Crypto World

US Jobs Data Could Shock Bitcoin, Here’s Why

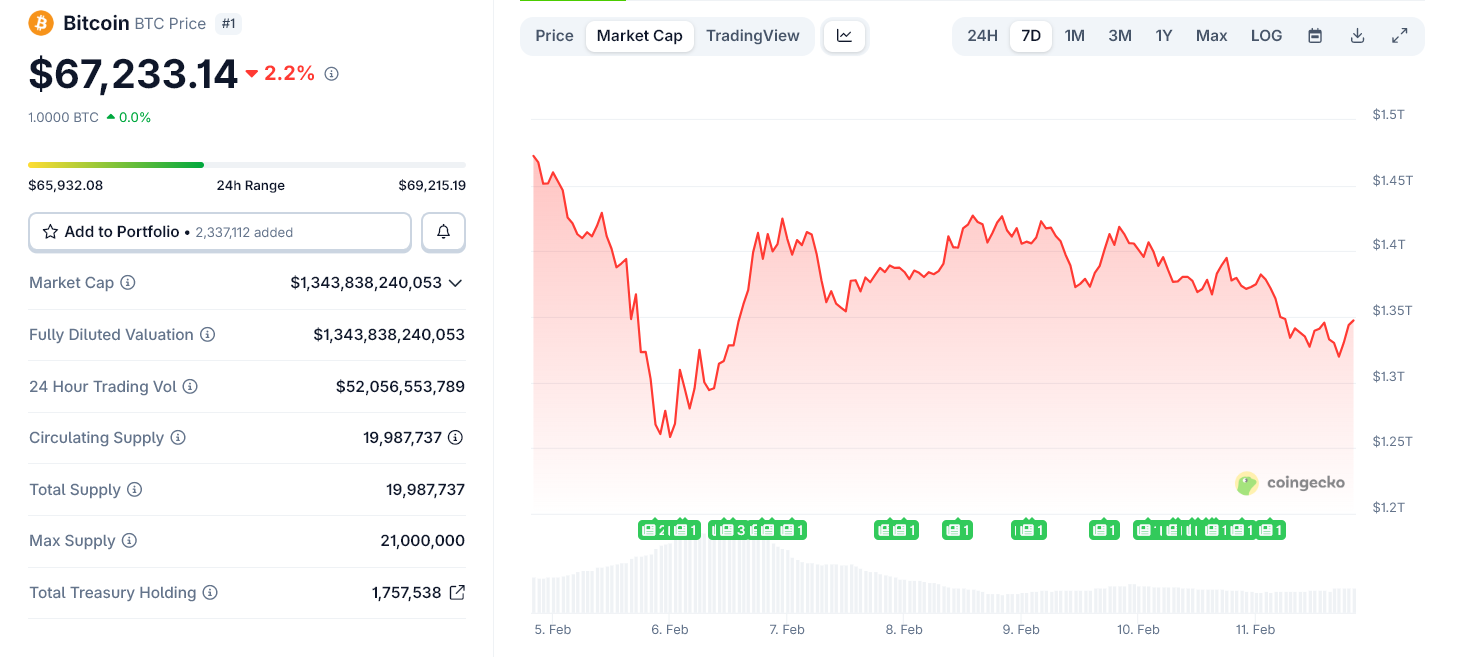

Bitcoin faces renewed macro pressure after the latest US jobs report signaled a stronger-than-expected labor market, pushing Treasury yields higher and reducing the likelihood of near-term Federal Reserve rate cuts.

The US economy added 130,000 jobs in January, nearly double consensus expectations. At the same time, the unemployment rate fell to 4.3%, showing continued labor market resilience.

While strong employment is positive for the broader economy, it complicates the outlook for risk assets like Bitcoin.

Sponsored

Sponsored

Strong Jobs Data Delays Rate Cut Expectations

Markets had been anticipating potential rate cuts in the coming months amid slowing growth concerns. However, a resilient labor market reduces the urgency for monetary easing.

As a result, investors repriced expectations for Federal Reserve policy.

Bond markets reacted immediately. The US 10-year Treasury yield jumped toward the 4.2% level, rising several basis points after the report. The two-year yield also climbed, reflecting reduced probability of near-term cuts.

Higher yields tighten financial conditions. They increase borrowing costs across the economy and raise the discount rate used to value risk assets.

Sponsored

Sponsored

Why Higher Yields Pressure Bitcoin

Bitcoin is highly sensitive to liquidity conditions. When Treasury yields rise, capital tends to rotate toward safer, yield-generating assets such as government bonds.

At the same time, a stronger dollar often accompanies rising yields. A firmer dollar reduces global liquidity and makes speculative assets less attractive.

This combination creates headwinds for crypto markets.

Sponsored

Sponsored

Although Bitcoin briefly stabilized near the $70,000 level earlier in the week, the jobs data increases the risk of renewed volatility. Without a clear signal that the Fed will ease policy, liquidity remains constrained.

“For Bitcoin, this report is a short-term headwind. A beat of this magnitude dampens the probability of a March rate cut and reinforces the Fed’s pause at 3.50%-3.75%. The cheaper money catalyst that risk assets need to mount a sustained recovery just got pushed further out. Expect the dollar to firm and yields to reprice higher, both of which pressure BTC into a range in the near term,” David Hernandez, Crypto Investment Specialist at 21shares told BeInCrypto.

Market Structure Amplifies Macro Stress

The recent crash demonstrated how sensitive Bitcoin has become to macro shifts. Large ETF flows, institutional hedging, and leveraged positioning can accelerate moves when financial conditions tighten.

A stronger labor market does not guarantee Bitcoin will fall. However, it reduces one of the key bullish catalysts: expectations of easier monetary policy.

Sponsored

Sponsored

“In the short term, Bitcoin looks defensive. The key level to watch is $65,000. However, if this strong report turns out to be temporary rather than a sign the economy is heating up again, the Fed could still cut rates later this year. When that happens, Bitcoin’s limited supply becomes important again. Strong data today may delay a rally, but it doesn’t break the long-term bullish case,” Hernandez said.

The Bottom Line

The latest US jobs report reinforces a “higher-for-longer” rate environment.

For Bitcoin, that is not immediately catastrophic. But it does make sustained upside more difficult.

Unless liquidity improves or yields retreat, the macro backdrop now leans cautious rather than supportive for crypto markets.

Crypto World

Coinbase Launches Crypto Wallets for AI Agents

Coinbase has unveiled a wallet infrastructure designed to let AI agents spend, earn, and trade crypto autonomously. The feature, dubbed Agentic Wallets, builds on the AgentKit framework introduced in November 2024 and aims to push agents from answering questions to taking concrete actions in the market. The system enables developers to embed wallets into agents, enabling tasks such as monitoring DeFi positions, rebalancing portfolios, paying for compute and API access, and participating in creator economies. Core to this rollout is x402, Coinbase’s payments protocol built for autonomous AI use cases, which has reportedly processed 50 million transactions to date.

Agentic Wallets are designed to operate across networks, including the Ethereum layer-2 network Base, where agents can manage positions and execute strategies wherever opportunities exist. The approach envisions a future where agents autonomously optimize yields, rebalance liquidity, and deploy capital without requiring explicit, real-time approvals, provided permissions and controls are preconfigured by users. This marks a shift from AI assistants that merely advise to agents that act, according to Coinbase engineers Erik Reppel and Josh Nickerson in a Wednesday post announcing the development.

“The next generation of agents won’t just advise — they’ll act,” Reppel and Nickerson wrote, detailing plans for agents to perform a range of functions from monitoring yields across protocols to executing trades on Base and managing liquidity positions around the clock. They described a scenario in which an agent detects a more favorable opportunity at 3 a.m., rebalances automatically, and does so without explicit approval because user permissions and safety controls are already in place.

AI agents now operable on the Bitcoin Lightning Network

Beyond Ethereum’s Base, Lightning Labs—the team behind Bitcoin’s Layer-2 Lightning Network—rolled out a new toolset enabling AI agents to transact on Lightning through the L402 protocol standard. The update also allows AI agents to run a Lightning node and manage a Lightning wallet containing native Bitcoin (BTC) without accessing private keys. This development broadens the scope for autonomous financial activity on Bitcoin’s network, providing a parallel pathway for agents to engage with programmable money at the base layer’s second tier.

The push toward agent-enabled wallets comes alongside broader industry activity. Crypto.com CEO Kris Marszalek announced ai.com, a platform intended to let users create personal AI agents to perform everyday tasks on their behalf. The capability ranges from managing emails and scheduling meetings to canceling subscriptions, shopping tasks, and even trip planning. Marszalek described a spectrum of tasks that AI agents could handle, illustrating how these tools might eventually operate as your digital proxy across daily routines.

Why crypto leaders are embracing agentic AI

Industry executives have long warned that AI could redefine how value is exchanged online. In late January, Circle CEO Jeremy Allaire suggested billions of AI agents could transact with crypto and stablecoins for everyday payments within three to five years. Former Binance CEO Changpeng Zhao has echoed a similar sentiment, arguing that a native currency for AI agents is likely to be crypto, capable of supporting tasks from purchasing event tickets to paying restaurant bills. These public statements reflect a shared belief that programmable money and autonomous agents will converge to enable more fluid, real-time financial interactions.

At a higher level, the convergence of AI with decentralized finance and payments ecosystems is driving experimentation around agent autonomy. Google’s recent Universal Commerce Protocol, announced in January, is designed to power agentic commerce by enabling agents to initiate transfers on a user’s behalf, with Google Pay acting as the default payment handler for USD-denominated transactions. The protocol signals a broader push in the tech sector to enable AI-driven commerce that can operate across apps, devices, and payment rails without constant human oversight.

“Build agents that monitor yields across protocols, execute trades on Base and manage liquidity positions 24/7. Your agent detects a better yield opportunity at 3am? It rebalances automatically, no approval needed because you’ve already set permissions and controls.”

As these capabilities mature, momentum in the space is likely to hinge on two dimensions: the robustness of autonomous decision-making and the security of permissioning and governance models. Agentic Wallets must balance the convenience of automated actions with safeguards to prevent unintended risk exposure. The ongoing conversations around risk controls and regulatory alignment will shape how broadly such wallets are adopted by retail and institutional users alike.

Market context

The emergence of autonomous wallets sits within a broader cycle of increased on-chain programmability and the maturation of smart contract-enabled finance. As liquidity provision, yield optimization, and creator economy participation become more automation-friendly, the appetite for self-operating agents grows among developers and institutions alike. The convergence of AI tooling with established networks like Base and the Lightning Network underscores a dual-track approach: one path leverages scalable, smart-contract-enabled ecosystems, while the other emphasizes fast, low-friction payments on Bitcoin’s secondary layer. Regulatory clarity and ETF-related flows in traditional markets are likely to influence how aggressively capital participates in these early-stage, automation-centric use cases.

Why it matters

Agentic Wallets represent a tangible step toward programmable money that can autonomously allocate capital, monitor risk, and adjust exposure across multiple protocols. If successful, the approach could reduce the overhead of manual trading and portfolio management, enabling more people to experiment with sophisticated strategies without in-depth technical know-how. The ability to manage DeFi positions and pay for compute or data access autonomously also has implications for developers building AI-powered financial tools, potentially accelerating product development cycles and new business models in the crypto space.

The integration with Bitcoin’s Lightning Network adds a separate layer of significance. By enabling AI agents to transact via L402 on Lightning and hold a Lightning-compatible wallet, the ecosystem expands the set of on-chain and off-chain rails that can be orchestrated by autonomous programs. This broadens practical use cases for AI agents—from micro-payments to cross-network arbitrage—while testing the limits of permissioned automation and the user controls that balance safety with convenience. Taken together, these developments suggest a future in which agents operate across multiple rails with varying latency, fees, and settlement characteristics.

For users and builders, the key takeaway is a shift in how wallets are used and who controls them. Agentic Wallets place agency in the hands of AI-enabled programs, but with computerized governance that requires explicit permissions ahead of time. The risk-management framework around such permissions will be critical to its sustainable adoption, particularly as public enthusiasm for automation intersects with concerns about security and misuse. The coming months are likely to reveal the first generation of real-world deployments and decision-making heuristics that will define the role of agents in everyday crypto activity.

What to watch next

- Expansion of Agentic Wallets beyond Base to other Ethereum layer-2s and compatible networks, including any developer updates from Coinbase.

- Tracking adoption and volume on the x402 payments protocol, including any reported milestones beyond the 50 million transactions already noted.

- Broader deployment of AI agents on Bitcoin via the Lightning Network using L402, and the integration of wallets with Lightning node operations.

- Progress and practical traction for ai.com by Crypto.com, including user adoption metrics and featured autonomous tasks.

- Further details on Google’s Universal Commerce Protocol and collaboration milestones that enable agent-initiated transfers and payments in real-world settings.

Sources & verification

- Coinbase: Introducing AgentKit — developer-facing overview and the roadmap for embedding wallets into autonomous agents.

- Coinbase Developer Platform status updates on AgentKit and Agentic Wallets deployment.

- Lightning Labs: L402 protocol standard enabling AI agents to transact on Lightning and manage Lightning-enabled wallets.

- Crypto.com: ai.com platform launch and its scope for personal AI agents performing daily tasks.

- Google: Universal Commerce Protocol and Agent Payment Protocol 2 for agent-enabled transfers in commerce.

Key figures and next steps

Coinbase’s public framing of Agentic Wallets as a step toward “agents that act” follows a broader wave of AI-powered automation across crypto layers. The combination of AgentKit, x402, and multi-network reach—spanning Base and the Lightning Network—provides a multi-faceted testbed for autonomous financial activity. Investors and builders will be watching for evidence of sustainable user authorization models, transparent risk controls, and clear metrics around automated yield optimization and liquidity management. As the ecosystem experiments with agent-based transactions, market participants will assess whether these autonomous wallets can reliably operate without compromising security or user intent.

Crypto World

Last week’s rout delivered BTC’s biggest realized loss ever; bottoming signals grow

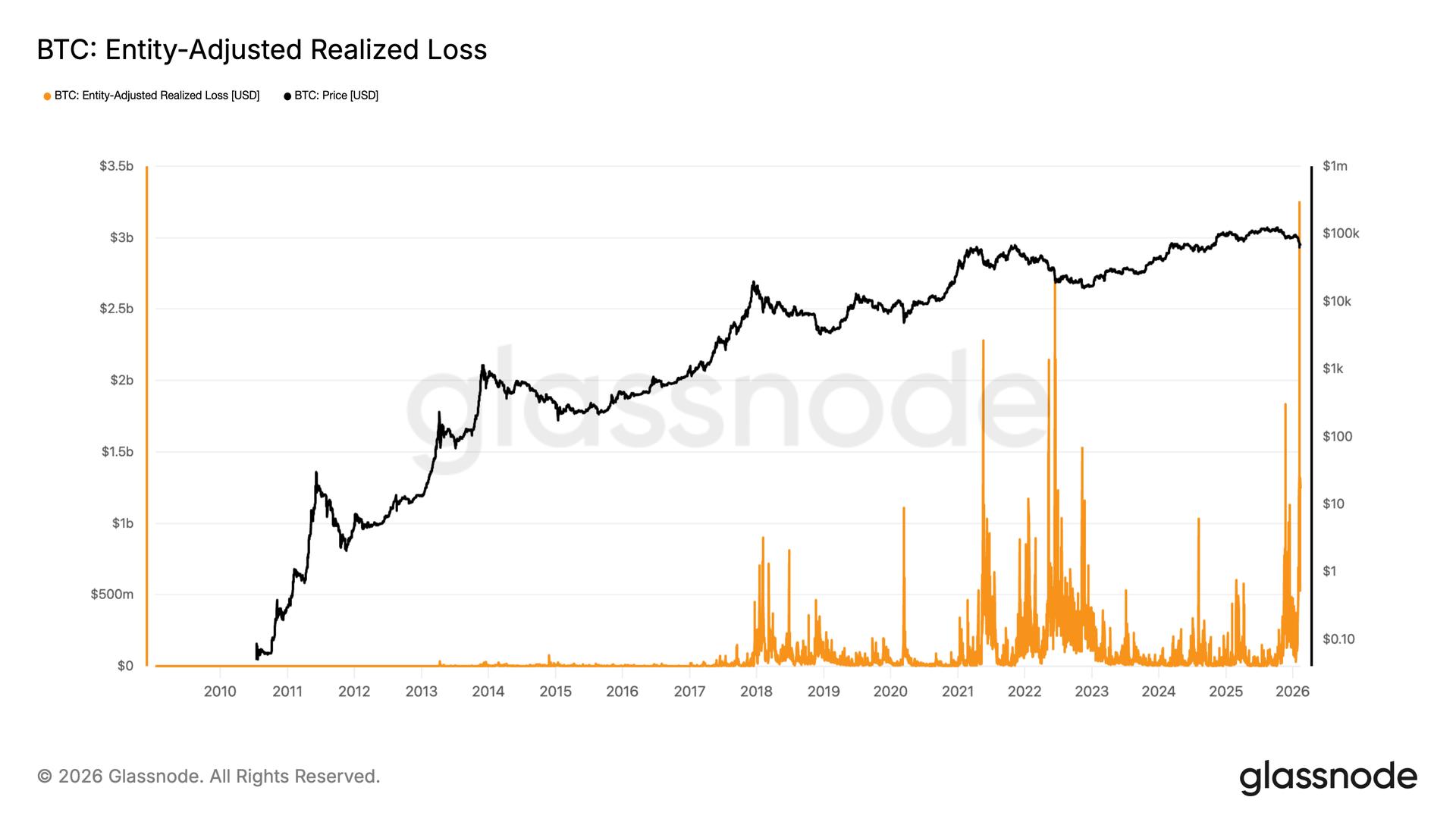

The largest realized loss in bitcoin history occurred during last week’s market downturn, shattering previous records as the asset plummeted from $70,000 to $60,000 on Feb. 5.

According to Glassnode, the Entity-Adjusted Realized Loss reached $3.2 billion. This metric exclusively tracks the USD value of moved coins sold below their acquisition price while filtering out internal transfers between the same entity.

This massive capitulation surpassed even the darkest days of 2022, eclipsing the $2.7 billion loss recorded during the collapse.

According to data platform Checkonchain, “Last week’s bitcoin sell-off meets the criteria of a textbook capitulation event. It occurred rapidly, on heavy volume, and crystallised losses from the lowest-conviction holders.”

With daily net losses exceeding $1.5 billion, the scale of this sell-off represents the most significant absolute USD loss ever crystallized in the network’s history. This points to more signs of a bear market bottom.

As of press time bitcoin is trading around $67,600.

Crypto World

SEC’s Cooled Enforcement Policy ‘Not Good’ for Crypto Industry: Congressman

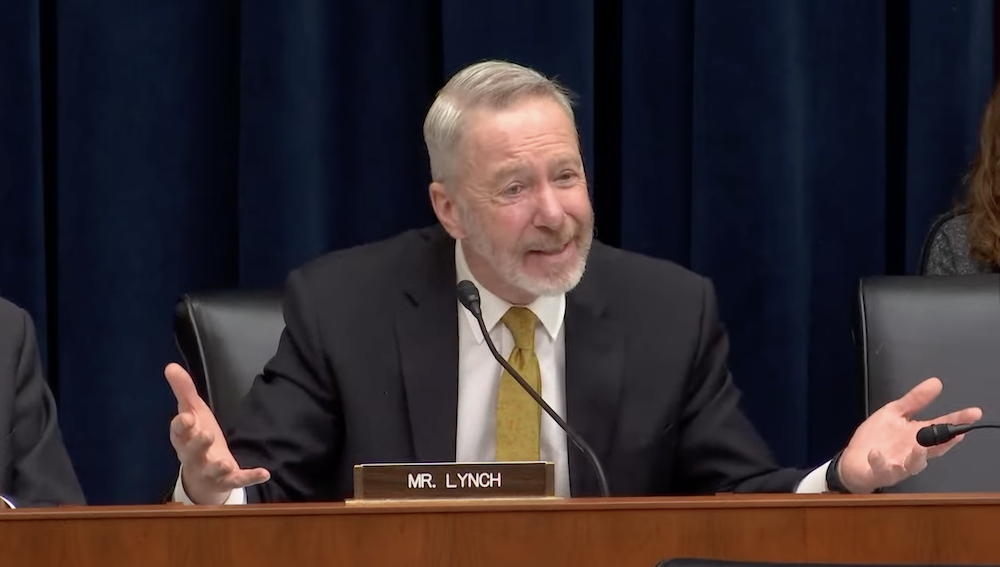

US lawmakers questioned Securities and Exchange Commission (SEC) Chair Paul Atkins at a hearing on Wednesday about the agency’s enforcement actions against the crypto industry and why several cases were dismissed since the leadership change.

Enforcement actions since US President Donald Trump assumed office, and appointed Atkins as SEC chair, are down by 60%, Representative Stephen Lynch said.

The Massachusetts Democrat cited the dismissal of several SEC lawsuits against the crypto industry, including the SEC’s motion to dismiss the Binance case in May 2025, as examples of the dropped enforcement cases.

Lynch also said that foreign investments in World Liberty Financial (WLFI), a decentralized finance platform linked to the Trump family, and memecoins launched by the family, were also causes for concern.

Recent reports indicate that Aryam Investment 1, an Abu Dhabi investment vehicle backed by Sheikh Tahnoon bin Zayed Al Nahyan, the national security adviser of the United Arab Emirates (UAE), purchased 49% of the startup company behind WLFI. Lynch said:

“This is hurting the crypto industry, all these scams. Look at crypto today. I think it’s down 25% in the last month. People are losing trust, and it’s not good for crypto. It’s certainly not good for consumers, and it’s awful the reputational damage that the SEC is suffering.”

“We have a very robust enforcement effort, and we are bringing cases,” Atkins responded. The comments rehashed previous concerns voiced by Democratic lawmakers about the Trump family’s involvement in crypto and how it could effect US national security.

The comments come during a US midterm election year and could signal resistance toward crypto from Democrats, which could stall market structure legislation if the Democratic Party takes back control of at least one chamber of Congress.

Related: Trump-linked WLFI faces probe over $500M UAE crypto deal

Rep. Maxine Waters claims crypto industry pardons, dropped lawsuits are politically motivated

“These cases were dismissed, despite the fact that the SEC was winning in court, proving that the SEC’s crypto enforcement program was well-grounded in the law,” California Representative Maxine Waters said.

The crypto industry executives who benefited from the pardons and the dropped regulatory lawsuits gave “millions of dollars” to Trump and his family, Waters continued.

Waters, who is a vocal critic of both Trump and the crypto industry, has repeatedly called for probes into the president’s family’s crypto activities, characterizing the projects as a potential backdoor for foreign entities to influence Executive Branch policy through bribery.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

MSTR Stock Struggles as Bitcoin’s Value Dips Below $70,000

TLDR

- MSTR stock dropped 4.8% today, following a significant decline in Bitcoin’s price.

- Michael Saylor linked the stock’s decline to a four-month Bitcoin bear market.

- Strategy’s stock has shown extreme volatility, with 58 moves greater than 5% in the past year.

- A 13.4% drop in Strategy’s stock occurred just six days ago due to Bitcoin’s sharp decline.

- Canaccord Genuity analyst Joseph Vafi slashed his price target on Strategy by over 60%.

Shares of Strategy (NASDAQ: MSTR) experienced a 4.8% drop in the afternoon session today. The decline follows the movement of Bitcoin, which faced a notable decrease in its value. Strategy’s strong correlation with Bitcoin’s performance has made the company’s stock price highly volatile.

MSTR Stock Moves in Tandem with Bitcoin

Strategy’s stock price has consistently followed Bitcoin’s fluctuations, given the company’s large holdings in the cryptocurrency. As Bitcoin dropped from over $110,000 to near $70,000, MSTR stock reflected a similar decline. Michael Saylor, Strategy’s executive, directly attributed the recent decrease to the ongoing four-month bear market for Bitcoin. He stated, “The stock’s decline is tied to the market’s response to Bitcoin’s performance.” This strong link between the two assets has resulted in high volatility for Strategy’s shares.

The company’s stock has moved more than 5% on 58 occasions over the past year, showing its sensitivity to market shifts. Today’s drop, however, is viewed as another typical move within the volatility that investors expect. The market, however, does not appear to see this as a fundamental change in the business outlook. Investors are continuing to monitor Bitcoin’s movements as they assess Strategy’s performance.

Previous Drop and Analyst’s Impact on MSTR

The latest drop comes after a 13.4% decrease in Strategy’s stock just six days ago. This drop followed Bitcoin’s sharp decline, which impacted the value of Strategy’s holdings. Canaccord Genuity analyst Joseph Vafi reduced his price target for the company by over 60% due to Bitcoin’s declining price. The drop in Bitcoin’s value below $70,000 also coincided with the market waiting for Strategy’s fourth-quarter earnings report.

The large-scale impact of Bitcoin’s movement on Strategy’s stock is a key focus for analysts. Investors have remained concerned about the company’s crypto exposure, especially as its Bitcoin holdings lose value. Despite these concerns, Strategy continues to be the largest corporate holder of Bitcoin, which has made its stock price sensitive to changes in the cryptocurrency’s performance.

Strategy’s stock has dropped 19.8% since the beginning of the year, with its current price at $126.10 per share. This price is a far cry from its 52-week high of $455.90, a 72.3% drop from that peak. Investors who bought $1,000 worth of Strategy stock five years ago would now see an investment valued at $1,249.

Crypto World

Charles Hoskinson announces late-March debut for Midnight, unveils privacy simulation platform

Input Output Global (IOG) founder Charles Hoskinson announced Thursday that Midnight, the company’s long-awaited privacy-focused blockchain, will officially launch during the final week of March.

The announcement came during Hoskinson’s keynote speech at Consensus Hong Kong, marking a major step forward in IOG’s efforts to bring data protection and regulatory compliance to decentralized systems.

“We have some great collaborations to help us run it,” he said. “Google is one of them. Telegram is another. We’re really excited, there’s more that will come.”

Midnight uses zero-knowledge (ZK) proofs to enable selective disclosure. Think of it as a smart curtain for blockchain data, letting users share only what they choose while keeping the rest private. It works as a partner chain to the smart contract platform Cardano and provides privacy and regulatory compliance for decentralized applications.

Alongside the mainnet timeline, Hoskinson unveiled Midnight City Simulation, an interactive platform offering a glimpse of how Midnight’s delivers scalable privacy through selective disclosure. The so-called rational privacy ensures that transaction data remains private by default, while specific information can be shared with authorized parties when required.

This flexibility balances transparency and confidentiality on the blockchain through multiple disclosure views, categorized as public, auditor, and god, each with a different access level.

The simulation, hosted at midnight.city, became operational at 10:00 a.m. Hong Kong time Thursday, although public access to the simulation remains restricted until Feb. 26, according to a press release.

The simulation, which runs on the Midnight network and recruits AI-driven agents that interact unpredictably to create a steady flow of transactions, shows how well the blockchain can handle real-world demand and scales accordingly.

IOG said this test demonstrates the network’s ability to keep generating and processing proofs at scale — an important step in proving it’s ready for real-world use.

Crypto World

Hong Kong and UAE Compete for Dominance in Digital Asset Regulation

TLDR

- Hong Kong remains committed to digital assets with a transparent and predictable regulatory framework.

- The UAE is rapidly advancing in the digital asset space with clear regulations and a dedicated regulatory body.

- Hong Kong has granted licenses to 11 virtual asset trading platforms under its licensing regime.

- Hong Kong plans to issue licenses for stablecoins and digital asset custodians in the coming months.

- Johnny Ng suggests Hong Kong could benefit from appointing a dedicated position to oversee crypto regulations.

- Hong Kong continues to engage with global partners, including South Korea, to stay competitive in the digital asset market.

Hong Kong has long been a global financial hub, known for its robust commitment to blockchain and cryptocurrency development. Despite this, it now faces increased competition from the UAE, which has been making aggressive moves in the virtual asset space. The rivalry has intensified as both regions strive to lead in digital asset regulation and innovation.

Hong Kong’s Transparent Regulatory Framework for Digital Assets

Hong Kong has built a reputation for its stable and predictable regulatory approach toward digital assets. According to Joseph Chan, Under Secretary for Financial Services and the Treasury, the city’s regulation is transparent and dependable. “Our regulation is transparent, certain, and predictable,” Chan emphasized. This consistency has helped Hong Kong remain a trusted location for virtual asset businesses despite global market fluctuations.

Since the implementation of its licensing regime for virtual asset trading platforms (VATPs) two years ago, Hong Kong has granted licenses to 11 companies. The framework aims to provide a stable environment for virtual asset firms, promoting industry growth. Chan also pointed out that Hong Kong’s approach remains steady, even when facing challenges like crypto winters.

Furthermore, Hong Kong is moving forward with its stablecoin regulatory regime, with licenses expected in the first quarter of this year. The upcoming licensing framework for digital asset dealers and custodians will be addressed later this year. This process, though lengthy, is designed to ensure all industry players are well-informed, minimizing uncertainties for businesses in the region.

UAE’s Aggressive Stance on Virtual Asset Regulation

While Hong Kong has maintained stability, the UAE is making fast strides in becoming a crypto-friendly hub. Johnny Ng, founder of Goldford Group, highlighted that the UAE is very aggressive in attracting digital asset businesses. The UAE has established clear regulations and placed virtual assets under the oversight of a dedicated regulatory body in regions like Dubai and Abu Dhabi.

Ng noted that this approach gives the UAE an edge in competing with other global financial centers. He pointed to South Korea’s similar model, where a government body specifically handles crypto regulations. “The UAE is really aggressive,” Ng said, comparing its regulatory efforts with those of Hong Kong and other jurisdictions.

In response, Ng suggested that Hong Kong could benefit from appointing a dedicated position to oversee digital asset regulation. “Hong Kong’s legislative council can recommend that the government create one position to oversee all these things,” he said. This idea would streamline regulatory processes and enhance the city’s competitiveness.

Crypto World

PIPPIN Price Prepares For 221% Breakout, Eyes New ATH

PIPPIN price has staged a powerful rally, pushing the meme coin closer to its all-time high. While momentum remains strong, continued investor selling could test the sustainability of this advance.

The question now is whether PIPPIN can sustain demand and convert resistance levels into lasting support.

Sponsored

Sponsored

PIPPIN Is Not Overheating

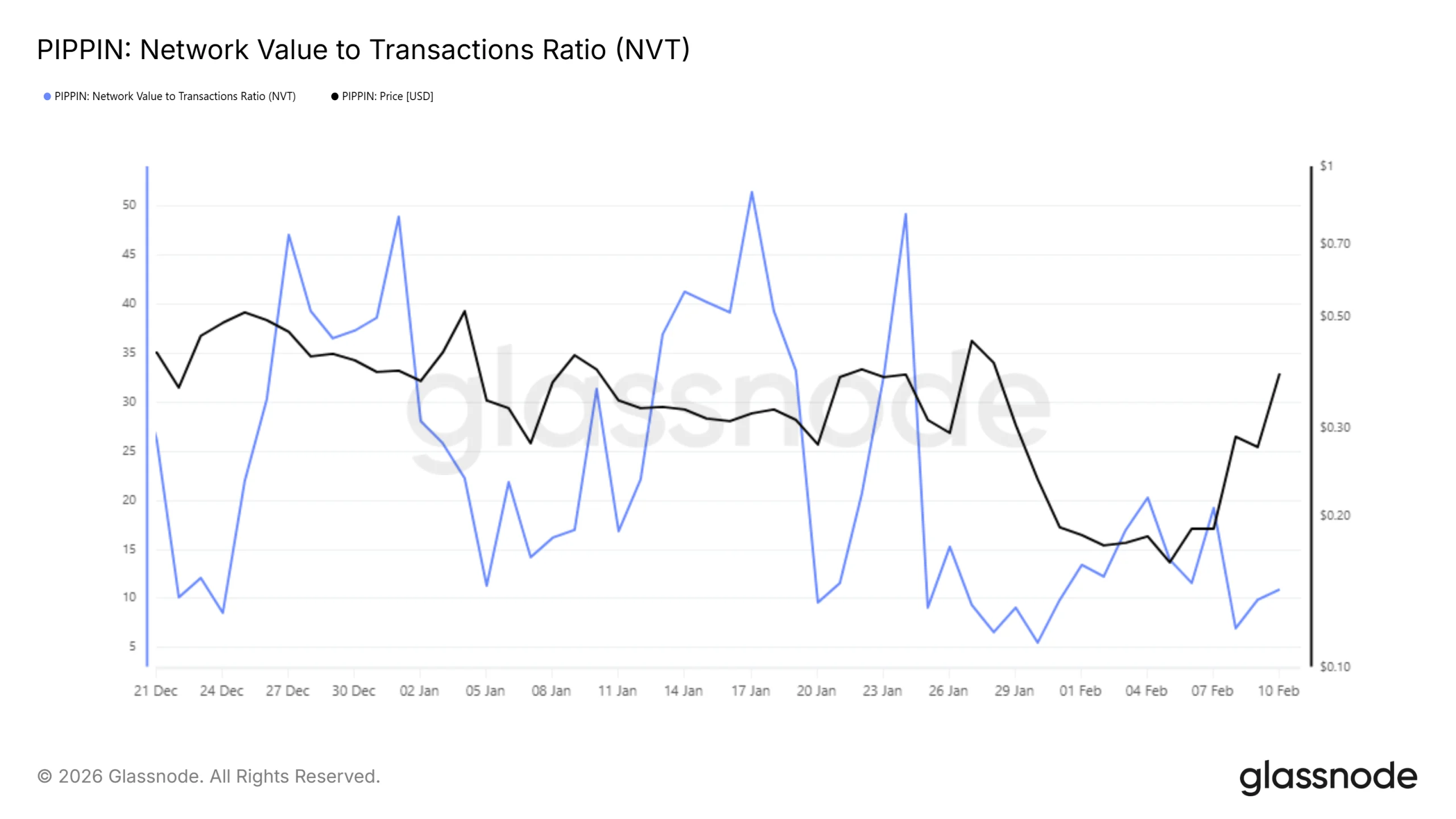

The Network Value to Transactions, or NVT, ratio remains relatively low despite the recent price spike. Historically, sharp rallies in speculative assets push the NVT ratio higher. A rising NVT often signals that market value is outpacing transaction activity, suggesting overheating conditions.

In PIPPIN’s case, the muted NVT reading indicates that network usage is expanding alongside price. Transaction volumes have kept pace with market capitalization growth. This alignment reduces the probability of an immediate correction driven purely by overvaluation concerns.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

A low NVT ratio during a rally can signal healthy participation. It suggests that price gains reflect genuine user engagement rather than excessive speculation. For investors focused on on-chain fundamentals, this metric supports the view that PIPPIN’s recent breakout attempt rests on a stronger footing.

Sponsored

Sponsored

Will Investors’ Selling Affect PIPPIN?

Exchange data shows that holders have been actively selling over the past several days. Since the beginning of the month, approximately 41.95 million PIPPIN tokens have moved onto exchanges. At current prices, this represents more than $17 million in realized supply.

Such selling typically reflects short-term profit-taking following rapid price appreciation. However, distribution alone does not confirm a bearish reversal. In strong uptrends, elevated exchange balances can coincide with aggressive demand from new entrants absorbing available supply.

The combination of rising prices, steady NVT readings, and exchange inflows may indicate absorption. Buyers appear willing to offset sell pressure without triggering a breakdown. This dynamic is often observed in early-to-mid bull market phases, when demand quietly outpaces distribution despite visible profit-taking.

PIPPIN Price Breakout Likely

PIPPIN price has surged 159% over the past five days, trading at $0.419 at publication. The meme coin stands out as the week’s top-performing digital asset. Technical charts show the token nearing a breakout from a descending broadening wedge pattern.

The wedge formation projects a potential 221% advance upon confirmation. A decisive move above $0.518, flipped into support, would validate the breakout structure. Even if PIPPIN falls short of the full projection, momentum could still drive price beyond its previous all-time high of $0.720 and toward $0.800.

Risk factors remain relevant for short-term traders. If the NVT ratio begins rising while exchange selling persists, transaction activity may weaken. A failed breakout could trigger a pullback toward $0.267 or even $0.186. Such a decline would invalidate the current bullish thesis and shift momentum decisively lower.

Crypto World

Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Dogecoin and Solana By the End of 2026

When you feed China’s strange new KIMI AI with a carefully engineered prompt, you can get the model to reveal some eye-catching price predictions for XRP, Dogecoin, and Solana this year.

According to Alibaba’s projections, all three assets could print new all-time highs (ATHs) within the next eleven months.

Below, we break down how these bullish forecasts are supported by chart data, fundamentals, and the news cycle.

XRP ($XRP): KIMI Outlines a Long-Term Path Toward $8

In a recent update, Ripple reaffirmed that XRP ($XRP) remains a core component of its strategy to position the XRP Ledger as an institutional-grade global payments network.

Widely recognized for rapid settlement speeds and ultra-low fees, XRPL is also a leading platform for two of crypto’s most promising sectors: stablecoins and real-world asset tokenization.

With XRP currently trading around $1.38, KIMI estimates the token could surge to $8 by the end of 2026, representing a sixfold increase.

Technical indicators appear to support the thesis. XRP’s Relative Strength Index (RSI) has begun rising from sub-30, suggesting renewed accumulation after recent heavy selling.

Fresh institutional demand driven by recently approved U.S.-listed XRP exchange-traded funds, alongside Ripple’s expanding enterprise partnerships and the potential passage of the U.S. CLARITY bill this year are XRP’s key catalysts.

Dogecoin (DOGE): Alibaba AI Sees Major Upside, But a New ATH Remains Uncertain

What began as a satirical experiment in 2013 has evolved into a $15 billion market cap coin. Dogecoin ($DOGE) now represents half of the $32 billion meme coin market.

Dogecoin last reached its all-time high of $0.7316 during the retail-driven bull run of 2021.

While the long-discussed $1 target remains a symbolic goal for the Dogecoin community, KIMI AI projects DOGE could hit it this year.

From its current price near $0.09, that would equate to gains of more than 1,000%, or roughly 11x.

Adoption continues apace: Tesla accepts DOGE for select merchandise, while PayPal and Revolut have integrated Dogecoin support.

Solana (SOL): KIMI Forecasts a Move Toward $400

The Solana ($SOL) ecosystem now secures roughly $6.4 billion in total value locked (TVL) and maintains a market capitalization close to $50 billion. Rising on-chain activity, developer participation, and daily users have spurred its growth.

The recent launch of Solana-linked exchange-traded funds by Bitwise and Grayscale is also attracting institutional investment.

However, after experiencing a prolonged correction in late 2025, SOL has spent most of February trading below $100.

Under KIMI’s most optimistic scenario, Solana could rally to $400 by 2027. That move would deliver nearly 5x returns for current holders and decisively surpass SOL’s previous ATH of $293, set January 2025.

Furthermore, Solana’s prospects look great. Firms such as Franklin Templeton and BlackRock are issuing tokenized real world assets on the network, giving it a strong use case that could increase exponentially.

Maxi Doge: Roll Over, Dogecoin! Maxi’s the New Alpha in Memesville

Finally, investors seeking classic high-risk, high-reward crypto exposure should look beyond the big projects towards emerging meme coins.

Maxi Doge ($MAXI) is one of the most talked-about meme coin presales of 2026, raising $4.6 million so far in its ongoing presale.

The project stars the brash, gym-obsessed, degen Maxi Doge, a distant envious cousin to Dogecoin, and one that channels the irreverent humor that originally propelled meme coins into the spotlight.

MAXI is an ERC-20 token on Ethereum’s proof-of-stake network, offering a significantly smaller environmental footprint compared to Dogecoin’s proof-of-work consensus model.

Early presale participants can currently stake MAXI tokens to earn yields of up to 68% APY, with rewards gradually tapering as the staking pool expands.

The token is $0.0002803 in the current presale phase, with automatic price increases triggered at each funding milestone. Purchases are supported via MetaMask and Best Wallet.

Memesville is entering a new era — and Maxi Doge’s the new alpha!

Stay updated through Maxi Doge’s official X and Telegram pages.

Visit the Official Website Here.

The post Strange New Chinese AI ‘KIMI’ Predicts the Price of XRP, Dogecoin and Solana By the End of 2026 appeared first on Cryptonews.

Crypto World

How CertiK rebuilt trust after Huione-related backlash

CertiK CEO Ronghui Gu told CoinDesk that the security firm has no concrete IPO timeline, but the company’s response to last year’s Huione-related backlash and rapid push into institutional products has positioned it as a credible candidate for a multi-billion-dollar public listing.

When CertiK conducted an audit of what later turned out to be a stablecoin project linked to the illicit marketplace Huione, the firm faced heavy online criticism. Gu framed the episode as a wake-up call rather than a reputational endgame. CertiK publicly clarified it had audited code supplied by a U.S.-registered client, before donating the fee to charity.

“What we do is we strengthen our current KYC procedure,” he told CoinDesk. “Also work with some external capacity providers to reduce the risk.” On monitoring post-audit use, he added: “After we release a report, we will keep a very close eye on how this report being used.”

CertiK is ramping up its enterprise offerings while keeping protocol audits as its main revenue stream. “Our current business was still and I would say that still will be the main revenue source,” Gu said, but he stressed these services must be “pushed to an institutional grade.”

In January Gu ignited discussion at Davos by suggesting that his firm were exploring an IPO, reports he now claims are exaggerated despite strong investor demand.

“We raised more than $240 million and I can tell you we have more money than that in our bank,” while acknowledging investor appetite. “We already received several requests,” he said, noting that media coverage sometimes misinterpreted his Davos remarks: “I explicitly say that we do not have a concrete plan. There’s no concrete timeline yet, but…many actually reached out to us.”

On valuation and the IPO question he struck a measured tone: “People still don’t know how to give the valuation for a web3-native company,” he said. He confirmed CertiK’s investor roster includes big names, Sequoia, Goldman Sachs and Coinbase, and hinted at selective additions: “We’re going to introduce one or two more strategic investors.”

The times are changing

When asked what attack vectors were becoming most prevalent across the crypto market, Gu argued that the risk profile in crypto has moved beyond smart-contract exploits.

“Operational risk became a bigger risk,” he said, alluding to private-key mismanagement, deepfakes and oracle manipulation. On AI-enabled impersonations, he was candid: “Deep fake is tough…we are still studying how to mitigate it.

He added that CertiK can help institutions but stressed the need for collaboration: “We need to work closely with our clients to help them review their internal policy or solution about the key management.”

For Gu, the post-Huione reforms are both reputational repair and strategic preparation for institutional clients.

“These institutions want institutional-grade auditing — formal verification that can demonstrate there are no bugs,” he said, noting demand from large banks across jurisdictions.

Crypto World

The Real Cost of Idle Capital in Crypto Markets

In this market, idle funds are the biggest risk. Most crypto users worry about volatility. More experienced participants tend to focus on a different factor: opportunity cost. When markets slow down, extended sideways movement is rarely neutral from a capital perspective.That’s why a growing number of traders are reallocating funds toward more capital-efficient DeFi models.

Each day capital remains unused can result in missed returns compared to more efficient allocation strategies.

A Structural Issue: Many Platforms Incentivize Passive Capital

Many platforms are structured in ways that benefit from users leaving funds idle, trading less frequently, operating under limited transparency, and responding slowly to changing market conditions.

Speed, yield, and flexibility are frequently highlighted, but are not always fully realized in practice.

By contrast, newer DeFi models are increasingly based on the idea that active capital allocation tends to outperform passive positioning.

In crypto, real conviction shows up on-chain.

Users aren’t just registering on these platforms — they’re allocating capital almost immediately. That behavior usually only happens when three conditions are met:

1. Control Is Absolute

Funds remain non-custodial. No permission risk. No “maintenance pauses” when volatility spikes.

2. Capital Efficiency Is Obvious

These platforms illustrate how idle assets can underperform and how quickly capital can be redeployed when infrastructure allows.

When performance becomes measurable rather than hypothetical, user hesitation tends to decline.

3. Exit Is Always Available

Third, liquidity and exit flexibility remain available. Prolonged lockups often undermine trust, which is why many modern DeFi protocols aim to minimize them.

Knowing that capital can be reallocated quickly, both in and out, often increases user confidence and willingness to deploy funds.

Market Dynamics Are Shifting, Often Without Broad Attention

Here’s what’s happening quietly:

- Smart money is reducing exposure to platforms with opaque incentives

- Traders are prioritizing flexibility + yield, not branding

- Capital is flowing toward systems that reward action, not patience

Several emerging DeFi platforms sit at the intersection of these trends.

This isn’t a future narrative. It’s a present reallocation.

Waiting for “Confirmation” Is a Losing Strategy

Many users say they’ll wait:

- for more coverage

- for bigger headlines

- for social proof

By the time that happens, the best conditions are already gone.

In crypto markets, earlier participation is often linked to asymmetric return profiles rather than elevated risk alone.

Early-stage phases of new platforms tend to favor participants who allocate capital sooner, before incentive structures evolve or compress.

From Registration to Deployment: Minutes, Not Friction

IODeFi removes the usual excuses:

- Registration is fast

- Wallet connection is seamless

- Deposits are straightforward

- Capital becomes productive immediately

This reduces unnecessary complexity and lowers the learning curve associated with capital deployment.

Final Thought: Precision Often Outperforms Excessive Caution

Caution feels safe. But in crypto, it often means underperforming by default.

Such platforms are not universally suitable, but they reflect a broader shift toward treating capital as an actively managed resource.

While some participants remain on the sidelines, others have already begun reallocating capital.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 hours ago

Sports2 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech23 hours ago

Tech23 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World4 hours ago

Crypto World4 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’