Crypto World

WTI Oil Prices Volatile Ahead of Potential Talks

As the XTI/USD chart shows, the price of a barrel rose above $65 yesterday, reacting to the risk of talks between Iran and the United States on the nuclear deal breaking down. These negotiations could begin on Friday.

According to Axios, Arab world leaders have urged Donald Trump not to follow through on his threats to withdraw from the talks and shift towards military action after demands put forward by Iran. This news prompted a pullback in prices below $64.

The news backdrop is further complicated by conflicting reports regarding India’s refusal to purchase Russian oil, alongside other global factors. All of this is contributing to heightened volatility in the oil market, a trend also confirmed by the ATR indicator.

Technical Analysis of XTI/USD

On 14 January, we:

→ analysed swings in WTI crude prices to identify a breakout from a descending channel (shown in red) and outline an upward trajectory (shown in blue);

→ noted that the breakout level (around $58.35) was acting as support;

→ suggested that the market was vulnerable to a corrective move.

Indeed, on the same day (as indicated by the blue arrow), the price formed a bearish impulse towards this support, where the market found some balance.

However, geopolitical developments since the second half of January have supported higher prices, providing grounds to draw a broad ascending channel (shown in purple). In this context:

→ its lower boundary is acting as support, with the long lower wick on the 3 February candle confirming aggressive buying interest;

→ the $65 level appears to be a key resistance. Broad price swings formed there on 29–30 January — a sign of “smart money” activity — after which prices declined. Yesterday, the market again reversed sharply from this level.

It is therefore reasonable to assume that this resistance will pose a significant hurdle for bulls if they attempt to keep prices within the ascending purple channel. At the same time, the further direction of WTI oil price movements will most likely be determined by developments surrounding Friday’s Iran–US nuclear talks in Oman.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Private credit meltdown fears: Why BondBloxx isn’t worried

BondBloxx ETFs has been making a big bet in private credit.

Even with Wall Street fears of an impending meltdown in the space, the firm’s co-founder and chief operating officer is confident private credit is a sensible way for investors to pursue income.

“What you’re seeing in the press… maybe a fund of one manager and one manager’s assets [are] being marked down, and that’s going to happen. There may be a concentration in that manager’s approach or in the loans and the companies that are in their fund,” Joanna Gallegos told CNBC’s “ETF Edge” this week.

Gallegos, who’s the former head of global ETF strategy at J.P. Morgan Asset Management, contends BondBloxx’s approach to private credit protects investors because it’s designed to give “immense diversification.”

“Because of the way it’s [BondBloxx Private Credit CLO ETF (PCMM)] structured, you’re getting exposure to almost over 7,000 of those loans,” she said. “It gives you a pure play to private credit because 80% of the exposure in that product is private credit. And I think there’s been a lot of discussion about other vehicles and ETFs that there may not be 100% private credit.”

The firm launched its BondBloxx Private Credit CLO ETF in December 2024 — promoting it as the first-ever ETF that offers investors direct exposure to private credit.

As of Wednesday’s market close, FactSet reports the fund is up 7% since its inception and up 2% over the past three months.

‘There’s good reason to look at private credit’

Gallegos finds the yield generated by private credit is still attractive.

“That’s a good reason to look at private credit. The reality is that more companies are private than they used to,” said Gallegos, who added that the fund spreads exposure across many loans and managers rather than relying on a single manager or a concentrated pool of credits.

In the same “ETF Edge” interview, Strategas Securities’ Todd Sohn said he didn’t see broad stress across credit markets right now, too.

“Credit spreads are still on multi-decades lows, whether it’s high yield or investment grade,” the firm’s senior ETF and technical strategist said.

However, a “credit event” is on his watch list.

“If any of this private credit in the illiquid space starts to leak into other areas of the financial system… that would be my kind of a glaring sign of risk I think that’s out there. Quite frankly, everything else so far seems all right,” Sohn said. “Banks are still okay. The consumer seems all right. But I think it would be some sort of credit then out of left field that leaks into other areas that we’re not maybe focused on.”

Crypto World

Bitcoin ETFs Slide Further as Daily Outflows Hit $545M

Bitcoin (CRYPTO: BTC) exchange-traded funds extended losses on Wednesday as the spot price hovered near the $70,000 threshold, underscoring ongoing headwinds across digital-asset markets. SoSoValue data show spot Bitcoin ETFs posting $545 million in outflows for the session, contributing to a negative weekly cadence of about $255 million. Year-to-date inflows have totaled roughly $3.5 billion, yet redemptions in the same period reached $5.4 billion, leaving net outflows of about $1.8 billion and total assets under management near $93.5 billion.

Key takeaways

- Spot Bitcoin ETFs recorded $545 million in daily outflows, extending a weekly net drain of approximately $255 million.

- Year-to-date, cumulative inflows stand around $3.5 billion, but redemptions total about $5.4 billion, yielding a net negative of roughly $1.8 billion.

- Total assets under management for spot BTC ETFs sit near $93.5 billion.

- Broader market breadth has deteriorated, with the overall crypto market capitalization down about 20% year-to-date to around $2.5 trillion per CoinGecko.

- Investor behavior appears cautiously resolute: about 6% of ETF assets have exited, while a heavyweight ETF issuer’s exposure has retreated from a peak near $100 billion to around $60 billion.

Tickers mentioned: $BTC, $ETH, $XRP, $SOL, $IBIT

Sentiment: Neutral

Price impact: Negative. The ongoing outflows from BTC ETFs and a broader market pullback contributed to downside pressure, with the crypto market cap retreating roughly 20% YTD.

Trading idea (Not Financial Advice): Hold. Market participants have, on balance, remained invested through the current downturn, suggesting a cautious, patient stance rather than aggressive repositioning.

Market context: ETF flows continue to reflect a liquidity-constrained environment and a shift in risk appetite as macro signals and regulatory developments influence investor decisions in crypto assets.

Why it matters

The ongoing pressure on Bitcoin ETFs matters because these products are among the most liquid conduits to gain regulated exposure to digital assets. The persistent outflows indicate a dissonance between investor expectations for ETF-driven liquidity and the prevailing risk-off sentiment that has cooled appetite for risk assets. While inflows remain in positive territory for the year, the magnitude of redemptions underscores the fragility of demand in a challenging macro backdrop.

Industry analysts have observed a paradox: despite the outflows, the cohort of ETF holders has largely stayed put. In comments cited by market watchers, some analysts described the BTC ETF ecosystem as resilient in the face of volatility, with a relatively small portion of assets exiting funds. The dynamics at play point to a nuanced landscape where big-name issuers, like the iShares Bitcoin ETF (IBIT), have seen their asset bases retreat from peak levels yet still maintain a substantial footprint. This juxtaposition—scarcity of new inflows against a backdrop of stubborn existing holders—speaks to the complexity of crypto-asset exposure via regulated wrappers in a volatile market regime.

Altcoin funds, meanwhile, delivered a mixed signal. Ethereum (CRYPTO: ETH) ETFs registered meaningful outflows, while XRP (CRYPTO: XRP) funds drew modest inflows and Solana (CRYPTO: SOL) saw small withdrawals. These patterns illustrate that capital is not uniformly fleeing all digital-asset exposures; rather, it is rebalancing within the broader lattice of crypto instruments as traders reassess risk, duration, and yield prospects in a high-stakes environment.

As discussed by several market observers, the sector’s longer-term trajectory will hinge on how regulatory and policy signaling evolves, and whether large institutions can sustain long-hold strategies through drawdowns. The cumulative inflows for spot BTC ETFs—neatly summarized at around $54.8 billion since inception, and just a shade below the prior peak of $62.9 billion—reflect a tempered but persistent demand for regulated crypto exposure despite periodic bouts of stress. The narrative remains one of guarded optimism: potential upside for ETF products if risk sentiment improves, tempered by the reality that macro headwinds and competition from non-regulated venues continue to pressure flows.

In context, Bitcoin’s price dynamics remain a critical influence on ETF behavior. If the market sustains a move back toward prior highs, ETF inflows could accelerate, reinforcing a favorable feedback loop for price discovery. However, negative signals—whether from macro data, regulatory developments, or a renewed round of capital outflows—could precipitate further reductions in new fund subscriptions and redemptions from existing positions. Investors and issuers alike will be watching closely how the balance between demand for regulated crypto exposure and risk-off sentiment evolves in the weeks ahead.

What to watch next

- Upcoming spot BTC ETF flow data releases to gauge whether the current outflows persist or reverse in the next reporting window.

- Regulatory and product announcements from major issuers (including IBIT) that could affect investor demand for exchange-traded crypto exposure.

- BTC price action relative to the $70,000 level and its potential impact on ETF inflows and selling pressure.

- Altcoin ETF flow trajectories, with attention to Ethereum, XRP, and Solana funds, over the near term.

- Analysts’ updates on market breadth and investor behavior in the wake of ongoing macro volatility and regulatory scrutiny.

Sources & verification

- SoSoValue data on spot BTC ETF flows for the cited session and weekly period.

- CoinGecko metrics documenting the approximate 20% year-to-date decline in total crypto market capitalization to around $2.5 trillion.

- Public comments from James Seyffart on ETF inflows versus peak inflows in the BTC ETF space.

- Eric Balchunas commentary on investor behavior within BTC ETFs and the IBIT asset trajectory.

Bitcoin ETFs in retreat as spot flows remain negative and risk appetite dampens

Bitcoin (CRYPTO: BTC) exchange-traded funds continue to retreat as the spot market trades near pivotal levels, highlighting how a risk-off stance is shaping fund flows. The latest data show spot BTC ETFs registering a $545 million outflow on a single session, intensifying a broader weekly draw of roughly $255 million. While year-to-date inflows have totaled around $3.5 billion, redemptions have climbed to about $5.4 billion, resulting in a net negative of nearly $1.8 billion and an assets-under-management tally around $93.5 billion. This backdrop mirrors a wider contraction in crypto liquidity, with the total market cap down about 20% year-to-date to roughly $2.5 trillion, according to CoinGecko.

Among the ETF universe, investor behavior has shown a blend of caution and resolve. The data imply that a small minority has exited positions—approximate turnover sits near 6% of total assets—while the bulk of holders remain invested despite repeated bouts of price volatility. The dynamics at play are further illustrated by the performance of the iShares Bitcoin ETF (EXCHANGE: IBIT), which has seen its assets retreat from a recent peak close to $100 billion to around $60 billion as risk sentiment waxes and wanes. As one Bloomberg analyst noted, the scale of inflows during the peak period was substantial, and the current retreat does not erase the earlier strength of demand for regulated exposure.

Against this backdrop, altcoin funds have shown a mixed complexion. Ethereum (CRYPTO: ETH) ETFs posted outflows of roughly $79.5 million, while XRP (CRYPTO: XRP) funds attracted about $4.8 million in net inflows. Solana (CRYPTO: SOL) ETFs also faced outflows, totaling around $6.7 million. The divergence within the altcoin cohort underscores the sophisticated nature of investor preference in a risk-off environment, where different narratives and fundamental updates across projects can drive uneven demand for ETF wrappers and direct exposure alike.

For investors and market watchers, the BTC ETF story remains a barometer of wider liquidity conditions and the pace at which regulated vehicles can deliver accessible exposure to a volatile asset class. The narrative will likely hinge on whether macro conditions improve enough to spur new inflows, or whether the market’s risk-off tilt persists, dampening appetite for crypto risk assets across the board.

https://platform.twitter.com/widgets.js

Crypto World

Tron extends USDT lead over Ethereum as TRX price decouples from network boom

Tron tightens its USDT lead over Ethereum as network activity and BTC reserve plans climb, yet TRX price lags, retracing into a multi‑month consolidation range.

Summary

- Tron’s share of USDT supply has grown, with on-chain data showing rising active addresses and record weekly transaction volumes tied to stablecoin usage.

- Justin Sun has signaled plans to increase Tron’s Bitcoin reserves, echoing Binance’s $1 billion SAFU conversion toward BTC as both networks tilt their treasuries to Bitcoin.

- Despite stronger fundamentals, TRX has retraced recent gains and is back in its late‑2025 consolidation zone, with price action tracking broader market conditions more than network growth.

The Tron network has surpassed Ethereum in stablecoin supply, marking a shift in the competitive landscape between the two blockchain platforms that have competed for USDT dominance in recent years.

USDT stablecoin supply on Tron has risen significantly, giving it a larger share of the USDT supply than Ethereum, according to data from DeFiLlama.

The increased USDT liquidity on Tron reflects the network’s faster and cheaper transaction capabilities compared to competing platforms. The growth corresponds with key network performance metrics, according to blockchain analytics data.

Tron on the radar

Address activity on the Tron network has surged alongside the rise in USDT supply. Active addresses maintained an upward trend over recent years and accelerated in recent weeks, with weekly active addresses rising sharply during this period, according to DeFiLlama data.

Transaction activity has followed a similar pattern. The Tron network recently recorded its highest weekly transaction volume, while the network’s stablecoin count reached a new historic high during the same week. Industry analysts have attributed the robust network growth to stablecoin transaction activity.

Tron has been accumulating Bitcoin reserves and may execute another large purchase, according to public statements. Binance recently announced plans to convert part of its Secure Asset Fund for Users (SAFU) into Bitcoin. Tron founder Justin Sun has indicated plans for a similar move, though the exact amount of Bitcoin currently held by Tron remains undisclosed.

Despite positive network activity and Bitcoin acquisition plans, Tron’s native cryptocurrency TRX has not experienced corresponding price gains. TRX began January with an upward price movement but has since retraced most gains, experiencing a decline over recent weeks.

The TRX token was not in oversold territory despite the price drop, according to technical indicators. The retracement brought the token back to the consolidation zone where it traded between November and December of the previous year. The TRX price movement has shown limited correlation with Tron network activity, with the cryptocurrency’s performance appearing to track broader market conditions rather than network-specific demand.

Long-term price charts indicate a natural retracement following a parabolic price movement from November 2022 to August 2025, according to market data.

Crypto World

Altcoins That Can Benefit If Bitcoin Crashes Below $70,000

Bitcoin has slipped nearly 7% in the past 24 hours and is now drifting closer to the critical $70,000 mark, a psychological level that could deepen fear across the broader crypto market if it breaks. As traders prepare for a possible downturn, attention is shifting toward specific altcoins that can benefit. Ones that may stay resilient if Bitcoin crashes below $70,000.

While most tokens tend to fall alongside BTC during major sell-offs, BeInCrypto analysts have identified three cryptocurrencies that are showing strong negative correlation, healthier chart structures, and improving capital flows. These signals suggest they could possibly outperform during market stress, making them potential opportunities even in a risk-off environment.

The White Whale (WHITEWHALE)

The White Whale (WHITEWHALE) is emerging as one of the few altcoins that can benefit if Bitcoin crashes under $70,000. All thanks to its growing independence from broader market trends. While most tokens have followed Bitcoin lower, the Solana-based WHITEWHALE has remained resilient.

Sponsored

Sponsored

It gained nearly 17% over the past seven days and rose close to 20% in the past 24 hours. This relative strength suggests that traders are possibly rotating into the token despite wider market weakness.

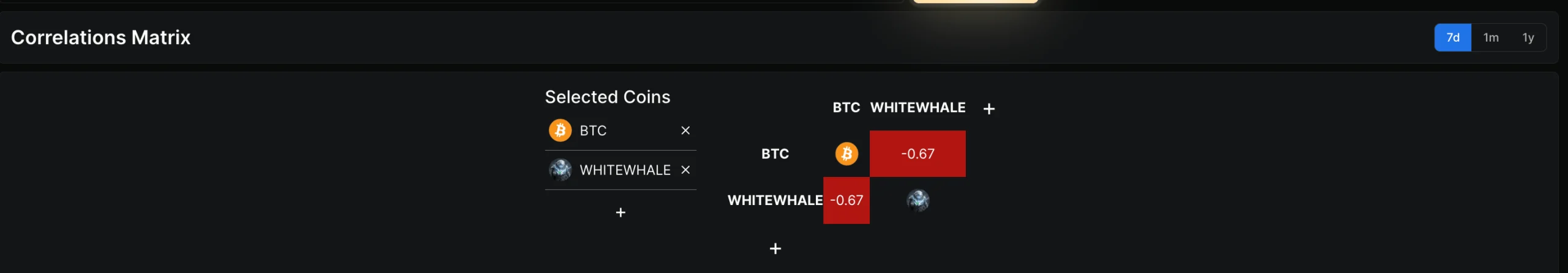

Over the last week, The White Whale has posted a strong negative correlation of –0.67 with Bitcoin. This means it has often moved in the opposite direction. This decoupling is important in a risk-off environment.

If Bitcoin crashes below $70,000, assets with low or negative correlation tend to attract speculative capital. And that makes WHITEWHALE one of the altcoins that can benefit from such a move. At the same time, the token is trading inside a bullish ascending channel on the 4-hour chart.

From a technical view, resistance sits near $0.127 and $0.143. A sustained move above this zone would confirm a breakout and open the path toward $0.226, implying upside of nearly 58% and a potential move into price discovery. On the downside, support lies at $0.098, with a deeper invalidation below $0.087. A break under these levels would weaken the bullish case and expose the price to a pullback toward $0.070.

Overall, The White Whale’s negative correlation, strong short-term performance, and bullish chart structure position it as a high-risk, high-reward candidate if Bitcoin enters a deeper correction.

Sponsored

Sponsored

Bitcoin Cash (BCH)

Bitcoin Cash is emerging as one of the altcoins that can benefit if Bitcoin crashes below $70,000, especially as it continues to show relative strength during broader market weakness. While the wider crypto market has slipped nearly 7% in recent sessions, BCH is down just over 1%, highlighting early signs of resilience. Over the past three months, it has also been up nearly 8%, making it one of the few large-cap altcoins still holding gains on a medium-term basis.

On-chain data supports this defensive setup. The Spent Coins Age Band metric, which tracks how many previously dormant coins are being moved, shows a sharp decline in activity.

Since early February, this figure has fallen from around 18,900 coins to roughly 8,278, a drop of nearly 56% in just a few days. This means far fewer long-held BCH tokens are being sold, even as prices remain under pressure. When coins stay inactive during market stress, it often reflects growing holder confidence.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At the same time, the Chaikin Money Flow (CMF) indicator, which measures whether large capital is entering or leaving an asset using price and volume, has risen steadily between January 29 and February 5. CMF has climbed back toward, and briefly above, the zero line, showing that large buyers are quietly increasing exposure despite weak sentiment elsewhere.

Sponsored

Sponsored

From a technical perspective, BCH needs to hold above $523 to maintain this structure. A daily close above $558 would strengthen the bullish case and open the path toward $615 and $655, with $707 as an extended target if conditions improve.

However, failure to reclaim $523 could expose the price to a deeper pullback toward $466.

Hyperliquid (HYPE)

Hyperliquid’s native token, HYPE, stands out as one of the altcoins that can benefit if Bitcoin crashes below $70,000. It is mainly because it has been moving in the opposite direction to BTC. Over the past month, HYPE is up nearly 28%, while Bitcoin has dropped around 24%.

Sponsored

Sponsored

During the same period, its correlation with BTC stands at –0.71, showing a strong inverse relationship. This means that when Bitcoin weakens, HYPE has recently tended to rise, making it a candidate for traders looking for relative strength during market stress.

The HYPE price chart supports this divergence. After rallying toward the $38.43 zone earlier, HYPE entered a consolidation phase that now resembles a bullish flag-and-pole pattern. This structure usually forms when an asset pauses after a strong rally before attempting another upward move. If the upper trendline breaks, the pattern projects a potential upside of around 87%.

Capital flow data also remains supportive. The Chaikin Money Flow (CMF) is still positive, showing that large buyers are active. However, CMF is moving below a descending trendline, meaning stronger inflows are still needed to confirm a new flag breakout.

For bullish confirmation, HYPE needs a clean daily close above $34.87. Clearing this level would open the path toward $38.43 first, and potentially toward the $65.70 zone if momentum builds. On the downside, weakness below $28.21 would damage the setup, while a fall under $23.82 would invalidate the bullish structure.

If Bitcoin crashes under $70,000 and HYPE maintains its negative correlation, strong structure, and inflow support, it remains one of the altcoins that can benefit from market stress rather than suffer from it.

Crypto World

EUR/USD and GBP/USD Consolidate After Pullback From Yearly Highs

The euro and the pound have retreated after setting new yearly highs and are now trading near key levels, reflecting a wait-and-see stance as markets look ahead to major events in the coming sessions. Following a strong upward move over recent weeks, traders opted to lock in part of their profits, triggering a corrective pullback and a shift into consolidation. Additional caution is being driven by today’s Bank of England meeting, the outcome of which could influence sterling and set the tone for European currencies ahead of more important US data releases.

Overall, EUR/USD and GBP/USD appear to be in a state of balance after a sharp rally. Today’s Bank of England decision and tomorrow’s US labour market reports are seen as key reference points for assessing the next directional move. A more measured stance from policymakers and weak or neutral employment data could support a resumption of the upward trend, while a more hawkish tone or strong US figures may increase pressure on the pairs and lead to a deeper correction from recent highs.

EUR/USD

After rebounding from 1.2080, EUR/USD has remained within a narrow range, showing no clear readiness either to resume strong gains or to extend the correction. The market is assessing whether the recent cooling in the US labour market — which previously underpinned expectations of Fed policy easing — will persist. Upcoming employment data are viewed as a decisive factor: they could either confirm conditions for further upside or weigh on the euro if signs of US economic resilience emerge.

Technical analysis of EUR/USD points to potential strengthening towards 1.1900–1.1920, as a bullish harami pattern has formed on the daily chart. Should the pair settle below 1.1760, a continuation of the decline towards 1.1720–1.1670 becomes possible.

Key events for EUR/USD:

- Today at 09:00 (GMT+2): German factory orders

- Today at 15:30 (GMT+2): US initial jobless claims

- Today at 17:00 (GMT+2): US JOLTS job openings

GBP/USD

GBP/USD has also entered a consolidation phase after pulling back from its yearly highs. The pair is currently trading within a range that capped gains for much of last year. If buyers manage to keep GBP/USD above 1.3600 in the coming sessions, a renewed test of the 1.3800–1.3850 area is possible. A move below 1.3600 would open the door to a deeper correction towards 1.3470–1.3520.

Key events for GBP/USD:

- Today at 14:00 (GMT+2): Bank of England interest rate decision

- Today at 14:30 (GMT+2): Speech by Bank of England Governor Bailey

- Tomorrow at 15:30 (GMT+2): US unemployment rate

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Oracle (ORCL) Shares Fall Below $150

The start of February has been negative for technology stocks, weighed down by a wave of pessimism driven by several factors, including:

→ “AI spending fatigue.” Results from Microsoft and Alphabet highlighted massive capital expenditure (CapEx). Tens of billions of dollars are being poured into servers and chips, and the market appears increasingly concerned that these costs may not be justified by actual AI-related revenues.

→ The launch of new “agent-based” AI tools (such as those released by Anthropic in early February), which has fuelled fears that AI could begin to replace software itself rather than enhance it. This has put pressure across the software sector, including Salesforce, Adobe and Oracle.

For Oracle, the situation is further complicated by plans to finance a large-scale programme in 2026 worth $45–50bn, which the company intends to fund by: 1) taking on debt; 2) issuing additional shares.

As a result:

→ analysts have downgraded their target prices for ORCL;

→ the share price has fallen below $150 for the first time since May 2025.

On 18 December, we noted that technical analysis of the ORCL share chart pointed to four reasons why a rebound towards the resistance area marked in blue was possible.

As the blue arrow shows, since then ORCL shares have:

→ shown signs of recovery;

→ however, a false bullish break above the psychological $200 level led to a resumption of the downtrend within the previously identified descending red channel.

The accelerating bearish momentum over the past three days may:

→ prompt weaker holders, gripped by panic, to sell ORCL shares;

→ attract “smart money”, which may view prices below $150 as appealing.

In addition, attention should be paid to the intersections of trend-channel lines from different timeframes. These may act as a cluster of support and slow the decline, giving the market a pause ahead of the quarterly earnings release scheduled for early March.

Buy and sell stocks of the world’s biggest publicly-listed companies with CFDs on FXOpen’s trading platform. Open your FXOpen account now or learn more about trading share CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

U.S. Launches Global Plan to Reshape Critical Minerals Market

TLDR

- The U.S. formed FORGE to coordinate global critical mineral policy, pricing, and project development with allies.

- Over 28 countries finalized or signed new mineral trade agreements to boost fairer pricing and supply chain security.

- The agreements aim to counter unfair practices like subsidies and below-market exports, often linked to China.

- Vice President JD Vance announced reference price floors and adjustable tariffs to protect domestic manufacturers.

- President Trump unveiled Project Vault, a $12B reserve to stabilize mineral prices and support U.S. industry.

The U.S. introduced new actions on Wednesday to lead a global effort reshaping trade rules for critical minerals; the initiatives target pricing control, ally cooperation, and China’s dominance, as agreements and a new forum took shape during a large ministerial meeting in Washington.

FORGE Coalition to Align Global Mineral Policies

According to a CNBC report, Secretary of State Marco Rubio hosted the Critical Minerals Ministerial this week in Washington. The event brought together representatives from 54 countries and the European Union. Officials discussed new frameworks to coordinate policy, stabilize markets, and increase investment.

Rubio announced the formation of a new alliance called the Forum on Resource Geostrategic Engagement (FORGE). The group aims to synchronize mineral-related policies and pricing across participating nations. “We have a number of countries that have signed on… and many more that we hope will do so,” Rubio stated.

FORGE will serve as a global coordination hub for mineral pricing and project development. It will work alongside an earlier agreement called Pax Silica. While Pax Silica focuses on securing artificial intelligence supply chains, FORGE will take a broader role.

Rubio emphasized the risks of mineral supply concentration in a single country. He did not name China directly but pointed to the dangers of supply disruption. He highlighted how instability, pandemics, or politics could affect global access to vital minerals.

U.S. Signs Deals with Over Two Dozen Countries

During the forum, the U.S. signed bilateral critical minerals agreements with 11 countries. These deals follow 10 similar agreements reached in the last five months. Negotiations also concluded with 17 additional countries.

The agreements aim to coordinate pricing, encourage project financing, and make markets fairer for mineral trade. Officials described the pacts as steps to unlock more secure mineral supply chains. Rubio said the U.S. would “continue expanding its network of reliable partners.”

The agreements form part of a larger U.S. effort to build resilient critical mineral supply chains. Officials say unfair competition has hurt domestic industries. State subsidies and below-market prices have made new projects unsustainable.

Vice President JD Vance also addressed the pricing issue during the summit. He said the U.S. would enforce pricing floors to protect domestic producers. “We will establish reference prices… maintained through adjustable tariffs,” he explained.

U.S. Establishes Project Vault to Stabilize Supply

As we had reported earlier, President Trump introduced Project Vault. The initiative includes a $12 billion mineral reserve to stabilize prices. It combines $10 billion from the U.S. Export-Import Bank and $2 billion in private investment.

The reserve will stockpile essential materials, including lithium, copper, and rare-earth elements. Officials said the goal is to shield manufacturers from extreme price fluctuations. Project Vault will support domestic production and reduce dependence on external sources.

Trump described the reserve as part of his administration’s push to “protect and grow” U.S. manufacturing. The announcement followed months of planning and interagency coordination. Project Vault marks the largest mineral reserve investment in recent U.S. history.

The reserve complements the FORGE initiative by adding financial stability to policy coordination. It will give manufacturers predictable access to materials needed for defense and technology. This development aligns with broader U.S. plans to compete in the global minerals arena.

Crypto World

Bitcoin Fills $94,800 CME Gap, Eyes $100K Rally

Join Our Telegram channel to stay up to date on breaking news coverage

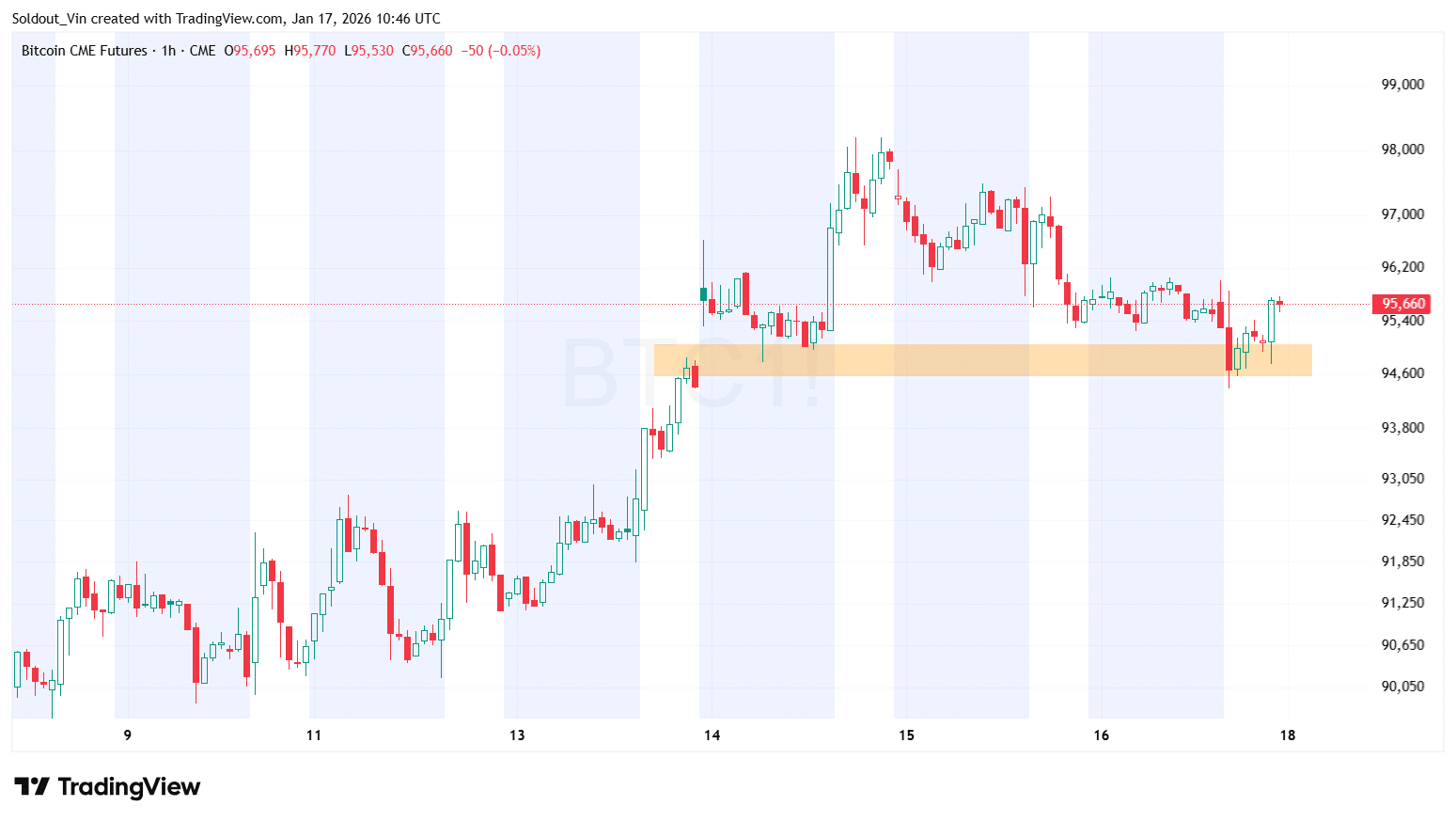

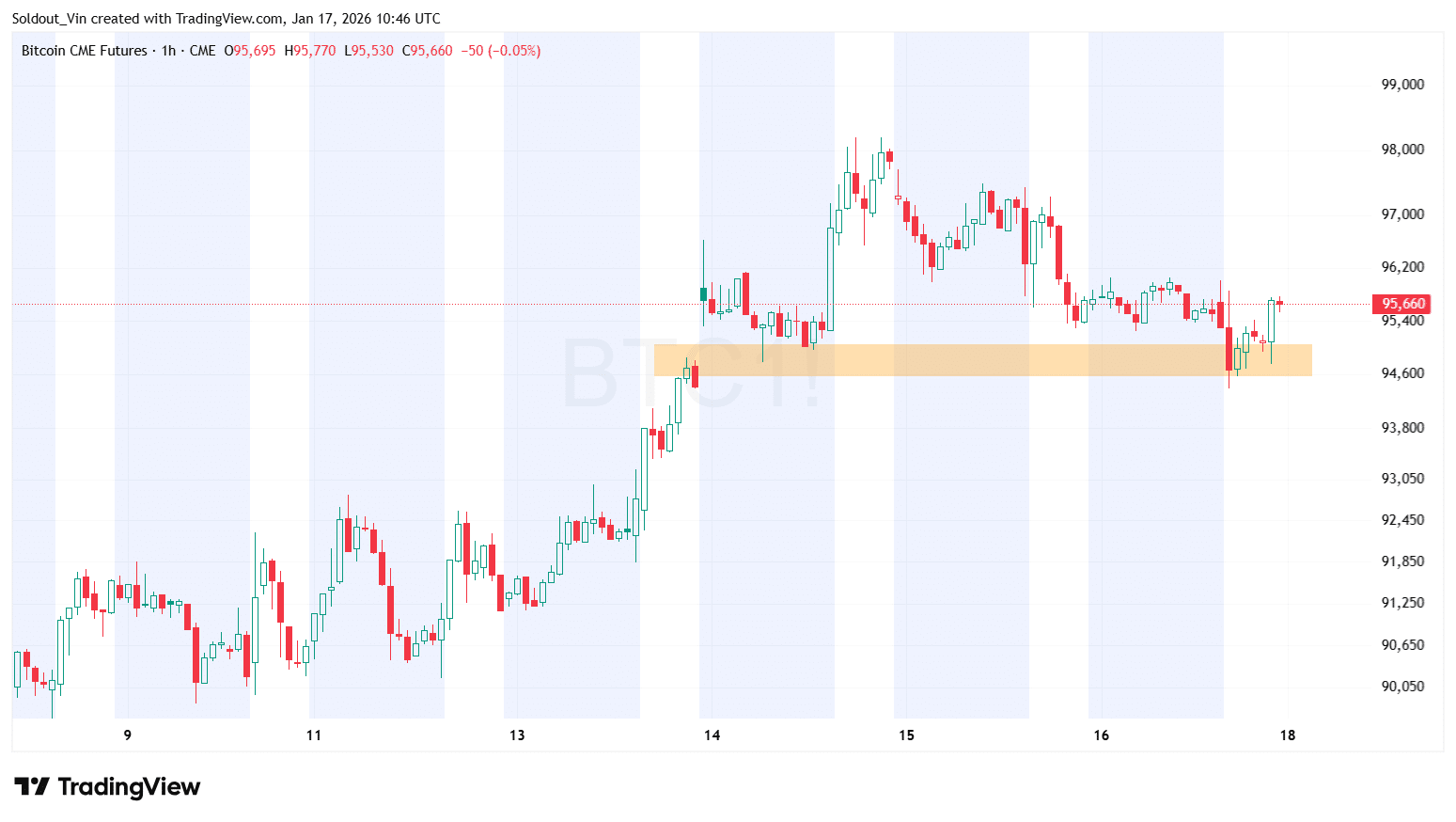

Bitcoin has closed the CME futures gap near $94,800, a technical milestone that analysts view as a bullish signal.

CME gaps form when Bitcoin’s weekend price movements on 24/7 spot markets create unfilled price ranges on the CME futures chart, which does not trade over weekends.

Historically, if these gaps act as focal points for technical traders, they tend to be revisited and filled by subsequent price action.

Based on the BTC CME futures chart, the gap near $94,800 has now been filled, a condition for further upside. Therefore, a weekly close above the $94,000 level may open the door for BTC to extend its rally toward the $100,000 threshold.

The CME gap is a significant level amid recent price resilience above $90,000, where bulls have defended support areas before staging rebounds. BTC dropped to below $94,000 and has since moved toward $95,000, filling the gap.

Bitcoin Heads for Weekly Gain After Muted New Year

Bitcoin is up 5% this week, as it also benefited from some bargain buying after a muted start of the new year.

A bulk of the coin’s gains this week came after top corporate holder, Strategy, disclosed a purchase of over $1 billion worth of BTC, drumming up some hopes over improving corporate demand for the King of crypto.

Strategy has acquired 13,627 BTC for ~$1.25 billion at ~$91,519 per bitcoin. As of 1/11/2026, we hodl 687,410 $BTC acquired for ~$51.80 billion at ~$75,353 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/bIbPbFAbTa

— Strategy (@Strategy) January 12, 2026

However, retail demand remained under pressure, as broader sentiment towards the crypto space remained skittish. The Bitcoin price continued to trade at a discount, indicating that retail sentiment remained weak.

This comes as US lawmakers earlier this week delayed a key discussion on a planned crypto regulatory framework, after Coinbase opposed the bill in its current version.

BTC is now down just a fraction of a percentage to trade at $95,100 as of 6:26 a.m. EST, according to Coingecko data.

Related News:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin erases 15 months of gains, falls below $70K amid $840M liquidations

- Bitcoin temporarily fell below $70,000, erasing gains built over the past 15 months.

- Over $840 million in leveraged long positions were liquidated during the sell-off.

- Traders now watch $65,000 support and $72,000 resistance for direction.

Bitcoin has suffered one of its sharpest corrections in recent years, wiping out roughly 15 months of bull market gains in a swift and brutal sell-off.

The world’s largest cryptocurrency temporarily plunged below the psychologically important $70,000 level, shocking traders who had grown accustomed to sustained upside momentum.

The move did not happen in isolation, as it was accompanied by heavy liquidations, weakening sentiment, and visible stress across centralised exchanges.

What initially appeared to be a routine pullback quickly evolved into a deeper reset for the broader crypto market.

Bitcoin price crash wipes out 15 months’ gains

Bitcoin’s drop to the $69,000–$70,000 range marked its lowest level in around 15 months, effectively erasing much of the progress made during the previous bull cycle.

This decline pushed BTC back toward price zones last seen before institutional inflows and ETF-driven optimism reshaped market expectations.

As the price broke below the key support level at $70,000, selling pressure intensified, and confidence among short-term traders deteriorated rapidly.

The correction also dragged down major altcoins, reinforcing the idea that this was a market-wide deleveraging event rather than a Bitcoin-only move.

From a market structure perspective, the fall represented a decisive break from the higher-highs and higher-lows pattern that had defined Bitcoin’s uptrend.

Liquidations accelerate the sell-off

One of the most significant drivers behind the crash was a massive wave of forced liquidations across crypto derivatives markets.

CoinGlass data shows that more than $840 million worth of leveraged positions were wiped out in a short period, with long positions accounting for the majority of losses.

As Bitcoin slipped below critical price thresholds, automated liquidation engines kicked in, amplifying downside momentum.

This cascade effect turned a controlled decline into a sharp flush, catching overleveraged traders off guard.

The liquidation-heavy nature of the drop suggests the move was driven more by market positioning than by a single fundamental catalyst.

After months of elevated leverage and crowded long trades, the market finally reached a breaking point.

Massive Bitcoin outflows from exchanges

At the same time, on-chain data from CryptoQuant shows notable Bitcoin outflows from major exchanges, particularly Binance.

A community-driven withdrawal campaign contributed to a sharp net outflow of BTC, briefly reducing exchange reserves.

In a recent press release, Binance publicly addressed speculation about these movements, denying claims of financial instability and emphasising that withdrawals were proceeding normally.

The exchange also encouraged users to practice self-custody if they felt uncertain, which further highlighted shifting trust dynamics within the market.

Despite the price crash, some analysts view sustained exchange outflows as a sign that long-term holders are not panic-selling.

This divergence between short-term trader behaviour and longer-term investor positioning adds complexity to the current market narrative.

Bitcoin price forecast – what to look at in the coming days

Looking ahead, traders should closely watch several key levels as Bitcoin attempts to stabilise after the sell-off.

The $70,000 zone now acts as immediate support, and a break below this level could push the price towards the $65,000 area, which stands out as a major support zone, as it aligns with previous consolidation ranges.

A deeper breakdown could expose Bitcoin to a move toward the $60,000 psychological level, where buyers may attempt a stronger defence.

On the upside, a sustained recovery above $72,000 would be an early sign that selling pressure is easing.

For now, volatility remains elevated, and traders are likely to stay cautious until Bitcoin establishes a clearer direction.

Crypto World

Galaxy Tokenizes First CLO on Avalanche With $50M Grove Allocation

Galaxy CLO 2025-1 totals $75 million and brings a private credit deal onchain.

Galaxy revealed on Jan. 15 that it has issued its first collateralized loan obligation (CLO) and tokenized the deal on Avalanche, a Layer 1 blockchain with a total value locked (TVL) of over $1.2 billion.

The instrument, dubbed Galaxy CLO 2025-1, totals $75 million and includes a $50 million allocation from Grove, an institutional credit protocol that operates as a Star, or SubDAO, within the Sky Ecosystem.

A CLO is a structured credit product that bundles corporate loans and sells them to investors across different risk tiers. Galaxy said the transaction will support its lending activities.

Avalanche said the CLO’s debt tranches were issued and tokenized on its network and are listed on INX for qualified investors. The network added that tokenization could enable lower-cost trading and faster settlement, while also improving transparency for investors.

“This transaction marks another meaningful step forward for onchain credit, demonstrating how familiar securitization structures can be brought onchain without compromising institutional standards,” said Sam Paderewski, co-founder at Grove Labs.

Paderewski added that Grove’s investment underscores its focus on supporting onchain tokenized credit products.

The allocation adds to Grove’s activity on Avalanche, according to the announcement. Grove previously deployed $250 million into tokenized real-world assets (RWAs) on the Avalanche network.

The announcement comes as more private credit products move onchain. Avalanche cited other institutional credit products already running on its network, including tokenized funds tied to Janus Henderson’s Anemoy Fund and Apollo’s ACRED.

Private credit remains the largest category in tokenized RWAs, with about $19.1 billion in onchain value, followed by tokenized securities, mainly Treasuries, at roughly $9 billion, according to a December report from RWAio.

AVAX, Avalanche’s native token, was trading around $13.74 on Thursday, down about 6.2% over 24 hours, according to CoinGecko. The token had roughly $388 million in daily trading volume.

Meanwhile, Galaxy (GLXY) shares were up about 13% on Thursday, trading around $31.90, according to Google Finance.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Crypto World7 days ago

Software stocks enter bear market on AI disruption fear with ServiceNow plunging 10%

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World6 days ago

Crypto World6 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video2 days ago

Video2 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech1 day ago

Tech1 day agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat6 days ago

NewsBeat6 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics3 days ago

Politics3 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World5 days ago

Crypto World5 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World3 days ago

Crypto World3 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports3 days ago

Sports3 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat2 days ago

NewsBeat2 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World6 days ago

Crypto World6 days agoWhy AI Agents Will Replace DeFi Dashboards