Crypto World

Goldman Sachs to tap Anthropic AI model to automate accounting, compliance

Goldman Sachs has been working with the artificial intelligence startup Anthropic to create AI agents to automate a growing number of roles within the bank, the firm’s tech chief told CNBC exclusively.

The bank has, for the past six months, been working with embedded Anthropic engineers to co-develop autonomous agents in at least two specific areas: accounting for trades and transactions, and client vetting and onboarding, according to Marco Argenti, Goldman’s chief information officer.

The firm is “in the early stages” of developing agents based on Anthropic’s Claude model that will collapse the amount of time these essential functions take, Argenti said. He expects to launch the agents “soon,” though he declined to provide a specific date.

“Think of it as a digital co-worker for many of the professions within the firm that are scaled, are complex and very process intensive,” he said.

Goldman Sachs CEO David Solomon said in October that his bank was embarking on a multi-year plan to reorganize itself around generative AI, the technology that has made waves since the arrival of OpenAI’s ChatGPT in late 2022. Even as investment banks like Goldman are experiencing surging revenue from trading and advisory activities, the bank will seek to “constrain headcount growth” amid the overhaul, Solomon said.

The news from Goldman, a leading global investment bank, comes as model updates from Anthropic, co-founded by a former OpenAI executive, have sparked a sharp selloff among software firms and their credit providers as investors wager on who the winners and losers from the AI trade will be.

Goldman began last year by testing an autonomous AI coder called Devin, which is now broadly available to the bank’s engineers. But it quickly found that Anthropic’s AI model could work in other parts of the bank, said Argenti.

“Claude is really good at coding,” Argenti said. “Is that because coding is kind of special, or is it about the model’s ability to reason through complex problems, step by step, applying logic?”

Argenti said the firm was “surprised” at how capable Claude was at tasks besides coding, especially in areas like accounting and compliance that combine the need to parse large amounts of data and documents while applying rules and judgment, he said.

Now, the view within Goldman is that “there are these other areas of the firm where we could expect the same level of automation and the same level of results that we’re seeing on the coding side,” he said.

The upshot is that, with the help of the agents in development, clients will be onboarded faster and issues with trade reconciliation or other accounting matters will be solved faster, Argenti said.

Goldman could next develop agents for tasks like employee surveillance or making investment banking pitchbooks, he said.

While the bank employs thousands of people in the compliance and accounting functions where AI agents will soon operate, Argenti said that it was “premature” to expect that the technology will lead to job losses for those workers.

Still, Goldman could cut out third-party providers it uses today as AI technology matures, he said.

“It’s always a tradeoff,” Argenti said. “Our philosophy right now is that we’re injecting capacity, which in most cases will allow us to do things faster, which translates to a better client experience and more business.”

Crypto World

Toyota Stock Rises 2% as Earnings Beat Estimates Despite Tariff Headwinds

TLDR

- Toyota reported Q3 operating profit of $7.6 billion, beating Wall Street estimates of $6.7 billion as higher prices and a weaker yen offset U.S. tariff impacts.

- The automaker raised its full-year profit forecast by $2.6 billion to $24.2 billion, citing strong sales and cost-cutting measures.

- Toyota stock rose 2% in overseas trading following the earnings beat despite implied Q4 guidance falling below analyst projections.

- CEO Koji Sato will step down and be replaced by CFO Kenta Kon, with Sato moving to vice chairman and chief industry officer roles.

- The company trimmed annual vehicle sales forecast to 9.75 million units from 9.8 million due to production disruptions in Brazil and continued U.S. tariff pressure.

Toyota stock climbed 2% in Friday trading after the Japanese automaker reported fiscal third-quarter earnings that crushed Wall Street expectations. The strong results came despite ongoing pressure from U.S. tariffs.

The company posted operating profit of ¥1.2 trillion ($7.6 billion) for the quarter ending December 31. Analysts had projected just $6.7 billion.

Higher vehicle prices helped the automaker maintain profitability. A weaker yen also provided a boost to the bottom line.

Toyota’s U.S.-listed American depositary receipts gained 1.8% in premarket trading. The stock has climbed 25% over the past 12 months.

Tariff Impact Less Severe Than Expected

U.S. import duties on Japanese vehicles remain at 15% after President Donald Trump reduced them from an initial 25% following a trade deal with Tokyo. Many analysts feared these tariffs would severely damage Toyota’s profit margins.

The third-quarter results showed those fears were overblown. Toyota managed to offset the tariff costs through pricing power and currency benefits.

Revenue grew nearly 8% year-over-year to ¥13.5 trillion. Net income fell 40% to ¥1.3 trillion, reflecting increased costs and investment spending.

The automaker increased its full-year profit forecast by ¥400 billion ($2.6 billion) to ¥3.8 trillion ($24.2 billion). The raised guidance reflects better-than-expected performance in the first three quarters.

Mixed Outlook for Fourth Quarter

Toyota’s implied fourth-quarter operating profit guidance sits at approximately $3.8 billion. Wall Street analysts currently project $5.6 billion for the period.

Last year, Toyota reported $7.7 billion in operating profit during the fiscal fourth quarter. The company’s fiscal year runs through March 31.

Toyota trimmed its annual vehicle sales forecast to 9.75 million units from 9.8 million. Production disruptions in Brazil contributed to the reduced outlook.

Chinese sales continue to face pressure as diplomatic tensions between Tokyo and Beijing persist. U.S. tariffs remain a headwind despite the recent reduction.

Leadership Transition Announced

Toyota announced a major leadership change alongside its earnings report. CEO Koji Sato will step down from his position.

CFO Kenta Kon will take over as chief executive. Sato will remain with Toyota as vice chairman and chief industry officer.

The leadership transition comes as Toyota navigates a challenging global trade environment. The company continues implementing cost-cutting measures to maintain profitability.

Foreign exchange movements provided tailwinds during the quarter. The yen’s weakness against the dollar helped offset some cost pressures.

Car stocks have performed well recently despite tariff concerns. Ford Motor stock is up 48% over the past year, while General Motors has gained 74%.

Toyota’s strong quarterly results and raised full-year guidance were enough to satisfy investors on Friday. The company’s ability to beat estimates while managing tariff headwinds demonstrates pricing power in a difficult environment.

Crypto World

Bithumb Error Sends Bitcoin Crashing 10% After 2,000 BTC Airdrop

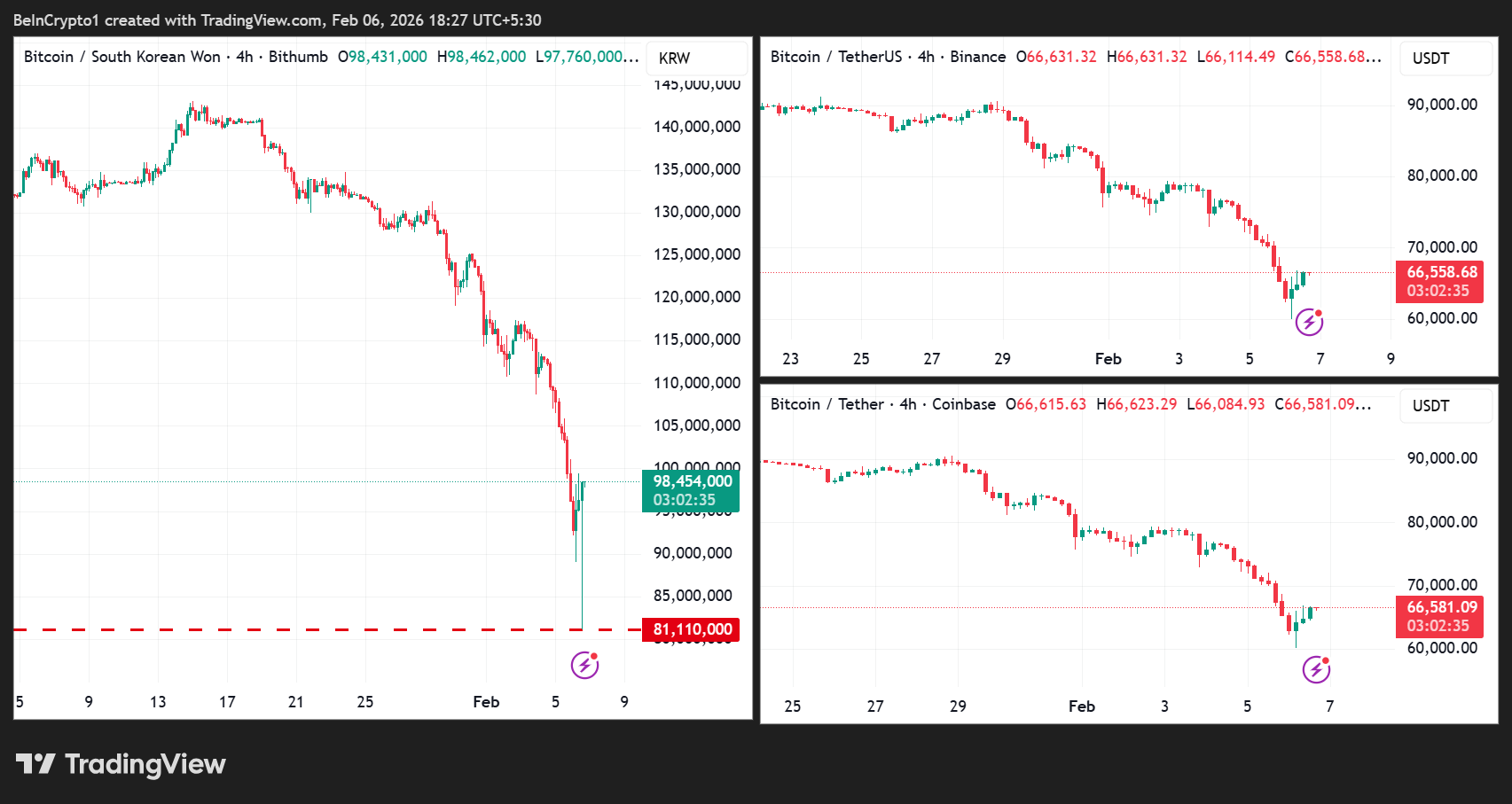

South Korea’s cryptocurrency exchange Bithumb faced a major operational mishap on February 6, 2026, which quickly sent the BTC/KRW trading pair down by double digits.

It brings to mind past controversies about the exchange, including incidents of partial liability in data leaks.

Sponsored

Sponsored

Bithumb’s Accidental 2,000 BTC Airdrop Sparks 10% Bitcoin Crash on Exchange

Reportedly, a staff member accidentally sent 2,000 Bitcoin (BTC) to hundreds of users instead of the intended 2,000 Korean Won (KRW) reward.

The error triggered an immediate wave of sell-offs, sending Bitcoin’s price on the exchange more than 10% below global market rates.

Dumpster DAO core member Definalist first reported the incident, citing a routine airdrop meant as a small incentive for platform users.

Amidst the chaos, some users reportedly benefited significantly from the mistake, selling their unexpected Bitcoin windfall at market prices.

The accidental BTC distribution has raised questions about internal controls and risk management at crypto exchanges, particularly those handling high-value digital assets.

Sponsored

Sponsored

“Crazy to think that exchanges can still do paper trading like this, even in 2026 lmao,” remarked Definalist.

Notably, however, the Bitcoin price crash was largely confined to Bithumb due to the exchange’s isolated order book. Users sold massive amounts of BTC directly on Bithumb, overwhelming its liquidity and causing a 10% local drop.

Other exchanges remained unaffected because the selling pressure didn’t enter their markets, and global arbitrage mechanisms hadn’t yet adjusted the discrepancy, keeping the impact largely contained.

Notwithstanding, the incident highlights the operational risks that can persist even in major exchanges, despite years of industry maturation. It also shows how a simple input error can cascade into substantial market disruption.

Sponsored

Sponsored

Bithumb did not immediately respond to BeInCrypto’s request for comment and has not yet released an official public statement on corrective measures.

Still, the event could influence market confidence in the short term, particularly on exchanges where operational errors have immediate price consequences.

Bithumb’s Operational History and Corporate Changes Highlight Ongoing Risks

Bithumb itself has a checkered history with security and operational issues. In 2017, a data breach exposed customer information, and in a 2020 ruling, local media reported that the exchange was found partially liable in one case in which a user lost $27,200.

The court ruled that, although Bithumb’s database had been accessed, the claimants should have recognized the scam attempts and awarded only $5,000 in damages.

Sponsored

Sponsored

Other claims were dismissed because the court found the private information could have been obtained elsewhere.

Bithumb has also undergone significant corporate changes in recent years. In 2018, the exchange sold a 50% stake to BK Global Consortium, a group led by startup investor Kim Byung-gun, who was already the company’s fifth-largest shareholder.

This acquisition came amid a broader contraction in the crypto sector investment. According to FinTech Global research, global crypto investments peaked at $7.62 billion in 2018 before falling to $3.11 billion in 2019. In the first half of 2020 alone, the sector raised just $578.2 million.

This latest mishap adds to Bithumb’s long history of operational challenges, reinforcing the view that while crypto adoption is growing, the sector remains vulnerable to human and technical errors, even in leading exchanges.

Crypto World

Citi trims price target after big decline

Wall Street bank Citigroup is dialing back expectations for Coinbase (COIN) amid a risk-off mood gripping markets.

In a Friday note to clients, the bank’s analysts lowered their price target on the crypto exchange to $400 from $505, citing weaker trading volumes, softer institutional activity and ongoing uncertainty around the timing of U.S. crypto legislation.

The new $400 price target still represents more than a doubling in price from COIN’s close last night of $146. The same analyst team lifted its price target on COIN to $505 in July 2025 as the stock was hitting a record high near $450.

Shares are up 6% in pre-market action on Friday as crypto markets recover a bit from Thursday’s crash that saw bitcoin plunge all the way to $60,000.

Despite the near-term reset, the firm reiterated its buy/high risk rating, calling Coinbase the category leader and a prime beneficiary of eventual crypto reform. Progress on CLARITY, Citi said, remains the key catalyst for reviving the stock’s momentum.

The bank now expects Senate negotiations over the market structure bill to stretch beyond 2026, even as groundwork continues.

Coinbase CEO Brian Armstrong said his firm had pulled support for a sweeping digital assets bill after finding provisions that could have harmed consumers and stifled competition.

The bill has repeatedly lost steam as crypto and banking lobbyists clash over stablecoin yield, while lawmakers from both parties remain deadlocked on several other provisions.

Marking current crypto prices to market, analysts led by Peter Christiansen cut their near-term forecasts, trimming Coinbase fourth-quarter 2025 net revenue by roughly 10% to $1.69 billion, about 4% below consensus.

After factoring in a $2.3 billion mark-to-market decline on crypto holdings and Coinbase’s equity stake in Circle (CRCL), the analysts now forecast a fourth-quarter GAAP EPS loss of $2.64.

Coinbase will release fourth quarter and full year 2025 financial results after the close on February 12.

Read more: Citi says CLARITY Act momentum builds, but DeFi fight could stall crypto bill

Crypto World

ARK Invest Dumps Coinbase, Buys Bullish Shares

ARK Invest, the asset manager led by Cathie Wood, has shifted its trading stance on crypto equities, moving away from Coinbase stock as the shares extended declines and turning toward Bullish, the NYSE-listed digital asset platform. In a Thursday filing observed by researchers, ARK sold 119,236 shares of Coinbase stock (EXCHANGE: COIN) for roughly $17.4 million, a move that comes on the heels of a smaller purchase the prior day. The stock has struggled this year, trading down about a third and stepping near multi-month lows as macro and crypto headwinds weigh on the sector. Despite the sale, ARK still holds a sizable stake in COIN across its flagship funds, underscoring the fund’s longer-term, high-conviction strategy in crypto-exposed equities.

Key takeaways

- ARK sold 119,236 Coinbase shares (EXCHANGE: COIN) for around $17.4 million, marking its first Coinbase exit in 2026 and its first sale since August 2025.

- The trade follows a modest, earlier purchase of 3,510 COIN shares for about $630,000, signaling a timing shift rather than a simple divestment.

- Coinbase stock has fallen roughly 37% year-to-date, illustrating broader weakness in crypto equities amid a retracement in digital-asset prices and regulatory uncertainty.

- ARK rotated the capital into Bullish (EXCHANGE: BLSH), taking 716,030 shares for about $17.8 million, a bet on an institution-focused platform listed on the NYSE in August 2025.

- Bullish has experienced a substantial drawdown since its listing, with shares trading around the $25 level after a more-than-60% drop from IPO highs; the move positions ARK as a notable, if opportunistic, early-stage investor in the platform.

- Despite the shift, ARK’s exposure to Coinbase remains substantial, with COIN representing a notable portion of its holdings across ARK’s flagship ETFs.

Tickers mentioned: $COIN, $BLSH, $ARKK, $ARKW, $ARKF, $BTC

Sentiment: Neutral

Price impact: Negative. The Coinbase sale and general crypto equities weakness contributed to a lower price environment for COIN and related holdings.

Trading idea (Not Financial Advice): Hold. ARK’s strategic reallocation hints at concentration risk management and sector rotation rather than a simple asset dump or outright pivot away from crypto exposure.

Market context: The latest moves come as crypto markets trade in a risk-off regime, with institution-focused platforms drawing attention as potential hedges or air-cover for traditional equities amid ongoing macro and regulatory considerations.

Why it matters

The decision by ARK Invest to trim Coinbase shares (EXCHANGE: COIN) while allocating capital to Bullish (EXCHANGE: BLSH) highlights a broader pattern among active managers navigating crypto equities in 2026. Coinbase, once a central pillar of public-market crypto participation, has weathered sharp swings as investors recalibrate exposure to digital-asset ecosystems in the face of evolving regulatory scrutiny and market volatility. ARK’s action underscores the importance of liquidity and portfolio rebalancing in a sector characterized by outsized moves and opaque macro-linked catalysts.

On the one hand, the Coinbase sale signals a realignment of risk as ARK seeks to diversify away from a single stock that has borne the brunt of multiple dislocations in the crypto space. On the other hand, the allocation to Bullish reveals an appetite for a different kind of exposure — one that concentrates on an exchange-traded vehicle that aggregates institution-grade access to digital assets and related services. Bullish, having listed on the NYSE in August 2025, has seen a challenging stretch, with shares down considerably since inception, yet it remains part of a broader ecosystem believed to be critical to mainstream institutional adoption of crypto infrastructure.

ARK’s ongoing stake in Coinbase across its three funds remains meaningful. The holdings, spread across ARK Innovation ETF (ARKK), ARK Next Generation Internet ETF (ARKW), and ARK Fintech Innovation ETF (ARKF), account for roughly 3.7%, 3.4%, and 4.95% of each fund’s COIN allocation, respectively. This positioning reflects a long-tail belief in Coinbase’s role within the crypto-financial services landscape, even as the stock has shifted in its relative weight. The juxtaposition of a continued COIN stake against a fresh BLSH bet reveals a nuanced strategy: maintain exposure to a marquee crypto access point while seeking to participate in a broader trend toward institutional-grade platforms and crypto-native financial infrastructure.

The backdrop to these moves includes bitcoin’s recent price dynamics and the broader risk-off tone that has pressured crypto equities. Bitcoin (CRYPTO: BTC) experienced volatility in the week, testing levels around the lower end of the prior range before rebounding into a more cautious stance among investors. The price action around BTC and other digital assets remains a critical driver for the equity valuations of publicly traded crypto-exposed firms, including Coinbase and Bullish, making ARK’s rebalancing a microcosm of how active funds adapt to shifting liquidity and sentiment in the cryptoverse.

In territory that remains volatile and highly followable, ARK’s positioning illustrates a continuity of its core thesis: basic, scalable exposure to transformative technologies and the financial infrastructure that supports them, even in the face of near-term price retrenchment. Coinbase, as one of the clearest on-ramps to crypto markets, continues to matter for both retail and institutional participants, while Bullish represents a distinct, institution-focused angle on the crypto economy. The divergence in performance between COIN and BLSH mirrors a broader market pattern where individual stock trajectories can diverge from sectoral or platform-level narratives, presenting both risk and potential opportunity for nimble investors.

What to watch next

- ARK’s next 13F filings and any subsequent COIN or BLSH trades, which will indicate whether the shift is ongoing or a one-off adjustment.

- COIN’s price action in the weeks ahead, particularly in response to crypto market volatility, regulatory updates, or earnings commentary from Coinbase management.

- Performance and liquidity changes in Bullish (BLSH) as it continues to navigate institutional demand for crypto-enabled platforms.

- Any further commentary from Ark Invest on its longer-term crypto thesis and how the COIN and BLSH positions fit into a broader risk framework.

Sources & verification

- ARK trade filing showing the sale of 119,236 COIN shares for roughly $17.4 million and the prior day’s smaller purchase.

- Nasdaq data confirming Coinbase’s year-to-date decline (about 37%).

- NYSE data confirming Bullish’s listing on the NYSE and its subsequent price trajectory, including the ~60% drop from IPO levels.

- ARK’s disclosed holdings of COIN across its funds: ARKK, ARKW, and ARKF, with COIN representing 3.7%, 3.4%, and 4.95% of each fund, respectively.

- Historical context on Coinbase’s direct listing and its long-term share-price performance since April 2021.

ARK reverses course: Coinbase stake discarded as Bullish bet grows

ARK Invest’s latest activity sheds light on an ongoing approach that blends conviction with tactical rotation. The firm’s exit from a portion of its Coinbase stake (EXCHANGE: COIN) — 119,236 shares valued at roughly $17.4 million — occurred on Thursday as the stock retraced from a string of gains and moved toward support levels near multi-month lows. This action followed a modest purchase on Tuesday, when ARK added 3,510 COIN shares for about $630,000, a signal that the firm remains comfortable with exposure to Coinbase but is recalibrating its risk posture amid a cooler macro and a softer price environment for crypto equities.

Even as ARK trims its Coinbase exposure, it did not abandon crypto-market participation altogether. The fund allocated capital to Bullish (EXCHANGE: BLSH), acquiring 716,030 shares for approximately $17.8 million. Bullish, which listed on the NYSE in August 2025, provides an institutional-grade gateway to crypto markets and related services — a structure ARK evidently views as a complementary exposure to COIN’s direct stock dynamic. Bullish’s post-listing performance has been uneven, with shares down more than 60% from the IPO highs, yet the asset’s placement in ARK’s portfolio underscores a strategic tilt toward infrastructure-driven plays rather than pure-asset bets.

Across Coinbase (COIN) and Bullish (BLSH), ARK’s activity this year reflects a delicate balancing act. COIN remains a meaningful component of ARK’s strategy, particularly within the ARKK, ARKW, and ARKF funds, where it represents a combined stake that surpasses several other holdings. Since Coinbase’s direct listing in April 2021, the stock has trended lower from its initial surge, illustrating the long arc of a company that once symbolized the crypto market’s public-market gateway. The overall trajectory for COIN this year has mirrored the broader sector’s volatility, influenced by interest-rate expectations, regulatory debates, and evolving investor appetite for crypto exposure through both direct equity and exchange-traded vehicles.

Bitcoin (CRYPTO: BTC) and other digital assets have remained pivotal in shaping the context for such trades. The price action of BTC and the ensuing risk sentiment influence how institutions value crypto-centric equities, including Coinbase and platforms like Bullish. In a market where liquidity and sentiment can flip quickly, ARK’s decision to simultaneously book a sale and pursue a fresh stake in an institutional gateway signals a nuanced stance: preserve exposure to a core asset while seeking to diversify through a platform with potential for broader institutional adoption. The net effect is a portfolio that can weather near-term volatility while maintaining a longer horizon exposure to the crypto economy’s infrastructure and liquidity channels.

For investors keeping a close eye on ARK’s moves, the underlying takeaway is not a simple binary bet on one asset but a calculated reallocation that emphasizes liquidity, diversification, and the belief that crypto infrastructure remains a meaningful layer in the broader financial system. The balance ARK seeks — continuing exposure to Coinbase while adding Bullish — indicates a perspective that the crypto economy will require both direct access points and regulated, institution-facing platforms as the market matures. As the sector continues to grapple with regulatory signals and macro headwinds, ARK’s actions offer a lens into how active managers navigate a landscape where volatility often coexists with potential for structural shifts in crypto finance.

Crypto World

Bitcoin Core Maintainer Gloria Zhao Quits After Six Years

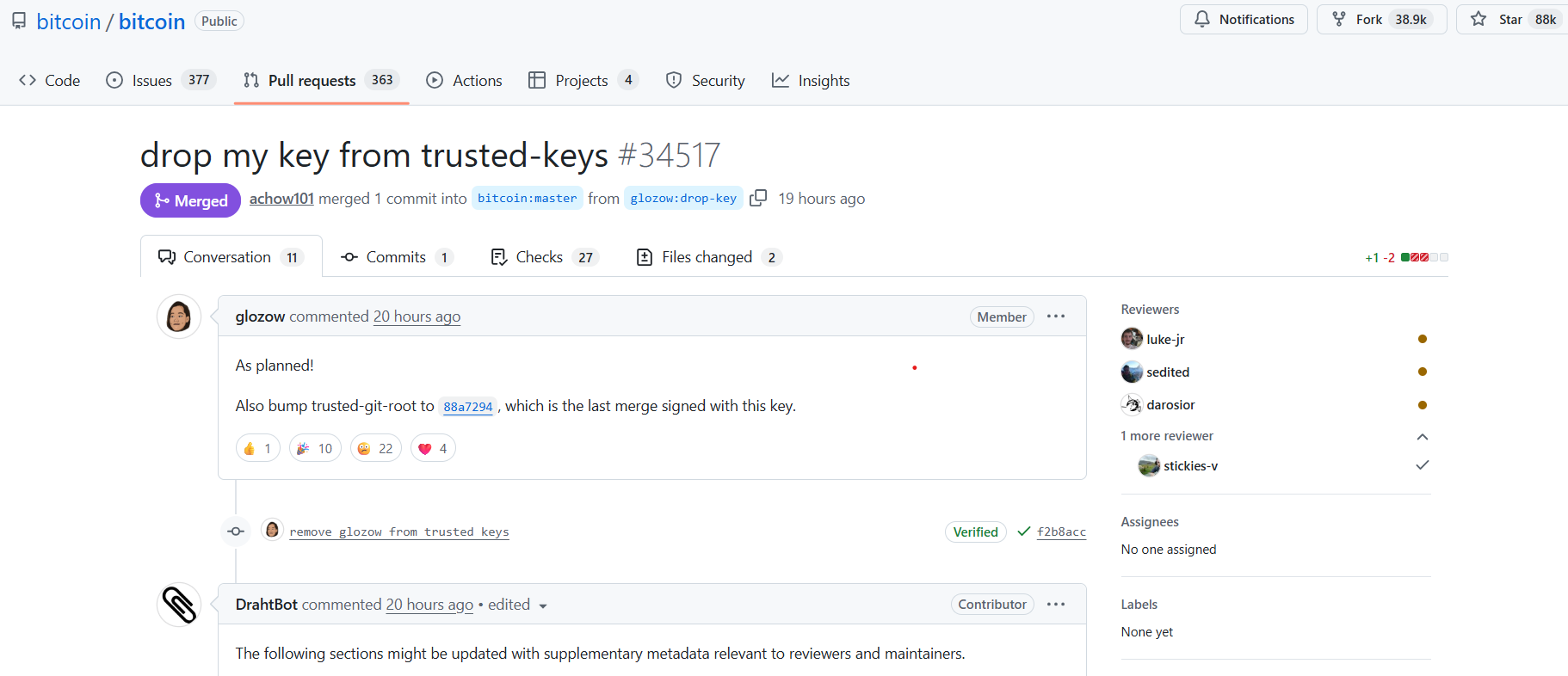

Bitcoin Core developer Gloria Zhao has stepped down as a maintainer and revoked her Pretty Good Privacy (PGP) signing key, ending about six years as one of the project’s gatekeepers.

On Thursday, Zhao submitted her last pull request to the Bitcoin GitHub repository, removing her key from the trusted keys and withdrawing herself as one of the few maintainers able to update Bitcoin’s software.

Becoming the first known female maintainer in 2022, she focused on mempool policy and transaction relay: the rules and peer‑to‑peer logic that decide which transactions get into nodes’ waiting rooms and how quickly they propagate across the network.

She helped design and implement package relay (BIP 331) and TRUC (Topologically Restricted Until Confirmation, BIP 431), along with upgrades to replace‑by‑fee (RBF) and broader P2P behavior, making fee bumping more reliable and reducing censorship.

Zhao’s work was funded through Brink, where she became the organization’s first fellow in 2021, with her fellowship backed by the Human Rights Foundation’s Bitcoin Development Fund and Jack Dorsey’s Spiral (formerly Square Crypto), placing her among a small cohort of publicly supported, full‑time open‑source Bitcoin protocol engineers.

Beyond her technical contributions, Zhao mentored new contributors and co‑ran the Bitcoin Core PR Review Club, helping junior developers learn how to review complex changes and navigate Core’s conservative review culture.

Related: Bitcoin Core v30 bug risks fund loss during legacy wallet upgrades

Split over OP_RETURN and Knots

Her resignation comes after more than a year of public disputes between Bitcoin Core and Bitcoin Knots, and the removal of OP_RETURN limits, a fight over whether Bitcoin’s default node software should make it harder to use block space for non‑monetary data.

In 2025, Zhao deleted her X account amid personal attacks during the OP_RETURN war, after a livestream in which a core developer questioned her credentials.

While some Bitcoin Core critics celebrated Zhao’s departure, others took a more somber tone.

“They bullied her and made her life as miserable as possible until she rage quit, and quite frankly, I think what they did to her was tragic,” said pseudonymous Bitcoiner Pledditor.

Pledditor added that it set a “terrible precedent” and called it, “sad and pathetic.

“Congratulations you finally did it. You bullied one of Bitcoin Core’s most prolific and consistently excellent maintainers until she gave up,” said Chris Seedor, co-founder and CEO at Bitcoin wallet backup company Seedor.

Crypto World

How Does Antier Help You Launch an A-Z White Label Crypto Wallet For Georgia?

Secure rails create sovereign value. For institutional investors sizing a white label crypto wallet for Georgia, the opportunity is not speculative theatre; it is infrastructure finance with measurable macro leverage. Georgia received roughly $3.1–3.5 billion in personal transfers and workers’ remittances in 2023, a material capital inflow that underwrites a clear payments use case for cheaper, programmable settlement. At the same time, Eastern Europe has emerged as one of the world’s most crypto-active regions on-chain, signaling strong product-market fit for wallet-led rails and DeFi-enabled services. Georgia’s National Bank has published a fintech strategy that privileges sandboxing, open APIs, and compliance-first innovation, creating a permissive regulatory runway for an enterprise-grade wallet that pairs MPC custody, HSM-backed keys, deterministic settlement, and embedded AML orchestration.

“Build the rails, capture the flow” This white paper begins with that premise and maps the technical blueprint investors should demand.

Why Is A Crypto Wallet A Strategic Tool for Georgia?

1. Financial resilience:a trusted onshore wallet provides a domestic rail that reduces reliance on correspondent banking and mitigates payment friction.

2. Remittance optimization: a purpose-built cryptocurrency wallet solution can reduce costs and settlement times for inward remittances, increasing net receipts to households and SMEs.

3. Tourism and commerce enablement:integrated stablecoin or multi-asset support lets merchants accept near-instant digital payments while avoiding FX and settlement delays.

4. Onshore compliance and transparency:a wallet operated under local licensure aligns customer protection, AML/CFT, and tax transparency with Georgian policy objectives.

5. Platform for programmable public goods: wallet-level APIs enable government and private sector pilots (digital identity, programmable social benefits, payroll rails) that require secure custody and traceability.

Where Does Georgia Stand Today on Web3?

Georgia is emerging as an active regional fintech hub, with rapid growth in its fintech community and constructive policy documents that explicitly recognize blockchain as infrastructure. The National Bank of Georgia has published supervisory and fintech strategy materials that prioritize innovation, regulatory alignment with international standards, and supervisory modernization. These documents indicate a government approach that favors measured integration of crypto into regulated financial plumbing rather than blanket prohibition.

Data-driven adoption signals show outsized crypto activity in several Eastern European countries, and independent industry studies repeatedly cite the region for elevated on-chain activity relative to population size. Practical evidence on the ground includes local fintech adoption, startup acceleration in Tbilisi, and merchant pilots accepting digital assets. At the macro level, remittances remain a meaningful part of Georgia’s foreign receipts, creating a clear use case for cheaper, faster rails.

Key takeaway for investors: The institutional environment is shifting from ambiguous to operational. Regulators are engaging, the fintech ecosystem is growing, and real-world commercial pilots are in motion. This makes a compliance-first, technically robust white label blockchain wallet app an investable infrastructure play rather than a speculative product.

Top Pain Points for Georgia Without a Trusted Web3 Crypto Wallet

1. Fragmented rails. Citizens and businesses juggle multiple foreign exchanges and offshore intermediaries, adding cost and settlement latency.

2. High remittance friction.Traditional remittances are relatively slow and expensive compared with blockchain-native settlement options, reducing household and SME liquidity.

3. Limited merchant integration.Local merchants lack a secure, standards-compliant way to accept and settle crypto receipts in local currency.

4. Regulatory uncertainty for service providers. Without a clear onshore VASP framework, market entrants face licensure risk, AML gaps, and enforcement ambiguity.

5. Custody and security exposure.Non-custodial and offshore solutions often shift operational and legal risk onto end users and local businesses.

6. Interoperability gaps between public sector services. (payments, benefits) and private fintech solutions.

However, these problems have a core solution, i.e, a customized mobile crypto wallet solution designed and deployed keeping the Georgia market challenges in mind.

How Does a White-Label Crypto Wallet Solve These Challenges?

- Licensed onshore hosting and KYC/KYB. White label cryptocurrency wallets can be deployed under local VASP regimes, bringing market access and regulatory predictability.

- Integrated remittance corridors. Native support for stablecoins and custody of fiat bridges reduces fee leakage and settlement time for cross-border receipts.

- Merchant SDKs and POS integrations. Turnkey merchant acceptance (web, POS, QR) converts tourist and retail flows into measurable, auditable revenue streams.

- Modular compliance stack. Built-in AML transaction monitoring, sanctions screening, and auditable audit trails make the product investable from day one.

- Custody options that match risk appetite: multi-party computation (MPC), hardware security modules (HSM), and optional self-custody flows give institutional-grade security and liquidity.

- Interoperability and APIs. Wallets that expose secure APIs allow government and enterprise integrations for payroll, benefits, and tax collection pilots.

What Should a White Label Crypto Wallet Designed for Georgia Look Like?

“Trust is not added to a wallet later. It is engineered into every line of code from the beginning.“

Every serious investor approaches infrastructure with a mental blueprint, not a blank canvas. When evaluating a Web3 crypto wallet development solution, the real question is not whether it works, but whether it is engineered to endure scale, scrutiny, and regulation. The most successful wallets are not built as products; they are built as financial infrastructure.

a) Security and Custody

- Cold wallet architecture with automated secure signing queues for large-value movements.

- Enterprise MPC-based key management, HSM-backed root keys, and threshold signing for operational resilience.

b) Compliance and Legal Readiness

- Native support for robust KYC/KYB flows, ongoing transaction monitoring, automated SAR/STR workflows, and sanctions lists.

- Audit logging and immutable reporting endpoints for regulator requests.

c) Payments and Settlement

- Multi-asset rails: native support for major stablecoins, Bitcoin, Ether, and fiat on/off ramps via licensed local liquidity partners.

- Merchant SDKs for web, native, and POS, and automatic settlement to local currency to minimize merchant FX risk.

d) Product and UX

- Tiered wallet models: basic consumer, custodial business, and institutional custody with separate controls and SLAs.

- Intuitive UX with explicit risk prompts, insurance disclosures, and one-tap merchant payment flows to drive adoption.

e) Integrations and Extensibility

- REST and gRPC APIs, Webhooks, and an SDK library for easy integration with banks, exchanges, and government systems.

- Smart contract wallet support for programmable payments, streaming payroll, and tokenized instruments.

f) Operational Excellence

- 24/7 SOC and incident response, high-availability cloud footprint with regional fallbacks, and DR plans.

- SLAs for uptime, settlement latency, and support response for enterprise customers.

g) Analytics and Monetization

- Real-time dashboards with AUM, flows by corridor, merchant volume, and cohort retention metrics to make the business investable.

- Built-in revenue features: interchange-style fees, settlement spreads, subscription tiers, and B2B integration fees.

Move From Concept to Launch-Ready & Customized Wallet Faster

Recommended White Label Cryptocurrency Wallet Design Choices

- Hybrid custody model: non-custodial options for privacy-conscious users + custodial (tiered KYC) accounts for public programs.

- Multi-asset (fiat + stablecoins + local CBDC readiness): support fast settlement and low volatility channels.

- Integrated fiat on/off ramps with regulated partners (VASPs) so users can move between GEL and crypto seamlessly.

- Verifiable credentials / eID integration: tie wallets to government digital ID to simplify KYC and service access.

- Auditable transaction logs & privacy layers: transparent where required (public programs) and private where needed (personal payments), with selective disclosure.

- Smart-contract modules for conditional disbursements (e.g., social benefits released on verified criteria).

- Low-fee micropayment support & batching to reduce on-chain costs.

- Offline/QR code transfer and agent networks for rural inclusion.

- Open APIs for third-party services (utilities, remittance providers, merchants).

To achieve this level of resilience and institutional readiness, you do not need a wish list. You need a proven, end-to-end crypto wallet service provider that translates financial controls, security primitives, and regulatory requirements into production-grade engineering. Engaging an expert development and compliance team converts technical complexity into a predictable, auditable infrastructure that earns regulatory signoff, merchant adoption, and investor confidence.

Antier’s A-Z Wallet Development Support to Launch Smartly in Georgia

There are numerous reasons why Antier is an ideal cryptocurrency wallet development company you would hire. The most important reason is that it offers end-to-end services right from the start to the end.

- End-to-end product delivery: Antier takes a turnkey approach from scoping and compliance design to engineering and post-launch operations. The offer includes product strategy, UI/UX, smart contract engineering, backend custody architecture, and API design. Antier designs the compliance layer to local licensure specifications and implements AML/KYC workflows that can be adapted as regulation evolves.

-

Regulatory liaison and legal scaffolding:Antier’s legal operations team maps local VASP requirements and prepares licensing-ready documentation, AML policies, and technical controls that regulators expect. This removes friction and accelerates time-to-market for an onshore operation.

-

Security and operations:Antier implements MPC custody, HSM integrations, and layered monitoring. Post-launch, Antier offers 24/7 SOC, SRE-led uptime guarantees, and incident playbooks so investors do not inherit operational gaps.

-

Commercialization and integrations:Antier provides merchant SDKs, POS integrations, and stablecoin corridor negotiations so the wallet starts with revenue-generating flows. Antier can also support pilot programs for remittances, tourism payments, and enterprise payroll to demonstrate traction rapidly.

-

Investor-friendly deliverables:A clear product roadmap, investor dashboards with KPIs, compliance attestations, and a tested incident response process make the wallet a defensible infrastructure asset for institutional portfolios.

Hire To Achieve a Production-Ready Wallet Today!

For serious investors, white label cryptocurrency wallet development in Georgia is a capital-efficient infrastructure play that aligns with national fintech priorities, remittance economics, and merchant modernization. The market signals are clear: regulators are preparing frameworks that reward compliance-first entrants, the fintech ecosystem is capable of driving adoption, and on-the-ground commercial pilots prove the product-market fit. The right technical architecture, combined with a proven compliance and operations partner, turns regulatory and operational risk into a sustainable moat.

Connect with our team today. Being one of the leading blockchain wallet development companies, we bring the legal expertise, technical depth, and operational discipline necessary to deploy an enterprise-grade wallet in Georgia. We design custody that institutional investors accept, compliance that local regulators approve, and product features that drive merchant and consumer adoption. If you are evaluating infrastructure plays in Web3, a licensed, secure, and commercially integrated Web3 wallet built to these specifications should be at the top of your diligence pipeline. m

Frequently Asked Questions

01. Why is a crypto wallet considered a strategic tool for Georgia?

A crypto wallet enhances financial resilience, optimizes remittances, enables tourism and commerce, ensures onshore compliance, and serves as a platform for programmable public goods.

02. How does Georgia’s fintech strategy support the development of crypto wallets?

Georgia’s fintech strategy promotes sandboxing, open APIs, and compliance-first innovation, creating a favorable regulatory environment for enterprise-grade crypto wallets.

03. What is the significance of Georgia’s position in the Web3 landscape?

Georgia is emerging as a regional fintech hub with a growing community and supportive policies that recognize blockchain as essential infrastructure, fostering innovation and regulatory alignment.

Crypto World

Metaplanet presses ahead with bitcoin purchase plans as shares slide

Simon Gerovich, CEO of Metaplanet (3350), doubled down on the company’s bitcoin buying strategy even as shares in Asia’s largest publicly traded holder of the cryptocurrency fell.

In a Friday post on X, Gerovich said Metaplanet would “steadily continue to accumulate bitcoin, expand revenue and prepare for the next phase of growth.” He thanked shareholders who continued to back the company despite bitcoin’s downward trend: The largest cryptocurrency has lost more than 47% of its value since touching a record high in October and fell 14% on Thursday alone.

Metaplanet’s stock has struggled alongside bitcoin, ending the week at 340 yen ($2.16) after falling roughly 82% from a high of 1,930 yen in June. On Friday, the stock fell 5.6% following bitcoin’s slump after Asian trading hours the day before.

The Tokyo-based company’s “555 Million Plan” aims to reach 100,000 BTC by the end of 2026 and 210,000 BTC by 2027. Its bitcoin holdings have climbed from 1,762 BTC at the end of 2024 to 35,102 BTC now, worth about $2.5 billion at current prices.

The investment is deep in the red, with an average acquisition cost of about $107,000 per bitcoin, according to its analytics page, and a current price of $66,270. The company has roughly $280 million in outstanding debt, according to the dashboard.

Globally, Metaplanet ranks as the fourth-largest publicly traded holder of bitcoin. Strategy Inc. (MSTR) ranks first with 713,502 BTC, MARA Holdings (MARA) is second with 53,250 BTC and Twenty One Capital (XX1) is third with 43,514 BTC, according to bitcointreasuries.net.

Metaplanet announced Jan. 29 that it planned to raise up to 21 billion yen to fund additional bitcoin purchases and pay down debt. It plans to raise the funds through the sale of 24.53 million new common shares at 499 yen each, along with stock warrants aimed at select investors.

Crypto World

BNB Price Forecast: Which Is The Best Crypto To Invest In As BNB Sell-off Intensifies

As BNB’s sell-off intensifies, breaking below $750 under a bearish technical pattern, investors are questioning which crypto assets can deliver reliable growth. The declining retail interest and falling momentum in major exchange tokens shift focus toward new projects with tangible utility and strong early-stage momentum. In this climate, Mutuum Finance (MUTM) emerges as a strong answer for what crypto to buy, combining a low-entry presale with a feature-rich protocol ready for adoption.

BNB Faces Strong Bearish Pressure

BNB is experiencing significant downward momentum, trading 46% below its all-time high. A critical “Death Cross” pattern has formed on its chart, where short-term moving averages fall below long-term ones, signaling entrenched bearish sentiment. While developers are proposing new token standards for AI assets, these long-term initiatives do not address the current weak price structure and low retail trading volume. For investors seeking growth, this environment makes BNB a risky hold, pushing the search toward newer, more dynamic projects.

Mutuum Finance’s Presale Phase Offers High-Growth Entry

For investors deciding what crypto to buy for substantial returns, Mutuum Finance presents a clear opportunity. The project is in Phase 7 of its presale, with tokens priced at $0.04. Having already raised over $20.4 million from 18,970 holders, the presale is moving swiftly toward its next phase, where the price will rise to $0.045.

The launch price is set at $0.06, but analysis points to a rapid surge toward $0.30-$0.40 post-listing, a 7.5x to 10x gain from the current price. This projection is based on the token’s fixed supply of 4 billion coins and the high demand expected from top-tier exchange listings. A $1,000 investment now could see a potential rise to $7,500 in a short period, defining MUTM as a top crypto to buy for accelerated growth.

Testnet Demonstration Proves Real Functionality

Building confidence in its roadmap, Mutuum Finance has successfully launched its V1 protocol on the Sepolia testnet. This public demonstration allows users to interact with the core lending system, including depositing test assets, taking out loans, and observing the automated liquidation processes that maintain stability. The testnet confirms the protocol’s readiness and operational security, providing a transparent look at the platform’s mechanics before any real-world funds are involved. This step is crucial for a new project, transitioning it from concept to a verifiable product.

Fixed Supply and Strategic Allocation Create Scarcity

A key feature supporting MUTM’s value is its definitive tokenomics. The total supply is capped at 4 billion tokens, with 45% allocated to the presale. No new tokens will be minted, meaning all future circulating supply is already defined. This fixed scarcity contrasts with inflationary tokens and directly supports price appreciation as user adoption grows. For a potential buyer, this means early acquisition positions them before demand from a growing user base meets a limited available supply, a fundamental driver for value increase.

Community Incentives Drive Engagement and Reward

Beyond the protocol, Mutuum Finance actively rewards its community, fueling participation. A standout incentive is the $100,000 giveaway, where ten winners will each receive $10,000 in MUTM tokens.

Additionally, a dynamic 24-hour leaderboard awards a daily $500 MUTM bonus to the top contributor. These initiatives, combined with the planned use of protocol fees to buy back and distribute tokens, create multiple avenues for holders to gain additional value simply by participating in the ecosystem.

Positioning as the Strategic Investment Choice

While BNB struggles with market-wide sell-offs and complex development initiatives, Mutuum Finance offers a straightforward growth narrative. Its presale stage, proven testnet technology, scarce token supply, and direct reward mechanisms provide a cohesive case for rapid appreciation. For investors determining the best crypto to invest in during market uncertainty, MUTM represents a structured opportunity with the potential for significant short-term gains and sustainable long-term utility.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Microsoft (MSFT) Stock: Should You Buy After 22% Plunge?

TLDR

- Microsoft stock plunged 22% from all-time highs after January 28 earnings report revealed AI growth challenges

- Copilot adoption reached only 15 million licenses out of 400 million available Microsoft 365 seats

- Azure cloud revenue growth slowed to 39% from 40% previous quarter despite beating analyst expectations

- OpenAI represents $281 billion or 45% of Microsoft’s $625 billion order backlog creating concentration risk

- Stock trades at P/E ratio of 26.5, cheapest valuation in three years compared to Nasdaq-100’s 32.8 multiple

Microsoft stock has tumbled 22% from record highs following its fiscal Q2 2026 earnings release. Shares fell over 10% on January 28 alone as investors questioned the company’s AI momentum.

The stock closed at $393.58 on February 5, marking a sharp retreat from its $555 peak. Despite posting 16.7% revenue growth over the trailing twelve months, concerns about AI execution have spooked Wall Street.

Microsoft’s Copilot virtual assistant has struggled to penetrate enterprise markets. The company sold just 15 million Copilot licenses for Microsoft 365 out of 400 million total business licenses available.

That 3.7% adoption rate doubled from a year earlier but disappointed investors. Copilot integrates AI capabilities into Word, Excel, Outlook and other productivity applications.

The company found more success with developers. Paid Copilot subscriptions for software developers surged 77% from the prior quarter.

Healthcare showed promise too. Dragon Copilot now assists over 100,000 medical professionals and processed 21 million patient encounters in Q2, tripling year-over-year.

Azure Growth Rate Decelerates

Azure cloud platform revenue increased 39% year-over-year in the second quarter. The result beat Wall Street’s 37.1% forecast but slowed from 40% growth three months earlier.

Investors interpreted the deceleration as a warning sign. Azure provides critical infrastructure and AI development tools for businesses building applications.

Microsoft pointed to data center capacity shortages as a limiting factor. The company’s order backlog from customers waiting for infrastructure ballooned 110% year-over-year to $625 billion.

OpenAI Concentration Creates Vulnerability

A closer look at the backlog revealed troubling details. OpenAI alone accounts for $281 billion or 45% of total future commitments.

The AI startup lacks sufficient cash reserves to fund those orders immediately. OpenAI must depend on investor capital and revenue expansion to meet obligations.

Microsoft’s CFO disclosed this concentration during the earnings call. Shareholder lawsuits emerged in February 2026 alleging the company misled investors about OpenAI dependence.

Capital spending reached $37.5 billion in Q2 2026 as Microsoft invests heavily in AI infrastructure. Company-wide gross margins contracted despite revenue gains, pressuring profitability.

The More Personal Computing division declined 3% year-over-year. Gaming revenue fell 9% with Xbox content and services dropping 5%.

Microsoft currently trades at a price-to-earnings ratio of 26.5 based on trailing earnings of $15.98 per share. That represents the lowest valuation in three years.

The Nasdaq-100 trades at a 32.8 P/E multiple, making Microsoft cheaper than most tech peers. Analysts project fiscal 2027 earnings of $19.06 per share, implying a forward P/E of 22.4.

The company maintains robust cash generation with a 25.3% free cash flow margin and 46.7% operating margin. Microsoft’s market capitalization stands at $2.9 trillion as of February 5, 2026.

Crypto World

What’s Been Behind the Bitcoin Crash as BTC Falls to $60K

Key Insights

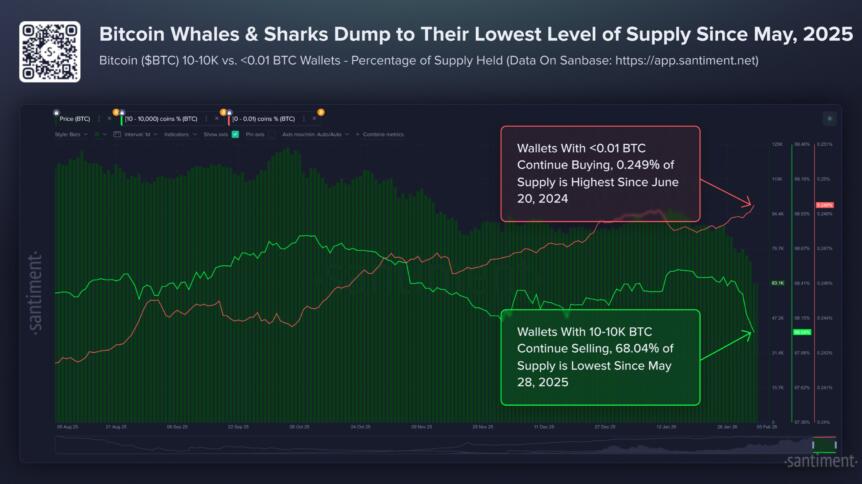

- Bitcoin whales sold over 81,000 BTC in eight days, adding strong supply pressure to the market.

- Large wallets now hold their lowest share of Bitcoin supply recorded in the past nine months.

- Retail wallets increased accumulation, reaching their highest Bitcoin supply share in 20 months.

Bitcoin continued its downward move as the broader cryptocurrency market faced renewed selling pressure. Total market capitalization declined by about 7.9% to $2.23 trillion, reflecting reduced risk appetite across digital assets. Bitcoin traded near $65,100 after briefly falling to $60,074, its lowest price level since October 2024.

Ethereum followed the same trend, falling close to 9% to around $1,913. The leading altcoins such as BNB, XRP, Solana, and Dogecoin also recorded losses of between 9 per cent to 14 per cent. The market evidence indicates internal supply forces but not one macroeconomic precipitator triggered the decline.

Large Holders Reduce Bitcoin Exposure

On-chain data from Santiment shows sustained selling by large Bitcoin holders. Wallets holding between 10 and 10,000 BTC reduced their holdings over recent weeks. These wallets now control about 68.04% of total Bitcoin supply, marking a nine-month low.

Over the last eight days, big holders sold about 81,000 BTC. This selling increased available supply during weaker demand sessions. As supply pressure grew, Bitcoin prices moved lower, testing levels not experienced in several months.

Large holders often adjust exposure during periods of uncertainty. Their actions tend to influence short-term price movements due to the volume involved.

Small Investors Increase Accumulation Despite Price Decline

Large wallets decreased holdings, but smaller investors kept on accumulating Bitcoin. The proportion of wallets that contained less than 0.01 BTC expanded their total supply to approximately 0.249.This value represents the highest level recorded in roughly 20 months.

The retail wallets dominate such a small part of the total supply, but their constant accumulation indicates that they are still involved at lower levels of prices. This trend shows that smaller investors were able to absorb some of the selling pressure that was generated by larger holders.

Supply Shifts Drive Market Volatility

The contrasting behavior between large and small holders continues to shape Bitcoin’s market structure. Similar patterns have appeared during extended corrective phases in past market cycles. Big sellers allocate supply and retail players slowly escalate exposure.

Until selling activity from large wallets declines and demand improves, Bitcoin may remain volatile. The trend in prices is expected to portray a continuing shift in supply allocation and not news flash.

-

Politics7 days ago

Politics7 days agoWhy is the NHS registering babies as ‘theybies’?

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports4 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business21 hours ago

Business21 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World21 hours ago

Crypto World21 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World20 hours ago

Crypto World20 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation