Crypto World

XRP price forecast: bulls falter amid fresh bearish sentiment

- XRP price dropped to $1.35 as selling pressure resumed.

- Bears have pushed Bitcoin back under $68k and altcoins are mirroring the decline.

- Short-term, bearish sentiment could trigger a sell-off to $1 or lower.

XRP continues to face bearish pressure as the latest attempts to establish an upside momentum stall, with prices down 14% in the past week.

In early trading on Wednesday, the Ripple cryptocurrency fell to lows of $1.35, extending its pullback from recent highs following a retest of $1.53.

The waning upside momentum suggests a potential further downside for the altcoin, whose performance mirrors the renewed selling pressure currently throttling Bitcoin and Ethereum bulls.

As of writing, market metrics showed derivatives data largely bearish, with retail traders signalling their downbeat perspective through dwindling XRP futures Open Interest.

Massive liquidations, most of which have been lopsided against longs, add to the retail indecision.

XRP price technical outlook

XRP’s struggles align with a cautious crypto environment. Bitcoin’s failure to hold above $70k means widespread selling that hasn’t spared top altcoins like XRP.

Technical indicators for XRP price, such as fading RSI, highlight potential weakness. If buyers fail to reclaim $1.50 and target $2.00, XRP risks testing key support levels near $1.22 and $1.13.

Conversely, breaking $2 might flip sentiment and allow bulls to target the $2.75 resistance level. The falling wedge pattern on the 4-hour chart signals such a breakout.

XRP price: likely bullish catalysts?

US XRP ETF demand has faded in recent weeks, while technical indicators highlight bears’ control.

Despite the gloom, several catalysts could spark a reversal for XRP holders.

Regulatory developments, particularly ongoing efforts to pass the Clarity Act, could be a key driver of crypto market sentiment.

A spike in adoption amid further regulatory clarity will cascade to XRP.

Whale accumulation also continues to ramp up as large holders add to positions.

This shows conviction and has the short-term effect of stabilizing prices ahead of what analysts see as an inevitable broader market recovery.

Stablecoin growth on the XRP Ledger adds another layer of utility, drawing institutional interest and increasing network activity.

DeFiLlama data shows that while DeFi TVL has declined, stablecoin market cap has jumped from around $331 million in early February to over $418 million as of writing.

Amid usage for XRPL, Ripple USD is also gaining traction.

Ripple has entered various partnerships aimed at tokenising traditional fund structures on the XRP Ledger, one of the moves set to accelerate growth.

Meanwhile, spot exchange-traded fund inflows have cooled in recent weeks. However, cumulative net inflows have topped $1.2 billion, and could explode when sentiment flips.

Crypto World

Pudgy Penguins Hit WIth Trademark Suit Over Merch

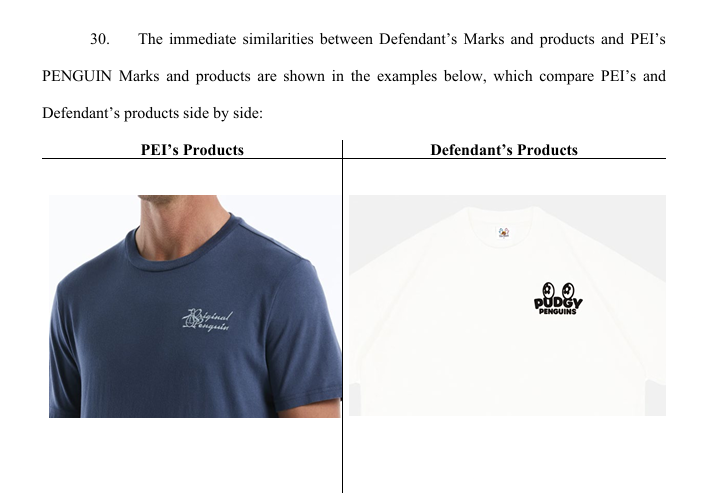

PEI Licensing, the firm behind the clothing brand Original Penguin, has filed a lawsuit against the nonfungible token project Pudgy Penguins, alleging trademark infringement, dilution and unfair competition.

The lawsuit, filed in a Florida federal court on Wednesday, focused on claims around Pudgy Penguins’ apparel, accusing the company of using a “family of penguin trademarks that are confusingly similar” to its own.

“This action results from Defendant’s unauthorized use and attempted registration of various PENGUIN word and design trademarks in connection with apparel and related goods and services that are confusingly similar to PEI’s federally registered and famous PENGUIN and penguin design trademarks,” PEI said in its complaint.

PEI claimed in its lawsuit that it has used the “PENGUIN word mark at least as early as 1967” and first used a “penguin design” on apparel as early as 1956.

PEI Licensing said that it sent a cease and desist to Pudgy Penguins in October 2023, claiming its “products infringe and dilute PEI’s famous PENGUIN Marks.”

The letter also demanded that Pudgy Penguins abandon applications with the US Patent and Trademark Office “to register various PENGUIN marks,” according to the lawsuit.

PEI claimed that Pudgy Penguins had “misappropriated valuable property rights of PEI,” which was “likely to cause confusion or mistake, or to deceive members of the consuming public.”

PEI asked the court to order the USPTO to reject Pudgy Penguins’ applications and stop the company from allegedly infringing on its trademark.

Related: SEC ends case against Justin Sun with $10M settlement

It also requested that Pudgy Penguins be ordered to destroy any products found “likely to be confused” with PEI’s trademarks and be awarded all profits from the sales of such products.

Pudgy Penguins’ legal chief, Jennifer McGlone, told Cointelegraph the company “was surprised by the action, particularly as both parties had been engaged in productive discussions to resolve this matter privately.”

McGlone said the company had advanced applications with the USPTO and was “confident that PEI’s claims lack merit. The trademarks in question are visually distinct and serve entirely different audiences and markets.”

“We have the utmost confidence that we will prevail as Pudgy Penguins has already secured multiple trademark application approvals from the USPTO covering the Pudgy Penguins brand and related marks,” she said.

Meanwhile, the Pudgy Penguins X account posted a meme implying that its brand bears no similarities with Original Penguin.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Vancouver’s Bitcoin ambitions face setback as staff urge council to drop plan

City officials in Vancouver are recommending that councillors abandon a proposal to integrate Bitcoin into municipal financial strategy, dealing a potential blow to a high-profile initiative championed by Mayor Ken Sim.

Summary

- Vancouver city staff recommend council drop Mayor Ken Sim’s proposal to explore making the city “Bitcoin-friendly.”

- The motion previously sought to examine accepting Bitcoin payments and potentially adding the asset to municipal reserves.

- Officials cited regulatory limits, financial risks, and operational challenges as reasons to halt further work on the proposal.

Vancouver staff throw cold water on the mayor’s Bitcoin city proposal

According to a staff report prepared for the Vancouver City Council meeting on March 10, officials advised councillors not to proceed with the mayor’s earlier motion to explore making Vancouver a “Bitcoin-friendly city.”

The proposal originally directed city staff to examine whether the municipality could incorporate Bitcoin into financial operations, including accepting cryptocurrency payments for municipal services or potentially allocating a portion of city reserves to digital assets.

The report outlines concerns related to regulatory authority, financial risk, and operational feasibility, ultimately recommending that council take no further action on the motion.

Sim first introduced the proposal in December 2024, arguing that Bitcoin could help protect the purchasing power of municipal funds amid inflation and economic uncertainty. The motion also framed the initiative as a way to position Vancouver as a global hub for blockchain innovation.

However, city staff said the proposal raises significant legal and policy issues under current municipal frameworks. Existing legislation governing local governments in British Columbia does not currently allow municipalities to hold or transact in cryptocurrencies as part of their financial management strategies, according to the report.

The recommendation comes after months of debate over the risks and potential benefits of integrating digital assets into public sector finance. Critics have argued that the volatility of cryptocurrencies could expose taxpayer funds to unnecessary risk, while supporters have promoted Bitcoin as a potential hedge against inflation.

The report will now be considered by Vancouver’s city council, which must decide whether to formally drop the proposal or pursue further analysis despite staff concerns.

If adopted, the recommendation would effectively halt the mayor’s push to explore Bitcoin’s role in the city’s financial reserves and payment systems.

Crypto World

Ethereum Founder Vitalik Buterin Calls for Bold Rethink of Crypto Applications

TLDR:

- Vitalik Buterin calls for radical Ethereum application redesign while protecting core network security guarantees.

- Ethereum founder says AI may replace traditional crypto wallets and reshape how users interact with blockchain apps.

- Privacy now ranks alongside censorship resistance and security as a foundational Ethereum network principle.

- Buterin urges developers to rethink DeFi, oracles, and layer-2 roles using a first-principles approach.

Ethereum co-founder Vitalik Buterin has urged developers to rethink how applications operate across the network.

He said Ethereum must remain firm on its core principles while exploring new approaches at the application layer. His comments point to changes in privacy, artificial intelligence integration, and decentralized finance design.

The remarks arrive as developers debate Ethereum’s long-term architecture and its relationship with emerging technologies.

Vitalik Buterin Pushes Ethereum Developers to Rethink Crypto Applications

Buterin said Ethereum must keep its fundamental properties intact despite rapid technological shifts. He listed censorship resistance, open source development, privacy, and security as non-negotiable network principles.

He warned against uncertainty around the base layer’s guarantees. According to his post on X, developers must maintain trustless verification tools such as light clients.

At the same time, he urged the community to adopt a more experimental approach to applications. Ethereum’s ecosystem, he said, should reconsider existing assumptions about user interfaces and platform design.

Artificial intelligence formed a central theme in his comments. Buterin suggested AI systems could replace traditional crypto wallet interfaces within a year.

He noted that AI tools may reshape how users interact with blockchain software. Instead of discrete applications, AI agents may guide users through a continuous interaction layer.

According to Buterin, such changes could transform how developers build services on Ethereum. Applications may become modular systems that users assemble dynamically.

Ethereum Privacy and Layer-2 Strategy Take Center Stage

Buterin also emphasized the importance of privacy across Ethereum’s application stack. He said the ecosystem increasingly treats privacy as a core security property.

That shift could lead developers to rebuild large parts of the Ethereum software stack. Current infrastructure rarely prioritizes privacy at every layer.

He also pointed to growing work around private networking technologies. Several Ethereum Foundation initiatives focus on improving privacy across network communications.

Decentralized finance design also appeared in his discussion. Buterin suggested some DeFi systems could evolve into universal futures markets built on reliable decentralized oracles.

He proposed that oracles could combine cryptographic proofs with artificial intelligence models. These systems may verify data from trusted news sources using privacy-preserving technologies.

The Ethereum founder also encouraged the community to reconsider the role of layer-2 networks. He said developers should reassess which L2 designs best complement Ethereum’s base layer.

Buterin framed the discussion as a broader cultural shift within the ecosystem. Developers, he said, should challenge existing assumptions and rebuild applications from first principles.

Crypto World

Solana Payment Volume Surges 755% as Visa, Stripe, and Western Union Go Onchain

TLDR:

- Solana’s TPV rose 755.3% YoY, nearly tripling the 268.24% median rate among fintech and L1 peers.

- Visa’s USDC pilot on Solana surpassed $3.5B in annualized volume; Worldpay cut processing times by 50%.

- Western Union’s USDPT stablecoin launches in 2026 to replace pre-funded accounts for 500K+ agents.

- Huma Finance hit $8.9B in transaction volume in 2025, replacing SWIFT with 24/7 onchain settlement.

Solana’s payments ecosystem posted explosive growth in the past year.

Total Payment Volume on the network climbed 755.3% year-over-year, according to a new Messari report. That figure nearly triples the median growth rate of 268.24% recorded across comparable fintech and blockchain platforms.

Global financial heavyweights, including Visa, Stripe, Worldpay, and Western Union, now use Solana as a live settlement layer.

Institutional Giants Bet on Solana’s Payment Rails

The institutions moving onto Solana are not experimenting quietly. Visa’s USDC pilot on the network has already surpassed $3.5 billion in annualized volume.

Worldpay cut its processing times by 50% after adopting the Global Dollar Network, known as USDG, for settlement. Solana hosts 57% of all USDG issuance, reflecting the network’s capacity to handle high-frequency institutional flows.

Fiserv, which processes payments for roughly 10,000 financial institutions globally, announced its own stablecoin on Solana called FIUSD. The move targets both its banking clients and merchant network.

Western Union is also building directly on the chain. The company plans to launch a stablecoin called USDPT in 2026, aiming to eliminate pre-funded accounts and cut international transfer costs for its 500,000-plus retail agents worldwide.

Stripe and Revolut are also part of the expanding ecosystem flagged in the Messari report.

PayPal’s dollar-backed token, PYUSD, reached a market cap of $834.7 million on Solana as of February 2, 2025. That marked a 500.9% year-over-year increase, driven by merchant integrations and a 4% reward rate offered to users.

Gusto launched a pilot in January 2026 to send instant USDC payouts to contractors for over 400,000 businesses. The integration, built with Zero Hash, targets the 11% of U.S. small and midsize businesses that hire international workers.

Traditional wire transfers take three to seven days. Solana settles in milliseconds.

Why Solana’s Infrastructure Attracts High-Volume Payments

The network’s technical profile explains much of the institutional interest.

Solana’s median block time sits at 392 milliseconds, with a median transaction fee of $0.0004, per the Messari data. That combination makes it viable for high-frequency, low-margin payment use cases that legacy rails cannot handle economically.

Legacy systems like SWIFT and ACH were built before the internet and depend on correspondent banking chains.

Settlement delays of multiple days trap trillions in pre-funded accounts globally. Solana merges messaging and settlement into one atomic step, removing that intermediary layer entirely.

Huma Finance recorded $8.9 billion in transaction volume during 2025, a 232% year-over-year jump.

Following its merger with Arf, the protocol originated $3.8 billion in onchain credit. It now replaces SWIFT settlement for global business payments with 24/7 stablecoin transfers.

Solana also hosts state-backed stablecoin pilots from Wyoming, Kazakhstan, and Bhutan. The Messari report places the network at the center of a payments stack that spans neobanks, digital wallets, treasury tools, and cross-border infrastructure.

Crypto World

Strategic Roadmap to Successful Metaverse Gaming Platform Development

AI Summary

- The blog post discusses the shift in the gaming industry towards metaverse gaming platforms, which offer persistent virtual ecosystems where players interact, trade assets, and participate in shared economies.

- Unlike traditional games, metaverse platforms operate as continuous worlds that evolve even when players are offline.

- The post details the key characteristics and components of metaverse gaming platforms, including the necessary technology stack for development.

- It emphasizes the importance of NFT integration, infrastructure requirements, monetization strategies, and enterprise use cases for metaverse platforms.

- The post also explores emerging trends in metaverse gaming platform development, such as interconnected ecosystems, AI-driven environments, creator economies, cross-platform accessibility, and tokenized digital ownership.

The gaming industry is moving beyond standalone titles toward persistent virtual ecosystems. Modern players expect digital ownership, interconnected worlds, and evolving economies that extend far beyond a single gameplay session. This shift is driving demand for metaverse gaming platform development.

Unlike traditional games, metaverse gaming platforms operate as persistent digital environments where users interact, trade assets, build communities, and participate in shared economies. These platforms require robust infrastructure, carefully designed architecture, and secure systems for asset ownership.

For enterprises and gaming studios entering this space, building a metaverse gaming platform is not simply about creating a game. It involves designing scalable ecosystems that support thousands or even millions of users interacting in real time.

Understanding the architecture and NFT integration behind these platforms is essential for building sustainable metaverse ecosystems.

Why Metaverse Gaming Platforms Are Different from Traditional Games

Traditional games are typically session-based experiences. Players log in, complete objectives, and exit the game environment. Metaverse gaming platforms, however, function as persistent worlds that continue evolving even when individual players are offline.

This difference introduces new technical requirements.

Metaverse platforms must support continuous interactions between users, assets, and virtual environments. They also enable economic activities such as asset trading, virtual land ownership, and NFT-based collectibles.

As a result, the development approach shifts from building isolated game mechanics to designing interconnected digital ecosystems. Key characteristics of metaverse gaming platforms include:

- Persistent virtual environments

- Player-driven economies

- Digital asset ownership

- Social interaction layers

- Interoperable game assets

- Continuous platform evolution

These features require specialized metaverse gaming platform architecture capable of supporting complex interactions at scale.

Core Components of a Metaverse Gaming Platform

A successful metaverse gaming platform is built on multiple interconnected systems working together to support gameplay, economy, and infrastructure. Important components include:

1. Virtual World Engine

This is the environment where players interact. It includes world-building tools, physics engines, and rendering systems that create immersive digital spaces.

2. Multiplayer Interaction Systems

Metaverse platforms must support thousands of concurrent users interacting within the same environment. Real-time networking infrastructure ensures smooth communication between players and servers.

3. Asset Management Systems

Digital items such as avatars, skins, equipment, and virtual land must be securely stored and transferable between players.

4. Economy and Marketplace Infrastructure

Virtual marketplaces enable players to trade assets, purchase upgrades, and participate in digital economies.

5. Identity and Authentication Systems

User identity management is critical for secure ownership of assets and personalized gameplay experiences.

Each of these components contributes to the stability and scalability of a metaverse gaming platform.

Metaverse Gaming Platform Architecture

Building a scalable metaverse platform requires layered architecture designed to manage both gameplay and blockchain interactions. A typical metaverse gaming platform architecture includes the following layers:

1. Experience Layer

This is the player-facing interface that includes:

- Game clients (mobile, PC, web)

- User interface systems

- Avatar customization

- Social interaction features

It is responsible for delivering immersive gameplay and seamless user interaction.

2. Game Logic Layer

The game logic layer controls gameplay mechanics, rule enforcement, and interaction logic. This includes:

- Quest systems

- Progression mechanics

- Player interactions

- Game physics

- Event triggers

Efficient game logic design ensures fair gameplay and consistent performance.

3. Blockchain Integration Layer

Blockchain infrastructure enables secure digital ownership within the metaverse ecosystem. Key components include:

- Smart contracts for asset ownership

- NFT minting systems

- Token-based reward mechanisms

- Wallet integration

This layer ensures that digital assets remain transparent, verifiable, and transferable.

4. Data and Infrastructure Layer

The infrastructure layer supports scalability and performance through systems such as:

- Distributed databases

- Cloud hosting environments

- Real-time communication servers

- Load balancing systems

Without reliable infrastructure, metaverse platforms cannot support large-scale user activity.

Planning to Build a Futuristic Metaverse Gaming Platform?

Technology Stack Used in Metaverse Gaming Platform Development

Metaverse gaming platform development requires a combination of game engines, blockchain infrastructure, cloud systems, and real-time networking technologies. The technology stack must support persistent virtual worlds, large-scale user interactions, and secure digital asset ownership. Choosing the right stack directly affects platform performance, scalability, and long-term sustainability. Below are the major technology layers commonly used in metaverse game development.

1. Game Engine and Rendering Layer

Game engines power the virtual environment, physics systems, and real-time graphics rendering of the metaverse platform. Common engines used include:

- Unity – widely used for cross-platform metaverse environments

- Unreal Engine – ideal for high-fidelity immersive worlds

- WebGL-based engines – used for browser-accessible metaverse platforms

These engines enable the creation of interactive environments, avatar systems, and multiplayer experiences across multiple devices.

2. Blockchain Infrastructure Layer

Blockchain technology enables decentralized ownership and secure asset management within metaverse ecosystems. Some of the commonly used blockchain networks include:

- Ethereum – widely adopted for NFT ecosystems

- Polygon – lower transaction costs for gaming platforms

- BNB Chain – scalable infrastructure for Web3 gaming

- Avalanche – high-performance blockchain for gaming ecosystems

These networks support smart contracts, NFT minting systems, and tokenized digital economies.

3. NFT and Digital Asset Layer

NFT standards define how digital assets are created, stored, and traded within the metaverse platform. Typical implementations include:

- ERC-721 for unique NFT assets

- ERC-1155 for semi-fungible game items

- NFT metadata storage systems for asset attributes

- Decentralized storage solutions such as IPFS

This layer enables players to own and trade digital assets securely.

4. Backend Infrastructure Layer

Metaverse platforms rely on robust backend systems that support real-time player interactions and persistent environments. Important infrastructure components include:

- Cloud computing platforms (AWS, Azure, Google Cloud)

- Real-time multiplayer servers

- Distributed databases

- Content delivery networks (CDNs)

- Microservices architecture

These systems ensure stable performance even when thousands of users interact simultaneously.

5. Wallet and Identity Integration

Wallet systems allow players to authenticate, store assets, and perform transactions within the metaverse ecosystem. Typical integrations include:

- MetaMask

- WalletConnect

- Phantom

- Custodial wallet systems for simplified onboarding

Wallet integration must be designed carefully to ensure secure and frictionless user experiences.

6. Analytics and Economy Monitoring

Metaverse gaming platforms generate large volumes of behavioral and economic data. Analytics systems help developers monitor platform performance and maintain balanced digital economies. Analytics tools are used to track:

- Player behavior patterns

- Asset trading activity

- Token circulation

- Gameplay engagement metrics

- Economic inflation within virtual marketplaces

These insights help developers continuously optimize gameplay mechanics and platform stability.

Why Technology Stack Decisions Matter

A poorly designed technology stack can lead to performance issues, security vulnerabilities, and limited scalability. Metaverse platforms must support persistent environments and complex interactions, making architecture decisions critical from the earliest development stages.

Experienced teams specializing in metaverse gaming platform development carefully evaluate technology choices based on platform requirements, scalability goals, and user experience considerations.

Selecting the right combination of game engines, blockchain networks, and backend infrastructure ensures that metaverse platforms remain stable as user communities grow.

NFT Integration in Metaverse Games

NFT integration in metaverse games plays a central role in modern platform development. NFTs allow players to own, trade, and transfer digital assets independently of centralized control. NFTs can represent various in-game elements such as:

- Character skins

- Weapons and equipment

- Virtual land parcels

- Unique collectibles

- Avatar identities

These assets can be bought, sold, or traded in decentralized marketplaces, creating real economic value within the game ecosystem.

From a development perspective, NFT integration requires careful planning to ensure that assets remain secure, scalable, and user-friendly. Smart contracts must be designed to prevent exploits, while wallet integration must be seamless for players unfamiliar with blockchain technology.

When implemented correctly, NFT systems enable sustainable digital economies within metaverse platforms.

Infrastructure Requirements for Persistent Virtual Worlds

One of the biggest challenges in metaverse gaming platform development is supporting persistent environments that remain active at all times. Infrastructure requirements typically include:

- High-performance cloud hosting

- Real-time communication servers

- Distributed storage systems

- Scalable database architecture

- Network latency optimization

These systems must handle large volumes of player interactions while maintaining stable performance. Metaverse platforms also require analytics pipelines to monitor user behavior, economic activity, and gameplay performance. This data helps developers optimize the platform and maintain balanced digital economies.

Want to Turn Your Game Idea Into a Metaverse Gaming Platform?

Monetization and Digital Asset Economy

Metaverse gaming platforms introduce new monetization opportunities that extend beyond traditional in-game purchases. Some of the common revenue models include:

- NFT asset sales

- Virtual land ownership

- Marketplace transaction fees

- Token-based reward systems

- Subscription or access models

Unlike conventional monetization models, metaverse economies are often partially controlled by the community, creating dynamic market behavior within the platform. Designing sustainable economic systems is one of the most complex aspects of metaverse platform development.

Enterprise Use Cases for Metaverse Gaming Platforms

While the term “metaverse gaming” often evokes images of entertainment-focused virtual worlds, enterprises are increasingly exploring metaverse platforms as interactive environments for engagement, branding, and digital commerce.

Metaverse gaming platforms combine immersive gameplay with persistent digital environments, making them valuable tools for organizations seeking new ways to interact with audiences. Common use cases include:

1. Virtual Brand Worlds

Brands are launching immersive environments where users can explore virtual spaces, interact with branded experiences, and purchase digital collectibles.

These environments often function as digital extensions of real-world brands and communities.

2. Community-Driven Gaming Platforms

Gaming studios and startups are using metaverse platforms to create persistent worlds where communities can participate in events, competitions, and social activities. Players become long-term participants rather than temporary users.

3. NFT Asset Ecosystems

NFT-enabled metaverse platforms allow players to own unique digital items such as:

- Character skins

- Equipment

- Vehicles

- Virtual land

- Event access passes

These assets often have real-world trading value and can be transferred across marketplaces.

4. Virtual Economies and Creator Ecosystems

Some metaverse gaming platforms enable users to create and sell content within the virtual world. Players can design custom assets, build environments, and monetize their creations, creating self-sustaining digital economies.

For enterprises and studios, these models unlock new revenue streams and deeper engagement with user communities.

5. Security and Asset Protection

Security becomes a critical priority because players own digital assets with real value. Hence, metaverse gaming platforms must implement:

- Smart contract auditing

- Anti-cheat systems

- Fraud detection mechanisms

- Secure wallet integrations

- Data encryption protocols

A single vulnerability in smart contracts or infrastructure can compromise the entire digital economy of the platform. Professional metaverse game development teams incorporate security practices throughout the development lifecycle.

The Future of Metaverse Gaming Platform Development

Metaverse game development is still evolving. However, several emerging trends are shaping the next generation of virtual worlds.

1. Interconnected Metaverse Ecosystems

Future platforms are likely to enable interoperability between different metaverse environments, allowing assets and avatars to move across virtual worlds. This will create larger, interconnected digital ecosystems.

2. AI-Driven Virtual Environments

Artificial intelligence is increasingly being used to enhance player experiences through dynamic NPCs, personalized gameplay environments, and adaptive virtual worlds. AI systems can help maintain engagement within persistent digital spaces.

3. Creator Economy Expansion

User-generated content is expected to become a major component of metaverse gaming platforms. Players will be able to create, sell, and monetize digital assets within platform marketplaces.

4. Cross-Platform Accessibility

Metaverse platforms will continue expanding across devices including:

- Mobile devices

- Desktop systems

- VR headsets

- XR environments

Cross-platform accessibility will help metaverse platforms reach broader audiences.

5. Tokenized Digital Ownership

NFTs and blockchain-based identity systems will continue to shape how players own and manage digital assets. These systems allow players to maintain control over their virtual identities and possessions across platforms.

As technology continues evolving, metaverse gaming platforms are expected to become more immersive, interoperable, and economically sophisticated. Organizations investing in metaverse gaming platform development today are positioning themselves at the forefront of this transformation.

Partnering with a top-rated metaverse gaming platform development company like Antier brings several years of experience and technological expertise to the table, ensuring successful results.

Why Businesses Partner with a Professional Metaverse Game Development Company

Metaverse gaming platform development involves multiple technical disciplines, starting from real-time networking to blockchain infrastructure. Most enterprises lack the internal teams required to manage these complexities.

Antier, an experienced metaverse game development company, allows businesses to access specialized expertise in architecture design, blockchain integration, and large-scale platform deployment. Antier’s professional development team helps organizations reduce technical risk while accelerating time-to-market.

For enterprises exploring the metaverse opportunity, partnering with experienced developers can make the difference between launching a basic virtual environment and building a fully functional digital economy.

Frequently Asked Questions

01. What distinguishes metaverse gaming platforms from traditional games?

Metaverse gaming platforms are persistent virtual environments that evolve continuously, allowing users to interact, trade assets, and participate in shared economies, unlike traditional games which are session-based and end when players log off.

02. What are the key characteristics of metaverse gaming platforms?

Key characteristics include persistent virtual environments, player-driven economies, digital asset ownership, social interaction layers, interoperable game assets, and continuous platform evolution.

03. What are the core components necessary for a successful metaverse gaming platform?

Core components include a virtual world engine, which encompasses world-building tools, physics engines, and rendering systems to create immersive digital experiences, along with interconnected systems that support gameplay, economy, and infrastructure.

Crypto World

Altcoin Season ‘Game Is Over’: Matt Hougan

The euphoric altcoin seasons where almost every cryptocurrency rises across the market are probably not coming back, says Bitwise investment chief Matt Hougan.

“I think that game is over. I think we’ll see a non-traditional altcoin season,” Hougan said in an interview on Wednesday. “An altcoin season that rewards assets with real-world traction and real-world application.”

“I don’t think we’ll see the sort of rising tide lifts all buckets where you rotate from Bitcoin to ETH to DeFi to NFT pictures of rocks.”

Hougan said future altcoin seasons could instead see the market “rerate” certain tokens, particularly those tied to what he described as “huge businesses.”

Altcoin season likely to be “more differentiated”

“I just think it’ll be more differentiated than previous altcoin seasons,” Hougan said.

Crypto traders typically expect, based on past cycles, that Bitcoin (BTC) would first reach new all-time highs, then capital will rotate into Ether (ETH) and then into altcoins, kicking off altcoin season.

As for Bitcoin, which recently fell as low as $60,000 in February, Hougan said it was “starting to bottom and trend higher.” Bitcoin is trading at $70,237 at the time of publication, according to CoinMarketCap.

Altcoin season debate continues

The altcoin season debate has divided the crypto industry, with crypto analyst Matthew Hyland saying in November that traders should have confidence in an altcoin season arriving soon, citing the Bitcoin dominance chart as “bearish for many weeks.”

Related: 38% of altcoins near all-time lows, worse than FTX crash: Analyst

In December, BitMEX co-founder Arthur Hayes said, “There is always an altcoin season happening.”

“[If you’re] always saying altcoin season isn’t there, [it’s] because you didn’t own what went up,” Hayes said.

Crypto sentiment platform Santiment said on Wednesday that mentions of altcoins on social media reached their lowest level in two years, while indicators suggest investors are focusing on Bitcoin.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

Crypto World

Update: Stablecoin Yield Fight Threatens U.S. Crypto Market Structure Bill

TLDR:

- Stablecoin yield rules now dominate crypto market structure negotiations in the U.S. Senate.

- Coinbase withdrew support after amendments restricted stablecoin reward programs earlier this year.

- Senator Thom Tillis now holds a key vote as Senate Republicans attempt to advance the bill.

- DeFi provisions remain unresolved while lawmakers focus on stablecoin reward language.

The push to advance a U.S. crypto market structure bill faces delays as lawmakers debate stablecoin yield rules.

Discussions intensified this week after fresh legislative language circulated among key Senate offices. Negotiations now center on how crypto firms handle rewards linked to stablecoins.

The outcome could determine whether the Senate Banking Committee resumes work on the bill later this month.

Crypto Market Structure Talks Focus on Stablecoin Yield

The stablecoin yield debate now sits at the center of crypto market structure negotiations in Washington.

According to reporting shared by journalist Eleanor Terrett on X, lawmakers continue discussions after weeks of industry lobbying. The White House recently circulated draft legislative text to Senator Thom Tillis’ office.

The document followed negotiations between banking groups and crypto firms during the past month. Those talks attempted to narrow disagreements over rewards tied to stablecoin products.

Senator Tillis previously raised concerns about stablecoin yield provisions earlier this year. In January, amendments linked to him and Senator Angela Alsobrooks restricted the scope of such rewards.

Those changes later prompted Coinbase to withdraw support for the bill. The company cited the amendments among several concerns about the proposal.

Recent meetings between Tillis’ staff, industry representatives, and White House officials now seek a workable compromise. Discussions reportedly continue as both sides adjust the language.

Digital Chamber CEO Cody Carbone said conversations with Tillis have remained constructive. Industry groups expect negotiations to focus on rules both banks and crypto firms can accept.

DeFi Issues and Committee Timeline Still Unresolved

While yield dominates debate, other crypto market structure provisions remain unresolved.

Industry participants told Terrett the stablecoin issue now consumes most attention in negotiations. As a result, discussions around decentralized finance rules have slowed.

Some DeFi stakeholders say Senate Democrats recently renewed focus on those outstanding sections. They want clarity on how decentralized protocols fall under the proposed regulatory framework.

Ethics concerns also remain part of the debate inside the Senate Banking Committee. Several Democratic lawmakers continue to review potential conflicts related to digital asset policy.

Despite these hurdles, lawmakers still aim to restart the legislative process soon. Committee leaders hope to reschedule a markup once stablecoin reward language stabilizes.

The bill could still advance along party lines if Republican support holds. However, Senator Tillis’ position remains central if Democrats decline to back the measure.

Industry groups continue pushing for a vote before delays push negotiations deeper into the year. Some participants now watch the next three weeks for movement on stablecoin yield language.

Trade groups told Terrett they remain cautiously optimistic about progress before late March. A revised draft could return to the Senate Banking Committee if talks advance

Crypto World

Why is crypto market going down today? (March 6)

The crypto market pulled back on Friday following a strong rebound on Thursday.

Summary

- The crypto market backpedalled on part of its recent gains after BTC faced rejection at $74K.

- Concerns around a major options expiry event and capital rotation to traditional safe-haven assets have also suppressed demand for risk assets.

After rallying nearly 5.5% over the past day, the global crypto market capitalization once again retracted, dropping 2% to $2.48 trillion on Friday, March 6. Bitcoin (BTC) was down 1.8% in the daily timeframe, while Ethereum (ETH) posted losses of 1.3%. Other major cryptocurrencies, such as BNB (BNB), XRP (XRP), and Solana (SOL), also faced similar losses as the broader market cooled.

As crypto prices fell, it triggered the liquidation of traders with highly leveraged bullish positions across leveraged markets. Data from CoinGlass shows that nearly $167.5 million of the total $252 million liquidations that took place in the past 24 hours came from long positions.

Amidst the market drop, the crypto fear and greed index fell by 4 points to 18, a sign that risk-on sentiment among investors seems to be evaporating.

The crypto market fell after Bitcoin faced rejection at $74,000 on Thursday after rallying over 16% in the past 5 days. This came as investors booked profits, which is quite common after an asset has rallied over multiple days.

Bitcoin’s rejection and successive drop caught highly leveraged traders off guard, triggering a cascade in liquidations which then rippled off to other altcoins in the leveraged markets.

Multiple analysts note that the rejection has left BTC vulnerable to more downside and has dampened the short term outlook for the entire sector.

$2.68 billion options expiry today

Another key reason why the market slipped lower today is fears surrounding a $2.68 billion options expiry across the crypto market on the Deribit exchange at 8:00 a.m. UTC.

Notably, around 32,000 Bitcoin contracts with a notional value of $2.2 billion are set to expire with the max pain price at $69,000. Concurrently, Ethereum options worth $397 million will also settle today.

Such a massive options expiry event typically leads to significant price volatility as traders adjust or close out their positions. The open interest of the total crypto market has dropped 4.76% over the past 24 hours, suggesting traders seem to be unwinding their bets ahead of the potential price swings.

Rising energy prices spark rotation to traditional safe-haven assets

The crypto market also tanked amid rising energy prices after Iran’s suspected attack on U.S. oil ships around the port of the Strait of Hormuz disrupted global supply chains.

Investors fear that rising crude oil and gas prices due to the conflict could reignite inflation. Consequently, they have turned risk-averse as they rotate capital towards traditional safe-haven assets such as gold, which has performed significantly better during these uncertain times.

Stalled crypto legislation

Investor sentiment was also hurt after progress on the CLARITY Act, a highly anticipated U.S. market structure bill, stalled once again.

While U.S. President Donald Trump has called for a swift implementation of the framework, the landmark bill hit a new impasse after leading banking groups rejected a White House compromise for the bill, citing risks to traditional institutions.

The delay has cast severe doubt on whether the CLARITY Act can pass before the 2026 summer recess, removing a major regulatory tailwind for the industry.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Fed, FDIC, OCC Clear Tokenized Assets for Bank Balance Sheets

TLDR:

- The Fed, OCC, and FDIC confirmed tokenized securities get identical capital treatment to traditional assets at U.S. banks.

- Banks can now use tokenized stocks and bonds as loan collateral under the same rules as conventional securities.

- The guidance covers both public blockchains like Ethereum and private permissioned networks without distinction.

- Derivatives tied to tokenized assets also receive standard regulatory treatment, expanding the scope significantly.

U.S. banking regulators have issued landmark joint guidance clearing banks to hold tokenized securities under the same rules as conventional financial assets.

The Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation released the coordinated announcement together.

It confirms that a tokenized stock, bond, or other asset carries identical capital treatment to its off-chain equivalent. The move removes a regulatory barrier that major financial institutions had cited for years as a reason to stay off blockchain rails.

Banks Can Now Use Tokenized Assets as Standard Collateral

The guidance covers three core operational changes for U.S. banks.

First, tokenized securities are now eligible collateral for loans, treated identically to traditional stocks or bonds. Second, the rules apply regardless of whether the token sits on a public blockchain like Ethereum or a private permissioned network.

Third, financial derivatives linked to tokenized assets receive the same treatment as conventional derivatives.

That last point carries significant weight. Derivatives markets dwarf spot markets in volume. Extending identical regulatory treatment to tokenized derivatives opens a much larger surface area for blockchain adoption.

The announcement does not require new legislation. It is guidance, meaning banks can act on it immediately. No waiting period applies.

For institutions like JPMorgan, Goldman Sachs, and Bank of America, the obstacle was never technological.

According to posts on X, including commentary from @BullTheoryio and @markchadwickx, major banks were awaiting exactly this kind of regulatory clarity before moving capital onto blockchain infrastructure.

Tokenization Market Stands to Absorb Trillions in Traditional Capital

The addressable pool of assets is enormous. Global equity markets alone exceed $100 trillion. Bond markets add tens of trillions more.

Real estate sits on top of that. Most of that capital has remained off-chain, not due to technical limitations, but due to unresolved regulatory questions around how tokenized versions would be treated on bank balance sheets.

That question now has a clear answer. A tokenized Apple share carries the same legal claim, the same ownership rights, and the same balance sheet weight as a traditional share. Regulators have confirmed this directly.

The practical effect is that banks can begin integrating tokenized securities into existing workflows without restructuring their risk or compliance frameworks. This lowers the operational cost of adoption substantially.

Public blockchains are specifically included in the guidance. That detail matters. Many institutions assumed regulators would favor private, permissioned networks.

The explicit inclusion of public chains broadens the infrastructure eligible to handle institutional-grade asset flows

Crypto World

Lyn Alden Tips Bitcoin Outperforming Gold Through to 2029

Bitcoin is likely to outperform gold on price performance through to 2029 after gold’s strong recent rally, says macroeconomist Lyn Alden.

“If I had to bet Bitcoin versus gold over the next two to three years, I would bet Bitcoin,” Alden said on the New Era Finance podcast on Wednesday.

“Gun to my head, if I had to say which one I think outperforms, I would say Bitcoin,” she added.

“It’s usually a pendulum between the two. If gold has gone up as much as it did, the entire diminishing return story per cycle is going to be erased in the coming one, too.”

Many crypto industry executives, including Coinbase CEO Brian Armstrong, have predicted that Bitcoin (BTC) will reach $1 million by 2030 with clearer regulations taking shape in the US, which Armstrong called a “bellwether for the rest of the G20.”

Alden dismisses that gold is in a bubble

Bitcoin is often compared to gold as a hedge against inflation and economic uncertainty, with many investors dubbing it “digital gold.”

Alden said gold is seeing “somewhat euphoric” sentiment after it reached a new all-time high of around $5,608 in January.

“I wouldn’t say it’s a bubble, but it’s somewhat euphoric,” she said.

The JM Bullion gold Fear and Greed Index, which tracks sentiment toward gold, posted a “Greed” score of 72 out of 100 on Friday. On the same day, the Crypto Fear and Greed Index, which measures sentiment across Bitcoin and the broader crypto market, posted an “Extreme Fear” score of 18 out of 100.

Alden said that the sentiment toward Bitcoin is “somewhat unfairly negative.” Bitcoin is trading at $71,164, down 44% from its October all-time high of $126,000, according to CoinMarketCap.

Alden said she avoids relying too heavily on rigid narratives about the relationship between the two assets.

“I try to be hesitant about reading into how absolute these things are. Gold and Bitcoin can go up together, they can go down together,” she explained.

Investors debate Bitcoin’s narrative

While the two assets are often grouped together as alternatives to fiat currencies, the relationship isn’t always consistent; sometimes the prices move in tandem during periods of macro uncertainty, and other times they decouple.

Alden’s comments come shortly after billionaire investor Ray Dalio warned against Bitcoin as a long-term store of value and safe-haven asset, arguing that it lacks central bank support and has lingering concerns about its privacy limitations and quantum resistance.

Related: Construction begins at quantum facility big enough to break Bitcoin

“Gold is not a precious metal that’s speculated on,” Dalio said on Tuesday, adding it is the “most established money” that is the second-largest reserve asset held by central banks.

Meanwhile, CryptoQuant CEO Ki Young Ju said in October 2025 that Bitcoin’s correlation with gold is increasing as both assets strengthen their reputations as hedges against macroeconomic uncertainty.

Magazine: Bitcoin may face hard fork over any attempt to freeze Satoshi’s coins

-

Politics3 days ago

Politics3 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech5 days ago

Tech5 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

NewsBeat5 days ago

NewsBeat5 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

NewsBeat6 days ago

NewsBeat6 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

Sports6 days ago

The Vikings Need a Duck

-

NewsBeat6 days ago

NewsBeat6 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat5 days ago

NewsBeat5 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech1 day ago

Tech1 day agoBitwarden adds support for passkey login on Windows 11

-

Entertainment4 days ago

Entertainment4 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports13 hours ago

Sports13 hours ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

Tech7 days ago

Tech7 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Politics5 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat4 days ago

NewsBeat4 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech5 days ago

Tech5 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video4 days ago

Video4 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business2 days ago

Business2 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

Crypto World5 days ago

Crypto World5 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

-

NewsBeat4 days ago

NewsBeat4 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker