Entertainment

The Most Iconic Cult Classic Sci-Fi Thriller Ever Had a Surprising Impact on a 1-Season Disney+ Series

New behind-the-scenes details from The Art of Star Wars: The Acolyte reveal that The Acolyte’s most unsettling character — the Stranger — carried a surprising nickname during production, one inspired by one of Jake Gyllenhaal’s most iconic films. According to the book, the Stranger, portrayed on screen by Manny Jacinto, was referred to internally as “Frank” during preproduction. The nickname was a direct nod to Frank the Bunny, the eerie, grinning figure from Richard Kelly’s 2001 cult sci-fi film Donnie Darko.

The reference wasn’t incidental. It became a creative shorthand for the tone and psychological discomfort the team wanted the Stranger to evoke — something uncanny, unsettling, and difficult to emotionally place.

Why the Stranger Was Called “Frank” During ‘The Acolyte’s Production

As The Art of Star Wars: The Acolyte makes clear, the Stranger is one of creator Leslye Headland’s most personal creations. Headland describes the character as a vessel for her own philosophy around freedom, identity, and belonging.

“In ‘Night,’ he says something that I would say is a good summation of how I feel moving through the world, which is that all he wants is freedom. When he says, ‘the Jedi say I can’t exist,’ there is something about my experience in the world that has felt that way to me. Sometimes walking through life, with its highs and lows, can feel like you’re not allowed to be yourself, that you have to follow certain rules of society. To be free of that is something I find really enticing.”

That emotional core directly informed the Stranger’s visual design — particularly his mask. Concept artists explored a wide range of disturbing imagery while developing the Stranger’s look, but one element remained constant from the earliest conversations: the grin. “That was very important from the beginning,” said creature effects supervisor Neal Scanlan. Headland immediately follows that thought in the book, explaining why the smile was non-negotiable.

“There’s some psychological thing that happens to your brain when you see a smile like this one.”

During preproduction, that unsettling smile led designers to nickname Jacinto’s character “Frank,” referencing Donnie Darko’s grinning, inhuman figure. For weeks, the image haunted the costume and creature departments as artists searched for the right balance between something never-before-seen and something that still fit within Star Wars’ established visual language. The final helmet emerged from a deeply collaborative process. “The Stranger’s mask is a good example of how a lot of the design elements come out of some combination of creators,” Headland said. “The final helmet is a collaboration of at least four departments — creatures, costumes, the stunt team, and visual effects — working together.”

The Art of Star Wars: The Acolyte is available now. Stay tuned at Collider for more.

- Release Date

-

2024 – 2024-00-00

- Showrunner

-

Leslye Headland

- Directors

-

Leslye Headland, Alex Garcia Lopez

- Writers

-

Leslye Headland, Charmaine De Grate, Kor Adana

- Franchise(s)

-

Star Wars

Continue Reading

Entertainment

‘Masters of the Universe’ Can’t Replace One of the Greatest ’80s Toy Shows

The 1980s were a veritable golden age of toy-based cartoons, especially in the action-figure-driven category. Many success stories grew out of that era, including Masters of the Universe, and its spin-off, She-Ra: Princess of Power, The Transformers, ThunderCats, and Teenage Mutant Ninja Turtles. However, the arguable king of the 1980s toy-based cartoons was the classic, animated series for Hasbro’s G.I. Joe: A Real American Hero. G.I. Joe led the pack through the formative decade of “toyetic” action-adventure animated shows, but Hollywood still struggles to get G.I. Joe right.

A Collaboration Between Hasbro and Marvel Comics Gave Birth to the Revamped Version of ‘G.I. Joe’

Although Hasbro’s line of G.I. Joe military-themed toys dates back to the 1960s, many fans and children of the 1980s who grew up with the IP know that the “Real American Hero” version of G.I. Joe derived from a collaboration between Hasbro and Marvel Comics, at a time when Hasbro wanted to revamp its G.I. Joe trademarks. Ultimately, the late former Marvel Editor-in-Chief Jim Shooter, as he explained in NYC Graphic Novelists, put together a creative team including himself, Larry Hama, Archie Goodwin, and Tom DeFalco, who broke the stories and came up with a new concept for what became G.I. Joe: A Real American Hero.

Ultimately, under their new concept, G.I. Joe would serve not as a nickname for a soldier, but as a codename for an elite, anti-terrorist unit. As Shooter described, “Maybe it’s like a secret squad of the best soldiers and sailors and airmen. They’re all in this secret group, and they fight terrorists and have special technology.’” Hama came up with many of the character names and would eventually become the writer of the original A Real American Hero comic series published by Marvel Comics.

Besides creating the popular 3.75-inch action figures for Marvel’s new comic, Hasbro also helped finance new animated commercials that advertised the series. The animated commercials proved so popular that an episodic animated series inspired by the new comics and action figures was commissioned, produced by Marvel and Sunbow Productions. Thus, the popular G.I. Joe: A Real American Hero animated series was born, debuting in 1983 with “The M.A.S.S. Device” miniseries, ushering in a new cartoon legend.

‘G.I. Joe’ Featured an Incredibly Diverse and Electic Cast

One of the things that’s still so striking about the 1980s G.I. Joe show, even to this day, is its incredibly diverse, eclectic, and unique cast of characters, including men and women from all walks of life and various nationalities. The troops in G.I. Joe were assembled from the best of their respective fields, with characters who specialized in everything from guerrilla warfare and ranged combat to underwater and naval battles, to pilots and airmen. G.I. Joe truly represents the melting pot culture that is America, and it spotlights those Americans coming together, fighting to defend their nation against a common enemy in COBRA. With such a large and diverse cast, there was a G.I. Joe for every type of kid.

Although the plots of the animated series were far less mature, dark, and intense than Marvel’s original comic series, some episodes of the 1980s show proved to be quite serious and provocative for their time. Series standouts easily include the two-parter, “Worlds Without Ends,” which finds a group of Joes transported to an alternate dimension where COBRA has succeeded and taken over the world, enforcing a brutal, fascist regime across the globe. In a dark scene, Steeler (Chris Latta) finds the open graves of the dead bodies of that dimension’s Joes, who were all wiped out by COBRA. The episode reinforces the importance of G.I. Joe’s work in fighting COBRA, especially for Steeler, who was growing weary from the two sides’ never-ending struggle. From time to time, G.I. Joe featured layers of nuance and pathos rarely seen in kids’ cartoons of the era.

Hollywood Constantly Struggles To Adapt ‘G.I. Joe’

Hollywood has struggled to find success in its multiple attempts to adapt G.I. Joe to the big screen, first with the 2009 live-action movie, G.I. Joe: The Rise of Cobra, and its 2013 sequel, G.I. Joe: Retaliation, which achieved mixed results. Then came the absolutely awful live-action spin-off, Snake Eyes: G.I. Joe Origins, in 2021. The 2009 movie attempted to force goofy personal backstories with Cobra Commander (Joseph Gordon-Levitt), The Baroness (Sienna Miller), and field leader Duke (Channing Tatum). The romance from the comics between Snake-Eyes (Ray Park) and Scarlett (Rachel Nichols) is sadly abandoned in favor of Scarlett and Ripcord (Marlon Wayans).

Something that all the live-action G.I. Joe movies have in common is that they failed to capture the magic of the cool characters that Larry Hama, Marvel Comics, and Sunbow Productions created, along with the more compelling elements of the G.I. Joe versus COBRA conflict. Additionally, A Real American Hero is very much steeped in 1980s values and Americana — something that does not always align with today’s values, and Hollywood creators struggle in attempting to recreate. Additionally, the Snake Eyes movie utterly fails in realizing the cool backstories of Snake Eyes (Henry Golding) and Storm Shadow (Andrew Koji), two of G.I. Joe’s most popular and iconic characters, making Snake Eyes come off like a selfish, amoral jerk. With Hollywood so desperate to reboot iconic properties over and over again, perhaps one day, someone will finally understand how to recapture the magic of G.I. Joe’s most popular era of A Real American Hero and bring it to life on the big screen.

Entertainment

The 23 best Super Bowl commercials of all time, from Hare Jordan to the E-Trade Babies

:max_bytes(150000):strip_icc():format(jpeg)/super-bowl-ads-etrade-baby-Terry-Tate-betty-white-020626-21eebf79a3204e519cdbff1796678001.jpg)

For some, they’re the best part of the big game.

Entertainment

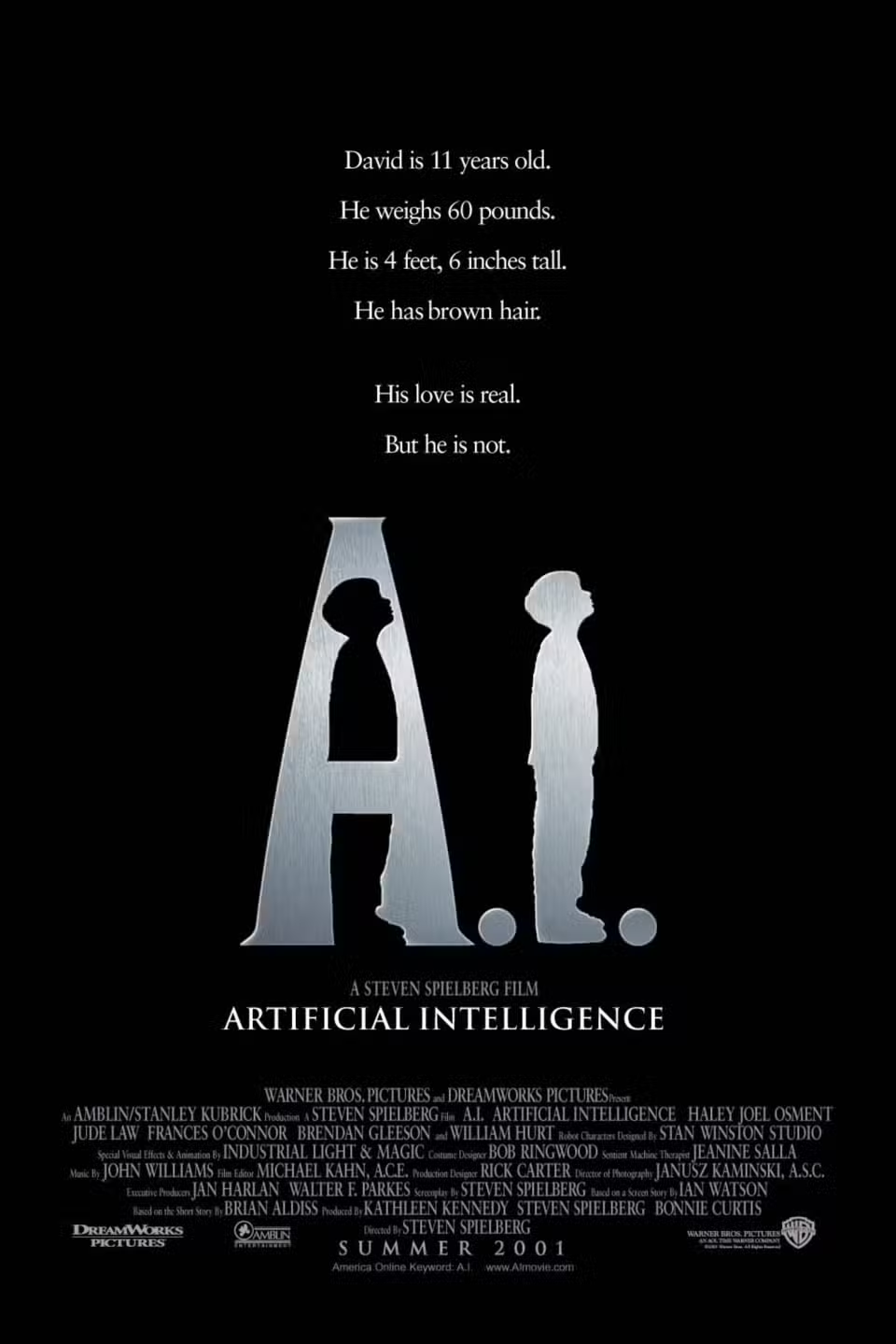

Steven Spielberg’s Most Debated Sci-Fi Film Is Being Reclaimed as a Free Streaming Hit

Few movies spark this much discourse two decades later. A.I. Artificial Intelligence has always been polarizing — too sentimental for some, too bleak for others — but now that it’s blowing up on free streaming, people are realizing something important: This movie was way ahead of its time.

Released in 2001 and directed by Steven Spielberg, A.I. sits at the crossroads of Spielberg’s emotional storytelling and Stanley Kubrick’s colder, more existential sci-fi instincts. That tonal collision confused audiences back then. Today? It feels eerily on point.

The film centers on David, an artificial child programmed to love unconditionally, played with devastating sincerity by Haley Joel Osment. Set in a future where climate collapse has reshaped civilization, David’s search for belonging becomes a brutal meditation on what it means to be human — and whether humanity actually deserves the empathy it demands from its creations.

Is ‘A.I. Artificial Intelligence’ Worth Watching?

Collider’s review stated that A.I.: Artificial Intelligence remained one of Spielberg’s most challenging and fascinating films, growing richer with distance from its initial release. Once seen as narratively alienating, the film revealed itself as a deliberate self-critique, using Spielberg’s familiar cinematic language to unsettling ends rather than emotional comfort. Technically impressive and emotionally icy, the story of David, a child Mecha programmed to love, inverted the sentimentality of E.T. and reframed it as something eerie and tragic. What initially felt like emptiness instead emerged as restraint, forcing viewers to sit with abandonment, longing, and artificial devotion without easy release.

“A.I.: Artificial Intelligence is not a Kubrick film in that it’s a commentary on humanity, instead it’s Spielberg deconstructing himself. Kubrick and Spielberg had a relationship that the two talked about and I don’t know what it was really like, but I wonder if Kubrick was kind of an asshole about Spielberg’s more sappy moments. The film seems to dispute so much of what Spielberg did in E.T. – again right down to the title. Where ET was a jesus figure, that’s pretty much the opposite here, and all the tricks Spielberg uses to make ET cute are used here to make David creepy. The moon that signifies Amblin and Elliot’s flight in that film becomes the enemy, and the mother is the person who casts David out. The film builds to an ending that Spielberg has seen as happy, but most audiences have viewed as anything but.”

A.I. Artiificial Intelligence is streaming now, on Tubi, for free.

- Release Date

-

June 29, 2001

- Runtime

-

146 Minutes

Entertainment

Which CBS Shows Have Gone Through Surprising Showrunner Changes?

Fire Country isn’t the only CBS show currently going through a surprising showrunner change.

News broke in January 2026 that showrunner Tia Napolitano was leaving after multiple onscreen departures.

“Tia has been instrumental in helping both build and steer Fire Country, which not only became a top series, but is also the foundation of a growing universe,” CBS Entertainment President Amy Reisenbach and CBS Studios President David Stapf said in a joint statement. “We’re grateful for all her contributions and tireless work, and look forward to collaborating with her on future projects.”

Napolitano was with the show since its 2022 premiere on CBS. Before her exit, Napolitano spoke exclusively to Us Weekly about what fans could expect from the remainder of the fourth season.

“[You should] be worried. We’ve got Bode and Tyler in a fire shelter in the middle of a blaze. Those things are built for one, there’s two lives in there,” Napolitano shared in December 2025. “And we’ve got Jake and his brother over the side of a cliff. You see how many times that vehicle goes over and over. We see heads hit hard surfaces.”

Napolitano teased that “those are not easy things to come back” from, adding, “We’ll watch our people fight to get out of there.” She also revealed there was a “huge twist” coming in the midseason premiere.

The showrunner change came after budget cuts led to Billy Burke and Stephanie Arcila‘s exits. Elsewhere at the network, NCIS‘ prequel series NCIS: Origins and FBI spinoff CIA also faced some shakeups behind the scenes.

Keep scrolling for a breakdown of the changes:

‘Fire Country’

Napolitano released a statement in January 2026, which read, “I am beyond proud of the past four seasons of Fire Country. All of my gratitude to our cast, crew, writers, producers, fans, and of course CBS and CBS Studios. It’s been a beautiful ride!”

Multiple outlets including Deadline reported that a replacement for Napolitano hasn’t been found yet.

‘NCIS: Origins’

Mariel Molino, Austin Stowell. Erik Voake/CBS

It was confirmed in January 2026 that co-showrunner Gina Lucita Monreal is departing from the show at the end of season 2. David J. North will remain and will serve as sole showrunner in her absence.

“Gina has been an important beloved member of the ‘NCIS’ family for many years,” CBS Entertainment President Amy Reisenbach and CBS Studios President David Stapf said in a joint statement. “We are incredibly grateful to her for helping launch and steer NCIS: Origins, and bringing these incredible characters and stories to life. We look forward to working with her again in the future on new projects, and know the creative foundation she helped build will continue to thrive.”

Monreal released her own statement about the surprise exit. “It’s been the biggest honor of my career to write NCIS: Origin’ alongside my incredible co-showrunner and friend David North,” she wrote. “I want to thank Amy Reisenbach, David Stapf, and everyone at CBS Network and Studio for their support.”

She continued: “To have had this opportunity to work again with the incomparable Mark Harmon, Sean Harmon, our writers, and the best cast and crew in the business — how lucky am I? I can’t wait to see what this extraordinary group cooks up for season 3.”

‘CIA’

In April 2025, CBS gave CIA a straight-to-series order starring Tom Ellis and Nick Gehlfuss. Originally planned for a fall 2025 premiere, CIA was pushed to midseason after Warren Leight replaced FBI: Most Wanted‘s David Hudgins as showrunner.

The changes kept coming when Michael Michele, one of the series’ leads, left in November 2025. Days later, Eriq La Salle left the series as executive producer. He was attached to CIA since its conception and directed the pilot before his exit.

Entertainment

Lindsey Vonn Airlifted After Olympic Ski Crash

Lindsey Vonn

Airlifted Off Mountain After Olympic Crash

Published

Lindsey Vonn‘s Olympic run ended in terrifying fashion Sunday after the skiing legend crashed hard during the downhill and was airlifted off the mountain by helicopter following medical treatment on the snow.

The American, racing despite a badly injured left knee, lost control early in her run after cutting the opening traverse too tight. Vonn was spun around in the air before slamming down and witnesses say she could be heard screaming in pain as ski patrol and medical personnel rushed to her side.

🚨 BREAKING: U.S. skiing legend Lindsey Vonn has crashed during competition at the Winter Olympics and was medevac’d by helicopter from the course.

Wishing her a full recovery — sending strength and support to Team USA. pic.twitter.com/IJIQPpX87j

— Brian Allen (@allenanalysis) February 8, 2026

@allenanalysis

The race was immediately put on hold as Vonn was surrounded by doctors, strapped to a gurney and flown off the course.

Vonn’s teammate Breezy Johnson held the early lead, but competition became secondary as attention turned to the fallen star. Family members were visible in the stands, including her father, Alan Kildow, who watched while his daughter was being treated.

Others in attendance, including Snoop Dogg, watched in stunned silence as Vonn was taken away from the same course where she built so many career-defining moments.

“That definitely was the last thing we wanted to see,” Vonn’s sister, Karin Kildow, said in an interview on Peacock. “She always goes 110 percent, there’s never anything less, so I know she put her whole heart into it and sometimes things happen. It’s a very dangerous sport.”

Kildow said Vonn is being evaluated and the family plans to meet her at the hospital.

Entertainment

1 Dead, 6 Hospitalized at Australia Music Festival

Dreamstate Festival

1 Dead, 6 Hospitalized

Published

A night of electronic music turned tragic in Australia after one man died and six others were hospitalized following medical emergencies at a major music festival.

New South Wales Police say officers were patrolling the Dreamstate music festival at Sydney Olympic Park Saturday when several attendees suddenly began suffering what authorities described as “medical episodes.”

Waiting for your permission to load the Instagram Media.

A man in his 40s was pronounced dead at the scene, while six other festivalgoers were rushed to nearby hospitals. Police confirmed one person remains in critical condition.

According to local outlet 9News Australia, investigators believe the man may have suffered cardiac arrest linked to a suspected drug overdose, and police are now considering whether a possible mass overdose occurred during the event.

Despite the warning, officials later confirmed there was no pill testing facility available at the event. Australia’s Minister for Music and the Night Time Economy told ABC News that while no drug testing was offered, a safety action plan was in place and followed government regulations.

Authorities have not said whether drugs were recovered from the scene or if any arrests have been made. The investigation remains ongoing.

Entertainment

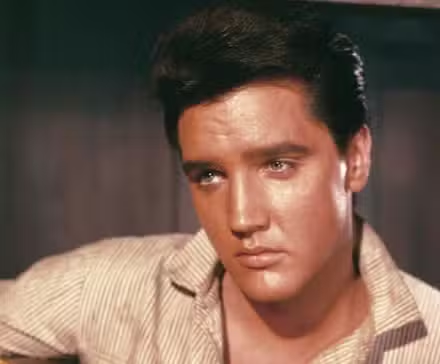

Before Passing, Johnny Cash Named Elvis Presley As the Greatest Performer of All Time

Johnny Cash hardly needs an introduction; the American-born singer and songwriter was known for his deep voice and defiant persona. During his lifetime and after his death, he became one of the most influential icons in American music history. His many successful songs, such as “One Piece At A Time”, “I Walk The Line” and “Ring of Fire”, have added to his credentials as a raw storyteller and musician with deep emotional depth. But when it came to who Cash felt was the best musician and entertainer of all time, Cash named none other than the king of rock ‘n’ roll.

Johnny Cash Called Elvis Presley the Best Performer of All Time

In 1968, following his widely televised comeback special, several media outlets proclaimed Elvis Presley the most outstanding living music performer. The title of greatest music performer was not given without merit to the then 33-year-old. By the time of his tragic death in 1977, Presley was already one of the best-selling solo artists of all time. To his credit, he achieved seventeen number-one singles and eight number-one albums, starred in seventeen top-ten films, and won three Grammy Awards. But it’s not only fans and music critics who were enthralled by Presley’s artistry. There was another famous musician, too, who sang the praises of the “Blue Suede Shoes” singer, and that was none other than Johnny Cash.

As ardent fans will know, Cash and Presley were not only comrades in the music industry but were also close friends. “They were part of the driving force that created rock and roll. My dad and Elvis were friends; they worked side by side when Elvis was at Sun Records. [Of course,],” revealed Cash’s son during an interview with the Express UK. “Elvis went on to make his films and some more music later on, and they never worked together again after the 1950s. They each had their own individual, unique traits as artists. Dads reached in different directions than Elvis’ did, enduring a legacy as a long-standing artist, having resurgences and renaissances throughout his life. Dad carried on, and he made music up until the very end. In some way, his legacy’s quite a bit different, but he always appreciated and loved Elvis.”

But beyond their friendship, Cash also admired Presley’s art above all else. And he made the admission nearly 21 years after Presley’s death, during a rare appearance on The Late Late Show. When the show’s host, Craig Ferguson, asked Cash, “Of all the performers you’ve seen in action, who do you reckon was the best?” Cash, who stared straight at the camera, answered plainly: “Elvis Presley.” When asked to elaborate, Cash stated that “He [Presley] had a lot of rhythm, he was a very good singer and a fabulous performer. And the way he moved the people…” Cash then went on to recall his first encounter with the king of rock n roll: “When he was 19 years old, that’s when I toured with him for the first time,” said Cash. “And not only did the girls love Elvis, but every man backstage was standing in the wings watching Elvis…He had that charisma, that magic that a great performer needs to get the people right there.“

Elvis Presley Was Crowned the King of Rock n’ Roll but His True Love Was a Different Genre

The King of Rock n’ Roll preferred a different genre altogether.

Elvis Presley Snubbed This Other Contemporary Artist

Elvis Presley may have admired and considered Johnny Cash a friend and respected peer, but the often temperamental artist didn’t extend that same grace to everyone. Case in point, Brian Wilson of The Beach Boys, who had long been a fan and admirer of Presley’s. During the early 1970s, when both artists were at the height of their fame, Wilson, who was busy recording music at the famed RCA Studios in Hollywood, got wind that Presley was there at the same time recording music with James Burton, he jumped at the chance to meet his idol.

According to Burton’s account of the fateful incident, Wilson asked him to facilitate the meeting: “He said, ‘Oh! Please, please take me to meet Elvis’. I took him in, and he walked up to Elvis and was just looking at him. And Elvis stuck his hand out to shake hands, and [Wilson] couldn’t move.” However, the meeting went from bad to worse after Presley’s friend Jerry Schillling revealed that as a starstruck, Wilson’ stood there in awe of the king of rock ‘n’ roll. The very private Elvis clearly showed no recognition of the Beach Boy and became a little angered that his security team had let a stranger wander in. “Elvis was very upset with us, thinking, ‘How did this guy get in here, and who is he? So Brian said, ‘I’m recording next door. Would you come over and listen?’ And Elvis looked at us; almost in spite of us, since this guy had gotten through. He said, ‘Yeah, I’ll go over.’” Schilling then stated that as the duo headed to the other recording studio, Wilson moved to playfully karate chop Elvis’ arm to break the ice. Presley then reportedly swiped Wilson’s arm away with no look of joviality on his face. “I knew he knew karate, and he karate chopped my arm so hard,” explained Wilson during his visit to Late Night With Jimmy Fallon in 2012. . “And he goes, ‘I’m leaving, I’m leaving,’ and he split. And that was it.”

Entertainment

Combs Twins Shut It Down On Social Media With Double Energy

Something about twin energy always hits different, and D’Lila and Jessie Combs just reminded the internet why they stay in their own lane. The Combs twins popped up online serving a look that had folks doing double takes. From the coordination to the confidence, the girls made it clear they came to shake the room—together.

RELATED: Boiling Tension? Combs Twins Go Back-And-Forth Over Spotlight In Kitchen Clip & Fans Are Stirred (VIDEO)

Matching Fits, Matching Faces, No Misses

In a new TikTok video, D’Lila and Jessie took to social media and proved once again that they are still THAT duo. Rocking matching chocolate-brown bodysuits, the twins posed like pros while serving synchronized face beats that were flawless from every angle. To seal the deal, they accessorized with matching nameplate necklaces—each customized with their own names—because why not remind everybody exactly who’s who while still looking identical?

The vibe only got stronger as the twins posed like they were mid–photo shoot, effortlessly moving in sync and giving camera-ready confidence. Their new hairstyle instantly stole the spotlight, framing their faces perfectly and adding even more heat to an already polished look. Between the sleek styling and undeniable chemistry, it was giving mirror image realness in the best way.

Comments Section Goes Up For The Twins

Naturally, the internet couldn’t get enough. Fans flooded TSR’s comments with fire emojis, heart eyes, and nonstop praise, calling the twins “tea.” Many viewers were quick to say the girls are all their mom Kim Porter. Meanwhile, others pointed out that the coordination, matching looks, and twin energy are exactly what we live for.

One Instagram user @theacaciamcbride said, “😍 I love that there’s a subtle difference in color and style. They look AMAZING!“

This Instagram user @keeorher wrote, “I know they was mad when they seen the colors was different.“

And, Instagram user @menamonroe added, “They’re so tea 😍😍😍”

Meanwhile, Instagram user @imanid4e shared, “I wish their mom could be here to see how beautiful they are omg🥹I know she’s smiling down🕊️”

While, Instagram user @_texasmarie commented, “I wanna be a twin next life. 🥰😌”

Finally, Instagram user @seankendii said, “They look just like they’re MOTHA 😍”

https://www.instagram.com/p/DUbxwRRgcSR/?img_index=1

RELATED: Copy & Paste? Jessie And D’Lila Combs Hit With Copycat Claims As Indie Brand Owner Speaks Out (VIDEO)

What Do You Think Roomies?

Entertainment

Netflix’s Most Reliable ‘Bosch’ Successor Is Quietly Dominating Watchlists

With Paramount+ and Prime Video having cornered the market for dad-content with shows such as Yellowstone and Bosch, Netflix found itself scrambling for a replacement that could divert some of those viewers. The streamer’s response — remember, Netflix passed on Yellowstone back in the day, and as a result, lost out on an opportunity to pin down Taylor Sheridan — was to play it safe. It turned to the bestselling books of Michael Connelly, whose Bosch series of detective-thrillers had given Prime Video one of its longest-running original franchises. Bosch ran for seven seasons, and then spawned a spin-off series titled Bosch: Legacy, which has already aired two seasons and is set to return for a third. Another spin-off, titled Ballard, premiered last year and is set to return for a second season. The franchise has provided a solid decade-plus of blockbuster content, and all this time, Netflix has watched from the sidelines. However, Netflix finally seems to have a worthy competitor on its roster.

Entertainment

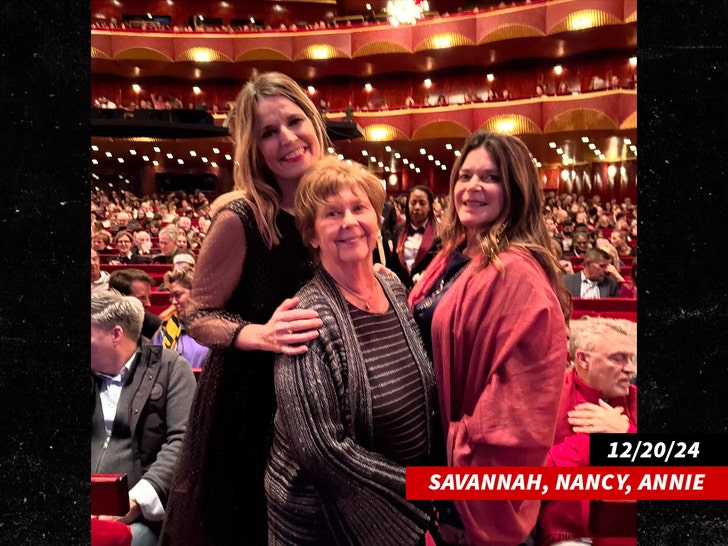

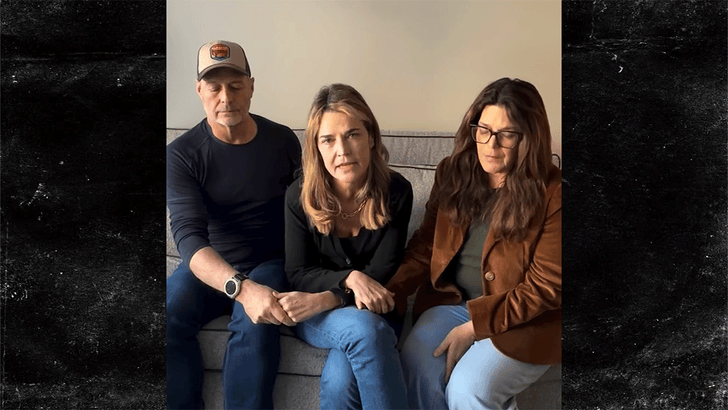

Savannah Guthrie’s Sister’s Home Searched Again as Mom Remains Missing

Savannah Guthrie’s Missing Mom

Police Search Sister’s Home Again

Published

The search for Savannah Guthrie‘s missing mother took another dramatic turn late Saturday night when investigators returned to the Arizona home of the “TODAY” anchor’s sister.

Authorities were inside Annie Guthrie‘s residence for several hours, photographing multiple rooms until about 10:30 PM local time. Reporters were kept at a distance as agents worked, with one officer seen carrying a silver briefcase into the home, raising questions about what evidence — if any — was collected.

Update from Annie Guthrie’s house where investigators remain inside.

They’ve been here for almost 3 hours. pic.twitter.com/irb8nJp3QY— Brian Entin (@BrianEntin) February 8, 2026

@BrianEntin

Outside Annie’s home, NewsNation correspondent Brian Entin documented camera flashes inside multiple rooms while several law enforcement vehicles waited nearby.

The renewed search comes as the disappearance of Nancy Guthrie stretches into its second week. Annie and her husband, Tommaso Cioni, were the last people to see Nancy after having dinner with her on January 31, just hours before she vanished. Annie’s home was also searched earlier this week.

Authorities have not explained why they returned late Saturday. On Friday, a vehicle was towed from Nancy’s garage, and a camera was removed from her house.

TMZ and other news outlets received an alleged ransom note earlier this week that contained two deadlines. The first deadline was Thursday at 5 PM, which changed the alleged abductors’ demands. The second deadline is Monday, February 9.

Instagram/@savannahguthrie

Earlier Saturday, Savannah appeared alongside Annie and their brother Cameron in a video, posted to social media, directly addressing Nancy’s alleged abductors. In the clip, the siblings said they had “received your message” and agreed to pay the ransom demands.

Savannah did not share details about the communication or the amount requested. The family had previously asked for proof of life.

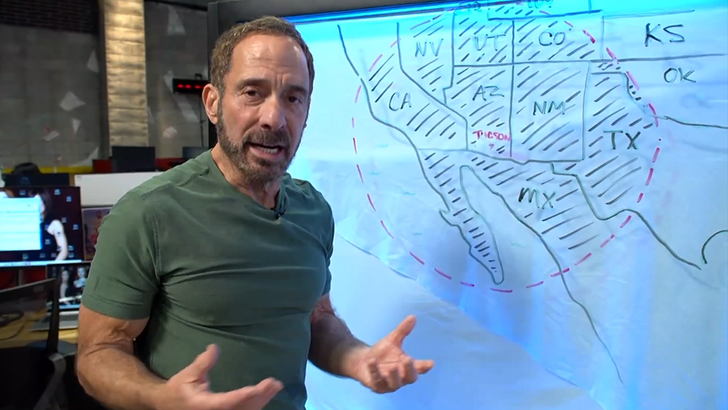

TMZ.com

On Friday, Harvey Levin broke down how far Nancy may have been taken, showing a geographic area where her abductors may be holding her based on clues in the alleged ransom note we received.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech4 days ago

Tech4 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics6 days ago

Politics6 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Former Viking Enters Hall of Fame

-

NewsBeat5 days ago

NewsBeat5 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Crypto World6 days ago

Crypto World6 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports2 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business6 hours ago

Business6 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat2 days ago

NewsBeat2 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports6 days ago

Sports6 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat6 days ago

NewsBeat6 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat3 days ago

NewsBeat3 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World5 days ago

Crypto World5 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat6 days ago

NewsBeat6 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know

-

Crypto World3 days ago

Crypto World3 days agoHere’s Why Bitcoin Analysts Say BTC Market Has Entered “Full Capitulation”

-

Crypto World3 days ago

Crypto World3 days agoWhy Bitcoin Analysts Say BTC Has Entered Full Capitulation