Crypto World

XRP Price Crash To 15-Month Low Inspires $2.2 Billion Whale Buying

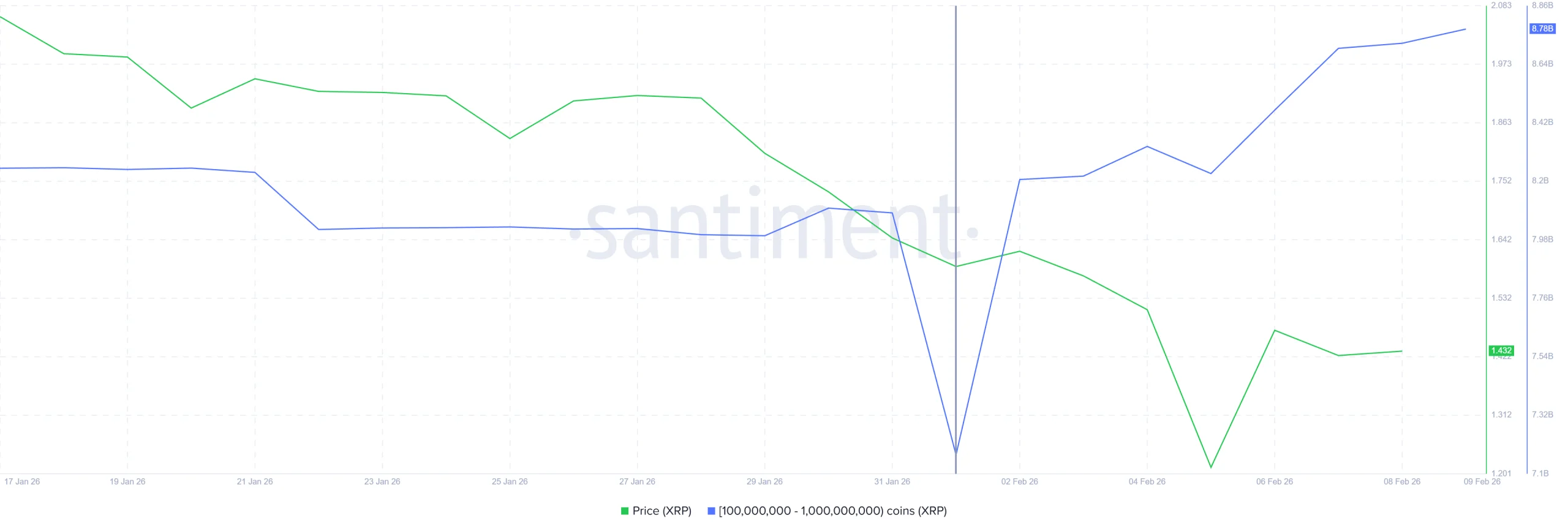

XRP recently suffered a sharp sell-off that dragged the price close to the $1.00 level, marking its lowest point in nearly 15 months. The decline shook market confidence and triggered widespread fear among short-term holders.

However, XRP avoided a deeper breakdown at the last moment. The key question now is whether downside pressure will resume or stabilize.

XRP Holders Exhibit Mixed Signals

Large XRP holders have returned to accumulation mode during the downturn. Wallets holding between 100 million and 1 billion XRP acquired more than 1.6 billion tokens over the past week. At current prices, this buying exceeds $2.24 billion, signaling renewed interest from influential market participants.

This accumulation helped support XRP’s bounce from recent lows. Whale buying often absorbs sell-side pressure and stabilizes price during volatile phases. While it does not guarantee immediate recovery, such activity improves liquidity conditions and provides a foundation for short-term price resilience.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Long-term holders remain cautious despite whale accumulation. The recent crash appears to have weakened confidence built over the prior weeks. XRP’s Liveliness indicator spiked during the decline, signaling increased movement of long-held tokens back into circulation.

A rising Liveliness reading suggests long-term holders are shifting from accumulation to distribution. This behavior is concerning because long-term investors typically anchor market stability. If their selling continues, it could offset whale demand and limit XRP’s ability to sustain a recovery rally.

XRP Traders Under Pressure

Derivatives positioning highlights a bearish bias in XRP’s broader market structure. Liquidation data shows roughly $399 million in short exposure compared with $152 million in long positions. This imbalance suggests traders are positioning for further downside rather than a sustained rebound.

XRP is particularly vulnerable if the price revisits the $1.00 level. A breakdown below that threshold could trigger cascading liquidations. Such an event would amplify volatility and accelerate selling, reinforcing bearish momentum in the futures market.

XRP Price Is Holding Support

XRP is trading near $1.44 at the time of writing, holding above the $1.42 support level. On the weekly chart, the token briefly dipped to $1.11 before rebounding. This move marked XRP’s lowest level in 15 months, stopping just above the critical $1.00 psychological zone.

Given current conditions, a retest of lower support remains possible. Weak long-term holder confidence and bearish derivatives positioning increase downside risk. A loss of $1.42 could send XRP back toward $1.11, where buyers would need to defend aggressively to prevent further losses.

A bullish alternative exists if selling pressure fades. Continued whale accumulation could help XRP regain momentum. A push toward $1.91 would mark a significant recovery. Breaking that resistance could lift the price toward $2.00, invalidating the bearish thesis and restoring market confidence.

The post XRP Price Crash To 15-Month Low Inspires $2.2 Billion Whale Buying appeared first on BeInCrypto.

Crypto World

Crypto News & Price Indexes

Interoperability remains a central challenge for the crypto ecosystem, especially as Bitcoin-native protocols shift asset validation and state management away from traditional on-chain models. In a concrete move, Utexo, a CTDG Dev Hub participant, has introduced RGB support for Tether’s Wallet Development Kit (WDK) via the Utexo SDK. The development aims to bridge two fundamentally different views of asset state: RGB’s off-chain validation and the wallet’s on-chain anchors. By layering RGB functionality into a widely used wallet framework, this integration seeks to streamline developers’ workstreams while preserving the security properties of Bitcoin-based assets.

Key takeaways

- The RGB protocol validates asset state off-chain and uses on-chain Bitcoin transactions as anchors, creating a fundamental mismatch with standard wallet SDKs that expect a global on-chain truth for balances.

- Utexo’s RGB support for Tether’s Wallet Development Kit adds a dedicated adapter layer, enabling RGB operations to ride on the wallet’s existing transaction workflows without replacing underlying RGB infrastructure.

- The new wdk-wallet-rgb module derives RGB keys from BIP-39 seeds and exposes RGB balances through wallet-facing interfaces, allowing backups and restores to be encrypted alongside other wallet data.

- Limitations remain: the module does not provide RGB Lightning nodes, network configuration, or application-level UX, underscoring its role as an integration layer rather than a complete RGB solution.

- As part of the CTDG Dev Hub ecosystem, Utexo’s work highlights a broader effort to nurture cross-chain tooling and encourage feedback from a global developer community.

Tickers mentioned:

Market context: The effort sits at a time when wallet architects increasingly seek modular adapters to support non-native asset models while preserving familiar user experiences. The push toward off-chain validation paired with on-chain anchors is part of a broader trend to balance security with scalable, cross-chain asset issuance.

Why it matters

The RGB protocol was designed with Bitcoin’s security model in mind, but its approach to asset state is not globally observable on-chain. Rather than publishing a universal on-chain ledger of RGB asset balances, RGB relies on client-side validation and off-chain state propagation. This design choice improves scalability and privacy but places additional burdens on wallet developers: keys, validation data, persistence, and the coordination between Bitcoin transactions and RGB state transitions all occur outside a single, centralized wallet view. The result is a delicate balance between robust security guarantees and the risk of mismatched expectations within wallet ecosystems.

By introducing a dedicated adapter layer within the Wallet Development Kit, Utexo addresses the core friction points without rearchitecting RGB’s entire infrastructure. The wdk-wallet-rgb module acts as a bridge, translating RGB wallet operations into abstractions compatible with WDK’s multi-chain philosophy. In practice, this means RGB issuance and transfers can be exercised through standard wallet transaction flows, rather than requiring bespoke coordination logic external to the wallet. For developers, this translates into a more cohesive development path: assets created via RGB can be managed, backed up, and recovered in encrypted form alongside other wallet data, using familiar key management and seed architectures.

Crucially, the module is explicit about its scope. It does not replace RGB infrastructure or automate deployment concerns, nor does it attempt to provide an RGB Lightning node, network configuration, or end-user UX flows. Instead, it preserves RGB’s off-chain validation model while integrating issuance and transfers into existing wallet lifecycles. This approach reflects a pragmatic evolution in wallet infrastructure: as more Bitcoin-native protocols move validation and state off-chain, wallet ecosystems will increasingly adopt integration layers that preserve security guarantees while simplifying development and user experience.

The collaboration positions RGB within a broader ecosystem where wallet tooling is increasingly modular and chain-agnostic. Utexo’s participation in the CTDG Dev Hub—a hub designed to connect developers and users across blockchains—highlights how a collaborative, globally distributed developer base can accelerate practical solutions. By linking RGB state management to the familiar WDK environment, the integration opens potential pathways for broader RGB adoption across wallets that rely on BIP-39 seed-based key management and standardized transaction workflows.

The module’s limitations

The integration layer is not a panacea. It intentionally leaves several RGB-critical components outside its scope, including:

- RGB Lightning node functionality remains unsupported.

- Network configuration and node discovery are not handled by the module.

- Application-level UX or payment-flow orchestration is not defined within the adapter.

- Backups, recovery, and the user experience associated with client-side validated assets still carry inherent complexity.

These limitations mirror the module’s role as a wallet integration layer rather than a complete RGB solution. The intent is to provide a structured pathway to incorporate RGB assets into the WDK ecosystem without disrupting existing wallet abstractions, acknowledging that further RGB infrastructure and tooling will be required for end-to-end deployment in production environments.

A hub nurturing the blockchain ecosystem

Utexo’s work aligns with the CTDG Dev Hub’s mission to foster collaboration across blockchains. As a Hub participant, Utexo benefits from a global workforce that can generate ideas, test concepts, and offer feedback, while contributing to Bitcoin’s broader ecosystem. This kind of cross-pollination underscores a shift toward more modular, interoperable tooling that can accelerate practical use cases for Bitcoin-native protocols and their associated asset models. The CTDG environment serves as a proving ground for adapters like wdk-wallet-rgb, helping to surface lessons learned and drive subsequent innovations within the Wallet Development Kit and beyond.

What to watch next

- Wider adoption of the wdk-wallet-rgb module by additional wallets within the CTDG Dev Hub and beyond, testing cross-chain compatibility.

- Subsequent updates to the adapter that broaden support for more RGB-led assets and refine synchronization between on-chain anchors and off-chain state.

- Expanded documentation and examples to illustrate best practices for backups, encryption, and recovery of RGB-managed state within wallet ecosystems.

- More feedback from the global developer community and potential integration with other wallet SDKs following similar architectural approaches.

Sources & verification

- The announcement of RGB support for Tether’s Wallet Development Kit (WDK) through the Utexo SDK, including the adapter concept and its goals.

- Descriptions of RGB’s off-chain validation model and how on-chain BTC transactions act as anchors for asset state.

- Explanations of the three core mismatch areas: balance tracking, transaction lifecycle, and state persistence/recovery.

- Details on the module’s limitations and its scoped role as a wallet integration layer rather than RGB infrastructure.

- References to CTDG Dev Hub involvement and Utexo’s role within the ecosystem.

Why it matters: a practical path forward for wallet developers

In practical terms, the integration lowers the barrier for wallet developers seeking to support RGB-issued assets without overhauling their core wallet architecture. By aligning RGB issuance and transfers with existing wallet workflows, developers can leverage familiar key management patterns and encrypted backups, reducing the risk of fragmentation across applications that handle off-chain asset state. For users, this could translate into more consistent experiences when managing Bitcoin-native assets issued via RGB, with asset state validated in client-side proofs rather than assumed from on-chain data alone.

From a market perspective, the move underscores ongoing efforts to harmonize Bitcoin’s security model with modern, multi-chain asset issuance. As more wallets adopt modular adapters and as cross-chain tooling matures, users may encounter a more cohesive experience when interacting with off-chain assets anchored to Bitcoin. However, the success of such efforts depends on continued collaboration among developers, clear documentation, and robust security practices around client-side state management and backup workflows.

What to watch next

- Upcoming releases of the wdk-wallet-rgb module with broader asset support and improved UX workflows.

- New integrations with other RGB-enabled assets beyond the initial focus on the Tether WDK partnership.

- Ongoing feedback cycles within CTDG Dev Hub that influence further refinements to wallet integration patterns.

Crypto World

Logan Paul fakes $1 million Polymarket bet

An apparent $1 million Polymarket bet placed by Logan Paul during the Super Bowl was actually a stunt that failed to pull the wool over the eyes of crypto sleuths.

Paul was filmed supposedly placing a bet on the New England Patriots racking up a record-breaking seventh Super Bowl victory. Polymarket captioned the clip “Logan Paul checking Polymarket at the Big Game 👀.”

However, crypto sleuth ZachXBT, and numerous other onlookers noted that Paul’s Polymarket account balance had no money in it, and so the $1 million bet he proceeded to tap through was never going to be made.

Additionally, ZachXBT pulled up the top holders within that market and showed that none of them matched Paul’s apparent bet.

He called the stunt “yet another Logan Paul scam,” a comment possibly referencing Paul’s failed CryptoZoo project that lost victims tens of thousands of dollars and led to numerous lawsuits, some of which are still ongoing.

Read more: Coinbase’s Super Bowl ad was fun until it wasn’t

ZachXBT also speculated that there’s “at least some sort of relationship not being disclosed” between Paul and Polymarket.

The sleuth shared one of Paul’s livestreams, filmed days earlier, that showed the influencer trying to candidly promote Polymarket in a fashion ZachXBT described as “inorganic.”

In the end, it was a good job for Paul that he didn’t make the bet as Seattle won the game 29 to 13.

Prediction markets are battling state courts

Polymarket and rival market Kalshi are battling various legal challenges in courts across the US. Today, Polymarket launched a lawsuit against the state of Massachusetts to attempt to prevent it from shutting down its sports prediction markets.

Polymarket is arguing that the federal law and the Commodity Futures Trading Commission are the only legal tools that can prevent it from offering sports contracts.

Meanwhile, Kalshi’s advertisements are attracting a different kind of criticism from users online who take offence to the platform framing prediction market gambling as a viable means of making money on the side.

Crypto podcast host “DeFi_Dad” described Kalshi’s advertisements as “rat poison squared,” noting that its trying to pass off betting on the duration of the national anthem, and other markets, as “easy money” and bets that “normal Joes” are making every day.

Read more: Maduro Polymarket bet raises insider trading concerns

“Every ad is uniquely shameless and cringe. Great way to wreck the middle class and young people who SHOULD be taking risks by investing or learning about investing vs gambling,” DeFi_Dad added.

“I would never advocate for censoring or preventing anyone from using these platforms but the marketing is so dishonest and mark my words, it will eventually blow back hard on our industry for them being associated with crypto.”

CEO of crypto casino BetHog, Nigel Eccles, also noted how Kalshi ads are advertising to young adults the message that, if they can’t afford their rent, they should gamble on the platform instead to make back even more money.

Eccles claimed that operators view these ads as “highly unethical,” and highlighted that the ads promote both underage and problem gambling.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Bitcoin Recovers $70,000 Levels After Multi-Billion Dollar Crash

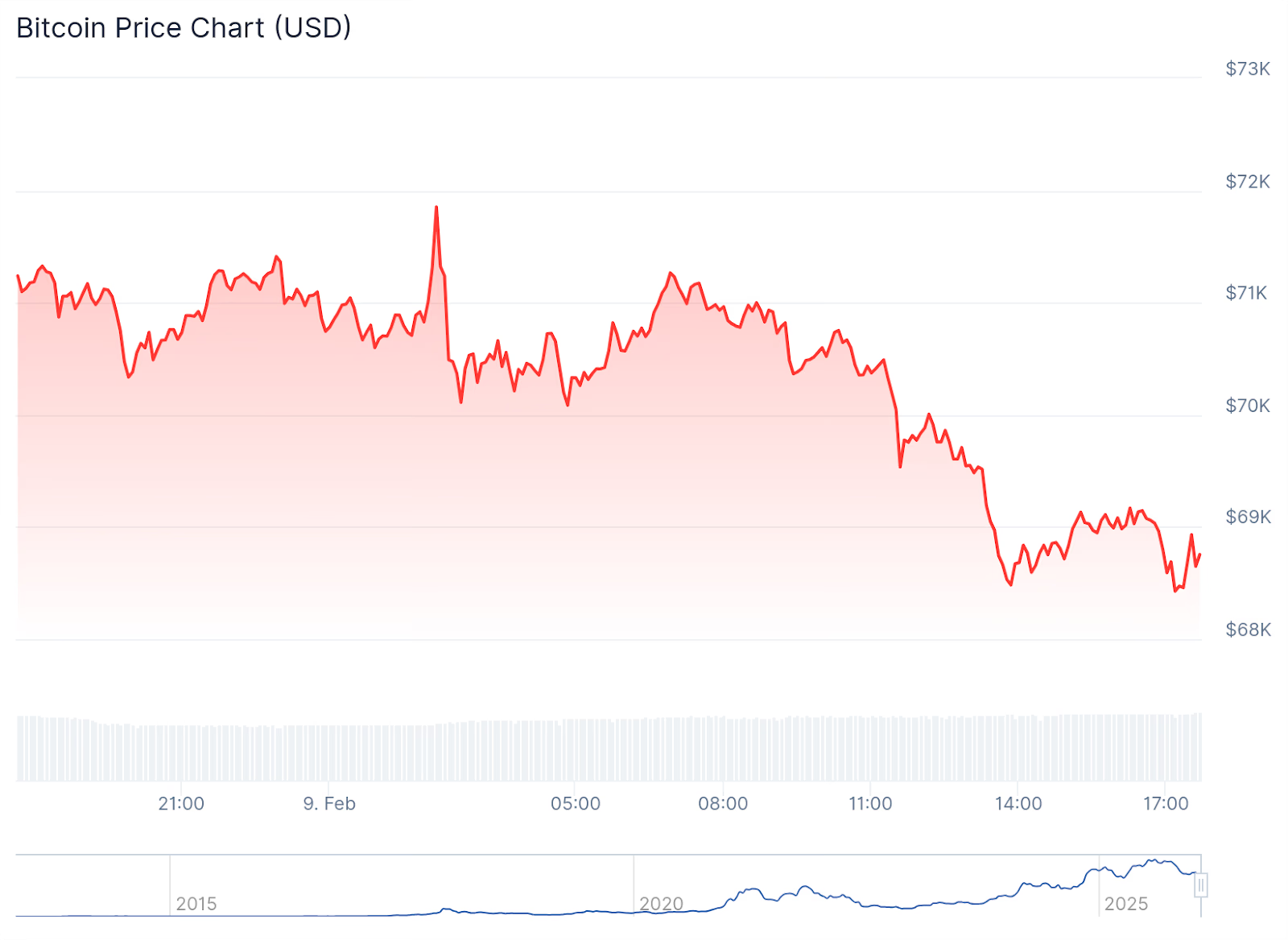

BTC is trading sideways around $68K-$71K since Thursday’s flash crash, but losses across major tokens continue.

Crypto markets saw a modest bounce after last week’s broad sell-off, though the sector remains in the red. Total market cap is down 2.2% today and most large-cap crypto assets are seeing losses on the daily and weekly timeframes.

As of Monday morning, Bitcoin (BTC) was still down about 3% on the day, trading near $69,280, after briefly dipping as low as $60,000 on Thursday.

Ethereum (ETH) is also down today, with 3.8% losses over the past 24 hours to trade just above $2,000, extending its seven-day losses to roughly 12%.

All remaining top-10 tokens by market capitalization were in the red as well, with Solana (SOL) leading losses, down about 4% on the day.

Echo of May 2022

Glassnode analysts said in a post on X today, Feb. 9, that market positioning for Bitcoin remains defensive across spot and derivatives markets, as well as per on-chain metrics, with any recovery dependent on a meaningful return of spot demand.

They added that while fundamental network activity is strengthening, profit-and-loss conditions continue to weaken, demonstrating only soft demand and limited profitability.

At $70,000 levels, unrealized losses account for about 16% of Bitcoin’s market cap, echoing the situation in early May 2022, glassnode noted, referring to heavy deleveraging that preceded the Terra-driven drawdown at the time.

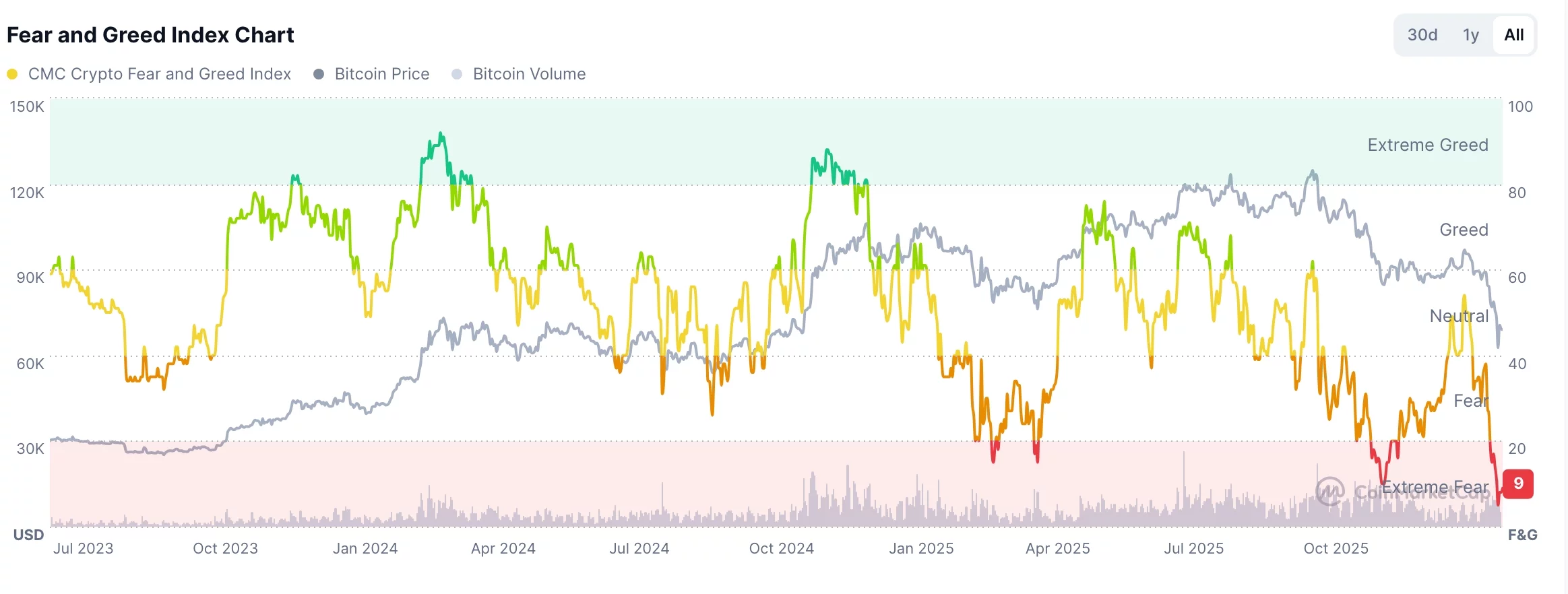

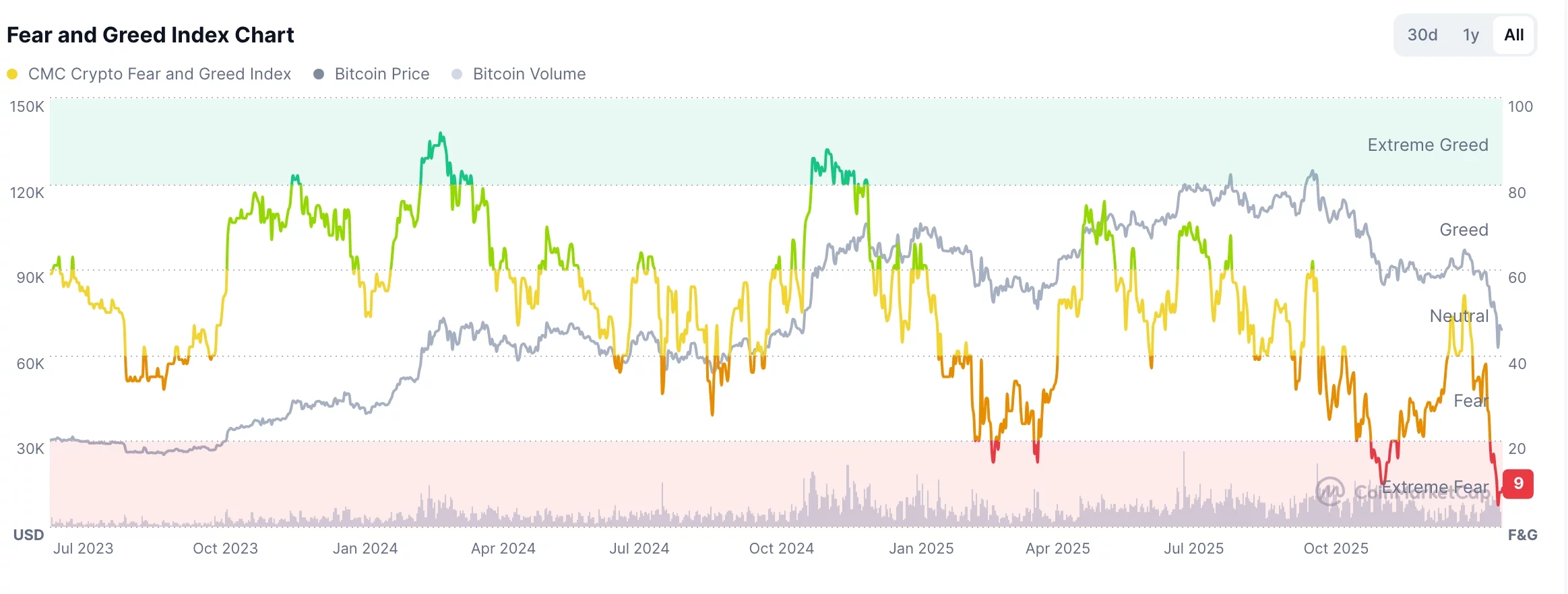

According to the Crypto Fear & Greed Index, investor sentiment remains in the “extreme fear” zone this morning, where it has been for most of the last month.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, Rain (RAIN) and the Trump family’s World Liberty Financial (WLFI) outperformed the market up 11% and 6% respectively.

On the downside, MemeCore (M), Bittensor (TAO), and Ondo (ONDO) were the three weakest performers, all down about 6% on the day.

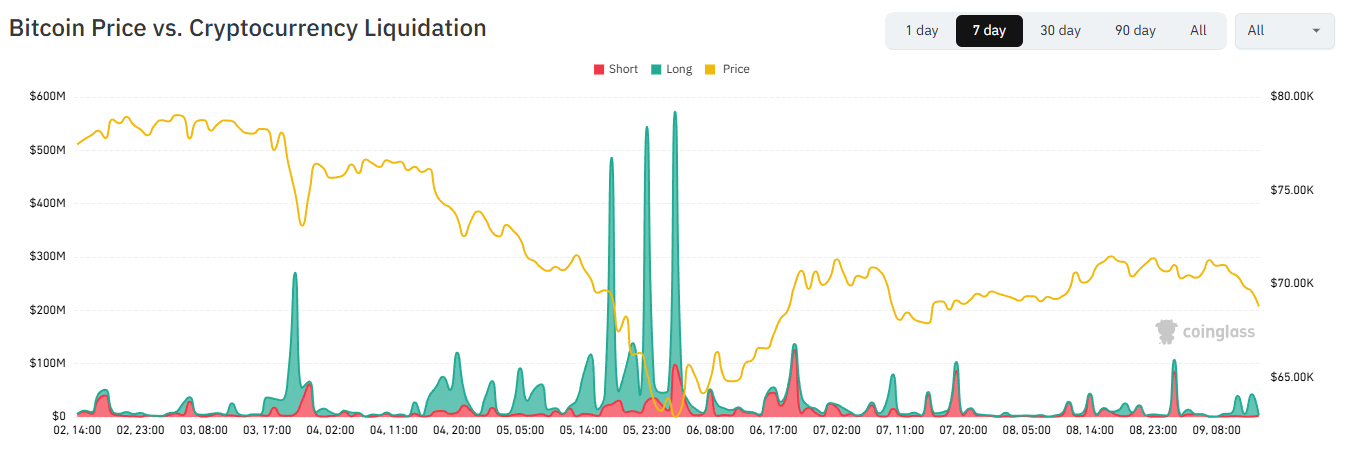

CoinGlass data showed continued forced deleveraging, with roughly $344 million in leveraged crypto positions liquidated over the past 24 hours, a far cry from the multi-billion liquidations that shook the market late last week amid quickly falling prices.

By asset, BTC led liquidations with approximately $182 million, followed by ETH at around $71 million.

ETFs and Macro Conditions

For the week ending on Feb. 6, spot Bitcoin exchange-traded funds recorded $318 million in net outflows, and ended the week with daily net inflows above $371 million. Cumulative net inflows stand at $54.7 billion, according to data from SoSoValue.

Spot Ethereum ETFs posted $166 million in weekly net outflows during the same timeframe, with net outflows every day last week but Feb. 3, while cumulative net inflows are currently around $11.8 billion.

In macro markets, U.S. Treasury yields moved higher to start the week as investors braced for a wave of delayed U.S. economic data. The 10-year Treasury yield rose to 4.236%, while the 30-year climbed to 4.889%, CNBC reports.

Markets are focused on the January nonfarm payrolls report, now scheduled for release this Wednesday, Feb. 11, which is expected to show job growth of 60,000, with the unemployment rate holding steady at 4.4%.

Crypto World

6 Leading Dogecoin mining platforms driving the 2026 cloud mining trend, and helping people to earn passive income

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Cloud mining is emerging as the mainstream way to participate in Dogecoin, offering simpler, faster access for new crypto users.

Summary

- Dogecoin mining shifts toward cloud platforms in 2026 as rising costs and difficulty reduce traditional hardware appeal.

- High electricity, maintenance, and difficulty push everyday investors toward simpler cloud-based Dogecoin mining options.

- Cloud mining emerges as a mainstream entry point for Dogecoin users seeking efficient, low-barrier crypto participation.

Dogecoin’s (DOGE) development journey is vastly different from that of other cryptocurrencies like Bitcoin and Ethereum. Unlike them, Dogecoin didn’t start with a complex technical whitepaper or the ambition to disrupt traditional financial systems. Instead, it began as a humorous and community-driven project, quickly capturing global attention with its lighthearted and approachable nature.

With fast transaction confirmation times and strong community support, Dogecoin has grown from an internet meme into a significant player in the cryptocurrency market, demonstrating its unique value.

As Dogecoin continues to mature, the ways in which users participate in its ecosystem are also evolving. Particularly in the field of mining, traditional hardware mining is gradually being replaced by a more efficient and convenient method — cloud mining. In 2026, cloud mining is becoming a mainstream trend, opening up new doors for everyday investors to participate in the cryptocurrency space with ease.

The current state of Dogecoin mining: Challenges of traditional mining

While Dogecoin can still be mined through traditional hardware, this process is no longer as straightforward as it once was. As the Dogecoin network expands, several challenges have emerged:

1. Increased Mining Difficulty: As more miners join the network, mining has become more challenging, making it harder for regular users to earn significant rewards.

2. High Electricity Costs: Mining equipment consumes a lot of electricity, making operational costs a major concern for miners.

3. Complex Hardware Maintenance: Mining rigs require regular maintenance, and aging hardware can reduce efficiency, leading to additional repair and replacement costs.

These challenges have made traditional mining less appealing, especially for everyday investors with limited technical knowledge or financial resources. As a result, cloud mining has emerged as an attractive alternative.

1.Hashbitcoin cloud mining: The future of cryptocurrency mining in 2026

Cloud mining is changing the cryptocurrency mining landscape. It eliminates the need for expensive hardware purchases and the hassle of managing electricity consumption. With cloud mining, users simply register on a platform, choose a mining contract, and let remote servers handle the mining process, generating daily rewards.

Hashbitcoin, as a leading cloud mining platform, offers a simple, efficient, and legally compliant mining solution. Here’s how to get started with Hashbitcoin:

1. Register an Account: Sign up using an email and complete KYC verification to secure your account.

2. Claim Free Hashpower: New users receive $15 worth of free hashpower to start mining with zero cost.

3. Choose a Mining Contract: Select a contract that suits a particular budget and preferences.

4. Earn Daily Rewards: Once the contract is active, daily cryptocurrency rewards will be automatically received.

5. Withdraw or Reinvest: Withdraw earnings anytime or reinvest them to purchase more hashpower for greater returns.

Hashbitcoin mining profit examples

Below are some examples of mining contracts and their potential returns on the Hashbitcoin platform:

Mining Plan

Investment

Contract Term

Daily Rewards

Total Return (Principal + Profit)

Newbie Mining Plan

$200

1 Day

$7

$200 + $7

Avalon A15 Pro Mining Rig

$1,200

2 Days

$43.2

$1,200 + $86.4

BitDeer SealMiner A2

$3,600

3 Days

$136.8

$3,600 + $410.4

Avalon Nano 3S Miner

$8,000

2 Days

$344

$8,000 + $688

Antminer S23 Hyd

$16,800

3 Days

$924

$16,800 + $2,772

Whatsminer M63S (390T)

$33,000

2 Days

$2,145

$33,000 + $4,290

Antminer E9 Pro

$58,000

1 Day

$5,104

$58,000 + $5,104

Visit Hashbitcoin now to claim a $15 free hashpower bonus and choose the perfect mining contract.

Other recommended cloud mining platforms

In addition to Hashbitcoin, here are some other excellent cloud mining platforms worth exploring:

2. EcoHash Global — A pioneer in green mining

EcoHash Global focuses on sustainable mining, utilizing wind and solar power for its data centers. The platform offers free trial hashpower and real-time performance monitoring, making it an ideal choice for environmentally conscious users.

3. SmartMine USA — AI-powered smart mining

SmartMine USA leverages artificial intelligence to dynamically allocate hashpower to the most profitable cryptocurrencies. The platform adheres strictly to U.S. regulations and supports mobile operations, providing users with a safe and convenient mining experience.

4. QuantumMiner — High-performance flexible contracts

QuantumMiner offers flexible mining contracts and transparent earnings reports. With AI optimization and eco-friendly servers, it ensures efficient and sustainable cryptocurrency mining.

5. PeakHash Cloud — Beginner-friendly platform

PeakHash Cloud features a simple interface and easy contract management, making it ideal for beginners. The platform offers free trial hashpower and daily payouts, making it an excellent option for those seeking passive income.

6. TitanHash Pro — Mobile AI mining

TitanHash Pro combines AI-powered optimization with mobile and web access, allowing users to monitor their earnings and manage their mining contracts effortlessly. The platform automatically allocates hashpower to the most profitable projects, maximizing returns for users.

Why cloud mining is the future of cryptocurrency mining

1. No Hardware Required: No need to purchase expensive mining rigs, significantly lowering the barrier to entry.

2. Time and Effort Savings: Platforms handle all technical maintenance, electricity management, and other operational tasks.

3. Eco-Friendly Mining: Many platforms now use renewable energy sources, reducing carbon emissions and supporting sustainability.

4. Flexible Contracts: Users can choose from a variety of mining contracts based on their budget and preferences.

5. Global Compliance: Leading platforms like Hashbitcoin and SmartMine USA operate in legally regulated jurisdictions, ensuring safety and transparency for users.

How to start the cloud mining journey in 2026

1. Choose a Reliable Platform: Select a trusted cloud mining platform like Hashbitcoin or EcoHash Global.

2. Register and Complete KYC Verification: Secure an account and ensure compliance with regulations.

3. Claim Free Hashpower: Use the free trial hashpower provided by the platform to start mining risk-free.

4. Select the Right Mining Contract: Choose the best plan based on budget and expected returns.

5. Monitor Earnings and Withdraw: Track earnings in real-time via mobile or web dashboards, and withdraw or reinvest as needed.

Conclusion: The golden age of cloud mining has arrived

In 2026, cloud mining is reshaping the cryptocurrency industry. With advancements in artificial intelligence, the integration of renewable energy, and the convenience of mobile access, cloud mining has become an efficient, eco-friendly, and accessible way to earn cryptocurrency.

As an industry leader, Hashbitcoin stands out with its legal compliance, $15 free hashpower bonus, AI-driven mining technology, and transparent operations, making it the go-to platform for both beginners and experienced investors. Similarly, platforms like EcoHash Global, SmartMine USA, and QuantumMiner offer safe, reliable, and sustainable cloud mining services to a global audience.

Whether someone is new to cryptocurrency or a seasoned investor, cloud mining offers a low-risk and lucrative way to earn passive income.

For more information, visit the official website, and start the cloud mining journey.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

BTC climbs above $70,000 as Bernstein makes bull case

Breaking a familiar pattern, bitcoin is on the rise during the U.S. session, climbing to $70,800 after falling to just above $68,000 earlier in the day.

Bitcoin is now higher by 0.5% over the past 24 hours, with ether , XRP and solana ahead closer to 1.5% over the same time frame.

Risk assets are generally in the green on Monday, with the Nasdaq up 1% and the S&P 500 up 0.5%. Gold is ahead 1.9% to $5,075 per ounce, and silver is up 7.4% to $82.50 per ounce.

“What we are experiencing is the weakest bitcoin bear case in its history,” wrote Bernstein’s Gautam Chhugani, reiterating the firm’s $150,000 year-end price target on bitcoin.

“When all stars are aligned, [the] Bitcoin community manufactures a self-imposed crisis of confidence,” Chhugani continued. “Nothing blew up, no skeletons will unravel; [the] media is back again to write an obituary.”

“Time,” said Chhugani, “remains a flat circle on Bitcoin.”

Getting a bit more technical, Schwab’s Jim Ferraioli said it is helpful to look to bitcoin miners to determine when the bottom is in.

“Previous selloffs have usually bottomed near bitcoin’s cost of production,” said Ferraioli. “Miners with less efficient equipment will often shut down operations temporarily … We can see this in real time by watching the mining difficulty adjustment — as more miners leave the network, difficulty falls. Once it starts to rise again, that is confirmation the bottom may be in.”

Indeed, CoinDesk reported earlier that bitcoin mining difficulty just dropped by its largest amount since 2021 as at least some miners did capitulate to plunging prices.

Crypto stocks move higher

Crypto platform Bullish (BLSH) is leading the sector higher on Monday with a 14..2% gain. Other big advancers include Galaxy Digital (GLXY), up 8.2% and Circle Financial (CRCL), up 5.1%. Strategy (MSTR) is up 3% and Coinbase (COIN) 1%.

Bitcoin miners who have pivoted to AI infrastructure are posting large gains as well as Morgan Stanley initiated positive coverage on TeraWulf (WULF) and Cipher Mining (CIFR) — both are up 14%. Hut 8 (HUT), IREN (IREN) and Bitfarms (BITF) are each ahead about 7%.

Crypto World

Bitcoin & Ethereum News, Crypto Prices & Indexes

Bitcoin (CRYPTO: BTC) steadied as Wall Street opened on Monday, marking a calmer exit from an earlier burst of volatility while gold extended its march toward February highs. Traders surveyed a landscape where risk-on catalysts were scarce and liquidity appeared to coalesce around key price levels. In this environment, analysts highlighted a potential range-bound dynamic for BTC, with buyers and sellers evaluating the same technical anchors that have governed recent moves. The broader macro backdrop—dovish whispers on inflation and a wary risk appetite—helped anchor prices as investors awaited clearer directional cues.

Key takeaways

- Bitcoin is expected to bounce within a defined range, with Fibonacci levels shaping the near-term support and resistance boundaries after a spell of pronounced volatility.

- The Coinbase Premium Index briefly flipped to positive territory for the first time in four weeks, suggesting a narrowing price gap between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs.

- On-chain data point toward defensive market behavior, as mean exchange outflows spike and large holders continue accumulating coins off exchanges.

- Analysts describe a broad risk-off stance across spot, derivatives, ETFs, and on-chain indicators, reinforcing a cautious mood despite occasional shifting signals.

- Whale activity is being watched closely, with CryptoQuant noting aggressive accumulation patterns on Binance during a period of price testing near the upper range.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Neutral

Trading idea (Not Financial Advice): Hold

Market context: The current phase sits within a broader environment of liquidity questions, cautious positioning, and mixed signals from on-chain data, as traders weigh potential catalysts and macro developments that could reaccelerate price discovery.

Why it matters

The near-term trajectory for Bitcoin remains tethered to a delicate balance between selling pressure and the willingness of large buyers to step in. As BTC hovers near technical levels, traders are parsing whether current price action represents a genuine base formation or a pause before the next leg of directional movement. The combination of subdued volatility on the hourly time frame and rising on-chain activity around key levels suggests that market participants are preparing for a potential breakout—but only if liquidity and demand align at the right junctures.

On the exchange front, the Coinbase Premium Index’s move back into positive territory, albeit briefly, adds texture to the narrative. The metric, which tracks the relative pricing between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs, has historically offered a rough proxy for where demand is strongest across major venues. A short-lived positive reading can signal shifting demand dynamics or a reevaluation of where liquidity will materialize first in a range-bound regime. Yet observers caution that a temporary tilt does not guarantee a sustained updraft, especially when broader risk-off signals persist elsewhere in crypto markets.

From an on-chain perspective, CryptoQuant documented a notable intake of coins away from exchange wallets, a classic hallmark of accumulation by large holders during periods of price consolidation. The narrative—described in the Quicktake piece as “accumulation during capitulation”—frames current activity as a potential precursor to a support base that could anchor prices if demand steadies. In tandem, the two-week moving average of mean exchange outflows reached 13.3 BTC per withdrawal on Feb. 8, a level that underscores the scale at which investors have been moving coins off centralized venues. Taken together, these signals hint at a more nuanced dynamic than simple momentum-driven moves, where hedging and reserve-building among market participants may provide a floor even as sentiment remains cautious.

“The market is currently witnessing a classic ‘accumulation during capitulation’ scenario,” CryptoQuant analysts wrote, noting that while sentiment remains fearful, the surge in mean exchange outflows points to active buying by large players.

“While sentiment is fearful, the sharp rise in the Mean Exchange Outflow confirms that large-scale investors are aggressively buying and withdrawing Bitcoin, signaling potential support formation at these levels.”

Beyond BTC alone, industry watchers pointed to a persistent risk-off tone across the ecosystem. Glassnode’s Market Pulse characterized conditions as defensive across spot, derivatives, ETFs, and on-chain indicators, noting compressed profitability and negative capital flows alongside elevated hedging demand after recent repricing. While some signals hint that selling pressure could be moderating, analysts emphasized that a durable rebound would likely require renewed spot demand capable of lifting prices above recent lows. The overall mood, while not uniformly bearish, remains cautious, with players calibrating risk management and liquidity considerations as macro narratives continue to evolve.

In the background, gold referenced a similar tension in risk appetite, continuing a broader push toward safe-haven assets as investors weigh the trajectory of rates and inflation expectations. The precious metal’s move toward new month-to-date highs provided a contrasting backdrop to crypto markets, highlighting the ongoing interplay between traditional assets and digital markets in a mixed macro environment.

What to watch next

- BTC price action around the defined Fibonacci levels: watch for a decisive break above or below current bands to confirm the range-bound thesis or signal a breakout.

- Movement in the Coinbase Premium Index: a sustained positive reading or a reversion could provide early hints about shifting exchange demand dynamics.

- On-chain accumulation signals: monitor changes in mean exchange outflow and large-holder activity that could indicate loosening or tightening supply pressure.

- Glassnode Market Pulse updates: any shift toward risk-on indicators or renewed profit-taking could influence near-term sentiment and liquidity flows.

Sources & verification

- TradingView BTCUSD price data on the BITSTAMP feed used to gauge volatility and range formation.

- CryptoQuant: Coinbase Premium Index data showing the index behavior around February 2026.

- CryptoQuant Quicktake: Bitcoin Aggressive Whale Accumulation on Binance and related discussion of capitulation-era accumulation patterns.

- Glassnode: Market Pulse report for February 2026, describing risk-off conditions across spot, derivatives, ETFs, and on-chain metrics.

- Public posts on StefanB’s X feed and CW8900’s tweet, illustrating trader sentiment and real-time micro-structure signals in BTC volatility and liquidity.

Bitcoin price action in a quiet range as momentum ebbs

Bitcoin (CRYPTO: BTC) has settled into a quiet framework after an eventful period, with price momentum cooling as traders await catalysts that could tip the balance toward a new trend. The market’s current complexion leans toward a defined range, with technical observers identifying Fibonacci retracement levels as the principal scaffolding around which near-term price action is likely to rotate. The absence of a clear directional impulse has encouraged participants to posture for a breakout or a sustainable pullback, depending on which side of the spectrum liquidity and demand prefer to emerge.

Analysts on X and other analytics platforms have highlighted a convergence of signals that are consistent with a cautious, range-bound stance. A notable commentary from StefanB underscored the idea that the market might be building liquidity into critical levels, a scenario often observed after episodes of elevated volatility. In practical terms, that means traders are watching price action near well-defined support and resistance horizons, waiting for a decisive move that could establish a new baseline for the next leg of the cycle. As the price slices through these thresholds, a sustained shift in volatility could either validate the range-play hypothesis or usher in a fresh wave of liquidity that drives BTC beyond the current confines.

On-chain data contribute a complementary perspective. The Coinbase Premium Index’s recent move into positive territory, even if temporary, points to a shifting balance of demand across major venues. The metric’s trend, combined with CryptoQuant’s discussion of aggressive whale accumulation on Binance, paints a more nuanced picture than simple speculation about price—one in which large players appear to be consolidating positions in preparation for potential price resilience. The argument for accumulation is reinforced by the reported rise in mean exchange outflows, a signal that investors are methodically removing coins from centralized exchanges to reduce selling pressure and preserve optionality as prices test nearby resistance.

Still, the broader market mood remains cautious. Glassnode’s Market Pulse notes that profitability across spot and derivatives has been compressed and hedging demand remains elevated, underscoring the fragility of any optimistic takeaway. In this environment, even as some indicators hint at underlying support, the absence of robust spot-driven demand means any upside may depend on a convincing uptick in risk appetite or a surprising development in macro data that redefines the risk-reward calculus for crypto assets.

Gold’s ongoing strength adds a macro layer to the discussion. As bullion tests new highs for the month, investors are reminded of the complex interplay between traditional assets and digital markets. The current cross-currents—ranging from inflation expectations to liquidity dynamics—highlight why BTC’s trajectory remains highly context-dependent, with a broad spectrum of catalysts capable of reshaping investor positioning in the short to medium term. The narrative continues to emphasize caution and disciplined risk management, even as people remain vigilant for a breakout that could unlock a fresh phase of price discovery.

//platform.twitter.com/widgets.js

Crypto World

Why Bitcoin Crashed Over 10% in One Week

Despite BTC’s rebound from a brief dip to $60,000, retail investor sentiment remains firmly in the “extreme fear” zone.

The crypto market went through another round of wild swings in early February after Bitcoin suddenly plunged to the low-$60,000s in just a few hours on Feb. 5, dragging the rest of the market down with it, before bouncing back to near $70,000.

As of Monday morning, the largest cryptocurrency by market cap is trading around $68,860, down 3.2% in the past 24-hours and almost 12% over the past seven days.

Data from Coinglass shows more than $2 billion in leveraged crypto positions were liquidated in that short window on Thursday, mostly made up of long bets forced to close as prices fell. That wave of automatic selling pushed the slide further than fundamentals alone would suggest.

Jeff Park, a Bitwise portfolio manager, suggested on X on Thursday evening that a lot of the indiscriminate selling seemed to come from multi-strategy hedge funds running delta-hedged trades “possibly with growth equity correlations spillovers.”

Hello from Hong Kong

Parker White, chief investment officer at DeFi Development Corporation, wrote in an X post several hours after Park that the market crash was probably triggered by the sudden collapse of Hong Kong hedge funds, as The Defiant previously reported.

Those funds held call options in IBIT, BlackRock’s spot Bitcoin exchange-traded fund and one of the largest in the market, which saw about $10.7 billion in trading that day — nearly double its previous record — with roughly $900 million in options premiums changing hands.

White suggested that Asia-based hedge funds had run a leveraged IBIT options trade funded in yen, added more leverage after losses, got hit by funding costs and silver trades, and then the final Bitcoin move triggered the collapse.

“We know that Asian traders, particularly in China, have been deeply involved in the Silver and Gold trade. Silver was down 20% today, which was the 2nd largest 1 day move in a very long time (largest on Jan 30). We also know that the JPY carry trade has been unwinding at an increasingly rapid pace,” White wrote.

But if the liquidation actually happened, it won’t show up in 13F filings — quarterly reports that disclose institutional holdings — until 45 days after the quarter ends, so mid‑May is the earliest the full picture could emerge.

Tanisha Katara, founder of Katara Consulting Group, echoed the sentiment, noting in commentary for The Defiant that institutional products like ETFs can accelerate both rallies and sell-offs.

She noted that U.S. spot Bitcoin ETFs, which provide streamlined access to the crypto market for large financial players, are now also net sellers, showing that having a way in doesn’t guarantee long-term commitment. Katara told The Defiant:

“The digital gold narrative has been conclusively debunked by this cycle. Like Gold is up 72% while Bitcoin is down 28% over the same period. What’s left is the infrastructure thesis: stablecoins, tokenisation, DeFi primitives, governance systems, and programmable money.”

Adding to the chaos, South Korea’s Bithumb mistakenly gave away thousands of BTC during a promotion, briefly sparking heavy local selling, though the exact amount of dumped tokens remains unclear.

As The Defiant reported earlier, users rushed to cash out their accidentally airdropped BTC and offramp funds, briefly sending the price of Bitcoin on Bithumb almost 18% below market price across other exchanges globally.

The mishap already prompted South Korea’s Financial Supervisory Service to warn it will tighten oversight and impose tougher penalties on financial firms.

Further Declines Ahead

As crypto struggles, other global risk assets are also unstable. Kyle Rodda, senior financial market analyst at Capital.com, explained in commentary shared with The Defiant that “everything is the one trade in the markets right now,” with fundamentals acting more as triggers than as main drivers of daily swings.

“The week ahead will also be dominated by U.S. data, with a batch of inflation figures and Non-Farm Payrolls data released in coming days after the latter was delayed by the partial US Government shutdown. The narrative is less pronounced given the resilience of U.S. economic activity recently, but the markets continue to try and balance signs of a sluggish labour market with sticky prices,” Rodda added.

Georgii Verbitskii, founder of crypto investment app TYMIO, told The Defiant that the sell-off also reflected long-term holders trimming exposure. He noted that Bitcoin’s inflation-hedge narrative was being questioned short-term, and predicted that the market would likely go lower:

“At this point, I don’t see strong catalysts for the upside. Most likely, Bitcoin will spend some time ranging between $55,000 and $67,000, possibly slightly higher. Looking further out, a deeper move toward the low $40,000s can’t be ruled out over the course of the year — especially given that 2026 is shaping up to be a challenging period across global markets.”

Speaking with The Defiant, Ryan Li, CEO of Surf, an AI tool built for crypto, pointed out that sentiment among retail investors is “extremely low right now, firmly in ‘extreme fear’ territory and on par with the November lows.”

Data from the Greed & Fear Index shows that even with Bitcoin bouncing back to $70,000 over the past 24 hours, investors are indeed still stuck in “extreme fear.”

Crypto World

Crypto market on edge as China asks banks to dump US Treasuries

The crypto market remained on edge on Monday, Feb. 9, as the recent recovery faltered, and after China continued to decouple from the U.S.

Summary

- The crypto market remained under pressure on Monday as US government bond yields rose.

- China asked banks and other financial services in the country to reduce their exposure to U.S. debt.

- The futures open interest in the crypto industry continued to fall, while the Fear and Greed Index retreated.

Bitcoin (BTC) retreated below the key support level at $70,000, while the market capitalization of all tokens fell by 2.75% in the last 24 hours. The Crypto Fear and Greed Index remained in the extreme fear zone, while positions worth over $356 million soared to $356 million.

China urges banks to reduce exposure to US Treasuries

Bitcoin and the broader crypto market retreated on Monday as other risky assets pulled back. Futures tied to the Dow Jones and the Nasdaq 100 Index also retreated, paring back some of the gains made on Friday.

This price action happened as Chinese regulators asked financial institutions, including banks, to reduce their exposure to U.S. Treasuries. It also urged those with a high exposure to these assets to reduce them.

According to Bloomberg, the new measures have been framed as a way to diversify their risks rather than the ongoing geopolitical tensions between the two economies. Officials are worried that higher holdings of US Treasuries may expose these companies to higher volatility in the future.

China’s government has also continued selling its own US government bonds in the past few years. It now holds $682 billion in US Treasuries, down from over $1 trillion a few years ago.

Worse, some European governments also considered using their large holdings of U.S. Treasury securities as leverage during the recent Greenland crisis. Many European countries, such as the United Kingdom, Belgium, and Luxembourg, hold trillions of U.S. dollars in bonds.

Continued selling of U.S. Treasuries as the government debt has jumped, is one reason why long-term bond yields and gold prices have soared in the past few years. The 30-year rose to 4.90%, while the gold price jumped to above $5,000 as the rally continued.

Crypto Fear and Greed Index remains in the fear zone

Crypto market traders are still fearful that the recent plunge will resume. For one, the Crypto Fear Index has dropped to the extreme fear zone of 9.

The volume in the crypto industry has also dropped sharply in the past few days. According to CoinMarketCap, trading volume dropped 12% over the last 24 hours to $100 billion.

Most importantly, futures open interest has retreated to $96 billion, down from last year’s high of over $255 billion. Falling futures open interest is a sign that investors are continuing their deleveraging, which often leads to lower crypto prices.

Crypto World

Bitcoin price low-volume bounce raises bull trap concerns

Bitcoin’s price has bounced from key support near $60,000, but declining volume and rising overhead resistance are raising concerns that the move may be a bull trap rather than a sustainable recovery.

Summary

- $60,000 support sparked the bounce, but demand remains weak

- Low volume and VWAP/Fibonacci rejection, signal fragile upside

- Acceptance below the point of control, favors rotation back toward support

Bitcoin (BTC) price action has staged a short-term rebound after successfully retesting a major high-timeframe support level near $60,000. While the bounce initially appeared constructive, deeper analysis reveals that the move higher has lacked strong participation.

Declining volume during the rally suggests that bullish momentum remains fragile, increasing the probability that the recent upside is corrective rather than trend-defining.

Bitcoin price key technical points

- $60,000 support has held, triggering a short-term bounce

- Rising price on declining volume, signaling weak bullish conviction

- Rejection at VWAP and 0.618 Fibonacci, reinforcing local resistance

From a volume profile perspective, Bitcoin’s recent advance has occurred on noticeably declining volume. In healthy bullish reversals, price expansion is typically accompanied by increasing participation, reflecting strong demand and conviction from buyers. In contrast, the current rally lacks this confirmation, suggesting the move may be driven by short-covering or opportunistic buying rather than sustained accumulation.

This type of low-volume bounce often appears during corrective phases within broader bearish or range-bound environments. Without renewed volume expansion, the probability of follow-through remains limited, leaving price vulnerable to renewed selling pressure.

Rejection from key resistance levels

Technically, Bitcoin is now facing a strong confluence of resistance. The current rejection is occurring near the 0.618 Fibonacci retracement of the recent decline, an area that often acts as a decision point in corrective rallies. This level is reinforced by VWAP resistance, drawn from the recent swing high prior to the series of sharp sell-offs.

The combination of Fibonacci resistance and VWAP creates a high-probability supply zone. Price rejection from this area, particularly on weak volume, strengthens the case that sellers remain active and willing to defend higher levels.

Acceptance below the point of control

Another important development is Bitcoin’s inability to hold above the local point of control (POC). The POC represents the price level at which the highest trading volume has occurred and often serves as a market balance point.

Finding acceptance below this level suggests that sellers are regaining control and that the market is transitioning back into imbalance. Historically, acceptance below the POC following a low-volume rally increases the likelihood of a rotational move lower, especially when broader structure remains bearish or neutral.

Range rotation likely to continue

From a market structure perspective, Bitcoin appears to be trading within a developing high-timeframe range. The lower boundary of this range is defined by the $60,000 support, while the upper boundary sits near $76,200. Until price can break above resistance with strong volume confirmation, rotations within this range remain the higher-probability outcome.

Given the current rejection and lack of bullish participation, the probability favors a move back toward the lower end of the range. A rotation toward $60,000 would be consistent with range behavior and would test whether buyers can continue to defend this critical support.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin’s recent bounce shows signs of weakness. The combination of declining volume, rejection from key resistance, and acceptance below the point of control raises the risk that the move higher is a bull trap.

If selling pressure increases, Bitcoin is likely to rotate back toward the $60,000 region to retest high-timeframe support. A strong reaction from this level would keep the broader range intact, while failure to hold could expose deeper downside risk.

Crypto World

BMNR stock slowly preps rebound as key Ethereum metrics soar

The BMNR stock price hovered at the crucial support level of $20 as BitMine continued to accumulate Ethereum, and its fundamentals improved.

Summary

- BitMine’s stock price has formed a falling wedge pattern, pointing to a rebound.

- Data shows that Ethereum’s transactions and network fees have soared recently.

- The supply of ETH tokens in exchanges has continued falling this month.

BitMine stock has retreated by over 85%from its highest level in July last year. It is also slowly forming the highly bullish falling wedge pattern, pointing to a strong rebound.

In a statement, Tom Lee’s BitMine said that it continued to buy Ethereum (ETH) tokens last week, bringing its total holdings to over 4.326 million. It also holds 193 Bitcoin (BTC) and nearly $600 million in cash. Its other assets include $200 million in Beast Industries and $19 million in Eightco Holdings, a company that has invested in Worldcoin.

BitMine stock may ultimately benefit from Ethereum’s fundamentals, which have continued improving in the past few months, with third-party data showing relentless growth. Ethereum transactions, fees, and active addresses have continued to soar over the past few months, a trend that has accelerated after the Fusaka upgrade.

More data show that the amount of staked Ethereum continues to rise. The staking queue has jumped to over 4 million coins, with entry rising to over 70 days. Rising staking inflow is a sign that demand continues rising.

At the same time, data show that the supply of ETH tokens on exchanges has continued to fall and is now at its lowest level since 2016.

BMNR stock price prediction: Technical analysis

The daily timeframe chart shows that the BitMine stock price has been in a strong downward trend in the past few months. It plunged from a record high of $160 to the current $20.

On the positive side, the coin has formed a falling wedge pattern, which consists of two descending and converging trendlines.

This wedge is nearing its confluence, which could lead to a rebound soon. Also, the Relative Strength Index has moved from the oversold level of 30 to the current 32.

Therefore, the stock will likely have a strong bullish breakout in the coming days, potentially to the key resistance level at $35, its highest level in January this year.

On the other hand, a move below the lower side of the wedge will point to more downside in the near term.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat20 hours ago

NewsBeat20 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports15 hours ago

Sports15 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat10 hours ago

NewsBeat10 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know