Business

NewsGuild battles New York Times over hybrid work, ‘wrongly excluding jobs’ from union and health fund

Former Education Department press secretary Angela Morabito criticizes the National Education Associations vow to fight I.C.E. and more on The Bottom Line.

FIRST ON FOX — The NewsGuild of New York is irked at The New York Times leadership.

The Times Guild Bargaining Committee sent staffers a newsletter on Tuesday detailing the latest labor negotiations. The Guild said it made a “big push to end the two-tier system The New York Times created and perpetuates by wrongly excluding jobs and workers from the Times Guild” and received a revised proposal from the company to end all hybrid work guarantees on March 1, 2027.

“At that point, they would have the right to require us to work in the office five days a week and to eliminate our contractually guaranteed three weeks of remote work per year. As we saw this fall: If the company can reduce our guaranteed remote-work days, they will. But when asked for data on how in-office work makes our news product, advertising and business operations better, the management side of the table was silent,” the Guild wrote in the email obtained by Fox News Digital.

JONATHAN TURLEY: NY TIMES COLUMNIST SINKS TO SICK NEW LOW MOCKING JD VANCE’S MOM

The NewsGuild of New York and The New York Times leadership held a bargaining session on Tuesday. (Beata Zawrzel/NurPhoto via Getty Images)

“On our side, we made a big push to end the two-tier system The New York Times created and perpetuates by wrongly excluding jobs and workers from the Times Guild. Today, we asked the company to recognize more than 50 of our colleagues’ proper place in our bargaining unit, people with whom we work side by side as members of the Times Guild,” the Times Guild Bargaining Committee continued. “Keeping union work in the union is one of our core priorities.”

The Guild believes positions including audio engineers, puzzle editors, audience and SEO editors, bureau chiefs based in cities across the country and editors on the Newsroom Development and Support team deserve “the same critical protections and benefits we have fought for under our union contract” and listed “annual raises, just cause job protections, hour-for-hour overtime or comp time and minimum salaries for each position” as key examples.

“One of the five core priorities we all identified for this contract campaign is keeping union work in our union. These wrongly excluded jobs represent another way the company has undercut our union by arbitrarily excluding colleagues who are doing the same work as us, thus creating a two-tier system of pay and benefits,” the Guild wrote.

The Times Guild Bargaining Committee sent staffers a newsletter on Tuesday detailing the latest labor negotiations. (Getty Images)

The Guild told members it proposed that the Times should give the Guild 30 days notice when it creates a new job “whether such job falls within the jurisdiction of the Guild or the position is excluded,” and that any disputes over newly created jobs should be “referred to the expedited arbitration provisions utilizing the parties’ Jurisdiction panel of arbitrators on a rotational basis.”

The Guild wants the Times to supply it with a description of the duties, responsibilities, proposed classification and effective date of a new job. The Guild is also asking it to be clearly noted that open jobs are Guild-represented positions when posted internally or externally, and for 30-days’ notice when individuals currently represented by the Guild are transferred to Guild-excluded positions.

“We received the company’s responses to our requests for information related to several of our core issues in these negotiations: badge-swipe surveillance being used to enforce in-office expectations; the company’s existing and planned uses of artificial intelligence; and the creation of a two-tier system by excluding The Athletic from our union,” the Times Guild Bargaining Committee wrote.

“Unfortunately, management declined to respond — nearly across the board — in detail to our requests, instead dismissing our questions as ‘overly broad,’ ‘speculative,’ ‘unduly burdensome,’ and ‘not relevant,’” they added.

DHS LASHES OUT AT NY TIMES AFTER REPORT CLAIMING PREGNANT WOMEN IN MINNEAPOLIS ‘HIDING FROM ICE’

Members of the Times Tech Guild picket outside the New York Times headquarters in New York on Nov. 4, 2024. (Yuki Iwamura/Bloomberg via Getty Images)

The Guild also told members that the Times “updated its proposal for financing our health fund,” but dismissed the notion it would “bankrupt the fund.”

“We understand that. It still goes back to [cost] sharing and responsibility,” Times Executive Director for Labor Relations Chris Biegner told the Guild, according to the newsletter distributed to members.

“In their counter to our performance evaluation proposal, management rejected several of our proposed changes, including exemptions from the rating system for employees who take a certain amount of leave, transparency about who (such as desk heads, masthead editors and H.R.) contributed to an employee’s evaluation, and shifting the review period so that it covers a full year of work,” the Guild wrote.

The next bargaining session is scheduled for Feb. 18. The current contract expires at the end of the month.

The Guild told members it proposed that the Times should give the Guild 30 days notice when it creates a new job “whether such job falls within the jurisdiction of the Guild or the position is excluded.”

When reached for comment, The New York Times provided Fox News Digital with a series of internal notes that managing editors Marc Lacey and Carolyn Ryan have sent to Times Guild unit members.

In January, Lacey and Ryan said conversations have been “productive,” but feel too much focus is being spent worrying about staffers who are not members of the Guild. The Athletic, a separate entity with its own leadership team that is owned by the Times, has been a sticking point.

“In the room, the Guild indicated that they would not accept any contract terms that don’t cover The Athletic joining The New York Times newsroom bargaining unit. We fear that setting this condition undermines the path to getting to a good deal any time soon,” Lacey and Ryan wrote last month after the first negotiating session.

CLICK HERE TO DOWNLOAD THE FOX BUSINESS APP

“The company has said many times that we would recognize unionization for Athletic employees as a separate unit if they choose to pursue it,” they continued. “We also want to state up front that we don’t think we should hold up a new contract and higher salaries for some 1,500 Times Guild employees because of a demand to incorporate employees from an entirely separate newsroom.”

Lacey and Ryan have insisted they would like to reach a deal.

The Athletic publisher David Perpich previously stated that he believes “the best approach is to have The Athletic’s journalists form a separate bargaining unit within the NewsGuild, not to have them absorbed into the Times unit.”

Business

ANZ Group cash profit jumps, shares hit record high on cost cuts

ANZ Group cash profit jumps, shares hit record high on cost cuts

Business

Global Market Today: Asian stocks rise, Treasuries fall after strong US jobs data

The MSCI Asia Pacific Index rose 0.4% to a record. The gauge is up around 13% so far this year, its best start to the year relative to the S&P 500 this century, as the region’s assets head for another strong year. Japanese shares advanced as markets returned after a holiday.

Treasuries dropped with the yield on the 10-year bond rising to 4.18% as traders pared bets on interest-rate cuts by the Federal Reserve this year following the jobs numbers. The latest data showed 130,000 roles added in January, twice the median forecast, as money markets priced in the Fed’s next cut in July, from June previously.

The moves signaled that for now, strength in the US economy counterbalances the desire for lower borrowing costs, supporting risk sentiment that has itself taken a battering over AI concerns in recent weeks. The next key hurdle for markets is Friday’s US inflation report, which could reinforce the case for keeping rates higher for longer if price pressures fail to ease.

“The report will ease concerns around the consumer,” wrote Krishna Guha at Evercore, referring to US jobs data. “It pours cold water on the idea the Fed could cut rates again before mid-year and will fuel internal debate as to how restrictive policy is and how much slack there is in the labor market.”

The S&P 500 ended Wednesday flat after a bumpy session with real estate services stocks getting hit, while the Nasdaq 100 rose 0.3%. In late hours, Cisco Systems Inc. gave a tepid margin forecast, overshadowing a generally positive outlook fueled by artificial-intelligence gains. McDonald’s Corp.’s US sales grew at the fastest pace in more than two years.

Elsewhere, gold and silver edged lower, while Bitcoin declined to trade around $67,000. The dollar held its losses, benefiting the yen, which touched a two-week high. In commodities, oil rose as tensions in the Middle East outweighed concerns that there’s a supply glut growing. Nickel extended gains after Indonesia signaled a sharp cut to output this year, curbing supply from the world’s biggest mine.

Concerns about rising unemployment that led to three rate cuts late in 2025 — before a pause in January — were likely eased by Wednesday’s data. At last month’s policy meeting, Fed officials had already cited signs of stabilization as a reason to hold rates steady.

US payrolls rose in January by the most in more than a year and the unemployment rate unexpectedly fell, suggesting the labor market continued to stabilize.

Elsewhere, the Canadian dollar was little changed after the Republican-led US House passed legislation aimed at ending President Donald Trump’s tariffs on Canada.

Business

Breakaway yen keeps dollar under the cosh

A stronger-than-expected U.S. jobs report overnight briefly lifted the greenback. But traders are taking recent signs of U.S. economic resilience as cues for a broader brightening in global growth and are laying bets on Japan as a likely winner.

The yen is up more than 2.6% since Prime Minister Sanae Takaichi’s Liberal Democratic Party swept to a landslide victory at Sunday’s election and a mood shift seems to be afoot as markets set aside fears about spending to focus on growth.

Against the dollar, the yen traded as strong as 152.55 on Wednesday, before steadying slightly below that at 153.05 per dollar on Thursday. The rebound is nascent – since the yen has been declining for years – but it has been big enough to turn heads in the market.

“It’s Japan buying,” said Naka Matsuzawa, chief strategist at Nomura Securities in Tokyo, with the yen – rather than the euro – turning into the favoured avenue for investing outside the U.S.

“Foreigners are buying both stocks and bonds,” he said.

“With a stronger government, the market hopes for higher growth.”Yen gains could easily accelerate, analysts said, if it broke past resistance around 152 per dollar, or even the 200-day moving average at 150.5. It has also made headway against crosses, rising 2% on the euro in two sessions and breaking to the strong side of a 50-day moving average.

Overnight data showed U.S. job growth unexpectedly accelerated in January and the unemployment rate fell to 4.3%. A survey published earlier in the month showed a surprise rebound in U.S. factory activity in January.

Thursday morning moves were fairly small, but the Australian dollar was above 71 cents and creeping back towards a three-year top after the central bank governor said the board would hike rates again if inflation becomes entrenched.

The euro was firm at $1.1875, sterling held at $1.3628 and the kiwi at $0.6052.

The other major mover on the dollar in recent weeks has been China’s yuan, which has been a steady gainer on the back of booming exports and hints from authorities that China may tolerate a stronger currency.

Corporate demand ahead of the Lunar New Year holiday helped it to a 33-month top of 6.9057 per dollar on Wednesday and in offshore trade on Thursday it was a fraction firmer still at 6.9025.

This week the U.S. dollar index is down 0.8% to 96.852. In terms of potential catalysts, U.S. jobless claims figures are due later on Thursday and January inflation data is due on Friday.

Business

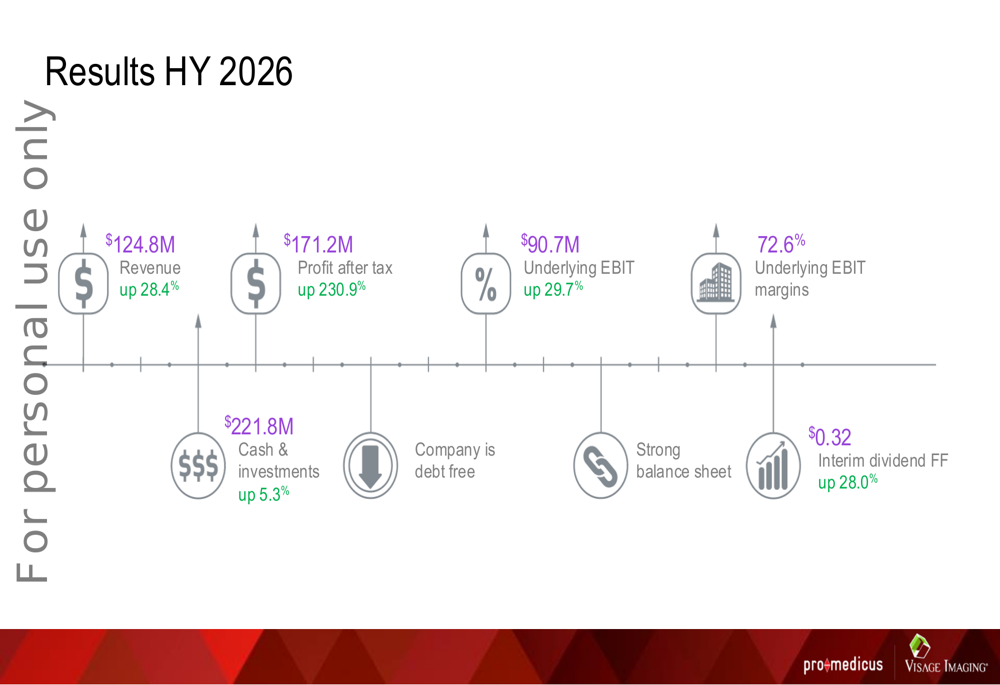

Pro Medicus HY 2026 slides reveal strong growth despite stock price drop

Pro Medicus HY 2026 slides reveal strong growth despite stock price drop

Business

US FTC raises concerns over accusations Apple News favors articles from left-wing outlets

US FTC raises concerns over accusations Apple News favors articles from left-wing outlets

Business

IDB president says El Salvador to receive $1.3 billion in 2026

IDB president says El Salvador to receive $1.3 billion in 2026

Business

Ford posts $11.1B quarterly loss on EV charges, worst quarter since 2008

Valvoline CEO Lori Flees discusses the used car boom, decreased interest in electric vehicles and more on ‘The Claman Countdown.’

Ford on Tuesday posted its largest quarterly loss since 2008 amid losses in the automaker’s electric vehicle (EV) division, as well as the impact of tariffs and a fire that impacted an aluminum supplier.

The Detroit automaker reported a fourth quarter net loss of $11.1 billion after previously disclosing large writedowns to its EV programs, which the company is realigning in response to lower-than-expected consumer demand and changing federal subsidies.

“I think the customer has spoken,” Ford CEO Jim Farley said on the company’s earnings call. “That’s the punchline.”

The company lost $4.8 billion on EVs last year and projects 2026 will bring losses in the range of $4 billion to $4.5 billion, adding that the division will continue losing money for at least the next two years. Ford CFO Sherry House said during the earnings call that the automaker is targeting break-even for its EV unit in 2029.

Ford also announced a larger than previously reported financial hit from tariff costs, as the company lost an additional $900 million after the Trump administration said in December that a tariff-relief program would only be retroactive to November, rather than back to May as originally anticipated.

FORD CUTS ELECTRIC F-150 LIGHTNING PRODUCTION, TAKES $19.5B CHARGE IN STRATEGIC SHIFT

Ford became famous for its revolutionary assembly line, introduced with the Model T in 1908. (Jeff Kowalsky/Bloomberg via Getty Images )

The automaker’s tariff bill last year was about $2 billion and Ford indicated it expects tariff costs will be roughly the same level this year.

Ford was more reliant on imported aluminum due to a pair of fires that impacted an aluminum plant near Oswego, New York, which isn’t expected to be fully operational again until sometime between May and September.

Despite those headwinds, Ford’s fourth quarter revenue of $45.9 billion beat analysts’ expectations. The company narrowly missed its revised guidance of $7 billion, as it posted earnings before interest and taxes of $6.8 billion for the year.

REGULATORS EXPAND PROBE INTO NEARLY 1.3M FORD F-150 PICKUP TRUCKS OVER TRANSMISSION ISSUES

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| F | FORD MOTOR CO. | 13.80 | +0.21 | +1.55% |

Late last year, Farley announced the company is cutting production of the electric F-150 Lightning and refocusing its investment on hybrid vehicles and affordable EVs, resulting in a $19.5 billion charge on its EV assets and product roadmap.

He said the move would allow the company to refocus investments in higher margin areas like American-built trucks, vans and hybrids across its lineup, as well as more affordable EVs.

FORD CEO HAILS TRUMP FUEL STANDARDS RESET AS A ‘VICTORY’ FOR AFFORDABILITY AND COMMON SENSE

Ford CEO Jim Farley previously announced EV writedowns and strategic pivot. (Emily Elconin/Bloomberg via Getty Images)

The company is planning a $30,000 EV platform and has signaled it will start rolling out an electric pickup on that platform next year. Ford also plans to pursue targeted partnerships in certain markets and investments in hybrid technologies.

“I do believe this is the right allocation of capital. It’s a combination of partnerships where it makes sense, efficient partial electrification investments where we have revenue power, and really hitting the EV market in the core,” Farley told analysts on a call Tuesday.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Reuters contributed to this report.

Business

FDA escalates cake mix recall to Class I over undeclared milk allergen

Check out what’s clicking on FoxBusiness.com.

The U.S. Food and Drug Administration (FDA) has elevated a nationwide recall of cake and bread mixes to a Class I designation, its most serious warning, issued when a product poses a risk of severe illness or death.

The recall, first announced in December, involves 866 bags of mixes from Dallas-based distribution company B.C. Williams Bakery Service. These include 51 bags of Spice Cake Mix, 720 bags of Bread and Roll Mix and 95 bags of Swiss Chocolate Cake Mix, according to the FDA.

The mixes may contain an undeclared milk allergen that could trigger life-threatening reactions in people with milk allergies, local outlet WHNT reported.

A Class I recall involves a “situation in which there is a reasonable probability that the use of or exposure to a violative product will cause serious adverse health consequences or death,” according to the FDA’s website.

The FDA has elevated a recall of cake and bread mixes to a Class I designation. (iStock / iStock)

Milk allergies, one of the most common food allergies in children, can cause symptoms ranging from vomiting and hives to anaphylaxis, a life-threatening reaction, according to the Mayo Clinic.

The recalled products were packaged in 50-pound bags.

RECALL OF CHEESE PRODUCTS UPGRADED TO HIGHEST DANGER LEVEL OVER LISTERIA-CAUSING BACTERIA: FDA

It was not immediately clear where the products were distributed or whether injuries had been reported. (iStock / iStock)

The recalled items include:

- Spice Cake Mix — Batch 221

- Bread and Roll Mix — Lot #072225-217, Lot #072225-218, Lot #080325-200, Lot #080325-201, Lot #081625-203, Lot #081625-204, Lot #092225-222, Lot #092225-223, Lot #092225-224, Lot #092225-225, Lot #092225-226, Lot #092225-227, Lot #092225-228, Lot #101725-208 and Lot #101725-209

- Swiss Chocolate Cake Mix — Lot #072925-220 and Lot #071825-36

It was not immediately clear where the products were distributed or whether any injuries had been reported.

POPULAR SALAD DRESSINGS, SOLD AT COSTCO AND REPORTEDLY PUBLIX, RECALLED OVER ‘FOREIGN OBJECTS’

The upgraded recall comes amid a wave of food safety concerns. (iStock / iStock)

The upgraded recall comes amid a wave of food safety alerts nationwide.

Thousands of popular products, including Diet Coke and Pringles, are being pulled from some store shelves after federal officials uncovered evidence of rodent and bird contamination at a Midwest distribution center.

Consumers are also being warned to avoid certain cans of Genova Yellowfin Tuna that were mistakenly shipped to stores in nine states despite being recalled last year.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

B.C. Williams Bakery Service did not immediately respond to FOX Business’ request for comment.

Business

WA's Melissa Price considers deputy run

Two WA Liberal MPs go public on the state of their party ahead of a leadership showdown.

Business

The Dutch love four-day working weeks, but are they sustainable?

The Netherlands has the lowest working hours in Europe, but some say it is harming its economy.

-

Politics3 days ago

Politics3 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports2 hours ago

Sports2 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech23 hours ago

Tech23 hours agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics3 days ago

Politics3 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business6 days ago

Business6 days agoQuiz enters administration for third time

-

Crypto World4 hours ago

Crypto World4 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World1 day ago

Crypto World1 day agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’