zones. In this context, a minority of observers highlighted a pattern that echoes the bear-market conditions of 2022, while others warned that a single holiday-driven session is not the best proxy for broader market health or a definitive trend reversal.

Social signals added texture to the narrative. One prominent trader noted that net buying pressure remained robust across most venues, with OKX standing out as an exception where the balance shifted toward selling pressure. The dialogue around the differing dynamics across exchanges highlighted how venue-specific liquidity can shape price trajectories in real time, contributing to a landscape where market participants must weigh cross-exchange liquidity, funding conditions, and cross-venue order flow as part of a single, evolving story.

Beyond Bitcoin itself, observers highlighted ongoing patterns in price response to liquidity shocks across the crypto market. The day’s action fed into a broader conversation about how investors seasonally recalibrate risk, particularly during holiday windows when traditional liquidity pools are thinner and risk sentiment can swing on a coin flip. While the event did not trigger any explicit new catalysts, its implications for short-term trading strategies—particularly those relying on liquidity-driven breakouts—remain a focal point for traders who seek to understand how much of BTC’s price movement is driven by depth versus fundamental shifts in demand.

What’s different about $BTC from yesterday is that net buying is maintained except for OKX. pic.twitter.com/x3Y1OegrsI

— CW (@CW8900) February 16, 2026

What to watch next

- Follow BTC price action in the next several sessions to determine if a sustained move beyond the current range emerges on higher liquidity.

- Monitor the weekly RSI to see whether momentum stabilizes above oversold territory or slides deeper, which could influence near-term bias.

- Track liquidation flows and changes in order-book depth across major venues to assess whether the market is rebalancing its risk tolerance.

- Observe cross-exchange buy/sell pressure differences, particularly after the holiday period, to gauge whether a broader consolidation or a fresh breakout is forming.

- Keep an eye on macro catalysts and regulatory developments that could shift appetite for risk assets in the coming weeks.

Sources & verification

- TradingView BTCUSD price action within the holiday session showing moves toward and away from $70,000 (BTCUSD chart).

- CoinGlass liquidity and liquidation data indicating roughly $120 million in liquidations over four hours.

- Material Indicators’ analysis of BTC/USDT liquidity and whale activity on major exchanges.

- Social posts from Daan Crypto Trades and Keith Alan discussing RSI patterns and bear-market similarities.

- Public social post from CW highlighting net buying dynamics and exchange-specific commentary.

Rewritten Article Body: Liquidity squeezes and RSI signals shape BTC price action on a holiday

Bitcoin, trading as Bitcoin (CRYPTO: BTC), confronted a unique set of conditions on a U.S. bank holiday: liquidity was thin, and that scarcity amplified even modest market forces into notable intraday moves. The price briefly tested the $70,000 mark before retreating, a pattern consistent with the kind of rapid, liquidity-driven reversals that have become familiar in low-volume sessions. Rather than a clean breakout, the action unfolded in a narrow corridor, with bids and asks repeatedly clearing and reforming at new levels as traders recalibrated risk exposure in the absence of the usual institutional floor.

Market observers described a day of “breakouts and shakeouts”—moments when prices appeared ready to run but were quickly checked by the lack of robust order-book depth. The dynamic is a reminder that, on days when major markets are closed, a handful of large participants can move prices meaningfully without the broader market’s participation. The net effect was a series of swift moves that left many participants unsure of the prevailing directional bias, reinforcing a common refrain: liquidity is the prime mover in such environments, more so than fresh macro catalysts or new fundamental data.

Data from CoinGlass illustrated the scale of activity during the session: approximately $120 million in liquidations occurred across a four-hour window. This is a hallmark of a market where thin liquidity can produce outsized volatility, as participants face sudden sifts in supply and demand balance. In practical terms, those who believed the momentum favored a sustained tilt toward the upside found themselves facing rapid opposition as new walls formed above and below the current price to absorb incoming bids or offers. The absence of deep liquidity magnifies the impact of individual large trades, making every order a potential flash point for the next move.

On the technical front, a closer look at momentum indicators painted a nuanced picture. Weekly RSI readings dipped toward oversold territory, with the metric landing at 27.8 on one trading day—its lowest reading since June 2022. Some analysts pointed to this as a potential bottoming signal, drawing parallels to prior bear-market cycles where oversold conditions laid the groundwork for a period of consolidation and eventual macro recovery. Others cautioned that history does not guarantee a repeat outcome and that the present pattern could diverge from 2022 depending on subsequent liquidity and macro dynamics. The discussion underscored how traders weigh technical signals in conjunction with the underlying liquidity environment, rather than relying on any single indicator in isolation.

Beyond the numbers, the day’s narrative included qualitative observations about exchange-specific activity. Traders noted that buying pressure remained more robust than on the previous session, with the exception of OKX, where selling pressure appeared to dominate. This divergence highlighted how different venues can diverge in real time, driven by liquidity distributions, funding conditions, and the behavior of large players who shuttle capital across platforms. A prominent market participant summarized the sentiment on social media, noting that net buying was generally positive across most venues, but the OKX discrepancy reminded the market that liquidity fragmentation persists and can influence short-term outcomes in unpredictable ways.

In a broader context, the episode fed into ongoing discussions about how crypto markets navigate cycles of risk appetite and liquidity stress. While the price action did not deliver a definitive directional signal, it reinforced a familiar pattern: during periods of limited depth, price discovery is a two-way process propelled by cautious, incremental moves rather than a single decisive breakout. The presence of “breakouts and shakeouts” as a recurring motif highlights how traders are adapting to a market structure where depth can evaporate quickly, forcing participants to reprice their expectations with each new order that clears the book.

Looking forward, the market will likely want to see a more explicit signal of conviction—whether it be a sustained move above a key level with robust volume or a decisive breakdown that confirms a shift in risk sentiment. For now, the data suggests that the landscape remains dominated by short-term liquidity dynamics rather than a clear, long-term directional thesis. The ongoing debate about potential bottoming signals versus continued consolidation is a reminder that, in crypto markets, the path of least resistance is often determined by how much liquidity remains available to absorb the next wave of orders.

//platform.twitter.com/widgets.js

Crypto World

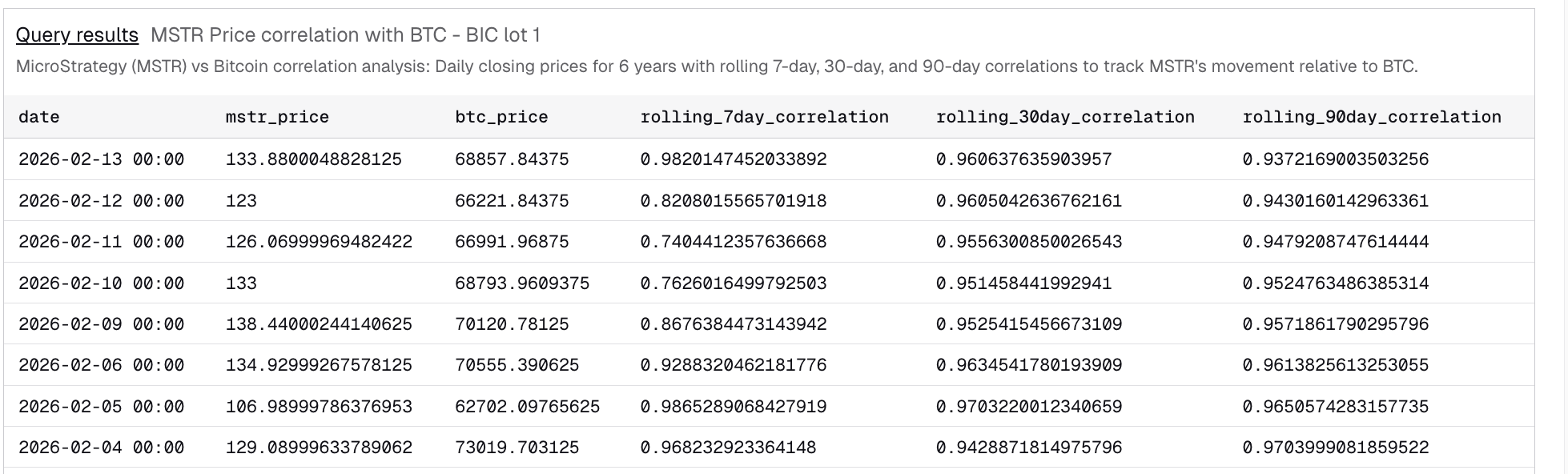

MicroStrategy Stock Price at 10% Risk as Bitcoin Link Tightens

The MicroStrategy stock price closed around $133 on February 13, rising 8.85% in one day. The weekly gain reached nearly 5%, showing strength despite broader uncertainty. But this rally comes at a strange time. Bitcoin fell about 2.2% over the same period, creating a gap between the two assets that rarely lasts long.

New data shows that MicroStrategy and Bitcoin are moving almost identically again. The 7-day rolling correlation has surged to 0.98, near perfect alignment. This tight link means the MicroStrategy price prediction going forward in 2026 may depend heavily on Bitcoin’s next move. At the same time, momentum indicators and volume signals show early warning signs that the recent MSTR price bounce may face pressure.

Sponsored

Sponsored

MicroStrategy’s Bitcoin Correlation and RSI Signal Correction Risk

Rolling correlation measures how closely two assets move together over a set period. The current 7-day correlation of 0.98 means MicroStrategy and Bitcoin are moving in nearly the same direction. This is the highest level since early February. When correlation reaches this level, price moves in one asset often carry over to the other.

This creates a risk because Bitcoin has weakened recently while MicroStrategy stock moved higher. Such gaps often close when markets reopen, causing delayed corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Relative Strength Index (RSI) is showing a hidden bearish divergence. RSI measures buying and selling momentum by comparing recent gains and losses. Between December 9 and February 13, the MicroStrategy price seems to be forming a lower high.

However, during the same period, the Relative Strength Index (RSI), a momentum indicator, has already flashed a higher high. This pattern is called hidden bearish divergence. It shows that even though momentum appears stronger, the underlying price structure remains weak. Sellers may still be in control.

Sponsored

Sponsored

A similar divergence formed earlier between December and February. After that signal, MicroStrategy stock dropped nearly 14%. The same setup is now appearing again.

The key level to watch is $133 ($133.88 to be exact). If the next MicroStrategy (Strategy) stock price candle stays below this level, the correction risk remains active. A move above it would weaken this bearish signal (the hidden divergence) for now and could further the bounce. But that would also mean that Bitcoin’s influence would weaken temporarily.

Institutional Buying Supports Price, While Retail Selling Weakens Conviction

Despite the bearish momentum signal, institutional investors are showing a different behavior. The Chaikin Money Flow (CMF) indicator tracks large money flows into and out of an asset. Since November 21, the MSTR price has trended lower overall. But CMF has steadily moved higher and is now above zero.

This means that large investors have continued to buy even as the price has struggled. Institutional accumulation can reduce downside risk and stabilize prices during corrections.

Sponsored

Sponsored

However, retail investors are showing the opposite trend.

The On-Balance Volume (OBV) indicator tracks cumulative buying and selling volume. Unlike CMF, OBV has been trending lower since November, aligning with the price. This shows that smaller investors have been selling during recent months.

This creates a conflict. Institutional buyers are supporting the price, but retail investors are possibly reducing exposure. The key OBV level now sits near 972 million. If OBV fails to break above this level, it would confirm continued retail weakness. This would increase correction risk and support the forming bearish divergence signal.

This conflict between institutional and retail investors leaves MicroStrategy’s price prediction uncertain in the short term.

Sponsored

Sponsored

MicroStrategy Price Prediction Depends on $139 Breakout or $119 Breakdown

The MSTR price levels now provide the clearest guide to the next move. On the downside, the first key support level sits at $119. This level aligns with the 0.236 Fibonacci retracement and represents a potential 10% decline from current levels. This target also matches the size of previous divergence-driven corrections.

If MicroStrategy stock falls below $119, the next support sits near $106. This would represent a deeper correction and confirm seller control.

On the upside, the most important recovery level is $133, as mentioned earlier, followed by $139. This resistance has capped recent rallies. A confirmed breakout above $139 would signal renewed strength.

If this breakout happens, MicroStrategy stock could move toward $165. A stronger rally could extend toward $190 if Bitcoin also recovers. However, if Bitcoin weakness continues, MicroStrategy could follow lower due to the strong correlation.

For now, MicroStrategy stock remains at a critical point. The extremely high correlation with Bitcoin means its next move may depend on Bitcoin’s direction. If Bitcoin weakness continues, the MicroStrategy stock price could face a delayed correction. But if institutional buying continues and resistance breaks, the bullish trend could still resume for MSTR.

Crypto World

Nexo Partners with Bakkt for US Crypto Exchange and Yield Programs

TLDR

- Nexo is relaunching its crypto services in the United States after more than three years of absence.

- The platform will offer yield programs, a spot exchange, and crypto-backed credit lines to US users.

- Nexo has partnered with Bakkt to provide the trading infrastructure for its US operations.

- The company’s return is driven by improved regulatory clarity for digital assets in the US.

- Nexo’s new US operations will be based in Florida and run by an announced management team.

Crypto platform Nexo is set to return to the United States after more than three years. The company paused its operations in 2022 due to regulatory concerns. Now, with clearer guidelines in place, Nexo aims to offer crypto services including yield programs, a spot exchange, and more.

Nexo Partners with Bakkt for Trading Infrastructure

Nexo’s trading infrastructure will be powered by Bakkt, a US-based digital asset platform. Bakkt primarily serves institutional clients but will help Nexo build its new US offering. Eleonor Genova, Nexo’s head of communications, confirmed that the platform will provide both flexible and fixed-term yield programs.

The platform will also feature crypto-backed credit lines and a loyalty program for US customers. Nexo’s management team will operate the new venture from Florida, with plans to announce the team soon. Genova emphasized that all services will be offered through partnerships with licensed US providers.

After leaving the US market in late 2022, Nexo now sees improved regulatory clarity for digital assets in the country. The company originally withdrew due to what it called an unfriendly regulatory environment under former SEC chair Gary Gensler. Nexo’s “Crypto Earn” program, which lets users earn interest on their crypto holdings, was a key issue in the company’s exit.

Nexo settled with the SEC in 2023, agreeing to pay $45 million for failing to register its interest-bearing program. The company later shut down the program for US users, marking the end of its earlier US operations. Despite these setbacks, Nexo now believes the regulatory landscape is more favorable for blockchain businesses.

Nexo’s Relaunch and US Crypto Regulatory Landscape

Nexo’s return comes as the US continues to work on crypto regulations. The House recently passed the CLARITY Act, but the Senate has yet to move it forward. Patrick Witt, a White House crypto advisor, called for compromises to pass crypto-related legislation before the 2024 elections.

This renewed effort to regulate crypto coincides with Nexo’s own regulatory framework. Genova stated that the new US operations are compliant with US securities laws. The company hopes to provide a stable platform for crypto users amid ongoing regulatory discussions.

Nexo’s rebooted platform will rely on third-party advisory services registered with the SEC. This ensures that the services offered are in line with applicable securities laws. The crypto exchange aims to establish itself as a trusted platform for US users after its previous exit.

Crypto World

Nexo Relaunches Crypto Platform in the United States

Nexo is set to relaunch its digital asset services and crypto exchange platform in the US on Monday, more than three years after it left the market following battles with federal and state regulators.

Now, citing improved regulatory clarity for digital assets in the US, the rebooted Nexo platform will offer flexible and fixed-term yield programs, a spot cryptocurrency exchange, crypto-backed credit lines and a loyalty program for US users, Nexo head of communications Eleonor Genova told Cointelegraph.

The platform’s trading infrastructure will be provided by Bakkt, a US-based digital asset platform focused on serving institutional clients. Genova said:

“Nexo’s US offering is structured through partnerships with appropriately licensed US service providers. Certain services are made available via a third-party Securities and Exchange Commission-registered (SEC) investment adviser, which provides advisory services under applicable US securities laws.”

The new US operations will be based in Florida and run by a management team to be announced soon, according to the company.

Nexo first announced plans to re-enter the US during an exclusive event in April 2025, which featured Donald Trump Jr., the son of US President Donald Trump, as a keynote speaker. At the event, Trump Jr. described crypto as the future of finance.

Related: Nexo to pay $500K fine to California regulator over ‘risky loans’

2022 exit cited regulatory uncertainty under Gensler regime

Nexo left the US market in December 2022 during the depths of the crypto bear market, citing the hostile regulatory posture toward the crypto industry under the leadership of former SEC chair Gary Gensler.

The company said it had decided to exit the US out of necessity after engaging in “good faith” conversations with US state and federal regulators over 18 months that did not move the needle.

“It is now unfortunately clear to us that despite rhetoric to the contrary, the US refuses to provide a path forward for enabling blockchain businesses,” the company said at the time.

Nexo’s “Crypto Earn” program, which allowed users to earn compounding interest on select cryptocurrencies loaned to the platform, was a major point of contention between the SEC and the company.

In January 2023, Nexo agreed to a $45 million settlement with the SEC over failing to register its interest-bearing crypto rewards program with the regulator. The company also settled a $22.5 million multi-state securities settlement related to the earn interest program.

The company shuttered its Crypto Earn program for US users one month later.

Washington mulls crypto “clarity”

Nexo’s market reentry comes amid efforts in Washington to pass a bill defining how US market regulators will police crypto. The House passed a similar bill, the CLARITY Act, in July, but the effort has stalled as the Senate Banking Committee has yet to gather enough bipartisan support to advance it.

White House crypto adviser Patrick Witt said on Friday that both sides must compromise on the issue and push for passage before November’s midterm elections. Contributing to the stalemate are concerns voiced by crypto industry executives, which US Treasury Secretary Scott Bessent believes have negatively impacted the industry, he told CNBC on Friday.

A White House-brokered meeting last week between crypto and banking industry representatives to reach an agreement on stablecoin provisions in the market structure bill was described as “productive,” but remains unresolved.

Magazine: Astrology could make you a better crypto trader: It has been foretold

Crypto World

How Paid Hype Pumps Tokens and Silences Critics

Crypto news stories are vanishing without a trace. Articles questioning the influence of paid press releases have quietly disappeared from major crypto websites, leaving little evidence they were ever published.

At the same time, thousands of promotional announcements continue to flood the industry, shaping narratives, moving markets, and blurring the line between journalism and advertising.

The Shadow Pipeline That Fuels FOMO

Chainstory analyzed 2,893 press releases distributed between June 16 and November 1, 2025. Using AI-driven sentiment tagging and risk classification, cross-referenced with blacklists like CryptoLegal.uk, Trustpilot, and scam alert feeds, the report found that:

- 62% originated from high-risk (35.6%) or confirmed scam projects (26.9%).

- Low-risk issuers accounted for only 27% of releases.

- In certain niches, such as cloud mining, scam, or high-risk content, dominated ~90% of releases.

The tone of the content was heavily promotional:

Sponsored

Sponsored

- Neutral: 10%

- Overstated: 54%

- Overtly promotional: 19%

Content type breakdown further highlighted the triviality of much coverage:

- Product tweaks or minor feature updates: 49%

- Exchange listing announcements (spam): 24%

- Substantive corporate events (funding, M&A): 2% (58 releases)

Based on this, the researchers concluded that these dynamics create a “manufactured legitimacy loop.” Dubious projects buy guaranteed placements across dozens of outlets, including mainstream financial portals, sidebars, and niche crypto aggregators.

Placement allows these projects to populate “As Seen On” sections, leveraging recognition to drive retail FOMO.

Headlines are deliberately loaded with marketing buzzwords like “AI-Powered Revolution,” “RWA Game-Changer,” terms editorial desks would likely reject if scrutinized.

PR Dollars Speak Louder Than Facts

The ecosystem echoes TradFi abuses. SEC data shows press releases fueled 73% of OTC penny-stock pump-and-dump schemes from 2002–2015.

In crypto, the effect is amplified, with algorithmic trading bots that scrape keywords such as “partnership” or “listing,” automatically triggering buy orders.

The result is a short-term price pump, often followed by unexpected declines once the underlying project fails to meet expectations.

Complicating matters, FTC rules for native advertising require clear disclosure. In practice, many crypto “Press Release” sections appear neutral, erasing the sponsored stigma and conferring the illusion of independent validation.

Retail investors often interpret the placement of content on recognized domains as evidence of legitimacy.

Sponsored

Sponsored

Who Pulls the Strings Behind Crypto Coverage?

Chainstory’s findings initially gained traction across crypto media, with coverage appearing on TradingView, KuCoin, MEXC, and other outlets. Yet, key articles disappeared without explanation on several outlets.

- Investing.com – formerly titled “Crypto press releases dominated by high-risk projects, Chainstory study finds.”

- CryptoPotato, which had described wire services turning placement into a “paid commodity.”

There were no 404 errors or notices. Posts were simply erased from search and archive.

As seen by BeInCrypto via email, sources indicate that an executive from a company implicated in the pay-to-play ecosystem contacted these outlets, citing alleged data faults or bias.

Some editorial teams complied, suggesting a broader vulnerability: advertiser leverage over editorial independence.

It is imperative to note that most crypto outlets rely heavily on PR distribution revenue, particularly during bear markets or when ad budgets are tight.

Therefore, it may be safe to assume that critical reports threatening that revenue stream can prompt quiet removals or editorial self-censorship.

“I’m not involved in the day-to-day of the site/ editorial. I need to ask about this,” CryptoPotato’s Yuval Gov responded to BeInCrypto’s request for comments.

Sponsored

Sponsored

The Man at the Center: Nadav Dakner and Chainwire

At the core of the paid-PR ecosystem is Nadav Dakner, co-founder and CEO of Chainwire (MediaFuse Ltd.), which markets “guaranteed coverage” across crypto and TradFi sites.

“Broadcast your crypto & blockchain news with guaranteed coverage, in industry-leading publications,” read an excerpt on the Chainwire website.

A source close to the matter told BeInCrypto that Nadav is the force behind the article takedowns.

Chainwire mirrors the practices highlighted by Chainstory: syndication to dozens of outlets in exchange for visibility, often leveraged to influence retail behavior.

Despite scrutiny, Chainwire remains influential:

- Named “Best PR Wire” at the 2026 CoinGape Awards (February 2, 2026).

- Maintains strong G2 ratings for 2025 campaigns.

Meanwhile, Dakner’s past ventures provide further context. He co-founded MarketAcross and InboundJunction and was involved in the 2017 Gladius Network ICO, which raised approximately $12.7 million in ETH.

Sponsored

Sponsored

The SEC settled with Gladius in February 2019 for unregistered securities violations, requiring refunds and registration, but no fines due to self-reporting.

Gladius dissolved later that year without full compliance, leaving investors uncompensated.

Court documents from Gladius v. Krypton Blockchain Holdings (2018) describe Dakner introducing Gladius to Krypton Capital (founded by Ilan Tzorya). InboundJunction appeared in the whitepaper as a marketing/PR partner.

Some reports frame Dakner as the de facto CMO and investor. Investigative reporting by FinTelegram and CryptoTicker (October 2025) notes proximity to funding conduits linked to broader fraud networks involving figures such as Gery Shalon, Vladimir Smirnov, and Gal Barak.

Importantly, these connections are indirect, as no charges were filed against Dakner.

Chainwire also faced separate 2025 allegations of exploitative practices, including unpaid “test” campaigns and ghosting publishers.

Notably, no direct link exists between Dakner or Chainwire and Chainstory takedowns.

However, overlap in ecosystems and timing raises questions about whether commercial relationships suppress critical reporting.

The Quiet Amplifiers That Shape Crypto Markets

Chainstory’s research exposes a market where credibility can be bought, manipulated, or quietly erased. When critical reports vanish from archives, it reinforces the opacity and manufactured legitimacy that fueled the original concerns.

For retail participants within crypto’s hype-driven environment, skepticism is essential. Verification via on-chain data, independent sources, and awareness of PR revenue dependence is crucial to avoid falling prey to the pay-to-play cycle.

In crypto’s ongoing information wars, the quietest edits—deleted posts, altered archives, and erased analysis—may speak loudest, revealing the subtle levers that shape perception, sentiment, and ultimately, market outcomes.

Chainwire did not immediately respond to BeInCrypto’s request for comment.

Crypto World

Bitcoin’s Next Bull Run Depends on This Single On-Chain Indicator

This on-chain metric turning negative has repeatedly meant seller exhaustion and the transition from bear markets to bull cycles.

The cryptocurrency market remained subdued amidst short-term nerves, mixed signals, and no clear direction. Bitcoin also showed limited conviction and was visibly under pressure after shedding over 1% of its value in the last 24 hours.

Data shows BTC’s strongest rallies start only after long-term investors absorb unrealized losses and selling pressure fully exhausts itself.

Bitcoin Bulls Await

Joao Wedson, co-founder of Alphractal, said Bitcoin’s next major bull cycle has historically begun only after long-term holders move into unrealized losses. According to Wedson, the Net Unrealized Profit/Loss (NUPL) metric for long-term holders, which tracks the average unrealized gains or losses of the most resilient market participants, currently stands at 0.36. Such a trend indicates that these investors remain in profit.

However, Wedson explained that the important signal appears when this metric turns negative. A negative NUPL means even long-term holders are underwater, a condition that has consistently coincided with periods of extreme market pessimism.

In past cycles, such phases pointed to seller exhaustion and a redistribution of coins toward stronger hands. Wedson noted that this environment has historically represented the final stage of bear markets and preceded the start of a new bull run, which means that major opportunities tend to emerge during periods of market depression rather than at cycle highs.

Low MVRV

Similar conditions are now being flagged by Bitcoin’s valuation indicators. CryptoQuant, for one, found that Bitcoin’s Market Value to Realized Value (MVRV) ratio has entered its “Accumulation Zone” for the first time in four years, a move last seen in May 2022.

According to the analytics firm, the previous instance of MVRV falling into this range was followed by a sharp price correction, as Bitcoin declined roughly 50% from around $30,000 to $15,000. CryptoQuant explained that the Accumulation Zone is defined by MVRV remaining below 1.44 and potentially falling as low as 0.90, levels that historically indicate periods when the crypto asset is undervalued relative to its realized price.

You may also like:

These conditions typically coincide with high market pessimism and reduced speculative activity. The firm also added that, based on historical patterns, continued periods with MVRV below 1.44 have offered favorable phases for long-term accumulation, even as price volatility and downside risk remain quite high in the short term.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin ‘Fakeouts And Shakeouts’ Liquidate Traders This US Bank Holiday

Bitcoin round tripped gains after a spike to $70,000 as liquidity traps began to characterize BTC price action on the US bank holiday.

Bitcoin (BTC) took out long and short positions during Monday as low-volume trading sparked short-term volatility.

Key points:

-

Bitcoin sees low-time frame manipulation clear both longs and shorts on the US bank holiday.

-

BTC price action offers “breakouts and shakeouts” while staying in a narrow range.

-

2022 bear market comparisons continue, now focused on weekly RSI.

BTC price liquidity squeezes shake out traders

Data from TradingView captured sharp moves within a narrow BTC price range on the US bank holiday which topped out at $70,000.

With Wall Street closed, thinner order books overall made it easier for large-volume entities to influence short-term price action. This resulted in multiple “squeezes” that impacted both longs and shorts.

Data from monitoring resource CoinGlass showed $120 million in crypto liquidations for the four hours to the time of writing.

Blocks of bids and asks were cleared on the day, with new “walls” placed immediately above price as it fell, adding to downward pressure.

“Volatility is much higher which is something that we also see in pretty much all other markets lately. Definitely not a calm period for markets around the world,” trader Daan Crypto Trades commented in a post on X.

Trading resource Material Indicators described the latest BTC price performance as “breakouts and shakeouts.”

An accompanying chart monitored both liquidity and whale activity on Binance’s BTC/USDT pair.

Trader CW nonetheless observed that buying pressure was more robust than on Sunday, with the exception of exchange OKX.

What’s different about $BTC from yesterday is that net buying is maintained except for OKX. pic.twitter.com/x3Y1OegrsI

— CW (@CW8900) February 16, 2026

Bitcoin RSI teases “once per cycle lows”

Continuing on the wider status quo, Material Indicators cofounder Keith Alan stressed ongoing resemblances between this year and Bitcoin’s 2022 bear market.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

Relative strength index (RSI) readings on weekly time frames, he said, were pointing to a BTC price bottoming phase.

“Finding more similarities with 2022 in the $BTC chart as Weekly RSI moves towards what has historically been, once per cycle lows in oversold territory,” he told X followers.

“In 2015 and 2018 it marked bottom, however in 2022 it led to a 5 month consolidation before establishing a macro bottom.”

Weekly RSI measured 27.8 on Monday, marking the lowest reading since June 2022. Readings below 30 are considered “oversold.”

“This doesn’t mean it has to develop the same way this time, but it’s worth watching closely to identify similarities and deviations in the pattern to help with forecasting,” Alan added.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Bitcoin Targets $84K CME Gap After Rising Accumulation in BTC

Bitcoin (BTC) saw a sharp dip below $67,400 during the Monday session open, after it rallied above $70,000 over the weekend. An immediate recovery may come at the back of BTC order book data, which shows aggressive bid positioning, and onchain data pointing to a rise in long-term accumulation.

Analysts now say the move may extend toward the $80,000–$84,000 region, with order book liquidity playing a key role in the next move.

Key takeaways:

-

The Bitcoin accumulator addresses held over 372,000 BTC on Feb. 15, up from 10,000 BTC in September 2024.

-

BTC order books show the largest bid skew in over two years, signaling a stronger near-term support.

Bitcoin futures and order book data support $80,000 retest

Crypto analyst Mark Cullen said Bitcoin may move toward the early February CME (Chicago Mercantile Exchange) gap, placing $80,000 to $84,000 as his upper price target this week.

A CME gap forms when the Bitcoin futures on the Chicago Mercantile Exchange close for the weekend and reopen at a different price, leaving a price range with no traded volume.

Previously, Bitcoin has revisited these gaps to “fill” them, meaning the price trades back through that untested range.

The current gap sits roughly between $80,000 and $84,000, making it a clear technical level. With 9 out of 10 CME gaps filled since August 2025, the $80,000–$84,000 range stands out as the key unfilled level.

Meanwhile, the order book data shared by crypto trader Dom shows roughly $596 million in bids within 0–2.5% of price versus $297 million in asks. This near 2:1 bid-to-ask imbalance represents the largest bid skew in over two years.

A bid skew of this magnitude indicates stronger immediate demand than the supply, which can support a short-term upward trend if sustained.

Dom said traders were hesitant to buy during the sharp drop. After Bitcoin swept below $60,000, demand picked up near the lows, suggesting growing interest in accumulating at discounted prices.

Related: Metaplanet revenue jumps 738% as Bitcoin generates 95% of sales

BTC accumulation demand hits new highs

CryptoQuant data shows that the demand from addresses classified as “accumulators” has reached new highs at roughly 372,000 BTC on Feb. 15. In September 2024, that figure was around about 10,000 BTC.

Crypto analyst Darkfost explained that these addresses are filtered using strict criteria: no outflows, multiple inflows, a minimum balance threshold, at least one active period in the past seven years, and exclusion of exchange, miner, and smart contract wallets.

Meanwhile, the long-term holder (LTH) distribution 30-day sum, which measures the total BTC moved by long-term holders over a rolling 30-day period, has fallen below $100,000, compared to averages above $1 million in November 2025.

A lower distribution suggests reduced selling from the LTHs, partially offsetting whale-driven inflows.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

-

Sports5 days ago

Sports5 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech6 days ago

Tech6 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Crypto World7 days ago

Crypto World7 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video4 hours ago

Video4 hours agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech2 days ago

Tech2 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video3 days ago

Video3 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Crypto World6 days ago

Crypto World6 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World5 days ago

Crypto World5 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Video5 days ago

Video5 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports7 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World7 days ago

Crypto World7 days agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat1 day ago

NewsBeat1 day agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business4 days ago

Business4 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World4 days ago

Crypto World4 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

Politics6 days ago

Politics6 days agoWhy was a dog-humping paedo treated like a saint?

-

NewsBeat1 day ago

NewsBeat1 day agoMan dies after entering floodwater during police pursuit

-

Crypto World3 days ago

Crypto World3 days agoBlackRock Enters DeFi Via UniSwap, Bitcoin Stages Modest Recovery

-

NewsBeat2 days ago

NewsBeat2 days agoUK construction company enters administration, records show