Crypto World

Gen Z trusts code over bank promises

Welcome to our institutional newsletter, Crypto Long & Short. This week:

- Haider Rafique of OKX shares a firm study on the generational perspectives of crypto investing

- Top headlines institutions should pay attention to by Francisco Rodrigues

- Sky defies 2026 downturn in Chart of the Week

Expert Insights

Gen Z Trusts Code Over Bank Promises

By Haider Rafique, global managing partner, OKX

It’s no secret that the banking industry is worried about crypto disruption.

After months of intense lobbying, the Senate Banking Committee postponed its markup of market structure legislation, due in part to banks’ stance on stablecoin yield.

But it might not matter, because banks have a much bigger crisis on their hands: they’re completely missing out on younger consumers based on the basic principle of trust.

Given the behaviors we’ve observed on the OKX app around the world, we decided to conduct a study to understand generational perspectives in our evolving industry.

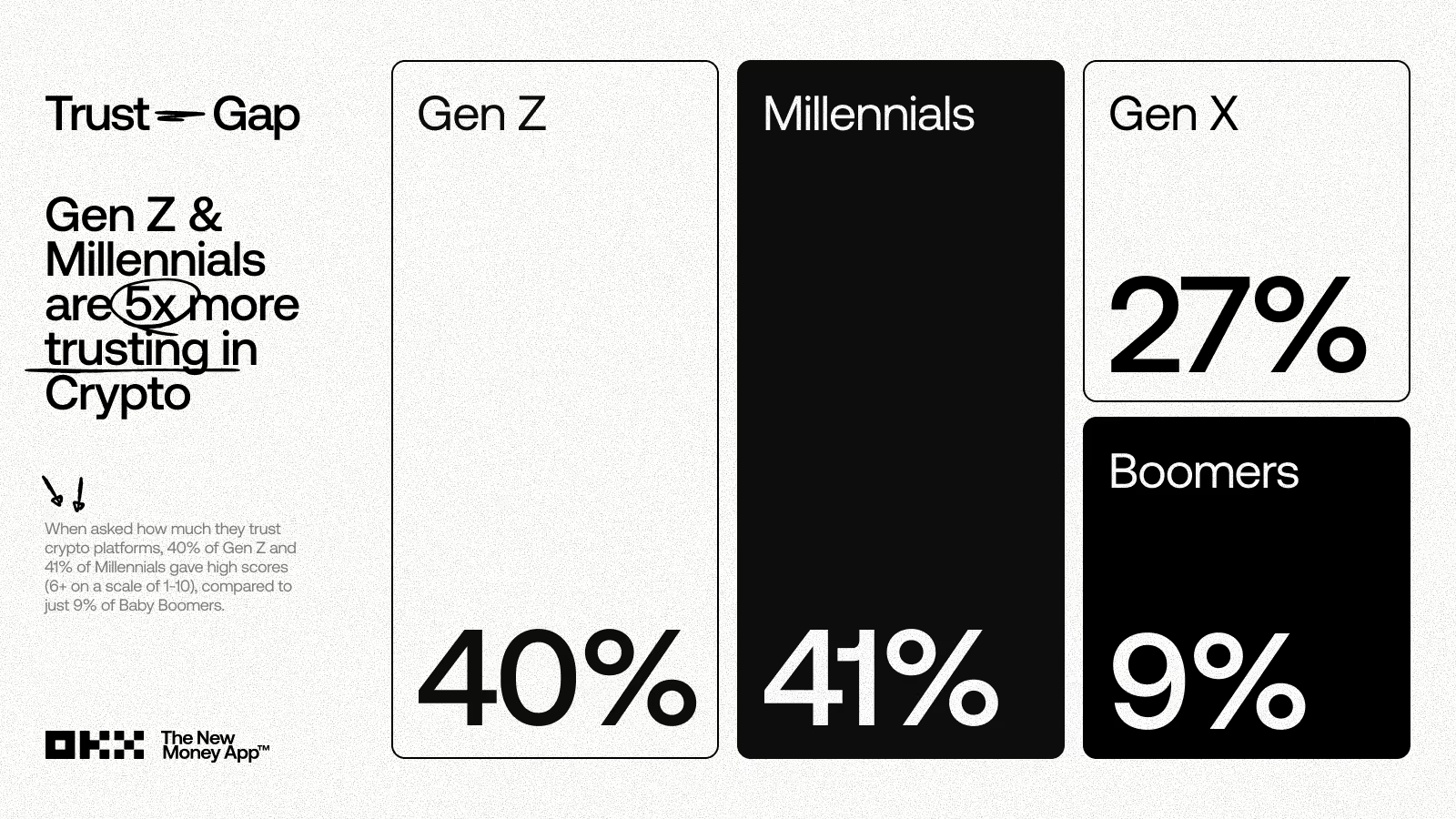

The key insights paint a clear picture: Gen Z and millennial consumers are nearly 5x more trusting of crypto compared to their boomer counterparts. Additionally, one in five Gen Z and millennial consumers say they have low trust in traditional financial institutions, while nearly three quarters (74%) of baby boomers maintain high levels of trust in the old system.

The “why” behind all of this is much deeper than viral trends and memecoins. This is a generation raised on open‑source code and real‑time dashboards who now expect the same transparency from TradFi.

And now, as the world moves on-chain and everything gets tokenized, it’s clear that young people see the digital economy as their stock market.

TradFi isn’t theirs. It belongs to their parents and grandparents.

A generation shaped by institutional failure

A recent FINRA and CFA Institute report suggests a sizable share of Gen Z investors now lean heavily into crypto relative to other assets — a behavioral signal that younger Americans are willing to look outside traditional channels when they don’t believe they’re getting transparency or competitive returns. According to the study, nearly 20% of Gen Z investors only hold crypto.

For banks, this should be a wake‑up call that trust is no longer something institutions can declare but something they must demonstrate.

Boomers built their financial lives in an era when institutions were the safest option available. Regulation meant protection, and trust was something you extended first and questioned later.

Gen Z has lived through the opposite. They came of age during the aftermath of the 2008 financial crisis, entered adulthood with high student debt and now face a housing market millions of units short alongside ongoing inflation.

They’ve also lived through years of policy whiplash on student loans, shifting repayment rules and weakened borrower protections. These reversals reinforced a simple lesson that institutional promises can change overnight. When trust is repeatedly tested, skepticism becomes rational.

Banks aren’t losing Gen Z to crypto; they’re losing them to trust.

Control over promises

That skepticism is reshaping what influences trust for younger generations. For boomers, security means regulatory oversight and the perceived stability of legacy institutions.

Contrarily, Gen Z consistently ranks platform security above regulation as the top driver of trust. For Gen Z, security is more personal and technical with direct ownership of assets, the ability to verify how systems work and the freedom to move value without intermediaries.

It’s why both Gen Z and millennials are 4x more bullish on crypto in 2026 compared to boomers. They can see transactions on-chain, self‑custody, audit protocols and understand the rules without waiting for a quarterly statement or a regulator’s update.

Transparency is central to this shift. Boomers tend to equate trust with regulatory approval, but Gen Z equates trust with visibility. They want to understand how decisions are made, how risks are managed and how incentives are aligned. They want clarity on fees, yields and conflicts of interest, and systems that are open by default.

Traditional banks have historically struggled here. Their value proposition was built in an era when limited transparency was often treated as a feature. And now, when a generation is accustomed to real‑time dashboards and proof of reserves, the idea of waiting for a monthly statement feels absurd. Transparency has become a baseline requirement for credibility.

The future of finance

Banks should be asking themselves: why do younger customers trust transparency more than tradition? Younger Americans want the stability of regulated finance paired with the transparency and control of digital assets, and they want products that reflect how they already interact with technology and money. The institutions that understand this shift and build for it will define the future of finance. The ones that don’t will continue to watch as younger Americans look elsewhere.

Headlines of the Week

Francisco Rodrigues

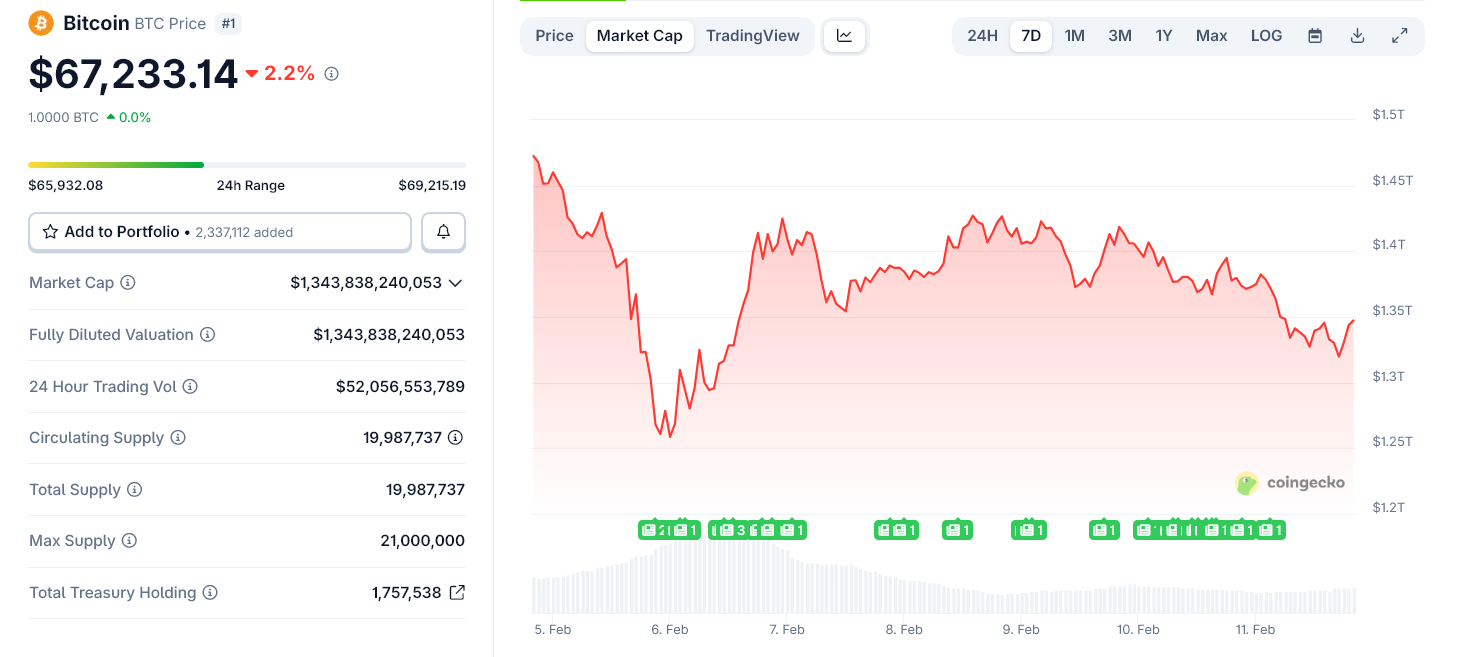

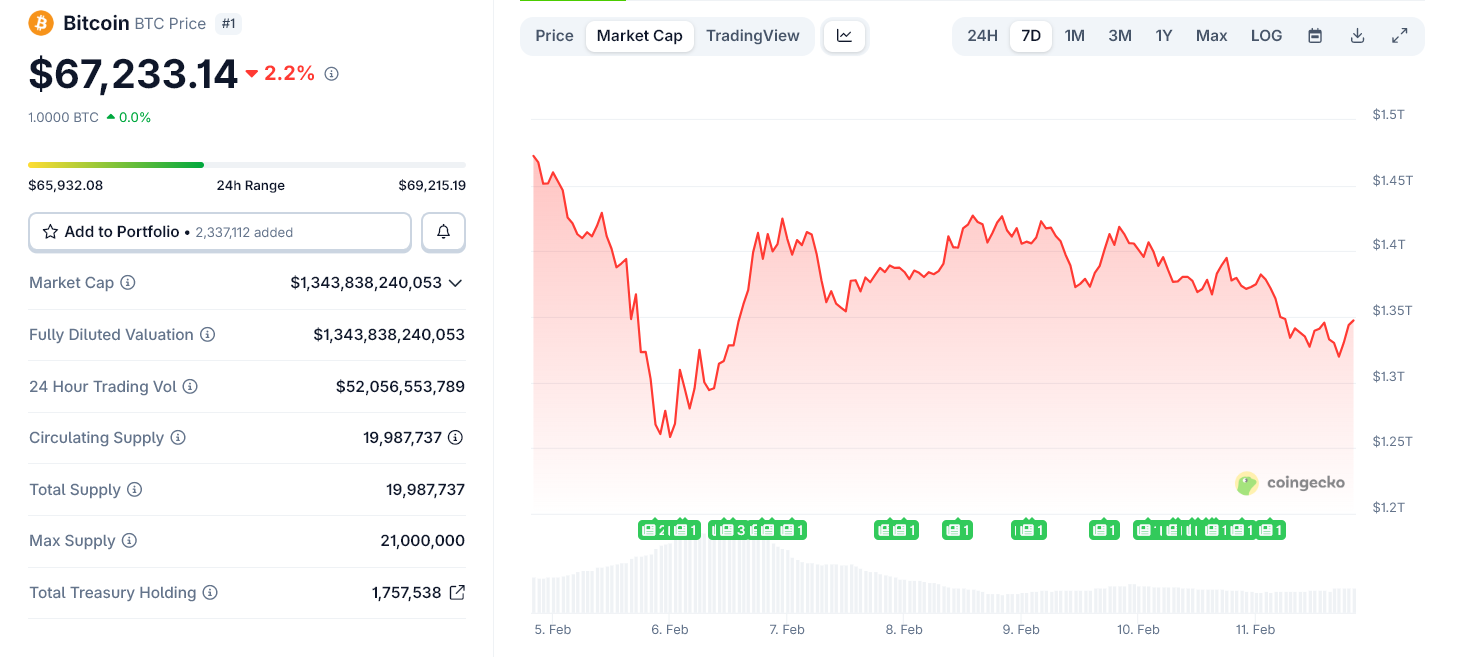

Markets stumbled this past week and miner capitulation intensified. That led to the steepest decline for Bitcoin’s mining difficulty since 2021, while corporate accumulation of cryptocurrencies and other assets continued and Russia moved closer to formalize crypto-backed lending.

Chart of the Week

Sky defies 2026 downturn

Sky has decoupled from the 2026 market downturn, outperforming BTC, CD5, and the CD20 index by 45%, 50% and 57% respectively YTD. This resilience is anchored by a consistent business model: January revenue surged 1.5x YoY to $19 million, fueling $10.4 million in YTD buybacks ($8.5 million in Jan; $1.9 million last week) and driving a flight to quality that pushed the USDS (Sky’s stablecoin) market cap from $5.8 billion to $6.5 billion.

Listen. Read. Watch. Engage.

Note: The views expressed in this column are those of the author and do not necessarily reflect those of CoinDesk, Inc., CoinDesk Indices or its owners and affiliates.

Crypto World

ZRO Soars 40% After Unveiling Layer 1 Blockchain

LayerZero announced its Zero blockchain yesterday, built in collaboration with Citadel, ICE, and Google Cloud.

LayerZero’s ZRO token is leading the altcoin market today, rallying 40% after unveiling Zero, its new Layer 1 blockchain.

ZRO sold off immediately after yesterday’s announcement; however, after more details emerged – such as Ark Invest founder Cathie Wood stepping on board as an advisor – the token surged from $1.7 to $2.5.

The ZRO token has been pricing in an impending announcement throughout 2026, and has been one of just a handful of strong altcoins over the last six weeks. The move brings ZRO’s market capitalization to $481 million, its highest level since January 2025.

In addition to Wood, the protocol also added Michael Blaugrund, the vice president of Strategic Initiatives at Intercontinental Exchange (ICE), and Caroline Butler, the former Head of Digital Assets at the Bank of New York Mellon, and co-chair of the Commodities and Futures Trading Commission (CFTC), to its advisory board.

LayerZero brands Zero as “the first multi-core world computer” and says it’s been designed to address all existing bottlenecks in blockchain design, with an explicit goal of 2 million transactions per second (TPS) for every component in its system.

“We have replaced the fragmented, one-size-fits-all model with a unified high-performance system that treats multiple applications like concurrent processes on a single modern multi-core CPU. Due to this massive cost reduction, Zero is not only an alternative to existing blockchains; it provides a credible alternative to centralized cloud providers like AWS,” the Zero debut article claims.

“By stripping away the overhead of redundant replication, we have finally made decentralization viable on a global scale. Zero is the first truly scalable, multi-core world computer,” the article concluded.

Crypto World

Crypto ETFs are here to stay, downturn be damned

Despite a bearish cryptocurrency market, ETF issuers continue to push forward with new filings, betting that demand for digital asset funds will remain strong.

Summary

- ETF issuers like Bitwise, ProShares, and 21Shares are advancing with new filings, including plans for Uniswap-linked and leveraged Bitcoin/Ether ETFs.

- The crypto ETF market is crowded, with over 140 existing funds, 10 new launches this year, and more expected.

- Bitcoin’s sharp price drop has led to significant losses for ETF buyers, with $1.5 billion withdrawn from Ether ETFs and over $3.5 billion from Bitcoin ETFs in the past three months.

This month, Bitwise Asset Management filed for a Uniswap-linked ETF, while ProShares sought approval for leveraged Bitcoin and Ether ETFs. 21Shares also resubmitted plans for funds based on Ondo and Sei, signaling progress in its efforts.

Todd Sohn, chief ETF strategist at Strategas, told Bloomberg that while firms like 21Shares and Bitwise remain committed to the long-term potential of crypto, ongoing poor performance could affect future flows.

This comes amid a crowded market, with over 140 crypto-focused US ETFs already trading, and 10 more launched this year. A BNB staking ETF is expected soon.

Cryptos have faced renewed pressure after October’s selloff, with Bitcoin falling sharply, dragging smaller tokens down. Investors are stepping back as liquidity tightens and risk appetite wanes.

Data from Glassnode shows that buyers of U.S. spot-Bitcoin ETFs are sitting on average paper losses, having bought Bitcoin at around $84,100 per coin, while the price now hovers near $66,000. This has led to significant outflows, with over $1.5 billion withdrawn from Ether-focused ETFs and more than $3.5 billion pulled from Bitcoin ETFs in recent months.

Crypto World

Chainlink Feeds Live for Ondo Tokenized US Stocks on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum. The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. This development provides on-chain pricing references for the tokenized assets and allows DeFi protocols to set collateral parameters and manage liquidations tied to underlying equities, while also accounting for corporate actions like dividends. The move marks a notable step in bringing traditional equities closer to decentralized finance, offering new avenues for lending and structured product design that hinge on reliable price data.

Key takeaways

- Chainlink has been designated as the official data oracle for Ondo Global Markets, supplying on-chain price feeds for tokenized US stocks on Ethereum.

- Initial support covers SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with the expectation of expanding to additional tokenized assets as coverage broadens.

- The price feeds feed into Euler, enabling tokenized equities to be used as collateral for borrowing stablecoins and for setting liquidation parameters in DeFi lending markets.

- Corporate actions, including dividends, are incorporated into the reference prices, helping maintain alignment between on-chain valuations and the underlying equities.

- Ondo’s move follows a broader push to tokenize US equities, underscored by regulatory and market actions across traditional finance and crypto venues, including Nasdaq’s rule-change efforts and public experiments by Robinhood and others.

- Industry developments highlight a growing ecosystem where tokenized stocks can feed DeFi protocols and potentially participate in broader on-chain trading and custody flows.

Tickers mentioned: SPYon, QQQon, TSLAon

Market context: The integration arrives amid a broader push to bring tokenized equities onto blockchain infrastructure as regulators in the United States refine custody and trading rules for tokenized securities. Observers note the convergence of traditional markets and DeFi as institutional and fintech players experiment with on-chain collateral, settlement efficiency and new product structures.

Why it matters

Ondo’s integration of Chainlink as the on-chain price oracle for tokenized stocks addresses a critical gap in DeFi’s treatment of synthetic equity representations. Before this development, tokenized equities had primarily served price exposure purposes or lightly simulated baseline risk rather than functioning as robust collateral. By linking on-chain prices to reference values tied to the underlying assets—and incorporating corporate actions—the ecosystem gains a more reliable mechanism for risk management, enabling lenders and protocol designers to calibrate collateral factors, liquidation thresholds and risk controls with greater fidelity to real-world equity behavior.

The partnership’s significance extends beyond Ondo. As markets experiment with tokenized versions of mainstream securities, the entire DeFi lending stack benefits from standardized, auditable price feeds that react to corporate actions and market dynamics. The collaboration with Chainlink—a long-standing oracle provider in the crypto space—also helps align DeFi protocols with real-world financial benchmarks, potentially fostering broader adoption of tokenized stocks within lending, derivatives and structured products. The move comes at a moment when traditional exchanges and fintechs are stepping up efforts to offer tokenized equity trading, custody and settlement on or near blockchain rails, signaling a converging trajectory for regulated tokenized assets and decentralized finance.

Regulatory and market developments underscore the momentum behind tokenized equities. Nasdaq has pursued a rule change with the U.S. Securities and Exchange Commission to enable listing and trading of tokenized stocks, aiming to integrate blockchain-based representations with a regulated exchange framework. Separately, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in custody, adding clarity to custody pathways for tokenized assets. In the broader crypto ecosystem, tokenized stock offerings have already surfaced on various platforms, illustrating a multi-pronged approach to bringing on-chain exposure to blue-chip equities without sacrificing the transparency and programmability that DeFi affords.

On the liquidity and trading front, major market participants are pursuing ways to expand access to tokenized securities. The New York Stock Exchange and its parent company, Intercontinental Exchange, announced efforts to develop a blockchain-based trading platform for tokenized stocks and ETFs with 24/7 trading and near-instant settlement, subject to regulatory approval. Meanwhile, crypto-native tokenization initiatives have already brought dozens of tokenized US stocks to multi-chain ecosystems, with platforms like Kraken and Bybit hosting tokenized stock markets under the xStocks banner, and Robinhood launching a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum, designed to support tokenized assets and on-chain lending and derivatives. These moves collectively illustrate a cross-market push toward more flexible capital markets built on tokenized representations and on-chain data feeds.

For developers and users, the Ondo–Chainlink integration signals a more practical pathway for tokenized equities to function as collateral within DeFi. It binds the on-chain price determiners to the equity’s fundamentals, potentially enabling more sophisticated service models and risk management strategies in decentralized lending and beyond. The collaboration also reinforces the role of oracles as a bridge between traditional asset classes and DeFi ecosystems, an area that continues to attract attention as regulators, exchanges and fintechs map out the future of tokenized securities and on-chain finance.

Additional context around the broader tokenization wave is reflected in the ongoing coverage of tokenized assets across crypto media, including continued discussions of how tokenized stocks could operate within regulated frameworks and the evolving custody landscape. The ecosystem’s trajectory remains contingent on regulatory clarity, liquidity, and the ability of on-chain price feeds to reflect real-time market movements and corporate actions with high fidelity.

What to watch next

- Expansion of oracle coverage to additional tokenized equities and ETFs as Ondo and Chainlink broaden their integration footprint.

- Regulatory progress on tokenized securities, including potential approvals or filings related to further tokenized-stock listings and custody rules.

- Adoption by more DeFi protocols that may incorporate tokenized equities as collateral or reference price sources in lending and derivatives.

- New corporate actions and governance events for tokenized assets that could drive updates to reference prices and collateral models.

Sources & verification

- Ondo post: Defi adoption of Ondo tokenized stocks live — https://ondo.finance/blog/defi-adoption-of-ondo-tokenized-stocks-live

- Chainlink partnership with Ondo (PR Newswire, October 2025) — https://www.prnewswire.com/news-releases/ondo-and-chainlink-announce-landmark-strategic-partnership-to-jointly-bring-financial-institutions-onchain-302599151.html

- Nasdaq rule-change for tokenized stocks — https://cointelegraph.com/news/nasdaq-asks-sec-for-rule-change-to-trade-tokenized-stocks

- SEC no-action letter for tokenization services (DTCC) — https://cointelegraph.com/news/sec-clears-dtcc-to-offer-tokenization-service

- Robinhood Chain testnet (public) — https://robinhood.com/us/en/newsroom/robinhood-chain-launches-public-testnet/

Ondo and Chainlink bring tokenized stocks to DeFi on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum (CRYPTO: ETH). The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. The integration anchors on-chain valuations to reference prices that reflect corporate actions like dividends, enhancing the reliability of on-chain pricing for collateral and liquidations. The collaboration marks a meaningful step in expanding the use cases for tokenized equities within decentralized finance and demonstrates how established oracle networks can support new asset classes on-chain.

Initial coverage includes SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with plans to expand as the oracle network and Ondo’s protocol integrations scale. The data feeds feed into lending markets on Euler, enabling users to collateralize tokenized stocks for stablecoin borrowing and to set risk controls based on up-to-date reference prices. This approach addresses a notable limitation: tokenized equities had been primarily used for price exposure rather than as robust collateral. By pairing exchange-linked liquidity with reliable on-chain price feeds, Ondo and Chainlink seek to unlock broader DeFi applications, including more sophisticated lending, risk management and perhaps new forms of on-chain structured products.

The broader ecosystem context includes a growing array of regulatory and market initiatives aimed at tokenized securities. Nasdaq’s pursuit of a rule change to permit listing and trading tokenized stocks signals a potential path for regulated, on-chain representations of listed shares. The same week, the SEC clarified custody rules for tokenized securities in collaboration with the Depository Trust & Clearing Corporation, which could streamline how tokenized assets move through the traditional custody pipeline. On the crypto front, platforms have already experimented with tokenized stock access, including tokenized stock offerings across Kraken and Bybit and the Robinhood Chain initiative, all pointing to increasing interoperability between on-chain finance and legacy markets.

With the Ondo–Chainlink integration, developers and users gain a practical mechanism to reference the true price of tokenized equities within DeFi protocols, enabling more reliable collateralization and liquidations. The development underscores the maturation of tokenized securities as a cross-border, cross-venue concept—one that depends on robust price oracles, regulatory clarity and continued collaboration between traditional finance operators and crypto infrastructure providers. As the market continues to experiment with tokenized assets, observers will watch for further asset coverage, governance updates, and regulatory milestones that could accelerate or recalibrate the adoption curve for tokenized stocks in DeFi and beyond.

Crypto World

US Jobs Data Could Shock Bitcoin, Here’s Why

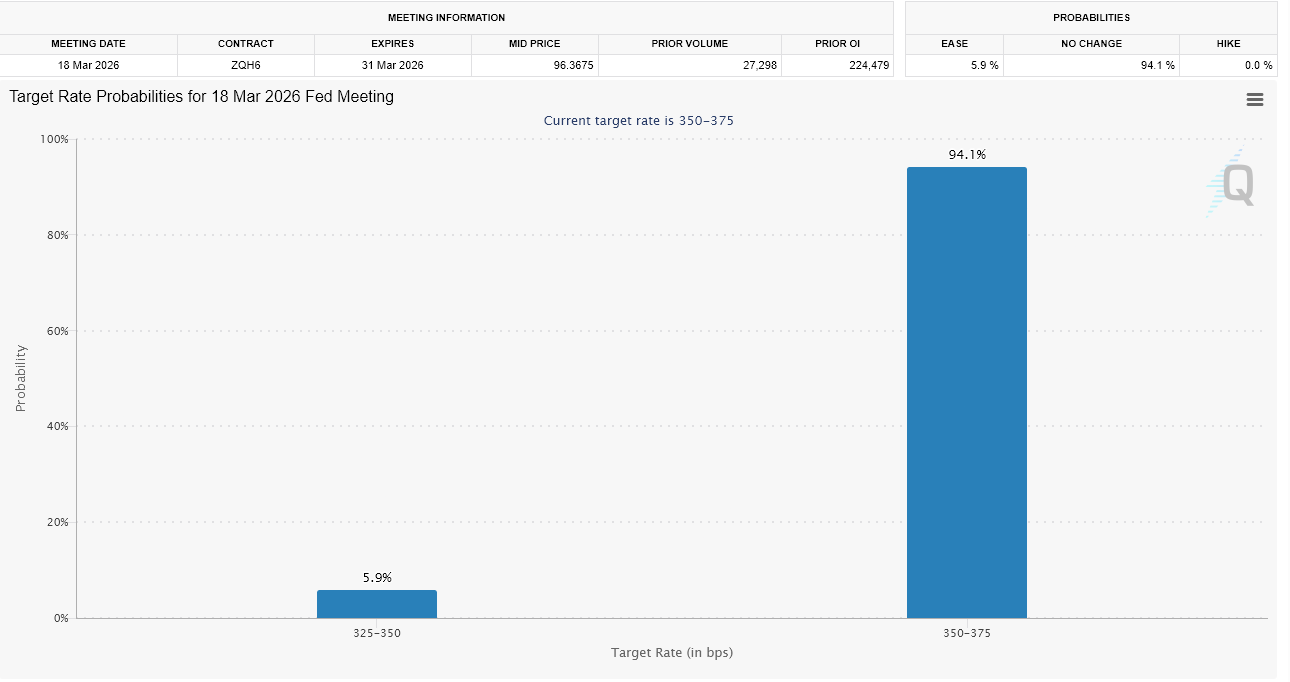

Bitcoin faces renewed macro pressure after the latest US jobs report signaled a stronger-than-expected labor market, pushing Treasury yields higher and reducing the likelihood of near-term Federal Reserve rate cuts.

The US economy added 130,000 jobs in January, nearly double consensus expectations. At the same time, the unemployment rate fell to 4.3%, showing continued labor market resilience.

While strong employment is positive for the broader economy, it complicates the outlook for risk assets like Bitcoin.

Sponsored

Sponsored

Strong Jobs Data Delays Rate Cut Expectations

Markets had been anticipating potential rate cuts in the coming months amid slowing growth concerns. However, a resilient labor market reduces the urgency for monetary easing.

As a result, investors repriced expectations for Federal Reserve policy.

Bond markets reacted immediately. The US 10-year Treasury yield jumped toward the 4.2% level, rising several basis points after the report. The two-year yield also climbed, reflecting reduced probability of near-term cuts.

Higher yields tighten financial conditions. They increase borrowing costs across the economy and raise the discount rate used to value risk assets.

Sponsored

Sponsored

Why Higher Yields Pressure Bitcoin

Bitcoin is highly sensitive to liquidity conditions. When Treasury yields rise, capital tends to rotate toward safer, yield-generating assets such as government bonds.

At the same time, a stronger dollar often accompanies rising yields. A firmer dollar reduces global liquidity and makes speculative assets less attractive.

This combination creates headwinds for crypto markets.

Sponsored

Sponsored

Although Bitcoin briefly stabilized near the $70,000 level earlier in the week, the jobs data increases the risk of renewed volatility. Without a clear signal that the Fed will ease policy, liquidity remains constrained.

“For Bitcoin, this report is a short-term headwind. A beat of this magnitude dampens the probability of a March rate cut and reinforces the Fed’s pause at 3.50%-3.75%. The cheaper money catalyst that risk assets need to mount a sustained recovery just got pushed further out. Expect the dollar to firm and yields to reprice higher, both of which pressure BTC into a range in the near term,” David Hernandez, Crypto Investment Specialist at 21shares told BeInCrypto.

Market Structure Amplifies Macro Stress

The recent crash demonstrated how sensitive Bitcoin has become to macro shifts. Large ETF flows, institutional hedging, and leveraged positioning can accelerate moves when financial conditions tighten.

A stronger labor market does not guarantee Bitcoin will fall. However, it reduces one of the key bullish catalysts: expectations of easier monetary policy.

Sponsored

Sponsored

“In the short term, Bitcoin looks defensive. The key level to watch is $65,000. However, if this strong report turns out to be temporary rather than a sign the economy is heating up again, the Fed could still cut rates later this year. When that happens, Bitcoin’s limited supply becomes important again. Strong data today may delay a rally, but it doesn’t break the long-term bullish case,” Hernandez said.

The Bottom Line

The latest US jobs report reinforces a “higher-for-longer” rate environment.

For Bitcoin, that is not immediately catastrophic. But it does make sustained upside more difficult.

Unless liquidity improves or yields retreat, the macro backdrop now leans cautious rather than supportive for crypto markets.

Crypto World

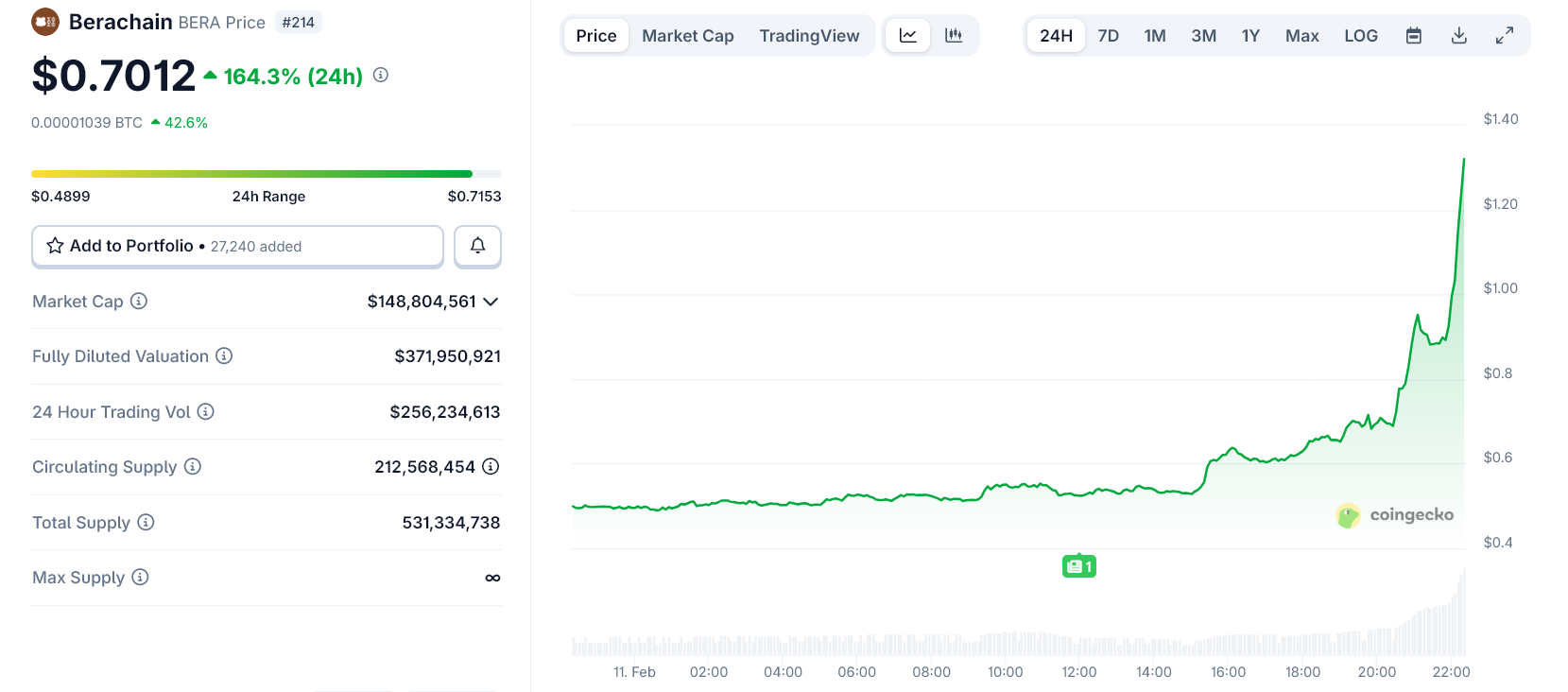

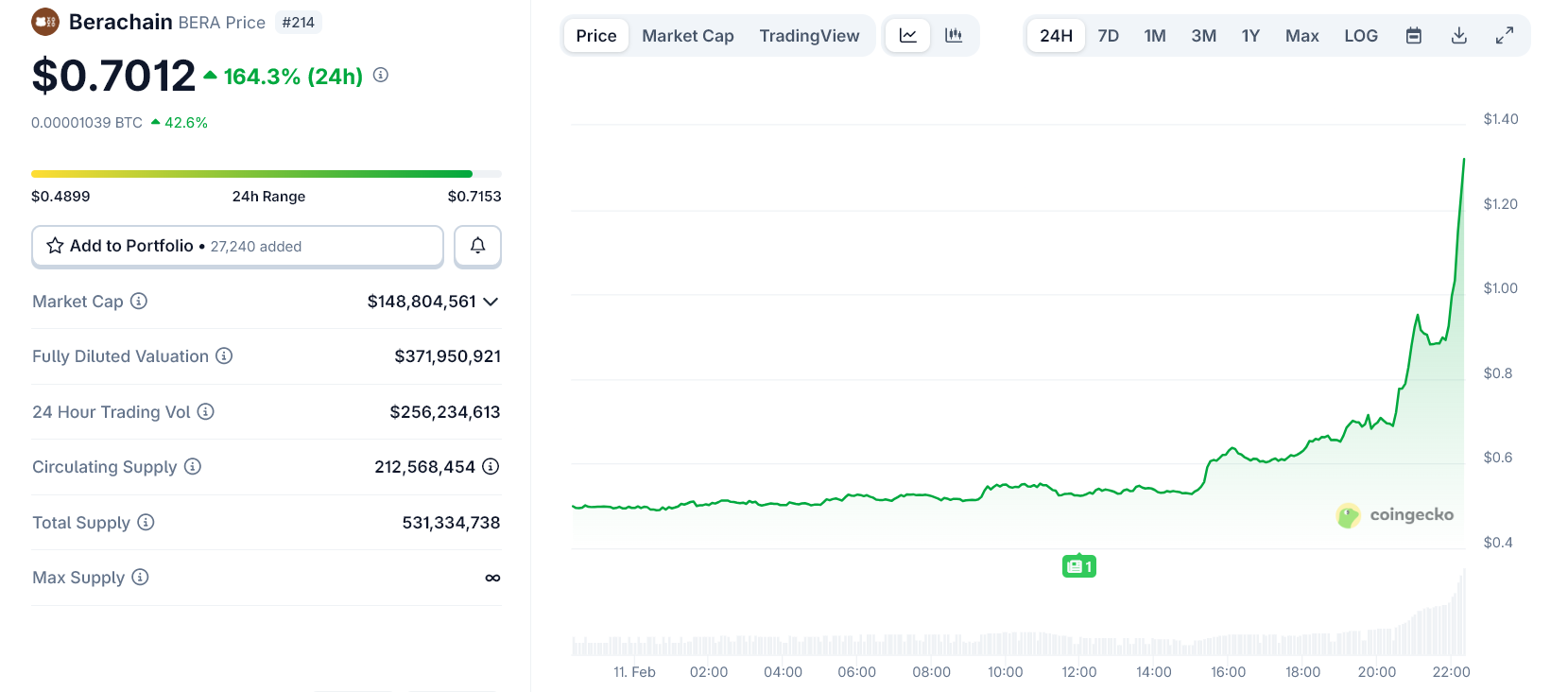

Why Is Berachain Up 150% Overnight After a Year of Silence?

Berachain’s native token, BERA, surged over 150% on February 11, marking its sharpest single-day gain in months. The rally follows weeks of renewed activity after the project spent much of 2025 under pressure from falling prices, token unlock concerns, and investor uncertainty.

The immediate catalyst appears to be the foundation’s strategic shift toward a new model called “Bera Builds Businesses.”

Sponsored

Sponsored

Berachain’s Refund Fears to Revenue Ambitions: What Changed?

Announced in January, the initiative aims to back three to five revenue-generating applications designed to create sustainable demand for BERA.

Instead of relying on heavy token incentives, the network now plans to focus on projects capable of producing real cash flow.

That pivot changed the narrative.

Throughout 2025, Berachain struggled as TVL (total value locked) collapsed from early highs, and the token fell more than 90% from its peak. Critics questioned whether its incentive-heavy growth model could survive a prolonged market downturn.

However, another major overhang also disappeared this month.

Sponsored

Sponsored

A controversial refund clause tied to Brevan Howard’s Nova Digital fund expired on February 6, 2026. The clause reportedly allowed the investor to request a $25 million refund if performance conditions were not met.

With the deadline passing, traders appear to view the removal of that risk as structurally positive.

At the same time, a large token unlock event also cleared without triggering heavy selling. That outcome fueled what analysts describe as a “relief rally.”

On-chain and derivatives data show rising trading volume and increasing open interest.

Liquidation heatmaps indicate clustered short positions above key resistance levels, suggesting that short covering may have amplified upward momentum.

Still, risks remain.

Berachain faces continued token distribution pressure and must prove that its business-focused strategy can generate sustained demand.

For now, however, the market appears to be rewarding clarity and the removal of uncertainty after a long period of silence.

Crypto World

Ondo Integrates Chainlink Price Feeds for Tokenized US stocks on Ethereum

Ondo Finance said its Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling price feeds for tokenized US stocks including SPYon, QQQon and TSLAon to go live on Ethereum.

According to a post from Ondo on Wednesday, the feeds are now being used on Euler, where users can post the tokenized equities as collateral to borrow stablecoins.

The integration provides onchain pricing data for the tokenized assets, allowing decentralized finance (DeFi) protocols to set collateral parameters and manage liquidations based on reference prices tied to the underlying equities. The feeds incorporate corporate actions such as dividends, enabling applications to reference updated equity values.

Initial support covers SPYon (which represents the SPDR S&P 500 ETF), QQQon (representing the Invesco QQQ ETF) and TSLAon (Tesla stock), with additional tokenized stocks and exchange-traded funds (ETFs) expected to be added as oracle coverage and protocol integrations are expanded.

According to the announcement, risk parameters for the new lending markets, including collateral factors and liquidation thresholds, are being set and monitored by Sentora.

Ondo said the move addresses a prior limitation for tokenized equities, which had largely been held for price exposure but were not widely accepted as collateral in DeFi. By pairing exchange-linked liquidity with onchain price feeds, the companies aim to enable broader use of tokenized stocks in lending and other structured products.

The announcement follows an October 2025 partnership between Ondo Finance and Chainlink, a blockchain oracle network launched in 2017, that designated Chainlink as the primary data provider for Ondo’s tokenized stocks and ETFs.

Related: Wemade taps Chainlink for Korean won stablecoin infrastructure

Race to tokenize US equities

As US regulators continue to refine the legal framework for tokenized securities, legacy financial institutions and crypto platforms are accelerating efforts to put equities on blockchain infrastructure.

In September, Nasdaq filed for a rule change with US Securities and Exchange Commission (SEC) that would enable it to list and trade tokenized versions of publicly traded stocks, potentially allowing blockchain-based representations of listed shares to trade within its regulated exchange framework.

On Dec. 11, the same day it clarifyied how broker-dealers may custody tokenized securities under existing rules, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in DTC custody.

On Jan. 19, the New York Stock Exchange and its parent company, Intercontinental Exchange, said they are developing a blockchain-based platform for trading tokenized stocks and ETFs with 24/7 trading and near-instant settlement, pending regulatory approval.

On the crypto side, more than 60 tokenized US stocks launched in June across exchanges Kraken and Bybit. The product, developed by Backed Finance under its xStocks brand, provides blockchain-based exposure to blue-chip companies, though it is not yet available to US customers.

Meanwhile, fintech Robinhood, which introduced tokenized versions of nearly 500 US stocks for EU users in October, has launched a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum.

On Wednesday, the company said the network is designed to support tokenized real-world and digital assets, including 24/7 trading, self-custody and onchain lending and derivatives applications.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Provenance Blockchain TVL Hits All-Time High of $1.2 Billion

HELOC provider Figure Markets accounts for the network’s entire TVL.

The Provenance blockchain hit a new milestone on Wed. Feb. 11, as its total value locked (TVL) climbed to an all-time high of $1.2 billion.

This marks a 7% increase in TVL over the past 24 hours, and a roughly 570% jump since early November 2025, when TVL stood at about $179.9 million, according to DeFiLlama data.

Notably, Figure Markets is currently the only protocol tracked on Provenance by DeFiLlama, meaning the network’s entire TVL is essentially tied to Figure’s activity. Figure Markets is described as a decentralized custody platform, which offers spot trading, crypto-backed lending, and yield-bearing assets.

DeFiLlama data shows Figure Markets’ TVL at approximately $1.22 billion, with about $301 million currently borrowed. The protocol has generated roughly $3.84 million in annualized fees and revenue, while 30-day decentralized exchange volume stands at approximately $2.08 billion.

Figure Technologies, the entity behind Figure Markets and Provenance, currently leads in the tokenized private credit space, accounting for $15 billion of the market’s $20 billion active loans, per RWAxyz. The company is also the largest non-bank home equity line of credit (HELOC) originator in the U.S.

Meanwhile, Provenance’s native token, HASH, was the second-best performing token on the day, rising about 8% in 24 hours to trade near $0.018, according to CoinGecko. Figure’s HELOC token is currently trading at $1.02, down 1% on the day.

Provenance’s TVL increase comes amid renewed attention towards tokenized real-world assets (RWAs), which have grown 14% over the past month to a distributed asset value of over $24.7 billion.

Experts are Divided

Still, not everyone views the milestone as a structural breakthrough. Brian Huang, co-founder of Glider, told The Defiant that tokenizing assets on a standalone or siloed blockchain does not necessarily increase their utility.

“Assets aren’t any more useful on chain than offchain unless they have composability. Provenance has no composability,” Huang said. “Overall, I wouldn’t read into the $1.2 billion in assets. In the long term, tokenization will favor open protocols like Ethereum and Solana.”

Danny Nelson, Research Analyst at Bitwise Asset Management, took a different viewpoint, calling Provenance’s business “very real.”

“It’s the secret sauce fueling Figure Markets’ rise to become the largest non-bank home equity loan (HELOC) business in the U.S,” Nelson said. “Figure Markets purpose built Provenance Chain to handle its HELOCs.”

He explained that Figure represents all loan-related paperwork, contracts, and finances as tokens on the blockchain. “There, it can process everything much faster than a traditional lending business can,” Nelson added. “Figure is cutting the costs of creating each loan, and speeding up its processing, by handling the entire loan lifecycle on Provenance.”

Provenance’s growth follows a January announcement from Figure launching the On-Chain Public Equity Network (OPEN) on Provenance. The move allowed companies to list their equity natively on-chain.

“Unlike other tokenization efforts, OPEN equities are blockchain-registered, not a tokenized version of Depository Trust and Clearing Corporation (DTCC) securities,” the announcement reads.

Figure said its own stock will be the first public equity trading natively on the blockchain, with market makers including Jump Trading preparing to support the platform.

The Defiant reached out to Figure and Provenance for comment, but has not heard back at the time of publishing.

Crypto World

Democrats Blast SEC Chair Atkins Over Crypto Enforcement

In a House Financial Services Committee hearing on Wednesday, lawmakers grilled Securities and Exchange Commission chair Paul Atkins over the agency’s crypto enforcement record and the fate of several cases that have been dismissed since leadership changes. The session highlighted a growing debate about the SEC’s approach to a fast-evolving sector as enforcement activity appears to have cooled under the current regime. Representative Stephen Lynch, a Democrat from Massachusetts, cited a roughly 60% drop in enforcement actions since Atkins took the helm, pointing to the dismissal of several high-profile lawsuits, including the Binance case in May 2025, as indicators of shifting dynamics in the agency’s crypto strategy.

The hearing also touched on connections between the Trump family and various crypto ventures, with Lynch flagging foreign investments and memecoins tied to the family as areas of concern. A notable development cited during the discussion involved Aryam Investment 1, an Abu Dhabi-based vehicle backed by Sheikh Tahnoon bin Zayed Al Nahyan, which reportedly acquired 49% of the startup behind World Liberty Financial (WLFI) — a decentralized finance platform linked to the Trump family. Lynch argued that such ties could undermine trust in the sector and complicate consumer protection, while Atkins maintained that the SEC remains committed to pursuing enforcement where warranted. World Liberty Financial (WLFI) was referenced in the discussions as a focal point of these concerns, a project that has drawn scrutiny amid international investment links and crypto-market activity.

“This is hurting the crypto industry, all these scams. Look at crypto today. I think it’s down 25% in the last month. People are losing trust, and it’s not good for crypto. It’s certainly not good for consumers, and it’s awful the reputational damage that the SEC is suffering.”

The SEC chair responded by reiterating the agency’s stance that enforcement actions continue where they are warranted and that the agency’s program remains robust. Atkins stressed ongoing cases and emphasized the normalization of enforcement efforts in the crypto space, even as some lawmakers pressed for a clearer accounting of stalled or dismissed actions. The exchange underscores a broader, bipartisan challenge: how to balance consumer protection with a market that is still evolving in terms of products, custody, and governance structures.

The discussion unfolded as the U.S. political calendar—set against a midterm election backdrop—adds complexity to crypto policy dynamics. Lawmakers suggested that a shift in congressional control could affect the pace and nature of market-structure legislation and other regulatory initiatives that touch the crypto industry. The hearing also touched on bilateral concerns about the influence of foreign actors in U.S. crypto projects, and how such links might shape lawmakers’ willingness to push ahead with comprehensive regulatory frameworks in the near term.

California Democrat Maxine Waters, who has been a persistent critic of both the Trump orbit and parts of the crypto ecosystem, pressed Atkins on the implications of pardons and dropped lawsuits for the credibility of the SEC’s enforcement program. “These cases were dismissed, despite the fact that the SEC was winning in court, proving that the SEC’s crypto enforcement program was well-grounded in the law,” Waters contended, underscoring concerns about the political contours surrounding enforcement decisions. The discussion touched on associations between pardoned executives and crypto ventures that have contributed to political fundraising, a point Waters framed as a broader issue of transparency and accountability in the sector.

The deliberations also highlighted broader questions about how foreign investment and purported national-security considerations intersect with crypto innovation. The conversation around WLFI and related projects was framed as part of a wider debate about whether foreign influence could shape policy at a moment when the sector is seeking mainstream adoption. The hearing did not resolve these questions, but it did illuminate the ongoing rift between calls for stronger enforcement and concerns about how aggressively regulators should pursue actions when cases appear to be in flux or subject to political considerations.

Why it matters

For investors and builders in the crypto space, the hearing underscores the evolving risk landscape around regulatory expectations. The fact that enforcement actions have declined by a substantial margin since Atkins took office raises questions about the SEC’s current priorities and the factors that drive case selection in a sector that is both technologically complex and rapidly changing. The dismissal of prominent cases—such as the Binance lawsuit—suggests that the regulatory environment can shift in meaningful ways, with potential implications for how market participants assess risk, pursue compliance, and engage with U.S. authorities.

At the same time, the linkage of crypto ventures to political figures and foreign investment underlines a broader narrative about governance, transparency, and consumer protection in the industry. The WLFI situation, in particular, places a spotlight on how geopolitical dynamics and high-profile associations might influence perceptions of legitimacy and safety in decentralized finance platforms. While lawmakers are calling for vigilance against scams and opaque schemes, others warn against overreach that could chill innovation or raise the hurdle for legitimate crypto projects seeking to operate within the U.S. regulatory framework.

As the midterm year unfolds, the conversation around crypto enforcement is likely to remain tightly connected to broader regulatory ambitions and the political calculus surrounding the Democratic and Republican coalitions in Congress. The balance between rigorous scrutability and enabling responsible innovation will continue to shape the direction of policy, enforcement priorities, and the market’s readiness to adopt new technologies and products in a compliant, transparent manner.

Beyond the immediate hearing, observers are watching for how the SEC will calibrate its approach to crypto assets, custody, exchanges, and complex DeFi structures in forthcoming rulemakings and guidance. The tension between enforcement actions and industry confidence is a key barometer for overall market sentiment—a factor that could influence liquidity, participation, and the pace of institutional involvement as the sector seeks clearer guardrails and consistent regulatory expectations.

Related coverage has tracked ongoing discussions about WLFI and related topics, including how foreign involvement in crypto ventures may intersect with national security considerations and regulatory oversight. As the ecosystem matures, stakeholders will be looking for signals on whether enforcement focus will intensify in certain sub-sectors or remain steady as policymakers evaluate the efficacy and proportionality of regulatory actions in a rapidly evolving landscape.

What to watch next

- Follow-up statements or actions from the SEC after the hearing, including any new policy guidance or adjustments to enforcement priorities.

- Updates on WLFI-related developments and any regulatory or legal steps involving Aryam Investment 1’s stake and its connections.

- Potential movements on market-structure legislation or other crypto regulatory bills during the current congressional cycle.

- Next round of congressional scrutiny or inquiries into crypto governance and cross-border links to high-profile projects.

Sources & verification

- YouTube video: US House Committee on Financial Services—Lynch questions SEC Chair Paul Atkins. https://www.youtube.com/watch?v=jAq7zM2sTuE

- Court documents: Motion to dismiss the Binance case. https://storage.courtlistener.com/recap/gov.uscourts.dcd.256060/gov.uscourts.dcd.256060.301.0.pdf

- Cointelegraph: SEC dismisses lawsuit against Binance (filings show). https://cointelegraph.com/news/sec-dismisses-lawsuit-against-binance-filings-show

- Cointelegraph: UAE-backed firm buys 49% Trump-linked World Liberty (WLFI). https://cointelegraph.com/news/uae-backed-firm-buys-49-percent-trump-linked-world-liberty-wsj

- Cointelegraph: Trump-linked WLFI probe and UAE investment. https://cointelegraph.com/news/trump-wlfi-probe-500-million-investment-from-uae-official

Congressional hearing highlights a shift in crypto enforcement and governance

The hearing laid bare a tension that will likely continue to define the crypto policy conversation: regulators assert that they will aggressively pursue violations where the law supports it, while lawmakers—and a portion of the industry—argue that the enforcement regime should be predictable, proportionate, and cognizant of the sector’s growth potential. Atkins reiterated the SEC’s commitment to due process and to enforcing rules designed to protect investors, even as several high-profile cases have fallen away or stalled. Lynch’s remarks framed these outcomes within a broader concern about the impact on public trust and the long-term legitimacy of crypto markets. The exchange also underscored how the regulatory narrative around foreign involvement, national security, and consumer protection intersects with ongoing debates about the appropriate pace of rulemaking and the extent of enforcement discretion.

As the discussion moves forward, observers will be watching for concrete signals about how the SEC plans to align its enforcement posture with the evolving technological landscape—including DeFi, stablecoins, and non-custodial products—and how lawmakers on both sides of the aisle intend to shape the regulatory architecture that will govern these innovations in the years to come.

Crypto World

Pippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

“Really nice chart, pure strength,” one popular analyst stated.

The meme coin pippin (PIPPIN) once again defied the ongoing bearish environment in the cryptocurrency market, with its price rallying by roughly 30% over the past 24 hours.

It has become a point of interest for well-known analysts who believe further short-term gains could be forthcoming.

Rising Through the Ranks

Earlier today (February 11), PIPPIN’s valuation climbed to as high as $0.46, marking the highest level since the end of January. Currently, it trades at around $0.44 (per CoinGecko’s data), representing a whopping 144% spike on a weekly scale.

Its market capitalization soared well above $400 million, making PIPPIN the 100th-largest cryptocurrency. Over the past few weeks, it flipped Pudgy Penguins (PENGU), dogwifhat (WIF), and FLOKI (FLOKI) and now stands as the eighth-biggest meme coin. The undisputed leader in the realm remains Dogecoin (DOGE), whose market cap exceeds $15 billion.

According to the analyst who goes by the X moniker Sjuul | AltCryptoGems, PIPPIN has more fuel to post additional gains, setting the next target at around $0.50.

“Really nice chart, pure strength! Extremely well-respected support and resistance levels, and full ripping after that deviation! If I smell this right, resistance should be next,” he said.

Earlier this week, the market observer Satori also put PIPPIN on their watchlist, claiming “a much stronger breakout” might be on the horizon.

Investors Should Beware

While the asset has undoubtedly turned into one of crypto’s sensations in the past few days, those planning to invest in it must tread lightly. First, meme coins are notorious for their high volatility, meaning PIPPIN can make a sudden move and crash by double digits in a short period.

You may also like:

Second, some analysts on X have warned that the token is primarily driven by speculation, whereas its utility and use cases are questionable (to say the least). Critics like Diane De crypto went even further, calling PIPPIN “the biggest money laundering event happening right in front of your eyes.”

The asset’s Relative Strength Index (RSI) can also be interpreted as a warning sign for investors. The technical analysis tool measures the recent speed and magnitude of the latest price changes, and traders often use it to spot potential reversal points.

It ranges from 0 to 100, and ratios above 70 indicate PIPPIN is overbought and could be due for an imminent pullback. On the contrary, anything beneath 30 might be viewed as a buying opportunity. Currently, the RSI stands at approximately 72.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

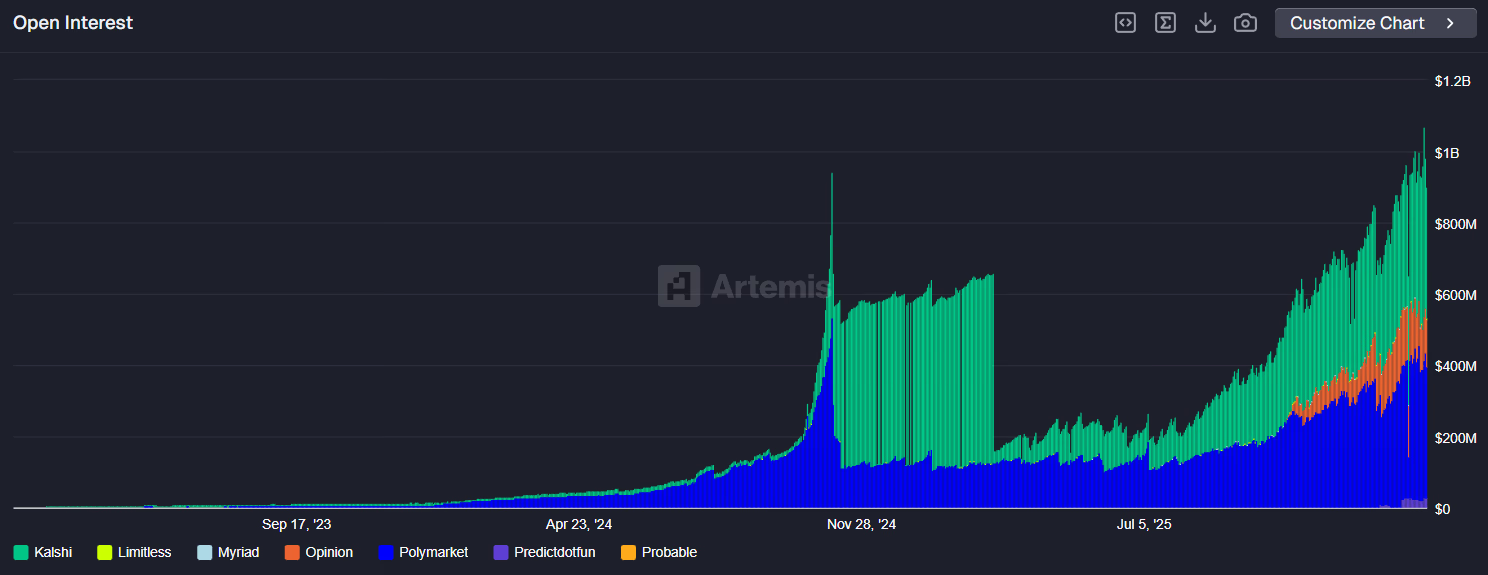

Prediction Market Open Interest Crosses $1B as Super Bowl Boosts Bets

Volume across Polymarket and Kalshi hit $400 million for the first time, with sports and political markets drawing nearly all the liquidity.

Open interest (OI) across crypto prediction markets just hit $1 billion for the first time, a surge likely fueled by increased activity around the 2026 Super Bowl.

According to data from Artemis, open interest across platforms, Polymarket, Kalshi, Limitless, Opinion, and others, jumped above $1.1 billion for the first time on Feb. 7, setting a new all-time high. OI indicates the value of all currently active positions — in this case, the “yes” or “no” positions across predictions — that have yet to be resolved, making it an indicator of capital inflow and liquidity.

As for spot volume, it also reached a new historic record of $1.4 billion across platforms, with Kalshi generating $800 million and Polymarket about $311 million on Super Bowl Sunday, Feb. 8, Artemis data shows.

Digging into sectors where users placed the most bets, sports led with $375.3 million, while politics was close behind at $359.7 million, and culture trails at $84.5 million, according to data from crypto venture capital firm Paradigm’s new dashboard, which tracks liquidity across sectors on Polymarket and Kalshi, the two largest marketplaces by OI and trading volume.

But the growing interest in placing bets on real-world outcomes doesn’t come without risks. In a recent report, analysts at blockchain security firm CertiK warned that despite the surge, prediction markets are still exposed to security risks like oracle attacks, admin key vulnerabilities and front-running.

The firm also warned that artificial volume on prediction markets reached 60% on some platforms “during airdrop farming peaks, distorting liquidity metrics, while probability outputs remained reliable for forecasting.”

The spike in prediction market OI coincided with news that Jump Trading, a high-frequency trading firm, is reportedly set to gain small stakes in both Kalshi and Polymarket in exchange for providing liquidity, Bloomberg reported on Feb. 9, citing sources familiar with the matter.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech21 hours ago

Tech21 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat7 days ago

NewsBeat7 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition