Crypto World

World Liberty Financial to launch institutional RWA product

World Liberty Financial has unveiled plans to roll out an institutional-grade real-world asset product, starting with a tokenized investment linked to Trump International Hotel & Resort, Maldives.

Summary

- WLFI is partnering with Securitize and DarGlobal to tokenize loan revenue from a major Maldives resort.

- The offering targets accredited investors and will operate under strict regulatory and transfer rules.

- The project reflects WLFI’s ongoing strategy to link DeFi, traditional assets, and institutional finance.

The goal of the project, which is being developed in partnership with Securitize and DarGlobal PLC, is to tokenize loan revenue interests tied to the upscale resort.

According to WLFI’s Feb. 18 statement, the offering is designed for accredited and eligible investors, providing access to fixed yield and revenue streams within a regulated framework.

How the tokenized product is structured

The initial offering will provide investors with fixed returns and access to loan-related income generated by the resort. Revenue from interest payments will be distributed through the token structure, allowing holders to gain exposure to the asset’s performance without direct property ownership.

The company noted that the product will operate within a regulated securities framework under Regulation D and Regulation S. Tokens will not be registered for public sale in the United States and may only be offered through approved exemptions.

Eric Trump, co-founder of WLFI, said the initiative aims to bring tokenized real estate to decentralized finance in a compliant way. He described the Maldives project as a flagship example of how high-end property can move on-chain.

“We built World Liberty Financial to open up decentralized finance to the world. With today’s announcement, we are now extending that access to tokenized real estate.”

— Eric Trump, co-founder of World Liberty Financial.

Securitize chief executive officer Carlos Domingo said scalable and compliant real estate tokens could see strong global demand, while DarGlobal CEO Ziad El Chaar called the partnership a step toward improving liquidity in private real estate markets.

The announcement clarified that The Trump Organization is not directly involved in issuing or promoting the tokens, and that branding is used under a licensing agreement.

World Liberty Financial (WLFI) also noted that the tokens may later be supported on multiple public blockchains and could be used as collateral through its WLFI Markets platform, where permitted by law.

Broader expansion strategy

The real estate launch follows a series of recent efforts by WLFI to position itself in institutional digital finance. On the same day as the announcement, the company hosted the World Liberty Forum at Mar-a-Lago, bringing together executives from firms including Goldman Sachs, Nasdaq, and Franklin Templeton.

The private event focused on digital assets, stablecoins, artificial intelligence, and monetary policy, according to people familiar with the gathering.

WLFI also announced a separate partnership with Apex Group to pilot its USD1 stablecoin for settlements in tokenized fund operations. The agreement will help integrate blockchain-based payments into traditional fund administration.

Crypto World

Bitcoin ETFs Extend Losses as Solana Funds Keep Ground

US-listed spot Bitcoin exchange-traded funds (ETFs) continued to bleed on Wednesday as market sentiment remained negative and BTC briefly dipped below $66,000.

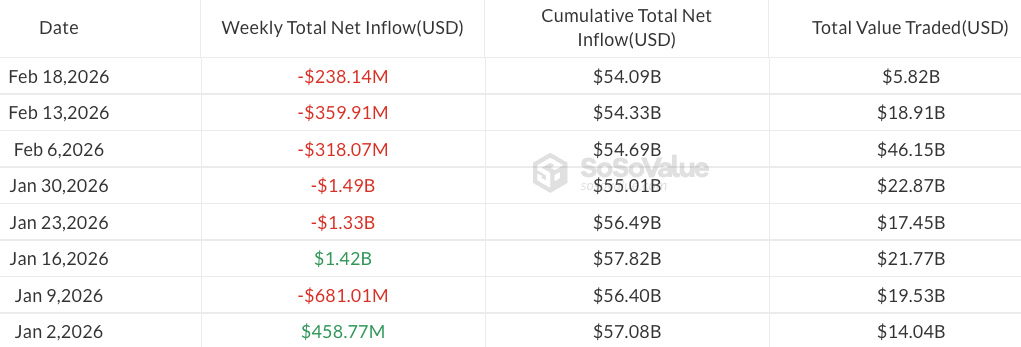

Spot Bitcoin ETFs recorded $133.3 million in net outflows on Wednesday, bringing weekly losses to $238 million, according to SoSoValue data. BlackRock’s iShares Bitcoin Trust (IBIT) led outflows, with over $84 million exiting.

Trading volumes remained subdued at less than $3 billion, highlighting a persistent lack of activity even as analysts had previously noted potential inflection points amid the slowdown in outflows.

If the ETFs fail to recover in Thursday and Friday sessions, this week will mark the first five-week outflow streak for Bitcoin (BTC) ETFs since last March.

Year-to-date, Bitcoin ETFs have seen about $2.5 billion in outflows, leaving assets under management at $83.6 billion.

Solana ETFs keep bucking the trend after launch in late 2025

While Ether (ETH) and XRP (XRP) ETFs posted modest daily outflows of $41.8 million and $2.2 million, respectively, Solana (SOL) funds continued to buck the trend.

Solana ETFs have recorded a six-day streak of inflows, with year-to-date gains totaling around $113 million. Trading activity, however, remains subdued compared with past months, as February inflows of $9 million so far are well below $105 million in January and December 2025’s $148 million.

Since their October 2025 launch, US spot Solana ETFs have accumulated almost $700 million in assets under management, trailing XRP funds, which have amassed $1 billion since their November debut.

Crypto market remains in extreme fear, BTC down 24% year-to-date

The ongoing sell-off in Bitcoin ETFs comes as the Crypto Fear & Greed Index continues to signal persistent negative sentiment.

Even though Bitcoin has slightly recovered from multi-month lows near $60,000 logged in early February, the index has remained mostly in “Extreme Fear” territory.

At the time of writing, Bitcoin traded at $67,058 on Coinbase, down about 24% year-to-date. Analysts at major financial institutions, including Standard Chartered, have predicted that BTC could fall as low as $50,000 before potentially recovering to $100,000 later in 2026.

Related: Bitwise, GraniteShares join race for prediction market-style ETFs

According to the crypto analytics platform CryptoQuant, Bitcoin’s short-term Sharpe ratio has reached levels historically associated with “generational buying zones.”

“The arrows in the chart illustrate this clearly: each prior extreme negative reading was followed by violent recoveries to new highs,” CryptoQuant analyst Ignacio Moreno De Vicente said.

Magazine: Did a Hong Kong fund kill Bitcoin? Bithumb’s ‘phantom’ BTC: Asia Express

Crypto World

Ledn’s $188M Bitcoin-Backed ABS Deal Enters US Bond Market

Bitcoin-backed loan platform Ledn sold about $188 million of bonds tied to Bitcoin‑collateralized consumer loans into the mainstream asset‑backed securities (ABS) market, Bloomberg reported on Wednesday, citing people familiar with the matter.

In a first-of-its-kind deal, one of the two tranches — the investment‑grade portion — was reportedly priced at a spread of about 335 basis points over a benchmark rate, implying that investors are demanding 3.35 percentage points in extra yield to hold crypto‑linked credit risk rather than conventional consumer ABS.

The deal is structured through Ledn Issuer Trust 2026‑1, which securitizes a pool of 5,441 short‑term, fixed‑rate balloon loans extended to 2,914 US borrowers, backed by 4,078.87 Bitcoin (BTC) held as collateral, according to S&P Global Ratings’ preliminary documentation on Feb. 9.

How the structure and ratings stack up

Balloon loans are structured with relatively small periodic payments and a large lump‑sum “balloon” payment at maturity, which keeps near‑term payments low but leaves a sizeable principal balance due at the end.

S&P assigned preliminary BBB‑ (sf) and B‑ (sf) ratings to the $160 million senior Class A notes and $28 million subordinated Class B notes, respectively.

Related: $25B crypto lending market now led by ‘transparent’ players: Galaxy

A BBB- rating is the lowest tier of investment-grade debt, reflecting an adequate capacity to meet financial commitments but higher vulnerability to adverse conditions than higher‑rated bonds, while B‑ sits in deep non‑investment‑grade “junk” territory, where default risk is materially higher.

Jefferies Financial Group acted as the sole structuring agent and bookrunner, as a major Wall Street dealer intermediated between institutional fixed‑income investors and this new form of crypto‑linked exposure.

BTC increasingly seen as legitimate collateral

Bitwise head of research Europe, Andre Dragosch, told Cointelegraph that the fact that Ledn was able to package these loans into a traditional ABS implied that BTC is “increasingly seen as safe and legit collateral by traditional financial institutions.”

He highlighted major banks like JPMorgan offering BTC-backed loans to customers as a further indication of this. “Bitcoin is increasingly being integrated into traditional finance as the new pristine collateral,” he said.

Jinsol Bok, research lead at Four Pillars global crypto research company, told Cointelegraph that this means liquidity no longer needs to remain locked up and “can instead be expanded into new lending,” adding that the size of the BTC collateralized lending market could “grow far beyond its current level in the future.”

Related: Anchorage–Mezo partnership opens institutional access to BTC-backed loans

He said that unlike real estate mortgages, BTC collateralized loans could be transparently tracked onchain and liquidated in a programmable manner. “For this reason, I believe that the risks associated with ABS in this context do not need to be excessively overstated.”

What investors are buying

Asset‑backed securities are bonds funded by pools of loans, so investors in Ledn’s notes do not own Bitcoin (BTC) directly.

Instead, they take on credit and structural risk to a pool of BTC‑secured loans whose performance depends on borrower repayments and the lender’s ability to liquidate collateral during market stress.

“These loans generally have a low default rate because they tend to have low LTV [loan-to-value] ratios and are well capitalized with BTC,” Dragosch said.

Founded in 2018, Ledn says it has funded over $9.5 billion in loans so far in over 100 countries. The company received a strategic investment from Tether, the issuer of the USDt (USDT) stablecoin, in November 2025.

Cointelegraph reached out to Ledn for comment but had not received a response by publication time.

Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

DOGE price eyes $0.20 if X, CLARITY Act spark breakout above $0.18

DOGE price slips ~1% in 24h, holding $0.09–$0.10 as traders eye X, CLARITY Act.

Summary

- DOGE price is trading around $0.098–$0.099, holding $0.09–$0.10 support but stuck below major MAs and a structural daily downtrend.

- Resistance sits near $0.104–$0.116, with $0.116 flagged as pivotal level aligning with upper Bollinger Band and 50% Fib of January’s drop.

- Base case is range‑bound; break above $0.116 could target $0.15–$0.20, while a clean loss of $0.09 risks a retest of yearly lows.

Dogecoin (DOGE) price is clinging to support just under the $0.10 mark, trading around $0.0988 as meme‑coin bulls try to turn a shaky bounce into a sustained reversal. Analysts describe the move as a “fragile recovery” after DOGE defended key support but failed to break out of its broader downtrend.

Market backdrop and key levels

Dogecoin is changing hands near $0.098–$0.099 today, marginally lower over the past 24 hours as liquidity concentrates around a tight support zone. A recent weekly analysis notes that DOGE “is currently trading at $0.099, staging a recovery attempt after successfully defending a critical support zone,” but stresses that “the daily chart confirms that Dogecoin remains in a structural downtrend.” Technicians flag resistance around $0.104–$0.116, with one wave analysis pointing to $0.1160 as “pivotal resistance,” aligning with the upper Bollinger Band and a 50% Fibonacci retracement of January’s selloff.

Crypto.news warns that the token “dropped to the important support level at $0.100, much lower than this month’s high of $0.1176,” and now trades below all major moving averages, with momentum gauges stuck in bearish territory. In parallel, bitcoin is trading near $66,879, down about 1.2% on the day, while ether changes hands around $2,466, up just under 1% over the same period, underscoring a cautious, range‑bound majors environment.

Catalysts and near‑term outlook

Sentiment hinges on two overlapping narratives: regulatory clarity and big‑tech integration. A recent outlook argues DOGE “could reach $0.20 in February 2026” if market growth, meme‑coin rotation and risk appetite align, but stresses that breaking “significant technical resistance levels” around $0.18–$0.20 with high volume is essential. Separate coverage highlights that DOGE’s recent spikes have tracked rumors around X’s crypto‑trading features and potential payment support, with one desk noting the coin “jumped 15.25% to $0.1113” following X’s trading announcement as volume surged to $1.76 billion on strong whale activity.

For now, the base case is range‑bound: DOGE holding the $0.09–$0.10 floor while facing overhead supply into the low‑$0.11s. A decisive close above $0.116 with expanding volume would open room toward $0.15, while a loss of $0.09 support risks a retest of the yearly lows. Traders watching this compressing range are effectively betting on whether the next major impulse comes from Washington’s CLARITY Act headlines or the next product move out of X.

Crypto World

Aptos Tokenomics Overhaul Targets Deflationary APT Supply Through Performance-Driven Mechanisms

TLDR:

- Aptos Foundation proposes cutting annual staking rewards from 5.19% to 2.6% to reduce long-term token emissions.

- A hard protocol-level cap of 2.1 billion APT will permanently limit total supply once approved through governance.

- Decibel DEX’s fully onchain execution model is projected to burn over 32 million APT annually at 100+ markets.

- Aptos Foundation will permanently stake 210 million APT, removing nearly 18% of circulating supply from distribution.

Aptos tokenomics is undergoing a structural overhaul designed to replace bootstrap-era subsidies with performance-linked supply mechanics.

The Aptos Foundation has outlined seven reform proposals tied to network activity, burn rates, and staking adjustments.

These changes target a crossover point where token removals exceed new token issuance. With major institutions already active onchain and a new decentralized exchange launching, the network is positioning itself for an institutional-grade economic model.

Hard Supply Cap and Staking Rate Cuts Anchor the Reform

The most definitive change proposed is a hard protocol-level cap of 2.1 billion APT. Currently, 1.196 billion APT circulate with no ceiling on future minting. The cap would close that open-ended issuance permanently once approved through governance.

Alongside the cap, the Aptos Foundation plans to propose cutting the annual staking reward rate from 5.19% to 2.6%.

The prior rate had already been reduced via AIP-119. This further cut aims to slow new token issuance without removing validator incentives entirely.

“Aptos Foundation believes it is critical to balance strong validator incentives with long-term supply discipline.” — Aptos Foundation

To balance the reduction, the Foundation is exploring a tiered staking model. Participants committing to longer lock-up periods would receive higher reward rates than short-term stakers.

Validator costs are also expected to drop through new architecture proposed in AIP-139, keeping operations viable even at lower reward rates.

Gas Fee Increase and Decibel DEX Drive Burn Acceleration

Aptos tokenomics reform also targets the burn side of the equation through a proposed 10x gas fee increase. All transaction fees on Aptos are permanently burned, so raising fees directly accelerates APT removal from circulation. Even after the increase, stablecoin transfers would cost roughly $0.00014, remaining the lowest globally.

The launch of Decibel, a fully onchain decentralized exchange incubated by Aptos Labs, adds a structural burn mechanism.

Unlike most DEX platforms, Decibel executes every order, match, and cancel onchain. That architecture generates high transaction volume continuously, which translates directly into sustained APT burns.

“The more markets listed and products supported by Decibel, the higher operational TPS is necessary. As Decibel approaches 100+ markets going into next year, it is projected to burn over 32 million APT per year.” — Aptos Foundation

At scale, Decibel is projected to burn over 32 million APT annually as it approaches 100 active markets. As throughput grows toward 10,000 TPS and beyond, that figure scales commensurately.

Together with the gas fee increase, this creates compounding deflationary pressure tied directly to trading activity.

Foundation Lock-Up, Buybacks, and Performance Grants Complete the Framework

The Aptos Foundation has committed to permanently staking 210 million APT, removing those tokens from any future sale or distribution. This represents roughly 18% of the current circulating supply.

The Foundation will fund its operations through staking rewards on these locked tokens rather than token sales.

“This is functionally equivalent to a token burn with 210 million APT removed from any sale or distribution.” — Aptos Foundation

On top of that, the Foundation is exploring a programmatic buyback program. The program would use cash reserves and revenue from licensing and ecosystem investments to purchase APT in the open market. Buyback timing would be based on market conditions rather than a fixed schedule.

Grant issuance is also being restructured around milestone-based vesting. Future grants tied to Aptos’s global trading engine positioning will only vest when specific performance targets are met.

If KPIs are missed, grants are deferred, not canceled, until those targets are achieved. This directly links token issuance to measurable network outcomes.

Taken together, these mechanisms are intended to create a crossover point where APT burned and locked consistently exceeds APT issued.

Natural unlock reductions are already underway, with the four-year investor and contributor unlock cycle concluding in October 2026, cutting annualized supply unlocks by 60%. Foundation grant distributions are also falling over 50% year-over-year from 2026 to 2027.

The combination of those natural dynamics with the proposed structural reforms positions APT supply for a sustained deflationary trajectory as high-throughput financial applications continue to scale on the network.

Crypto World

Coinbase Unlocks $100,000 Borrowing Power for XRP, DOGE, ADA, and LTC Holders

TLDR:

- Coinbase onchain loans now accept XRP, DOGE, ADA, and LTC as collateral, capped at $100,000 in USDC.

- The lending product has surpassed $1.9 billion in total loan originations since its initial Bitcoin launch.

- Altcoin borrowers face a tighter 49% LTV limit, with liquidation triggering at 62.5% due to price volatility.

- Wrapping native assets like XRP for use on Base may constitute a taxable event under current U.S. tax rules.

Coinbase onchain loans have expanded to include four new cryptocurrencies as eligible collateral. XRP, Dogecoin (DOGE), Cardano (ADA), and Litecoin (LTC) holders in the U.S. can now borrow up to $100,000 in USDC.

The loans run through the Morpho lending protocol on Base, Coinbase’s Ethereum layer-2 network. Users post their crypto holdings as collateral and receive USDC without selling their assets. New York residents remain excluded from the service at this time.

Coinbase Expands Collateral Options Beyond Bitcoin and Ether

Coinbase originally launched its onchain loan product with Bitcoin support before adding Ether. That early offering allowed BTC holders to borrow up to $5 million and ETH holders up to $1 million in USDC. The product has now crossed $1.9 billion in total loan originations since its launch.

The four newly added assets carry a lower borrowing cap of $100,000 each. Their combined market capitalization stood at around $117 billion at the time of the announcement, according to CoinGecko data.

That figure is less than half of Ethereum’s total market value, though all four coins maintain a consistent retail following.

Jacob Frantz, product lead at Coinbase, explained the thinking behind the move:

“No matter what you’re holding, you should be able to leverage your crypto without having to sell. Being able to borrow against more tokens means more opportunity to make your crypto work for you.” — Jacob Frantz, Product Lead, Coinbase

Coinbase has indicated plans to extend the service internationally in the future.

Loan-to-Value Ratios Reflect Altcoin Volatility

The loan-to-value ratio, or LTV, is central to how these loans operate. It measures loan size against the current market value of the posted collateral. As collateral prices drop or interest builds, the LTV rises accordingly.

Bitcoin and Ether borrowers can access up to 75% LTV, with liquidation triggering at 86%. XRP, DOGE, ADA, and LTC holders face tighter terms, borrowing up to 49% LTV, with liquidation set at 62.5%. The stricter limits reflect the higher price volatility these altcoins carry compared to Bitcoin and Ether.

There is no fixed repayment schedule attached to these loans. However, borrowers must keep their LTV below the liquidation threshold at all times.

Coinbase sends alerts as frequently as every 30 minutes as a borrower’s ratio approaches the danger zone, providing an added layer of risk management.

Tax Considerations and Platform Restrictions Apply

Crypto-backed loans are often seen as a way to avoid triggering capital gains taxes. Since no sale occurs, the tax event is deferred. That said, liquidations can create taxable events, according to law firm Greenspoon Marder LLP.

There is also a wrapping issue to consider. Assets like XRP are wrapped before use on Base, Coinbase’s Ethereum-compatible network.

Under current U.S. tax rules, converting a native asset to its wrapped version counts as a taxable event. Coinbase has acknowledged this and noted it does not provide tax advice.

One additional restriction applies to loan proceeds. Borrowers cannot use the USDC received to trade on the Coinbase exchange.

This steers users toward practical uses, such as covering expenses or making purchases, rather than leveraged speculation.

Interest rates on Morpho markets fluctuate based on supply and demand within each lending pool, so rates are not fixed at the time of borrowing.

Crypto World

AlienWP Relaunches as Alien Wise Play: Expanding Into iGaming News, Casino Reviews, and a New Player Dashboard App

February 2026 — AlienWP.com, a long-established digital platform has officially relaunched as Alien Wise Play, a new independent hub focused on online casino reviews, iGaming news, and player-first safety tools.

The brand’s expansion marks a significant new chapter for the AlienWP domain, bringing its legacy of clarity, transparency, and user-focused guidance into the rapidly growing world of online gaming and digital gambling.

A New Focus on Trust, Transparency, and Smarter Play

Alien Wise Play has been created to help players navigate an increasingly complex online casino landscape, where licensing standards, bonus terms, payout reliability, and player protections can vary significantly between operators.

The platform provides structured casino reviews, clear educational content, and ongoing iGaming news coverage, with a focus on transparency rather than hype.

“At its core, Alien Wise Play is about helping players make smarter decisions online,” said a spokesperson for the project. “The casino space is crowded, and users deserve independent information they can actually trust.”

Introducing the Wise Play Score

A central feature of the new platform is the Wise Play Score, an independent rating system designed to assess casinos based on the factors that matter most to players.

Rather than relying on subjective star ratings or promotional rankings, the Wise Play Score evaluates operators across areas such as licensing, payment reliability, bonus fairness, game quality, and customer support — providing a clear trust-focused score from 0 to 10.

The company emphasised that scores cannot be bought or influenced through commercial partnerships, and that player safety remains the top priority.

Expanding Into iGaming News and Industry Coverage

Alongside casino reviews and rankings, Alien Wise Play is also launching as a growing source of iGaming news, covering major developments across the online gambling industry.

The site will publish updates on licensing changes, operator launches, regulatory trends, and emerging topics such as crypto gaming, responsible gambling tools, and player protection standards.

This broader editorial direction positions Alien Wise Play as more than an affiliate comparison site — aiming instead to become a trusted industry resource for both players and operators.

Future Plans: A Mobile-First Player Dashboard App

Looking ahead, Alien Wise Play confirmed that it is currently developing a new mobile-first web app designed to give players something the industry has long lacked: a personal dashboard to manage online casinos in one place.

The upcoming app will allow users to save favourite casinos, track bonuses, compare platforms using the Wise Play Score, and receive useful alerts.

The platform is being built as a utility layer above casinos, focused on organisation, safety, and informed decision-making.

The app is expected to launch in stages later this year.

About Alien Wise Play

Alien Wise Play is an independent online casino review and iGaming news platform built to promote transparency, player safety, and responsible gambling. The site provides structured casino profiles, trust-based scoring, bonus tracking tools, and educational content to help users play smarter.

Originally launched in 2013 as AlienWP, the platform has evolved into a modern resource focused on the future of online gaming and digital entertainment.

For more information, visit https://alienwp.com

Media Contact

Press & Partnerships

Email: contact@kooc.co.uk

Website: alienwp.com

Crypto World

Ripple (XRP) Drops 5% Daily, Bitcoin (BTC) Slips to $67K: Market Watch

M, HASH, and ZEC have plunged the most in the past 24 hours.

Bitcoin’s struggles since the beginning of the business week continued in the past 24 hours as the asset dipped below $66,000 before rebounding slightly to $67,000 as of now.

Most altcoins are in the red as well, with ETH losing the $2,000 support once again. XRP is among the poorest performers among the larger caps.

BTC Down to $67K

Although the primary cryptocurrency bounced off immediately on February 6 when it plunged to a 15-month low at $60,000 to $72,000, it has been unable to stage a more profound recovery since then. Just the opposite, it was rejected several times at the $71,000-$72,000 resistance, with the latest example taking place over the past weekend.

At the time, BTC jumped to $71,000 and was close to breaking above it. However, the bears quickly intercepted the move and drove the asset south to $67,000 on Tuesday. The adverse price moves continued yesterday, and bitcoin dipped below $66,000 for the first time since last Friday.

It managed to rebound since that weekly low, and now sits at $67,000. However, this still means that it’s over 1.5% down on the day. Its market capitalization has fallen below $1.340 trillion, while its dominance over the alts struggles below 56.5% on CG.

Alts Back in Red

Almost all altcoins are in the red once again today. Ethereum’s adventure above $2,000 was short-lived once again, and the asset is back below it as of press time. XRP and SOL have dropped the most from the larger caps, with losses of nearly 5%. As a result, XRP trades inches above $1.40 while SOL is down to $82.

DOGE, ADA, BNB, LINK, and CC are also in the red by up to 4%, while ZEC has plunged by 8.5% to $260. Further losses are evident from M and Hash, both of which have dumped by more than 10%.

The total crypto market cap has erased another $50 billion daily and is down to $2.370 trillion on CG.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Coinbase is ‘misunderstood’ amid wall street’s crypto divide

Coinbase CEO Brian Armstrong pushed back against what he described as Wall Street’s persistent underestimation of the crypto exchange, arguing that the company is navigating a classic “innovator’s dilemma” as traditional finance grapples with digital asset disruption.

Summary

- The CEO argued Wall Street underestimates the company as crypto disrupts traditional finance, describing the moment as an “innovator’s dilemma” with roughly half of major institutions now leaning into digital assets.

- Coinbase reported 156% year-over-year trading volume growth, a doubling of market share in 2025, tripled assets over three years, and 12 products generating over $100 million in annualized revenue.

- Some X users questioned Armstrong’s stock sales, security practices, product strategy and conviction in Ethereum, with one asking why he is not buying Coinbase shares if the company is truly undervalued.

In a post on X following an analyst AMA session, Armstrong said Coinbase is often “misunderstood or under-appreciated” by traditional financial analysts. While some major institutions are embracing crypto, others remain skeptical, he said, largely due to entrenched incentives within the legacy financial system.

“Five of the GSIB banks are starting to work with Coinbase,” Armstrong wrote, adding that roughly half of large financial institutions are leaning into crypto as regulatory clarity improves. At the same time, he suggested that lagging firms view digital assets as a competitive threat — comparing crypto’s rise to disruptions caused by Uber, Airbnb and SpaceX in their respective industries.

Armstrong argued that Coinbase and the broader crypto sector are in their strongest position yet, citing three years of revenue diversification and expanding institutional engagement. He also addressed recent earnings coverage, noting that GAAP net income includes unrealized gains and losses on crypto holdings. Adjusted net income, he said, showed profitability last quarter despite a weaker market environment.

Critics question Coinbase CEO’s claims

The remarks drew sharp responses from some users on X.

One critic argued that Coinbase appears “misunderstood” in part because Armstrong continues selling shares, questioning why investors should hold the stock if the CEO is not buying it. The same user accused the company of failing to prioritize customer security, making questionable product decisions, and lacking conviction in the Ethereum ecosystem by selling accumulated Base sequencer fees rather than holding or staking ETH.

Another user bluntly asked: “Why aren’t you buying your own stock then if it is so misunderstood?”

The company’s latest Q4 and full-year figures highlighted significant growth metrics. Total trading volume rose 156% year-over-year, while Coinbase’s crypto trading market share doubled in 2025.

Assets held on the platform have tripled over the past three years, Armstrong said, and the firm now has 12 products generating more than $100 million in annualized revenue. Both USDC balances and Coinbase One subscriptions reached new all-time highs.

Armstrong concluded that investors must be “early and right” to generate alpha, suggesting Coinbase remains undervalued by traditional analysts as the financial system undergoes structural transformation.

Crypto World

Will Pi Network price rally continue before first anniversary as multiple bullish patterns emerge?

Pi Network price has soared over 40% this week on community hype surrounding the first anniversary of its mainnet launch.

Summary

- Pi Network price rallied to a four-week high of $0.205 on Sunday, supported by increased trading activity ahead of Pi Network’s first anniversary.

- The token’s price action has formed multiple bullish patterns on the daily chart.

According to data from crypto.news, Pi Network (PI) price shot up to a four-week high of $0.205 last Sunday before settling at $0.187 at press time. This move reflects gains of over 40% over a seven-day period and has pushed its market cap up to $1.68 billion.

The biggest catalysts for the surge have been investor excitement over the celebration of the first anniversary of the Pi Network mainnet launch on Friday, Feb. 19. Traders seem to be pricing in the likelihood of developers revealing major announcements to commemorate the event.

At the same time, PI has significantly reduced monthly token unlocks, which has also contributed to the upside as reported earlier by crypto.news. There’s also significant community chatter around a potential Kraken listing, which is adding to the momentum.

At press time, Pi Network was trading close to the 38.2% Fibonacci Retracement level at $0.193.

Pi Network price has formed multiple bullish patterns on the daily chart, which suggest the token rally still has steam left for more upside this week.

First, Pi Network price has broken out of a falling wedge pattern that had been forming since late November last year. This pattern consists of two converging and descending lines. A breakout is confirmed when price moves above the upper trendline, typically signaling a shift in momentum from bears to bulls.

Second, the token’s price action has also formed a bullish pennant pattern marked by a flagpole and a consolidation triangle. Bullish pennant patterns are considered strong continuation signals, often preceding another leg higher.

Hence, if PI token can reclaim the 38.2% retracement level, which is widely considered the primary threshold for trend validation, it would signal that the bullish trend remains strong.

Subsequently, the coin may continue rising as bulls target the next key resistance level at $0.212, which marks its monthly high and aligns with the 50% Fibonacci Retracement level.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Ledn Clinches $188M in First Bitcoin-Backed Loan Securitization

Ledn’s latest financing move marks a notable milestone for crypto-backed credit in traditional capital markets. The Bitcoin‑collateralized consumer loan platform is reported to have securitized roughly $188 million in bonds tied to a pool of small-dollar, short‑term loans, packaged as asset‑backed securities (ABS) through a vehicle called Ledn Issuer Trust 2026‑1. The issuance represents one of the first times bitcoin collateral has been embedded into a mainstream ABS structure, signaling growing interest from conventional fixed‑income investors in crypto‑linked credit risk. The deal, described by people familiar with the matter to Bloomberg, has set a precedent for how crypto collateral can be leveraged within regulated securitization channels.

Key takeaways

- The securitization is framed as a first‑of‑its‑kind ABS that pools 5,441 short‑term, fixed‑rate balloon loans extended to 2,914 U.S. borrowers and is secured by 4,078.87 Bitcoin (BTC).

- The deal’s senior tranche totals $160 million and carries a preliminary BBB‑ (sf) rating, while a $28 million subordinated tranche carries a preliminary B‑ (sf) rating, according to S&P Global Ratings’ documentation dated February 9.

- The investment‑grade Class A notes reportedly priced at a spread of about 335 basis points over a benchmark rate, implying an approximate 3.35% yield relative to riskless debt and reflecting investors’ pricing for crypto‑credit risk versus traditional consumer ABS.

- Jefferies Financial Group served as the sole structuring agent and bookrunner, bridging institutional fixed‑income buyers with this novel crypto‑linked exposure.

- The deal underscores Bitcoin as a form of collateral that traditional finance institutions are increasingly willing to accept, a trend highlighted by notable industry voices and ongoing collaboration between crypto lenders and traditional banks.

Tickers mentioned: $BTC

Sentiment: Neutral

Price impact: Neutral. The ABS issuance reflects growing institutional appetite for crypto‑backed credit exposure rather than a direct price move in Bitcoin itself.

Market context: The transaction arrives amid a broader shift toward integrating Bitcoin as usable collateral within regulated finance, a trend reinforced by lenders and banks expanding BTC‑backed products. The piece aligns with broader industry discussions about how liquidity can flow from crypto assets into traditional financing structures, while the market remains attentive to the evolving regulatory backdrop and the resilience of collateral performance during volatility.

Why it matters

The Ledn ABS illustrates a practical bridge between on‑chain asset dynamics and off‑chain credit markets. By securitizing a pool of loans secured by Bitcoin, the structure leverages a transparent, programmable asset class that can be tracked through conventional reporting channels, potentially broadening access to crypto‑backed lending for a wider base of institutions. The use of balloon payments in balloon loan structures is designed to keep near‑term cash outlays manageable for borrowers, while exposing investors to a larger principal balance at maturity. This mechanism can provide a clearer risk profile for buyers of crypto‑linked ABS who seek to diversify their exposure away from direct crypto ownership while retaining the upside of Bitcoin’s collateral cushion.

Industry participants see the inclusion of BTC as collateral in a traditional ABS framework as a signal that crypto assets are moving from speculative use cases into mainstream financial plumbing. In remarks cited by market observers, Andre Dragosch, head of research at Bitwise Europe, noted that packaging such loans into a familiar ABS format implies Bitcoin is increasingly viewed as safe and legitimate collateral by established financial institutions. Dragosch pointed to JPMorgan’s BTC‑backed loan offerings as a corroborating data point, suggesting that large banks are evolving their product menus to accommodate crypto collateral within standard risk frameworks. This sentiment reflects a broader trend: liquidity that was previously constrained within crypto‑native markets could gradually find channels into regulated financing ecosystems, potentially expanding the size and scope of BTC‑collateralized lending over time.

From a research standpoint, observers argue that the on‑chain traceability and programmable liquidation capabilities inherent to Bitcoin‑backed lending reduce opacity around collateral management, which can help attract institutional buyers who demand clear governance around defaults and recoveries. Jinsol Bok, research lead at Four Pillars Global Crypto Research, highlighted the potential for on‑chain transparency to lower information asymmetries for ABS investors and to unlock scalable liquidity as BTC‑collateralized loans diversify beyond boutique, crypto‑focused channels. The dynamic could unlock new lending products and broaden the ecosystem’s capacity to absorb capital against crypto collateral, particularly as issuance volumes in the crypto lending space have drawn attention for their growth and risk management approaches.

The catalytic elements of this transaction extend beyond the initial securitization. Ledn, founded in 2018, has amassed more than $9.5 billion in loan originations across over 100 countries, a figure that signals the company’s ability to scale crypto‑backed lending into traditional capital markets. The relationship with Tether, which invested strategically in Ledn in November 2025, adds a layer of credibility and institutional interest that could spur further collaboration between stablecoin issuers and crypto lenders. The broader implication for traders and borrowers alike is the potential for BTC‑backed lending to become a more common, lower‑cost, and more transparent instrument, with on‑chain asset tracking complementing off‑chain securitization disclosures.

As the market digests this development, analysts caution that investment‑grade ratings still sit at a relatively modest level of comfort, reflective of the embedded credit risk in crypto‑linked debt. BBB‑ (sf) for the senior notes signals adequate capacity to meet financial commitments but indicates heightened sensitivity to adverse conditions compared with higher‑rated debt. The subordinated B‑ (sf) tranche sits in the lower tiers of credit quality, signaling substantially higher risk of default relative to investment‑grade bonds. Yet the mere existence of such ratings demonstrates that risk‑adjusted access to funding can be extended to crypto‑backed assets within a structured finance framework, provided that collateral mechanics and liquidity remain robust enough to support timely repayments and potential liquidations in stressed markets.

What to watch next

- Final ratings and closing terms for Ledn Issuer Trust 2026‑1, including any adjustments to the BBB‑ sf and B‑ sf designations.

- Performance of the underlying loan pool, including delinquency rates and recovery rates on BTC collateral during market stress.

- Subsequent securitizations or new tranches announced by Ledn or other crypto lenders leveraging BTC collateral in ABS formats.

- Regulatory commentary or disclosures that could influence the appetite for crypto‑backed ABS and the permissible collateral standards for such securitizations.

Sources & verification

- S&P Global Ratings preliminary documentation for Ledn Issuer Trust 2026‑1 (ratings: BBB‑ sf for Class A; B‑ sf for Class B), dated Feb. 9.

- Bloomberg reporting on the transaction and pricing details (Feb. 18, 2026).

- Ledn’s platform history and loan origination figures (Ledn official materials).

- Tether’s strategic investment in Ledn, announced in late 2025.

Ledn’s Bitcoin‑backed ABS signals growing mainstream embrace of BTC collateral

Ledn’s securitization effort, structured through Ledn Issuer Trust 2026‑1, deploys a pool of 5,441 balloon loans to 2,914 U.S. borrowers and backs them with 4,078.87 Bitcoin (BTC). The single senior tranche, consisting of $160 million, carries a preliminary BBB‑ (sf) rating, while the $28 million subordinate class carries a preliminary B‑ (sf) rating, according to S&P Global Ratings’ early assessment published in February. The notes were positioned as an investment‑grade instrument with a spread of roughly 335 basis points above a benchmark rate, implying an all‑in yield around 3.35% for the senior notes, a level that reflects the perceived credit risk of crypto‑backed lending as opposed to traditional consumer ABS.

Jefferies Financial Group acted as the sole structuring agent and bookrunner, coordinating negotiations with fixed‑income investors who are now exposed to a new form of crypto‑linked credit. The approach demonstrates how traditional finance channels can absorb crypto collateral in a regulated setting, offering a pathway for more standardized risk assessment and investor protections. The presence of a clearly delineated pool of loans and collateral helps reduce some of the information asymmetries that have historically characterized crypto credit markets, while also exposing participants to the volatility of the underlying crypto asset under pressure.

From a wider industry perspective, the deal underscores a broader shift in how Bitcoin is viewed by banks and non‑bank lenders alike. Andre Dragosch, head of research Europe at Bitwise, observed that packaging BTC‑backed loans into a conventional ABS framework signals that Bitcoin is increasingly regarded as “safe and legit collateral” by institutional players. He pointed to JPMorgan’s BTC‑backed loan offerings to customers as a corroborating datapoint—an indication that large banks are integrating crypto collateral into their traditional product lines. Four Pillars’ Jinsol Bok added that this could unlock liquidity that has previously been locked up, potentially allowing the BTC‑collateralized lending market to expand far beyond its current scale as more lenders enter the space and refine their risk models.

Ledn’s growth—originating more than $9.5 billion in loans across over 100 countries since its founding in 2018—highlights the capacity of crypto lenders to scale these products to mainstream markets. The strategic investment from Tether in November 2025 further signals investor confidence in the platform’s risk controls and governance, a factor that could influence future securitizations and investor buy‑side demand for crypto‑linked debt. While the broader market remains mindful of regulatory uncertainties and volatility in crypto assets, the emergence of BTC as a credible collateral backbone for ABS demonstrates how the industry is evolving toward more mature, diversified financing structures that integrate crypto with traditional market mechanisms.

-

Video3 days ago

Video3 days agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech4 days ago

Tech4 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Crypto World2 days ago

Crypto World2 days agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports2 days ago

Sports2 days agoGB's semi-final hopes hang by thread after loss to Switzerland

-

Video6 days ago

Video6 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech2 days ago

Tech2 days agoThe Music Industry Enters Its Less-Is-More Era

-

Business1 day ago

Business1 day agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video2 days ago

Video2 days agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Entertainment21 hours ago

Entertainment21 hours agoKunal Nayyar’s Secret Acts Of Kindness Sparks Online Discussion

-

Crypto World5 days ago

Crypto World5 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Tech1 day ago

Tech1 day agoRetro Rover: LT6502 Laptop Packs 8-Bit Power On The Go

-

Sports6 hours ago

Sports6 hours agoClearing the boundary, crossing into history: J&K end 67-year wait, enter maiden Ranji Trophy final | Cricket News

-

Entertainment12 hours ago

Entertainment12 hours agoDolores Catania Blasts Rob Rausch For Turning On ‘Housewives’ On ‘Traitors’

-

NewsBeat4 days ago

NewsBeat4 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business7 days ago

Business7 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World6 days ago

Crypto World6 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

Business1 day ago

Business1 day agoTesla avoids California suspension after ending ‘autopilot’ marketing

-

Crypto World15 hours ago

Crypto World15 hours agoWLFI Crypto Surges Toward $0.12 as Whale Buys $2.75M Before Trump-Linked Forum

-

Crypto World7 days ago

Crypto World7 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat4 days ago

NewsBeat4 days agoMan dies after entering floodwater during police pursuit