Crypto World

Is Hyperliquid Losing Ground? On-Chain Data Highlights Rising HFDX Adoption

Some parts of the crypto world think Hyperliquid might be slowing down. That talk comes as new numbers show traders and capital flow shifting toward new DeFi projects like HFDX. On-chain data shows trading patterns and volume trends that hint at real changes in where users spend their time and capital.

Meanwhile crypto prices, news, and expert views shape how people see these projects today. In this piece, we look at Hyperliquid’s recent situation and then contrast it with what HFDX is doing. The goal is to give you a clear snapshot of the current state of play.

Hyperliquid: On-Chain Data, Price Moves and What Experts Say

Hyperliquid’s native token HYPE has had a mixed run lately. Some reports show that HYPE had strong periods of trading and network activity in 2025. At times, its prices climbed after large on-chain liquidity and network upgrades that lowered fees and drew traders to its perpetual markets. On-chain figures show huge trading volumes and growing open interest, which helped push HYPE toward past price highs.

But recent market chatter suggests pressure on the token. Some news points to price slides or sideways trading around current levels, even though earlier in late 2025 it rallied thanks to on-chain liquidity innovations.

Analysts and price prediction models still talk about potential upside for HYPE into future years. Some long-term price outlooks suggest that if adoption and volume remain strong, HYPE could trade significantly higher in the medium term.

Still, not all views are upbeat. Some experts say the market overall remains weak, and the hype around early growth may fade as users look for fresh opportunities. The idea that Hyperliquid is losing ground is tied to how traders react to alternatives and look for new ways to manage capital and risk.

HFDX: On-Chain Futures and Structured Yield Momentum

HFDX is a newer protocol that offers non-custodial perpetual futures trading along with structured yield frameworks based on real protocol revenue. It targets active traders and investors who want precise tools without giving up control of their assets. HFDX runs entirely on-chain, and all actions, whether trades or liquidity participation, happen in smart contracts.

On-chain data shows some traders migrating from legacy decentralized exchanges to HFDX because of its risk-managed liquidity strategies and transparent fee structure. Reports that Bitcoin perpetual traders have been splitting volume between Hyperliquid and HFDX point to a real shift in user priorities. HFDX’s structured approach draws those who want returns tied to actual trading revenue and borrowing fees rather than just speculation.

HFDX’s technical design mixes deep liquidity with risk controls that appeal to DeFi-native users. The liquidity loan note (LLN) strategies let participants put capital into protocol liquidity and receive fixed rates that reflect real activity. This model may attract users seeking a different balance of risk and return.

What HFDX offers:

- On-chain perpetual futures with full user custody

- Trades that clear against shared liquidity pools

- Pricing based on decentralized oracle feeds

- Liquidity Loan Note strategies with fixed terms

- Yield tied to trading fees and borrow costs

- Smart contracts that manage risk rules on-chain

Experts Note A Shifting Landscape

In the short term, Hyperliquid still holds significant on-chain volume and active user counts. Its upgrades and network features helped it achieve strong adoption in earlier phases, and experts continue to discuss its price prospects. Still, recent market signals and trader behavior hints that some of its user base is looking elsewhere.

HFDX’s rise does not mean Hyperliquid is done. It just shows the market is evolving. Traders now split capital, test new products, and choose platforms based on what fits their goals. HFDX’s structured yield options and transparent execution are part of that shift. The next few months will be critical for both protocols as price trends, on-chain metrics, and user choices play out in real time.

Make Your Money Work Smarter And Unlock A Wealth Of Opportunities With HFDX Today!

Website: https://hfdx.xyz/

Telegram: https://t.me/HFDXTrading

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

$55B in BTC Futures Positions Unwound In 30 Days: Will Bitcoin Recover?

Bitcoin’s (BTC) struggle to hold above $70,000 carried on into Wednesday, raising concerns that the a drop into the $60,000 range could be the next stop. The sell-off was accompanied by futures market liquidations, a $55 billion drop in BTC open interest (OI) over the past 30 days, and rising Bitcoin inflows to exchanges.

The price weakness has analysts debating whether crypto-specific factors or larger macro-economic issues are the driving factor behind the sell-off and what it may mean for BTC’s short-term future.

Key takeaways:

-

Around 744,000 BTC in open interest exited major exchanges in 30 days, equal to roughly $55 billion at current prices.

-

BTC futures cumulative volume delta (CVD) fell by $40 billion over the past 6-months.

-

Crypto exchange reserves have risen by 34,000 BTC since mid-January, increasing the near-term supply risk.

BTC open interest collapse points to large-scale deleveraging

CryptoQuant data noted that Bitcoin’s 30-day open interest change shows a sharp contraction across exchanges, reflecting widespread position closures, not just freshly opened short positions.

On Binance, the net open interest fell by 276,869 BTC over the past month. Bybit recorded the largest decline at 330,828 BTC, while OKX saw a reduction of 136,732 BTC on Tuesday.

In total, roughly 744,000 BTC worth of open positions were closed, equivalent to more than $55 billion at current prices. This drop in open positions coincided with Bitcoin’s drop below $75,000, indicating deleveraging as a driving factor, not just spot selling.

Onchain analyst Boris highlighted that the cumulative volume delta (CVD) data shows market sell orders continue to dominate, particularly on Binance, where derivatives CVD sits near -$38 billion over the past six months.

Other exchanges show varying dynamics: Bybit’s CVD flattened near $100 million after a sharp December liquidation wave, while HTX stabilized at -$200 million in CVD as the price consolidates near $74,000.

Related: Bitcoin bounces to $76K, but onchain and technical data signal deeper downside

Increased exchange flows add pressure as analysts watch key levels

Meanwhile, Bitcoin inflows to exchanges surged in January, totaling roughly 756,000 BTC, led by Binance and Coinbase. Since early February, inflows have exceeded 137,000 BTC, underscoring traders’ repositioning and not necessarily leaving the market.

On the supply side, analyst Axel Adler Jr. noted that exchange reserves have risen from 2.718 million BTC to 2.752 million BTC since Jan. 19. The analyst warned that continued growth above 2.76 million BTC could increase selling pressure. The analyst believed that a complete capitulation is yet to take place, which may happen at lower price levels.

Market analyst Scient said Bitcoin is unlikely to form a bottom in a single day or week. Durable market bottoms may develop through two to three months of consolidation near the major support zones, with higher time frame indicators. Scient noted that whether this structure forms in the high $60,000 range or the low $50,000 level remains unclear.

Bitcoin Trader Mark Cullen continues to see potential downside toward $50,000 in a broader macro scenario, but expects a short-term reversion toward the local point of control ($89,000 to $86,000) after BTC swept weekly lows below $74,000 on Tuesday.

Related: Bitcoin’s $68K trend line seen as potential BTC price floor: Traders

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

Losses Top $17 Billion at Crypto Treasury Companies

The digital asset treasury (DAT) movement is drowning, with nearly every DAT underwater.

Crypto World

Cathie Wood’s Ark Invest Loads Up on Crypto Stocks Amid Market Slump

The Tuesday purchases followed a heavier round of acquisitions on Monday, during which Ark Invest loaded up on crypto-related shares worth more than $71 million.

The broader digital asset market is in a bearish state, but some experts are leveraging the dip to expand their crypto exposure. Cathie Wood’s investment management company, Ark Invest, is one of them, having scooped up thousands of shares linked to crypto firms over the last few trading days.

According to the latest trade filing from Ark Invest, the firm spent over $19 million to purchase additional crypto-related stocks through its exchange-traded funds (ETFs) on February 3. The acquired shares are tied to multiple companies, including the stablecoin issuer Circle, crypto exchanges Coinbase and Bullish, and Ethereum treasury firm Bitmine.

Ark Invest Buys Crypto Stocks

On Tuesday, Ark Invest bought 145,488 Bitmine shares for $3.25 million and 125,218 Bullish shares for $3.46 million. In addition, the company purchased 42,878 Circle shares for $2.4 million and 3,510 Coinbase shares for $630,606. Notably, Ark Invest also tapped into the Bitcoin-focused tech entity Block Inc. and financial services firm Robinhood, buying shares totaling 31,202 and 89,677 for $1.77 million and $7.8 million, respectively.

The Tuesday purchases followed a heavier round of acquisitions on Monday. Ark Invest had scooped up crypto-related shares worth more than $71 million.

Similarly, the Monday buys included shares of Coinbase, Circle, Bitmine, Robinhood, Bullish, and Block Inc. The firm made these purchases through several ETFs, including ARK Blockchain & Fintech Innovation ETF (ARKF) and ARK Innovation ETF (ARKK).

Market Crashes as BTC Declines

Ever since bitcoin (BTC) began its descent late last year, crypto stocks have followed suit. Data from Trading View shows that the stocks of most crypto-related companies are down by double digits over the last three months. Their decline has intensified as BTC remains below $90,000 and faces the risk of plummeting under $60,000. At the time of writing, the leading digital asset was changing hands at $76,000, down 17% monthly and 14% weekly.

While BTC and the broader market continue to decline, Ark Invest has been on a buying spree. The asset manager has spent millions of dollars on crypto-related stocks in December and January. From the look of things, the company is likely to continue buying crypto stocks for as long as the bearish season lasts.

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Fidelity launches FIDD stablecoin with over $59M supply on Ethereum

TLDR

- Fidelity Digital Assets has officially launched the FIDD stablecoin with an initial supply of over 59 million dollars.

- The FIDD stablecoin is now live on the Ethereum blockchain and is available for on-chain payments and institutional settlements.

- Fidelity confirmed that FIDD is fully backed by US dollars held in accredited banks and complies with the GENIUS Act.

- Mike O’Reilly stated that Fidelity is committed to stablecoin development and has researched the digital asset space for years.

- The FIDD token will be available through Fidelity Digital Assets, Fidelity Crypto, and other institutional platforms.

Fidelity Digital Assets has officially launched its native stablecoin FIDD on the Ethereum blockchain, following a recent announcement. The asset began with an initial issuance of over $59 million and is now live for transactions. The token is fully backed by US dollars held in accredited financial institutions.

FIDD Stablecoin Launches with Initial Supply and Ethereum Integration

Fidelity introduced the FIDD stablecoin as part of its broader expansion into the blockchain and digital payments market. The company minted the token on Ethereum, aligning with the industry’s move toward on-chain settlement. The initial supply exceeds $59 million but remains largely limited in wallet distribution.

Mike O’Reilly, President of Fidelity Digital Assets, emphasized the company’s dedication to digital innovation. “We have spent years researching and advocating for the benefits of stablecoins,” he said. The token aims to serve as both a payment method and a settlement tool for institutional clients.

The FIDD stablecoin complies with the regulatory framework set by the GENIUS Act, allowing for secure and compliant issuance. It is backed by US dollar reserves stored in regulated banks. The GENIUS Act also permits backing by US Treasury bills, enhancing issuer control over earnings.

Utility, Custody, and Institutional Access

Fidelity has confirmed that FIDD will be available across its platforms, including Fidelity Crypto and Fidelity Crypto for Wealth Managers. Purchase and redemption will be handled internally, while external trading will occur through major cryptocurrency exchanges. The asset is fully transferable within Ethereum-based wallets.

The company will also offer custodian services for holding FIDD and managing associated reserves. This includes both direct and institutional client servicing. As Fidelity already operates digital asset custody, it expands its offerings by adding a compliant stablecoin.

FIDD is designed for on-chain payments and institutional use cases, especially for settlement across digital asset platforms. Its compatibility with Ethereum ensures wide infrastructure support. Despite the launch, liquidity and adoption are expected to build gradually.

Stablecoin Ecosystem Sees New Entrants with FIDD in Focus

The FIDD stablecoin enters a market dominated by USDT and USDC, both of which have seen growth over the past year. New regulations like the GENIUS Act have encouraged more issuers to develop compliant tokens. FIDD is Fidelity’s answer to the emerging demand for tokenized dollars with regulatory clarity.

Fidelity joins the list of fintechs and banks offering branded stablecoins, focusing on secure reserves and usage controls. However, like many new stablecoins, FIDD must still prove its real-world utility and demand. Several newly launched stablecoins have remained underutilized due to limited liquidity or application.

The Fidelity Digital Interest Token, launched in September 2025, demonstrates the firm’s ongoing blockchain efforts. That token reached over $264 million in total value before dropping due to redemptions. Its current assets under management stand at approximately $161 million.

Crypto World

Put crypto to work with KT DeFi and earn up to $5,000 per day with cloud mining

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

KT DeFi launches regulated cloud mining, offering low-entry, transparent access to BTC, XRP, ETH, SOL, and DOGE.

Summary

- Global crypto mining shifts to renewable energy as KT DeFi offers sustainable, low-cost cloud mining access.

- KT DeFi supports BTC, XRP, DOGE, SOL, and ETH, enabling steady mining returns without active trading.

- As miners adopt solar and wind power, KT DeFi positions cloud mining as a stable, eco-friendly income option.

In today’s rapidly evolving crypto landscape, a quiet but powerful transformation is taking place — one driven by energy efficiency and sustainability.

Across the globe, large-scale mining operations are moving away from traditional high-energy mining models and adopting renewable energy sources such as solar and wind power. This shift not only significantly reduces operating costs, but also improves long-term stability while aligning mining profitability with environmental responsibility.

For investors, this represents more than an environmental upgrade; it marks a smarter and more sustainable way to participate in crypto mining.

Why cloud mining is gaining momentum

As market volatility increases and mining technology becomes more complex, many investors are reconsidering how they participate in crypto mining.

Instead of purchasing hardware, managing electricity costs, and handling technical maintenance, more users are turning to cloud mining — a simpler and more efficient alternative.

With cloud mining:

- Hardware deployment and maintenance are handled by professional teams

- Energy management and system optimization are centralized

- Users simply select a mining contract

- Mining rewards are calculated and distributed daily

- No technical knowledge or active trading is required

This makes cloud mining an ideal entry point for beginners and a time-efficient solution for long-term investors.

KT DeFi: A beginner-friendly and transparent cloud mining platform

KT DeFi is a regulated cloud mining platform designed to make crypto mining accessible, transparent, and sustainable.

The platform supports multiple major cryptocurrencies, including BTC, XRP, DOGE, SOL, ETH, and more. With a clear interface and straightforward contract structure, users can participate in mining with a low entry threshold and predictable returns.

For investors who prefer steady income over short-term speculation, KT DeFi offers a clear alternative:

No market timing, no frequent trading — just consistent, automated mining rewards.

Why choose KT DeFi

- Beginner-friendly design – Simple setup, intuitive interface, no technical background required

- Global mining infrastructure – Hundreds of mining facilities and over one million devices worldwide

- 100% renewable energy mining – Powered by solar and wind energy for long-term sustainability

- Stable passive income model – Mining runs automatically once a contract is activated

- Strong security standards – Multi-layer protection and transparent platform operations

This model has attracted over 9 million users globally, reflecting strong trust and long-term adoption.

Key platform benefits

- $17 instant signup bonus for new users

- No hidden service or management fees

- Multi-currency settlement: XRP, SOL, DOGE, BTC, LTC, ETH, USDC, USDT, BCH

- Affiliate program with referral rewards of up to $50,000

- Protected by McAfee® Security and Cloudflare®

- 100% uptime guarantee

- 24/7 live customer and technical support

How to start mining with KT DeFi

Step 1: Create an account

Register using an email address and gain immediate access to cloud mining services. New users can start mining Bitcoin and other cryptocurrencies right away.

Step 2: Choose a mining contract

| Contract Name | Asset Type | Investment (USD) | Duration | Expected Return (Principal + Profit) |

| BTC Welcome Plan | BTC | $100 | 2 Days | $108 |

| Goldshell Mini DOGE Pro | DOGE / LTC | $500 | 6 Days | $539.6 |

| Bitmain Antminer L7 | DOGE / LTC | $5,000 | 20 Days | $6,500 |

| Antminer S19k Pro | BTC | $10,000 | 30 Days | $14,830 |

| ANTSPACE HK3 | BTC / BCH | $50,000 | 35 Days | $80,625 |

Mining rewards begin the day after contract activation

Once total earnings reach $100, users may withdraw or reinvest

About KT DeFi

Founded in 2019, KT DeFi is a UK-registered and licensed cloud mining platform dedicated to making cryptocurrency mining more accessible, efficient, and sustainable.

By leveraging advanced mining hardware, intelligent hash rate allocation, and renewable energy infrastructure, KT DeFi lowers the barriers to entry for crypto mining, allowing users of all experience levels to participate with confidence.

KT DeFi believes that long-term value comes from stability, transparency, and sustainable returns, not short-term speculation. Through continuous system optimization and strict security standards, the platform aims to help users achieve steady asset growth in a reliable environment.

For investors seeking consistent passive income in the crypto space, KT DeFi is built to be a trusted long-term partner.

For more information, visit the official website, or download the mobile app.

Email: [email protected]

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

Crypto World

Bitcoin bleeds for second straight day, nearly grazes $72,000

Bitcoin signage in Times Square in New York, US, on Tuesday, Dec. 9, 2025.

Michael Nagle | Bloomberg | Getty Images

Bitcoin nearly touched the $72,000 mark on Wednesday, marking the second straight day of its massive retreat this week.

The world’s oldest cryptocurrency sank as low as $72,096.20, plunging more than 5% on the day. It was last trading at $72,958.38, down about 4% on the day. Bitcoin is currently more than 40% off its record high of about $126,000 hit last October.

Bitcoin in the past day, per Coin Metrics

Bitcoin first broke below the $73,000 mark on Tuesday, hitting its lowest price in roughly 16 months and approaching its pre-election value. Analysts say $70,000 is a key level to watch as the digital asset’s downturn deepens, according to a Citi note to clients dated Tuesday.

The token’s value is bleeding as a result of several of geopolitical and economic challenges, among other headwinds.

Chief among them is investors’ recent rotation out of risk-on assets due to rising tensions between the U.S. and Europe over U.S. President Donald Trump‘s Greenland gambit and a recently ended partial government shutdown that delayed the release of some critical economic data. Also at play are expectations of a U.S. monetary policy shift following Trump’s nomination of Kevin Warsh for Fed chair late last month as well as a slowdown in efforts to create more crypto-friendly regulatory and legislative guardrails in the U.S.

Large institutional outflows driven by expectations of a deeper bitcoin correction has also thinned liquidity for the token, hurting its price, according to a recent analyst note from Deutsche Bank.

Spot bitcoin exchange-traded funds have seen significant outflows since a series of liquidations of highly leveraged digital asset positions last October, the analysts noted. The funds have recorded outflows of more than $3 billion in January, roughly $2 billion last December, and about $7 billion last November.

Bitcoin’s pullback hit several crypto stocks. Strategy, a bitcoin treasury firm, was also down 5% on the day, while digital asset mining names like Riot Platforms and MARA Holdings shed almost 11%.

Crypto World

XLM Falls Below $0.2, Yet TVL Hits an ATH. Why?

Stellar (XLM) has fallen below $0.20. This move has erased all of the recovery it achieved last year. However, several positive signals suggest that many investors are still staying within the ecosystem.

In addition, real-world assets (RWA) and stablecoins could become key drivers of further XLM accumulation.

Sponsored

Positive Signs for Stellar (XLM) Despite the Sharp Price Drop

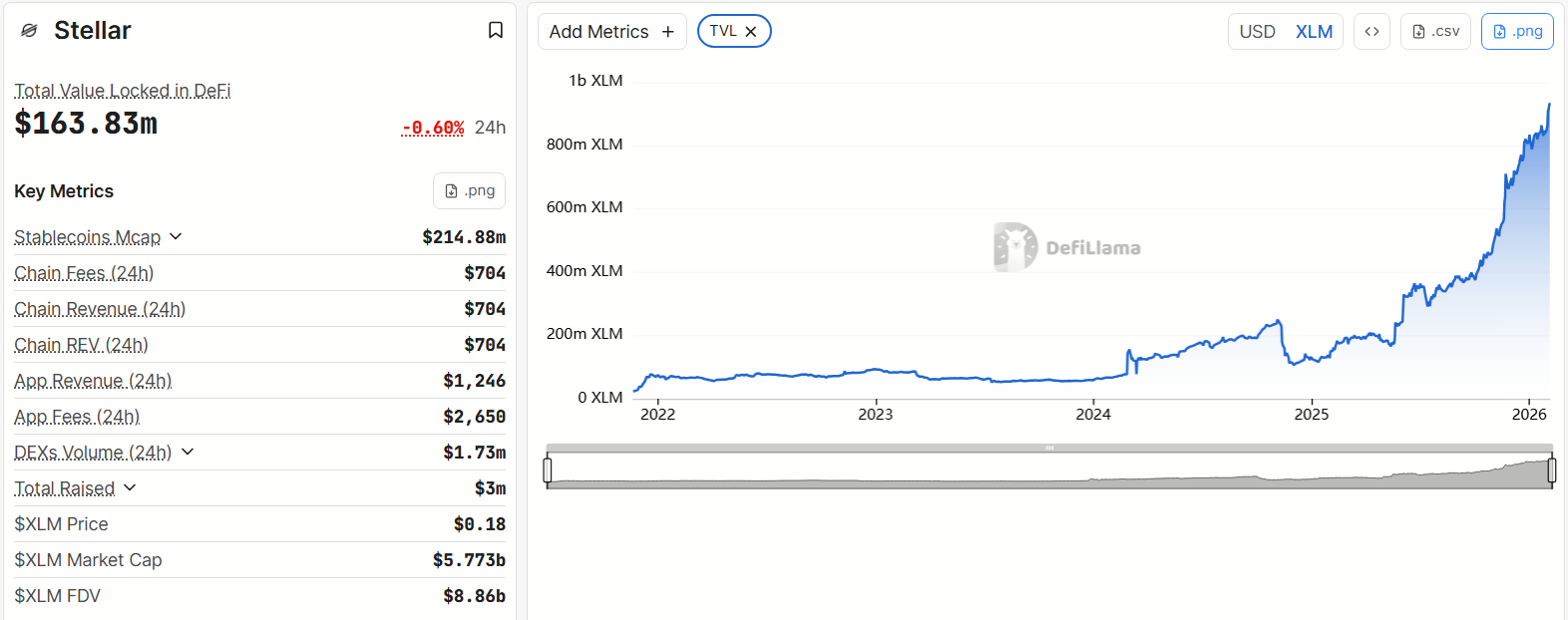

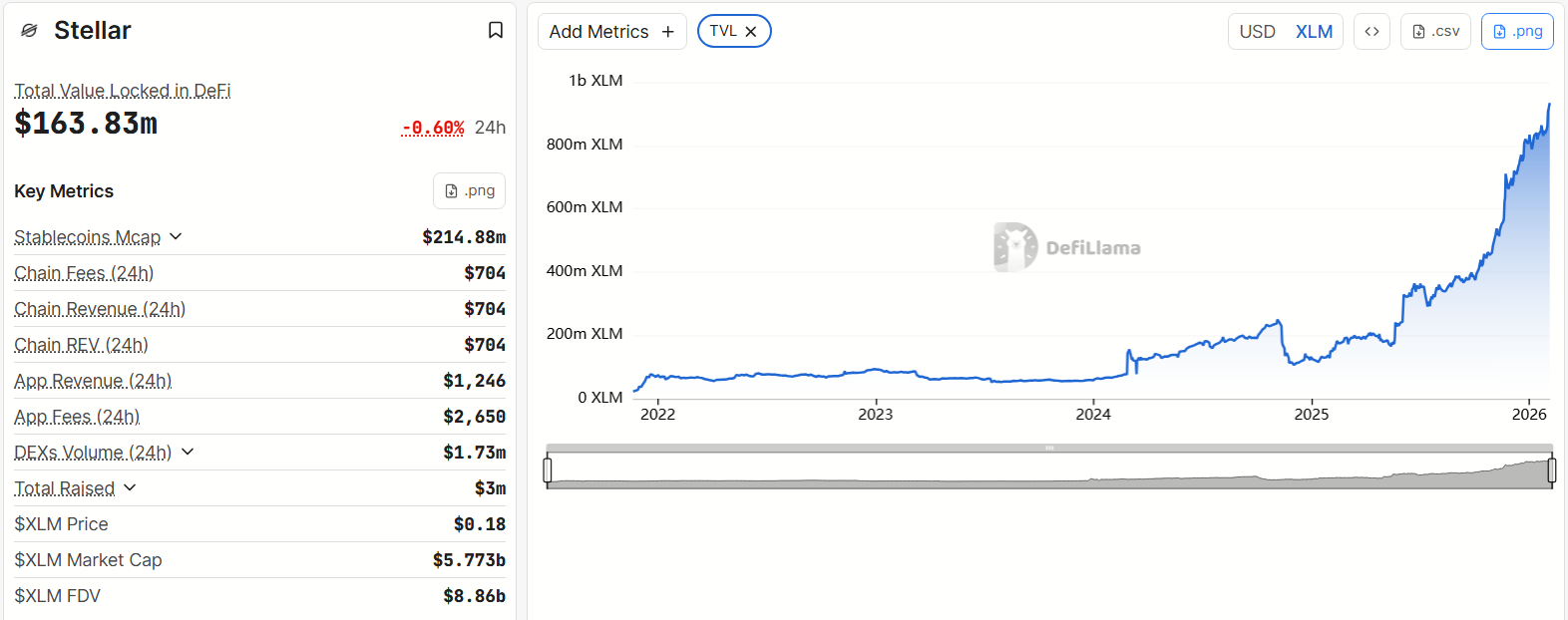

Data from DefiLlama shows that the amount of XLM locked in DeFi protocols on the Stellar network reached a new all-time high in early February 2026. It surpassed 900 million XLM.

This milestone reflects the growth of Stellar’s DeFi ecosystem. It comes even as XLM continues to fall below the year’s key support level at $0.20.

Although Stellar’s TVL, measured in USD, currently sits around $163 million, the sharp rise in locked XLM underscores strong confidence from the community and long-term investors in the network’s adoption potential.

The main protocols driving this capital inflow include Blend, a liquidity protocol that allows anyone to create flexible lending markets on Stellar, and Aquarius Stellar, an AMM protocol and liquidity management layer for the network. Together, these two protocols account for nearly 70% of total TVL.

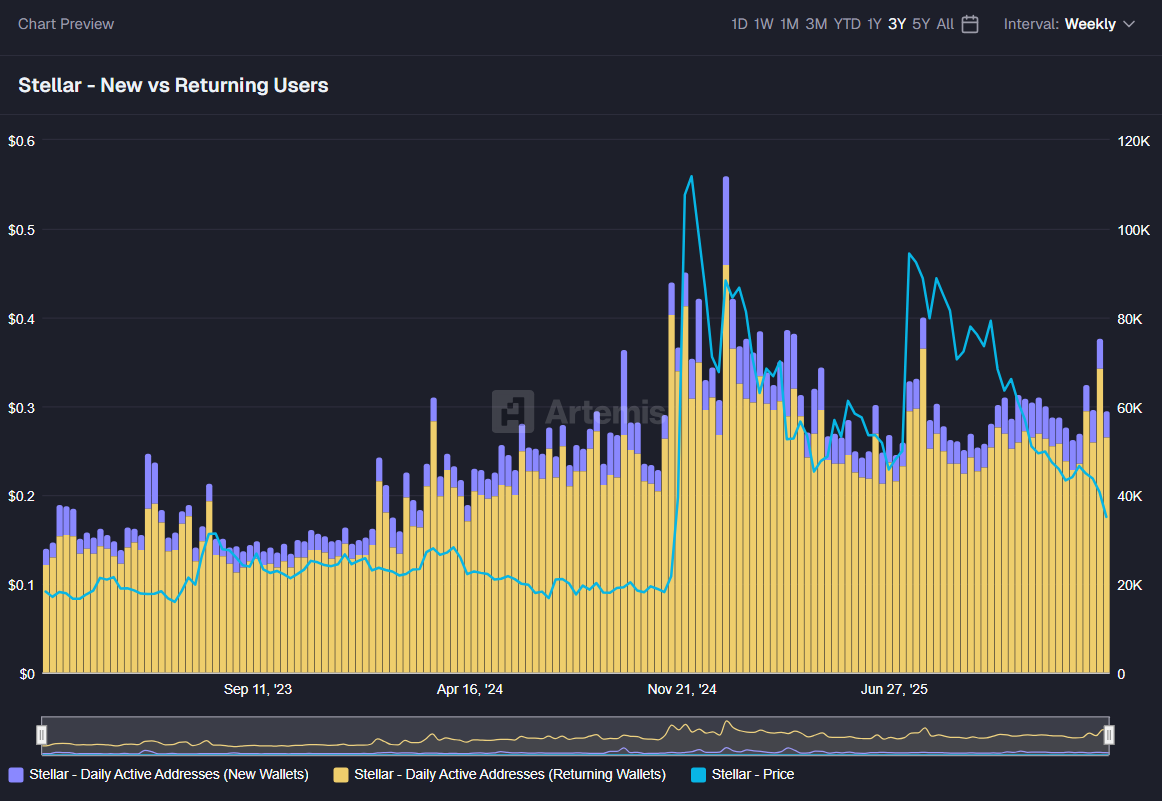

Artemis data also reveals another notable signal. Weekly active users across the Stellar ecosystem have remained steady at around 60,000 over the past few weeks. No significant decline has appeared despite the deep XLM price dump.

Sponsored

The chart indicates that in late 2024, when XLM fell below $0.10 before rising to $0.60, user activity remained stable and even trended upwards.

This suggests that Stellar users are not abandoning the network, even as capital continues to exit the broader crypto market. However, the current lack of new users may explain why XLM has not yet recovered.

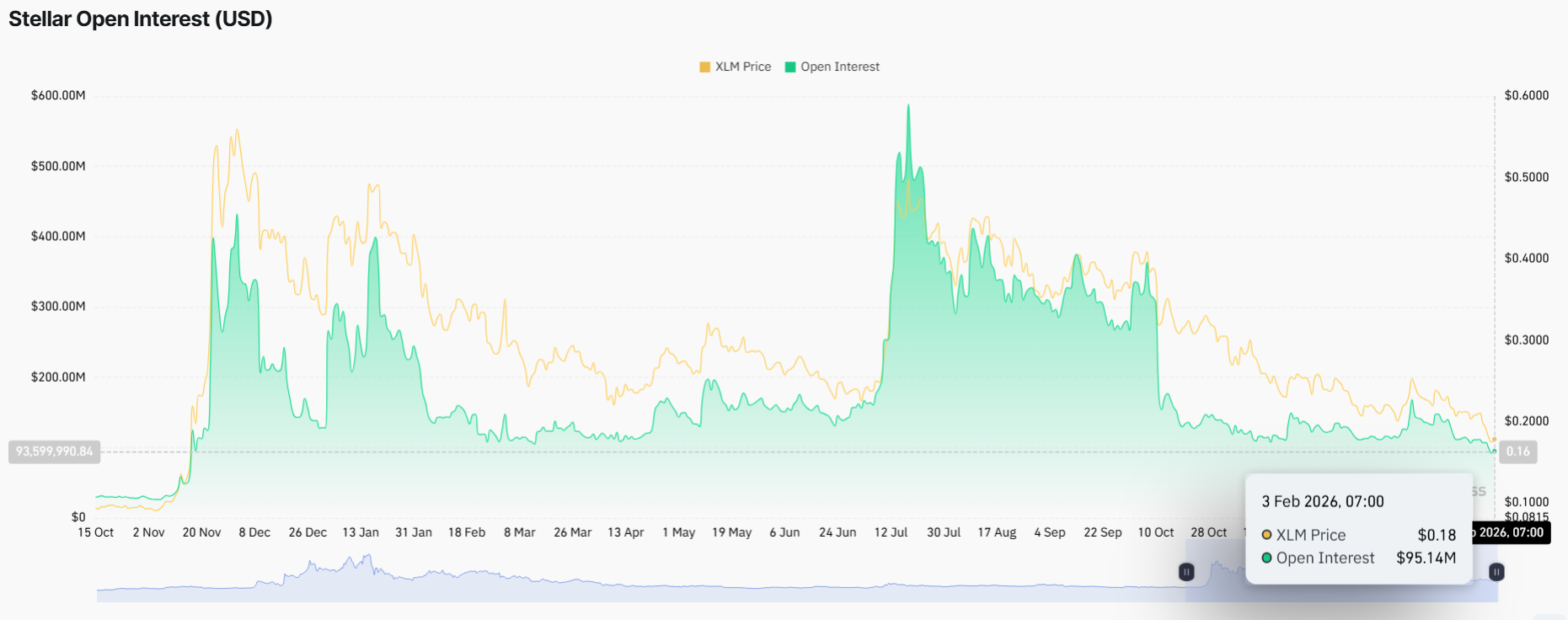

Derivatives metrics also indicate that XLM could be entering a new consolidation zone. Open Interest volume has dropped to its lowest level since November 2024. This decline reflects a sharp reduction in leveraged exposure among traders.

Sponsored

As a result, strong volatility may be fading. XLM could now be moving into a sideways phase, with less leveraged buying and selling pressure. This environment often allows a new accumulation zone to form.

However, identifying the exact market bottom and timing a recovery remains challenging under current market conditions.

Real-World Assets and Stablecoins Could Be Stellar’s Main Drivers in 2026

A report published last month stated that the total value of tokenized real-world assets on Stellar, excluding stablecoins, reached $1 billion at the start of this year.

Sponsored

Santiment, a crypto market analytics platform, also reported that Stellar ranks among the top four RWA projects by GitHub development activity since the beginning of the year.

“XLM isn’t a speculative add-on. It’s required for transactions, account operations, and network activity. As RWA volumes grow, usage of $XLM scales with it — not cyclically, but fundamentally,” said Scopuly, a Stellar wallet provider.

Stellar’s stablecoin market cap remains relatively modest at around $200 million. However, MoneyGram, one of the world’s leading companies in international remittance services and P2P payments, recently reaffirmed the stability of its USD-backed stablecoin instrument. The firm continues testing it on Stellar.

Therefore, demand for RWAs and stablecoins could become the primary drivers of XLM accumulation, especially as the token faces strong selling pressure near current lows.

Crypto World

Bitcoin Crash To $35,000? This Is What Analysts Reveal

Bitcoin fell sharply to $73,000 on February 3, extending a broader bearish trend that has now erased 41% from its October 2025 all-time high above $126,000. The drawdown has intensified debate over whether the market is approaching a cyclical bottom—or entering a deeper corrective phase.

The sell-off mirrors rising anxiety across traditional markets. US equity indices weakened amid concerns about artificial intelligence-driven disruption and escalating geopolitical risks, prompting investors to rotate away from risk assets.

In that environment, capital flowed back into traditional safe havens such as gold and silver, while Bitcoin failed to attract defensive demand.

Sponsored

Sponsored

Macro and Geopolitical Stress Push Investors Toward Traditional Havens

Bitcoin’s volatility continues to reflect macro sensitivity rather than isolation from global markets. The latest leg down coincided with renewed tensions between the United States and Iran after an Iranian drone was reportedly shot down near a US aircraft carrier.

The incident pushed the VIX up roughly 10% and drove the Crypto Fear & Greed Index into “extreme fear” territory.

At the same time, developments in artificial intelligence—including new announcements around Anthropic’s Claude chatbot—sparked renewed concerns about disruption across the tech sector.

That uncertainty weighed on major technology stocks and further reduced appetite for speculative assets.

While Bitcoin declined, gold rose 6.8% and silver gained 10%, reinforcing their role as preferred hedges during periods of monetary and geopolitical stress.

Speaking to CNN, Gerry O’Shea, Global Head of Market Insights at Hashdex, noted that the divergence between Bitcoin and gold suggests investors still view precious metals as the primary safe haven during periods of uncertainty.

That shift has weakened Bitcoin’s short-term refuge narrative and added downside pressure.

Analysts Warn of Deeper Drawdowns and a Potential Bull Trap

Market participants remain divided, but several analysts are openly warning that the correction may not be over.

Sponsored

Sponsored

Crypto analyst Benjamin Cowen argued that Bitcoin’s near-term path is critical:

Other analysts are more pessimistic. Nehal, a widely followed trader on X, suggested the current structure resembles a classic bull trap, warning that the move lower may only be halfway complete.

According to Nehal’s historical comparison, Bitcoin’s previous cycles ended with drawdowns of 86% in 2018 and 78% in 2021.

Applying a similar framework to the current cycle implies a potential 72% decline, which would place Bitcoin near $35,000.

This cyclical perspective remains influential despite structural changes in the market, including ETF adoption and greater institutional participation.

Sponsored

Sponsored

On-Chain Data Signals “Bottom Discovery” Phase

On-chain indicators are adding another layer to the debate. Analyst CryptOpus noted that Bitcoin has entered what he describes as a “bottom discovery” phase for the first time this cycle.

At the 2025 peak, roughly 19.8 million BTC were held in profit. That figure has now dropped to 11.1 million BTC, a 40% reduction in profitable supply.

Historically, similar conditions have marked transitions from corrective phases toward cycle resets. In 2018, Bitcoin remained in this state for roughly eight months before stabilizing.

Key Technical Levels Under Scrutiny

From a technical standpoint, downside risks remain clearly defined. Nic, CEO of Coin Bureau, highlighted that Bitcoin has remained under pressure since breaking below the 50-week moving average in November.

Bitcoin is currently trading near MicroStrategy’s cost basis and close to the April lows around $74,400.

“If we break lower, the next major level is $70,000, just above the previous all-time high of $69,000. A clean break below that opens the door to a bear market target in the $55,700–$58,200 range, between realized price and the 200-week moving average,” Nic warned.

Sponsored

Sponsored

Conflicting Views on Whether a Bottom Is Near

Not all analysts agree with the bearish outlook. Michaël van de Poppe believes Bitcoin may already be nearing the end of its downturn.

Meanwhile, analyst David Battaglia focused on liquidation dynamics, describing current conditions as increasingly irrational.

Battaglia noted that below $85,000, liquidity gaps were significant, meaning panic sellers—whether institutional or whales—likely exited at suboptimal prices.

He contrasted this with the October 10 crash tied to Binance, which he described as structurally cleaner.

“Between $90,000 and $100,000, there’s massive short density and a 14:1 puts-to-calls imbalance, which under normal conditions already signals a strong bottom,” Battaglia said.

In Summary

Bitcoin’s drop to $73,000 has reignited fears of a deeper correction. Macro uncertainty, geopolitical tension, and mixed on-chain signals leave the market split between expectations of further downside and signs of an emerging bottom.

The coming weeks will likely determine whether this move represents a temporary pause—or the foundation of a new trend for 2026.

Crypto World

CME Group Considers Crypto Token Launch

The world’s largest futures and options marketplace is exploring ‘tokenized cash’ as it leans further into crypto markets.

Crypto World

Solana price outlook: bears test $90 amid massive liquidations

- Solana dropped to $90 amid massive liquidations across the crypto market.

- Bitcoin and Ethereum fell to under $73,000 and $2,150.

- Standard Chartered forecasts SOL rally to $250 in 2026 and $2,000 by 2030.

Cryptocurrencies are bearish, and Solana’s price has experienced one of the sharpest declines among top altcoins.

In the past 24 hours, the cryptocurrency has dropped nearly 10% to under $91, with many traders caught off guard amid heightened market volatility.

As can be seen in the crypto heat map below, Solana’s plunge aligns with broader market pressure. Billions of dollars in leveraged positions have been wiped out in the past week as the sector faces massive unwinding.

Price dips 10% amid crypto liquidations

With market sentiment in shambles for much of 2026, it is no surprise that Bitcoin tanked to its multi-month lows of $72,800.

BTC and ETH’s latest dips mean Michael Saylor’s Strategy and Tom Lee’s BitMine currently sit on billions of dollars in unrealized losses.

Digital asset treasury companies that flocked to Solana, BNB, Cardano, and others have similar trajectories.

For Solana, the coin’s price under the psychological level of $100 has strengthened this. Sellers sustained this negative trend with another 10% push over the past 24 hours, hitting lows of $90.60.

Onchain perpetual markets on Solana contributed significantly, with over $70 million in liquidations from Solana-based platforms in the past 24 hours.

During the downturn, over $65 million of these were longs.

The surge in forced selling exacerbated the decline, with high leverage amplifying losses for over 15,900 bullish traders.

The liquidations reflect the rapid deleveraging that has also wiped billions of bullish bets from Bitcoin and Ethereum.

Solana price prediction

The SOL dip is part of a broader market correction, but there’s a potential for recovery if bulls hold $90.

However, liquidity contractions and liquidation overhangs, such as the $800 million in total liquidations in the past 24 hours, suggest a possible down leg as excess leverage clears.

The technical picture also has Solana trading below its 50-day moving average around $132, which adds to the bearish outlook of the RSI and MACD.

SOL could drop to $70 if markets continue to struggle.

Despite the overall bearish picture, Standard Chartered has pointed out a bullish forecast for SOL.

According to the bank, SOL could reach $2,000 by 2030 but has cut its 2026 forecast to from about $310 to $250.

Catalysts include the macro picture and capital flows, as well as a fresh explosion in rotation from memecoins to top altcoins. Stablecoin adoption is another factor in the bank’s outlook.

-

Crypto World5 days ago

Crypto World5 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World6 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics5 days ago

Politics5 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech12 hours ago

Tech12 hours agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Fashion5 days ago

Fashion5 days agoWeekend Open Thread – Corporette.com

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World4 days ago

Crypto World4 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports4 days ago

Sports4 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World4 days ago

Crypto World4 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World2 days ago

Crypto World2 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World5 days ago

Crypto World5 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business5 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports2 days ago

Sports2 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat2 days ago

NewsBeat2 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World21 hours ago

Crypto World21 hours agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards