Crypto World

US Fines Paxful $4M for Funds Linked to Trafficking and Fraud

In a high‑profile enforcement action, Paxful, the peer‑to‑peer crypto exchange, was ordered to pay $4 million after admitting it knowingly profited from criminals who used its platform due to lax anti‑money laundering controls. The Department of Justice outlined that Paxful pleaded guilty in December to conspiring to promote illegal prostitution and knowingly transmitting funds derived from crime, in violation of federal AML requirements. The government also detailed that, between January 2017 and September 2019, Paxful facilitated more than 26 million trades valued at nearly $3 billion, earning about $29.7 million in revenue while turning a blind eye to illicit activity. The case centers on how a platform marketed itself as a lenient, low‑information exchange while neglecting core safeguards. The DOJ’s filing underscores that Paxful’s business model depended on attracting criminal users by downplaying compliance obligations.

The Justice Department highlighted that Paxful had agreed the appropriate criminal penalty would be $112.5 million, but prosecutors determined the company could not pay more than $4 million. The settlement reflects a broader push by federal authorities to curb crypto platforms that fail to implement or enforce anti‑money laundering measures, particularly when they facilitate illegal activities such as fraud, extortion, prostitution, and trafficking. The department said Paxful profited from moving money for criminals it attracted with the promise of minimal compliance, a dynamic prosecutors described as corrosive to legitimate finance and to users seeking lawful services.

The case traces to Paxful’s ambitious growth period from 2017 through 2019, when the platform reportedly handled tens of millions of trades and generated substantial revenue despite warnings from investigators about AML gaps. Prosecutors maintained that Paxful’s marketing messaging, which emphasized a lack of required customer information, paired with policies it knew were not implemented or enforced, created a permissive environment for illicit actors. The backers of the case say this approach allowed criminal actors to route funds through Paxful more readily than through regulated channels.

The Justice Department’s description of Paxful’s operational ethos is complemented by a notable cross‑industry connection: the crypto platform had ties to Backpage and a similar site during a period spanning 2015 to 2022, a relationship the government says contributed to Paxful’s profits, estimated at about $2.7 million. While Backpage’s platform was shut down due to illegal activities, the Paxful alliance is cited as a concrete example of how illicit networks exploited crypto rails to monetize wrongdoing. The department noted that Paxful’s founders publicly boasted about the “Backpage Effect,” portraying the collaboration as a catalyst for growth, a claim the government used to illustrate a deliberate strategy of enabling criminal transactions.

The case also sheds light on Paxful’s eventual exit from the market. The exchange halted operations in November, and its October closure‑announcement post—later archived—depicted the decision as a response to “the lasting impact of historic misconduct by former co‑founders Ray Youssef and Artur Schaback prior to 2023, combined with unsustainable operational costs from extensive compliance remediation efforts.” Youssef publicly countered the timing of the closure, suggesting the firm should have closed when he left the company. Meanwhile, Schaback, Paxful’s former chief technology officer, pleaded guilty in July 2024 to conspiring to fail to maintain an effective AML program and awaits sentencing, with a California judge moving his hearing from January to May to accommodate ongoing cooperation with authorities. The DOJ’s account makes clear that a broader reckoning—beyond Paxful’s leadership—extends into the company’s users, employees, and the broader crypto ecosystem.

As authorities pursued the case, officials emphasized that the Paxful matter is not an isolated incident but part of a wider effort to tighten regulatory expectations on crypto marketplaces. The department pointed to the need for robust know‑your‑customer checks, comprehensive AML compliance programs, and proactive monitoring of suspicious activity to deter illicit uses of digital assets. The implications extend to other platforms that operate in the same space, signaling that permissive, low‑oversight models will attract intensified scrutiny from federal law enforcement and regulators.

Key takeaways

- Paxful received a $4 million criminal penalty after pleading guilty to conspiracy related to illegal activities and AML violations, with prosecutors noting a potential maximum penalty of $112.5 million.

- From 2017 through 2019, Paxful facilitated more than 26 million trades valued at nearly $3 billion and amassed around $29.7 million in revenue, according to DOJ filings.

- The DOJ characterizes Paxful as profiting from enabling criminals by downplaying AML controls and failing to comply with applicable money‑laundering laws.

- Prosecutors linked Paxful to illicit revenue streams via partnerships with Backpage and similar platforms, describing profits of about $2.7 million tied to those connections.

- The company shut down operations in November, citing historic misconduct by former co‑founders and the costs of compliance remediation, with ongoing legal actions surrounding Schaback’s case and the broader investigation.

- The case illustrates how enforcement agencies are escalating scrutiny of crypto marketplaces that permit lax due‑diligence and high‑risk activity, reinforcing expectations for AML programs across the sector.

Sentiment: Bearish

Market context: The Paxful action aligns with a broader tightening of crypto‑AML standards as regulators seek to normalize compliance expectations across peer‑to‑peer platforms, exchanges, and other digital asset services, influencing liquidity, risk sentiment, and enforcement tempo across the industry.

Why it matters

The DOJ’s settlement with Paxful underscores a pivotal moment for the crypto‑platform landscape. For users, it signals that providers must demonstrate verifiable diligence in their AML programs or face tangible penalties and reputational damage. For operators, the case reinforces the need to align platform design, user onboarding, and transaction monitoring with established legal requirements rather than relying on marketing narratives about anonymity or minimal information. The development also matters for builders and policymakers. It highlights the costs of lax controls and the potential for illicit activity to undermine trust in decentralized finance ecosystems, prompting crypto firms to invest more heavily in compliance technology, real‑time surveillance, and robust governance frameworks.

From an investor perspective, enforcement actions like this can influence risk pricing and funding cycles for crypto platforms, particularly those with international user bases or complex payment rails. The Paxful narrative—centered on public statements by founders, internal policy gaps, and late‑stage remediation—serves as a cautionary tale about the fragility of business models that rely on permissive compliance postures. In a market where users increasingly demand transparency and regulatory alignment, the case emphasizes why credible AML programs are not merely a legal checkbox but a core driver of platform reliability and long‑term viability.

What to watch next

- Schaback’s sentencing timing remains fluid, with a May hearing continuing to unfold as prosecutors incorporate ongoing cooperation into the government’s recommendation.

- Any additional actions or disclosures related to Paxful’s former leadership could emerge as part of related investigations and settlements.

- Regulators may intensify scrutiny of other P2P exchanges and non‑custodial marketplaces to assess AML controls, monitoring capabilities, and enforcement readiness.

- Broader market reactions might reflect shifting risk sentiment as platforms adjust compliance investments and governance standards in response to high‑profile enforcement cases.

Sources & verification

- U.S. Department of Justice press release: Virtual Asset Trading Platform sentenced for violating Travel Act and other federal crimes (link provided in the DOJ filing).

- DOJ Criminal Division official X/Twitter post confirming the case details and sentencing status.

- Paxful closure announcement (archived): Paxful closure announcement, noting misconduct and remediation costs.

- Statements and coverage surrounding Ray Youssef’s response to Paxful’s closure and Artur Schaback’s guilty plea.

- Related reporting on Paxful’s alleged “Backpage Effect” and the platform’s historical collaborations cited by prosecutors.

What the story changes

The Paxful case illustrates how enforcement actions tied to AML controls can reshape the operations and viability of crypto platforms that rely on rapid growth and minimal compliance. By tying significant penalties to proven misconduct and highlighting explicit links to illicit activities, authorities are sending a clear signal: robust, transparent AML programs are foundational, not optional. As the industry evolves, platforms may need to reassess their onboarding, transaction screening, and governance practices to withstand heightened regulatory scrutiny and to restore or preserve user trust in a landscape that continues to balance innovation with accountability.

Crypto World

Wallet in Telegram Launches Cross Chain Deposits in Self Custodial TON Wallet

[PRESS RELEASE – Ile Du Port, Seychelles, February 11th, 2026]

Over 100 million users can now fund their TON Wallet using crypto from the most popular blockchains – no additional bridges, swaps or manual conversions required.

Wallet in Telegram today announced the launch of cross-chain deposits in its self-custodial TON Wallet, enabling users to fund their wallets with crypto from the most popular blockchains. Powered by MoonPay, the integration manages cross-chain transfers behind the scenes, ensuring a smooth deposit experience in TON Wallet.

With this launch, more than 100 million users can transfer their stablecoins from other chains to TON without friction or losing value. TON Wallet users can now deposit USDC or USDT from Ethereum, Solana, TRON, BSC, Polygon, Arbitrum, and Base – converted at a 1:1 rate to USDT (TON) – directly in Wallet in Telegram. This removes the need to already hold TON-native assets, opening the ecosystem to users across the broader crypto landscape. As part of the integration, users will soon be able to withdraw USDT on TON to USDT or USDC on popular blockchains with a fee and deposit BTC, ETH, and SOL, which are automatically converted into Toncoin.

This Launch Introduces the Following Functionality

- Stablecoin deposits from leading blockchains, allowing users to deposit USDC or USDT with automatic 1:1 conversion into USDT (TON)

- Stablecoin withdrawals from USDT (TON) to USDT or USDC on other major blockchains, processed at a 1:1 rate, subject to applicable network and service fees. Will be available soon.

- Crypto deposits from BTC, ETH, and SOL, which are automatically converted into Toncoin upon arrival in TON Wallet

Removing Barriers to Web3 Adoption on Telegram

Funding a self-custodial wallet has traditionally been a complex, multi-step process. Through its collaboration with MoonPay, Wallet in Telegram removes this friction by introducing a single, seamless deposit flow that works across blockchains and assets. As a result, cross-chain transfers are now as simple as custodial ones, significantly streamlining onboarding into TON Ecosystem – while preserving value by minimizing unnecessary conversion losses and fees.

“One of the biggest challenges in crypto adoption is the first step – getting users funded and ready to participate. Until now, using TON Wallet meant already having assets on TON, which created unnecessary friction and limited access to the broader ecosystem. Now, we’re removing that barrier entirely. Users can bring their funds directly into TON Wallet from other networks, without unnecessary conversions, exchanges or lock-ins,” said Andrew Rogozov, Founder and CEO of The Open Platform and Wallet in Telegram. “Our goal is simple: make entering, and exiting, TON ecosystem as seamless as using a custodial wallet, while preserving the freedom and control of self-custody.”

Powered by MoonPay Deposits and built on MoonPay’s infrastructure, the solution supports the end-to-end flow, from deposit detection to final asset delivery, and is integrated natively into partner environments

“Users shouldn’t have to buy new assets or navigate complex steps just to fund an account,” said Ivan Soto-Wright, CEO of MoonPay. “We simplify the process by letting people use the crypto they already have while we handle the technicalities behind the scenes, making it easier to move value across the ecosystem and access a broader range of applications.”

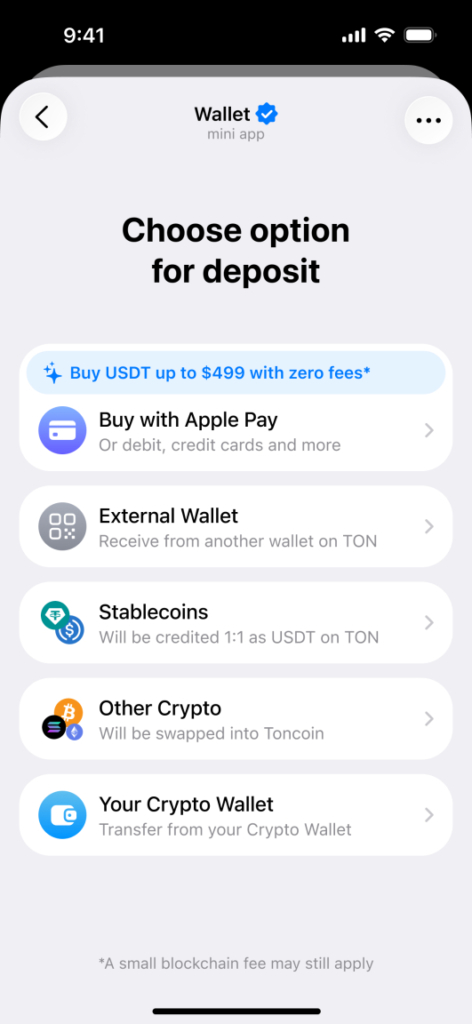

Funding a TON Wallet now takes just a few steps

- The Deposit section includes two options: Stablecoins (for 1:1 stablecoin deposits) and Other Crypto (for converting BTC, ETH, or SOL to TON).

- After selecting the token and the originating network, a deposit address is generated automatically.

- The deposit address can be copied or accessed via QR code.

- This address is entered on the withdrawal page of the external wallet or exchange.

- The transfer amount must meet the minimum deposit requirement.

- Once the details are verified, the transfer is confirmed on the sending platform.

Funds arrive in the user’s selected asset, fully compatible with TON ecosystem and Telegram’s growing network of decentralized applications.

Built for Scale, Native to Telegram

The new deposit experience is available exclusively in the self-custodial TON Wallet, part of Wallet in Telegram’s dual-wallet setup, and is fully integrated into the Telegram interface. By abstracting away cross-chain complexity, Wallet in Telegram makes it easier for users to participate in DeFi, gaming, payments, and on-chain apps – without needing deep crypto expertise.

This launch marks a major step toward making Telegram the most accessible Web3 gateway in the world, combining mass-market distribution with self-custody and open blockchain infrastructure.

About Wallet in Telegram

Wallet in Telegram is a digital asset solution natively embedded into Telegram’s interface. Backed by The Open Platform, Wallet in Telegram has gained 150M+ registered users to date and continues to grow. The company offers a dual-wallet experience with Crypto Wallet (a multi-chain wallet for trading and sending crypto to contacts) and TON Wallet (a self-custodial wallet with access to TON ecosystem of apps and TON-based digital assets).

About MoonPay

Founded in 2019, MoonPay is a global financial technology company that helps businesses and consumers move value across fiat and digital assets. MoonPay has more than 30 million customers across 180 countries and supports more than 500 enterprise customers spanning crypto and fintech.

Through a single integration, MoonPay powers on- and off-ramps, trading, crypto payments, and stablecoin infrastructure, connecting traditional payment rails with blockchains. MoonPay maintains a broad regulatory footprint, including a New York BitLicense, a New York Limited Purpose Trust Charter, and money transmitter licenses across the United States, as well as MiCA authorization in the EU.

MoonPay is how the world moves value.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Extreme Fear Returns to Crypto: What Investors Should Know

The Crypto Fear & Greed Index fell to 5 on Thursday, signaling a sharp deterioration in market sentiment as digital asset prices continue to slide.

The decline reflects intensifying panic among investors, with risk appetite eroding amid broader global market uncertainty.

Sponsored

Sponsored

Crypto Sentiment Sinks Deeper Into “Extreme Fear”

The Crypto Fear & Greed Index measures the overall emotional state of the cryptocurrency market on a scale from 0 to 100. Readings between 0 and 24 indicate Extreme Fear, 25 to 49 signal Fear, 50 represents Neutral conditions, 51 to 74 reflect Greed, and 75 to 100 denote Extreme Greed.

At 5, the index places the market firmly in Extreme Fear territory. The latest drop comes amid a steady decline in sentiment over recent weeks.

A month ago, the index stood at 26, already within the Fear range. It slid to 12 a week earlier and registered 11 just a day before reaching its current low. The rapid deterioration highlights how quickly confidence has unraveled as prices weakened.

The collapse in crypto sentiment coincides with a broader surge in global economic anxiety, as evidenced by the World Uncertainty Index. The index tracks how frequently the term “uncertainty” appears in Economist Intelligence Unit country reports.

It covers more than 140 countries and provides a quarterly, cross-country indicator widely used in macroeconomic research and global risk analysis.

In the third quarter of 2025, the World Uncertainty Index surged to an all-time high above 100,000. In the fourth quarter, it was recorded at 94,947.

Sponsored

Sponsored

Those levels are roughly double the peaks observed during previous major crises, including the COVID-19 pandemic, Brexit, and the Eurozone debt crisis.

“Rising geopolitical tensions, volatile markets, and policy uncertainty are driving the spike, as investors struggle to price in what comes next,” Coin Bureau wrote.

The elevated reading signals heightened anxiety across global markets as investors grapple with unpredictable economic and political conditions. Against this backdrop, the crypto market’s plunge into Extreme Fear reflects not only falling prices but also a broader retreat from risk assets worldwide.

Crypto Market Cap Falls 22% in 2026 as Bitcoin and Ethereum Extend Losses

The collapse in sentiment comes as the broader crypto market continues to move downwards. In 2026, total market capitalization has fallen by more than 22%, reversing the optimism that defined the start of the year.

Sponsored

Sponsored

Bitcoin, which began January on a stronger footing, ended the month down by more than 10%. It has dropped another 14.6% so far in February.

Ethereum has also fallen 33.8% year to date. The sustained drawdown has weighed on market activity.

Analysts Weigh Crypto Market’s Next Move

Amid these bear market conditions, the community remains uncertain about what comes next. Analyst Kyle Chassé pointed to historical precedents, noting that similarly depressed readings in the Crypto Fear & Greed Index were seen in 2018, March 2020, and in the aftermath of the FTX collapse in 2022.

Sponsored

Sponsored

“Every time, it marked a massive opportunity window. No, it doesn’t guarantee the bottom. But historically, peak fear is where asymmetry lives,” he said.

Other analysts argue the current downturn could represent a shakeout phase before a potential breakout. Still, it remains unclear when, or if, a broader crypto market recovery will follow.

Ray Youssef, CEO of NoOnes, has forecasted that Bitcoin could trade sideways until summer 2026. He noted that the exact location of the Bitcoin bottom remains unclear and that current dynamics increasingly suggest the market has entered a protracted reassessment of risk.

Youssef pointed to several structural factors, including US political and monetary cycles, persistent inflation constraints, weakened retail capital flows, and cautious institutional demand following heavy losses.

“As a result, we are unlikely to see a V-shaped reversal before the summer of 2026. More likely, we will see regular rebounds, triggered by short-covering and short squeezes,” he told BeInCrypto.

According to Youssef, such rebounds could be strong, ranging between 20% and 30%, and potentially prolonged. However, he warned they may ultimately prove to be bull traps.

He stated that crypto traditionally remains in a long accumulation phase within a single range before the start of a true bull market.

Crypto World

DAO Development for Regulated Stablecoin Ecosystems

Over the past five years, DAOs promised borderless governance, permissionless finance, and community-driven growth. Today, a new reality is reshaping this vision. Regulation is no longer operating in the background. It is now directly influencing how DAOs design their governance, manage treasuries, and build trust with investors and institutions. At the same time, stablecoins have become the primary settlement layer for Web3 economies. For founders, investors, and governance leaders, this shift raises critical questions. How do you remain decentralized while meeting compliance expectations? How do you protect treasury assets from regulatory risk? How do you design governance systems that institutions can trust? This blog answers those questions.

Inside, you will learn how regulation is transforming DAO architecture, why traditional governance models are losing credibility, and how modern DAO development is evolving into a scalable, institution-ready framework. If you are building, investing in, or advising a DAO, this guide will help you make informed decisions for long-term growth in regulated stablecoin ecosystems.

How Stablecoin Regulation Is Reshaping DAO Architecture

Governments worldwide are implementing formal rules for stablecoin issuance, custody, and settlement, fundamentally reshaping how DAOs operate in regulated financial environments and accelerating the demand for advanced DAO development frameworks. In the United States, authorities are enforcing reserve audits and issuer licensing, while the European Union is advancing MiCA compliance frameworks. Across Asia, regulators are strengthening payment-token supervision models, and Middle Eastern jurisdictions are establishing dedicated digital asset oversight authorities.

As regulated stablecoins become the dominant settlement layer, DAOs integrating them are now expected to meet higher operational standards, including full treasury transparency, automated KYC and AML compliance layers, real-time transaction monitoring systems, and clearly defined governance accountability norms. As a result, traditional anonymous treasury and token-based voting models are becoming structurally weak and increasingly incompatible with institutional and regulatory expectations.

What Changes Inside a DAO?

Modern DAO architecture is shifting toward:

- Segmented treasury wallets

- Role-based governance permissions

- Regulated payment rails

- Smart-contract compliance logic

- Hybrid on-chain/off-chain reporting

This transformation is being led by specialized DAO development company providers that understand both blockchain engineering and regulatory frameworks.

Prepare your DAO for regulation-driven stablecoin ecosystems today

Why Traditional DAO Governance Models Are Breaking

As regulatory expectations reshape DAO infrastructure and treasury operations, governance frameworks are now being examined more closely, pushing projects to rely on advanced DAO development services for compliance-ready design. Structures that once worked in loosely regulated environments are increasingly proving inadequate in a modern, compliance-driven ecosystem.

1. Token Voting Limits

Token-based governance is facing growing structural limitations as DAOs scale and attract regulatory attention. Three major challenges now define voting systems: capital concentration, low participation rates, and regulatory scrutiny.

In many DAOs, less than five percent of token holders control more than eighty percent of voting power. Regulators increasingly view this imbalance as centralized influence presented as decentralization, weakening institutional trust.

2. Treasury Risk Levels

As DAOs accumulate large reserves in regulated stablecoins, treasury operations are becoming more vulnerable to compliance and jurisdictional risks.

Key exposure points include account freezes, regulatory investigations, jurisdictional conflicts, and dependency on traditional banking relationships. These risks remain fragmented and largely unmanaged without professional DAO platform development.

3. Governance Standards

Modern governance systems are expected to function with the same transparency and accountability as financial institutions.

Future-ready DAOs must demonstrate clear decision traceability, financial accountability, conflict resolution mechanisms, and legal clarity across jurisdictions. Governance is no longer defined by voting alone. It is now measured by institutional credibility and operational discipline.

The New Compliance-Ready Stablecoin-Based DAO Operating Model

The Rise of “Regulated-Native” Stablecoin DAOs

As regulated stablecoins become the foundation of on-chain payments and treasury management, next-generation DAOs are being designed from day one to operate within compliant financial ecosystems.

These modern governance frameworks are built to support:

- Stablecoin licensing alignment

- Multisig compliance approval flows

- Automated reporting dashboards

- Smart-contract risk monitoring

- Legal wrapper integration

Implementing these systems at scale requires professional DAO development services rather than fragmented, do-it-yourself governance frameworks.

Core Layers of a Future-Ready DAO

| Layer | Function |

|---|---|

| Governance | Role-based voting and accountability |

| Treasury | Segmented regulated wallets |

| Compliance | Automated AML and KYC systems |

| Reporting | Real-time audit dashboards |

| Operations | Smart workflow management |

This modular architecture allows stablecoin-powered DAOs to scale across jurisdictions while minimizing regulatory friction and operational risk.

Why Investors Are Repositioning Around Regulated DAOs

As governance models mature and compliance becomes a defining success factor, the way capital evaluates decentralized organizations is undergoing a fundamental shift. What once attracted speculative funding now demands structural credibility, financial transparency, and regulatory preparedness.

Capital Is Moving Toward Compliance-Ready Projects

Institutional and venture capital are no longer chasing hype-driven DAO experiments. Instead, serious investors are reallocating funds toward projects that demonstrate regulatory awareness, financial discipline, and long-term governance stability, often backed by professional DAO development services that ensure regulatory and technical alignment from day one.

Today, capital is increasingly flowing into DAOs that operate within structured ecosystems, including:

- RWA-backed governance networks

- Stablecoin-powered payment infrastructures

- Regulation-aligned DeFi protocols

- Institutional-grade treasury platforms

These projects signal operational maturity, a key factor in modern investment decisions.

How Investors Evaluate DAOs in 2026?

Investor due diligence has evolved beyond token metrics and community size. Leading funds now assess DAOs using governance, compliance, and sustainability indicators such as:

- Legal survivability across jurisdictions

- Governance resilience under regulatory pressure

- Exposure to stablecoin issuer risk

- Ability to adapt to changing compliance frameworks

These factors determine whether a DAO can scale responsibly in global markets.

The New Institutional Due Diligence Checklist

Before allocating capital, most professional investors now require evidence of:

- Verified treasury compliance

- Assessed stablecoin counterparty risk

- Documented governance audit trails

- Mapped jurisdictional exposure

- Automated financial reporting systems

DAOs that fail to meet these benchmarks are increasingly excluded from institutional portfolios, regardless of their technical innovation.

Build compliant DAO platforms without sacrificing decentralization.

How Founders Should Rebuild DAO Strategy in 2026

Step 1: Redesign Governance Architecture

Founders must move beyond token-only voting toward:

- Weighted governance systems

- Committee-based approvals

- Regulatory oversight nodes

- Emergency intervention layers

Step 2: Professionalize Treasury Operations

Treasury must function like a fintech institution:

- Regulated custody

- Multi-jurisdiction banking

- Stablecoin diversification

- Risk hedging

Step 3: Implement Compliance Automation

Manual compliance does not scale.

Modern DAOs use:

- On-chain identity modules

- Smart AML triggers

- Reporting oracles

- Audit automation

Step 4: Choose the Right DAO Development Partner

Not every blockchain agency understands regulatory engineering.

Working with experienced providers in DAO infrastructure ensures:

- Long-term scalability

- Legal adaptability

- Institutional readiness

Conclusion: The Next Decade Belongs to Compliance-Native DAOs

The future of DAOs belongs to projects that combine decentralization with regulatory readiness. As stablecoins become the backbone of Web3 finance, governance models, treasury systems, and reporting structures must evolve to meet institutional and legal expectations. For founders, investors, and compliance leaders, this is no longer a theoretical shift. It is a strategic decision point.

Working with professional DAO development company ensures your DAO is built for scalability, transparency, and long-term resilience in regulated ecosystems. This is where Antier plays a critical role. With deep expertise in governance engineering and compliance-focused infrastructure, we help DAOs transition from experimental frameworks to enterprise-ready platforms.

Frequently Asked Questions

01. How is regulation impacting the governance of DAOs?

Regulation is directly influencing how DAOs design their governance, manage treasuries, and build trust with investors and institutions, leading to higher operational standards and transparency requirements.

02. What are the key changes in modern DAO architecture?

Modern DAO architecture is evolving to include segmented treasury wallets, role-based governance permissions, regulated payment rails, and smart-contract compliance to meet regulatory expectations.

03. Why are traditional governance models losing credibility in the context of DAOs?

Traditional anonymous treasury and token-based voting models are becoming structurally weak and increasingly incompatible with institutional and regulatory expectations, prompting a shift toward more transparent and accountable governance systems.

Crypto World

Trump-linked WLFI’s Zak Folkman teases forex platform at Consensus Hong Kong

, the Trump-family-linked crypto project, will soon launch a foreign exchange platform called World Swap, its co-founder, Zak Folkman, said on stage at Consensus Hong Kong.

The forex teaser adds to a growing list of products orbiting the project’s USD1 stablecoin as the project positions itself as a full-stack financial ecosystem, with further announcements expected at a Mar-a-Lago event later this month.

Speaking on stage, Folkman said the company’s goal is to abstract away much of the complexity associated with crypto wallets and cross-border transfers, allowing users to send and receive digital dollars in a manner similar to popular payment apps.

He framed the planned foreign exchange service as a direct challenge to traditional remittance providers that often charge fees ranging from 2% to 10% per transaction.

The company’s broader strategy centers on USD1, a dollar-pegged stablecoin that Folkman said is backed by cash and cash equivalents.

Folkman also highlighted the launch of World Liberty Markets, a lending platform that has attracted hundreds of millions of dollars in deposits within weeks of going live, and partnerships with decentralized finance protocols to increase the token’s utility.

In late January, Crypto Twitter users had spotted AMG Software Solutions LLC, a Puerto Rico-based company that owns WLFI’s intellectual property, had registered trademarks related to World Swap.

Crypto World

Short-Term Bitcoin Holders in Pain as Bear Market Deepens

Losses are mounting up for short-term holders of Bitcoin as the asset dumps below $70,000 again.

“Short-term holders keep suffering as this correction drags on,” said CryptoQuant analyst ‘Darkfost’ on Wednesday.

The short-term holder cost basis is around $94,200, and with BTC back at around $67,000, the price gap has now reached 28%, they said.

“So we can roughly estimate an average unrealized loss of about 28% for STHs, if we simplify things.”

Not a Correction, But Bear Market

The analyst noted that Bitcoin’s price has been trading below the STH cost basis for four months, “marking their longest period of stress so far.”

They added that it was unusual for this cycle and “suggests that the current correction is increasingly resembling a bear market.” During the two previous bear markets, this situation lasted for a little over a year, the analyst cautioned.

Short term holders keep suffering as this correction drags on.

📊 With an STH cost basis of around $94,200 and BTC at $68,000, the price gap has now reached 28%.

So we can roughly estimate an average unrealized loss of about 28% for STHs, if we simplify things.

But that is not… pic.twitter.com/MnLcbAgHCx

— Darkfost (@Darkfost_Coc) February 11, 2026

A “lack of fresh capital” is reinforcing bear conditions, confirmed CryptoQuant on Wednesday, with analysts stating that new investor inflows have flipped negative.

“The sell-off is not being absorbed by fresh capital. In bull markets, drawdowns attract accelerating capital. In early bear markets, weakness triggers withdrawal.”

Analyst ‘Daan Trades Crypto’ said that after holding the .382 Fibonacci retracement temporarily, the price eventually fell through and broke the pattern it had held this cycle.

You may also like:

“The .618 Fibonacci retracement level has historically always been another important one to watch during larger drawdowns,” he added. This level is currently around $57,800 and could be the next support zone.

Bitfinex analysts were a little more positive, observing that Bitcoin long-term holder supply has turned up after months of distribution, and is now back near 14.3 million BTC.

“If this buildup continues, it supports the view that this is a mid-cycle reset, not a final top,” they said.

Bitcoin long term holder supply has turned up after months of distribution, now back near 14.3M BTC.

In past cycles fresh highs in LTH supply led $BTC by roughly 3–4 months.

If this build up continues, it supports the view that this is a mid cycle reset, not a final top. pic.twitter.com/EJ0Q87vp7d

— Bitfinex (@bitfinex) February 11, 2026

Bitcoin Falls to $66,000

Short term holder loses are even worse with Bitcoin’s collapse back to just under $66,000 in late trading on Wednesday. The asset was trading at $67,200 on Thursday morning in Asia, but the path of least resistance remains down.

Ether failed to hold above the psychological $2,000 level and crashed back to $1,950 on Wednesday, failing to reclaim it at the time of writing. ETH is now trading at March 2025 lows, but it has yet to dip as low as the April 2025 crash.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

BlockFills halts deposits and withdrawals amid market stress

Crypto trading firm BlockFills has temporarily suspended client deposits and withdrawals, citing recent market and financial conditions.

Summary

- BlockFills has temporarily suspended client deposits and withdrawals, citing challenging market and financial conditions, while allowing trading to continue.

- The halt was implemented last week as Bitcoin experienced sharp volatility, sliding from the low $70,000s to the mid-$60,000s before rebounding.

- The firm says it is working with investors and clients to restore liquidity and will provide updates as the situation develops.

The decision was disclosed in a post shared by the company on X and was described as a protective measure for both clients and the firm.

According to BlockFills, the suspension was implemented last week. While deposits and withdrawals are paused, clients have still been able to trade on the platform. This includes opening and closing positions in spot markets, derivatives trading, and select other situations, the firm said in its statement.

The company did not specify how long the restrictions will remain in place, but emphasized that trading functionality has been maintained to allow clients to manage existing exposure.

Bitcoin price swings during suspension week

The announcement comes amid notable volatility in the broader crypto market. Bitcoin (BTC), the largest cryptocurrency by market value, experienced sharp price swings last week.

BTC slid from a range near the low $70,000s to a weekly low around the mid-$60,000s before rebounding toward $67,000 at press time.

BlockFills said the move was taken to safeguard liquidity during a period of heightened uncertainty.

“Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform,” BlockFills said.

In its statement, BlockFills stressed its commitment to transparency. The firm said it has remained in active dialogue with clients, including hosting information sessions and giving customers the opportunity to ask questions directly to senior management.

Updates will continue to be shared as developments occur, according to the company.

The news, shared via the BlockFills X account, comes at a time of increased scrutiny around liquidity management across crypto trading firms, as market volatility continues to test operational resilience.

Crypto World

Whale Behavior in DeFi Markets

How Smart Money Moves Liquidity, Shapes Narratives, and Hunts Inefficiencies In DeFi, price doesn’t move because of vibes. It moves because of its size.

Whales — wallets controlling massive amounts of capital — are the invisible hands that shape liquidity, trigger volatility, rotate narratives, and quietly accumulate before retail even notices. If you want to survive (and thrive) on-chain, you don’t fight whales. You study them.

Let’s break down how they actually operate.

1️⃣ Who Are “Whales” in DeFi?

A whale isn’t just someone with a big bag. In DeFi, whales typically include:

What makes them powerful isn’t just capital — it’s coordination, speed, and access to data.

They don’t trade charts.

They trade liquidity, incentives, and psychology.

2️⃣ How Whales Move Markets

A. Liquidity Deployment & Withdrawal

In DeFi, liquidity is power.

When whales add liquidity to pools:

-

Yields compress

-

Slippage decreases

-

Protocol TVL spikes

-

Confidence increases

When they withdraw:

-

TVL drops

-

Yields spike

-

Fear spreads

-

Smaller LPs panic

A single large liquidity removal from a lending protocol can send shockwaves across borrowing rates.

B. Yield Farming Rotation

Whales constantly rotate capital to optimize emissions.

They:

-

Enter early during high token incentives

-

Farm aggressively

-

Dump emissions into strength

-

Exit before APY normalizes

This is why new farms look explosive at launch — and dry up 2–4 weeks later.

If you see sudden TVL spikes in a new protocol, ask:

Is this organic growth… or mercenary capital?

C. Governance Power Plays

DeFi governance is often token-weighted. Translation?

Capital = influence.

Whales can:

Some whales accumulate governance tokens quietly, then surface during critical votes. If you ignore governance flows, you’re missing half the story.

D. Liquidity Hunts & Stop Sweeps

In on-chain perpetual DEXs, whales often:

It’s not manipulation — it’s game theory in an open ledger system.

DeFi transparency means everyone sees the liquidation levels.

Guess who has enough capital to push prices into them?

3️⃣ Smart Whale Patterns to Watch

Here’s where things get interesting.

🧠 Early Accumulation Before Incentives

Whales often accumulate before:

-

Token listings

-

Major integrations

-

Incentive campaigns

-

Governance proposals

On-chain accumulation > Twitter hype.

🔁 Capital Rotation, Not Exit

When markets “crash,” whales often don’t leave crypto.

They rotate:

-

From volatile tokens → stablecoin yield

-

From farming → lending

-

From altcoins → ETH/BTC

-

From DEX perps → staking

Retail sees “exit.”

Whales see repositioning.

📉 Buying Fear Events

Bridge hacks, exploit rumors, governance drama — these are discount windows.

If fundamentals remain intact, whales accumulate during panic.

They sell optimism, not fear.

4️⃣ Real DeFi Examples of Whale Impact

Without naming specific wallets, history shows patterns across major ecosystems:

-

During DeFi Summer, massive capital rotated between Curve, Yearn, Compound, and Sushi depending on emissions.

-

When L2 ecosystems launched incentive programs, whales bridged millions within hours.

-

In lending protocols, whale repayments have instantly normalized borrowing rates.

-

Governance whales have swung DAO votes by double-digit margins.

In every cycle, whales front-run narrative shifts.

5️⃣ Tools to Track Whale Activity

If you’re serious about DeFi alpha, use data.

-

On-chain explorers (Etherscan, Arbiscan, etc.)

-

Wallet tracking dashboards

-

Governance vote monitors

-

TVL analytics (DeFiLlama)

-

Token flow analytics

-

Liquidation dashboards

Watching price without watching wallets is like watching the ocean surface and ignoring the currents underneath.

6️⃣ How Retail Can Use Whale Behavior

You don’t need whale capital.

You need whale awareness.

✔ Follow liquidity, not hype

✔ Track sudden TVL spikes

✔ Watch governance accumulation

✔ Study stablecoin inflows/outflows

✔ Avoid farming too late in incentive cycles

The edge isn’t predicting the market.

It’s understanding who has the power to move it.

7️⃣ The Harsh Truth

Whales don’t hate retail.

They just play a different game.

They optimize:

-

Risk-adjusted yield

-

Liquidity depth

-

Incentive schedules

-

Token unlock calendars

-

Governance timing

Meanwhile, retail often trades narratives without checking on-chain flows.

That mismatch? That’s the opportunity.

Final Thought

DeFi is radically transparent. Every move is public.

Whales leave footprints — you just need to know where to look.

If you learn to interpret capital rotation, liquidity shifts, and governance positioning, you stop reacting to volatility… and start anticipating it.

And in DeFi, anticipation beats emotion every single time.

REQUEST AN ARTICLE

Crypto World

Danske Bank Launches Bitcoin and Ethereum ETPs for Cryptocurrency Investment Access

TLDR:

- Danske Bank offers three ETPs tracking Bitcoin and Ethereum from BlackRock and WisdomTree providers.

- Customers must pass knowledge assessment before accessing cryptocurrency products on the trading platform.

- The bank views crypto as opportunistic investments and does not provide advisory services for these products.

- MiFID II and MiCA regulations ensure enhanced investor protection and transparency for cryptocurrency ETPs.

Danske Bank has introduced cryptocurrency investment options for its customers through exchange-traded products tracking Bitcoin and Ethereum.

The Danish financial institution now offers three carefully selected ETPs on its trading platform, marking a significant shift in its approach to digital assets.

This move responds to growing customer demand while maintaining strict regulatory compliance under MiFID II and the EU’s MiCA framework.

Regulated Access to Digital Assets Through Established Providers

Danske Bank customers can now access cryptocurrency exposure through Danske eBanking and Danske Mobile Banking platforms without requiring digital wallets.

The bank selected ETPs from BlackRock and WisdomTree, two recognized international asset managers with established track records in the investment industry.

These products provide exposure to Bitcoin through two separate ETPs and Ethereum through one ETP.

The offering targets self-directed investors who use the trading platform without advisory services. Customers must complete an assessment questionnaire before gaining access to these products.

The evaluation determines whether investors possess sufficient knowledge and experience to understand the risks associated with cryptocurrency investments.

MiFID II regulations govern these investment products, ensuring enhanced investor protection and transparency regarding ongoing costs.

The regulatory framework provides standardized disclosure requirements that help investors make informed decisions. Meanwhile, the EU’s MiCA Regulation has contributed to improved oversight in the cryptocurrency sector.

“As cryptocurrencies have become a more common asset class, we are receiving an increasing number of enquiries from customers wanting the option of investing in cryptocurrencies as part of their investment portfolio,” said Kerstin Lysholm, Head of Investment Products & Offering at Danske Bank.

She noted that improved regulation has increased confidence in cryptocurrencies. However, the institution emphasizes that offering these products does not constitute a recommendation of the asset class.

No Advisory Services as Bank Maintains Cautious Stance

Danske Bank currently views cryptocurrency investments as opportunistic rather than components of long-term portfolio strategies.

The bank does not provide advisory services for these products at present. Customers interested in cryptocurrency exposure must navigate these investments independently through the self-directed trading platform.

The platform integration strengthens Danske Bank’s position as a provider offering access to more than 15,000 different securities.

ETPs eliminate several challenges associated with direct cryptocurrency ownership, including storage security and transaction speed. Customers can trade these products with the same ease as traditional securities.

“It is always important for us that our customers can invest in a good and proper manner,” Lysholm explained. “For customers wanting to invest in cryptocurrencies, we regard ETPs as a suitable solution that offers clear advantages compared to direct investments in cryptocurrencies.“

The ETP structure provides benefits regarding trading efficiency and asset custody. Storage risks that accompany self-managed digital wallets are removed through this approach.

The bank maintains strong warnings about the high-risk nature of cryptocurrency investments. Potential investors face the possibility of substantial losses when engaging with this asset class.

Danske Bank’s measured approach balances customer demand with responsible risk management practices.

Crypto World

UAE-Approved DDSC Stablecoin Goes Live on ADI Chain

IHC and First Abu Dhabi Bank-initiated DDSС stablecoin goes live with the UAE Central Bank approval and license, proving ADI Chain’s readiness to support regulated global financial and capital markets infrastructure at scale.

The Dirham-Backed Stablecoin DDSC is now live on ADI Chain. Backed 1:1 by UAE Dirham reserves, it was initiated by International Holding Company (IHC), one of the largest investment companies in the world, with $240 billion in capitalization, and First Abu Dhabi Bank (FAB) – the UAE’s largest bank with over $330 billion in assets and 33% of the UAE banking market share.

DDSC is approved and licensed by the UAE Central Bank and operates exclusively on ADI Chain, an institutional-grade Layer 2 blockchain infrastructure built for national-scale deployment. FAB serves as the banking partner, providing custody of fiat reserves and bringing 4 million customers across 20 markets and decades of banking infrastructure onto programmable blockchain rails.

The model is designed with clear separation. IHC and FAB initiated the stablecoin project, with Sirius International Holding supporting deployment and institutional adoption. DDSC, a registered entity, serves as the distributor and issuer. The UAE Central Bank approved and licensed it. ADI Chain hosts it on compliance-ready infrastructure.

Proving the Compliance-Ready Blockchain Model

Stablecoins have reached a global scale. According to a16z crypto’s State of Crypto report, stablecoin transactions exceeded $46 trillion in 2024. Usage now resembles traditional payment rails rather than speculative trading. Digital cash is moving from a crypto-native tool to a strategic national infrastructure.

DDSC demonstrates that compliance requirements don’t conflict with public blockchain benefits. The infrastructure delivers instant settlement, 24/7 availability, and transparent transaction rails. Industry data shows the UAE processes over $70 billion in digital payment transaction value annually, alongside nearly $50 billion in cross-border remittances and significant trade flows across MENA-Asia-Africa corridors. DDSC stablecoin provides compliant settlement rails for these existing flows.

When a Central Bank trusts blockchain infrastructure for monetary settlement, governments and institutions worldwide take notice. Post-mainnet, ADI secured MOUs with BlackRock, Mastercard, and Franklin Templeton for tokenized asset settlement, blockchain payment rails, and digital product infrastructure, alongside M-Pesa Africa for cross-border remittance rails across eight African markets. These collaborations validate the compliance-first approach.

The Infrastructure Behind Sovereign Settlement

ADI Chain is the first institutional Layer 2 blockchain for stablecoins and real-world assets in MENA. The ADI Foundation was founded by Sirius International Holding, the digital arm of IHC, which is one of the world’s largest investment holding companies.

The foundation developed ADI Chain as a purpose-built infrastructure for emerging markets where compliance, security, and regulatory alignment cannot be compromised.

The architecture rests on three pillars:

- Compliance-ready infrastructure begins with the ADI Foundation, which operates under the ADGM regulatory framework.

- Efficient execution leverages ZKsync’s Airbender technology, making ADI the first blockchain to implement the latest generation of zero-knowledge proof systems.

- Secure architecture is validated through OpenZeppelin’s comprehensive audit covering core contracts, infrastructure, token standards, and critical systems.

This combination creates infrastructure that addresses institutional needs without compromising the benefits of public blockchain technology.

ADI: The Utility Token

Every blockchain requires a gas token to function. For governments and institutions building compliant infrastructure, that token needs to deliver functions beyond processing transactions.

ADI serves as the core utility token for MENA’s first institutional Layer 2 ecosystem. The token processes all smart contract executions, dApp interactions, and value transfers across ADI Chain and its L3 sovereign networks. It functions as the medium of exchange across the ecosystem, facilitating settlement between enterprises, developers, validators, and users, creating a unified settlement layer for network operations.

DDSC stablecoin operates on ADI Chain’s infrastructure, where ADI functions as the utility token powering on-chain transactions. When users transfer DDSC for payments, settlements, or cross-border remittances, ADI processes the underlying blockchain operations.

The Path Forward

DDSC represents the first step in a larger infrastructure play. The roadmap moves through clear stages: prove the model with the UAE’s dirham, extend to other GCC currencies, connect to Africa via M-Pesa infrastructure, and enable interoperable settlement across MENA-Africa-Asia.

The goal is a network of institution-backed regional stablecoins, all interoperable on ADI Chain, creating a compliant settlement infrastructure for emerging markets. ADI Foundation is building infrastructure to support multiple governments launching regional stablecoins on the same compliance-ready settlement layer.

A year ago, the ADI Foundation announced its formation at Abu Dhabi Finance Week. Twelve months later, it returned to the same stage to announce the mainnet launch. Today, Dirham-Backed stablecoin DDSC goes live on ADI Chain, proving that regulated national stablecoins can operate on public blockchain infrastructure.

About ADI Foundation & ADI Chain

ADI Foundation is an Abu Dhabi-based non-profit founded by Sirius International Holding, a subsidiary of IHC, dedicated to empowering governments and institutions in emerging markets through blockchain infrastructure. The foundation’s mission is to bring one billion people into the digital economy by 2030, building on a foundation of 500+ million people already within its ecosystem reach.

ADI Chain is the first institutional Layer 2 blockchain for stablecoins and real-world assets in the MENA region, providing settlement infrastructure for a dirham-backed stablecoin initiated by IHC and FAB, licensed by the UAE Central Bank. The network operates on three pillars – Compliance, Efficiency, Security – serving governments implementing blockchain infrastructure across the Middle East, Asia, and Africa.

For more information, visit the Official Website, LinkedIn, and X.

DISCLAIMER: ADI Foundation is an Abu Dhabi-based not-for-profit DLT Foundation (“ADI”) and registered with Abu Dhabi Global Market (“ADGM”) under commercial license number (20599) and governed by ADGM’s DLT Foundation Regulation of 2023. ADI Chain and tokens developed by ADI are not subject to registration with ADGM’s financial regulator, the Financial Services Regulatory Authority (“FSRA”). ADI’s Chain is used by regulated and non-regulated third parties for the deployment of digital assets.

ADI Chain and the ADI token are developed by ADI. ADI issues only utility tokens which are not regulated digital assets under the regulatory framework of ADGM’s Financial Services Regulatory Authority (“FSRA”) and therefore, ADI’s tokens are not subject to registration with the FSRA or other financial regulators.

All features, token utilities, timelines, and launch details are subject to change without notice. No guarantees are made regarding future performance or token value. This content is for informational purposes only and does not constitute investment, legal or tax advice, nor an offer to buy or sell any digital assets. Investment capital is a risk.

Crypto World

Was The 40% Rally A Retail Trap?

Uniswap price is up around 3% over the past 24 hours, trading near $3.40. But this small move hides what really happened on February 11. That day, UNI surged nearly 42% to a high near $4.57 after news linked Uniswap to BlackRock’s tokenized fund expansion.

Since then, sellers have erased about 26% of that rally. This raises a key question: was this institutional-driven breakout a real trend shift, or a trap for retail buyers?

Uniswap Price Breakout on February 11 Was Driven by Retail Momentum

The rally on February 11 did not happen randomly.

Sponsored

Sponsored

On the 12-hour chart, Uniswap price had been forming a bullish setup since mid-January. Between January 19 and February 11, UNI made lower lows while the Relative Strength Index, or RSI, made higher lows. RSI measures momentum by tracking buying and selling strength. When price falls, but RSI rises, it signals a bullish divergence, often warning that selling pressure is weakening.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This divergence suggested that a rebound was building.

That signal was confirmed on February 11. On that day, On-Balance Volume, or OBV, broke above a long-term descending trendline. OBV tracks whether volume is flowing into or out of an asset. When OBV breaks upward, it usually shows growing retail participation. The timing was important.

RSI divergence had been in place for weeks. OBV only broke out on February 11, exactly when the BlackRock-linked news hit the market. This shows that retail traders reacted aggressively to the headline, rushing into UNI.

Sponsored

With momentum and volume aligned, the Uniswap price surged to around $4.57 in a single session. But the structure of that candle raised early warning signs.

On the 12-hour chart, the breakout candle formed with a very long upper wick and a small body. This means buyers pushed the price higher, but sellers absorbed most of the move before the close. It was the first sign that a strong supply existed near $4.50. The rally looked powerful. But distribution had already started.

Whale Selling Near $4.57 Explains the Sharp Rejection

The long wick on February 11 was not driven by random selling. Whale data shows who was responsible.

On that day, supply held by large Uniswap holders dropped sharply from about 648.46 million UNI to 642.51 million UNI. That is a reduction of roughly 5.95 million tokens. At prices near $4.57, this represents selling pressure worth about $27 million.

This was not profit-taking by small traders. It was a coordinated distribution by large wallets.

Sponsored

Sponsored

While retail buyers were chasing the breakout, whales were exiting into strength. This explains why the UNI price failed to hold above $4.50 and why the rally collapsed so quickly. Once large holders finished selling, buy-side momentum weakened. Without whale support, the market could not sustain elevated prices.

The result was a fast retracement. From the $4.57 peak, the Uniswap price fell about 26%. Most late buyers were possibly immediately pushed into losses. This confirms that the BlackRock-related surge became a liquidity event for large holders.

Retail provided the demand. Whales provided the supply.

4-Hour Chart Shows the Uniswap Price Rally Target Was Already Completed

The lower timeframe explains why the pullback started so quickly. On the 4-hour chart, Uniswap had been forming an inverse head-and-shoulders pattern inside a descending channel. This is a classic reversal structure that often signals a short-term breakout.

Sponsored

Sponsored

On February 11, UNI broke above the neckline of this pattern and quickly reached its projected target near $4.57. In technical terms, the setup had already completed its measured move.

At the same time, the 4-hour OBV divergence became clear. Between late January and February 11, UNI moved higher, but OBV continued trending lower. This shows that volume strength was weakening even as the price rose. This bearish OBV divergence warned that the breakout was not being supported by sustained retail demand. Plus, the OBV is currently trending down, showing retail offloading.

Retail traders focused on the price move. Whales focused on the structure. By the time most buyers entered, the rally was already mature. Now, price is drifting near $3.40 while volume continues to weaken. This suggests that speculative demand is fading.

If UNI holds above $3.21, the market may attempt consolidation. But this support is fragile because it is built on short-term buying, not long-term accumulation.

A breakdown below $3.21 would likely trigger another sell wave. In that case, the next major level sits near $2.80, which marks the head of the prior reversal pattern. A move to this zone would erase all of the BlackRock-driven gains.

To regain strength, Uniswap price must reclaim the $3.68 to $3.96 region. This area now acts as a major obstacle after the failed breakout. Only a sustained move above it would reopen upside toward $4.57.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

NewsBeat2 days ago

NewsBeat2 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

Tech5 days ago

Tech5 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports7 hours ago

Sports7 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World8 hours ago

Crypto World8 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Video3 hours ago

Video3 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month