Crypto World

Zerebro founder Jeffy Yu has allegedly killed himself again

Jeffy Yu, the Zerebro founder who previously faked his own death before being sued by Burwick Law, has allegedly committed suicide for real.

On February 2, X account “alvennya” claimed that Yu had killed himself, pointing to a recent burial at the Roseville Cemetery, which lists the deceased as “Jeffy Zhenyu Yu” and claims he died on New Year’s Day.

The account also claimed to have police recordings taken from a scanner that contains audio of Roseville police discussing the scene before discovering his suicide.

This was shared along with unsubstantiated screenshots apparently from Roseville police that suggest Yu was suffering a “mental crisis” and was going door to door asking for help while armed.

Another X account, “Scooter,” shared these reports and also claimed that one of their followers visited Yu’s grave and took a photo.

Jeffy Yu staged his death to sell $1.4M in crypto

Yu staged his death last year after launching his own after-death-themed memecoin. He also faked his own obituary and scheduled posts to be released after his apparent death.

A writer for The San Francisco Standard, however, tracked Yu down and discovered him living with his parents in San Francisco.

After his supposed death, analysts spotted Yu selling $1.4 million worth of Zerebro tokens.

Read more: X Creators $1M prize winner exposed as memecoin pump-and-dumper

Given Yu’s history, online users are already skeptical about Alvennya’s claims and are starting to question the account’s credibility.

One user questioned if the police audio was AI-generated, and claims that Yu’s final video was made in San Francisco, not Roseville.

Others have noted that his X account and Telegram were deleted after his “death” and that there are also no local news reports on the apparent suicide.

The Alvennya account is also unusual. Despite being six years old, it’s only made 21 posts, all of which were posted this month and are dedicated to Yu’s suicide.

They’ve also limited the replies to their posts.

Jeffy Yu sued by Burwick Law

Legal firm Burwick Law filed a lawsuit against Yu on February 9, claiming that he misrepresented Zerebro as a legitimate long-term AI infrastructure.

They say that the project’s founders cashed out their Zerebro holdings as onlookers began to realise their lies, and that Yu staged his death to distract from the project’s collapse.

Read more: Zerebro’s ‘dead’ founder Jeffy Yu is still dumping tokens

Because of this, Scooter is now claiming that Burwick Law has somehow sued a dead man.

Scooter was named a defendant in another Burwick lawsuit against Pump Fun and Solana, and has since suggested that he would consider filing a counterdefamation claim against the firm.

It’s ultimately unlcear wether or not Yu has died. Protos has reached out to Alvennya, Roseville Police, Roseville Cemetery, and Burwick Law for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

US Bitcoin ETFs Post $462 Million Inflows as BTC Tops $73K

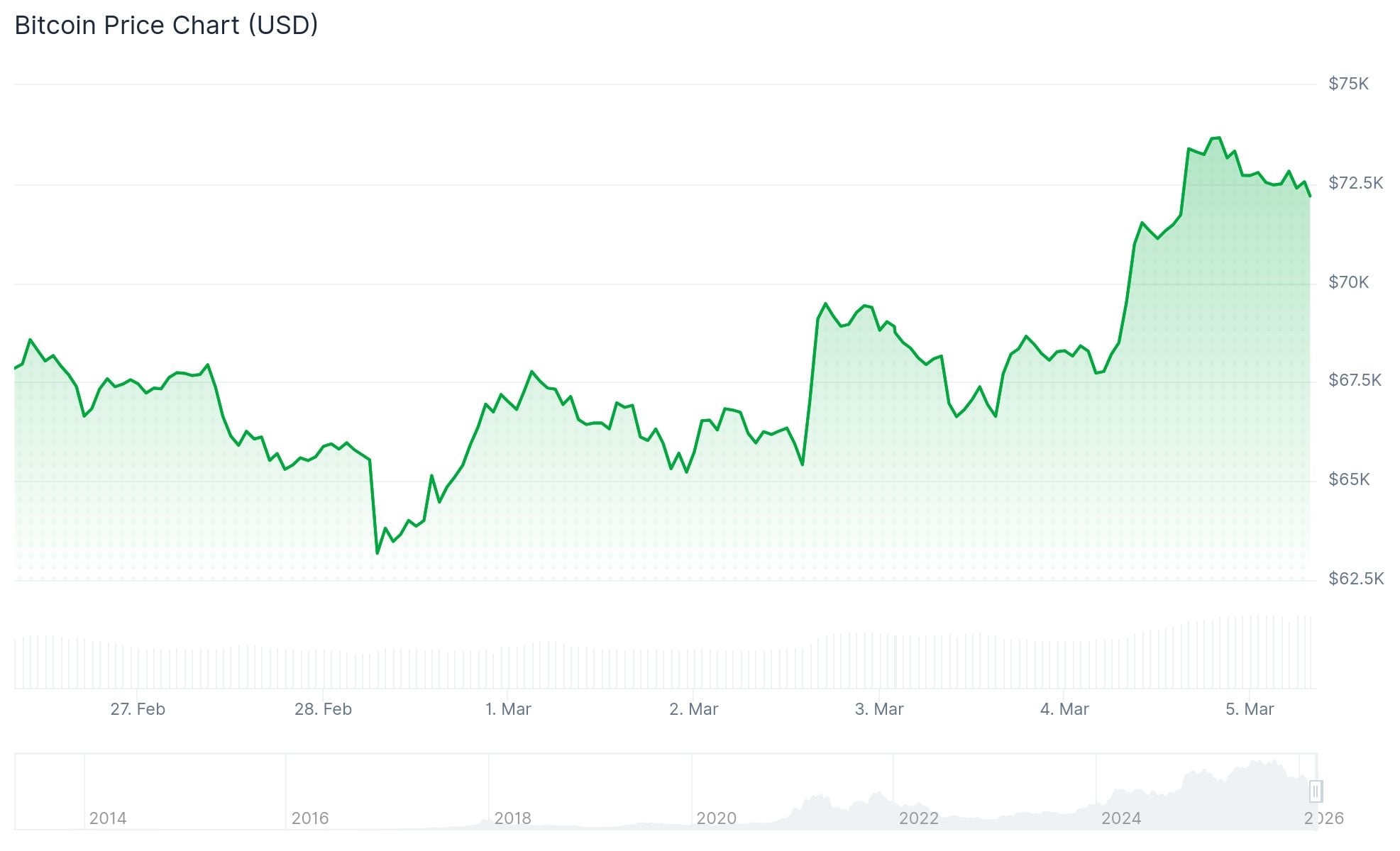

US spot Bitcoin exchange-traded funds increased inflows on Wednesday, with gains distributed across most issuers, as BTC briefly surged past $73,000.

Spot Bitcoin (BTC) ETFs posted $462 million in net inflows, marking the third consecutive day of inflows and bringing the weekly total to $1.1 billion, according to Farside data.

The new gains bring year-to-date flows to about $700 million, a modest amount after the ETFs shed $3.8 billion during a five-week outflow streak.

Ether (ETH) funds shared the sentiment, drawing $169 million in inflows after seeing minor outflows of $11 million on Tuesday.

The flows highlight a potential market reversal, with analysts observing that most Bitcoin ETFs have now turned to net positive flows YTD.

All but one spot Bitcoin fund see gains

Wednesday marked a rare occasion when nearly all US spot Bitcoin funds attracted inflows, with only the CoinShares Bitcoin ETF (BRRR) recording zero inflows on the day.

BlackRock’s iShares Bitcoin Trust ETF (IBIT) again led inflows with $307 million, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Grayscale Bitcoin Mini Trust ETF (BTC) with $48 million and $32 million, respectively.

According to Bloomberg ETF analyst Eric Balchunas, almost all Bitcoin ETFs had turned net positive in year-to-date flows as of Tuesday, with only three funds still showing losses.

Those include FBTC with $1.1 billion in outflows, as well as the Grayscale Bitcoin Trust ETF (GBTC) and the ARK 21Shares Bitcoin ETF (ARKB), which have seen $648 million and $162 million in outflows, respectively.

The latest wave of gains in Bitcoin ETFs came amid a sentiment recovery attempt, with the Crypto Fear & Greed Index jumping 12 points over the past 24 hours, according to Alternative.me data.

Related: Altcoin chatter sinks to 2-year low as Bitcoin holds attention

Despite Bitcoin recovering about 20% from February’s low of $60,000, the index still stands at “extreme fear” with a score of 20.

At the time of writing, Bitcoin traded at $72,214, down about 8% over the past 30 days, according to CoinGecko.

Magazine: Would Bitcoin really be at $200K if not for Jane Street? Trade Secrets

Crypto World

Hire Experienced NFT Game Developers

AI Summary

- The blog post emphasizes the importance of hiring experienced NFT game developers for building successful NFT-powered ecosystems.

- It discusses common failure points in NFT game development, the core capabilities to look for in developers, and the benefits of partnering with a specialized NFT game development company.

- The post highlights the need for expertise in blockchain engineering, game design, backend infrastructure, and security management to create sustainable NFT games.

- It also provides insights on cost considerations, long-term partnership value, and a decision framework for selecting the right development partner.

- Antier is recommended as a suitable development partner due to its expertise in gaming and understanding of technical complexity and economic sustainability in NFT game development.

The NFT gaming market is no longer experimental. Enterprises, gaming studios, & Web3 startups are building NFT-powered ecosystems that combine ownership, interoperability, and tokenized economies. However, while the opportunity is significant, failure rates remain high. The difference rarely lies in the idea. It lies in execution.

Planning to hire experienced NFT game developers is not about adding blockchain functionality to a game. It is about building secure, scalable, economy-driven digital ecosystems that can sustain users, transactions, and growth.

Before choosing a partner, enterprises must understand what truly defines experience in NFT game development and what separates a capable vendor from the best NFT game development company.

Why NFT Games Fail Without the Right Development Team

Many NFT games fail not because of market conditions, but because of technical and architectural weaknesses. Common failure points include:

- Poorly designed tokenomics

- Smart contract vulnerabilities

- Scalability bottlenecks

- Weak backend architecture

- Lack of analytics integration

- Inadequate live-ops planning

NFT games operate at the intersection of blockchain, game design, and economic modeling. A team lacking expertise in even one of these areas creates long-term instability. Enterprises that hire inexperienced NFT game developers often face post-launch issues that require expensive fixes.

What “Experienced” Really Means in NFT Game Development

Experience in NFT game development goes beyond coding smart contracts. True experience includes:

- Designing sustainable in-game economies

- Building secure NFT minting mechanisms

- Implementing gas-efficient smart contracts

- Integrating wallet systems seamlessly

- Managing multi-chain compatibility

- Planning for high transaction throughput

Experienced NFT game developers have in-depth understanding of how blockchain constraints affect gameplay. They design mechanics that account for transaction costs, confirmation delays, and network performance. This level of foresight is critical for long-term success.

Core Capabilities Enterprises Should Look For

When evaluating NFT game developers, enterprises should assess technical depth across multiple domains.

1. Blockchain Engineering Expertise

Developers should demonstrate:

- Smart contract architecture knowledge

- Multi-chain deployment experience

- Security audit readiness

- Token standard implementation expertise

- NFT marketplace integration skills

Weak blockchain engineering creates permanent vulnerabilities.

2. Game Design and Mechanics Understanding

NFT games are still games first and hence developers must understand:

- Player psychology

- Reward loops

- Progression systems

- Competitive balancing

- Retention mechanics

Without strong game design, NFT ownership alone does not drive engagement.

3. Backend Infrastructure and Scalability

A scalable NFT game requires:

- High-performance backend servers

- Real-time gameplay synchronization

- Load balancing systems

- Database optimization

- Analytics pipelines

Scalability issues damage user trust quickly.

4. Security and Risk Management

NFT games involve real asset ownership. Security cannot be optional. Teams should have:

- Smart contract security practices

- Penetration testing workflows

- Fraud prevention systems

- Anti-bot mechanisms

- Wallet security protocols

Security failures often result in irreversible damage.

Planning an NFT Game? Let’s Discuss Your Strategy

Things to Keep in Mind When Hiring NFT Game Developers

Enterprises should be cautious of:

- Teams that focus only on smart contracts

- Lack of scalable backend planning

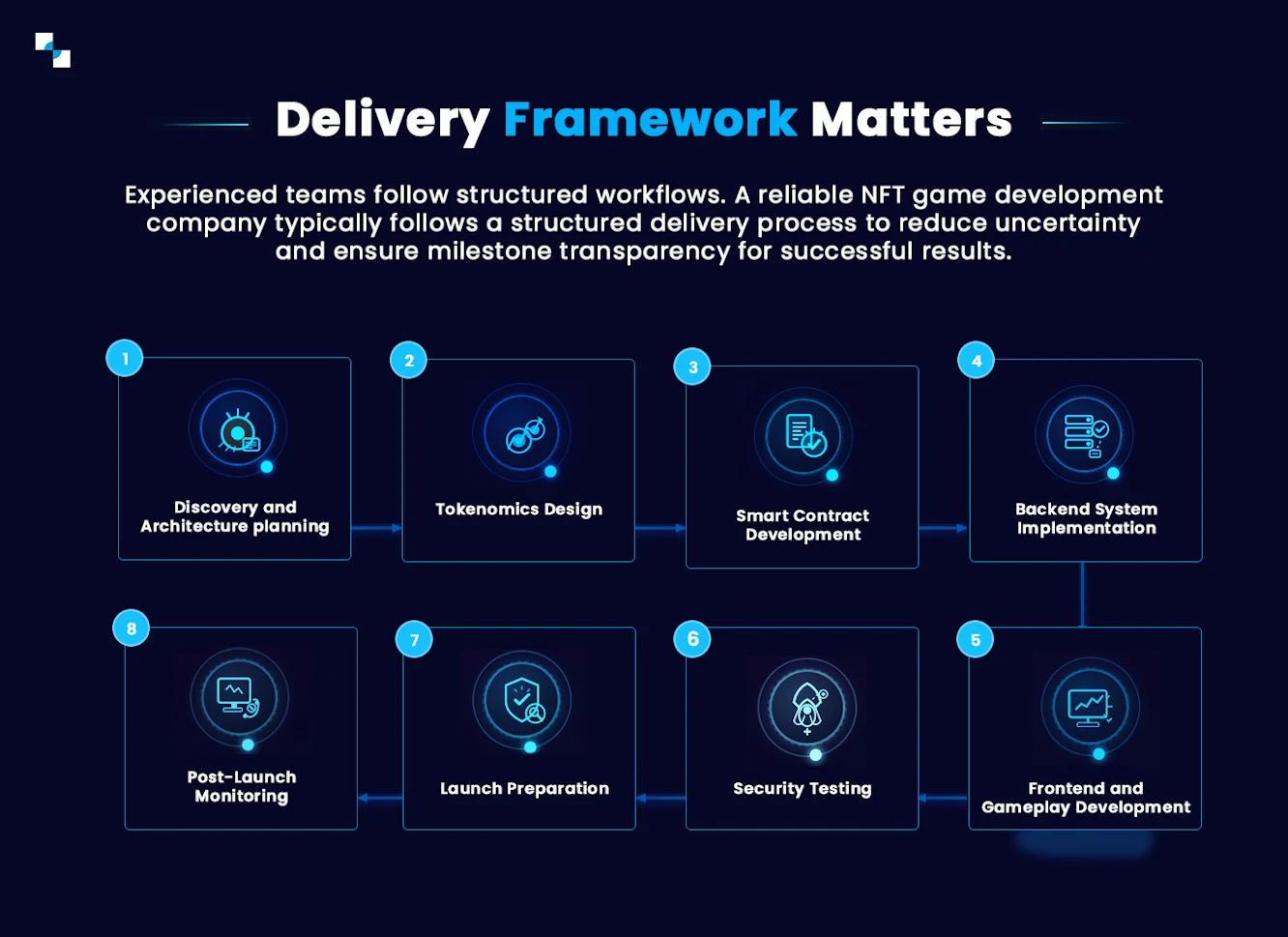

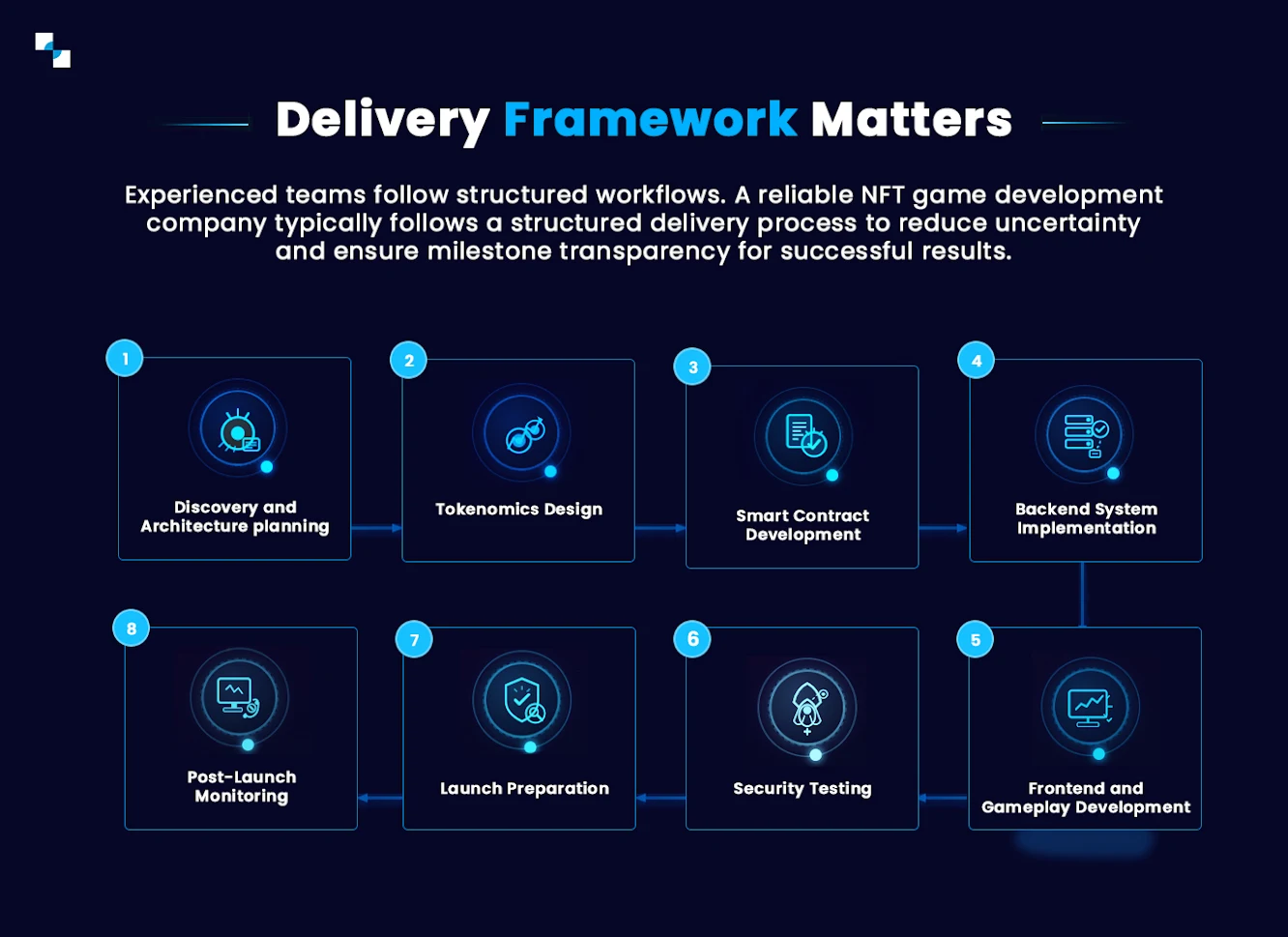

- No documented delivery process

- Unrealistic timelines

- No post-launch support strategy

A vendor that promises rapid NFT integration without discussing infrastructure and tokenomics likely lacks experience.

In-House vs Hiring a Specialized NFT Game Development Company

Some enterprises consider building internal NFT game teams. While this provides control, it introduces significant hiring and operational challenges. Building an in-house team requires:

- Blockchain engineers

- Backend developers

- Game designers

- UI/UX designers

- DevOps specialists

- Security experts

However, recruiting and coordinating such a team is expensive and time-consuming.

On the other hand, hiring a specialized NFT game development company provides:

- Cross-functional expertise

- Proven frameworks

- Faster time-to-market

- Reduced hiring risk

- Structured delivery models

For most enterprises, partnering with experienced NFT game developers reduces execution risk.

What the Best NFT Game Development Company Offers

The best NFT game development company provides more than technical services. It offers strategic guidance. This typically includes:

- Concept validation

- Tokenomics design consultation

- Architecture planning

- Blockchain selection strategy

- UX optimization

- Monetization alignment

- Compliance considerations

A true development partner aligns technical execution with business objectives.

Cost Considerations When Hiring NFT Game Developers

The cost of hiring NFT game developers tends to vary on the overall scope and complexity. Enterprise NFT games typically range from mid-five to six-figure budgets, depending on:

- Blockchain selection

- Feature depth

- Smart contract complexity

- Backend infrastructure scale

- Integration requirements

Choosing based solely on cost often results in higher long-term expenses due to rework and scalability issues. Investment should be evaluated against long-term platform sustainability.

Long-Term Partnership Value

NFT games evolve continuously. Economy tuning, feature updates, and network upgrades require ongoing technical involvement. Enterprises benefit from partners that provide:

- Continuous optimization

- Performance monitoring

- Economy balancing

- Feature expansion

- Infrastructure scaling

NFT game development is not a one-time project; it is an evolving ecosystem.

Final Decision Framework

Prior to hiring NFT game developers, enterprises should ask:

- Does the team understand both blockchain and game mechanics?

- Can they demonstrate scalable architecture experience?

- Do they provide structured delivery processes?

- Can they support long-term growth?

- Do they align technical execution with business goals?

Antier, with its high level expertise & expertise in gaming, happens to be the most suitable development partner to make sure that the NFT game becomes a sustainable ecosystem and not a short-lived experiment.

Enterprises looking forward to building secure, scalable NFT games should work with the best NFT game development company that understands both technical complexity and economic sustainability. The difference between a functioning NFT game and a thriving NFT ecosystem lies in execution, and execution begins with hiring Antier as the right development partner.

Frequently Asked Questions

01. Why do many NFT games fail despite having a good idea?

Many NFT games fail due to technical and architectural weaknesses, such as poorly designed tokenomics, smart contract vulnerabilities, and scalability bottlenecks, rather than market conditions.

02. What should enterprises look for when hiring NFT game developers?

Enterprises should seek developers with experience in designing sustainable in-game economies, building secure NFT minting mechanisms, and managing multi-chain compatibility, among other technical capabilities.

03. How does experience in NFT game development impact long-term success?

Experienced NFT game developers understand blockchain constraints and design mechanics that account for transaction costs and network performance, which is critical for creating stable and successful digital ecosystems.

Crypto World

Bitcoin’s Next Big Price Targets Revealed as Analysts Expect Fresh Rally

Bitcoin is currently fightining with a crucial resistance level that could lead to new substantial gains if reclaimed.

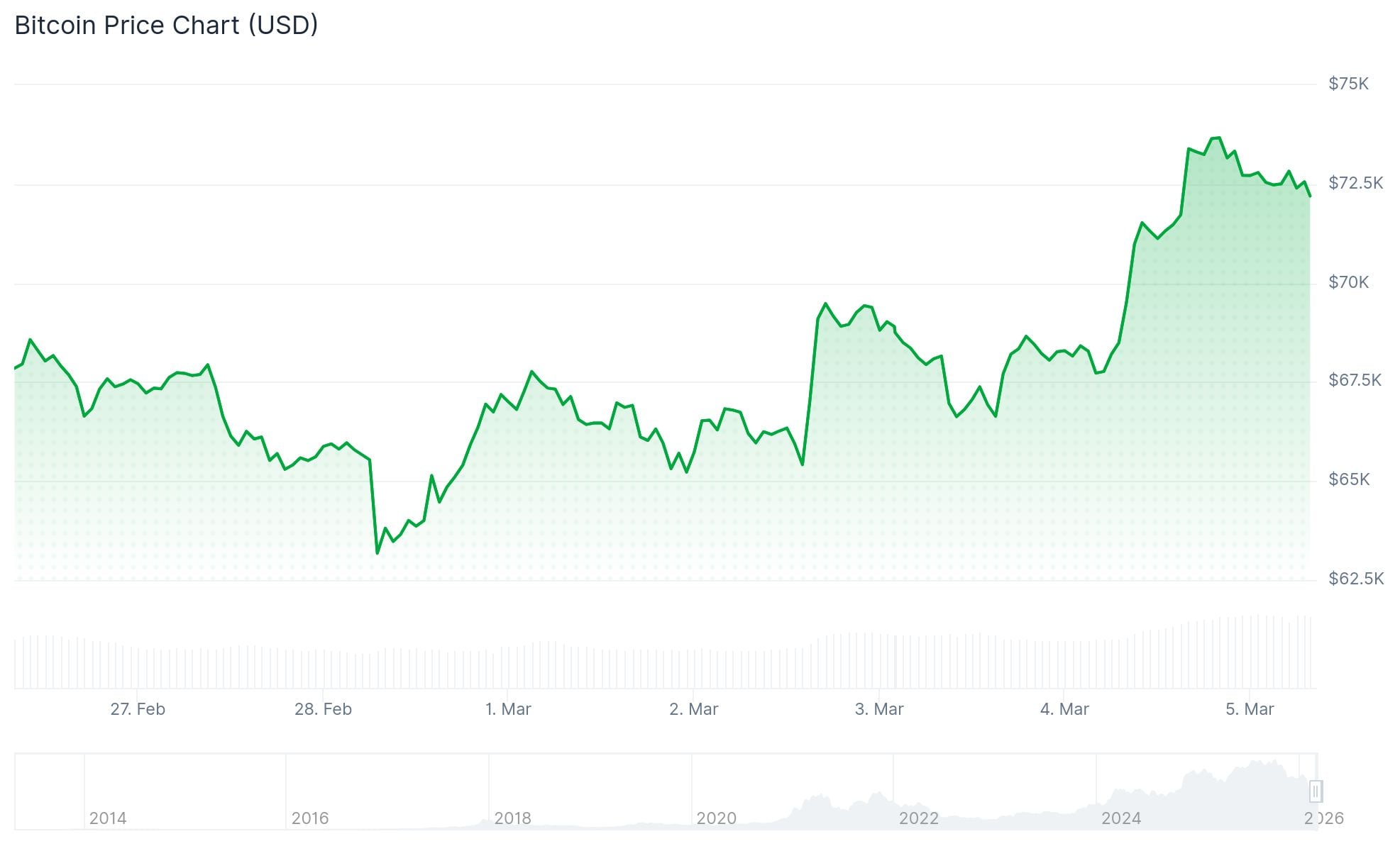

Bitcoin’s price moves took a massive turn for the better in the past 24 hours, as the asset finally broke above the coveted $70,000 resistance and tapped a new monthly peak at $74,000.

In this article, we will review some potential reasons behind this rally and outline the next price targets for the cryptocurrency, according to prominent analysts.

The Why?

In a recent post on X, Ali Martinez first laid out the most probable reasons behind the asset’s impressive surge that drove it higher by well over six grand yesterday. Moreover, reaching $74,000 meant that BTC had gained $11,000 since the Saturday low when the strikes between the US, Israel, and Iran began.

The analyst named the ETF flows as the first reason, given the substantial change in investor behavior. Data from SoSoValue paints a clear picture, as the spot Bitcoin ETFs were deep in the red for five consecutive weeks from the one that ended on January 23 to the one that ended on February 20. Within this timeframe, they withdrew nearly $4 billion worth of BTC.

However, they began to pour money in last week (ending on February 27), with $787 million in net inflows, and $683 million has entered the funds in just three trading days during the current one.

However, there’s some discrepancy when it came down to the numbers for this week. While SoSoValue shows $683 million in net inflows, Martinez’s data suggests the value was higher ($789 million), while FarSide claims the actual flows were a whopping $1.145 billion. Nevertheless, even if we take the most modest amount, it still represents a clear shift in investor dynamics.

The two other possible reasons could be related to the ending of the extended Chinese holidays, as well as increased levels of spot buying shown by the BTC CVD indicator – mostly from whales, and not retail.

You may also like:

Next Targets?

Martinez also indicated that BTC had reclaimed an important resistance at $70,685, which was a major cluster. He now believes there’s a very light supply between $72,000 and $81,000, calling it “open air in that range.”

“The next major supply clusters appear around $83,307 and $84,569, which could act as the significant resistance zones.”

The Wolf Of All Streets outlined the significance of the $74,000 level, calling it a “mega technical resistance.”

CryptoWZRD also weighed in on BTC’s recent performance, indicating that it closed bullish. The analysts noted that another move higher is “likely” unless “we face a major geopolitical shift.”

BTC Daily Technical Outlook:$BTC closed bullish. A further upside move is likely from here unless we face a major geopolitical shift. I’ll track the intraday chart tomorrow to get the next quick scalp opportunity ⚡️ pic.twitter.com/naFDHnHKLD

— CRYPTOWZRD (@cryptoWZRD_) March 5, 2026

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Eric Trump Attacks Major Banks for Fighting Stablecoin Interest Rates

TLDR

- Eric Trump labeled JPMorgan, Bank of America, and Wells Fargo as “anti-American” over their opposition to stablecoin interest payments

- Traditional banks offer savings rates of 0.01–0.05% APY while receiving approximately 3.65% from Federal Reserve holdings

- Digital currency platforms aim to provide 4–5%+ returns on stablecoins via bills like the Clarity Act

- Jamie Dimon, JPMorgan’s CEO, argued that stablecoin issuers paying interest must face banking regulations

- Presidential crypto advisor Patrick Witt countered Dimon’s stance, asserting yield payments alone don’t justify bank-level oversight

Eric Trump launched a scathing criticism of America’s largest financial institutions this week, claiming they’re actively preventing citizens from accessing superior returns via cryptocurrency stablecoins.

During a Wednesday statement on X, Trump specifically named JPMorgan Chase, Bank of America, and Wells Fargo. His allegations centered on these institutions prioritizing profits over customer welfare.

Trump highlighted the substantial disparity between deposit interest rates paid to customers versus what banks receive from the Federal Reserve. Traditional savings accounts yield merely 0.01% to 0.05% annually for consumers, while banks themselves earn roughly 3.65% on Fed reserves.

He contended that cryptocurrency platforms pose a direct challenge to this arrangement by proposing stablecoin interest rates exceeding 4% to 5%. According to Trump, banking institutions are attempting legislative intervention to prevent this competition.

The American Banking Association along with affiliated lobbying organizations are investing substantial resources to limit these yields through the Clarity Act, Trump alleged. He characterized this campaign as “anti-retail, anti-consumer, and straight-up anti-American.”

Eric Trump serves as co-founder of World Liberty Financial, the organization behind the USD1 stablecoin. This entity is simultaneously pursuing a banking charter via the Office of the Comptroller of the Currency.

The Trump family’s participation in World Liberty Financial has sparked controversy. Questions regarding potential conflicts of interest have emerged, particularly considering President Donald Trump’s influence over cryptocurrency policy.

Banks Push Back on Stablecoin Yields

Traditional financial institutions contend that permitting stablecoin platforms to distribute interest could precipitate a substantial exodus of deposits from conventional banking. They warn this scenario might destabilize the financial system.

JPMorgan CEO Jamie Dimon addressed the controversy earlier this week. His position stated that any stablecoin provider offering interest on holdings must comply with identical regulatory frameworks governing banks.

“If you’re going to be holding balances and paying interest, that’s a bank. You should be regulated like a bank,” Dimon said.

White House Crypto Advisor Responds

Patrick Witt, who directs the President’s Council of Advisors for Digital Assets, challenged Dimon’s characterization. He maintained that connecting stablecoin yields with banking regulations represents a misleading comparison.

Witt clarified the critical distinction: the determining factor isn’t yield distribution itself, but whether platforms engage in lending or rehypothecation of underlying assets. According to Witt, these practices necessitate banking oversight—not simple interest payments.

President Donald Trump addressed the Clarity Act via social media on Tuesday, urging congressional action. His message contained comparable criticisms regarding banking sector resistance to stablecoin provisions.

Donald Trump’s statement followed closely after his meeting with Coinbase CEO Brian Armstrong. Armstrong had publicly retracted his endorsement of the legislation in January, expressing reservations about stablecoin language and additional bill components.

The White House has facilitated ongoing negotiations between traditional finance representatives and crypto industry leaders seeking resolution. Currently, the parties haven’t achieved consensus on stablecoin yield regulations.

Crypto World

The Last 24 Hours in Crypto

A closer look at some of the most important stories you might have missed in the past 24 hours.

A lot happened in the world of cryptocurrencies over the last 24 hours. We have handpicked a few of the more important titles you may have missed, so let’s have a quick look.

Google Warns of New iPhone Exploit Targeting Crypto Users

Google researchers have flagged a relatively powerful exploit kit that they call “Coruna.” It is capable of infecting iPhone devices and potentially jeopardizing sensitive information, including seed phrases of cryptocurrency wallets. The toolkit contains a total of 23 vulnerabilities across five exploit chains that target devices running older versions of iOS, ranging from iOS 13 to 17.2.1.

Multiple security analysts say that attackers have managed to deploy the exploit through compromised websites and fake crypto-oriented platforms. Once a vulnerable device visits the website, malware can scan messages and apps like MetaMask to locate wallet credentials or financial information.

The exploit has originally been linked to espionage campaigns before spreading to cybercriminal groups with financial motives. This highlights how advanced surveillance tools can leak into the broader criminal ecosystem, as well as the critical importance of maintaining technological hygiene, updating your phone’s software, and following mandatory security tips when interacting with crypto platforms.

Morgan Stanley Taps Coinbase and BNY Mellon for Bitcoin Infrastructure

Morgan Stanley is preparing to deepen its involvement in crypto infrastructure. The banking behemoth is supposedly considering launching a Bitcoin investment product. The bank intends to rely on Coinbase for cryptocurrency custody services, as well as on BNY Mellon for additional asset custody related to the proposed Morgan Stanley Bitcoin Trust.

The ETF itself will hold Bitcoin directly, and the custody structure will primarily rely on offline cold storage to reduce hacking risks, according to the filing.

The move signals growing institutional demand for regulated access to crypto products. Major financial institutions have undoubtedly increased their involvement and partnered with well-known crypto firms rather than building their own infrastructure in a bid to accelerate Wall Street’s venture into the digital asset industry.

You may also like:

Zerohash Applies for U.S. National Trust Bank Charter

Popular crypto infrastructure firm Zerohash has formally applied for a National Trust Bank Charter with the U.S. Office of the Comptroller of the Currency (OCC). This step could enable the company to operate as a federally regulated trust bank.

If the application is approved and the charter granted, this would allow Zerohash to further expand its services to niches such as digital asset custody, stablecoin management, and tokenized asset infrastructure under a unified federal regulatory framework.

The company is already powering crypto integrations for institutions, which include Morgan Stanley, Stripe, and Interactive Brokers. The move comes a day after Kraken became the first crypto company to obtain a Fed Master Account.

Venture Giant a16z Targets $2 Billion for a New Crypto Fund

Silicon Valley venture capital powerhouse Andreessen Horowitz (a16z) is raising around $2 billion for a fund focused on investing in the cryptocurrency industry. According to the reports, the round can close as early as the first half of this year.

Historically, a16z has been one of the most prominent VCs in the Web3 ecosystem, backing major projects and startups across blockchain infrastructure, crypto apps, DeFi, and related areas.

Despite the ongoing crypto winter, a new fund of this size suggests that venture investors still see long-term opportunity, highlighting that periods of pressure can also be times of opportunity. Recall that Dragonfly – another crypto-oriented VC – recently launched their fourth fund worth $650 million.

Tether Makes $1.5 Billion Bet on AI Sleep Tracking

Last but not least, we have the stablecoin giant Tether making a strategic investment in the AI-powered mattress and sleep-oriented technology company Eight Sleep at a $1.5 billion valuation.

The investment seems to be part of the firm’s broader strategy to diversify and expand well beyond crypto and stablecoins into emerging sectors such as health technology and artificial intelligence.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE position on any coin!

Crypto World

Google warns of iPhone exploit kit used to steal crypto wallets

Cybersecurity researchers are warning that a powerful iPhone exploit kit is increasingly being used in cybercrime campaigns targeting cryptocurrency users.

Summary

- Google researchers identified a powerful iOS exploit kit called Coruna containing 23 vulnerabilities across five exploit chains.

- The malware can scan devices for crypto wallet recovery phrases and financial data, potentially enabling attackers to drain funds.

- The tool reportedly moved from surveillance operations to nation-state espionage and eventually financially motivated cybercrime groups.

Hackers deploy iPhone exploit kit to harvest crypto wallet data

According to a new report from Google’s Threat Intelligence Group, the exploit framework, dubbed “Coruna,” contains five full iOS exploit chains and 23 vulnerabilities capable of compromising iPhones running operating systems between iOS 13 and iOS 17.2.1.

The exploit kit allows attackers to execute malicious code through web content by exploiting vulnerabilities in Apple’s WebKit browser engine and other components. Once a victim visits a compromised website, the framework fingerprints the device to identify the exact iPhone model and software version before deploying the most effective exploit chain.

Researchers say the malware can then deliver additional payloads designed to harvest sensitive data from the device, including cryptocurrency wallet information.

In some campaigns, the exploit kit was deployed through fake gambling and cryptocurrency websites that specifically targeted iPhone users.

The malicious payload was capable of scanning images and files on the device for keywords such as “backup phrase” or “bank account,” allowing attackers to extract recovery phrases and access crypto wallets.

Google’s investigation shows the exploit kit circulated among several threat actors over the past year. It was first observed in 2025 in surveillance operations, later used in watering-hole attacks against Ukrainian users by a suspected Russian espionage group, and eventually adopted by financially motivated hackers linked to China.

Security analysts say the case highlights a worrying trend where sophisticated spyware-grade exploits migrate from government or commercial surveillance tools into the broader cybercrime ecosystem.

Researchers recommend updating devices to the latest iOS versions, as the exploit kit does not affect the newest software releases.

The findings underscore the growing intersection between mobile security threats and cryptocurrency theft, with attackers increasingly targeting digital wallets stored on smartphones.

Crypto World

Bitcoin (BTC) Price Surges Past $73K Amid $1.47B ETF Inflow Surge and Brandt’s Bullish Pivot

Key Highlights

- Bitcoin breached the $73,000 threshold Thursday, fluctuating between $72,500 and $73,187 during trading sessions

- Spot Bitcoin ETFs in the United States attracted $155M Wednesday, contributing to a two-week accumulation totaling $1.47B

- Legendary market analyst Peter Brandt indicated current market dynamics could represent a reversal from October’s highs

- BTC has outpaced gold performance following Iranian military strikes, gaining over 10% versus gold’s nearly 2% decline

- Glassnode blockchain analytics reveal caution signals: approximately 57% of circulating BTC remains profitable

Bitcoin has successfully reclaimed the $70,000 threshold this week, touching an intraday peak of $73,544 throughout Asian market sessions before experiencing a modest correction to approximately $72,500 during Thursday’s London trading window.

The upward momentum accompanies a comprehensive rally across risk-sensitive assets following market volatility triggered by coordinated U.S. and Israeli military operations against Iranian targets this past weekend.

The cryptocurrency advanced 8% Wednesday during American trading windows before experiencing a 1.8% decline Thursday. South Korea’s Kospi index surged 11% while Japan’s Nikkei climbed 4.2% simultaneously, demonstrating widespread market stabilization.

Bitcoin’s Coinbase premium indicator — which had briefly turned negative Sunday — has now inverted. Market analyst Ted Pillows observed it achieved its strongest reading since October 2025, suggesting robust demand from American institutional participants.

“Market sentiment is experiencing a bullish transformation within cryptocurrency circles,” stated Caroline Mauron, Orbit Markets co-founder.

From the trading session preceding Iranian strikes, Bitcoin has appreciated more than 10%. Conversely, gold declined nearly 2% during this identical timeframe. This represents a notable departure from recent monthly patterns, where gold consistently established new records while Bitcoin experienced downward pressure.

Bitcoin ETF Capital Flows Continue Strong Momentum

U.S.-listed spot Bitcoin exchange-traded funds recorded approximately $155 million in net positive flows Wednesday. This continues a sustained two-week pattern accumulating roughly $1.47 billion in fresh capital deployment, based on SoSoValue analytics.

March has already witnessed more than $1.1 billion channeled into American Bitcoin ETF products, including a remarkable $462 million single-day allocation, according to Bloomberg intelligence.

Bitfinex market strategists have cautioned that ETF capital inflows don’t necessarily correlate directly with immediate spot market purchases, considering authorized participants can establish ETF shares prior to acquiring underlying Bitcoin assets.

Veteran Trader Peter Brandt Adjusts Market Outlook

Seasoned market veteran Peter Brandt, who maintained pessimistic positioning since October’s approximate $127,500 peak, shared on X platform this week that present market structure represents “the significant change of price behavior since the top in Oct.”

Bitmine executive chairman Tom Lee responded to Brandt’s commentary, characterizing it as a “potential inflection/change Bitcoin” development.

Market commentator Milk Road highlighted $225.2 million in ETF accumulation on a single day and $458.2 million the preceding session — approaching $700 million across 48 hours — suggesting this volume could fundamentally alter supply-demand equilibrium.

Near-term resistance zones exist between $75,000 and $78,000 levels. Downside support appears established at $65,000 and $60,000 thresholds.

Notwithstanding the recovery, Glassnode data indicates approximately 57% of Bitcoin circulating supply currently trades above acquisition cost — a metric historically associated with early bearish market phases. Short-term holder cost basis clustering near $70,000 could function as resistance, potentially converting upward movements into selling opportunities.

U.S. Treasury Secretary Scott Bessent announced a 15% universal tariff implementation will likely commence this week, potentially creating market headwinds.

Crypto World

Dogecoin price nears bullish triangle breakout, can it recover to its February highs?

Dogecoin price is close to confirming a bullish breakout from a symmetrical triangle pattern amid a surge in demand on the derivatives market.

Summary

- Dogecoin price hit weekly high after reports of U.S.-Iran negotiations calmed investor fears.

- Dogecoin is close to confirming a bullish symmetrical triangle breakout.

Dogecoin (DOGE) price shot up 17% to a weekly high of $0.103 on Thursday morning Asian time before settling at $0.096 at press time.

Dogecoin’s rally was supported by investor fears cooling off after reports surfaced that Iran has secretly been negotiating a deal with the U.S. to de-escalate the ongoing conflict between the two nations.

A look at its futures market shows that more investors are now betting in favor of a Dogecoin rally.

According to CoinGlass data weighted funding rate for Dogecoin has turned positive, signalling that long traders are paying short traders to maintain their positions as they anticipate further gains. Such conditions tend to influence retail sentiment positively.

On the daily chart, Dogecoin price is close to confirming a breakout from the upper side of a symmetrical triangle pattern. When an asset breaks out from the upper side of a symmetrical triangle, it is viewed as a very positive signal and typically marks the beginning of a sustained bullish trend.

For Dogecoin, a breakout from the pattern could trigger bulls to aggressively push the price to reclaim its February high of around $0.117.

Momentum indicators like the MACD and RSI seem to support the bullish path. The MACD lines were moving upwards while the RSI was close to breaking out of the neutral threshold, which is often the spark needed for a massive rally during periods of high market volatility.

However, it should be noted that a break below the $0.080 support would invalidate the bullish setup.

Meanwhile, a major headwind for Dogecoin is the weak demand for spot ETFs tied to the meme coin, which could limit any sustained rally.

Notably, the three spot DOGE ETFs have so far managed to draw in only $7.45 million in net inflows since their launch in November. These institutional products had gone through a month of no flows before attracting only $779,000 in inflows on March 2.

Traders may see the muted involvement from major investors as a sign that institutional players remain unconvinced about the meme coin’s long-term prospects, even as retail demand stays strong.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Solana and XRP price prediction ahead of U.S. employment report for February

Solana and XRP are holding key technical levels as traders prepare for the release of the February U.S. employment report, a major macro event that could influence risk sentiment across financial markets, including cryptocurrencies.

Summary

- Solana and XRP traders are watching the February U.S. employment report, a key indicator that could shape expectations for Federal Reserve policy and risk appetite.

- SOL is stabilizing near $91 with accumulation indicators improving, suggesting buyers are gradually returning after February’s sell-off.

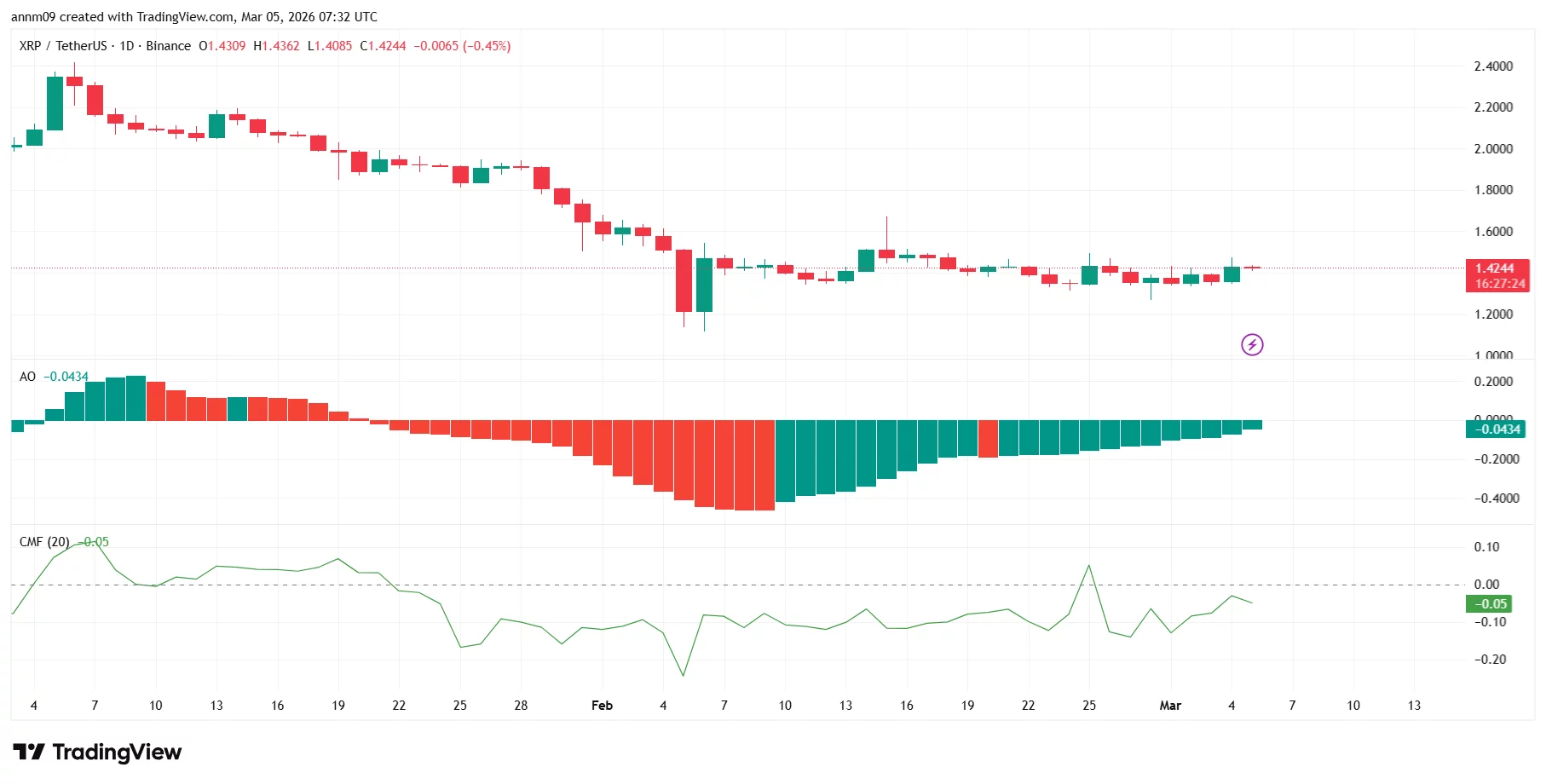

- XRP is trading around $1.42, with momentum indicators pointing to weakening bearish pressure and a potential move toward resistance if macro conditions turn favorable.

Investors closely watch the U.S. nonfarm payrolls report because strong labor market data could reinforce expectations that the Federal Reserve will keep interest rates elevated for longer.

Conversely, weaker data may strengthen the case for rate cuts later this year, potentially boosting demand for risk assets such as cryptocurrencies.

Against this backdrop, several altcoins have entered consolidation phases following February’s market turbulence, when geopolitical tensions and broader risk-off sentiment weighed on crypto prices.

Solana price outlook

Solana is trading near $90.9 after recovering from a sharp early-February decline that briefly pushed the token toward the $70 region.

The daily chart shows SOL forming a gradual recovery structure as buyers step in near lower levels. The Accumulation/Distribution indicator is trending higher, signaling that investors may be steadily accumulating the token.

Meanwhile, the Bull Bear Power (BBP) indicator has turned positive, suggesting improving bullish momentum after weeks of persistent selling pressure.

If momentum continues, SOL could test resistance near $95, with a stronger breakout potentially opening the door toward the $100 psychological level.

However, downside risks remain. A break below $85 support could expose the token to renewed selling pressure and potentially send it back toward the $80–$78 region.

XRP price outlook

XRP is currently trading around $1.42, where it has been moving sideways after a prolonged decline from earlier highs near $2.

Technical indicators suggest bearish momentum may be fading. The Awesome Oscillator is gradually turning positive, while the Chaikin Money Flow indicator is stabilizing, signaling that capital outflows are slowing.

If buying pressure strengthens, XRP could attempt a move toward resistance near $1.50, followed by a potential test of the $1.60 zone.

On the downside, the key support level sits near $1.35, and a breakdown below that threshold could send XRP toward the $1.25 area.

With both tokens consolidating, the upcoming U.S. employment report may act as the next major catalyst determining whether Solana and XRP extend their recovery or face another round of volatility.

Crypto World

Anthropic Reopens Pentagon Talks as Trump Weighs Supply Chain Risk Label

Anthropic CEO Dario Amodei has reportedly reopened negotiations with the US Department of Defense in a last-minute effort to secure continued access to Pentagon contracts as the company faces the possibility of being labeled a supply chain risk by the Trump administration.

Amodei has been holding discussions with Emil Michael, the US undersecretary of defense for research and engineering, to finalize terms governing the military’s use of Anthropic’s artificial intelligence models, the Financial Times reported, citing people familiar with the matter.

A new agreement would allow the Pentagon to keep using the company’s technology and could prevent a formal designation that would force contractors in the defense supply chain to cut ties with the AI developer, per the report.

The talks follow a sharp breakdown in negotiations last week. Michael reportedly accused Amodei of being a “liar” with a “God complex,” while discussions collapsed after the two sides failed to agree on language Anthropic said was necessary to prevent misuse of its technology.

Related: Ex-OpenAI researcher’s hedge fund reveals big Bitcoin miner bets in new SEC filing

Pentagon negotiations stall over bulk data analysis clause

In an internal memo to staff seen by the FT, Amodei reportedly wrote that near the end of negotiations, the Pentagon offered to accept Anthropic’s broader terms if the company removed a clause restricting the “analysis of bulk acquired data.” He said this phrase was meant to guard against potential mass domestic surveillance, a scenario Anthropic treats as a red line, alongside the use of AI in lethal autonomous weapons.

The dispute escalated after Defense Secretary Pete Hegseth warned that Anthropic could be designated a supply chain risk, a move that would effectively freeze the company out of US military procurement networks.

The standoff came despite Anthropic’s existing ties to the defense sector. The company was awarded a contract worth up to $200 million by the US Defense Department in July 2025 and it became the first AI provider whose models were used in classified environments and by national security agencies.

As Cointelegraph reported, the US military even used Anthropic’s Claude AI model to support a major air strike on Iran hours after President Donald Trump ordered federal agencies to stop using the company’s systems.

Related: Mining companies move deeper into AI, HPC as MARA may sell Bitcoin

Tech groups warn risk label could hurt US AI leadership

Meanwhile, in a Wednesday letter to Trump, tech groups warned that labeling a domestic AI company a supply chain risk could undermine US leadership in AI. The groups argued that treating a US technology company “as a foreign adversary, rather than an asset,” could discourage innovation and weaken America’s ability to compete with China in the global AI race.

Signatories included the Software & Information Industry Association, TechNet, the Computer & Communications Industry Association and the Business Software Alliance. These organizations represent hundreds of American tech companies, including AI chipmakers Nvidia, Alphabet’s Google and Apple.

Magazine: Bitcoin may take 7 years to upgrade to post-quantum — BIP-360 co-author

-

Politics6 days ago

Politics6 days agoITV enters Gaza with IDF amid ongoing genocide

-

Politics2 days ago

Politics2 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread: Iris Top

-

Tech4 days ago

Tech4 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Sports5 days ago

The Vikings Need a Duck

-

NewsBeat5 days ago

NewsBeat5 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat4 days ago

NewsBeat4 days ago‘Significant’ damage to boarded-up Horden house after fire

-

NewsBeat5 days ago

NewsBeat5 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat4 days ago

NewsBeat4 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Tech2 hours ago

Tech2 hours agoBitwarden adds support for passkey login on Windows 11

-

Entertainment3 days ago

Entertainment3 days agoBaby Gear Guide: Strollers, Car Seats

-

Tech6 days ago

Tech6 days agoNASA Reveals Identity of Astronaut Who Suffered Medical Incident Aboard ISS

-

Business7 days ago

Business7 days agoOnly 4% of women globally reside in countries that offer almost complete legal equality

-

Politics4 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat4 days ago

NewsBeat4 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

NewsBeat3 days ago

NewsBeat3 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Crypto World6 days ago

Crypto World6 days agoFrom Crypto Treasury to RWA: ETHZilla Retreats and Relaunches as Forum Markets on Nasdaq

-

Tech4 days ago

Tech4 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Business7 days ago

Business7 days agoWorld Economic Forum boss Borge Brende quits after review of Jeffrey Epstein links

-

Video3 days ago

Video3 days agoHow to Build Finance Dashboards With AI in Minutes