Crypto World

Robinhood unveils its layer-2 testnet

Network News

ROBINHOOD UNVEILS BLOCKCHAIN: Robinhood debuted the public testnet for its Ethereum layer-2 blockchain with plans for broader introduction later this year as the brokerage app aims to move more trading activity onchain. The new network, called Robinhood Chain, is built on Arbitrum and is designed to support tokenized real-world assets, including equities and exchange-traded funds (ETFs). Developers will be able to publicly build on the network for the first time after six months of private testing, ahead of a future mainnet launch, the company announced at CoinDesk’s Consensus Hong Kong conference. With the chain, Robinhood aims to allow users to trade 24/7 and self-custody their assets in Robinhood’s own crypto wallet. Users will also be able to bridge across different chains and into decentralized finance (DeFi) applications on Ethereum, the company said. The timing comes as Ethereum’s core roadmap shifts more attention back to the base layer. Certain upgrades have already lowered transaction costs, and further improvements are expected to continue easing congestion, a development that weakens the case for layer 2s as a pure scaling necessity. Robinhood’s approach suggests it is already operating under that assumption. “I think Vitalik [Buterin, the co-founder of Ethereum] was always pretty clear on this, that L2s were not just here to scale Ethereum,” said Johann Kerbrat, Robinhood’s senior vice president and general manager of crypto, in an interview. “For us, it was never really about scaling Ethereum or doing faster transactions.” — Margaux Nijkerk & Krisztian Sandor Read more.

CITADEL SECURITIES BACKS LAYERZERO BLOCKCHAIN: LayerZero Labs unveiled Zero, a blockchain aimed at powering institutional-grade financial markets, alongside a strategic investment from Citadel Securities into ZRO, the network’s native token and governance asset. ARK Invest is also investing in LayerZero’s equity and ZRO token, with CEO Cathie Wood joining a newly formed advisory board alongside ICE executive Michael Blaugrund and former BNY Mellon digital assets head Caroline Butler, the company said. The size of the investments was not disclosed. The announcement signals a deeper push by traditional market infrastructure companies into blockchain-based trading, clearing and settlement as scalability and performance constraints have long limited real-world adoption. Tether Investments, the investment arm of the largest stablecoin issuer, also made a strategic investment in LayerZero Labs, it said. Citadel Securities said it is working with LayerZero to evaluate how Zero’s architecture could support high-throughput workflows across trading and post-trade processes. The firm’s investment in ZRO adds to growing institutional interest in LayerZero, which is best known for operating one of crypto’s largest interoperability networks. Zero is designed around LayerZero’s first-of-its-kind heterogeneous architecture, which uses zero-knowledge proofs (ZKPs) to separate transaction execution from verification. The company claims the design can scale to roughly 2 million transactions per second across multiple zones, with transaction costs approaching a millionth of a dollar and effectively unlimited blockspace. — Will Canny Read more.

MEGAETH MAINNET GOES LIVE: MegaETH, a high-performance blockchain built to make Ethereum applications feel nearly instant, debuted its public mainnet, entering an ecosystem mired in a fundamental debate over how Ethereum should scale. The project, which had pitched itself as a layer-2 “real-time blockchain” targeting more than 100,000 transactions per second (tps), would make onchain interactions feel closer to traditional web apps than today’s crypto networks. Ethereum works at less than 30 tps, according to Token Terminal. The release caps a rapid rise that has drawn both technical curiosity and major financial backing. The project’s development arm, MegaLabs, raised a $20 million seed round in 2024 led by Dragonfly. Last October, it announced a $450 million oversubscribed token sale backed by some of the most recognizable names in crypto, including Ethereum co-founders Vitalik Buterin and Joe Lubin. The sale was one of the largest crypto fundraises of that year. — Margaux Nijkerk Read more.

ENS SCRAPS LAYER-2 PLANS: ENS decided not to move forward with Namechain, a planned layer-2 rollup, marking another high-profile shift away from the once-dominant narrative that Ethereum’s future would be built primarily on L2s. Instead of its own rollup, ENS will now deploy the long-awaited ENSv2 upgrade exclusively on the Ethereum mainnet, citing dramatically lower gas costs and a broader change in Ethereum’s scaling philosophy. According to ENS founder and lead developer Nick Johnson, the original rationale for launching a bespoke rollup no longer holds. “The landscape has changed between when we first decided to pursue an L2,” Johnson said in an interview with CoinDesk. Two years ago, high gas prices made rollups the “official trajectory,” but Ethereum’s base layer has since scaled to the point where transaction costs are sustainable. — Margaux Nijkerk Read more.

In Other News

- Kraken sacked its chief financial officer, Stephanie Lemmerman, just as the crypto exchange prepares to publicly list in the U.S. in the early part of this year, according to two people familiar with the matter. Lemmerman joined Kraken from Dapper Labs in November 2024 and was the exchange’s CFO for one year and four months. She now has a strategic advisory role at Kraken, one of the people said. Robert Moore, formerly VP of business expansion, has basically taken over her job, the person said. An updated leadership page on the website of Kraken’s parent company, Payward Inc., lists Moore as deputy CFO. Lemmerman does not appear. Clearly, it matters that Kraken removed its CFO after lodging a confidential filing with U.S. regulators in November. That came just days after Kraken raised $800 million at a $20 billion valuation, including $200 million from Citadel Securities. — Ian Allison Read more.

- Jump Trading plans to take a small stake in each of the prediction-market platforms Kalshi and Polymarket, Bloomberg reported, citing people with knowledge of the matter. The trading powerhouse, which has a significant focus on cryptocurrency, will gain the stakes in exchange for providing liquidity on the two platforms. Jump is set to take a fixed amount of equity in Kalshi, while its stake in Polymarket will grow over time depending on the trading capacity that the firm provides to the platform’s U.S. operation. Jump expanded into prediction-market trading in recent months, recruiting 20 staffers for that business, according to Bloomberg. — Jamie Crawley Read more.

Regulatory and Policy

- President Donald Trump’s U.S. bitcoin reserve doesn’t exist yet, and there is no mechanism in the federal government for the wholesale purchase of crypto. Keep that in mind when considering this weekend’s speculation about the price point that would cause the White House to push a buy button, thanks in large part to CNBC’s Jim Cramer. There is no such button. The president did order a “strategic reserve” established to hold bitcoin, but that didn’t make it spring into existence. The Treasury Department and crypto advisers spent months auditing the federal holdings of crypto (though White House crypto adviser Patrick Witt told CoinDesk last week that they still won’t share a number). But the process hit a snag: The advocates said they need Congress to establish the stockpile under law. The crypto sector’s new U.S. law for stablecoin issuers didn’t include it, nor does the sweeping crypto market structure bill currently grinding through the U.S. Senate. Clearing legislation through this Congress — even less controversial matters — is a tall order, and industry lobbyists are focused on the bill to finally establish market and oversight regulations for digital assets. A reserve may not even be second on the list of priorities, because crypto tax rules also beckon. — Jesse Hamilton Read more.

- Cryptocurrency exchange and wallet provider Blockchain.com won regulatory approval in the U.K. nearly four years after seemingly giving up. Blockchain.com was added to the Financial Conduct Authority’s (FCA) registry of licensed crypto companies on Tuesday under its trading name “BC Operations.” The London-based company elected to withdraw its application for FCA licensing in March 2022, having not won approval ahead of an impending deadline. Blockchain.com pivoted to its registered business in Lithuania. Registration in the U.K. allows Blockchain.com to carry out certain crypto-related activities in the U.K. provided it complies with money laundering and counter-terrorist financing rules. — Jamie Crawley Read more.

Calendar

- Feb. 10-12, 2026: Consensus, Hong Kong

- Feb. 17-21, 2026: EthDenver, Denver

- Feb. 23-24, 2026: NearCon, San Francisco

- Mar. 24-26, 2026: Digital Asset Summit, New York City

- Mar. 30-Apr. 2, 2026: EthCC, Cannes

- Apr.15-16, 2026: Paris Blockchain Week, Paris

- Apr. 29-30, 2026: Token2049, Dubai

- May 5-7, 2026: Consensus, Miami

- Sept. 29-Oct.1, 2026: Korea Blockchain Week, Seoul

- Oct. 7-8, 2026: Token2049, Singapore

- Nov. 3-6, 2026: Devcon, Mumbai

- Nov. 15-17, 2026: Solana Breakpoint, London

Crypto World

BNB price slips below $620 golden pocket

BNB price is now trading around $609, slipping below the previously defended $620 golden pocket level and putting long-term support to the test.

Summary

- Price dips under the $620 0.618 Fibonacci “golden pocket”

- Trading near the 200-week moving average, a key macro support

- Structure remains intact — but bulls need a reclaim of $620

Binance (BNB) is once again at a critical inflection point after losing the $620 region that had been acting as a high-timeframe support cluster. Following weeks of corrective pressure, price briefly stabilized at the 0.618 Fibonacci retracement before slipping modestly lower, now hovering near $609.

This move shifts the technical narrative slightly: rather than cleanly holding support, BNB is now probing the lower bounds of a major confluence zone. Whether this becomes a deviation below support or the start of deeper consolidation will likely define the next multi-week trend.

BNB price key technical points

- $620 remains the high-timeframe golden pocket (0.618 Fibonacci retracement)

- Price is hovering around the 200-week moving average

- A reclaim of $620 would strengthen the bullish case

- Sustained acceptance below opens the door to further downside exploration

The $620 level continues to carry heavy technical weight. It marks the 0.618 Fibonacci retracement of the broader advance — often referred to as the “golden pocket,” a zone that frequently acts as a high-probability reversal area.

However, with BNB now trading below that level, the focus shifts to whether this is a temporary liquidity sweep or a more meaningful breakdown.

Importantly, price remains near the 200-week moving average — a widely followed macro trend indicator. Historically, sustained closes below this level tend to invite extended consolidation, while swift recoveries often signal a false breakdown.

The next few weekly closes will therefore be critical.

Market structure supports a potential bottom

From a broader market structure perspective, the chart has not yet confirmed a full trend reversal. While the loss of $620 weakens the immediate bullish structure, BNB has not decisively broken down into lower macro territory.

This type of price action — slipping below support before reclaiming it — is common during bottoming formations. Markets often sweep liquidity below obvious levels before rotating higher.

If buyers step in and push price back above $620 with conviction and expanding volume, the move could be classified as a deviation, reinforcing the broader bullish structure.

If not, deeper consolidation becomes increasingly likely.

Upside targets come back into focus

Bullish case:

- Reclaim and hold above $620

- Strong weekly close back inside the golden pocket

- Gradual rotation toward higher resistance

- $932 remains the key high-timeframe resistance target

Bearish case:

- Continued weekly closes below $620

- Loss of the 200-week moving average

- Expansion in selling volume

- Potential move toward lower value areas before base formation

What to expect in the coming price action

The $932 high-timeframe resistance remains the primary upside objective if macro structure holds. However, reclaiming $620 is the first major hurdle bulls must clear before that target comes back into play.

With BNB now around $609, this is no longer simply a stabilization story — it is a support test.

High-timeframe setups require patience. The coming weekly closes will determine whether the current move becomes a confirmed breakdown or a classic deviation below major support.

For now, the broader structure is under pressure but not broken. A decisive reclaim of $620 would quickly restore bullish momentum. Failure to do so would shift focus toward extended consolidation before any meaningful upside rotation can begin.

Crypto World

MYX Finance Set For 43% Crash As Price Falls Below $5

MYX Finance price has dropped sharply, slipping below the critical $5.00 level and signaling growing downside risk.

The breakdown follows several sessions of declining momentum. Selling pressure accelerated after MYX failed to hold key intraday support. Market structure now reflects a bearish shift.

MYX Traders Turn Bearish

The recent dip has triggered increased short positioning among MYX traders. Funding rate data shows the futures market is dominated by short contracts. Negative funding reflects bearish conviction, as traders position for further declines in MYX Finance price.

Sponsored

Sponsored

A surge in short interest often signals expectations of a deeper correction. Traders appear to be anticipating a price crash they can capitalize on through leveraged positions. This imbalance in derivatives markets may amplify volatility and reinforce downward pressure if selling accelerates further.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The Money Flow Index, or MFI, indicates heavy selling pressure on the MYX price, reinforcing the ongoing correction. The indicator has trended lower in recent sessions, reflecting sustained capital outflows. This weakness confirms that bearish momentum remains dominant across short-term trading activity.

Although the MFI is approaching the oversold threshold, it has not yet dropped below the 20.0 mark. A decisive move under that level typically signals selling saturation, where accumulation may emerge at discounted prices. If accumulation strengthens, MYX could attempt a technical rebound.

MYX Price May See Further Decline

MYX price is down 23% in the last 24 hours, trading at $4.87 after sliding below $5.00. The token now appears to be breaking down from a bearish ascending wedge pattern. Such formations often precede sharp corrections when support levels fail.

The wedge structure projects a potential 43% decline toward $2.81, coinciding with the 1.78 Fibonacci level. However, a more immediate and realistic target lies near the $4.07 (1.23 fib line) support zone. A confirmed break below $4.61 would increase the probability of testing $4.07, with further downside risk if broader crypto sentiment deteriorates.

A shift in investor behavior could alter this outlook should MYX end up being oversold, as the MFI hints at. If inflows begin to outweigh outflows and short positions unwind, MYX Finance may attempt stabilization. A decisive move above $5.75 resistance would invalidate the bearish thesis and potentially drive the price toward $6.00 in the near term.

Crypto World

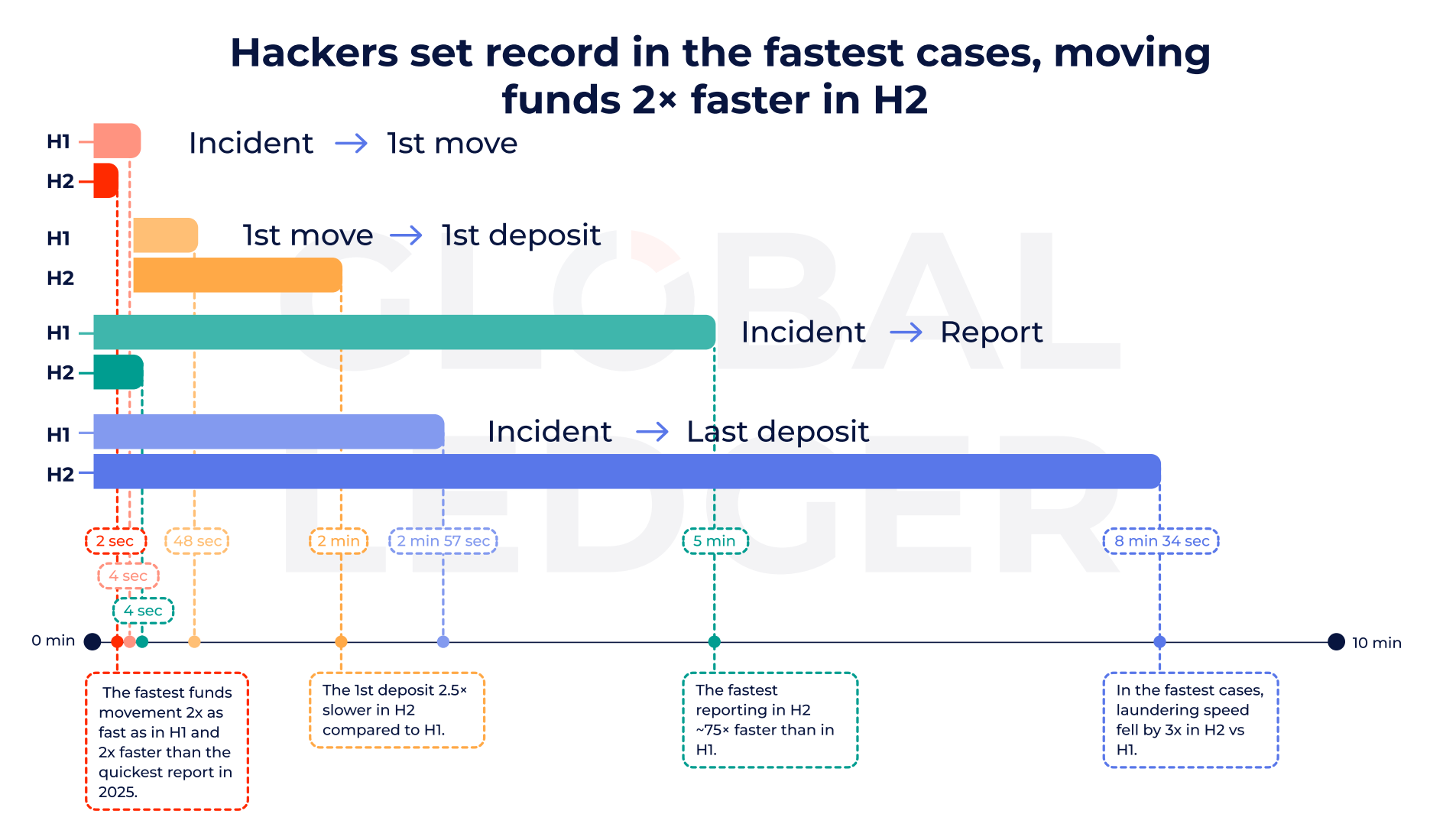

The 2-Second Crypto Laundering Shockwave

Crypto hackers are now moving stolen funds in as little as two seconds after an attack begins. In most cases, they shift assets before victims even disclose the breach.

That is the clearest finding from Global Ledger’s 2025 analysis of 255 crypto hacks worth $4.04 billion.

Sponsored

Sponsored

Blink and It’s Gone: Crypto Laundering Now Starts Before Disclosure

The speed is striking. According to Global Ledger, 76% of hacks saw funds move before public disclosure, rising to 84.6% in the second half of the year.

This means attackers often act before exchanges, analytics firms, or law enforcement can coordinate a response.

However, speed tells only part of the story.

While first transfers are now near-instant, full laundering takes longer.

On average, hackers needed about 10.6 days in the second half of 2025 to reach final deposit points such as exchanges or mixers, up from roughly eight days earlier in the year.

In short, the sprint is faster, but the marathon is slower.

Sponsored

Sponsored

This shift reflects improved monitoring after disclosure. Once incidents go public, exchanges and blockchain analytics firms label addresses and increase scrutiny.

As a result, attackers break funds into smaller pieces and route them through multiple layers before attempting cash-out.

Hacking Speed Increased, but Crypto Laundering Speed Became Slower. Source: Global Ledger

Sponsored

Sponsored

Bridges, Mixers, and the Long Road to Cash-Out

Bridges have become the main highway for that process. Nearly half of all stolen funds, about $2.01 billion, moved through cross-chain bridges.

That is more than three times the amount routed via mixers or privacy protocols. In the Bybit case alone, 94.91% of stolen funds flowed through bridges.

At the same time, Tornado Cash regained prominence. The protocol appeared in 41.57% of hacks in 2025. Its usage share jumped sharply in the second half of the year, following sanctions changes cited in the report.

Meanwhile, direct cash-outs to centralized exchanges fell sharply in the second half. DeFi platforms received a rising share of stolen funds. Attackers appear to avoid obvious off-ramps until attention fades.

Sponsored

Sponsored

Notably, nearly half of all stolen funds remained unspent at the time of analysis. That leaves billions sitting in wallets, potentially waiting for future laundering attempts.

The scale of the problem remains severe. Ethereum accounted for $2.44 billion in losses, or 60.64% of the total.

Overall, $4.04 billion was stolen across 255 incidents.

Yet recovery remains limited. Only about 9.52% of funds were frozen, and 6.52% were returned.

Taken together, the findings show a clear pattern. Attackers now operate at machine speed in the first seconds after a breach.

Defenders respond later, forcing criminals into slower, staged laundering strategies. The race has not ended. It has simply entered a new phase—measured in seconds at the start, and days at the finish.

Crypto World

ZRO Soars 40% After Unveiling Layer 1 Blockchain

LayerZero announced its Zero blockchain yesterday, built in collaboration with Citadel, ICE, and Google Cloud.

LayerZero’s ZRO token is leading the altcoin market today, rallying 40% after unveiling Zero, its new Layer 1 blockchain.

ZRO sold off immediately after yesterday’s announcement; however, after more details emerged – such as Ark Invest founder Cathie Wood stepping on board as an advisor – the token surged from $1.7 to $2.5.

The ZRO token has been pricing in an impending announcement throughout 2026, and has been one of just a handful of strong altcoins over the last six weeks. The move brings ZRO’s market capitalization to $481 million, its highest level since January 2025.

In addition to Wood, the protocol also added Michael Blaugrund, the vice president of Strategic Initiatives at Intercontinental Exchange (ICE), and Caroline Butler, the former Head of Digital Assets at the Bank of New York Mellon, and co-chair of the Commodities and Futures Trading Commission (CFTC), to its advisory board.

LayerZero brands Zero as “the first multi-core world computer” and says it’s been designed to address all existing bottlenecks in blockchain design, with an explicit goal of 2 million transactions per second (TPS) for every component in its system.

“We have replaced the fragmented, one-size-fits-all model with a unified high-performance system that treats multiple applications like concurrent processes on a single modern multi-core CPU. Due to this massive cost reduction, Zero is not only an alternative to existing blockchains; it provides a credible alternative to centralized cloud providers like AWS,” the Zero debut article claims.

“By stripping away the overhead of redundant replication, we have finally made decentralization viable on a global scale. Zero is the first truly scalable, multi-core world computer,” the article concluded.

Crypto World

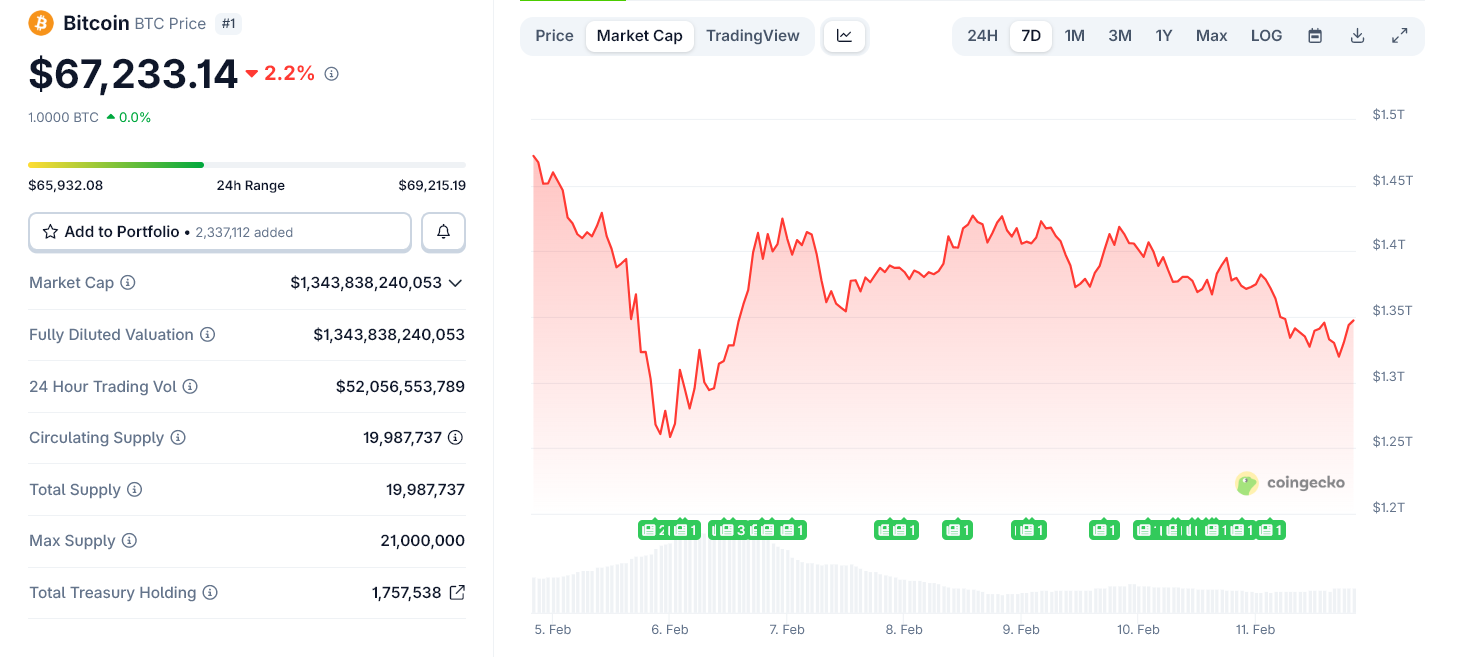

Crypto ETFs are here to stay, downturn be damned

Despite a bearish cryptocurrency market, ETF issuers continue to push forward with new filings, betting that demand for digital asset funds will remain strong.

Summary

- ETF issuers like Bitwise, ProShares, and 21Shares are advancing with new filings, including plans for Uniswap-linked and leveraged Bitcoin/Ether ETFs.

- The crypto ETF market is crowded, with over 140 existing funds, 10 new launches this year, and more expected.

- Bitcoin’s sharp price drop has led to significant losses for ETF buyers, with $1.5 billion withdrawn from Ether ETFs and over $3.5 billion from Bitcoin ETFs in the past three months.

This month, Bitwise Asset Management filed for a Uniswap-linked ETF, while ProShares sought approval for leveraged Bitcoin and Ether ETFs. 21Shares also resubmitted plans for funds based on Ondo and Sei, signaling progress in its efforts.

Todd Sohn, chief ETF strategist at Strategas, told Bloomberg that while firms like 21Shares and Bitwise remain committed to the long-term potential of crypto, ongoing poor performance could affect future flows.

This comes amid a crowded market, with over 140 crypto-focused US ETFs already trading, and 10 more launched this year. A BNB staking ETF is expected soon.

Cryptos have faced renewed pressure after October’s selloff, with Bitcoin falling sharply, dragging smaller tokens down. Investors are stepping back as liquidity tightens and risk appetite wanes.

Data from Glassnode shows that buyers of U.S. spot-Bitcoin ETFs are sitting on average paper losses, having bought Bitcoin at around $84,100 per coin, while the price now hovers near $66,000. This has led to significant outflows, with over $1.5 billion withdrawn from Ether-focused ETFs and more than $3.5 billion pulled from Bitcoin ETFs in recent months.

Crypto World

Chainlink Feeds Live for Ondo Tokenized US Stocks on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum. The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. This development provides on-chain pricing references for the tokenized assets and allows DeFi protocols to set collateral parameters and manage liquidations tied to underlying equities, while also accounting for corporate actions like dividends. The move marks a notable step in bringing traditional equities closer to decentralized finance, offering new avenues for lending and structured product design that hinge on reliable price data.

Key takeaways

- Chainlink has been designated as the official data oracle for Ondo Global Markets, supplying on-chain price feeds for tokenized US stocks on Ethereum.

- Initial support covers SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with the expectation of expanding to additional tokenized assets as coverage broadens.

- The price feeds feed into Euler, enabling tokenized equities to be used as collateral for borrowing stablecoins and for setting liquidation parameters in DeFi lending markets.

- Corporate actions, including dividends, are incorporated into the reference prices, helping maintain alignment between on-chain valuations and the underlying equities.

- Ondo’s move follows a broader push to tokenize US equities, underscored by regulatory and market actions across traditional finance and crypto venues, including Nasdaq’s rule-change efforts and public experiments by Robinhood and others.

- Industry developments highlight a growing ecosystem where tokenized stocks can feed DeFi protocols and potentially participate in broader on-chain trading and custody flows.

Tickers mentioned: SPYon, QQQon, TSLAon

Market context: The integration arrives amid a broader push to bring tokenized equities onto blockchain infrastructure as regulators in the United States refine custody and trading rules for tokenized securities. Observers note the convergence of traditional markets and DeFi as institutional and fintech players experiment with on-chain collateral, settlement efficiency and new product structures.

Why it matters

Ondo’s integration of Chainlink as the on-chain price oracle for tokenized stocks addresses a critical gap in DeFi’s treatment of synthetic equity representations. Before this development, tokenized equities had primarily served price exposure purposes or lightly simulated baseline risk rather than functioning as robust collateral. By linking on-chain prices to reference values tied to the underlying assets—and incorporating corporate actions—the ecosystem gains a more reliable mechanism for risk management, enabling lenders and protocol designers to calibrate collateral factors, liquidation thresholds and risk controls with greater fidelity to real-world equity behavior.

The partnership’s significance extends beyond Ondo. As markets experiment with tokenized versions of mainstream securities, the entire DeFi lending stack benefits from standardized, auditable price feeds that react to corporate actions and market dynamics. The collaboration with Chainlink—a long-standing oracle provider in the crypto space—also helps align DeFi protocols with real-world financial benchmarks, potentially fostering broader adoption of tokenized stocks within lending, derivatives and structured products. The move comes at a moment when traditional exchanges and fintechs are stepping up efforts to offer tokenized equity trading, custody and settlement on or near blockchain rails, signaling a converging trajectory for regulated tokenized assets and decentralized finance.

Regulatory and market developments underscore the momentum behind tokenized equities. Nasdaq has pursued a rule change with the U.S. Securities and Exchange Commission to enable listing and trading of tokenized stocks, aiming to integrate blockchain-based representations with a regulated exchange framework. Separately, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in custody, adding clarity to custody pathways for tokenized assets. In the broader crypto ecosystem, tokenized stock offerings have already surfaced on various platforms, illustrating a multi-pronged approach to bringing on-chain exposure to blue-chip equities without sacrificing the transparency and programmability that DeFi affords.

On the liquidity and trading front, major market participants are pursuing ways to expand access to tokenized securities. The New York Stock Exchange and its parent company, Intercontinental Exchange, announced efforts to develop a blockchain-based trading platform for tokenized stocks and ETFs with 24/7 trading and near-instant settlement, subject to regulatory approval. Meanwhile, crypto-native tokenization initiatives have already brought dozens of tokenized US stocks to multi-chain ecosystems, with platforms like Kraken and Bybit hosting tokenized stock markets under the xStocks banner, and Robinhood launching a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum, designed to support tokenized assets and on-chain lending and derivatives. These moves collectively illustrate a cross-market push toward more flexible capital markets built on tokenized representations and on-chain data feeds.

For developers and users, the Ondo–Chainlink integration signals a more practical pathway for tokenized equities to function as collateral within DeFi. It binds the on-chain price determiners to the equity’s fundamentals, potentially enabling more sophisticated service models and risk management strategies in decentralized lending and beyond. The collaboration also reinforces the role of oracles as a bridge between traditional asset classes and DeFi ecosystems, an area that continues to attract attention as regulators, exchanges and fintechs map out the future of tokenized securities and on-chain finance.

Additional context around the broader tokenization wave is reflected in the ongoing coverage of tokenized assets across crypto media, including continued discussions of how tokenized stocks could operate within regulated frameworks and the evolving custody landscape. The ecosystem’s trajectory remains contingent on regulatory clarity, liquidity, and the ability of on-chain price feeds to reflect real-time market movements and corporate actions with high fidelity.

What to watch next

- Expansion of oracle coverage to additional tokenized equities and ETFs as Ondo and Chainlink broaden their integration footprint.

- Regulatory progress on tokenized securities, including potential approvals or filings related to further tokenized-stock listings and custody rules.

- Adoption by more DeFi protocols that may incorporate tokenized equities as collateral or reference price sources in lending and derivatives.

- New corporate actions and governance events for tokenized assets that could drive updates to reference prices and collateral models.

Sources & verification

- Ondo post: Defi adoption of Ondo tokenized stocks live — https://ondo.finance/blog/defi-adoption-of-ondo-tokenized-stocks-live

- Chainlink partnership with Ondo (PR Newswire, October 2025) — https://www.prnewswire.com/news-releases/ondo-and-chainlink-announce-landmark-strategic-partnership-to-jointly-bring-financial-institutions-onchain-302599151.html

- Nasdaq rule-change for tokenized stocks — https://cointelegraph.com/news/nasdaq-asks-sec-for-rule-change-to-trade-tokenized-stocks

- SEC no-action letter for tokenization services (DTCC) — https://cointelegraph.com/news/sec-clears-dtcc-to-offer-tokenization-service

- Robinhood Chain testnet (public) — https://robinhood.com/us/en/newsroom/robinhood-chain-launches-public-testnet/

Ondo and Chainlink bring tokenized stocks to DeFi on Ethereum

Ondo Finance’s Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling on-chain price feeds for tokenized US stocks such as SPYon, QQQon and TSLAon to go live on Ethereum (CRYPTO: ETH). The feeds are now being utilized on Euler, where users can post tokenized equities as collateral to borrow stablecoins. The integration anchors on-chain valuations to reference prices that reflect corporate actions like dividends, enhancing the reliability of on-chain pricing for collateral and liquidations. The collaboration marks a meaningful step in expanding the use cases for tokenized equities within decentralized finance and demonstrates how established oracle networks can support new asset classes on-chain.

Initial coverage includes SPYon (SPDR S&P 500 ETF), QQQon (Invesco QQQ ETF), and TSLAon (Tesla stock), with plans to expand as the oracle network and Ondo’s protocol integrations scale. The data feeds feed into lending markets on Euler, enabling users to collateralize tokenized stocks for stablecoin borrowing and to set risk controls based on up-to-date reference prices. This approach addresses a notable limitation: tokenized equities had been primarily used for price exposure rather than as robust collateral. By pairing exchange-linked liquidity with reliable on-chain price feeds, Ondo and Chainlink seek to unlock broader DeFi applications, including more sophisticated lending, risk management and perhaps new forms of on-chain structured products.

The broader ecosystem context includes a growing array of regulatory and market initiatives aimed at tokenized securities. Nasdaq’s pursuit of a rule change to permit listing and trading tokenized stocks signals a potential path for regulated, on-chain representations of listed shares. The same week, the SEC clarified custody rules for tokenized securities in collaboration with the Depository Trust & Clearing Corporation, which could streamline how tokenized assets move through the traditional custody pipeline. On the crypto front, platforms have already experimented with tokenized stock access, including tokenized stock offerings across Kraken and Bybit and the Robinhood Chain initiative, all pointing to increasing interoperability between on-chain finance and legacy markets.

With the Ondo–Chainlink integration, developers and users gain a practical mechanism to reference the true price of tokenized equities within DeFi protocols, enabling more reliable collateralization and liquidations. The development underscores the maturation of tokenized securities as a cross-border, cross-venue concept—one that depends on robust price oracles, regulatory clarity and continued collaboration between traditional finance operators and crypto infrastructure providers. As the market continues to experiment with tokenized assets, observers will watch for further asset coverage, governance updates, and regulatory milestones that could accelerate or recalibrate the adoption curve for tokenized stocks in DeFi and beyond.

Crypto World

US Jobs Data Could Shock Bitcoin, Here’s Why

Bitcoin faces renewed macro pressure after the latest US jobs report signaled a stronger-than-expected labor market, pushing Treasury yields higher and reducing the likelihood of near-term Federal Reserve rate cuts.

The US economy added 130,000 jobs in January, nearly double consensus expectations. At the same time, the unemployment rate fell to 4.3%, showing continued labor market resilience.

While strong employment is positive for the broader economy, it complicates the outlook for risk assets like Bitcoin.

Sponsored

Sponsored

Strong Jobs Data Delays Rate Cut Expectations

Markets had been anticipating potential rate cuts in the coming months amid slowing growth concerns. However, a resilient labor market reduces the urgency for monetary easing.

As a result, investors repriced expectations for Federal Reserve policy.

Bond markets reacted immediately. The US 10-year Treasury yield jumped toward the 4.2% level, rising several basis points after the report. The two-year yield also climbed, reflecting reduced probability of near-term cuts.

Higher yields tighten financial conditions. They increase borrowing costs across the economy and raise the discount rate used to value risk assets.

Sponsored

Sponsored

Why Higher Yields Pressure Bitcoin

Bitcoin is highly sensitive to liquidity conditions. When Treasury yields rise, capital tends to rotate toward safer, yield-generating assets such as government bonds.

At the same time, a stronger dollar often accompanies rising yields. A firmer dollar reduces global liquidity and makes speculative assets less attractive.

This combination creates headwinds for crypto markets.

Sponsored

Sponsored

Although Bitcoin briefly stabilized near the $70,000 level earlier in the week, the jobs data increases the risk of renewed volatility. Without a clear signal that the Fed will ease policy, liquidity remains constrained.

“For Bitcoin, this report is a short-term headwind. A beat of this magnitude dampens the probability of a March rate cut and reinforces the Fed’s pause at 3.50%-3.75%. The cheaper money catalyst that risk assets need to mount a sustained recovery just got pushed further out. Expect the dollar to firm and yields to reprice higher, both of which pressure BTC into a range in the near term,” David Hernandez, Crypto Investment Specialist at 21shares told BeInCrypto.

Market Structure Amplifies Macro Stress

The recent crash demonstrated how sensitive Bitcoin has become to macro shifts. Large ETF flows, institutional hedging, and leveraged positioning can accelerate moves when financial conditions tighten.

A stronger labor market does not guarantee Bitcoin will fall. However, it reduces one of the key bullish catalysts: expectations of easier monetary policy.

Sponsored

Sponsored

“In the short term, Bitcoin looks defensive. The key level to watch is $65,000. However, if this strong report turns out to be temporary rather than a sign the economy is heating up again, the Fed could still cut rates later this year. When that happens, Bitcoin’s limited supply becomes important again. Strong data today may delay a rally, but it doesn’t break the long-term bullish case,” Hernandez said.

The Bottom Line

The latest US jobs report reinforces a “higher-for-longer” rate environment.

For Bitcoin, that is not immediately catastrophic. But it does make sustained upside more difficult.

Unless liquidity improves or yields retreat, the macro backdrop now leans cautious rather than supportive for crypto markets.

Crypto World

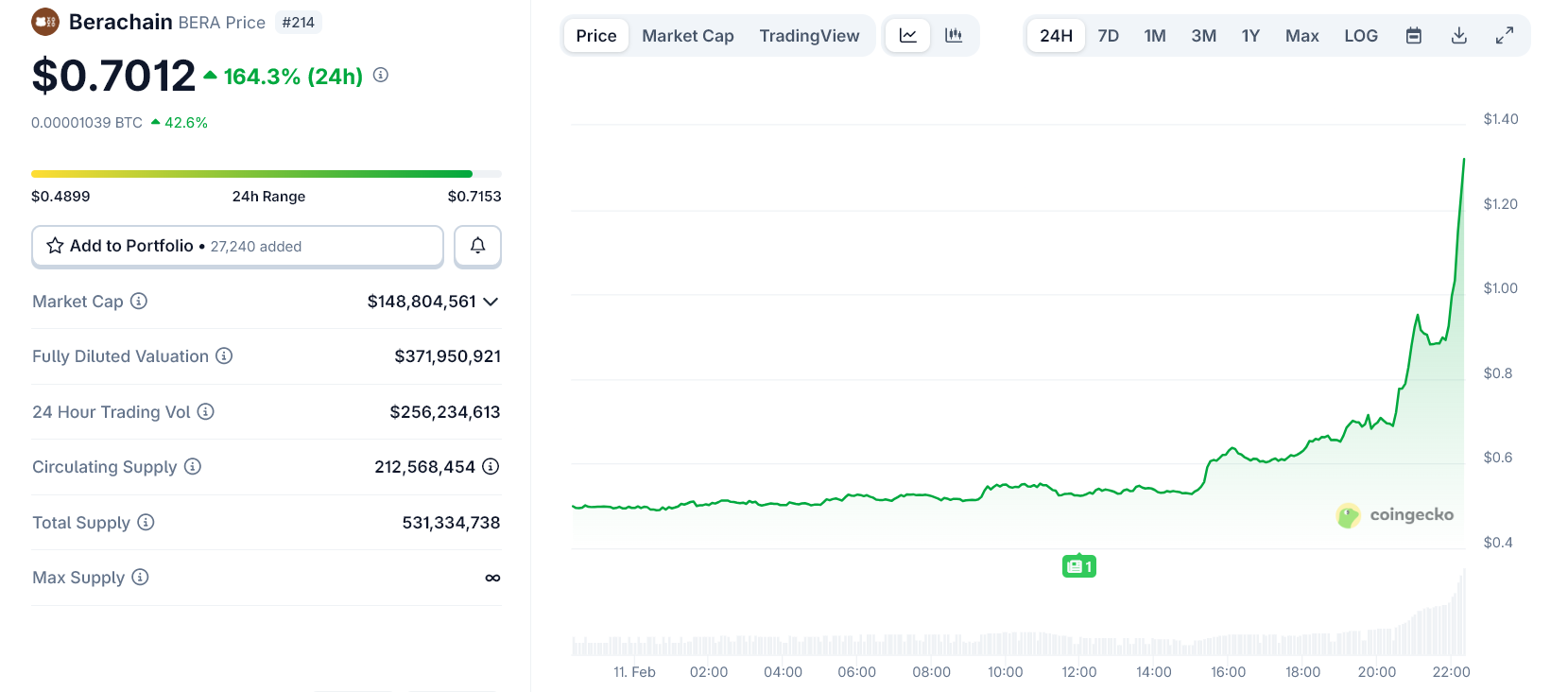

Why Is Berachain Up 150% Overnight After a Year of Silence?

Berachain’s native token, BERA, surged over 150% on February 11, marking its sharpest single-day gain in months. The rally follows weeks of renewed activity after the project spent much of 2025 under pressure from falling prices, token unlock concerns, and investor uncertainty.

The immediate catalyst appears to be the foundation’s strategic shift toward a new model called “Bera Builds Businesses.”

Sponsored

Sponsored

Berachain’s Refund Fears to Revenue Ambitions: What Changed?

Announced in January, the initiative aims to back three to five revenue-generating applications designed to create sustainable demand for BERA.

Instead of relying on heavy token incentives, the network now plans to focus on projects capable of producing real cash flow.

That pivot changed the narrative.

Throughout 2025, Berachain struggled as TVL (total value locked) collapsed from early highs, and the token fell more than 90% from its peak. Critics questioned whether its incentive-heavy growth model could survive a prolonged market downturn.

However, another major overhang also disappeared this month.

Sponsored

Sponsored

A controversial refund clause tied to Brevan Howard’s Nova Digital fund expired on February 6, 2026. The clause reportedly allowed the investor to request a $25 million refund if performance conditions were not met.

With the deadline passing, traders appear to view the removal of that risk as structurally positive.

At the same time, a large token unlock event also cleared without triggering heavy selling. That outcome fueled what analysts describe as a “relief rally.”

On-chain and derivatives data show rising trading volume and increasing open interest.

Liquidation heatmaps indicate clustered short positions above key resistance levels, suggesting that short covering may have amplified upward momentum.

Still, risks remain.

Berachain faces continued token distribution pressure and must prove that its business-focused strategy can generate sustained demand.

For now, however, the market appears to be rewarding clarity and the removal of uncertainty after a long period of silence.

Crypto World

Ondo Integrates Chainlink Price Feeds for Tokenized US stocks on Ethereum

Ondo Finance said its Ondo Global Markets platform has integrated Chainlink as its official data oracle, enabling price feeds for tokenized US stocks including SPYon, QQQon and TSLAon to go live on Ethereum.

According to a post from Ondo on Wednesday, the feeds are now being used on Euler, where users can post the tokenized equities as collateral to borrow stablecoins.

The integration provides onchain pricing data for the tokenized assets, allowing decentralized finance (DeFi) protocols to set collateral parameters and manage liquidations based on reference prices tied to the underlying equities. The feeds incorporate corporate actions such as dividends, enabling applications to reference updated equity values.

Initial support covers SPYon (which represents the SPDR S&P 500 ETF), QQQon (representing the Invesco QQQ ETF) and TSLAon (Tesla stock), with additional tokenized stocks and exchange-traded funds (ETFs) expected to be added as oracle coverage and protocol integrations are expanded.

According to the announcement, risk parameters for the new lending markets, including collateral factors and liquidation thresholds, are being set and monitored by Sentora.

Ondo said the move addresses a prior limitation for tokenized equities, which had largely been held for price exposure but were not widely accepted as collateral in DeFi. By pairing exchange-linked liquidity with onchain price feeds, the companies aim to enable broader use of tokenized stocks in lending and other structured products.

The announcement follows an October 2025 partnership between Ondo Finance and Chainlink, a blockchain oracle network launched in 2017, that designated Chainlink as the primary data provider for Ondo’s tokenized stocks and ETFs.

Related: Wemade taps Chainlink for Korean won stablecoin infrastructure

Race to tokenize US equities

As US regulators continue to refine the legal framework for tokenized securities, legacy financial institutions and crypto platforms are accelerating efforts to put equities on blockchain infrastructure.

In September, Nasdaq filed for a rule change with US Securities and Exchange Commission (SEC) that would enable it to list and trade tokenized versions of publicly traded stocks, potentially allowing blockchain-based representations of listed shares to trade within its regulated exchange framework.

On Dec. 11, the same day it clarifyied how broker-dealers may custody tokenized securities under existing rules, the SEC issued a no-action letter allowing a Depository Trust & Clearing Corporation subsidiary to launch a tokenization service for securities already held in DTC custody.

On Jan. 19, the New York Stock Exchange and its parent company, Intercontinental Exchange, said they are developing a blockchain-based platform for trading tokenized stocks and ETFs with 24/7 trading and near-instant settlement, pending regulatory approval.

On the crypto side, more than 60 tokenized US stocks launched in June across exchanges Kraken and Bybit. The product, developed by Backed Finance under its xStocks brand, provides blockchain-based exposure to blue-chip companies, though it is not yet available to US customers.

Meanwhile, fintech Robinhood, which introduced tokenized versions of nearly 500 US stocks for EU users in October, has launched a public testnet for Robinhood Chain, an Ethereum layer-2 network built on Arbitrum.

On Wednesday, the company said the network is designed to support tokenized real-world and digital assets, including 24/7 trading, self-custody and onchain lending and derivatives applications.

Magazine: Bitcoin’s ‘biggest bull catalyst’ would be Saylor’s liquidation: Santiment founder

Crypto World

Provenance Blockchain TVL Hits All-Time High of $1.2 Billion

HELOC provider Figure Markets accounts for the network’s entire TVL.

The Provenance blockchain hit a new milestone on Wed. Feb. 11, as its total value locked (TVL) climbed to an all-time high of $1.2 billion.

This marks a 7% increase in TVL over the past 24 hours, and a roughly 570% jump since early November 2025, when TVL stood at about $179.9 million, according to DeFiLlama data.

Notably, Figure Markets is currently the only protocol tracked on Provenance by DeFiLlama, meaning the network’s entire TVL is essentially tied to Figure’s activity. Figure Markets is described as a decentralized custody platform, which offers spot trading, crypto-backed lending, and yield-bearing assets.

DeFiLlama data shows Figure Markets’ TVL at approximately $1.22 billion, with about $301 million currently borrowed. The protocol has generated roughly $3.84 million in annualized fees and revenue, while 30-day decentralized exchange volume stands at approximately $2.08 billion.

Figure Technologies, the entity behind Figure Markets and Provenance, currently leads in the tokenized private credit space, accounting for $15 billion of the market’s $20 billion active loans, per RWAxyz. The company is also the largest non-bank home equity line of credit (HELOC) originator in the U.S.

Meanwhile, Provenance’s native token, HASH, was the second-best performing token on the day, rising about 8% in 24 hours to trade near $0.018, according to CoinGecko. Figure’s HELOC token is currently trading at $1.02, down 1% on the day.

Provenance’s TVL increase comes amid renewed attention towards tokenized real-world assets (RWAs), which have grown 14% over the past month to a distributed asset value of over $24.7 billion.

Experts are Divided

Still, not everyone views the milestone as a structural breakthrough. Brian Huang, co-founder of Glider, told The Defiant that tokenizing assets on a standalone or siloed blockchain does not necessarily increase their utility.

“Assets aren’t any more useful on chain than offchain unless they have composability. Provenance has no composability,” Huang said. “Overall, I wouldn’t read into the $1.2 billion in assets. In the long term, tokenization will favor open protocols like Ethereum and Solana.”

Danny Nelson, Research Analyst at Bitwise Asset Management, took a different viewpoint, calling Provenance’s business “very real.”

“It’s the secret sauce fueling Figure Markets’ rise to become the largest non-bank home equity loan (HELOC) business in the U.S,” Nelson said. “Figure Markets purpose built Provenance Chain to handle its HELOCs.”

He explained that Figure represents all loan-related paperwork, contracts, and finances as tokens on the blockchain. “There, it can process everything much faster than a traditional lending business can,” Nelson added. “Figure is cutting the costs of creating each loan, and speeding up its processing, by handling the entire loan lifecycle on Provenance.”

Provenance’s growth follows a January announcement from Figure launching the On-Chain Public Equity Network (OPEN) on Provenance. The move allowed companies to list their equity natively on-chain.

“Unlike other tokenization efforts, OPEN equities are blockchain-registered, not a tokenized version of Depository Trust and Clearing Corporation (DTCC) securities,” the announcement reads.

Figure said its own stock will be the first public equity trading natively on the blockchain, with market makers including Jump Trading preparing to support the platform.

The Defiant reached out to Figure and Provenance for comment, but has not heard back at the time of publishing.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech21 hours ago

Tech21 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports4 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat5 days ago

NewsBeat5 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Sports2 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

-

NewsBeat7 days ago

NewsBeat7 days agoStill time to enter Bolton News’ Best Hairdresser 2026 competition