Business

What Is Risk? | Seeking Alpha

da-kuk/iStock via Getty Images

The risk that matters most is the risk of permanent loss [of capital]. – Howard Marks

The many varieties of risk

“Risk” is a funny word. In the context of investing, it is used constantly; however, if you ask somebody to define what he or she really means, you are likely to be met with plenty of hesitation. “Risk” is one of those words we all use every day without giving too much thought to what it actually means.

When I think about risk, though, one definition towers over and above all the other ones. To me, when investing, “risk” is mostly, but not exclusively, about the risk of permanently losing your capital. Whichever of those silos above you think offer the best description of risk, in almost all cases, the risk of a permanent loss of capital hovers above it. In the following, I will talk about how the risk of that can be minimised.

How to measure risk

When professional investors manage risk, two measures of risk tend to dominate:

- (equity) beta; and

- value at risk (VaR).

Allow me to spend a minute on how to define the two terms. Equity beta is a measure of the sensitivity of a stock (or portfolio) relative to movements in the equity market. If you assume the equity market is represented by S&P 500, an equity beta of 1 suggests the stock in question will move in line with S&P 500, whereas an equity beta suggests the stock in question is more (less) volatile than S&P 500.

The beta can be measured against other benchmarks as well – doesn’t have to be against the equity market. If, for example, you wish to measure the sensitivity to commodity prices, you calculate the commodity beta, etc, etc.

VaR is a bit more complicated. It is a measure of the maximum expected loss over a given time horizon and at a pre-defined confidence level (typically 97.5% or 99%) assuming normal market conditions . The latter is a very important assumption.

The primary problem with both of those measures is that they are akin to rear-mirror viewing. One cannot be sure that history will repeat itself, and both measures depend, to a significant degree, on historical patterns being repeated. That said, there isn’t much you can do to improve the analytical outcome. One option is to introduce a Month Carlo model when calculating the VaR, which will eliminate the dependence on history, but that won’t protect you against every possible outcome.

Every day, we calculate the equity beta on every single holding in our fund, and we calculate the portfolio VaR. In terms of the latter, we work with a self-imposed limit of 3%; i.e. we aim to keep the portfolio’s 97.5% 1-day VaR below 3%.

How you should manage risk

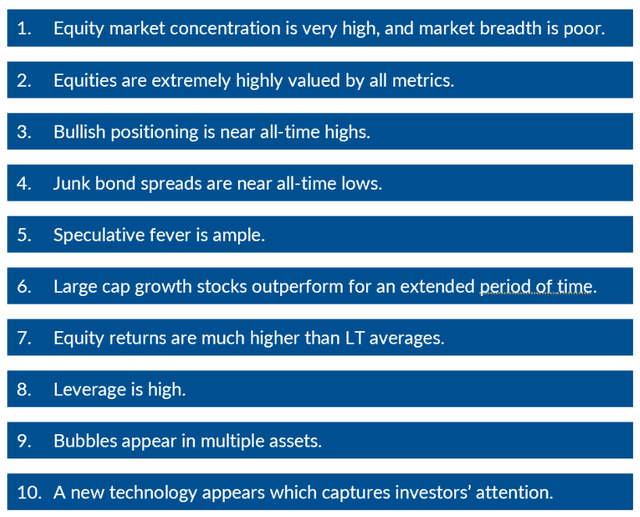

Most private investors don’t have the tools, nor the time, to spend hours every day on risk management, so a more pragmatic approach is warranted. I suggest the following approach: identify a handful or two of indicators which, historically, have led to the party coming to an abrupt end. To me, the ten most important ‘end of secular bull market’ indicators are listed in Exhibit 1 below.

Exhibit 1: End of secular bull market indicators

Sources: The Felder Report, Absolute Return Partners LLP

I work with these indicators in a rather simple way. Essentially, the more boxes I can tick, the more likely, I believe, it is for the secular bull market to come to an end rather soon. Now to the serious part: All ten boxes are currently ticked off! That tells me that the end might not be that far away. Three caveats:

1. Secular bull markets rarely end ‘just’ because equities are expensive. Some sort of catalyst shall be required.

2. When going through this exercise, you may end up with a different set of indicators than me but that matters less. Choose those that you are comfortable with and that have worked for you over the years.

3. Timing is the most difficult part of an exercise like this, and it is easy to be (too) early – in fact so early that it poses real career risk to professional investors, and that is probably why many prefer to stay on the train until it is too late to get off without an injury or two.

Re the last point, I learnt in 1990 when Tokyo Stock Exchange crashed, and again in 2000 when the same happened in New York, that most investors prefer to participate in the party to the very end, knowing very well that they may end up with plenty of (rotten) egg on their face.

Nothing has convinced me that investors have changed even the slightest. Momentum continues to drive markets forward, whatever asset class you look at, and the crowd mentality is stronger than ever. That is sort of a “if my neighbour got rich on gold, why shouldn’t I do the same?” mentality, which is very dangerous.

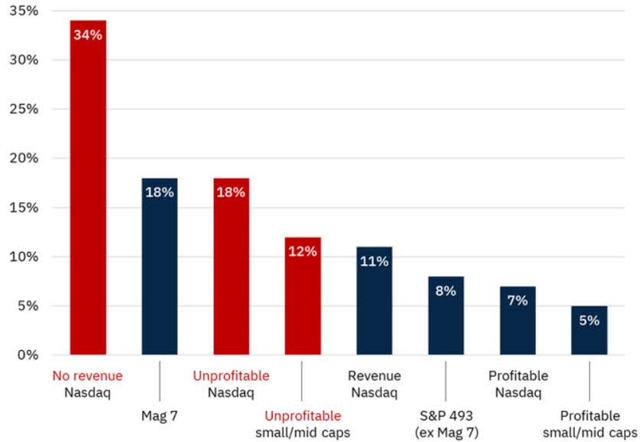

Allow me to finish this month’s Absolute Return Letter by sharing a chart from Goldman Sachs (GS) which shows how abundant speculative fever currently is (#5 on the list above). The chart was produced last October, i.e. it only provides 2025 data through September, but there is no reason to believe that anything happened in 4Q25 which would change the picture.

Exhibit 2: Price return on various US equities (Note: 2025 to 30 September)

Source: Goldman Sachs Global Investment Research

Now to my point: If Nasdaq stocks with no revenues delivered the highest return to US investors in Q1-Q3 last year, and if unprofitable Nasdaq stocks came joint second, isn’t that about as strong a signal you can get that speculative fever is ample?

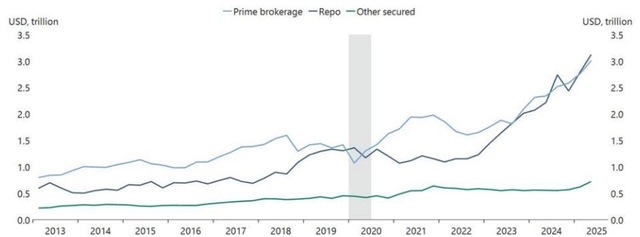

I could indeed provide plenty of other charts to support the issues I listed in Exhibit 1 but will only do one more – leverage is high (#8). Exhibit 3 below is testament to the fact that it is not only retail investors who get carried away from time to time. As you can see, in recent years when equity returns have been particularly strong, what have hedge funds done? Piling on ever more leverage, is the answer. This can only end in tears.

Line chart showing Hedge fund borrowings by source from 2013 to 2025.

Source: Apollo Global Management

Final few words

In the fund we manage, we are, at least to a degree, caught in the same dilemma. It is easy to see (many) equities are overvalued, but by going too conservative you risk missing out on returns. Consequently, we remain nearly fully invested but with a defensive twist. We hold large positions in low beta equities and in certain commodities which tend to do much better than equities when stocks decline. Most importantly, we hold plenty of gold.

Rather surprisingly, our ‘defensive’ approach still led to extraordinary returns in 2025. We finished the year delivering +29.24% net to USD investors. That is obviously very pleasing; however, at the same time, I find it uncharacteristically worrying. If you deliver almost 30% to your investors, do you in fact take more risk than you think you do? Finding the answer to that question has kept us very busy in January.

Niels

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Business

Ford and Geely in talks for manufacturing, technology partnership, sources say

Ford and Geely in talks for manufacturing, technology partnership, sources say

Business

Analysis: Fiscal realities rein in US’s aggressive Nordic ambitions

ANALYSIS: The negative response of financial markets dissuaded the US president from pursuing his designs on Greenland.

Business

Pinterest sacks engineers for tracking layoffs

The social media platform announced last week that it was laying off around 15% of its workforce.

Business

Brokerages May Start Charging ETF Issuers Distribution Fees, Says J.P. Morgan

This copy is for your personal, non-commercial use only. Distribution and use of this material are governed by our Subscriber Agreement and by copyright law. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at 1-800-843-0008 or visit www.djreprints.com.

Business

Analysis-Ultra-low bond spread unity still out of reach for euro area

Analysis-Ultra-low bond spread unity still out of reach for euro area

Business

Opinion: Net downside in fishing bans

OPINION: The state government may have hooked itself with what looked like an easy political decision.

Business

Airbnb: Hotel Expansion Is Promising, But The Valuation Leaves Little Room For Error

Airbnb: Hotel Expansion Is Promising, But The Valuation Leaves Little Room For Error

Business

Voters concerned about affordability of homeownership, new poll shows

Ohio GOP gubernatorial candidate Vivek Ramaswamy discusses his economic vision for the state, calling for deregulation and expanded housing on ‘Kudlow.’

American voters are concerned about being able to afford homeownership amid high housing costs as the electorate prepares to cast ballots in this fall’s midterm elections, a new poll shows.

A poll conducted for the National Association of Realtors by Public Opinion Strategies and Hart Research showed that over half of voters (52%) say that the affordability of housing is a very important voting issue to them.

Sentiment around the housing market remains at a historically low level, as the poll shows that just 17% of voters think now is a good time to buy a home – down from 69% in 2013.

Despite the headwinds affecting housing affordability, homeownership remains a key part of what voters view as the American dream, with 85% calling it an essential part of the American dream, an increase from 79% in 2013 with strong support across political groups.

EFFORTS TO REIN IN WALL STREET LANDLORDS COULD PUSH US HOME PRICES UP, INVESTORS SAY

Homeownership remains a key part of how voters view the American dream, the NAR poll showed. (Loren Elliott/Bloomberg via Getty Images)

Renters and other non-homeowners expressed concerns about never being able to afford homeownership, with 76% of that group expressing the belief that they will never be able to afford buying a home and 59% saying they want to buy but lack affordable options in their community.

In contrast, just 27% of all voters were concerned about never being able to afford to buy a home and only 21% cited a lack of affordable options in their community as a barrier.

Homeowners in the survey were asked about reasons that are keeping them from moving, with 35% saying their current mortgage rate is low, and they can’t afford a higher rate.

Additionally, 30% said they would like to buy another home but lack affordable options in their community, while 16% said they would like to sell but can’t afford the taxes from the profit on the sale.

TRUMP SAYS HE’S ‘NOT A HUGE FAN’ OF 401(K) WITHDRAWAL PLAN FOR HOMEBUYERS’ DOWN PAYMENTS

Voters cited a lack of affordable homes as a key barrier to homeownership. (iStock/Getty Images Plus)

Voters across political groups generally said that federal government policies make it harder to buy a home, with majorities of Democrats (56%) and Independents (53%) along with a plurality of Republicans (41%) expressing that sentiment.

The NAR poll also gauged respondents’ views of several congressional proposals aimed at improving housing affordability.

More than four-fifths of all voters, 84%, expressed support for letting prospective home buyers save money tax-free that can be used to buy a home, with over 80% of all political groups.

Over three-fourths of voters, 76%, backed a proposal to provide a one-time option to sell your home without paying taxes on the profit. That idea was most strongly backed by Republicans (87%) and saw some skepticism among Democrats (65%).

HOUSING EXPERT WARNS PRE-PANDEMIC AFFORDABILITY LEVELS MAY NEVER RETURN IN AMERICA

NAR’s poll asked voters about proposals aimed at making housing more affordable. (Mandel Ngan/AFP via Getty Images)

A similar proposal that would increase the amount of profit that sellers can take before having to pay taxes was backed by two-thirds (67%) of voters, with Republicans (78%) and Independents (66%) viewing the idea more favorably than Democrats (58%).

Providing tax incentives requiring building developers to provide affordable rentals for low-income households was backed by 71% of voters, with Democrats more bullish on the idea (90% support) than Republicans (53%).

Incentivizing home rental investors to sell homes to first-time home buyers was backed by 71% of voters, with similar levels of support across political groups.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

NAR and its polling firm partners then asked voters whether Congress passing those proposals would make it easier to buy or sell a home, and 64% of respondents said that it would, compared to the 9% who think current federal policies make it easier to buy or sell a home.

Business

Costco Tillamook cheese bargain makes membership worthwhile for shoppers: report

Check out what’s clicking on FoxBusiness.com.

From gas pumps to the food court, Costco is known for its wide range of value-packed products.

Some shoppers, however, say that just one item in particular makes the $65 annual warehouse membership worthwhile.

Tillamook block cheese has been a standout bargain for many households, according to Food Republic, which conducted a taste test that ranked the cheese brand in first place for burgers.

A 2.5-pound block of Tillamook Medium or Sharp Cheddar is priced at roughly $11.23, though prices may vary by location.

COSTCO’S LESSER-KNOWN MEMBERSHIP BENEFITS, EXPLAINED

Packages of Tillamook cheddar cheese are displayed at a Costco Wholesale store on April 25, 2025 in San Diego, California (Kevin Carter/Getty Images)

At just 28 cents an ounce, Costco’s bulk blocks are considerably more affordable than its competitors. For instance, Walmart sells its medium cheddar for 39 cents an ounce; Kroger at 62 cents and Target at 55 cents, the outlet reported.

With those savings, warehouse shoppers can expect to save 11 to 34 cents per ounce, or $1.76 to $5.44 per pound, compared with similar products at other grocery stores.

COSTCO’S SURPRISE NIKE COLLABORATION SENDS SNEAKER RESALE MARKET INTO COMPLETE FRENZY

Customers look over food items at a Costco store in Colchester, Vermont, in August 2024. (Robert Nickelsberg/Getty Images / Getty Images)

Last year, one cheese fan said on social media that they found 2-pound Tillamook blocks on sale for $5.95 each and bought 17 blocks, 34 pounds total, for their yearlong supply.

“You never see Tillamook Sharp Cheddar for less than $9 on its best sale, and usually sells for $10-11,” the user said on Reddit.

A Costco store in Alhambra, California, US, on Thursday, June 27, 2024. The news about Sam’s Club fixing flat tires for “free” has some wondering if Costco does the same. (Eric Thayer/Bloomberg via Getty Images / Getty Images)

According to the Tillamook County Creamery Association, the farmer-owned co-op based in Oregon uses real milk with no artificial growth hormones or fillers.

“For basic supermarket quality, Tillamook Sharp Cheddar because they’re local and generally better than their competitors,” another Reddit user wrote, referring to it as their go-to Costco dairy item.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| COST | COSTCO WHOLESALE CORP. | 977.92 | +9.56 | +0.99% |

Due to their large bulk size, the average shopper typically struggles to finish the item before mold develops. Experts recommend wrapping the blocks tightly in parchment or wax paper, vacuum-sealing them or freezing portions if they cannot be eaten quickly.

Business

China’s Renminbi Poised to Achieve Global Reserve Currency Status

Xi Jinping has clearly emphasized the goal of elevating the Chinese renminbi (RMB) to global reserve currency status, offering the most definitive expression yet of China’s ambition to expand its currency’s international influence.

The renewed discourse strengthens China’s strategy for de-dollarisation; however, the immediate effect on the market is minimal since capital controls and a cautious policy approach keep the demand for yuan reserves in check.

This directive, published in the Communist Party’s ideology journal Qiushi and originating from a 2024 speech, outlines the need to build a “powerful currency” widely used in international trade, investment, and foreign exchange markets.

To support this ambitious goal, Xi Jinping detailed several critical foundations:

- Robust Financial Infrastructure: The establishment of a “powerful central bank” for effective monetary management.

- Competitive Institutions: The development of globally competitive financial institutions.

- Influential Financial Hubs: The creation of international financial centers capable of attracting global capital and exerting influence over global pricing.

The timing of these comments reflects a strategic response to global economic shifts and uncertainties:

- Global Market Dynamics: The call comes amidst a weaker US dollar, changes in Federal Reserve leadership, and rising geopolitical and trade tensions, prompting central banks worldwide to reconsider their exposure to dollar assets.

- Shifting Global Order: Analysts note China’s perception of a changing global order, with the RMB positioned as a “strategic counterweight” to limit US leverage in an increasingly fractured financial system.

Despite China’s ambitions, the renminbi’s current international standing reveals significant challenges:

- Trade Finance Role: The RMB has become the world’s second-largest currency in trade finance since 2022.

- Limited Reserve Status: However, its role in official global reserves remains limited, accounting for only 1.93% as of Q3 2025, placing it sixth behind the US dollar (57%) and the euro (approximately 20%).

- Key Obstacles for Greater Adoption: Analysts identify an open capital account and full convertibility as crucial for increasing global investor and central bank holdings of RMB.

- Calls for Appreciation: International trading partners and the IMF have urged Beijing to allow the RMB to appreciate more sharply, arguing it is undervalued, contributes to China’s large trade surplus, and has recently experienced real exchange rate depreciation due to deflation. Chinese policymakers, while stating no intention to use a weaker RMB for trade advantage, have shown tolerance for mild appreciation against a weaker US dollar, though it has depreciated against the euro.

Beijing has intensified efforts on several fronts to bolster its influence in global finance and trade. One significant development is the expansion of the Cross-Border Interbank Payment System (CIPS), which serves as a parallel settlement mechanism to the established SWIFT network. This move is particularly evident in transactions involving Russia, especially in the context of heightened geopolitical tensions and economic sanctions. By facilitating transactions in yuan instead of the US dollar, China aims to create a more resilient financial framework that can withstand external pressures.

In the realm of energy trade, the collaboration between China and Russia has grown stronger, with an increasing number of transactions being settled in yuan. This shift not only enhances the bilateral momentum of the two economies but also shields their financial exchanges from the risks associated with international sanctions, which have affected both countries in various capacities.

Beyond its relationship with Russia, China has proactively signed currency swap agreements with approximately 50 countries. These agreements serve as liquidity backstops, enabling participating nations to engage in local-currency trade without relying on US dollars. This initiative is part of China’s broader strategy to promote financial cooperation and enhance the use of the yuan on the global stage, facilitating smoother trade relations and reducing dependency on Western financial systems.

As a result of these efforts, China is positioning itself as a key player in the global financial system, where it seeks to establish a more multipolar currency landscape that diminishes the dominance of the US dollar while fostering economic partnerships with a diverse array of countries.

Looking ahead, analysts believe that while Xi’s rhetoric won’t immediately transform global foreign exchange markets, it solidifies a long-term strategic tilt that investors are already observing. China’s focus on domestic growth and advances in emerging technology are expected to support longer-term appreciation for the renminbi, as Beijing continues to “nudge its currency forward” amid perceived weakening of the dollar’s global dominance.

Other People are Reading

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World5 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World5 days ago

Crypto World5 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video1 day ago

Video1 day agoWhen Money Enters #motivation #mindset #selfimprovement

-

NewsBeat5 days ago

NewsBeat5 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Politics2 days ago

Politics2 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports3 days ago

Sports3 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Fashion4 days ago

Fashion4 days agoWeekend Open Thread – Corporette.com

-

Crypto World3 days ago

Crypto World3 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World4 days ago

Crypto World4 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business4 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat22 hours ago

NewsBeat22 hours agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World7 hours ago

Crypto World7 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World5 days ago

Crypto World5 days agoWhy AI Agents Will Replace DeFi Dashboards

-

Tech4 days ago

Tech4 days agoVery first Apple check & early Apple-1 motherboard sold for $5 million combined