Crypto World

Shiba Inu Sees Bullish Revival as Token Burn Rates Surge

Join Our Telegram channel to stay up to date on breaking news coverage

Shiba Inu (SHIB) is showing renewed bullish momentum after a sharp rebound in on-chain activity and a major spike in token burn rates.

Following a volatile session where SHIB defended key support, the meme coin pushed higher, climbing nearly 3% on the day to trade around $0.0000078 as traders responded to aggressive supply-reduction efforts.

The rebound comes as the wider crypto market starts to stabilize. Total market capitalization has climbed back above $3.12 trillion, Bitcoin has recovered toward $90,000, and Ethereum trades above $3,000.

These moves give SHIB a boost, since it often follows momentum in the Ethereum ecosystem. Market sentiment has improved as well, with the Crypto Fear and Greed Index rising from “Extreme Fear” to 29.

The crypto market’s Relative Strength Index (RSI) has bounced back to about 47 after dipping into oversold territory, signaling growing buying pressure and more stable prices. If the broader market keeps moving higher, the ShibArmy could push SHIB into a stronger, sustained uptrend.

Source – 99Bitcoins YouTube Channel

Shiba Inu Burn Surge Strengthens Bullish Supply Outlook

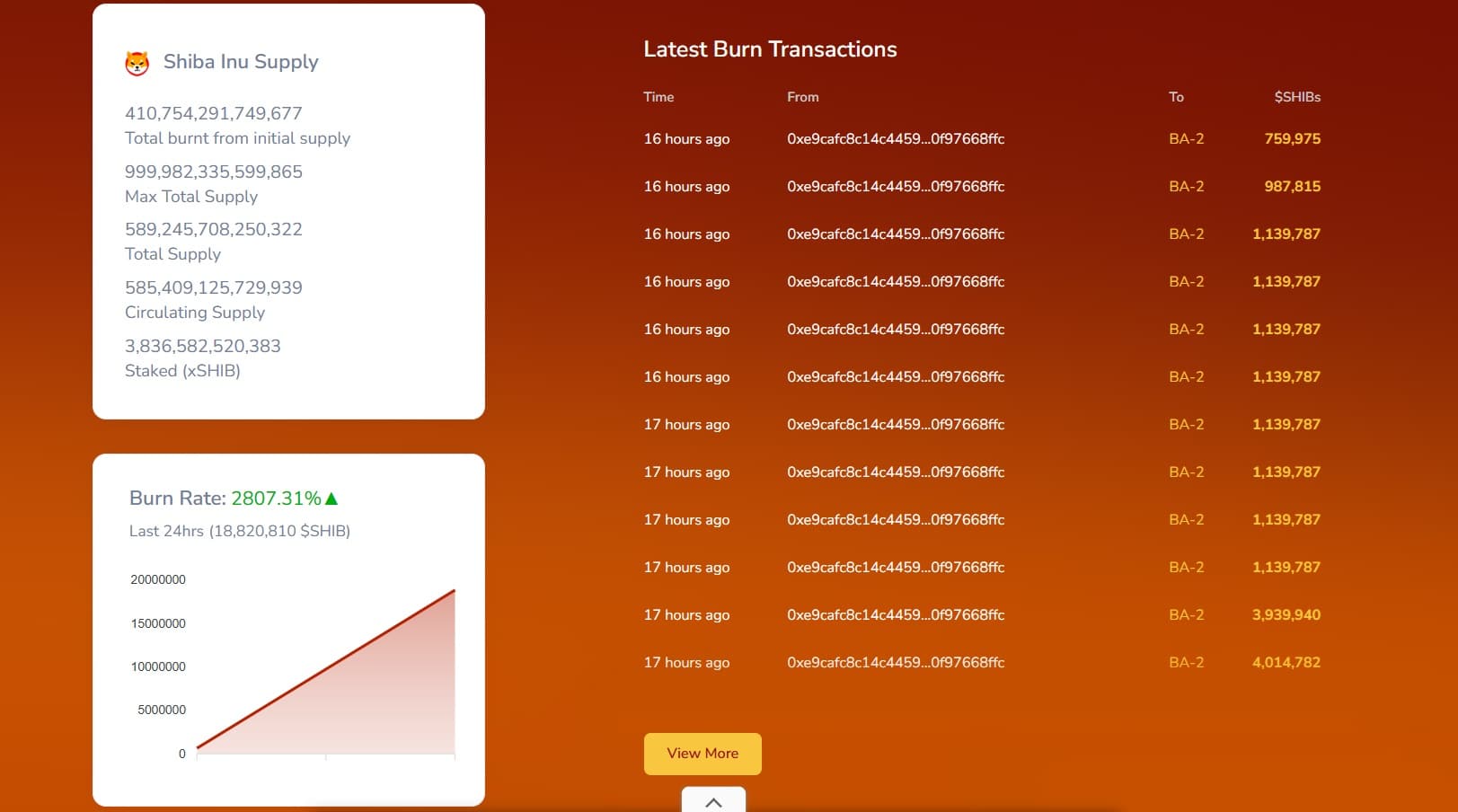

One of the strongest bullish signals for Shiba Inu right now comes from its aggressive deflationary mechanics. Over the past 24 hours, the ecosystem recorded a major surge in activity, with the burn rate jumping by 2,807%.

During this time, the network permanently removed more than 18.8 million SHIB tokens from circulation, sharply increasing efforts to tighten supply amid early 2026 market volatility.

This surge feeds into a broader shift in Shiba Inu’s supply structure. Although the project launched with one quadrillion tokens, the community has now permanently burned over 410 trillion SHIB.

Source – Shibburn Data

As a result, total supply stands near 589.2 trillion, with about 585.4 trillion tokens actively circulating. The community also continues to support long-term scarcity through staking, with roughly 3.8 trillion SHIB locked as xSHIB.

These numbers point to a clear, long-term strategy focused on reducing supply. In past market cycles, high burn activity combined with strong demand zones has often preceded major price rallies.

For many analysts, the ongoing drop in circulating supply strengthens the bullish case and positions SHIB to benefit from a broader return of market momentum.

Shiba Inu Price Prediction

Shiba Inu recently dropped into a historically significant demand zone that has sparked massive rallies of up to 300% in past cycles, with analysts pointing out that price action in this area often signals the early stages of major trend reversals.

From a technical standpoint, higher time frames show a bullish reversal wedge taking shape, suggesting that despite trading near recent lows, history could be setting up to repeat itself.

As of late January 2026, SHIB shows signs of quiet accumulation: the token sits down roughly 5% on the week but remains up more than 5% on the month, holding firm near the $0.00000750 support level.

This consolidation coincides with a sharp increase in burn rates and strengthening demand signals, reinforcing SHIB’s position as the second-largest meme coin by market cap and a top-tier candidate for investors positioning ahead of the next major market move.

Short-term indicators remain neutral but primed, with the MACD hovering slightly above the signal line and hinting at a potential bullish crossover, while a flat histogram awaits confirmation of fresh buying momentum.

At the same time, the RSI sits at a balanced 51, leaving ample room for upside before overbought conditions emerge.

On the price map, bulls target $0.00000850 as immediate resistance, followed by $0.00000900, while a breakdown below $0.00000750 risks a retest of the $0.00000700 support floor.

As SHIB pushes to regain bullish momentum through scarcity and community-driven burns, savvy investors in 2026 are diversifying into “utility-first” assets that address key network bottlenecks.

Bitcoin Hyper (HYPER) stands out as the best crypto presale to buy this quarter, having already raised over $31 million during its viral funding phase.

As SHIB Shows Strength, Bitcoin Hyper Rises as a High-Potential Altcoin

Rising Bitcoin prices could give Bitcoin Hyper a big boost by driving more presale interest and increasing demand for $HYPER once it starts trading on exchanges.

As BTC climbs, profit-taking by large holders often flows into higher-risk, higher-reward projects. In this environment, Bitcoin Hyper could attract more early investors who see its potential in a future, utility-focused Bitcoin ecosystem.

Over time, Bitcoin Hyper and Bitcoin will become closely linked. The project aims to expand BTC’s role beyond a store of value, letting it act as an active medium of exchange within the Layer-2 network it is building.

Every rollup needs a sequencer; the real question is how control evolves over time. Bitcoin Hyper starts simple with a single sequencer, but is designed to progress toward distributed, neutral sequencing anchored by Bitcoin itself.

Read the full article 👇… pic.twitter.com/c6HaL8RWpf

— Bitcoin Hyper (@BTC_Hyper2) January 28, 2026

The network supports apps built on the Solana Virtual Machine (SVM) while staying connected to Bitcoin through a canonical bridge. Users can wrap BTC to use it inside the Bitcoin Hyper ecosystem, where it powers DeFi, payments, and other applications.

When users exit, the wrapped BTC is burned, and the original BTC returns to the main chain, keeping Bitcoin’s security intact. From an investment perspective, $HYPER’s potential goes beyond the presale. The presale gives early access at a lower price before exchange listings.

If Bitcoin continues to rise and $HYPER hits the market, the token could attract even more capital as a higher-risk, higher-reward option, making it a prime candidate for the best altcoin to buy, especially as its ecosystem expands.

Bitcoin Hyper recommends using a top crypto wallet, like Best Wallet, when buying $HYPER. The token already appears in Best Wallet’s “Upcoming Tokens” section, making it easy for users to buy, track, and claim $HYPER once it launches.

Related News

- Get Educational Courses & Tutorials

- Free Content & VIP Group

- Jacob Crypto Bury Market Analysis Videos

- Leverage Trading Signals on Bybit

- Next 10x Altcoin Gems

- Upcoming Presales & ICOs

Join Our Telegram channel to stay up to date on breaking news coverage

Crypto World

Bitcoin Hovers Around $67,000 as Crypto Markets Drift Lower

Experts say volatility is cooling as investors await macro catalysts.

Crypto markets edged lower on Tuesday, Feb. 17, as traders remain cautious ahead of new economic data.

Bitcoin (BTC) is trading at about $67,500, down 0.5% over the past 24 hours, while Ethereum (ETH) is up 1% at $1,995. Other large-cap tokens are largely unchanged, with BNB trading at $618, XRP at $1.48, and Solana (SOL) at $85.

Meanwhile, the total cryptocurrency market capitalization stood near $2.39 trillion, down about 0.5% on the day, while 24-hour trading volume was $93.1 billion, according to CoinGecko.

Among top gainers, MemeCore (M) rose about 9%, Pi Network (PI) climbed 6%, and World Liberty Financial (WLFI) advanced around 4.2%.

On the downside, Quant (QNT) fell 3.7%, Worldcoin (WLD) dropped 2.7%, and Sky (SKY) slipped 2.3%.

Paul Howard, senior director at Wincent, noted in comments shared with The Defiant that volatility has cooled after the Feb. 6 spike, with markets now in a holding pattern as institutions hedge rather than take new directional bets.

Howard added that prices are likely to remain rangebound until a clear catalyst emerges, such as major macro or policy headlines. In the meantime, investors are watching this week’s initial jobless claims report.

Liquidations and ETF Flows

Roughly $193.7 million in leveraged crypto positions were liquidated over the past 24 hours, according to CoinGlass. Long liquidations accounted for $126.2 million, while shorts made up $67.5 million.

Bitcoin accounted for $77 million, while Ethereum followed with $44.9 million. More than 83,000 traders were liquidated during the same period.

In the exchange-traded fund (ETF) space, Bitcoin spot ETFs recorded $15.2 million in inflows on Feb. 13, while Ethereum spot ETFs posted $10.26 million in inflows.

Moreover, XRP spot ETFs added $4.5 million on the day, and U.S. Solana spot ETFs recorded $1.57 million in inflows.

Elsewhere

In traditional markets, precious metals were also lower on the day. Gold traded around $4,900, down 2.2%, while silver fell 4% to $74.20. Platinum slipped 1.4% to $2,033, and palladium declined 2.6% to $1,710.

Geopolitics were also in focus as U.S. officials said talks with Iran in Geneva made progress, CNN reported. Negotiations over Russia’s war in Ukraine also continued, with delegations set to resume talks after the initial meetings conclude.

Meanwhile, in Washington, the Department of Homeland Security remained shut down amid an ongoing policy standoff. Experts say this adds to both political and economic uncertainty.

Crypto World

Prediction Markets Working Group Will Support Push For Regulatory Clarity

Blockchain advocacy group The Digital Chamber has launched a new unit focused on supporting prediction markets and helping gain regulatory clarity for the sector in the US.

In an announcement via X on Tuesday, The Digital Chamber unveiled the Prediction Markets Working Group, outlining a multi-year plan to bring clarity to what it called a “misunderstood segment of finance.”

The Digital Chamber said the first course of action was sending a letter to Commodity Futures Trading Commission (CFTC) chairman Mike Selig praising his efforts to maintain federal jurisdiction over prediction markets, while also calling for an end to regulation by enforcement.

“In our letter, we applauded Chair Selig’s recent statements regarding the intent for CFTC staff to provide tailored rulemaking and guidance for this rapidly growing segment of the financial and digital asset industries,” The Digital Chamber said.

“For too long, operators in this space have navigated a maze of regulatory ambiguity including unclear overlaps between federal and state regulators,” it added.

Moving forward, the group plans to continue engaging with the CFTC, develop policy principles, submit policy recommendations, publish research and build a coalition of industry stakeholders and participants.

It also mentioned “participating in litigation” via friend-of-the-court briefings to educate courts on what it deems the “CFTC’s historic regulatory exclusivity” over the sector.

Prediction markets are heading to court

The move comes amid intense scrutiny of the sector from state governments and regulators.

Kalshi, one of the leading prediction market platforms, was hit with a civil enforcement action by the Nevada Gaming Control Board on Tuesday. The gaming board is calling for an injunction to stop Kalshi from offering “unlicensed wagering” in the state.

Both Kalshi and competitor Polymarket have seen multiple state regulators push to stop them from offering markets such as sports contracts in their respective states, arguing that they are offering unlicensed gambling products.

Last week, Polymarket filed a federal lawsuit against the state of Massachusetts to preemptively block any potential enforcement action, arguing that the CFTC has primary oversight over the sector, not state governments.

Related: Prediction markets should become hedging platforms, says Buterin

The CFTC chair has also been echoing such sentiments recently, urging state governments to respect the CFTC’s authority and oversight over the sector or risk facing them in court.

“Prediction markets aren’t new — the CFTC has regulated these markets for over two decades,” Selig emphasized in a video posted to X on Monday.

Responding to Selig on Tuesday, Utah Governor Spencer Cox welcomed any possible legal stoushes with the CFTC, labeling prediction markets as a form of gambling, which is “destroying the lives” of Americans.

“Mike, I appreciate you attempting this with a straight face, but I don’t remember the CFTC having authority over the ‘derivative market’ of LeBron James rebounds. These prediction markets you are breathlessly defending are gambling—pure and simple.”

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Crypto World

Italian banking giant Intesa Sanapolo discloses near $100 million bitcoin ETF holdings, along with Strategy hedge

Italian banking giant Intesa Sanpaolo disclosed $96 million in bitcoin ETF holdings and a substantial options position tied to Strategy shares, along with smaller crypto-linked exposure.

In a 13F filing for the quarter ending December 2025, the bank lists five spot bitcoin ETF positions, including $72.6 million in the ARK 21Shares Bitcoin ETF and $23.4 million in the iShares Bitcoin Trust, for a total exposure of just over $96 million.

It also includes a $4.3 million stake in the Bitwise Solana Staking ETF, which tracks the value of solana (SOL) and captures staking rewards.

The bank also posted a large put option position on Strategy, the largest corporate holder of bitcoin with 714,644 BTC on its balance sheet, valued at approximately $184.6 million.

That put option gives the firm the opportunity, but not the obligation, to sell MSTR shares at a specific price in the future. The position, coupled with the directionally long position on bitcoin ETFs, could reflect a trade capitalizing on the company trading above the value of its BTC holdings, as measured by the multiple of net asset value (mNAV), which compares enterprise value to bitcoin value.

Strategy was trading at 2.9 mNAV at one point and is now at 1.21 mNAV, according to its website. That gap closing would see the position make a profit as the stock price falls back to the level of its bitcoin holdings.

The filing also shows equity stakes in crypto-linked companies, including Coinbase, Robinhood, BitMine, and ETHZilla. These are minor positions, with the largest one of around $4.4 million being on Circle.

The filing uses the “DFND” (Shared-Defined) designation, indicating that investment decisions were made jointly by Intesa Sanpaolo S.p.A. and affiliated asset managers. Whether those asset managers are Intesa’s own trading desk or institutional clients remains unclear.

This structure is common when the parent bank exercises oversight or centralized strategy while subsidiaries execute trades. CoinDesk has reached out to Intesa Sanapolo for comment but hasn’t heard back at the time of writing.

The bank’s U.S. wealth management arm filed a separate 13F with no digital asset exposure.

Early last year, Intesa Sanapolo bought 11 bitcoin for over $1 million. The firm has had a proprietary trading desk in place for years, which also handles cryptocurrency trading.

Crypto World

Senate Asked to Not Axe Crypto Developer Protection Bill

Crypto industry lobby Coin Center has sent a letter to the US Senate Banking Committee urging it to follow through with a bill that seeks to prevent well-intended crypto developers from being prosecuted.

The Blockchain Regulatory Certainty Act (BRCA) was first introduced by House Representative Tom Emmer in September 2018, with a new version of the bill written last month by Senators Cynthia Lummis and Ron Wyden to clarify that software developers and infrastructure providers who do not control user funds are not money transmitters under federal law.

Coin Center policy director Jason Somensatto’s letter to the Senate Banking Committee, which he shared on Tuesday, further stated that blockchain innovation cannot thrive in the US when developers face constant threats of prosecution and that they deserve the same legal protections as ordinary internet developers.

“This is the same type of activity conducted every day by internet service providers, cloud hosting services, router manufacturers, browser developers, and email providers,” he said, adding that “we do not threaten those actors with prison when a criminal uses the internet, sends an email, routes traffic, or uploads files.”

“The same principle must apply to blockchain developers.”

Somensatto added that the “BRCA ensures that the next Satoshi Nakamoto, Vitalik Buterin, or Hayden Adams is able to develop the very systems that a market structure bill is designed to promote and protect.”

Coin Center is a Washington, DC-based non-profit think tank and advocacy center that focuses on public policy issues related to crypto and decentralized technologies.

Several crypto developers convicted in the US last year

Its push for crypto developer protections to coincide with the CLARITY Act comes amid several high-profile convictions of crypto developers last year.

Those convictions include Tornado Cash developer Roman Storm and Samourai Wallet founders Keonne Rodriguez and Will Lonergan Hill.

Related: When will crypto’s CLARITY Act framework pass in the US Senate?

All three were convicted of conspiracy to operate an unlicensed money-transmitting business in 2025. Rodriguez and Lonergan Hill were sentenced to five years and four years in prison, respectively, in November, while Storm is awaiting his sentencing date.

Weakening BRCA provisions could deter developers

The Senate Banking Committee is still reviewing the latest BRCA draft. It has not been marked up or voted on yet.

Somensatto said removing or even weakening provisions of the BRCA would lead to legal uncertainty for crypto developers, potentially deterring well-intended developers from operating in the US and pushing them offshore.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

company added 2,486 bitcoin last week

Strategy (MSTR) continued with its customary bitcoin purchases in the last week, adding 2,486 BTC for $168.4 million.

The company’s holdings are now 717,131 bitcoin acquired for $54.52 billion, or an average of $76,027 per coin. Bitcoin’s current price sits at $68,000, putting the company at a loss of about $8,000 per coin, or a total of about $5.7 billion.

Last week’s buys were funded via $90.5 million in common stock sales and $78.4 million in sales of the company’s STRC preferred series of stock, according to a Tuesday morning filing.

MSTR shares are lower by 3.2% in premarket trading and down more than 60% year-over-year.

Crypto World

Elemental Royalty Corporation Offers Dividends in Tether Gold

Elemental Royalty Corporation becomes the first publicly listed gold company to offer dividends in Tether Gold (XAU₮)

Elemental Royalty Corporation plans to offer dividends in Tether Gold (XAU₮), making it the first publicly listed gold company to embrace this financial model. According to the company, this move showcases the potential of tokenized assets in modern finance by integrating traditional gold with digital financial infrastructure.

Tether Gold (XAU₮) is a digital asset representing ownership of one troy ounce of gold on a London Good Delivery bar. It is available as an ERC-20 token on Ethereum and a TRC20 token on TRON, bridging the gap between conventional gold value and digital finance.

“Gold has always been one of the most trusted stores of value in the world, yet integrating it directly into modern financial distribution models has been difficult,” said Paolo Ardoino, CEO of Tether. “Using XAU₮ for shareholder dividends changes that dynamic completely. This marks a major step forward for the gold industry and shows how tokenized assets can unlock new financial models that were previously out of reach.”

Elemental Royalty Corporation specializes in acquiring royalties from gold mining companies, providing investors with exposure to gold without the direct risks associated with mining. This new dividend initiative is expected to offer investors more direct exposure to gold, rather than cash equivalents.

This article was generated with the assistance of AI workflows.

Crypto World

CFTC Chair Doubles Down on Defending Prediction Markets

Michael Selig, who chairs the US Commodity Futures Trading Commission under President Donald Trump, said the agency would be responding to what he called an “onslaught of state-led litigation” against prediction market platforms.

In a video posted to X on Tuesday, Selig said that the CFTC had filed an amicus brief, also known as a “friend of the court” brief, to “defend its exclusive jurisdiction” in regulating prediction markets, which he equated to derivatives markets. The chair warned that any state-level entities challenging the CFTC’s authority over such markets would be met in court.

“Prediction markets aren’t new — the CFTC has regulated these markets for over two decades,” said Selig. “They provide useful functions for society by allowing everyday Americans to hedge commercial risks […] they also serve as an important check on our news media and our information streams.”

Selig’s remarks followed several state-level regulators and authorities filing legal challenges against prediction platforms offering event contracts, including Coinbase, Crypto.com, Kalshi and Polymarket. Last week, Polymarket filed a lawsuit against the state of Massachusetts, claiming that only the CFTC, as a federal regulator, had the authority to police such markets.

Related: Prediction markets should become hedging platforms, says Buterin

Selig has been doubling down on his public statements supporting prediction markets amid the state-led enforcement actions. On Monday, the Wall Street Journal published an op-ed by Selig, reiterating his position that states were “encroaching” on the CFTC’s authority.

On Friday, a group of 23 US senators sent a letter to Selig, urging the CFTC chair to “abstain from intervening in pending litigation” involving event contracts and to “realign the Commission’s actions with the statute and with the testimony” he provided to Congress during his confirmation hearing. Selig said that he would look to the court for guidance during a November hearing.

“[Y]our recent comments instead suggest that you view the prohibitions Congress enacted […] as subject to reinterpretation through regulatory posture or litigation strategy,” said the senators, addressing Selig. “That approach converts a statutory prohibition into case-by-case policy judgments. It also places the Commission in direct conflict with state and tribal governments whose gambling laws Congress expressly chose not to preempt.”

Federal regulators await crypto market structure bill

For months, lawmakers in the US Senate have been considering a digital asset market structure bill, passed under the CLARITY Act by the House of Representatives in July. Although the Senate Agriculture Committee voted to advance the bill in January, it was unclear as of Tuesday whether the legislation would have enough support to pass a potential vote in the full chamber.

Selig was scheduled to speak on the progress of the bill at an event organized by the Trump family-backed crypto platform World Liberty Financial at the president’s Mar-a-Lago club in Florida on Tuesday.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Gemini ousts COO, CFO and Chief Legal Officer after international exit and 25% staff cuts

Gemini Space Station Inc. (GEMI) is parting ways with three top executives, including its chief operating officer (COO), chief financial officer (CFO) and chief legal officer (CLO), the exchange disclosed in a filing on Tuesday.

COO Marshall Beard, CFO Dan Chen and CLO Tyler Meade are all leaving effective immediately, according to the filing. Beard has also resigned from Gemini’s board of directors. The company said his resignation was not the result of any disagreement related to its operations, policies or practices.

The stock fell more than 10% in early Tuesday trading, underperforming most of its peers.

The departures come just days after Gemini announced it would shut down its crypto exchange operations in the U.K., European Union (EU) and Australia.

The exchange said it plans to cut roughly 25% of its global workforce and refocus its strategy on the U.S. market and prediction markets, marking a sweeping retrenchment only months after the company went public.

Gemini said it does not plan to appoint a successor COO at this time. Instead, co-founder Cameron Winklevoss will assume many of Beard’s responsibilities, including revenue-generating duties, in addition to his existing role.

The board appointed Danijela Stojanovic, Gemini’s chief accounting officer since May 2025, as interim CFO, and named Kate Freedman, currently associate general counsel and corporate secretary, as interim general counsel, effective Tuesday.

At least one other higher-level staff member attached to Gemini’s APAC division was let go on Tuesday as well, according to a person familiar with the matter.

Gemini did not immediately respond to a CoinDesk request for comment.

Crypto World

Altcoin News: Michael Saylor Pledges To Buy BTC Forever As Altcoin Season Index Stays At 30 While Bitcoin Dominance Holds 60% But DeepSnitch AI Presale Rockets 164%

Altcoin news just delivered a reality check for anyone waiting on the sidelines. Michael Saylor doubled down on his Bitcoin obsession, telling CNBC on February 10 that Strategy will buy Bitcoin every single quarter forever, even if BTC crashes to $8,000. The company already holds 714,644 BTC purchased for $54.35 billion, making it the largest corporate holder globally with roughly 3.4% of all Bitcoin in circulation.

The altcoin season hopium just took another hit as Saylor’s latest buy of 1,142 BTC for $90 million at an average price of $78,815 keeps institutional capital locked into Bitcoin rather than flowing into alts. This altcoin market updates reality is exactly why smart traders are looking at presales like DeepSnitch AI for parabolic gains.

Why altcoin season keep getting delayed, according to market data?

Michael Saylor’s conviction level is off the charts. Despite Strategy reporting a $12.4 billion loss in Q4 2025 due to unrealized losses on digital assets, he’s not budging. During the CNBC interview, Saylor made it clear the company has enough cash to cover operating expenses and dividends for 2.5 years without touching its Bitcoin stack.

The altcoin season index currently sits at a dismal 30 out of 100, way below the 75 threshold needed to confirm we’re actually in altseason. Only 30% of the top 50 altcoins have outperformed Bitcoin over the past 90 days. It means we’re deep in Bitcoin season with no rotation in sight.

Bitcoin dominance trends show BTC holding above 60% market share, a level that typically crushes altcoin news bulls. Every time institutional money enters crypto in 2026, it goes straight into spot Bitcoin ETFs that now hold over $130 billion in assets.

Fidelity, BlackRock, and other Wall Street giants are funneling capital exclusively into BTC, leaving alts to fight for scraps.

The altcoin market updates paint a brutal picture. While BTC trades around $66,000 after hitting $126,000 in October 2025, most alts have been absolutely demolished. The traditional four-year cycle that used to deliver massive altseasons has been replaced by an ETF-driven market where retail capital rotation barely exists anymore.

DeepSnitch AI rules altcoin news with live utility and 164% presale gains

While the altcoin season index stays stuck in the mud and Bitcoin dominance trends keep alts suppressed, DeepSnitch AI is crushing it with over 164% gains in presale. The token has pumped from $0.01510 to $0.03985 in Stage 5, and 4 out of 5 crypto AI surveillance agents are already live and working.

Built for volatile markets where information moves faster than retail can process it, DeepSnitch deploys an LLM-powered intelligence layer monitoring on-chain transactions, social channels, and private groups simultaneously. Paste any contract address into SnitchScan and get instant risk scoring for honeypots, liquidity traps, and suspicious tax structures.

AuditSnitch runs security analysis in plain language, flagging vulnerabilities before you approve transactions. The platform tracks stealth wallets and delivers private alerts on whale movements that institutional desks pay premium subscriptions to access.

Presale math works differently when you’re buying actual utility. Drop $5,000 at $0.03985 and receive 125,500 DSNT tokens. The DSNTVIP50 bonus code adds 50% more tokens, pushing your total to 188,250 without spending extra.

The project climbed from $0.01510 to the current pricing, already delivering 164% returns for the earliest holders. With AI agent technology exploding across crypto and 100x to 300x projections based on comparable platform valuations, this presale window is basically peak leverage before bigger money and institutions show up after launch and reprice everything fast.

Bitcoin holds strong despite volatility, while altcoin news shows weakness

BTC currently trades around $68,000 on February 16 after crashing from its October 2025 all-time high of $126,000, marking a brutal 47% correction. The altcoin news on Bitcoin actually shows institutional conviction with Michael Saylor’s Strategy adding 1,142 BTC for $90 million at an average price of $78,815, bringing total holdings to 714,644 BTC worth $54.35 billion.

Analysts project BTC could recover toward $100,000 by year-end as the four-year halving cycle plays out.

Even if Bitcoin doubles from current levels to $132,000, that’s a 2x. Solid for blue chip crypto, but nowhere near the parabolic upside available in the presale market, where early positioning on projects with live utility actually delivers life-changing returns.

Solana shows promise but limited upside compared to presale opportunities

SOL currently trades around $85 on February 16 after briefly dipping below $70 for the first time since December 2023. The altcoin news on Solana actually shows some green shoots with $92.9 million in institutional inflows during January, making it the second-highest recipient of capital after Bitcoin.

Analysts project SOL could hit $200-$300 by year-end if the network successfully shifts from meme coins toward stablecoins and tokenization.

But here’s the trader reality check on altcoin market updates: even if Solana triples from current levels to $240, that’s a 3x. Not bad for established coins, but nowhere near the parabolic upside available in the presale market where early positioning actually matters.

Conclusion

Altcoin season might eventually show up when Bitcoin dominance finally breaks down, but waiting for that rotation while sitting in coins already up 50x from their lows makes zero sense. The real alpha in altcoin market updates points toward DeepSnitch AI that combines working products with presale pricing that won’t last forever.

Visit the official website for priority access and check out X and Telegram for the latest altcoin news and community intelligence.

FAQs

Is altcoin season actually coming in 2026 based on current altcoin news?

The altcoin season index needs to crack 75 but sits at 30 while Bitcoin dominance trends hold above 60%. ETFs changed the game completely. Institutional money goes straight to BTC now, not rotating through alts like 2021.

Why does Bitcoin dominance trends matter so much for altcoin market updates?

When BTC dominance stays high, it means Bitcoin is sucking up all the oxygen in the room. Capital flows to safety and regulatory clarity, which is Bitcoin right now with $130B in spot ETFs. Alts only rip when dominance drops hard and money rotates out. That rotation hasn’t happened yet in 2026’s structure.

Can Solana really deliver solid gains despite weak altcoin season index readings?

SOL has institutional backing with $92.9M January inflows and strong fundamentals around stablecoins. Could it run to $200-$300? Yeah, definitely possible. But that’s 3x-4x upside from $85. Compare that to DeepSnitch AI with live products offering 100x potential. Depends on your risk tolerance and timeline, honestly.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Dragonfly Capital Raises $650M Fourth Fund to Lead Crypto’s Shift Toward Financial Infrastructure

TLDR:

- Dragonfly Capital closed its fourth fund at $650M, competing directly with Andreessen Horowitz and Paradigm.

- The firm led Ethena’s $6M seed round in 2023; the stablecoin now holds a $6.3B market capitalization.

- Dragonfly’s strategy targets stablecoins, onchain finance, and tokenized assets over native crypto protocols.

- Partner Haseeb Qureshi says speaking openly in a hype-driven space has been the firm’s greatest superpower.

Dragonfly Capital has officially closed its fourth fund at $650 million. The crypto-focused venture firm made the announcement even as the broader blockchain investment sector faces serious headwinds.

The firm continues to focus on financial infrastructure, including stablecoins, onchain finance, and tokenized real-world assets.

This latest raise cements Dragonfly’s place among the top crypto venture firms globally competing with Andreessen Horowitz and Paradigm.

Dragonfly Bets on Finance as Crypto’s Next Frontier

The firm’s strategy has shifted noticeably toward Wall Street-style financial products built on blockchain rails. General partner Rob Hadick, who joined in April 2022 from hedge fund GoldenTree, has been central to that repositioning.

He arrived just as the Terra Luna collapse rocked the market and stayed through the FTX implosion shortly after. Recalling that turbulent period, Hadick said, “I was scared about what was happening to the industry, but I was excited about the opportunity we had, because we still had $500 million to deploy.”

One early product of that vision was Ethena, a synthetic dollar project that most investors rejected following the Terra Luna fallout. Dragonfly led Ethena’s $6 million seed round during the bear market of 2023.

Ethena founder Guy Young recalled that most investors told him, “It’s actually offensive that you’re even saying this after what just happened.”

Dragonfly, however, took a different view. Young credited the firm’s ability to “look at it from first principles” as the reason they moved forward.

Today, Ethena’s flagship stablecoin carries a market cap of roughly $6.3 billion. Franklin Templeton and Fidelity’s venture arm joined a subsequent $100 million round, further validating Dragonfly’s early conviction.

The bet stands as one of the clearest examples of the firm’s contrarian approach during a difficult market period.

A broader shift is now visible across the entire crypto venture space. Partner Tom Schmidt noted that fewer funds are chasing native protocol tokens and more are backing assets tied to real-world instruments.

“This is the biggest meta shift I can feel in my entire time in the industry,” Schmidt said. Hadick added, “A lot of crypto funds are now saying they’re fintech funds, which is what I think we do better than anybody.”

Leadership and Long-Term Vision Drive the Firm Forward

Dragonfly’s current leadership includes four partners with distinct, complementary roles. Haseeb Qureshi serves as the firm’s most visible voice, known for his Chopping Block podcast and direct commentary on Crypto Twitter.

He once nearly secured Polymarket’s seed round in 2020 but passed on matching a competing term sheet. Reflecting on it, Qureshi said plainly, “It was obviously a massive miss on our part, but we had the right idea.” The firm eventually invested at the Series B stage.

The firm has also navigated serious internal and external turbulence. A Department of Justice inquiry surfaced in 2025, tied to Dragonfly’s investment in privacy protocol Tornado Cash.

Prosecutors briefly suggested Schmidt could face criminal charges before the DOJ reversed course. Qureshi maintained that “the investment was never ideological,” and the episode ultimately became a point of credibility within the broader crypto community.

Dragonfly restructured significantly after co-founder Alex Pack departed around 2020. Pack himself acknowledged that he and Feng were “very different culturally,” adding that he spent “a few months helping to hire and train my replacements” before the two parted ways.

The firm also relocated its Asia operations from Beijing to Singapore amid China’s sweeping crypto crackdown, though Schmidt confirmed it still maintains a meaningful regional presence.

With $650 million now secured, Dragonfly enters the next cycle as one of the sector’s most established players. “It’s bizarre to see us now become one of the incumbents,” Qureshi said.

He added that the firm’s willingness to speak directly has been a key differentiator: “In a space that is just completely flooded with bullshit and with fakers and self-promoters, I think that has actually been a superpower.”

The firm is now positioned to shape how blockchain technology continues merging with mainstream financial systems.

-

Sports6 days ago

Sports6 days agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Tech7 days ago

Tech7 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

Video1 day ago

Video1 day agoBitcoin: We’re Entering The Most Dangerous Phase

-

Tech3 days ago

Tech3 days agoLuxman Enters Its Second Century with the D-100 SACD Player and L-100 Integrated Amplifier

-

Video5 days ago

Video5 days agoThe Final Warning: XRP Is Entering The Chaos Zone

-

Tech24 hours ago

Tech24 hours agoThe Music Industry Enters Its Less-Is-More Era

-

Business3 hours ago

Business3 hours agoInfosys Limited (INFY) Discusses Tech Transitions and the Unique Aspects of the AI Era Transcript

-

Video18 hours ago

Video18 hours agoFinancial Statement Analysis | Complete Chapter Revision in 10 Minutes | Class 12 Board exam 2026

-

Crypto World4 days ago

Crypto World4 days agoBhutan’s Bitcoin sales enter third straight week with $6.7M BTC offload

-

Crypto World6 days ago

Crypto World6 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 days ago

Video6 days agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World18 hours ago

Crypto World18 hours agoCan XRP Price Successfully Register a 33% Breakout Past $2?

-

Sports1 day ago

Sports1 day agoGB's semi-final hopes hang by thread after loss to Switzerland

-

NewsBeat2 days ago

NewsBeat2 days agoThe strange Cambridgeshire cemetery that forbade church rectors from entering

-

Business6 days ago

Business6 days agoBarbeques Galore Enters Voluntary Administration

-

Crypto World7 days ago

Crypto World7 days agoCrypto Speculation Era Ending As Institutions Enter Market

-

Crypto World5 days ago

Crypto World5 days agoEthereum Price Struggles Below $2,000 Despite Entering Buy Zone

-

NewsBeat3 days ago

NewsBeat3 days agoMan dies after entering floodwater during police pursuit

-

Crypto World5 days ago

Crypto World5 days agoKalshi enters $9B sports insurance market with new brokerage deal

-

NewsBeat4 days ago

NewsBeat4 days agoUK construction company enters administration, records show

![WARNING: History Is Repeating! [Bitcoin Must Hold This Level]](https://wordupnews.com/wp-content/uploads/2026/02/1771385251_maxresdefault-80x80.jpg)