Business

Datadog: AI Isn't The Main Problem

Business

VestoFX.net Review: Is This Trading Platform Any Good?

In this VestoFX.net review, we take a detailed look at what the platform offers, how it works, and what traders can expect when using it for CFD trading across multiple global markets.

The goal is to explain the platform in clear, simple language so everyday traders can understand whether it fits their trading style and experience level.

VestoFX.net Review: What Is VestoFX.net and Who Operates It?

VestoFX.net is an online CFD trading platform designed for traders who want access to multiple asset classes through one account. The platform focuses entirely on Contracts for Difference (CFDs), allowing traders to speculate on price movements without owning the underlying assets.

This website (www.vestofx.net) is operated by Fairmont Financial Services (PTY) LTD, a South African investment firm.

The company is authorized and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa and operates under Financial Service Provider (FSP) license number 51766.

VestoFX.net Review: What Markets Can Traders Access?

One of the main highlights in this VestoFX.net review is the range of CFD markets available. The platform brings together several popular asset classes that appeal to traders worldwide.

Traders can access CFDs on:

- Cryptocurrencies

- Forex currency pairs

- Commodities such as metals and energy products

- Shares of selected companies

- Global indices

All instruments are traded strictly as CFDs, allowing traders to focus on price movements rather than ownership.

VestoFX.net Review: How Does CFD Trading Work on the Platform?

CFD trading on VestoFX.net enables traders to speculate on whether an asset’s price will move up or down. Instead of purchasing the asset itself, traders open positions based on price changes.

The platform supports trading in both rising and falling markets.

Tools such as stop-loss and take-profit features are available to help traders manage positions more effectively.

VestoFX.net Review: How Does the Trading Platform Operate?

VestoFX.net provides a web-based trading platform that can be accessed from different devices. The interface is designed to be straightforward, making it easier to monitor markets and execute trades.

Key platform features include real-time charts, trade execution tools, account balance tracking, and market monitoring features. The layout avoids unnecessary complexity, which may appeal to both new and experienced traders.

VestoFX.net Review: How Can Traders Register an Account?

The registration process on VestoFX.net begins with creating an online account. Traders are required to complete a questionnaire during sign-up.

This questionnaire collects information about trading experience, financial background, and understanding of CFD products. Completing it accurately is part of the onboarding process before funding the account and accessing live trading.

VestoFX.net Review: What Account Types Are Available?

VestoFX.net offers four distinct trading account options, structured to suit a wide range of traders, from those just entering the CFD market to highly experienced participants.

The Basic Account is designed for beginners and requires a minimum deposit of $250. It features floating spreads starting from 3.0 pips on EUR/USD, 3.4 pips on GBP/USD, and 3.3 pips on USD/JPY.

This account allows new traders to begin with a relatively low initial commitment and includes one free withdrawal, making it a practical starting point.

The Gold Account is aimed at traders with more market experience and comes with a minimum deposit requirement of $25,000. Compared to the Basic Account, it offers improved trading conditions, with spreads starting from 2.7 pips for EUR/USD, 3.1 pips for GBP/USD, and 3.0 pips for USD/JPY.

Gold account holders also receive one free withdrawal per month, supporting more frequent trading activity.

For traders looking for more advanced conditions, the Platinum Account requires a minimum deposit of $100,000. This account provides tighter spreads, beginning at 2.1 pips for EUR/USD, 2.5 pips for GBP/USD, and 2.4 pips for USD/JPY.

In addition, Platinum traders benefit from three free withdrawals each month, offering greater flexibility in managing funds.

The VIP Account is structured for professional traders seeking premium trading conditions. With a minimum deposit of $250,000, this account offers the most competitive spreads, starting at 1.6 pips for EUR/USD, 2.0 pips for GBP/USD, and 1.9 pips for USD/JPY.

VIP account holders enjoy unlimited fee-free withdrawals, supporting high trading volumes and active fund movement.

Overall, these account options allow traders to choose a structure that aligns with their experience level, trading activity, and financial objectives, while progressively offering tighter spreads and more flexible withdrawal benefits at higher tiers.

VestoFX.net Review: What Can Traders Invest In Using These Accounts?

All account types provide access to the same core CFD markets, including crypto, forex, commodities, shares, and indices. Differences between accounts relate to trading conditions and platform features rather than market availability.

This setup allows traders to diversify their CFD trading activity across multiple asset classes within one platform.

VestoFX.net Review: Who Is the Platform Designed For?

VestoFX.net is built for traders from around the world, including Switzerland, UAE,Saudi Arabia, Malaysia, Kuwait, Singapore. Its multi-asset CFD structure may appeal to traders who prefer managing different markets from a single account.

With multiple account options, the platform supports traders at different experience levels and trading volumes.

VestoFX.net Review: What Are the Key Strengths and Limitations?

Strengths include:

- Access to multiple CFD markets

- Clear account type structure

- Regulated operator under the FSCA

Limitations to consider:

- Only CFD trading is available

- Trading conditions depend on the selected account type

This balanced overview helps set realistic expectations.

VestoFX.net Review: Final Thoughts on the Platform

This VestoFX.net review presents a CFD trading platform focused on providing access to crypto, forex, commodities, shares, and indices through a single interface. The platform emphasizes clarity, structured onboarding, and multiple account choices.

Rather than offering unnecessary extras, VestoFX.net focuses on core CFD trading functionality, making it a platform worth exploring for traders seeking multi-market exposure.

FAQs

Is VestoFX.net suitable for beginners?

Yes, the Basic account and simple platform layout support new traders.

What markets are available on VestoFX.net?

CFDs on crypto, forex, commodities, shares, and indices.

Do traders own assets on VestoFX.net?

No, all trading is done through CFDs only.

Can traders from Switzerland use the platform?

Yes, traders from Switzerland and many other countries can register.

Are multiple account types available?

Yes, Basic, Gold, Platinum, and VIP accounts are offered.

Business

Nancy Guthrie disappearance brings focus on cryptocurrency crime tracking

Former hostage negotiator Dan O’Shea discusses the ongoing investigation into the alleged abduction of Nancy Guthrie on day 10 of the search on ‘Mornings With Maria.’

The disappearance of Nancy Guthrie has brought a renewed focus on the traceability of cryptocurrencies and their use by criminals following reports of alleged ransom notes requesting payment in bitcoin.

Guthrie, 84, was last seen on Feb. 1, when authorities believe she was kidnapped from her home. There have been reports about multiple alleged ransom notes demanding payment in bitcoin during the course of the investigation, now in its second week.

While bitcoin gained a reputation for being associated with crime following the 2013 takedown of the Silk Road online black market, where crypto was used to buy illegal drugs and other items, the evolution of the digital assets industry and expanded regulatory oversight of it in the years since has made it more difficult for bad actors to do so.

“Every single bitcoin transaction is recorded on a public ledger called the blockchain, so when it comes to tracing transactions, following the money, you have a perfect record with bitcoin,” Perianne Boring, founder and chair of the Digital Chamber, told FOX Business. The Digital Chamber advocates for the use of digital assets and blockchain-based technologies.

EX-FBI OFFICIAL FLAGS POSSIBLE SCAM AS THIRD ALLEGED NANCY GUTHRIE LETTER EMERGES

Bitcoin transactions are recorded on the blockchain, which can be tracked by the public and law enforcement, which has more sophisticated tools. (Jakub Porzycki/NurPhoto via Getty Images)

“The blockchain is a public ledger that is free for anyone to audit, so anyone can look up a specific bitcoin wallet address and see every transaction that’s come in and out from the very beginning,” she said.

“So, there’s no way to hide those tracks. This is actually an incredibly powerful tool for law enforcement. In fact, it’s a way better tool for law enforcement than it is for criminals, which is why we really don’t see a lot of criminal activity with bitcoin anymore now that the industry has matured,” Boring added.

SEE THE PHOTOS: ARMED MAN AT NANCY GUTHRIE’S HOME

FBI Director Kash Patel shared still images recovered from a doorbell camera outside Nancy Guthrie’s residence on Tuesday, Feb. 10. (@FBIDirectorKashPatel via X)

Boring said that criminals may “self-custody” their bitcoin without using a third party – like a bank – to hold on to the money, though they would still face issues trying to convert the crypto to the fiat currency of their choice.

“If a ransom was paid to a bitcoin wallet and the criminal has control of that money, that’s totally possible. But at some point they’re going to have to transfer that money into U.S. dollars or to yen or to euros or whatever currency they want so they can use the money,” she said.

“The companies that provide that money exchange service are all regulated businesses globally… you have to use a regulated financial institution like Coinbase to do that, and at that point, you’re at a [know your customer] entity so we would know the identity of the person who’s trying to exchange the bitcoin that’s linked to the ransom payment,” Boring said.

NANCY GUTHRIE CASE: WHY CRIMINALS ARE TURNING TO CRYPTOCURRENCY FOR RANSOMS

The bitcoin and digital assets industry has developed advanced track and trace technologies, Boring said. (Photo illustration by Chesnot/Getty Images)

Another tactic used by criminals to try and subvert the traceability of bitcoin is to send it from a self-custodied crypto wallet to multiple wallets, although those various distributions are still trackable by law enforcement. Boring noted that this tactic led to the emergence of mixing services in the crypto space that will “receive crypto from multiple parties and mix it together, and then you can pull it out the other end.”

“That’s one way to conceal it. But even that, you get all the money that goes into a mixer, you can see all the crypto that comes out of it, so there’s still traceability on it, but it does confuse things a little bit for law enforcement purposes – but law enforcement is very, very sophisticated with being able to track and trace all transactions on the blockchain,” Boring said.

She noted that within the crypto economy, businesses have created track-and-trace software used by compliance officers at crypto firms as well as law enforcement.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

“This is a very sophisticated effort that’s been built over a decade. There is a lot of coordination that happens with the crypto exchanges and law enforcement to track and trace illicit activity in this space, and it’s very effective and very efficient,” Boring said.

She added that the Justice Department has had a number of cases in which they’ve seized large amounts of crypto from criminals, saying that “law enforcement has really done a very good job of helping police criminals that are abusing this technology for nefarious purposes and keeping this ecosystem safe.”

Business

Have Tech Stocks Hit A Reset Moment?

While tech firms may benefit from a longer-term “renaissance” in AI, TD Wealth’s Chief Wealth Strategist Brad Simpson says the recent selloff may be a “reset moment” for the sector.

Transcript

Anthony Okolie: While many of the high-flying tech stocks have come under pressure recently, our featured guest today says that investors need to be thinking about the longer-term renaissance that’s happening in the sector. Joining us now with more is Brad Simpson, Chief Wealth Strategist with TD Wealth.

And Brad, welcome to the show.

Brad Simpson: It’s great to be here.

Anthony Okolie: Alright. So, for people who haven’t seen it yet, what’s the big theme of your latest portfolio strategy quarterly? And what inspired that title?

Brad Simpson: Yeah, it’s a big title, isn’t it? “The Brand New Renaissance.” I think the reality is, we wanted to make a publication that, on first blush, it seems like a lot of hyperbole. We are of this belief that– and I think that we are in the middle of the second Renaissance right now. And the first one was 500 years ago, and we’re in the middle of a new one. And I don’t think that’s an overstatement.

And so what inspired us was, on one hand, was that we really wanted to map that out and what does that mean– take it and go back a little bit and actually look at the original Renaissance and what were some of the implications of it, and then compare it to today.

But also to hit home that this is happening at a massive rate, like a 10 times rate. The Renaissance unrolled over a series over a couple hundred years. We’re seeing this unfold rapidly, and it’s changing not just in the things that we’re seeing around us, but how we think about our cognition

Business

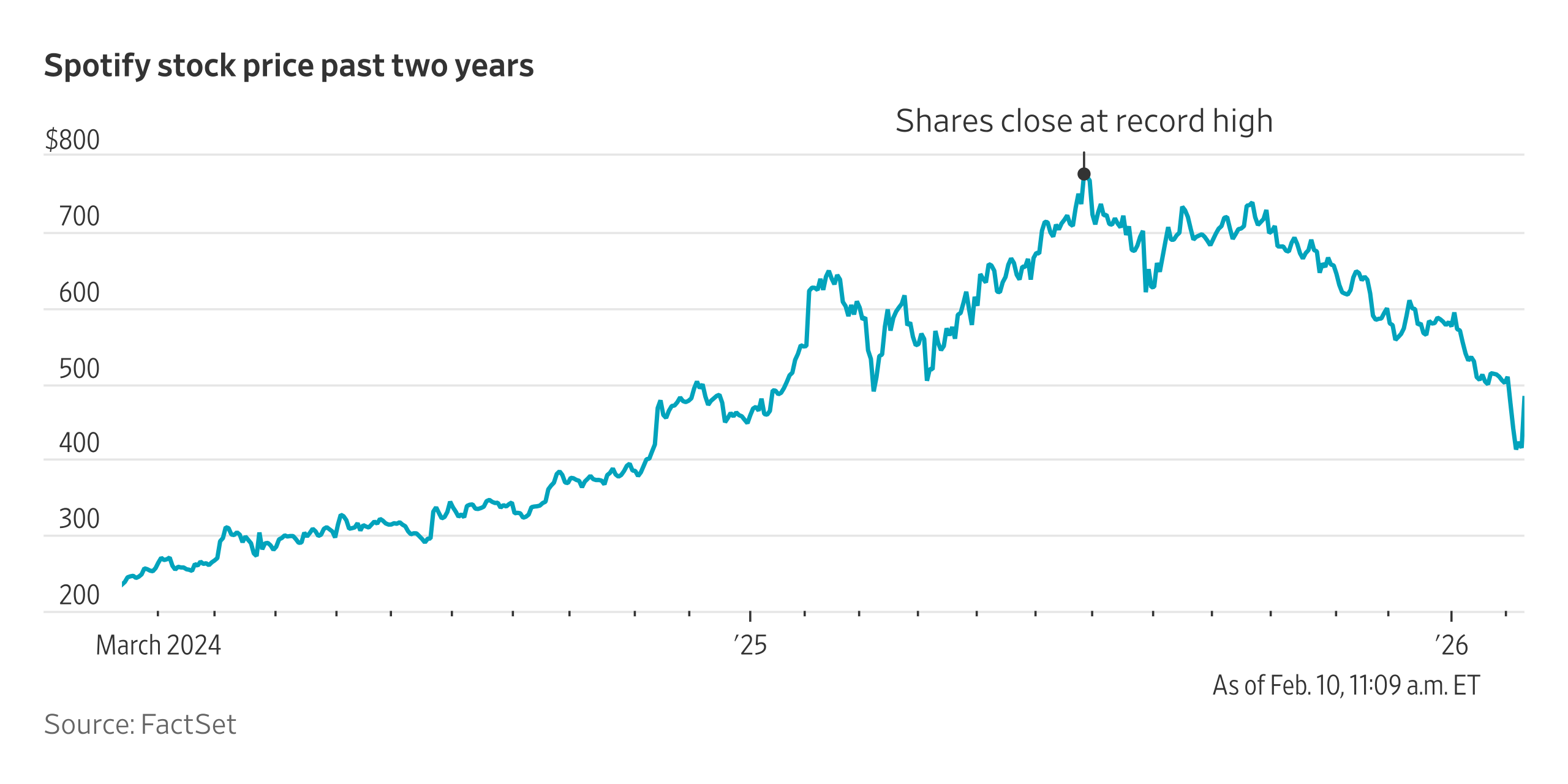

Spotify Shares Soar on Record User Gain

Spotify shares surged Tuesday, after the company added a record 38 million monthly users to its audio-streaming platform late last year.

The fourth-quarter additions took the company to 751 million monthly active users.

Spotify said more than 300 million users engaged with its year-end “Spotify Wrapped” campaign. The feature gives listeners a look back at their listening history for the year and is popular for sharing on social media.

Business

October World Oil Production Drops

October World Oil Production Drops

Business

Check Point Software earnings beat by $0.64, revenue fell short of estimates

Check Point Software earnings beat by $0.64, revenue fell short of estimates

Business

Oakmark Global All Cap Strategy Q4 2025 Performance Review

Oakmark Global All Cap Strategy Q4 2025 Performance Review

Business

SBI still offers value, CV cycle looking strong; IT volatility a concern: Neeraj Dewan

Responding to ET Now on whether SBI still offers an opportunity at current levels, Dewan said he remains constructive on PSU banks, citing strong earnings momentum and reasonable valuations.

“Yes, I have been positive on PSU banks and the kind of stellar results SBI came out with, it makes sense to still stay invested in SBI. In fact, it is still a buy-on-dips kind of a stock and if someone has already invested, they should hold on to it because valuation-wise they could be still available at less than 1.5 times book and historically, it has gone even as high as 1.6, 1.7. With this kind of earnings and the growth that the balance sheet can give them going ahead, I think at this price State Bank or even other PSU banks still, there is a valuation comfort and they can still give you decent returns from these levels also for a long-term investor,” Dewan said.

On the commercial vehicle (CV) space, Dewan remained optimistic, pointing to improving capex trends and replacement demand. He noted that recent numbers from Ashok Leyland reflected operational improvements and better cost management.

“Yes, I feel that the CV cycle is already doing well right now and they should continue doing well in this quarter also. Capex is picking up, which was delayed earlier, which we saw in the second and third quarter. But now from the third quarter onward you are seeing a meaningful pick-up there. Even some of these equipment manufacturers for CVs have been shoring up their capacities and I feel that CV for this quarter also can give you a good surprise, looking at the back of the capex and the capex pickup,” he said.

However, Dewan advised caution on the IT sector, suggesting that the space remains highly volatile and difficult to assess amid rapid changes linked to artificial intelligence and recent negative developments.

“Yes, actually definitely some bottom fishing did happen last quarter and even when the initial results were declared, Infosys kind of guidance and the results and people were getting a little positive, but then this bad news came from Anthropic. So, still for an investor, he can avoid it right now because there is too much volatility which is there in the sector, too much of changes which can happen going ahead. So, it is better to avoid right now because we are not sure in the next six to eight months what kind of changes or what kind of new flow from AI and related will impact the earnings,” Dewan said.He added that recent developments could have a structural impact on IT business models and earnings visibility.

“The kind of news which has come in the last couple of weeks has been pretty worrying also, so that can have an impact, but to what extent we still have to see. But definitely some impact will be there on IT companies and there will be a lot to think and change in business models, how IT companies behave and how they function also,” he noted.

On Lenskart, despite acknowledging strong post-IPO numbers and expansion potential, Dewan flagged valuation concerns and relatively weak returns on capital as key risks.

“So, first thing on the numbers, numbers were definitely good and after the IPO this kind of numbers are positive for the company. But second, everything comes at valuation. The stock is already at ₹81,000 crore market cap. Even if they do about — I think at the current run rate they are doing — at ₹134 crores profit, even if you do ₹600 crores, still it is a very-very expensive stock. ROC is very weak, it is I think 6–7% ROC business. So, there are definitely better opportunities in the market,” he said.

Dewan also compared Lenskart with established listed players, highlighting the importance of balancing growth with valuation discipline.

“One has to play the growth, I agree to some extent, but then growth also has to come at a price. So, it is an expensive stock. So, I will not say it is a compelling buy. Maybe if you get some correction in the stock, then maybe one can look at buying it for a long term. But still it is very expensive and if you compare to already listed strong plays like Titan, which is maybe ₹3,77,000 crore market cap, but then the ROCE is 36–37, going towards 40%. So, there are much better opportunities in the market right now. So even if you want to buy growth, it has to come at a price,” he said.

Overall, Dewan’s comments reflect continued confidence in PSU banks and the CV cycle, while urging investors to remain cautious on IT amid structural uncertainty and selective on high-growth stocks where valuations may be running ahead of fundamentals.

Business

2 top stock recommendations from Rajesh Bhosale

Speaking to ET Now, Rajesh Bhosale from Angel One said the Nifty has been finding it difficult to move past the psychological 26,000 level, leading to some profit booking in the benchmark index. However, he pointed out that the broader technical setup remains constructive.

“If we talk about markets, last few sessions Nifty was struggling around the psychological 26,000 mark and due to weakness in IT space we are seeing some profit booking in this benchmark index. But if we consider the weekly charts of Nifty, last week there was a very strong formation that happened and because of that we remained on the market where a dip should be considered as a buying opportunity. If we see, there is a bullish gap left around 25,700 that coincides with key moving averages. So, 25,700 is what we are expecting to act as a support, but on the higher side 26,000 is the immediate resistance. So, 25,700 to 26,000 is the key range for now and one should play this range. But having said that, stock specific opportunities are there and one should focus on there,” Bhosale said.

With the frontline index moving in a tight band, attention is shifting to sectoral and stock-specific opportunities. Bhosale highlighted strength in the financial space, noting broad-based buying interest.

“So, if we see, financial space is doing very good and broad-based buying is witnessed there. One of the counters from that space I am liking is Bajaj Finance. If we see, despite market weakness this counter is up around 2%. If we see the chart structure, it has been holding above its key moving averages and today we are seeing a flag pattern breakout. Also, on the futures front we are seeing a strong long formation. So, Bajaj Finance can be bought with a stop loss of around 965, in the near term we expect a move towards the levels of 1,025,” he said.

From the auto space, Bhosale also sounded positive on Hero MotoCorp, citing improving momentum indicators.

“The second counter which I am liking is Hero MotoCorp. So, from the auto space as well we are seeing a broad-based positive momentum. This counter, if we see, it has been holding above its key moving averages and forming a base on the intraday charts and today there is a range breakout. Particularly, in the RSI if we see, it has crossed its previous swing high and trading above 60 zone, so Hero Moto can be bought in the near term, we expect targets of around 5,960 and for this trade setup stop loss can be kept at around 5,600,” he added.Meanwhile, sentiment around Hindustan Unilever (HUL) has turned cautious following its recent results, with the stock under pressure. Bhosale said the technical setup suggests continued weakness unless key resistance levels are reclaimed.

“So, if we see, since last few weeks HUL was holding on to some gains but it was struggling to cross the 2,500 levels and the kind of formation we are seeing is bearish engulfing, so as of now the momentum can remain on the negative side. So, until the stock does not cross 2,500, one should wait. Once it crosses 2,500, we can see positive momentum. Until then, wait for it. If it dips back towards 2,250 to 2,300, that would be ideal to add or else wait for a price breakout above 2,500 levels,” he said.

Overall, while the Nifty remains range-bound, market experts suggest that selective stock picking could continue to offer opportunities even as the broader index consolidates near key technical levels.

Business

Nissan reports better-than-expected Q3 operating profit, raises outlook

Nissan reports better-than-expected Q3 operating profit, raises outlook

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports10 hours ago

Sports10 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business3 days ago

Business3 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat3 days ago

NewsBeat3 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World11 hours ago

Crypto World11 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video7 hours ago

Video7 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

![[KPOP IN PUBLIC] LISA - 'MONEY' | Cover by BN DANCE TEAM FROM VIETNAM](https://wordupnews.com/wp-content/uploads/2026/02/1770893501_maxresdefault-80x80.jpg)