Crypto World

New Crypto Casino With 275% Welcome & 75 Free Spins!

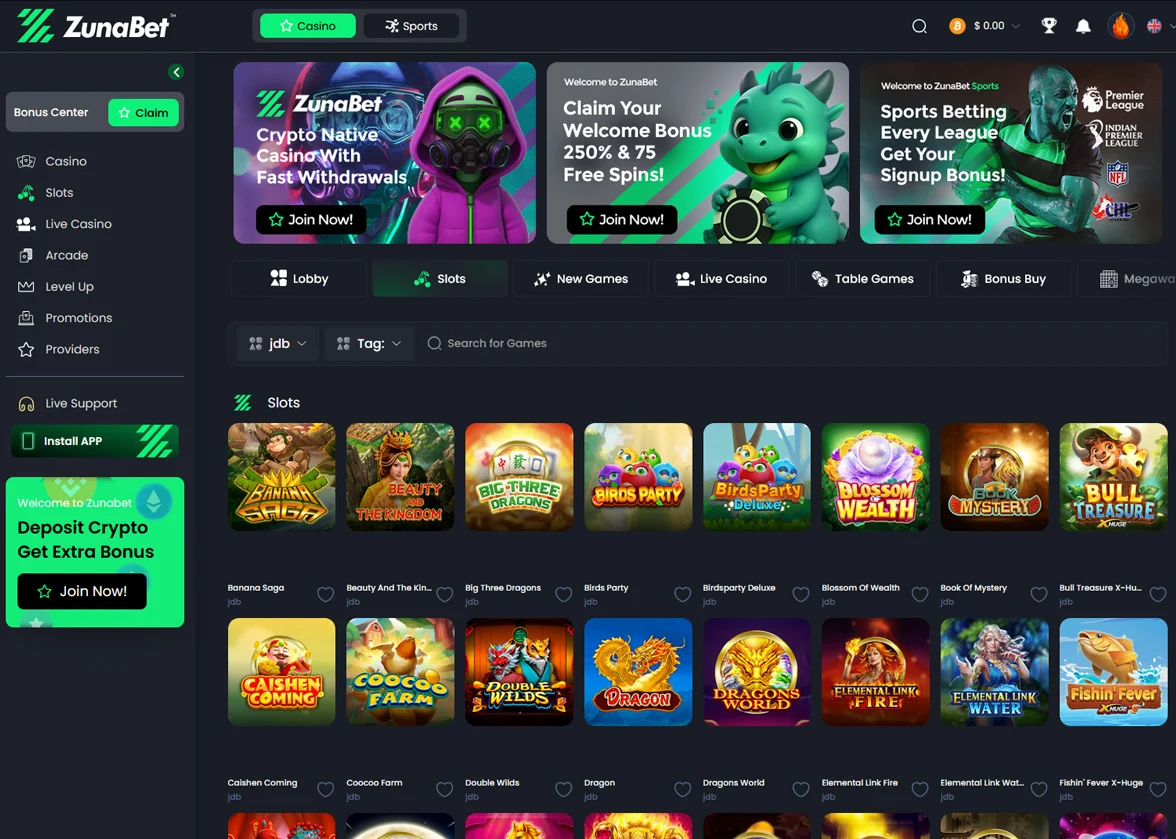

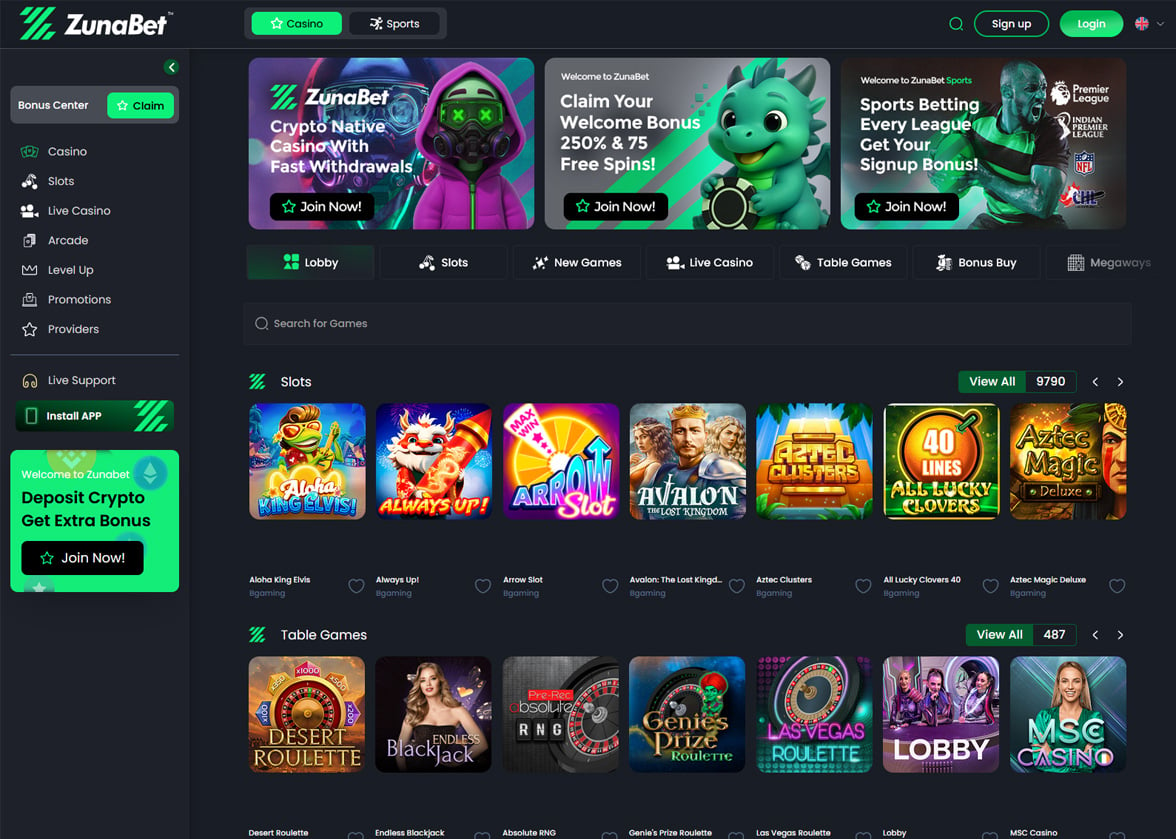

ZunaBet is a new crypto casino and sportsbook that launched in 2026. The platform combines traditional casino gaming with cryptocurrency payments and modern features. With over 11,000 games and a full sports betting section, it aims to serve players looking for a crypto-friendly gambling destination.

Here’s our full review!

Quick Verdict: ZunaBet is a crypto casino offering over 11,000 games from 63 providers, extensive sports betting options across traditional and eSports, and a generous welcome package of 250% up to $5000 with 75 free spins,

Quick Facts

| Category | Information |

|---|---|

| Launch Year | 2026 |

| License | Government of Anjouan, License No. ALSI-202510047-FI2 |

| Operator | Strathvale Group Ltd., Belize |

| Number of Games | 11,294+ |

| Game Providers | 63 providers |

| Cryptocurrencies | 20+ including BTC, ETH, USDT, SOL |

| Sports Betting | Traditional sports and eSports |

| Welcome Bonus | 250% up to $5000 + 75 Free Spins |

| Loyalty Program | Dragon Evolution System with 6 tiers |

| Mobile Access | Responsive design plus downloadable apps |

| Customer Support | Email at support@zunabet.com |

| Supported Languages | English, Italian, Spanish, French, German, Indian |

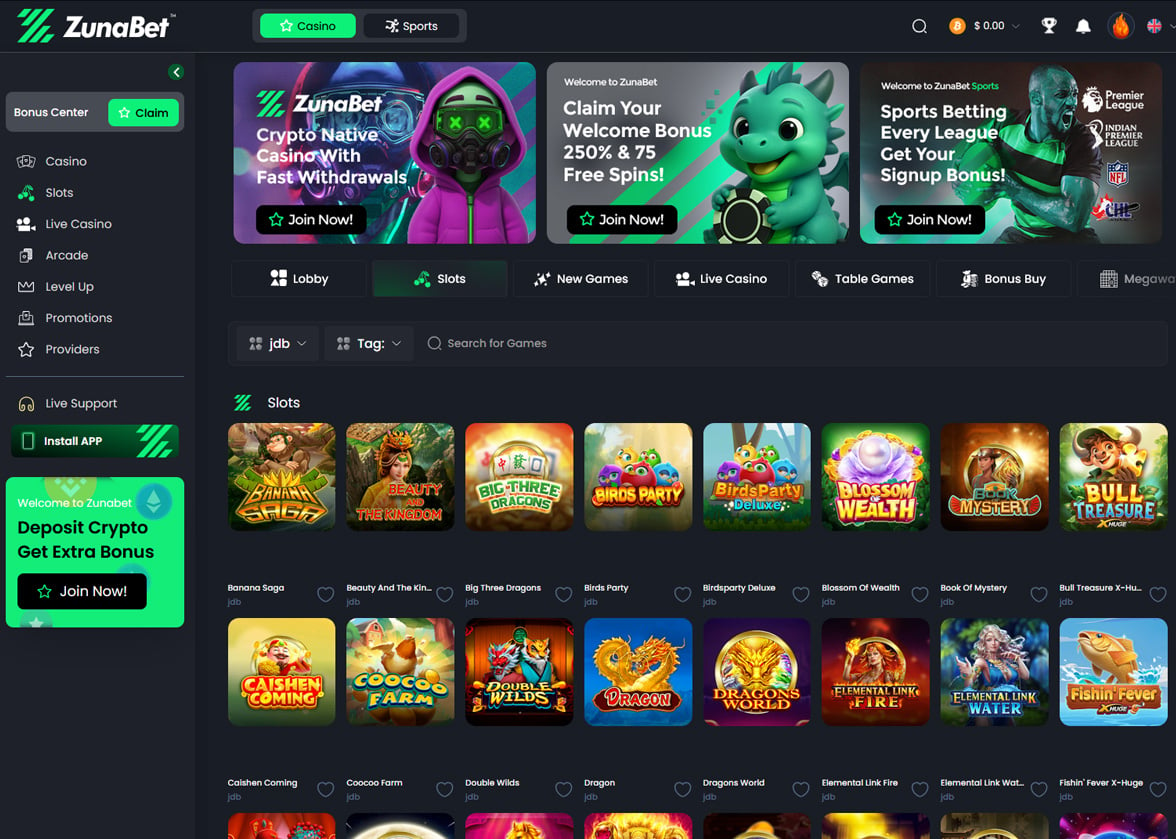

Casino Games

ZunaBet hosts an impressive collection of 11,294 casino games. This extensive library comes from 63 different software providers, giving players access to a wide variety of gaming styles and themes. The selection covers all major casino game categories that players expect from a modern online casino.

The slot game section makes up the majority of the casino’s offerings. Players can find everything from classic three-reel slots to modern video slots with complex bonus features. The games come with different volatility levels and return-to-player percentages to suit different playing styles.

Table game fans have access to multiple versions of blackjack, roulette, baccarat, and poker. These games range from standard versions to variants with special rules or side bets. The variety ensures that both casual players and experienced table game enthusiasts can find options that match their preferences.

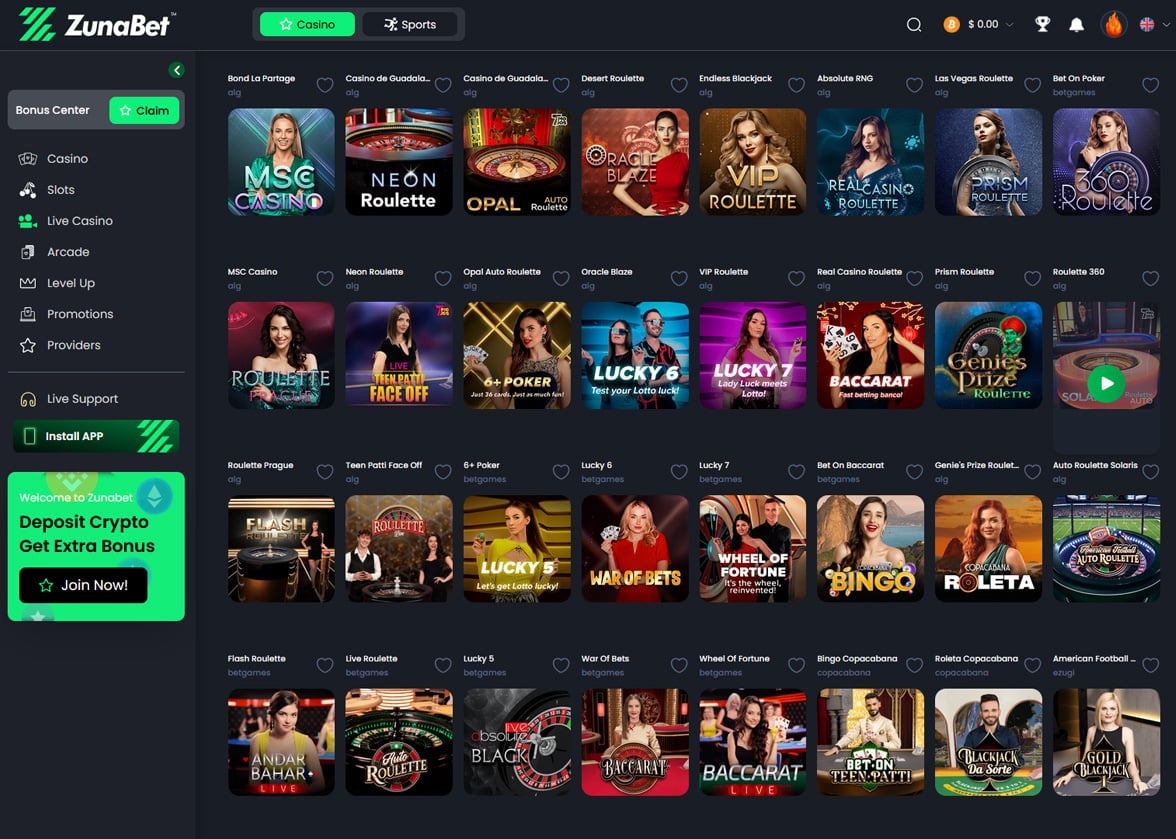

Live dealer games bring the casino floor experience to your screen. The platform includes live versions of popular table games where real dealers run the games in real-time. Players can interact with dealers and other players through chat functions while placing their bets.

The game providers list reads like a who’s who of the online casino industry. Pragmatic Play and Hacksaw Gaming feature prominently, offering their popular slot titles. Playtech contributes both slots and table games to the collection. Evolution Gaming powers the live dealer section with their industry-leading live casino products.

Other major providers include BGaming, Booming Games, Endorphina, Evoplay, Ezugi, Habanero, and Yggdrasil. Each provider brings their own unique style and game mechanics to the platform. This diversity means players can explore different themes, features, and gameplay styles without leaving the site.

The casino doesn’t require downloads to play games. All titles run directly in web browsers using HTML5 technology. This means players can access games from any device with an internet connection and a modern browser.

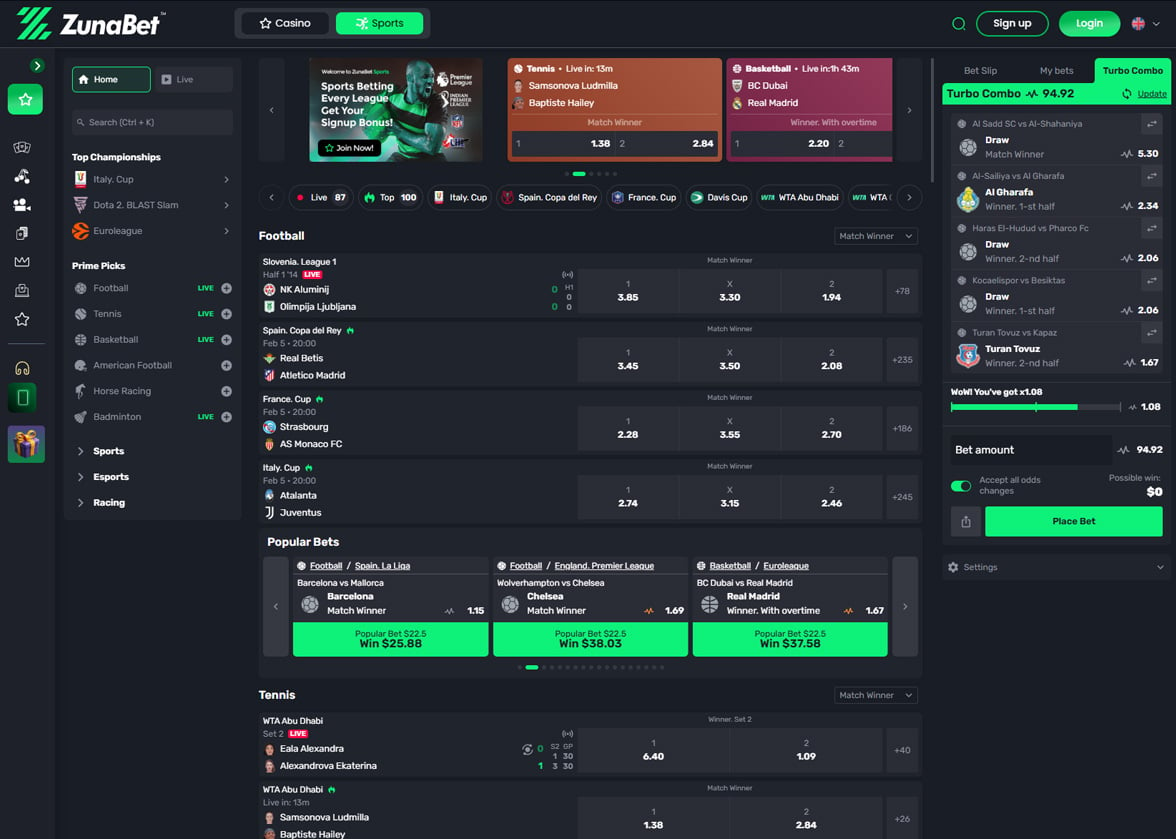

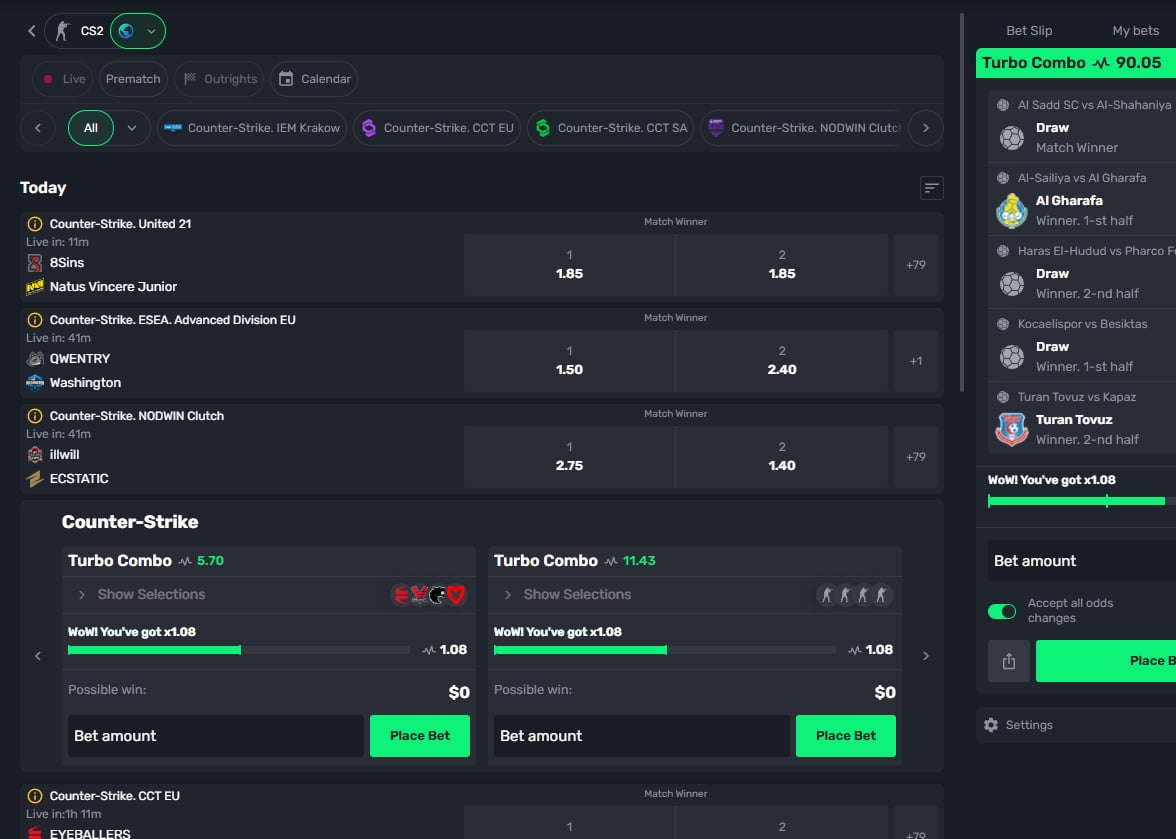

Sports Betting

The sportsbook at ZunaBet covers a comprehensive range of sporting events. Traditional sports betting includes football, which features leagues and matches from around the world. Bettors can place wagers on major European leagues, international tournaments, and regional competitions.

Tennis betting includes ATP, WTA, and Grand Slam events. The platform offers markets on match winners, set betting, and game handicaps. Basketball coverage includes both NBA action and international leagues, with 3×3 basketball also available for betting.

Ice hockey fans can bet on NHL games and international competitions. Baseball betting focuses primarily on MLB, with markets on game winners, run lines, and totals. Volleyball and beach volleyball provide options for fans of court sports.

Rugby betting covers both rugby union and rugby league competitions. The platform includes markets on Six Nations, Rugby Championship, and club competitions. Other traditional sports include badminton, table tennis, handball, Australian football, and futsal.

Water polo, snooker, and darts provide options for fans of these sports. Combat sports coverage includes boxing and MMA, with betting available on major promotions. The platform also added Power Slap, reflecting its commitment to covering emerging combat sports.

Cricket betting serves fans in countries where the sport is popular. Chess betting offers a unique option for those interested in wagering on intellectual competitions. Bowls, cycling, Formula 1, lacrosse, and golf round out the traditional sports offerings.

eSports coverage includes all major competitive gaming titles. Counter-Strike betting covers tournaments from around the world. Dota 2 and League of Legends, two of the biggest eSports titles, have dedicated betting markets. The platform includes major tournaments like The International and the League of Legends World Championship.

Other Products

The loyalty program stands out as a unique product. Built around a dragon theme, it gamifies the player experience. New members choose an elemental egg when joining. This egg evolves as players wager, eventually hatching into a personalized Zuna Dragon.

The dragon mascot, named Zuno, serves as the casino’s brand ambassador. According to the casino’s lore, Zuno is a dragon who grew up in the ZunaBet vaults surrounded by casino games. The character adds personality to the platform and features in promotional materials.

Players can install dedicated apps for iOS, Android, Windows, and MacOS. These apps provide quick access to the casino without opening a web browser. The apps mirror the functionality of the website, giving players a seamless experience across devices.

The platform includes social elements through its community features. Players can interact through the VIP club, which becomes available at higher loyalty tiers. Random promotions add an element of surprise to the player experience.

A wheel spin feature gives players additional chances to win prizes. This becomes a double wheel spin at certain loyalty levels. These extra features create more engagement opportunities beyond standard casino games and sports betting.

Welcome Bonuses

ZunaBet offers a substantial welcome package for new players. The promotion is structured across three deposits, giving new members multiple opportunities to claim bonus funds and free spins. The total potential value reaches $5000 in bonus money plus 75 free spins.

- The first deposit triggers a 100% match bonus up to $2000. This means if a player deposits $2000, they receive an additional $2000 in bonus funds. The first deposit also includes 25 free spins that can be used on selected slot games.

- The second deposit comes with a 50% match bonus up to $1500. A player depositing $1500 would receive $750 in bonus funds. This deposit also awards 25 free spins, bringing the total to 50 free spins across the first two deposits.

- The third deposit provides a 100% match bonus up to $1500. Combined with another 25 free spins, this completes the welcome package. When fully claimed across all three deposits, players receive the maximum $5000 in bonuses plus 75 free spins total.

The casino markets this as a “250% Match bonus up to $5000 + 75 FS” for new players. This calculation adds together the percentages from all three deposit bonuses. The structure encourages players to make multiple deposits to unlock the full value.

Free spins awarded as part of the welcome package apply to specific slot games. The casino determines which games are eligible for free spin use. Players should check the promotion terms to see which slots are included.

How to Signup

Creating an account at ZunaBet follows a straightforward process:

- Visit the ZunaBet website at zunabet.com

- Click the registration or sign-up button, typically located in the top right corner of the homepage

- Enter your email address and create a secure password for your account

- Choose your preferred cryptocurrency for deposits and withdrawals

- Select your elemental egg, which starts your journey in the dragon loyalty program

- Agree to the casino’s terms and conditions and confirm you meet the minimum age requirements

- Complete any verification steps required, which may include email confirmation

- Make your first deposit using one of the supported cryptocurrencies

- Claim your welcome bonus if you want to participate in the promotion

- Start playing games or placing sports bets

The registration process takes only a few minutes. The casino uses email verification to confirm account ownership. Once your email is verified and your first deposit is made, you can access the full range of games and betting options.

Regular Promotions and Loyalty Program

The loyalty program at ZunaBet uses a tiered system with six levels. Each level offers increasing rewards and benefits. Players progress through levels based on their total wagering volume. The system tracks all bets placed on casino games and sports betting to calculate advancement.

- The first tier is Squire, which is the starting level for all new players. Squire members receive 1% rakeback on their bets. This level requires no minimum wagering and provides no free spins. However, it grants access to random promotions and the double wheel spin feature.

- Warden is the second tier, requiring $1,000 in total wagers. The rakeback increases to 2% at this level. Warden members receive 20 free spins as a tier reward. All the benefits from Squire continue, including random promotions and wheel spin access.

- Champion tier requires $5,000 in total wagering. Rakeback jumps to 4% for Champion members. The tier awards 50 free spins. Players maintain access to all previous benefits while enjoying the improved rakeback rate.

- Divine tier becomes available at $20,000 in total wagers. Members receive 5% rakeback and 150 free spins. The increased rakeback means players get more value returned on every bet they place, whether in the casino or on sports.

- Knight tier is for serious players with $200,000 in total wagering. The rakeback rate reaches 10%, providing substantial returns on play volume. Knight members receive 400 free spins. Access to VIP club benefits becomes more valuable at this level.

- Ultimate tier represents the highest achievement in the loyalty program. It requires $1,000,000 in total wagering. Ultimate members enjoy 20% rakeback, the maximum rate available. The tier awards 1,000 free spins. These players receive the best treatment available at the casino.

Rakeback is a valuable benefit that returns a percentage of all wagers to players. Unlike traditional bonuses, rakeback typically has fewer restrictions. Players receive rakeback regularly based on their betting activity, providing a steady stream of value.

The free spins awarded at each tier can be used on selected slot games. These spins provide opportunities to try new games or play favorites without risking additional funds. Free spins from tier advancement are separate from promotional free spins.

Random promotions add an element of surprise to the loyalty program. The casino runs special offers that vary based on seasons, events, or promotional calendars. These might include deposit bonuses, free spin packages, or tournament entries.

The double wheel spin feature gives players two chances instead of one when using the wheel feature. This doubles the potential for winning prizes from the wheel, which may include bonus funds, free spins, or other rewards.

VIP club access becomes more meaningful at higher tiers. VIP members may receive personalized customer service, faster withdrawal processing, and exclusive bonus offers. The casino tailors VIP benefits to reward its most loyal players.

The dragon evolution theme ties the loyalty program together. Your chosen egg evolves as you progress through tiers. The visual representation of your dragon growing provides a fun way to track loyalty progress. Each tier brings your dragon closer to its ultimate form.

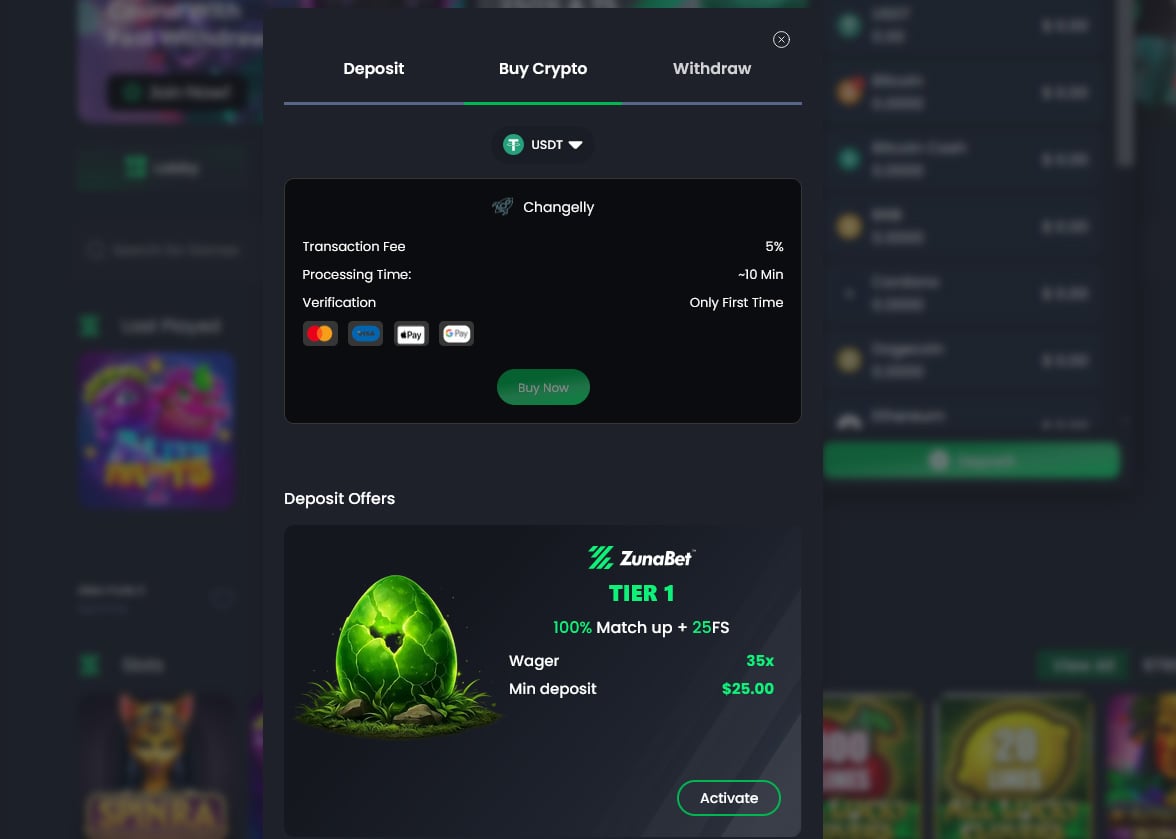

Payment Methods

ZunaBet operates as a cryptocurrency casino, accepting 20 different digital currencies for deposits and withdrawals. The platform’s crypto-first approach means all transactions use blockchain technology. This provides fast processing times and lower fees compared to traditional banking methods.

The supported cryptocurrencies include:

- Bitcoin (BTC) – The original cryptocurrency remains the most popular option

- Ethereum (ETH) – The second-largest cryptocurrency by market cap

- Binance Coin (BNB) using the BSC network

- Ripple (XRP) – Known for fast transaction speeds

- Tron (TRX) – Popular for low transaction fees

- Bitcoin Cash (BCH) – A Bitcoin fork with larger block sizes

- Litecoin (LTC) – Often called the silver to Bitcoin’s gold

- Dogecoin (DOGE) – Originally a meme coin, now widely accepted

- Cardano (ADA) using the Cardano network

- Solana (SOL) – Known for high-speed transactions

- Toncoin (TON) – The blockchain associated with Telegram

- Polygon (POL) – A scaling solution for Ethereum

The casino also accepts multiple stablecoins pegged to the US dollar. These include USDC on Ethereum, Polygon, and Solana networks. USDT (Tether) is available on Ethereum, Polygon, TON, Tron (TRC20), and Solana networks. Stablecoins provide price stability while maintaining the benefits of cryptocurrency transactions.

Players select their preferred cryptocurrency during account registration. Deposits require sending the chosen cryptocurrency to the wallet address provided by the casino. The platform generates unique deposit addresses for each player to ensure funds reach the correct account.

Cryptocurrency deposits typically process within minutes, depending on blockchain confirmation times. Bitcoin transactions may take longer during periods of network congestion. Faster blockchains like Solana and Tron often complete deposits in seconds.

Withdrawals follow a similar process. Players request a withdrawal to their personal cryptocurrency wallet. The casino processes the request and sends funds to the provided wallet address. Blockchain transactions provide transparency, allowing players to track their transfers.

The casino plans to introduce fiat currency payment options during 2026. This expansion will allow players to deposit using traditional currencies through methods like credit cards, bank transfers, or e-wallets. The addition of fiat options will make the casino accessible to a broader audience.

Is it Legit?

ZunaBet operates under a gambling license from the Government of the Autonomous Island of Anjouan, Union of Comoros. The license number is ALSI-202510047-FI2. This license authorizes the casino to offer games of chance and wagering to players in permitted jurisdictions.

The casino is owned and operated by Strathvale Group Ltd., a company registered in Belize. The registration number is 000050881, and the registered address is San Victor Street, Orange Walk Town, Belize. This information is publicly available and can be verified.

The Anjouan license allows the casino to operate legally within its regulatory framework. The Government of Anjouan regulates online gambling operators under its jurisdiction. Licensed casinos must meet certain standards to maintain their authorization.

The casino states it has passed all regulatory compliance requirements. This includes verification of gaming systems, fairness of games, and proper business practices. Licensed operators undergo review processes to ensure they meet licensing standards.

The team behind ZunaBet brings over 20 years of combined experience in online casino operations. This experience suggests the operators understand the industry and how to run a gambling platform. Experienced operators are more likely to maintain professional standards.

Design & Usability

ZunaBet features a modern design with a dark color scheme. The black background creates a sleek appearance that reduces eye strain during extended gaming sessions. Green accents throughout the interface tie into the casino’s brand colors and logo design.

The dark theme has become popular among online casinos and gaming platforms. It provides a contemporary look that appeals to modern players. The green highlights stand out against the dark background, making important buttons and features easy to locate.

The layout follows current web design principles with clear navigation menus. The homepage showcases featured games, popular slots, and current promotions. Players can quickly access different sections without searching through complicated menus.

The casino organizes games into categories for easy browsing. Players can filter by game type, provider, or popularity. A search function allows finding specific titles quickly. This organization helps players navigate the large game library of over 11,000 titles.

The sports betting section maintains the same design aesthetic. The sportsbook interface shows available events and markets clearly. Live betting features are accessible, with real-time odds updates displayed prominently.

Visual elements throughout the site reflect the dragon theme. The Zuno mascot appears in various places, adding personality to the platform. The dragon imagery creates a cohesive brand experience that makes ZunaBet memorable.

Members Area

The members area serves as the hub for account management. After logging in, players access their dashboard showing account balance, recent activity, and available bonuses. The dashboard provides an overview of account status at a glance.

Account settings allow players to update personal information and preferences. This includes email address, password changes, and communication preferences. Players can manage how they receive notifications from the casino.

The loyalty program status displays prominently in the members area. Players can see their current tier, progress toward the next level, and available rewards. The dragon evolution visual shows how close the dragon is to its next stage.

Transaction history is accessible through the members area. Players can review all deposits and withdrawals with dates, amounts, and transaction IDs. This transparency helps players track their gambling activity and verify transactions on blockchains.

Mobile Offering

ZunaBet provides full mobile access through multiple channels. The website uses responsive design that adapts to different screen sizes. Players can access the casino through mobile web browsers on smartphones and tablets without any loss of functionality.

The responsive design ensures games display properly on smaller screens. Touch controls work smoothly for navigation and gameplay. The mobile web version includes all features available on desktop, from casino games to sports betting.

Dedicated mobile apps are available for multiple operating systems. iOS users can install the app on iPhones and iPads. Android users have an app optimized for Android devices. The availability of native apps improves performance and convenience.

Windows and MacOS apps extend mobile access to laptops and desktop computers. These apps provide quick access without opening a web browser. Installing the app creates a shortcut that launches directly to the casino.

The apps mirror the website’s functionality completely. Players have access to the full game library, sportsbook, and account features. There’s no compromise in available features between web and app access.

Mobile gameplay performs well across games. Slots are optimized for touch controls with easy tap-to-spin functions. Table games work smoothly with touch-based betting interfaces. Live dealer games stream in good quality on mobile devices.

Customer Support

ZunaBet provides customer support through email at support@zunabet.com and also the live chat area of the website. Players can contact the support team with questions, issues, or feedback. Email support allows for detailed explanations of problems and provides a written record of communications.

The support team assists with account issues including login problems, password resets, and verification questions. They can help troubleshoot technical issues if players experience problems with games or the website.

Deposit and withdrawal inquiries are handled through customer support. If transactions are delayed or players have questions about cryptocurrency transfers, the support team can investigate. They can provide updates on pending withdrawals or verify deposit confirmations.

Bonus-related questions are common support inquiries. The team can explain wagering requirements, bonus terms, and eligibility for promotions. They can verify bonus crediting and help resolve issues if bonuses don’t appear correctly.

Game-specific issues can be reported to customer support. If a game malfunctions or a round doesn’t complete properly, the team can investigate. They can review game logs to determine what happened during a disputed session.

Conclusion

ZunaBet enters the online casino market with a strong offering. The platform combines over 11,000 games from 63 providers with comprehensive sports betting coverage. The cryptocurrency focus provides fast transactions and lower fees for players comfortable with digital currencies.

The welcome bonus package offers good value with up to $5000 in bonuses plus 75 free spins across three deposits. The structure encourages new players to make multiple deposits to unlock the full value. This compares favorably with welcome offers at other crypto casinos.

The dragon-themed loyalty program adds a unique element to the player experience. The six-tier system with increasing rakeback rates rewards regular players. The gamification aspect makes progress feel more engaging than standard VIP programs.

The game selection is impressive in both quantity and variety. Having 63 providers ensures diverse gaming options from established names and innovative newcomers. Players will find popular titles alongside games they might not encounter at other casinos.

Sports betting coverage is thorough across traditional sports and eSports. The inclusion of lesser-known sports and extensive eSports options broadens the appeal. Live betting functionality allows action on events as they happen.

The modern design with dark theme and green accents creates a contemporary feel. The platform performs well with responsive design across devices. Mobile apps for multiple operating systems provide convenient access for players on the go.

For players seeking a crypto casino with extensive games, solid sports betting, and rewarding loyalty benefits, ZunaBet delivers. The platform provides entertainment value with enough variety to keep regular players engaged. The combination of features positions it well in the competitive crypto casino space.

FAQs

What cryptocurrencies does ZunaBet accept?

ZunaBet accepts over 20 cryptocurrencies including Bitcoin, Ethereum, Litecoin, Dogecoin, Solana, Cardano, and multiple stablecoins like USDT and USDC on various networks. The platform also accepts BNB, XRP, TRX, BCH, ADA, TON, and POL.

How does the loyalty program work?

The loyalty program has six tiers from Squire to Ultimate. Players progress through tiers based on total wagering volume. Each tier offers increased rakeback percentages from 1% to 20%, free spins, and access to random promotions and VIP benefits. Your dragon evolves as you advance through tiers.

What is the welcome bonus at ZunaBet?

New players receive a welcome package worth up to $5000 plus 75 free spins across three deposits. The first deposit gets 100% up to $2000 plus 25 free spins, the second deposit gets 50% up to $1500 plus 25 free spins, and the third deposit gets 100% up to $1500 plus 25 free spins.

Can I play on my mobile device?

Yes, ZunaBet is fully mobile-compatible with responsive web design that works on any mobile browser. The casino also offers downloadable apps for iOS, Android, Windows, and MacOS devices for convenient access.

How many games are available at ZunaBet?

ZunaBet offers over 11,294 games from 63 different software providers. The library includes slots, table games, live dealer games, and various specialty games. Major providers include Pragmatic Play, Hacksaw Gaming, Evolution Gaming, and many others.

Zunabet

Pros

- Massive game library with over 11,000 titles from 63 providers

- Generous welcome bonus package

- Unique dragon-themed loyalty program

- Extensive cryptocurrency support

- Comprehensive sports betting

Cons

- Currently crypto-only payments

- New casino without established track

Crypto World

Crypto industry experts at Consensus see Asian institutions pivot toward stablecoins

Hong Kong — Institutional crypto participation across Asia is moving into a more mature phase as regulators establish clear frameworks for stablecoins and exchange-traded funds. Large players now favor market-neutral strategies and regulated vehicles over direct, directional exposure to digital assets.

Vicky Wang, president of Amber Premium, highlighted this shift during a panel discussion at Consensus Hong Kong. She noted that while transaction volumes reached $2.3 trillion by mid-2025, capital allocation remains cautious. “The institutional participation in Asia, I would say it’s real, but at the same time it’s very cautious,” Wang said. She observed that institutions prefer “market neutral and yield strategy” over aggressive directional bets.

Fakhul Miah, managing director of GoMining Institutional, pointed to the recent approval of ETFs and perpetuals in Hong Kong as a major driver for liquidity. He noted that even traditional “mega banks” in Japan are now working on stablecoin solutions. These developments allow traditional capital to enter the space through familiar structures. Miah explained that institutions must pass through “risk committees and operational governance structures,” which historically did not exist for onchain products.

The focus for many Asian institutions has shifted toward real-world asset tokenization and stablecoin settlement. Wendy Sun, chief brand officer at Matrixport, noted that while these topics are popular, there remains a gap in internal treasury adoption. “For the internal treasury-based stablecoin, we are still waiting for the standard to come out,” Sun said. She argued that the behavior of these institutions is becoming more “rule-based and scheduled” rather than pursuing short-term gains.

Wang concluded that the industry’s future rests on the convergence of artificial intelligence and digital assets. “In the future, digital assets would not be a just alternative asset class or an alternative financial system,” Wang said. “It will be the financial layer of the AI.”

Crypto World

Russia Weighs Support for Cuba Amid Fuel Crisis and U.S. Tariff Threats

TLDR

- Russia is exploring ways to aid Cuba, which is facing a severe fuel shortage.

- Russia emphasizes “constructive dialogue” with the U.S. over the situation in Cuba.

- The U.S. threatens sanctions on countries supplying oil to Cuba, escalating tensions.

- U.S. tariff revenue has surged by over 300%, reaching $124 billion for the year.

- The U.S. Supreme Court’s upcoming ruling on tariffs could impact the country’s fiscal health.

On Thursday, the Kremlin expressed its willingness to provide assistance to Cuba, which is grappling with a severe fuel shortage. In response to the growing crisis, Kremlin spokesperson Dmitry Peskov dismissed U.S. President Donald Trump’s tariff threats, stating that Moscow had limited trade with Cuba. Tensions continue to rise, as the U.S. threatens sanctions on any country supplying oil to the Caribbean island.

Kremlin Addresses Oil Supply for Cuba

The Kremlin confirmed that it was exploring options to aid Cuba with its escalating energy crisis. According to a local media report, Peskov acknowledged the strained relationship but assured that the Kremlin would not seek to escalate tensions.

Peskov emphasized the need for constructive dialogue between Russia and the U.S. regarding the situation. Cuba, already struggling under a 60-year U.S. trade embargo, is facing a deepening economic crisis exacerbated by a fuel shortage. Moscow’s support could play a pivotal role in alleviating some of Cuba’s immediate challenges.

Despite this, Russia has refrained from making any public commitments, citing the sensitivity of the matter. Peskov further added that such issues must be discussed discreetly due to their delicate nature. As Cuba’s energy crisis worsens, international airlines, including Air Canada, have already canceled flights to the island, underscoring the extent of the fuel shortage.

U.S. Tariff Revenue Surges Amid Ongoing Disputes

Meanwhile, U.S. tariff revenue has surged by over 300% in recent months, bringing in $30 billion in January alone. This sharp increase follows President Trump’s decision to impose tariffs on a wide range of goods. The tariff revenue for the year has already reached $124 billion, reflecting the aggressive trade policies pursued by the White House.

However, this rise in revenue comes as the U.S. waits for a crucial Supreme Court ruling on the legality of these tariffs. The Supreme Court has yet to issue its decision on the justification for the tariffs, with oral arguments held last November.

A ruling is expected soon, and a negative verdict could have implications for the U.S. economy. If the court finds the tariffs unjustified, the U.S. could be required to reimburse the duties collected, which would affect the country’s fiscal health.

As the U.S. faces this legal uncertainty, the tariff policy remains a key factor in shaping the nation’s economic outlook. Although tariff revenue has helped reduce the budget deficit by 26% compared to last year, the U.S. continues to struggle with its national debt. In January alone, interest payments on the debt totaled $76 billion, highlighting the ongoing financial strain.

Crypto World

US Credit Union Regulator Proposes Stablecoin Licensing Path

The United States National Credit Union Administration (NCUA) has laid out its first proposed rules under the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, detailing how subsidiaries of federally insured credit unions could apply to become federally supervised payment stablecoin issuers. This marks a tangible step toward setting a licensing and oversight framework for a niche of digital assets that regulators view as both a payments solution and a potential systemic risk. The proposal aligns with the NCUA’s broader mandate to supervise credit unions that collectively serve roughly 144 million members and manage about $2.38 trillion in assets as of mid-2025. If the rulemaking proceeds, issuers would need an NCUA-permitted payment stablecoin issuer (PPSI) license before issuing coins, and federally insured credit unions would face investment and lending restrictions related to PPSIs. The agency has also signaled that a forthcoming rule will implement GENIUS Act standards for PPSIs, addressing reserves, capital, liquidity, illicit finance controls, and information technology risk management.

The agency’s stance reflects a cautious yet orderly approach to stabilizing the regulatory ground for stablecoins issued through bank-like affiliates. The NPRM focuses on licensing architecture and investment limits, laying the groundwork for a regulated path to potential stablecoin services for credit union members. The policy landscape around stablecoins in the U.S. has evolved alongside ongoing discussions about the GENIUS Act’s broader technical standards, including soundness provisions and risk controls that would govern PPSIs. Notably, the draft emphasizes that any licensing framework would be built around separate supervised subsidiaries rather than direct issuance by insured depository institutions themselves. This structural choice mirrors a recurring policy design across U.S. banking and payments regulation, seeking to isolate stablecoin activities within regulated, auditable entities while preserving the safety and soundness of the parent institutions.

The draft is notable for its clock and openness provisions. A key feature is a 120‑day deadline to approve or deny an application once it has been deemed substantially complete. If the agency does not act within that period, the application would be deemed approved by default. The rule also ensures a level playing field by stating that an issuer’s choice to operate on an open, public, or decentralized network cannot be used as the sole reason to deny a PPSI application. In addition, the NPRM reiterates a core GENIUS Act design principle: insured depository institutions, including credit unions, would not issue payment stablecoins directly; rather, they would channel activities through separately supervised subsidiaries that meet uniform federal standards.

Stakeholders now have a 60‑day window from the Federal Register publication to comment on the proposed rule before the NCUA moves to finalize or revise the licensing framework. The proposal, in its current form, serves as a narrow but important first step in shaping licensing, oversight, and investment parameters for PPSIs. A second wave of rulemaking is anticipated to implement the GENIUS Act’s broader standards for PPSIs, including risk management and anti‑money‑laundering controls.

Public chain neutral and 120‑day clock

Two features stand out for the broader crypto market. First, the NCUA would be barred from denying a substantially complete application solely because a stablecoin is issued “on an open, public, or decentralized network,” language that explicitly prevents public blockchain issuance from being rejected on that basis alone. Second, once an application is deemed “substantially complete,” the agency would have 120 days to approve or deny it, and if the NCUA fails to act within that window, the application would be “deemed approved” by default.

The draft also implements a central GENIUS Act design choice: insured depository institutions, including credit unions, cannot issue payment stablecoins directly and must instead use separately supervised subsidiaries that meet uniform federal standards. For credit unions, that generally means routing activity through credit union service organizations and other qualifying entities that fall under NCUA’s jurisdiction as “subsidiaries of an insured credit union.” The document, however, is only a notice of proposed rulemaking. Stakeholders have 60 days from Federal Register publication to comment before the NCUA can finalize or revise the licensing regime.

The NPRM signals a cautious but deliberate approach to how traditional financial institutions might intersect with digital assets through regulated vehicles. While the GENIUS Act has been a focal point of debate among policymakers, this initial draft concentrates on licensing mechanics and investment boundaries, deliberately deferring the detailed standards to a forthcoming proposal. The NCUA’s posture suggests an intent to create a controlled pathway for any PPSI that seeks to serve members, rather than open the door to a broad, unregulated stablecoin issuance environment.

As the public comment period opens, market participants and industry observers will be watching for how the agency delineates eligibility criteria for PPSIs, how it defines “substantial completeness,” and how the licensing process interacts with other federal regulators. The regulatory cadence around stablecoins remains a dynamic frontier in U.S. financial policy, particularly as other jurisdictions pursue their own approaches to stablecoin governance and payments infrastructure.

For now, the rulemaking is narrowly scoped to licensing and investment limits. A forthcoming proposal will implement GENIUS Act standards and restrictions for PPSIs, including reserves, capital, liquidity, illicit finance safeguards, and IT risk management. The NCUA indicated in the notice that the GENIUS Act’s standards would provide a cohesive framework for the prudential oversight of PPSIs operating via insured credit unions’ subsidiaries.

What to watch next

- 60‑day comment period following Federal Register publication to shape the final rule.

- Release of the final PPSI licensing framework, including application procedures and eligibility criteria.

- Publication of the GENIUS Act–driven standards for PPSIs, covering reserves, capital, liquidity, and IT risk management.

- Any regulatory guidance on investments by credit unions in PPSIs and related vehicle structures through subsidiaries.

- Potential pilot programs or demonstrations of PPSI services within insured credit unions, subject to approvals.

Sources & verification

- NCUA press release: NC UA proposes rule permitting payment stablecoin issuer applications — https://ncua.gov/newsroom/press-release/2026/ncua-proposes-rule-permitted-payment-stablecoin-issuer-applications

- NCUA press release: NC UA releases second quarter 2025 credit union system performance data — https://ncua.gov/newsroom/press-release/2025/ncua-releases-second-quarter-2025-credit-union-system-performance-data

- GENIUS Act overview and implications — https://cointelegraph.com/learn/articles/genius-act-how-it-could-reshape-us-stablecoin-regulation

- Magazine coverage: Bitcoin stablecoins showdown looms as GENIUS Act nears — https://cointelegraph.com/magazine/bitcoin-stablecoins-showdown-looms-genius-act-nears/

Crypto World

Another 80% Crash Comes Next?

Are SHIB bulls about to face another massive setback?

Shiba Inu (SHIB) has lately been a pale shadow of its former self, with its valuation tumbling by double digits in a matter of weeks.

According to some analysts, the bad days for the bulls might be just starting.

Devastating Crash Ahead?

As of press time, SHIB trades at around $0.000006127, representing a 20% decline on a 14-day scale. Its market cap slipped to around $3.6 billion, making it the 30th-biggest cryptocurrency. Recall that it ranked much higher in the spring of last year when the capitalization neared $10 billion.

One popular analyst who touched upon the meme coin’s downfall is Ali Martinez. He claimed that the recent drop below $0.00000667 could have opened the door to a much deeper collapse to as low as $0.00000138. Such a move south would represent a whopping 77% crash from current levels.

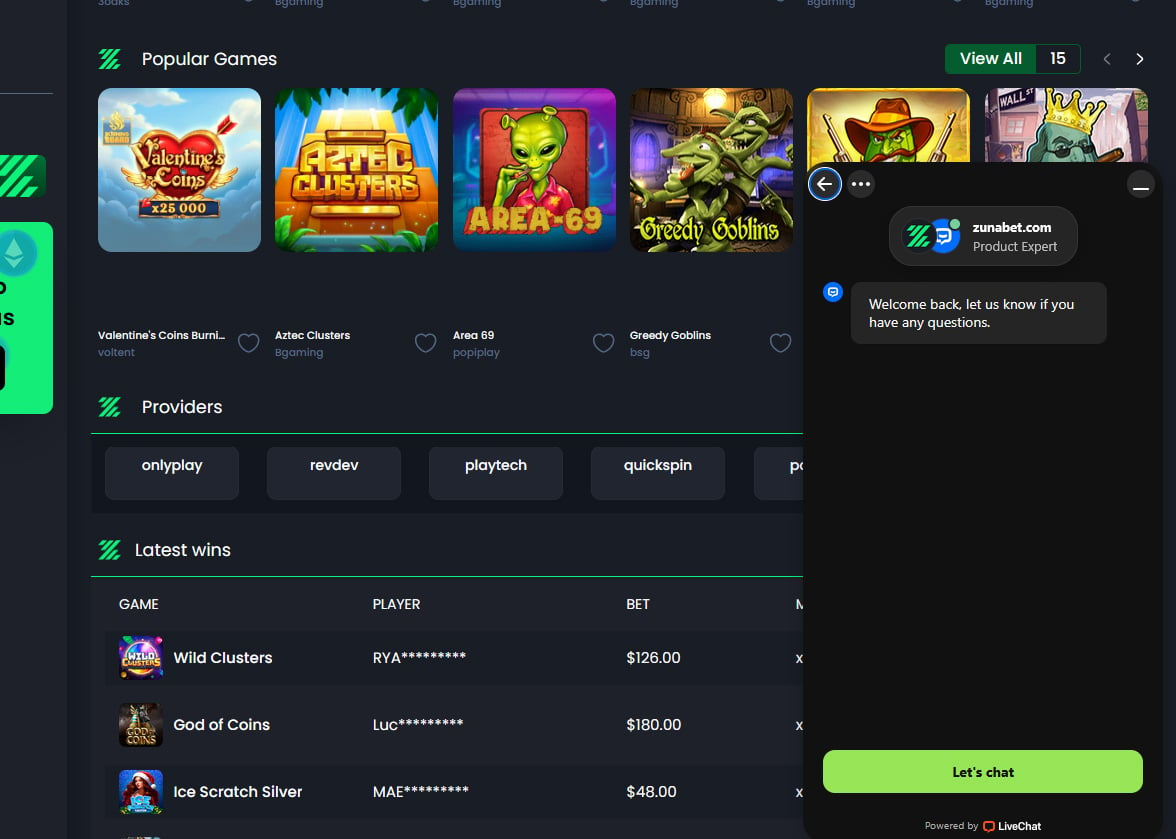

Several key indicators also suggest that SHIB’s price could be headed for a further plunge. Over the past 24 hours, the Shiba Inu team and community have burned a negligible 483 coins, representing a 99% decline from yesterday’s figure.

The ultimate goal of the mechanism, adopted in 2022, is to reduce the meme coin’s overall supply, potentially making it more valuable in time (assuming demand remains constant or heads north). Data shows that the current circulating supply is roughly 585.46 trillion tokens after more than 410.7 trillion SHIB have been scorched over the years.

Meanwhile, Shibburn – the X account spreading information about the recent token burns – has been inactive lately. The last update on the matter, from January 9, showed that the daily and weekly burn rates have been unimpressive.

You may also like:

Shiba Inu’s Relative Strength Index (RSI) supports the bearish scenario. Over the past few hours, the metric’s ratio exceeded 70, indicating the asset is overbought and could be gearing up for a pullback. The technical analysis tool ranges from 0 to 100, where readings between 30 and 70 are considered neutral, whereas anything below 30 may be viewed as a buying opportunity.

Can the Bulls Return?

Contrary to Martinez’s grim prediction, the analyst who goes by the X moniker Vuori Trading argued that SHIB may explode in the foreseeable future.

They claimed that the asset remains in the “bear trap” stage, characterizing the setup as “pure manipulation before shooting higher.” The analyst set a target of “at least” $0.00014, which would be an all-time high and represent a staggering 2,200% increase from the ongoing valuation.

Despite the recent price plunge, SHIB investors don’t appear to be rushing to sell. In fact, CryptoQuant’s data shows that the number of coins stored on exchanges has declined over the past month. This trend signals a shift toward self-custody and reduces immediate selling pressure.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Hong Kong Crypto Sentiment Stays Bullish as $2 Trillion Market Crash Tests Asia

The rest of the world is panic-selling into a $2 trillion wipeout, but Hong Kong isn’t blinking.

While Bitcoin hovers precariously around $67,000, down nearly 50% from its October highs, institutional players in Asia’s financial capital are doubling down on infrastructure rather than fleeing the liquidity crisis.

It sounds counterintuitive, given the carnage, seeing altcoins decimated and liquidity described as “perilously patchy” by Bloomberg, but the smart money in Hong Kong is playing a different game entirely.

Key Takeaways

- Bitcoin trades near $67,000, down 47% from peaks, while wider crypto markets suffer a $2 trillion rout.

- Hong Kong officials reaffirmed support at Consensus 2026, citing $3.71 billion in tokenized deposits.

- Institutional focus in HK contrasts sharply with South Korean retail traders currently fleeing the market.

Is Asia, Especially Hong Kong, Decoupling from the Crash?

To understand the disconnect between price action and sentiment, look at who is actually buying.

While retail traders globally are capitulating, Hong Kong is leveraging a regulatory framework years in the making.

The city has spent the last three years positioning itself as a hub for regulated digital assets, and that investment is creating a buffer against current volatility.

While U.S. markets flounder under uncertainty, we are seeing similar patterns of institutional positioning from major players on Wall Street who remain invested despite the drawdown. In Hong Kong, this resolve is policy-backed.

Hong Kong Chief Executive John KC Lee, yesterday, reaffirmed the city’s commitment to a “sustainable digital asset ecosystem” during Consensus Hong Kong 2026.

This isn’t just talk: the city’s Securities and Futures Commission (SFC) is pushing ahead with licensing regimes that institutionalize the sector, regardless of the spot price of Bitcoin.

The $3.71 Billion Safety Net

The numbers coming out of the region paint a starkly different picture than the red candles on your charts.

While retail sentiment is crushed, Financial Secretary Paul Chan Mo-po revealed that Hong Kong banks are on track to offer tokenized deposit services worth US$3.71 billion by the end of 2025.

Compare this to the situation in South Korea. There, retail traders are bailing on crypto’s riskiest trades as alts collapse.

This mirrors the accumulation behavior we are tracking elsewhere, where large entities are controlling supply during price crashes to strengthen positions.

Even amid this crash, analysts are identifying the best crypto to buy, betting that Hong Kong’s regulatory clarity will draw serious volume once the dust settles.

Discover: The best crypto to diversify your portfolio

What the Hong Kong Situation Means for Global Regulation

Hong Kong is effectively calling the bottom by refusing to halt progress. The SFC is advancing legislative proposals for custodian licensing in early 2026, focusing on safeguarding private keys. This is the kind of clarity institutions need to deploy capital.

It’s a sharp contrast to the West, where stablecoin talks have stalled amid banking yield restrictions. Hong Kong’s approach of integrating tokenized assets directly into banking could force other jurisdictions to speed up or risk losing the center of gravity for crypto finance to Asia.

Solana Foundation President Lily Liu summed it up best at Consensus, noting that “Asia underpinned Bitcoin in any aspect.”

If Hong Kong holds firm while the $2 trillion crash plays out, it may emerge as the de facto capital for the recovery.

Discover: What is the next crypto to explode?

The post Hong Kong Crypto Sentiment Stays Bullish as $2 Trillion Market Crash Tests Asia appeared first on Cryptonews.

Crypto World

Is the Bottom In for ETH? $1.8K Support Holds Key to Recovery

Following the aggressive sell-off toward the $1.8K demand region, Ethereum stabilised and produced a corrective rebound. However, this recovery lacks strong momentum and is unfolding within a broader bearish structure. The current price behaviour indicates a potential consolidation between a well-defined demand zone below and an overhead supply area that continues to cap upside attempts.

Ethereum Price Analysis: The Daily Chart

On the daily timeframe, ETH remains within a descending channel, with the price trading below both the 100-day and 200-day moving averages, which are now sloping downward and serving as dynamic resistance. The recent breakdown below the prior major swing low around $2.4K accelerated the sell-off, confirming bearish continuation and triggering a move toward the $1.8K demand zone.

The rebound from this crucial zone shows that buyers are defending this key historical support, which previously acted as an accumulation area. However, the price is currently trading at approximately $2K and remains below the internal resistance near $2.2K.

As long as Ethereum remains between $1.8K and $2.2K, the market is likely to consolidate within this range. A daily close below $1.8K would expose the next lower liquidity pocket toward $1.6K, while a reclaim of $2.2K could open the path toward the $2.6K supply region.

ETH/USDT 4-Hour Chart

Zooming into the 4-hour timeframe, the price action reveals a compression structure following the sharp decline. Ethereum formed a local bottom near $1.8K and then produced a higher low, creating a short-term ascending trendline against the broader downtrend. At the same time, a descending resistance line from the recent swing high continues to cap price, forming a tightening range.

The immediate supply lies around $2.2K, where the previous breakdown occurred, while the nearest demand remains at $1.8K. With price hovering near $1,960, Ethereum appears to be consolidating between these two zones. A breakout above $2.2K on the 4-hour chart would signal short-term bullish continuation toward $2.4K, whereas a breakdown below $1.8K would likely invalidate the consolidation scenario and resume the dominant bearish trend.

Overall, the structure remains bearish on higher timeframes, but in the short term, Ethereum is compressing between $1.8K demand and $2.8K supply, and the next impulsive move will likely emerge from a decisive break of this range.

Sentiment Analysis

The ETH liquidation heatmap over the last 6 months provides critical confirmation of the bearish technical structure. A significant concentration of liquidity has been built around and just below the $2K level, which has recently acted as a strong magnet for price. The sharp sell-off into this area confirms that downside liquidity was actively targeted, resulting in a large flush of leveraged long positions.

Despite this liquidation event, the heatmap still reveals residual liquidity pockets extending slightly below current price levels, indicating that the market may not have fully exhausted its downside objectives yet. These remaining clusters continue to exert gravitational pull on price, especially if spot demand remains weak and derivatives positioning rebuilds on the long side too quickly.

That said, the intensity of liquidations around the $2K zone suggests that a meaningful portion of forced selling has already occurred. This reduces immediate liquidation pressure and explains the short-term stabilization seen after the drop. However, from an on-chain perspective, this behavior supports consolidation or corrective rebounds, not a confirmed trend reversal, unless liquidity interest decisively shifts back above current levels.

In summary, on-chain data aligns closely with the technical picture: Ethereum is still operating in a bearish liquidity-driven environment, with downside risks remaining active as long as price fails to reclaim key supply zones and attract sustained spot demand.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Bitcoin layer-2 builders pitch BTCFi as the next institutional unlock

Leaders from Citrea, Rootstock Labs and BlockSpaceForce argued that bitcoin’s scaling layers are less about throughput and more about turning the asset into a programmable financial base layer.

Crypto World

YZi Labs is backing AI, biotech and Web3

In a market where crypto cycles rise and fall while AI feels inevitable and biotech plays out over decades, YZi Labs is deliberately positioning itself across multiple technological frontiers.

The unifying thesis is “to focus on the things haven’t happened yet, and to focus on the people who are there to dream them up and to make it happen,” head of YZi Labs Ella Zhang said at Consensus Hong Kong 2026 on Thursday.

YZi, formerly Binance Labs, invests across AI, biotech and Web3, balancing time horizons, particularly as crypto “feels very cyclical at the moment,” while AI adoption accelerates, Zhang said.

“Focus on user demand. Is there real demand happen or the demand is imagined?” she said. Instead of chasing narratives, the firm pressures founders on product fundamentals: what pain point is being solved, how distribution works, and whether there are early signals that the problem truly matters.

That philosophy also shapes capital deployment. “We’re not obligated to deploy all the capital we have,” Zhang said, emphasizing that checks follow conviction, not the other way around. YZi aims to be an early backer but continues supporting companies across multiple rounds, offering mentorship and strategic resources alongside funding.

On infrastructure, Zhang pointed to BNB Chain’s scale as a natural distribution layer, with “thousands of protocols” and “hundreds of millions of users” forming a ready ecosystem for new applications. At the same time, YZi is “very, very open for the founders to fail and welcome them to come back,” she said, framing failure as part of long-term founder development.

As for product trends, Zhang called stablecoins the first true mass-market application beyond trading. “Stablecoins are currently a very good application for crypto to go to mass adoption,” she said, citing improving compliance frameworks globally. Still, she sees further work ahead in custody, exchange infrastructure and on-chain FX before stablecoins fully mature.

Crypto World

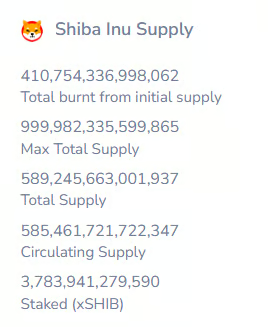

15% growth in malicious email attacks in 2025

Editor’s note: In crypto and fintech security, email remains a critical attack vector. The 2025 Kaspersky findings show a sharp rise in malicious and potentially unwanted emails, with spam accounting for nearly half of global traffic and millions of dangerous attachments hitting users. For crypto firms and investors, these trends mean more phishing, more BEC attempts, and combined-channel scams that blend email with messaging apps and even legitimate-looking services. This editorial summarizes the implications and directs attention to the press release’s key points, which detail where threats are coming from, how attackers adapt, and practical defenses for the year ahead.

Key points

- 44.99% of global email traffic was spam in 2025.

- Over 144 million malicious and potentially unwanted email attachments.

- APAC led detections at 30%, Europe 21%, with China 14% among top countries.

- Detections peaked in June, July and November.

- Trends include cross-channel scams, evasion techniques, platform abuse, and refined BEC tactics.

Why this matters

Kaspersky’s 2025 telemetry shows 44.99% of global email traffic was spam, with 144 million malicious attachments and APAC leading detections, underscoring rising phishing risks.

Attackers increasingly blend email with other channels, employ advanced disguises, and imitate legitimate services, creating risk for crypto platforms and users alike. Staying ahead requires awareness, user training, and layered security measures.

What to watch next

- Monitor cross-channel phishing and fraudulent outreach patterns.

- Watch for increased use of legitimate platforms to send spam and scams.

- Be vigilant for refined BEC tactics and fake email threads.

- Strengthen phishing awareness and security controls across organizations.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Kaspersky reports 15% growth in malicious email attacks in 2025

12 February 2026

According to Kaspersky telemetry, almost every second email – 44.99% of global traffic – was spam in 2025. Spam consists not only of unsolicited emails, but can also include various email threats such as scam, phishing and malware. In 2025, individuals and corporate users encountered over 144 million malicious and potentially unwanted email attachments, representing a 15% increase compared to the previous year figures.

In 2025, APAC had the largest share of email antivirus detections: it reached 30%, followed by Europe with 21%. Next came Latin America (16%) and the Middle East (15%), Russia and CIS (12%) and Africa (6%). As for individual countries, China had the highest rate of malicious and potentially unwanted email attachments, with the share of email antivirus detections of 14%. Russia ranked second (11%), followed by Mexico (8%), Spain (8%) and Turkey (5%).

Email antivirus detections peaked moderately in June, July and November.

Key trends in email spam and phishing

Kaspersky’s annual analysis has also identified several persistent trends in the email spam and phishing threat landscape that are expected to continue into 2026:

- Combination of various communication channels. Attackers lure email users into switching to messengers or calling fraudulent phone numbers. For instance, scam investment mailings may redirect victims to fake websites, where they are asked to provide their contact information, and then cybercriminals will follow up with a phone call.

- Usage of diverse evasion techniques in phishing and malicious emails. Threat actors frequently try to disguise phishing URLs, for example, with the help of link protection services and QR codes. These QR codes are often embedded directly in email bodies or within PDF attachments, which not only conceals phishing links but also encourages users to scan them on mobile devices, potentially exploiting weaker security measures than corporate PCs.

- Mailings exploiting diverse legitimate platforms. For example, Kaspersky experts discovered a fraudulent tactic that abuses OpenAI’s organization creation and team invitation features to send spam emails from legitimate OpenAI addresses, potentially tricking users into clicking scam links or dialing fraudulent phone numbers. Additionally, a calendar-based phishing scheme, which originated in the late 2010s, resurfaced last year with a focus on corporate users.

- Refining tactics in business email compromise (BEC) attacks. In 2025 attackers attempted to become even more persuasive by incorporating fake forwarded emails into their correspondence. These emails lacked thread-index headers or other headers, making it difficult to verify their legitimacy within an email conversation.

Email phishing shouldn’t be underestimated. Our report reveals that one in ten business attacks starts with phishing, with a significant proportion being Advanced Persistent Threats (APTs). In 2025, we saw an increase in the sophistication of targeted email attacks. Even the smallest details are meticulously crafted in these malicious campaigns, including the composition of sender addresses and the tailoring of content to real corporate events and processes. The commodification of generative AI has significantly amplified this threat, enabling attackers to craft convincing, personalized phishing messages at scale with minimal effort, automatically adapting tone, language and context to specific targets,

To learn more about spam and phishing threat landscape, visit securelist.com.

To stay safe, Kaspersky recommends:

- Treat unsolicited invitations from any platform with suspicion, even if they appear to come from trusted sources.

- Carefully inspect URLs before clicking.

- Do not call any phone numbers indicated in suspicious emails – if you need to call support of a certain service, it is best to find the phone number on the official webpage of this service.

- For corporate users, Kaspersky Security for Mail Server with its multi-layered defense mechanisms powered by machine learning algorithms provides robust protection against a wide range of evolving threats and offers peace of mind to businesses in the face of evolving cyber risks.

- Ensure all employee devices, including smartphones, are equipped with robust security software.

- Conduct regular training on modern phishing tactics.

About Kaspersky

Kaspersky is a global cybersecurity and digital privacy company founded in 1997. With over a billion devices protected to date from emerging cyberthreats and targeted attacks, Kaspersky’s deep threat intelligence and security expertise is constantly transforming into innovative solutions and services to protect individuals, businesses, critical infrastructure, and governments around the globe. The company’s comprehensive security portfolio includes leading digital life protection for personal devices, specialized security products and services for companies, as well as Cyber Immune solutions to fight sophisticated and evolving digital threats. We help millions of individuals and nearly 200,000 corporate clients protect what matters most to them. Learn more at www.kaspersky.com.

Crypto World

Cathie Wood Loads Up on Robinhood (HOOD) Stock During 9% Crash

TLDR

- Cathie Wood’s ARK Invest bought $33.8 million in Robinhood shares after the stock dropped 9% on Q4 earnings miss

- Robinhood now represents ARK’s largest crypto holding at $248 million, a 4.1% portfolio weighting

- CEO Vlad Tenev predicts prediction markets will enter a “supercycle” with trillions in annual volume potential

- The company launched Robinhood Chain testnet, a Layer 2 blockchain for tokenized assets

- Bitcoin ETFs saw $276 million in outflows Wednesday as crypto trading volumes declined

Cathie Wood made a bold move Wednesday, buying the dip on Robinhood shares while most investors headed for the exits. ARK Invest purchased $33.8 million worth of stock as shares plunged nearly 9% following a disappointing Q4 earnings report.

The buying spree wasn’t limited to Robinhood. ARK also added $16 million in other crypto-related stocks including Bullish and Circle as the broader digital asset market sold off.

Robinhood missed revenue estimates in Q4 as cryptocurrency trading volumes collapsed during Bitcoin’s recent weakness. The digital currency briefly dropped below $66,000, triggering a wave of selling across crypto-linked equities.

But Wood saw opportunity where others saw risk. The purchases pushed Robinhood to become ARK’s largest crypto-related position, with total holdings now worth approximately $248 million.

Blockchain Infrastructure Play

The timing coincided with Robinhood’s testnet launch of Robinhood Chain. This Layer 2 blockchain targets tokenized real-world assets and institutional financial services.

ARK appears to be betting on Robinhood’s transformation from a retail trading platform into a blockchain infrastructure provider. The quarterly earnings miss seems less important than the long-term strategic positioning.

Bitcoin ETFs recorded $276.3 million in net outflows Wednesday, nearly erasing weekly gains. Total assets under management dropped to $85.7 billion, the lowest level since late 2024.

While Bitcoin has stabilized around $67,200, institutional appetite remains muted. Many large investors are waiting for clearer market direction before deploying capital.

Prediction Markets Opportunity

CEO Vlad Tenev offered a different perspective during the earnings call. He described prediction markets as entering a “supercycle” that could eventually generate trillions in annual trading volume.

The data supports his optimism. Prediction markets volume more than doubled in Q4, reaching $12 billion in total contracts for 2025. The company has already processed $4 billion in 2026.

Robinhood is building its own prediction market platform through a joint venture with Susquehanna International Group. The move would give the company greater control over product offerings and potentially stronger margins.

Launch is expected later this year. The platform will compete with Kalshi and Polymarket in a rapidly expanding market.

Tenev told CNBC he remains bullish on crypto despite recent volatility. The company plans to continue expanding both digital asset offerings and prediction markets.

More details are expected at Robinhood’s “Take Flight” event on March 4. Tenev is scheduled to unveil new products and strategic initiatives.

Wall Street maintains a Strong Buy rating on the stock. Analysts have issued 14 Buy ratings, three Holds, and zero Sells over the past three months. The average price target of $135.79 suggests 56.9% upside potential.

Shares have declined nearly one-third year-to-date following Wednesday’s selloff.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports5 days ago

Sports5 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports14 hours ago

Sports14 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech1 day ago

Tech1 day agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports3 days ago

Sports3 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World15 hours ago

Crypto World15 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video10 hours ago

Video10 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month