Video

Cathie Wood Breaks Her Silence On Bitcoin & Crypto Bloodbath! New 2026 Prediction

🧠 My FREE Daily 5-Min Crypto Newsletter: https://www.cryptonutshell.com/subscribe

⮕ 🔒 Cold Storage Wallet: https://ledger.pxf.io/aOZEeQ

⮕ 💰 Get Up To $200 With Coinbase: https://coinbase-consumer.sjv.io/R59WLg

Has the 4 year crypto cycle broken? Or is it playing out exactly as expected?

After the October 10 Bitcoin flash crash triggered automated liquidations and wiped out roughly $28B in forced deleveraging, the market assumed the same thing it always assumes after a brutal crash: the bull run is over.

But Cathie Wood says that crash was not a structural failure of Bitcoin. It was a mechanical purge caused by market plumbing. The kind of leverage flush that forms bottoms, not tops. And more importantly, she believes the classic “4 year Bitcoin downdraft” may be breaking down as Bitcoin matures, institutional market structure grows, and crypto rails become real financial infrastructure.

In this video, we break down Cathie Wood’s latest bullish thesis on:

Bitcoin cycle theory and the 4 year crash narrative

Why the October 10 flash crash matters, and why “basing” is not bearish

Bitcoin as digital gold, inflation hedge, and long term store of value

Stablecoin adoption and why stablecoins overtaking payments is a bullish signal for the crypto stack

Tokenization and real world asset (RWA) tokenization on public blockchains

DeFi growth, onchain settlement, and why finance is migrating onto blockchain rails

AI and blockchain productivity gains and the next wave of entrepreneurship

The big takeaway: why the next inflection could be up, even if price looks boring right now

This framework is one of the cleanest explanations for why Bitcoin may be entering a new phase, where the market moves are sharper, the flushes are faster, and the repricing happens before consensus shows up.

If you want more Bitcoin and crypto market analysis, macro context, and simple explanations of what matters each week, subscribe for more.

My FREE Daily 5-Min Crypto Newsletter: https://www.cryptonutshell.com/subscribe

Cold Storage Wallet: https://ledger.pxf.io/aOZEeQ

Get Up To $200 With Coinbase: https://coinbase-consumer.sjv.io/R59WLg

Disclaimer: This video is for educational purposes only and is not financial advice. Crypto is risky. Do your own research and never invest money you cannot afford to lose.

#Bitcoin #crash #crypto

Cathie Wood Breaks Her Silence On Bitcoin & Crypto Bloodbath! New 2026 Prediction

source

Video

Allianz Financial Results 3Q 2025

Please note the following disclaimers:

English: https://www.allianz.com/en/press/disclaimer.html

German: https://www.allianz.com/de/presse/disclaimer.html

Find us online if you want to learn more about what’s going on in the world of Allianz!

Facebook: https://www.facebook.com/allianz

Instagram: https://www.instagram.com/allianz

LinkedIn: https://www.linkedin.com/company/allianz

Threads: https://www.threads.com/@allianz

X (Twitter): https://twitter.com/allianz

YouTube: https://www.youtube.com/allianz

Website: https://www.allianz.com

About Allianz

The Allianz Group is one of the world’s leading insurers and asset managers with around 128 million* private and corporate customers in nearly 70 countries (as of December 31, 2024).

* Including non-consolidated entities with Allianz customers

source

Video

Ripple CEO: Nobody Cares More About XRP(Price/Silent Part) Than We Do

Buy & Sell Crypto With iTrustCapital

https://www.itrustcapital.com/xrparmy

Get Your Tickets To XRP Las Vegas 2026

http://www.xrplasvegas.com

Open A Caleb & Brown Account(Institutional Custody & A Personal Rep)

Click Here: https://xrpwealth589.com

Become An Official Member Of The Digital Asset Investor Channel

Youtube

https://tinyurl.com/ycx9ases

Patreon

http://www.daixrp.com

Diversify Your PORTFOLIO with Gulf of America Oceanfront Real Estate.

http://www.gulfofamericaXRP.com

Digital Asset Investor Email

digitalassetinvestor2018@gmail.com

#xrp #ripple #bitcoin #ethereum #litecoin

#paid #promotion #sponsorships The above links are either affiliate links or paid promotions and deals.

___________________________________________

Disclaimer:

I am not a licensed financial advisor. All videos on this channel are intended for entertainment purposes only. You should not buy, sell, or invest in any asset based on what I say in these videos. You should know that investing carries extreme risks. You could lose your entire investment. This is not trading advice and I am in no way liable for any losses incurred.

source

Video

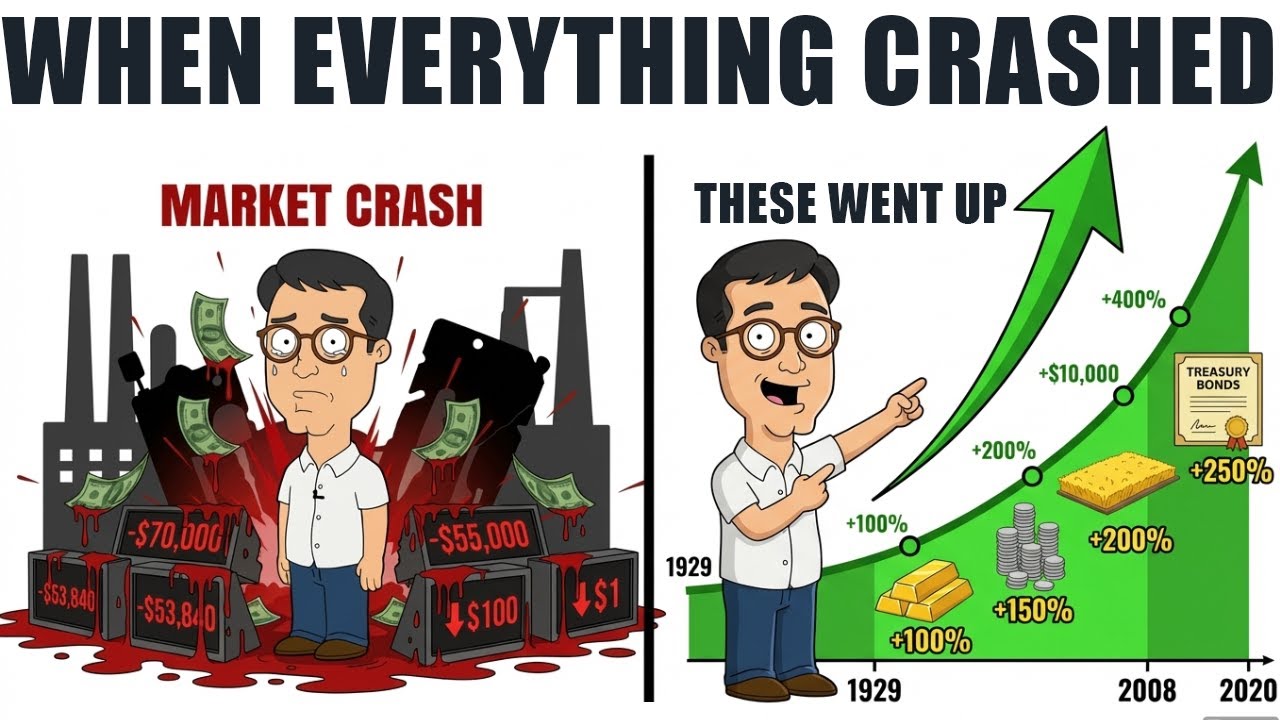

4 Assets That Doubled During Every Depression (And Why Nobody Owns Them)

#marketcrash #economiccollapse #investing

In 1929, 2008, 2020, and again in 2022, markets collapsed—yet the same small group of investors came out richer every single time. This was not luck. It was positioning.

In this video, I break down the four asset categories that historically doubled or outperformed during every major economic depression of the last century, while traditional portfolios were being destroyed. Using real historical data—from the Great Depression to the Global Financial Crisis—you’ll see exactly where money flowed when panic set in, and why fewer than 2% of investors owned these assets beforehand.

This is not speculation. It’s pattern analysis.

Why gold mining stocks surged nearly 500% during the Great Depression

How long-term Treasury bonds quietly delivered positive returns while stocks collapsed

Why farmland preserved and rebuilt wealth across generations

How consumer staples stocks declined less and recovered faster in every crisis

The three signals that consistently appear before recessions begin

Why most investors unknowingly play only half the market game

We also expose why these assets are rarely discussed by mainstream financial media or financial advisors—and why the traditional “buy and hold forever” strategy fails precisely when protection matters most.

This video is not about predicting the next crash. Predictions are useless. It’s about preparing for what history says always comes.

If you’ve been doing everything right but still feel like you’re falling behind, this will change how you think about risk, safety, and wealth preservation forever.

⚠️ Disclaimer

This video is for educational and informational purposes only. I am not a financial advisor. Nothing in this video constitutes financial advice. All data discussed is based on historical research and publicly available sources. Always conduct your own research and consult a qualified professional before making investment decisions.

If you want source links, historical charts, or datasets referenced in this video, ask in the comments—I’m compiling them.

source

Video

A lesson I learned early on about money #money #wealth #financialliteracy #finacialfreedom

Video

Bitcoin: The Early March Rally

Bitcoin usually gets a rally into early March, then forms a lower high and goes lower into April/May. Let’s discuss!

Into The Cryptoverse Premium:

For inquiries:

https://www.benjamincowen.com/

Into The Cryptoverse Newsletter:

https://newsletter.intothecryptoverse.com/

LIFETIME OPTION:

Alternative Option:

https://www.patreon.com/intothecryptoverse

Merch:

https://store.intothecryptoverse.com/

Disclaimer: The information presented within this video is NOT financial advice.

Telegram: https://t.me/intocryptoverse

Twitter: https://twitter.com/intocryptoverse

TikTok: tiktok.com/@benjamincowencrypto

Instagram: https://www.instagram.com/bjcowen/

Discord: https://discord.gg/UGwc6eR

Facebook: https://www.facebook.com/groups/intothecryptoverse

Reddit: https://www.reddit.com/r/intothecryptoverse/

Website: https://intothecryptoverse.com/

source

Video

A masterclass in financial responsibility right here #grwm #newmakeup #sephoramakeup #madeleine

#MadeleineWhite

#Madeleine #White

source

Video

Money Checks (Prod. by Hukky Shibaseki)

Provided to YouTube by Genie Music Corporation

Money Checks (Prod. by Hukky Shibaseki) · NOWIMYOUNG · Fleeky Bang · Royal 44 · Double Down · Young Shooter

Show Me The Money 12 Episode 1

℗ 2026 Stone Music Entertainment

Released on: 2026-03-06

Lyricist: NOWIMYOUNG

Lyricist: Fleeky Bang

Lyricist: Royal 44

Lyricist: Double Down

Lyricist: Young Shooter

Composer: Hukky Shibaseki

Arranger: Hukky Shibaseki

Arranger: NOWIMYOUNG

Auto-generated by YouTube.

source

Video

HOA Collected “Donations.” The Financial Records Told the Truth. #hoadrama

The HOA demanded what they called “mandatory donations” from residents.

Later, the financial reports quietly categorized the money as landscaping expenses.

But the invoices, vendor records, and meeting minutes revealed where the money actually went — the HOA president’s luxury courtyard.

When HOA finances meet public records, the truth tends to surface fast.

🔥 New stories every day

🔔 Subscribe for more HOA nightmares and crazy Karen moments!

Copyright © 2025 HOA Horror Stories. All Rights Reserved.

#hoahorrorstories #hoa #hoadrama #hoanightmare #karenstories #revenge #suburbandrama #redditstories #storytime #maliciouscompliance #entitledpeople #propertyrights #crazyhoa #instantkarma #realrevenge #redditreadings #karengonewild #neighborhooddrama

source

Video

WhatsApp number +233241843076 #reels #money #lifeisbutadream #contactnumber

Video

SHORT BITCOIN NOW ????????

Subscribe to CHAMPS CRYPTO: https://youtube.com/@ChampsCryptoEng?si=ZxGYeQmEKOxyZlPZ

🟧 BYBIT: http://themoon.co/Bybit 👉 10% DISCOUNT & $30,000 BONUS

🔥 Coinflare: https://themoon.co/coinflare-iphoneair 👉 Win the New iPhone Air

🟠 BloFin: https://themoon.co/blofinexclusive 👉 Deposit $2,000, Get $300 Futures Bonus

🟨 WEEX: https://themoon.co/WEEXwelcome 👉 Weekly 100 winners get $500 bonus each + Deposit $100, Get $50 bonus

Carl Moon Music Channel: https://www.youtube.com/@CarlMoon_Music

⚔ Play Medieval Empires: https://themoon.co/MedievalEmpires

🔥 *EXCHANGE TUTORIALS* 🔥

📺 BloFin: https://youtu.be/WwWwp2miv0E

📺 Binance: https://youtu.be/80zosJeVhU4

📺 Bybit: https://youtu.be/_1M5gag_Zm0

📺 Coinflare: https://youtu.be/Xn-Ptvt1eeI

📺 Phemex: https://youtu.be/AJbYFEOn02Q

📺 MEXC: https://youtu.be/QN2NzpCQ2G0

📺 Bitget: https://youtu.be/726Vrm03ZMc

*FAVOURITE EXCHANGES RIGHT NOW FULL LIST*

⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇

🔥 *Coinflare is the fastest growing alternative to Bybit, with LOWER FEES!*

_Click this link to Earn Up to $5,050 in Rewards_

Sign up here 👉 https://themoon.co/Coinflare

🟨 *WEEX is available in ALL COUNTRIES with NO KYC:*

_Click this link to get $500 bonus each to Weekly 100 winners + Deposit $100, Get $50 bonus_

Sign up here 👉 https://themoon.co/WEEXwelcome

🟠 *BloFin offers best liquidity:*

_Click this link to get $100,000 Deposit & Trade Rewards_

Sign up here 👉 https://themoon.co/blofin100k

✳️ *SwissBorg is secure and reliable crypto app:*

_Click this link to get up to €100 in Crypto Rewards_

Sign up here 👉 https://themoon.co/swissborgmoon

🟦 *MEXC requires NO KYC:*

_Click this link to get $30,000 in welcome rewards!_

Sign up here 👉 https://themoon.co/MEXC

❎ *LeveX is a Social Crypto Exchange:*

_Click this link to get 20% Deposit Bonus + VIP5 Benefits + Exclusive Content (NO KYC)_

Sign up here 👉 https://themoon.co/LeveX

🟢 *Bitunix requires NO KYC and is highly liquid:*

_Click this link to get a free $100 after your first $500 deposit!_

Sign up here 👉 https://themoon.co/Bitunix

🟧 *Bybit is the MOST TRUSTED and liquid exchange for leverage trading in crypto:*

_Click this link to get 10% fee reduction & $30,000 BONUS_

Sign up here 👉 https://themoon.co/Bybit

🔸 *Binance is the best exchange for SPOT TRADING:*

_Click this link to get a permanent 20% fee reduction!_

Sign up here 👉 https://themoon.co/Binance

Want to earn passive income from Bybit? Become my sub-affiliate with this link: https://affiliates.bybit.com/v2/en/apply?affiliate_id=1205

*FOLLOW CARL MOON ONLINE*

⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇⬇

Vlog channel: https://www.youtube.com/@Carl

Instagram: https://www.instagram.com/carlmoon

Twitter: https://www.twitter.com/TheMoonCarl

Tik-Tok: https://www.tiktok.com/@carlmoon

Tik-Tok: https://www.tiktok.com/@moon

Facebook: https://www.facebook.com/TheMoon

Website 1: https://carlrunefelt.com

Website 2: https://carlmoon.com

🗣️ Join The Moon Show Community:

Website: https://themoonshow.com

Twitter: https://x.com/TheMoonShow

Telegram Group: https://t.me/TheMoonGroup

Telegram Alerts: https://t.me/TheMoonOfficial

🌙 BUY BITCOIN WITH FIAT ($ €):

⭕️ Swissborg Win up to $100: https://swissborg.com/r/themoon

⭕️ Binance $1,000 cashback: https://themoon.co/Binance

🌙 EVERY BITCOIN INVESTOR NEEDS:

⭕️ Tradingview: https://themoon.co/Tradingview

⭕️ Ngrave Hardware Wallet: https://themoon.co/Ngrave

⭕️ GET NORDVPN UP TO 72% OFF + 4 EXTRA months: https://nordvpn.com/themoon

⭕️ Ledger Wallet: http://ledger.com/?r=f988

⚠️ I don’t accept donations, use that money to invest in yourself or buy Bitcoin! If you want to support me, use any of the affiliate links above and leave a like & subscribe! THANK YOU!

#Coinflare #WEEX #Bybit #Bitunix #Crypto #Bitcoin #Binance #MEXC #LeveX

DISCLAIMER: By accessing this channel, you agree to the following: Content is for general information and entertainment only—not financial, legal, or professional advice. No guarantee is made regarding accuracy; use at your own risk. Views are my personal. Investing involves risk—do your own research. Not intended for users in the UK, US, India, China, or other restricted jurisdictions.

PROMOTIONS & AFFILIATES: Ads and links may appear but do not imply endorsement in any way. Sponsored content reflects personal views. Compensation may be received—verify third-party services independently.

source

-

Politics4 days ago

Politics4 days agoAlan Cumming Brands Baftas Ceremony A ‘Triggering S**tshow’

-

Tech6 days ago

Tech6 days agoUnihertz’s Titan 2 Elite Arrives Just as Physical Keyboards Refuse to Fade Away

-

Business16 hours ago

Form 8K Entergy Mississippi LLC For: 6 March

-

NewsBeat6 days ago

NewsBeat6 days agoAbusive parents will now be treated like sex offenders and placed on a ‘child cruelty register’ | News UK

-

Fashion13 hours ago

Fashion13 hours agoWeekend Open Thread: Ann Taylor

-

NewsBeat7 days ago

NewsBeat7 days agoDubai flights cancelled as Brit told airspace closed ’10 minutes after boarding’

-

NewsBeat7 days ago

NewsBeat7 days agoThe empty pub on busy Cambridge road that has been boarded up for years

-

NewsBeat6 days ago

NewsBeat6 days ago‘Significant’ damage to boarded-up Horden house after fire

-

Tech2 days ago

Tech2 days agoBitwarden adds support for passkey login on Windows 11

-

Entertainment5 days ago

Entertainment5 days agoBaby Gear Guide: Strollers, Car Seats

-

Sports2 days ago

Sports2 days ago499 runs and 34 sixes later, India beat England to enter T20 World Cup final | Cricket News

-

NewsBeat6 days ago

NewsBeat6 days agoEmirates confirms when flights will resume amid Dubai airport chaos

-

Politics6 days ago

FIFA hypocrisy after Israel murder over 400 Palestinian footballers

-

NewsBeat5 days ago

NewsBeat5 days agoIs it acceptable to comment on the appearance of strangers in public? Readers discuss

-

Tech6 days ago

Tech6 days agoViral ad shows aged Musk, Altman, and Bezos using jobless humans to power AI

-

Video5 days ago

Video5 days agoHow to Build Finance Dashboards With AI in Minutes

-

Fashion6 days ago

Fashion6 days agoOn the Scene at the 57th Annual NAACP Image Awards: Teyana Taylor in Black Ashi Studio, Colman Domingo in Yellow Sergio Hudson, Chloe Bailey in Christian Siriano, and More!

-

Business3 days ago

Business3 days agoGuthrie Disappearance Enters Fifth Week as Family Visits Memorial

-

NewsBeat5 days ago

NewsBeat5 days agoUkraine-Russia war latest: Belgium releases video showing forces boarding Russian shadow fleet oil tanker

-

Crypto World6 days ago

Crypto World6 days agoUS Judge Lets Binance Unregistered Token Class Action Proceed