Crypto World

Will XRP Plunge Below $1 in February? ChatGPT Reassesses After Ripple’s Crash

The last time we asked ChatGPT this question, it was rather dismissive. Now, its answers were significantly less optimistic.

The price moves from precisely a month ago could hardly have anticipated what happened in the following 30 days. XRP, for example, skyrocketed by 30% at the time to $2.40 amid growing ETF inflows.

The subsequent rejection and correction, though, were brutal. After several consecutive leg downs, the culmination, at least for now, transpired earlier today when it plunged below $1.40 and now struggles at $1.35. As such, we decided to revisit a painful question for ChatGPT.

Below $1 Now?

CryptoPotato first asked this question over the weekend when the landscape around Ripple and its native token was not as grim. XRP traded at around $1.60 after its most recent crash, but it seemed as if it had bottomed. Perhaps that’s why most AIs agreed that the chances for a drop beneath $1.00 in February were quite slim at the time.

However, that perceived bottom gave in during the current trading week, as mentioned above. Consequently, we asked ChatGPT whether its view on the matter will change now.

The AI’s short answer was yes, as the probability of such a drop is “meaningfully higher now than it was when XRP was at $1.60-$1.70.” At the time, the token still traded above major structural support, and the broader market hadn’t rolled over so decisively. There was no confirmed breakdown of higher-timeframe levels, and the sentiment wasn’t entirely bearish.

A lot changed in the following several days, though. Momentum has accelerated to the downside as XRP sold off aggressively, “slicing through intermediate supports and failing to hold rebounds.” Additionally, February has just started, and there’s too much time for such a drop to occur if the overall conditions do not improve rapidly.

Dip or Breakdown?

Given the current circumstances, ChatGPT believes that the probability of XRP remaining above $1.00 in February is around 40%. It expects that there will be some consolidation and choppy trading after such heightened volatility and declines.

You may also like:

However, it also noted that there’s a 35-40% chance of a liquidity sweep to just under $1.00 in the next few weeks. It would be prompted by a fast sell-off, resulting in a panic wick, before a sharp rebound. This scenario, it added now, has become “very real.”

It still dismissed the possibility of a full-on breakdown below $1.00, saying the percentages are around 15-20% now. Although this scenario appears least likely for ChatGPT, it still acknowledged that it had gone from negligible (over the weekend) to quite possible (now).

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How to Choose the Right AI Development Partner for Enterprises in 2026

Key Takeaways:

- Enterprises need production-ready, scalable AI systems to drive real business impact.

- Clarify business problems, workflows, and success metrics before choosing a partner.

- Look for technical expertise, domain knowledge, and co-development capabilities.

- Ensure data protection, governance, and ongoing support are built in.

- Evaluate use cases, conduct technical assessments, run PoCs, and finalize IP and support models.

The landscape of enterprise technology has shifted. In 2026, artificial intelligence is no longer an experimental feature; it is the core engine of corporate strategy. According to Gartner, by 2026, more than 80% of enterprises will have moved from basic generative AI pilots to production-grade systems, including multi-agent architectures and domain-specific models.

As the global AI market is projected to reach $312 billion in 2026, the pressure to choose a capable AI development partner has never been higher. This guide provides a strategic framework for identifying, evaluating, and onboarding the right AI development company to lead your digital transformation.

Understanding Your AI Requirements Before Engaging a Partner

Before evaluating any AI development company, enterprises must clearly define their internal objectives and constraints. As AI systems become more complex, success increasingly depends on aligning technical architecture with measurable business outcomes.

1. Clarify the Business Problem

Enterprises should begin by identifying the exact problem AI is expected to solve. This may include reducing operational inefficiencies, improving decision accuracy, automating high-volume workflows, or enabling new revenue models. Leading organizations are shifting away from bottom-up experimentation toward targeted, high-impact transformations aligned with strategic priorities.

2. Identify the Type of AI Solution Required

Different business goals require different AI approaches. Common enterprise-grade solutions in 2026 include:

- Multi-Agent Systems (MAS): Autonomous agents that collaborate to execute complex, multi-step workflows.

- Domain-Specific Language Models (DSLMs): Models trained or fine-tuned on industry-specific data to improve reliability and contextual understanding.

- Recommendation and Personalization Engines: AI systems that drive individualized experiences across marketing, sales, and digital platforms.

3. Define Success Metrics Early

Traditional metrics such as model accuracy are no longer sufficient. Enterprises increasingly track performance through operational and financial indicators, including decision latency reduction, inference cost relative to business value, risk mitigation, and employee productivity gains.

Choose a Trusted AI Development Partner

The Enterprise AI Partner Landscape in 2026

The market for custom AI development services has matured and diversified. Selecting the right AI development partner depends heavily on an organization’s scale, regulatory environment, and technical maturity.

Common Types of AI Service Providers

- Global Consulting Firms: Suitable for large-scale digital transformation initiatives, though often slower and more expensive to execute.

- Niche AI Specialists: Strong in advanced R&D and complex model development but may face challenges scaling enterprise-wide deployments.

- Product-Led AI Firms: Offer faster deployment using pre-built platforms, with potential limitations in customization and IP ownership.

1. Co-Development and IP Ownership

- Global Consulting Firms: Suitable for large-scale digital transformation initiatives, though often slower and more expensive to execute.

- Niche AI Specialists: Strong in advanced R&D and complex model development but may face challenges scaling enterprise-wide deployments.

- Product-Led AI Firms: Offer faster deployment using pre-built platforms, with potential limitations in customization and IP ownership.

2. Co-Development and IP Ownership

Enterprises are increasingly favoring co-development models that allow them to build proprietary intellectual property alongside their AI solutions provider. This approach reduces dependency on vendor-controlled platforms and supports long-term strategic flexibility.

3. Local vs. Distributed Delivery Models

While distributed teams offer cost efficiencies, enterprises in regulated industries often prioritize providers with a strong regional presence to address data residency, compliance, and governance requirements.

Core Criteria for Selecting an AI Development Partner

1. Technical Capability and Innovation

An enterprise AI development partner must demonstrate hands-on expertise with modern AI architectures, including agent-based systems, retrieval-augmented generation (RAG), and vector databases. Equally important is a commitment to continuous research and experimentation with evolving open-source and commercial AI frameworks.

2. Industry and Domain Knowledge

Domain familiarity significantly accelerates development timelines and reduces operational risk. Partners with experience in regulated industries such as finance, healthcare, or logistics are better equipped to handle domain-specific data structures, compliance obligations, and validation requirements.

3. Collaboration and Delivery Model

AI development is inherently iterative. Enterprises should look for transparent governance structures, clearly defined roles across data science and engineering teams, and agile delivery processes that emphasize frequent validation over long development cycles.

4. Security, Compliance, and Governance

In 2026, AI security and governance are non-negotiable. A qualified AI solutions provider for enterprises must demonstrate adherence to regional regulations, provide explainability mechanisms, and maintain full data lineage across training and deployment pipelines.

5. Pricing Structure and Long-Term ROI

Enterprise AI investments typically extend beyond initial development. Organizations should assess the total cost of ownership, including infrastructure usage, ongoing monitoring, retraining, and performance optimization. Flexible pricing models—such as dedicated teams or hybrid engagement structures—often provide better long-term value than rigid fixed-price contracts.

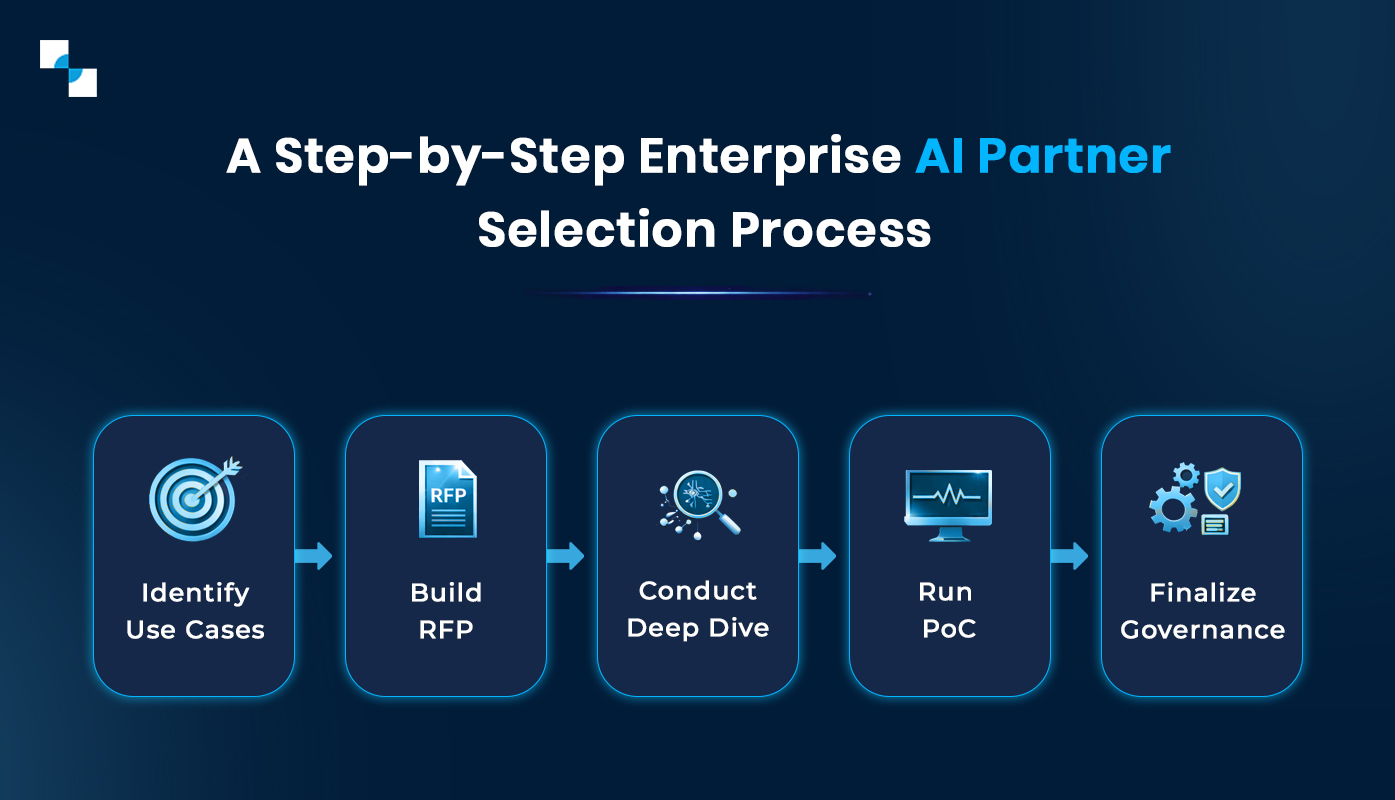

A Step-by-Step Enterprise AI Partner Selection Process

Step 1: Identify High-Value Use Cases

Rather than pursuing broad AI initiatives, enterprises should prioritize workflows where AI can deliver measurable operational impact. High-value use cases often involve decision automation, exception handling, or high-volume manual processes.

Step 2: Design a Future-Ready RFP

Modern RFPs should assess more than cost and timelines. Enterprises should evaluate a partner’s MLOps maturity, approach to model monitoring, explainability frameworks, and ability to support agentic workflows.

Step 3: Conduct a Technical Deep Dive

Involving senior technical stakeholders is essential. Enterprises should assess architecture design, data handling strategies, and cloud-native deployment approaches to ensure scalability and avoid vendor lock-in.

Step 4: Run a Production-Oriented PoC

A proof of concept should reflect real-world conditions. Using unrefined enterprise data allows organizations to evaluate a partner’s ability to manage data complexity, deliver reliable performance, and meet defined KPIs within a limited timeframe.

Step 5: Finalize Governance, IP, and Support Models

Before onboarding, enterprises should clearly define IP ownership, model maintenance responsibilities, performance SLAs, and post-deployment support mechanisms to ensure long-term alignment.

Critical Warning Signs When Evaluating an AI Development Partner

- Unclear System Architecture: If a provider cannot clearly explain how their AI system works end to end—including data flow, decision logic, and integration points—it’s a sign the solution may not be production-ready.

- No Plan for Post-Deployment Maintenance: AI models require continuous monitoring, retraining, and performance evaluation. A partner that treats deployment as the finish line is likely to deliver a system that degrades quickly over time.

- Lack of Cost Transparency: Be cautious of vendors who provide high-level estimates without detailing infrastructure usage, cloud compute requirements, data preparation costs, or long-term operational expenses.

- Generic or Reused Demonstrations: If the same demo or example is used across industries and use cases, it suggests limited customization capability. Enterprise AI solutions should be designed around specific business and domain requirements.

- Limited Accountability After Delivery: A weak or undefined support model—such as unclear SLAs, response times, or ownership boundaries—can create operational risk once the solution is live.

Positive Indicators When Evaluating an AI Development Partner

- Clearly Documented Development Processes: A strong AI development partner follows well-defined, repeatable frameworks for data ingestion, model training, validation, deployment, and monitoring. This signals maturity and reduces delivery risk.

- Deep Focus on Data Quality and Validation: Instead of starting with tools or timelines, the right partner spends time understanding your data sources, data integrity, labeling standards, and validation methods. This focus on ground truth is critical for reliable AI outcomes.

- Security Built into the Design Phase: Trusted enterprise AI partners address data protection, access controls, and model security early in the design process—often recommending secure execution environments and governance measures without being prompted.

- Strong Alignment with Business Objectives: A capable AI development company consistently connects technical decisions to business impact, ensuring models are designed to support measurable outcomes rather than theoretical performance.

- Clear Ownership and Long-Term Support Model: Reliable partners define responsibilities for maintenance, updates, monitoring, and issue resolution upfront, demonstrating accountability beyond initial delivery.

Build Future-Ready AI Solutions with Us

Building Long-Term AI Capability Through the Right Partnership

Choosing the right AI development partner is no longer just a procurement decision—it’s a strategic pivot. By 2026, the gap between AI leaders and laggards will be defined by the quality of their technical partnerships.

At Antier, we help enterprises build robust, scalable, and ethically grounded AI solutions. Whether you are looking for custom AI development services or need an enterprise AI solutions provider to overhaul your operations, our team is ready to bridge the gap between vision and production.

Crypto World

Here’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

Bitcoin (BTC) sellers resumed their activity on Thursday as the BTC price dropped below $69,000, the lowest since Nov. 6, 2024.

Analysts said that Bitcoin showed signs of “full capitulation” and a potential bottom forming, due to extreme market fear, panic selling by short-term holders and the relative strength index (RSI).

Key takeaways:

-

Short-term Bitcoin holders have sold nearly 60,000 BTC in 24 hours.

-

The Crypto Fear & Greed index shows “extreme fear,” signaling a potential bottom.

-

Bitcoin’s “most oversold” RSI points to seller exhaustion.

Short-term holder capitulation deepens

Nearly 60,000 BTC, worth about $4.2 billion at current rates, held by short-term holders (STHs), or investors who have held the asset for less than 155 days, were moved to exchanges at a loss over the last 24 hours, according to data from CryptoQuant.

This was the largest exchange inflow year-to-date, which is contributing to selling pressure.

“The correction is so severe that no BTC in profit is being moved by LTHs,” CryptoQuant analyst Darkfost said in a post on X, adding:

“This is a full capitulation.”

When analyzing the volume of coins spent at a loss, Glassnode found that the 7-day SMA of realized losses has risen above $1.26 billion per day.

This reflects a “marked increase in fear,” Glassnode said, adding:

“Historically, spikes in realized losses often coincide with moments of acute seller exhaustion, where marginal sell pressure begins to fade.”

Bitcoin’s capitulation metric has also “printed its second-largest spike in two years,” occurrences that have previously coincided with accelerated de-risking and elevated volatility as market participants reset positioning,” Glassnode said.

“Extreme fear” could signal market bottom

The Crypto Fear & Greed Index, which measures overall crypto market sentiment, posted an “extreme fear” score of 12 on Thursday.

These levels were last seen on July 22, a few months before the BTC price bottomed at $15,500 and then embarked on a bull run.

Data reveals that in all capitulation events where the index hit this extreme level, short-term weakness was common, but almost every event produced a rebound.

“We are at an ‘extreme fear’ level with a Crypto Fear and Greed Index of 11,” said analyst Davie Satoshi in an X post on Thursday, adding:

“History has shown this is the time to buy and accumulate more!”

Crypto sentiment platform Santiment said in an X post on Thursday that the investor sentiment has “turned extremely bearish toward Bitcoin.”

“This remains a strong argument for a short-term relief rally as long as the small trader crowd continues to show disbelief toward cryptocurrency as a whole.”

Bitcoin “most oversold” RSI signals seller exhaustion

CoinGlass‘ heatmap shows that BTC’s RSI is displaying oversold conditions on five out of six time frames.

Bitcoin’s RSI is now at 18 on the 12-hour chart, 20 on the daily chart and 23 on the four-hour chart. Other intervals also display oversold or near-oversold RSI values, such as 30 and 31 on the weekly and hourly time frames, respectively.

In fact, data from TradingView shows that the weekly RSI is at 29 on Thursday, the “most oversold” since the 2022 bear market, according to analysts.

“Bitcoin is now the MOST oversold since the FTX crash,” CryptoXLARGE said in an X post on Wednesday, adding that it reflects panic selling among investors.

“Historically, this is where fear peaks and opportunity begins,” the analyst added.

Bitcoin’s RSI is at the same oversold levels last seen around $16K in 2022, which marked the “last major capitulation,” phase, said analyst HodlFM in a recent post on X, adding:

“Not a timing signal by itself, but historically, this is where risk/reward favors the buyers.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Cardano faces deeper plunge as Bitcoin breaches $70K amid bear-cycle fears

- Cardano price dropped to near $0.26 as cryptocurrencies continued to struggle.

- ADA bulls face further pain if the price breaks below $0.25.

- Bitcoin’s crash to under $70,000 amid bear cycle fears is a major trigger.

Cardano price fell more than 9% to extend its downturn, with this coming as Bitcoin tumbled to below the $70,000 support level.

With BTC dragging the broader crypto market into turmoil, Cardano (ADA) dropped to lows of $0.26, signaling prolonged downside risks in this bear cycle.

Other altcoins had it even rougher, with XRP plummeting 14% to under $1.40 and Solana breaching support at $90.

Altcoins slide as BTC tanks amid market panic

Bitcoin sank further on Thursday, with bears breaking below $70,000 to plunge the whole sector into fresh turmoil.

The 8% drop from a retest of $73,000 came as Strategy, the world’s largest corporate holder of Bitcoin, sank into unrealized losses worth billions of dollars.

Treasury Secretary Scott Bessent had also noted on Wednesday that the government would not “bail out” Bitcoin.

However, despite confirmation that the US will not sell its BTC holdings, Cardano, alongside all the top altcoins, nosedived as BTC touched lows of $69,500.

Analysts at Glassnode pointed out that forced selling is escalating.

The $BTC capitulation metric has printed its second-largest spike in two years, highlighting a sharp escalation in forced selling.

These stress events typically coincide with accelerated de-risking and elevated volatility as market participants reset positioning.… pic.twitter.com/mcvVqXJcYq— glassnode (@glassnode) February 5, 2026

Cardano ADA price dives to $0.26

Cardano traded at $0.27 at the time of writing on February 5, 2026, down nearly 9% on the day.

Recent declines mean Cardano price has dived 21% in the past week and 36% in the past month.

The plunge from the $0.8 peak in October 2025 has only accelerated in the past month, with bulls failing to hold onto notable bounces above the $0.30 level.

ADA’s move aligns with bear cycle indicators, including a Fear & Greed Index in extreme fear territory and negative funding rates across exchanges.

Retail and institutional outflows have also amplified the slide, with macroeconomic conditions fueling further pain in a brutal start to the year for buyers.

Given Bitcoin’s outlook, analysts see the current support level of $0.26 as a fragile one for Cardano.

Bearish technicals signal further ADA downtrend

ADA’s daily chart gives a largely bearish outlook after the token’s dip below $0.30 and $0.28.

The dump across risk assets saw buyers fail to hold the 50-day moving average mark, while daily RSI hovers near oversold but lacks bullish divergence.

Data from Coinglass also shows a sharp decline in open interest, and negative funding rates reinforce the outlook.

If the altcoin carnage accelerates amid a broader bear cycle crash, ADA could revisit $0.20 or lower.

On the upside, a shift in macro conditions and regulatory tailwinds could spark bullish bets.

Catalysts like network upgrades or ETF approvals also favour bulls, with short-term targets at $0.50 and $1.

Crypto World

Can It Pump Even More?

Will HYPE continue its uptrend or will it follow the broader market downtrend?

It’s quite difficult to spot a popular cryptocurrency whose price hasn’t tumbled by 20% or even more in the last few weeks.

Hyperliquid (HYPE), though, is an evident exception, and its solid performance has caused analysts to envision further gains in the near future.

The Lone Survivor

Bitcoin (BTC) has crashed to a 14-month low of around $69,000, Ethereum (ETH) is struggling to keep the $2,000 level, while Ripple’s XRP and Solana (SOL) have plummeted by 27% in the past seven days. However, Hyperliquid (HYPE) has somehow defied the ongoing massacre and currently trades at around $32, representing a 50% increase on a two-week scale.

Its strong performance comes amid a string of positive developments surrounding the ecosystem. Earlier this week, Ripple announced that its institutional prime brokerage platform (called Ripple Prime) enabled support for Hyperliquid. Meanwhile, Grayscale recently revealed that it was encouraged by the rise in perpetual futures trading for non-crypto assets on the decentralized exchange.

Before that, on-chain data revealed growing interest in HIP-3 activity amid skyrocketing trading volume and open interest. These metrics continued to increase as the market tumbled in the past few days, reaching new peaks of $1B in OI and $4.8B in 24-hour volume.

HYPE has been the subject of numerous optimistic predictions, and many analysts believe there’s fuel left for additional gains. The analyst, using the X moniker Crypto General, expects volatility ahead and an eventual explosion above $100 later this year. Speaking on the matter was also Zach, who argued there are “so many reasons to buy and hold HYPE.”

There are so many reasons to buy and hold $HYPE.

The more it takes over market share and volume, the bigger the buybacks are, which is one of the reasons it’s so strong.

Really would love to get a spot entry around yearly open of $25 but who knows if it’ll come

— Zach (@CryptoZachLA) February 4, 2026

You may also like:

The popular analyst Crypto Tony chipped in, too, suggesting that HYPE could do “magical things when the market conditions are right.” Those interested in additional bullish forecasts for the token can read our dedicated article here.

Can It Follow the Pack?

It is important to note that the broader crypto market remains shaky, and sustained bearish conditions could eventually weigh in on HYPE as well.

Some analysts believe this is a likely outcome. The one using the X handle, Greeny, predicted that the native token of Hyperliquid could plummet to $20 later in 2026.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

How Cosmos Powers Real World Asset Tokenization for Institutional Capital Markets

TLDR:

- Tokenized U.S. Treasuries reached $5.6 billion by April 2025, growing five times year over year.

- Cosmos powers 150+ blockchains including Provenance, Progmat, and institutional RWA platforms.

- Ondo Finance moved $95 million into BlackRock’s BUIDL fund, enabling continuous redemptions.

- Lombard’s LBTC token surpassed $1 billion in three months with Franklin Templeton backing.

Capital markets are shifting toward blockchain infrastructure as tokenization gains traction across traditional finance.

Asset managers and banks now issue tokenized treasuries, credit instruments, and securities through distributed ledgers.

Stablecoins represent $250 billion in circulating value, while tokenized U.S. Treasuries reached $5.6 billion in assets under management by April 2025.

Citi analysts project tokenized assets could reach $4 to $5 trillion by 2030. Cosmos has emerged as preferred infrastructure for institutions seeking on-chain capital markets solutions.

Cosmos Architecture Addresses Institutional Requirements

Cosmos provides institutions with blockchain infrastructure that balances operational control and market connectivity.

The framework allows financial firms to build custom chains with internal governance, security protocols, and compliance automation.

Over 150 interoperable blockchains currently operate on Cosmos technology, with regulated institutions increasingly adopting the stack for capital markets applications.

Provenance powers Figure’s non-bank home equity lending platform, which leads the U.S. market in this segment. Progmat, a joint venture of Japan’s MUFG, Mizuho, and SMB, operates the country’s largest regulated tokenization platform on Cosmos infrastructure.

These deployments validate the technology for high-stakes financial operations requiring regulatory compliance and institutional-grade security.

The Inter-Blockchain Communication protocol enables asset distribution across networks while preserving issuer sovereignty.

Institutions can issue securities on proprietary chains and connect to external liquidity venues without surrendering control over core asset rules.

This separation of governance and distribution resolves a fundamental tension in institutional blockchain adoption.

Ledger-based settlement reduces reconciliation costs across custodians, transfer agents, and clearing systems. Asset managers achieve faster liquidity access, while banks minimize counterparty exposure.

Tokenization expands distribution by enabling asset fractionalization across regions without reconstructing product structures for each venue.

These operational benefits have accelerated adoption in cash equivalents, credit products, and exchange-traded instruments.

Production-Scale Implementations Demonstrate Market Readiness

Injective addresses digital securities market fragmentation through purpose-built financial infrastructure. The platform provides native primitives for tokenized asset issuance and trading at institutional scale.

DigiShares and publicly listed Valereum deployed their digital securities platform on Injective using the ERC-7943 interoperability standard for single-asset tokenization.

The integration supports real estate, pre-IPO equity, and alternative assets with institutional-grade settlement. Valereum’s secondary trading platform leverages Injective’s on-chain order book and cross-chain capabilities.

Institutions can perform due diligence, execute investments, and trade digital securities through a unified interface built on Cosmos-compatible infrastructure.

Ondo Finance solves liquidity constraints that limited early tokenized markets. The platform connects tokenized assets to public exchange liquidity through direct acquisition mechanisms.

Users fund purchases with stablecoins, Ondo acquires underlying securities on regulated venues, and redemption processes maintain price alignment.

In March 2024, Ondo moved $95 million into BlackRock’s BUIDL tokenized money market fund. This enabled continuous redemptions instead of T+2 settlement delays.

Ondo Global Markets, built on the Cosmos Stack, now offers hundreds of tokenized equities and ETFs. Partnerships with Franklin Templeton and BlackRock position the platform as a bridge between traditional finance and on-chain markets.

Lombard Finance demonstrates Bitcoin’s evolution as capital markets collateral through its liquid-staked LBTC token.

The product surpassed $1 billion in total value locked within three months, with supply actively deployed across on-chain financial markets.

Franklin Templeton participated in the $16 million seed round, while Wintermute, Galaxy, and DCG provide security oversight.

ZIGChain combines brokerage rails with blockchain settlement to extend retail access to global tokenized equities.

Announced in 2024 with a $100 million ecosystem fund, the platform recently partnered with Apex Group to launch regulated on-chain fund structures.

The $3.4 trillion fund administrator collaboration demonstrates institutional confidence in Cosmos infrastructure for real-world asset tokenization at scale.

Crypto World

Bitcoin’s $70,000 Support Shatters as ‘Warsh Shock’ Triggers Massive Liquidity Exodus

Bitcoin collapsed below the psychological $70,000 support level Thursday, marking a 15-month low as markets aggressively repriced the liquidity outlook under incoming Federal Reserve Chair Kevin Warsh.

The world’s largest cryptocurrency fell as low as $67,619. The rout erased $40 billion from open interest in under 48 hours, showing a capitulation of leveraged longs.

The catalyst? The market’s digestion of President Trump’s nomination of Kevin Warsh. While Warsh is historically pro-crypto, calling Bitcoin “new gold,” traders are fleeing his well-known stance on balance sheet reduction.

The Liquidity Vacuum

Spot ETF flows exacerbated the decline, with total assets under management sinking below $100 billion for the first time in Q1.

The technical damage is severe, as the $70,000 level had served as a fortress for bulls throughout 2025. Its failure has exposed the lack of bid depth below, with order books thinning out toward the mid-$60k range.

The divergence is stark: Gold shattered records Thursday, crossing $5,100/oz. Investors are rotating from “risk-on” stores of value (BTC) to “safety” stores of value (Gold), anticipating that Warsh’s restrictive monetary policy will strengthen the dollar and drain the excess liquidity that fuels crypto rallies.

The Warsh Paradox: Pro-Bitcoin, Anti-Liquidity

This sell-off represents a sophisticated pricing of the “Warsh Paradox.” Retail sees a pro-Bitcoin nominee; institutions see a hawk who despises quantitative easing.

Warsh has explicitly argued that the Fed’s swollen balance sheet distorts asset prices. The desk view? The “Fed Put” is dead. Warsh may support Bitcoin’s legality, but he will not print the dollars required to pump it. Expect volatility to persist until the market finds a price floor based on utility rather than liquidity overflow.

The post Bitcoin’s $70,000 Support Shatters as ‘Warsh Shock’ Triggers Massive Liquidity Exodus appeared first on Cryptonews.

Crypto World

What next for XRP price after the $128 billion wipe out?

XRP price continued its strong downward momentum and lost a crucial support level as the crypto market crash gained steam.

Summary

- XRP price has dropped for five consecutive weeks and moved to the lowest level since November 2024.

- The decline coincided with the ongoing crypto market crash.

- It dropped and moved below the key support level at $1.5463.

The Ripple (XRP) token continued to fall, reaching a low of $1.3495, its lowest level since November 2024. It has been in a free fall after falling from the record high of $3.6650.

The ongoing XRP crash has led to a $128 billion wipeout, with the market capitalization dropping from a record high of $210 billion in July last year to the current $82 billion.

The main reason for the ongoing drop is the ongoing performance of Bitcoin and other cryptocurrencies as concerns about a potential strike on Iran, which may happen at any time. Data on Polymarket shows that odds of this attack have risen since Trump sent an armada to the region.

An attack would increase geopolitical risks and drive up crude oil prices. Data shows that Brent and the West Texas Intermediate rose to $67 and $66, respectively. Higher oil prices would lead to higher inflation and make it hard for the Federal Reserve to cut interest rates.

More data shows that demand for spot XRP ETFs has waned in the past few weeks as investors have remained on the sidelines. According to SoSoValue, spot XRP ETFs have added over $28 million in inflows this month, down from over $666 million in November.

On the positive side, the XRP Ledger network is doing well, with the amount of assets on Ripple USD growing to over $1.4 billion. Its volume has continued growing in the past few months. Similarly, the amount of assets in its real-world asset tokenization ecosystem has jumped by over 270% in the last 30 days.

XRP Ledger is also preparing to launch a permissioned decentralized exchange platform that will be useful for financial institutions.

XRP price prediction: Technical analysis

The weekly chart shows that the XRP price continued its strong downward trend in the past few months, moving from a high of $3.6650 to the current level of $1.3565.

Most importantly, the coin has now moved below the important support level at $1.5465, its lowest level in April last year and the 50% Fibonacci Retracement level. Moving below that level is a sign that bears have prevailed.

The coin is now attempting to move below the 200-week Exponential Moving Average, which will confirm the bearish outlook.

At the same time, the Relative Strength Index and the Stochastic Oscillator have continued moving downwards.

Therefore, the most likely XRP price prediction is where it continues falling, potentially to the 78.6% Fibonacci Retracement level at $1, which is about 26% below the current level.

Crypto World

Zcash price falls 20% to hit 4-month lows under $220

- Zcash price plunged to $217, hitting a four-month low amid a 20% dip.

- The privacy coin dumped as bears pushed Bitcoin under $70,000.

- ZEC traded around $228 at the time of writing, but risks breaching support at $200.

Zcash (ZEC) has declined by more than 20% in the past 24 hours, accelerating its sharp descent amid an increasingly bearish cryptocurrency market.

The privacy coin’s dip to below $220, the first time in four months, came as Bitcoin crashed to $69,500 and Ethereum fell to lows of $2,070.

Among other top altcoin losers on the day was Cardano, which broke to $0.26.

Monero, Dash, and Decred all tanked as privacy coins suffered the bearish flip, hurting cryptocurrencies.

Notably, BTC’s dip has Michael Saylor’s Strategy sitting on approximately $4.5 billion of unrealised losses on the company’s 713,502 BTC.

Meanwhile, BitMine’s 4.2 million ETH currently has about $7.5 billion in unrealised losses.

Top privacy coin turns bearish

Zcash’s plunge stands out among privacy coins, especially after the ZEC price recently jumped to highs above $744 as Bitcoin struggled.

Headwinds amid waning demand now see Zcash changing hands at lows of $217, just a few weeks after it topped $540.

The more than 20% dip in the past 24 hours and 40% nosedive in the past week put Zcash at risk of further technical breakdown.

Capitulation among holders has accelerated sell volumes, with a 36% spike to $538 million in the past day.

Despite the losses, Zcash tops Bitcoin, Bitcoin Cash, and Monero in terms of overall performance over the past year.

Bitwise CIO Matt Hougan shared this view via X.

The relative returns of different monetary crypto assets since Jan. 1, 2025, is remarkable:

Bitcoin (BTC): -22%

Bitcoin Cash (BCH): +23%

Monero (XRM): +97%

Zcash (ZEC): +347%Lots of confounding variables here, including that BTC holders were sitting on the biggest…

— Matt Hougan (@Matt_Hougan) February 5, 2026

Zcash risks plunge below $200

Bears have relentlessly pressured ZEC bulls since the cryptocurrency’s 2025 peak above $740, when early privacy hype drove explosive growth.

Now, after dipping to $217 on February 5, 2026, ZEC risks testing sub-$200 levels.

On Feb. 5, the altcoin came close to the critical psychological support after failing to recover following Electric Coin Company’s core team exit.

Continued regulatory scrutiny on privacy tokens and market-wide profit-taking amid Bitcoin’s latest price crash are key negative triggers.

While ZEC has shattered its key trendline support at $250, a daily RSI deep in oversold territory suggests a rebound is likely.

However, the downturn highlights the privacy coin’s struggles amid broader market volatility, and breaching $200 might result in a new downtrend.

Key support levels beneath this would be $173 and $125 – levels reached in October 2025 before the parabolic surge to the multi-year highs above $700.

Per CoinMarketCap data, ZEC traded around $228 across major exchanges during the early US session on Thursday.

This aligned with Bitcoin’s slight bounce above $70,500, and Monero looked to hold $345.

Crypto World

JPMorgan Issues Bold Bitcoin Prediction Amid Crash

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee and settle in — the market’s been on a rollercoaster lately. Bitcoin is moving, stocks are shifting, and headlines are coming fast. While some investors are hitting pause, others are watching closely, trying to read the signals beneath the noise.

Crypto News of the Day: Bitcoin Slides Below $68,000 Amid Forced Deleveraging

Bitcoin fell below $70,000 on Thursday, before extending a leg down to levels below $68,000, an area last tested on October 28, 2024. The move came as intensified selling swept across crypto markets.

Sponsored

Sponsored

The decline marks roughly a 45% drop from October highs, fueled by ETF outflows, fading demand, and a “forced deleveraging” phase in futures markets.

“…with demand fading, ETF inflows drying up, and futures markets entering a “forced deleveraging” phase. Analysts say weak volumes and sustained selling are prompting investors to exit at a loss, despite technical indicators signaling oversold conditions,” wrote Walter Deaton.

Weak volumes and sustained selling pressure have prompted many investors to exit positions at a loss, even as technical indicators signal oversold conditions.

Despite the short-term turbulence, JPMorgan is increasingly bullish on Bitcoin’s long-term potential relative to gold.

The bank highlighted that BTC is now trading well below its estimated production cost of $87,000, a level historically considered a soft floor, and that its volatility relative to gold has dropped to record lows.

“…large outperformance of gold vs. Bitcoin since last October, coupled with the sharp rise in gold volatility, has left Bitcoin looking even more attractive compared to gold over the long term,” MarketWatch reported, citing JPMorgan’s quantitative strategist Nikolaos Panigirtzoglou.

According to the bank, this improved risk-adjusted profile suggests significant upside for investors willing to hold over a multi-year horizon.

Market stress metrics highlight the fragility of the current environment. Glassnode data shows that Bitcoin’s capitulation metric has recorded its second-largest spike in two years. This reflects sharp forced selling and accelerated de-risking by market participants.

Sponsored

Sponsored

Meanwhile, it is worth noting that Bitcoin has erased all gains since Donald Trump won the election, wiping out a 78% post-election rally and highlighting ongoing volatility.

Crypto Stocks Tumble Amid Bitcoin Sell-Off and Rising Economic Uncertainty

Crypto equities mirror the broader weakness in Bitcoin. Shares of Coinbase, Riot, Marathon, and Strategy fell between 5% and 7% premarket after the drop below $70,000, with ETF holdings also down more than 5%.

The crypto downturn comes amid broader macroeconomic headwinds. US January layoffs surged 205% year-over-year to 108,435, the highest January total since 2009, according to Challenger, Gray & Christmas.

Job cuts were concentrated in transportation — led by UPS — and tech, with Amazon announcing 16,000 layoffs. Healthcare also saw notable reductions.

Sponsored

Sponsored

Meanwhile, federal job protections were overhauled, with the Trump administration finalizing reforms affecting 50,000 civil service workers. Continuing claims remain elevated at 1.84 million, highlighting ongoing economic uncertainty.

Equity markets are also witnessing a similarly complex backdrop, with the BMO Capital Markets projecting the S&P 500 could reach 7,380 by the end of 2026, implying an 8% expected return.

The firm favors cyclical sectors such as industrials, materials, energy, and financials, while underweighting defensive sectors. Inflation remains a principal risk, though global monetary and fiscal stimulus provide support.

With all these in mind, Bitcoin and broader financial market investors face a delicate balancing act:

- Technical oversold conditions and low relative volatility suggest a long-term opportunity

- Yet, immediate pressures from leveraged positions, ETF outflows, and macro uncertainty continue to weigh on sentiment.

JPMorgan’s analysis points to potential gains for patient holders, but the short-term outlook remains volatile, reflecting a market in the midst of recalibration.

Sponsored

Sponsored

Chart of the Day

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Crypto Equities Pre-Market Overview

| Company | Close As of February 4 | Pre-Market Overview |

| Strategy (MSTR) | $129.09 | $120.78 (-6.58%) |

| Coinbase (COIN) | $168.62 | $159.42 (-5.46%) |

| Galaxy Digital Holdings (GLXY) | $20.16 | $19.10 (-5.26%) |

| MARA Holdings (MARA) | $8.28 | $7.81 (-5.68%) |

| Riot Platforms (RIOT) | $14.14 | $13.36 (-5.51%) |

| Core Scientific (CORZ) | $16.15 | $15.50 (-4.02%) |

Crypto World

Aave Delegate Platform Proposes Pausing Three L2 Deployments Citing Weak Revenue

The proposal also includes requiring any new deployment to guarantee at least $2 million in annual revenue to Aave.

A governance delegation platform for Aave, the largest decentralized lending platform, with more than $29 billion in total value locked (TVL), has proposed pausing three underused Layer 2 deployments of Aave V3.

In a Jan. 29 governance proposal that moved to a snapshot vote on Feb. 3, the Aave Chan Initiative (ACI) proposed that Aave freeze its V3 deployments on Ethereum L2s zkSync Era, Metis, and Soneium to cut costs.

“Over time, it has become clear that a small subset of instances contributes very little user activity, TVL, and revenue, while still requiring a non-trivial amount of attention from service providers and governance participants,” ACI wrote in the prospal.

The proposed reduction in L2 deployments aims “to reduce operational overhead and governance burden by addressing instances that are clearly non viable today.”

Among the three networks, zkSync currently has the largest TVL at about $26 million, followed by Soneium with $21.6 million and Metis with $11.7 million, according to DefiLlama data.

Over the past 30 days, Aave generated just $714 in revenue on zkSync, $679 on Metis, and just $150 on Soneium, per DefiLlama. For comparison, within the same timeframe Aave made over $7.7 million on Ethereum and nearly $298,000 on Base.

Now, ACI is pushing for stricter terms on future expansions. The proposal calls for any new chain deployment to guarantee Aave a minimum of $2 million in annual revenue, arguing that the protocol’s liquidity is often underpriced given the “upfront and recurring costs.”

The snapshot vote on the proposal, which runs through Feb. 7, has so far drawn unanimous support, with 257,300 votes in favor and none against.

Voting kicked off the same day that Ethereum’s broader scaling strategy came under renewed scrutiny. As The Defiant reported earlier this week, Ethereum co-founder Vitalik Buterin published an X post arguing that the rollup-centric roadmap for the network “no longer makes sense,” and arguing that L2s should focus on other use cases.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat6 hours ago

NewsBeat6 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

Trump nominates Kevin Warsh to be the new head of the federal reserve.

Trump nominates Kevin Warsh to be the new head of the federal reserve.