Crypto World

3 Meme Coins To Watch In The Second Week Of February 2026

Meme coins are once again drawing trader attention as speculative capital rotates back into high-volatility setups. After weeks of choppy conditions, several meme-driven assets are beginning to show technical signs of stabilization and early reversals.

BeInCrypto has analysed three such meme coins that investors should watch in February week 2.

Sponsored

Sponsored

Pippin (PIPPIN)

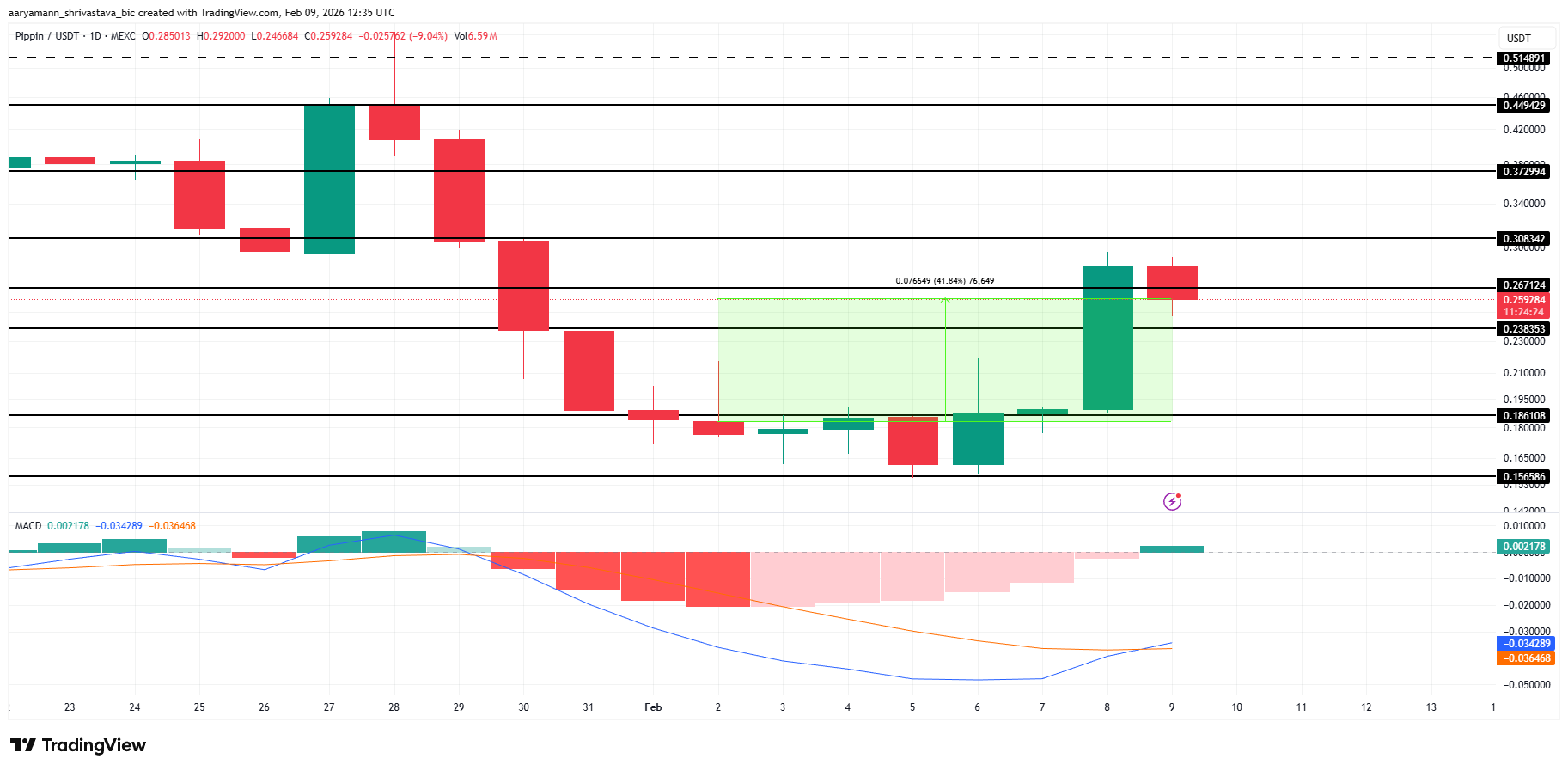

PIPPIN is attempting a trend reversal after a sharp corrective leg, with price bouncing cleanly from the $0.1565 demand zone and forming short-term higher lows. Momentum is improving as the MACD histogram is forming a bullish crossover, suggesting selling pressure is fading, and buyers are stepping back in.

Price is currently trading around $0.2592, which remains the immediate level to reclaim. A strong daily close above $0.2671 would confirm continuation and open the path toward $0.3083, with a further extension toward $0.3729 if momentum and volume expand in favor of bulls.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This recovery structure stays intact as long as the price holds above $0.1861 on a daily closing basis. A breakdown and close below $0.1565 would invalidate the bullish reversal, flip momentum back bearish, and expose downside continuation, signaling the bounce was corrective rather than trend-changing.

Sponsored

Sponsored

Bone ShibaSwap (BONE)

BONE is noting a bounce after an extended downtrend, with price defending the $0.0482 swing low and reclaiming the 23.6% Fibonacci level at $0.0607. The structure hints at a potential short-term reversal as bullish candles step in, while CMF ticks up to -0.11, signaling declining but still cautious capital outflows.

Price is currently trading at $0.0685, testing the 38.2% Fibonacci retracement. A clean daily close above $0.0685 would open upside continuation toward $0.0747 (50% Fib), followed by a move to $0.0810 at the 0.618 level. A breach above $0.0810 would shift the market structure bullish and target $0.0899 next.

This recovery remains valid as long as the price holds above $0.0607 on a daily closing basis. A breakdown below this support would fully invalidate the bullish reversal, sending BONE to $0.0481.

Banana For Scale (BANANAS31)

BANANAS31 has rallied sharply over the past four days, trading near $0.0043 at the time of writing. The meme coin is pressing against the $0.0043 resistance, which aligns with the 38.2% Fibonacci retracement. This level is critical for determining whether recent momentum can sustain further upside.

Historically, BANANAS31 has failed to clear this resistance, making the current attempt decisive. A successful breakout would confirm bullish continuation. The Money Flow Index indicates strong buying pressure, reinforcing upside potential. A move above $0.0047, the 50% Fibonacci level, could accelerate gains toward the $0.0051 target.

On the other hand, failure to break $0.0043 may trigger a pullback toward $0.0039. Losing the 23.6% Fibonacci support would weaken the structure. Under that scenario, BANANAS31 could slide to $0.0035, invalidating the bullish thesis and erasing the meme coin’s recent recovery gains, sending it back to early February’s price.

Crypto World

Bitcoin & Ethereum News, Crypto Prices & Indexes

Bitcoin (CRYPTO: BTC) steadied as Wall Street opened on Monday, marking a calmer exit from an earlier burst of volatility while gold extended its march toward February highs. Traders surveyed a landscape where risk-on catalysts were scarce and liquidity appeared to coalesce around key price levels. In this environment, analysts highlighted a potential range-bound dynamic for BTC, with buyers and sellers evaluating the same technical anchors that have governed recent moves. The broader macro backdrop—dovish whispers on inflation and a wary risk appetite—helped anchor prices as investors awaited clearer directional cues.

Key takeaways

- Bitcoin is expected to bounce within a defined range, with Fibonacci levels shaping the near-term support and resistance boundaries after a spell of pronounced volatility.

- The Coinbase Premium Index briefly flipped to positive territory for the first time in four weeks, suggesting a narrowing price gap between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs.

- On-chain data point toward defensive market behavior, as mean exchange outflows spike and large holders continue accumulating coins off exchanges.

- Analysts describe a broad risk-off stance across spot, derivatives, ETFs, and on-chain indicators, reinforcing a cautious mood despite occasional shifting signals.

- Whale activity is being watched closely, with CryptoQuant noting aggressive accumulation patterns on Binance during a period of price testing near the upper range.

Tickers mentioned: $BTC

Sentiment: Bearish

Price impact: Neutral

Trading idea (Not Financial Advice): Hold

Market context: The current phase sits within a broader environment of liquidity questions, cautious positioning, and mixed signals from on-chain data, as traders weigh potential catalysts and macro developments that could reaccelerate price discovery.

Why it matters

The near-term trajectory for Bitcoin remains tethered to a delicate balance between selling pressure and the willingness of large buyers to step in. As BTC hovers near technical levels, traders are parsing whether current price action represents a genuine base formation or a pause before the next leg of directional movement. The combination of subdued volatility on the hourly time frame and rising on-chain activity around key levels suggests that market participants are preparing for a potential breakout—but only if liquidity and demand align at the right junctures.

On the exchange front, the Coinbase Premium Index’s move back into positive territory, albeit briefly, adds texture to the narrative. The metric, which tracks the relative pricing between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs, has historically offered a rough proxy for where demand is strongest across major venues. A short-lived positive reading can signal shifting demand dynamics or a reevaluation of where liquidity will materialize first in a range-bound regime. Yet observers caution that a temporary tilt does not guarantee a sustained updraft, especially when broader risk-off signals persist elsewhere in crypto markets.

From an on-chain perspective, CryptoQuant documented a notable intake of coins away from exchange wallets, a classic hallmark of accumulation by large holders during periods of price consolidation. The narrative—described in the Quicktake piece as “accumulation during capitulation”—frames current activity as a potential precursor to a support base that could anchor prices if demand steadies. In tandem, the two-week moving average of mean exchange outflows reached 13.3 BTC per withdrawal on Feb. 8, a level that underscores the scale at which investors have been moving coins off centralized venues. Taken together, these signals hint at a more nuanced dynamic than simple momentum-driven moves, where hedging and reserve-building among market participants may provide a floor even as sentiment remains cautious.

“The market is currently witnessing a classic ‘accumulation during capitulation’ scenario,” CryptoQuant analysts wrote, noting that while sentiment remains fearful, the surge in mean exchange outflows points to active buying by large players.

“While sentiment is fearful, the sharp rise in the Mean Exchange Outflow confirms that large-scale investors are aggressively buying and withdrawing Bitcoin, signaling potential support formation at these levels.”

Beyond BTC alone, industry watchers pointed to a persistent risk-off tone across the ecosystem. Glassnode’s Market Pulse characterized conditions as defensive across spot, derivatives, ETFs, and on-chain indicators, noting compressed profitability and negative capital flows alongside elevated hedging demand after recent repricing. While some signals hint that selling pressure could be moderating, analysts emphasized that a durable rebound would likely require renewed spot demand capable of lifting prices above recent lows. The overall mood, while not uniformly bearish, remains cautious, with players calibrating risk management and liquidity considerations as macro narratives continue to evolve.

In the background, gold referenced a similar tension in risk appetite, continuing a broader push toward safe-haven assets as investors weigh the trajectory of rates and inflation expectations. The precious metal’s move toward new month-to-date highs provided a contrasting backdrop to crypto markets, highlighting the ongoing interplay between traditional assets and digital markets in a mixed macro environment.

What to watch next

- BTC price action around the defined Fibonacci levels: watch for a decisive break above or below current bands to confirm the range-bound thesis or signal a breakout.

- Movement in the Coinbase Premium Index: a sustained positive reading or a reversion could provide early hints about shifting exchange demand dynamics.

- On-chain accumulation signals: monitor changes in mean exchange outflow and large-holder activity that could indicate loosening or tightening supply pressure.

- Glassnode Market Pulse updates: any shift toward risk-on indicators or renewed profit-taking could influence near-term sentiment and liquidity flows.

Sources & verification

- TradingView BTCUSD price data on the BITSTAMP feed used to gauge volatility and range formation.

- CryptoQuant: Coinbase Premium Index data showing the index behavior around February 2026.

- CryptoQuant Quicktake: Bitcoin Aggressive Whale Accumulation on Binance and related discussion of capitulation-era accumulation patterns.

- Glassnode: Market Pulse report for February 2026, describing risk-off conditions across spot, derivatives, ETFs, and on-chain metrics.

- Public posts on StefanB’s X feed and CW8900’s tweet, illustrating trader sentiment and real-time micro-structure signals in BTC volatility and liquidity.

Bitcoin price action in a quiet range as momentum ebbs

Bitcoin (CRYPTO: BTC) has settled into a quiet framework after an eventful period, with price momentum cooling as traders await catalysts that could tip the balance toward a new trend. The market’s current complexion leans toward a defined range, with technical observers identifying Fibonacci retracement levels as the principal scaffolding around which near-term price action is likely to rotate. The absence of a clear directional impulse has encouraged participants to posture for a breakout or a sustainable pullback, depending on which side of the spectrum liquidity and demand prefer to emerge.

Analysts on X and other analytics platforms have highlighted a convergence of signals that are consistent with a cautious, range-bound stance. A notable commentary from StefanB underscored the idea that the market might be building liquidity into critical levels, a scenario often observed after episodes of elevated volatility. In practical terms, that means traders are watching price action near well-defined support and resistance horizons, waiting for a decisive move that could establish a new baseline for the next leg of the cycle. As the price slices through these thresholds, a sustained shift in volatility could either validate the range-play hypothesis or usher in a fresh wave of liquidity that drives BTC beyond the current confines.

On-chain data contribute a complementary perspective. The Coinbase Premium Index’s recent move into positive territory, even if temporary, points to a shifting balance of demand across major venues. The metric’s trend, combined with CryptoQuant’s discussion of aggressive whale accumulation on Binance, paints a more nuanced picture than simple speculation about price—one in which large players appear to be consolidating positions in preparation for potential price resilience. The argument for accumulation is reinforced by the reported rise in mean exchange outflows, a signal that investors are methodically removing coins from centralized exchanges to reduce selling pressure and preserve optionality as prices test nearby resistance.

Still, the broader market mood remains cautious. Glassnode’s Market Pulse notes that profitability across spot and derivatives has been compressed and hedging demand remains elevated, underscoring the fragility of any optimistic takeaway. In this environment, even as some indicators hint at underlying support, the absence of robust spot-driven demand means any upside may depend on a convincing uptick in risk appetite or a surprising development in macro data that redefines the risk-reward calculus for crypto assets.

Gold’s ongoing strength adds a macro layer to the discussion. As bullion tests new highs for the month, investors are reminded of the complex interplay between traditional assets and digital markets. The current cross-currents—ranging from inflation expectations to liquidity dynamics—highlight why BTC’s trajectory remains highly context-dependent, with a broad spectrum of catalysts capable of reshaping investor positioning in the short to medium term. The narrative continues to emphasize caution and disciplined risk management, even as people remain vigilant for a breakout that could unlock a fresh phase of price discovery.

//platform.twitter.com/widgets.js

Crypto World

Why Bitcoin Crashed Over 10% in One Week

Despite BTC’s rebound from a brief dip to $60,000, retail investor sentiment remains firmly in the “extreme fear” zone.

The crypto market went through another round of wild swings in early February after Bitcoin suddenly plunged to the low-$60,000s in just a few hours on Feb. 5, dragging the rest of the market down with it, before bouncing back to near $70,000.

As of Monday morning, the largest cryptocurrency by market cap is trading around $68,860, down 3.2% in the past 24-hours and almost 12% over the past seven days.

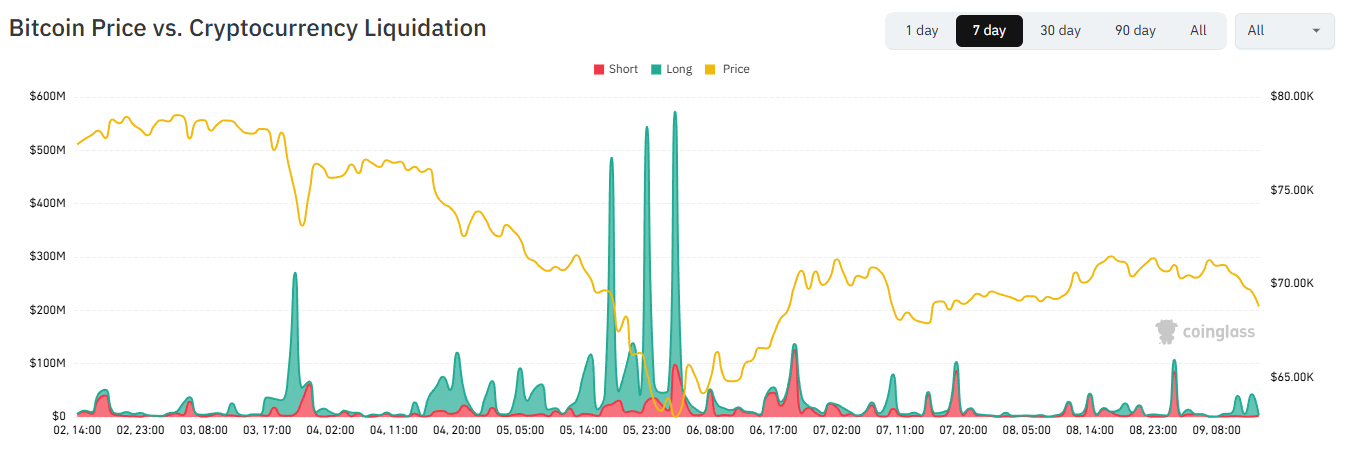

Data from Coinglass shows more than $2 billion in leveraged crypto positions were liquidated in that short window on Thursday, mostly made up of long bets forced to close as prices fell. That wave of automatic selling pushed the slide further than fundamentals alone would suggest.

Jeff Park, a Bitwise portfolio manager, suggested on X on Thursday evening that a lot of the indiscriminate selling seemed to come from multi-strategy hedge funds running delta-hedged trades “possibly with growth equity correlations spillovers.”

Hello from Hong Kong

Parker White, chief investment officer at DeFi Development Corporation, wrote in an X post several hours after Park that the market crash was probably triggered by the sudden collapse of Hong Kong hedge funds, as The Defiant previously reported.

Those funds held call options in IBIT, BlackRock’s spot Bitcoin exchange-traded fund and one of the largest in the market, which saw about $10.7 billion in trading that day — nearly double its previous record — with roughly $900 million in options premiums changing hands.

White suggested that Asia-based hedge funds had run a leveraged IBIT options trade funded in yen, added more leverage after losses, got hit by funding costs and silver trades, and then the final Bitcoin move triggered the collapse.

“We know that Asian traders, particularly in China, have been deeply involved in the Silver and Gold trade. Silver was down 20% today, which was the 2nd largest 1 day move in a very long time (largest on Jan 30). We also know that the JPY carry trade has been unwinding at an increasingly rapid pace,” White wrote.

But if the liquidation actually happened, it won’t show up in 13F filings — quarterly reports that disclose institutional holdings — until 45 days after the quarter ends, so mid‑May is the earliest the full picture could emerge.

Tanisha Katara, founder of Katara Consulting Group, echoed the sentiment, noting in commentary for The Defiant that institutional products like ETFs can accelerate both rallies and sell-offs.

She noted that U.S. spot Bitcoin ETFs, which provide streamlined access to the crypto market for large financial players, are now also net sellers, showing that having a way in doesn’t guarantee long-term commitment. Katara told The Defiant:

“The digital gold narrative has been conclusively debunked by this cycle. Like Gold is up 72% while Bitcoin is down 28% over the same period. What’s left is the infrastructure thesis: stablecoins, tokenisation, DeFi primitives, governance systems, and programmable money.”

Adding to the chaos, South Korea’s Bithumb mistakenly gave away thousands of BTC during a promotion, briefly sparking heavy local selling, though the exact amount of dumped tokens remains unclear.

As The Defiant reported earlier, users rushed to cash out their accidentally airdropped BTC and offramp funds, briefly sending the price of Bitcoin on Bithumb almost 18% below market price across other exchanges globally.

The mishap already prompted South Korea’s Financial Supervisory Service to warn it will tighten oversight and impose tougher penalties on financial firms.

Further Declines Ahead

As crypto struggles, other global risk assets are also unstable. Kyle Rodda, senior financial market analyst at Capital.com, explained in commentary shared with The Defiant that “everything is the one trade in the markets right now,” with fundamentals acting more as triggers than as main drivers of daily swings.

“The week ahead will also be dominated by U.S. data, with a batch of inflation figures and Non-Farm Payrolls data released in coming days after the latter was delayed by the partial US Government shutdown. The narrative is less pronounced given the resilience of U.S. economic activity recently, but the markets continue to try and balance signs of a sluggish labour market with sticky prices,” Rodda added.

Georgii Verbitskii, founder of crypto investment app TYMIO, told The Defiant that the sell-off also reflected long-term holders trimming exposure. He noted that Bitcoin’s inflation-hedge narrative was being questioned short-term, and predicted that the market would likely go lower:

“At this point, I don’t see strong catalysts for the upside. Most likely, Bitcoin will spend some time ranging between $55,000 and $67,000, possibly slightly higher. Looking further out, a deeper move toward the low $40,000s can’t be ruled out over the course of the year — especially given that 2026 is shaping up to be a challenging period across global markets.”

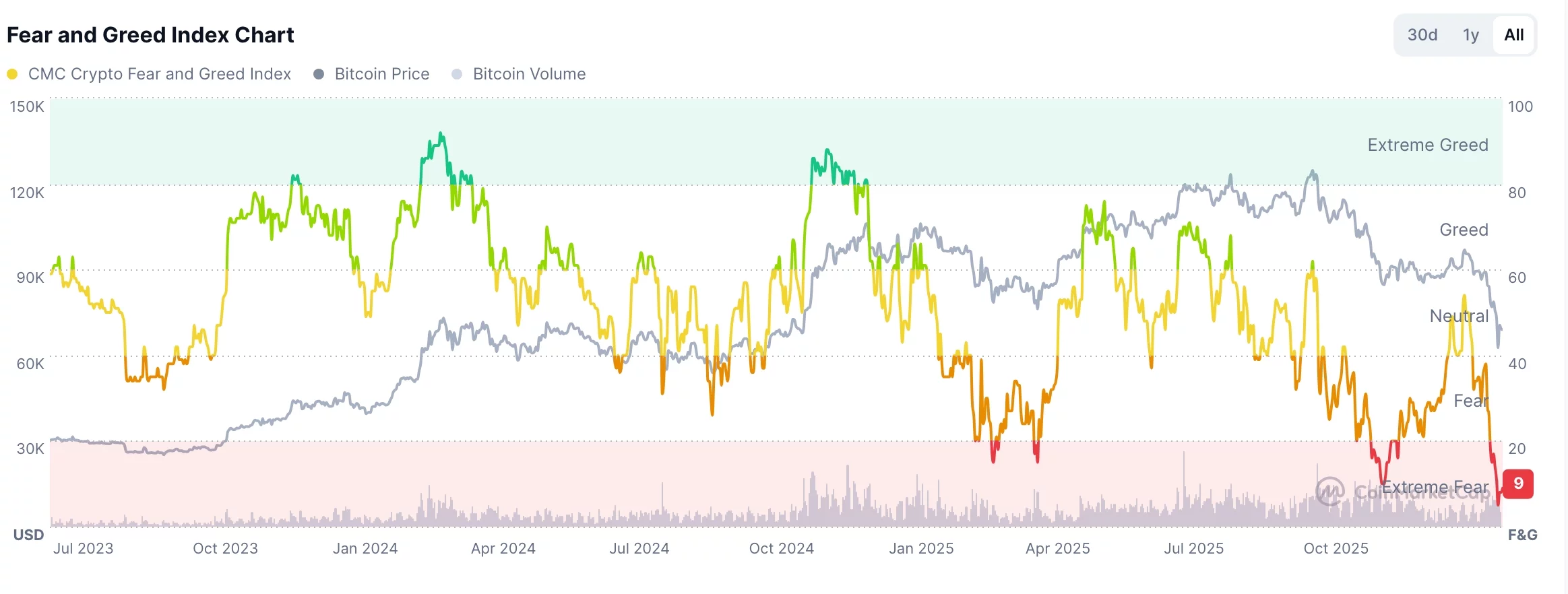

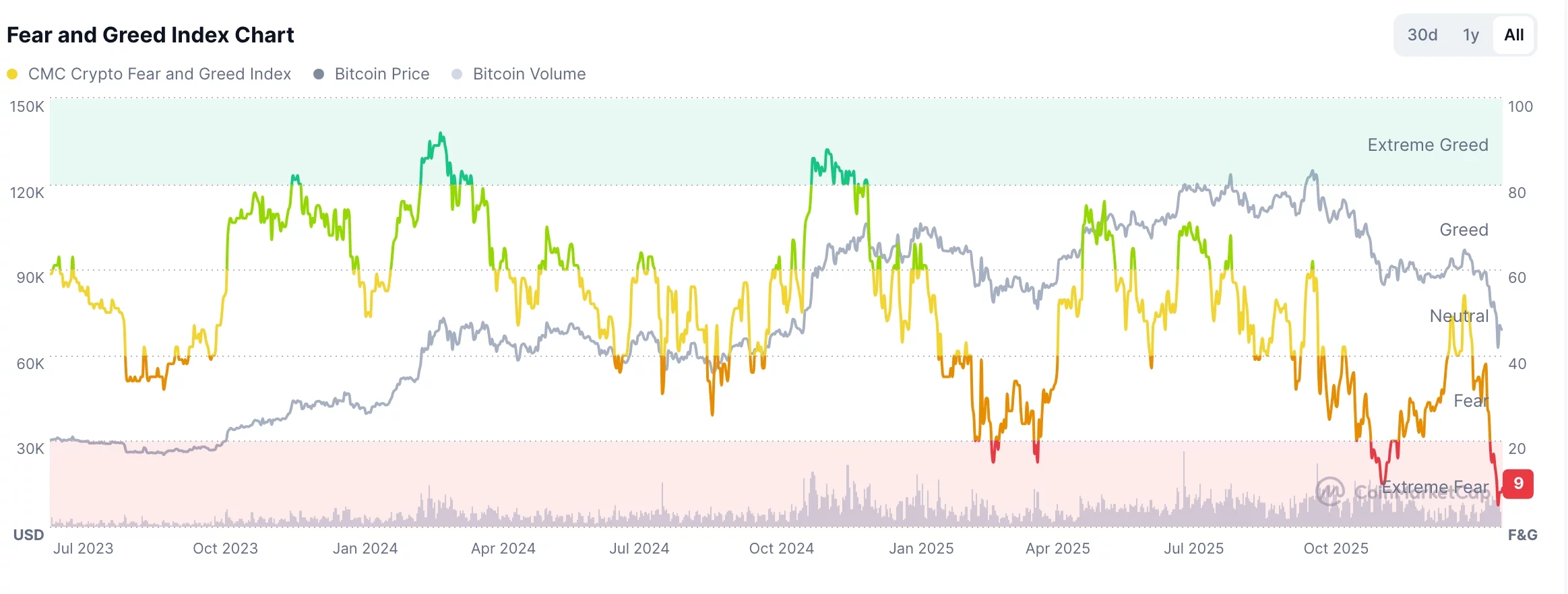

Speaking with The Defiant, Ryan Li, CEO of Surf, an AI tool built for crypto, pointed out that sentiment among retail investors is “extremely low right now, firmly in ‘extreme fear’ territory and on par with the November lows.”

Data from the Greed & Fear Index shows that even with Bitcoin bouncing back to $70,000 over the past 24 hours, investors are indeed still stuck in “extreme fear.”

Crypto World

Crypto market on edge as China asks banks to dump US Treasuries

The crypto market remained on edge on Monday, Feb. 9, as the recent recovery faltered, and after China continued to decouple from the U.S.

Summary

- The crypto market remained under pressure on Monday as US government bond yields rose.

- China asked banks and other financial services in the country to reduce their exposure to U.S. debt.

- The futures open interest in the crypto industry continued to fall, while the Fear and Greed Index retreated.

Bitcoin (BTC) retreated below the key support level at $70,000, while the market capitalization of all tokens fell by 2.75% in the last 24 hours. The Crypto Fear and Greed Index remained in the extreme fear zone, while positions worth over $356 million soared to $356 million.

China urges banks to reduce exposure to US Treasuries

Bitcoin and the broader crypto market retreated on Monday as other risky assets pulled back. Futures tied to the Dow Jones and the Nasdaq 100 Index also retreated, paring back some of the gains made on Friday.

This price action happened as Chinese regulators asked financial institutions, including banks, to reduce their exposure to U.S. Treasuries. It also urged those with a high exposure to these assets to reduce them.

According to Bloomberg, the new measures have been framed as a way to diversify their risks rather than the ongoing geopolitical tensions between the two economies. Officials are worried that higher holdings of US Treasuries may expose these companies to higher volatility in the future.

China’s government has also continued selling its own US government bonds in the past few years. It now holds $682 billion in US Treasuries, down from over $1 trillion a few years ago.

Worse, some European governments also considered using their large holdings of U.S. Treasury securities as leverage during the recent Greenland crisis. Many European countries, such as the United Kingdom, Belgium, and Luxembourg, hold trillions of U.S. dollars in bonds.

Continued selling of U.S. Treasuries as the government debt has jumped, is one reason why long-term bond yields and gold prices have soared in the past few years. The 30-year rose to 4.90%, while the gold price jumped to above $5,000 as the rally continued.

Crypto Fear and Greed Index remains in the fear zone

Crypto market traders are still fearful that the recent plunge will resume. For one, the Crypto Fear Index has dropped to the extreme fear zone of 9.

The volume in the crypto industry has also dropped sharply in the past few days. According to CoinMarketCap, trading volume dropped 12% over the last 24 hours to $100 billion.

Most importantly, futures open interest has retreated to $96 billion, down from last year’s high of over $255 billion. Falling futures open interest is a sign that investors are continuing their deleveraging, which often leads to lower crypto prices.

Crypto World

Bitcoin price low-volume bounce raises bull trap concerns

Bitcoin’s price has bounced from key support near $60,000, but declining volume and rising overhead resistance are raising concerns that the move may be a bull trap rather than a sustainable recovery.

Summary

- $60,000 support sparked the bounce, but demand remains weak

- Low volume and VWAP/Fibonacci rejection, signal fragile upside

- Acceptance below the point of control, favors rotation back toward support

Bitcoin (BTC) price action has staged a short-term rebound after successfully retesting a major high-timeframe support level near $60,000. While the bounce initially appeared constructive, deeper analysis reveals that the move higher has lacked strong participation.

Declining volume during the rally suggests that bullish momentum remains fragile, increasing the probability that the recent upside is corrective rather than trend-defining.

Bitcoin price key technical points

- $60,000 support has held, triggering a short-term bounce

- Rising price on declining volume, signaling weak bullish conviction

- Rejection at VWAP and 0.618 Fibonacci, reinforcing local resistance

From a volume profile perspective, Bitcoin’s recent advance has occurred on noticeably declining volume. In healthy bullish reversals, price expansion is typically accompanied by increasing participation, reflecting strong demand and conviction from buyers. In contrast, the current rally lacks this confirmation, suggesting the move may be driven by short-covering or opportunistic buying rather than sustained accumulation.

This type of low-volume bounce often appears during corrective phases within broader bearish or range-bound environments. Without renewed volume expansion, the probability of follow-through remains limited, leaving price vulnerable to renewed selling pressure.

Rejection from key resistance levels

Technically, Bitcoin is now facing a strong confluence of resistance. The current rejection is occurring near the 0.618 Fibonacci retracement of the recent decline, an area that often acts as a decision point in corrective rallies. This level is reinforced by VWAP resistance, drawn from the recent swing high prior to the series of sharp sell-offs.

The combination of Fibonacci resistance and VWAP creates a high-probability supply zone. Price rejection from this area, particularly on weak volume, strengthens the case that sellers remain active and willing to defend higher levels.

Acceptance below the point of control

Another important development is Bitcoin’s inability to hold above the local point of control (POC). The POC represents the price level at which the highest trading volume has occurred and often serves as a market balance point.

Finding acceptance below this level suggests that sellers are regaining control and that the market is transitioning back into imbalance. Historically, acceptance below the POC following a low-volume rally increases the likelihood of a rotational move lower, especially when broader structure remains bearish or neutral.

Range rotation likely to continue

From a market structure perspective, Bitcoin appears to be trading within a developing high-timeframe range. The lower boundary of this range is defined by the $60,000 support, while the upper boundary sits near $76,200. Until price can break above resistance with strong volume confirmation, rotations within this range remain the higher-probability outcome.

Given the current rejection and lack of bullish participation, the probability favors a move back toward the lower end of the range. A rotation toward $60,000 would be consistent with range behavior and would test whether buyers can continue to defend this critical support.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Bitcoin’s recent bounce shows signs of weakness. The combination of declining volume, rejection from key resistance, and acceptance below the point of control raises the risk that the move higher is a bull trap.

If selling pressure increases, Bitcoin is likely to rotate back toward the $60,000 region to retest high-timeframe support. A strong reaction from this level would keep the broader range intact, while failure to hold could expose deeper downside risk.

Crypto World

BMNR stock slowly preps rebound as key Ethereum metrics soar

The BMNR stock price hovered at the crucial support level of $20 as BitMine continued to accumulate Ethereum, and its fundamentals improved.

Summary

- BitMine’s stock price has formed a falling wedge pattern, pointing to a rebound.

- Data shows that Ethereum’s transactions and network fees have soared recently.

- The supply of ETH tokens in exchanges has continued falling this month.

BitMine stock has retreated by over 85%from its highest level in July last year. It is also slowly forming the highly bullish falling wedge pattern, pointing to a strong rebound.

In a statement, Tom Lee’s BitMine said that it continued to buy Ethereum (ETH) tokens last week, bringing its total holdings to over 4.326 million. It also holds 193 Bitcoin (BTC) and nearly $600 million in cash. Its other assets include $200 million in Beast Industries and $19 million in Eightco Holdings, a company that has invested in Worldcoin.

BitMine stock may ultimately benefit from Ethereum’s fundamentals, which have continued improving in the past few months, with third-party data showing relentless growth. Ethereum transactions, fees, and active addresses have continued to soar over the past few months, a trend that has accelerated after the Fusaka upgrade.

More data show that the amount of staked Ethereum continues to rise. The staking queue has jumped to over 4 million coins, with entry rising to over 70 days. Rising staking inflow is a sign that demand continues rising.

At the same time, data show that the supply of ETH tokens on exchanges has continued to fall and is now at its lowest level since 2016.

BMNR stock price prediction: Technical analysis

The daily timeframe chart shows that the BitMine stock price has been in a strong downward trend in the past few months. It plunged from a record high of $160 to the current $20.

On the positive side, the coin has formed a falling wedge pattern, which consists of two descending and converging trendlines.

This wedge is nearing its confluence, which could lead to a rebound soon. Also, the Relative Strength Index has moved from the oversold level of 30 to the current 32.

Therefore, the stock will likely have a strong bullish breakout in the coming days, potentially to the key resistance level at $35, its highest level in January this year.

On the other hand, a move below the lower side of the wedge will point to more downside in the near term.

Crypto World

South Korea’s FSS Launches AI-Powered Crackdown on Crypto Market Manipulation

TLDR:

- FSS targets whale trading, cage methods, and racehorse schemes in planned 2026 market investigations

- AI-powered systems will analyze abnormal price surges within seconds to identify manipulation patterns

- Digital Asset Basic Act preparatory team established to support phase-2 virtual asset legislation

- New licensing manuals developed for digital asset service providers and stablecoin issuers nationwide

South Korea’s Financial Supervisory Service announced comprehensive plans to investigate virtual asset market manipulation on February 9.

The regulatory body outlined targeted enforcement actions against high-risk trading schemes that disrupt market order.

The FSS will deploy artificial intelligence tools to detect abnormal price movements and suspicious trading patterns.

A preparatory team for the Digital Asset Basic Act was also established to support upcoming phase-2 legislation implementation.

Planned Investigations Target High-Risk Market Manipulation Schemes

The FSS identified several manipulation methods as priority investigation targets for 2026. Whale trading operations that deploy substantial capital for coordinated buy-and-sell activities will face increased scrutiny.

The cage method, which artificially controls prices of assets with suspended deposits on specific exchanges, represents another enforcement focus.

Racehorse schemes that rapidly inflate prices through concentrated buying at predetermined times also made the list.

Market manipulation through application programming interface orders presents additional concerns for regulators. The automated nature of API-based trading allows manipulators to execute complex strategies at scale.

Social media platforms have become tools for spreading false information about virtual assets. These coordinated misinformation campaigns can trigger artificial price movements and harm retail investors.

The FSS plans to develop sophisticated detection capabilities using artificial intelligence technology. The new system will analyze virtual assets experiencing abnormal price surges within seconds or minutes.

Automated extraction functions will identify suspect trading periods and participant groups. Text analysis powered by AI will examine communications and social media posts for manipulation indicators.

Fraudulent transactions remain a persistent threat to market integrity and investor protection. The combination of human oversight and technological tools aims to create a more robust enforcement framework.

Regular monitoring of high-risk trading patterns will enable faster regulatory responses. The FSS expects these measures to deter potential manipulators and restore confidence in virtual asset markets.

Digital Asset Framework Prepares for Phase-2 Legislative Implementation

The Financial Supervisory Service recently formed a preparatory group for the Digital Asset Basic Act. This team will support the effective rollout of phase-2 virtual asset legislation currently under development.

The preparatory group’s mandate includes creating comprehensive regulatory frameworks for market participants.

Coordination with lawmakers and industry stakeholders will ensure practical implementation of new legal requirements.

Disclosure systems for virtual asset issuance and transaction support are under active development. The preparatory team will establish standardized reporting requirements for token launches and trading platforms.

Transparency measures aim to provide investors with essential information for informed decision-making. Clear disclosure standards will also help distinguish legitimate projects from potentially fraudulent schemes.

Licensing review procedures for digital asset operators and stablecoin issuers require detailed operational manuals. The FSS will create guidelines covering application processes, compliance requirements, and ongoing obligations.

Stablecoin issuers face particular scrutiny given their role in maintaining price stability mechanisms. Digital asset service providers must demonstrate adequate technical capabilities and financial stability for licensure.

The regulatory body plans to enhance virtual asset exchange fee management and disclosure practices. Current fee structures lack standardization across different trading platforms and service types.

Refined disclosure requirements will enable users to compare costs across exchanges more effectively. The FSS believes transparent fee structures will promote healthy competition and rational consumer choices.

Better fee management should reduce barriers to entry for new market participants while protecting existing users.

Crypto World

Only 130M BDAG Left in BlockDAG’s $0.00025 Entry As DOGE & XRP Chase Gains

2026’s crypto market continues to navigate a period of uncertainty, with volatility, macro pressure, and shifting liquidity shaping short-term price action across major assets. As sentiment stabilizes, traders are closely watching key support zones.

Within this environment, Dogecoin price today is showing signs of stabilization after defending a long-term support range, while the XRP price prediction remains cautious amid ongoing downside pressure and weakening technical momentum. Both assets reflect the broader market’s search for direction.

At the same time, attention is turning toward early-stage opportunities like BlockDAG (BDAG). As it approaches its February 16 exchange launch, its final private sale phase, fixed pricing, and early access structure are drawing interest from traders looking beyond short-term volatility and serious gains..

Target Recovery for Dogecoin Price Today at 0.15

Analysts believe Dogecoin price today is entering a stabilization phase after hitting a long-term support base between 0.105 and 0.110. This specific zone has historically acted as a springboard for multi-month growth during past market cycles. Technical indicators suggest the current Dogecoin price today represents a generational accumulation zone with a very favorable risk-to-reward ratio.

While resistance levels at 0.135 and 0.150 currently cap the upside, the lack of aggressive selling suggests buyers are absorbing the available supply. If the support holds, Dogecoin price today could be positioned for a steady recovery toward its 0.15 target as speculative excess leaves the market.

While resistance levels at 0.135 and 0.150 currently cap the upside, the lack of aggressive selling suggests buyers are absorbing the available supply. If the support holds, Dogecoin price today could be positioned for a steady recovery toward its 0.15 target as speculative excess leaves the market.

Bearish Targets for XRP Price Prediction at 1.00

The current XRP price prediction remains cautious as the asset faces significant downward pressure after crashing 35% from its yearly peak. Despite Ripple securing new licenses in Europe and the UK, and real-world assets on the ledger growing by 270% to 1.47 billion, technical momentum is fading. Technical indicators like the RSI falling to 30 suggest the token is oversold but still vulnerable to further selling.

Looking ahead, the XRP price prediction centers on critical support levels at 1.37 and 1.15 to determine if a rebound is possible. If the current bearish momentum persists and the price breaks below 1.37, analysts warn of a potential crash toward the 1.00 psychological milestone. While institutional interest remains high with 1.3 billion in total inflows, the short-term outlook depends on market stabilization.

Final Countdown: Secure Your 100% Unlocked BDAG Before Feb 16

BlockDAG is entering its final private sale stage at $0.00025 per token, just ahead of its confirmed exchange debut on February 16 at $0.05. This steep pricing gap highlights a shrinking opportunity for early positioning before public trading fully determines valuation.

The project has already secured over $452 million in funding, underscoring strong demand and long-term backing. With only 130 million tokens remaining in this last allocation, the private sale is approaching its definitive end as availability tightens rapidly.

What sets this phase apart is its simplicity and transparency. There are no vesting periods, unlock schedules, or delayed withdrawals. Buyers receive 100% of their tokens directly into their wallets on launch day, ensuring immediate access, full liquidity, and complete control from the outset.

Participants in the private round also gain a meaningful timing advantage, with up to nine hours of early trading access before public markets open. This window allows holders to observe initial liquidity, assess price behavior, and position calmly before wider participation accelerates volatility and demand.

As the February 16 launch draws closer, BlockDAG completes its shift from development to a live market asset. Once the final allocation is filled, private access closes permanently. For investors researching the next big crypto, the combination of early access, instant delivery, and a potential 200× pricing gap defines a closing window that will not reopen.

Key Takeaways

Dogecoin and XRP reflect two very different phases of the current market. Dogecoin price today shows early signs of stabilization after defending a critical long-term support zone, suggesting recovery potential if buying pressure continues to build. In contrast, the XRP price prediction remains cautious, with downside risks still present.

But only one project stands out with a time-sensitive opportunity. What analysts are now calling the next big crypto, BlockDAG, offers a final private sale at $0.00025 before a confirmed $0.05 exchange launch, only 130M tokens left, zero vesting, and up to nine hours of early trading access. With a potential 200× pricing gap and permanent closure once filled, the urgency is real.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Morgan Stanley backs Cipher (CIFR) and TeraWulf (WULF), but is cool on Marathon (MARA)

Morgan Stanley initiated coverage of three publicly traded bitcoin mining companies on Monday, backing two names tied to data center leasing while taking a more cautious stance on a miner focused on bitcoin exposure.

Analyst Stephen Byrd and his team started coverage of Cipher Mining (CIFR) and TeraWulf (WULF) with Overweight ratings and set price targets of $38 and $37, respectively. Shares of CIFR are higher by 12.4% Monday to $16.51, while WULF is ahead 12.8% to $16.12.

He also initiated coverage of Marathon Digital (MARA) with an Underweight rating and an $8 target. Shares of MARA are marginally higher on Monday at $8.28.

Byrd’s core argument rests on viewing certain bitcoin mining sites less as crypto bets and more as infrastructure assets. Once a mining company has built a data center and signed a long-term lease with a strong counterparty, he wrote, the asset is better suited to investors who value steady cash flow than to traders focused on bitcoin price swings.

“At a macro level, once a bitcoin company has a built-in data center and entered into a long-term lease with a creditworthy counterparty, that DC’s natural investor habitat is not among bitcoin investors but among infrastructure investors,” Byrd wrote, adding that such assets should be valued for “long-term, stable cash flow.”

To make the point concrete, Byrd compared these facilities to data center real estate investment trusts such as Equinix (EQIX) and Digital Realty (DLR), which he described as “the closest comparable companies to consider when valuing DC assets developed by bitcoin companies.” Their shares trade at more than 20 times forward EBITDA, meaning investors are willing to pay over $20 for every $1 of expected annual operating cash flow because those firms offer scale, diversification and steady growth.

Byrd does not expect data centers developed by bitcoin companies to trade at similar levels, “primarily because these data center REITs have growth potential that a single DC asset does not provide.” Still, he sees room for higher valuations than the market currently assigns.

Cipher sits at the center of that view. Byrd described the company’s data centers as suitable for what he called a “REIT endgame.” “We use the phrase ‘REIT endgame’ to describe our valuation approach because, ultimately, these contracted DCs should be owned by REIT-like investors that appropriately value long-term, low-risk contracted cash flows,” he wrote.

In a simple scenario, a Cipher site that shifts from self-mining bitcoin to leasing space to a large cloud or computing customer could resemble a toll road. Cash flows become predictable. The role of bitcoin fades.

TeraWulf earned a similar framework. Byrd pointed to the company’s history of signing data center agreements and to management’s background in power infrastructure. “TeraWulf has a strong track record of signing agreements with data center customers, and the management team has extensive experience in building a wide range of power infrastructure assets,” he wrote.

He expects the firm to convert sites without bitcoin-to-data-center contracts at a present value of about $8 per watt. His base case assumes the company succeeds in roughly half of its planned annual data center growth of 250 megawatts per year over 2028-2032. In a more optimistic scenario, he assumes that the success rate rises to 75%.

The tone shifted with Marathon Digital. Byrd argued that the company offers “lower potential upside driven by bitcoin-to-DC conversions.” He cited Marathon’s hybrid strategy, which combines mining with data center ambitions rather than fully repurposing sites, along with its focus on maximizing exposure to bitcoin’s price, including issuing convertible notes and using the proceeds to buy bitcoin.

Marathon’s limited history of hosting data centers also weighed on the view. “For MARA, bitcoin mining economics are the dominant driver of the stock’s value,” Byrd wrote.

That focus carries risk. “Fundamentally, we see significant risks to profitability of bitcoin mining, both in the near and long terms,” Byrd added, noting that “the historical ROIC of the bitcoin mining business has been unattractive.”

The coverage lands as investors debate whether bitcoin miners should evolve into power and computing landlords. Morgan Stanley’s answer is selective. Where long-term leases and infrastructure discipline take hold, Byrd sees value. Where mining remains the core business, he sees fewer reasons to expect outsized gains.

Crypto World

BYD Sues U.S. Government Over Tariffs on Chinese Imports

TLDR

- BYD has filed a lawsuit against the U.S. government, challenging tariffs imposed by President Trump using IEEPA.

- The company seeks a refund for tariffs paid since April 2018, claiming they harm its U.S. operations.

- BYD’s lawsuit is the first by a Chinese automaker to challenge U.S. tariffs on imports.

- Despite tariffs, BYD overtook Tesla in 2025 global EV sales, delivering 2.26 million vehicles.

- BYD plans expansion with 13 models, including the U9 Xtreme hypercar, and 3,000 fast-charging stations.

Chinese automaker BYD has filed a lawsuit against the U.S. government over tariffs imposed by President Donald Trump. The lawsuit challenges Trump’s use of the International Emergency Economic Powers Act (IEEPA) to impose tariffs. BYD also seeks a refund for all levies paid since April 2018 as part of its ongoing dispute.

BYD’s Legal Challenge Against U.S. Tariffs

BYD’s lawsuit is the first by a Chinese carmaker challenging U.S. tariffs on imported goods. The company filed the complaint on January 26 at the U.S. Court of International Trade. In its suit, BYD’s U.S. subsidiaries argue that the IEEPA does not authorize the imposition of tariffs.

The complaint asserts that the word “tariff” is not used within the text of the law, invalidating the basis for the levies. BYD’s suit seeks a refund for the tariffs it has already paid since April 2018.

The company claims the tariffs unfairly impacted its operations in the U.S., which includes sales of buses, commercial vehicles, batteries, and solar panels. The lawsuit also argues that the levies violate international trade principles by imposing excessive costs on foreign businesses operating in the U.S.

Legal Implications and Ongoing Supreme Court Case

In addition to BYD’s lawsuit, the U.S. Supreme Court is reviewing a separate case on the legality of the tariffs. Trade Representative Jamieson Greer confirmed that the Supreme Court is carefully considering the case, given its broad implications.

The decision could affect future tariffs and trade policies, especially regarding their impact on foreign companies and their rights to challenge such measures. Despite the legal actions, the tariffs remain in place for the time being, with BYD pushing forward to protect its interests.

The company’s lawsuit represents a broader push by global businesses to challenge the U.S. government’s use of tariffs under the IEEPA. These legal proceedings are likely to shape future trade policies and enforcement.

BYD Overtakes Tesla in Global EV Sales

Despite pressure from tariffs, BYD surpassed U.S.-owned Tesla in global EV sales, delivering 2.26 million battery-electric vehicles in 2025. The company, originally a battery manufacturer, has expanded into a major EV maker, employing over 120,000 R&D engineers.

BYD’s manufacturing expertise plays a key role in its success, producing components for about a third of the world’s smartphones. The company now offers 13 car models across Europe and the Gulf region, including the high-speed U9 Xtreme hypercar and the Euro NCAP five-star-rated Dolphin. BYD is addressing charging infrastructure with innovative 1-megawatt charging technology and plans for 3,000 fast-charging stations.

Crypto World

Pony AI Begins Mass Production of Robotaxis with Toyota Partnership

TLDR

- Pony AI has started mass production of its autonomous robotaxis in partnership with Toyota, planning 1,000 units this year.

- By 2026, Pony AI aims to operate a fleet of 3,000 autonomous vehicles across mainland China, Europe, and the GCC.

- The robotaxis will feature level 4 (L4) autonomous capabilities, capable of operating without human intervention.

- Pony AI plans to offer affordable robotaxi services, with fares up to 10% lower than regular taxi rides.

- The company’s strategy includes expanding infrastructure, such as ultra-fast charging stations, to support robotaxi growth.

Pony AI has initiated mass production of its autonomous robotaxis in collaboration with Toyota. The company plans to roll out 1,000 driverless cabs this year, with deployment in key cities across mainland China. This move signals a major milestone in the commercialization of autonomous vehicles and the company’s ambitious expansion.

Mass Production of Robotaxis Begins

Pony AI, the Chinese self-driving technology firm, has started the production of its robotaxis in collaboration with Toyota. By the end of 2026, the company expects to operate a fleet of more than 3,000 autonomous vehicles globally. The Guangzhou-based company emphasized the milestone as a new phase in scaling production and commercial deployment.

The development also highlights the deep integration between the partners in autonomous driving technology and vehicle manufacturing. According to the company, the partnership leverages Toyota’s vehicle manufacturing capabilities combined with Pony AI’s advanced self-driving technology.

The vehicles will feature level 4 (L4) autonomous capabilities, meaning they can operate without human intervention under most conditions. As the first step in its global strategy, Pony AI aims to provide autonomous services in mainland Chinese cities and potentially expand to other international markets by 2026.

Pony AI’s Vision for the Future of Autonomous Vehicles

Pony AI has outlined its plans to expand its robotaxi fleet to more than 3,000 units by the end of 2026. The company intends to operate autonomous vehicles not just in China, but also in regions such as Europe and the Gulf Cooperation Council (GCC). The cars will provide affordable mobility options, with fares up to 10% lower than regular taxi services.

Pony AI’s rapid scaling strategy includes establishing the necessary infrastructure for autonomous driving, such as ultra-fast charging stations and battery storage solutions. Pony AI’s collaboration with Toyota aims to create a model for the global autonomous taxi market.

According to financial consultant Ding Haifeng, the combination of self-driving technology and robust vehicle assembly creates a powerful growth engine for the robotaxi industry. With 1,000 driverless cabs set to hit the streets this year, the company is making strides toward widespread adoption and furthering its mission to revolutionize urban transportation.

-

Video7 days ago

Video7 days agoWhen Money Enters #motivation #mindset #selfimprovement

-

Tech5 days ago

Tech5 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics1 day ago

Politics1 day agoWhy Israel is blocking foreign journalists from entering

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech3 days ago

Tech3 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat19 hours ago

NewsBeat19 hours agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

NewsBeat6 days ago

NewsBeat6 days agoUS-brokered Russia-Ukraine talks are resuming this week

-

Business1 day ago

Business1 day agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports14 hours ago

Sports14 hours agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Politics1 day ago

Politics1 day agoThe Health Dangers Of Browning Your Food

-

Sports2 days ago

Former Viking Enters Hall of Fame

-

Sports3 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business1 day ago

Business1 day agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat3 days ago

NewsBeat3 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business4 days ago

Business4 days agoQuiz enters administration for third time

-

NewsBeat9 hours ago

NewsBeat9 hours agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

NewsBeat4 days ago

NewsBeat4 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout

-

Crypto World6 days ago

Crypto World6 days agoRussia’s Largest Bitcoin Miner BitRiver Enters Bankruptcy Proceedings: Report

-

NewsBeat7 days ago

NewsBeat7 days agoImages of Mamdani with Epstein are AI-generated. Here’s how we know