Business

Trump congratulates Japan’s Takaichi on election win

Business

FIIs ease bearish bets post-Budget, but charts warn of range-bound Nifty: Anand James

Edited excerpts from a chat:

FII shorts in Nifty futures have been a worrying trend. How has the data changed after the Budget?

Since Budget, FII’s longs in the index future segment have been on a rising trend, while the shorts have been on a declining trend. This pattern was rarely seen in the last six months, and assumes importance hinting at a potential towards FIIs changing their unilaterally bearish stance. At 43462 contracts, their longs in the index future segment is the highest since late January, and sub 2 lakh contracts level on the short side held by FIIS now, was last seen in the early January period. The consequent long short ratio of 18 levels was last seen on 1st of December, but at that point, the longs were just 26k, and shorts were just 1.1 lakh. In other words, FIIs are still short heavy, and the 3% boosting of shorts on Friday suggest that we need more days of reduction in shorts or a larger reduction in size, to establish it as a trend, and project a rise in Nifty.The news heavy week saw Nifty ending around 1.5% higher. What are the charts indicating in terms of how sustainable the rally can be this month and whether the momentum can take us to record high once again?

Despite the positive weekly close, it must not be forgotten that Nifty failed to sustain the peaks seen on 3rd February, which saw an up gapped opening. Also, on Friday, we came close to seeing Nifty filling the break away gap. This is certainly an indication that momentum has weakened, and we have most likely slipped on to a range trading bias. That said, that Nifty did not stretch all the way to 25450, in order to fill the gap, and that a close in the vicinity of 25700 was seen in the last three days, suggesting that buying interest is still around. Alternatively, a repeat fall into the 25496-450 territory should push the trend into a sideways mode signalled already or announce the re-dominance of bears.

IT stocks hogged limelight for the wrong reasons. Is the dip here a buy or do you see more pain ahead?

Following the recent selloff, the Nifty IT index is likely to look for support around the SuperTrend level near 35,100, which also aligns with a rising trendline. However, the emergence of a bearish crossover on the weekly MACD is weighing on near-term upside potential. Failure to sustain above the 35,100–35,000 zone could lead to further downside toward 34,320 (200‑week moving average), with an extended decline possible toward 33,500.

Key constituents such as TCS, Infosys, HCL Technologies, and Tech Mahindra have reversed from their recent highs on both daily and weekly charts, accompanied by strong volumes, indicating persistent profit booking. Meanwhile, Wipro and LTI Mindtree have also registered bearish MACD crossovers on the weekly timeframe, reinforcing the risk of deeper corrections. Heavyweights TCS, Infosys, and Wipro, which collectively make up nearly 70% of the index weight, have convincingly slipped below their 100‑day and 200‑day moving averages, pointing to underlying weakness in the index. Although HCL Technologies and Tech Mahindra continue to trade above key moving average supports, any breakdown in these stocks could further intensify downside pressure on the Nifty IT index.

HAL was one of the biggest losers in the week. Do you see some buying support coming in at lower levels?

Though it was only two days of sharp fall, a sideways range has been broken, projecting a large downsides, having also closed below super trend. However, the stock has slipped 15%, after testing the 200 day SMA. It appears to have formed an inside bar on Friday, when a positive oscillator divergence was also seen. This fills up with hope that despite all the gloom, some green shoots are visible and a swing higher to 4140-4236 may be played for, with risk restricted to Friday’s low.

Consumer durables have been on an uptrend with Amber shares up xx% in the week. How should one trade the momentum?

Ideally, the stock looks poised for 7082, the 200 day SMA. However, oscillators appear to be signalling an exhaustion in momentum, especially as the stock is approaching a horizontal resistance coinciding with January’s peaks. This warns us to take some money off the table, or put 6410 as stop for existing longs.

Give us your top ideas for the week ahead.

FINCABLES (CMP: 771)

View: Buy

Target: 820

SL: 742

Price has built a base around 730–745 and is rebounding toward the declining 100 DSMA near 779 which coincides with the SuperTrend level, first meaningful resistance. A daily close above 780–785 would signal a range breakout, opening 815–820. Failure to clear the 100 DSMA keeps the stock in a sideways-to-down bias within the 745–780 band. Volume has ticked up on the bounce, hinting at improving momentum, but overhead supply remains heavy. Bias turns positive only on strong close above 785 with volume; below 742, risk shifts back to the downside toward 730, 705 levels.

LICI (CMP: 901)

View: Buy

Target: 930-950

SL: 864

A strong breakout candle with heavy volume has pushed price above the recent supply zone 880–890, and the SuperTrend level of 848 turning it into immediate support. Momentum has improved with RSI near 70 and MACD has turned up with a fresh positive cross in daily scale. In the weekly scale, we have seen Supertrend break and the MACD is about to see bullish crossover, confirming trend acceleration. Bias stays positive while above 890. A decisive close above 930 can extend the move to 950; failure to hold 890 would weaken momentum, risking a retrace toward 864-860.

Business

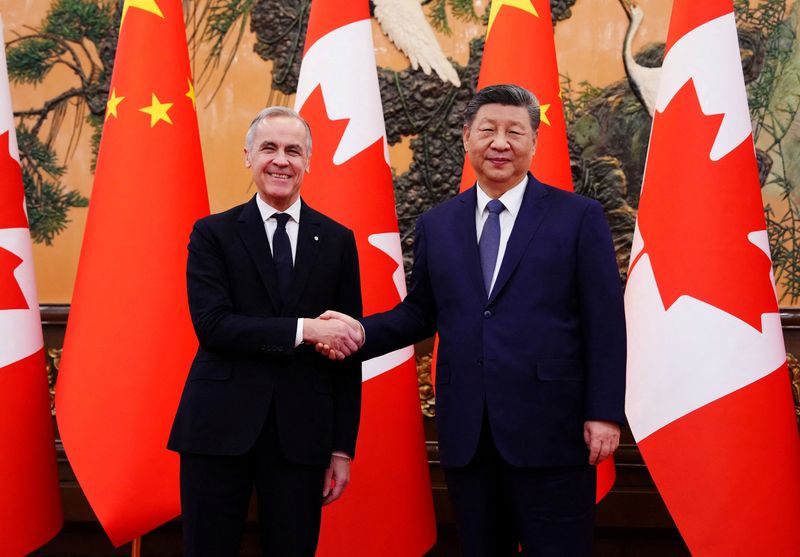

China overturns Canadian’s death sentence after Carney visit, lawyer says

China overturns Canadian’s death sentence after Carney visit, lawyer says

Business

Asia FX muted, yen buoyed by intervention warnings after Takaichi election win

Asia FX muted, yen buoyed by intervention warnings after Takaichi election win

Business

Contender for Bank of Korea governor backs higher property taxes to contain inflation

Contender for Bank of Korea governor backs higher property taxes to contain inflation

Business

Should long term investors bet on Aye Finance IPO?

Top three institutional holders including Elevation Capital (formerly known as SAIF Partners), LGT Capital Invest Mauritius, and Alpha Wave India (formerly Falcon Edge India) hold a combined 41% stake in the company.

The company has a geographically spread loan book and has reported improvement in net interest margin. It has a strong capital adequacy ratio, which supports long-term business growth. However, the issue is priced at a discount to peers, reflecting relatively higher asset-quality stress and return ratios that trail those of peers. Given these factors, the issue is suitable for long-term retail investors with a higher risk tolerance.

Agencies

Agenciesnet interest is getting better Geographical spread, capital adequacy ratio seem good for the lender, but return ratios trail that of peers

Business

Founded in 1993 and later rebranded in 2014, Aye Finance provides small-ticket business loans to MSMEs. It had ₹6,027 crore worth of assets under management (AUM) spread across 568 branches in 18 states and three union territories as of September 2025. It focuses on micro-businesses with annual turnovers of ₹2-10 crore, primarily in semi-urban markets. Nearly 91% of customers own their residence or place of business, and 94% employ five or fewer workers, highlighting the grassroots nature of its borrower base. No single state accounts for more than 16% of AUM, while the top five states together contribute 57%. Loan disbursements expanded by 34.9% annually to ₹4,291.3 crore in FY25 from ₹2,357.1 crore in FY23.The business faces risks such as rising non-performing assets, vulnerability to interest rate fluctuations, and competition from other NBFCs.

Financials

Net interest income rose by 52.6% annually to ₹858 crore in FY25 from ₹368.5 crore in FY23. Net profit surged to ₹175.2 crore in FY25 from ₹39.9 crore in FY23. The capital adequacy ratio remained robust at 35% in FY25 rising from 31% in FY23. Net interest margin expanded to 15% in FY25 from 13.5% in FY23-within the 10-16% peer range. Gross NPA rose to 4.2% in FY25 from 2.5% in FY23, exceeding the 1.8-2.7% range of its peers. Return on equity rose to 12% in FY25 from 5.5% in FY23, placing it at the lower end of the 11.6-18.7% peer range.

Valuation

Aye Finance is valued at a price-to-book (P/B) multiple of 1.3, which is at a discount to listed peers such as MAS Financial Services at 2.05, SBFC Finance at 3, and Fedbank Financial Services at 1.9.

Business

Seattle Seahawks Dominate New England Patriots to Win

The Seattle Seahawks claimed their second Super Bowl title in franchise history Sunday night, Feb. 8, 2026, defeating the New England Patriots 29-13 in Super Bowl LX at Levi’s Stadium. The Seahawks’ suffocating defense forced three turnovers, sacked quarterback Drake Maye six times and held the Patriots scoreless through three quarters, avenging their heartbreaking loss in Super Bowl XLIX 11 years earlier.

Seattle (16-3 entering the game) dominated from the outset in a defensive battle that saw no offensive touchdowns until the fourth quarter. Kicker Jason Myers set a Super Bowl record with five field goals, while quarterback Sam Darnold managed the game efficiently with 202 yards passing and one touchdown. The win denied the Patriots (17-4) a record seventh Lombardi Trophy and marked a triumphant return to glory for the franchise that last hoisted the trophy in 2014.

The Seahawks struck first with Myers’ 33-yard field goal midway through the first quarter, capitalizing on strong field position after a punt return. New England struggled offensively early, managing just 0 yards in the opening period as Seattle’s front seven pressured Maye relentlessly. The Patriots’ defense held firm initially, but Myers added a 41-yarder late in the half to make it 9-0 at the break — the first scoreless first half for both teams since Super Bowl LIII.

The third quarter remained a grind, with Myers extending the lead to 12-0 on a 57-yard bomb and then 15-0 on another kick. Seattle’s defense continued to harass Maye, who completed only a handful of passes under duress. The Patriots’ first points came in the fourth when Maye connected with wide receiver Mack Hollins for a 35-yard touchdown strike, cutting the deficit to 19-7 after a Seahawks fumble return touchdown by DeMarcus Lawrence pushed Seattle ahead 19-0 earlier in the period.

Seattle responded immediately, with Darnold finding tight end A.J. Barner for a 16-yard touchdown — the game’s first offensive score — to make it 26-7. Myers tacked on his fifth field goal for the record, sealing the 29-13 final after a late Patriots consolation touchdown from Maye to running back Rhamondre Stevenson.

Defensive end Leonard Williams led Seattle with two sacks, while the unit as a whole limited New England to under 200 total yards. Maye finished with modest numbers amid constant pressure, throwing one interception and losing two fumbles. Darnold, in his first Super Bowl start, avoided mistakes and let the defense carry the load.

The game echoed Seattle’s 2014 championship formula: elite defense and opportunistic special teams. Coach Mike Macdonald’s scheme neutralized New England’s explosive plays, forcing Maye into uncomfortable decisions. For the Patriots, the loss ended a resurgence under new leadership, falling short of adding to their storied legacy.

Halftime provided a cultural spectacle as Bad Bunny headlined the Apple Music Super Bowl Halftime Show, delivering a 13-minute celebration of Puerto Rican heritage. The performance featured hits like “Tití Me Preguntó,” “Yo Perreo Sola,” “Safaera” and “El Apagón,” with surprise guests Lady Gaga (performing a Latin version of “Die with a Smile”) and Ricky Martin (joining for “Lo Que Le Pasó a Hawaii”). A live wedding ceremony onstage and cameos from Pedro Pascal, Jessica Alba, Karol G and Cardi B added to the festive vibe. Bad Bunny closed with a unifying message naming countries across the Americas before declaring “God Bless America.”

The show drew widespread praise for its inclusivity and energy, contrasting the low-scoring on-field action. It marked the first primarily Spanish-language halftime performance, boosting viewership among diverse audiences.

Postgame, Seahawks players hoisted the Lombardi Trophy amid confetti and celebrations. Darnold was named MVP for his steady play, though the defense earned equal acclaim. Myers’ record five field goals highlighted special teams’ impact.

The victory caps a remarkable season for Seattle, who overcame early injuries and emerged as the NFC’s top seed. For New England, the defeat stings as a missed opportunity to reclaim dominance, but the young core around Maye offers hope for future runs.

Super Bowl LX will be remembered for its defensive masterclass, historic halftime celebration and Seattle’s sweet redemption over their longtime rivals. As the Seahawks begin their championship parade, the NFL offseason begins with questions about dynasty potential in the Pacific Northwest.

Business

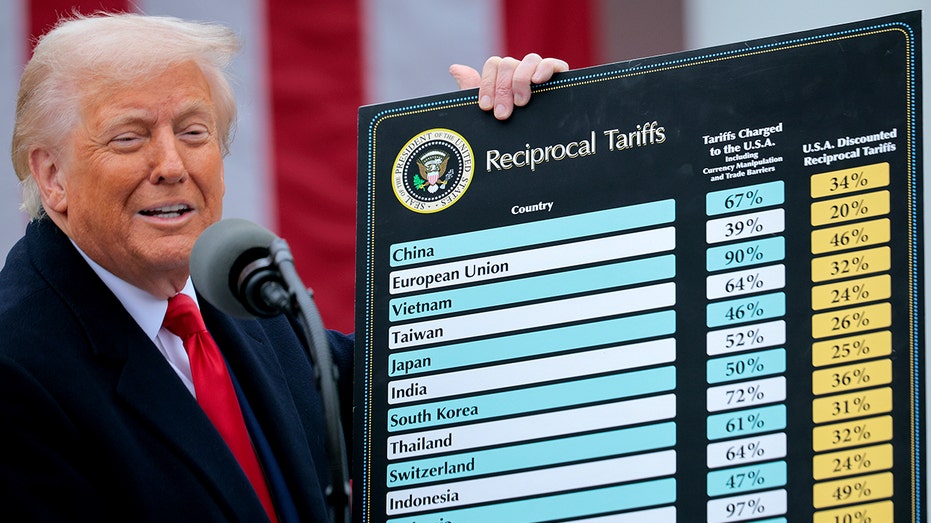

Trump predicts Dow will hit 100K by end of term, says ‘great tariffs’ driving ‘record stock market’

Former federal prosecutor Andrew Cherkasky breaks down the delay in the Supreme Court ruling on President Donald Trump’s tariffs as well as the upcoming birthright citizenship case on ‘Varney & Co.’

President Donald Trump on Sunday said he was predicting the Dow Jones Industrial Average to reach 100,000 by the time he leaves the White House in January 2029.

This comes after the Dow closed past 50,000 on Friday for the first time.

“Record Stock Market, and National Security, driven by our Great TARIFFS. I am predicting 100,000 on the DOW by the end of my Term,” Trump wrote on Truth Social.

President Donald Trump said he was predicting the Dow Jones Industrial Average to reach 100,000 by the time he leaves the White House. (Photo by Andrew Harnik/Getty Images / Getty Images)

“REMEMBER, TRUMP WAS RIGHT ABOUT EVERYTHING! I hope the United States Supreme Court is watching,” he added.

The president’s comment about the Supreme Court comes as a high-profile case over the legality of his tariff authority is expected to be decided. The Supreme Court recently heard arguments on whether sweeping tariff powers used by Trump are constitutional.

The tariff costs were found to be largely absorbed by American consumers and businesses rather than by foreign exporters, according to economists. A study published last month by the Kiel Institute for the World Economy found that about 96% of tariff costs were taken on by Americans.

The Dow closed past 50,000 on Friday for the first time. (Anna Moneymaker / Getty Images / Getty Images)

Trump had made an identical post on Friday night, as well as a separate post that also credits himself for the Dow’s closing.

“The ‘Experts’ said that if I hit 50,000 on the Dow by the end of my Term, I would have done a great job, but I hit 50,000 today, three years ahead of schedule — Remember that for the Midterms, because the Democrats will CRASH the Economy!” he wrote on Friday.

TARIFFS MAY HAVE COST US ECONOMY THOUSANDS OF JOBS MONTHLY, FED ANALYSIS REVEALS

The tariff costs were found to be largely absorbed by American consumers and businesses rather than by foreign exporters. (Chip Somodevilla/Getty Images / Getty Images)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In another post on Sunday, Trump wrote: “Enjoy the Super Bowl, America! Our Country is stronger, bigger, and better than ever before and, THE BEST IS YET TO COME!”

Business

Jimmy Lai sentenced to 20 years in Hong Kong national security case

Jimmy Lai sentenced to 20 years in Hong Kong national security case

Business

Indian rupee to gauge sustenance of foreign flows, bonds back to supply worries

In fixed income, bond market investors will monitor demand-supply dynamics, which could prove key in determining the direction of bond yields.

The rupee closed at 90.6550 on Friday, up over 1% on the week.

The U.S. and India unveiled an interim trade framework on Friday, building on an initial announcement earlier last week. While the breakthrough has lifted sentiment on Indian assets, analysts remain cautious about its impact on portfolio flows.

Foreign investors have net bought nearly $900 million of Indian stocks so far in February, after pulling $4 billion last month, though they have sold $19 billion so far in 2025.

“While the currency (INR) could trade more stably for a while, especially if the drawdown in risk extends, spot upside is likely to prove limited,” analysts at Goldman Sachs said in a note.

In global markets, the focus this week will be on the release of key U.S. economic data alongside reactions to elections outcomes in Japan and Thailand. BONDS

The 10-year benchmark 6.48% 2035 yield settled at 6.7363% on Friday, notching its second consecutive weekly rise, after the Reserve Bank of India’s monetary policy decision.

The central bank held rates at 5.25% as expected but offered no fresh liquidity support. Traders had expected tweaks to liquidity rules to ease deposit tightness amid rising yields and credit growth.

Traders expect the yield to move in a 6.71%-6.80% range this week, with sellers in the driving seat. On Friday,

With the budget and the central bank policy behind, the market focus will be on debt supply.

The MPC is set for a prolonged pause, with the RBI focusing on liquidity via open market purchases and FX swaps, though higher FY27 borrowing could add upward pressure on yields, said Puneet Pal, PGIM India MF.

India aims to gross borrow a record 17.20 trillion rupees ($189.70 billion) next financial year, with net borrowing of 11.73 trillion rupees. India’s financial year starts in April and runs through March.

RBI Governor Sanjay Malhotra said the focus on the size of gross borrowing could be misleading and that net borrowing provides a more accurate assessment of the fiscal position.

“Looking at gross borrowing is not the correct way because there are many more redemptions next year than in the current year.”

KEY EVENTS: India January retail inflation – February 12, Thursday (4:00 p.m. IST) U.S. December import prices – February 10, Tuesday (7:00 p.m. IST)

December retail sales – February 10, Tuesday (7:00 p.m. IST) January non-farm payroll and unemployment rate – February 11, Wednesday (7:00 p.m. IST) Initial weekly jobless claims for week to February 7 – February 12, Thursday (7:00 p.m. IST) January existing home sales – February 7 – February 12, Thursday (8:30 p.m. IST)

January consumer price inflation – February 13, Friday (7:00 p.m. IST) (Reuters poll: 2.5%)

Business

Pfizer: ‘Hold’ As Patent Cliff Looms, Along With Need For Differentiating Factor (PFE)

Terry Chrisomalis is a private investor in the Biotech sector with years of experience utilizing his Applied Science background to generate long term value from Healthcare. He is the author of the investing group Biotech Analysis Central which contains a library of 600+ Biotech investing articles, a model portfolio of 10+ small and mid-cap stocks with deep analysis for each, live chat, and a range of analysis and news reports to help Healthcare investors make informed decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

-

Video6 days ago

Video6 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics7 days ago

Politics7 days agoSky News Presenter Criticises Lord Mandelson As Greedy And Duplicitous

-

Politics10 hours ago

Politics10 hours agoWhy Israel is blocking foreign journalists from entering

-

Sports2 days ago

Sports2 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech2 days ago

Tech2 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat5 hours ago

NewsBeat5 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business10 hours ago

Business10 hours agoLLP registrations cross 10,000 mark for first time in Jan

-

Politics12 hours ago

Politics12 hours agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Crypto World7 days ago

Crypto World7 days agoMarket Analysis: GBP/USD Retreats From Highs As EUR/GBP Enters Holding Pattern

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business17 hours ago

Business17 hours agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business3 days ago

Business3 days agoQuiz enters administration for third time

-

Sports7 days ago

Sports7 days agoShannon Birchard enters Canadian curling history with sixth Scotties title

-

NewsBeat7 days ago

NewsBeat7 days agoGAME to close all standalone stores in the UK after it enters administration

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat2 days ago

NewsBeat2 days agoDriving instructor urges all learners to do 1 check before entering roundabout