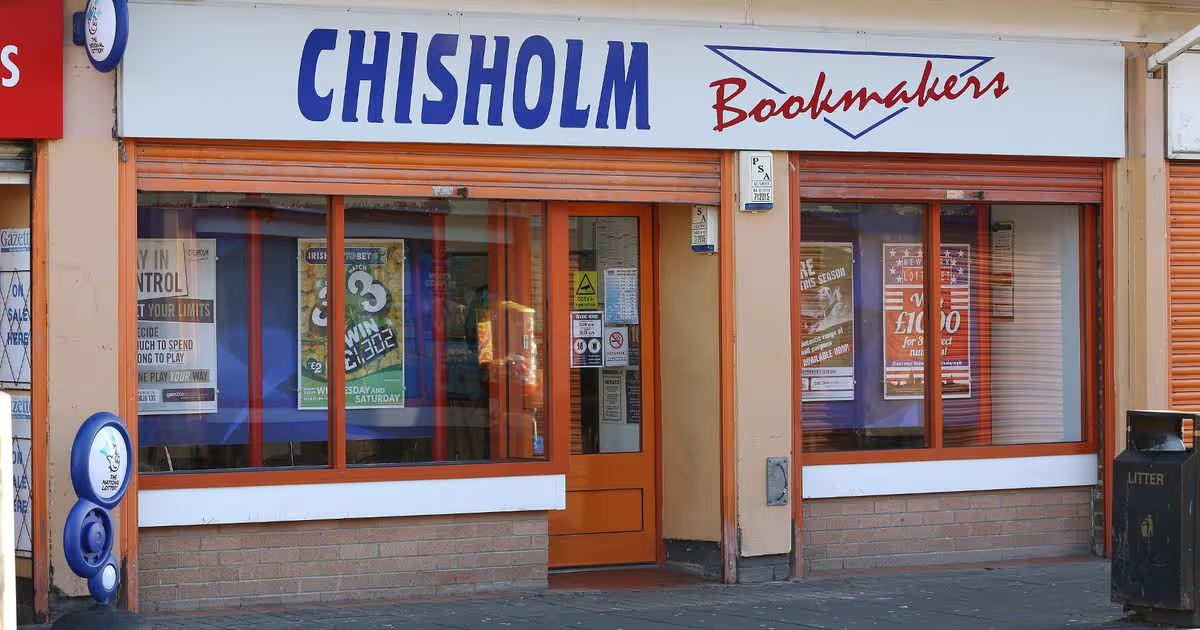

The Ashington-based business runs 34 shops across the North East as well as online betting services

Directors at Northumberland bookmaker Chisholm have described a “disappointing” year after falling to a loss amid increased costs and a need to update its gaming machines. The Ashington-based business, which runs 34 shops across the North East as well as online betting services, has published accounts for the year ended April 2025, citing “out of date” gaming machines which were seeing customers fall away in search of newer models, as one factor for the fall in finances.

Since then, it said investments had been made in newer machines, but turnover for the year fell from £29.99m to £27.1m, while the previous year’s operating profit of £542,773 was converted to a loss of £257,553. The company highlighted how increases in employers’ National Insurance contributions, introduced in April 2025, had impacted the business, adding that “further increases in taxes present an ongoing risk to the business”.

Directors said they would continue to focus on careful cost control, and that shops it operated would be “kept under constant review regarding future viability”.

A report within the accounts said: “The directors are disappointed with the results for the year, the poor performance being due to a number of factors. During the year became clear that the performance of the gaming machines in the shops was declining.

“The reason for the decline was found to be that over time the model of machines installed had become out of date and customers were leaving to use newer models in competing locations. Post year end all gaming machines have been replaced with newer models and performance has improved substantially.

“Media rights costs during 2024 and 2025 increased by a total of 30%. This, together with an above inflation increase in the National Minimum Wage increased costs across the business. Throughout the year it was noticed that many ordinary customers baulked at providing ‘know your customer’ information and were lost to the business.

“This is surprising as often the information requested is no more onerous than that required to register with a supermarket loyalty card. The hope is that these customers will return when they find KYC requests are now universally implemented among retail betting operators.

“Recruitment continues to be problematic for all high street businesses and the betting industry is no different. The focus of the business continues to be high volume, low stake turnover which is appropriate for the geographical locations that the business operates in.”

During the year, Chisholm made contributions totalling £100 to a national charity focused primarily on research and education programmes in order to combat problem gambling in the UK.

It added that changes to legislation and regulation continues to present a risk to the business, saying: “A balance must be in place between regulations intended to protect the small minority of individuals who experience problems with gambling and the rights of the ordinary gambler to conveniently place a bet via legal means.

“The company has a strong focus on encouraging responsible gambling by its customers and ensures all staff are aware of their responsibilities. We continue to be concerned that there is a risk that regulatory action designed to improve standards online goes further and unnecessarily impacts the retail industry.”