Crypto World

LINEA price is up 24%: here’s what analysts predict could happen next

- LINEA has surged 24% amid strong social engagement and trading volume.

- The launch of trustless agents and ERC‑8004 has boosted ecosystem adoption and interest.

- The immediate support in case of a pullback lies at $0.0037, while the immediate resistance is at $0.00413.

LINEA has surged by 24% in just 24 hours, marking one of its strongest short-term rallies in recent months.

The token is currently trading at $0.003805, recovering from a recent low of $0.002987.

This price jump comes after weeks of consolidation, where LINEA had been hovering in the $0.003–$0.004 range.

The sudden momentum signals a possible shift in market sentiment.

Recent catalysts driving the rally

One of the key drivers behind this surge is LINEA’s growing presence in the crypto community.

Social engagement metrics have shown that LINEA has outperformed other Layer‑2 projects in terms of mentions, interactions, and overall online attention.

This heightened activity appears to correlate with price movement, suggesting that increased visibility and investor interest are fueling the recent uptick.

Technical indicators also support the bullish momentum, with LINEA recently breaking above a multi-week resistance zone around $0.00370.

This breakout coincided with the token reclaiming its 20-day exponential moving average (EMA), which traders often see as a signal for short-term trend reversal.

Furthermore, momentum indicators, including the Relative Strength Index (RSI), are approaching overbought levels, indicating strong buying pressure but also cautioning that a brief pullback or consolidation could occur.

In addition, volume trends show a notable increase in trading activity, further reinforcing that the market is responding to both sentiment and technical factors.

Beyond market activity, developments in LINEA’s ecosystem are adding to optimism.

The launch of trustless agents powered by ERC‑8004 introduces verifiable identity and portable reputation for AI-driven smart contracts.

This feature positions LINEA as more than just a Layer‑2 scaling solution, highlighting its potential as a platform for next-generation decentralised applications.

Analysts suggest that these technological milestones could attract developers and new users, supporting both short-term interest and long-term adoption.

LINEA price forecast

Looking ahead, analysts predict that LINEA could continue to show volatility but remain within a defined range.

The token’s support level is around $0.00370, which traders will watch closely to gauge whether the recent breakout can hold.

Immediate resistance is near $0.00413, aligning with longer-term moving averages.

If LINEA breaks through this level, it could test higher targets, with analysts projecting potential upside toward $0.0939 by the end of the year.

Conversely, a failure to hold support could push the price down toward $0.0308, highlighting the token’s potential for significant swings.

Traders should monitor volume, sentiment, and key technical levels to navigate this highly dynamic market.

Overall, LINEA’s combination of social momentum, ecosystem development, and short-term bullish technical signals suggests that the token remains one to watch.

While risks remain, the current rally and forward-looking developments provide a compelling case for both traders and investors looking for opportunities in the Layer‑2 crypto space.

Crypto World

Bitget Targets 40% of Tokenized Stock Trading by 2030

Bitget, the world’s largest Universal Exchange (UEX), today announced a major mobile app upgrade that puts crypto and traditional financial markets side by side on the homepage, reflecting how traders are increasingly moving between asset classes in one trading session. The release follows Bitget’s January rollout of TradFi trading, which expanded access to stock-linked products, FX, indices, commodities, and precious metals such as gold and silver, all settled in USDT.

Bitget’s tokenized TradFi thesis is that crypto is changing from its speculative traits to a rising global financial infrastructure. While annual stock trading is estimated at $100 – $130 trillion currently, it could reach $160 –$200 trillion by 2030, with a significant share of stocks, credit, funds, and commodities shifting onchain as Bitcoin strengthens its role in macro hedge portfolios.

As tokenized stocks increasingly route through crypto-market platforms, exchanges could facilitate roughly 20–40% of that flow; Bitget’s UEX strategy is to be a primary liquidity and distribution hub by expanding into tokenized stocks, FX, gold, and more with an internal base case of handling 40% of the tokenized stock activity roughly $15–$30 trillion in tokenized-stock trading volume by 2030.

Under the new layout, all crypto products including futures, spot, margin, onchain, and earn are consolidated under a unified “Trade” tab, reducing friction for active traders who move frequently between crypto assets. Simultaneously, a new, dedicated TradFi tab provides one-tap access to global markets such as gold, FX, indices, and stock perps and real-world asset tokens, eliminating the need to navigate multiple menus or workflows.

“Bitget is building for the trillion dollar migration. As regulation matures and institutions bring products like treasuries onchain, the direction is clear: crypto is turning into the settlement layer for everyday finance. Sooner than most people think, stablecoins and native assets won’t feel crypto at all, just backend infra working behind when people move value worldwide,” said Gracy Chen, CEO at Bitget.

That’s also why the product experience has been rebuilt around it, on Bitget TradFi is accessible within a click and a UI/UX flow cuts the total steps by around 30% versus typical industry journeys,” she added.

Bitget has successfully pivoted from a crypto-native exchange to the global liquidity hub for this migration. The platform has established itself as the dominant venue for tokenized equities. Bitget currently captures 89.1% of the global market share for Ondo’s tokenized stock tokens, reaching record daily volumes of $6 Billion in January 2026.

The upgraded app experience is now live globally.

For more information, please click here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

Looking for the Best White-Label Tokenization Providers? A Deep Dive

As global capital markets evolve, asset owners and financial institutions are increasingly leveraging blockchain technology to digitize real-world assets (RWAs) such as real estate, private equity, commodities, and debt instruments. Real-world asset tokenization promises enhanced liquidity, fractional ownership, borderless investing, and transparency. But behind these benefits is a complex technical and regulatory ecosystem that enterprises must navigate to unlock sustainable value.

This has given rise to a new category of technology companies — white-label tokenization development company and enterprise tokenization solutions providers — that deliver fully customizable, secure, and compliance-ready infrastructure for token issuance, investor onboarding, secondary trading, and asset lifecycle management. As we enter 2026, these platforms are no longer experimental tech; they are institutional-grade frameworks powering mainstream adoption.

Before identifying the current leaders in the tokenization industry, it’s important to recognize the infrastructure issues that have created a demand for these solutions.

The Infrastructure Gap in RWA Tokenization

The tokenization of real-world assets is becoming increasingly popular. However, it has not yet been adopted at scale due to a variety of operational and regulatory challenges. Despite the immense opportunity in the market, many companies launching or exploring tokenized asset solutions do not understand just how complex the process will be to launch a compliant and real-world asset tokenization platform. Transitioning from a conceptual pilot project to a full-production, institutional-grade implementation requires many more assets and resources (beyond just creating smart contracts); this includes building a comprehensive compliance framework, providing secure custody integration, and implementing a liquidity-ready framework.

Overcoming Key Infrastructure Gaps

1) Fragmentation in Regulations Across Jurisdictions

Various countries have differing laws regarding the regulation of securities, licensing guidelines, eligibility of investors and anti-money-laundering and ‘know your customer’ (AML/KYC) regulations. Enterprises wishing to issue tokens on a cross-border basis will have to comply with multiple regulatory schemes simultaneously, thereby increasing both their legal risk and the operational burden placed on them.

2) Lack of Integrated Liquidity Mechanisms

Issuing tokens without a compliant structure for secondary trading reduces investor access to those tokens and potentially limits the liquidity of the tokenized asset. Without a structured marketplace (i.e., an exchange) with automated transfer controls, the tokenized asset won’t achieve sufficient liquidity.

3) Significant In-House Development Costs

Building smart contracts, dashboards for investors, compliance engines, wallet integrations, and reporting systems from scratch typically takes a considerable amount of time and expertise in blockchain engineering.

4) Security and Audit Risks

Poorly designed contracts, insufficient audits of the smart contracts, and unsafe custody of tokens all pose significant risk to the issuer, both with respect to financial exposure and reputational impact—this is especially true when high-value assets are being tokenized.

5) Cross-border operational complexity

Data privacy compliance, tax reporting standards, custody licensing requirements, and jurisdictional transfer restrictions create layered complexity for global scaling.

Transform Real-World Assets into Scalable Digital Opportunities with the Experts

How White-Label Models Address These Gaps

In order to eliminate the obstacles to adopting on a large scale, enterprises will work with white-label tokenization development companies that provide an existing product with the required technology and have experience in developing similar tokens. These types of models allow companies the ability to use a single system that is already compliant and meets the requirements mentioned before (i.e., regulatory, technical, liquidity, & security). By using this approach instead of trying to put together different systems, there are now complete end-to-end enterprise tokenization solutions and will meet the requirement for scalability and will be able to be deployed in an environment where institutions are usually located.

1. Embedding Compliance at the Core

Regulatory uncertainty is one of the biggest deterrents in RWA tokenization. White-label models reduce this risk by integrating compliance mechanisms directly into the token architecture.

They typically include:

- Automated AML/KYC verification modules

- Investor accreditation validation workflows

- On-chain transfer restrictions aligned with securities laws

- Role-based access controls for regulated asset distribution

- Audit-ready transaction and reporting systems

By embedding compliance logic into smart contracts themselves, real-world asset tokenization platforms ensure that tokens cannot be transferred or traded outside predefined regulatory parameters. This transforms compliance from a manual oversight process into a programmable safeguard.

2. Accelerating Time-to-Market

Building infrastructure from scratch can take 12–24 months and require extensive blockchain engineering resources. White-label providers dramatically compress this timeline.

Key acceleration factors include:

- Pre-audited smart contract templates

- Configurable asset tokenization frameworks

- Ready-to-deploy investor dashboards

- Integrated wallet and custody solutions

- API-driven backend integrations

This allows enterprises to launch tokenized offerings within weeks or months, capturing early-mover advantage in competitive markets. For institutions evaluating RWA infrastructure providers 2026, speed combined with reliability has become a defining metric.

3. Enabling Liquidity and Secondary Market Readiness

Liquidity is essential for investor confidence. White-label tokenization models integrate trading-enablement features directly into the infrastructure.

These often include:

- Built-in secondary marketplace modules

- Automated compliance checks during transfers

- Custodian and broker integrations

- Settlement automation

- Cap table and ownership tracking tools

By solving the liquidity bottleneck, white-label platforms transform tokenized assets from static digital representations into dynamic, tradable financial instruments.

4. Reducing Technical and Operational Risk

In-house blockchain development introduces significant risk, particularly around smart contract security and system scalability. A professional white-label tokenization Development Company mitigates these risks through:

- Third-party audited smart contracts

- Multi-signature custody frameworks

- Hardware security integrations

- Continuous monitoring systems

- Scalable cloud-native architecture

This enterprise-grade security posture is critical for institutional adoption, where asset values can run into millions or billions.

5. Supporting Multi-Asset and Multi-Jurisdiction Scalability

Modern enterprises require flexibility across asset classes and geographic markets. White-label infrastructure is designed to support:

- Real estate tokenization

- Equity and debt instruments

- Funds and structured products

- Commodities and alternative assets

Additionally, these platforms accommodate jurisdiction-specific compliance configurations, enabling global expansion without rebuilding the system for each new market.

6. Preserving Brand Identity with Backend Strength

White-label solutions allow enterprises to retain full ownership of their user experience while leveraging powerful backend technology.

This includes:

- Fully customizable investor portals

- White-labeled dashboards and interfaces

- CRM and ERP integration

- Multi-language and multi-currency capabilities

As a result, organizations can deploy robust enterprise tokenization solutions under their own brand without exposing third-party infrastructure.

Leading White-Label Tokenization Providers in 2026

The competitive landscape among RWA infrastructure providers 2026 is defined by scalability, compliance depth, multi-asset capability, and enterprise adaptability. Below are the platforms shaping this market.

1. Antier

Antier is widely recognized as a full-stack white-label tokenization Development Company delivering comprehensive enterprise tokenization solutions across asset classes.

Core Capabilities:

- Multi-asset tokenization (real estate, equity, debt, commodities, funds)

- Regulatory-aligned smart contract frameworks

- Built-in secondary marketplace modules

- Cross-chain interoperability

- Institutional-grade security infrastructure

What Sets Antier Apart:

Antier offers end-to-end lifecycle management — from asset structuring and token issuance to investor onboarding, compliance automation, and secondary trading. Its modular architecture enables enterprises to deploy scalable ecosystems rather than standalone issuance tools.

The company’s expertise in blockchain engineering ensures flexibility across jurisdictions, making it a strategic partner for institutions targeting global markets.

2. Brickken

Brickken positions itself as a streamlined solution for asset digitization and marketplace deployment.

Key Strengths:

- Structured token issuance workflows

- Investor onboarding and compliance automation

- Integrated dashboard for asset performance tracking

- Marketplace-ready trading modules

Platform Focus:

Brickken emphasizes operational simplicity, enabling asset owners to tokenize and manage assets without extensive technical intervention. Its integrated marketplace layer enhances liquidity readiness, making it suitable for asset managers seeking structured deployment.

3. Kalp Studio

Kalp Studio offers a customizable toolkit designed for enterprises requiring adaptable infrastructure.

Core Features:

- Developer-friendly APIs and SDKs

- Multi-chain compatibility

- Modular smart contract templates

- Integration with existing fintech ecosystems

Market Position:

Kalp Studio appeals to organizations seeking flexibility and customization. Its architecture allows enterprises to integrate tokenization into broader fintech stacks without rebuilding entire systems.

4. Tokeny

Tokeny is known for its strong compliance-first approach, particularly in regulated digital securities markets.

Platform Highlights:

- ERC-3643-based token standards

- Protocol-level compliance enforcement

- Rights and restrictions management

- Institutional transfer controls

Strategic Strength:

Tokeny’s specialization in regulated securities infrastructure makes it particularly relevant for financial institutions prioritizing legal certainty and regulatory precision.

5. Blocktunix

Blocktunix focuses on vertical specialization, particularly in real estate tokenization.

Key Offerings:

- Fractional property ownership modules

- Investor KYC/AML onboarding systems

- Smart contract–based ownership tracking

- Real estate marketplace integration

Ideal Use Cases:

Blocktunix is suitable for property developers and real estate investment firms seeking streamlined fractionalization platforms.

Strategic Takeaways and Choosing the Right Partner

By the end of 2026, tokenization will have become a commercial reality, and companies have moved from having proof-of-concept projects to creating an infrastructure that is robust, secure and compliant enough to support institutional investors and scale globally.

Top-tier white-label tokenization providers are addressing the most significant challenges in the RWA ecosystem, including regulatory fragmentation, liquidity challenges, security risks and complexity across different jurisdictions. These platforms are designed to allow companies to launch, manage, and scale tokenized products faster and with less risk, enabling enterprise-level functionality.

Of these innovative providers, Antier is an ideal strategic partner for companies that want comprehensive white-label tokenization development services and an end-to-end solution for enterprise tokenization. Antier has a modular architecture, in-depth compliance integration capabilities and a proven track record with multiple asset classes, making it easier for forward-thinking companies to realize the full benefits of their real-world asset tokenization platform without having to go through extensive internal development.

Crypto World

Transforming Healthcare with AI Chatbot Development Services

Key Takeaways:

- Virtual health assistants enable 24/7 patient engagement, improving accessibility and response times across healthcare services.

- AI chatbots in healthcare streamline administrative workflows, reducing staff workload and operational costs.

- AI chatbots for patient support enhance triage accuracy, appointment management, and follow-up care.

- AI-powered healthcare assistants help healthcare providers achieve measurable cost reduction while improving care quality.

- Partnering with a trusted AI Chatbot development Company ensures secure, compliant, and scalable deployments.

Investing in professional AI Chatbot Development Services positions healthcare organizations for long-term efficiency, patient satisfaction, and digital transformation.

In a healthcare environment that struggles with rising costs, stretched clinical resources, and demanding patient expectations, technology has never been more crucial. Among these, virtual health assistants powered by AI chatbots in healthcare are revolutionizing how care is delivered, experienced, and managed. Their rapid growth reflects a broader shift toward AI-powered healthcare assistants that enhance clinical workflows, improve patient engagement, and provide real-time support 24/7. As healthcare providers and administrators seek scalable, efficient solutions, AI Chatbot Development Services are emerging as strategic investments for modern health systems.

Understanding Virtual Health Assistants and Healthcare AI Chatbots

At their core, virtual health assistants are intelligent software applications designed to interact with users in natural language, typically through text or voice interfaces. These systems leverage advanced technologies such as natural language processing, machine learning, and cognitive computing to simulate human-like conversations and perform specific healthcare-related tasks with speed and precision.

In the healthcare domain, healthcare AI chatbots go far beyond simple FAQ responses. They are designed to support clinical workflows, enhance patient engagement, and automate routine processes.

Key capabilities include:

- Symptom evaluation and intelligent triage recommendations

- Appointment scheduling, confirmations, and automated reminders

- Personalized health guidance and medication follow-ups

- Patient education and chronic condition monitoring

- Seamless integration with Electronic Health Records (EHRs) for contextual interactions

As AI capabilities continue to evolve, these solutions increasingly function as AI healthcare assistants for cost reduction, enabling healthcare providers to scale patient interactions efficiently while maintaining quality, personalization, and compliance.

Why Healthcare Needs AI Chatbots

To understand the urgency behind this shift, it is essential to examine the structural challenges facing healthcare organizations today, beginning with the most pressing issue: rising operational and administrative costs.

2.1 Addressing Rising Healthcare Costs

Healthcare spending continues to escalate globally. Traditional models struggle to balance patient demand with resource constraints. AI chatbots for patient support help lower operating expenditures by automating repetitive tasks such as scheduling, triage, billing queries, and patient education. According to recent industry analyses, integrating AI automation can significantly reduce administrative costs while freeing staff to focus on high-value clinical work.

For example, administrative burdens such as appointment confirmations and registration can siphon significant clinical time. Automating these through AI contributes to both cost reduction and operational efficiency; a top priority for providers facing workforce shortages and burnout.

2.2 Enhancing Access and Patient Experience

One of the greatest advantages of AI chatbots in healthcare is accessibility. Unlike human staff who work limited hours, AI virtual assistants are available 24/7, delivering instant responses. This constant availability enhances patient experiences and fosters trust, particularly in underserved or remote populations where access to healthcare providers is limited.

Patients increasingly expect digital responsiveness and convenience; trends amplified by mobile health, telemedicine, and consumer preferences for self-service options. Virtual assistants deliver on this expectation, offering personalized interactions that adapt to each patient’s needs.

Build Your AI Healthcare Chatbot Today!

High-Impact Use Cases of AI Chatbots in Healthcare

While the strategic need for AI is clear, its true value becomes evident when examining how these intelligent systems function in real-world healthcare environments. From patient-facing interactions to backend clinical workflows, AI chatbots are delivering measurable outcomes across multiple touchpoints.

3.1 Patient Support and Self-Service Triage

One of the most direct applications of AI chatbots for patient support is symptom assessment and initial triage. Patients can enter symptoms in natural language, and virtual assistants provide guidance on urgency, suggested actions, or recommended care paths. Research shows that advanced AI systems can outperform traditional symptom checkers by significant margins, accurately suggesting specialist referrals and reducing unnecessary clinical visits.

Patient-facing bots also help:

- Reduce emergency room congestion for non-urgent cases

- Educate patients on symptom management

- Provide follow-up check-ins after discharge

These functions significantly elevate patient empowerment and reduce unnecessary clinical workload.

3.2 Appointment Management and Patient Engagement

AI bots revolutionize the traditionally clerical task of appointment scheduling. From booking to confirmation, cancellation, and reminders, chatbots reduce no-show rates and improve clinic flow. Connected with EHR systems, they can adjust schedules in real time, notify patients of delays, and handle changes seamlessly.

This automated scheduling capability improves clinic efficiency and patient satisfaction – leading to revenue improvements and smoother operations.

3.3 Remote Monitoring and Chronic Care Support

Virtual health assistants increasingly integrate with remote monitoring technologies and wearables. Patients with chronic conditions such as diabetes, hypertension, or heart disease benefit from continuous monitoring and timely follow-ups. AI bots can alert care teams when vital signs trend dangerously, ensuring timely intervention and reducing hospital readmissions.

This ongoing engagement supports improved adherence to care plans, medication compliance, and lifestyle modifications; all critical for long-term health outcomes.

3.4 Behavioral Health and Wellness Guidance

While regulated clinical diagnosis and treatment remain the purview of licensed practitioners, AI systems provide supplemental support for emotional wellness and mental health education. They offer stigma-free, immediate responses, mood tracking, and wellness tips. However, recent regulatory scrutiny in some regions warns against relying exclusively on AI for therapeutic care without licensed oversight.

This highlights the need for an AI Chatbot development Company to implement guardrails, ethical guidelines, and escalation pathways to human professionals when needed.

The Business Case for Healthcare AI Chatbots: ROI and Cost Reduction

While innovation and patient experience matter, healthcare leaders evaluate technology based on measurable ROI and operational efficiency. AI-driven automation is not just an upgrade; it is a strategic investment in financial sustainability.

4.1 Measurable Cost Savings

Experts estimate that AI-driven automation will save healthcare systems billions annually by 2025 through reductions in administrative overhead and improved operational efficiency. Automating frontline interactions reduces reliance on call centers and manual scheduling, minimizing labor costs and human error.

Real financial impacts include:

- Lower staffing requirements for routine inquiries

- Reduced emergency room congestion

- Fewer missed appointments

- Better resource utilization

These efficiencies directly support improved margins and the ability to reallocate investment toward patient-centric care.

4.2 Reducing Diagnostic and Clinical Delays

Through continuous engagement and data collection, AI tools augment early detection and proactive interventions. Some studies demonstrate that intelligent systems maintain high accuracy rates in symptom assessment thus improving triage accuracy and timely referrals.

By reducing diagnostic delays and unnecessary escalations, virtual assistants contribute to better patient outcomes, fewer complications, and lower long-term care costs.

How to Successfully Build and Deploy Healthcare AI Chatbots

Implementing AI chatbots in healthcare is not just a technology upgrade; it is a strategic transformation initiative. From regulatory compliance to clinical validation, healthcare organizations must ensure that their virtual health assistants are secure, accurate, and aligned with operational workflows. A structured, phased approach minimizes risk, ensures stakeholder buy-in, and maximizes return on investment.

5.1 Partnering with an AI Chatbot Development Company

Choosing the right AI Chatbot development Company is one of the most critical decisions in your AI journey. Healthcare is a highly regulated, data-sensitive industry; generic chatbot vendors often lack the compliance, interoperability, and domain expertise required for safe deployment.

An experienced partner offering specialized AI Chatbot Development Services should provide:

1. Healthcare Domain Expertise

Healthcare AI systems must understand:

- Clinical terminology and workflows

- Patient journey mapping

- Care coordination processes

- Regulatory constraints

A qualified partner ensures that healthcare AI chatbots are clinically contextual, not just conversational.

2. Seamless EHR & System Integration

A chatbot that cannot integrate with your existing systems becomes a silo.

Your development partner must support:

- Integration with legacy EHR platforms (Epic, Cerner, etc.)

- Secure API connectivity

- Interoperability standards like HL7 and FHIR

- Real-time data synchronization

This enables AI chatbots for patient support to access appointment schedules, patient histories, and care plans securely.

3. Compliance-First Architecture

Healthcare AI must meet strict regulatory standards such as:

- HIPAA (US)

- GDPR (EU)

- Local health data protection regulations

A trusted AI Chatbot development Company builds:

- End-to-end encryption

- Role-based access controls

- Audit logs and traceability

- Secure cloud or on-premises deployment models

Security is not an add-on; it must be foundational.

4. Customization for Clinical Workflows

Every healthcare organization operates differently. Your chatbot should support:

- Custom triage protocols

- Specialty-specific logic (cardiology, oncology, pediatrics, etc.)

- Automated escalation rules

- Multilingual patient engagement

This level of customization ensures your AI-powered healthcare assistants align with real-world operations.

5. Ongoing Optimization & Analytics

Deployment is just the beginning.

A strategic partner should provide:

- Usage analytics dashboards

- Performance monitoring

- Continuous model improvement

- Bias detection and accuracy validation

AI systems must evolve with patient behavior and regulatory changes.

5.2 Best Practices for Development and Deployment

Building effective AI chatbots in healthcare requires more than technical implementation; it demands clinical validation, operational alignment, and structured rollout strategies.

Here are proven best practices:

1. Conduct Clinical Validation and Pilot Testing

Before full-scale deployment:

- Run controlled pilot programs

- Validate triage accuracy with medical professionals

- Test escalation pathways

- Simulate edge-case scenarios

This ensures patient safety and builds clinician confidence in the system.

2. Involve Stakeholders Early

Successful adoption depends on collaboration between:

- Clinicians

- IT teams

- Compliance officers

- Administrative staff

- Patient representatives

Early involvement prevents resistance and ensures the chatbot supports real operational needs rather than theoretical workflows.

3. Implement Phased Rollouts

Instead of launching across the entire organization at once:

- Start with a single department

- Measure engagement and accuracy

- Collect clinician feedback

- Optimize before expansion

Phased deployment reduces risk and improves long-term adoption rates.

4. Design for Multi-Channel Accessibility

Modern patients interact across platforms. Your virtual health assistants should support:

- Mobile apps

- Web portals

- SMS integration

- Voice interfaces

- Patient portals

Multi-channel deployment improves accessibility and increases engagement.

5. Build Human-in-the-Loop Escalation

AI should augment, not replace clinical expertise.

Effective systems include:

- Clear escalation to live agents

- Emergency redirection protocols

- Transparent AI disclaimers

- Real-time clinician override options

This hybrid model ensures patient safety while maintaining automation efficiency.

6. Measure ROI and Patient Impact

To justify investment in AI healthcare assistants for cost reduction, organizations should track:

- Reduction in call center volume

- Decrease in appointment no-shows

- Patient satisfaction scores

- Average response time improvements

- Reduction in administrative workload

Quantifiable metrics strengthen the business case and support future AI expansion initiatives. Partnering with an experienced provider of AI Chatbot Development Services ensures your organization moves beyond experimentation and toward secure, compliant, and scalable digital transformation.

Start Your AI Chatbot Development Project!

The Future of Virtual Health Assistants and AI Chatbots

Looking ahead, the evolution of AI chatbots in healthcare is poised to bring even more sophisticated capabilities:

- Emotionally intelligent conversations with sentiment and affect interpretation

- Multilingual support to serve diverse populations

- Predictive analytics for preventative care planning

- Integration with advanced wearables and AI diagnostics tools

Industry forecasts anticipate accelerated adoption as healthcare systems seek smarter, scalable solutions to meet patient expectations and operational demands.

Shaping the Next Era of Patient-Centric Healthcare with AI

As healthcare transforms rapidly, virtual health assistants and AI healthcare chatbots are fundamental to modern care delivery. They drive cost reduction, improve patient access and satisfaction, support clinical staff, and build efficiencies that traditional systems struggle to achieve. Whether you’re a hospital system, clinic, insurer, or health tech provider, investing in AI Chatbot Development Services supported by a trusted AI Chatbot development Company can unlock substantial value and future-proof your patient engagement strategies.

Antier is a leading AI Chatbot development Company delivering secure, scalable, and compliance-ready services tailored for the healthcare ecosystem. We empower providers with intelligent virtual health assistants that enhance patient engagement, streamline operations, and drive measurable cost efficiency.

Crypto World

DraftKings (DKNG) Stock: Can Thursday Earnings Spark a Reversal?

TLDR

- DraftKings reports Q4 earnings Thursday with analysts projecting $0.09 EPS and $1.99 billion revenue, both up year-over-year

- Shares hit two-year low of $25.01 last week, trading at $26.28 after 3% drop Wednesday, down 23.8% in 2026

- Company launched DraftKings Predictions to counter prediction market threat and access states without legal sports betting

- Wall Street analysts now say prediction market fears overblown, estimating only 5% impact on legal betting handle

- Technical indicators show oversold RSI at 27.7 while 7.8% short interest could fuel post-earnings rally

DraftKings delivers its fourth-quarter earnings report Thursday after the closing bell. Wall Street expects earnings per share of $0.09 on revenue of $1.99 billion.

Zacks Research projects higher earnings of 50 cents per share on the same revenue figure. Both estimates exceed last year’s Q4 results.

The stock closed down 3% Wednesday at $26.28. Year-to-date, shares have plunged 23.8%.

Stock Performance and Technical Setup

DraftKings touched a two-year low of $25.01 on Feb. 5. The stock has failed multiple attempts to break through resistance at $37.50.

Technical indicators paint an interesting picture. The 14-day RSI reads 27.7, signaling oversold conditions. Historically, readings below 30 often precede rebounds.

Short interest represents 7.8% of the float. That’s nearly three days of potential buying pressure if shorts scramble to cover on positive earnings news.

Options markets expect a 15.9% move after earnings. This dwarfs the stock’s typical 5.3% post-earnings swing. The company has closed higher in five of its last eight earnings sessions, including an 8.6% jump in November.

Prediction Markets Enter the Picture

Three months ago, CEO Jason Robins declared himself “the most bullish” about DraftKings’ future. The stock is down 6% since.

Prediction markets emerged as a concern for investors. These platforms let users bet in states without legalized sports betting, potentially cutting into DraftKings’ growth.

DraftKings responded by launching DraftKings Predictions. The platform serves defensive and offensive purposes. It protects market share while giving the company access to restricted states.

The move also builds a customer database. If those states legalize sports betting later, DraftKings already has users to convert.

Wall Street Reconsiders the Threat

Analysts are walking back their prediction market concerns. Third Bridge’s Alex Smith doesn’t expect DraftKings to fully commit to the space. Regulatory uncertainty and unproven demand outside sports remain issues.

Sports betting drives 89% of Kalshi’s fee revenue in 2025. Kalshi and Polymarket dominate the prediction market landscape.

Citizens analyst Jordan Bender downplayed the competitive threat in January. His research suggests prediction markets capture roughly 5% of total legal sports betting handle.

Bender noted one poor Monday Night Football game could match the EBITDA impact of the entire prediction market sector. The comparison highlights how much investors may have overreacted.

Thursday’s earnings call will shed light on DraftKings Predictions performance. Management’s commentary will reveal whether the company views prediction markets as a real threat or minor distraction.

The stock’s oversold condition and high short interest create potential for a sharp move if results beat expectations. Analysts will focus on revenue growth, user metrics, and any updated guidance for 2026.

Crypto World

Top 10 Crypto Wallet Development Trends To Watch in 2026 & Beyond

Crypto wallets have become a foundational layer of the Web3 financial stack, operating as secure execution environments rather than passive storage interfaces. In 2026, modern wallet architectures integrate programmable accounts, cryptographic custody frameworks, on-chain identity layers, and payment orchestration modules that support both decentralized protocols and regulated financial infrastructure. As institutional participation in digital assets continues to mature, the technical depth and architectural soundness of wallet solutions are now critical parameters in investment due diligence, treasury management, and platform scalability.

For serious investors and enterprises, staying aligned with emerging web3 crypto wallet trends is not simply about tracking innovation. It is about anticipating shifts in security standards, execution models, compliance mechanisms, and user-access frameworks that directly impact asset protection, operational continuity, and long-term capital efficiency. The rapid evolution of account abstraction, MPC custody, delegated execution standards, and privacy-preserving identity systems is redefining how digital assets are managed and transacted. Understanding these developments provides the clarity required to evaluate opportunities with precision and invest with confidence in a rapidly advancing Web3 ecosystem.

Top 10 Cryptocurrency Wallet Development Trends

Trend 1: Virtual and Physical Crypto Card Integration

Physical and virtual crypto cards that debit on-chain balances are now a core product extension for wallets that want mainstream utility. Issuers tokenize stablecoin or reserve balances and connect to card networks, enabling instant fiat settlement while keeping crypto accounting native. For investors, the value proposition is clear: Web3 crypto wallets that secure certified relationships with regulated card processors and embed real-time reconciliation reduce liquidity conversion risk and raise monetization potential through interchange and FX flows. Technical and commercial checks include custody-to-issuer settlement latency, dispute-resolution processes, payment-regulatory licensing, and anti-money-laundering controls at the card on-ramp.

Trend 2: Invisible Onboarding

- What it is: user acquisition without asking for native gas, private key dumps, or advanced crypto literacy.

- Technical enablers: account abstraction, paymasters that sponsor gas, social recovery frameworks, and delegated key management.

- Enterprise implications: dramatically higher conversion for non-crypto users, simpler SaaS integrations, and lower CAC.

- Risks and diligence: sponsor availability and economics, attack surface from sponsor logic, regulatory exposure around sponsored transactions, and UX flows for recovery and escrow.

Investors should require stress tests of sponsored flows, recovery timelines, and the maturity of the account abstraction implementation in their cryptocurrency wallet development solutions.

Trend 3: Account Abstraction (AA)

Account abstraction converts crypto wallet development solutions from static key containers into programmable accounts with embedded policy. When implemented via standards such as ERC 4337 or compatible smart account patterns, accounts can host multisig rules, batched execution, meta-transactions, delegated signers, and spend limits. This matters for institutional investors because AA enables automated treasury operations, regulatory hooks, and safer recovery models. Evaluate the standard adherence, proof of audit coverage for the account entry points, and SDK maturity for enterprise integrations. Also, check for deterministic gas accounting and how upgrades are governed to avoid lock-in.

Trend 4: Hybrid Neo Bank Features

Core capabilities

- Fiat rails and custodial settlement: on-chain balances with bank partner settlement.

- Card issuance and tokenized payroll: programmable payouts and corporate expense flows.

- Interest and yield wrapper products: compliant yield on tokenized deposits.

- Why it matters: Blockchain wallet solutions that act as regulated rails reduce counterparty settlement risk and attract treasury deposits from enterprises. For investors, confirm banking partner contracts, liquidity sweep rules, reconciliation frequency, and whether the wallet provider segregates client reserves.

Trend 5: On-chain Identity

On chain identity and verifiable credentials let wallets express accredited investor status, jurisdictional residency, and sanctions screening while minimizing plaintext PII exchange. Modern stacks combine verifiable credential issuance with revocation registries and selective disclosure primitives. The investor lens should focus on the attestation trust model, how issuers are accredited, revocation latency, and the privacy guarantees when proofs are minted and verified. Strong identity primitives reduce regulatory friction for tokenized assets and institutional onboarding.

Trend 6: Security Standards Converge on Multi-Party Computation

Technical dimensions to verify

1. Threshold configuration and fault tolerance, including recovery thresholds.

2. Share lifecycle management, rotation cadence, and secure key share onboarding.

3. Dependence on trusted execution environments and fallback modes.

4. Third-party custody exposure and contractual SLAs.

Why review these: The MPC crypto wallet reduces a single point of failure and improves corporate key management, but implementations differ in security assumptions and operational complexity. Investors should demand cryptographic proofs of correct protocol execution and independent red team reports.

Trend 7: Post-quantum Cryptography Readiness

Post-quantum readiness is now a procurement criterion, not a theoretical debate. Crypto wallet development companies should demonstrate cryptographic agility, hybrid signing schemes that combine classical and PQC primitives, and tested migration pathways that do not break transaction compatibility. From an institutional perspective, evaluate archive policies for private material, plan for forward secrecy, and insist on roadmap commitments that reference NIST candidate algorithms and interoperability testing. Lack of a clear PQC migration path is a material long-term risk for custody plays.

Trend 8: EIP 7702 Delegation and Sponsored Execution

Delegation standards such as EIP 7702 enable an auditable delegation of execution rights while maintaining on-chain enforcement of permission boundaries. For enterprises, this enables batched payroll, gasless customer interactions, and delegated treasury operations that are still verifiable on-chain. Investment diligence should examine economic incentives for delegates, revocation semantics, fallback behaviors when a delegate fails, and auditability of delegated action histories.

Build Your Enterprise-Grade Wallet Platform Now!

Trend 9: Autonomous Agents and Wallet Native Agents

- Algorithmic market execution and automated rebalancing.

- B2B microservice payments and subscription settlements.

- Liquidity management bots for treasury desks.

- Operational risk considerations.

- Oracle and data feed dependence can create cascading failure modes.

- Emergent behaviors require robust governance, limits, and kill switches.

- Liability and indemnity need an explicit contractual definition when agents act autonomously.

Investors must confirm hard spending caps, formal verification or sandbox testing of agent logic, and transparent audit trails that link agent actions to governance authority.

Trend 10: ZK Identity

Zero-knowledge identity primitives provide privacy-preserving assertions that a user meets a condition without revealing their underlying identity. This enables accredited investor proofs, sanctions screening, and KYC lite models where marketplaces must verify eligibility but cannot retain raw PII. Key evaluation metrics include prover and verifier performance, proof size, on-chain cost, revocation handling, and whether proofs are interoperable across credential issuers. ZK identity embedded in wallets is a strong signal of enterprise readiness for regulated offerings.

Investment Implications and Scoring Checklist

When evaluating cryptocurrency wallet projects for institutional investment, refer to this technical scoring checklist

1. Protocol compatibility, standards adoption, and clear upgrade paths for PQC readiness.

2. Security architecture, including MPC threshold configurations, TEE dependence, and third-party custody exposure.

3. Account abstraction and delegation support, including paymaster economics and sponsored flow resiliency.

4. Compliance primitives, such as ZK identity, verifiable credentials, and enterprise KYC integrations.

5. Stablecoin Payment rails, card integrations, and banking partner relationships for liquidity.

6. Agent safety, governance, and off-chain controls for any autonomous agent integrations.

7. Product market fit, SDK maturity, and white-label support for enterprise deployments.

Use this checklist to derive a weighted score aligned to your risk appetite and time horizon. Consider separate weightings for custody risk, regulatory readiness, and go-to-market strength.

How Does Antier’s Certified Team Help?

Our team combines deep Web3 engineering, enterprise-grade security design, and regulatory counsel to build and deploy white label cryptocurrency wallets for regulated clients. We architect MPC-based custody with cryptographic agility for post-quantum preparedness. We design smart accounts using account abstraction standards and integrate delegated execution mechanics like EIP-7702 to enable gasless onboarding and programmable treasury workflows. On the compliance side, we deploy verifiable credentials and zero-knowledge identity stacks so marketplaces can scale with privacy-preserving AML controls. So, in short, you know that you have A-Z development assistance when you partner with us. Apart from this, our legal and compliance advisors help onboard banking partners and shape KYC AML workflows that satisfy jurisdictional regulators while maximizing product reach.

Frequently Asked Questions

01. What are the key features of modern crypto wallets in 2026?

Modern crypto wallets in 2026 integrate programmable accounts, cryptographic custody frameworks, on-chain identity layers, and payment orchestration modules, supporting both decentralized protocols and regulated financial infrastructure.

02. Why is understanding crypto wallet trends important for investors and enterprises?

Understanding crypto wallet trends is crucial for investors and enterprises as it helps them anticipate shifts in security standards, execution models, compliance mechanisms, and user-access frameworks that impact asset protection and operational continuity.

03. What is “invisible onboarding” in the context of crypto wallets?

Invisible onboarding refers to user acquisition methods that do not require users to provide native gas, private key dumps, or advanced crypto literacy, facilitated by technologies like account abstraction and delegated key management.

Crypto World

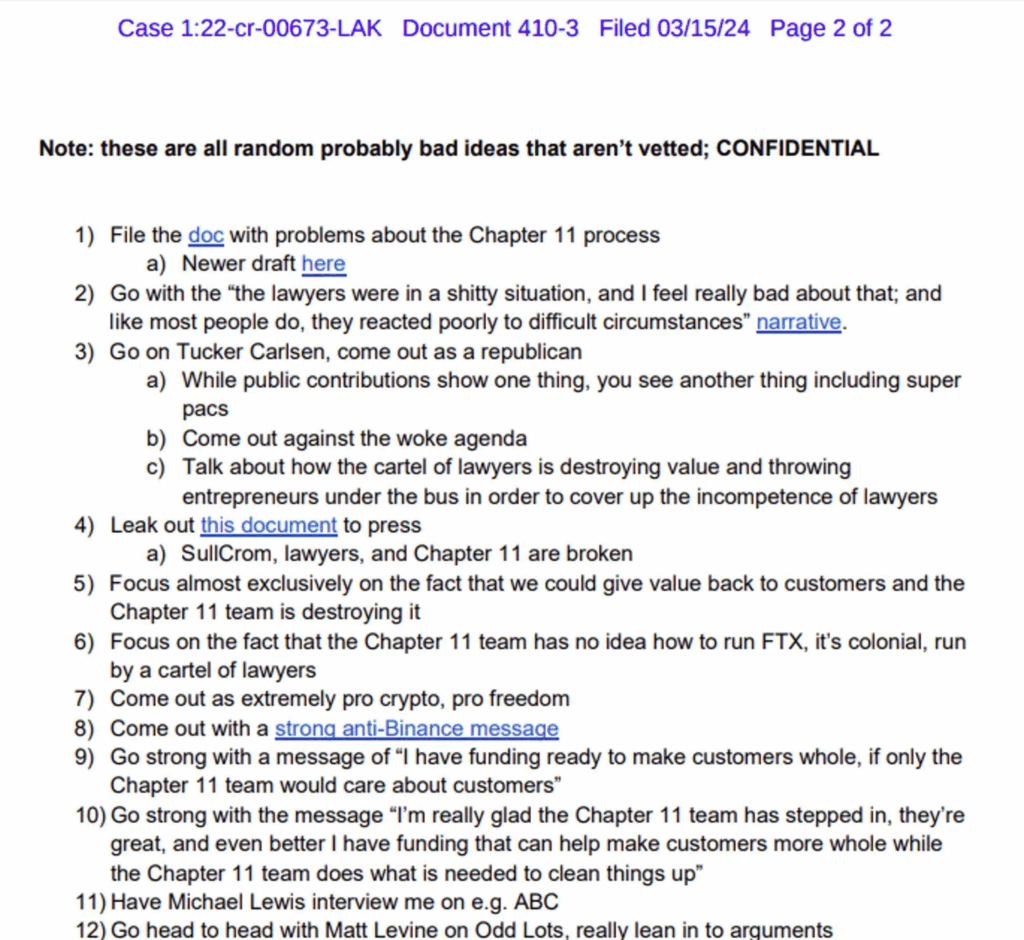

Sam Bankman-Fried had a plan to get out of prison, and he’s following it

From behind prison bars, Sam Bankman-Fried continues to make headlines. Even though he stole $8 billion from FTX customers, he thinks he has a chance on his 2023 appeal, or his new 2026 pro se (self-represented) retrial request.

In reality, he’s simply following cringeworthy pre-written plans to exploit any media stunt that has a chance of getting him out of prison.

Ever the autist, Bankman-Fried wrote down tactics to get out of custody after his arrest. Haphazardly, he itemized them in a simple Google Doc that soon went through legal discovery processes.

Thanks to a sentencing submission that helped earn him a 25-year prison sentence, the criminal mastermind’s formerly “confidential” document is now in the public domain.

Putting Bankman-Fried’s January 15, 2023 document side-by-side with his broadcasts from prison today, anyone can quickly identify his premeditated stunts.

For example, he proposed a fake conversion to win over conservatives. “Go on Tucker Carlsen, come out as a republican… Come out against the woke agenda.”

As another way to fabricate sympathetic media coverage, “Have Michael Lewis interview me on e.g. ABC.”

Bankman-Fried was so desperate that he thought an argumentative podcast appearance might be worth a shot. “Go head to head with Matt Levine on Odd Lots, really lean in to arguments.”

To be specific, Bankman-Fried wrote 12 ideas after US authorities indicted, arrested, extradited, and arraigned him. A dozen last-ditch efforts to manipulate the media.

“Come out with a strong anti-Binance message,” he thought. If only he could convince people to hate CZ more than his own crimes.

A jury convicted Bankman-Fried on seven criminal charges. Although he has a right to file appeals and requests for retrials, those efforts are exceedingly unlikely to gain appellate approval.

The most likely outcome is that his prison sentence will not change, leaving him with only one hope: a presidential pardon.

‘It’s like, just get me out of here’

On the topic of pardons, which Donald Trump has handed out generously to wealthy crypto insiders like Ross Ulbricht and Changpeng Zhao, YouTuber Atrioc summarized his view of Bankman-Fried’s thought process.

“I think after two years in the same jail as Diddy, SBF finally realized, no matter how embarrassing it is, he’s got to use his 10 minutes a week of internet access. Because he recently tweeted this: Why I became a Republican in 2022.”

Laughing at the obvious self-interest of Bankman-Fried’s broadcast from prison and half-hearted conversion, Atrioc highlighted his difficult-to-believe assertions.

“Biden bungled crypto,” he tweeted from prison via a proxy.

“@realDonaldTrump is right on crypto,” he beamed.

Read more: Diddy joins SBF, Avraham Eisenberg in ‘horrific’ Brooklyn prison

“Biden bungled COVID,” Bankman-Fried parroted Trump style. “Insane Dem woke policies.”

Atrioc called out these obvious theatrics. “Like you almost have to respect that he waited two years before going for the pardon. He went for the Hail Mary pardon, because Trump’s pardoning every villain you can see.

“It is the most transparent pardon attempt you can imagine. He tags Trump like every post. It’s just embarrassing, it’s embarrassingly transparent. It’s like, just get me out of here.”

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

BYDFi Joins Solana Accelerate APAC at Consensus Hong Kong, Expanding Solana Ecosystem Engagement

[PRESS RELEASE – Victoria, Seychelles, February 12th, 2026]

BYDFi, a global cryptocurrency trading platform, announced its participation as a sponsor of Solana Accelerate APAC during Consensus Hong Kong 2026. The event was held at the Hong Kong Convention and Exhibition Centre alongside the broader Consensus Hong Kong conference.

The combined gathering brought together founders, institutional representatives, policymakers, and blockchain developers, underscoring Hong Kong’s role as a regional hub and an established meeting point for Web3 and blockchain innovation across the Asia-Pacific region.

BYDFi at Solana Accelerate APAC in Hong Kong

Solana Accelerate APAC convened the Solana community and broader crypto ecosystem around the future of internet capital markets and onchain innovation, set against the backdrop of a global financial center known for clear frameworks and active market participation. BYDFi’s participation marked a first, deeper step into Solana-focused programming and community dialogue. Discussions also reflected ongoing market focus on crypto regulation in Hong Kong and crypto licensing in Hong Kong.

During the event, the BYDFi team was on site to meet attendees, share product context, and distribute limited merchandise, including Newcastle United co-branded items as part of BYDFi’s ongoing brand collaboration with the club. The booth saw strong foot traffic throughout the day.

What BYDFi Is Sharing in Hong Kong

BYDFi used the event to share how a CEX + DEX dual-engine approach can support clearer participation across venues and workflows, particularly for users who want both centralized liquidity and onchain discovery in one connected experience. MoonX, BYDFi’s onchain trading engine, supports Solana and is designed to help users track and navigate fast moving onchain markets with a workflow built for speed, signal clarity, and execution efficiency.

In parallel, BYDFi highlighted reliability foundations that support long term trust in volatile markets, with an emphasis on operational safeguards and service responsiveness. These include over 1:1 Proof of Reserves with periodic public reporting, an 800 BTC Protection Fund, and 24/7 multilingual customer support with timely responses across official channels, including social media.

Why This Matters for BYDFi and the Solana Ecosystem

Solana Accelerate APAC brought ecosystem builders and market infrastructure discussions into the same orbit. BYDFi’s participation centered on two goals: listening closely to Solana-native users and teams, and exploring deeper collaboration opportunities that can strengthen product coverage, user experience, and market access as the crypto market continues to mature.

Michael, Co-Founder and CEO of BYDFi, said: Solana Accelerate APAC creates the right setting for practical conversations between builders, market participants, and policymakers. BYDFi joined to learn, connect, and contribute in a way that holds up over time. Reliability is built through consistent infrastructure, clear safeguards, and responsive support, and BYDFi will continue strengthening all three as engagement across the Solana ecosystem deepens.

About BYDFi

Founded in 2020, BYDFi now serves over 1 million users across 190+ countries and regions. BYDFi is Newcastle United’s Exclusive Official Crypto Exchange Partner. Recognized by Forbes as one of the Best Crypto Exchanges In Canada For 2026, BYDFi offers intuitive, low-fee trading across Spot and Perpetual Contracts to Copy Trading, and Automated Crypto Trading Bots, empowering both new and experienced traders to navigate digital assets with confidence.

BYDFi is dedicated to delivering a world-class crypto trading experience for every user.

BUIDL Your Dream Finance.

- Website: https://www.bydfi.com

- Support email: cs@bydfi.com

- Business partnerships: bd@bydfi.com

- Media inquiries: media@bydfi.com

Twitter( X ) | LinkedIn | Telegram | YouTube | TikTok | How to Buy on BYDFi

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

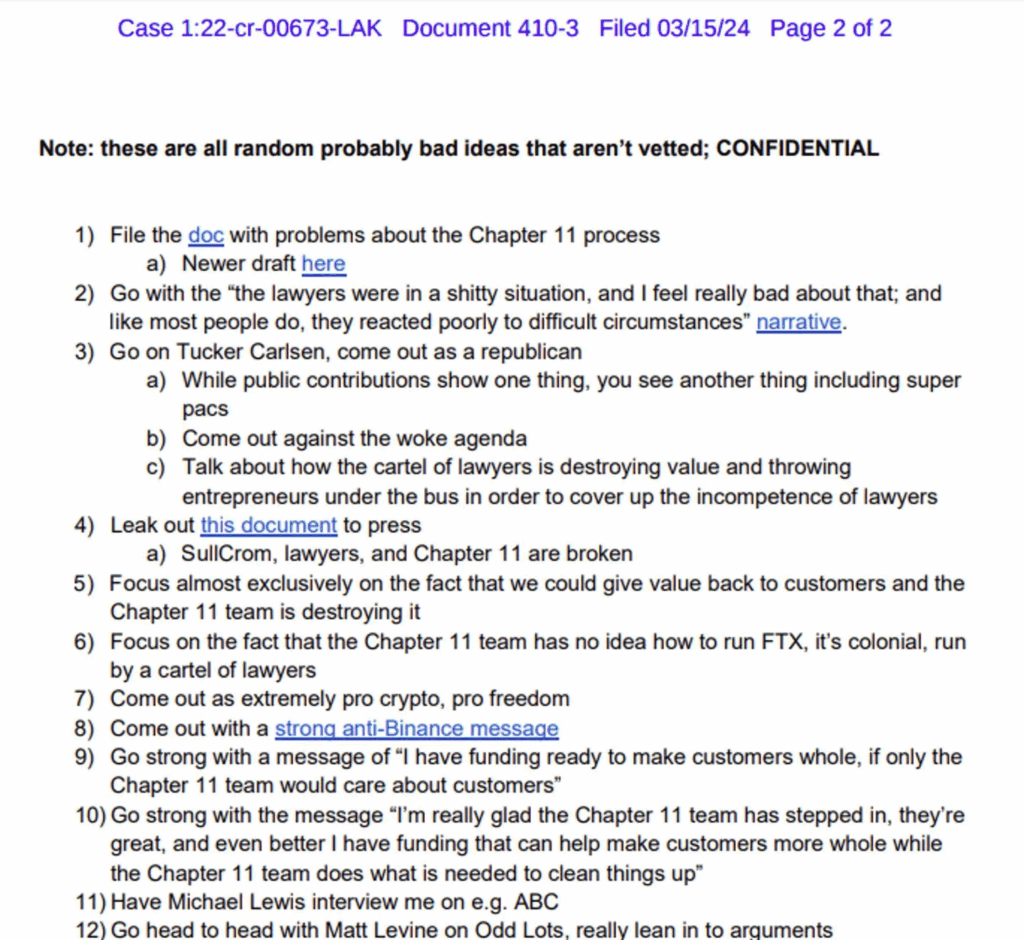

Binance Refutes Huge Outflows Allegations, Says Data is Misreported

Binance dismisses circulating concerns that the exchange is in trouble because of high outflows in the past days.

Binance, the world’s largest cryptocurrency exchange, is facing mounting rumors on social media that funds are flowing out of it at unprecedented rates.

“Get your funds off of Binance. -$17bn of withdrawals in the last 7 days. There is a risk they will become insolvent, and you won’t be able to get your money out. Withdraw now or cry later,” wrote a popular crypto analyst on X. Although the figures range from $10 billion to $17 billion, many others reiterated this opinion.

The exchange was quick to respond, saying that data from third-party sources shows discrepancies and that it is to be “restored.”

Thank you everyone for your concern about Binance. The data cited by Coinglass comes from third-party sources, and DefiLlama previously showed discrepancies. It will take another 24 to 48 hours for their data to be restored.”

Moreover, Binance said that they believe that “regularly conducting withdrawal tests on all trading platforms is a positive and healthy practice. When performing these tests, please double-check the address carefully. Confirm, then withdraw.”

They even went so far as to suggest an annual “withdrawal day” that should be established for all platforms to thoroughly verify the authenticity of their assets.

Meanwhile, the Proof-of-Reserves report on their official website reveals that all cryptocurrencies are, at the time of this writing, overcollateralized, meaning that there is more USD backing their reserves than crypto – a sign of health.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Euro And Sterling Rally Slows After Strong US Data

At the start of the week, the euro and sterling posted solid gains amid dollar weakness and expectations of a more accommodative Federal Reserve policy path, testing local highs. However, the release of the January US employment report shifted market sentiment.

Non-farm payrolls rose by 130K versus a forecast of 66K, the unemployment rate unexpectedly fell to 4.3% (forecast: 4.4%), and average hourly earnings increased by 0.4%, exceeding previous readings. The data confirmed the resilience of the US labour market and supported the dollar, prompting a pullback in EUR/USD and GBP/USD from their recent peaks.

EUR/USD

After testing the 1.1920–1.1900 range, EUR/USD entered a moderate correction, retracing part of the gains recorded in recent weeks. The move appears largely technical, driven by profit-taking.

While dollar strength following the upbeat data has reduced expectations of imminent Fed easing, it is still premature to speak of a reversal in the medium-term trend. Market participants continue to assess the sustainability of the latest macroeconomic figures and their implications for monetary policy.

Technical analysis suggests the formation of a sideways range between 1.1830 and 1.1920. A break above the upper boundary could pave the way for a move towards 1.2000, whereas a drop below 1.1830 may deepen the correction towards 1.1770.

Key events for EUR/USD:

- Today at 13:00 (GMT+2): Germany’s headline PCSI consumer sentiment index

- Today at 15:30 (GMT+2): US initial jobless claims

- Today at 21:30 (GMT+2): Speech by Bundesbank President Joachim Nagel

GBP/USD

Following the formation of a piercing pattern on the daily chart at the end of last week, GBP/USD strengthened towards the key 1.3700–1.3720 zone. However, after the release of strong US labour market data, the pair corrected to 1.3610.

If the pair consolidates below this level over the coming sessions, a return towards last week’s lows near 1.3500 is possible. A break above resistance at 1.3720 could open the way for a renewed test of this year’s highs.

Key events for GBP/USD:

- Today at 09:00 (GMT+2): UK GDP

- Today at 09:00 (GMT+2): UK services activity index

- Today at 13:00 (GMT+2): UK headline Thomson Reuters/Ipsos PCSI consumer sentiment index

Trade over 50 forex markets 24 hours a day with FXOpen. Take advantage of low commissions, deep liquidity, and spreads from 0.0 pips (additional fees may apply). Open your FXOpen account now or learn more about trading forex with FXOpen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Crypto World

Robinhood Launches Ethereum Layer-2 Testnet, Expands Blockchain Vision

Robinhood has launched the public testnet for Robinhood Chain, marking a significant step in its blockchain ambitions. This Ethereum Layer-2 network aims to expand the company’s on-chain financial services. The move is part of Robinhood’s broader strategy to build its own blockchain infrastructure and bring tokenized assets and 24/7 trading to its platform.

The public testnet allows developers to test and evaluate applications on the network before its full launch. With the testnet in place, Robinhood aims to create a robust ecosystem for tokenized real-world and digital assets. In addition, the platform plans to integrate decentralized finance (DeFi) liquidity within the Ethereum ecosystem.

While this testnet launch marks an important milestone, Robinhood’s stock price has faced a downturn. Despite the promising developments, HOOD stock has dropped by 8.8%, trading at $78.09. The price drop follows a broader decline in stock value, particularly over the past few days.

Expanding Blockchain Infrastructure

Robinhood’s testnet launch signals its broader push into blockchain and decentralized finance. The Ethereum Layer-2 network is not only designed to improve scalability but also to rebuild Robinhood’s existing infrastructure. This focus on enhancing its systems is intended to integrate tokenized assets and DeFi features seamlessly into its platform.

In a statement, Johann Kerbrat, SVP and GM of Crypto and International at Robinhood, highlighted the company’s goal. He emphasized that the blockchain initiative is not just about scaling, but about transforming Robinhood’s core systems. The launch of Robinhood Chain is a crucial step in the company’s vision to establish its blockchain infrastructure.

The company expects that this infrastructure will create opportunities for developers to build innovative applications. With the Ethereum Layer-2 network, developers will be able to access the tools needed to bring their applications to life. The initiative aims to foster an ecosystem that will drive the future of tokenized financial services.

Revenue Declines and Market Reaction

Despite the excitement surrounding the testnet launch, Robinhood’s recent quarterly performance has raised concerns. The company reported Q4 revenue of $1.28 billion, falling short of expectations. This revenue miss came after the company had projected $1.35 billion in earnings for the quarter.

Additionally, Robinhood’s crypto transaction revenue also saw a decline, dropping to $221 million from $268 million in the previous quarter. This decrease in crypto-related revenue may have contributed to the negative market reaction. Despite these setbacks, the company remains committed to its blockchain plans and is pushing forward with its blockchain-based services.

The dip in stock price, combined with a decline in crypto transaction revenue, has raised questions about the company’s financial stability. However, Robinhood’s focus on its blockchain infrastructure could position it for long-term growth. The testnet launch is just the first step in a larger strategy to transform its platform and provide more advanced services to its users.

Integration with Key Blockchain Partners

Robinhood is partnering with several prominent blockchain infrastructure providers to integrate into the Robinhood Chain ecosystem. Companies like Alchemy, Allium, Chainlink, LayerZero, and TRM are among the first to join the initiative. These partnerships are expected to help strengthen the technical foundation of the network and expand its capabilities.

As Robinhood continues to develop its blockchain infrastructure, more partnerships will likely emerge. These collaborations will provide additional resources and tools to enhance the platform’s functionality. The involvement of established players in the blockchain space underscores the importance of Robinhood’s move into this new area.

The partnerships also signal Robinhood’s intention to build a robust ecosystem that can support a variety of applications. By integrating blockchain technology and decentralized finance liquidity, Robinhood aims to redefine financial services. The testnet launch marks the beginning of a larger effort to create a comprehensive blockchain platform that will serve the company’s growing user base.

Future Prospects of Robinhood Chain

The launch of the public testnet for Robinhood Chain is just the beginning of the company’s long-term blockchain strategy. The platform aims to bring tokenized real-world assets and DeFi services to its users. Over time, Robinhood plans to scale the network and introduce more advanced features that will transform its financial services.

With the support of key blockchain infrastructure providers, Robinhood is well-positioned to establish itself as a leader in the blockchain space. As the company continues to develop Robinhood Chain, it will likely attract more developers and businesses to the ecosystem. The future of Robinhood’s blockchain ambitions looks promising, as it seeks to disrupt traditional financial systems with its innovative approach.

While the road ahead may be challenging, Robinhood’s commitment to blockchain technology could lead to a transformative shift in the financial sector. The launch of Robinhood Chain represents a bold move to redefine how financial services are delivered and consumed. With a strong focus on tokenization and decentralized finance, Robinhood aims to lead the way in the next generation of financial technology.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports12 hours ago

Sports12 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World14 hours ago

Crypto World14 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video9 hours ago

Video9 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month