Crypto World

Whale Behavior in DeFi Markets

How Smart Money Moves Liquidity, Shapes Narratives, and Hunts Inefficiencies In DeFi, price doesn’t move because of vibes. It moves because of its size.

Whales — wallets controlling massive amounts of capital — are the invisible hands that shape liquidity, trigger volatility, rotate narratives, and quietly accumulate before retail even notices. If you want to survive (and thrive) on-chain, you don’t fight whales. You study them.

Let’s break down how they actually operate.

1️⃣ Who Are “Whales” in DeFi?

A whale isn’t just someone with a big bag. In DeFi, whales typically include:

What makes them powerful isn’t just capital — it’s coordination, speed, and access to data.

They don’t trade charts.

They trade liquidity, incentives, and psychology.

2️⃣ How Whales Move Markets

A. Liquidity Deployment & Withdrawal

In DeFi, liquidity is power.

When whales add liquidity to pools:

-

Yields compress

-

Slippage decreases

-

Protocol TVL spikes

-

Confidence increases

When they withdraw:

-

TVL drops

-

Yields spike

-

Fear spreads

-

Smaller LPs panic

A single large liquidity removal from a lending protocol can send shockwaves across borrowing rates.

B. Yield Farming Rotation

Whales constantly rotate capital to optimize emissions.

They:

-

Enter early during high token incentives

-

Farm aggressively

-

Dump emissions into strength

-

Exit before APY normalizes

This is why new farms look explosive at launch — and dry up 2–4 weeks later.

If you see sudden TVL spikes in a new protocol, ask:

Is this organic growth… or mercenary capital?

C. Governance Power Plays

DeFi governance is often token-weighted. Translation?

Capital = influence.

Whales can:

Some whales accumulate governance tokens quietly, then surface during critical votes. If you ignore governance flows, you’re missing half the story.

D. Liquidity Hunts & Stop Sweeps

In on-chain perpetual DEXs, whales often:

It’s not manipulation — it’s game theory in an open ledger system.

DeFi transparency means everyone sees the liquidation levels.

Guess who has enough capital to push prices into them?

3️⃣ Smart Whale Patterns to Watch

Here’s where things get interesting.

🧠 Early Accumulation Before Incentives

Whales often accumulate before:

-

Token listings

-

Major integrations

-

Incentive campaigns

-

Governance proposals

On-chain accumulation > Twitter hype.

🔁 Capital Rotation, Not Exit

When markets “crash,” whales often don’t leave crypto.

They rotate:

-

From volatile tokens → stablecoin yield

-

From farming → lending

-

From altcoins → ETH/BTC

-

From DEX perps → staking

Retail sees “exit.”

Whales see repositioning.

📉 Buying Fear Events

Bridge hacks, exploit rumors, governance drama — these are discount windows.

If fundamentals remain intact, whales accumulate during panic.

They sell optimism, not fear.

4️⃣ Real DeFi Examples of Whale Impact

Without naming specific wallets, history shows patterns across major ecosystems:

-

During DeFi Summer, massive capital rotated between Curve, Yearn, Compound, and Sushi depending on emissions.

-

When L2 ecosystems launched incentive programs, whales bridged millions within hours.

-

In lending protocols, whale repayments have instantly normalized borrowing rates.

-

Governance whales have swung DAO votes by double-digit margins.

In every cycle, whales front-run narrative shifts.

5️⃣ Tools to Track Whale Activity

If you’re serious about DeFi alpha, use data.

-

On-chain explorers (Etherscan, Arbiscan, etc.)

-

Wallet tracking dashboards

-

Governance vote monitors

-

TVL analytics (DeFiLlama)

-

Token flow analytics

-

Liquidation dashboards

Watching price without watching wallets is like watching the ocean surface and ignoring the currents underneath.

6️⃣ How Retail Can Use Whale Behavior

You don’t need whale capital.

You need whale awareness.

✔ Follow liquidity, not hype

✔ Track sudden TVL spikes

✔ Watch governance accumulation

✔ Study stablecoin inflows/outflows

✔ Avoid farming too late in incentive cycles

The edge isn’t predicting the market.

It’s understanding who has the power to move it.

7️⃣ The Harsh Truth

Whales don’t hate retail.

They just play a different game.

They optimize:

-

Risk-adjusted yield

-

Liquidity depth

-

Incentive schedules

-

Token unlock calendars

-

Governance timing

Meanwhile, retail often trades narratives without checking on-chain flows.

That mismatch? That’s the opportunity.

Final Thought

DeFi is radically transparent. Every move is public.

Whales leave footprints — you just need to know where to look.

If you learn to interpret capital rotation, liquidity shifts, and governance positioning, you stop reacting to volatility… and start anticipating it.

And in DeFi, anticipation beats emotion every single time.

REQUEST AN ARTICLE

Crypto World

LINEA price is up 24%: here’s what analysts predict could happen next

- LINEA has surged 24% amid strong social engagement and trading volume.

- The launch of trustless agents and ERC‑8004 has boosted ecosystem adoption and interest.

- The immediate support in case of a pullback lies at $0.0037, while the immediate resistance is at $0.00413.

LINEA has surged by 24% in just 24 hours, marking one of its strongest short-term rallies in recent months.

The token is currently trading at $0.003805, recovering from a recent low of $0.002987.

This price jump comes after weeks of consolidation, where LINEA had been hovering in the $0.003–$0.004 range.

The sudden momentum signals a possible shift in market sentiment.

Recent catalysts driving the rally

One of the key drivers behind this surge is LINEA’s growing presence in the crypto community.

Social engagement metrics have shown that LINEA has outperformed other Layer‑2 projects in terms of mentions, interactions, and overall online attention.

This heightened activity appears to correlate with price movement, suggesting that increased visibility and investor interest are fueling the recent uptick.

Technical indicators also support the bullish momentum, with LINEA recently breaking above a multi-week resistance zone around $0.00370.

This breakout coincided with the token reclaiming its 20-day exponential moving average (EMA), which traders often see as a signal for short-term trend reversal.

Furthermore, momentum indicators, including the Relative Strength Index (RSI), are approaching overbought levels, indicating strong buying pressure but also cautioning that a brief pullback or consolidation could occur.

In addition, volume trends show a notable increase in trading activity, further reinforcing that the market is responding to both sentiment and technical factors.

Beyond market activity, developments in LINEA’s ecosystem are adding to optimism.

The launch of trustless agents powered by ERC‑8004 introduces verifiable identity and portable reputation for AI-driven smart contracts.

This feature positions LINEA as more than just a Layer‑2 scaling solution, highlighting its potential as a platform for next-generation decentralised applications.

Analysts suggest that these technological milestones could attract developers and new users, supporting both short-term interest and long-term adoption.

LINEA price forecast

Looking ahead, analysts predict that LINEA could continue to show volatility but remain within a defined range.

The token’s support level is around $0.00370, which traders will watch closely to gauge whether the recent breakout can hold.

Immediate resistance is near $0.00413, aligning with longer-term moving averages.

If LINEA breaks through this level, it could test higher targets, with analysts projecting potential upside toward $0.0939 by the end of the year.

Conversely, a failure to hold support could push the price down toward $0.0308, highlighting the token’s potential for significant swings.

Traders should monitor volume, sentiment, and key technical levels to navigate this highly dynamic market.

Overall, LINEA’s combination of social momentum, ecosystem development, and short-term bullish technical signals suggests that the token remains one to watch.

While risks remain, the current rally and forward-looking developments provide a compelling case for both traders and investors looking for opportunities in the Layer‑2 crypto space.

Crypto World

RENDER Down 76% From Peak While Processing 1.5M Frames Monthly: Capitulation or Opportunity?

TLDR:

- RENDER processes record 1.5M frames monthly while token crashes 76% to $1.30 from May 2025 peak of $5.50

- Network burned 1.04M tokens with 35% of all-time frames rendered in 2025 alone despite brutal price action

- AI rendering launch and Dispersed.com platform expand services while trading volume collapses 87% in 30 days

- 5,600 active GPU nodes and partnerships with Nvidia, Apple signal strong fundamentals amid $671M market cap

RENDER token crashes to $1.30 after plummeting 76% from its May 2025 high of $5.50, creating a stark disconnect between price action and explosive network growth.

The cryptocurrency’s market capitalization sits at $671 million following a 66% collapse from previous peaks, while the platform processes record-breaking 1.5 million frames monthly.

Trading volume of $28.7 million reflects an 87% monthly decline, yet network fundamentals surge to unprecedented levels across multiple metrics.

Price Crashes While Network Usage Explodes

The contrast between price performance and network activity reaches extreme levels. RENDER bleeds across all timeframes with a 3.59% drop in 24 hours, 17.63% decline over seven days, and catastrophic 49.97% collapse in 30 days.

Meanwhile, the network hit a monumental milestone of 67 million total frames rendered since inception. The data reveals something remarkable: 35% of all-time frames were processed in 2025 alone, making it the strongest year in platform history.

Network infrastructure expanded dramatically during the price decline. Active GPU nodes grew to 5,600 contributors powering the distributed rendering network.

Token burns reached 1.04 million RENDER tokens through network fee mechanisms. Monthly frame processing hit an all-time record of 1.5 million, demonstrating actual usage growth while token holders suffer massive losses. The divergence between utility metrics and price creates a puzzling scenario for market participants.

Social indicators suggest accumulation despite the carnage. Sentiment analysis shows 80% positive outlook among community members.

Social dominance spiked 158% while AltRank climbed 270 positions in just 30 days. Volume collapse of 87% over the past month signals capitulation-level selling or complete trader exhaustion. The question becomes whether this represents final washout or further downside ahead.

GPU demand for artificial intelligence workloads surges globally while RENDER prices tank. The platform sits at the intersection of two massive narratives: AI infrastructure and decentralized physical infrastructure networks.

Enterprise-grade hardware onboarding through RNP-021 brings NVIDIA H200 and AMD MI300X chips to the network.

These developments target professional-grade computational workloads worth billions in traditional cloud markets.

AI Expansion Launches as Token Holders Face Pain

RENDER launched AI rendering capabilities on January 26, 2026, marking a strategic pivot beyond traditional graphics rendering.

The Dispersed.com platform went live, aggregating global GPU resources for machine learning and AI model training.

This infrastructure directly addresses exploding demand for computational power in the AI sector. Partnerships with Nvidia, Apple, and Stability AI validate the technical approach and market positioning.

The fundamentals tell an insane story of growth. Processing 1.5 million frames monthly while burning over one million tokens creates deflationary pressure amid increasing utility. Network activity proves real users pay real fees for real computational work.

Enterprise GPU integration brings institutional-grade hardware to a decentralized network. The technical roadmap advances with Octane 2026 integration scheduled and RenderCon 2026 event planned.

Price action tells a brutal counter-narrative. The 76% collapse from $5.50 to $1.30 destroys holder value across the board. Market capitalization evaporated from roughly $1.9 billion to $671 million in less than a year.

Trading volume contraction suggests either accumulation by strong hands or complete market disinterest. Traditional investors face cognitive dissonance: fundamentals scream strength while charts scream weakness.

The setup creates a classic value versus momentum dilemma. Bears point to relentless selling pressure and macro headwinds crushing all risk assets.

Bulls highlight record network usage, strategic partnerships, and positioning in high-growth AI markets. The 87% volume decline could signal final capitulation or prolonged bear market ahead.

Either scenario presents radically different outcomes for current price levels and future potential.

Crypto World

Strategy CEO Seeks More Preferred Stock to Fund Bitcoin Buys

Bitcoin (CRYPTO: BTC) treasury company Strategy will lean more heavily on its perpetual preferred stock program to finance additional Bitcoin purchases, moving away from a reliance on issuing common stock. CEO Phong Le outlined the pivot during Bloomberg’s The Close, explaining that the company intends to shift from equity capital to preferred capital as a core funding channel. The move centers on Stretch (STRC), Strategy’s perpetual preferred offering launched in July, which targets investors seeking steadier returns through an annual dividend north of 11%. The instrument has been positioned as an alternative to diluting the company’s stock while it continues to amass BTC holdings. The development comes as Strategy eyes a broader rollout of STRC later in the year, signaling a potential shift in how corporate treasuries wield equity-like instruments to grow crypto reserves.

Le emphasized that the preferred stock will “take some seasoning” and marketing before traders fully embrace the product, but he remained upbeat about STRC’s trajectory. He told The Close that, in the course of this year, Stretch could become a cornerstone offering for Strategy as it seeks to fund further Bitcoin acquisitions. The company’s financing strategy has repeatedly leaned on STRC to finance BTC purchases since its inception, providing a mechanism to accumulate digital assets without triggering immediate dilution of common equity. The approach is part of a broader class of crypto treasuries that use perpetual preferreds to balance income generation with asset accumulation.

STRC, which was introduced to market as Strategy’s fourth perpetual preferred instrument, was explicitly designed to appeal to buyers seeking long-term stability. It carries an annual dividend and is marketed as a capital-structure play rather than a plain equity raise. The instrument’s structure aims to deliver predictable income while enabling Strategy to keep building its Bitcoin stack. The narrative around STRC has fed into a wider discussion about how corporate treasuries are managing liquidity, risk, and exposure to crypto markets without immediately triggering shareholder dilution. Critics, however, have warned that the space has grown crowded and that some companies’ holdings now exceed their market capitalization, raising questions about concentration risk and governance.

Strategy could restart offerings as STRC hits $100

In late trading, STRC regained its par value of $100 for the first time since mid-January, a development Le described as the “story of the day.” The move back to par could unlock renewed appetite for STRC issuances, potentially enabling Strategy to fund additional Bitcoin purchases without issuing new common shares. Earlier this month, the stock traded under $94 when Bitcoin briefly slid below $60,000, underscoring how BTC price dynamics can influence the attractiveness of STRC as a funding mechanism. With Bitcoin trading roughly around $66,800, the market environment remains relatively constructive for asset accumulation through alternative financing vehicles, even as volatility lingers on near-term horizons.

Bitcoin’s price trajectory has been steady but not spectacular in the immediate term, hovering around the mid-$66,000s after peaking above $68,000 intraday. The price backdrop supports narratives that corporate treasuries can pursue more disciplined, income-generating avenues for finance, while still chasing the long-term upside of BTC exposure. The evolving dynamics around STRC and similar instruments come as crypto returns and risk sentiment influence decisions across corporate balance sheets, with issuers seeking to optimize cost of capital and dilution concerns in parallel.

Buying Bitcoin treasury rivals a “distraction”

Analysts have cautioned that the crypto treasury space is becoming crowded as several firms vie for a relatively small pool of traders and investors. In a crowded market, some observers warn that corporate treasuries could face diminishing marginal value as more players announce similar funding structures. The fragmentation raises questions about price discovery, liquidity, and the true strategic value of perpetual preferreds in maintaining BTC accumulation over the long run.

Related: Saylor’s Strategy buys $90M in Bitcoin as price trades below cost basis

Beyond pure competition concerns, Le dismissed the notion that Strategy would pursue aggressive consolidation through acquisitions of underperforming peers. He argued that focusing on the core STRC product is preferable to pursuing opportunistic takeovers, likening the approach to other technology or finance markets where companies emphasize product development over opportunistic acquisitions. “In any new market, whether it be electric cars or AI or SaaS software, you want to focus on your core product,” Le said. “It would be a distraction to go buy, at a discount to net asset value, another digital asset treasury company.”

As the wider market digests these developments, Strategy’s stock, traded as MSTR, closed down more than 5% at $126.14, reflecting a sentiment that remains cautious in the near term even as STRC gains traction. The price action underscores the delicate balance investors weigh between funded BTC accumulation and the potential dilution risk associated with new equity or preferred stock offerings. The discussion around STRC also feeds into broader debates about how corporate treasuries manage risk, yield, and the opportunity cost of capital when BTC becomes a strategic asset rather than a speculative instrument.

To contextualize the conversation, industry observers have pointed to a broader trend: as more companies adopt crypto treasuries, the market could see consolidation through mergers and acquisitions or more aggressive share-issuing strategies when faced with capital needs. Yet Strategy’s leadership seems intent on refining its preferred-stock route rather than chasing rapid expansion through bolder balance-sheet moves. The decision to prioritize a steady, dividend-bearing instrument aligns with a philosophy of measured growth and risk control, even as BTC remains a volatile, high-beta asset that can swing strategic outcomes in a single trading session.

In parallel, the crypto treasury sector has become a focal point for investors seeking visibility into how corporate treasuries navigate liquidity, risk, and regulatory constraints. Analysts suggest that while the category has matured in some respects, it remains a moving target shaped by Bitcoin’s price action, macroeconomic conditions, and evolving market structure. The emergence of streaming discussions around STRC and similar products indicates a willingness among issuers to experiment with bespoke capital-structure solutions as legitimate means of funding crypto purchases. The question remains: how durable will these instruments prove in different market regimes, and will investor demand stabilize as more issuers publish performance data and governance disclosures?

Why it matters

For investors, Strategy’s pivot toward preferred stock as a primary funding mechanism highlights a shift in how crypto treasuries can balance income with exposure to Bitcoin outright. The STRC instrument promises yield and stability, potentially reducing the pressure to issue more common stock and mitigate dilution. If STRC continues to perform and attract sufficient investor interest, Strategy could emerge as a case study for how treasuries combine traditional fixed-income features with crypto exposure to create a hybrid financing model.

From a market perspective, the development reinforces the idea that institutional players are increasingly treating BTC as a fundamental corporate asset rather than a speculative risk. The use of perpetual preferreds could provide a template for other issuers seeking to augment BTC reserves without triggering immediate equity dilution. Yet the crowded nature of the space also invites closer scrutiny of governance, risk management, and the alignment of incentives between a company’s treasury activities and shareholder interests. The balance between discipline in funding and the pursuit of BTC upside remains a central tension, one that Strategy appears intent on navigating with caution and clarity.

For builders and researchers, the case raises questions about the transparency of crypto-treasury deals, the long-term performance of perpetual preferreds in crypto contexts, and how such instruments should be regulated as they gain traction in mainstream finance. The evolving narrative around STRC and related products could influence product design, disclosure standards, and investor education as more firms explore innovative capital-structure solutions to support digital-asset accumulation.

What to watch next

- Progress in STRC marketing and adoption, including any new issuances or marketing milestones (dates to watch).

- Bitcoin price movements and any corresponding shifts in Strategy’s BTC purchase cadence or balance-sheet disclosures.

- Regulatory developments affecting corporate crypto treasuries and preferred-stock financings.

- Q3 and Q4 earnings context for Strategy (or related entities) that could reflect changes in capital-raising strategies.

- Market sentiment indicators for crypto treasuries, including liquidity and trading volumes for perpetual-preferred products.

Sources & verification

- Bloomberg – Phong Le interview on The Close discussing Strategy’s move from equity capital to preferred capital and STRC’s role (YouTube link provided in original coverage).

- Cointelegraph – Strategy raises $2B in preferred stock to back Bitcoin purchases (article detailing STRC launch and purpose).

- Cointelegraph – Why Saylor’s Strategy keeps buying Bitcoin: Long-term investment rationale and treasury approach.

- Cointelegraph – Saylor/Strategy buys $90M in Bitcoin as price trades below cost basis (context on BTC purchases and treasury activity).

- Cointelegraph – Crypto treasury more merger/acquisition cycle mature (analysis of competitive dynamics in the treasury space).

What to watch next

Market development and official disclosures in the coming quarters will be critical to assess STRC’s effectiveness as a funding tool and Strategy’s broader strategy for growing its BTC holdings through preferred-stock issuances.

Crypto World

Bankers Urge OCC to Slow Crypto Trust Bank Charters

The American Bankers Association (ABA) is urging the Office of the Comptroller of the Currency (OCC) to slow its approval of national trust bank charters for crypto and stablecoin firms until the regulatory landscape under the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act is clearer.

In a Wednesday comment letter on the OCC’s national bank chartering notice of proposed rulemaking, the trade group warned that recent and future applicants engaged in stablecoin and digital asset activities face still‑unsettled oversight from multiple federal and state regulators.

The ABA said that the OCC should not advance applications where an institution’s full regulatory obligations, including under forthcoming GENIUS Act rulemakings, are not yet fully defined.

The association warned that uninsured, digital asset‑focused national trusts raise unresolved safety and soundness, operational and resolution issues, particularly around the segregation of customer assets, conflicts of interest and cybersecurity.

Related: OCC boss says ‘no justification’ to judge banks and crypto differently

It also cautioned that national trust charters could be used to avoid registration and scrutiny by the Securities and Exchange Commission (SEC) or Commodity Futures Trading Commission (CFTC) when firms engage in activities that would otherwise trigger securities or derivatives regulation.

The ABA urged the OCC to be “patient,” resist applying traditional timing expectations to these applications, and ensure each charter applicant’s regulatory responsibilities “come fully into view” before moving applications forward.

The association further called for greater transparency around how the OCC calibrates capital, operational and resilience standards in conditional approvals for crypto‑related charters, and pressed the agency to tighten naming rules so that limited‑purpose trust banks that are not engaged in the business of banking cannot use “bank” in their names.

That, it argued, would reduce the risk of consumer confusion about the status and safety of obligations at uninsured entities.

Related: Stablecoin rewards provisions face industry test in Senate crypto bill

Warning after new crypto trust charters

The intervention comes less than two months after the OCC granted conditional national trust bank approvals to five crypto firms: Bitgo Bank & Trust, Fidelity Digital Assets, Ripple National Trust Bank, First National Digital Currency Bank, and Paxos Trust Company.

On Dec. 12, 2025, the OCC greenlighted a path for these companies to hold and manage customer digital assets under a federal charter while remaining outside the deposit-taking and lending business.

The same banking lobby is also pressing Congress, through pending crypto market structure legislation such as the Digital Asset Market Clarity (CLARITY) Act, to curb stablecoin rewards, contending that yield‑bearing stablecoins and affiliate “rewards” programs would function as bank‑like products without being subject to the full bank regulatory regime.

Magazine: When privacy and AML laws conflict — Crypto projects’ impossible choice

Crypto World

Will PIPPIN price crash after rallying 200% this week?

PIPPIN price has shot up nearly 200% over the past week, driven by sharp demand from futures traders. Is the meme coin set to see more gains, or will it crash?

Summary

- PIPPIN price rallied 200% over the past week, primarily driven by a spike in speculative trading.

- The meme coin has confirmed a rounded bottom pattern on the daily chart.

According to data from crypto.news, the Pippin (PIPPIN) price rallied over 200% in the past 7 days to a high of $0.52, which is roughly 7% short of breaking past its previous all-time high of $0.55 hit last month.

The PIPPIN rally appears to be mostly fueled by increased speculative activity, as traders aggressively opened bullish positions in the derivatives market, a trend common among high-volatility meme coins where momentum is often driven by leverage rather than fundamental developments.

Data from CoinGlass shows that PIPPIN futures open interest has jumped to an all-time high of $217 million, nearly four times the amount recorded nearly a week ago. At the same time, the long/short ratio stood above 1, suggesting more investors were betting on further price increases.

Open Interest reflects the total number of outstanding derivative contracts that have not been settled. When a surge in Open Interest comes along with the price rise of an asset, it indicates new money entering the market.

Meanwhile, the aggregated funding rate was positive at press time at 0.0070%, which shows that long position holders were paying fees to short sellers, conditions that help support continued upward momentum.

It should, however, be noted that PIPPIN’s rally came without the backing of any major news or development from the project’s team. Its official X account has not posted anything since August last year.

Despite this lack of official communication, the retail sentiment surrounding the token has remained bullish, as seen in CoinMarketCap.

Another point of concern is the market-wide downturn fueled by Bitcoin’s underperformance over the past trading sessions. Crypto investors are currently spooked by concerns over another U.S. government shutdown and uncertainty over Fed policy direction.

On the daily chart, PIPPIN price appears to be forming the cup of a multi-week cup and handle pattern, which has been developing since late January.

The cup and handle pattern is one of the most bullish continuation patterns that often signals an existing uptrend is likely to resume after a period of consolidation. The cup in itself is also formed of a rounded bottom pattern, which is yet another bullish indicator by itself.

At press time, the PIPPIN price had already broken above the neckline of the rounded bottom formed.

Considering this, the Solana-based meme coin could likely continue to be in an uptrend, with the path of least resistance appearing to be a bullish move to new highs around $0.89, calculated by adding the height of the rounded bottom formed to the point at which the price crossed the neckline.

Looking at technical indicators also gives us a grounded view of such a bullish forecast. Notably, the supertrend indicator has flashed green while the MACD lines have pointed upwards, both signs that bulls still have significant control over the market price action.

Unless the current upward momentum is hampered by macroeconomic headwinds, PIPPIN’s technical breakout is expected to serve as a bullish catalyst.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Crypto World

Pentagon Pushes AI Companies to Deploy Tools on Classified Networks

TLDR

- The Pentagon is urging AI companies to make their tools available on classified networks.

- Chief Technology Officer Emil Michael highlighted AI’s role in all classification levels.

- OpenAI and Anthropic are negotiating military use of their tools with varying degrees of restriction.

- OpenAI has agreed to provide its models on unclassified networks under genai.mil.

- Anthropic has expressed concerns over military use in weapon targeting and domestic surveillance.

The Pentagon is pushing for top AI companies like OpenAI and Anthropic to make their tools available on classified networks. The military aims to expand the deployment of AI across both classified and unclassified domains. The move has sparked debate between the Pentagon and AI companies over usage restrictions.

Pentagon Aims to Deploy AI Tools on All Classification Levels

According to a Reuters report, Pentagon Chief Technology Officer Emil Michael urged tech executives to provide AI models for use on both classified and unclassified networks.

“The Pentagon is moving to deploy frontier AI capabilities across all classification levels,” a government official stated.

Currently, AI companies mainly offer their tools for unclassified networks, but this push marks a shift in the military’s strategy. The military seeks to use AI’s power to synthesize data and assist decision-making processes.

However, many AI models have built-in safeguards to prevent misuse. These safeguards have led to tension as Pentagon officials argue for fewer restrictions on deployment, saying the tools should be accessible as long as they comply with U.S. laws.

Ongoing Negotiations with AI Companies

The Pentagon has engaged in ongoing talks with leading AI firms about military applications. OpenAI recently struck a deal with the Pentagon to make its tools available on an unclassified network, known as genai.mil. As part of the agreement, OpenAI removed many restrictions but kept some safeguards in place to ensure safe usage.

While OpenAI’s agreement focuses on unclassified networks, discussions with Anthropic have been more complex. Anthropic executives have expressed concerns about using their models for weapon targeting or domestic surveillance. The company, however, is working with the Department of War to find ways to support national security missions while maintaining its guidelines.

These developments signal a shift in how AI will be integrated into the military. The Pentagon continues to explore the potential of AI tools in critical missions, despite concerns over their reliability in high-risk situations.

Crypto World

Withdrawal Freeze at BlockFills Revives Post-FTX Anxiety

BlockFills, a Chicago-based crypto lender and liquidity provider, has temporarily halted client deposits and withdrawals.

The move comes as the crypto market continues to experience notable volatility, with asset prices trending lower.

Crypto Liquidity Provider BlockFills Stops Withdrawals and Deposits During Market Stress

BlockFills operates as a cryptocurrency solutions firm and digital asset liquidity provider. It serves approximately 2,000 institutional clients, including crypto-focused hedge funds and asset managers. In 2025, the firm handled $60 billion in trading volume.

Sponsored

Sponsored

The company said in a statement posted on X that the suspension was implemented last week and remains in effect. According to BlockFills, the decision was made in light of “recent market and financial conditions” and is intended to “protect both clients and the firm.”

Despite the suspension of deposits and withdrawals, clients have continued to trade on the platform. BlockFills said users are still able to open and close positions in spot and derivatives markets, as well as select other circumstances.

The company also said management is working closely with investors and clients to resolve the situation and restore liquidity to the platform.

“The firm has also been in active dialogue with our clients throughout this process, including information sessions and an opportunity to ask questions of senior management. BlockFills is working tirelessly to bring this matter to a conclusion and will continue to regularly update our clients as developments warrant,” the statement read.

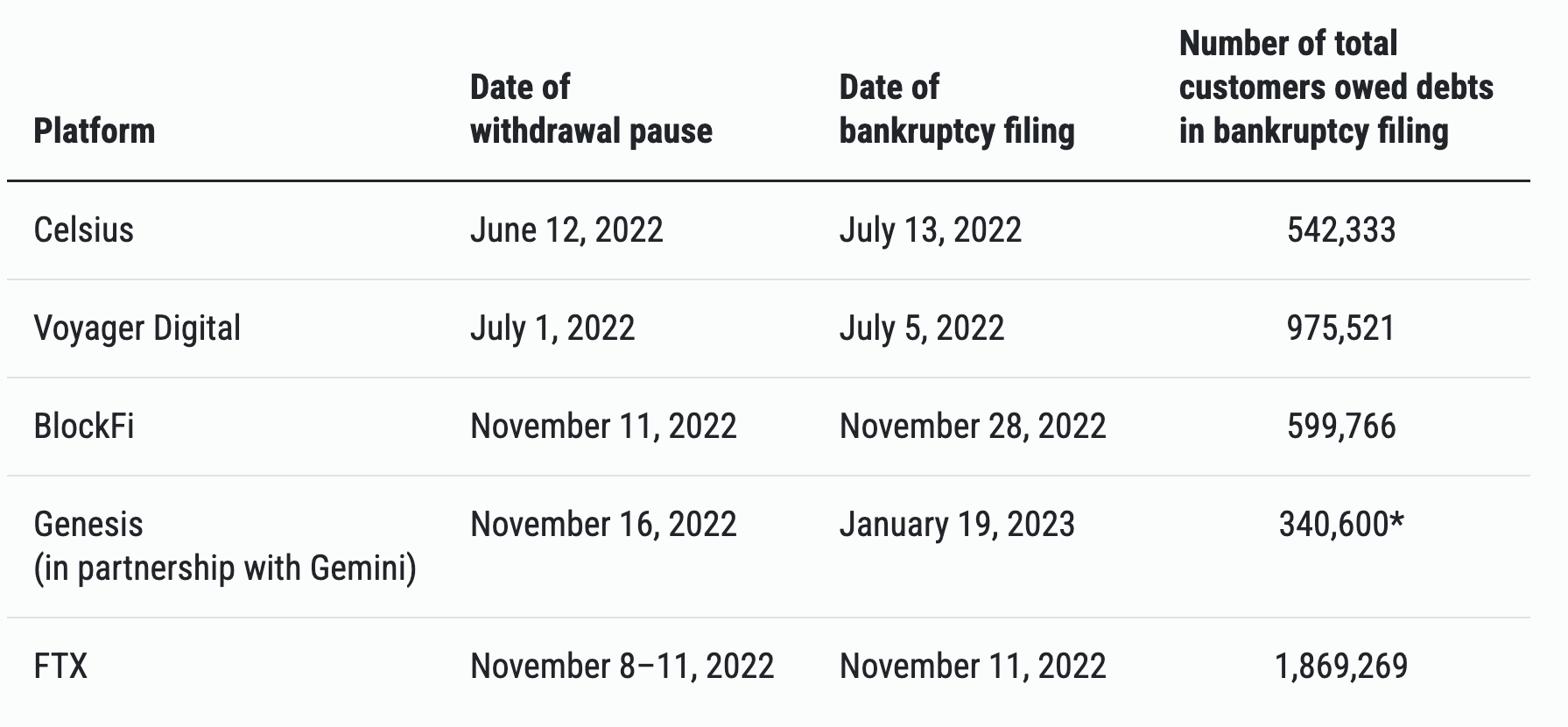

In the crypto industry, withdrawal freezes often trigger concern. The sector’s last severe downturn in 2022 saw several high-profile lenders, including Celsius, BlockFi, Voyager, FTX, and more, halt withdrawals before filing for bankruptcy.

Many of the crypto bankruptcies, such as those of FTX, BlockFi, and Three Arrows Capital, were interconnected, leading to a domino effect in the market. The events led to market destabilization and negatively impacted sentiment.

Nonetheless, it’s worth noting that temporary suspensions can also function as defensive measures during periods of intense market stress. At present, there is no publicly available evidence suggesting that BlockFills is insolvent.

Meanwhile, the suspension comes as some market participants warn of a renewed “crypto winter.” Since the start of the year, the total cryptocurrency market capitalization has declined by more than 22%.

Last Friday, Bitcoin fell to around $60,000, marking its lowest level since October 2024. The asset remains roughly 50% below its all-time high of approximately $126,000, recorded in October.

Crypto World

Will XRP Community Day trigger a rally?

XRP Community Day has put Ripple’s token back in focus as traders look for catalysts amid a fragile market structure.

Summary

- XRP Community Day has refocused attention on the XRP Ledger’s ecosystem, highlighting developer activity and community engagement rather than delivering a single market-moving announcement.

- XRP is consolidating near the $1.37–$1.38 support zone, with narrowing Bollinger Bands and a recovering CMF suggesting selling pressure is easing, though upside remains capped below $1.45–$1.50.

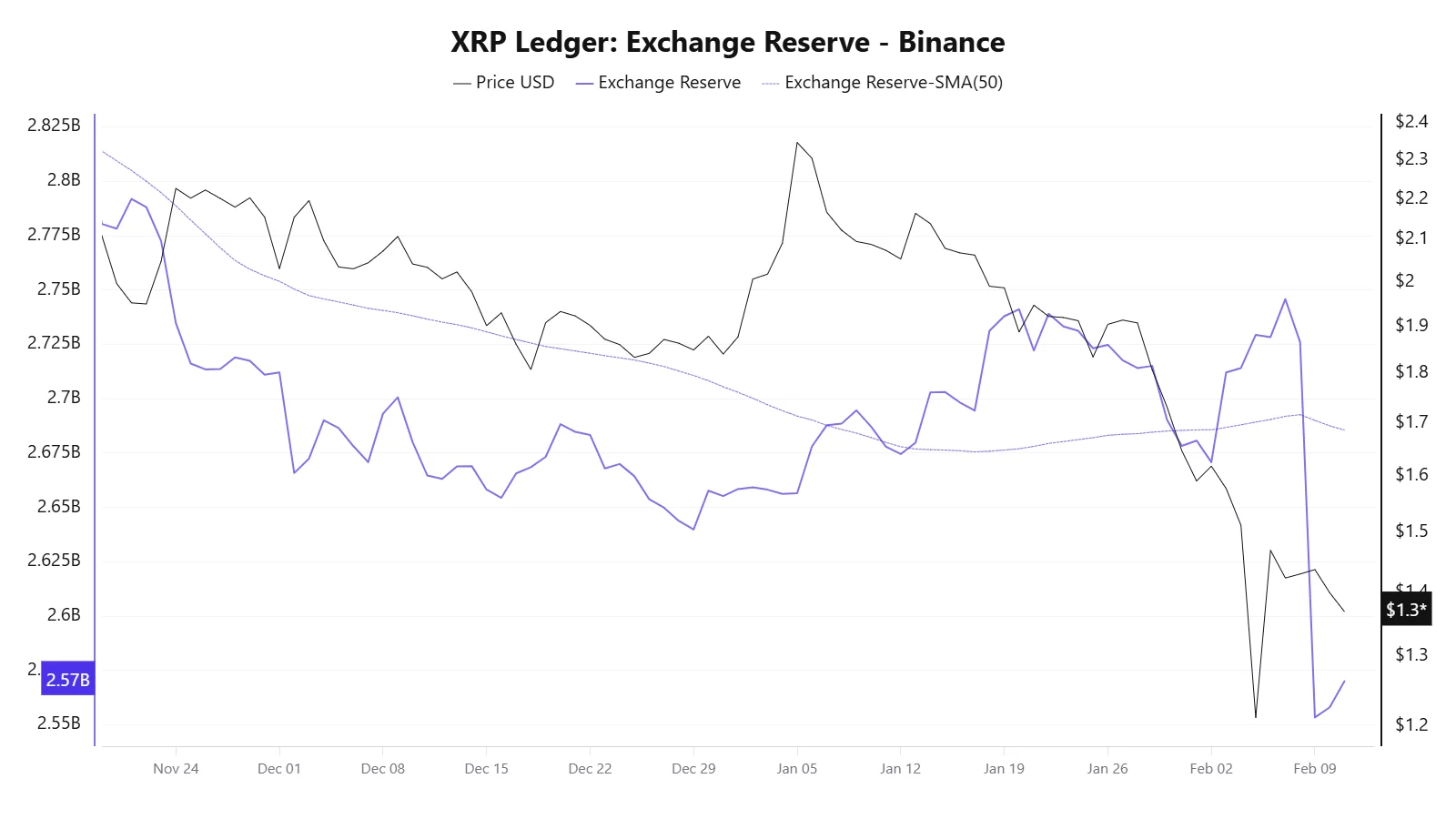

- Declining XRP exchange reserves on Binance point to reduced immediate sell-side supply, offering a supportive backdrop if renewed community-driven interest translates into demand.

The community-led event highlights ecosystem updates, developer activity, and ongoing engagement around the XRP (XRP) Ledger. This could help refocus attention on fundamentals after weeks of price weakness.

While XRP Community Day is not tied to a single market-moving announcement, it often serves as a sentiment booster, particularly during consolidation phases.

Increased visibility, renewed social engagement, and discussion around XRPL use cases can act as short-term momentum drivers if broader market conditions cooperate.

XRP price action steadies near key support

XRP is trading near the $1.37–$1.38 zone at press time, attempting to stabilize after a steady pullback from highs above $1.60 earlier this month.

The price is holding near the middle-to-lower portion of the Bollinger Bands on the daily chart. The bands have started to narrow, signaling reduced volatility following the recent sell-off.

While XRP is no longer hugging the lower Bollinger Band, indicating that downside momentum has eased, price has struggled to reclaim the mid-band (20-day moving average). As long as XRP remains below this level, upside attempts are likely to face resistance.

A sustained move above the mid-band would open the door toward the upper band near the $1.45–$1.50 zone.

The Chaikin Money Flow (CMF) remains slightly below the zero line but has turned higher from recent lows, suggesting selling pressure is fading. A move back into positive territory would signal improving capital inflows.

A failure to do so could leave XRP vulnerable to a retest of support around $1.35, followed by $1.28 on a deeper pullback.

Exchange reserve data hints at supply dynamics

Moreover, CryptoQuant data shows XRP exchange reserves on Binance have declined recently, suggesting fewer tokens are being held on exchanges.

This trend typically points to reduced immediate sell-side pressure, as more XRP moves into private wallets rather than remaining available for spot selling.

While falling exchange reserves alone do not guarantee a rally, they can provide a supportive backdrop if demand picks up. Combined with community-driven attention from XRP Community Day, the supply-side dynamics could help limit downside risk in the near term.

Overall, XRP remains in a consolidation phase, with Community Day acting as a sentiment catalyst rather than a guaranteed breakout trigger. Traders will be watching whether XRP can defend the $1.35 support zone and reclaim resistance near $1.45 to signal a shift toward recovery.

Crypto World

WTI Oil Price Climbs to a Monthly High

As the XTI/USD chart shows, the price per barrel moved above the 4 February peak yesterday, marking its highest level since the start of the month. The bullish sentiment has been driven by geopolitical uncertainty. According to media reports:

→ The Trump–Netanyahu meeting in Washington on 10–11 February failed to ease tensions. Despite Omani mediation and statements suggesting a “near compromise”, no formal agreement has yet been reached.

→ Reports of a possible deployment of additional US carrier strike groups to the Middle East have added to market nerves. Any escalation could threaten supplies through the Strait of Hormuz, which accounts for around 20% of global oil consumption.

While the fundamental backdrop remains tense and continues to support higher oil prices, the chart simultaneously points to vulnerability to a pullback.

Technical Analysis of the XTI/USD Chart

When analysing the WTI oil chart on 5 February, we:

→ used recent price swings to construct a broad ascending channel (shown in purple), noting that its lower boundary was acting as support;

→ suggested that the $65 level would become a key obstacle for bulls attempting to maintain upward momentum.

Recent price action supports this view, as:

→ if yesterday’s move above the 4 February high is treated as a bullish breakout, it appears to have failed — a potential bull trap;

→ a bearish engulfing reversal pattern has formed on the chart (indicated by the arrow).

It is noteworthy that many investment bank analysts consider current WTI prices to be overstretched, forecasting a decline towards the $57–59 range due to oversupply. However, such a scenario would likely require a reduction in geopolitical risk.

In light of the above, it is reasonable to assume that the initiative may now be shifting to the bears, who could attempt to push prices towards the lower boundary of the channel. The $64.40 level — which acted as resistance last week — now appears to offer local support.

Start trading commodity CFDs with tight spreads (additional fees may apply). Open your trading account now or learn more about trading commodity CFDs with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Binance CEO Richard Teng breaks down the ‘10/10’ nightmare that rocked crypto

Binance did not cause the crypto market liquidation event on Oct. 10, but every exchange — centralized or decentralized — saw massive liquidations that day after China imposed rare earth metal controls and the U.S. announced fresh tariffs, said Binance Co-CEO Richard Teng.

About 75% of the liquidations took place around 9:00 p.m. ET, alongside two unrelated, isolated issues: a stablecoin depegging and “some slowness in terms of asset transfer,” Teng said Thursday at CoinDesk’s Consensus Hong Kong conference.

“The U.S. equity market plunged $1.5 trillion in value that day,” he said. “The U.S. equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

Some users were affected by this, which Binance helped support, he said, an action other exchanges did not take.

Binance facilitated $34 trillion in trading volume last year, he said, with 300 million users. Trading data does not indicate any massive withdrawals from the platform.

“The data speaks for itself,” he said.

Speaking more broadly, Teng said the crypto market was tracking broader geopolitical tensions but that institutions are still pouring into the sector.

“At the macro level, I think people are still uncertain about interest rate movements going forward,” he said. “And there’s always the trend of geopolitics, tension, etc. Those weigh on these assets, such as crypto.”

However, pointing to how the sector has changed over the past four to six years, Teng said long-term industry participants will have noticed that crypto prices move cyclically.

“I think what we have to look at is the underlying development,” he said. “At this point in time, retail demand is somewhat more muted compared to the past year, but the institutional deployment, the corporate deployment is still strong.”

Institutions are still entering the sector, even despite the market, he said, “meaning the smart money is deploying.”

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports9 hours ago

Sports9 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World10 hours ago

Crypto World10 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video6 hours ago

Video6 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month