Crypto World

Wormhole Records $17.6B in 2025 Volume as Institutions Drive Multichain Adoption

TLDR:

- Wormhole processed $17.6B in 2025 volume, bringing cumulative transactions beyond $70B milestone.

- BlackRock, Apollo Global, and VanEck deployed tokenized funds across chains via Wormhole infrastructure.

- Over 100 tokens worth $170B in market cap launched using Wormhole’s NTT standard across 40+ blockchains.

- Ripple’s RLUSD and Sky’s USDS adopted NTT for native multichain expansion without liquidity fragmentation.

Wormhole has emerged as a leading multichain protocol, processing $17.6 billion in volume throughout 2025 and surpassing $70 billion in cumulative transactions.

The platform expanded its reach across more than 40 blockchains while securing partnerships with major institutions, including BlackRock, Apollo Global, and VanEck.

This growth reflects increasing demand for secure, cross-chain infrastructure as real-world assets move onchain.

Institutional Players Deploy Real-World Assets Through Wormhole Infrastructure

BlackRock’s BUIDL fund expanded operations across Solana and BNB Chain using Wormhole’s multichain infrastructure.

Securitize powered the tokenization process for this expansion, marking a notable milestone in institutional crypto adoption.

Apollo Global chose Wormhole through Securitize for the multichain tokenization of its Apollo Diversified Credit Securitize Fund, known as ACRED.

This selection demonstrates growing confidence in Wormhole’s ability to handle regulated financial products across multiple blockchain networks.

VanEck launched its first tokenized treasury fund spanning Solana, Avalanche, BNB Chain, and Ethereum. The asset manager relied on Securitize for tokenization while Wormhole provided the necessary interoperability between chains. “2025 marked a clear shift in how institutions approached multichain systems,” Wormhole noted in its annual report.

Hamilton Lane expanded its flagship SCOPE fund to Optimism and Ethereum via Securitize, designating Wormhole as the exclusive interoperability provider.

Meanwhile, Transfero Group adopted Wormhole’s Native Token Transfers (NTT) standard to expand BRZ, the world’s largest non-USD stablecoin, across different chains.

Mercado Bitcoin, a leading Latin American digital asset platform, selected Wormhole as its exclusive interoperability provider for a tokenized assets platform supporting over $200 million in assets.

NTT Standard Powers Over 100 Tokens Across Stablecoins and Major Assets

Wormhole’s NTT standard gained significant traction in 2025, with more than 100 tokens launching across 40-plus chains.

These tokens represented a combined market capitalization exceeding $170 billion, establishing NTT as an infrastructure for multichain asset issuance.

“NTT became the go-to infrastructure for issuing multichain assets without breaking liquidity, fragmenting supply, or losing issuer control,” the protocol stated.

Ripple’s RLUSD, regulated by the New York Department of Financial Services, adopted the NTT standard for expansion to Base, Optimism, Ink, and Unichain.

Sky Ecosystem’s USDS expanded to Solana via Wormhole NTT, transferring more than $880 million across the multichain economy.

M0, a decentralized stablecoin infrastructure layer, expanded to Arbitrum, Base, Solana, and Optimism using NTT. This enabled day-one native multichain launches for assets including MetaMask’s mUSD and Noble’s USDN.

Mento Labs selected Wormhole as its exclusive interoperability provider for multichain trading between 17-plus stablecoins. The platform emphasized that stablecoins “became one of the clearest signals of multichain maturity” during the year.

Beyond stablecoins, major assets adopted NTT for multichain expansion. Stacks brought sBTC and STX across Solana and Sui Network.

DOGE became a canonical multichain asset through NTT, while Hyperliquid’s HYPE expanded to Solana and Unichain. Lido Finance expanded wstETH to BNB Chain following community approval.

The Uniswap Foundation collaborated with Wormhole to enable native access to assets like SOL and HYPE on Unichain. Ethereum remained the leading destination chain with $4.5 billion in inflows, closely followed by Solana and BNB Chain.

Crypto World

Binance Secures ISO 22301 Certification to Strengthen Business Continuity and Operational Resilience

TLDR:

- Binance receives ISO 22301 certification verifying its global Business Continuity Management framework.

- The certification confirms Binance can maintain services during disruptions through tested recovery systems.

- Binance strengthens infrastructure with redundant data centers, monitoring systems, and 24/7 response teams.

- The exchange is aligning internal controls with the EU’s DORA framework for stronger ICT risk management.

Binance secures ISO 22301 certification for Business Continuity Management, marking a new operational milestone for the global cryptocurrency exchange.

The certification confirms that Binance maintains structured systems designed to sustain services during unexpected disruptions.

The recognition was issued by the British Standards Institution after an independent audit. The development comes as Binance continues strengthening operational resilience and aligning its internal frameworks with emerging regulatory expectations in global financial and digital asset markets.

Global Standard Confirms Binance’s Business Continuity Framework

Binance secures ISO 22301 certification after completing an external audit conducted by the British Standards Institution. The certification evaluates Business Continuity Management Systems that ensure organizations maintain operations during disruptive events.

ISO 22301 is an internationally recognized framework designed to verify readiness, response capability, and recovery speed following operational interruptions. Organizations receiving the certification must demonstrate structured risk management and continuity procedures.

Binance operates several safeguards designed to maintain stable service availability during infrastructure or security disruptions. These safeguards include redundant data centers, secure data backups, and continuous monitoring systems.

The platform also maintains a 24-hour incident response structure designed to detect and address technical issues quickly. Disaster recovery planning and technology continuity procedures form part of the operational framework.

Binance Chief Executive Officer Richard Teng addressed the milestone in a public statement shared on X.

In the post, Teng stated, “Binance is now ISO 22301-certified. I’m proud to share that we’ve secured ISO 22301 certification for Business Continuity Management.”

He added that the recognition confirms Binance’s ability to maintain seamless services even during unexpected operational disruptions.

Alignment With EU Digital Operational Resilience Requirements

Alongside the certification, Binance continues aligning operational frameworks with the European Union’s Digital Operational Resilience Act. The regulation aims to strengthen technology risk management standards across financial entities.

The DORA framework requires firms to maintain resilient infrastructure, structured reporting processes, and stronger oversight of operational risks. Binance has introduced measures designed to meet these requirements.

The company is expanding internal controls while refining incident reporting procedures across its operational teams. The framework also improves monitoring of third-party service providers supporting the platform’s infrastructure.

These measures focus on improving system reliability and maintaining platform access during technology-related disruptions. The approach also allows earlier identification of operational risks and faster response coordination.

Binance Chief Security Officer Jimmy Su also addressed the certification in an official company statement.

Su said, “Achieving the ISO 22301 certification marks a milestone for Binance, affirming that our Business Continuity Management system meets a globally recognized standard.”

He stated that the framework allows users to maintain confidence in the safety and accessibility of their assets at all times.

The certification arrives as digital asset platforms continue strengthening operational safeguards and resilience standards across global markets.

Crypto World

2 Indicators Turn Bullish for Bitcoin: What’s Next for BTC’s Price?

Bitcoin (BTC) jumped from $68,000 to roughly $74,000 on March 4 to reach a new monthly high, as two distinct datasets flashed bullish signals nearly simultaneously.

On-chain data shows a sharp spike in Binance futures open interest delta coinciding with the price breakout, while U.S. spot Bitcoin ETFs have added approximately 23,600 BTC to their holdings since February 25, pointing toward fresh institutional demand entering the market.

Derivatives Activity and ETF Inflows Increase

Market analyst Amr Taha wrote in a March 5 update that Bitcoin futures open interest expanded substantially on March 4, with Binance alone adding about $430 million in new positions. Other exchanges also posted sizeable increases, including Gate.io with roughly $189 million and Bybit with about $166 million.

The increase happened as Bitcoin flew to $74,000 to hit a new monthly peak. According to Taha, the overall rise in open interest across exchanges exceeded the peak recorded in January, pointing to the strongest derivatives expansion in nearly two months.

“The rise in OI Delta, particularly when it is led by Binance, usually suggests that new positions are entering the market,” Taha noted. “In other words, fresh liquidity appears to be flowing into derivatives.”

At the same time, U.S. spot Bitcoin ETFs accumulated about 23,600 BTC between February 25 and March 5, according to the same dataset. The amount is worth around $1.5 billion at current prices and adds to ETF holdings that many traders use as a gauge of institutional demand.

“Historically, rising ETF demand tends to support bullish market conditions, as it introduces steady buy-side pressure into the market,” Taha pointed out.

Separate order-flow data shared by analyst Maartunn on X also pointed to large buyers entering the market. He wrote that the Coinbase premium gap widened to $61, meaning BTC traded higher on Coinbase than on other exchanges. The metric often reflects demand from U.S. traders.

Price Rally Follows Rebound From Geopolitical-Driven Sell-Off

Bitcoin’s recent move continues a rebound that began after a sudden drop tied to geopolitical tensions in the Middle East.

At the time of writing, the flagship cryptocurrency was trading near the $72,500 level after gaining nearly 6% in the last 24 hours and about the same over the past week. Despite the bounce, BTC still sits more than 42% below its all-time high recorded in October 2025 when the asset went past $126,000.

Technical traders have also focused on the $71,700 level. Maartunn wrote that the market has reclaimed this range high, which could keep the current upward structure intact if the price holds above it.

Still, derivatives markets show rising leverage, with the analyst saying that Bitcoin derivatives added about $3.55 billion in new leveraged positions, an 18% increase, while Ethereum saw close to $1.8 billion in additional leverage.

According to him, these new positions require continued spot demand to remain stable, and if supportive bids slow down, overleveraged positioning can unwind quickly, increasing volatility. However, as it stands, Maartunn says institutional spot demand is supporting the move.

The post 2 Indicators Turn Bullish for Bitcoin: What’s Next for BTC’s Price? appeared first on CryptoPotato.

Crypto World

Google Exposes Coruna Exploit Kit Stealing Cryptocurrency from iPhone Users on iOS 13-17.2.1

Key Takeaways

- Google’s security researchers reveal Coruna exploit framework designed to steal cryptocurrency from iPhones.

- The exploit framework successfully compromises iOS versions 13 through 17.2.1 via WebKit vulnerabilities.

- Multiple threat actors deploy identical exploits for both espionage campaigns and financial cybercrime.

- Malicious code targets cryptocurrency wallets, QR codes, and stored notes containing sensitive credentials.

- Immediate iOS updates or Lockdown Mode activation recommended for device protection.

Security researchers at Google have uncovered a sophisticated exploitation framework specifically designed to compromise iPhones operating on iOS versions ranging from 13 to 17.2.1. According to Google’s Threat Intelligence Group, cybercriminals leverage this exploit toolkit to extract cryptocurrency wallet credentials and other valuable financial data. Google’s analysis reveals that the framework has been adopted by various malicious actors conducting both state-sponsored surveillance and widespread financial fraud operations.

Google monitors Coruna exploit framework distribution among cybercriminal groups

The Threat Intelligence division at Google first encountered this exploitation toolkit while investigating targeted surveillance activities during the early months of 2025. Security analysts at Google observed threat actors utilizing the framework through specialized JavaScript code engineered to profile iPhone hardware. This profiling mechanism determines specific device models and firmware versions before deploying customized exploitation sequences.

Google subsequently traced connections between this identical exploit framework and watering-hole compromises specifically aimed at Ukrainian internet users. The malicious JavaScript appeared embedded within legitimate but compromised websites, loading through concealed iFrames that activated exclusively when visitors accessed sites using iPhones. Google’s research team attributed these intrusion attempts to UNC6353, a threat actor suspected of conducting Russian intelligence operations.

Further investigation by Google revealed the same exploitation toolkit operating across extensive networks of deceptive Chinese financial platforms. These fraudulent websites presented themselves as legitimate cryptocurrency exchanges and online gambling services to deceive potential victims. Google’s findings indicate that financially motivated cybercriminals subsequently adopted the toolkit for mass-scale criminal operations.

Google researchers document exploit sequences across multiple iOS releases

According to Google’s technical analysis, the Coruna framework encompasses five complete exploitation sequences utilizing twenty-three distinct security vulnerabilities. The toolkit successfully compromises iPhone devices operating any firmware version between iOS 13 and iOS 17.2.1. Google’s security analysts verified that attackers weaponize WebKit browser vulnerabilities as the initial attack vector to gain code execution on victim devices.

The exploitation framework incorporates sophisticated techniques to circumvent advanced security mechanisms including pointer authentication controls. Following successful initial compromise, attackers deliver encrypted binary components specifically crafted to inject additional malicious modules into the operating system. Google’s technical documentation describes a specialized loader component that infiltrates code directly into iOS power management system processes.

Google additionally documented that the exploit framework intentionally avoids compromising devices operating with Lockdown Mode enabled or during private browsing sessions. The toolkit employs advanced fingerprinting methodologies to confirm it exclusively targets authentic iPhone hardware. Google’s technical assessment demonstrates that attackers meticulously engineered the framework to deploy version-specific exploit sequences tailored to each target device.

Google security team identifies crypto wallet theft as primary objective

Google‘s security analysts determined that the ultimate malware payload concentrates on harvesting financial credentials and cryptocurrency information stored within compromised devices. The malware systematically scans filesystem contents and image files searching for cryptocurrency wallet recovery phrases and banking-related references. Google documented that the malicious code specifically searches for BIP39 mnemonic seed phrases and associated wallet backup terminology.

The malicious application possesses capabilities to analyze photographic content stored on compromised devices, specifically scanning for QR code patterns containing wallet credentials or transaction information. Upon successfully identifying valuable data, the malware establishes connections with attacker-operated command infrastructure to exfiltrate the stolen information. Google’s analysis confirmed the malware additionally searches Apple Notes application data for content referencing banking credentials or cryptographic recovery keys.

Google verified that the exploitation framework no longer successfully compromises the most recent iOS firmware releases. Nevertheless, Google strongly advises users to immediately update devices currently operating outdated operating system versions. The security team additionally recommends activating Lockdown Mode on devices where immediate updates prove impractical, significantly reducing vulnerability to similar exploitation attempts.

Crypto World

Exclusive: Yuliya Barabash Says the Biggest Winners of Crypto’ Next Cycle May Be the Most Regulated

If you have been in crypto for a while, you have probably noticed how quickly the industry has been maturing in terms of regulation.

Not long ago, the market lived in a gray zone. Exchanges launched overnight. Startups issued tokens across borders. Regulation struggled to keep up with how fast the space was moving.

Then came FTX and everything changed.

“The game completely changed after FTX and Celsius collapsed, exposing just how badly customer funds were being mismanaged,” said Yuliya Barabash.

Since those failures, regulators across the world have started moving much faster. New rules are appearing, oversight is tightening, and crypto companies are being pushed toward stronger compliance.

But this shift raises a question. Is regulation helping the industry grow up, or could it end up slowing the innovation that made crypto possible in the first place?

In an exclusive interview with Cryptonews, Barabash, Yulia Barabash, founder of consulting company SBSB Fintech Lawyers, shares her views on how regulation is reshaping crypto, why institutions now care more about compliance, and what the next phase of the industry could look like.

The Post-FTX Crypto Regulatory Era

According to Barabash, the collapse of several major crypto firms forced regulators to act more aggressively.

High-profile failures revealed serious problems in how some platforms handled customer funds and risk management. Once those issues became impossible to ignore, regulators began accelerating new frameworks.

“After FTX and Celsius, regulators could not just sit back anymore,” Barabash explained.

Authorities began focusing much more on transparency, investor protection, and anti-money-laundering rules.

For crypto companies, this meant the environment started changing quickly. Operating in regulatory gray zones became much harder.

Institutions Now Want Regulated Platforms

Another big shift is how institutional investors approach crypto.

Large investors are becoming far more selective about where they put their money. This is very different from how things were back in 2021.

Many now prefer licensed exchanges, regulated infrastructure, and platforms that operate within clear legal frameworks.

They want to know exactly how a platform operates before committing capital to reduce risks.

As Barabash points out, this is creating a clear divide in the industry. Companies that invest in compliance and licensing are increasingly attracting institutional attention, while loosely regulated platforms are becoming less appealing.

MiCA and Europe’s Regulatory Push

One of the biggest regulatory developments in recent years is Europe’s Markets in Crypto-Assets regulation, known as MiCA.

The framework aims to introduce consistent rules for crypto companies operating across the European Union.

Barabash believes this could play an important role in building trust around the industry.

Clear regulations can make it easier for institutions and traditional financial firms to participate in crypto markets.

At the same time, some companies worry that stricter requirements could increase costs and make it harder for smaller startups to compete.

But Really, Does Crypto Regulation Slow Innovation?

The idea that regulation might slow innovation is a common concern in the crypto community.

Barabash sees it a bit differently.

“Regulation does not necessarily kill innovation,” she said. “Sometimes it actually creates the structure needed for new technologies to grow safely.”

Without clear rules, many institutional investors and banks remain cautious about entering the space.

In that sense, stronger regulation can help unlock larger pools of capital and push the industry toward long-term growth.

Why Banking Relationships Still Matter

One area that often gets overlooked is the role of traditional banking infrastructure.

Crypto companies still rely heavily on banks for payment processing, fiat on-ramps, and financial services. Without those partnerships, even large platforms can run into serious operational challenges.

That is why compliance and anti-money-laundering programs have become so important.

For many crypto businesses, maintaining stable banking relationships can be just as critical as launching new products.

Political Leadership Still Shapes Crypto Policy

Regulation does not move in a vacuum. Politics often plays a bigger role than many people expect.

Barabash pointed out that regulatory priorities can shift depending on who is in charge. Changes in political leadership or institutional direction can influence how aggressively governments push crypto policies.

The digital euro is a good example.

The project has been discussed for years, but its timeline and direction have shifted several times as policymakers debated privacy concerns, financial stability, and the role of central bank digital currencies.

According to Barabash, leadership changes inside institutions like the European Central Bank could still influence how quickly the digital euro moves forward and what form it eventually takes.

For the crypto industry, that uncertainty means regulation will likely continue evolving alongside political priorities.

In other words, the rules of the game may keep changing as governments figure out how digital assets fit into the broader financial system.

The Industry Is Growing Up

The crypto industry is clearly entering a new phase.

The early days of rapid experimentation and limited oversight are slowly giving way to a more structured environment.

While regulation may introduce new challenges, it could also help build the trust needed for broader adoption.

According to Barabash, the companies that succeed in the next cycle will likely be those that adapt to this new reality.

“The industry is maturing,” she said. “And that maturity will shape where crypto goes next.”

The post Exclusive: Yuliya Barabash Says the Biggest Winners of Crypto’ Next Cycle May Be the Most Regulated appeared first on Cryptonews.

Crypto World

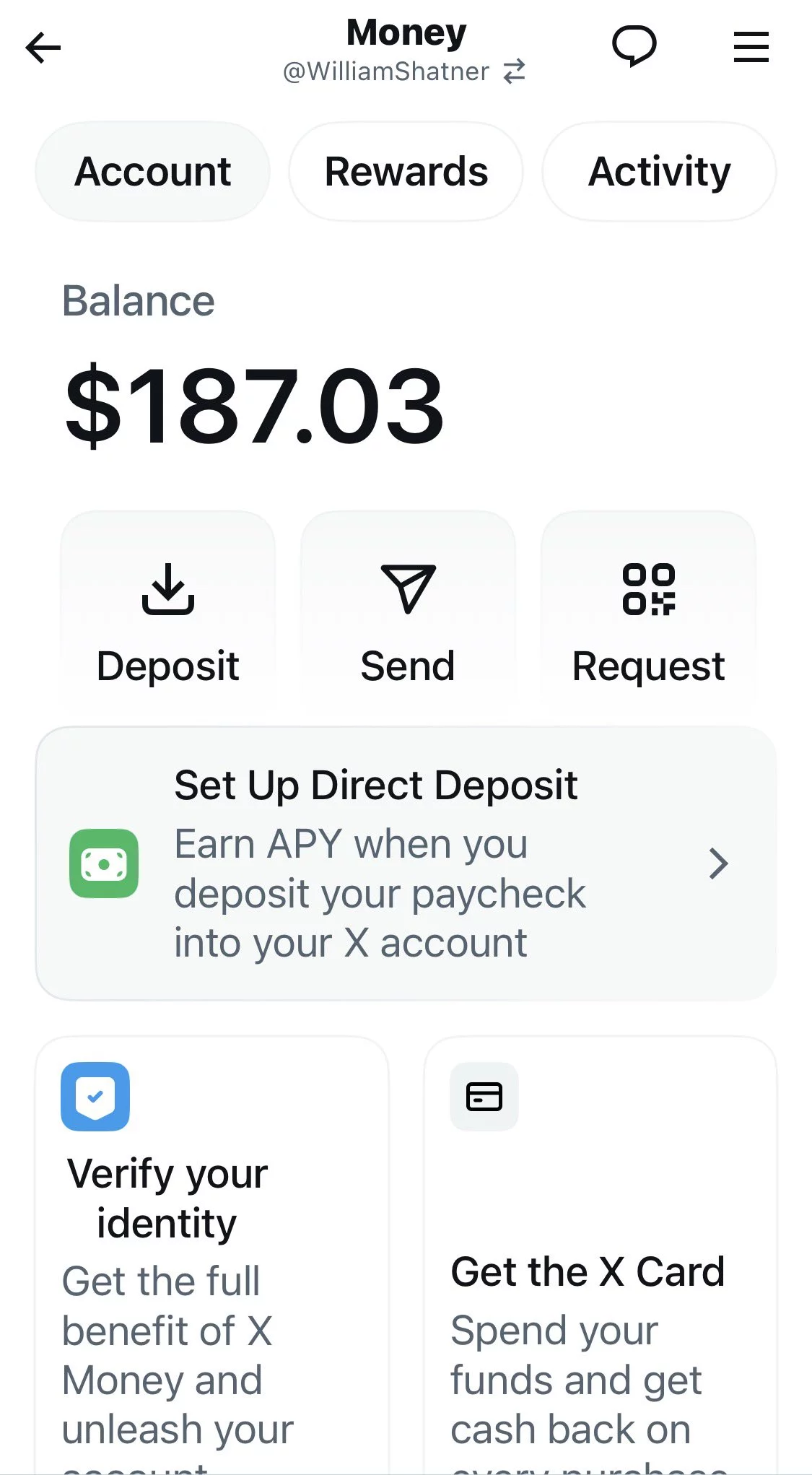

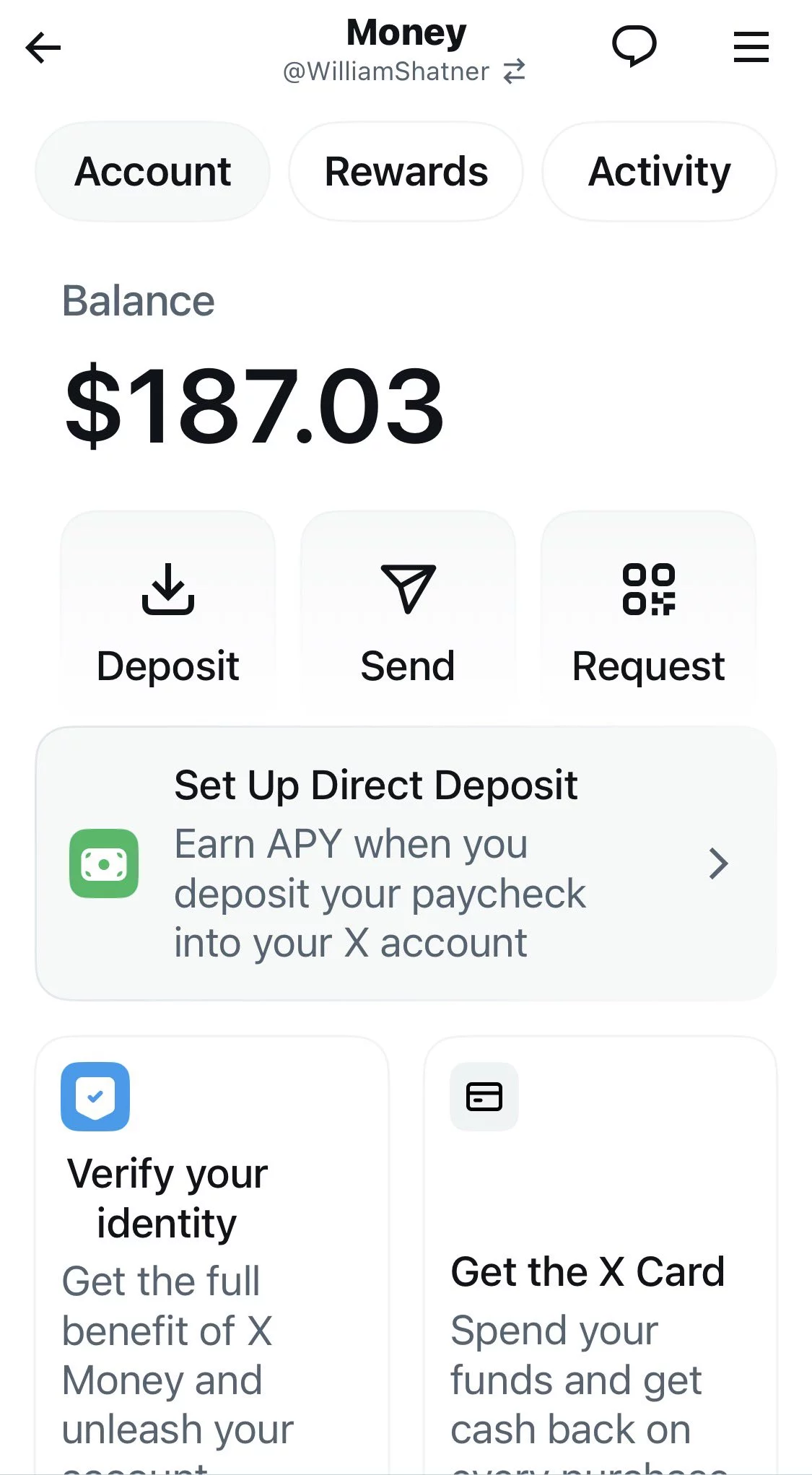

Is crypto coming to X Money? Elon Musk responds after first images appear

The launch of X Money has moved into a high-profile limited external beta, sparked by recent social media activity from Elon Musk and William Shatner.

Summary

- X Money has entered a high-profile external beta, highlighted by posts from Elon Musk and William Shatner promoting early access.

- The initial version focuses on peer-to-peer fiat payments, a debit card, and cash deposits with up to 6% APY, despite speculation about future crypto integration.

- Musk continues pushing X toward becoming a single hub for financial services, with the platform already holding money transmitter licenses across 40+ U.S. states.

While speculation regarding cryptocurrency integration is high, current reports indicate the initial rollout focuses primarily on fiat services.

Shatner tapped for X Money beta rollout

Actor William Shatner recently confirmed his involvement in the beta, posting about the “42nd X Money opportunity”. With X’s permission, Shatner has been auctioning invites to the payment service for charity. His posts revealed key features of the service, including:

- 6% Annual Percentage Yield (APY) on cash deposits.

- A $25 welcome gift for new beta users.

- An all-black X debit card offering cashback on eligible purchases.

Musk’s “Everything App” vision

Elon Musk reinforced the significance of the launch by retweeting screenshots of the new interface and debit card.

He also share a post from Teslaconomics on X Money stating, “This will be big”.

Musk has described X Money as the “central source of all monetary transactions,” aiming to eliminate the need for traditional bank accounts. This move returns Musk to his roots at X.com, the online bank he founded in 1999 that eventually became PayPal.

X Money is currently in closed internal testing, with a broader, limited external beta expected to expand in March and April 2026. The platform has already secured money transmitter licenses in over 40 U.S. states and is registered with FinCEN.

Regarding crypto, although Musk has hinted at future support for assets like Dogecoin, the current beta focuses on peer-to-peer fiat transfers and Visa-partnered payments.

However, the inclusion of “Smart Cashtags”—intended for seamless in-app trading—suggests that official crypto and stock integration may follow shortly after the initial launch.

Crypto World

Bitcoin Nears Two-Year ‘Make-or-Break’ Resistance: What’s Next?

Traders are hopping the Bitcoin (BTC) selloff has finally exhausted itself as prices trade around $73,000 for the first time since early February, although resistance is still there.

After rebounding from structural support near $63,000 over the weekend earlier in March, Bitcoin has now gained 8% in the last 7 days and about 2.5% in the last 24 hours.

Traders are now watching the $74,000 level specifically, as it formed the height of the post-ETF approval rally in 2024 and then later, the bottom of a selloff between February and April 2025, when Bitcoin dropped from $100,000 to that level.

With the asset up significantly from its recent lows but stalling at resistance, the next 48 hours will likely dictate the trend for the remainder of Q1.

Discover: The best crypto to diversify your portfolio with

Bitcoin Price Prediction: Is a Larger Rally Forming?

Bitcoin is currently above $71,000, a critical area that represents the heavy resistance that halted February’s advance.

The bounce from $63,350, confirmed by a Hammer candlestick pattern, showed that buyers are willing to step in at lower valuations.

The bearish argument now rests on whether Bitcoin can consolidate recent gains and push ahead to $76,000.

As of this writing, Bitcoin is down 7% on the month, but if the original and biggest crypto can retain value over the next few days, its thirty-day price change will be positive, giving it a stabler platform to go a leg higher.

Bears are watching for “hidden bearish divergence” on the RSI, where price makes a lower high while momentum makes a higher high.

If this divergence plays out and Bitcoin rejects $72,265, the downside targets are steep. Some veteran traders warn a final flush is coming, with technical projection levels sitting as low as $56,800 or even $41,400 if the $62,300 support floor gives way.

However, the bullish invalidation is clear. A sustained close above $79,000 by the end of the week would completely negate the bear flag thesis. Immediate bullish confirmation comes earlier: if BTC can reclaim the $73,000 level and turn it into support, it opens the path to retest the psychological $80,000 handle.

Recent price predictions suggest a move past $72k could trigger a mega rally, provided the volume supports the breakout.

Analyst View: The Line in the Sand

Market analysts are currently split on whether the recent recovery is a dead cat bounce or a genuine reversal. The consensus, however, is that current levels are effectively a “no man’s land” until a decisive break occurs.

To the upside, Bitcoin may have to resurface above its 50-day SMA and reclaim the psychological $80k handle before more buyers are enticed back into the fold.

Other analysts, like Samer Hasn, note that recent extreme fear readings and ETF outflows may have signaled a local bottom, flushing out weak hands in a classic capitulation event.

Bitcoin Resistance Level and Price Prediction: The Levels That Change Everything

Traders should ignore the noise and focus on three specific price levels in the coming sessions. First, watch $74,000. A daily close above this level suggests the 50-day moving average, which has formed a strong resistance zone, is flipping to support.

Second, monitor the support band at $63,000. This is a clear line in the sand for bulls. Losing this level confirms the bear flag breakdown and activates downside targets toward $56,000.

Finally, keep an eye on the invalidation level at $80,000. Reclaiming this zone effectively cancels the macro bearish structure and puts new all-time highs back on the table. The next few daily candles will likely resolve this multi-month tension.

Discover: The hottest meme coins in crypto

The post Bitcoin Nears Two-Year ‘Make-or-Break’ Resistance: What’s Next? appeared first on Cryptonews.

Crypto World

American Bitcoin (ABTC) insiders purchased more than $1 million in company stock

Two board members of American Bitcoin (ABTC), the bitcoin mining company backed by the Trump family, have made significant open-market share purchases of the firm’s stock, according to a Thursday filing.

Justin Mateen, co-founder of Tinder and an ABTC board member since March 2025, bought approximately 1.3 million shares at an average price of about $1 per share. The stock closed at $1.15 on Wednesday.

Fellow board member Richard Busch, a partner at law firm King & Ballow, purchased about 330,000 shares over the last two days.

The timing is notable, as the trading window opened after ABTC released its latest earnings report, making these the first purchases insiders could make following the disclosure.

The bitcoin mining firm reported a $59 million loss in the fourth quarter of 2025, as the sharp decline in the price of the largest cryptocurrency reduced the value of its holdings.

Eric Trump said in a Wednesday post on X that American Bitcoin now holds more than 6,500 BTC, an increase of over 500 BTC since the last disclosure. The update places the firm among the world’s 17 largest publicly traded bitcoin holders.

The miner went public in September, less than a month before bitcoin reached a record high. The stock has struggled along with the price of BTC, the shares tumbling from about the $8 level to the current $1.15.

ABTC is following a dual strategy of BTC mining and direct purchases. About one-third of its bitcoin comes from mining operations, while the remainder is acquired through open-market purchases and strategic transactions, largely financed by stock sales. The firm is 20% owned by Eric Trump and Donald Trump Jr.

The company announced Tuesday that it had bought 11,298 ASIC miners, a move that it said will increase its mining capacity by about 12%.

Read more: Eric Trump’s American Bitcoin buys 11,298 ASIC miners, increasing mining capacity by 12%

Crypto World

Stablecoin Inflows Jump to $1.7B as Washington Battles Yield Rules

Stablecoin inflows rebounded last week as on-chain activity regained momentum, even as US lawmakers and banking groups sparred over whether third-party yield on stablecoins should be allowed. Messari’s latest data shows weekly net inflows climbing to $1.7 billion, a 414.5% increase from the prior week. The shift helped flip the 30-day average to a positive $162.5 million in daily inflows, while transaction volumes rose about 6.3%. The uptick signals renewed issuance demand and renewed participation from retail investors, suggesting a steadier baseline for stablecoins after a softer start to the year.

Key takeaways

- Weekly net stablecoin inflows surged to $1.7 billion, representing a 414.5% week-on-week increase and signaling renewed issuance demand.

- The 30-day average turned positive, with daily inflows averaging about $162.5 million and on-chain activity rising by roughly 6.3%.

- Average transaction size declined, a pattern that often accompanies broader issuance and more diverse retail participation.

- Earlier in the period, inflows were weaker—about $249 million in weekly inflows two weeks prior, with a net $4.4 billion of outflows over the 30 days leading up to February 18.

- Policy and regulatory dynamics framed the backdrop: the CLARITY Act advanced in the House in July 2025 to establish a clearer framework for digital assets, while the GENIUS Act—also designed to regulate stablecoins—was enacted in July 2025, with President Trump publicly criticizing banks for stalling the process. The ongoing debate over yield-bearing stablecoins remains a central point of contention in any broader market-structure bill.

- In the broader market, the environment remains sensitive to regulatory signals and the balance between fostering innovation and safeguarding consumers, with the yield question at the core of the current stalemate.

Tickers mentioned: $USDC, $USDT

Sentiment: Neutral

Market context: The rebound in inflows comes amid a wider on-chain revival and ongoing regulatory scrutiny of stablecoins. As lawmakers weigh whether to permit yield-bearing features and how to structure a broader crypto market framework, market participants continue to monitor regulatory clarity and the potential impact on stablecoin demand and issuance strategies.

Why it matters

The renewed inflows underscore the enduring importance of stablecoins as a liquidity layer for crypto markets. As traders and institutions seek faster settlement and more predictable liquidity, the appetite for stablecoins like USDC (CRYPTO: USDC) and USDT (CRYPTO: USDT) remains robust. This trend matters for exchanges, DeFi protocols, and liquidity providers, who rely on stablecoins to manage risk and enable efficient trading even amid volatility in other crypto sectors.

Regulators’ move toward clarity—through measures like the CLARITY Act and the GENIUS Act—has been a defining theme for 2025. While the former is designed to provide a clear regulatory framework for digital assets, the latter restricts issuers from paying yield solely for holding a stablecoin while permitting third-party rewards tied to stablecoin balances. The laws aim to strike a balance between consumer protection and innovation, a dynamic that can influence both the attractiveness of stablecoins for everyday users and the cost structure for issuers and wallets. The political context remains fluid, with public statements from high-profile figures adding another layer of risk and anticipation for market participants.

For investors and developers, the significance extends beyond inflows. The stability of on-chain volumes and the resilience of demand for stablecoins feed into DeFi activity, pegged lending, and cross-chain bridges. A policy environment that provides clearer rules could accelerate institutional engagement, while a restrictive stance on yield could slow some use cases but preserve overall capital stability for other participants. In short, the current inflow rebound matters not just as a one-week stat but as a signal about how the market expects regulatory clarity to shape user incentives and the broader crypto liquidity landscape.

What to watch next

- Whether the Senate resumes or adjusts markup on the CLARITY Act and the GENIUS Act, and any new regulatory guidance on yield-bearing strategies.

- Upcoming Messari or other on-chain data releases that could confirm whether the recent inflow spike translates into sustained issuance and on-chain activity.

- Any official statements or regulatory filings from stablecoin issuers regarding yield programs and reserve management in the wake of policy debates.

- Public commentary from policymakers and industry groups that could signal a shift in the balance between innovation and investor protection.

Sources & verification

- Messari, In the Stables: Inflows Surge 414% as Stablecoin Use Returns — https://messari.io/report/in-the-stables-inflows-surge-414-as-stablecoin-use-returns

- Digital Asset Market Structure Clarity Act explained — https://cointelegraph.com/explained/clarity-act-explained-what-it-means-for-crypto-week-and-beyond

- What does the US GENIUS Act mean for stablecoins — https://cointelegraph.com/explained/what-does-the-us-genius-act-mean-for-stablecoins

- Trump on the GENIUS Act and banks — https://truthsocial.com/@realDonaldTrump/posts/116167496865556148

- Indiana crypto rights bill coverage — https://cointelegraph.com/news/indiana-crypto-rights-bill-governor-signature

Stablecoin inflows rebound as policy debate stalls yields and structure

The latest Messari data portrays a market that remains sensitive to both on-chain dynamics and the policy questions that shape the incentive to issue, hold, and use stablecoins. The jump to $1.7 billion in weekly inflows represents a dramatic swing from earlier in the year and highlights a broader return of demand among a diverse investor base. While the headline figure is compelling, it sits within a larger context of fluctuating regulatory expectations and evolving market structure debates that aim to determine whether yield-bearing features can coexist with a robust, stable, and transparent financial system for digital assets.

On the technology and usage side, the increase in transaction volume coupled with a smaller average transaction size suggests a broadening base of participants entering the market. Retail interest appears to be returning, and the composition of flows may reflect a mix of retail, market-making, and liquidity-provision activity that extends beyond the traditional crypto trading venues. This is an important development for the ecosystem, as it signals a potentially more resilient liquidity layer that can support a wide range of DeFi protocols and cross-chain activities.

Policy developments continue to dominate the conversation. The CLARITY Act’s passage in the House and the GENIUS Act’s trajectory indicate a push toward a more predictable regulatory framework for stablecoins and digital assets overall. The debate over whether stablecoin issuers’ affiliates can pay yield—versus preventing issuers from paying yield solely for holding a stablecoin—touches directly on how users interact with these tokens in everyday finance. The public comments by President Trump, criticizing banks for stalling regulatory progress, underscore the political salience of these issues. As the legislative process unfolds, market participants will be watching for any concrete regulatory milestones that could influence issuance incentives, user behavior, and the competitive landscape among stablecoins.

Crypto World

A16z crypto plans $2 billion fund to back next wave of blockchain startups: Fortune

Andreessen Horowitz’s crypto arm is back in the market with a fifth venture fund, even as the digital asset sector navigates a slower investment environment, Fortune reported.

A16z crypto aims to raise $2 billion for the fund and hopes to close the process during the first half of 2026, Fortune said, citing unidentified sources.

The venture capital firm declined to comment on the fundraising effort to Fortune, and neither the firm nor its PR team in London responded to a CoinDesk request for confirmation before publication.

The target is significantly below the company’s fourth fund, which raised $4.5 billion in 2023 and remains one of the largest dedicated crypto venture funds ever assembled. Still, it’s larger than the $650 million Dragonfly Capital raised last month.

The reported size suggests a more cautious approach to venture capital deployment as crypto markets cool from the highs seen only last year. Dragonfly’s was one of the largest raises in the sector at a time when many blockchain-focused VCs are struggling, according to Haseeb Qureshi, the firm’s managing partner.

Led by general partner Chris Dixon, a16z crypto has been one of the most influential investors in the digital asset sector, backing projects such as decentralized exchange Uniswap, digital asset platform Anchorage Digital and Jito Network, a core infrastructure protocol. Since its first $300 million crypto fund in 2018, the firm has played a major role in bringing institutional venture capital into blockchain startups.

In an X post last month, Dixon said he sees crypto as entering what he describes as its “financial era,” where blockchain-based financial applications could serve as the foundation for broader decentralized internet services.

Crypto World

On-chain mortgages will start in the Gulf

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Few places in the world have advanced as quickly as the Gulf. It’s a place filled with skylines that rise almost overnight, governments that execute on their promises, and an appetite for innovation. This same environment is turning the Gulf into one of the few places where real-world assets, specifically tokenized real estate, are emerging as live, investable projects, not just ideas that only exist on conference stages.

Summary

- The Gulf has the regulatory speed and digital land infrastructure to pioneer on-chain mortgages, turning tokenized property into programmable credit markets.

- Mortgages aren’t broken — the rails are: Paper-heavy, multi-ledger systems create opacity, delays, and risk that tokenization can structurally reduce.

- Dubai’s RWA momentum creates a first-mover advantage: With land registries digitized and regulated asset frameworks in place, the Gulf can set the global template.

Across developed markets, progress in tokenized real estate has been constrained by existing securities and market infrastructure built decades ago, with broad adoption still out of reach. Take Germany, for example. BaFin, the financial regulator, stated clearly that a security token offering will require a full prospectus unless the issuer qualifies for a specific exemption, adding time, money, and months of runway before anything can launch at scale.

The West likes to say innovation has to wait for the rulebook, but the Gulf is proving that the rules can evolve into systems that work. In recent months, the Dubai Land Department has begun converting real estate assets into on-chain digital tokens, effectively tokenizing title deeds and reshaping how property is owned, traded, and accessed.

But the transformation isn’t just tokenizing property; it’s tokenizing credit. Once ownership is on-chain, the next obvious step is to bring mortgages on-chain too. Home loans stop being static, bank-held contracts and become investments that are easier to track, distribute, and finance across a broad investor base.

On-chain mortgages are an opportunity the Gulf can’t ignore, and a chance to introduce a better model to the world. If the region doesn’t take the lead, the whole world risks remaining stuck in an outdated cycle, with slow, opaque processes prone to repeating the same mistakes that have held markets back for generations.

What’s broken in today’s traditional mortgage market

Globally, crypto has struggled to break out of its speculative phase. The Gulf, though, is moving in a different direction. Recent projections estimate that Dubai’s tokenized RWA real-estate market, for example, could exceed $16 billion in market value by 2033.

Yet, mortgages in the Gulf, like mortgages elsewhere, run on systems that haven’t kept up with how people actually live or move money today.

The root of the issue is the “multi-ledger” process. The modern mortgage process itself is manual and paper-based, filled with weeks of document chasing, repetitive form-filling, appraisal, and title checks. Much of it happens in silos, with back-and-forth communication between brokers, banks, insurers, and registries. This creates latency, hefty administrative costs, and risk.

And in the Gulf, the stakes are amplified by the market’s global nature, which includes cross-border capital, international buyers, and fast-moving transactions. When the admin layer is slow, the whole process becomes fragmented, especially when investors don’t always operate under the same banking norms.

Even the property record itself presents weaknesses. While documents are essential for proving ownership and securing mortgages, the infrastructure behind them leaves room for errors, manipulation, and gaps in data integrity. The risk isn’t just theoretical. According to the National Association of Realtors, 63 percent of real estate professionals reported deed or title fraud in the past year.

On-chain mortgages aren’t a magic fix, nor do they eliminate the basic responsibilities of a loan. What they do is replace rigid, opaque processes with something better suited to the financial realities of digital economies, especially in the Emirates.

The mortgage upgrade we’ve needed for decades

Mortgages are far from a broken idea. What’s broken are the systems beneath them. When loans are bundled into opaque securities, it becomes harder for outsiders to see performance, ownership, and risk with clarity. The lesson of the 2008 financial crisis wasn’t that mortgages shouldn’t exist, but that the infrastructure around them can obscure reality at scale.

Tokenization is the infrastructure fix mortgages desperately need. By representing loan exposure digitally, mortgages become easier to track, transfer, and administer, giving investors globally the chance to hold smaller slices of risk with greater visibility into what they own and how it’s performing.

Still, this infrastructure will only work if the inputs are legitimate. Better rails only matter if they’re anchored to credible inputs such as title, liens, and valuations. That’s where the Gulf has an advantage. Regulators have already been digitizing land registries and transaction data, laying down the foundation for verified pricing and pricing history. With that foundation in place, oracle-based pricing tools can push verified appraisal data directly into the chain, giving lenders and investors far more clarity than legacy systems allow.

Beyond data, Dubai has advanced in regulatory guardrails. The Virtual Assets Regulatory Authority has created clearer routes for bringing investments on-chain through its Assets-Referenced Virtual Asset category. This regulated framework links token value to RWAs and clearly identifies who gets paid, how, and when, along with other rights attached to the asset. This can include income distribution, governance rights, and other entitlements, giving markets the clarity they need to build.

Indeed, turning a mortgage into a digital asset does not change the borrower’s obligations or completely remove risk. But what it does do is change the reliability and speed of the administrative layer, which determines the loan’s status at any given moment.

Tokenization can’t bend the laws of credit, but it can help remove the drag of outdated rails. By reducing the time and cost of coordinating mortgages with shared, programmable records, tokenization can improve efficiency, access, transparency, and accuracy across the mortgage lifecycle.

While implementing on-chain mortgages carries technological and regulatory risks, the Gulf’s dominance in tokenized assets makes it one of the most promising regions for this model to take hold. With its regulatory cohesion and appetite for financial innovation, the region has the potential to turn on-chain mortgages from an experiment into a market standard, eventually providing the blueprint for global practice.

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

Tech5 hours ago

Tech5 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World7 days ago

Crypto World7 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes