Crypto World

XRP Holders Realize Major Losses as Price Decline Triggers Panic Selling

Since August 2025, XRP holders have increasingly spent their coins, adding to the selling pressure that has flipped the asset’s on-chain profitability negative.

The past six months have been primarily depressing for XRP, the native cryptocurrency of the Ripple Network. Now, the asset appears to be flashing a capitulation signal as holders realize major losses amid panic selling.

Data from Glassnode shows that on-chain profitability for the digital asset has flipped negative, with the Spent Output Profit Ratio (SOPR) falling from 1.16 on July 25, 2025, to 0.96 currently. Analysts say the current setup mirrors that seen during the September 2021 to May 2022 period, when the SOPR for XRP fell into the <1 range. A prolonged consolidation followed the plunge, leading to stabilization.

XRP Holders Realize Huge Losses

Since August 2025, the price of XRP has been in a steady decline, recovering only briefly before resuming its descent. By late October, the price had dropped 27% from $3.5 in mid-July to $2.4. As the asset lost its value, long-term holders who had accumulated before November 2024 increased their spending by 580% from $38 million per day to $260 million per day.

The numbers remained steady into early November, highlighting a distribution into weakness, not strength. Analysts noted that the spending spree was unlike past profit-realization waves that aligned with rallies. There was a clear signal that experienced traders were exiting their positions, adding pressure to the price of XRP.

By mid-November, the share of XRP supply in profit had plummeted to 58.5%, the lowest since November 2024, when the asset was worth $0.53. Even though XRP traded around $2.15 at the time, four times higher than the November 2024 price, more than 41% of the coin’s supply was sitting in losses. It was an indication that the market was top-heavy, structurally fragile, and dominated by late buyers.

Capitulation Signal or Structural Failure?

As the bears would have it, the price of XRP fell below $2 in mid-November, and the 30-day estimated market average (30D-EMA) of daily realized losses surged to $75 million. Since the beginning of the year, investors have realized between $500 million and $1.2 billion in losses per week each time XRP has retested $2. $2 is now a major psychological zone for XRP holders.

At the time of writing, XRP was trading at $1.40, having lost its aggregate holder cost basis, which explains the panic selling. Such moves have raised questions about whether the XRP market is in a capitulation or experiencing a structural failure. Experts insist the former is the case because fundamentals are stronger now, unlike 2022, when regulatory clarity did not exist.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Vancouver City Staff Moves to Kill Bitcoin Reserve Plan Over Legal Barriers

TLDR:

- Vancouver city staff found Bitcoin is not an allowable investment asset under the Vancouver Charter.

- Mayor Ken Sim’s November 2024 motion sought to protect city reserves from inflation using Bitcoin funds.

- British Columbia’s Ministry of Municipal Affairs cited undue risk in barring local governments from holding crypto.

- Bitcoin dropped nearly 50% from its all-time high of $126,000, reinforcing provincial caution over crypto holdings.

Vancouver city staff has recommended that the city council rescind a motion to establish a Bitcoin reserve. A legal review concluded that cryptocurrency does not qualify as an allowable investment asset under provincial law.

Vancouver Charter Bars Bitcoin as a Reserve Asset

A formal report was recently submitted to the Vancouver City Council by city staff. The document outlined a clear recommendation to scrap the reserve motion entirely.

Staff determined that the Vancouver Charter does not permit Bitcoin as an investment vehicle for the city. The Charter is the provincial statute governing city operations in British Columbia.

The report was direct in its conclusion. “Staff has conclusively determined that under the Vancouver Charter, Bitcoin is not an allowable investment asset for the City, and therefore recommends that this work be concluded,” the document stated.

Beyond the legal issue, staff also pointed to the need to reprioritize internal resources. Coordination with other ongoing city programs further supported the recommendation to end this work.

The Ministry of Municipal Affairs of British Columbia had previously addressed this matter directly. The ministry confirmed that local governments across the province are barred from holding cryptocurrency in reserve.

Officials cited exposure to undue risk as the core concern behind this restriction. That position from the province aligned closely with the findings in the staff report.

The Vancouver City Council had formally approved the motion in December 2024. Staff received direction to assess the proposal’s feasibility and return with findings by Q1 2025.

Despite the deadline passing, no report was publicly released until earlier this week. The delay raised questions about the transparency of the review process.

Mayor’s Bitcoin Initiative Faces Legal and Financial Setbacks

The motion was originally brought forward in November 2024 by Vancouver Mayor Ken Sim. It aimed to diversify the city’s financial reserves and shield its purchasing power from inflation.

Sim openly called Bitcoin “the greatest invention in human history” while presenting the proposal. That statement drew both widespread attention and scrutiny from various observers at the time.

As part of the broader initiative, Sim pledged to personally donate $10,000 worth of Bitcoin to the city. The proposal also sought to allocate a portion of municipal funds directly into the cryptocurrency.

The stated purpose was to protect the city’s finances against inflation and long-term market volatility. However, those ambitions have now been formally halted by legal constraints.

Bitcoin’s recent price history added another layer of concern to this debate. Since late 2024, the cryptocurrency reached an all-time high exceeding $126,000 before falling sharply.

It declined nearly 50%, dropping to lows near $63,000 over roughly four months. That level of volatility strengthened the provincial government’s caution about municipal crypto holdings.

At the time of reporting, Bitcoin was trading at approximately $70,534. The sharp price movements since late 2024 reinforced concerns from both city staff and provincial authorities.

The staff report, backed by the Vancouver Charter, appears to mark the end of the city’s crypto reserve ambitions.

Crypto World

MiCA is not a break of blockchain innovation

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

I keep hearing the same lazy line that Europe “regulates first, innovates later.” That sounds clever on a panel. It also ignores what is happening on the ground. Firstly, financial markets do not develop on vibes. They grow on repeatable rules, predictable supervision, and credible enforcement. MiCA has started to provide that. Secondly, MiCA isn’t about innovation and doesn’t need to be; it’s a fundamentally different area. It was created to support structured and predictable rules for market participants, and not to prevent or boost new initiatives.

Summary

- MiCA creates predictability, not paralysis: Markets scale on repeatable rules and supervision. MiCA provides a structured, staged framework for cross-border crypto activity across the EU.

- Compliance is becoming a competitive edge: Licensing under MiCA signals credibility, shifts liquidity toward compliant stablecoins, and attracts institutional capital rather than deterring it.

- Regulation reshapes incentives, not innovation: Europe’s volumes remain strong, while sandboxes and supervisory clarity reduce costly legal uncertainty for serious builders.

Businesses and entrepreneurs who want to innovate keep doing so. Yes, getting a license under MiCA requires extensive resources, but that doesn’t prevent projects from moving forward or exploring and testing new business models. Thirdly, the industry completely changed after FTX and Celsius collapsed, and this is the main catalyst and reason behind MiCA.

The Sandbox proved a simple truth

The European Blockchain Regulatory Sandbox is the most underappreciated part of the EU’s blockchain strategy. It runs from 2023 to 2026 and supports 20 projects per year, matching them with national and EU authorities for confidential, structured regulatory dialogues. Now, I’ve seen headlines calling it a marketing exercise. It’s really a mechanism for converting legal uncertainty into implementation steps.

Look at cohort three published earlier in February. The EU Blockchain Observatory and Forum did something important between June and November 2025. They brought together projects with regulators who deal with cybersecurity, data protection, and financial authorities. This matters because many blockchain failures occur at the intersections of GDPR, custody, AML, and other rules. The sandbox surfaces these gaps early, while products can still adapt. That is how you reduce the most expensive risk in crypto: building the wrong thing and discovering it after you have spent a lot of money.

MiCA’s real gift is market access at scale

MiCA is not perfect, but its core promise is powerful. One licensing framework designed to support cross-border activity, backed by a central register and common supervisory tooling. ESMA’s MiCA page explains the interim register structure and that it will be maintained through mid-2026 before full integration into ESMA systems.

So why is this timeline important? The MiCA rules started in 2023. The rules for stablecoins begin from 30 June 2024, and the wider regime applies from 30 December 2024. That staged roll-out is exactly what good regulation looks like. Give the market time to migrate, then enforce.

The “lean jurisdiction” argument misses what founders learn the hard way: you can incorporate cheaply in a light-touch venue, but you can’t easily buy credibility.

When you need reliable banking, institutional partnerships, and procurement-grade governance, you end up building the same controls anyway — just later, under stress, and usually after a near-miss. MiCA lets teams build those controls deliberately.

Regulation is reshaping markets, not killing them

Start with activity. Chainalysis reports that Europe’s transaction volumes recovered after a mid-2024 dip and peaked at $234 billion in December 2024, carrying momentum into early 2025. That does not look like a region that regulated itself into irrelevance.

Then look at stablecoins, where MiCA is already changing market structure. ESMA’s interim register lists 15 e-money token issuers managing 25 single-currency stablecoins. More importantly, the compliance filter is altering liquidity choices. MiCA alignment pushed the market toward compliant stablecoins. EURC grew 2,727% (July 2024–June 2025) versus USDC at 86%, in the same window.

That is what smart regulation does. It changes incentives so the safest, most transparent instruments win share. This is boring, but also how you attract serious capital.

There are still pain points

Let’s be honest about the trade-offs, because founders feel them every day. The biggest positive change is that licensing has become a competitive signal. Germany’s approach is a case study. BaFin approved 20 CASPs in 2025, leading the EU and accounting for 30% of total approvals across the bloc. There is also a clear concentration in licensing, with Germany and the Netherlands leading issuance.

That concentration reflects supervisory capacity and institutional comfort. Firms cluster where approvals are predictable and standards are clear. But there are still a lot of painpoints. Compliance is expensive, and Europe’s banking layer still behaves like a gatekeeper. Minimum licensing and compliance costs have risen roughly six-fold (€10k to €60k), venture funding is down 70% from 2022 levels, and blockchain-related job postings are down roughly 90% from 2022 levels.

Some of those trends track the global downcycle. Some are self-inflicted friction: slow onboarding, inconsistent national interpretations during transition, and banks that remain risk-averse even when regulation exists.

This is exactly why the sandbox matters. It gives regulators a feedback loop and gives companies a way to show controls early, before the bank says “no” by default.

A practical playbook for founders

If you are building in Europe, stop treating regulation like a box to tick at the end. Use dialogue early. If you can enter a structured forum like the EU sandbox, do it. It compresses legal uncertainty into product decisions.

The most important thing is to build with MiCA requirements in mind from the very beginning. Even if you launch lean, architect custody, disclosures, governance, and incident response as if licensing is inevitable. Pick your supervisory home strategically. Licensing concentration tells you where processes work today.

Treat compliance as a sales asset. Banks and institutional partners respond to governance, controls, and audited processes far more than they respond to “community”.

Crypto World

Bitcoin (BTC) price drops toward $70,000 as Iran war sends oil price higher

Bitcoin is on the cusp of falling below $70,000 for the first time since Wednesday, after climbing as high as $74,000 earlier this week.

The decline reflects a broader risk-off shift in markets as investors position ahead of key U.S. macroeconomic data and the developing war in Iran.

For now, attention is focused on the U.S. jobs report due at 13:30 UTC. The unemployment rate is expected to remain unchanged at 4.3% while nonfarm payrolls are forecast to drop to 59,000.

Labor market data is closely watched because it can influence expectations around Federal Reserve interest-rate policy, often leading investors to reduce risk exposure ahead of the release.

The war with Iran, nearing the end of its first week, is also contributing to market caution, pushing oil prices higher. WTI crude has climbed to around $83 per barrel, up more than 5% over the past 24 hours.

Meanwhile, the U.S. Dollar Index (DXY) has strengthened above 99 and the yield on the 10-year Treasury has risen to roughly 4.16%. Equity markets are slightly weaker, with the Invesco QQQ ETF, which tracks the Nasdaq 100 index, down about 0.5% in pre-market trading.

Crypto related stocks including Strategy (MSTR), Coinbase (COIN), and MARA Holdings (MARA) are also lower in pre-market trading.

Crypto World

SEC Ends Justin Sun Case as the TRON Founder Pays $10M

TLDR:

- SEC moved to dismiss fraud claims against Justin Sun and TRON entities after nearly three years of litigation

- Rainberry Inc. will pay a $10M civil penalty while all claims against Justin Sun personally disappear

- The original SEC case accused TRON firms of 600,000 wash trades tied to $TRX market activity

- Celebrity promotions involving $TRX and $BTT tokens formed a central part of the regulator’s case

The U.S. SEC has moved to end its long-running lawsuit against TRON founder Justin Sun. Regulators asked a court to dismiss claims tied to a 2023 fraud case involving TRON entities.

A TRON-affiliated company will pay a $10 million civil penalty as part of the agreement. The resolution closes a dispute that centered on token sales, trading activity, and celebrity promotions.

SEC Ends Justin Sun Lawsuit Over TRX and BTT Token Sales

The original complaint targeted Justin Sun, the TRON Foundation, and the BitTorrent Foundation. Regulators alleged the firms sold unregistered securities tied to the TRX and BTT tokens.

According to the filing, the SEC claimed TRON entities conducted large volumes of wash trading. The complaint referenced more than 600,000 trades designed to inflate market activity.

The regulator also accused Sun’s companies of paying celebrities to promote tokens without disclosure. Those promotions included social media campaigns tied to $TRX and BitTorrent’s $BTT token.

The SEC now seeks to dismiss the claims against Sun personally. Court filings show the dismissal would occur without admissions of wrongdoing from the defendants.

The civil penalty will come from Rainberry Inc., a company linked to TRON operations. The proposed settlement would close the enforcement case after nearly three years.

TRON Founder Responds as SEC Crypto Enforcement Approach Shifts

Justin Sun confirmed the development through a post on X. He stated the regulator had moved to dismiss claims against him and TRON-related entities.

Sun also noted that the resolution closes the legal dispute while allowing him to continue working in the sector. He said his focus remains on expanding crypto innovation globally.

A separate post from the Wise Advice account summarized the settlement terms. It noted the penalty payment and the dismissal of all charges against Sun personally.

The same post argued the outcome reflects a wider shift in the SEC’s crypto enforcement strategy. Recent settlements and paused cases have reduced several ongoing legal battles.

The earlier complaint formed part of a broader regulatory push targeting token sales and trading activity. The settlement now closes one of the more visible cases tied to TRON’s ecosystem.

TRON’s market capitalization currently sits near $25 billion, according to widely cited market data. Some commentators questioned the relatively small penalty in relation to the network’s size.

Sun and TRON DAO described the outcome as a positive step for the project. The resolution allows the organizations to move forward without further litigation tied to the case.

Crypto World

Vancouver’s Bitcoin Reserve Faces City Bureaucrats’ Pushback

Vancouver’s financial staff have recommended against establishing a dedicated Bitcoin reserve, arguing the move would breach the Vancouver Charter and advising the council to drop the proposal. In a March 2 motions update, Colin Knight, who heads the Finance and Supply Chain Management department, stated that Bitcoin (CRYPTO: BTC) cannot be held as an allowable investment for the city. The recommendation comes after Mayor Ken Sim had floated the idea in 2024 as part of a broader effort to diversify reserves and embrace digital assets. Although the proposal previously cleared the council with bipartisan support, staff now say a pragmatic path forward is to merge the initiative with related workstreams and defer a formal decision until the March 10 council meeting. The context is further colored by ongoing debates about Bitcoin’s role as an inflation hedge and the asset’s recent price gyrations.

Key takeaways

- Vancouver staff concluded Bitcoin cannot be considered an allowable municipal investment under the Vancouver Charter, effectively blocking a dedicated Bitcoin reserve.

- The original proposal, spearheaded by Mayor Ken Sim in late 2024, aimed to diversify the city’s reserves and position Vancouver as a Bitcoin-friendly city; it had received council support in earlier votes.

- The strategy’s momentum faced a heads-up from macro-market dynamics, with Bitcoin’s inflation-hedge narrative challenged as the asset’s price retreated from its peak in 2025.

- Staff recommended folding the Bitcoin reserve idea into other priorities, with a final decision expected at the March 10 council meeting.

- Analysts remain divided on Bitcoin’s near- to mid-term role as a treasury hedge, with some staying bullish while others caution against relying on the narrative amid volatility.

Tickers mentioned: $BTC

Market context: The Vancouver staff decision reflects the tension between public-treasury policy constraints and the evolving crypto market narrative. While some policymakers and economists have highlighted Bitcoin as a potential inflation hedge, municipal treasuries must operate within charter provisions and risk frameworks. The discussion in Vancouver mirrors broader debates about whether public funds should allocate to volatile digital assets, especially as BTC has experienced pronounced drawdowns after a multi-year rally.

Why it matters

The case unfolding in Vancouver highlights how municipal governance intersects with crypto asset policy. If a major metropolis cannot classify Bitcoin as an allowable investable asset, it signals the seriousness of charter constraints that curb public exposure to asset classes with inherently high volatility and regulatory uncertainty. For investors and builders in the crypto space, the outcome may affect the tempo of public-sector pilots or pilot-like programs in other jurisdictions, nudging cities to pursue more conservative treasury strategies or to explore non-custodial partnerships and educational initiatives rather than direct holdings.

From a market perspective, the incident underscores that Bitcoin’s appeal as a potential hedge is not static. While proponents have described BTC as “digital gold” due to its capped supply, the asset has weathered tough macro conditions, with price action testing the resilience of the inflation-hedge thesis. In recent cycles, price volatility has intensified discussions about whether institutions and public bodies should treat BTC as a long-duration store of value or a speculative instrument. The Vancouver update underscores a broader caution that policy decisions can lag or diverge from rapid shifts in market sentiment, potentially shaping how future public-sector experiments with digital assets are framed.

For city staff and policymakers, the decision sets a precedent on how to reconcile long-term financial resilience with legal and governance constraints. Proponents argued that diversifying reserves could help counter inflationary pressures and preserve purchasing power, but skeptics pointed to charter limits, risk tolerance, and the need for clear governance frameworks. This tension—between ambition for innovative treasury tools and the discipline of municipal finance rules—will likely inform future discussions in Vancouver and similar jurisdictions as crypto assets remain part of the broader policy conversation.

What to watch next

- March 10 council vote: whether to drop the Bitcoin reserve motion entirely or to flesh out a merged initiative that remains within charter constraints.

- Any formal amendments to Vancouver’s investment policy or treasury framework that could reflect a more nuanced approach to digital assets without direct holdings.

- Subsequent clarifications from city staff on the precise language of “allowable investments” under the Vancouver Charter and how it applies to digital assets.

- Public and expert commentary on Bitcoin’s ongoing role as an inflation hedge in the context of municipal-level risk management.

- Broader municipal-stewardship experiments with crypto assets in other Canadian cities, which could foreshadow a wider policy trajectory if Vancouver’s stance evolves.

SOURCES & verification

- Vancouver City Council motions update report dated March 2, linked in the council documentation

- The late-2024 motion introduced by Mayor Ken Sim titled “Preserving the City’s Purchasing Power Through Diversification of Financial Reserves — Becoming a Bitcoin-Friendly City”

- Cointelegraph coverage on Vancouver’s Bitcoin-friendly city initiative and subsequent council vote

- Cointelegraph reporting on Bitcoin’s inflation-hedge narrative and price movements referenced in the discussion

Bitcoin’s change of course in municipal finance

The Vancouver episode provides a focused lens on how public funds intersect with crypto policy. The staff’s conclusion—that Bitcoin cannot be classified as an allowable investment under the Vancouver Charter—does not erase the underlying questions about digital assets’ place in government balance sheets. It signals a move toward caution, prioritization, and policy alignment over rapid adoption of new asset classes in municipal reserves. While the market continues to debate Bitcoin’s long-term role as an inflation hedge, public finance remains anchored in governance, risk tolerance, and legal frameworks that govern how treasury assets are defined, managed, and reported.

What to watch next

As Vancouver prepares for its March 10 council session, observers will look for whether staff’s recommendations are accepted as-is or if the motion is redesigned to fit within the city charter while preserving the broader objective of financial resilience. The outcome could influence similar deliberations in other jurisdictions, where the balance between innovation and prudence remains a central theme in the governance of public funds and digital assets.

What to watch next

- March 10 council meeting: final decision on the merged approach or outright dismissal of the Bitcoin reserve proposal.

- Clarifications on allowed investments under the Vancouver Charter and potential policy updates to treasury guidelines.

- Public communication from the city explaining how any future exploration of digital assets would be conducted with safeguards and reporting standards.

Crypto World

Bitcoin Liquidity Analysis Eyes $65,000 Support Retest to Come

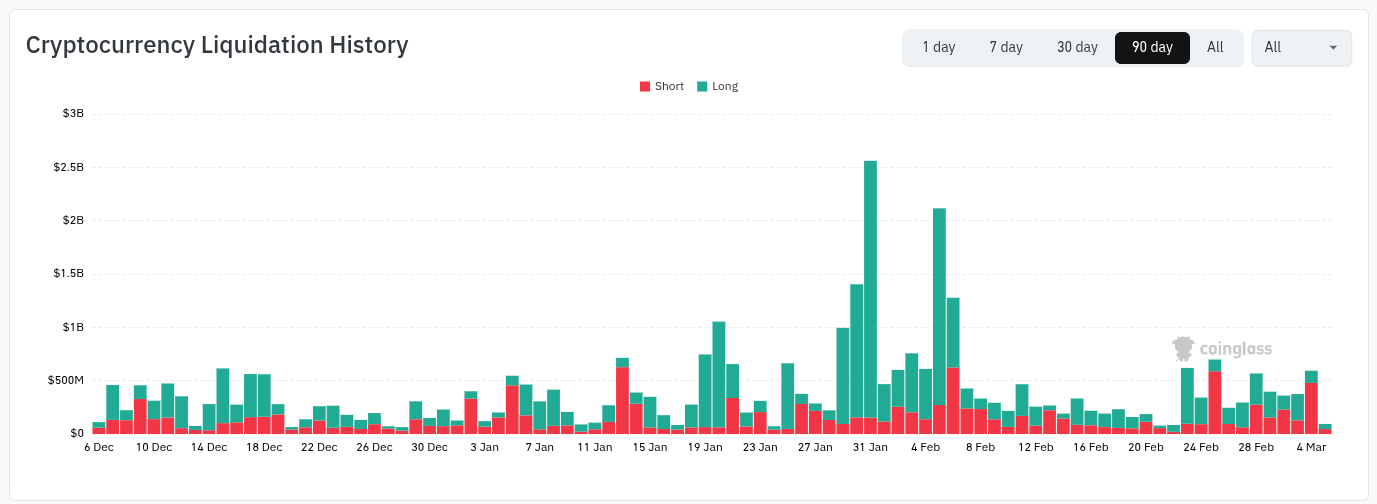

Bitcoin (BTC) has “annihilated” short sellers with its latest trip to monthly highs as crypto liquidations pass $500 million.

Key points:

-

Bitcoin bears suffer as BTC price action hits $74,000.

-

Analysis sees more liquidations to come, including longs, with possible market dips below $70,000 to test support.

-

Bitcoin inflows begin to copy a broad ETF rebound in place through 2026.

BTC price analysis: “Bulls just took back control”

New analysis from CryptoReviewing, the pseudonymous cofounder of trading community Wealth Capital, says that the “entire market scenario” for Bitcoin has changed.

The past few days have seen BTC price swings take out both long and short positions worth hundreds of millions of dollars, but the trip to $74,000 ultimately cost bears more.

“Bears just got annihilated,” CryptoReviewing summarized.

Accompanying exchange order-book data from monitoring resource CoinGlass shows price slicing through walls of liquidations.

Wednesday’s liquidation total for Bitcoin and altcoins neared $600 million, with more shorts erased than on any day since Feb. 25.

“And now the entire market scenario has changed… At $73,000 – $75,000 we have a large liquidity zone which could be swept, potentially leading to even higher levels,” CryptoReviewing continued.

“However, $65,000 – $71,000 below has roughly 4x more liquidity built up, making it the ‘more likely’ zone from a liquidity perspective to be visited next. Bulls just took back control.”

Such a support test is also on the radar for Keith Alan, cofounder of trading platform Material Indicators.

As part of a new market analysis published on Wednesday, Alan argued that a consolidation phase should form part of a reliable trend change.

“A support test, sooner than later, would be healthy, but I’m not sure that the market is going to make it that easy on us. However this develops, IMO, the longer it takes to grind up, the more durable the rally will likely be,” he wrote.

Alan nonetheless warned that long-term bearish signals remained in place, expecting Bitcoin’s “next leg down” to result from the current setup.

Bitcoin ETFs in focus amid “historic acceleration”

As Cointelegraph reported, price upside has accompanied renewed interest in Bitcoin from institutional sources.

Related: ‘This is not World War III:’ Five things to know in Bitcoin this week

The US spot Bitcoin exchange-traded funds (ETFs) saw net inflows of nearly $500 million on Wednesday.

Data from UK-based investment company Farside Investors confirms that inflows have been net positive on all but one trading day since Feb. 24. Even then, outflows were modest at just $27.5 million.

So far in March, the ETFs have taken in over $1.1 billion in capital.

Commenting, trading resource The Kobeissi Letter noted that ETF interest has broadly spiked this year, making the US Bitcoin and Ethereum offerings relative laggards after months of outflows.

“Investors are pouring money into US funds at a record pace: US-listed ETFs have pulled in +$380 billion so far in 2026, on track for the best year on record. This marks a +80% increase compared to the first two months of 2025,” it revealed on X.

Kobeissi described the US ETF industry as “experiencing a historic acceleration in investor demand.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

OKX introduces social networking feature to connect crypto traders inside its app

Crypto exchange OKX has launched a new social trading platform called Orbit, designed to connect traders through shared strategies, market insights, and community-driven discussions.

Summary

- OKX launched Orbit, a social trading network where users can share trade ideas, market insights, and strategies.

- The platform aims to combine social media-style interaction with crypto trading tools to help traders collaborate and learn from each other.

- The launch follows broader momentum for the exchange, including a recent surge in the OKB token after an ICE-linked investment tied to the OKX ecosystem.

OKX launches in-app trader network

According to the exchange, Orbit functions as a social network built specifically for crypto traders, enabling users to share trade ideas, post analysis, and interact with other market participants in real time.

The platform aims to combine elements of social media with trading-focused tools to help users discover strategies and track market sentiment more efficiently.

Through Orbit, traders can publish posts, discuss market developments, and follow experienced traders to gain insights into different trading approaches. OKX said the platform is designed to help both retail and experienced traders collaborate, learn from each other, and stay informed about emerging trends in the digital asset market.

The launch reflects a broader shift across the crypto industry toward community-driven trading ecosystems, where investors increasingly rely on social signals, influencer commentary, and peer insights to guide trading decisions.

Orbit is part of OKX’s broader effort to expand its product ecosystem beyond traditional exchange services. In recent months, the company has been rolling out new features aimed at strengthening user engagement and building a more integrated crypto platform.

The expansion comes as OKX has also been gaining momentum in its native token ecosystem. The exchange’s OKB token surged yesterday after reports that Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, made a strategic investment tied to OKX’s ecosystem, highlighting growing institutional interest in the platform.

The move helped boost market sentiment around OKB and underscored OKX’s efforts to strengthen its position among the largest global crypto exchanges.

Crypto World

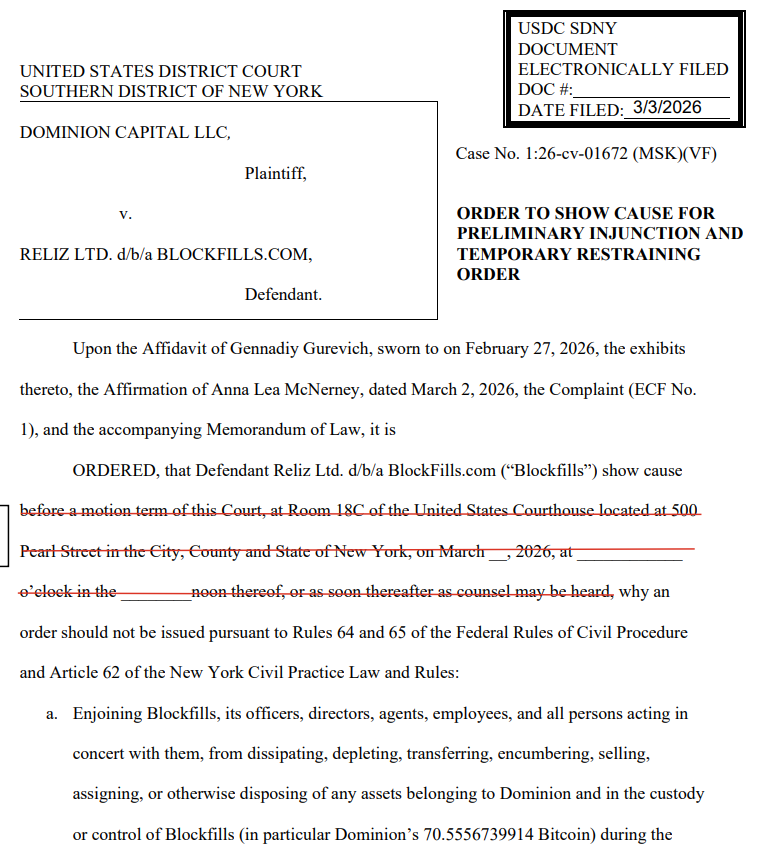

Judge Freezes 70 BTC from BlockFills in Court Dispute Tied to User Funds

A US Judge has temporarily frozen 70.6 Bitcoin tied to cryptocurrency lending and trading company BlockFills and ordered a full segregated account of customer funds after Dominion Capital accused the company of misappropriating customer assets and commingling funds, according to a court filing.

The complaint, filed Feb. 27, alleges that BlockFills unlawfully retained millions of dollars in customer crypto assets and used commingled funds to cover losses. Judge Mary Kay Vyskocil issued a temporary restraining order (TRO) for 70.6 Bitcoin (BTC), worth about $5 million, currently held by BlockFills, which Dominion says belongs to it, according to a Tuesday court filing.

BlockFills must respond to the court order by March 17, 2026. The order comes three weeks after BlockFills halted withdrawals in February.

The TRO was issued against the defendant without notice because Dominion Capital clearly showed the “immediate and irreparable injury, loss, or damage” that will result to the plaintiff before the defendant may be heard in opposition, the filing reads.

BlockFills halts user withdrawals amid Bitcoin crash

BlockFills announced a halt to customer deposits and withdrawals amid the broader crypto market correction on Feb. 11.

The company said it decided to stop withdrawals to protect clients and restore liquidity on the platform following Bitcoin’s decline to $60,000.

Related: Analysts reject Jane Street ‘10 a.m. dump’ claims, say Bitcoin isn’t easily manipulated

“Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform,” wrote BlockFills in the statement, adding that clients have been able to open and close their existing spot and derivatives positions.

The decision impacted about 2,000 institutional clients, including asset managers and hedge funds that contributed to the $60 billion trading volume logged on BlockFills in 2025, according to its annual report.

Related: Indiana lawmakers pass crypto rights bill banning discriminatory taxes

Chicago-based BlockFills is an institutional-focused platform serving professional traders, hedge funds and asset managers, with a minimum $10 million threshold for certain services, including its Options Products.

Dominion Capital is a New York-based investment company founded in 2011, primarily focusing on private equity, structured finance and real estate investments.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Dubai Regulator Warns KuCoin Over Unlicensed Crypto Services

Dubai’s digital asset regulator has instructed entities behind crypto exchange KuCoin to halt unlicensed virtual asset activities in the emirate, warning investors that the platform is not authorized to serve Dubai residents.

In a Thursday investor and marketplace alert, the Virtual Assets Regulatory Authority (VARA) said that Phoenixfin Pte Ltd, MEK Global Limited, Peken Global Limited and Kucoin Exchange EU GmbH, all commercially advertising as KuCoin, may be providing virtual asset activities to Dubai residents, “without the necessary regulatory approvals and misrepresenting its licensing status.”

VARA said the group had been instructed to cease and desist all unlicensed digital asset activities and stressed that KuCoin did “not hold any licence to provide Virtual Asset services in/from Dubai.”

The watchdog added that any virtual asset activities advertised or conducted by the entities were in breach of VARA regulations and wider United Arab Emirates legislation, including Dubai Law No. 4 of 2022 and Cabinet Resolution No. 111/2022, which require all virtual asset service providers to be licensed to operate legally.

VARA also clarified that “any promotion, advertising, or solicitation related to KuCoin has not been approved,” and that the exchange was not permitted to offer, promote or market virtual asset products or services in Dubai or to its residents.

Related: KuCoin taps former LSEG exec Sabina Liu to lead MiCA expansion in Europe

Consumers engaging with unlicensed platforms face “significant financial risks and potential legal consequences” for violating regulatory requirements or even criminal laws, the regulator warned.

VARA urged Dubai-based users to avoid using KuCoin for virtual asset services, to verify that companies are on its public register of licensed providers before transacting and to report any suspected unlicensed activity directly to the authority.

Dubai alert follows Austria freeze on KuCoin EU operations

The Dubai alert comes shortly after Austria’s Financial Market Authority froze new business at KuCoin EU, the Vienna-based entity that holds a Markets in Crypto-Assets Regulation license, citing failures to maintain key Anti-Money Laundering, Counter-Terrorist Financing and sanctions compliance roles.

KuCoin’s European management said that it had voluntarily paused new onboarding and some trading activities while it worked to refill those positions and bring the business back into full compliance.

Cointelegraph reached out to KuCoin for comment but had not received a response by publication.

Magazine: Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Crypto World

Vara tells crypto exchange KuCoin to halt operations in Dubai

Dubai’s digital assets regulator said cryptocurrency exchange KuCoin has been operating without the necessary regulatory approvals and licensing, and must cease and desist from serving clients in the region.

“Kucoin does not hold any licence to provide virtual asset services in/from Dubai. Any activities related to Virtual Assets advertised or conducted by this company are therefore in breach of the VARA Regulations,” the Virtual Assets Regulatory Authority (VARA) said in a statement.

“Any promotion, advertising, or solicitation related to Kucoin has not been approved by VARA, and the company is therefore not allowed to offer, promote, or market any Virtual Asset products or services in Dubai or to its residents,” the regulator added, advising consumers and investors in Dubai to avoid engaging with Kucoin.

The alert comes just weeks after Austria’s financial regulator prohibited the European arm of KuCoin from conducting new business and onboarding customers due to a lack of appropriate compliance staff.

A few months earlier, Austria’s finance regulator, FMA, granted KuCoin a Markets in Crypto Assets (MiCA) permit to operate across the European Union.

KuCoin, a Seychelles-based cryptocurrency exchange founded in China in 2017, is now one of the largest offshore crypto platforms, ranked in the top 10 by trading volume.

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports17 hours ago

Sports17 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker