Crypto World

Midnight token price jumps after Google and Telegram partnership news

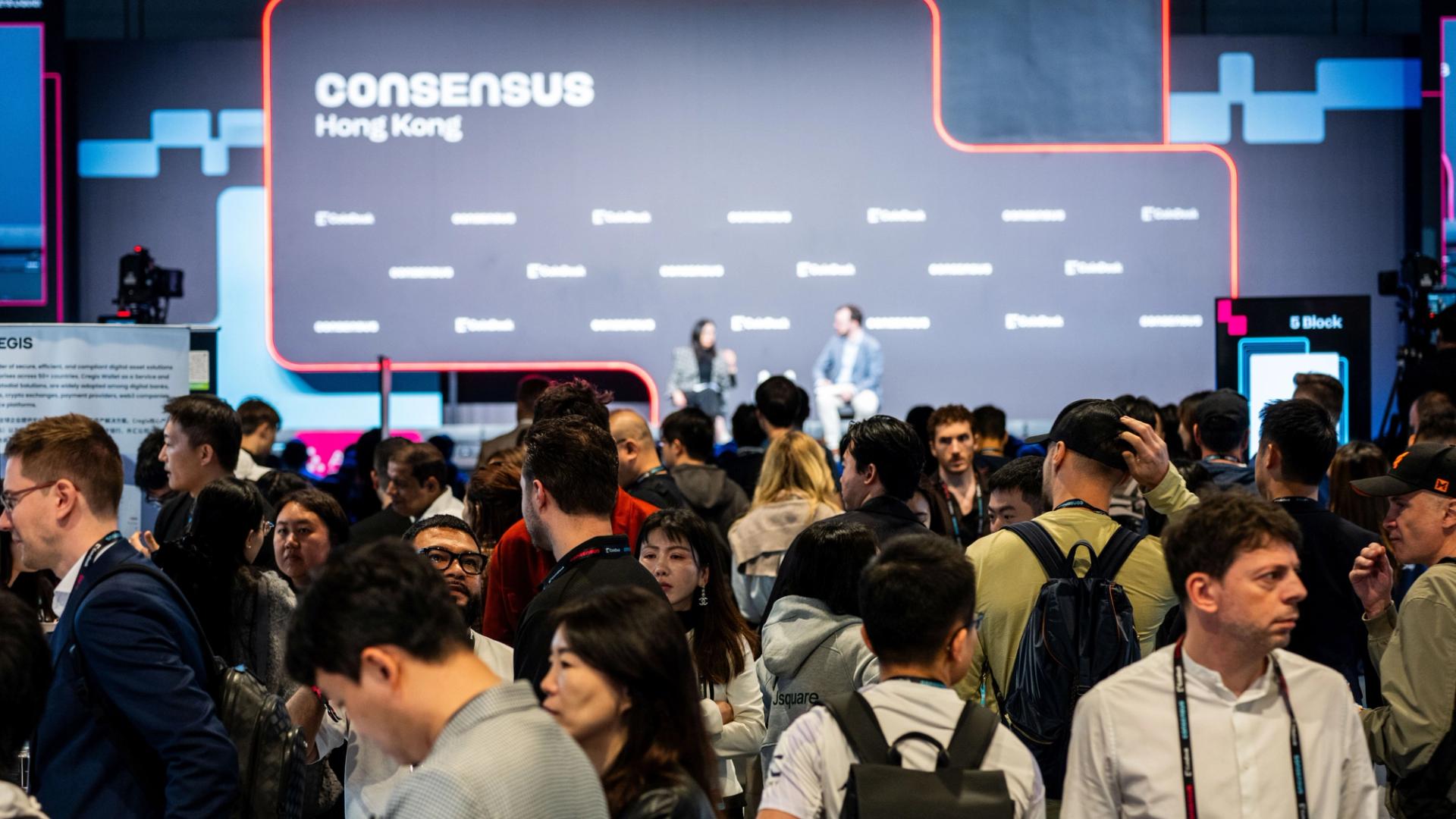

The privacy-focused blockchain Midnight saw renewed market interest this week after Cardano founder Charles Hoskinson announced key developments at the Consensus Hong Kong conference.

Summary

- Midnight gained attention after Charles Hoskinson confirmed a late-March mainnet launch and cited collaborations with Google and Telegram at Consensus Hong Kong.

- The project is positioned as a selective-disclosure privacy layer, with the new Midnight City Simulation introduced to test the network ahead of launch.

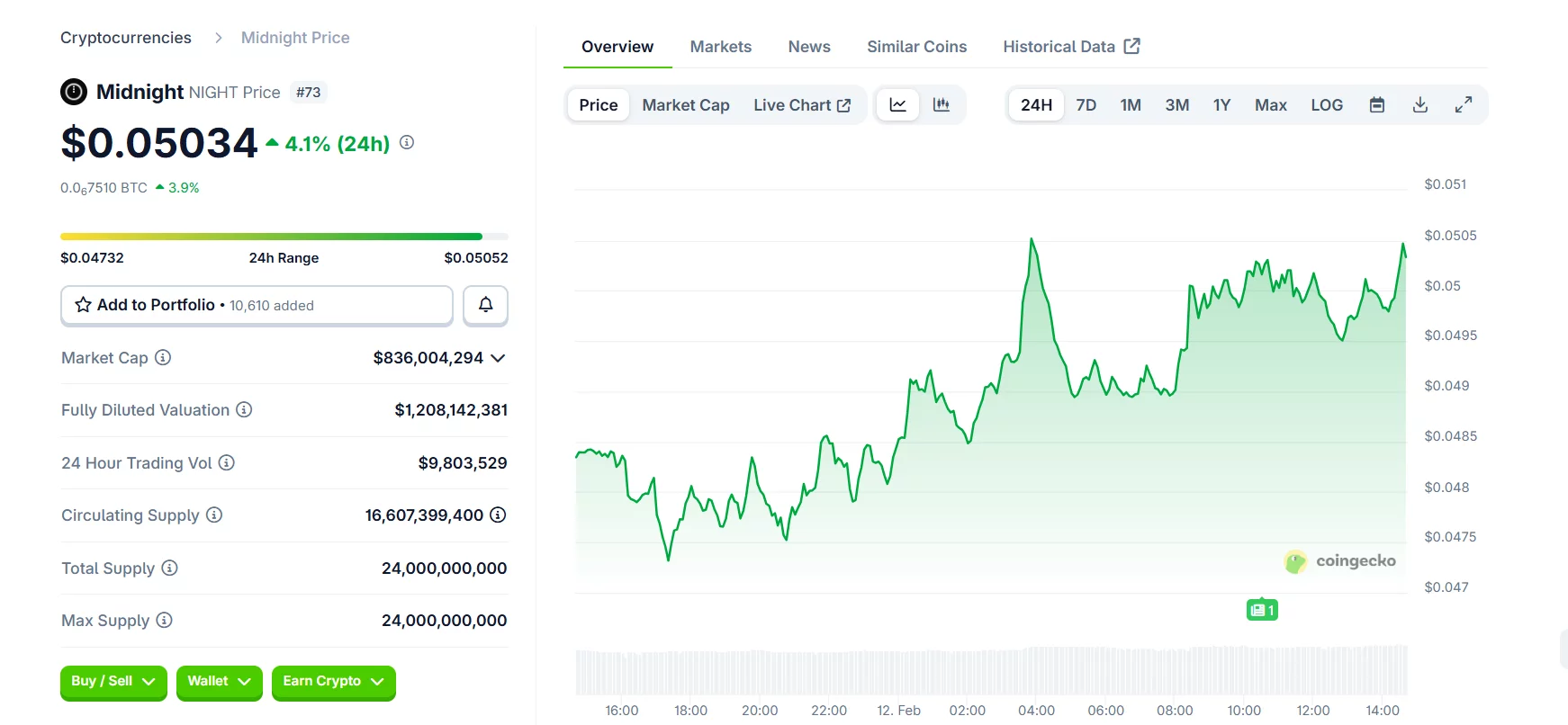

- The NIGHT token rose to around $0.048–$0.051, up roughly 3–4% in 24 hours.

This includes the project’s scheduled mainnet launch in late March and collaborations involving Google and Telegram.

Hoskinson’s remarks highlight Midnight’s evolution toward a “selective disclosure” privacy layer for blockchain applications, balancing confidentiality with real-world compliance.

While neither Google nor Telegram have independently confirmed the arrangement, Hoskinson said they are among partners helping support Midnight’s rollout and infrastructure.

“We have some great collaborations to help us run it,” he said. “Google is one of them. Telegram is another. We’re really excited, there’s more that will come.”

The announcement also introduced the Midnight City Simulation, a testing platform intended to stress-test network proof generation with AI agents well ahead of mainnet.

Midnight price uptick reflects renewed interest

Midnight’s native token NIGHT has responded positively to the news, trading at around $0.048–$0.051 at press time with modest short-term gains.

According to live price data, the token is up roughly 3–4 % in the past 24 hours, indicating renewed investor appetite following the partnership and mainnet timeline disclosure.

Midnight’s full mainnet debut, expected in March as a Cardano (ADA) partner chain with zero-knowledge proofs and “rational privacy” features, is now the next major catalyst for global markets.

Hoskinson has also made it clear that Midnight will not pursue direct onboarding of legacy privacy coin communities, such as Monero and ZCash, instead focusing on broader user adoption.

“You don’t try to get anybody from Monero or ZCash over,” he said during a Q&A session at Consensus Hong Kong on Thursday.

Crypto World

Hong Kong Crypto Sentiment Stays Bullish as $2 Trillion Market Crash Tests Asia

The rest of the world is panic-selling into a $2 trillion wipeout, but Hong Kong isn’t blinking.

While Bitcoin hovers precariously around $67,000, down nearly 50% from its October highs, institutional players in Asia’s financial capital are doubling down on infrastructure rather than fleeing the liquidity crisis.

It sounds counterintuitive, given the carnage, seeing altcoins decimated and liquidity described as “perilously patchy” by Bloomberg, but the smart money in Hong Kong is playing a different game entirely.

Key Takeaways

- Bitcoin trades near $67,000, down 47% from peaks, while wider crypto markets suffer a $2 trillion rout.

- Hong Kong officials reaffirmed support at Consensus 2026, citing $3.71 billion in tokenized deposits.

- Institutional focus in HK contrasts sharply with South Korean retail traders currently fleeing the market.

Is Asia, Especially Hong Kong, Decoupling from the Crash?

To understand the disconnect between price action and sentiment, look at who is actually buying.

While retail traders globally are capitulating, Hong Kong is leveraging a regulatory framework years in the making.

The city has spent the last three years positioning itself as a hub for regulated digital assets, and that investment is creating a buffer against current volatility.

While U.S. markets flounder under uncertainty, we are seeing similar patterns of institutional positioning from major players on Wall Street who remain invested despite the drawdown. In Hong Kong, this resolve is policy-backed.

Hong Kong Chief Executive John KC Lee, yesterday, reaffirmed the city’s commitment to a “sustainable digital asset ecosystem” during Consensus Hong Kong 2026.

This isn’t just talk: the city’s Securities and Futures Commission (SFC) is pushing ahead with licensing regimes that institutionalize the sector, regardless of the spot price of Bitcoin.

The $3.71 Billion Safety Net

The numbers coming out of the region paint a starkly different picture than the red candles on your charts.

While retail sentiment is crushed, Financial Secretary Paul Chan Mo-po revealed that Hong Kong banks are on track to offer tokenized deposit services worth US$3.71 billion by the end of 2025.

Compare this to the situation in South Korea. There, retail traders are bailing on crypto’s riskiest trades as alts collapse.

This mirrors the accumulation behavior we are tracking elsewhere, where large entities are controlling supply during price crashes to strengthen positions.

Even amid this crash, analysts are identifying the best crypto to buy, betting that Hong Kong’s regulatory clarity will draw serious volume once the dust settles.

Discover: The best crypto to diversify your portfolio

What the Hong Kong Situation Means for Global Regulation

Hong Kong is effectively calling the bottom by refusing to halt progress. The SFC is advancing legislative proposals for custodian licensing in early 2026, focusing on safeguarding private keys. This is the kind of clarity institutions need to deploy capital.

It’s a sharp contrast to the West, where stablecoin talks have stalled amid banking yield restrictions. Hong Kong’s approach of integrating tokenized assets directly into banking could force other jurisdictions to speed up or risk losing the center of gravity for crypto finance to Asia.

Solana Foundation President Lily Liu summed it up best at Consensus, noting that “Asia underpinned Bitcoin in any aspect.”

If Hong Kong holds firm while the $2 trillion crash plays out, it may emerge as the de facto capital for the recovery.

Discover: What is the next crypto to explode?

The post Hong Kong Crypto Sentiment Stays Bullish as $2 Trillion Market Crash Tests Asia appeared first on Cryptonews.

Crypto World

Is the Bottom In for ETH? $1.8K Support Holds Key to Recovery

Following the aggressive sell-off toward the $1.8K demand region, Ethereum stabilised and produced a corrective rebound. However, this recovery lacks strong momentum and is unfolding within a broader bearish structure. The current price behaviour indicates a potential consolidation between a well-defined demand zone below and an overhead supply area that continues to cap upside attempts.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH remains within a descending channel, with the price trading below both the 100-day and 200-day moving averages, which are now sloping downward and serving as dynamic resistance. The recent breakdown below the prior major swing low around $2.4K accelerated the sell-off, confirming bearish continuation and triggering a move toward the $1.8K demand zone.

The rebound from this crucial zone shows that buyers are defending this key historical support, which previously acted as an accumulation area. However, the price is currently trading at approximately $2K and remains below the internal resistance near $2.2K.

As long as Ethereum remains between $1.8K and $2.2K, the market is likely to consolidate within this range. A daily close below $1.8K would expose the next lower liquidity pocket toward $1.6K, while a reclaim of $2.2K could open the path toward the $2.6K supply region.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the price action reveals a compression structure following the sharp decline. Ethereum formed a local bottom near $1.8K and then produced a higher low, creating a short-term ascending trendline against the broader downtrend. At the same time, a descending resistance line from the recent swing high continues to cap price, forming a tightening range.

The immediate supply lies around $2.2K, where the previous breakdown occurred, while the nearest demand remains at $1.8K. With price hovering near $1,960, Ethereum appears to be consolidating between these two zones. A breakout above $2.2K on the 4-hour chart would signal short-term bullish continuation toward $2.4K, whereas a breakdown below $1.8K would likely invalidate the consolidation scenario and resume the dominant bearish trend.

Overall, the structure remains bearish on higher timeframes, but in the short term, Ethereum is compressing between $1.8K demand and $2.8K supply, and the next impulsive move will likely emerge from a decisive break of this range.

Sentiment Analysis

The ETH liquidation heatmap over the last 6 months provides critical confirmation of the bearish technical structure. A significant concentration of liquidity has been built around and just below the $2K level, which has recently acted as a strong magnet for price. The sharp sell-off into this area confirms that downside liquidity was actively targeted, resulting in a large flush of leveraged long positions.

Despite this liquidation event, the heatmap still reveals residual liquidity pockets extending slightly below current price levels, indicating that the market may not have fully exhausted its downside objectives yet. These remaining clusters continue to exert gravitational pull on price, especially if spot demand remains weak and derivatives positioning rebuilds on the long side too quickly.

That said, the intensity of liquidations around the $2K zone suggests that a meaningful portion of forced selling has already occurred. This reduces immediate liquidation pressure and explains the short-term stabilization seen after the drop. However, from an on-chain perspective, this behavior supports consolidation or corrective rebounds, not a confirmed trend reversal, unless liquidity interest decisively shifts back above current levels.

In summary, on-chain data aligns closely with the technical picture: Ethereum is still operating in a bearish liquidity-driven environment, with downside risks remaining active as long as price fails to reclaim key supply zones and attract sustained spot demand.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin layer-2 builders pitch BTCFi as the next institutional unlock

Leaders from Citrea, Rootstock Labs and BlockSpaceForce argued that bitcoin’s scaling layers are less about throughput and more about turning the asset into a programmable financial base layer.

Crypto World

YZi Labs is backing AI, biotech and Web3

In a market where crypto cycles rise and fall while AI feels inevitable and biotech plays out over decades, YZi Labs is deliberately positioning itself across multiple technological frontiers.

The unifying thesis is “to focus on the things haven’t happened yet, and to focus on the people who are there to dream them up and to make it happen,” head of YZi Labs Ella Zhang said at Consensus Hong Kong 2026 on Thursday.

YZi, formerly Binance Labs, invests across AI, biotech and Web3, balancing time horizons, particularly as crypto “feels very cyclical at the moment,” while AI adoption accelerates, Zhang said.

“Focus on user demand. Is there real demand happen or the demand is imagined?” she said. Instead of chasing narratives, the firm pressures founders on product fundamentals: what pain point is being solved, how distribution works, and whether there are early signals that the problem truly matters.

That philosophy also shapes capital deployment. “We’re not obligated to deploy all the capital we have,” Zhang said, emphasizing that checks follow conviction, not the other way around. YZi aims to be an early backer but continues supporting companies across multiple rounds, offering mentorship and strategic resources alongside funding.

On infrastructure, Zhang pointed to BNB Chain’s scale as a natural distribution layer, with “thousands of protocols” and “hundreds of millions of users” forming a ready ecosystem for new applications. At the same time, YZi is “very, very open for the founders to fail and welcome them to come back,” she said, framing failure as part of long-term founder development.

As for product trends, Zhang called stablecoins the first true mass-market application beyond trading. “Stablecoins are currently a very good application for crypto to go to mass adoption,” she said, citing improving compliance frameworks globally. Still, she sees further work ahead in custody, exchange infrastructure and on-chain FX before stablecoins fully mature.

Crypto World

15% growth in malicious email attacks in 2025

Editor’s note: In crypto and fintech security, email remains a critical attack vector. The 2025 Kaspersky findings show a sharp rise in malicious and potentially unwanted emails, with spam accounting for nearly half of global traffic and millions of dangerous attachments hitting users. For crypto firms and investors, these trends mean more phishing, more BEC attempts, and combined-channel scams that blend email with messaging apps and even legitimate-looking services. This editorial summarizes the implications and directs attention to the press release’s key points, which detail where threats are coming from, how attackers adapt, and practical defenses for the year ahead.

Key points

- 44.99% of global email traffic was spam in 2025.

- Over 144 million malicious and potentially unwanted email attachments.

- APAC led detections at 30%, Europe 21%, with China 14% among top countries.

- Detections peaked in June, July and November.

- Trends include cross-channel scams, evasion techniques, platform abuse, and refined BEC tactics.

Why this matters

Kaspersky’s 2025 telemetry shows 44.99% of global email traffic was spam, with 144 million malicious attachments and APAC leading detections, underscoring rising phishing risks.

Attackers increasingly blend email with other channels, employ advanced disguises, and imitate legitimate services, creating risk for crypto platforms and users alike. Staying ahead requires awareness, user training, and layered security measures.

What to watch next

- Monitor cross-channel phishing and fraudulent outreach patterns.

- Watch for increased use of legitimate platforms to send spam and scams.

- Be vigilant for refined BEC tactics and fake email threads.

- Strengthen phishing awareness and security controls across organizations.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Kaspersky reports 15% growth in malicious email attacks in 2025

12 February 2026

According to Kaspersky telemetry, almost every second email – 44.99% of global traffic – was spam in 2025. Spam consists not only of unsolicited emails, but can also include various email threats such as scam, phishing and malware. In 2025, individuals and corporate users encountered over 144 million malicious and potentially unwanted email attachments, representing a 15% increase compared to the previous year figures.

In 2025, APAC had the largest share of email antivirus detections: it reached 30%, followed by Europe with 21%. Next came Latin America (16%) and the Middle East (15%), Russia and CIS (12%) and Africa (6%). As for individual countries, China had the highest rate of malicious and potentially unwanted email attachments, with the share of email antivirus detections of 14%. Russia ranked second (11%), followed by Mexico (8%), Spain (8%) and Turkey (5%).

Email antivirus detections peaked moderately in June, July and November.

Key trends in email spam and phishing

Kaspersky’s annual analysis has also identified several persistent trends in the email spam and phishing threat landscape that are expected to continue into 2026:

- Combination of various communication channels. Attackers lure email users into switching to messengers or calling fraudulent phone numbers. For instance, scam investment mailings may redirect victims to fake websites, where they are asked to provide their contact information, and then cybercriminals will follow up with a phone call.

- Usage of diverse evasion techniques in phishing and malicious emails. Threat actors frequently try to disguise phishing URLs, for example, with the help of link protection services and QR codes. These QR codes are often embedded directly in email bodies or within PDF attachments, which not only conceals phishing links but also encourages users to scan them on mobile devices, potentially exploiting weaker security measures than corporate PCs.

- Mailings exploiting diverse legitimate platforms. For example, Kaspersky experts discovered a fraudulent tactic that abuses OpenAI’s organization creation and team invitation features to send spam emails from legitimate OpenAI addresses, potentially tricking users into clicking scam links or dialing fraudulent phone numbers. Additionally, a calendar-based phishing scheme, which originated in the late 2010s, resurfaced last year with a focus on corporate users.

- Refining tactics in business email compromise (BEC) attacks. In 2025 attackers attempted to become even more persuasive by incorporating fake forwarded emails into their correspondence. These emails lacked thread-index headers or other headers, making it difficult to verify their legitimacy within an email conversation.

Email phishing shouldn’t be underestimated. Our report reveals that one in ten business attacks starts with phishing, with a significant proportion being Advanced Persistent Threats (APTs). In 2025, we saw an increase in the sophistication of targeted email attacks. Even the smallest details are meticulously crafted in these malicious campaigns, including the composition of sender addresses and the tailoring of content to real corporate events and processes. The commodification of generative AI has significantly amplified this threat, enabling attackers to craft convincing, personalized phishing messages at scale with minimal effort, automatically adapting tone, language and context to specific targets,

To learn more about spam and phishing threat landscape, visit securelist.com.

To stay safe, Kaspersky recommends:

- Treat unsolicited invitations from any platform with suspicion, even if they appear to come from trusted sources.

- Carefully inspect URLs before clicking.

- Do not call any phone numbers indicated in suspicious emails – if you need to call support of a certain service, it is best to find the phone number on the official webpage of this service.

- For corporate users, Kaspersky Security for Mail Server with its multi-layered defense mechanisms powered by machine learning algorithms provides robust protection against a wide range of evolving threats and offers peace of mind to businesses in the face of evolving cyber risks.

- Ensure all employee devices, including smartphones, are equipped with robust security software.

- Conduct regular training on modern phishing tactics.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure, and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.

Crypto World

Cathie Wood Loads Up on Robinhood (HOOD) Stock During 9% Crash

TLDR

- Cathie Wood’s ARK Invest bought $33.8 million in Robinhood shares after the stock dropped 9% on Q4 earnings miss

- Robinhood now represents ARK’s largest crypto holding at $248 million, a 4.1% portfolio weighting

- CEO Vlad Tenev predicts prediction markets will enter a “supercycle” with trillions in annual volume potential

- The company launched Robinhood Chain testnet, a Layer 2 blockchain for tokenized assets

- Bitcoin ETFs saw $276 million in outflows Wednesday as crypto trading volumes declined

Cathie Wood made a bold move Wednesday, buying the dip on Robinhood shares while most investors headed for the exits. ARK Invest purchased $33.8 million worth of stock as shares plunged nearly 9% following a disappointing Q4 earnings report.

The buying spree wasn’t limited to Robinhood. ARK also added $16 million in other crypto-related stocks including Bullish and Circle as the broader digital asset market sold off.

Robinhood missed revenue estimates in Q4 as cryptocurrency trading volumes collapsed during Bitcoin’s recent weakness. The digital currency briefly dropped below $66,000, triggering a wave of selling across crypto-linked equities.

But Wood saw opportunity where others saw risk. The purchases pushed Robinhood to become ARK’s largest crypto-related position, with total holdings now worth approximately $248 million.

Blockchain Infrastructure Play

The timing coincided with Robinhood’s testnet launch of Robinhood Chain. This Layer 2 blockchain targets tokenized real-world assets and institutional financial services.

ARK appears to be betting on Robinhood’s transformation from a retail trading platform into a blockchain infrastructure provider. The quarterly earnings miss seems less important than the long-term strategic positioning.

Bitcoin ETFs recorded $276.3 million in net outflows Wednesday, nearly erasing weekly gains. Total assets under management dropped to $85.7 billion, the lowest level since late 2024.

While Bitcoin has stabilized around $67,200, institutional appetite remains muted. Many large investors are waiting for clearer market direction before deploying capital.

Prediction Markets Opportunity

CEO Vlad Tenev offered a different perspective during the earnings call. He described prediction markets as entering a “supercycle” that could eventually generate trillions in annual trading volume.

The data supports his optimism. Prediction markets volume more than doubled in Q4, reaching $12 billion in total contracts for 2025. The company has already processed $4 billion in 2026.

Robinhood is building its own prediction market platform through a joint venture with Susquehanna International Group. The move would give the company greater control over product offerings and potentially stronger margins.

Launch is expected later this year. The platform will compete with Kalshi and Polymarket in a rapidly expanding market.

Tenev told CNBC he remains bullish on crypto despite recent volatility. The company plans to continue expanding both digital asset offerings and prediction markets.

More details are expected at Robinhood’s “Take Flight” event on March 4. Tenev is scheduled to unveil new products and strategic initiatives.

Wall Street maintains a Strong Buy rating on the stock. Analysts have issued 14 Buy ratings, three Holds, and zero Sells over the past three months. The average price target of $135.79 suggests 56.9% upside potential.

Shares have declined nearly one-third year-to-date following Wednesday’s selloff.

Crypto World

Tech IPO hype drowned out by prospect of $1 trillion in debt sales

Magnificent 7 tech stocks on display at the Nasdaq.

Adam Jeffery | CNBC

While the prospect of a SpaceX initial public offering and the hopeful listings from OpenAI and Anthropic have juiced IPO excitement on Wall Street, the current action in tech capital markets has nothing to do with equity. Rather, it’s all about debt.

Tech’s four hyperscalers — Alphabet, Amazon, Meta and Microsoft — are collectively projected to shell out close to $700 billion this year on capital expenditures and finance leases to fuel their artificial intelligence buildouts, responding to what they call historic levels of demand for computing resources.

To finance those investments, industry giants may have to dip into some of the cash they’ve built up in recent years. But they’re also looking to raise mounds of debt, adding to concerns about an AI bubble and fears about a market contagion if cash-burning startups like OpenAI and Anthropic hit a growth wall and pull back on their infrastructure spending.

In a report late last month, UBS estimated that after tech and AI-related debt issuance across the globe more than doubled to $710 billion last year, that number could soar to $990 billion in 2026. Morgan Stanley foresees a $1.5 trillion financing gap for the AI buildout that will likely be filled in large part by credit as companies can no longer self-fund their capex.

Chris White, CEO of data and research firm BondCliQ, says the corporate debt market has experienced a “monumental” increase in size, amounting to “massive supply now in the debt markets.”

The biggest corporate debt sales this year have come from Oracle and Alphabet.

Oracle said in early February that it planned to raise $45 billion to $50 billion this year to build additional AI capacity. It quickly sold $25 billion of dollars worth of debt in the high-grade market. Alphabet followed this week, upping the size of a bond offering to over $30 billion, after holding a prior $25 billion debt sale in November.

Other companies are letting investors know that they could come knocking.

Amazon filed a mixed shelf registration last week, disclosing that it may seek to raise a combination of debt and equity. On Meta’s earnings call, CFO Susan Li said the company will look for opportunities to supplement its cash flow “with prudent amounts of cost-efficient external financing, which may lead us to eventually maintain a positive net debt balance.”

And as Tesla bolsters its infrastructure, the electric vehicle maker may look to outside funding, “whether it’s through more debt or other means,” CFO Vaibhav Taneja said following fourth-quarter earnings.

With some of the world’s most valuable companies adding to their debt loads by the tens of billions, Wall Street firms are plenty busy as they await movement on the IPO front. There haven’t been any IPO filings from notable U.S. tech companies this year, and the attention is focused on what Elon Musk will do with SpaceX after he merged the rocket maker with AI startup xAI last week, forming a company that he says is worth $1.25 trillion.

Reports have suggested SpaceX will aim to go public in mid-2026, while investor Ross Gerber, CEO of Gerber Kawasaki, told CNBC he doesn’t think Musk will take SpaceX public as a standalone entity, and will instead merge it with Tesla.

As for OpenAI and Anthropic — competing AI labs that are both valued in the hundreds of billions of dollars — reports have surfaced about eventual plans for public debuts, but no timelines have been set. Goldman Sachs analysts said in a recent note that they expect 120 IPOs this year, raising $160 billion, up from 61 deals last year.

‘Not that appetizing’

Class V Group’s Lise Buyer, who advises pre-IPO companies, isn’t seeing bustling activity within tech. The volatility in the public markets, particularly around software and its AI-related vulnerabilities, along with geopolitical concerns and soft employment numbers are some of the factors keeping venture-backed startups on the sidelines, she said.

“It’s not that appetizing out there right now,” Buyer said in an interview. “Things are better than they’ve been the last three years, but an overabundance of IPOs is unlikely to be a problem this year.”

That’s unwelcome news for venture capitalists, who have been waiting for an IPO resurgence since the market shut down in 2022 as inflation soared and interest rates rose. Certain venture firms, hedge funds and strategic investors have generated handsome profits from large acquisitions, including those disguised as acquihires and licensing deals, but startup investors historically need a healthy IPO market to keep their limited partners happy and willing to write additional checks.

There were 31 tech IPOs in the U.S. last year, more than the three years prior combined, though far below the 121 deals completed in 2021, according to data compiled by University of Florida finance professor Jay Ritter, who has long tracked the IPO market.

Greg Abbott, governor of Texas, left, and Sundar Pichai, chief executive officer of Alphabet Inc., during a media event at the Google Midlothian Data Center in Midlothian, Texas, US, on Friday, Nov. 14, 2025.

Jonathan Johnson | Bloomberg | Getty Images

Alphabet has shown that the debt market is extremely receptive to its fundraising efforts, for now at least. The bonds have varying maturity dates, with the first debt coming due in three years. Yields are narrowly higher than for the 3-year Treasury, meaning investors aren’t getting rewarded for risk.

In its U.S. bond sale, Alphabet priced its 2029 notes at a 3.7% yield and its 2031 notes at 4.1%.

John Lloyd, global head of multi-sector credit at Janus Henderson Investors, said spreads are historically tight across the investment grade landscape, which makes it a tough investment.

“We’re not worried about ratings downgrades, not worried about fundamentals of the companies,” Lloyd said. But in looking at potential for returns, Lloyd said he prefers higher-yield debt from some of the so-called neoclouds and the converted bitcoin miners that are now focused on AI.

After raising $20 billion in debt in the U.S., Alphabet immediately turned to Europe for roughly $11 billion of additional capital. A credit analyst told CNBC that Alphabet’s success overseas could convince other hyperscalers to follow, as it shows demand goes well beyond Wall Street.

Concentration risk?

With so much debt coming from a small number of companies, corporate bond indexes are faced with a similar issue as stock benchmarks: too much tech.

Roughly one-third of the S&P 500’s value now comes from tech’s trillion-dollar club, which includes Nvidia and the hyperscalers. Lloyd said tech is now about 9% of investment grade corporate debt indexes, and he sees that number reaching the mid to high teens.

Dave Harrison Smith, chief investment officer at Bailard, described that level of concentration as an “opportunity and a risk.”

“These are tremendously profitable cash flow generative businesses that have a great deal of flexibility to invest that cash flow,” said Smith, whose firm invests in equities and fixed income. “But the way we’re looking at it increasingly is the sheer amount of investment and capital that is being required is quite simply eye-popping.”

That’s not the only concern for the debt market.

White of BondCliQ says that with such a vast supply of debt hitting the market from the top tech companies, investors are going to demand stronger yields from everyone else. Increased supply leads to lower bond prices, and when bond prices fall, yields rise.

Alphabet’s sale was reportedly five times oversubscribed, but “if you supply this much paper into the marketplace, eventually demand is going to wane,” White said.

For borrowers, that means a higher cost of capital, which results in a hit to profits. The companies to look out for, White said, are those that have to come back to the market in the next couple years, when interest rates for corporate bonds are likely to be higher.

“It will cause much, much higher corporate debt financing across the board,” White said, specifying increased costs for companies like automakers and banks. “That’s a big problem down the line because it means higher debt servicing costs.”

— CNBC’s Seema Mody and Jennifer Elias contributed to this report.

Crypto World

developers, scaling, PitchFest , Hackathon

HONG KONG — CoinDesk wrapped up Consensus Hong Kong on Thursday with north of 11,000 attendees visiting booths and stages.

While day 1 focused on institutional projects and professional investor audiences, the second day concentrated on developers. Representatives of the Bitcoin, Ethereum and Solana communities all spoke to the challenge of scaling their networks and the tooling needed to support growing user bases.

World Liberty Financial, the crypto project linked to U.S. President Donald Trump and his family, is planning to start a foreign-exchange platform called World Swap, which co-founder Zak Folkman said will target cross-border transfers. World Swap will use the USD1 stablecoin and charge less than traditional remittance providers, which can impose a cost of up to 10% per transaction.

The institution-focused LayerZero blockchain will port over to Cardano, and the privacy-focused Midnight mainnet will go live next month, Input Output Global CEO Charles Hoskinson said on stage. In a question-and-answer session, he added that Midnight would not be targeting deeply committed privacy users who might use ZCash and Monero.

Binance co-CEO Richard Teng defended his company from accusations that it played an outsize role in the Oct. 10 liquidation event, which saw $19 billion worth of liquidations. Rather, macro shocks caused a broader market downturn, he said.

Consensus day 2 also saw zkME win the Consensus PitchFest and FoundrAI win the Easy A x Consensus Hackathon.

Both of these events will return on May 5-7, when CoinDesk hosts its flagship North American Consensus — this time in Miami.

Crypto World

Bitget Targets 40% of Tokenized Stock Trading by 2030

Bitget, the world’s largest Universal Exchange (UEX), today announced a major mobile app upgrade that puts crypto and traditional financial markets side by side on the homepage, reflecting how traders are increasingly moving between asset classes in one trading session. The release follows Bitget’s January rollout of TradFi trading, which expanded access to stock-linked products, FX, indices, commodities, and precious metals such as gold and silver, all settled in USDT.

Bitget’s tokenized TradFi thesis is that crypto is changing from its speculative traits to a rising global financial infrastructure. While annual stock trading is estimated at $100 – $130 trillion currently, it could reach $160 –$200 trillion by 2030, with a significant share of stocks, credit, funds, and commodities shifting onchain as Bitcoin strengthens its role in macro hedge portfolios.

As tokenized stocks increasingly route through crypto-market platforms, exchanges could facilitate roughly 20–40% of that flow; Bitget’s UEX strategy is to be a primary liquidity and distribution hub by expanding into tokenized stocks, FX, gold, and more with an internal base case of handling 40% of the tokenized stock activity roughly $15–$30 trillion in tokenized-stock trading volume by 2030.

Under the new layout, all crypto products including futures, spot, margin, onchain, and earn are consolidated under a unified “Trade” tab, reducing friction for active traders who move frequently between crypto assets. Simultaneously, a new, dedicated TradFi tab provides one-tap access to global markets such as gold, FX, indices, and stock perps and real-world asset tokens, eliminating the need to navigate multiple menus or workflows.

“Bitget is building for the trillion dollar migration. As regulation matures and institutions bring products like treasuries onchain, the direction is clear: crypto is turning into the settlement layer for everyday finance. Sooner than most people think, stablecoins and native assets won’t feel crypto at all, just backend infra working behind when people move value worldwide,” said Gracy Chen, CEO at Bitget.

That’s also why the product experience has been rebuilt around it, on Bitget TradFi is accessible within a click and a UI/UX flow cuts the total steps by around 30% versus typical industry journeys,” she added.

Bitget has successfully pivoted from a crypto-native exchange to the global liquidity hub for this migration. The platform has established itself as the dominant venue for tokenized equities. Bitget currently captures 89.1% of the global market share for Ondo’s tokenized stock tokens, reaching record daily volumes of $6 Billion in January 2026.

The upgraded app experience is now live globally.

For more information, please click here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

Crypto World

Looking for the Best White-Label Tokenization Providers? A Deep Dive

As global capital markets evolve, asset owners and financial institutions are increasingly leveraging blockchain technology to digitize real-world assets (RWAs) such as real estate, private equity, commodities, and debt instruments. Real-world asset tokenization promises enhanced liquidity, fractional ownership, borderless investing, and transparency. But behind these benefits is a complex technical and regulatory ecosystem that enterprises must navigate to unlock sustainable value.

This has given rise to a new category of technology companies — white-label tokenization development company and enterprise tokenization solutions providers — that deliver fully customizable, secure, and compliance-ready infrastructure for token issuance, investor onboarding, secondary trading, and asset lifecycle management. As we enter 2026, these platforms are no longer experimental tech; they are institutional-grade frameworks powering mainstream adoption.

Before identifying the current leaders in the tokenization industry, it’s important to recognize the infrastructure issues that have created a demand for these solutions.

The Infrastructure Gap in RWA Tokenization

The tokenization of real-world assets is becoming increasingly popular. However, it has not yet been adopted at scale due to a variety of operational and regulatory challenges. Despite the immense opportunity in the market, many companies launching or exploring tokenized asset solutions do not understand just how complex the process will be to launch a compliant and real-world asset tokenization platform. Transitioning from a conceptual pilot project to a full-production, institutional-grade implementation requires many more assets and resources (beyond just creating smart contracts); this includes building a comprehensive compliance framework, providing secure custody integration, and implementing a liquidity-ready framework.

Overcoming Key Infrastructure Gaps

1) Fragmentation in Regulations Across Jurisdictions

Various countries have differing laws regarding the regulation of securities, licensing guidelines, eligibility of investors and anti-money-laundering and ‘know your customer’ (AML/KYC) regulations. Enterprises wishing to issue tokens on a cross-border basis will have to comply with multiple regulatory schemes simultaneously, thereby increasing both their legal risk and the operational burden placed on them.

2) Lack of Integrated Liquidity Mechanisms

Issuing tokens without a compliant structure for secondary trading reduces investor access to those tokens and potentially limits the liquidity of the tokenized asset. Without a structured marketplace (i.e., an exchange) with automated transfer controls, the tokenized asset won’t achieve sufficient liquidity.

3) Significant In-House Development Costs

Building smart contracts, dashboards for investors, compliance engines, wallet integrations, and reporting systems from scratch typically takes a considerable amount of time and expertise in blockchain engineering.

4) Security and Audit Risks

Poorly designed contracts, insufficient audits of the smart contracts, and unsafe custody of tokens all pose significant risk to the issuer, both with respect to financial exposure and reputational impact—this is especially true when high-value assets are being tokenized.

5) Cross-border operational complexity

Data privacy compliance, tax reporting standards, custody licensing requirements, and jurisdictional transfer restrictions create layered complexity for global scaling.

Transform Real-World Assets into Scalable Digital Opportunities with the Experts

How White-Label Models Address These Gaps

In order to eliminate the obstacles to adopting on a large scale, enterprises will work with white-label tokenization development companies that provide an existing product with the required technology and have experience in developing similar tokens. These types of models allow companies the ability to use a single system that is already compliant and meets the requirements mentioned before (i.e., regulatory, technical, liquidity, & security). By using this approach instead of trying to put together different systems, there are now complete end-to-end enterprise tokenization solutions and will meet the requirement for scalability and will be able to be deployed in an environment where institutions are usually located.

1. Embedding Compliance at the Core

Regulatory uncertainty is one of the biggest deterrents in RWA tokenization. White-label models reduce this risk by integrating compliance mechanisms directly into the token architecture.

They typically include:

- Automated AML/KYC verification modules

- Investor accreditation validation workflows

- On-chain transfer restrictions aligned with securities laws

- Role-based access controls for regulated asset distribution

- Audit-ready transaction and reporting systems

By embedding compliance logic into smart contracts themselves, real-world asset tokenization platforms ensure that tokens cannot be transferred or traded outside predefined regulatory parameters. This transforms compliance from a manual oversight process into a programmable safeguard.

2. Accelerating Time-to-Market

Building infrastructure from scratch can take 12–24 months and require extensive blockchain engineering resources. White-label providers dramatically compress this timeline.

Key acceleration factors include:

- Pre-audited smart contract templates

- Configurable asset tokenization frameworks

- Ready-to-deploy investor dashboards

- Integrated wallet and custody solutions

- API-driven backend integrations

This allows enterprises to launch tokenized offerings within weeks or months, capturing early-mover advantage in competitive markets. For institutions evaluating RWA infrastructure providers 2026, speed combined with reliability has become a defining metric.

3. Enabling Liquidity and Secondary Market Readiness

Liquidity is essential for investor confidence. White-label tokenization models integrate trading-enablement features directly into the infrastructure.

These often include:

- Built-in secondary marketplace modules

- Automated compliance checks during transfers

- Custodian and broker integrations

- Settlement automation

- Cap table and ownership tracking tools

By solving the liquidity bottleneck, white-label platforms transform tokenized assets from static digital representations into dynamic, tradable financial instruments.

4. Reducing Technical and Operational Risk

In-house blockchain development introduces significant risk, particularly around smart contract security and system scalability. A professional white-label tokenization Development Company mitigates these risks through:

- Third-party audited smart contracts

- Multi-signature custody frameworks

- Hardware security integrations

- Continuous monitoring systems

- Scalable cloud-native architecture

This enterprise-grade security posture is critical for institutional adoption, where asset values can run into millions or billions.

5. Supporting Multi-Asset and Multi-Jurisdiction Scalability

Modern enterprises require flexibility across asset classes and geographic markets. White-label infrastructure is designed to support:

- Real estate tokenization

- Equity and debt instruments

- Funds and structured products

- Commodities and alternative assets

Additionally, these platforms accommodate jurisdiction-specific compliance configurations, enabling global expansion without rebuilding the system for each new market.

6. Preserving Brand Identity with Backend Strength

White-label solutions allow enterprises to retain full ownership of their user experience while leveraging powerful backend technology.

This includes:

- Fully customizable investor portals

- White-labeled dashboards and interfaces

- CRM and ERP integration

- Multi-language and multi-currency capabilities

As a result, organizations can deploy robust enterprise tokenization solutions under their own brand without exposing third-party infrastructure.

Leading White-Label Tokenization Providers in 2026

The competitive landscape among RWA infrastructure providers 2026 is defined by scalability, compliance depth, multi-asset capability, and enterprise adaptability. Below are the platforms shaping this market.

1. Antier

Antier is widely recognized as a full-stack white-label tokenization Development Company delivering comprehensive enterprise tokenization solutions across asset classes.

Core Capabilities:

- Multi-asset tokenization (real estate, equity, debt, commodities, funds)

- Regulatory-aligned smart contract frameworks

- Built-in secondary marketplace modules

- Cross-chain interoperability

- Institutional-grade security infrastructure

What Sets Antier Apart:

Antier offers end-to-end lifecycle management — from asset structuring and token issuance to investor onboarding, compliance automation, and secondary trading. Its modular architecture enables enterprises to deploy scalable ecosystems rather than standalone issuance tools.

The company’s expertise in blockchain engineering ensures flexibility across jurisdictions, making it a strategic partner for institutions targeting global markets.

2. Brickken

Brickken positions itself as a streamlined solution for asset digitization and marketplace deployment.

Key Strengths:

- Structured token issuance workflows

- Investor onboarding and compliance automation

- Integrated dashboard for asset performance tracking

- Marketplace-ready trading modules

Platform Focus:

Brickken emphasizes operational simplicity, enabling asset owners to tokenize and manage assets without extensive technical intervention. Its integrated marketplace layer enhances liquidity readiness, making it suitable for asset managers seeking structured deployment.

3. Kalp Studio

Kalp Studio offers a customizable toolkit designed for enterprises requiring adaptable infrastructure.

Core Features:

- Developer-friendly APIs and SDKs

- Multi-chain compatibility

- Modular smart contract templates

- Integration with existing fintech ecosystems

Market Position:

Kalp Studio appeals to organizations seeking flexibility and customization. Its architecture allows enterprises to integrate tokenization into broader fintech stacks without rebuilding entire systems.

4. Tokeny

Tokeny is known for its strong compliance-first approach, particularly in regulated digital securities markets.

Platform Highlights:

- ERC-3643-based token standards

- Protocol-level compliance enforcement

- Rights and restrictions management

- Institutional transfer controls

Strategic Strength:

Tokeny’s specialization in regulated securities infrastructure makes it particularly relevant for financial institutions prioritizing legal certainty and regulatory precision.

5. Blocktunix

Blocktunix focuses on vertical specialization, particularly in real estate tokenization.

Key Offerings:

- Fractional property ownership modules

- Investor KYC/AML onboarding systems

- Smart contract–based ownership tracking

- Real estate marketplace integration

Ideal Use Cases:

Blocktunix is suitable for property developers and real estate investment firms seeking streamlined fractionalization platforms.

Strategic Takeaways and Choosing the Right Partner

By the end of 2026, tokenization will have become a commercial reality, and companies have moved from having proof-of-concept projects to creating an infrastructure that is robust, secure and compliant enough to support institutional investors and scale globally.

Top-tier white-label tokenization providers are addressing the most significant challenges in the RWA ecosystem, including regulatory fragmentation, liquidity challenges, security risks and complexity across different jurisdictions. These platforms are designed to allow companies to launch, manage, and scale tokenized products faster and with less risk, enabling enterprise-level functionality.

Of these innovative providers, Antier is an ideal strategic partner for companies that want comprehensive white-label tokenization development services and an end-to-end solution for enterprise tokenization. Antier has a modular architecture, in-depth compliance integration capabilities and a proven track record with multiple asset classes, making it easier for forward-thinking companies to realize the full benefits of their real-world asset tokenization platform without having to go through extensive internal development.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports13 hours ago

Sports13 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World15 hours ago

Crypto World15 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video10 hours ago

Video10 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month