By SuperWest Sports Staff

Sports

Celtics trade F Chris Boucher to Jazz

Oct 15, 2025; Boston, Massachusetts, USA; Toronto Raptors forward Brandon Ingram (3) knocks the ball away from Boston Celtics center Chris Boucher (99) during the first half at TD Garden. Mandatory Credit: Paul Rutherford-Imagn Images

Oct 15, 2025; Boston, Massachusetts, USA; Toronto Raptors forward Brandon Ingram (3) knocks the ball away from Boston Celtics center Chris Boucher (99) during the first half at TD Garden. Mandatory Credit: Paul Rutherford-Imagn Images Two days after acquiring center Nikola Vucevic, the Boston Celtics traded forward Chris Boucher to the Utah Jazz on Thursday.

Guard John Tonje heads to Boston, while Utah also receives a second-round draft pick and cash.

Boucher, 33, signed a one-year contract in the offseason but played just one game since Nov. 23.

In nine games off the bench with Boston, he averaged 2.3 points and 2.0 rebounds in 10.4 minutes per game. In nine seasons with the Golden State Warriors, Toronto Raptors and Celtics, Boucher has averaged 8.7 points and 5.1 rebounds in 416 games (23 starts). Along with opening up a roster spot for the Celtics, shipping out Boucher sheds $2.3 million from their salary cap.

Tonje, 24, was selected by Utah in the second round of last year’s NBA draft out of Wisconsin, but he has yet to make his NBA debut. He is averaging 18.1 points, 4.3 rebounds and 1.6 assists through 18 games in the NBA’s second-tier G League.

The Vucevic deal, which sent guard Anfernee Simons to the Chicago Bulls on Tuesday, shored up the Celtics’ frontcourt and saved the team about $6 million.

–Field Level Media

Sports

Why Colts WR Reggie Wayne will continue to wait to make Hall of Fame

Colts legends Reggie Wayne and Frank Gore were among the 11 Pro Football Hall of Fame modern-day player finalists on this year’s ballot who won’t be sporting gold jackets at this summer’s induction ceremony. And from the looks of next year’s potential first-time ballot members, the pair may very well remain on the outside of the Hall for a bit longer.

Longtime Colts kicker Adam Vinatieri – arguably the best kicker in NFL history – was among the five members voted to make up the Class of 2026, unveiled Thursday night during the NFL Honors ceremony. The Class’s other modern-day players included Cardinals receiver Larry Fitzgerald, Saints quarterback Drew Brees and Panthers linebacker Luke Kuechly. Vinatieri and Kuechly were voted in on their second years of eligibility, with Brees and Fitzgerald joining the esteemed list of first-ballot Hall of Famers.

Advertisement

Gore, along with Brees, Fitzgerald and longtime Cowboys tight end Jason Witten, was in his first year of eligibility for the Hall. Wayne, on the other hand, was tied this year with fellow star wideout Torry Holt for being a finalist the most times (7) without being voted into the Hall. Wayne has been a finalist in each of his seven years of eligibility.

But he continues to struggle to break the threshold – particularly with the Hall’s new more exclusive voting process. Under the new Pro Football Hall of Fame voting rules, each year a group of 25 (and ties) of semifinalists is whittled down to 15 finalists, and that group then shrinks through subsequent rounds of voting to 10 and then seven. The Hall’s pool of 50 voters have five picks among that pool of seven modern-day players, and the top-three vote-getters will be inducted into the Hall of Fame with as many as two more players able to join the group if they garner 80% of the vote.

Longtime Colts beat writer Mike Chappell, who is on the Hall’s voting committee as the Indianapolis-area representative, lifted the curtain a bit on X Thursday night regarding how the voting process went this time around. Wayne, he said, did not make the first cut-down from 15 to 10, meaning, at best, he remains the seventh-highest returning vote-getter for next year with Vinatieri, Brees, Fitzgerald and Kuechly off the list.

Gore, according to Chappell, made the cut-down to 10, but was not among the seven ‘final’ finalists who were among the Hall-deciding vote. The three ex-players from that final seven who weren’t voted into this year’s class – Bengals tackle Willie Anderson, Ravens edge rusher Terrell Suggs and Ravens offensive lineman Marshal Yanda – will automatically advance to become finalists for the Class of 2027.

Advertisement

Those who made the initial cut from 15 finalists down to 10, according to Chappell, included the aforementioned seven plus Gore, Witten and Cowboys safety Darren Woodson.

Along with Wayne, the other Hall of Fame finalists who were cut from the initial vote from 15 down to 10 were Saints guard Jahri Evans, Giants quarterback Eli Manning, Vikings defensive tackle Kevin Williams and Holt.

Wayne continues to wait, despite sitting 10th on the NFL’s all-time receiving yards list (14,435 yards). Only longtime Panthers great Steve Smith Sr. (8th all-time, 14,731 yards) ranks above him and hasn’t yet been voted into the Hall. Five other receivers (Andre Johnson, James Lofton, Cris Carter, Andre Reed and Steve Largent) all rank within the top-20 all-time in receiving yards and, too, have been voted into the Hall.

Advertisement

The Colts receiving great also ranks 11th all-time in catches, with seven of the nine retired players ahead of him on the list now voted into the Hall, along with three others inside the top-20 (Johnson, Isaac Bruce and Randy Moss). Wayne also ranks tied-for-31st all-time in receiving touchdowns.

After an iron man-like run for a running back of 16 years in the league – 15 of which where he appeared in at least 14 games – with nine 1,000-rushing yard campaigns and 12 consecutive seasons with at least 800 yards (2006-2017), Gore finished his career in 2020 third all-time on the NFL’s career rushing yards list with 16,000. Only Derrick Hendry (13,018 yards) and Saquon Barkley (8,356) have even 8,000 rushing yards among active running backs.

Those resumes next year will run up against a strong contingent of potential first-time ballot members – most notably running back Adrian Peterson, tight end Rob Gronkowski, quarterback Ben Roethlisberger, cornerback Richard Sherman and tackle Andrew Whitworth.

Peterson ranks fifth all-time in all-time rushing yards as well as rushing touchdowns. Emmitt Smith, who tops both categories, is the only other player in the top-5 on both lists.

Advertisement

Gronkowski ranks sixth all-time among tight ends in career receiving yards (9,286) – with three of the five players ahead of him already voted into the Hall, the other two being Witten and certain future Hall of Famer Travis Kelce. Gronkowski also sits 10th all-time in receptions among tight ends (621) and third in touchdowns (92) to go with his four Super Bowl victories (tied for second-most among tight ends) and four first-team All-Pro selections (tied for second-most).

Roethlisberger enters his first year of Hall of Fame eligibility seventh all-time in career passing yards (64,088) and ninth in passing touchdowns (418). Of the nine others who also sit in the top-10 of both those categories, four (Brees, Peyton Manning, Brett Favre and Dan Marino) have been voted into the Hall, with Tom Brady, Aaron Rodgers and Matthew Stafford seemingly locks to be voted in when their time comes.

Players remain eligible for the ‘modern era’ Pro Football Hall of Fame ballot for 20 years after having been retired for five seasons, meaning Wayne has 13 more shots to make it before he would be voted upon among a pool of those with ‘senior’ eligibility who go through an entirely different voting process. He now ranks second-most in career receiving yards (behind Smith) and catches (behind Anquan Boldin) among Hall of Fame-eligible receivers who’ve not yet been voted in.

Joel A. Erickson and Nathan Brown cover the Colts all season. Get more coverage on IndyStarTV and with the Colts Insider newsletter.

Advertisement

This article originally appeared on Indianapolis Star: Why Colts WR Reggie Wayne will continue to wait to make Hall of Fame

Sports

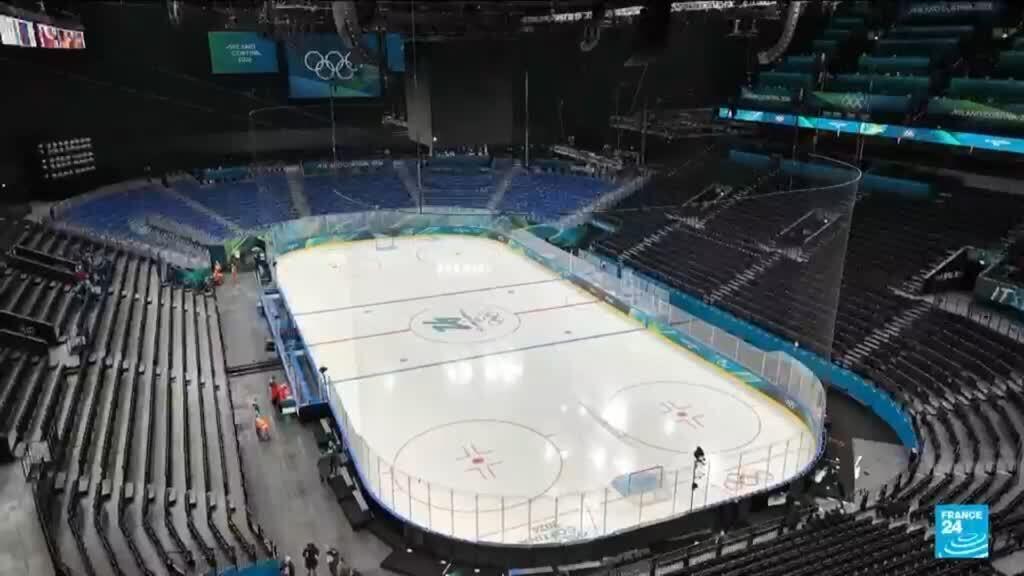

Milan-Cortina Winter Olympics set for lavish opening ceremony

The opening ceremony of the Milan-Cortina Winter Olympics, which will kick off in Milan’s San Siro Stadium on Friday, is expected to draw a global audience of hundreds of millions of viewers.

Sports

Updated Colorado Buffaloes All-Time Football Seasons

After last year’s 3-9 campaign, Colorado football has played 136 seasons, dating back to 1890.

The Buffs have compiled a record of 735–556–36 (.577) through the 2025 season.

The program ranks 27th on the all-time win list and 40th in all-timewinning percentage.

Colorado also has two Heisman Trophy winners in Rashaan Salaam (1994) and Travis Hunter (2024).

Since the program’s initial season, the Buffaloes have appeared in 29 bowl games, winning 27 conference championships, five division championships, and an AP National Championship in 1990.

—Conference affiliations—

- Independent (1890–1892, 1905)

- Colorado Football Association (1893–1904, 1906–1908)

- Colorado Faculty Athletic Conference/Rocky Mountain Faculty Athletic Conference (1909–1937)

- Mountain States Conference (1938–1947)

- Big Eight Conference (1948–1995)

- Big 12 Conference (1996–2010, 2024–present)

- Pac-12 Conference (2011–2023)

- Big 12 Conference (2024-present)

The table below gives an all-time season rundown with Conference, W-L record, win percentage, coach, and bowl game, if any, for each year

| Year | Conf | W | L | T | Pct | Coach | Bowl |

|---|---|---|---|---|---|---|---|

| 2025 | Big 12 | 3 | 9 | 0 | .250 | Deion Sanders | |

| 2024 | Big 12 | 9 | 4 | 0 | .692 | Deion Sanders | Alamo Bowl-L |

| 2023 | Pac-12 | 4 | 8 | 0 | .333 | Deion Sanders | |

| 2022 | Pac-12 | 1 | 11 | 0 | .083 | Karl Dorrell/Mike Sanford | |

| 2021 | Pac-12 | 4 | 8 | 0 | .333 | Karl Dorrell | |

| 2020 | Pac-12 | 4 | 2 | 0 | .667 | Karl Dorrell | Alamo Bowl-L |

| 2019 | Pac-12 | 5 | 7 | 0 | .417 | Mel Tucker | |

| 2018 | Pac-12 | 5 | 7 | 0 | .417 | Kurt Roper Mike MacIntyre | |

| 2017 | Pac-12 | 5 | 7 | 0 | .417 | Mike MacIntyre | |

| 2016 | Pac-12 | 10 | 4 | 0 | .714 | Mike MacIntyre | Alamo Bowl-L |

| 2015 | Pac-12 | 4 | 9 | 0 | .308 | Mike MacIntyre | |

| 2014 | Pac-12 | 2 | 10 | 0 | .167 | Mike MacIntyre | |

| 2013 | Pac-12 | 4 | 8 | 0 | .333 | Mike MacIntyre | |

| 2012 | Pac-12 | 1 | 11 | 0 | .083 | Jon Embree | |

| 2011 | Pac-12 | 3 | 10 | 0 | .231 | Jon Embree | |

| 2010 | Big 12 | 5 | 7 | 0 | .417 | Dan Hawkins Brian Cabral | |

| 2009 | Big 12 | 3 | 9 | 0 | .250 | Dan Hawkins | |

| 2008 | Big 12 | 5 | 7 | 0 | .417 | Dan Hawkins | |

| 2007 | Big 12 | 6 | 7 | 0 | .462 | Dan Hawkins | Independence Bowl-L |

| 2006 | Big 12 | 2 | 10 | 0 | .167 | Dan Hawkins | |

| 2005 | Big 12 | 7 | 6 | 0 | .538 | Gary Barnett Mike Hankwitz | Champs Sports Bowl-L |

| 2004 | Big 12 | 8 | 5 | 0 | .615 | Gary Barnett | Houston Bowl-W |

| 2003 | Big 12 | 5 | 7 | 0 | .417 | Gary Barnett | |

| 2002 | Big 12 | 9 | 5 | 0 | .643 | Gary Barnett | Alamo Bowl-L |

| 2001 | Big 12 | 10 | 3 | 0 | .769 | Gary Barnett | Fiesta Bowl-L |

| 2000 | Big 12 | 3 | 8 | 0 | .273 | Gary Barnett | |

| 1999 | Big 12 | 7 | 5 | 0 | .583 | Gary Barnett | Insight Bowl-W |

| 1998 | Big 12 | 8 | 4 | 0 | .667 | Rick Neuheisel | Aloha Classic-W |

| 1997 | Big 12 | 5 | 6 | 0 | .455 | Rick Neuheisel | |

| 1996 | Big 12 | 10 | 2 | 0 | .833 | Rick Neuheisel | Holiday Bowl-W |

| 1995 | Big 8 | 10 | 2 | 0 | .833 | Rick Neuheisel | Cotton Bowl-W |

| 1994 | Big 8 | 11 | 1 | 0 | .917 | Bill McCartney | Fiesta Bowl-W |

| 1993 | Big 8 | 8 | 3 | 1 | .708 | Bill McCartney | Aloha Bowl-W |

| 1992 | Big 8 | 9 | 2 | 1 | .792 | Bill McCartney | Fiesta Bowl-L |

| 1991 | Big 8 | 8 | 3 | 1 | .708 | Bill McCartney | Blockbuster Bowl-L |

| 1990 | Big 8 | 11 | 1 | 1 | .885 | Bill McCartney | Orange Bowl-W |

| 1989 | Big 8 | 11 | 1 | 0 | .917 | Bill McCartney | Orange Bowl-L |

| 1988 | Big 8 | 8 | 4 | 0 | .667 | Bill McCartney | Freedom Bowl-L |

| 1987 | Big 8 | 7 | 4 | 0 | .636 | Bill McCartney | |

| 1986 | Big 8 | 6 | 6 | 0 | .500 | Bill McCartney | Bluebonnet Bowl-L |

| 1985 | Big 8 | 7 | 5 | 0 | .583 | Bill McCartney | Freedom Bowl-L |

| 1984 | Big 8 | 1 | 10 | 0 | .091 | Bill McCartney | |

| 1983 | Big 8 | 4 | 7 | 0 | .364 | Bill McCartney | |

| 1982 | Big 8 | 2 | 8 | 1 | .227 | Bill McCartney | |

| 1981 | Big 8 | 3 | 8 | 0 | .273 | Chuck Fairbanks | |

| 1980 | Big 8 | 1 | 10 | 0 | .091 | Chuck Fairbanks | |

| 1979 | Big 8 | 3 | 8 | 0 | .273 | Chuck Fairbanks | |

| 1978 | Big 8 | 6 | 5 | 0 | .545 | Bill Mallory | |

| 1977 | Big 8 | 7 | 3 | 1 | .682 | Bill Mallory | |

| 1976 | Big 8 | 8 | 4 | 0 | .667 | Bill Mallory | Orange Bowl-L |

| 1975 | Big 8 | 9 | 3 | 0 | .750 | Bill Mallory | Bluebonnet Bowl-L |

| 1974 | Big 8 | 5 | 6 | 0 | .455 | Bill Mallory | |

| 1973 | Big 8 | 5 | 6 | 0 | .455 | Eddie Crowder | |

| 1972 | Big 8 | 8 | 4 | 0 | .667 | Eddie Crowder | Gator Bowl-L |

| 1971 | Big 8 | 10 | 2 | 0 | .833 | Eddie Crowder | Bluebonnet Bowl-W |

| 1970 | Big 8 | 6 | 5 | 0 | .545 | Eddie Crowder | Liberty Bowl-L |

| 1969 | Big 8 | 8 | 3 | 0 | .727 | Eddie Crowder | Liberty Bowl-W |

| 1968 | Big 8 | 4 | 6 | 0 | .400 | Eddie Crowder | |

| 1967 | Big 8 | 9 | 2 | 0 | .818 | Eddie Crowder | Bluebonnet Bowl-W |

| 1966 | Big 8 | 7 | 3 | 0 | .700 | Eddie Crowder | |

| 1965 | Big 8 | 6 | 2 | 2 | .700 | Eddie Crowder | |

| 1964 | Big 8 | 2 | 8 | 0 | .200 | Eddie Crowder | |

| 1963 | Big 8 | 2 | 8 | 0 | .200 | Eddie Crowder | |

| 1962 | Big 8 | 2 | 8 | 0 | .200 | Bud Davis | |

| 1961 | Big 8 | 9 | 2 | 0 | .818 | Everett Grandelius | Orange Bowl-L |

| 1960 | Big 8 | 6 | 4 | 0 | .600 | Everett Grandelius | |

| 1959 | Big 7 | 5 | 5 | 0 | .500 | Everett Grandelius | |

| 1958 | Big 7 | 6 | 4 | 0 | .600 | Dallas Ward | |

| 1957 | Big 7 | 6 | 3 | 1 | .650 | Dallas Ward | |

| 1956 | Big 7 | 8 | 2 | 1 | .773 | Dallas Ward | Orange Bowl-W |

| 1955 | Big 7 | 6 | 4 | 0 | .600 | Dallas Ward | |

| 1954 | Big 7 | 7 | 2 | 1 | .750 | Dallas Ward | |

| 1953 | Big 7 | 6 | 4 | 0 | .600 | Dallas Ward | |

| 1952 | Big 7 | 6 | 2 | 2 | .700 | Dallas Ward | |

| 1951 | Big 7 | 7 | 3 | 0 | .700 | Dallas Ward | |

| 1950 | Big 7 | 5 | 4 | 1 | .550 | Dallas Ward | |

| 1949 | Big 7 | 3 | 7 | 0 | .300 | Dallas Ward | |

| 1948 | Big 7 | 3 | 6 | 0 | .333 | Dallas Ward | |

| 1947 | MSAC | 4 | 5 | 0 | .444 | Jim Yeager | |

| 1946 | MSAC | 5 | 4 | 1 | .550 | Jim Yeager | |

| 1945 | MSAC | 5 | 3 | 0 | .625 | Frank Potts | |

| 1944 | MSAC | 6 | 2 | 0 | .750 | Frank Potts | |

| 1943 | MSAC | 5 | 2 | 0 | .714 | Jim Yeager | |

| 1942 | MSAC | 7 | 2 | 0 | .778 | Jim Yeager | |

| 1941 | MSAC | 3 | 4 | 1 | .438 | Jim Yeager | |

| 1940 | MSAC | 5 | 3 | 1 | .611 | Frank Potts | |

| 1939 | MSAC | 5 | 3 | 0 | .625 | Bunny Oakes | |

| 1938 | MSAC | 3 | 4 | 1 | .438 | Bunny Oakes | |

| 1937 | RMC | 8 | 1 | 0 | .889 | Bunny Oakes | Cotton Bowl-L |

| 1936 | RMC | 4 | 3 | 0 | .571 | Bunny Oakes | |

| 1935 | RMC | 5 | 4 | 0 | .556 | Bunny Oakes | |

| 1934 | RMC | 6 | 1 | 2 | .778 | William Saunders | |

| 1933 | RMC | 7 | 2 | 0 | .778 | William Saunders | |

| 1932 | RMC | 2 | 4 | 0 | .333 | William Saunders | |

| 1931 | RMC | 5 | 3 | 0 | .625 | Myron Witham | |

| 1930 | RMC | 6 | 1 | 1 | .813 | Myron Witham | |

| 1929 | RMC | 5 | 1 | 1 | .786 | Myron Witham | |

| 1928 | RMC | 5 | 1 | 0 | .833 | Myron Witham | |

| 1927 | RMC | 4 | 5 | 0 | .444 | Myron Witham | |

| 1926 | RMC | 3 | 5 | 1 | .389 | Myron Witham | |

| 1925 | RMC | 6 | 3 | 0 | .667 | Myron Witham | |

| 1924 | RMC | 8 | 1 | 1 | .850 | Myron Witham | |

| 1923 | RMC | 9 | 0 | 0 | 1.000 | Myron Witham | |

| 1922 | RMC | 4 | 4 | 0 | .500 | Myron Witham | |

| 1921 | RMC | 4 | 1 | 1 | .750 | Myron Witham | |

| 1920 | RMC | 4 | 1 | 2 | .714 | Myron Witham | |

| 1919 | RMC | 2 | 3 | 1 | .417 | Joe Mills | |

| 1918 | RMC | 2 | 3 | 0 | .400 | Joe Mills | |

| 1917 | RMC | 6 | 2 | 0 | .750 | Bob Evans | |

| 1916 | RMC | 1 | 5 | 1 | .214 | Bob Evans | |

| 1915 | RMC | 1 | 6 | 0 | .143 | Fred Folsom | |

| 1914 | RMC | 5 | 1 | 0 | .833 | Fred Folsom | |

| 1913 | RMC | 5 | 1 | 1 | .786 | Fred Folsom | |

| 1912 | RMC | 6 | 3 | 0 | .667 | Fred Folsom | |

| 1911 | RMC | 6 | 0 | 0 | 1.000 | Fred Folsom | |

| 1910 | RMC | 6 | 0 | 0 | 1.000 | Fred Folsom | |

| 1909 | CFAC | 6 | 0 | 0 | 1.000 | Fred Folsom | |

| 1908 | CFA | 5 | 2 | 0 | .714 | Fred Folsom | |

| 1907 | CFA | 5 | 3 | 0 | .625 | Frank Castleman | |

| 1906 | CFA | 2 | 3 | 4 | .444 | Frank Castleman | |

| 1905 | Ind | 8 | 1 | 0 | .889 | Willis Keinholtz | |

| 1904 | CFA | 6 | 2 | 1 | .722 | David Cropp | |

| 1903 | CFA | 8 | 2 | 0 | .800 | David Cropp | |

| 1902 | CFA | 5 | 1 | 0 | .833 | Fred Folsom | |

| 1901 | CFA | 5 | 1 | 1 | .786 | Fred Folsom | |

| 1900 | CFA | 6 | 4 | 0 | .600 | T. W. Mortimer | |

| 1899 | CFA | 7 | 2 | 0 | .777 | Fred Folsom | |

| 1898 | CFA | 4 | 4 | 0 | .500 | Fred Folsom | |

| 1897 | CFA | 7 | 1 | 0 | .875 | Fred Folsom | |

| 1896 | CFA | 5 | 0 | 0 | 1.000 | Fred Folsom | |

| 1895 | CFA | 5 | 1 | 0 | .833 | Fred Folsom | |

| 1894 | CFA | 8 | 1 | 0 | .889 | Harry Heller | |

| 1893 | CFA | 2 | 3 | 0 | .400 | None | |

| 1892 | Ind | 3 | 2 | 0 | .600 | None | |

| 1891 | Ind | 1 | 4 | 0 | .200 | None | |

| 1890 | Ind | 0 | 4 | 0 | .000 | None |

Sports

Milano-Cortina: Venues delivered at the 'final breath'

The 2026 Milano-Cortina Winter Olympics open tomorrow following a frantic race to complete venues like the Cortina sliding centre and Milan ice hockey arena just in time. While the total cost has climbed to $6.7 billion—exceeding original estimates—it remains significantly lower than the record-breaking budgets of Sochi and Beijing. Despite these financial pressures, organizers view the Games as a vital infrastructure investment expected to draw two million spectators and boost tourism in Northern Italy by 160%.

Sports

Winter Olympics 2026 LIVE: Team GB curling updates and controversy over penis injections ahead of Opening Ceremony

Winter Olympics opening ceremong

The Winter Olympics officially kick off today, with the Opening Ceremony celebrating the start of two weeks of the very best of winter sport.

The main Opening Ceremony takes place in Milan’s San Siro Stadium, one of the historic site’s final events before it is slated to be torn down.

But due to the spread-out nature of these Games – taking place all across northern Italy – there will also be athlete parades in the mountain clusters, including Cortina, where the curling, bobsleigh, skeleton and luge all take place.

This Opening Ceremony has taken ‘Harmony’ as its theme, and will celebrate the two main sites hosting this Games: Milan and Cortina, which also hosted the 1956 Winter Olympics.

Mike Jones6 February 2026 11:01

Good morning!

Welcome to The Independent’s coverage of the Winter Olympics.

Though the Games have already begun tonight sees the official opening ceremony of the winter sports festival ahead of two weeks of intense sporting action.

The ceremony is scheduled to begin at 7pm GMT so we’ll have all the updates from Milan before it kicks off.

Mike Jones6 February 2026 10:59

Sports

Caulfield return for 2026 Australian Guineas hope Planet Red

Planet Red, the Caulfield Guineas placegetter, prepares for his seasonal reappearance in a high-class Stakes race at Caulfield.

On Saturday, the Group 2 Autumn Stakes (1400m) stands as Planet Red’s singular foray before the Group 1 Australian Guineas (1600m) at Flemington set for February 28.

Mick Price and Michael Kent Jnr’s charge, a three-year-old gelding, was last seen placing second to Autumn Boy during the Group 1 Caulfield Guineas (1600m) in October.

With three prior Australian Guineas triumphs under his belt, Price admitted Planet Red was drained following his Caulfield Guineas exertions.

“He had five weeks off after the Caulfield Guineas,” Price said.

“When he went into the Caulfield Guineas, he only had a certain amount of energy left in him, but we got it to come together in the last two weeks before that race and he ran super.

“He had five weeks off, but I haven’t got enough horse to do the Space Rider prep.

“Space Rider is going to have three runs into the Australian Guineas, but I’m going to take a punt on Planet Red. He runs in the 1400 metres and then it is three weeks to the Guineas.

“He has improved a little bit as a gelding, but it’s a quick turnaround from the spring.”

Space Rider placed 11th when last facing the Caulfield Guineas field and resumed winning the Group 3 Manfred Stakes (1200m) at Caulfield January 26.

His trajectory leads to the Group 3 C S Hayes Stakes (1400m) at Flemington a week from Saturday.

Price’s Australian Guineas ledger shines with Light Fantastic (2008), Heart Of Dreams (2009), Grunt (2018) victories, plus Tarzino’s near-miss against Palentino in 2016 where the protest failed.

Teaming with Kent Jnr, Price eyes his first joint Guineas score.

“The Australian Guineas has been good to me,” Price said.

“Planet Red will be pretty cherry ripe come the Australian Guineas and I think he’ll run well.”

Those keen on the Autumn Stakes action have plenty of options in the racing betting markets to consider for Planet Red’s performance.

The post Caulfield return for Guineas hope first appeared on Just Horse Racing.

Sports

Seahawks vs. Patriots odds, picks: Experts reveals exact score predictions for the Big Game

All eyes will be on Levi’s Stadium in Santa Clara, Calif., when the New England Patriots take on the Seattle Seahawks in the Big Game. It’s an unlikely matchup after the Patriots came into the season off back-to-back 4-13 seasons and hadn’t been to the NFL playoffs since the 2021 season. Seattle hadn’t been to the playoffs since the 2022 season, but made huge strides in the second season under head coach Mike Macdonald and quarterback Sam Darnold, a free-agent acquisition.

Kickoff is at 6:30 p.m. ET on Sunday, Feb. 8. The latest Seahawks vs. Patriots odds from DraftKings Sportsbook list Seattle as the 4.5-point favorite, with the over/under at 45.5 points. The Seahawks are -230 money line favorites (risk $230 to win $100), while the Patriots are +190 underdogs. Seahawks running back Kenneth Walker III is -195 (risk $195 to win $100) to score a touchdown, Seahawks wide receiver Jaxon Smith-Njigba is -110 and Patriots RB Rhamondre Stevenson is +140. SportsLine’s NFL experts teamed up to give exact score projections for the Big Game, and while they’re unanimously backing the Seahawks to win, their score predictions lead to some different spread and total picks.

The team of NFL betting experts includes R.J. White, who is SportsLine’s all-time No. 1 NFL spread expert and Larry Hartstein, who enters the game on a 43-33 run on NFL ATS picks (+596). Other NFL betting experts featured include Alex ‘PropStarz’ Selesnick, who is on a 62-44 (+916) roll on NFL player props and Jeff Hochman, who is 83-66-3 (plus +1217) over the past four NFL seasons.

Now, SportsLine’s NFL experts have analyzed the NFL odds and locked in their final score predictions for Seahawks vs. Patriots.

Patriots vs. Seahawks score predictions

R.J. White

Big Game score prediction: Seahawks 19, Patriots 16

“The last four Big Games have seen both teams get to 20 points, but I think there’s a chance touchdowns will be hard to come by in this game. The Seahawks defense is elite, allowing just two touchdowns in the six games since Week 12 where they haven’t faced the Rams. The Patriots defense has risen to that level in the postseason thanks to getting key players back in the front seven as well as playcaller Zak Kuhr putting on a masterclass each week. There’s no denying the talent on these offenses, but I see two defensive units that will be tough to crack in the red zone and a lot of kicking points in this game.” New users can target the DraftKings promo code, which offers $300 in bonus bets if your bet wins, and target the Patriots +4.5:

Larry Hartstein

Big Game score prediction: Seahawks 23, Patriots 16

“It’s been four months since a team not named the Rams excelled offensively versus Seattle’s No. 1 defense. Unless Drake Maye runs wild, I have a hard time seeing the Patriots getting to 20 points. New England’s defense is stout too, with a front that shuts down the run and Christian Gonzalez patrolling the back end. But Seattle has better weapons, led by the unstoppable Jaxon-Smith Njigba. He, Rashid Shaheed and Cooper Kupp will make enough plays to complete the Sam Darnold redemption story.” You can bet Seahawks (-4.5) at DraftKings:

Jeff Hochman

Big Game score prediction: Seahawks 27, Patriots 20

“Seattle’s edge in Net Yards Per Play (+1.4 vs. +1.0) is even more impressive considering they played the fourth-toughest schedule, while New England had the league’s easiest. Since 2000, just four teams have captured the title with a negative sack differential, while teams with a +20 or higher sack differential — such as Seattle — have won six times. The Patriots’ sack differential of -13 is the lowest ever for a championship team in this span. After monitoring both teams all season, Seattle appears superior in every phase: offense, defense and special teams.” You can go Over on the total (45.5) at DraftKings:

Alex ‘PropStarz’ Selesnick

Big Game score prediction: Seahawks 23, Patriots 19

“This looks like a game where both offenses could find it difficult to score touchdowns. New Englands defense has been dominant through the playoffs and features the type of scheme and personnel that could potentially give Sam Darnold fits coupled with limiting Seattle’s run game. I also expect Mike McDonald’s defense to make life really difficult on Drake Maye who has not been same player that was a bonafide MVP candidate through the entirety of the regular season. I think this is ultimately a low scoring game decided by 4 points or less. The Seahawks have been very fortunate in high leverage situations and I do expect some major regression in the turnover department, however that may not come to fruition until next season. Seattle feels like a team of destiny.” You can pick Under (45.5) the total at DraftKings:

How to get more Patriots vs. Seahawks picks

SportsLine’s model has simulated Seahawks vs. Patriots 10,000 times and revealed its picks. See who wins and covers the spread here, all from the model that’s on a 53-37 roll on top-rated NFL picks.

Sports

Risky Business Gets Baked into Vikings Decision on ‘Backer with Pass Rush Upside

Soon enough, a Vikings decision needs to arrive on Eric Wilson.

The off-ball ‘backer soaked up plenty of snaps at edge rusher, filling in for the injured Jonathan Greenard and Andrew Van Ginkel at various points. He did so despite being in his early 30s, not having a ton of experience at the position, and being undersized for the task at 6’1″ and 231 pounds. Wilson responded by dropping down a career-high 6.5 sacks alongside 17 tackles for loss. Not too shabby.

The Vikings Decision on Eric Wilson Looks Risky

Bringing Brian Flores back makes keeping Wilson more likely.

Coach Flores, affectionately called “The Mad Scientist” in Minnesota, figured out how to unlock Wilson’s various skills. Not just someone who could run down running backs and tight ends, Wilson could pin his ears back to create havoc as a pass rusher. Essentially every linebacker prefers to run forward rather than backward, so one has to assume to Wilson enjoyed playing for Flores.

Originally, Eric Wilson got added to Minnesota’s roster as an undrafted talent who turned pro after getting completely overlooked in the 2017 NFL Draft.

At the time, Mike Zimmer’s Vikings were on the cusp of one of the franchise’s all-time great seasons. The linebacker spot was being led by Anthony Barr and Eric Kendricks, both of whom were very good players in Minnesota.

Wilson came to town as a speedy, athletic linebacker who looked like he could stick around as a special teams menace and depth defender. For most of his career, Wilson lived up to that description, though he did earn a solid amount of playing time on defense over the years.

What’s notable is that he has had staying power. He’s impressive on the field in a physical sense, often demonstrating good speed and physicality. So, too, have coaches uplifted his acumen, an intelligence that allows him to stay a step ahead while also helping his teammates. Add it all together and there’s a veteran defender who possesses nice athleticism (though undersized) as well as someone who thinks and communicates the game at a high level.

In February of 2026, Eric Wilson is coming off a career-best season just as he jaunts into free agency. Soon, he’s going to get paid.

Wilson’s NFL journey has involved working for the Vikings, the Texans, the Eagles, the Saints, the Packers, and now for the Vikings again. At the high-end of his past paydays has been a yearly amount coming in at $3,259,000, which was when he worked for Minnesota in 2020.

Wilson is going to smash that number in March, blowing it to smithereens.

Spotrac offers an estimate that puts Eric Wilson at roughly $4.3 million per season. If that’s indeed what he’ll play for, then Minnesota would be wise to keep him around. Goodness, pay Wilson more than that. A two-year deal for $5 million per season would be a great deal for the Vikings.

Given the success Wilson had in 2025, then the ask on the open market may be much higher. Journeying over to the linebacker section of Over the Cap clarifies that there are a lot of linebackers who make $5 million per season or more. Wilson, very likely, is going to find himself among them. How high is too high?

In the NFL, the contracts that get handed out should be all about the future. Looking to the past is helpful only insofar as past play offers hints about future play.

Eric Wilson is coming off a sizzling season and he legitimately has earned a hearty payday. Whether that comes in Minnesota remains to be seen; the budget is snug and the roster needs to get younger. Is it too risky to pay for a breakout season for Wilson?

Eric Wilson will turn 32 in September of 2026.

Sports

Former WWE female star makes a personal confession

The WWE Universe has seen a major evolution in the women’s professional wrestling picture over the years. However, appearance has been one of the most important factors in the wrestling business, and many acknowledge that. Recently, a former female superstar made a similar confession about herself.

The former star in question is Brooke Adams. Speaking in an interview with WrestlingNewsCo’s The Velvet Ropes, she talked about how women had to trust in the process and opened up about her time in the Stamford-based promotion. She came in as a dancer when she didn’t even know how to dance, and also said that she had a “beautiful booty.”

Thanks for the submission!

“Another example of trust the process, I came in as a dancer. Honey, I cannot dance. I know it kinda looks like it. Fake it till you can make it. I can just pop it. I was twerking before twerking was a thing because I was blessed with a beautiful booty, okay, I cannot dance, and you get into that ring with a double bounce, and you want me to hear a beat on some speakers that don’t match, and I am like no, trust the process,” she said. (From 6:45 – 7:08)

Why Did WWE Waste This Year’s Royal Rumble? Find Out!

Top WWE women’s champion made Brooke Adams question herself

Speaking on the same interview, Brooke Adams spoke highly about one-half of the WWE Women’s Tag Team Champions, Rhea Ripley, and said that she is obsessed with The Nightmare. Here is what she expressed:

“I’m obsessed with her [Rhea]. If I was going to be a lesbian, girl, let’s be honest, you couldn’t get me off you. I don’t know what it is, but she makes me question [myself]. She’s so hot, and it’s just her aura. She walks in, and you just have it. She’s one in a million girls, and I don’t think you’ll ever see anybody like her. She gets the attention and brings the energy like the men do, and that’s very rare for the women,” she said.

Currently, the former Women’s World Champion is ruling the WWE Women’s Tag Team division on Monday Night RAW alongside IYO SKY.

Edited by Sanchari Bhattacharya

Sports

Christian McCaffrey thankful for 2025 success after last season’s injuries

NEWYou can now listen to Fox News articles!

SAN FRANCISCO – As long as Christian McCaffrey is on the field, he’s going to show out.

The San Francisco 49ers star running back was the only non-quarterback to be an MVP finalist, and was also in the running for his second Offensive Player of the Year Award in three years after putting up 2,126 scrimmage yards and scoring 17 total touchdowns.

In most cases, that should surprise nobody, but given McCaffrey’s devastating 2024 season, when he missed 13 games due to Achilles tendinitis and a knee injury, “what if” was in the conversation.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXNEWS.COM

Kyle Juszczyk of the San Francisco 49ers and Christian McCaffrey of the San Francisco 49ers celebrate after McCaffrey’s receiving touchdown during the first quarter against the Cleveland Browns at Cleveland Browns Stadium on Oct. 15, 2023, in Cleveland, Ohio. (Gregory Shamus/Getty Images)

“Yeah, you know, I think last year was tough. There was a lot of uncertainty for me the whole offseason just working extremely hard day and night to try to come back to where I needed to be,” McCaffrey told Fox News Digital on Radio Row. “I really just thank God. I feel very fortunate that I played in every game. You know, that’s something I don’t take for granted ever anymore. And I feel blessed to be able to come out of the season healthy.”

McCaffrey became just the second player ever to be nominated for MVP, Offensive Player of the Year, and Comeback Player of the Year in the same season. He was also voted by fans as one of FedEx’s Air & Ground Players of the Year.

“This is a cool award. Voted for by the fans, which makes it really cool, and it’s been going on for 23 years now, so it’s one of the longest NFL awards. So, I’m super thankful,” McCaffrey said. “They’re also giving $15,000 to Feeding America, a local food bank here in San Francisco. So, you know, getting an award, being able to give back a little bit, it’s pretty cool.”

San Francisco 49ers running back Christian McCaffrey celebrates after scoring against the Arizona Cardinals during the first half of an NFL football game Sunday, Dec. 17, 2023, in Glendale, Arizona. (AP Photo/Matt York)

McCaffrey won the Comeback Player of the Year on Thursday night given last year’s injuries and this year’s rousing success. Given his age, many were worried that it was the beginning of the end.

McCaffrey, too, was admittedly nervous, but that is not exactly a new feeling for him.

“I’ve been worrying since I was in high school. Most of my mindset is just worrying. You know, part of what drives me is just that, you know, that anxiety of not living up to my potential or not being able to play. So, that’s definitely something that’s always in my head transparently,” McCaffrey said. “But I think that’s the beauty of training. Whenever that’s kind of how you start, and then you train and train and train and do all the things you can to get to where you want to be, which will instill confidence that, you know what? I trust my training. I know that I can do this now. I feel good about where I’m at.”

San Francisco 49ers running back Christian McCaffrey, right, celebrates his touchdown with offensive tackle Trent Williams during the first half of an NFL football game against the Los Angeles Rams Sunday, Sept. 17, 2023, in Inglewood, California. (AP Photo/Ashley Landis)

CLICK HERE TO GET THE FOX NEWS APP

McCaffrey will be 30 years old by the time he plays meaningful football again, but after nearly another 1,000-1,000 yard season, there’s not much to worry about.

Follow Fox News Digital’s sports coverage on X, and subscribe to the Fox News Sports Huddle newsletter.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports7 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat3 hours ago

NewsBeat3 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business23 hours ago

Business23 hours agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World23 hours ago

Crypto World23 hours agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World22 hours ago

Crypto World22 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation