Tech

SIVGA Nightingale Pro Review: Premium Planar IEM Craftsmanship or a Surprising Miss?

SIVGA is a Chinese HiFi audio brand that was founded in 2016. They’re an end-to-end organization, running their own R&D, branding, and manufacturing, in-house. This all-original approach gives SIVGA freedom to experiment and innovate, but also creates a distinct “SVIGA-iness” across their lineup. The company builds both over-ear headphones and in-ear monitors, and its latest release, the Nightingale Pro, revisits the original planar magnetic Nightingale IEM with revised tuning and execution.

The first Nightingale earned a loyal following but never crossed into broad market relevance. The question now is simple and unavoidable: does the Nightingale Pro finally have the balance, refinement, and accessibility to break out of the niche—or is it still speaking mainly to the faithful?

About My Preferences

This review is a subjective assessment, and pretending otherwise would be dishonest. I do my best to separate personal taste from performance-based criticism, but bias never fully disappears—it just gets managed. So consider this your calibration point. My ideal sound signature prioritizes competent sub-bass, textured mid-bass, a slightly warm midrange, and extended but controlled treble. I also have mild treble sensitivity, which means I’m quick to notice glare, edge, or artificial sparkle.

Sources, DAPs, and Dongles Used

Listening was split between dedicated digital audio players and dongles to reflect how most people will actually use the Nightingale Pro. DAPs included the HiFiMAN SuperMini, Hidizs AP80 Pro MAX, and the Astell&Kern PD10, covering everything from ultra-portable to genuinely high-end. Dongle testing included the Astell&Kern HC5, Audioengine HXL, Meze Audio Alba Dongle, and the ubiquitous Apple USB-C dongle.

Testing equipment and standards can be found here.

Build

As is typical for SIVGA, the Nightingale Pro is constructed from a carefully chosen mix of high-quality, tactile materials. The faceplate is carved from polished zebrawood and set into a precisely anodized aluminum chassis, giving the IEM a premium, handcrafted feel that’s immediately apparent in the hand and consistent with the brand’s design ethos.

The Nightingale Pro uses metal nozzles with an integrated debris filter positioned just below the lip, a practical touch that should help with long-term durability and maintenance. At the top of each shell is an extruded 0.78 mm two-pin socket, firmly set into the housing to ensure a secure cable connection and reduce long-term wear from repeated swaps.

Because of the extruded design of the Nightingale Pro’s sockets, the pool of compatible third-party cables is smaller than with a standard flush 0.78 mm connection. Fortunately, that limitation is softened by the fact that the included cable is genuinely solid.

It uses a two-tone twisted braid paired with metal hardware and feels purpose-built rather than disposable. SIVGA also employs a substantial spring as strain relief near the base of the fixed 4.4 mm termination, lending the cable an almost industrial look while adding real-world durability. From a construction and longevity standpoint, there’s nothing here that raises red flags.

Comfort

Comfort is inherently personal and heavily dependent on individual ear anatomy, so mileage will vary. The Nightingale Pro features a shallow fit profile, with nozzles that are slightly shorter than average. As a result, some experimentation with eartip sizes and shapes is likely required to achieve an optimal seal.

That said, the IEMs themselves are neither heavy nor bulky, and once dialed in, they proved comfortable for multiple consecutive hours of listening. The trade-off is isolation. The shorter nozzle and shallower insertion mean passive noise attenuation is below average, especially compared to deeper-fitting designs. For that reason, the Nightingale Pro isn’t an ideal choice for air travel or consistently noisy environments, where isolation matters as much as comfort.

Accessories

The Nightingale Pro’s accessory bundle is fairly bare-bones. Inside the box, you’ll find a semi-hard carrying case and six pairs of silicone eartips—and that’s about it. Unfortunately, the included eartips are the weak link here. Paired with the Nightingale Pro’s shallow fit profile, they simply didn’t work well for my ears and made achieving a consistent seal more difficult than it should be.

For an IEM in this price range, the accessory selection feels underwhelming. At a minimum, higher-quality silicone eartips would be a welcome upgrade. Including a pair or two of Comply-style foam tips would also go a long way toward improving comfort, seal, and perceived value out of the box.

The Nightingale Pro’s carrying case is a bright spot in an otherwise modest accessory bundle. It offers enough internal space to comfortably store the IEMs, the attached cable, and even a compact dongle without feeling cramped. With a bit of careful arrangement, you can also fit a few spare pairs of eartips. Protection is solid but not exceptional—best described as average—making the case well suited for static storage and light travel rather than heavy-duty, throw-it-in-a-bag use.

Technical Specifications

The Nightingale Pro is built around a 14.5 mm planar magnetic driver, a relatively large diaphragm for an in-ear monitor. With a 16 ohm impedance and 107 dB sensitivity, it’s an easy IEM to drive and performs well from dongles and portable sources without requiring excessive power.

Its rated frequency response of 20 Hz to 40 kHz aligns with the Nightingale Pro’s airy top-end and controlled low-frequency extension, while the supplied 1.25 m cable terminates in a 4.4 mm balanced connector, reinforcing its intended use with modern balanced sources. At 14 g, the shells remain light enough for long listening sessions, even with the slightly shallow fit. Overall, the specs point to a planar IEM designed for portable versatility rather than source dependency, with few practical barriers to entry for everyday listening.

Listening

The Nightingale Pro presents a largely linear tuning with a subtle warm tilt. Its low end is well extended and lightly emphasized in the lower registers, while the midrange remains even and neutrally voiced overall. The upper mids receive a modest lift to improve instrumental separation and vocal clarity without pushing the presentation forward.

Treble is expressive but deliberately restrained, never asserting itself as the focal point. By carefully attenuating energy around the 8, 10, and 12 kHz regions, the Nightingale Pro avoids sharpness and metallic timbre. Extension, however, is excellent, reinforcing the point that convincing air and detail don’t require aggressive treble peaks to fully articulate the upper registers.

Glittering, Gleaming, Subtlety

The Nightingale Pro is not an in-your-face IEM, and that restraint is most evident in its treble tuning. While planar drivers are often associated with a boisterous or overly dramatic upper register, that reputation is more a byproduct of inconsistent tuning than an inherent trait of the technology itself. Here, the Nightingale Pro operates firmly in the realm of linearity, delivering strong resolution, texture, and dimensionality while integrating treble information naturally into the soundstage rather than spotlighting it.

The gentle, muted snares in the background of “Anna Sun” by Walk the Moon peek through the edges of the soundstage during the intro, then open up and sit more forward in the mix during the chorus. The Nightingale Pro’s carefully measured treble makes that kind of finesse easy to follow. A brighter treble would have been more “exciting,” sure—but it also would have been more likely to smear that detail and mask what the track’s mastering is actually doing.

Muted Mids

SIVGA tuned the Nightingale Pro’s midrange to be deliberately linear, resulting in a warm, smooth presentation that stands in clear contrast to the more aggressive upper-midrange peaks often associated with planar IEMs. This predictable, even-handed approach makes the Nightingale Pro a strong candidate for reference-style listening, but it also places it outside the comfort zone of more mainstream tastes. Certain genres and mastering styles can come across as overly warm, which in turn affects the perceived width and scale of the soundstage.

EDM tracks like “Light Up The Sky” by Wooli are largely unaffected by this tuning, retaining their drive and structure. Rock recordings, however, such as “Lost in the Echo” by Linkin Park fare worse. On tracks like these, the soundstage can feel compressed, with vocals and guitars sounding dense and constrained.

Male vocals, while full-bodied and weighty, can lean heavy at times. Female vocals and higher-pitched male vocals are better served by the tuning and tend to sound clearer and more balanced. Even so, lyric intelligibility remains strong, and instrumental layering is consistently well handled. The Nightingale Pro presents music in an intimate, close-up manner, but it avoids sounding muddy thanks to its solid technical performance. Listeners accustomed to a more recessed lower midrange may take issue with this tuning choice, as it meaningfully reshapes how instruments and vocals are positioned within the mix.

Gentle and Firm Bass

Thanks to its mildly lifted bass shelf, the Nightingale Pro is reasonably well equipped to resolve low-frequency information. Drum hits carry a touch of punch and a hint of rumble, though not to the extent you’d expect from a traditional dynamic-driver design. The lower register isn’t boisterous, but it is clean, quick, and well controlled, which makes the Nightingale Pro a capable partner for fast-moving genres like metal.

Electronic music can also fare well, depending on the mastering. The Nightingale Pro is able to dig into the sub-bass to resolve deep synth lines and will occasionally deliver a convincing sense of rumble. This gives it enough low-end contrast to support tracks like “Swimming in the Sky” by ARMNHMR, helping establish tonal depth without overwhelming the rest of the presentation. It won’t shake your skull, but it also avoids the flat or anemic low-end character that plagues some planar IEMs.

Comparisons

Kiwi Ears Aether

The Kiwi Ears Aether is a $170 planar IEM built around plastic shells with metal nozzles and a thin 0.78 mm two-pin cable. It uses a fixed 3.5 mm termination, rather than the fixed 4.4 mm balanced termination found on the Nightingale Pro. At roughly $130 less, the Aether clearly targets more cost-sensitive buyers—and it looks the part. Build quality and material choices fall short across the board, from the faceplates and nozzles to the cable itself. Nothing about the Aether’s physical execution approaches the Nightingale Pro’s level of refinement.

Sonically, however, the gap narrows considerably. The Aether ranks among the stronger planar IEMs currently available, offering a well-balanced, natural tuning and solid technical performance at an accessible price. The Nightingale Pro, by contrast, caters more directly to listeners who favor linearity and a flatter, reference-leaning presentation. The Aether brings slightly more mid-bass presence and a less emphasized lower midrange, while its upper mids are marginally more forward. Treble is another point of divergence: the Nightingale Pro is more restrained overall, whereas the Aether’s lower treble is noticeably more forward, making it easier to create a sense of air and openness.

Between the two, the Aether is the easier recommendation for everyday listening. Its broader genre compatibility and less linear tuning make it more forgiving and more enjoyable across a diverse music library. Listeners who are treble-averse or specifically seeking a more reference-oriented presentation, however, will likely find the Nightingale Pro better aligned with their preferences.

7Hz Divine

The Divine is a relatively recent planar IEM from 7Hz, typically priced around $150. It features polished metal shells and a detachable cable that’s noticeably thicker and heavier than the Nightingale Pro’s. That cable terminates in a fixed 3.5 mm plug rather than a 4.4 mm balanced connection. Despite costing roughly half as much as the Nightingale Pro, the Divine ships with a larger carrying case and a more generous selection of eartips.

In terms of tuning, the Nightingale Pro leans more linear and reference-oriented, with a warmer overall balance than the Divine. Both IEMs employ modest bass shelves, but the Divine’s low end comes across drier and more matter-of-fact. The Divine also features a larger upper-midrange lift and a more pronounced upper treble, giving it a cooler, airier presentation. From a technical standpoint, both perform competently, though the Nightingale Pro does a better job of capturing fine vocal inflections that the Divine tends to smooth over. The Divine can surface certain details more readily, but it misses some of the subtler mastering nuances that the Nightingale Pro renders more convincingly.

Between the two, the Nightingale Pro edges ahead. While the Divine offers broader genre flexibility, the Nightingale Pro’s bass tonality is more satisfying, and its overall presentation is easier to live with over long sessions. Comfort also plays a role: despite its attractive design, the Divine can become fatiguing to wear, whereas the Nightingale Pro proves more accommodating for extended listening.

Juzear Harrier

The Juzear Harrier is a tribrid IEM built with resin shells and metal nozzles, typically priced at $330, though it was available for $300 at the time of writing. It includes a modular 0.78 mm two-pin cable with both 3.5 mm and 4.4 mm terminations. The cable itself is quite good—noticeably thicker than the Nightingale Pro’s—and feels more substantial in hand. In terms of construction, the Nightingale Pro’s metal-and-wood chassis is clearly sturdier than the Harrier’s resin build, though the Harrier does fit my ears more comfortably.

Sonically, the Harrier takes a very different approach. It is the bassier of the two, with a much more pronounced low end and a particularly forward mid-bass. The Nightingale Pro counters with tighter, more controlled mid-bass and sub-bass performance, along with stronger technical discipline. The Harrier leans cooler overall, with a larger upper-midrange lift and greater treble emphasis.

By comparison, the Nightingale Pro sounds more linear and noticeably more cohesive from top to bottom. While the Harrier’s treble is more forward, it can also come across as grainier. The Nightingale Pro generally exhibits superior technicalities, though it can sound congested when directly A/B tested against the Harrier on certain tracks.

Between the two, the Nightingale Pro takes the nod. Its sturdier build quality, stronger technical performance, and greater tonal cohesion work in its favor. The Harrier is still an appealing option, but it feels like a less fully realized execution of its tuning vision. Listeners who are sensitive to warmth or prefer a more open, brighter midrange and treble balance may gravitate toward the Harrier. Personally, I’m comfortable sticking with the Nightingale Pro.

The Bottom Line

The Nightingale Pro is a thoughtfully built planar IEM that sticks closely to SIVGA’s established design language and tuning philosophy. Its presentation leans linear and reference-minded, with real sub-bass reach, a touch of warmth through the mids, and a treble response that stays extended without ever tipping into sharpness or sibilance. The craftsmanship is legitimately excellent—shells and faceplates feel premium in a way that’s immediately apparent—but sound quality, not aesthetics, is where buying decisions are made.

And this is where the Nightingale Pro becomes selective rather than universal. The restrained mid-bass and more relaxed treatment of male vocals and electric guitars limit its emotional punch, especially for listeners accustomed to more forward or dynamic presentations. In a price range crowded with strong alternatives, build quality alone isn’t enough to move it to the top of the list.

That said, there is a clear audience here. Listeners chasing a clean, sharpness-free planar sound, engineers looking for balance over excitement, and anyone drawn to a controlled, reference-style tuning will find a lot to respect. Bassheads, V-shaped devotees, and those who want vocals pushed front and center should keep moving. The Nightingale Pro doesn’t try to win everyone over—and that may be its most honest trait.

Pros:

- Sibilance-free tuning that stays composed even on hot recordings

- Expressive, nuanced midrange with strong vocal and acoustic texture

- Genuine sub-bass extension with reach and control

- High-quality craftsmanship that feels deliberate, not mass-produced

- Excellent layering and separation, especially in complex mixes

- Impressive upper-treble extension that adds air without bite

Cons:

- Mid-bass lacks authority, limiting slam and rhythmic weight

- Cable feels wiry above the Y-split, detracting from overall ergonomics

- Included silicone eartips are sub-par and do the IEM no favors

- Shallow shell profile demands careful tip selection to get proper seal

- Below-average passive isolation, especially for commuting or travel

- Male vocals and electric guitars sound muted on select tracks

Where to buy:

Related Reading:

Tech

Honor’s upcoming Magic V6 could have the best foldables beat in one key area

Honor’s Magic V6 is set to debut next month, and leaks suggest it will be the fastest‑charging foldable yet.

This is thanks to 120W wired charging and a battery capacity of up to 7150mAh. This marks a huge leap over the Magic V5 and rivals like Samsung’s Galaxy Z Fold 7 and Google’s Pixel 10 Pro Fold.

The mobile phone brand has confirmed that the Magic V6 will be unveiled a day before MWC 2026 officially begins, positioning it as one of the headline launches of the event.

Certification from China’s CCC authority reveals support for 120W wired charging, which is nearly double the 67W maximum offered by the Magic V5.

This upgrade could make the V6 the quickest foldable to recharge, a significant advantage in a category where battery life and charging speeds remain pain points. For comparison, Samsung’s Galaxy Z Fold7 is still capped at 25W wired charging, while Google’s Pixel 10 Pro Fold manages 39W, and Oppo’s Find N5 sits in the 67W range.

The leak also indicates that Honor will release two versions of the Magic V6, labelled PNM‑AN10 and PNM‑AN20, with the latter expected to include Beidou satellite messaging support. This feature could appeal to users who value connectivity in remote areas, though it is unlikely to be a mainstream selling point in the UK.

More universally appealing is the rumoured battery capacity: the flagship model may carry a 7150mAh cell, while cheaper variants could ship with a slightly smaller 6,850mAh unit. Either way, the combination of high‑capacity batteries and ultra‑fast charging should deliver a practical improvement in day‑to‑day usability.

Performance is another area where Honor appears determined to compete. All Magic V6 models are expected to run Qualcomm’s Snapdragon 8 Elite Gen 5 chipset, which integrates Oryon Gen 3 cores capable of up to 4.6GHz and offers multi‑core performance that rivals Apple’s A19 Pro.

This SoC also supports advanced AI features and high‑bandwidth LPDDR5X memory, ensuring the V6 will be competitive with other 2026 flagships. Combined with rumours of a 200MP primary camera and periscope lens, the Magic V6 could be one of the most technically ambitious foldables yet.

Finally, the timing of the launch gives Honor a chance to capture attention before rivals announce their own MWC updates. If the Magic V6 delivers on its charging promises, it could set a new benchmark for foldables and force competitors to rethink their approach.

Tech

Top book-style and clamshell foldables

Foldable smartphones have gone from strength to strength in the past couple of years; these once-chunky, fragile devices are now slimmer, more robust and more capable, and that means they’re more tempting than ever.

The question is, which foldable should you buy? While there was initially a limited number of foldable available, that number has greatly expanded in the past 12 months. Whether you’re looking for the slimmest book-style foldable around, a compact clamshell-style foldable that fits in the palm of your hand or something that helps you multitask on the go, there’s a foldable for your needs.

Generally, it’s worth keeping in mind that foldable phones are still more fragile than regular smartphones with the flexible nature of foldable screens means that there is more potential for damage, but this could be a worthy trade-off depending on your needs.

In fact, durability issues and premium prices are the main reasons why we’ve yet to give any foldable the coveted five-star rating and remain key reasons to opt for a traditional flagship – though a couple of foldable entries have come closer than ever, suggesting that foldables are slowly but surely closing the gap.

You can see a selection of some of the most impressive regular phones we’ve tested in our best iPhone, best Android phone and best smartphone guides for context.

However, if that doesn’t put you off, keep reading. In this list, we’ve detailed the top-performing foldables we’ve tried and tested.

Best foldable phones at a glance

SQUIRREL_ANCHOR_LIST

Learn more about how we test phones

All the phones included in our Best foldable phone list have been thoroughly tested and used by one of our expert reviewers.

We don’t review phones based purely on benchmark scores or marketing hype. We use them as our everyday device for the review period, which is usually at least five days but can often be much longer if the device requires it.

Whenever you read a phone review published on Trusted Reviews, you should be confident that the reviewer has put their personal SIM card into the phone, synced across their most-used apps and logged into all their typical accounts. We do this so you’ll feel confident in our review and trust our verdict.

Our review process includes a mixture of real-world tests, more than 15 measured tests, and industry-standard benchmarks. We believe this gives the most rounded view of a device.

Pros

- Excellent and brighter external display

- Solid camera performance

- Unique finish options

- Smooth performance

Cons

- Only 3 years of Android OS updates

- Moto AI still needs work

- No telephoto lens

Pros

- Lightest book-style foldable around

- Ultra thin design makes it really nice to use

- Larger, wider, wholly more useful screens

- Same main camera as Galaxy S25 Ultra

Cons

- Relatively small 4400mAh battery

- Slow 25W wired charging

- Zoom camera could be better for the price

Pros

- Larger cover screen is a much-needed improvement

- More convenient 21:9 ratio screen is much easier to use

- Improved camera performance

- Fast, flagship performance with strong battery life

Cons

- Cover screen software could be better

- Samsung software is full of duplicate/redundant apps

- No dedicated zoom camera

Pros

- Really solid, durable build for a foldable

- IP68 is the highest dust-water resistance in a folding phone

- Gorgeous, colour-rich displays with great stereo sound

Cons

- It’s big and heavy

- Underpowered compared to competitors

- Zoom and ultrawide cameras are underwhelming in lower light

Pros

- Bright displays

- Excellent cameras

- Proper two-day battery life

- Solid performance across the board

Cons

- MagicOS is still a letdown

-

Excellent and brighter external display -

Solid camera performance -

Unique finish options -

Smooth performance

-

Only 3 years of Android OS updates -

Moto AI still needs work -

No telephoto lens

Samsung may have been the first company to truly bring new-age flip phones to the masses, but it’s Motorola that’s taken the torch and run with it, emboldening the concept with key areas of innovation that have culminated thus far in the outstanding Motorola Razr 60 Ultra.

The key headline here is that both the internal and external displays have been given several upgrades. For starters, the internal display is now slightly bigger, moving from 6.9-inches to 7-inches, so you have more space than ever to help make gaming and watching films feel even more immersive.

The brightness of that internal display has also shot up to 4500nits, making it easier than ever to use outdoors against direct sunlight. The 4-inch external display hasn’t been left behind either, with that also seeing a brightness boost, going from 2400nits to now 3000nits, which really goes a long way towards making the more compact screen pop.

Even with those screen upgrades in tow, Motorola hasn’t forgotten about the one thing that should always be the focus of any foldable device: durability. Thankfully the company has introduced a new titanium-infused hinge which not only feels more sturdy than before, it has also allowed the phone to now carry an IP48 dust and water resistance rating, which significantly outperforms the IPX8 rating of the Razr 50 Ultra.

Powering all of this is the super fast Snapdragon 8 Elite chipset, which has a sizeable 16GB RAM to lean on for everyday operations. You won’t have any issues playing the latest games here, and with 512GB storage as standard, you won’t be running out of room where apps are concerned either.

SQUIRREL_PLAYLIST_10207648

-

Lightest book-style foldable around -

Ultra thin design makes it really nice to use -

Larger, wider, wholly more useful screens -

Same main camera as Galaxy S25 Ultra

-

Relatively small 4400mAh battery -

Slow 25W wired charging -

Zoom camera could be better for the price

The Samsung Galaxy Z Fold 7 marks a genuine leap forward for Samsung’s book-style foldable, finally delivering the ultra-slim, lightweight design many have been waiting for.

Shedding much of the bulk and weight of its predecessors, the 4.2mm-thick Fold 7 is now among the thinnest foldables around, and at 215g, it’s both lighter than the book-style competition and even the Galaxy S25 Ultra. It makes it a joy to handle, and it’s almost unnoticeable in the pocket as a result.

Samsung has also nailed the usability of both displays this year. The wider 6.5-inch cover screen is genuinely practical for everyday tasks, while the 8-inch internal panel feels more solid with a way less intrusive crease. Both screens are bright, vibrant and ideal for everything from gaming to multitasking.

Camera performance is another highlight, with the main 200MP sensor borrowed from the S25 Ultra delivering sharp, detailed shots that put the Fold 7 on par with regular bar phones. General performance is equally impressive, thanks to the Snapdragon 8 Elite and up to 16GB of RAM.

Battery life and charging remain the main drawbacks with a 4400mAh cell and 25W charging falling far behind rivals. Still, for most users, the Fold 7 will comfortably last a day, and the overall package is compelling enough to make it the standout book-style foldable of 2025.

SQUIRREL_PLAYLIST_10207783

-

Larger cover screen is a much-needed improvement -

More convenient 21:9 ratio screen is much easier to use -

Improved camera performance -

Fast, flagship performance with strong battery life

-

Cover screen software could be better -

Samsung software is full of duplicate/redundant apps -

No dedicated zoom camera

The Samsung Galaxy Z Flip 7 takes the crown for the best design in the foldable space, with a slimmer, lighter build and a hinge that feels both robust and satisfyingly smooth.

The new 4.1-inch cover screen finally makes the Flip genuinely useful when closed, and the wider 6.9-inch internal screen is a joy to use, with a less noticeable crease and a more comfortable aspect ratio for typing and media.

Powered by the Exynos 2500, the Flip 7 delivers fast, reliable performance for everyday tasks, and the 4300mAh battery is the biggest yet in a Flip, easily lasting a full day as a result.

Camera performance has also been improved, with more natural colours and solid results in most conditions, though the lack of a zoom lens remains a limitation.

The software, meanwhile, is packed with features and offers seven years of updates, but the cover screen experience still trails behind Motorola’s Razr 60 Ultra in terms of flexibility and ease of use.

Still, if you want a foldable that nails the basics and looks fantastic doing it, the Z Flip 7 is a great choice.

SQUIRREL_PLAYLIST_10207784

-

Really solid, durable build for a foldable -

IP68 is the highest dust-water resistance in a folding phone -

Gorgeous, colour-rich displays with great stereo sound

-

It’s big and heavy -

Underpowered compared to competitors -

Zoom and ultrawide cameras are underwhelming in lower light

If you want a foldable but are concerned about its durability, then the Pixel 10 Pro Fold is an easy recommendation. Not only does it sport a thick frame that feels reassuringly sturdy in hand, but it’s the first foldable with an IP68 rating.

In addition, the Pixel 10 Pro Fold benefits from a new dual-layer protection over the display and a redesigned hinge which, according to Google, can handle up to 10 years’worth of folding and unfolding.

Otherwise, its 6.4-inch OLED cover display is brilliant for quick uses, thanks to its convenient aspect ratio that makes quickly replying to messages, following a route on Google Maps or operating the camera easy without needing you to open the phone up.

Even so, the main draw is undoubtedly the eight-inch square OLED panel which is great to use and offers a vibrant picture quality. Sure, you will have to overlook the visible crease, but it’s still a great display for streaming, gaming and multitasking between apps too.

The Pixel series has a reputation for being among the best camera phones, and although the Pixel 10 Pro Fold might not be as impressive as the Pixel 10 Pro XL, it still performs admirably. While its 48MP main lens is supported by measly 10.8MP telephoto and 10.5MP ultrawide lenses, the 10 Pro Fold can still take a good shot in most conditions.

Powering the Pixel 10 Pro Fold is Google’s Tensor G5 chip, which although doesn’t achieve particularly high benchmarking scores, still performs well in everyday use – and especially when running Google’s AI toolkit. In fact, arguably one of the reasons to opt for the Pixel 10 Pro Fold is its range of AI features from Magic Editor and Camera Coach for photography, to Live Translate and the use of Gemini.

Like the rest of the Pixel 10 series, the Pixel 10 Pro Fold’s battery life is decent enough as it should comfortably see you through a day’s use. Charging speeds aren’t particularly fast, with 30W support, but it’s enough to see a 50% charge in about 30 minutes.

If you want to finally embrace a foldable smartphone but worry about its longevity, then the Google Pixel 10 Pro Fold is a brilliant choice.

-

Bright displays -

Excellent cameras -

Proper two-day battery life -

Solid performance across the board

-

MagicOS is still a letdown

Building upon the already excellent foundations of the Honor Magic V3, the V5 doesn’t just take Honor’s foldable range to a new level, it elevates the market as a whole to show just how far the engineering in this sector has come. This is the phone that other foldables will be emulating for quite some time to come.

The biggest boon with the Magic V5 is just how sleek the whole thing is. With the slimmest version being just 8.8mm thick and weighing only 217g, it honestly doesn’t feel like you’re carrying a foldable phone as it’s barely that much bigger than a standard candy-bar style phone. That lightweight frame also makes it easy to use when unfolded, as it never leads to fatigue of holding the device as you enjoy the benefits of the larger display.

Speaking of displays, while the outer display is near identical to the one from the V3, the interior 7.95-inch panel has been given a serious spec boost to pack the same 5000 nits peak brightness as the outer display. This degree of parity between the two screens now means that you’re getting a top-shelf experience regardless of which one you’re looking at.

Also helping the phone to stand out against its closest competitors is the use of the super fast Snapdragon 8 Elite chipset which doesn’t just allow the device to blitz through tasks such as writing up emails or scrolling through social media – it also enables a superior gaming experience too. We were able to get through a couple of rounds of Call of Duty Mobile running with impressive levels of performance, which is only made all the more immersive when you play on the larger display.

Maybe what is most perplexing about the Honor Magic V5 is that, in spite of its super slim frame and all of the tech that’s been crammed in here from the flagship level chipset to the versatile camera array, it still manages to bring the heat where battery life is concerned. With a massive 5820mAh cell that uses silicon carbon technology, the Magic V5 can last for up to two days at a time, so you never have to worry about serious battery drain when running intensive apps.

FAQs

Apple hasn’t released or announced any intention to make a foldable phone yet, however rumours swirl that we’ll see a big play for this category from the Cupertino company in the coming years. For now, all the best foldable phones run on Android.

Test Data

| Motorola Razr 60 Ultra | Samsung Galaxy Z Fold 7 | Samsung Galaxy Z Flip 7 | Google Pixel 10 Pro Fold | Honor Magic V5 | |

|---|---|---|---|---|---|

| Geekbench 6 single core | 2828 | 2318 | 2251 | 2317 | 1151 |

| Geekbench 6 multi core | 8552 | 8828 | 7584 | 6251 | 4818 |

| 1 hour video playback (Netflix, HDR) | 6 % | 8 % | 7 % | 7 % | – |

| 30 minute gaming (light) | 5 % | 7 % | 6 % | 5 % | – |

| Time from 0-100% charge | 80 min | 87 min | 89 min | – | 70 min |

| Time from 0-50% charge | 39 Min | 31 Min | 28 Min | – | 30 Min |

| 30-min recharge (no charger included) | 40 % | 49 % | 54 % | – | 50 % |

| 15-min recharge (no charger included) | 23 % | 24 % | 29 % | – | 29 % |

| 3D Mark – Wild Life | 6294 | 5574 | 4896 | 3328 | – |

| GFXBench – Aztec Ruins | 105 fps | 70 fps | 109 fps | 49 fps | 60 fps |

| GFXBench – Car Chase | 95 fps | 71 fps | 107 fps | 52 fps | 74 fps |

Full Specs

| Motorola Razr 60 Ultra Review | Samsung Galaxy Z Fold 7 Review | Samsung Galaxy Z Flip 7 Review | Google Pixel 10 Pro Fold Review | Honor Magic V5 Review | |

|---|---|---|---|---|---|

| UK RRP | £1099.99 | £1799 | £1049 | £1749 | £1699.99 |

| USA RRP | – | $1999 | $1099 | $1799 | – |

| Manufacturer | Motorola | Samsung | Samsung | Honor | |

| Screen Size | 7 inches | 8 inches | 6.9 inches | 8 inches | – |

| Storage Capacity | 512GB | 256GB, 512GB, 1TB | 256GB, 512GB | 256GB, 512GB, 1TB | 512GB |

| Rear Camera | 50MP + 50MP | 200MP + 12MP + 10MP | 50MP + 12MP | 48MP + 10.8MP + 10.5MP | 50MP wide, 64MP telephoto, 50MP ultra-wide |

| Front Camera | 50MP | 10MP + 10MP | 10MP | 10MP | Dual 20MP cameras |

| Video Recording | Yes | Yes | Yes | Yes | Yes |

| IP rating | Not Disclosed | Not Disclosed | Not Disclosed | IP68 | IP57 |

| Battery | 4700 mAh | 4400 mAh | 4300 mAh | 5015 mAh | 5820 mAh |

| Wireless charging | Yes | Yes | – | Yes | Yes |

| Fast Charging | Yes | Yes | Yes | Yes | Yes |

| Size (Dimensions) | 74 x 7.1 x 171 MM | 143.2 x 4.2 x 158.4 MM | 75.2 x 6.5 x 166.7 MM | 150.4 x 5.2 x 155.2 MM | 74.3 x 8.8 x 156.8 MM |

| Weight | 199 G | 215 G | 188 G | 258 G | 217 G |

| ASIN | B0F68G1YR8 | – | – | – | – |

| Operating System | Android 15 | OneUI 8 (Android 16) | OneUI 8 (Android 16) | Android 16 (Material 3 Expressive) | MagicOS |

| Release Date | 2025 | 2025 | 2025 | 2025 | 2025 |

| First Reviewed Date | 20/05/2025 | 17/07/2025 | 09/07/2025 | 08/10/2025 | 28/08/2025 |

| Resolution | 2992 x 1224 | 2184 x 1968 | 2640 x 1080 | 2076 x 2152 | x |

| HDR | Yes | Yes | Yes | Yes | Yes |

| Refresh Rate | 165 Hz | 120 Hz | 120 Hz | 120 Hz | 120 Hz |

| Ports | USB-C | USB-C | USB-C | USB-C | USB-C |

| Chipset | Qualcomm Snapdragon 8 Elite | Qualcomm Snapdragon 8 Elite for Galaxy | Samsung Exynos 2500 | Google Tensor G5 | Snapdragon 8 Elite |

| RAM | 16GB | 12GB, 16GB | 12GB | 16GB | 16GB |

| Colours | Pantone Rio Red, Pantone Cabaret, Pantone Mountain Trail, Pantone Scarab | Blue Shadow, Silver Shadow, Jet-black, Mint | Blue Shadow, Jet Black, Coral Red, Mint | Moonstone, Jade | Black, Ivory White, Dawn Gold, Reddish Brown |

| Stated Power | 68 W | 25 W | – | 30 W | – |

Tech

YouTube rolls out an AI playlist generator for Premium users

YouTube is rolling out a new AI-powered playlist-generation feature that allows Premium users on iOS and Android to use text prompts to create playlists.

Users can go to the Library tab, tap the “New” button, and select the “AI playlist” option to get started. They can then use text or voice to enter the prompt of their choice, such as “raging death metal,” “sad post rock,” “progressive house mix for a chill party,” “indie pop” or “90s classic hits,” to build a playlist.

YouTube has been toying around with using AI to create playlists for a while. In July 2024, the company was testing a feature to let people create custom radio stations using prompts in the U.S.

Other rival streaming services like Spotify, Amazon Music and Deezer, have also rolled out AI-powered playlist or radio creation features.

YouTube has been trying to make its Premium plan more attractive to users. Earlier this week, the company started restricting free users from viewing song lyrics on the YouTube Music app. The company told TechCrunch that the restriction was an experiment it was running “with a small percentage of ad-supported users,” and that song lyrics are available to the vast majority of free users.

Google has seen an uptick in its subscription business, and YouTube is a key part of that division. Earlier this month, the company said it now has 325 million paying users across Google One and YouTube Premium.

Techcrunch event

Boston, MA

|

June 23, 2026

Tech

You’ll soon make WhatsApp video calls right in your browser

WhatsApp web video calls are starting to roll out, so you can place voice and video calls straight from a browser tab. You won’t need the desktop app for the basics anymore, at least if the feature has reached your account.

The first wave is limited to one-to-one chats. Open a conversation, tap the call icon, and you can start a voice or video call without leaving WhatsApp Web. Group calls aren’t part of this initial release.

This is a practical fix for people who live in the browser all day, and it’s especially useful on Linux, where WhatsApp still doesn’t offer an official desktop app.

The web version gets serious

WhatsApp has been building toward this for roughly a year, aiming to make the web experience feel closer to its desktop apps instead of a messaging-only companion. The big change is that calling now sits alongside chat in the same window, which reduces friction when you’re working on a laptop.

Security doesn’t shift with the move to the browser. Calls on WhatsApp Web keep end-to-end encryption, using the Signal protocol WhatsApp already uses across messages, calls, and status updates.

WhatsApp Web also supports screen sharing, but only during a video call. If your goal is to show a document or walk someone through a settings menu, you’ll need to start a video session even if you don’t plan to be on camera.

The next milestone is bringing group calling to the web. The same report points to group calls with up to 32 participants, plus extras like call links and scheduled calls, once that phase is ready.

What you should do now

WhatsApp has begun its gradual rollout of native voice and video calling for beta users. If you’re in the WhatsApp Web beta, the simplest check is inside a one-to-one chat. If you see calling controls, you can use the browser for voice and video calls, plus screen sharing during video.

If you don’t see it yet, you’re likely still waiting on the wider rollout, and WhatsApp hasn’t said which browsers or platforms get priority first. For now, treat web calling as the fast option for one-to-one chats, and keep the phone app handy if group calls are part of your routine.

Tech

Tem raises $75 M to automate energy markets with AI-first platform

London-based energy software company Tem has closed a $75 million Series B round led by Lightspeed Venture Partners, with additional funding from AlbionVC, Atomico, Hitachi Ventures, Schroders Capital, Voyager Ventures, Allianz, and others. The round reportedly values the company at more than $300 million and will fund its expansion into the United States and Australia. Tem builds an AI-native energy platform designed to automate the pricing, matching, and execution of electricity transactions, a market that has long relied on manual processes and legacy infrastructure. Its core system uses machine learning to forecast supply and demand, match buyers with suppliers, and…

This story continues at The Next Web

Tech

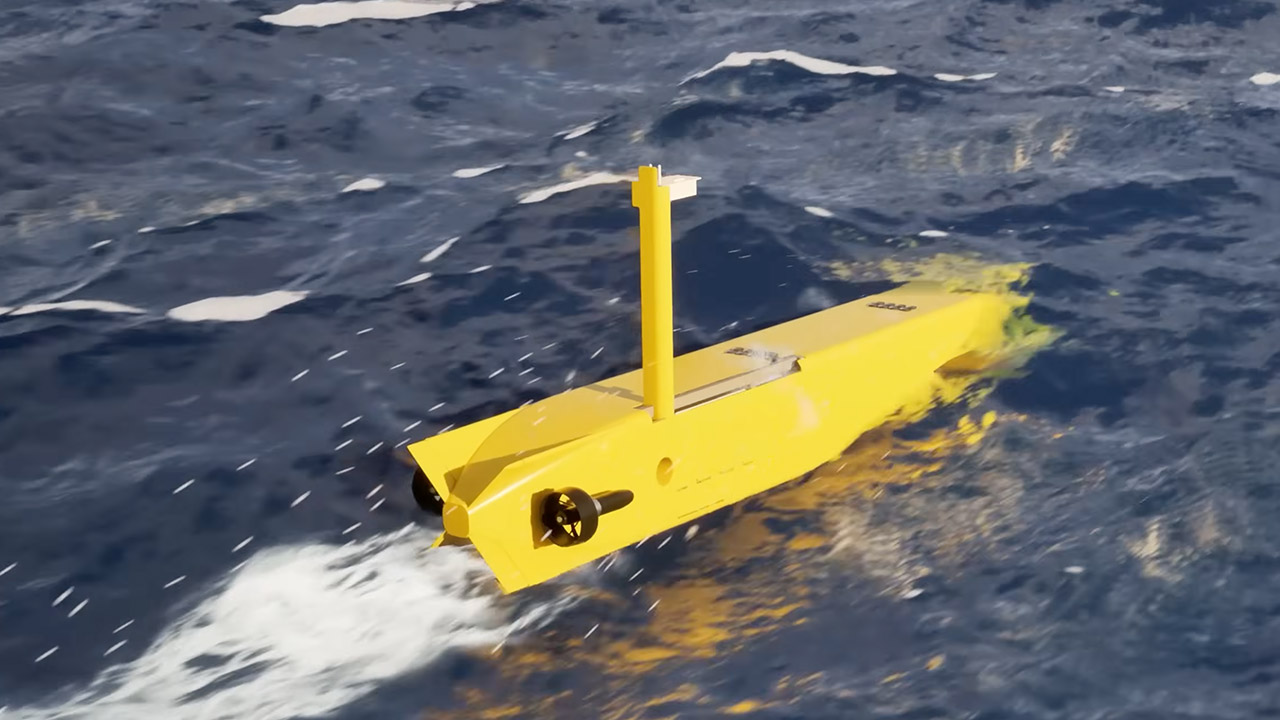

Lockheed Martin’s LampreyMMAUV Can Launch Underwater Drones in Contested Waters

Lockheed Martin’s Lamprey Multi-Mission Autonomous Undersea Vehicle (MMAUV) challenges traditional methods for operating underwater drones in adverse environments. This stealthy autonomous vehicle attaches to a larger ship or sub, travels quietly to remote locations, and is ready to enter without using up its own power.

Lockheed Martin engineers drew inspiration from nature for the basic idea, similar to how lampreys and remoras employ hosts for free rides. They did the same thing with the Lamprey, using a docking system that clicks onto the hull of a surface ship or submarine, requiring no alterations to the host vessel. As it travels, it includes built-in generators that use the energy from the host’s movement to fully recharge its batteries, ensuring that it reaches at its destination with all of the necessary power.

DJI Neo 2 (Drone Only), Lightweight & Foldable 4K Drone With Camera, Palm Takeoff & Landing, Gesture…

- Lightweight & Portable Design – Weighing just 151g [9] and C0 certified, this compact drone features full-coverage propeller guards for safer,…

- Palm Takeoff & Landing [1], Gesture Control [2] – Enjoy easy palm takeoff and landing, plus intuitive gesture controls for hands-free operation and…

- Smooth & Reliable Tracking – ActiveTrack [3] keeps your subject in focus, while Apple Watch lets you view live feed, check flight status, or use voice…

Once in position, the Lamprey breaks free and begins to operate on its own. Its boxy hull includes a 24 cubic foot cargo bay with plenty of capacity inside for the operator to arrange to suit the mission, and no defined limits on what can be stored within. You can equip it with lightweight torpedoes to destroy submarines, retractable tubes that launch up to six aerial drones for surveillance or attack, and just about any other type of equipment you might think of.

With four thrusters, it can move in any direction, while the onboard computers handle navigation, steering it through hazardous waters. A retractable mast rises to the surface to send a signal, while data is transmitted below through seabed nodes or to adjacent aircraft such as an F-35.

The Lamprey’s capabilities are nearly limitless, as it can acquire information using its own sensors (which could include sonar, radio signals, or optical gear) or drop down sensors to the seafloor to monitor objects. It can use a variety of technology to monitor large areas of the floor, then silently collect the data and go, or stay and observe. This indicates that commanders can keep an eye on areas where humans cannot reasonably be kept for a lower cost than a manned submarine.

The Lamprey is designed with two main roles in mind: in a scenario where you need to get in and out without being noticed, it’s great for stealthy surveillance, long-term watching, and precise strikes; however, if you need to disrupt the enemy, it can also do that by deploying decoys, delivering attacks, or just generally causing havoc.

Lockheed Martin had total control over the Lamprey’s development budget, allowing them to complete tasks far faster than they could otherwise. According to Paul Lemmo, VP of Sensors, Effectors, and Mission Systems, this speed enabled them to design a platform capable of detecting threats, manipulating them, creating diversions, and defending itself against attacks.

[Source]

Tech

Fugitive behind $73M ‘pig butchering’ scheme gets 20 years in prison

A dual Chinese and St. Kitts and Nevis national was sentenced to 20 years in prison in absentia for his role in an international cryptocurrency investment scheme (also known as pig butchering or romance baiting) that defrauded victims of more than $73 million.

In pig butchering scams, criminals use messaging apps, dating platforms, and social media accounts to build trust with their targets before introducing fraudulent investment schemes. In the end, rather than investing the funds to deliver the promised huge profits, the scammers drain victims’ cryptocurrency wallets.

42-year-old Daren Li pleaded guilty in November 2024 to conspiracy to launder funds obtained through “pig butchering” scams operated from centers in Cambodia after his April 2024 arrest at Hartsfield-Jackson Atlanta International Airport.

However, Li fled in December 2025 after cutting off his ankle monitor, becoming a fugitive before sentencing in California federal court. In addition to the 20-year prison sentence, he also received three years of supervised release after the prison term.

“As part of an international cryptocurrency investment scam, Daren Li and his co-conspirators laundered over $73 million dollars stolen from American victims,” said Assistant Attorney General A. Tysen Duva of the Criminal Division. “The Court’s sentence reflects the gravity of Li’s conduct, which caused devastating losses to victims throughout our country.”

Court documents revealed that Li and co-conspirators were part of an international crime syndicate that used a network of money launderers to move millions stolen from dozens of victims to U.S. bank accounts linked to approximately 74 shell companies, then transferred funds to domestic and international accounts and cryptocurrency platforms to conceal their origins.

He instructed accomplices to open bank accounts and transfer more than $73 million to Deltec Bank in the Bahamas for conversion into cryptocurrency, including Tether. The investigators also discovered more than $341 million in cryptocurrency in one of the crypto wallets the fraud ring used for money laundering.

Li is the first defendant directly involved in receiving victim funds to be sentenced among eight co-conspirators who have also pleaded guilty.

The Justice Department charged four additional suspects in December with involvement in another pig butchering scheme linked to over $80 million in losses.

The FBI’s 2024 Internet Crime Report noted that investment scammers stole over $6.5 billion from 47,919 victims, up from $4.57 billion in 2023.

Tech

‘I Can Read, But I Don’t Know What It Means’: Rethinking Literacy for Multilingual Kids

In classrooms across the country, children are showing progress in reading, yet many students cannot tell you what those words mean, why they matter or how the text connects to their lives.

My first grade multilingual learner asked for help with an assignment that required reading the word and matching it to the corresponding picture. I assumed that my student had not read it. My student replied, “I read the word, but I don’t know what it means.”

At that moment I realized that my students were decoding but not understanding what they read. According to the simple view of reading, students must be able to decode and have linguistic comprehension to attain reading comprehension. Multilingual learners are developing language, which makes comprehension more challenging.

Data from national assessments revealed that reading comprehension outcomes have worsened nationwide (Figure 1). More students scored below proficiency in reading in the 2024 report than in the 2022 and 2019 reports (Figure 2).

Figure 1: National Assessment of Educational Progress, 2024

Figure 2: Trend in Eighth Grade NAEP Reading Achievement-Level Results, 2024

The sharpest declines, according to NAEP and the Department of Public Instruction, are among African American, Hispanic, Native American, and multilingual learners. The data highlights that despite widespread science of reading reforms emphasizing foundational literacy skills, minority students continue to struggle with comprehension.

Culturally and Linguistically Sustaining Practices Matter

America’s classrooms are more diverse today than at any point in history. There are over 5 million multilingual learners in the United States.

Yet science of reading curricula rarely reflect this diversity. Many curricula assume that students come from white, English-speaking, middle-class households.

Research shows students improve in reading when texts reflect their racial, cultural and linguistic identities, because culture shapes the oral language needed for comprehension. When curricula ignore students’ experiences, understanding suffers, not from lack of ability, but from lack of relevance.

Science of reading reforms have boosted decoding, but they were built for monolingual, culturally narrow classrooms.

Grounded in English-only assumptions, many science of reading curricula lack multilingual learners’ home languages and cultural knowledge, making it harder for them to comprehend texts. Decodable texts deepen this gap because they are designed to practice phonics rather than to develop rich vocabulary, complex language or connections to texts.

As a result, students may look strong on decoding data while continuing to lag in comprehension, confirming NAEP’s widening comprehension gaps even with decoding gains.

Classroom solutions

Despite these challenges, teachers have powerful tools at their disposal that do not require abandoning foundational skills. Instead, they ask us to expand our definition of literacy beyond decoding and provide instructional time for students to develop language comprehension.

1. Choose culturally representative texts

Research with African American, Latinx, Indigenous, and multilingual students shows that literature that affirms identities improves comprehension, motivation and critical thinking. Representation matters.

2. Make read-alouds a daily nonnegotiable

Read-alouds provide students with rich vocabulary and syntax, model fluent reading, and build shared background knowledge, all essential for reading comprehension. Choose read-alouds that are 2-3 levels above students’ reading levels to provide opportunities to learn new vocabulary.

3. Explicitly teach vocabulary before, during and after reading

Building vocabulary is needed for students to construct background knowledge and linguistic comprehension.

Multilingual learners and some students from lower-income backgrounds may require images or visuals to support comprehension. I discovered that students were unfamiliar with simple consonant-vowel-consonant words like “fig” or “hut.”

Additionally, vocabulary instruction is more effective when woven into the lesson rather than as an afterthought. Students also benefit from thematic units that reuse vocabulary words, which provide students with opportunities to practice new oral language.

4. Use collaborative talk structures frequently

Oral language develops language comprehension, one of the two main components necessary for reading comprehension. According to the simple view of reading framework, reading comprehension is the product of decoding words and language comprehension.

While foundational literacy science of reading curricula teach students to decode, students must engage in collaborative learning through turn-and-talks, small-group discussions and shared inquiry to develop language comprehension.

5. Allow translanguaging for multilingual learners

When students use their home languages to process ideas, compare concepts or discuss texts, comprehension deepens. It is a powerful cognitive tool, validated by decades of research in bilingual education.

Try using strategies such as identifying cognates, teaching children to use bilingual dictionaries or apps, and providing a space within the lesson for students of the same home language to brainstorm.

We Can’t Do It Alone

Teachers cannot solve the literacy crisis without the support of parents and community partners.

I recently read an article about a literacy initiative in a refugee camp, which found that sending home tablets with stories in families’ home languages increased students’ motivation and improved reading comprehension.

When parents are given tools to read with their children, regardless of language, students develop literacy skills. Teachers can improve literacy efforts at home through bilingual books, multilingual reading apps, family literacy nights, community tutoring partnerships and take-home literacy kits.

One of my most successful classroom projects was a “Bilingual Book in a Bag.” Students took home a bilingual book, a stuffed animal, creative activities and a writing journal to complete with their families. The joy students brought back to the classroom, and the growth in their writing and comprehension, proved what research has long shown: Children learn best when their languages and families are valued.

A Call for a More Humanizing Literacy Future

If we expect students to improve reading comprehension, we must move beyond narrow, English-only interpretations of the science of reading. Foundational skills matter, but decoding is only the beginning.

Children need oral language, background knowledge and cultural connections. Reading is not simply sounding out words. It is making meaning, connecting text to identity, culture and lived experience. The future of literacy depends on our willingness to honor the full humanity of every child.

Tech

Databricks CEO says SaaS isn’t dead, but AI will soon make it irrelevant

On Monday, Databricks announced it reached a $5.4 billion revenue run rate, growing 65% year-over-year, of which more than $1.4 billion was from its AI products.

Co-founder and CEO Ali Ghodsi wanted to share these growth numbers because there’s so much talk about how AI is going to kill the SaaS business, he told TechCrunch.

“Everybody’s like, ‘Oh, it’s SaaS. What’s going to happen to all these companies? What’s AI going to do with all these companies?’ For us, it’s just increasing the usage,” he said.

To be sure, he also wants to distance Databricks from the SaaS label, given that private markets value it as an AI company. Databricks on Monday also officially closed on its massive, previously announced $5 billion raise at a $134 billion valuation, and nabbed a $2 billion loan facility as well.

But the company is straddling both worlds. Databricks is still best known as a cloud data warehouse provider. A data warehouse is where enterprises store massive amounts of data to analyze for business insights.

Ghodsi called out, in particular, one AI product that’s driving usage of its data warehouse: its LLM user interface named Genie.

Genie is an example of how a SaaS business can replace its user interface with natural language. For instance, he uses it to ask why warehouse usage and revenue spike on particular days.

Just a few years ago, such a request required writing queries in a specific technical language, or having a special report programmed. Today, any product with an LLM interface can be used by anyone, Ghodsi noted. Genie is one reason for the company’s usage growth numbers, he said.

The threat of AI to SaaS isn’t, as one AI VC jokingly tweeted, that enterprises will rip out their SaaS “systems of record” to replace them with vibe-coded homegrown versions. Systems of record store critical business data, whether it’s on sales, customer support, or finance.

“Why would you move your system of record? You know, it’s hard to move it,” Ghodsi said.

The model makers aren’t offering databases to store that data and become systems of record anyway. Instead, they hope to replace the user interface with natural language for human use, or APIs or other plug-ins for AI agents.

So the threat to SaaS businesses, Ghodsi says, is that people no longer spend their careers becoming masters of a particular product: Salesforce specialists, or ServiceNow, or SAP. Once the interface is just language, the products become invisible, like plumbing.

“Millions of people around the world got trained on those user interfaces. And so that was the biggest moat that those businesses have,” Ghodsi warned.

SaaS companies that embrace the new LLM interface could grow, as Databricks is doing. But it also opens up possibilities for AI-native competitors to offer alternatives that work better with AI and agents.

That’s why Databricks created its Lakebase database designed for agents. He’s seeing early traction. “In its eight months that we’ve had it in the market, it’s done twice as much revenue as our data warehouse had when it was eight months old. Okay, obviously, that’s like comparing toddlers,” Ghodsi says. “But this is a toddler that’s twice as big.”

Meanwhile, now that Databricks has closed on its massive funding round, Ghodsi tells us that the company is not immediately working on another raise, nor prepping for an IPO.

“Now is not a great time to go public,” Ghodsi said. “I just wanted to be really well capitalized” should the markets go “south” again as they did in the 2022 downturn, when interest rates rose sharply after years of near-zero rates. A thick bank account “protects us, gives us many, many years of runway,” he added.

Tech

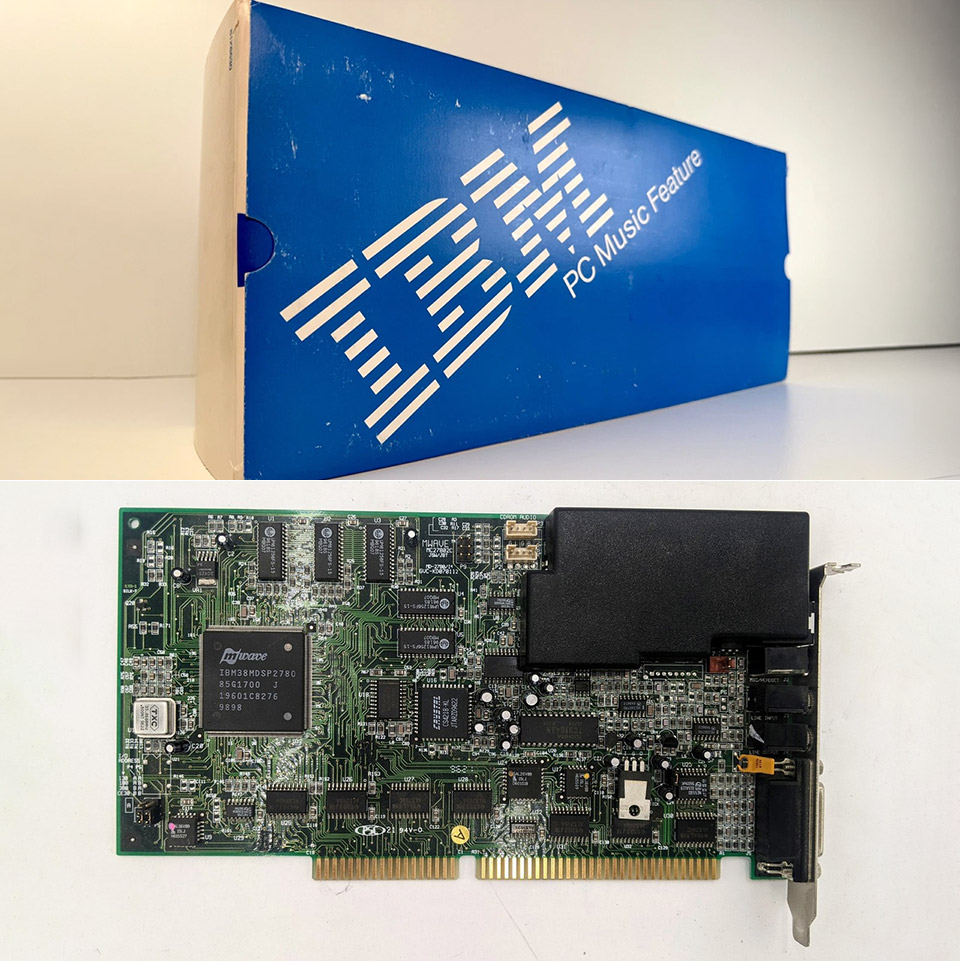

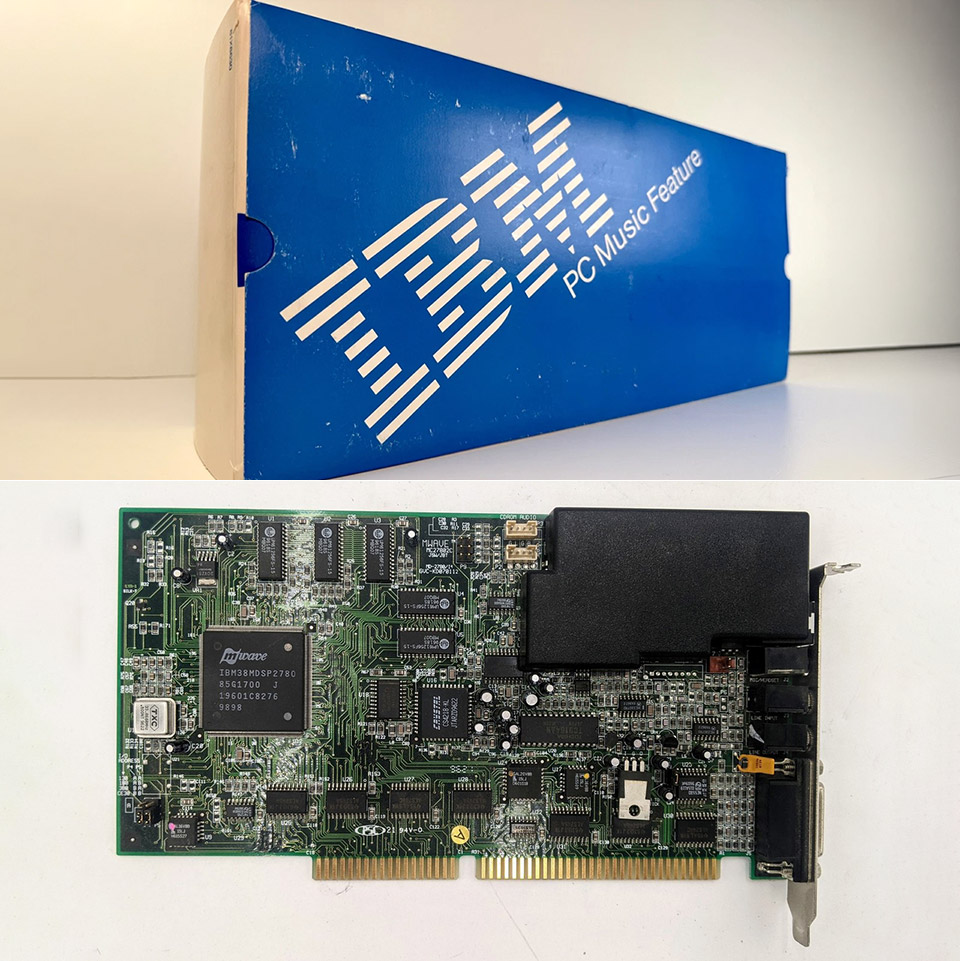

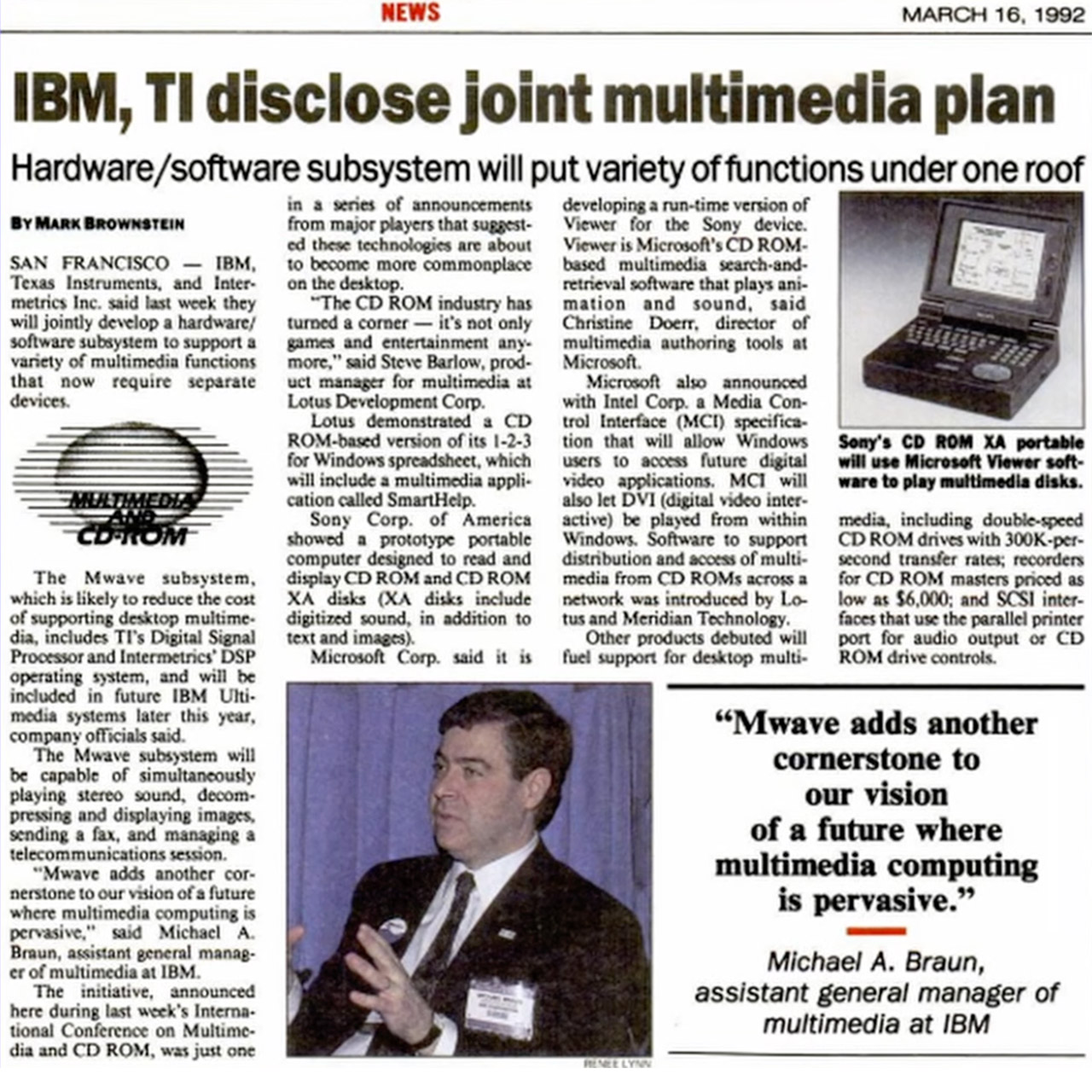

Why the IBM MWave Sound Card Could be One of the Most Disappointing Pieces of Hardware from the 1990s

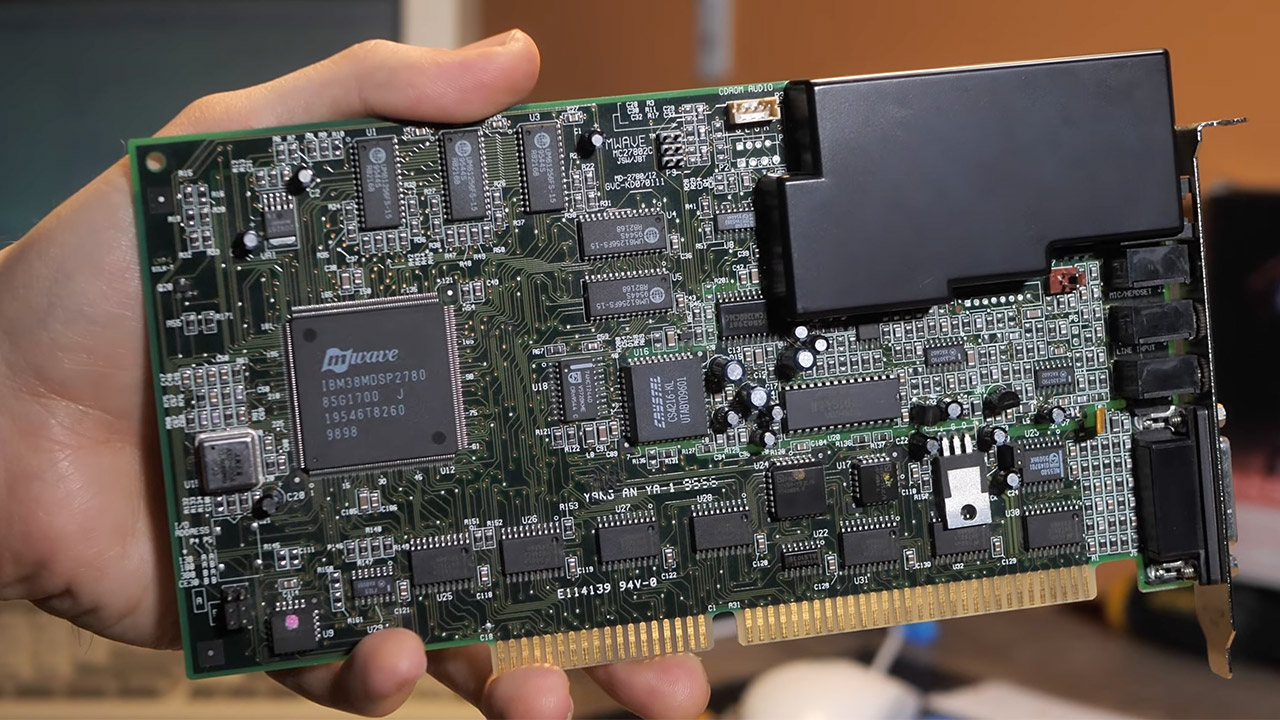

The IBM MWave sound card is still talked about in retro computing circles today, though not in a good way. It’s remarkable how many people can’t stop thinking about how disappointing it was. Launched around 1992 and utilized in IBM’s Aptiva desktops and ThinkPads, the MWave was designed to be a nifty little combo of sound playback and dial-up modem on a single chip. The idea promised convenience and cost savings during an era when sound cards carried prices similar to today’s graphics cards, but reality delivered something far different.

IBM created the MWave around a unique digital signal processor that was expected to handle audio and modem functions. It had a separate chip for digital to analog conversion and another for dealing with the very rudimentary game audio of FM synthesis, as well as General MIDI wavetables for fuller sound and, of course, modem functions up to 28.8 kbps. Later drivers touted 33.6 kbps, since this all appeared to be a forward-thinking approach at first, with one card handling game sound effects, MIDI backgrounds, and internet connections without the need for additional hardware. You have some useful features, such as wake on ring for the Aptivas resume functionality. Few other manufacturers were attempting this tight integration at the time.

Sale

Anker Soundcore 2 Portable Bluetooth Speaker with Stereo Sound, Bluetooth 5, Bassup, IPX7 Waterproof,…

- Outdoor-Proof Speaker: Portable design with IPX7 waterproof protection to safeguard against splashes, waves, and water vapor. Get incredible sounds at…

- 24H Non-Stop Music: With Anker’s world-renowned power management technology and a 5,200mAh Li-ion battery, the soundcore 2 speaker delivers a full day…

- Powerful Sound: The speaker features 12W power with enhanced bass from dual neodymium drivers. An advanced digital signal processor ensures pounding…

The compatibility concerns began almost immediately, with owners complaining about the modem and audio conflicts at startup. The shared CPU simply wasn’t powerful enough to manage both tasks. Owners experienced frequent failed connections, garbled audio, or no audio at all, with the modem failing in one instance while the audio worked in another. From the start, the drivers seemed suspicious. People frequently had to manually meddle with restarts and fiddling around the edges in the hopes that their system would even recognize the card.

Users who used Windows reported a host of issues, beginning with frequent crashes and system errors, particularly when attempting to run Sound Blaster emulation in Windows 95 and 98. DOS games had to be booted up in specific ways so that when you heard audio, it was actually there rather than just gone.

The audio quality suffered significantly as a result of FM synthesis, which was intended to replicate the iconic sound of the soundblaster but instead produced horrible distorted sound. Pitches would shift unexpectedly, notes would vanish, and percussion would just evaporate, while sound effects such as reverb, chorus, and so on would become muddy. The wavetable MIDI was considerably worse, with instruments sounding out of sync, missing vibrato pitch bends, and terrible timbres that sounded if a game’s original soundtrack had been blended. Some audio clips from games like as Duke Nukem 2, Commander Keen, Descent, and Tyrian 2000 demonstrate the severity of the issues, with severe artificial echoes, warped melodies, and what should have been magnificent sound effects reduced to glitches as well as awful basic tones.

It wasn’t only Windows; even DOS-based games suffered from static and poor audio quality. Most consumers were vocal about their dissatisfaction, and IBM faced a class-action lawsuit in the late 1990s, which was eventually settled in 2001. Some customers received a check and a modem in exchange for their quiet and a non-disclosure agreement, while others just had their forum postings “disappear” when they dared to report difficulties. IBM eventually removed the MWave from new systems in 1998, nearly 6 years after it initially began failing, and replaced it with separate sound cards and a modem.

[Source]

-

Tech6 days ago

Tech6 days agoWikipedia volunteers spent years cataloging AI tells. Now there’s a plugin to avoid them.

-

Politics2 days ago

Politics2 days agoWhy Israel is blocking foreign journalists from entering

-

NewsBeat16 hours ago

NewsBeat16 hours agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Sports3 days ago

Sports3 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Tech4 days ago

Tech4 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

NewsBeat2 days ago

NewsBeat2 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Business2 days ago

Business2 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Sports1 day ago

Sports1 day agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports3 days ago

Former Viking Enters Hall of Fame

-

Politics2 days ago

Politics2 days agoThe Health Dangers Of Browning Your Food

-

Sports4 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business2 days ago

Business2 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat4 days ago

NewsBeat4 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business5 days ago

Business5 days agoQuiz enters administration for third time

-

NewsBeat1 day ago

NewsBeat1 day agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports15 hours ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

Crypto World4 hours ago

Crypto World4 hours agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat5 days ago

NewsBeat5 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition

-

Crypto World4 hours ago

Crypto World4 hours agoEthereum Enters Capitulation Zone as MVRV Turns Negative: Bottom Near?

-

NewsBeat3 days ago

NewsBeat3 days agoDriving instructor urges all learners to do 1 check before entering roundabout