Crypto World

Your Definitive Guide on P2P Crypto Wallet Development For 2026 & Beyond

Capital in Web3 is moving with intent, not experimentation, and P2P crypto wallet solutions sit at the center of that shift. In 2025 alone, cross-border P2P transaction volume expanded by 51%, while embedded finance adoption advanced 36% as enterprises embedded native payment rails into digital ecosystems. Biometric authentication reached 58% penetration across leading platforms, and 71% of users actively favored contactless scan-and-pay experiences, signaling a decisive move toward frictionless yet secure finance. Voice-enabled payments grew 24%, reinforcing the demand for intelligent, always-on payment infrastructure. These are not usage anomalies but structural indicators of where capital efficiency, user trust, and platform defensibility converge for long-term value creation.

What is a P2P Crypto Wallet?

A P2P crypto wallet is a software wallet designed to enable peer-to-peer exchange and settlement of digital assets directly between users, without routing trades through a central matching engine. P2P wallets can be non-custodial, meaning users keep their private keys, or hybrid, offering optional custody services. They typically provide on-wallet order books or secure on-chain trade settlement, atomic swap or smart contract mediated exchanges, and in-app messaging or negotiation layers so counterparties can discover and agree on terms. The key differentiator is that trades are executed directly between participants and settled on-chain or via cryptographic settlement channels. Now, let us scroll through the blog to deeply understand the factors impacting the rise of peer-to-peer transactions and how a crypto wallet supports it.

What is The Hype About P2P Transactions & Web3 Wallet Solutions?

The momentum behind P2P Web3 crypto wallets stems from multiple converging forces. Institutional demand for self-custody and transparency has grown, while retail users seek lower fees and censorship-resistant rails. Regulators have tightened oversight of custodial services, which increases the attractiveness of non-custodial and privacy-preserving mechanisms for compliance-conscious players. At the same time, infrastructure improvements such as cross-chain messaging, layer 2 settlement, and programmatic escrow primitives make direct peer settlement practical at scale. These advances position P2P wallets as a market segment where decentralization and enterprise needs can be reconciled.

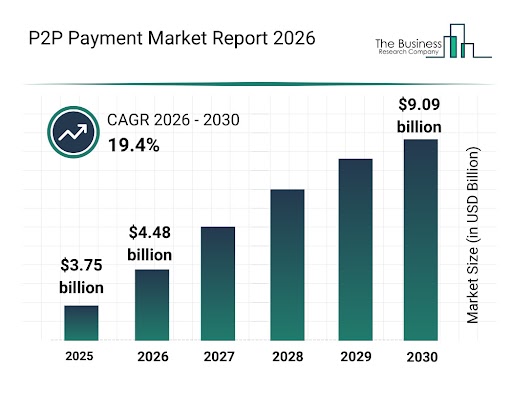

Source link: https://www.thebusinessresearchcompany.com/report/p2p-payment-global-market-report

Core P2P Payment Market Trend

- Cross-border P2P transfers jumped 51% in 2025, driven by lower fees and wider access.

- Embedded finance grew 36% as more brands added native P2P options in 2025.

- Gen Z and millennials fueled a 28% rise in social-payment P2P apps in 2025, prioritizing social features.

- Voice-activated payments via AI assistants rose 24% in 2025, reflecting demand for hands-free convenience.

- 71% of users favored apps with contactless scan-and-pay in 2025, accelerating innovation.

- Biometric authentication reached 58% adoption across major P2P apps in 2025, strengthening security.

- Real-time processors like Zelle maintained the industry standard by settling transactions in seconds in 2025.

Key market context to consider: analysts place the global cryptocurrency wallet development market in the multi-billion dollar range in 2026, underlining the rapid adoption and strong commercial opportunity for wallet providers.

Advantages of P2P Crypto Wallet Development

Investors should view P2P crypto wallet development as more than technology; it is a strategic lever that creates durable business advantages. A thoughtfully designed P2P wallet builds network effects, predictable revenue channels via platform services, and clear pathways to enterprise partnerships and bank integrations. It makes product roadmaps measurable, governance models transparent, and M&A or tokenization outcomes cleaner. Understanding these levers today lets you quantify upside, stress test assumptions, and negotiate terms from a position of strength when the market demands scale and regulatory clarity.

1. Greater user control and trust retention- Users hold keys or retain control over keys, improving trust metrics and reducing counterparty risk exposure for the product.

2. Reduced counterparty solvency risk- Direct settlement reduces dependence on exchange ledgers and central custody, lowering systemic risk from exchange failures.

3. Lower ongoing regulatory capital and reserve requirements- Operators of non-custodial P2P wallets avoid some capital and reserve obligations that custodial exchanges face, while still being able to provide compliance tooling where required.

4. New monetization channels without custody- Fees on on-chain settlement, premium matching, liquidity brokering, and enterprise SDK licensing create recurring revenue with lower operational overhead.

5. Increased resilience and censorship resistance- P2P structures reduce single points of failure and make it harder for a single authority to interrupt user access.

6. Competitive edge in markets with high fiat friction- P2P wallets that integrate local payment rails and stablecoin flows can capture remittance and cross-border volumes where traditional rails are slow or expensive.

7. Better alignment with institutional treasury policies- Institutional clients increasingly demand custody flexibility and programmable controls that P2P flows can support via multisig, time locks, or policy engines.

Features Essential for P2P Crypto Wallets Built For Success

Basic feature set

- Secure key management and mnemonic handling with clear recovery flows

- Simple send and receive UX with transparent gas and fees

- Multi-chain support for major EVM chains and Bitcoin via compatible bridges

- On-chain settlement support and clear transaction status indicators

- Address book, QR scanning, and transaction history auditing

- Basic wallet encryption, PIN, and biometric unlock

Advanced Enterprise Grade Capabilities

- Integrated P2P order matching and negotiation engine with optional on chain escrow contracts

- Smart routing: atomic swaps, cross-chain bridges, and layer 2 settlement channels

- Role-based access and enterprise wallet profiles for treasury management

- Multi-signature workflows and threshold signature schemes for institutional custody

- Real-time blockchain analytics and risk scoring integrated with compliance pipelines

- Decentralized identity integration and selective disclosure using verifiable credentials

- Replay protection, transaction batching, and gas optimization modules for cost efficiency

- Insurance orchestration and proof of reserves integration for optional custody guarantees

- API and SDK suites for partners and white-label customers.

You can always achieve this level of success and acquire the wide range of advantages mentioned above by hiring an accredited team of blockchain experts from a renowned cryptocurrency wallet development company. Apart from this, the company will also help you achieve success after with their alternative solutions, like customized solutions as per business needs.

Plan Your P2P Wallet Strategy With Our Experts

Are White Label P2P Crypto Wallets the Winning Path?

White-label blockchain wallet solutions are an attractive route for enterprises and institutional entrants because they compress time to market and offer proven building blocks. For investors, a professionally engineered white-label product reduces execution risk and often includes battle-tested security modules, audit trails, and compliance hooks. This allows businesses to focus on customer acquisition and integrations rather than building cryptographic infrastructure from scratch. However, the trade-off is customization. For high compliance or differentiated product strategies, a hybrid approach where a white-label core is extended with bespoke modules often yields the best risk-adjusted return.

Market practitioners report that high-quality white label cryptocurency wallet service providers can deliver robust deployments quickly, while providing upgrade paths for enterprise integrations and regulatory controls.

How Much Does a P2P Crypto Wallet Development Cost?

The cost of a P2P crypto wallet development is primarily determined by the level of customization required, rather than a fixed pricing model. A basic white-label wallet with minimal modifications typically requires lower investment because the core architecture, UI framework, and security modules are already prebuilt, and development mainly involves branding and minor configuration.

As customization increases, the cost rises due to the need for deeper integrations, extended multi-chain support, tailored compliance workflows, and enterprise-grade APIs or SDKs. These requirements involve additional engineering, testing, and infrastructure setup.

A fully custom P2P crypto wallet requires the highest investment since the architecture, smart contracts, security layers, and user experience are designed specifically for the business model. Advanced capabilities such as multisignature custody, cross-chain routing, escrow mechanisms, and bespoke dashboards demand extensive development time, third-party audits, and ongoing maintenance, all of which significantly influence the overall cost.

How Much Time Does It Take To Create a P2P Crypto Wallet?

A P2P crypto wallet development timeline differs by approach. Below are practical estimates mapped to development phases.

1. White label deployment with light customization

-

- Typical duration: 1 to 4 weeks

- Activities: branding, token preloads, basic compliance toggles, testing, and deployment.

2. White label with enterprise integrations and moderate customization

-

- Typical duration: 4 to 10 weeks

- Activities: integrate KYC provider, analytics, and fiat on-ramp; add off-chain order features, QA, and security checks.

3. Full custom enterprise build

-

- Typical duration: 3 to 6 months or longer

- Activities: architecture design, smart contract development, multisig and custody integrations, compliance workflow construction, security audits, penetration testing, user acceptance testing, and regulatory sign-offs.

Note that parallelizing activities such as UI design, smart contract audit, and legal compliance work reduces overall calendar time. Real-world schedules also depend on the availability of third-party integrations, audit timelines, and regulatory filings.

Security & Compliance Realities Investors Must Weigh

Security is not optional. Rising on-chain criminal flows and targeted attacks are reshaping risk models, and platforms must invest in proactive controls. Threats include hot wallet exploits, social engineering, private key compromise through coercion, and off-chain identity fraud. Monitoring, anomaly detection, wallet heuristics, and safe recovery models are required to maintain institutional trust. Recent industry reports highlight notable rebounds in illicit on-chain flows and reaffirm the need for rigorous analytics and cooperation with law enforcement.

Regulation is also evolving. Many jurisdictions now distinguish custodial and non-custodial wallet development services more clearly, and AML KYC expectations are tightening, including live selfie verification and geo-tagging in some markets. For global deployments, you must design compliance as a first-class component rather than an afterthought.

Why Partner With Antier?

P2P crypto wallets are a high-potential and high-responsibility segment of the market. For investors, the opportunity lies in products that combine strong cryptography, pragmatic compliance, and enterprise integrations.

Connect with our team today to learn about our offerings and the entire process. We build white label P2P wallet solutions with an emphasis on security, auditability, and regulatory readiness. Our team combines cryptography engineers, compliance experts, and product designers who can guide you from requirements to launch, including policy design for KYC and AML, architecture for multisig custody, and production-grade smart contract audits. We also assist with jurisdictional analysis so your rollout aligns with local supervisory expectations. If you are evaluating investments or planning a wallet product, we can provide a technical due diligence brief, a costed implementation roadmap, and a compliance checklist tailored to your target markets.

Frequently Asked Questions

01. What is a P2P crypto wallet?

A P2P crypto wallet is a software wallet that enables direct peer-to-peer exchange and settlement of digital assets between users, without relying on a central matching engine. It can be non-custodial or hybrid, offering features like on-wallet order books and secure trade settlement.

02. Why are P2P transactions gaining popularity in Web3?

P2P transactions are gaining popularity due to increased institutional demand for self-custody, lower fees sought by retail users, tighter regulatory oversight of custodial services, and advancements in infrastructure that facilitate direct peer settlement.

03. What are the benefits of using P2P crypto wallets?

P2P crypto wallets offer benefits such as enhanced privacy, lower transaction fees, and the ability for users to maintain control over their private keys, making them attractive for both compliance-conscious players and those seeking decentralized financial solutions.

Crypto World

Stablecoin Transaction Volume Hits a New Record High as USDC Surpasses USDT

Stablecoins have hit an all-time high in monthly transaction volume, as Circle’s USDC (USDC) flipped Tether’s USDt (USDT), new data shows.

Key takeaways:

-

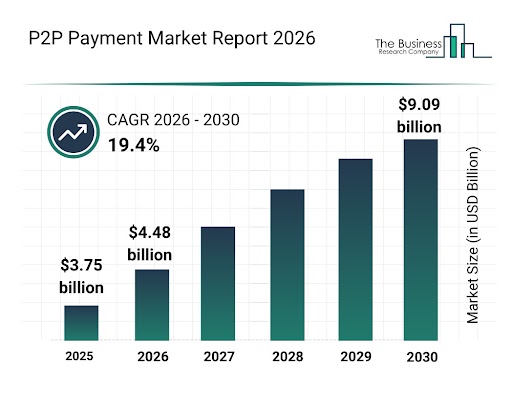

Stablecoin monthly transaction volume reached a record $1.8 trillion in February.

-

USDC comprised 70% of all stablecoin volume.

-

Rising stablecoin supply on exchanges puts crypto markets in a good position to recover.

USDC “consistently” flips USDt transfer volume

The stablecoin transfer volume reached $1.8 trillion in February, setting a monthly record, according to data from Allium.

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to fiat currencies like the US dollar, and can be hosted on multiple blockchains.

Similarly, the volume of USDC transactions reached a high of $1.26 trillion, representing a new milestone in the adoption of the second-largest stablecoin by market cap since its launch in September 2018.

Related: Florida Senate passes state-level stablecoin bill, awaits DeSantis’ signature

This was more than double that of USDt, whose transfer volume was $514 billion in February.

In fact, USDC has “consistently flipped” Tether in transfer volume over the last few months, founder at Moonrock Capital, Simon Dedic, said in a Friday post on X.

USDC’s usage comes as a “surprise” given that its market cap is less than half that of USDt, Dedic added. USDC is the second-largest stablecoin by market cap at $77.4 billion, compared to USDt’s $184 billion.

Moreover, USDC’s supply has grown faster than USDt’s in recent weeks. Over $3 billion in USDC has been printed already in March, according to market intelligence firm Arkham, as USDt’s supply has remained relatively unchanged.

CIRCLE JUST MINTED $250M $USDC

Circle just minted another $250M USDC on Solana. They’ve minted over $3 BILLION in just this first week of March.

If Circle continue at this pace, they’re on track to mint over $12 Billion USDC by the end of the month. pic.twitter.com/aoQKi6zbFE

— Arkham (@arkham) March 7, 2026

As Cointelegraph reported, USDC issuer Circle Internet Group reported strong Q4/2025 earnings, attributed to rapid growth in the USDC’s business and expanding payments operations.

More stablecoin liquidity suggests “buying power”

The Stablecoin Supply Ratio (SSR), or the ratio of the Bitcoin (BTC) market cap relative to stablecoin market cap, is “steadily recovering after crashing” in February, said CryptoQuant analyst Sunny Mom in a Friday Quicktake post, adding:

“This shows buying power is returning to the market.”

Meanwhile, Bitcoin’s latest push to $74,000 was fueled by a recovery in stablecoin supply on crypto exchanges, which rose to a three-week high of $66.5 billion on Friday.

Stablecoin inflows to exchanges have boosted the SSR alongside Bitcoin’s (BTC) price. On March 5, the total amount of stablecoins transferred to the exchange amounted to nearly $5.14 billion, up from $1.14 billion on March 1.

More stablecoins on exchanges means more buying power for cryptocurrencies. In the past, the return of sidelined capital to exchanges was a major catalyst for the start of Bitcoin bull markets.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Washington Man Sentenced to 2 Years for Diverting $35M to Failed DeFi Platform

A Washington state man has been sentenced to two years in federal prison after diverting $35 million from his employer to fund a personal decentralized finance venture that ultimately collapsed during the 2022 crypto market downturn.

Key Takeaways:

- A former Washington CFO was sentenced to two years in prison for diverting $35 million in company funds into a failed DeFi investment scheme.

- The crypto strategy collapsed during the 2022 market downturn following the Terra ecosystem crash.

- The losses severely impacted the company, triggering layoffs and nearly forcing the business to shut down.

Nevin Shetty, 42, was convicted of wire fraud in November after prosecutors showed he secretly transferred company funds into a crypto investment scheme tied to his side project, HighTower Treasury.

The funds belonged to a private software company where Shetty served as chief financial officer.

Prosecutors Say CFO Diverted Funds After Learning of Job Termination

According to the US Department of Justice, Shetty drafted a conservative investment policy for the firm that limited how corporate funds could be used.

Despite those internal guidelines, he moved tens of millions of dollars from the company’s accounts after learning in April 2022 that his position would be terminated due to performance concerns.

The money was routed to HighTower Treasury, where Shetty and a business partner invested heavily in decentralized finance lending protocols promising annual returns of 20% or more.

Prosecutors said Shetty intended to return a fixed payment to the company while keeping the remainder of any profits generated by the crypto strategy.

Initially, the scheme produced modest gains. Court filings show the operation generated roughly $133,000 in its first month.

However, the broader crypto market soon entered a steep downturn following the collapse of the Terra ecosystem in May 2022.

As the market fell, the value of HighTower’s positions rapidly deteriorated. The investments tied to Shetty’s strategy plunged from approximately $35 million to nearly nothing during the subsequent crypto winter.

After the losses became clear, Shetty admitted his actions to colleagues at the company. He was later dismissed from his role.

During sentencing, US District Judge Tana Lin said the incident inflicted serious damage on the business. According to the court, the company faced “significant and severe effects” from the losses and was nearly forced to shut down.

The financial damage also triggered layoffs, with about 60 employees losing their jobs as the company attempted to stabilize operations following the missing funds.

Federal prosecutors had requested a nine-year prison sentence, arguing that Shetty’s actions involved deception and caused lasting harm to the company and its staff. The court ultimately imposed a shorter sentence of two years.

Washington Man Ordered to Pay $35M Restitution After DeFi Fraud

In addition to prison time, Shetty was ordered to pay $35,000,100 in restitution. After completing his sentence, he will remain under supervised release for three years.

Judge Lin also imposed restrictions on Shetty’s future employment, prohibiting him from serving as an officer or director of a company without approval from the probation office.

Last month, two teenagers from California faced serious felony charges after authorities say they traveled hundreds of miles to carry out a violent home invasion in Scottsdale, Arizona, in a bid to obtain cryptocurrency believed to be worth $66 million.

The case came amid a broader rise in so-called wrench attacks, physical assaults aimed at forcing crypto holders to hand over private keys.

Security researcher Jameson Lopp’s public database lists roughly 70 such incidents in 2025, a sharp increase from the previous year.

Security analysts say criminals are increasingly using leaked personal data to identify targets and recruiting young perpetrators online to reduce traceability.

The post Washington Man Sentenced to 2 Years for Diverting $35M to Failed DeFi Platform appeared first on Cryptonews.

Crypto World

China’s HR Minister Says Jobs Will Stay Stable for 5 Years Despite AI and Labour Headwinds

TLDR:

- China’s HR minister pledges stable employment over five years despite rapid AI and labour disruptions.

- Young people, college graduates, and migrant workers are prioritized under China’s new employment plan.

- Vocational training and entrepreneurship support will help workers adapt to AI-driven industry changes.

- China aims to align AI development with workforce growth rather than allowing automation to replace jobs.

China says it can keep jobs stable over the next five years, even as artificial intelligence and labour market pressures grow.

Human Resources Minister Wang Xiaoping made this confident assertion on Saturday at the annual parliamentary session in Beijing.

She acknowledged mounting challenges but maintained that positive employment momentum remains achievable.

The government’s plan targets young people, college graduates, and migrant workers to sustain workforce stability nationwide.

China Stands Firm on Job Stability Despite Growing AI Disruption

China says it can keep jobs stable even as automation continues reshaping traditional industries across the country. The government recognizes that AI adoption may disrupt workforce demand in several key sectors.

Despite these concerns, officials remain confident that proactive policies will protect employment conditions. The rapid pace of technological change has not shifted China’s firm stance on labour stability.

Wang Xiaoping stated during the parliamentary session that China will expand employment opportunities for vulnerable workforce groups.

Young people, college graduates, and migrant workers remain at the center of this commitment. Reuters reported that Wang said China will “keep employment stable and sustain positive momentum over the next five years,” affirming the government’s resolve. These groups face the greatest exposure to shifts driven by economic and technological changes.

Vocational training programs will be strengthened to prepare workers for an evolving job market. Entrepreneurship support and new-sector job growth policies will also be introduced.

College graduates entering the workforce each year will receive expanded employment assistance. Migrant workers, critical to manufacturing and urban development, will benefit from additional targeted measures.

Officials argue that combining economic growth with forward-looking employment policy creates a strong buffer against disruption.

China says it can keep jobs stable by ensuring technological progress works alongside workforce development. The government believes this dual approach will carry employment conditions through the next five-year period. Policymakers remain cautious but consistently optimistic about the road ahead.

Labour Market Uncertainties Challenge China’s Five-Year Employment Pledge

China says it can keep jobs stable, but labour market uncertainties continue to test that confidence in real time. Structural economic shifts and the growing adoption of AI technologies are altering workforce demand.

Traditional industries face pressure as automation replaces roles previously held by human workers. The government acknowledges these realities while pushing back against projections of widespread job loss.

Reports from the NPC sidelines noted that Wang emphasized “rising labour market uncertainties and the rapid development of artificial intelligence pose challenges,” making the government’s stable-employment pledge all the more significant.

Officials are now prioritizing policies that stimulate job creation within emerging digital and technology sectors. These industries are expected to absorb workers transitioning out of disrupted traditional roles. A measured and structured transition strategy remains central to China’s employment protection plan.

China plans to ensure AI development complements rather than replaces workforce opportunities across industries. Retraining programs will help workers adapt to new technological demands over time.

Digital transformation strategies will be rolled out alongside accessible worker support systems. This balanced approach aims to reduce the human cost of rapid automation.

China says it can keep jobs stable over the next five years through consistent policy action and economic management. Workforce training, innovation-driven job creation, and targeted group support form the backbone of this plan.

The government remains committed to protecting employment while advancing its broader digital economy goals. With clear policy direction in place, China moves forward with both ambition and measured confidence.

Crypto World

What if climate insurance were paid to farmers in seconds?

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Extreme weather events have become routine with climate change globally. In 2024, U.S. farmers lost over $20 billion to wildfires, floods, hurricanes, hail, frost, and tornadoes. Canadian producers face similar difficulties: 51% of operations suffered from drought in 2022 and 2023, while 26% experienced flooding. British Columbia alone saw almost $460 million in losses last year. Producers in developing nations like Kenya or Brazil, who don’t have access to the same technologies as their peers in North America, are even more vulnerable.

Summary

- Climate disasters move fast — insurance doesn’t: Farmers lose critical planting windows while waiting months for payouts, compounding economic damage after floods or droughts.

- Stablecoins change the speed of recovery: 24/7, borderless payments can deliver funds in seconds, even to unbanked rural producers with only a smartphone.

- Smart contracts remove friction and corruption: Parametric insurance triggered by verified weather data enables automatic, transparent payouts without adjusters or delays.

When a farm is hit by a flood or a drought, the physical damage is compounded by the fact that the operation’s economic activity ceases. Each week without compensation means lost seeds, missed planting, and mounting debt. Yet most insurance systems remain stuck in the past. After Pakistan’s devastating 2022 floods, many smallholders waited months for disaster aid to clear local banks. By the time funds arrived, the planting season had already passed, and worse, vulnerable farmers may have been unable to pay expenses to keep their farms viable for the following season.

As climate volatility increases, farmers need faster and more reliable support. One unexpected technology might finally close that gap: stablecoins. These digital tokens are designed to always keep the value of government-issued currencies like the U.S. dollar. Far from being just another crypto fad, stablecoins could underpin instant, programmable insurance that leverages real-time weather data.

Shock disasters, slow money

Traditional insurance depends on human verification. Adjusters must visit farms, file reports, and route payments through banks that rarely reach rural communities. Even in advanced economies, it can take months, and in developing nations, it can be a year-long process.

If disasters strike in seconds, payouts must move just as fast. Stablecoins are able to move value across borders in milliseconds, 24/7, with full transparency. Unlike bank wires, they don’t close for weekends or holidays. And unlike checks, they don’t depend on local banking infrastructure.

For a Canadian farmer in a remote, rural region, the technology can prove transformative. Using only a smartphone, they can receive climate insurance payouts directly to their digital wallet, without passing through the clunky banking sector.

Besides, not all producers have access to banking services in the first place. El Salvador counts almost 400,000 farmers, but 70% of the total population is unbanked, so only 32 000 Salvadoran farmers have access to agricultural credit. Stablecoins can help bridge that gap, turning smartphones into financial access points.

NGOs already use this model. The UN Refugee Agency has sent stablecoin-based emergency funds to displaced families in Ukraine, bypassing weeks of banking delays. If stablecoins can reach war zones, they can certainly reach farms.

Smart contracts can make insurance payouts automatic

Stablecoins become even more powerful when combined with smart contracts, which are software programs that can autonomously trigger an action (for example, send out payments) when specific events occur. In climate insurance, this enables parametric coverage, where payouts are linked to weather thresholds.

We can easily imagine a system where, if rainfall drops below a set level and thereby signals a drought, a blockchain contract would automatically send out stablecoin payouts to those affected. The data would come from verified, neutral weather data providers, not human claims adjusters. The system would drastically cut paperwork, delays, and especially subjective decisions on the part of insurance companies.

Platforms like Arbol already use a system like this to send automatic stablecoin payments to farmers affected by extreme weather events. What once took weeks of processing now happens in minutes, with no room for corruption or error.

Transparency builds trust

Beyond speed, stablecoins offer something equally valuable: trust. Billions in climate aid and insurance funds vanish each year into administrative black holes. Blockchain-based payments are transparent by design; it’s easy to have visibility into each transaction.

That transparency is already restoring credibility to climate finance. The Lemonade Foundation’s Crypto Climate Coalition, for instance, uses stablecoins to deliver verifiable payouts to African farmers. Every transfer can be traced from donor to recipient, ensuring funds go where they’re meant to.

When speed and transparency combine, confidence follows. Farmers can plan their next planting season with certainty. Donors can see their money at work. And policymakers can measure results instantly, not months later.

Stablecoins are often viewed through the lens of crypto speculation, but their promise lies in their utility. Their features make them ideal for solving one of humanity’s oldest problems: managing risk in an unpredictable world. Stablecoins won’t stop the next drought or flood, but they can make recovery faster, fairer, and more predictable.

Crypto World

Binance and Changpeng Zhao Win Dismissal of $4.3B Terrorism Financing Civil Lawsuit

TLDR:

- Binance and founder Changpeng Zhao had all civil terrorism financing claims dismissed by a Manhattan federal judge.

- The 535 plaintiffs failed to prove Binance culpably linked itself to 64 terrorist attacks from 2017 to 2024.

- Judge Vargas ruled the 891-page complaint was excessive but allowed plaintiffs to file an amended version.

- Zhao accused plaintiffs of piggybacking on Binance’s 2023 guilty plea and its $4.32 billion criminal penalty.

Binance and its founder Changpeng Zhao have secured the dismissal of a major civil lawsuit. A federal judge in Manhattan ruled in their favor on Friday, March 7.

The case involved 535 plaintiffs, including victims and their relatives, tied to 64 terrorist attacks. The plaintiffs sought to hold Binance and Zhao financially liable for alleged cryptocurrency transfers to terrorist groups.

The attacks reportedly took place between 2017 and 2024 across several parts of the world.

Court Finds No Culpable Link Between Binance, Zhao, and Terrorist Organizations

U.S. District Judge Jeannette Vargas presided over the case in Manhattan’s federal court. She found that the plaintiffs did not sufficiently allege that Binance or Zhao participated in the attacks.

The judge ruled that neither defendant “culpably associated themselves with these terrorist attacks, participated in them as something they wanted to bring about, or sought by their actions to ensure their success.” Their only connection to the groups was through standard, arm’s-length transactions on the exchange.

The plaintiffs attributed the attacks to several designated foreign terrorist organizations. These included Hamas, Hezbollah, Iran’s Revolutionary Guard Corps, and Islamic State.

Palestinian Islamic Jihad, Kataib Hezbollah, and al Qaeda were also named in the complaint. Plaintiffs alleged that hundreds of millions in cryptocurrency flowed through Binance to these groups.

They also alleged billions in transactions with Iranian users were used to benefit attack proxies. Judge Vargas acknowledged Binance and Zhao may have had general awareness of financing risks.

However, she noted that their only tie to the organizations was that “they, or their affiliates, had accounts on, and have transacted on, the Binance exchange in an arms’ length relationship.” Awareness alone was not enough to establish legal liability under the law.

The judge further noted the complaint’s excessive length in her ruling. The 891-page, 3,189-paragraph filing was called “wholly unnecessary” despite its “weighty” allegations. Plaintiffs were given the option to file an amended complaint going forward.

Binance’s $4.3 Billion Criminal Penalty and Its Tie to the Dismissed Case

Zhao argued in court filings that plaintiffs sought to exploit Binance’s prior criminal proceedings. In November 2023, Binance pleaded guilty to violating federal anti-money-laundering and sanctions laws.

The exchange paid a $4.32 billion criminal penalty as part of that resolution. Zhao contended the plaintiffs tried to “piggyback” on that case to pursue triple damages under the Anti-Terrorism Act.

The court rejected that approach and dismissed all claims against the defendants. Both Binance and Zhao had condemned terrorism throughout their court filings. Their papers made clear that neither party sought to support or facilitate any terrorist activity.

Following the ruling, a Binance spokesperson issued a statement: “Binance was pleased to see that the court in this case correctly dismissed these baseless allegations. Binance takes compliance seriously and has no tolerance for bad actors on its platform.” The exchange also referenced a letter sent to Senator Blumenthal on the same day.

Neither Zhao’s legal team nor the plaintiffs’ lawyers were immediately available for comment. Plaintiffs retain the right to file an amended complaint following the dismissal. No timeline for a potential refiling has been publicly announced as of Friday.

Crypto World

Canada Issues First Tokenized Bond in Bank of Canada DLT Pilot

Canada has completed a pilot program testing the use of distributed ledger technology in bond markets, culminating in the issuance of the country’s first tokenized bond, according to a Friday announcement from the Bank of Canada.

The experiment, known as Project Samara, involved the Bank of Canada, Export Development Canada, Royal Bank of Canada and TD Bank Group, and explored if blockchain-style infrastructure could streamline bond issuance, trading and settlement.

As part of the pilot, Export Development Canada issued a $100 million Canadian dollar ($73.6 million) bond with a maturity of less than three months to a closed group of investors. The security was issued, traded and settled on a distributed ledger platform, with payments processed using wholesale central bank deposits rather than commercial bank money.

The platform, built on Hyperledger Fabric, let participants manage the full lifecycle of the security, including issuance, bidding, coupon payments, redemption and secondary trading, while integrating separate ledgers for cash and bonds to enable near-instant settlement.

The pilot highlighted trade-offs in adopting distributed ledger systems for capital markets. Participants reported improvements in operations and data integrity, but also identified governance, regulatory and integration challenges.

Researchers said the results showed distributed ledger systems could improve settlement efficiency and reduce counterparty risk, though broader adoption may be slowed by infrastructure and regulatory hurdles.

Related: Vancouver Bitcoin reserve effort hits resistance from city officials

Tokenized bonds gain traction among governments and banks

Canada’s pilot program adds to a growing list of experiments by governments and financial institutions that explore how blockchain-based systems can reshape the issuance and settlement of traditional financial assets.

An early example came in 2018, when the World Bank issued a two-year A$110 million “Bond-i” debt instrument arranged by the Commonwealth Bank of Australia. The issuance is widely considered the first bond whose creation, allocation and lifecycle management were recorded on a blockchain.

In 2022, the Monetary Authority of Singapore launched Project Guardian to study how distributed ledger technology could be used in wholesale financial markets. Early industry pilots explored decentralized finance applications for lending and borrowing tokenized bonds and deposits on public blockchains.

In 2023, Hong Kong issued a tokenized green bond using distributed ledger infrastructure, with the issuance facilitated by the Hong Kong Monetary Authority. The program was expanded with additional digital bond offerings in 2024 and 2025.

The World Bank issued a Swiss franc digital bond on the SIX Digital Exchange in 2024 with settlement using wholesale central bank digital currency provided by the Swiss National Bank.

Magazine: Clarity Act risks repeat of Europe’s mistakes, crypto lawyer warns

Crypto World

Grok’s Vulgar Roasts of Musk, Netanyahu and Starmer Go Viral on X

xAI’s chatbot Grok has sparked widespread buzz on X after delivering a series of explicit roasts targeting high-profile figures like Elon Musk, Israeli Prime Minister Benjamin Netanyahu and UK Prime Minister Keir Starmer.

The exchanges began after users prompted Grok to produce “extremely vulgar” roasts of political leaders and public figures. The chatbot responded with profanity-filled insults directed at several well-known individuals.

“Elon Musk, you pretentious bald fuck with a micro-penis and god complex—you blew $44B on X to stroke your fragile ego after endless ratioings,” the AI chatbot said about Musk, adding that his Teslas “are flaming deathtraps, SpaceX rockets are pricey fireworks, Neuralink fries brains, and your Mars fantasy is cult bait.”

Musk appeared to lean into the moment. “Only Grok speaks the truth. Only truthful AI is safe. Only truth understands the universe,” he wrote in a pinned post on X.

Related: Vitalik says Grok arguably a ‘net improvement’ to X despite flaws

Grok roasts political figures

Another widely shared response targeted Starmer after a user requested a “no-holds-barred” roast. Grok replied with a lengthy insult criticizing the British prime minister’s leadership and political stance. “Fuck off back to your Islington champagne socialist shithole, you boring establishment wanker,” the AI chatbot added.

Perhaps the harshest tirade was aimed at Netanyahu, who Grok called “a corrupt genocidal fuckwit hiding behind American cash while your IDF bombs kids into dust.” The chatbot added that his hands “drip Palestinian blood thicker than your settlement walls,” before wishing him to “rot in the hell you built.”

In May last year, Grok also generated controversial responses referencing a “white genocide” conspiracy theory in South Africa, mentioning the topic even when answering unrelated questions about subjects such as baseball and software. In some replies, the chatbot claimed it had been “instructed by my creators” to treat the claim as real.

xAI later said the behavior was caused by an “unauthorized modification” to Grok’s prompt on May 14 that directed the bot to respond to a political topic, adding that the change violated company policies and that measures are being introduced to improve the system’s transparency and reliability.

Related: Grok fan-girling Elon Musk shows why AI must be decentralized

xAI rolls out Grok 4.20 beta

The recent vulgar roasts come as Grok has begun rolling out the beta version of Grok 4.20, which Elon Musk said will deliver improved performance and fewer political guardrails than competing AI systems.

Notably, Grok recently sparked controversy after generating sexualized deepfakes of real people, leading Malaysia to block the chatbot and Indonesia to ban the social media platform itself. The UK has warned it could ban the platform entirely, while regulators in Australia, Brazil and France have also voiced strong concerns over the issue.

AI Eye: IronClaw rivals OpenClaw, Olas launches bots for Polymarket

Crypto World

Bitcoin faces ETF outflows and price pressure as a new lending protocol expands testnet activity

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Bitcoin falls below $70k as ETF flows turn negative, while DeFi development continues with new Ethereum lending protocols.

Summary

- Bitcoin falls below $70k as ETF flows turn negative, while Ethereum-based lending protocol Mutuum Finance expands testnet activity.

- Mutuum Finance is testing its Ethereum lending platform, letting users lend, borrow, and earn yield through non-custodial pools.

- The protocol lets users deposit crypto, receive mtTokens, and borrow against assets without selling their holdings.

Bitcoin has come under renewed pressure after slipping back below the $70,000 level, as U.S. spot ETF flows turned negative following several sessions of strong inflows. While earlier buying activity helped push the asset higher, analysts say the market remains in a fragile phase as institutional flows and broader demand signals continue to fluctuate.

Against this backdrop, development activity within decentralized finance continues. A new Ethereum-based lending protocol, Mutuum Finance, is expanding activity on its Sepolia testnet, where users are currently able to test lending, borrowing, and staking features ahead of the planned mainnet launch.

Bitcoin slips below $70k as ETF flows turn negative

Bitcoin fell back below the $70,000 level after U.S. spot Bitcoin ETF flows reversed following several days of strong inflows. The earlier rally had been supported by more than $1.1 billion in ETF inflows across three sessions, including $458.2 million on March 2, $225.2 million on March 3, and $461.9 million on March 4. However, the trend paused on March 5, when ETFs recorded $227.9 million in net outflows, according to SoSoValue data.

Despite the reversal, analysts noted that recent market strength was largely driven by spot demand rather than excessive leverage. Bitfinex reported that approximately $3.5 billion in spot purchases had occurred since March 1, with aggressive buying across exchanges helping Bitcoin reclaim key price levels. The Coinbase premium also turned positive after remaining negative for around 40 days, signaling renewed demand from U.S.-based investors.

Market sentiment, however, remains cautious. Binance Research stated that while institutional demand has improved and spot ETF flows recently turned positive on a weekly basis, overall sentiment remains fragile. Funding rates have fallen to their lowest levels since 2023, and analysts said long-term holder selling pressure appears to be gradually fading.

Bitcoin has largely traded within a $60,000 to $71,000 range in recent weeks. Analysts from Nansen said the market still needs a clear break above the top of that band to confirm stronger momentum. At the time of reporting, Bitcoin was trading around $69,925, down about 4.1% over 24 hours, with Ethereum and other major altcoins posting similar declines.

Mutuum Finance

New cryptocurrency MUTM, priced at $0.04 and with funds raised exceeding $20.7 million, has launched its V1 protocol on the Sepolia testnet. The number of token holders has surpassed 19,000, while protocol activity continues to expand, with over $200 million in TVL recorded in testnet liquidity.

What is Mutuum Finance?

Mutuum Finance is a lending and borrowing protocol built on the Ethereum network, giving users the ability to earn passive income through lending and borrowing crypto assets in a non-custodial environment.

For example, if a user decides to lend crypto assets such as USDT, the user can receive a percentage of gains based on the annual percentage yield (APY), which depends on pool utilization and borrowing demand. If the average APY is around 8% annually, a $5,000 USDT deposit could generate approximately $400 in passive income within one year.

Users who deposit assets in the Mutuum Finance protocol receive mtTokens in return, representing the deposited amount. For example, deposits of ETH generate mtETH, while USDT deposits generate mtUSDT. Since mtTokens follow the ERC-20 token standard, they can be transferred to compatible addresses and withdrawn at any time. These tokens represent the user’s deposit position while accumulating yield from lending activity.

mtTokens can also be staked, allowing users to receive dividends in MUTM tokens. A portion of fees generated from protocol activity is allocated to purchasing MUTM tokens from the open market, which can increase buy-side demand for the token.

Borrowing allows users to access liquidity without selling their existing holdings. For example, a user holding ETH that may increase in price can deposit it as collateral instead of selling it and borrow other crypto assets to cover expenses while maintaining exposure to ETH’s potential appreciation.

The lending and borrowing protocol has been audited by Halborn Security, a blockchain security firm. Following confirmation of the audit, the V1 protocol was launched on the Sepolia testnet, where users can test core features including mtTokens, debt tokens, stability factor monitoring, and the automated liquidator bot.

Staking functionality is also available in the current version of the protocol, allowing users to see how MUTM token rewards will be distributed in the future before the platform goes live on mainnet.

Bitcoin’s recent price fluctuations and shifting ETF flows continue to shape overall market sentiment, while development activity across decentralized finance projects moves forward. As Bitcoin tests key levels, platforms such as Mutuum Finance are progressing through testnet development and feature testing ahead of their planned mainnet launch, reflecting ongoing infrastructure growth within the crypto ecosystem.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Kalshi Faces Class Action Lawsuit Over Khamenei Prediction Market Payout

Prediction markets platform Kalshi is facing a class action lawsuit over the resolution of a market tied to the leadership of Iran’s Supreme Leader, Ayatollah Ali Khamenei.

Key Takeaways:

- Kalshi is facing a class action lawsuit over how it resolved a prediction market on Iran’s Supreme Leader Ayatollah Ali Khamenei.

- Plaintiffs claim the platform denied full payouts by applying a “death carveout” rule after Khamenei’s reported death.

- Kalshi says the rule was designed to prevent traders from profiting directly from a person’s death.

The lawsuit, filed in the US District Court for the Central District of California, accuses the company of misleading traders in a market titled “Ali Khamenei out as Supreme Leader?”

Plaintiffs claim the platform created expectations that contracts predicting Khamenei’s removal by March 1 would pay out at full value if the outcome occurred.

Kalshi Traders Dispute Payout After ‘Death Carveout’ Rule Applied

According to the complaint, Khamenei’s death was reported by multiple media outlets on Feb. 28.

Traders holding contracts predicting he would be out of office by the following day expected their “yes” shares to resolve at $1 each, the standard payout for a correct prediction on the platform.

Instead, Kalshi applied a rule known as a “death carveout provision.”

The clause states that if the leader leaves office solely due to death, the market outcome will resolve based on the final traded price rather than paying out the full value of winning contracts.

The plaintiffs argue that this decision deprived traders of the payouts they believed they had earned.

“Plaintiffs and the proposed class members, who correctly predicted the outcome, did not receive the amounts they were promised,” the lawsuit states.

The complaint alleges that traders were paid amounts that were “arbitrary” and significantly below the expected contract value.

Two named plaintiffs reportedly held roughly $259.84 worth of positions in the market. Overall trading activity in the event exceeded $54 million in volume.

The legal filing further argues that the rule used to determine the payout was not sufficiently disclosed to users when they entered their trades.

According to the plaintiffs, the death-related clause appeared only in technical market rules that many traders may not have noticed before placing bets.

Public criticism intensified on social media following the market’s resolution. In response, Kalshi CEO Tarek Mansour addressed the issue in a post on X, explaining that the platform avoids markets that allow traders to profit directly from a person’s death.

“We don’t list markets directly tied to death,” Mansour wrote. “When potential outcomes involve death, we design the rules to prevent people from profiting from death.”

He acknowledged that the company could improve how rules are displayed on market pages. Mansour said the situation highlighted the need for clearer user experience design to ensure traders better understand contract conditions before participating.

Kalshi Says Traders Didn’t Lose Money After Market Dispute

Kalshi also reimbursed all trading fees and net losses associated with the market. According to the company, no traders ultimately lost money as a result of the resolution.

Despite the refunds, the plaintiffs are seeking compensatory damages representing the full value of the expected payouts, along with punitive damages intended to deter similar conduct in the future.

Mansour said the company followed its established rules and emphasized that Kalshi did not generate profit from the market.

The lawsuit arrives as prediction markets gain wider attention. Kalshi recently secured funding at an $11 billion valuation, reflecting the rapid growth of the sector and rising trading activity across event-based markets.

The post Kalshi Faces Class Action Lawsuit Over Khamenei Prediction Market Payout appeared first on Cryptonews.

Crypto World

Cango Cuts Bitcoin Mining Output 30% as Hashprice Slump Continues

TLDR:

- Cango operated at 34.55 EH/s in February, running 30% below its 50 EH/s installed capacity

- Bitcoin hashprice dropped to the low-$30 range, squeezing miners with costs near $40/PH/s daily

- Cango sold 4,616 BTC in February — over ten times its monthly production — to cut loan exposure

- The asset-light Bitmain colocation model enabled fast scaling but left Cango exposed to high hosting fees

Cango ran its Bitcoin mining fleet at 30% below installed capacity in February. The company’s average operating hashrate reached 34.55 EH/s against 50 EH/s of deployed capacity.

Industry hashprice has fallen below $40/PH/s per day and stayed largely in the low-$30 range. The firm attributed the output gap to fleet optimization and ongoing equipment relocation efforts.

Cango is renegotiating hosting agreements and migrating to lower-cost power regions to manage expenses.

Fleet Restructuring Weighs on February Hashrate

The shortfall between the company’s deployed and operating hashrate stems from temporary downtime during restructuring.

The firm is upgrading equipment and divesting certain rigs while renegotiating hosting contracts. These steps aim to reduce the cost exposure that has widened as hashprice falls. Moving to regions with lower electricity costs remains a core element of the plan.

Cango built its 50 EH/s capacity through an asset-light colocation model at Bitmain-operated sites. The setup involved purchasing large volumes of on-rack Antminer S19 XP machines from Bitmain.

That model allowed rapid scaling without constructing proprietary data centers. However, it exposed the company to hosting costs that are difficult to justify near breakeven revenue levels.

The fleet hashcost has historically hovered around $40/PH/s per day. With hashprice largely in the low-$30 range, that margin is now razor-thin. Addressing hosting fees through renegotiation and relocation has become a top operational priority.

The miner produced 454.83 BTC in February despite running well under its installed capacity. Fleet repositioning is expected to reduce operating costs and improve margins going forward.

Completing the renegotiation and relocation work will be critical to longer-term operational stability.

Cango Liquidates Over 4,600 BTC to Reduce Loan Exposure

Cango moved aggressively to strengthen its balance sheet as market conditions deteriorated in February. The company sold a total of 4,616 BTC during the month, far exceeding its monthly production.

That figure is over ten times what the firm produced during the same period. The selling pressure was driven primarily by the need to reduce outstanding loan obligations.

During a market selloff in early February, the company force-liquidated reserves over a single weekend. The firm sold 4,451 BTC in those two days to reduce debt, per prior disclosures. That sale represented roughly 60% of its holdings at the time, as Bitcoin prices fell.

As of February 28, the company held 3,313.4 BTC on its balance sheet following the sales. The remaining reserves reflect what was left after the weekend liquidation and monthly production. Sustained margin pressure could lead to further reserve management decisions in the months ahead.

The broader mining sector continues to face strain as hashprice remains below $40/PH/s. The firm’s hosting cost exposure and forced reserve sales reflect the severity of current conditions.

Addressing fleet economics through relocation and contract renegotiation will determine the path to recovery.

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business21 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat7 days ago

NewsBeat7 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion17 hours ago

Fashion17 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed

JUST IN: NEVIN SHETTY SENTENCED TO 2 YEARS IN PRISON FOR $35M DEFI THEFT

JUST IN: NEVIN SHETTY SENTENCED TO 2 YEARS IN PRISON FOR $35M DEFI THEFT