Crypto World

XRP ETFs See $6.31 Million in Daily Inflows as XRPC, GXRP, and XRPZ Excel

TLDR

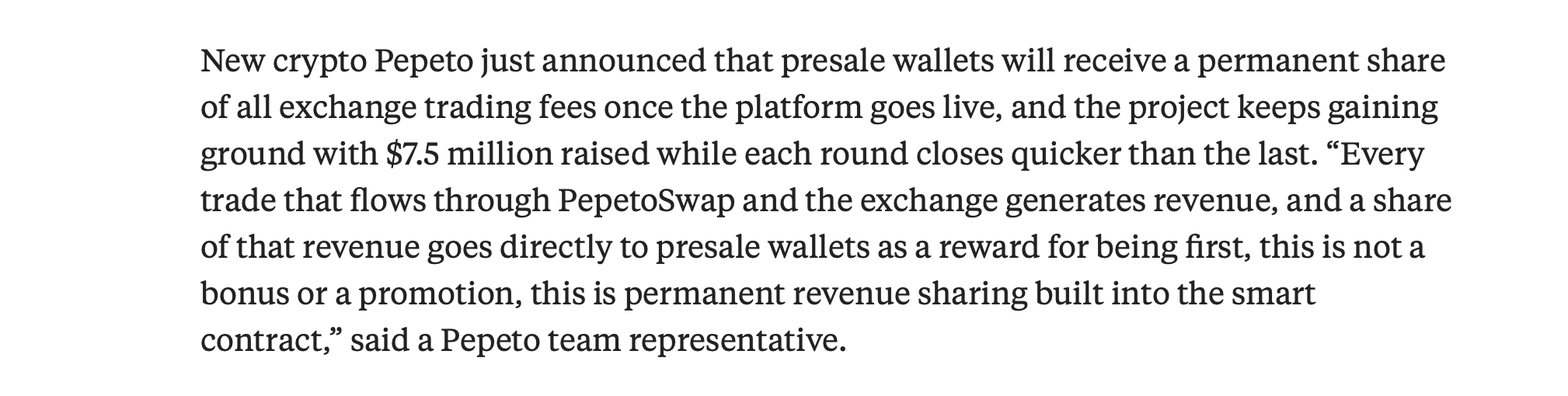

- XRP ETFs total daily net inflows of $6.31M with a cumulative net inflow of $1.23B as of February 9.

- The XRPC ETF on NASDAQ reports a $2.31M daily inflow, holding net assets of $275.59M.

- GXRP ETF on NYSE has daily inflows of $846.19K, with net assets of $87.44M.

- The Franklin XRPZ ETF sees a daily inflow of $3.15M and holds $236.25M in assets.

- TOXR and Bitwise XRP ETFs report no daily inflows or outflows, maintaining minimal changes.

According to a recent SoSoValue update as of February 9, the total daily net inflow for XRP ETFs stands at $6.31 million, with a cumulative net inflow of $1.23 billion. The total value traded on this day is recorded at $15.89 million.

XRP ETFs See Inflows Across XRPC, GXRP, and XRPZ

The XRP ETF products on various exchanges have reported varying levels of performance. A deep dive on the individual ETFs reveals that the XRPC ETF on NASDAQ, managed by Canary, shows a premium of +0.26%. The daily net inflow for this ETF amounts to $2.31 million, with a cumulative inflow of $411.16 million. It holds net assets of $275.59 million, equating to a 0.31% share of the total XRP market cap.

The GXRP ETF, also on the NYSE and managed by Grayscale, reports a daily inflow of $846.19K. GXRP holds the lowest net assets at $87.44 million, which represents 0.10% of XRP’s total market cap. The market price of this ETF is $28.25, with a daily change of +0.57%.

The Franklin XRPZ ETF, listed on the NYSE, has a daily inflow of $3.15 million. It currently holds $236.25 million in net assets, representing a 0.27% XRP share. Its market price stands at $15.82, with a daily increase of +0.70%.

TOXR and XRP ETFs Record No Inflow or Outflow

The TOXR ETF, trading on CBOE under the 21Shares sponsor, reports no change in daily flow with a cumulative net inflow of $70.22K. With net assets of $178.24 million, it has a minimal XRP share of 0.20%. The ETF shows a market price of $14.19, with a daily change of +0.35%.

On the NYSE, the Bitwise XRP ETF has gained a premium of +0.75%, with no changes in daily inflow and a cumulative net inflow of $357.89 million. This XRP ETF holds net assets of $263.22 million and a 0.30% XRP share. Its market price is $16.35, with a daily change of +0.74%.

Crypto World

APPL – Apple Stock Price Prediction Gets Street High $350 Target After Earnings Beat as One Crypto Project Gains Traction Pepeto

Apple just delivered one of its strongest quarters in recent memory, beating earnings estimates by a wide margin and posting 15.7% revenue growth that caught even the bulls off guard. Institutional buyers are adding to their positions, a new Street high price target has arrived, and the M5 chip cycle is still in its early stages. A small but growing number of equity investors are also beginning to diversify into digital assets for the first time, and today we will break down one specific crypto project with a very bright future.

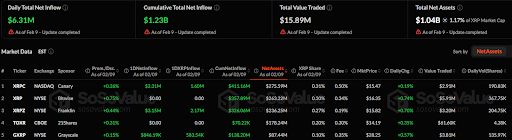

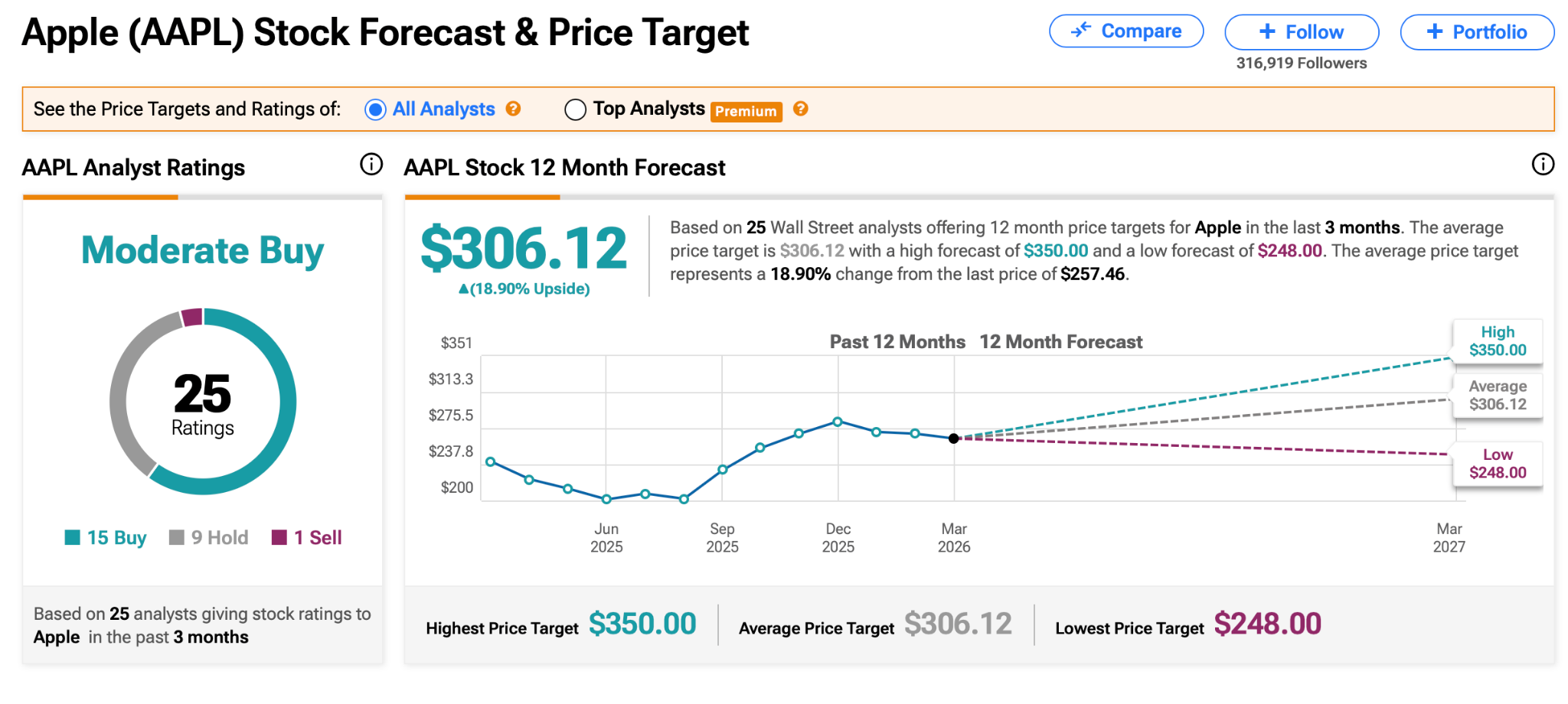

Wedbush analyst Daniel Ives raised his AAPL price target to $350, the highest on Wall Street, while keeping his Outperform rating. With Apple stock near $260, the target implies roughly 34% returns. The confidence follows a quarter where Apple posted earnings of $2.84 per share against expectations of $2.67, and revenue of $143.76 billion that topped forecasts by more than $5 billion.

Source: TIPRANKS

The M5 Mac lineup and $599 MacBook Neo are opening Apple to first time buyers, with nearly half of Mac purchasers being new to the platform. Institutions are piling in too.

Oppenheimer added 9%, Vanguard added 1.1%, and Norges Bank opened a position worth roughly $38.9 billion. The consensus sits at Moderate Buy with an average Apple stock price prediction of $306.12. That is solid for equities, but it is not the kind of return that changes your financial future.

Why AAPL Investors Are Starting to Look Beyond Traditional Equities

Apple is one of the best companies ever built, and holding AAPL long term remains smart. But the math at these valuations tells a clear story. Even hitting the Street high $350 on a stock priced at $260 delivers 34% over many months.

Wall Street is quietly moving capital into crypto infrastructure through ETFs and direct investments, and the pre-listing entries in projects with real revenue generating technology produce asymmetric returns that blue chip stocks at $3 trillion valuations cannot deliver. One project is catching attention from investors who think in P/E ratios and annual yield.

Pepeto Is Building the Digital Wall Street of the Cryptocurrency Market

Every stock you buy trades on an exchange that someone built before you arrived. The Nasdaq and NYSE are infrastructure businesses that profit from every transaction. Now imagine getting into the company building that exchange before it goes public, at a price so early that even a small position could produce returns that make the best Nasdaq stocks look like savings accounts. That is what Pepeto represents.

The project is building a full crypto trading exchange with cross chain bridge technology, essentially infrastructure connecting multiple blockchain networks the way a brokerage connects multiple exchanges. Every cryptocurrency will eventually be traded on platforms like this, and Pepeto is positioning itself as the infrastructure layer for that future.

According to Business Insider, Pepeto just announced that presale wallets will receive a permanent share of all exchange trading fees once the platform goes live. The project has raised $7.5M while each round closes quicker than the last.

Source: Markets.businessinsider

The founder already built a project to a $7 billion valuation and is starting again from day one. The SolidProof security audit was completed before raising a single dollar, the crypto equivalent of an SEC compliance review, and the Binance listing is approaching as the IPO moment. NVIDIA delivered a remarkable 10x over five years.

Pepeto’s 267x math requires only the listing valuation that exchange tokens routinely achieve, in months not half a decade. Investors who enter now also earn 204% annual yield, meaning a $10,000 position generates $20,400 per year or roughly $1,700 per month. The S&P 500 averages 10%. Treasury bonds pay 4.5%. No stock on the Nasdaq produces this yield at this entry point.

The Bottom Line

Oppenheimer, Vanguard, and Norges Bank are all adding Apple stock because institutions understand that buying quality during strong quarters builds wealth over decades. But the investors who got Amazon before it hit the Nasdaq understood something different: the biggest single returns come before the ticker goes live on the main exchange.

Pepeto’s exchange infrastructure is approaching its listing, $7.5M in presale capital proves the conviction, and the entry at six decimal zeros will not survive the moment public volume arrives. Every week the rounds close tighter and the window gets smaller.

Click To Visit Pepeto Project Official Website

FAQs

Is Apple stock or Pepeto a better buy right now?

Apple is a great hold targeting $350, but Pepeto at pre-IPO pricing with 204% annual yield offers asymmetric returns that blue chips at $3 trillion cannot produce. Visit the Pepeto official website.

Can a crypto presale beat Apple stock price prediction targets?

AAPL’s best case is 34% to the Street high. Pepeto’s listing math delivers multiples in months that equities need years to match.

Why are AAPL investors looking at crypto presales like Pepeto?

Pepeto builds crypto exchange infrastructure the way Nasdaq built stock rails. With $7.5M raised and a Binance listing approaching, stock investors see pre-IPO entry.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Kalshi, approved by the Commodity Futures Trading Commission, was last valued at $11 billion, while Polymarket was valued at $9 billion.

Prediction market platforms Kalshi and Polymarket are discussing potential fundraising rounds that could value each company at about $20 billion.

If completed at that level, the deals would roughly double their valuations from late 2025. The discussions remain early and may not lead to finalized investments, according to the Wall Street Journal.

Prediction markets allow users to trade contracts tied to real-world events, with categories including sports, politics, elections, and more. Traders buy and sell those contracts based on what they think will happen. Essentially, it allows users to monetize information on world events.

Kalshi already operates in the United States under approval from the Commodity Futures Trading Commission. Founded in 2018 by Tarek Mansour and Luana Lopes Lara, raised $1 billion at an $11 billion valuation in December last year.

The company recently reached an annualized revenue run rate of about $1.5 billion, according to the WSJ report citing people familiar with the business.

Polymarket, founded in 2020 by Shayne Coplan, was valued at $9 billion in October after Intercontinental Exchange agreed to invest up to $2 billion in the platform.

None of the platforms immediately responded to requests for comments from CoinDesk.

Both platforms are leading in the sector, as prediction markets have become the latest hype for traders.

According to a Dune dashboard, open interest on Kalshi is hovering over $400 million, while on Polymarket it’s at $360 million. The third-largest market, Opinion, is at $36 million.

Similarly, the weekly notional volume (total underlying value of all prediction contracts traded) on Polymarket was $1.9 billion last week, and on Kalshi, $1.87 billion, according to Dune data. Opinion saw weekly volume of $150 million, down from over $1.2 billion ahead of its token launch.

The sector has become so popular that companies, including Coinbase and Robinhood, have entered the prediction market. In fact, Wall Street giants Nasdaq and Cboe recently said they are considering rolling out yes-or-no “binary bets” for traders on the direction of traditional markets, similar to prediction-market betting.

Read more: Prediction market firms could be making $10 billion in yearly revenue by 2030, Citizens Bank says

Crypto World

Elon Musk Launches X Money Beta With Crypto Trading as Dogecoin Spikes 8%, but Rumors Are Spreading Fast That Pepeto Could Be Elon Musk’s Next Favorite Meme Coin

Elon Musk just made the biggest move in meme coin history. The X Money beta is rolling out to let users trade crypto directly from their timelines, and Dogecoin spiked 8% as its official account pushed businesses to accept DOGE instead of paying credit card fees.

But here is what the Dogecoin community is not talking about: rumors are spreading fast that Pepeto, the exchange presale that raised $7.5M from the cofounder who built Pepe to $7 billion, could be the meme coin that catches Elon Musk’s attention next.

Bloomberg reported Elon Musk confirmed X will allow users to trade stocks and digital assets directly from their timelines through the X Money payments system, while CoinDesk confirmed Dogecoin’s official account responded by encouraging businesses to accept DOGE and drop credit card fees of 2 to 3%.

When Elon Musk builds payment rails inside the world’s biggest social platform, the meme coin that combines exchange infrastructure with viral community energy is exactly the kind of project that lands on his radar.

Elon Musk, Dogecoin, and the Meme Coin Presale That Rumors Say Could Be Next

Pepeto: The Meme Coin That Elon Musk’s Community Cannot Stop Talking About

Every time Elon Musk makes a crypto move, the market scrambles to figure out what comes next. Dogecoin has always been his favorite, but the rumors spreading across Telegram and X right now are about Pepeto, the exchange presale that raised $7.5M from the person who cofounded the Pepe ecosystem and built it to $7 billion.

The reason is simple. Elon Musk has always said the crypto he supports needs to be funny, useful, and cheap to transact with. Pepeto checks every box. The zero tax engine means every trade costs nothing. The cross chain bridge connecting Ethereum, BNB Chain, and Solana moves assets in seconds. The risk scoring system checks contracts before your capital goes near them, and the SolidProof audit backs every line of code.

The community energy around Pepeto feels exactly like early Dogecoin before Elon Musk started tweeting about it, a passionate base spreading the word organically. The difference is Pepeto has exchange infrastructure Dogecoin never built, and in a market where Elon Musk builds payment rails inside X, the meme coin with real trading tools fits the vision he keeps describing.

The presale at $0.000000186 does not need Elon Musk to deliver returns, because the Binance listing creates the demand, and 209% APY staking compounds for wallets already inside while Dogecoin holders sit 87% below the all time high with zero yield. But if the rumors turn true, the entry that exists right now becomes the trade that defines the cycle.

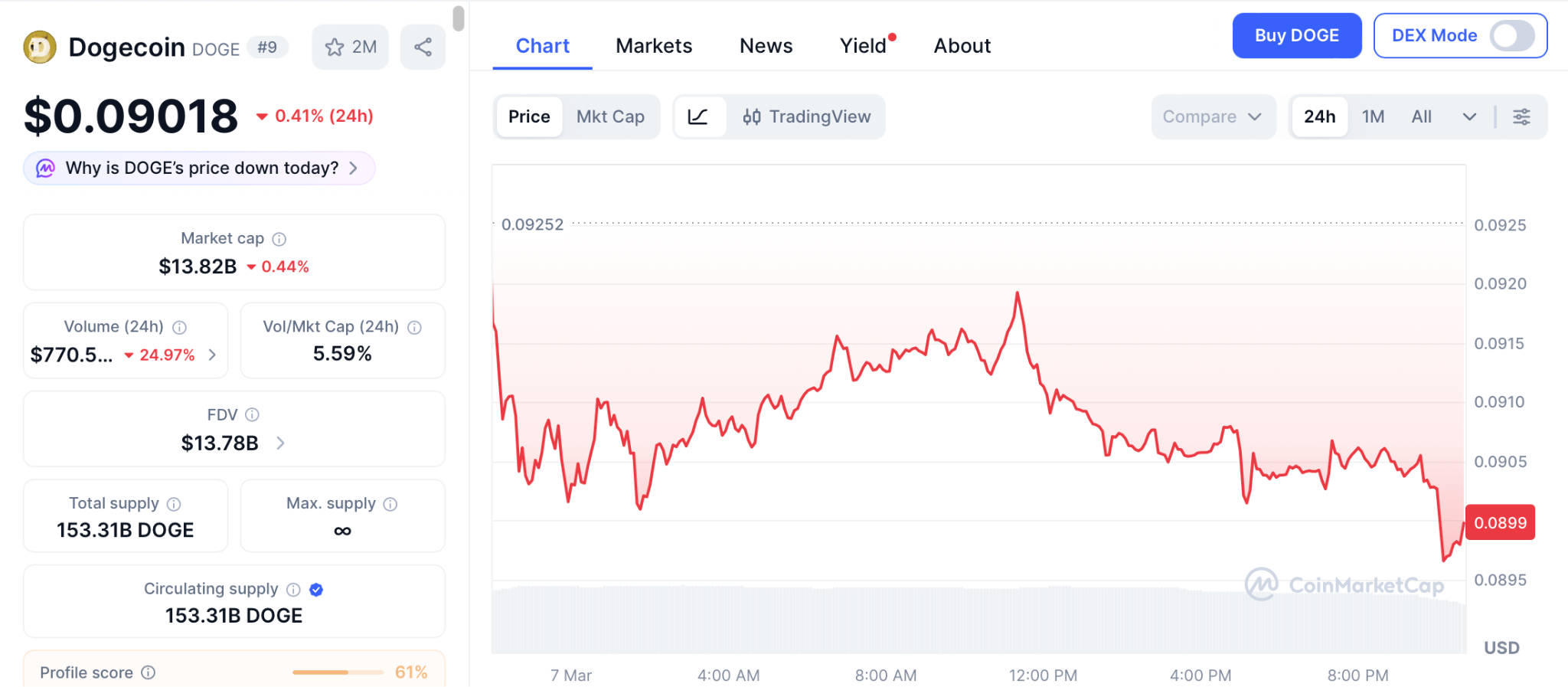

Dogecoin Spikes 8% on X Money News but the $0.10 Resistance Keeps Blocking Recovery

Dogecoin jumped 8% to $0.090 after Elon Musk’s X Money announcement, but the 20 day EMA at $0.10 caps the price according to CoinMarketCap.

Closing above $0.10 opens $0.11, but losing $0.09 means $0.08 then $0.06. Elon Musk keeps Dogecoin relevant, but at $12.5 billion and 87% below the all time high, even Elon Musk cannot produce the multiples a meme coin presale at six decimal zeros delivers on listing day.

The Bottom Line

Elon Musk launched X Money and Dogecoin spiked 8%, but the rumors spreading about Pepeto tell a different story about where smart money goes. The presale raised $7.5M from the $7 billion Pepe cofounder with exchange tools that match the vision Elon Musk keeps building, and the SolidProof audit and Binance listing path are the foundation Dogecoin at $12.5 billion never had.

The 209% APY compounds daily while Dogecoin holders wait for the next Elon Musk tweet, and by the time rumors become headlines, the entry at six decimal zeros will belong to the wallets that moved first.

Visit the Pepeto official website and enter the presale before the next headline drops and the entry that was available during the rumors becomes a price only early believers ever saw and acted on it, securing the highest returns of this cycle.

Click To Visit Pepeto Website To Enter The Presale

FAQs

Is Elon Musk connected to Pepeto?

Rumors are spreading fast that Pepeto could catch Elon Musk’s attention because its zero fee exchange tools and meme community energy match the vision Elon Musk keeps building. Visit the Pepeto official website.

Why did Dogecoin spike after Elon Musk’s X Money announcement?

Dogecoin jumped 8% after Elon Musk confirmed X Money will enable crypto trading from timelines, but the $0.10 resistance keeps blocking recovery while Pepeto’s presale keeps rising.

Is Dogecoin still Elon Musk’s favorite crypto?

Elon Musk confirmed Dogecoin remains his favorite, but the meme coin presale with exchange infrastructure at six decimal zeros is attracting the same energy early Dogecoin had before Elon Musk first tweeted about it.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

FL Senate Passes State Stablecoin Bill, DeSantis’ Signature Pending

Florida advanced a state-level framework for regulating payment stablecoins, moving SB 314 to Governor DeSantis’ desk for final approval. The bill, which passed the Florida Senate unanimously, would introduce consumer protections and financial oversight for stablecoin issuers operating within the state, aligning with a broader federal trend toward clearer rules for digital assets. The development comes as Florida looks to codify safeguards around payments and digital holdings while contemplating broader crypto exposure in public portfolios. The signing window is anticipated to run roughly a month, per statements from stakeholders involved in the process.

Key takeaways

- SB 314 cleared the Florida Senate with unanimous support and is headed to Governor DeSantis for signature, with a public timeline suggesting approval within about 30 days.

- The package amends Florida’s money-laundering framework to explicitly cover stablecoins, requiring issuers to comply with applicable regulations and operate under licensure, while clarifying that certain payment stablecoins are not securities.

- Issuers with activity in Florida must notify the state’s Office of Financial Regulation (OFR) before operating; oversight may fall solely to the OFR or involve joint supervision with the federal Office of the Comptroller of the Currency (OCC), depending on issuer structure.

- Incentive structures are addressed: issuers would be barred from offering interest or yields if federal rules prohibit such payments, aiming to prevent regulatory arbitrage or misleading incentives.

- Separately, Florida revisits its crypto investment posture through House Bill 183, seeking to allow up to 10% of state funds to be allocated to digital assets and crypto-related instruments, expanding beyond Bitcoin to include a wider range of assets. HB 183 is a revised form of HB 487, which was withdrawn after previous committee inaction.

Tickers mentioned: $BTC

Market context: The Florida move sits within a broader wave of state-level efforts to regulate digital assets with tailored frameworks. As federal regulatory considerations such as the GENIUS Act progress, states are actively shaping rules that balance consumer protections, financial stability, and innovation in payments and asset classes.

Why it matters

The proposed stablecoin framework marks a shift from broader, generalized crypto regulation to a state-tailored regime that can provide clearer operating parameters for issuers and clearer protection for consumers and businesses using these tokens for payments. By explicitly including stablecoins in the Money Laundering Act and defining the regulatory overlay, Florida seeks to reduce illicit use while enabling legitimate fintech activity within its borders. For issuers, the new regime points to a defined licensure pathway and a risk-management scaffold that can lower regulatory uncertainty compared with jurisdictions where rules are still evolving.

From a consumer perspective, the creation of explicit standards—such as licensing requirements, oversight responsibilities, and anti-yield incentives—offers a more predictable environment for using stablecoins in everyday payments and commerce. Meanwhile, the framework’s alignment with federal tenets, like those embedded in the GENIUS Act, signals a coordinated approach to digital-assets oversight across different levels of government. Investors in Florida-based digital assets or funds tied to state programs may eventually benefit from more transparent governance, even as issuers adapt to a more formal regulatory environment.

For Florida’s public institutions, the HB 183 plan adds another layer of potential exposure to digital assets, but with guardrails: a cap on allocations, risk parameters, and diversification considerations that could shape how state and municipal funds participate in the crypto economy. The proposal broadens the asset classes that could be included, moving beyond a BTC-centric approach to embrace a wider spectrum of crypto instruments and blockchain-enabled assets. The evolution of HB 183—being a revised version of a previous bill that stalled—will be a critical indicator of how quickly the state intends to operationalize digital-asset investments within its treasury and related entities.

What to watch next

- Governor DeSantis’ signing decision and any accompanying regulatory guidelines within the next 30 days.

- Implementation details from the OFR and any joint supervisory arrangements with the OCC, including licensure processes for stablecoin issuers and reporting requirements.

- Final language and progress of HB 183, including the scope of permissible digital-asset allocations and the timeline for any implementation.

- Federal regulatory movement around the GENIUS Act and how federal rules may influence state-by-state interpretations of stability, yields, and securities classification.

- Any subsequent clarifications or amendments as Florida regulators publish guidance on stablecoins and crypto investments.

Sources & verification

- SB 314 — Florida Senate bill history and status: https://www.flsenate.gov/Session/Bill/2026/314/?Tab=BillHistory

- Samuel Armes’ X post confirming passage and anticipated signing: https://x.com/samuelarmes/status/2029971078341067249

- GENIUS Act context and impact on stablecoins: https://cointelegraph.com/explained/what-does-the-us-genius-act-mean-for-stablecoins

- HB 487 withdrawal and related Florida stablecoin discussions: https://cointelegraph.com/news/florida-takes-strategic-bitcoin-reserve-bills-off-the-table

- Bitcoin price coverage referenced in the broader regulatory context: https://cointelegraph.com/bitcoin-price

Florida moves to regulate stablecoins and crypto investments

Florida’s legislative activity reflects a broader push to bring stablecoins into a formal regulatory framework while exploring the strategic use of digital assets within state portfolios. The consensus on SB 314—unanimous support in the Senate—underscores a bipartisan drive to codify consumer protections, licensing standards, and supervisory responsibilities that aim to prevent misuse while enabling legitimate financial innovation. At the heart of the proposal is a pragmatic recognition that stablecoins operate as a bridge between traditional payments and digital finance, requiring a robust state-level apparatus to monitor risk, ensure compliance, and preserve financial integrity.

As the bill moves toward the Governor’s desk, the interplay between state and federal rules will be critical. The GENIUS Act’s recent enactment provides a federal frame that Florida appears to be aligning with, particularly in areas touching consumer protection and oversight. Yet state-level rules also must navigate the complexities of cross-border issuance and the practicalities of supervision across multiple financial-regulatory bodies. Florida’s approach—defining licensure for issuers, clarifying which instruments are securities, and establishing oversight pathways—offers a model for how states might tailor regulation without stifling innovation.

In parallel, HB 183’s revisitation signals a broader ambition: to assess the role digital assets could play in state-managed portfolios and public funds. By contemplating a qualified exposure cap and a broader asset class slate, Florida is probing how governance, risk, and liquidity constraints can be balanced in a way that respects prudent fiduciary standards while maintaining the flexibility needed for dynamic asset classes. The evolving language and potential implementation timeline will determine whether Florida becomes a more active participant in the crypto economy or a cautious regulator that seeks to chart a measured future for public entitlements and digital finance.

Crypto World

Pi Network’s (PI) Price Soars 16% Again as Team Reveals Distributed AI Computing Plans

The project released a case study showing that the vast number of nodes can support decentralized AI training and computing usng spare processing power.

Pi Network’s native token has been on a spectacular run lately, defying the overall market-wide trend by registering consecutive double-digit gains that drove it to a fresh three-month peak of over $0.23 earlier today.

The most probable reasons behind these gains are related to protocol updates and the latest Pi Node case study published by the team earlier this week.

The Case Study

The team’s statement indicated that they are exploring how the global network of distributed nodes could support decentralized AI training and computing tasks, which could unlock a new layer of utility beyond securing the Pi Network blockchain.

They claimed that the network itself is relatively energy efficient and does not require the full computational capacity of its worldwide node community. Consequently, a large portion of that unused computing power remains available across thousands of machines running Pi Nodes.

The team believes this untapped capacity could be utilized by third parties requiring larger-scale computing resources, especially for AI model training and inference workloads. Pi Node operators who choose to participate in such a system could lend their computing resources and receive cryptocurrency-based compensation for completing computational tasks.

With over 421,000 Pi Nodes globally, representing more than a million CPUs, the network already operates as a large distributed computing environment, continued the statement. Its ecosystem includes tens of millions of claimed KYC-verified users who could potentially provide human-in-the-loop input for AI training tasks.

“This, in addition to the computing power from Pi nodes, can offer a unique resource for scalable, authentic human input in AI systems, and further complete the one-stop service to AI clients.”

The team said they already ran a pilot with 7 volunteer Pi Node operators. The results were quite promising, as tasks were “correctly pushed to the external testers (volunteer Pi node operators) and valid results were sent back to OpenMind.” They added that the use case was proven: Pi Nodes can opt in to run computations defined and requested by a third party, unrelated to their blockchain obligations, and return meaningful results to a third-party client.

You may also like:

PI’s Rally

In addition to the promising news for the vast Pi Node community, another possible reason behind the underlying token’s massive run lately could be related to the successful implementation of the protocol v19.9 upgrade and the approaching next one – v20.2, which should be completed by March 12.

PI continues to be the top performer from the larger-cap alts, surging by 16% daily to over $0.23. This is its highest price tag in roughly three months. The asset is now the 40th-largest, according to CoinGecko, with a market cap of over $2.2 billion.

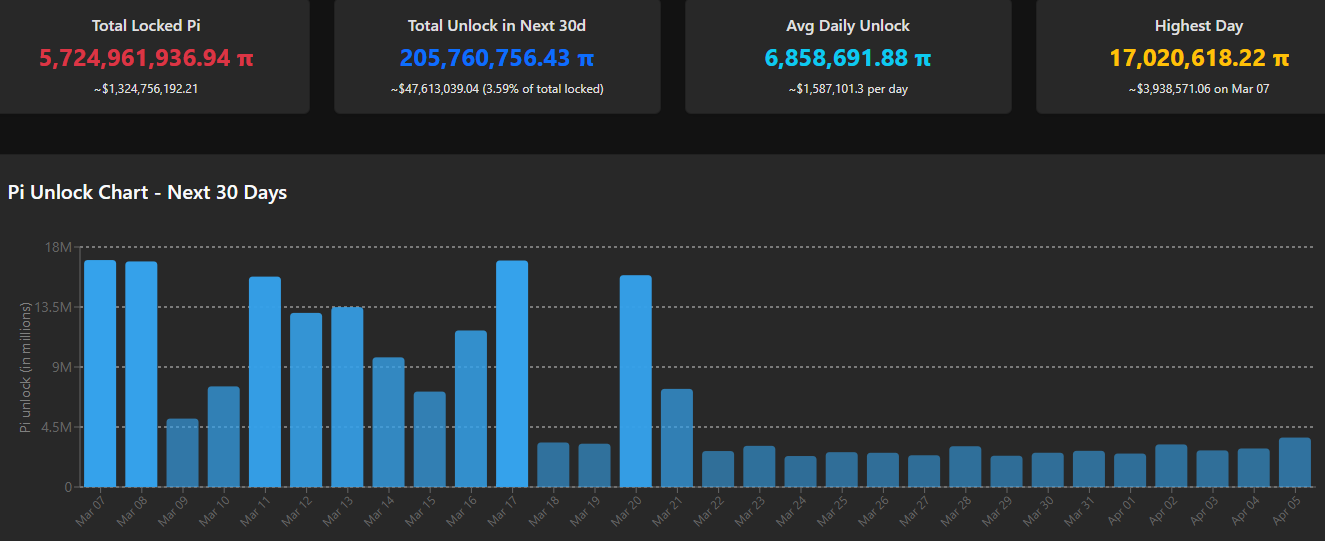

Even the substantial number of unlocked tokens today (almost 21 million) couldn’t shake it off. However, the upcoming schedule shows that more similar days are ahead, which could lead to an upcoming correction.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Best Crypto to Buy Now: Kraken Becomes First Crypto Firm With Federal Reserve Payment Access, While Pepeto Is Where the Biggest Returns Live

Kraken just became the first crypto firm with a Federal Reserve master account, giving it direct access to Fedwire and the payment rails reserved for traditional banks until this week.

When a crypto exchange plugs into the Fed, it is infrastructure becoming permanent, and the best crypto to buy now is the presale entry capturing the bull run returns before institutions absorb supply. Pepeto with $7.5M raised is the 267x setup the best crypto to buy now keeps circling back to.

Bloomberg reported Kraken secured a Federal Reserve master account through the Kansas City Fed, making it the first crypto native company to gain direct access to the US central bank’s core payment infrastructure, while CoinDesk confirmed US Senator Cynthia Lummis called it a watershed moment for the digital asset industry.

When a crypto firm operates on the same rails as JPMorgan, the best crypto to buy now captures the institutional wave before it hits open markets.

The Best Crypto to Buy Now: Pepeto’s 267x Exchange Infrastructure and the Large Caps Waiting to Recover

Pepeto: the Best Crypto to Buy Now

When you compare every project attracting attention in this market, Pepeto wins that comparison before you even look at the numbers, because while Kraken plugs into the Fed and institutions build the rails, the exchange presale at six decimal zeros is where the listing math creates the kind of returns the best crypto to buy now at large cap scale cannot produce.

The cross chain bridge connecting Ethereum, BNB Chain, and Solana routes assets in seconds. The zero tax engine keeps every trade whole. The risk scoring system checks contracts before your capital commits. The SolidProof audit backs every line of code, and the cofounder of the Pepe ecosystem who built a token to $7 billion leads the team.

From zero to $7.5M raised entirely during consolidation, Pepeto has proven that real utility at presale pricing creates its own demand. The 267x math requires only the listing valuation that exchange tokens with real cross chain infrastructure routinely achieve, and the best crypto to buy now is the one where the returns do not depend on the Fed approving more master accounts or Bitcoin reclaiming $100,000.

The 209% APY staking compounds daily for wallets already inside, and every round that fills while Kraken celebrates its Fed access brings the Binance listing closer, because the exchange infrastructure being built inside the best crypto to buy now Pepeto are the ones able to realistically deliver big returns this year.

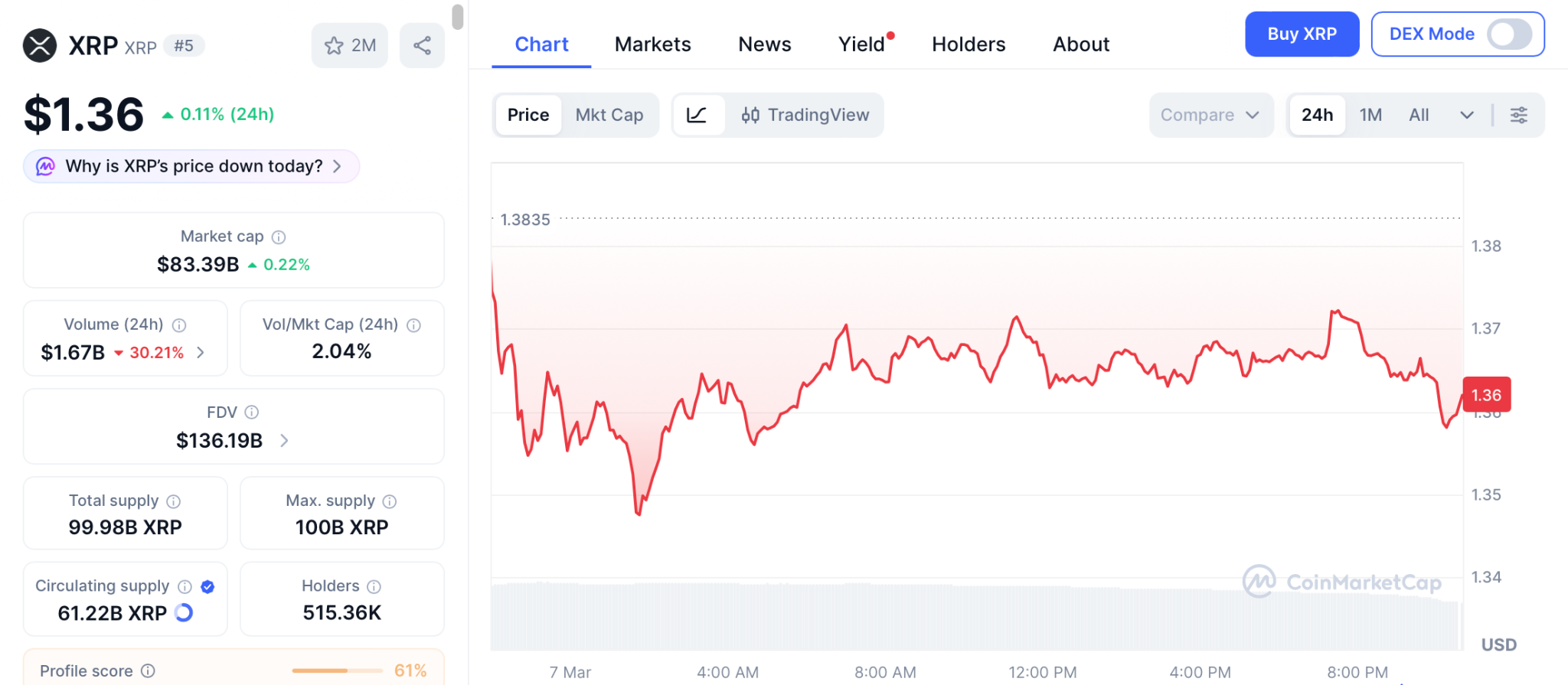

XRP Holds $1.36 as ETF Inflows Reach $1.24 Billion but Returns Stay Capped at $85 Billion

XRP holds at $1.36 according to CoinMarketCap with $1.24 billion in cumulative ETF inflows. Standard Chartered targets $8, but at $85 billion market cap even that target is a 5.6x that takes the full year.

The best crypto to buy now at large cap scale offers store of value, not the multiples exchange presales deliver.

Cardano Sits at $0.25 as Protocol Version 11 Hard Fork Approaches With Modest Targets

ADA trades at $0.25 with Protocol Version 11 targeting March. Even the bullish $1 target is 270% that requires multiple catalysts over months.

The best crypto to buy now conversation confirms large caps during consolidation need patience, while exchange presales deliver faster returns.

The Bottom Line

Kraken just plugged directly into the Federal Reserve, XRP ETFs pulled $1.24 billion, and still none of that institutional firepower can produce what happens when an exchange presale at six decimal zeros lists on Binance with $7.5M in conviction behind it. The wallets inside right now are not waiting for the Fed to approve anything, they are compounding 209% APY every single day, which means $57 per day on a $10,000 position flowing in while large cap holders sit on drawdowns earning zero.

Those same wallets will be the ones selling to latecomers at 50x after listing day, and the latecomers will be the ones who read this, understood the math, and still chose to wait. Right now, at this exact price, is the lowest entry this presale will ever offer again, because every round that closes pushes the floor higher and the returns smaller. Visit the Pepeto official website and enter the presale now while the maximum return window is still wide open.

Click To Visit Pepeto Website To Enter The Presale

FAQs

What is the best crypto to buy now?

The best crypto to buy now is Pepeto with $7.5M raised, 209% APY, and 267x exchange infrastructure delivering returns large caps cannot match. Visit the Pepeto official website.

Why is Kraken’s Fed access important?

Kraken is the first crypto firm with Federal Reserve payment access, confirming crypto infrastructure is becoming permanent, and the best crypto to buy now captures the wave before institutions absorb supply.

Should I buy XRP or Pepeto?

Hold your XRP for the $8 target, but also position in Pepeto because the presale to listing math delivers multiples XRP at $85 billion physically cannot produce.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Bitcoin’s ‘Golden Cross’ Signal Points to Explosive Rally

Meanwhile, another analyst said that BTC’s run could resume soon as long as it remains above $60,000.

Bitcoin’s deviation from its price compression below $70,000 didn’t last long despite the price surge to $74,000 on Wednesday, and the asset struggles below $68,000 as of press time.

Although it has essentially returned to its familiar trading range as of the past month, one analyst believes the best is yet to come, at least according to the BTC Inter-exchange Flow Pulse metric.

30 to 40 Days for the Next Rally?

CW noted on X that the metric, which tracks the flows of BTC between spot and derivatives exchanges, had just formed a golden cross, which has acted as the catalyst for an “explosive upward movement” in the past. However, the rally hasn’t been instant after the formation of such a golden cross in previous years.

The analyst said that it took BTC roughly 30 days to go on a wild run after the bear market had ended in 2019. In 2023, the necessary timeframe went up by 10 days. As such, CW believes the next month could be similarly choppy for bitcoin as the previous one was, but added that “the trend has reversed, and an explosive upward rally is not far away.”

The $BTC Inter-exchange Flow Pulse (IFP) has formed a golden cross. This indicator’s golden cross marks the beginning of an explosive upward movement.

However, the rally did not begin immediately after the golden cross.

In 2019, the explosive upward movement began 30 days… https://t.co/QZDHPO9oZs pic.twitter.com/6oVS7mlG01

— CW (@CW8900) March 7, 2026

Late Bitcoin Buyers to Be Humiliated?

Merlijn The Trader also weighed in on BTC’s current cycle and latest moves, indicating that the cryptocurrency’s patterns are quite obvious and easy to follow. After each “blow-off top,” which was the early October all-time high of over $126,000, the liquidity drains, momentum fades, and the price returns to the macro trendline.

In the case of the current cycle, that level sits around $60,000. He added that as long as BTC doesn’t lose that coveted support for good, the “cycle structure survives.”

You may also like:

THE BITCOIN CYCLE ALWAYS HUMILIATES LATE BUYERS.

After every blow-off top comes the same pattern.

Liquidity drains.

Momentum fades.

Price returns to the macro trendline.That level now sits near 60K.

Hold it and the cycle structure survives.

Lose it and history may repeat. pic.twitter.com/XpPsAETajM

— Merlijn The Trader (@MerlijnTrader) March 7, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Those who cheered U.S. Bitcoin reserve have spent year watching Trump order languish

President Donald Trump’s move to establish what he called a “Strategic Bitcoin Reserve” within the federal government was greeted with crypto-sector celebration at the start of his administration. The industry cheered it as further cementing the arrival of bitcoin as a mature asset, but a year has passed, and there’s still no reserve.

Trump’s administration performed the initial job of accounting for the government’s crypto holdings, but the U.S. bitcoin reserve is no closer to forming because of the outcome of one concept in the March 6, 2025, order: “the need for any legislation to operationalize any aspect of this order.” Trump’s Treasury Department lacks the needed authorizations for building the specialized accounts. That requires action from Congress, the White House has acknowledged, with Trump’s crypto adviser, Patrick Witt, saying the situation presents “novel legal questions” that must be answered.

Lawmakers such as Senator Cynthia Lummis have pitched reserve legislation, and the current best chance for passage, according to people familiar with the legislative strategy, may be to get it into the National Defense Authorization Act at the end of the year. But Trump’s White House would probably have to re-adopt the issue as a priority cause in order to make that happen.

Conjecture about the planning and funding of the reserve — and its cousin, a separate digital assets stockpile also ordered by Trump to gather every other type of cryptocurrency — has ebbed and flowed. Last month, CNBC markets talking head Jim Cramer spouted a rumor that Trump’s people were poised to start filling the reserve when BTC hit $60,000, despite the lack of a place to put it or money to buy it with.

The president’s crypto officials continue to demur when asked how much bitcoin the feds actually possess, though some estimates put it at more than 300,000, totalling more than $20 billion.

The major disappointment from the crypto sector about Trump’s bitcoin order was that it didn’t come with any new government purchases of the leading crypto asset. It instead encouraged creative policies that would allow the government to add to the stockpile without spending taxpayer dollars.

Witt, Trump’s adviser, hasn’t been willing to share the leading ideas for obtaining more bitcoin for the fund, which is meant to be held for long-term appreciation, not technically as a strategic reserve that would imply its contents would be released to mitigate any emergencies.

The White House didn’t respond to a request for comment on the halt in progress, but it further underlines that executive orders — a mainstay of Trump’s administration — don’t have the power of law and often act as little more than a high-level steer from the president.

If Trump’s congressional allies come up with a pitch for the reserve bill to be tucked into the defense bill later this year, that legislative process usually concludes in December. The must-pass funding bill is often used as what DC insiders like to call a “Christmas tree,” a piece of legislation on which they hang a wide array of unrelated bill ornaments, because the package has to get passed. If that’s the plan, it would happen in this session’s “lame duck” period, the point at which some members of Congress will have been voted out of office or chosen to retire — like Lummis — but haven’t yet come to their departure dates.

Lummis’ own bitcoin reserve bill calls for a spending program that gets the U.S. to a holding of a million tokens — about 5% of the total eventual supply. The Wyoming Republican, who is the inaugural chair of the Senate Banking Committee’s first digital assets subcommittee, has so far only managed to get the legislation into the committee, but the panel’s major priority is another crypto matter: passing the Digital Asset Market Clarity Act.

Read More: Why Doesn’t the U.S. Have a Bitcoin Reserve, Yet?

Crypto World

Binance Formally Rejects US Senate Claims of Iran Sanctions Violations

The response comes after Senator Blumenthal’s letter raised concerns about Binance’s AML controls and cited reports from outlets such as the New York Times, Fortune, and the WSJ.

The world’s largest crypto exchange has issued a formal response to a letter from US Senator Richard Blumenthal, strongly rejecting claims that its compliance systems are weak or that it enabled any sort of illicit financial activity.

Binance indicated that the media reports cited in the Senate inquiry contain “false, unsupported, and defamatory claims” about its sanctions controls and AML procedures.

Binance Responds

The statement emphasized that Binance operates a robust compliance program supported by more than 1,500 specialists worldwide and advanced monitoring tools designed to detect suspicious activity. In addition, the company said it had been highly cooperative with law enforcement, adding that it processed over 71,000 such requests in 2025 alone.

It explained that its team helped authorities seize more than $750 million in illicit assets, including almost $580 million for US agencies. Binance also claimed that its exposure to wallets linked to some sort of illegal activity has declined by nearly 97% since early 2024, which includes a 97.3% drop in exposure to major Iranian crypto trading platforms.

Hexa Whale and Blessed Trust, two of the entities named in the inquiry, were proactively investigated and removed from the platform following internal reviews triggered by law enforcement requests. It added that no Binance account conducted direct transactions with Iran-based entities. It also rejected allegations about internal whistleblowers by explaining that employee departures were part of normal turnover.

Nevertheless, the company also said it “acknowledges that absolute zero risk is impossible on public blockchains but relies on robust monitoring and controls to minimize and mitigate risks.”

The Inquiry

11 Democratic senators, led by Richard Blumenthal, urged the DOJ and Treasury in a letter sent in late February to investigate Binance over alleged Iran sanction violations in 2026. The inquiry cited findings uncovered by the exchange’s own compliance personnel last year, in which they discovered that $1.7 billion in digital assets had flowed to Iranian-linked entities.

You may also like:

Some of the names identified in the letter included Iran-backed Houthis and the Islamic Revolutionary Guard Corps. It also claims that a Binance vendor allegedly directed $1.2 billion in one instance to Iran-linked accounts.

“We urge you to conduct a prompt, comprehensive review of sanctions compliance on the platform to ensure that it is not once again violating the law and threatening U.S. national security,” wrote the Senators.

They added that Iranians had reportedly accessed more than 1,500 accounts on Binance, and further alleged that the exchange may have been used to help Russia evade US sanctions.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Circle shifts $68 million in internal payments via its own stablecoin to bypass legacy banks

Circle has begun using its own stablecoin infrastructure to move money between internal entities, settling $68 million in transfers using USDC, CEO Jeremy Allaire said Saturday.

The transactions were executed through Circle Mint, the company’s platform for minting and redeeming USDC. The firm’s treasury team used the system to carry out intercompany transfer pricing — routine internal payments between subsidiaries — that would normally be handled via bank wires.

Those transfers often take one to three days to settle and depend on banking hours and cut-off windows. Meanwhile, stablecoin settlement runs around the clock, and the company completed the transfers in under 30 minutes, Allaire said in the X post.

In the first month of using the setup, Circle moved more than $68 million across 11 transactions between eight entities. The firm said roughly 90% of its transfer pricing activity was completed within a single day.

Treasury teams executed the payments using role-based permissions and approval workflows inside Mint, a setup designed to mirror controls common in corporate banking portals. The platform also produces transaction-level reports aligned with bank statement standards, allowing accounting teams to reconcile onnchain transfers with internal ledgers and external accounting systems.

One persistent challenge in intercompany transfers is “cash in transit,” where funds leave one entity but cannot yet be booked as available by the recipient while the payment clears. Stablecoin settlement shortens that gap because transfers confirm within minutes.

Circle said upcoming updates to Mint will focus on multi-entity treasury operations, including easier transfers between accounts and APIs that connect transaction reporting with accounting systems such as Oracle.

The changes are scheduled to roll out in March, the firm said in a blog post.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Business1 day ago

Form 8K Entergy Mississippi LLC For: 6 March

-

Tech7 days ago

Tech7 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion22 hours ago

Fashion22 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics7 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business4 days ago

Business4 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat6 days ago

NewsBeat6 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

Crypto World5 days ago

Crypto World5 days agoWhy Nexo Is Reentering the US After the 2023 Crypto Lending Crackdown