Crypto World

Crypto PACs Amass Millions Ahead of Midterms

As the United States moves toward the 2026 midterm elections, crypto industry lobbying and fundraising activity has accelerated, highlighting a strategic shift in how the sector seeks to shape policy. Super PACs linked to crypto interests have begun pooling funds, with a notable fundraising push that includes a main industry vehicle and prominent tech donors. The landscape features a blend of bipartisan engagement and party-aligned advocacy, underscored by legislative efforts such as the CLARITY Act, which has stalled in the Senate even as committees in the House advance. This push comes amid a broader backdrop of regulatory scrutiny, market volatility, and debates over how best to foster innovation while protecting consumers.

Key takeaways

- The crypto sector’s political spending surged last cycle, with total contributions reaching at least $245 million in 2024, signaling a robust, well-funded lobbying posture ahead of midterm elections.

- Fairshake, the industry’s leading super PAC, raised about $133 million in 2025 and now holds more than $190 million in cash on hand, reflecting significant donor commitments from major players including a16z, Coinbase, and Ripple.

- Discontent about influence in Washington is real among reform groups, who warn that large, industry-aligned money can marginalize ordinary voters and complicate democratic processes.

- Crypto donors are pursuing a bipartisan strategy, supporting both parties or pivoting to align with policymakers who promise a friendlier regulatory environment, while some in Congress push for a unified framework like the CLARITY Act.

- Historical context matters: the sector’s political clout has grown since the 2020–2021 lobbying surge and the FTX collapse, which did not halt the industry’s push to engage lawmakers and shape policy on market structure and consumer protection.

Tickers mentioned: $BTC, $ETH, $COIN

Market context: As the midterm cycle sharpens, the crypto lobby’s visibility in Washington mirrors broader regulatory debates and a shifting investment climate. The policy trajectory—particularly around market structure and stablecoins—remains uncertain, even as lobby groups deploy sizable resources to influence committees and votes.

Why it matters

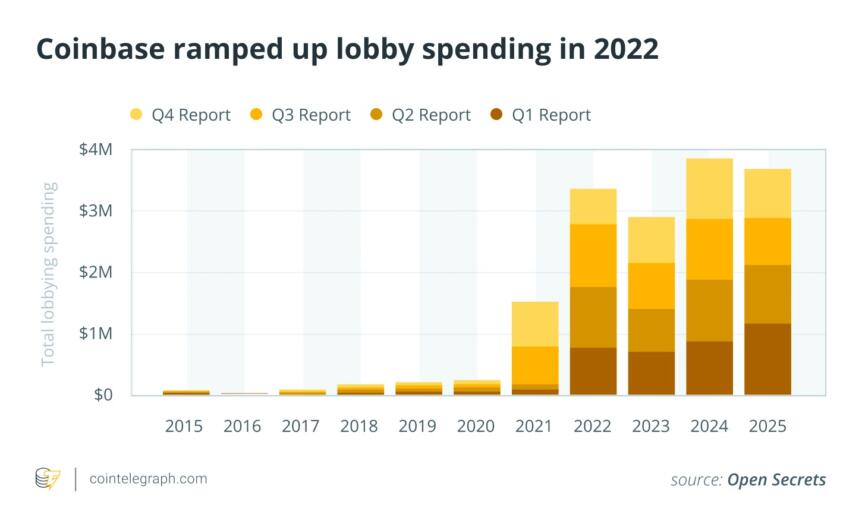

The scale of money funneled into crypto lobbying marks a meaningful departure from earlier eras of campaign finance. Industry-aligned super PACs have become major players, capable of marshaling independent expenditures and transfers to allied committees in a way that can outpace more traditional advocacy channels. This dynamic matters for users, investors, and builders because policy decisions—ranging from regulatory clarity to enforcement actions—directly affect product innovation, market access, and consumer protections.

Observers say the growing influence of well-funded crypto PACs is changing the calculus inside Congress. While some lawmakers welcome clearer rules and a predictable regulatory environment, critics argue that high-dollar donations risk sidelining everyday constituents and distorting legislative priorities. The tension between fostering innovation and imposing guardrails is at the core of ongoing debates about market structure, stablecoins, and the broader crypto economy. The argument is not merely about dollars and elections; it touches the core question of how the American political system can balance rapid technological change with responsible oversight.

Within this landscape, the industry’s messaging is increasingly tailored to bipartisan themes, while some prominent figures invest in politically aligned avenues that promise favorable outcomes. The Winklevoss twins’ support for a conservative pro-crypto fund, for example, underscores a strategic tilt toward candidates perceived as crypto-friendly, even as others push for more centrist or Democratic support to maintain broad accessibility to policymakers. The result is a more nuanced, multi-faceted lobbying approach that seeks to hedge policy risk across party lines and ideological spectrums.

Looking back, the sector’s political activity has evolved alongside its own evolution as a market sector. During the 2020–2021 bull run, crypto firms ramped up advertising and public-relations campaigns, while high-profile names in the industry entered politics or attempted to influence policy through visible campaigns. The FTX saga and related enforcement actions accelerated a broader embrace of Washington engagement, as industry participants sought to define a path toward functioning product rails under a potential regulatory framework.

In Congress, the debate often centers on balance. Proponents argue that a comprehensive framework could unlock innovation and reduce uncertainty, while opponents warn against overreach that could stifle the development of new financial products. The debate around a major piece of legislation, commonly referred to as the CLARITY Act, illustrates this tug-of-war: supporters contend that clear rules would legitimize the sector and invite responsible participants to operate within a defined system, whereas critics warn that the bill may still fall short of satisfying industry stakeholders and ethics officials in the Senate.

One notable donor in the crypto space—Bankman-Fried—made headlines years earlier with immense campaign contributions, a fact cited by prosecutors as part of a broader indictment about how influence was used to push for policies favorable to his business interests. His case serves as a cautionary backdrop to current financing strategies, illustrating how the line between political advocacy and business priorities can blur in high-velocity markets. While Bankman-Fried has faced severe legal scrutiny, the broader ecosystem continues to pursue access to policymakers, albeit with increased attention on governance, compliance, and transparency.

As the 2024 cycle demonstrated, crypto funding did not merely surge; it also diversified. The Fairshake network, originally built as a single-issue pro-crypto fund, grew into a hub for multiple committees and independent expenditures. Its disclosed activity included substantial support for Democrats during the 2023–2024 period, alongside other, more conservative-aligned committees. This diversification is indicative of a broader strategy: deploying resources to achieve leverage across the political spectrum, while maintaining an emphasis on lawmakers perceived as aligned with crypto-friendly regulatory approaches.

“Super PACs are increasingly becoming in vogue for special interests who want to make their presence known in Washington,” said Michael Beckel, research director of Issue One, noting that large, industry-backed reservoirs of cash have become a significant force in shaping policy outcomes. As a result, the cadence and flow of money—both donations and independent expenditures—have become a persistent feature of the policy landscape, with significant implications for how regulations are written and how quickly they move through Congress.

“Industry-aligned super PACs with huge bank accounts have made a huge splash and helped thwart new regulations on their business interests.”

Beyond the halls of Congress, attention has turned to broader governance questions, including the ongoing debate around market structure, consumer protections, and the role of stablecoins in a broad financial ecosystem. The White House has hosted closed-door discussions among crypto and banking leaders in a bid to bridge gaps, but public progress remains cautious, with officials signaling that meaningful consensus may require additional time and negotiation. The dynamic between White House oversight, Senate deliberations, and industry lobbying will likely shape the regulatory timetable for years to come.

As election season resumes, the crypto lobby’s influence remains a core variable in policy outcomes. The sector’s strategy—balancing donor networks, bipartisan outreach, and legislative pressure—highlights how political influence now intersects with technology policy in a way that goes beyond traditional lobbying. If lawmakers can craft a coherent, forward-looking framework that protects consumers while enabling innovation, it could mark a watershed moment for both the crypto industry and the broader financial ecosystem. If not, the divergence between policy ambitions and practical implementation could prolong regulatory uncertainty for years ahead.

What to watch next

- Tracking the CLARITY Act’s status in the Senate and any new consensus on market structure legislation (dates and committee votes).

- Updates on major crypto donors’ disclosures and whether new transparency rules affect PACs and independent expenditures.

- White House-industry talks outcomes and potential regulatory proposals touching stablecoins and consumer protections.

- Upcoming midterm dynamics and how shifts in party control may influence crypto-friendly policy initiatives.

- Monitoring any shifts in the funding strategy of Fairshake and its affiliated committees as the 2026 cycle approaches.

Sources & verification

- FEC committee records for Fairshake (C00835959) and its 2024–2025 activity.

- Open Secrets data on Fairshake expenditures and donor contributions from 2023–2024.

- Reuters reporting on Bankman-Fried’s political donations and related investigations.

- Politico commentary on the blockchain network and party strategy in 2025.

- Senate roll-call votes related to the GENIUS Act and related crypto policy debates.

Crypto money and the midterm race: donors, policy, and power

Political action committees representing the crypto industry have already mobilized substantial funding as the United States heads toward its 2026 midterm elections. The focal point is a blend of large, unrestricted sums and more targeted campaigns designed to influence key policymakers and committees. The industry’s flagship super PAC, Fairshake, has emerged as a central vehicle for fundraising and political spending, with documented contributions and independent expenditures that exceed a century-and-a-half in collective capacity when combined with allied groups.

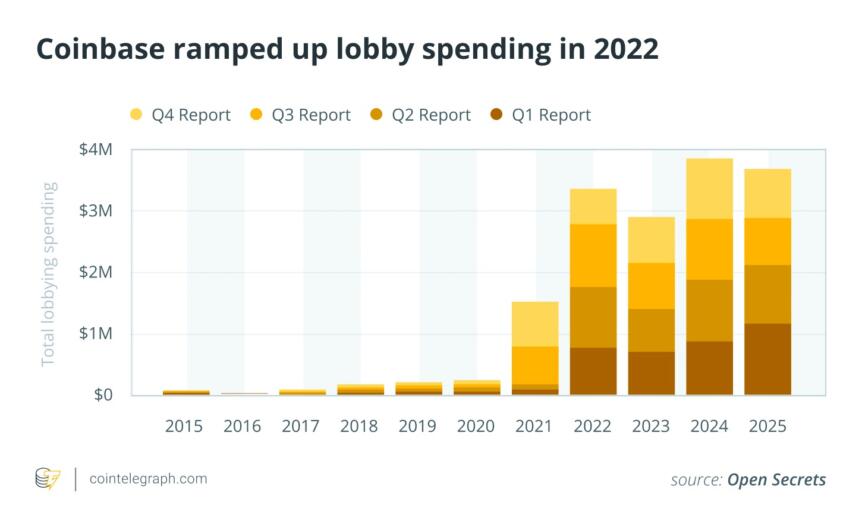

Last year, the crypto industry spent at least $245 million on campaign contributions, a figure that underscored the sector’s appetite for influence. The main super PAC funded by the industry, Fairshake, raised about $133 million in 2025, and its cash on hand now exceeds $190 million. Notable backers include venture-capital powerhouse a16z which contributed an initial $24 million, with Coinbase and Ripple each donating $25 million. The scale here is not merely academic: it represents a deliberate attempt to tilt regulatory and legislative outcomes in ways that supporters argue will create a more predictable environment for innovation and growth, while critics warn of the democratic perils of concentrated influence.

Activist groups have pressed back, arguing that large, industry-backed money undermines the voice of everyday Americans. “This kind of influence buying ultimately undermines the democratic process by marginalizing everyday Americans, ensuring that their voices and interests take a backseat to the crypto industry’s deregulatory desires,” said Saurav Ghosh, director of the Campaign Legal Center. The concern is not limited to the abstract; it centers on the real-world risk that policy outcomes could skew toward a narrow set of corporate interests rather than broad public goals, particularly as midterm dynamics favor the party controlling the House, Senate, or White House.

The broader political calculus shows crypto lobbying pursuing a degree of bipartisanship, even as the industry remains most comfortable with a regulatory posture that favors innovation. The Senate’s posture toward the CLARITY Act remains a barometer of how far policymakers are willing to go in crafting a comprehensive framework. The act advanced in the House this summer, but in the Senate it has yet to reach a conclusion that satisfies the governance and ethics concerns raised by many Democrats. In the interim, crypto advocates have sought to demonstrate broad-based appeal, balancing support within both major parties and pushing a long-term vision of a policy regime that accommodates new financial technologies without compromising consumer protections.

Publicly, some in the industry emphasize the necessity of nonpartisan engagement. Representative Sam Liccardo, a crypto-friendly Democrat, suggested that no industry should “put eggs in one basket,” signaling a preference for diversified political support. Yet others warn that aligning too closely with one party could backfire as political winds shift. The Winklevoss twins’ strategic donations to Digital Freedom Fund illustrate how industry actors are attempting to influence the policy conversation from multiple angles, covering both conservative and liberal lanes in pursuit of favorable regulatory outcomes.

The policy dialogue has also intersected with discussions about market structure and consumer protections, with Coinbase’s leadership engaging in public debates about proposed restrictions on stablecoin yields. Coinbase argued that a blanket ban could stifle innovation and impede legitimate financial services, while supporters of tighter controls contend that consumer safety cannot be compromised in the name of rapid innovation. The White House has attempted to broker a dialogue on these issues, hosting a closed-door summit with leaders from both crypto and banking sectors; however, Reuters reports that the gathering did not yield a definitive breakthrough on policy alignment.

The broader context is a political environment in which the crypto industry’s influence is increasingly visible and, for some observers, troubling. Critics warn that a system in which wealthier donors shape policy can cast doubt on the electorate’s ability to influence outcomes. Election-oversight advocates argue that this trend could erode trust in democratic institutions if policy results appear engineered to accommodate corporate interests rather than public benefit. In this light, the ongoing lobbying activity surrounding the CLARITY Act, the market structure debate, and related regulatory proposals will be essential to watch as the 2026 midterms approach.

As with any sector undergoing rapid evolution, the stakes are high for users, investors, and builders who rely on a stable, transparent policy framework. The current cycle demonstrates that money, messaging, and momentum can affect the speed and direction of regulatory developments, even in a landscape as complex and dynamic as crypto. The coming months will reveal whether policymakers can translate high-level objectives into clear, workable rules that support innovation while safeguarding the integrity of financial markets.

Crypto World

Turn $100 Into $300 Now With Remittix – Project Rewards Presale Buyers With 300% Bonus

Investors searching for the best crypto to buy now are increasingly focusing on projects that provide real infrastructure alongside structured early participation incentives. Among these projects, Remittix is gaining popularity with its PayFi payment framework and its 300% allocation incentive that is limited.

As discussions regarding cryptocurrency with actual use continue to grow, Remittix is included in discussions regarding the use of blockchain technology for payments and actual use of cryptocurrency.

Market participants are not only evaluating future price movement potential but also looking at how early allocation incentives can influence entry positioning. With the Remittix ecosystem progressing through product launches and rollout milestones, attention is shifting toward participation timing as access windows narrow across the platform.

Allocation Windows Tighten As Bonus Multiplier Drives Demand

Remittix is valued at $0.123 per RTX token, making it a part of the search discussions on the top crypto under $1. Remittix has managed to raise over $29 million from private funding, which is a clear indication of the demand for the blockchain infrastructure focused on payments.

Over 703 million tokens out of the 750 million available have already been secured. This is a clear indication that over 93% of the total allocation is no longer available. Participation activity has accelerated as availability continues to shrink across the ecosystem.

A major factor behind this surge is the 300% bonus available via email, allowing participants to receive up to three times more RTX tokens compared to their initial allocation. This incentive is widely viewed as one of the strongest allocation multipliers currently available among early stage crypto investment opportunities.

Infrastructure Launch Timeline Strengthens Real Utility Narrative

Remittix is widely recognized as a Remittix DeFi project focused on solving cross-border payment inefficiencies. The ecosystem is entering a critical rollout phase, supported by the Remittix Wallet already live on Apple devices while Android deployment continues toward release.

The broader PayFi platform is scheduled to go live on the 9th February 2026, marking the first full release of the crypto-to-fiat infrastructure. The platform aims to allow users to send digital assets directly into traditional bank accounts, addressing one of blockchain’s largest real-world adoption challenges.

Users can track ecosystem progress and allocation access directly through the Remittix platform homepage, where dashboard tools allow allocation monitoring and reward tracking.

As the platform rollout approaches, participation timing is becoming a major focus. Investors tracking how to buy crypto early are positioning themselves before broader payment infrastructure deployment expands user access.

Security Verification And Exchange Expansion Build Market Confidence

Remittix recently achieved a major credibility milestone after receiving full verification from CertiK. The project is also ranked as the #1 pre-launch token on CertiK, strengthening investor confidence and highlighting platform transparency.

The full security verification details can be reviewed through CertiK’s Remittix audit listing, which confirms project security standards and infrastructure validation.

The project has also revealed upcoming centralized exchange partnerships with BitMart and LBank. These future listings are expected to expand liquidity, increase accessibility and improve global exposure for RTX holders once trading access opens.

Allocation tracking, bonus activation and participation tools remain available through the Remittix dashboard portal, where referral rewards and allocation monitoring are currently active.

Core Factors Supporting Remittix Ecosystem Growth:

- Crypto-to-bank transfers designed for global payment efficiency

- Wallet infrastructure already deployed and expanding

- CertiK verification reinforcing platform security

- Global PayFi rollout targeting cross-border finance

- Referral rewards offering 15% USDT returns for ecosystem growth

Referral Rewards Expand Community-Driven Adoption

Remittix recently introduced a referral program allowing participants to receive 15% of new allocations in USDT, claimable every 24 hours through the dashboard. The program is helping accelerate ecosystem expansion while rewarding early network contributors.

The referral structure is designed to increase liquidity growth and broaden global participation. Many community members are using referral participation as an additional allocation strategy while supporting project expansion across new regions.

Final Allocation Phase Before PayFi Infrastructure Goes Live

Remittix is entering one of the most time-sensitive phases of its rollout as the PayFi platform launch approaches. With security verification completed, exchange partnerships revealed and wallet infrastructure already deployed, the ecosystem is transitioning toward full payment network deployment.

With over 93% of token allocation already secured, remaining access is narrowing rapidly. The 300% email allocation multiplier continues to drive strong participation as investors race to secure remaining availability.

As infrastructure rollout accelerates, the final allocation phase is expected to close quickly, marking one of the last opportunities to secure expanded RTX participation before broader ecosystem activation begins.

Discover the future of PayFi with Remittix by checking out their project here:

Website: remittix.io

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

XRP Sees Impressive Recovery Wick With Massive 37% Price Surge: Here’s Why

Ripple’s token has also surpassed BNB in terms of market cap after its sublime surge.

It was just hours ago, less than a day, when we wrote about XRP’s spectacular collapse as the asset plummeted to $1.11 for the first time since before the US presidential elections at the end of 2024.

This meant that it had shed over 50% of its value in a month as it peaked at $2.40 on January 6. Oh, how the landscape in crypto can change in hours sometimes, not even days or weeks.

What happened with XRP’s price since that local low has been nothing short of amazing. There were some signs about a potential rebound, such as the plummeting RSI metric, but even the most vocal XRP bulls were probably surprised by the extent of the rally.

After all, the cross-border token skyrocketed by 37% in about 18 hours – going from the aforementioned low to $1.54 before it faced some resistance and now trades around $1.50. This still represents a 34% surge in less than a day.

Santiment also weighed in on the token’s performance. The analysts acknowledged XRP’s rise in terms of market cap as well, as it now sits above BNB as the fourth-largest crypto asset.

They blamed the massive price pump in the past several hours on the overall network stability and growing activity on the XRP Ledger. Moreover, they showcased a chart indicating that Ripple whales went on an accumulation spree, with almost 1,400 separate $100K+ whale transactions (the highest in four months).

📈 Crypto markets are rebounding, but $XRP‘s price has been on a particularly huge tear. Since bottoming out below $1.15 just under 18 hours ago, the #4 market cap has now recovered to back above $1.50.

😱 Panic sellers should have stopped to notice the massive activity on the… pic.twitter.com/3y0eyGxpo2

— Santiment (@santimentfeed) February 6, 2026

You may also like:

The ETF behavior will also be interesting to compare, but we would need to verify the data at the end of the trading day in the US. Preliminary data on SoSoValue shows a minor net inflow even for yesterday, but there’s no official confirmation as of yet, which is rather surprising.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Galaxy Authorizes $200M Share Buyback Amid Crypto Market Downturn

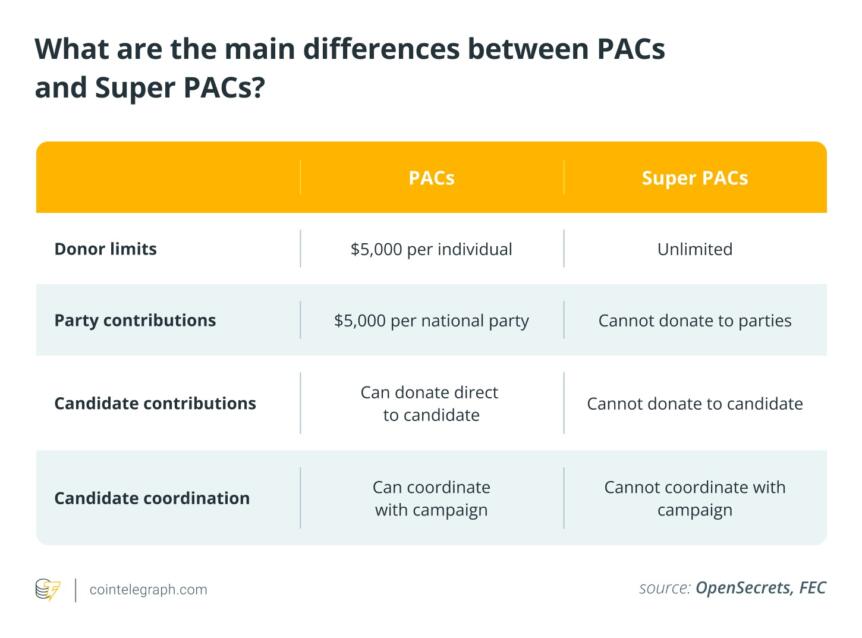

Galaxy Digital Inc. (Nasdaq: GLXY) has authorized a share repurchase program of up to $200 million, allowing the company to buy back its Class A common stock over the next 12 months.

According to a company announcement, the repurchases may be conducted on the open market or through privately negotiated transactions, including under Rule 10b5-1 trading plans, and remain subject to applicable securities laws and exchange rules. The program does not obligate Galaxy to repurchase any shares and may be suspended or discontinued at any time.

The buyback program has a term of 12 months and, if conducted on the Toronto Stock Exchange, remains subject to regulatory approval under a normal course issuer bid. Purchases made on Nasdaq would be capped at 5% of Galaxy’s outstanding shares at the start of the program, according to the announcement.

Galaxy is listed on the Nasdaq and the Toronto Stock Exchange and operates across digital asset trading, asset management, staking, custody and data center infrastructure. The company did not disclose how much of the $200 million authorization it expects to use, or when repurchases might begin.

Mike Novogratz, founder and CEO of Galaxy, said the company is “entering 2026 from a position of strength,” adding that its balance sheet and ongoing investments give it flexibility to return capital when management believes the stock is undervalued.

The news comes three days after Galaxy reported a net loss of $482 million for the fourth quarter of 2025 and a $241 million loss for the full year, citing lower digital asset prices and about $160 million in one-time costs.

At the time of writing, shares of Galaxy were up about 17% over 24 hours, but remained down about 25% for the month, according to Yahoo Finance.

Related: Optimism passes buyback proposal to bolster OP token

Market downturn impacts crypto stocks

Galaxy’s recent share-price decline reflects a broader pullback across crypto-related equities, as Bitcoin has fallen over the past month from January highs above $97,000 to to a low of about $60,300 on Thursday.

Shares of Coinbase Global (COIN) were down about 36% over the past month, while Circle Internet Group (CRCL) fell about 34% over the same period and about 65% over six months.

Strategy (MSTR), the largest public holder of Bitcoin with 713,502 BTC on its balance sheet, has fallen about 20% over the past month and nearly 68% over six months. Cointelegraph reported Thursday that the company posted a $12.4 billion net loss in the fourth quarter of 2025.

Bitcoin mining stocks have also declined, with MARA Holdings (MARA) down about 27% over the past month and about 52% over the past six months, while IREN Limited (IREN) is down about 8% on the month.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Samson Mow Breaks Down Bitcoin Market Crash

In a video interview, Samson Mow shares his views on Bitcoin’s latest bloodbath, quantum fears and the catalysts that could drive Bitcoin’s next recovery.

In an exclusive Cointelegraph interview, Bitcoin OG Samson Mow shares his perspective on Bitcoin’s latest massive crash, what’s driving the sell-offs and why a rebound could be closer than most expect.

We discuss gold and silver’s rally, forced liquidations, the “quantum threat” to crypto, and examine the long-term Bitcoin thesis: Is Bitcoin truly designed to rise in price due to fiat devaluation, or is that a flawed narrative?

After months of relentless selling pressure, sharp liquidations and growing bearish sentiment, many investors are asking the same question: Why does Bitcoin keep falling despite strong fundamentals, and when could it finally recover?

According to Mow, Bitcoin’s unique role as the most liquid asset in global markets, combined with its 24/7 tradability, makes it particularly sensitive to downside shocks that more traditional assets often avoid, at least in the short term.

The discussion also explores one of the most important dynamics in today’s market: the relationship between gold, silver and Bitcoin. After a powerful rally in precious metals, Mow lays out the case for why capital rotation from other hard assets may be setting the stage for Bitcoin’s next move.

If you’re trying to understand the nature of Bitcoin’s recent decline and what may come next, watch the full interview on our YouTube channel.

This interview has been edited and condensed for clarity.

Crypto World

Bitcoin’s Rollercoaster Ride Continues as BTC Price Recovers $10K in a Day

Bitcoin’s price jumped past $71,000 minutes ago, while XRP and other altcoins have produced massive double-digit daily gains.

What a ride it has been in the cryptocurrency space lately. The quick and sharp moves continue as of press time, as BTC has skyrocketed to over $71,000 just less than a day after it dipped to $60,000.

The altcoins are well in the green now on a daily scale, and the total crypto market cap has increased by roughly $200 billion since its low from earlier this morning.

Bitcoin’s price chart from above paints a very clear and volatile picture. It shows that the cryptocurrency plummeted by roughly $30,000 in the span of just over a week – from last Wednesday to Friday morning.

As reported earlier today, popular analysts blamed this latest crash, in which bitcoin dropped from $77,000 to $60,000 in about 24 hours, to emotional selling and structural change rather than broken fundamentals within BTC and the crypto market.

Since then, BTC has gone on a tear. It added over $10,000 since this morning’s multi-year low, and briefly surpassed $71,000 minutes ago before it was stopped and now trades inches below it.

The altcoins have produced even more impressive gains, with XRP leading the pack. Ripple’s cross-border token has soared by 19% daily to over $1.50 as of press time, while ETH has reclaimed the psychological $2,000 level.

The total value of wrecked positions daily is still over $2 billion, but most of it is from longs, which happened before today’s recovery. Nevertheless, over $350 million worth of shorts have been wrecked in the past 12 hours, with BTC responsible for the lion’s share ($261 million).

You may also like:

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Bitcoin gets slashed in half. What’s behind the crypto’s existential crisis

Bitcoin tumbled toward $60,000 this week as investors reassessed its utility. And while there isn’t one clear catalyst driving the bloodbath, one thing is clear: the crypto market is in crisis.

“There’s nothing going on in the marketplace that should have necessitated this type of a crash,” Anthony Scaramucci, founder and managing partner of alternative investment firm SkyBridge, told CNBC. “And so I think that’s made people, frankly, more fearful. … You have to ask yourself, ‘is it over for bitcoin?’”

Bitcoin fell as low as $60,062 on Thursday, bringing it to its lowest level since Oct. 11, 2024. That’s more than 52% off from its record high of $126,000 hit in early October 2025.

The previous session marked one of bitcoin’s bloodiest ever, with the token shedding more than 15% on the day. Its daily relative strength index fell to 18, putting the asset in extremely oversold territory. As of Thursday, other digital assets like ether and solana were also down 24% and 26% for the week to date, respectively — a sign investors’ confidence in the entire crypto market is faltering.

Bitcoin bounces, but losses loom large

Bitcoin was rebounding on Friday, with the token last trading at $69,631.97, up more than 9% on the day.

But, its recent drawdown has prompted investors to re-evaluate its utility, including its role as a digital currency or as a store of value. Simultaneously, institutional appetite for the flagship crypto appears to be waning as spot bitcoin exchange-traded funds record outsized outflows, threatening to drive bitcoin deeper into the red.

“This time is markedly different from other bear markets, however, in that it’s not in response to a structural blowup,” Jasper De Maere, desk strategist at crypto market-making firm Wintermute, said in a statement shared with CNBC. “It’s a fundamentally macro-driven deleveraging tied to positioning, risk appetite and narratives rather than systemic failures within crypto itself.”

Bitcoin prices over the past year

Over the past few months, investors have grown increasingly skeptical of efforts to recast bitcoin as “digital gold,” or an alternative to traditional safe havens such as gold. Bitcoin is down 28% over the past 12 months, while gold is up 72% during the same period — a testament to the latter’s utility as a hedge against macro risks.

Conversely, bitcoin has often traded down alongside other risk-on assets such as equities amid periods of high macroeconomic and geopolitical uncertainty, raising doubts about its utility as a safe haven. Nearly a week after Trump’s “liberation day” tariff announcement on April 2, 2025, bitcoin had fallen about 10% to below $80,000, while the S&P 500 had declined roughly 4%.

Separately, investors are also reassessing the extent to which financial institutions, treasury firms and governments are willing to adopt bitcoin — a major catalyst for the token in recent years.

Large institutional outflows are mounting as investors brace for bitcoin to go lower, thinning liquidity for the token, according to a recent analyst note from Deutsche Bank.

Those outflows are also noticeable among spot bitcoin ETFs in recent months, according to the investment firm. The funds have seen outflows of more than $3 billion in January, in addition to roughly $2 billion last December and about $7 billion last November.

Additionally, a swath of Strategy copy-cats that emerged over the past year or so have slowed or paused their bitcoin purchases amid the digital asset’s correction.

Finally, traders have acknowledged that long-time efforts to market bitcoin as an alternative to fiat currencies have largely faded. While Steak ‘n Shake and Compass Coffee have rolled out support for bitcoin payments in recent years, initiatives to make the asset a form of payment have largely died, particularly as interest in dollar-pegged stablecoins grows, according to Bitwise’s Ryan Rasmussen.

“We’re seeing Wall Street adopt stablecoins because it is a fundamental transformation of the way payments work, and bitcoin is just a different asset. It’s not meant for that today,” Rasmussen said, arguing that the token’s purpose has evolved from that of a currency to a decentralized, non-governable store of value. “I’ve never paid for coffee or a sandwich with Bitcoin, and I never will.”

And beyond those more immediate concerns, investors are also increasingly worried that bitcoin’s underlying network could be hacked, driving the token to zero.

“It certainly is a risk that is seeing more attention from investors as they’re getting more worried about [it], and I think you’re seeing a little bit of that risk priced into bitcoin,” Rasmussen said.

He noted that Bitwise has allocated funds toward efforts to mitigate the threat from quantum computing.

Nevertheless, traders’ appetite for bitcoin has largely dwindled, denting its price. That’s true even as long-time believers are still proudly betting on bitcoin, despite of the charts and the naysayers.

“I believe that the story is intact,” said Scaramucci, adding that he bought bitcoin for his fund on Thursday. “But, I don’t have a crystal ball. … Who the hell knows.”

Crypto World

PBOC Officially Bans ‘Unapproved’ Yuan-Pegged Stablecoins

The People’s Bank of China (PBOC), the country’s central bank, and seven Chinese regulatory agencies published a joint statement on Friday banning the unapproved issuance of Renminbi-pegged stablecoins and tokenized real-world assets (RWAs).

The ban applies to both domestic and foreign stablecoin and tokenized RWA issuers, according to the statement, which was also signed by the Ministry of Industry and Information Technology and China’s Securities Regulatory Commission. A translation of the announcement said:

“Stablecoins pegged to fiat currencies perform some of the functions of fiat currencies in disguise during circulation and use. No unit or individual at home or abroad may issue RMB-linked stablecoins without the consent of relevant departments.”

Winston Ma, an adjunct professor at New York University (NYU) Law School and former Managing Director of CIC, China’s sovereign wealth fund, told Cointelegraph that the ban extends to the onshore and offshore versions of China’s Renminbi, also called the yuan.

“The Beijing crypto ban rule applies across all RMB-related markets, whether CNH or CNY,” he said. CNH is the offshore version of the Renminbi, designed to give the currency flexibility in foreign exchange markets, without sacrificing currency controls, Ma said.

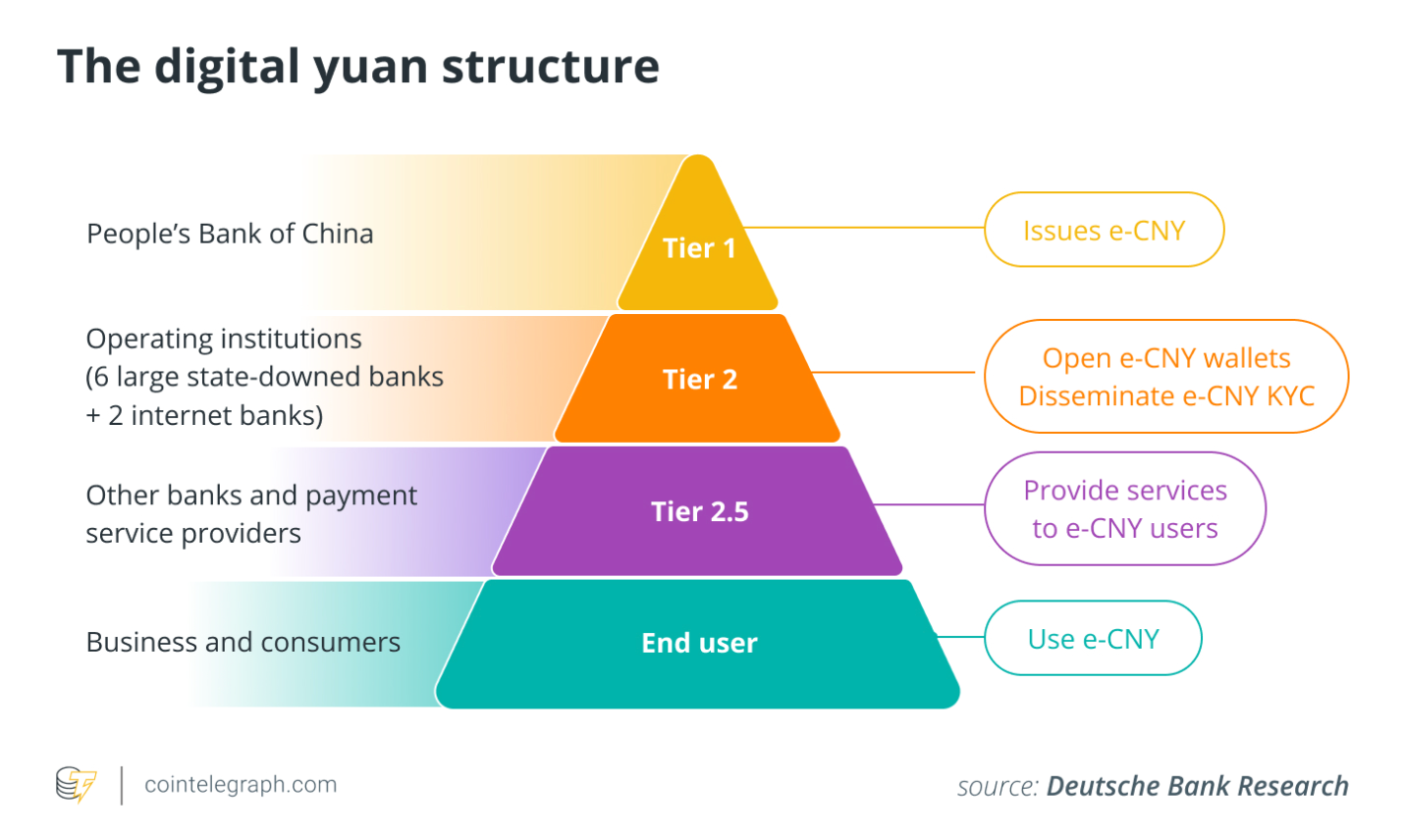

“This is the latest step in a multi‑year project: Keep speculative crypto outside the formal financial system, while actively promoting the usage of e-CNY, the sovereign CBDC issued by China’s central bank,” he said.

The announcement follows the Chinese government approving commercial banks to share interest with clients holding the country’s digital yuan, a central bank digital currency (CBDC) managed by state authorities.

Related: China’s interest-bearing digital yuan piles pressure on US stablecoin rules

Chinese government briefly considered yuan-pegged stables, but focused on CBDC instead

In August 2025, reports began circulating that China’s government was considering allowing private companies to issue yuan-pegged stablecoins, a major reversal of long-standing policy.

However, the Chinese government restricted stablecoin and digital asset issuance in September of that same year, instructing stablecoin issuers to pause or halt their stablecoin trials until further notice.

In January 2026, the PBOC approved commercial banks paying interest to digital yuan wallets in a push to make the CBDC more attractive to investors.

Magazine: China officially hates stablecoins, DBS trades Bitcoin options: Asia Express

Crypto World

Ending In 24 Hours, Be Fast! Remittix Secures Top Altcoin Spot After 300% Crypto Bonus Offer

Crypto markets have this funny habit of rewarding urgency right when most people are feeling hesitant. When Bitcoin chops sideways, Ethereum news turns into ETF chatter and big-cap altcoins start moving like slow trucks instead of sports cars, traders don’t stop hunting, They just switch lanes. That’s exactly the backdrop Remittix (RTX) is taking advantage of right now.

Because while the broader market is busy arguing about “what’s next,” Remittix has been stacking the kind of signals that usually show up right before a presale breaks into the mainstream conversation: a live product, a fixed launch date, major listings lined up and a 300% bonus window that’s now in its final stretch.

Why the Market Suddenly Cares About “PayFi” Again

A few years ago, payment tokens were mostly “promises.” Now they’re turning into one of the most practical categories in crypto, because real money movement is still weirdly hard in a world full of blockchains.

Even with stablecoins everywhere, the last mile is still messy:

- cashing out without getting clipped by FX spreads

- sending money cross-border without delays

- getting paid as a freelancer without jumping through hoops

That’s the niche Remittix is leaning into with its PayFi model: Send crypto, recipient gets fiat in their bank account, with pricing shown upfront. It’s not just a whitepaper story anymore.

The Credibility Jump: Wallet Live + Launch Date Locked

This is a big reason Remittix is being treated differently from the average presale. The Remittix Wallet is already live on Apple’s App Store not “coming soon”. The PayFi platform launch is confirmed for February 9th, 2026

That mix of a working consumer product and a fixed platform rollout date is exactly what investors look for when separating substance from pure marketing.

Then there’s the element driving the most conversation: the 300% bonus. In real terms, incentives of this scale don’t merely boost interest, they accelerate decision-making. Investors who might typically wait for exchange listings are stepping in earlier, recognizing the clear entry advantage. Several outlets have already framed the bonus as a narrow window, one that’s fueling a noticeable surge in participation.

“Top Altcoin Spot”: What That Actually Means

Whenever you see phrases like “top altcoin spot,” it’s usually shorthand for a mix of:

- trending attention (search + social + media pickup)

- unusual presale velocity

- a narrative that’s easy for non-crypto people to understand

Remittix is getting that kind of lift right now partly because “crypto-to-fiat bank transfers” is a story even skeptics can grasp. The bonus has pushed it into broader discussion across crypto news coverage as a top-of-mind presale topic.

The Exchange Question Everyone Is Asking Next

Whenever a presale starts accelerating like this, the market inevitably jumps to the same follow-up question: where will it trade first? In Remittix’s case, that part of the story is already taking shape.

The project has confirmed upcoming centralized exchange listings on BitMart and LBank, two platforms known for onboarding high-momentum presale tokens and giving early communities immediate access to liquidity. That confirmation alone separates Remittix from the majority of presales that are still hoping for listings rather than securing them in advance.

For investors, locked-in exchanges matter. They signal:

- A defined path from presale to open market

- Basic due diligence clearance by established platforms

- Reduced uncertainty around post-presale access

Now that these exchanges are in place, the conversation naturally shifts from whether Remittix will list to which exchange will be next, especially as the 300% bonus continues to attract new users and compress the presale timeline. In past cycles, this is often the stage where additional exchanges begin circling quietly, not wanting to be late to a token that’s already generating demand elsewhere.

The Real Reason This Setup Is Working

Strip away the hype and Remittix is benefiting from a simple recipe that tends to perform in crypto:

- A clear use case people actually need (payments, cross-border transfers)

- A visible product (App Store wallet)

- A fixed catalyst date (February 9th, 2026, platform launch)

- A short-term incentive that accelerates early participation (300% bonus)

When those four align, presales don’t usually “slowly trend.” They tend to move in bursts, especially as the bonus window tightens and late buyers realize the math is changing.

Discover the future of PayFi with Remittix by checking out the project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Rebuilding Global Payments with Stablecoins | Circle & USDC with Nikhil Chandhok

Stablecoins have quietly become the most successful use case in crypto.

Crypto World

Remittix Presale Holders Set To See A 5x This Week As Mega 300% Bonus Event Goes Live

Remittix (RTX) holders are positioning for gains this week as a mega 300% bonus event has gone live and early data shows strong participation momentum. Investors in the crypto market are analysing potential returns as Remittix’s recent adoption signals accelerate with downloads and wallet engagement.

The activated bonus means new buyers receive 300% extra tokens via email activation, which is driving demand and giving holders reasons to expect a 5x move in the short term.

With over 703 million tokens sold and the platform launch scheduled for 9th February 2026, Remittix is standing out as a top crypto under $1 project that blends incentives with early product engagement.

Remittix Sales And Bonus Event Fuel Short-Term Upside

Remittix has sold more than 703 million tokens from its total 750 million allocation, with tokens priced at $0.123 and funds raised exceeding $29 million, moving quickly toward the $30 million milestone.

This strong uptake shows that demand remains high, driven in part by the newly activated 300% bonus available via email signup. The bonus gives every new buyer a larger token allocation for the same contribution, which in turn boosts market activity.

Downloads of the Remittix wallet have increased as users prepare to engage with upcoming features. The wallet is currently live on the Apple App Store with a Google Play release underway, allowing holders to store, send and manage assets ahead of the full platform launch on 9 February 2026.

This product engagement supports the thesis that Remittix is gaining real user participation rather than passive speculation.

Market observers also note that incentives, when paired with growing usage, often correlate with increased interest and volume. The activated bonus, combined with a limited remaining supply, is creating conditions where holders see the potential for strong upside this week.

Why Remittix’s Fundamentals Support Continued Growth

Remittix’s appeal goes beyond short-term incentives. The project is positioned at the intersection of crypto, payments and global remittance, a market worth $19 trillion. The goal is to make Remittix the go-to crypto-to-fiat payment hub for merchants, users, and businesses worldwide.

This Remittix DeFi project roadmap includes a wallet, web app, fiat rails and API integrations for developers and payment providers, practical tools that give the token real utility.

Security and credibility are strong points for Remittix. The team is fully verified by CertiK, the gold standard in blockchain security and Remittix is ranked #1 on CertiK Skynet with an 80.09 Grade A score from over 24,000 community ratings. These metrics help build investor trust and reinforce confidence among holders and new entrants alike.

Remittix also offers a 15% USDT referral program, boosting participation beyond basic buying incentives. The project has already secured two CEX listings on BitMart and LBANK, with preparations in motion for a third major exchange listing once the $30 million raise is reached.

The upcoming full platform release on the 9th February 2026 marks a transition from early engagement to real utility as PayFi infrastructure begins rolling out. This scheduled launch, combined with the mega bonus event and rising wallet activity, gives holders multiple reasons to believe that strong moves could unfold this week and beyond.

Reasons Why Remittix Is Drawing Attention:

- Solving a real-world $19 trillion cross-border payments problem

- Utility first token model built around real transaction volume

- Deflationary tokenomics with growth potential

- Global payout rails are expanding with a focus on key remittance corridors

- Built for adoption rather than short-term speculation

Why This Week Could Mark A Turning Point For Remittix

Remittix’s activated 300% bonus, strong sales data, expanding product footprint and scheduled platform launch align in a way that supports both short-term interest and longer-term utility adoption. Early participants now see a potential path to meaningful gains, while the project’s growth signals continue to attract attention in the broader crypto market.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

-

Video4 days ago

Video4 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech2 days ago

Tech2 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Fashion7 days ago

Fashion7 days agoWeekend Open Thread – Corporette.com

-

Politics4 days ago

Politics4 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Crypto World6 days ago

Crypto World6 days agoU.S. government enters partial shutdown, here’s how it impacts bitcoin and ether

-

Sports6 days ago

Sports6 days agoSinner battles Australian Open heat to enter last 16, injured Osaka pulls out

-

Crypto World6 days ago

Crypto World6 days agoBitcoin Drops Below $80K, But New Buyers are Entering the Market

-

Crypto World4 days ago

Crypto World4 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports8 hours ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

NewsBeat4 hours ago

NewsBeat4 hours agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business1 day ago

Business1 day agoQuiz enters administration for third time

-

Crypto World7 days ago

Crypto World7 days agoKuCoin CEO on MiCA, Europe entering new era of compliance

-

Business7 days ago

Entergy declares quarterly dividend of $0.64 per share

-

NewsBeat3 days ago

NewsBeat3 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Sports4 days ago

Sports4 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat4 days ago

NewsBeat4 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat1 day ago

NewsBeat1 day agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World3 days ago

Crypto World3 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

Crypto World1 day ago

Crypto World1 day agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World24 hours ago

Crypto World24 hours agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation