Crypto World

Aptos-Based Perp DEX Merkle Trade Shutters Business

The move comes amid a broader Aptos TVL decline and less than two years after Merkle closed a $2 million seed round with participation from Aptos Labs.

Merkle Trade, the largest decentralized perpetual futures exchange on Aptos by trading volume, said in an X post on Feb. 3 that it will begin winding down operations over the coming weeks.

The team said the decision followed “careful consideration” and comes after the platform processed nearly $30 billion in cumulative trading volume since launch. Without specifying a reason for the winddown, the statement concludes: “But we are proud of what we built, and grateful to everyone who was part of it.”

According to the announcement, new positions will be disabled on Feb. 6, with all remaining positions forcibly closed on Feb. 10. Merkle Trade’s native MKL token will become redeemable without fees or withdrawal delays, while a final revenue distribution is scheduled for Feb. 12, after which staked MKL can also be redeemed, the announcement said.

The price of MKL spiked 11.5% in the past 24 hours, though the token is down 90% from its all-time high in December 2024.

Launched in late 2023, Merkle Trade offered non-custodial derivatives trading alongside features such as trading missions and loot boxes, leaning heavily into game-like mechanics.

That approach helped Merkle raise $2.1 million in a seed round in April 2024 led by Hashed and Arrington Capital, with participation from Aptos Labs, Morningstar Ventures, Amber Group and others.

By May 2024, total value locked (TVL) on the platform peaked at more than $7.4 million, according to DefiLlama data. Since then, TVL has fallen by more than half to about $3.47 million, making Merkle Trade the 17th-largest protocol by TVL on Aptos at press time.

Among the four Aptos-based perp DEXs listed on DefiLlama, however, Merkle is the leader by far, accounting for $12.4 million of the total $13.68 million in perp volume on the chain in the past 24 hours.

Aptos Struggles

Merkle’s slide in TVL since 2024 reflects weakness across the broader Aptos ecosystem, where total value locked is currently around $332.6 million, making it the 16th-largest chain by DeFi TVL.

Current TVL across the ecosystem is down more than 70% from December 2024 where it was over $1.2 billion, and back to levels last seen in the summer of 2024.

App revenue on the network, however, increased in 2025, though it remains relatively low. Weekly revenue from decentralized applications (DApps) on Aptos is led by DEX PancakeSwap, with $44,396 followed by Merkle Trade with $29,575.

By comparison, the top-four chains by app revenue today — Solana, Hyperliquid L1, Ethereum and EdgeX — have all recorded over $1 million in the past 24 hours.

The broader perp DEX sector exploded in 2025, with 24-hour volumes now outpacing most centralized exchanges. Hyperliquid has led the sector by trading volume, with rivals Lighter and Aster sometimes taking the lead.

Crypto World

Dogecoin, Shiba Inu slid deeper as on-chain activity spike

Dogecoin and Shiba Inu slid deeper into selloff territory even as on-chain activity spiked, underscoring a growing disconnect between network usage and price action across the meme-coin sector.

Summary

- Despite a 36% surge in Dogecoin active addresses, prices fell 3%, with Shiba Inu also losing 2%.

- Increased network activity is driven more by distribution than accumulation, signaling vulnerability to further declines.

- Trading at $0.00000641, SHIB is down 92% from its 2021 peak, facing weak transaction volumes and uncertain future utility.

Dogecoin (DOGE) active addresses jumped 36% over the past week to more than 71,400, signaling renewed participation on the network.

But the surge failed to support prices, with DOGE falling 3% to about $0.102 and Shiba Inu dropping 2% to roughly $0.0000066.

Heavy net outflows, weakening technical structures, and broken support levels suggest both tokens remain vulnerable to further downside, as increased activity appears driven more by distribution than accumulation.

Dogecoin, originally created as a joke in 2013, briefly soared to a $90 billion market cap in 2021 but has since lost over 90% of its value.

Despite a rally in late 2024, the meme coin remains down 62% in 2025 and lacks a real use case like Bitcoin or Ethereum.

Its speculative nature and endless supply—leading to constant dilution—make it vulnerable to further declines. With no fundamental catalysts in sight, a 50% drop in 2026, potentially returning Dogecoin to its 2022 low of $0.05, seems likely.

Shiba Inu is the pits

Shiba Inu (SHIB) has been volatile after recently hitting a monthly low of $0.0000065 on February 1, following a high of $0.0000097 on January 6.

These price swings reflect SHIB’s sensitivity to sentiment and liquidity.

Shiba Inu is currently trading at $0.00000641, a 92% drop from its October 2021 all-time high. The token is below key moving averages, and while the RSI shows oversold conditions, no reversal has occurred. SHIB is testing critical support at $0.00000638, and a breakdown below this level could push it to $0.0000055.

The Shiba Inu ecosystem is facing challenges, including weak daily transaction volume and a lack of sustained utility, despite its integration of Fully Homomorphic Encryption (FHE) in Q2 2026, which could boost privacy and security. The launch of a crypto ETF by T. Rowe Price could also attract regulated capital, but approval odds are low.

According to one report, Shiba Inu’s price could range between $0.000015-$0.000025 by 2027 if privacy upgrades succeed and the ETF is approved, with conservative estimates placing it between $0.000010–$0.000015.

Key resistance levels are $0.00000732, $0.0000078, and $0.00000851. Monitoring Shibarium transaction volumes and burn rates, along with Bitcoin’s performance, will be key for investors tracking SHIB’s potential recovery.

Crypto World

Crypto Exploit Losses Hit $370 Million in January: CertiK

The security firm also revealed that wrench attacks are on the rise.

Crypto users lost about $370.3 million to exploits in January, according to data from security analytics firm CertiK.

CertiK said in a post on X that $311.3 million of the total was linked to phishing, with a single social engineering scam accounting for about $284 million. Phishing is a type of cybercrime in which attackers impersonate reputable entities (such as banks or employers) to deceive individuals into revealing sensitive information.

The firm said the single large incident targeted an individual user rather than exploiting a smart contract bug. This means that only about 16% of total losses were linked to non-phishing incidents, such as code flaws, price manipulation, or wallet compromises, according to CertiK’s breakdown.

The findings suggest that even as protocols improve their defenses against technical exploits, it can still be difficult to prevent losses tied to human behavior. Scams that rely on deception, trust, and errors in judgment continue to account for a large share of losses.

Physical Attacks Are Also Rising

CertiK also found a rise in physical attacks linked to crypto theft in its Skynet Wrench Attacks Report. The firm said so-called wrench attacks increased 75% in 2025, resulting in $40.9 million in confirmed losses, though it noted the figure is likely underreported.

These attacks involve using force or threats to gain access to crypto wallets or private keys. Kidnapping remained the most common method, while physical assaults rose 250% year over year. Europe accounted for more than 40% of reported cases, with France recording the highest number of attacks.

CertiK said the trend shows that physical violence is becoming a real risk for crypto holders, especially founders and people known to control large amounts of digital assets. The firm added that protecting crypto now requires thinking beyond software security to include personal safety.

Crypto World

David Sacks promised ‘market structure bill in 100 days’ a year ago

Exactly one year ago, “crypto czar” David Sacks hosted a press conference alongside Representative French Hill, Senator John Boozman, Senator Tim Scott, and Representative GT Thompson to announce they hoped to advance a stablecoin regulation bill and a cryptocurrency market structure bill out of both the Senate and the House within 100 days.

Despite these bold commitments, neither of these bills was passed within those first 100 days.

Eventually, the stablecoin regulation bill would be passed, in the form of the GENIUS Act, but well after the self-imposed deadline had lapsed.

Read more: David Sacks sends silly legal threat to the New York Times

However, the market structure bill has proven to be more contentious and more difficult to get legislative consensus on.

This bill would place the Commodity and Futures Trading Commission (CFTC) at the center of crypto regulation, a position that the SEC has largely filled before (though the CFTC has always had some role to play).

Members of the Democratic Party have been advocating for amendments to the bill that they believe would limit the president’s ability to continue to profit from the crypto industry while also shaping regulations and opportunities in the space.

Read more: Tether’s new USAT stablecoin led by Trump’s former advisor Bo Hines

However, members of the Republican Party have shown solidarity with the president, refusing to include that type of limitation.

Currently, the bill has cleared the Senate Agricultural Committee, along partisan lines, but has yet to clear the Senate Banking Committee.

Once the committee approves its draft of the bill the two different committee versions will need to be harmonized before it can come up for a vote, where it will need substantial support from senators in the Democratic Party to pass.

Once the Senate has passed it, then it will return to the House, which has previously approved an earlier version of the bill.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

What Happens to XRP if the $1.30 Demand Zone Breaks?

Ripple’s XRP remains under sustained bearish pressure, with the price continuing to print lower lows and failing to reclaim key supply zones. The broader structure still reflects a dominant downtrend, and the recent price action suggests sellers remain in control as the market approaches a critical demand area that could define the next directional move.

Ripple Price Analysis: The Daily Chart

On the daily timeframe, XRP is trading deep within a bearish market structure, having lost multiple former support levels that have now flipped into resistance. The price is currently pressing into a well-defined demand zone at the $1.3 range highlighted on the chart, an area that previously acted as a base before the last impulsive upside move. This zone represents the first meaningful area where buyers may attempt to slow the decline.

However, the broader daily trend remains decisively bearish. Each corrective bounce over the past months has been capped by lower supply zones, and the asset has consistently respected these areas before continuing lower. As long as XRP remains below the channel’s mid-trendline of $1.6, any bounce from the current demand should be treated as corrective rather than trend-reversing.

Nevertheless, a failure to hold this demand zone would significantly weaken the structure and open the door for a deeper continuation toward lower, untested liquidity levels. Conversely, a strong daily reaction from this area would be required to signal short-term relief, but not yet a confirmed trend shift.

XRP/USDT 4-Hour Chart

The 4-hour chart provides additional clarity on the internal structure of the downtrend. Recent price action shows a sharp rejection from successive supply zones, confirming that sellers are aggressively defending these levels.

Following the latest rejection, the asset accelerated lower and is now approaching the $1.3 critical support, which also aligns with the broader demand zone visible on the daily timeframe. This confluence increases the probability of at least a short-term reaction, as short sellers may begin to take profits and reactive buyers step in.

That said, the presence of multiple stacked supply zones above the current price at $1.6 and $2 significantly limits upside potential in the near term. Any rebound toward these levels would likely face renewed selling pressure, unless accompanied by a clear break in structure and acceptance above the channel. Until such confirmation appears, the 4-hour trend remains firmly bearish, with rallies best viewed as pullbacks within a broader downtrend.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Analysts Explain Why BTC Just Crashed to $65K and Where the Bottom Lies

Meanwhile, XRP continues to be the poorest performing altcoin today.

Bitcoin has officially wiped out all gains registered after the reelection of Donald Trump to step back in the White House at the end of 2024. The cryptocurrency plummeted to just over $65,000 minutes ago, which actually puts it in a minor loss since the presidential elections.

Moreover, this means that it has lost almost $25,000 since last Wednesday. It has also shed nearly 50% of its value since the all-time high marked in early October 2025.

Naturally, investors tend to ask themselves what the most probable reason is behind this crash. As with all previous declines from the past several weeks, it doesn’t seem to be aligned with problematic fundamentals within the BTC ecosystem as a whole.

Analysts from the Kobeissi Letter indicated that the actual reason behind the consecutive price dumps is “emotional” selling. Riskier assets, such as BTC, tend to move frequently due to investor sentiment, and the current bearish trend appears to be driven by a mass exodus without any fundamental basis.

BREAKING: Bitcoin falls below $66,000 for the first time since October 2024, now down -$11,000 this week alone.

This is beginning to feel like “emotional” selling. pic.twitter.com/SMUczlcNzo

— The Kobeissi Letter (@KobeissiLetter) February 5, 2026

Doctor Profit, an analyst known for their rather bearish calls who has been predicting a substantial crash for months, noted that they have placed “big buy” orders at around $57,000-$60,000, which could be the current trend’s bottom.

The analyst added that they plan to hold for 2-3 months, and they are not interested in buying higher than that.

You may also like:

“I consider $57k-$60k as a great entry to make money for the short term and gain some serious % before we continue going down.”

On the other hand, MMCrypto said he believes BTC is indeed in a bear market, but it’s almost over time-wise.

I think this Bitcoin Bear Market is almost over (time wise).

We are in the last capitulation move, which may continue for a bit. Once we have MAX PAIN, it’s over, soon!

I am getting ready NOW already.

MONEY MAKING TIME IS APPROACHING! 🚀

— MMCrypto (@MMCrypto) February 4, 2026

Elsewhere, the altcoins are getting obliterated as well, and XRP is the poorest performer for some reason. The token has plummeted by almost 20% in just 24 hours and now struggles below $1.25.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

XRP Bull Buys the Dip as Ripple’s Price Gets Obliterated by 22% in Just 1 Day

The question now is whether a price dump below $1.00 is inevitable at this point.

The past 24 hours, just like several other such periods in the past few weeks, will go down in the history books as highly volatile and violent for the entire cryptocurrency market.

Although BTC and most altcoins are deep in the red, XRP has emerged as the worst-performing coin from the top 100 digital assets, which is somewhat strange and unexpected since it’s the third-largest altcoin.

The token has plunged by almost 22% in a day, a pattern more commonly seen in small caps. However, XRP’s demise is spectacular on different timeframes, not just daily.

For instance, it has plunged by 32% in the past week. Furthermore, it traded at $2.40 on January 6, meaning that its current dump to $1.20 came after a 50% monthly decline. On a more macro scale, the cross-border token has erased 67% of its value since its all-time high of $3.65 registered in mid-July 2025.

At the time of this writing, it’s not clear why XRP has crashed so much harder than most other larger-cap cryptocurrencies. After all, the company behind it continues to expand and make major announcements. However, ETH, BNB, and BTC are down by more modest 10-11%.

Nevertheless, some members of the XRP Army remain unfazed by the ongoing crash. ERGAG CRYPTO, who is among the most vocal supporters of Ripple’s token, admitted that the asset’s breakdown has been confirmed.

Still, they told their 92,000+ followers on X that they “pulled the trigger after 3 years” by buying XRP at $1.28 as a swing trade. On the plus side, they plan to hold that position until the price bounces to $2.20 if it reclaims $1.85. If the $1.28 suppor cracks decisively, they are comfortable holding the tokens as it’s a small allocation.

You may also like:

#XRP – Sweep & Bounce or Breakdown (Update):

The breakdown is now confirmed.

I pulled the trigger after 3 years: I bought #XRP $1.28 as a swing trade.

My plan:

▫️ If price reclaims $1.85, I’ll hold for a move toward $2.20

▫️ A confirmed close above $2.50 → reassess the… pic.twitter.com/2O5inqQlSo— EGRAG CRYPTO (@egragcrypto) February 5, 2026

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Ethereum Falls Below $2,000 as Crypto Sell-Off Deepens

Bitcoin plunged under $66,000 while most altcoins cratered.

Ethereum (ETH) traded under $2,000 on Thursday, Feb. 5, for the first time since May 2025, amid a broader sell-off across crypto markets.

ETH fell about 10% over the past 24 hours to trade near $1,925, extending its weekly losses to 30%. Paul Howard, senior director at Wincent, said Ethereum’s move lower was driven by a broader shift away from risk in global markets, rather than a crypto-specific event.

“The defining characteristic of the sell-off was a synchronised de-risking across asset classes, marked by forced unwinds and elevated volatility even in assets typically viewed as hedges, including precious metals,” he said.

Howard also explained that the shift’s catalyst was the markets “rapidly repricing the outlook for monetary policy” following the nomination of Kevin Warsh as Federal Reserve chair.

Meanwhile, data from Lookonchain showed that Ethereum co-founder Vitalik Buterin has sold 2,961.5 ETH (around $6.6 million) at an average price of $2,228 over the past three days.

Bitcoin and Altcoins

Bitcoin (BTC) dropped roughly 10% on the day to around $65,700, extending its seven-day losses to nearly 21%. Among other major tokens, BNB slid 9% to $646, while XRP plunged nearly 20% to about $1.24. Solana (SOL) fell 12% on the day to trade near $82.

“Bitcoin is now testing key technical support between $60,000 and $70,000, the base of the pre-election rally. A sustained break below this range would increase the risk of a more protracted move lower, while stabilization here would point to a corrective reset rather than a structural shift,” Diana Pires, VP at sFOX, told The Defiant.

Total cryptocurrency market capitalization declined to approximately $2.33 trillion, down about 10% over the past 24 hours. Trading activity during the same period totaled roughly $259.5 billion.

A small number of tokens traded higher despite the broader downturn. Rain (RAIN) rose about 7% over the past 24 hours, while MYX Finance (MYX) gained 5.4%. MemeCore (M) added 1.6%.

On the downside, XRP fell more than 16%, while Zcash (ZEC) dropped 15.4%. Monero (XMR) slid nearly 14%.

Liquidations and ETF flows

More than $1.44 billion in leveraged positions were liquidated over the past 24 hours, according to CoinGlass, with long positions accounting for roughly $1.23 billion of that total.

Bitcoin recorded the largest liquidations at about $738 million, followed by Ethereum at $338 million. Solana posted liquidations of around $77 million. In total, more than 304,000 traders were liquidated on the day.

Spot Bitcoin ETFs recorded $544.9 million in net outflows on Feb. 4, while Ethereum ETFs saw $79.5 million in net outflows. Spot Solana ETFs recorded $6.7 million in net outflows. By contrast, spot XRP ETFs posted $4.8 million in net inflows.

Tech Selloff Continues

Elsewhere, political developments are also weighing on digital assets, driven by uncertainty in Washington as lawmakers continue to negotiate key budget and immigration measures.

Weakness in U.S. tech stocks has also placed pressure on the situation, contributing to a broader pullback across global markets.

Meanwhile, gold prices have fallen 1.3% on the day, while silver dropped more than 9%, after hitting all-time highs recently.

Crypto World

World Liberty Financial Offloads Bitcoin to Pay Debt

The Trump family’s DeFi protocol was forced to sell $5 million of BTC today to cover an Aave loan.

World Liberty Financial (WLFI), the decentralized finance (DeFi) protocol affiliated with President Trump’s sons, was forced to sell some Bitcoin at roughly $67,000 today to avoid liquidation on Aave.

According to Arkham Intelligence, the WLFI wallet was forced to liquidate more than 170 BTC, worth roughly $11 million, to repay its loans on Aave.

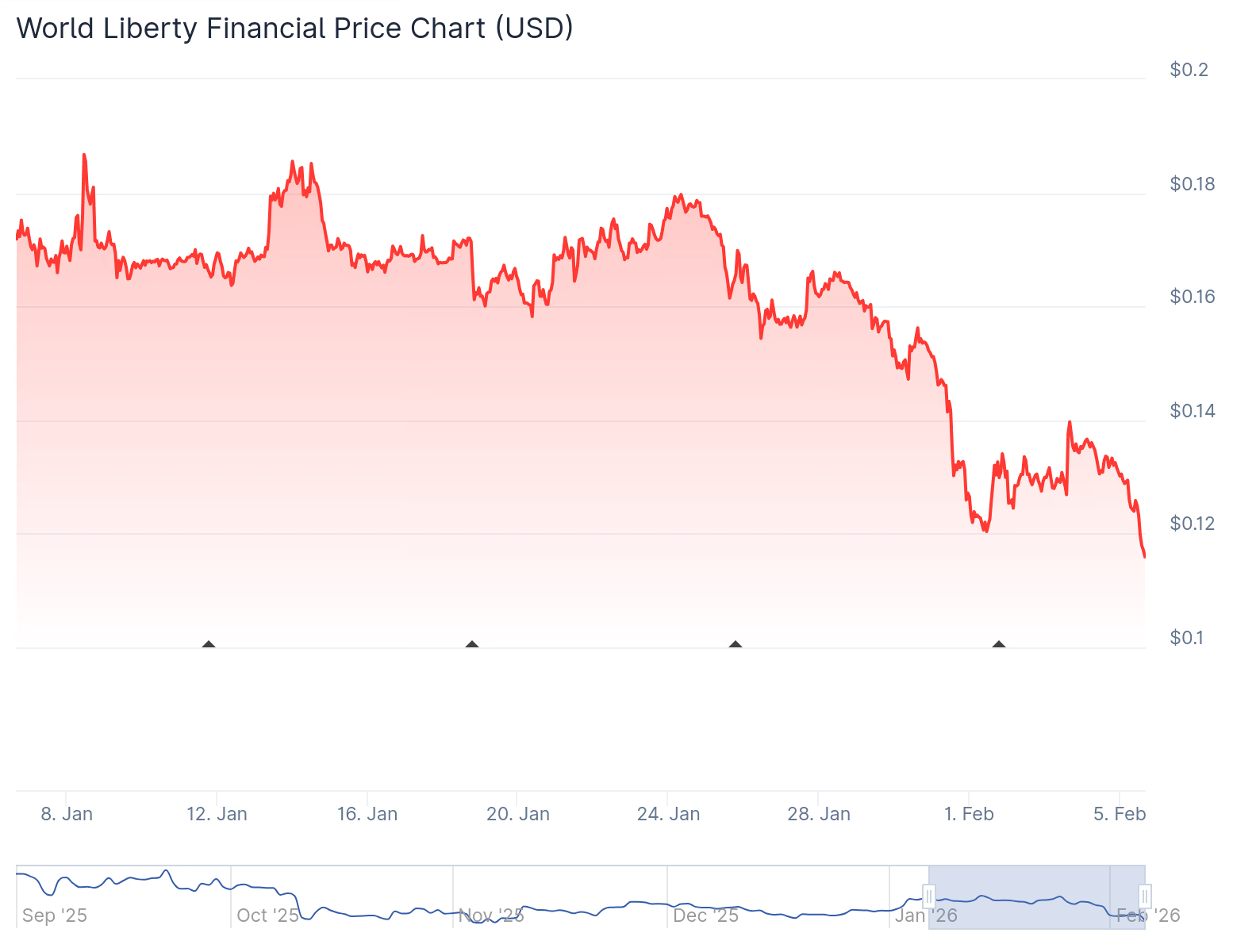

Meanwhile, the WLFI token is down 14% today, slightly underperforming BTC and ETH, which are both down 13%.

WLFI has been in a consistent downtrend since its token launch in September. The token started trading on Sept. 1 at $0.23, or a $6.6 billion market capitalization, and now trades 65% lower at $0.115.

In addition to the protocol’s financial woes, Trump’s political opponents continue to call for probes and investigations into the DeFi protocol.

Today, U.S. Representative Ro Khanna announced that he has launched an investigation into a $500 million investment in WLFI from the United Arab Emirates. Back in November, Senators Elizabeth Warren and Jack Reed claimed that the protocol is tied to malicious actors from North Korea and Russia; however, it remains unclear if there has been any progress on this probe.

Warren, in particular, is no fan of cryptocurrency, broadly referring to DeFi users as “scammers” and labeling the GENIUS bill as a “grift.”

Crypto World

Is It Time For A Bounce?

Bitcoin touched new lows under $64,000 as market selling reached a historic level, and analysts warn that the bottom is not in. Does data support analysts’ sub-$60,000 prediction?

Bitcoin (BTC) has fallen 13% over the past four days, sliding to $63,844 from $79,300. It is currently trading below $69,000, which is the 2021 bull market high, a level many see as a support level.

The drop was matched by a sharp decline in futures activity, with BTC’s open interest falling by more than $10 billion over the past seven days.

Analysts are now focusing on the long-term technical zones and onchain indicators that may signal a major turning point for BTC.

Key takeaways:

-

Bitcoin has dropped 13% in four days, slipping below the 2021 cycle high near $69,000 after a sharp leverage reset.

-

A key Bitcoin demand zone from $58,000 to $69,000 is supported by heavy transaction volume and the 200-week moving average.

-

Oversold technical and sentiment indicators suggest downside pressure may be peaking for BTC, even if a relief rally fails to manifest.

Why the $69,000 level matters for Bitcoin

The $69,000 level represents the peak of the 2021 bull market. Prior cycle tops have historically acted as support during bear markets. In the last cycle, Bitcoin bottomed near the 2017 high of $19,600 before briefly dipping lower to about $16,000 in November 2022.

The current drop below $69,000 may follow this pattern. However, past cycles also show that prices can fall below prior highs before forming a final bottom. This keeps downside risk open for BTC.

Bitwise European Head of Research André Dragosch noted that a large share of recent transactions occurred between $58,000 and $69,000. This range also aligns with the 200-weekly moving average near $58,000, reinforcing it as a key demand zone.

Meanwhile, crypto analyst exitpump highlighted that large BTC bids are visible on order books between $68,000 and $65,000, suggesting buyer interest on dips.

Related: Bitcoin price may drop below $64K as veteran raises ‘campaign selling’ alarm

BTC flashes record oversold signals

Market analyst Subu Trade said that Bitcoin’s weekly relative strength index (RSI) has fallen below 30. Bitcoin has reached this level only four times, and in each case, the price rallied by an average of 16% over the next four days.

Crypto analyst MorenoDV also noted that the adjusted net unrealized profit/loss (aNUPL) has also turned negative for the first time since 2023. This means the average holder is now at a loss. Similar conditions in 2018–2019, 2020 and 2022–2023 all led to price recoveries for BTC.

While a relief rally might not take shape immediately, Moreno pointed out that the current “speed of sentiment deterioration” is much faster than the previous cycles. The analyst added,

“This rapid transition suggests an acute sentiment reset rather than a gradual decline, potentially shortening the capitulation phase.”

Related: Three signs that Bitcoin price could be near ‘full capitulation’

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Crypto World

ETHZilla to Tokenize $4.7 Million in Manufactured Home Loans on Ethereum Layer 2

ETHZilla plans to tokenize the loan portfolio into a cash-flow-generating manufactured home loan token.

ETHZilla has announced its acquisition of a portfolio comprising 95 manufactured and modular home loans valued at approximately $4.7 million, with plans to tokenize these assets on Ethereum Layer 2. This strategic move is aimed at enhancing transparency and accessibility in real estate finance.

The tokenization initiative will be executed through the Liquidity.io ecosystem, with the launch expected in late February or early March.

“Manufactured housing loans offer predictable cash flows and strong underlying collateral, which we believe makes them well suited for tokenization within a regulated, transparent structure,” said McAndrew Rudisill, CEO of ETHZilla.

ETHZilla’s strategy is designed to meet institutional compliance and reporting standards, crucial for the integration of real-world assets into blockchain systems.

The manufactured housing market is projected to grow significantly, from $45.82 billion in 2024 to $75.1 billion by 2035, driven by affordability and sustainability.

This article was generated with the assistance of AI workflows.

-

Crypto World6 days ago

Crypto World6 days agoSmart energy pays enters the US market, targeting scalable financial infrastructure

-

Politics6 days ago

Politics6 days agoWhy is the NHS registering babies as ‘theybies’?

-

Crypto World7 days ago

Crypto World7 days agoAdam Back says Liquid BTC is collateralized after dashboard problem

-

Video3 days ago

Video3 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion6 days ago

Fashion6 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

NewsBeat7 days ago

NewsBeat7 days agoDonald Trump Criticises Keir Starmer Over China Discussions

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports5 days ago

Sports5 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World5 days ago

Crypto World5 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Business4 hours ago

Business4 hours agoQuiz enters administration for third time

-

Crypto World6 days ago

Crypto World6 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business6 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat11 hours ago

NewsBeat11 hours agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat3 days ago

NewsBeat3 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World2 days ago

Crypto World2 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report