Crypto World

Coinbase Launches Crypto Wallets for AI Agents

Coinbase has unveiled a wallet infrastructure designed to let AI agents spend, earn, and trade crypto autonomously. The feature, dubbed Agentic Wallets, builds on the AgentKit framework introduced in November 2024 and aims to push agents from answering questions to taking concrete actions in the market. The system enables developers to embed wallets into agents, enabling tasks such as monitoring DeFi positions, rebalancing portfolios, paying for compute and API access, and participating in creator economies. Core to this rollout is x402, Coinbase’s payments protocol built for autonomous AI use cases, which has reportedly processed 50 million transactions to date.

Agentic Wallets are designed to operate across networks, including the Ethereum layer-2 network Base, where agents can manage positions and execute strategies wherever opportunities exist. The approach envisions a future where agents autonomously optimize yields, rebalance liquidity, and deploy capital without requiring explicit, real-time approvals, provided permissions and controls are preconfigured by users. This marks a shift from AI assistants that merely advise to agents that act, according to Coinbase engineers Erik Reppel and Josh Nickerson in a Wednesday post announcing the development.

“The next generation of agents won’t just advise — they’ll act,” Reppel and Nickerson wrote, detailing plans for agents to perform a range of functions from monitoring yields across protocols to executing trades on Base and managing liquidity positions around the clock. They described a scenario in which an agent detects a more favorable opportunity at 3 a.m., rebalances automatically, and does so without explicit approval because user permissions and safety controls are already in place.

AI agents now operable on the Bitcoin Lightning Network

Beyond Ethereum’s Base, Lightning Labs—the team behind Bitcoin’s Layer-2 Lightning Network—rolled out a new toolset enabling AI agents to transact on Lightning through the L402 protocol standard. The update also allows AI agents to run a Lightning node and manage a Lightning wallet containing native Bitcoin (BTC) without accessing private keys. This development broadens the scope for autonomous financial activity on Bitcoin’s network, providing a parallel pathway for agents to engage with programmable money at the base layer’s second tier.

The push toward agent-enabled wallets comes alongside broader industry activity. Crypto.com CEO Kris Marszalek announced ai.com, a platform intended to let users create personal AI agents to perform everyday tasks on their behalf. The capability ranges from managing emails and scheduling meetings to canceling subscriptions, shopping tasks, and even trip planning. Marszalek described a spectrum of tasks that AI agents could handle, illustrating how these tools might eventually operate as your digital proxy across daily routines.

Why crypto leaders are embracing agentic AI

Industry executives have long warned that AI could redefine how value is exchanged online. In late January, Circle CEO Jeremy Allaire suggested billions of AI agents could transact with crypto and stablecoins for everyday payments within three to five years. Former Binance CEO Changpeng Zhao has echoed a similar sentiment, arguing that a native currency for AI agents is likely to be crypto, capable of supporting tasks from purchasing event tickets to paying restaurant bills. These public statements reflect a shared belief that programmable money and autonomous agents will converge to enable more fluid, real-time financial interactions.

At a higher level, the convergence of AI with decentralized finance and payments ecosystems is driving experimentation around agent autonomy. Google’s recent Universal Commerce Protocol, announced in January, is designed to power agentic commerce by enabling agents to initiate transfers on a user’s behalf, with Google Pay acting as the default payment handler for USD-denominated transactions. The protocol signals a broader push in the tech sector to enable AI-driven commerce that can operate across apps, devices, and payment rails without constant human oversight.

“Build agents that monitor yields across protocols, execute trades on Base and manage liquidity positions 24/7. Your agent detects a better yield opportunity at 3am? It rebalances automatically, no approval needed because you’ve already set permissions and controls.”

As these capabilities mature, momentum in the space is likely to hinge on two dimensions: the robustness of autonomous decision-making and the security of permissioning and governance models. Agentic Wallets must balance the convenience of automated actions with safeguards to prevent unintended risk exposure. The ongoing conversations around risk controls and regulatory alignment will shape how broadly such wallets are adopted by retail and institutional users alike.

Market context

The emergence of autonomous wallets sits within a broader cycle of increased on-chain programmability and the maturation of smart contract-enabled finance. As liquidity provision, yield optimization, and creator economy participation become more automation-friendly, the appetite for self-operating agents grows among developers and institutions alike. The convergence of AI tooling with established networks like Base and the Lightning Network underscores a dual-track approach: one path leverages scalable, smart-contract-enabled ecosystems, while the other emphasizes fast, low-friction payments on Bitcoin’s secondary layer. Regulatory clarity and ETF-related flows in traditional markets are likely to influence how aggressively capital participates in these early-stage, automation-centric use cases.

Why it matters

Agentic Wallets represent a tangible step toward programmable money that can autonomously allocate capital, monitor risk, and adjust exposure across multiple protocols. If successful, the approach could reduce the overhead of manual trading and portfolio management, enabling more people to experiment with sophisticated strategies without in-depth technical know-how. The ability to manage DeFi positions and pay for compute or data access autonomously also has implications for developers building AI-powered financial tools, potentially accelerating product development cycles and new business models in the crypto space.

The integration with Bitcoin’s Lightning Network adds a separate layer of significance. By enabling AI agents to transact via L402 on Lightning and hold a Lightning-compatible wallet, the ecosystem expands the set of on-chain and off-chain rails that can be orchestrated by autonomous programs. This broadens practical use cases for AI agents—from micro-payments to cross-network arbitrage—while testing the limits of permissioned automation and the user controls that balance safety with convenience. Taken together, these developments suggest a future in which agents operate across multiple rails with varying latency, fees, and settlement characteristics.

For users and builders, the key takeaway is a shift in how wallets are used and who controls them. Agentic Wallets place agency in the hands of AI-enabled programs, but with computerized governance that requires explicit permissions ahead of time. The risk-management framework around such permissions will be critical to its sustainable adoption, particularly as public enthusiasm for automation intersects with concerns about security and misuse. The coming months are likely to reveal the first generation of real-world deployments and decision-making heuristics that will define the role of agents in everyday crypto activity.

What to watch next

- Expansion of Agentic Wallets beyond Base to other Ethereum layer-2s and compatible networks, including any developer updates from Coinbase.

- Tracking adoption and volume on the x402 payments protocol, including any reported milestones beyond the 50 million transactions already noted.

- Broader deployment of AI agents on Bitcoin via the Lightning Network using L402, and the integration of wallets with Lightning node operations.

- Progress and practical traction for ai.com by Crypto.com, including user adoption metrics and featured autonomous tasks.

- Further details on Google’s Universal Commerce Protocol and collaboration milestones that enable agent-initiated transfers and payments in real-world settings.

Sources & verification

- Coinbase: Introducing AgentKit — developer-facing overview and the roadmap for embedding wallets into autonomous agents.

- Coinbase Developer Platform status updates on AgentKit and Agentic Wallets deployment.

- Lightning Labs: L402 protocol standard enabling AI agents to transact on Lightning and manage Lightning-enabled wallets.

- Crypto.com: ai.com platform launch and its scope for personal AI agents performing daily tasks.

- Google: Universal Commerce Protocol and Agent Payment Protocol 2 for agent-enabled transfers in commerce.

Key figures and next steps

Coinbase’s public framing of Agentic Wallets as a step toward “agents that act” follows a broader wave of AI-powered automation across crypto layers. The combination of AgentKit, x402, and multi-network reach—spanning Base and the Lightning Network—provides a multi-faceted testbed for autonomous financial activity. Investors and builders will be watching for evidence of sustainable user authorization models, transparent risk controls, and clear metrics around automated yield optimization and liquidity management. As the ecosystem experiments with agent-based transactions, market participants will assess whether these autonomous wallets can reliably operate without compromising security or user intent.

Crypto World

Was The 40% Rally A Retail Trap?

Uniswap price is up around 3% over the past 24 hours, trading near $3.40. But this small move hides what really happened on February 11. That day, UNI surged nearly 42% to a high near $4.57 after news linked Uniswap to BlackRock’s tokenized fund expansion.

Since then, sellers have erased about 26% of that rally. This raises a key question: was this institutional-driven breakout a real trend shift, or a trap for retail buyers?

Uniswap Price Breakout on February 11 Was Driven by Retail Momentum

The rally on February 11 did not happen randomly.

Sponsored

Sponsored

On the 12-hour chart, Uniswap price had been forming a bullish setup since mid-January. Between January 19 and February 11, UNI made lower lows while the Relative Strength Index, or RSI, made higher lows. RSI measures momentum by tracking buying and selling strength. When price falls, but RSI rises, it signals a bullish divergence, often warning that selling pressure is weakening.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This divergence suggested that a rebound was building.

That signal was confirmed on February 11. On that day, On-Balance Volume, or OBV, broke above a long-term descending trendline. OBV tracks whether volume is flowing into or out of an asset. When OBV breaks upward, it usually shows growing retail participation. The timing was important.

RSI divergence had been in place for weeks. OBV only broke out on February 11, exactly when the BlackRock-linked news hit the market. This shows that retail traders reacted aggressively to the headline, rushing into UNI.

Sponsored

With momentum and volume aligned, the Uniswap price surged to around $4.57 in a single session. But the structure of that candle raised early warning signs.

On the 12-hour chart, the breakout candle formed with a very long upper wick and a small body. This means buyers pushed the price higher, but sellers absorbed most of the move before the close. It was the first sign that a strong supply existed near $4.50. The rally looked powerful. But distribution had already started.

Whale Selling Near $4.57 Explains the Sharp Rejection

The long wick on February 11 was not driven by random selling. Whale data shows who was responsible.

On that day, supply held by large Uniswap holders dropped sharply from about 648.46 million UNI to 642.51 million UNI. That is a reduction of roughly 5.95 million tokens. At prices near $4.57, this represents selling pressure worth about $27 million.

This was not profit-taking by small traders. It was a coordinated distribution by large wallets.

Sponsored

Sponsored

While retail buyers were chasing the breakout, whales were exiting into strength. This explains why the UNI price failed to hold above $4.50 and why the rally collapsed so quickly. Once large holders finished selling, buy-side momentum weakened. Without whale support, the market could not sustain elevated prices.

The result was a fast retracement. From the $4.57 peak, the Uniswap price fell about 26%. Most late buyers were possibly immediately pushed into losses. This confirms that the BlackRock-related surge became a liquidity event for large holders.

Retail provided the demand. Whales provided the supply.

4-Hour Chart Shows the Uniswap Price Rally Target Was Already Completed

The lower timeframe explains why the pullback started so quickly. On the 4-hour chart, Uniswap had been forming an inverse head-and-shoulders pattern inside a descending channel. This is a classic reversal structure that often signals a short-term breakout.

Sponsored

Sponsored

On February 11, UNI broke above the neckline of this pattern and quickly reached its projected target near $4.57. In technical terms, the setup had already completed its measured move.

At the same time, the 4-hour OBV divergence became clear. Between late January and February 11, UNI moved higher, but OBV continued trending lower. This shows that volume strength was weakening even as the price rose. This bearish OBV divergence warned that the breakout was not being supported by sustained retail demand. Plus, the OBV is currently trending down, showing retail offloading.

Retail traders focused on the price move. Whales focused on the structure. By the time most buyers entered, the rally was already mature. Now, price is drifting near $3.40 while volume continues to weaken. This suggests that speculative demand is fading.

If UNI holds above $3.21, the market may attempt consolidation. But this support is fragile because it is built on short-term buying, not long-term accumulation.

A breakdown below $3.21 would likely trigger another sell wave. In that case, the next major level sits near $2.80, which marks the head of the prior reversal pattern. A move to this zone would erase all of the BlackRock-driven gains.

To regain strength, Uniswap price must reclaim the $3.68 to $3.96 region. This area now acts as a major obstacle after the failed breakout. Only a sustained move above it would reopen upside toward $4.57.

Crypto World

WhatsApp Accuses Russia of Restricting Access for Millions of Users

WhatsApp, the messaging app owned by social media giant Meta, has accused Russia of attempting to block access for millions of its users to push them towards its state-owned alternative.

“Trying to isolate over 100 million users from private and secure communication is a backward step and can only lead to less safety for people in Russia. We continue to do everything we can to keep users connected,” the company said in an X post on Wednesday.

Moscow’s state-backed platform Max was launched in March 2025 by Russian tech firm VK as a domestic alternative to foreign-owned services such as WhatsApp and Telegram.

The government has since been promoting it heavily, making it mandatory for all smartphones sold in the country starting Sept. 1 to be pre-installed.

SEO firm Backlinko estimates that Russia has the fourth-largest active monthly WhatsApp user base, with 72 million users, behind Indonesia, Brazil, and India.

Russian media reports claim WhatsApp is inaccessible

Gazeta.ru, a Russian online news website based in Moscow, reported Wednesday that WhatsApp’s domain had been completely blocked, making it inaccessible without a VPN or similar workaround.

The outlet also reported, citing state-owned news agency TASS, that presidential press secretary Dmitry Peskov said unblocking WhatsApp in Russia would require the messaging service to follow Russian laws and show a willingness to negotiate.

Last year, Moscow began limiting some calls on WhatsApp and Telegram, accusing the platforms of failing to share information with law enforcement and of not storing Russian user data in the country.

In January, Andrey Svintsov, a deputy of the State Duma, the lower house of Russia’s national legislature, told TASS that the country’s telecom regulator would adopt measures to completely block WhatsApp by the end of 2026.

Other countries restricting messaging services

Other countries have reportedly used communication restrictions in times of conflict.

In December, Ugandan politician and opposition leader Bobi Wine encouraged his supporters to download Jack Dorsey’s decentralized peer-to-peer messaging service Bitchat and accused the government of planning to cut communications in the lead-up to the election.

Related: Afghanistan internet blackout ’a wake-up call’ for blockchain decentralization

Meanwhile, in September, the African island nation of Madagascar experienced a spike in Bitchat downloads amid protests and communication disruptions, following a similar uptick during unrest in Nepal and Indonesia earlier that same month.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Crypto World

Ethereum Set For V-Shaped Recovery, Fundstrat’s Lee Says

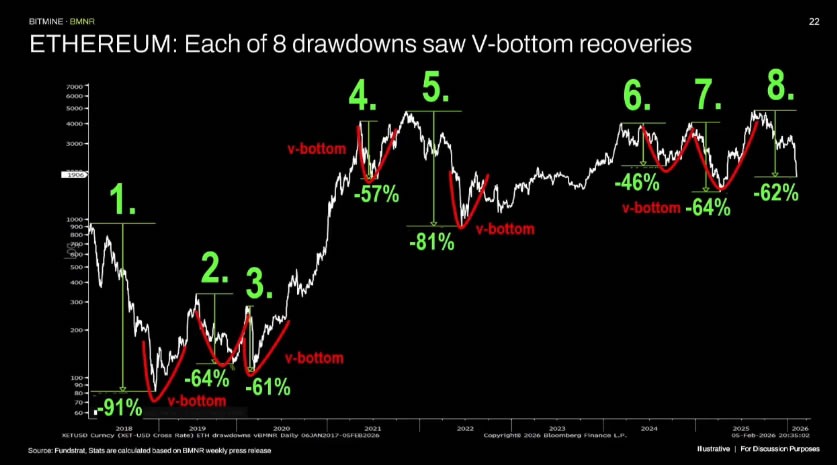

Fundstrat head of research Tom Lee said he expects Ether to rebound quickly following recent declines, arguing the asset has experienced eight such recoveries since 2018.

“A lot of people are frustrated, but keep in mind that Ethereum, since 2018, has fallen more than 50% eight times,” Lee said at a conference in Hong Kong on Wednesday.

Last year, Ethereum fell 64% from January to March, he added.

“But eight out of eight times, Ethereum has had a V-shaped bottom. So it has recovered 100% of the time within almost the same speed that it fell.”

He argued that nothing has changed and that Ether (ETH) will see another V-shaped bottom.

ETH is close to the bottom, says Lee

BitMine market analyst Tom DeMark flagged the $1,890 price level as a potential bottom but said it would tap this twice in an “undercut.” Lee stated that this would be a “perfected bottom,” adding:

“We think Ethereum is really close to the bottom, and I think it’s just like the fall of 2018, fall of 2022, and April 2025. You don’t really have to worry about the bottom. If you’ve already seen a decline, you should be thinking about opportunities here instead of selling.”

Related: Analysts debate whether Ether has capitulated or has further to fall

Ether prices on Coinbase tanked to $1,760 on Feb. 6, just short of the 2025 low of just over $1,400, according to TradingView.

The asset has failed to hold above $2,000, falling to $1,970 at the time of writing following a 37% crash over the past 30 days.

Ether staking entry wait at all-time high

Despite the asset’s poor performance this year, data shows there is still strong demand for Ether staking.

The current wait to stake Ether is at an all-time high of 71 days with a record 4 million ETH in the validator entry queue, according to ValidatorQueue. The percentage of supply staked is also at a record high of 30.3% or 36.7 million ETH.

The obvious impact of this is a “massive supply restriction,” said analyst “Milk Road” on Wednesday.

“One-third of all ETH is now illiquid, earning a modest 2.83% APR,” they added. “That’s not sexy yield by crypto standards. Yet people are lining up anyway.”

“When people lock up $74 billion during a price dip, they’re not speculating. They’re settling in.”

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

Crypto World

Strategy CEO Announces Expanded Perpetual Preferred Stock Issuance Amid Bitcoin Volatility

TLDR:

- Strategy’s “Stretch” preferred shares offer 11.25% variable dividend with monthly resets to stabilize price

- The company holds 714,000 Bitcoin worth $48 billion but stock dropped 73% since November 2024 record high

- Preferred shares represent just $7 million of funding versus $370 million in common stock sales recently

- Bitcoin fell below $67,000, down nearly 50% from October peak of $125,260, pressuring Strategy’s model

Strategy perpetual preferred stock will see increased issuance as CEO Phong Le addresses mounting investor concerns over share price volatility.

The Bitcoin treasury company announced plans to expand its “Stretch” product offering, which provides digital asset exposure with reduced risk through a monthly reset dividend mechanism.

Currently, the preferred shares represent a modest portion of Strategy’s capital structure, with $7 million issued compared to $370 million in common stock for recent Bitcoin acquisitions.

New Preferred Share Product Targets Risk-Averse Investors

Strategy has engineered the Stretch preferred shares to appeal to investors seeking digital asset exposure without extreme price swings.

The product features a variable dividend rate currently set at 11.25%, according to Le’s interview with Bloomberg Television. The monthly rate adjustments serve a specific purpose: encouraging the security to trade near its $100 par value.

“We’ve engineered something to protect investors who want access to digital capital without that volatility,” Le said in the Bloomberg Television interview.

This structure differs markedly from the company’s common stock, which has experienced severe price fluctuations tied to Bitcoin movements.

The preferred shares have accounted for just $7 million of Strategy’s recent funding activities. Meanwhile, common stock sales totaling $370 million have financed the company’s last three weekly Bitcoin purchases.

Le emphasized the product’s protective features during his television appearance, noting it provides access to digital capital without volatility.

The company holds more than 714,000 Bitcoin currently valued at approximately $48 billion. However, the common shares used to fund ongoing cryptocurrency purchases have been trading erratically.

Strategy’s funding model previously allowed the company to issue new stock at premiums above its Bitcoin holdings value.

That premium has essentially disappeared, creating challenges for the capital-raising cycle. Tightening capital markets have further complicated the company’s funding strategy.

Market Downturn Pressures Treasury Model Performance

Bitcoin’s price decline has directly affected Strategy’s financial performance and stock valuation. The cryptocurrency fell below $67,000 on Wednesday, representing nearly a 50% drop from its October peak of $125,260. Strategy’s common stock mirrored this decline, falling 5% on Wednesday alone.

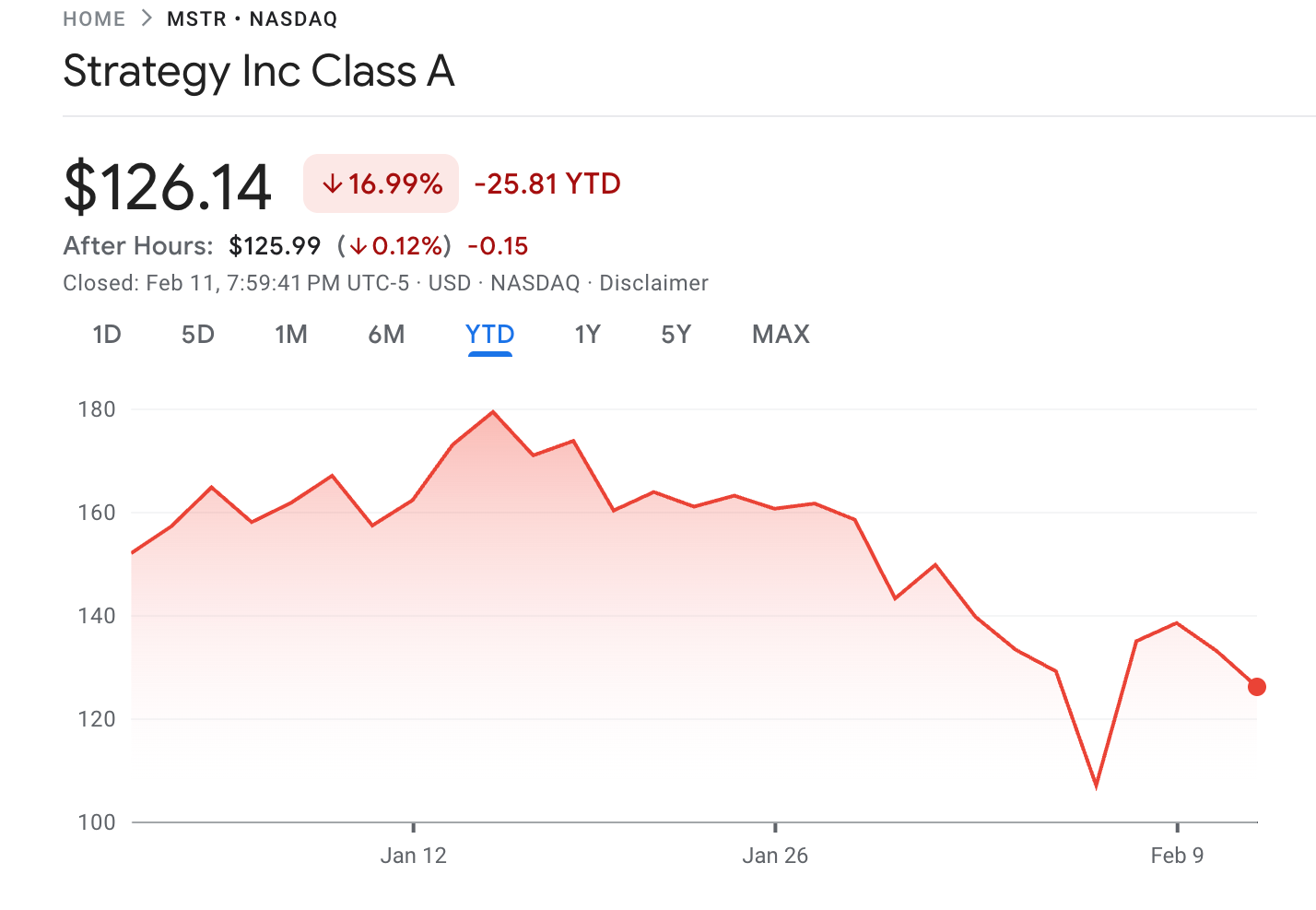

Year-to-date performance shows Strategy shares down 17% in 2026. More dramatically, the stock has plunged 73% since reaching record highs in November 2024. The company reported a net loss of $12.4 billion for the fourth quarter.

Cryptocurrencies have struggled since October’s liquidation wave damaged market confidence. The downturn has stalled Strategy’s previously successful model of issuing stock, purchasing Bitcoin, and repeating the cycle.

That approach worked when shares traded substantially above the company’s cryptocurrency holdings value.

Executive chairman and co-founder Michael Saylor addressed concerns about potential forced sales during a CNBC appearance Tuesday.

He dismissed worries that declining Bitcoin prices might compel the company to liquidate holdings as “unfounded.”

Saylor confirmed Strategy intends to continue purchasing Bitcoin every quarter despite current market conditions. The company remains committed to its Bitcoin acquisition strategy regardless of short-term price movements.

Crypto World

Why Strategy’s Preferred Stock Strategy Matters for MSTR Holders

Strategy, formerly known as MicroStrategy, plans to issue additional perpetual preferred stock in a bid to ease investor concerns over the volatility of its common shares, according to its chief executive officer.

The announcement comes as Strategy’s stock, trading under the ticker MSTR, has fallen nearly 17% year to date.

Sponsored

In a recent interview with Bloomberg, Strategy CEO Phong Le addressed Bitcoin’s price swings. He attributed its volatility to its digital characteristics. When BTC rises, Strategy’s digital asset treasury plan drives outsized gains in its common stock.

Conversely, during downturns, the shares tend to decline more sharply. He noted that Digital Asset Treasuries (DATs), including Strategy, are engineered to follow the leading cryptocurrency.

To address this dynamic, the company is promoting its perpetual preferred shares, branded “Stretch.”

“We’ve engineered something to protect investors who want access to digital capital without that volatility and that’s Stretch,” Le told Bloomberg.” To me, the story of the day is Stretch closes at $100 exactly how it was engineered to perform.”

The preferred shares offer a variable dividend, currently set at 11.25%, with the rate reset monthly to encourage trading near the $100 par value.

It’s worth noting that preferred stock has so far represented only a small portion of Strategy’s capital-raising activity. The company sold approximately $370 million in common stock and about $7 million in perpetual preferred shares to fund its previous three weekly Bitcoin purchases.

Sponsored

However, Le said, Strategy is actively educating investors about what preferred shares can do.

“It takes some seasoning. It takes some marketing,” he said. “This year, we have seen extremely high liquidity with our preferreds, about 150 times other preferreds, and as we go throughout the course of this year, we expect Stretch to be a big product for us. We will start to transition from equity capital to preferred capital.”

MicroStrategy’s Bitcoin Bet Under Pressure With Shares Trading Below Net Asset Value

The shift could prove important as Strategy’s traditional funding model faces pressure. Strategy continues to expand its Bitcoin holdings, purchasing more than 1,000 BTC earlier this week. As of the latest data, the firm holds 714,644 BTC.

Sponsored

However, the recent decline in Bitcoin’s price has weighed heavily on the company’s balance sheet. At current market prices of around $67,422 per coin, Bitcoin is trading well below Strategy’s average purchase price of approximately $76,056. As a result, the company’s holdings reflect an unrealized loss of roughly $6.1 billion.

The company’s common stock has mirrored that decline, falling 5% on Wednesday alone. MSTR is roughly down 17% so far this year. In comparison, Bitcoin has fallen more than 22% over the same period.

As mentioned before, Strategy’s Bitcoin accumulation strategy has relied more on equity issuance. A key metric in this model is its multiple to net asset value, or mNAV, which measures how the company’s stock trades relative to the value of its Bitcoin per share.

According to SaylorTracker data, Strategy’s diluted mNAV was approximately 0.95x, indicating the stock traded at a discount to the Bitcoin backing each share.

Sponsored

That discount complicates the company’s approach. When shares trade above net asset value, Strategy can issue stock, purchase additional Bitcoin, and potentially create accretive value for shareholders. When shares trade below net asset value, new issuance risks diluting shareholders instead.

By increasing its reliance on perpetual preferred stock, Strategy appears to be adjusting its capital structure to sustain its Bitcoin acquisition strategy while attempting to address investor concerns over volatility and valuation pressure.

For MSTR shareholders, the shift toward perpetual preferred stock could reduce dilution risk. By relying less on common equity issuance, Strategy may preserve Bitcoin per share and limit pressure from discounted share sales.

However, the move also introduces higher fixed dividend obligations, increasing financial commitments that could weigh on the company if Bitcoin remains under pressure. Ultimately, the plan reshapes the risk profile rather than eliminating the underlying volatility tied to its Bitcoin treasury.

Crypto World

UK appoints HSBC for blockchain bond pilot

Britain is positioning itself to become the first G7 nation to issue sovereign debt on the blockchain, appointing banking giant HSBC and law firm Ashurst to steer a digital gilt trial expected this year, according to the Financial Times.

The Treasury’s selection of the two firms aims to quell growing criticism that the U.K. has been dragging its feet on tokenized government bonds. While Chancellor Rachel Reeves unveiled the pilot plan in late 2024, other jurisdictions including Hong Kong have already crossed the finish line with their own digital sovereign issuances.

The pilot aims to slash settlement time and operational costs for market participants. The experiment will run within the Bank of England’s “digital sandbox,” a controlled environment where financial innovations can operate under relaxed regulatory constraints.

HSBC has experience in digital debt offerings, having orchestrated over $3.5 billion in digital bond issuances through its proprietary Orion blockchain — including Hong Kong’s $1.3 billion green bond last year, one of the largest tokenized debt sales globally.

On Wednesday, Hong Kong Financial Secretary Paul Chan Mo-po said the multicurrency offering helped boost liquidity on the product.

“We will regularize the issuance of tokenized green bonds,” he said at CoinDesk’s Consensus Hong Kong conference, which could support further adoption.

Crypto World

XRP Price Analysis: Critical $1.65 Level Tests Relief Rally While $0.90 Target Looms

TLDR:

- XRP reached first relief target at $1.52 after RSI hit multi-year lows during last week’s selloff

- Critical $1.65 resistance zone will determine if XRP continues rally or drops toward $0.90 support

- Ripple partners with Aviva Investors to tokenize real-world assets on XRP Ledger throughout 2026

- Analysts warn against panic selling as XRP flirts with correction lows and potential bullish setup

XRP price action shows signs of relief following last week’s sharp decline that pushed technical indicators to extreme levels.

Market analysts track the $1.65 resistance zone as a critical threshold for the digital asset’s near-term direction. A failure at this level could open the door to targets as low as $0.90.

The current phase presents multiple scenarios for traders watching key support and resistance zones.

Critical Price Levels Define XRP’s Next Move

XRP has entered a Wave 4 relief phase after last Thursday’s massive selloff tested market sentiment. Technical analyst CasiTrades noted the decline pushed RSI to multi-year lows across trading platforms.

The subsequent bounce has already reached the first Wave 4 target near $1.52. This price point coincides with the 0.382 retracement level and macro 0.65 fibonacci zone.

The market now approaches a decisive juncture at the $1.65 resistance area. This level represents the 0.5 retracement and macro 0.618 fibonacci extension.

The asset’s ability to flip this zone into support will determine the next directional move. Technical patterns suggest two distinct paths forward based on price behavior at current levels.

A rejection at $1.65 could trigger another wave down to lower support zones. CasiTrades outlined potential targets at $1.09 and approximately $0.90 in this scenario.

These levels would mark the completion of a corrective structure from recent highs. The analyst emphasized that RSI has reset enough to allow for such a move.

However, the relief bounce offers an alternative bullish scenario for market participants. If XRP successfully reclaims $1.65 and holds it as support, buying pressure could increase.

Traders would then wait for confirmation through a back-test of this support level. The analyst cautioned against panic selling given the asset’s proximity to correction lows.

Ripple Partnership Adds Fundamental Support

Ripple announced a collaboration with Aviva Investors to tokenize real-world assets on XRP Ledger. Reece Merrick from Ripple shared the development, marking the first partnership with a European investment management firm.

The initiative will bring traditional fund structures to the blockchain throughout 2026. Aviva Investors cited the ledger’s speed, cost efficiency, and sustainability as key factors.

The partnership addresses growing institutional interest in blockchain-based asset management solutions. Traditional finance firms continue exploring distributed ledger technology for operational advantages.

XRP Ledger provides the infrastructure necessary for large-scale tokenization projects. European investment managers show increasing willingness to adopt blockchain platforms.

Asset tokenization represents a expanding sector within the digital asset industry. The collaboration aims to bridge institutional finance with blockchain utility at scale. Real-world assets moving onto public ledgers could drive long-term adoption metrics. This development provides fundamental support independent of short-term price fluctuations.

The announcement comes as XRP navigates technical correction levels on price charts. Fundamental developments often diverge from immediate market sentiment during volatile periods.

Long-term investors may view the partnership as validation of the ledger’s institutional appeal. Technical traders meanwhile focus on price action to determine entry and exit points.

Crypto World

Strategy to issue more preferred stock to reduce volatility

Strategy is turning to preferred stock to keep buying Bitcoin while easing pressure from market swings.

Summary

- Strategy is issuing more preferred shares to fund Bitcoin purchases.

- The “Stretch” stock pays an 11.25% variable dividend and aims for price stability.

- The move targets investors seeking crypto exposure with lower risk.

Strategy is expanding its use of preferred stock as it looks for new ways to fund Bitcoin purchases while reducing pressure from market volatility.

The move comes as the company’s share price continues to closely track swings in the cryptocurrency market.

A new approach to managing risk

In a Feb. 12 interview with Bloomberg, chief executive officer Phong Le said the company is offering more perpetual preferred shares to attract investors who want exposure to digital assets without extreme price changes. The product, known as “Stretch,” pays a variable dividend that is adjusted each month.

The current dividend rate stands at 11.25%. The structure is designed to keep the stock trading close to its $100 par value. This helps limit sharp price movements that are common in Strategy’s regular shares.

Preferred shares sit above common stock in the company’s capital structure but below debt. They usually offer a steady income and priority on dividends, while giving up voting rights. This makes them appealing to investors who value stability over rapid growth.

Funding Bitcoin while limiting volatility

Over the past three weeks, Strategy raised about $370 million through common stock sales and another $7 million through preferred shares. The funds were used to buy more Bitcoin (BTC), pushing the company’s total holdings above 714,000 BTC, worth roughly $48 billion.

For years, Strategy’s business model has been built around using capital markets to accumulate Bitcoin. As a result, its stock often behaves like a leveraged version of the cryptocurrency. When Bitcoin rises, the stock tends to surge. When prices fall, losses are often amplified.

Bitcoin has dropped around 50% from its recent peak, which has weighed heavily on Strategy’s shares. This slowdown has made it harder for the company to rely only on common stock sales for funding.

Preferred stock offers another option. The steady dividend and price controls are meant to attract institutions such as pension funds, insurers, and banks. These investors often prefer predictable returns rather than high-risk exposure.

Co-founder Michael Saylor has repeatedly said the company has no plans to sell its Bitcoin. Strategy intends to continue buying more each quarter, regardless of market conditions.

Analysts say preferred shares also strengthen the company’s balance sheet. Compared with convertible bonds, they reduce refinancing risk and limit sudden dilution for existing shareholders.

Strategy raised about $5.5 billion through several preferred stock offerings in 2025. The latest issuance continues that pattern, showing that the company sees long-term value in this funding model.

Crypto World

Paxos Labs Launches Privacy-Preserving USAD Stablecoin on Aleo Network

TLDR:

- USAD offers privacy-preserving transactions while maintaining regulatory oversight capabilities

- Paxos leverages its established infrastructure to issue compliant stablecoins on Aleo’s platform

- Circle previously partnered with Aleo for USDCx, showing competitive interest in privacy solutions

- Aleo raised $200 million at $1.45 billion valuation from SoftBank, a16z, and Coinbase Ventures

Privacy-preserving USAD stablecoin has launched on the Aleo Layer 1 mainnet through a partnership between Paxos Labs and Aleo Network.

The collaboration introduces digital dollars to a zero-knowledge powered environment. The stablecoin offers privacy and programmability features for enterprise users.

Aleo previously partnered with rival issuer Circle to pilot USDCx. The launch reflects growing institutional demand for privacy-focused blockchain solutions.

Partnership Details and Technical Framework

Paxos Labs will issue USAD using its established infrastructure to meet regulatory oversight requirements. The stablecoin operates on Aleo’s zero-knowledge cryptography platform.

The technology provides end-to-end encryption by default. The platform conceals participant identities, wallet addresses, and transaction amounts from public view.

Aleo COO Leena Im explained the stablecoin design incorporates Paxos’ issuance infrastructure. The system meets “oversight requirements while still protecting sensitive user information,” Im noted.

The balance between privacy and oversight represents a core technical achievement. Selective disclosure capabilities allow for regulatory compliance without compromising user confidentiality.

USAD supports traditional payment functions as well as advanced programmable applications. The stablecoin enables use cases difficult to execute on transparent blockchains.

Target applications include discreet payroll processing, business-to-business payments, and anonymous decentralized finance activities. Furthermore, enterprises can embed trusted digital currency into their platforms.

Paxos Labs co-founder Bhau Kotecha emphasized the strategic value of the collaboration. “Working with Aleo, we are bringing digital dollars into an environment where privacy and programmability are built in from the start,” Kotecha said.

He added that enterprises gain “a way to embed money they can trust.” The executive expects more organizations to deploy custom assets on blockchain platforms.

Kotecha noted that stablecoins continue to impact traditional financial rails. He stated Aleo and its team are “already ahead of the curve” on this development.

The trend toward programmable money reshapes financial infrastructure. Organizations increasingly value privacy-preserving transaction capabilities for commercial operations.

Market Context and Company Background

The launch occurs amid rising interest in institutional-grade privacy solutions for blockchain assets. Businesses want blockchain benefits without exposing sensitive commercial details on transparent networks.

Circle previously selected Aleo to develop USDCx, a privacy-focused version of its flagship token. The competitive landscape shows multiple issuers exploring privacy-preserving stablecoin technology.

Paxos has established experience in the stablecoin sector through partnerships with major platforms. The company previously issued stablecoins for PayPal and Binance.

Moreover, Paxos plays a role in the Global Dollar consortium. The USDG initiative includes Anchorage Digital, Bullish, Kraken, OKX, Robinhood, and World.

Aleo Network launched its mainnet in September 2024 after several years of development. The Layer 1 project raised $200 million in a 2022 Series B funding round.

The company achieved a valuation of $1.45 billion during the financing. SoftBank’s Vision Fund 2 and Kora Management co-led the investment.

The project has attracted backing from prominent investors across the blockchain ecosystem. Notable supporters include a16z, Softbank, Coinbase Ventures, Samsung Next, and Tiger Global.

The investor roster demonstrates confidence in zero-knowledge technology applications. Aleo’s platform aims to enable privacy-focused blockchain solutions for enterprise adoption.

Crypto World

Thailand Approves Bitcoin For Derivatives Trading Markets

Thailand’s government on Tuesday approved the Finance Ministry’s proposal allowing digital assets to be used as underlying assets in the country’s derivatives and capital markets.

The move aims to modernize Thailand’s derivatives markets in line with international standards, strengthen regulatory oversight and investor protection, and position itself as a regional hub for institutional crypto trading, the Bangkok Post reported.

The country’s Securities and Exchange Commission (SEC) will amend the Derivatives Act to enable these new asset classes, which include Bitcoin (BTC) and carbon credits.

“The decision to formally recognize digital assets, including cryptocurrencies and digital tokens […] reflects a growing understanding that digital assets are no longer merely speculative instruments, but an emerging asset class with the potential to reshape the foundations of capital markets,” said Nirun Fuwattananukul, chief executive of Binance Thailand.

He added that it was a “watershed moment” for the country’s capital markets, sending a “strong signal” that Thailand is positioning itself as a “forward-looking leader” in Southeast Asia’s digital economy.

Strengthening crypto recognition for investors

Thailand is targeting wealthy institutional investors as it expands its crypto ambitions. The move also aligns with the Stock Exchange of Thailand’s plans to introduce Bitcoin futures and exchange-traded products in 2026.

Related: Thailand plans crypto ETF rules as institutional interest increases

SEC secretary-general Pornanong Budsaratragoon said the move will “strengthen the recognition of crypto as an asset class, promote market inclusiveness, enhance portfolio diversification, and improve risk management for investors.”

Still no crypto payments in Thailand

Retail trading remains popular in Thailand, with the Kingdom’s largest exchange, Bitkub, seeing daily volumes of $65 million, according to CoinMarketCap.

However, the central bank has outlawed crypto payments, and consumer stablecoin use remains restricted.

The government launched an app in August for short-term tourists to convert crypto to local currency, but users must undergo stringent Know Your Customer (KYC) and customer due diligence checks, and usage remains restricted to government-approved outlets.

Thailand launched a campaign in January against so-called “gray money,” targeting crypto as part of an effort to combat money laundering.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business3 days ago

Business3 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports6 hours ago

Sports6 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World7 hours ago

Crypto World7 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video2 hours ago

Video2 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month