Crypto World

Russia Weighs Support for Cuba Amid Fuel Crisis and U.S. Tariff Threats

TLDR

- Russia is exploring ways to aid Cuba, which is facing a severe fuel shortage.

- Russia emphasizes “constructive dialogue” with the U.S. over the situation in Cuba.

- The U.S. threatens sanctions on countries supplying oil to Cuba, escalating tensions.

- U.S. tariff revenue has surged by over 300%, reaching $124 billion for the year.

- The U.S. Supreme Court’s upcoming ruling on tariffs could impact the country’s fiscal health.

On Thursday, the Kremlin expressed its willingness to provide assistance to Cuba, which is grappling with a severe fuel shortage. In response to the growing crisis, Kremlin spokesperson Dmitry Peskov dismissed U.S. President Donald Trump’s tariff threats, stating that Moscow had limited trade with Cuba. Tensions continue to rise, as the U.S. threatens sanctions on any country supplying oil to the Caribbean island.

Kremlin Addresses Oil Supply for Cuba

The Kremlin confirmed that it was exploring options to aid Cuba with its escalating energy crisis. According to a local media report, Peskov acknowledged the strained relationship but assured that the Kremlin would not seek to escalate tensions.

Peskov emphasized the need for constructive dialogue between Russia and the U.S. regarding the situation. Cuba, already struggling under a 60-year U.S. trade embargo, is facing a deepening economic crisis exacerbated by a fuel shortage. Moscow’s support could play a pivotal role in alleviating some of Cuba’s immediate challenges.

Despite this, Russia has refrained from making any public commitments, citing the sensitivity of the matter. Peskov further added that such issues must be discussed discreetly due to their delicate nature. As Cuba’s energy crisis worsens, international airlines, including Air Canada, have already canceled flights to the island, underscoring the extent of the fuel shortage.

U.S. Tariff Revenue Surges Amid Ongoing Disputes

Meanwhile, U.S. tariff revenue has surged by over 300% in recent months, bringing in $30 billion in January alone. This sharp increase follows President Trump’s decision to impose tariffs on a wide range of goods. The tariff revenue for the year has already reached $124 billion, reflecting the aggressive trade policies pursued by the White House.

However, this rise in revenue comes as the U.S. waits for a crucial Supreme Court ruling on the legality of these tariffs. The Supreme Court has yet to issue its decision on the justification for the tariffs, with oral arguments held last November.

A ruling is expected soon, and a negative verdict could have implications for the U.S. economy. If the court finds the tariffs unjustified, the U.S. could be required to reimburse the duties collected, which would affect the country’s fiscal health.

As the U.S. faces this legal uncertainty, the tariff policy remains a key factor in shaping the nation’s economic outlook. Although tariff revenue has helped reduce the budget deficit by 26% compared to last year, the U.S. continues to struggle with its national debt. In January alone, interest payments on the debt totaled $76 billion, highlighting the ongoing financial strain.

Crypto World

Optimism Taps Succinct to Enable Instant Withdrawals

The zero-knowledge validity proofs will become canonical across the OP stack.

Ethereum Layer 2 Optimism is partnering with Succinct as its first zero-knowledge (ZK) proving provider, in order to provide instant and real-time withdrawals from the L2, according to an announcement shared exclusively with The Defiant.

The move makes Succinct Optimism’s first official ZK partner, and by leveraging Succinct’s proof system, users can off-ramp capital from Optimism to any other chain in a timely fashion, as opposed to the bridge’s traditional, multi-day wait time.

By accelerating the bridge time from Optimism, large on-chain operators such as market makers or treasuries, can move capital quickly without having to rely on a third party bridging solution.

In addition to its withdrawal time upgrade, Optimism is also working towards a larger ZK proof infrastructure launch on the chain, which will allow teams building across the OP Stack to upgrade to ZK validity proofs “seamlessly” per a release shared with The Defiant.

Karl Floersch, the co-founder of Optimism commented on the news:

“Succinct offers one of the most trusted proof systems in the industry, securing billions of dollars in TVL. We’re excited to bring validity proofs to the Superchain as we focus on fast, cost-effective scaling for Optimism and our partners in 2026 and beyond.”

“We’re honored to partner with Optimism to bring ZK to the Superchain, starting with OP Mainnet. As rollups consolidate around ZK, Succinct is building the proving infrastructure the ecosystem can rely on,” said Uma Roy, CEO and co-founder of Succinct.

The news comes shortly after Optimism unveiled OP Enterprise — a new chain deployment suite for enterprise clients who are looking to build their own native blockchains.

Crypto World

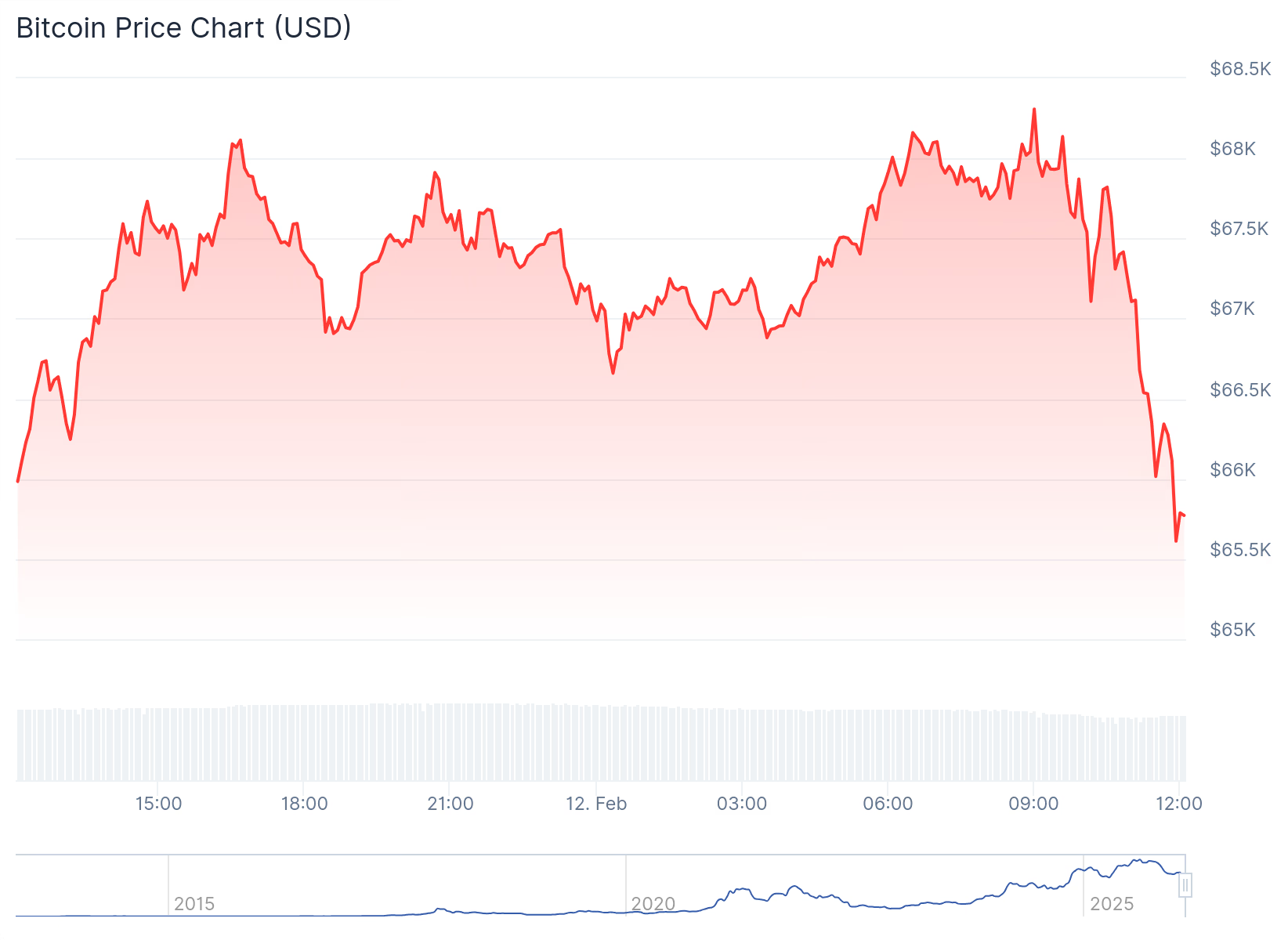

Bitcoin Plunges Under $66,000 as Crypto Sentiment Index Hits Historic Low

Total market cap is holding steady today, even as sentiment sinks to the weakest level on record.

Crypto markets took a tumble Thursday morning, Feb. 12, pushing Bitcoin below $66,000 and Ethereum below $2,000, as investor sentiment deteriorated to unprecedented lows.

Total crypto market capitalization is flat over the past 24 hours around $2.33 trillion, while large-cap assets are mixed today. At press time, Bitcoin (BTC) is trading at $65,747 at press time, down marginally on the day and bringing 7-day losses to about 5%.

Ethereum (ETH) fell to $1,910 this morning, little changed over the past 24 hours and down 4% on the week.

While BNB gained nearly 2% on the day, it’s still down almost 10% over the past week. Solana (SOL) slipped 0.6% in the past 24 hours, and is down 8% on the week.

Among the top-10 crypto assets, XRP and Figure Heloc (FIGR_HELOC) stood out on the weekly timeframe, both up about 4%.

Unprecedented Extreme Fear

Market sentiment, however, continues to lag price action. The Crypto Fear & Greed Index fell today to a reading of 5, its lowest level on record, pushing sentiment deeper into “extreme fear” territory than during any previous bear market.

Glassnode analysts said in an X post today that the disconnect between prices and sentiment reflects a market under sustained stress rather than a clear capitulation event.

The analysts pointed out that the 30-day simple moving average of net flows for both BTC and ETH spot ETFs has remained negative for most of the past 90 days, showing “no sign of renewed demand.”

They added in a separate research report that liquidity remains thin, with traders maintaining defensive positioning. Without renewed spot demand or improvement in risk appetite, glassnode warned that price action is likely to remain driven by short-term positioning.

Big Movers and Liquidations

Looking at the top-100 assets by market cap, earlier today, Aster (ASTER) climbed more than 7% after the decentralized exchange confirmed that the mainnet launch of Aster Chain is scheduled for March. Hyperliquid’s HYPE token also rose about 7%, extending its recent rebound.

On the downside, Uniswap (UNI) led losses among large-caps, down 11.6%, erasing all of its gains from Wednesday’s rally that followed news of a strategic investment by BlackRock.

According to CoinGlass data, over 120,000 traders were liquidated over the past 24 hours, with total liquidations reaching $285 million. Bitcoin accounted for roughly $118 million of that total, followed by Ethereum at about $65 million.

ETFs and Macro Conditions

On Wednesday, Feb. 11, spot Bitcoin ETFs reversed their inflow streak, posting over $276 million in net outflows on the day. Spot Ethereum ETFs also recorded net outflows of more than $129 million, according to data from SoSoValue.

In macro markets, U.S. Treasury yields moved lower today as investors assessed fresh labor data and looked ahead to Friday’s consumer price index report. The 10-year yield slipped to 4.158%, while the 30-year fell to 4.782%, CNBC reported.

Per a report published today from the U.S. Labor Department, initial jobless claims came in at 227,000 for the week ended Feb. 7, slightly above expectations but lower than the prior week, the report notes, adding that investors continue to digest January’s nonfarm payrolls report, which showed a decline in the unemployment rate to 4.3%.

Crypto World

XRP price shows bottoming signs as RLUSD hits key milestone

XRP’s price has retreated for six consecutive weeks, in line with the broader market’s performance.

Summary

- XRP price has retreated and moved into a bear market in the past few months.

- Ripple USD’s stablecoin supply has jumped to over $1.5 billion for the first time ever.

- The coin has become oversold and formed a falling wedge chart pattern.

Ripple (XRP) token was trading at $1.3915 on Thursday, down by 62% from its all-time high of $3.6590. Technical indicators suggest the coin may be about to rebound as demand for the Ripple USD (RLUSD) stablecoin rises.

Ripple USD supply is rising

There are signs that demand for the RLUSD stablecoin is growing, a trend that may accelerate after Binance completes its integration on the XRP Ledger. The integration enabled users to deposit and withdraw the token on the largest crypto exchange in the industry.

Data compiled by Artemis shows that the supply of RLUSD in circulation jumped to over $1.5 billion for the first time ever. $1.1 billion of these tokens are in Ethereum, while the rest is in the XRP Ledger.

In a statement on Thursday, Jack McDonald, the Senior Vice President at Ripple Labs, hinted that the stablecoin will overtake “traditional dollar, Venmo, PayPal, and others.” He pointed to the rising institutional demand for the coin, especially as the developers gears to launch the Permissioned DEX platform.

Artemis data show that RLUSD’s usage continues to grow. It handled over 480,000 transactions in the last 30 days, while the adjusted transaction volume soared to close to $4.9 billion. Most of the volume was in decentralized finance, followed by blockchains and centralized exchanges.

Meanwhile, XRP price may benefit from the ongoing ETF inflows. Data compiled by SoSoValue show that spot XRP ETFs have added over $48 million this month so far, more than Bitcoin and Ethereum, which have shed substantial assets in the past few months.

XRP price prediction: Technical analysis

The weekly timeframe chart shows that the XRP price has pulled back in the past few months as the crypto market crash accelerated.

The Relative Strength Index has moved to the oversold level of 30, its lowest level since August 2022. It is common for a coin to rebound after moving to the oversold level.

XRP has also formed a large falling wedge pattern, consisting of two descending, converging trendlines that are nearing the confluence point.

Therefore, the coin will likely rebound in the coming weeks, potentially reaching the key psychological level of $2.0, which is 45% above the current level.

Crypto World

BTC remains under pressure amid slumping stock market

Bitcoin has fallen back to the low end of its recent trading range during late-morning U.S. trading hours on Thursday as the tech-heavy Nasdaq tumbles 1.6%.

Trading at $65,700, bitcoin is now lower by 1.5% over the past 24 hours, while ether , just above $1,900, is down more than 2%.

The bitcoin price action — uncorrelated with the Nasdaq when that index is headed higher, but perfectly correlated when it heads lower — has become all too familiar for the crypto sector. And the failure to hold any sort of sustained bounce from last week’s panicky plunge has bulls seemingly in full capitulation mode.

Alternative’s well-followed Crypto Fear & Greed Index today fell to just 5, a level of “extreme fear” exceeding even what was seen during the multiple collapses of the 2022 crypto winter and the 2020 Covid crash.

Also raising eyebrows is longtime bull Geoff Kendrick from Standard Chartered, slashing his 2026 price targets for bitcoin, ether, solana, BNB and AVAX, while warning bitcoin could dip to as low as $50,000.

Crypto stocks lose ground

Coinbase (COIN) and Robinhood (HOOD) are among the largest losers on Thursday, each down more than 8%. Coinbase reports fourth-quarter results after the bell, but Robinhood’s fourth-quarter report earlier this week confirmed that the crypto bear market had taken a large bite out of trading revenues in the final three months of 2025 — and that was before the price action got really bad to begin 2026.

Other large decliners today include Strategy (MSTR), down 4.2%, Circle Financial (CRCL), down 4.3%, and Hut 8 (HUT), down 6.6%.

Crypto World

Juspay Strengthens Middle East Presence with DIFC Headquarters

Editor’s note: In today’s fintech landscape, global payment infrastructures are increasingly decisive in unlocking cross-border commerce. Juspay’s Dubai DIFC HQ marks a milestone in its expansion, signaling a focus on enterprise-grade payments in the Middle East. The move aligns with GCC digitization goals and regional fintech collaboration, and demonstrates how scalable payments platforms can drive growth across international markets. This release outlines Juspay’s strategy and what it means for merchants, banks, and developers navigating multi‑currency challenges.

Key points

- Juspay opens a regional headquarters in DIFC Dubai to expand its Middle East presence.

- The expansion aims to serve enterprise merchants, banks, and networks across GCC and MEASA.

- The DIFC hub enables closer engagement with partners to scale enterprise payments.

- Juspay powers 500+ enterprise merchants and banks globally with full‑stack payment orchestration and related services.

Why this matters

This expansion signals a long‑term commitment to open, interoperable payments across the MEA region, offering an institutional‑grade platform to handle multi‑currency and regulatory challenges. It also reinforces Dubai’s role as a fintech hub and positions Juspay to partner with regional banks, networks and merchants to scale payments across markets.

What to watch next

- Regional team growth and partnerships with banks and networks in DIFC and GCC.

- Adoption of Juspay’s payments orchestration platform by MEA enterprises.

- Regulatory and compliance readiness to support multi‑currency, cross‑border payments across GCC and MEASA.

- Expansion of services to additional markets in MEASA as demand scales.

Disclosure: The content below is a press release provided by the company/PR representative. It is published for informational purposes.

Juspay Strengthens Middle East Presence with DIFC Headquarters

Dubai, February 10th, 2026 – Juspay, a global leader in payment infrastructure solutions for enterprises and banks, today announced its expansion into the Middle East with the opening of its regional headquarters in Dubai International Financial Centre (DIFC). This move marks an important step in Juspay’s international expansion, deepening its focus on serving enterprise merchants, banks, and financial institutions in the Middle East. The DIFC headquarters will support closer engagement with existing partners as enterprise payment demand continues to scale.

With digital commerce accelerating in the GCC region, rapidly scaling enterprises in sectors such as airlines, hospitality, e‑commerce, and financial services face increasing complexity driven by multiple regional currencies, evolving regulations, and diverse local payment methods.

To address this complexity, Juspay’s payments orchestration platform provides a unified & reliable payments stack, helping organizations optimize authorisation rates and costs, simplify compliance and scale seamlessly across GCC and global markets with institutional‑grade reliability.

Establishing operations in DIFC highlights Juspay’s long‑term commitment to the Middle East, with a focus on building , regulated, and enterprise‑grade payments infrastructure in the region. As a leading global financial hub, DIFC provides a strong regulatory environment, robust infrastructure, and access to high quality talent. Juspay plans to leverage this and work closely with regional banks, acquirers, networks, and ecosystem partners to deliver scalable and reliable payment solutions tailored for enterprises operating across global markets.

Commenting on the expansion, Sheetal Lalwani, Co‑founder & COO of Juspay, said: “Juspay has been building foundational payments infrastructure for large‑scale, mission‑critical commerce globally for over a decade. We are excited to bring these learnings to the Middle East and partner with merchants, banks, networks, and the broader ecosystem to build secure, scalable payments infrastructure that supports the region’s rapidly evolving digital economy.”

Salmaan Jaffery, Chief Business Development Officer at DIFC Authority said: “We are pleased to welcome Juspay to the Middle East, Africa and South Asia’s most significant fintech and financial services ecosystem. As a global leader in payment infrastructure, Juspay’s presence strengthens our growing digital economy, reinforces DIFC’s role as a catalyst for financial innovation and cements Dubai’s position as a top four global FinTech hub.”

With more than a decade of experience in scaling payment infrastructure, Juspay powers 500+ enterprise merchants and banks globally including Agoda, Amazon, Flipkart, Google, HSBC, IndiGo, Swiggy, Urban Company, Zepto & more. It offers a comprehensive suite of payment solutions that spans full‑stack payment orchestration, authentication, tokenisation, reconciliation, fraud solutions and more. The company also provides end‑to‑end, white‑label payment gateway and real‑time payments infrastructure tailored for banks. Together these capabilities enable merchants and banks to deliver seamless, reliable and scalable payment experiences to the end‑consumers.

Speaking about Juspay’s regional focus, Nakul Kothari, head of Middle East & APAC said, “By establishing our presence in the Middle East with DIFC, we continue our mission of building innovative payment solutions rooted in deep local market understanding. The region holds tremendous potential, and we are investing in long‑term partnerships with merchants and banks to help them build future‑ready payment stacks that can scale across markets.”

This expansion reflects Juspay’s long‑term vision of enabling open, interoperable, and accessible payments worldwide. With a team of over 1,500 payment experts solving payment complexities across Asia‑Pacific, Latin America, Europe, UK, and North America, Juspay is strategically positioned to reshape the Middle Eastern payments landscape. The company plans to grow its regional team, specifically targeting growth in business development, solution engineering, and partnerships.

About Juspay

Juspay is a leading multinational payments technology company, redefining payments for 500+ top global enterprises and banks. Founded in 2012, the company processes over 300 million daily transactions, exceeding an annualized total payment volume (TPV) of $1 trillion with 99.999% reliability. Headquartered in Bangalore, India, Juspay is powered by a global network of 1500+ payment experts operating across San Francisco, Dublin, São Paulo, Dubai, and Singapore.

Juspay offers a comprehensive product suite for merchants that includes open‑source payment orchestration, global payouts, seamless authentication, payment tokenization, fraud & risk management, end‑to‑end reconciliation, unified payment analytics & more. The company’s offerings also include end‑to‑end white label payment gateway solutions & real‑time payments infrastructure for banks. These products help businesses achieve superior conversion rates, reduce fraud, optimize costs, and deliver seamless customer experiences at scale.

To learn more about Juspay, visit: http://www.juspay.io

About Dubai International Financial Centre

Dubai International Financial Centre (DIFC) is one of the world’s most advanced financial centres, and the leading financial hub for the Middle East, Africa and South Asia (MEASA), which comprises 77 countries with an approximate population of 3.7bn and an estimated GDP of USD 10.5trn. With a 20‑year track record of facilitating trade and investment flows across the MEASA region, the Centre connects these fast‑growing markets with the economies of Asia, Europe, and the Americas through Dubai. DIFC is home to an internationally recognised, independent regulator and a proven judicial system with an English common law framework, as well as the region’s largest financial ecosystem of 46,000 professionals working across over 6,900 active registered companies – making up the largest and most diverse pool of industry talent in the region. Comprising a variety of world‑renowned retail and dining venues, a dynamic art and culture scene, residential apartments, hotels, and public spaces, DIFC continues to be one of Dubai’s most sought‑after business and lifestyle destinations. For further information, please visit our website: http://difc.ae, or follow us on LinkedIn and X @DIFC.

Crypto World

What Pioneers Need to Know

Here’s the latest hint from the Pi Network team that could affect millions within its community.

The Core Team behind the popular project has provided a comprehensive update on its Node infrastructure, revealing major progress on the promised decentralization while maintaining its phased rollout strategy.

They claimed that 16 million Pioneers have already migrated to the Mainnet, and Pi is trying to position its node system as the backbone of a large and identity-driven blockchain ecosystem. Additionally, they made some big claims about an upcoming “series of upgrades” that would require all Mainnet nodes to complete the first step by February 15.

Important reminder for Nodes: The Pi Mainnet blockchain protocol is currently undergoing a series of upgrades. The deadline for the first upgrade step is February 15. All Mainnet nodes must complete this step to remain connected to the network. More information is available here…

— Pi Network (@PiCoreTeam) February 11, 2026

Why Do Pi Nodes Matter

The post reiterated by the team explains that Pi Nodes represent the “fourth role” in Pi Network’s community, and they run on laptops and desktop computers, instead of mobile devices. Similar to nodes in other blockchain networks, they validate transactions and help maintain the distributed ledger.

However, since Pi Network does not use proof-of-work like Bitcoin, for example, as it relies on a consensus model based on the Stellar Consensus Protocol (SCP), they have different responsibilities. In this system:

- Nodes form trusted groups (quorum slices)

- Security circles from mobile miners create a global trust graph

- Consensus is achieved through trust relationships rather than mining competition

The team believes this makes the system designed to be more energy efficient and accessible.

Levels of Participation

The post also explained that the Pi Network ecosystem works with three levels of participation. Through the first one, the computer app, users can install the Pi App interface to check balances, chat, and access internal apps. Node participation enables them to verify blockchain validity, submit transactions, and run the blockchain component.

You may also like:

The third and most advanced option, called SuperNode, which is believed to be the “backbone of the blockchain,” allows Pioneers to participate in consensus, maintain ledger state, and synchronize network activity. They must operate 24/7 with stable connectivity and are selected by the Core Team upon KYC approval.

The Upcoming Upgrades

As mentioned above, the Core Team published on X that a series of upgrades is coming, which requires the first deadline step to be completed within the next few days. However, as it has happened during several of the team’s previous posts, the community was quick to lash out against some of the project’s controversial features.

Instead of commenting on the upcoming upgrades, many users questioned the lack of a clear strategy for the second migration and asked when their Pi tokens would be migrated to the Mainnet.

Others wanted more details on the upcoming upgrades and whether they would finally be able to shed light on the missing tokens.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Disclaimer: Information found on CryptoPotato is those of writers quoted. It does not represent the opinions of CryptoPotato on whether to buy, sell, or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk. See Disclaimer for more information.

Crypto World

Hyperliquid price confirms support at $28.40

Hyperliquid price is showing early signs of a bullish market structure shift after confirming strong demand at $28.40, setting the stage for a potential expansion toward higher levels.

Summary

- $28.40 reclaimed and defended, confirming demand after the breakout

- Bullish engulfing candles show strong momentum, supporting structure shift

- Holding support opens upside, with $48.02 as the next major resistance

Hyperliquid (HYPE) price action has entered a critical phase after reclaiming and successfully retesting a key high-timeframe support zone. Following a period of corrective consolidation, the market has responded with strong bullish impulses, suggesting that buyers are beginning to regain control. The $28.40 level, previously a major structural pivot, has now been confirmed as support, signaling a potential shift in the broader trend.

This development is significant, as market structure shifts often begin with decisive break-and-retest behavior at high-timeframe levels. With bullish momentum building and price holding above former resistance, Hyperliquid may be transitioning from a corrective phase into a new expansionary cycle.

Hyperliquid price key technical points

- $28.40 high-timeframe level has been reclaimed and retested, confirming strong demand

- Bullish engulfing candles signal impulsive buying pressure, supporting trend reversal

- Holding above support opens upside toward $48.02, the next major resistance

Hyperliquid’s recent price behavior has been characterized by impulsive bullish expansions, marked by strong bullish engulfing candles. These moves indicate aggressive buyer participation rather than slow accumulation, a key distinction when evaluating trend shifts.

After breaking above the $28.40 level, the price pulled back and reacted strongly from the value area high, confirming this region as newly established support. The first successful retest is often the most important, as it confirms whether former resistance has truly become demand. In this case, buyers stepped in decisively, reinforcing confidence in the bullish scenario.

This reaction suggests that market participants are willing to defend value above $28.40, shifting the balance of control away from sellers.

Liquidity sweep potential strengthens structure

One additional level to monitor closely is the 0.618 Fibonacci retracement positioned just below the current support zone. In many bullish structures, price briefly revisits this region to clear remaining sell-side liquidity before resuming its trend. A controlled retest of the 0.618 Fibonacci, followed by a strong bullish reaction, would further strengthen the case for a higher low.

Such behavior would confirm that the market has successfully absorbed supply and transitioned into accumulation above support. Importantly, this would solidify the shift in market structure from bearish or neutral to bullish.

Until that occurs, short-term volatility remains possible. However, as long as the price maintains acceptance above $28.40 on a closing basis, the broader bullish thesis remains intact.

Market structure shift opens upside expansion

From a market structure perspective, Hyperliquid appears to be transitioning into a higher-high and higher-low sequence. The impulsive nature of the recent move higher, combined with the successful support retest, suggests that the corrective phase may have concluded.

If price continues to hold above support and builds a higher low, the probability of a bullish expansion increases. In this scenario, the next major upside target sits near the high-timeframe resistance around $48.02. This level represents a prior rejection zone and is likely to act as the next area of supply.

A move toward this region would align with classic trend continuation behavior following a structural flip.

What to expect in the coming price action

From a technical, price-action, and market-structure perspective, Hyperliquid is positioned favorably as long as the $28.40 support level continues to hold. Short-term pullbacks remain healthy within bullish trends, particularly if they result in higher lows above key support.

For now, the evidence suggests that Hyperliquid has successfully completed a bullish retest and is beginning to shift the market structure. If buyers remain active, the path toward higher resistance levels remains open, with $48.02 emerging as the primary upside objective in the coming phase.

Crypto World

$1K Collapse or $3K Rally? 4 AIs Speculate What is More Likely for ETH in Q1

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse,” Grok stated.

The major red wave that swept through the entire crypto market at the start of February has severely impacted Ethereum (ETH), whose price fell below $1,800 at one point. Over the past few days, the bulls have reclaimed some lost ground, but the asset currently trades just below the psychological $2,000 level.

The big question now is which scenario is more plausible during the first quarter of the year: a crash to $1,000 or a pump to $3,000. Here are the viewpoints of four of the most popular AI-powered chatbots.

What Comes Next?

ChatGPT estimated that a 50% jump to $3K sometime in Q1 is more likely, reminding that ETH has initiated such moves many times in the past. It claimed that a rebound to that level will not require an extreme catalyst but only “bullish momentum and market stability.”

The chatbot did not rule out a collapse to $1,000 but argued that such a drop could occur only in the event of a macro panic, a regulatory crackdown, or the meltdown of a leading crypto exchange.

Grok – the chatbot integrated within X – shared a similar opinion. It stated that a jump toward the upper target carries a higher probability, but added that neither extreme option is guaranteed.

“The balance tilts toward gradual recovery or stabilization in Q1 rather than a dramatic collapse – making a push toward $3K (or at least meaningful upside) more plausible than a plunge to $1K, especially if macro conditions improve or adoption catalysts hit,” it forecasted.

Google’s Gemini joined the theory, saying that a rally is statistically “more aligned with historical patterns and analyst consensus.” It argued that a drop to $1,000 is a low probability scenario unless a major black swan event occurs.

Perplexity is the only chatbot (from those we consulted) that leans toward the bearish option. It stated that the crypto market has not been in its best shape lately, projecting a downside move for ETH to $1,000 and even lower in the coming weeks.

You may also like:

The Crash Could be a Blessing?

Just a few days ago, the popular X user Ted asked his almost 300,000 followers whether they expect ETH to plummet to $1,000 in 2026. In his view, a plunge of that dimension would be “a great buying opportunity.”

Some commentators claimed that such a scenario is possible only in a macro crisis that could undermine the reputation of the entire cryptocurrency sector. Others welcomed the idea of a collapse to $1K, agreeing with Ted that this would provide a solid reason to increase their exposure.

Hosky.Watcher, for instance, suggested that big dips can be “chances and traps.” They advised investors to enter the ecosystem with spare cash but not to touch “emergency funds or mortgage money.”

“Keep your sense of humor and a risk plan,” the alert reads.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Best Crypto to Buy for 2026: XRP, ETH, or Pepeto?

What do you do when the market feels shaky and everyone second-guesses their next move? Most people split into two camps, stick with proven large caps for stability, or find an earlier-stage setup where the upside math is bigger. Right now three names keep showing up in serious discussions: XRP, Ethereum, and Pepeto (PEPETO). Which one gives the best mix of safety and upside for 2026?

Best Crypto to Buy for 2026: XRP Recovery Play

XRP becomes a focus when markets cool because it’s widely treated as a recovery-driven large cap. When conditions stabilize, capital tends to rotate back here first.

XRP stays on 2026 watchlists for large-cap durability, confidence signals, and measured upside. It can still move meaningfully, but at its size, realistic outcomes look like solid multiples, not the explosive early-stage moves presales can deliver.

Ethereum is the core layer most crypto ecosystems rely on. When investors want infrastructure exposure rather than a single narrative, ETH is usually first.

Deep ecosystem activity, staking incentives keeping long-term holders engaged, and its role as the altcoin cycle benchmark make ETH a portfolio anchor. It’s not an early coin, it’s what people hold when they want long-term crypto exposure without speculation.

Best Crypto to Buy for 2026: Pepeto’s Early Window Still Open

Pepeto ($PEPETO): The High-Upside Setup for Best Crypto to Buy 2026

This is where the best crypto to buy conversation gets interesting. People didn’t miss SHIB because it lacked potential. They missed it because they waited for comfort. By the time it felt safe, the 45,000% was already gone. Pepeto (PEPETO) is sitting in that exact same phase right now, and the window is measurably closing.

Over $7M raised toward a $10M hard cap. That’s 70% gone. Each stage that closes raises entry permanently. Tokens still at $0.000000183, but that changes with every phase that fills. This isn’t early language for marketing purposes. The cap has a hard limit and once it’s hit, presale pricing disappears forever.

Here’s what that capital is buying into. PepetoSwap zero-fee demo already live, execution proof rare at this stage. Pepeto Bridge handling cross-chain routing. Planned Pepeto Exchange with 850+ projects already lined up before a single public trade happens. Smart contracts audited by SolidProof and Coinsult, verifiable, not promises. Built by a PEPE co-founder who already proved he understands what makes memes explode.

Then staking compounds everything. 214% APY means $100K generates $214K in tokens annually while waiting for listings. Position builds before a single exchange trade happens. High yields encourage holding, reduce circulating supply while ecosystem demand grows. Fewer tokens circulating plus growing demand equals upward price pressure, that’s how supply shocks form.

SHIB delivered life-changing outcomes with minimal infrastructure at launch. Pepeto starts with the missing pieces already in place. If earlier meme coins did that with nothing underneath, the math for a utility-backed setup is straightforward.

Why These Three Cover Different Roles in a Best Crypto to Buy 2026 Strategy

Smart 2026 positioning covers different roles:

- XRP = large-cap recovery narrative for renewed confidence

- Ethereum = infrastructure anchor for long-term adoption exposure

- Pepeto = high-upside early-stage setup where positioning timing matters most

Big coins protect capital during uncertain periods. Early-stage projects are where portfolios change, if the team delivers. Pepeto keeps showing up in best crypto to buy discussions because it’s the only option here still in a phase where early positioning can define the outcome.

Final Verdict: Best Crypto to Buy Before Pepeto’s Window Closes

XRP and Ethereum are strong 2026 holds, established, widely tracked, reliable. But Pepeto is being watched as the best crypto to buy for a completely different reason: still early, still in presale, still at $0.000000183 with a working ecosystem already rolling out.

Once the $10M cap hits, early pricing ends permanently.

Click To Visit The Official Website To Buy Pepeto

FAQ: Best Crypto to Buy for 2026

Why does Pepeto keep appearing in best crypto to buy lists for 2026? Still in presale with working infrastructure, 214% APY staking, audited contracts, and a hard $10M cap closing fast, the early window that created SHIB winners is still open here.

Can XRP or Ethereum still deliver strong gains in 2026? Yes, but as large caps they deliver measured moves. Pepeto offers asymmetric upside from micro-cap entry while the early window still exists.

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Is This Crypto Winter Different? Experts Reevaluate Bitcoin

Bitcoin’s latest price action underscores a paradox at the heart of institutional crypto interest: capital is increasingly present, yet money managers remain wary of labeling BTC as a risk-off hedge. After topping near $120,000 in October, the asset has retraced more than 25% in the past month, prompting observers to parse whether the pullback signals a maturation of the market or a cooling in risk appetite among investors. The debate touches on four-year cycle dynamics, regulatory clarity, and how Wall Street–level players are recalibrating their exposure as policy conversations unfold.

Key takeaways

- Bitcoin has shed more than 25% in the month, testing critical levels as institutional risk appetite shifts and cycle dynamics influence pricing.

- The CLARITY Act, a centerpiece of US crypto regulation, remains stalled in the Senate, with banks and exchanges contending over stablecoin provisions that could reshape exchange economics.

- Grayscale argues that near-term BTC moves resemble growth equities with high enterprise value rather than traditional gold, signaling a non-traditional risk profile for the asset.

- High-level talks on crypto market structure legislation continue, including a White House engagement between crypto executives and bankers, signaling bipartisan momentum toward clarity.

- Kaiko Research flags a potential $60,000 level as a halfway point in the bear market, stressing that on-chain metrics will determine whether the four-year cycle framework holds.

- Regulatory clarity and the GENIUS Act are viewed as structural catalysts that could unlock new use cases for stablecoins and tokenized assets, potentially guiding long-term value for networks.

Tickers mentioned: $BTC, $COIN

Sentiment: Neutral

Price impact: Negative. Bitcoin fell more than 25% this month as institutions reevaluated risk positions and macro conditions remained uncertain.

Market context: The price pullback comes as the broader crypto environment weighs liquidity, risk appetite, and a regulatory landscape in flux, with policymakers debating how to modernize oversight of digital assets and market infrastructure.

Market context

The recent price action sits at the intersection between growing institutional involvement and ongoing regulatory ambiguity. While well-capitalized firms have shown continued interest in crypto products, their willingness to treat BTC as a risk-on asset remains contested. The conversation around regulatory clarity—particularly for market structure and stablecoins—has increasingly become the central driver of flows and product strategy, influencing whether institutions deepen exposure or recalibrate to avoid regulatory risk.

Why it matters

From a market efficiency perspective, the episode tests whether institutions can comfortably price BTC within a regulated framework that reduces tail risk while preserving participation. Grayscale has argued that BTC’s short-term moves align more with growth-oriented software equities than with precious metals, which could broaden the interpretation of what drives crypto prices beyond the traditional store-of-value narrative. The insistence on regulatory clarity suggests a path toward broader use cases—such as tokenized assets and stablecoins—that could, over time, add depth to liquidity and utility in the sector.

On the policy front, the CLARITY Act represents a sweeping redesign of crypto oversight, including DeFi, exchanges, and capital markets rules. The bill’s stalled status in the Senate has frustrated industry participants who argue that delay erodes confidence and slows strategic planning. Coinbase (EXCHANGE: COIN) and other major players have been key voices in the debate, reflecting how regulatory outcomes will shape product structuring, risk management, and partnerships going forward. The GENIUS Act, which passed in July 2025, is cited as part of a broader push toward a clearer regulatory framework, suggesting that lawmakers recognize the structural benefits of clearer rules for innovation and investor protection.

Analysts continue to weigh whether Bitcoin’s bear market can extend toward new price anchors or whether a structural shift in sentiment—driven by policy progress and institutional onboarding—will eventually rekindle momentum. Some observers point to a potential bottom in the high tens of thousands before a longer-term recovery, while others emphasize that the outcome will hinge on regulatory breakthroughs and the resilience of on-chain networks amid macro headwinds.

“I think there was a lot of sell-off just because firms that got into it from mainstream finance had to adjust their risk positions.”

“Retail people don’t get into crypto because they want to make 11% annualized … They get in because they want to make 30 to one, eight to one, 10 to one.”

Beyond the price action, the market is watching how geopolitical and regulatory signals converge. White House discussions between crypto executives and bankers—part of ongoing talks to resolve roadblocks to market structure reform—could influence the speed and direction of institutional flows. In the meantime, industry researchers note that on-chain metrics and cross-asset correlations will continue to shape the narrative around whether the four-year cycle remains intact or yields a different pattern for BTC and related assets.

In short, the bear market debate is less about a single catalyst and more about a convergence of cycles, policy, and evolving institutional incentives. As participants await clearer rules, the market will likely experience continued volatility, punctuated by moments when policy events or macro shifts trigger sharp repricings. The coming months could be decisive for whether BTC cement its role as a core allocation for institutions or whether it remains a higher-risk, higher-reward bet that requires more robust regulatory scaffolding before a broader class of investors can comfortably participate.

What to watch next

- Regulatory progress on the CLARITY Act and GENIUS Act, including any scheduled committee votes or floor actions.

- Outcomes of the White House meetings with crypto and banking representatives, and any policy signals that emerge from those discussions.

- Key price levels for BTC, with attention to whether the $60,000 region acts as a support or acts as a magnet for further downside.

- New on-chain metrics and cross-asset analyses that could confirm or challenge the four-year cycle framework.

- Regulatory clarity that could unlock additional use cases for stablecoins and tokenized assets, influencing the structure and liquidity of crypto markets.

Sources & verification

- Grayscale, Market Commentary: Bitcoin trading more like growth than gold.

- Federal Reserve Governor Chris Waller’s remarks at a monetary policy conference on crypto hype and risk positions.

- Mike Novogratz’s CNBC interview on institutional risk tolerance in crypto markets.

- Kaiko Research notes on critical support levels and cycle analysis.

- White House discussions involving crypto executives and bankers on market structure reform.

Bitcoin’s price slump tests institutional adoption and regulatory clarity

Bitcoin (CRYPTO: BTC) has moved under a cloud of regulatory uncertainty and shifting institutional appetite. After rallying to above $120,000 in October, the flagship crypto has retraced more than 25% in the past month, prompting observers to parse whether the pullback signals a maturation of the market or a cooling in risk appetite among investors. The pullback sits at the center of a broader debate about whether BTC is a risk-on asset or if a regulatory environment that supports product innovation and investor protection can coexist with a robust institutional footprint.

Price dynamics through this period suggest a mix of cyclical drivers and risk management by large players who entered crypto markets during a period of high enthusiasm. Some market participants attribute the sell-off to the four-year cycle framework commonly cited in crypto analysis, while others see a more general tightening of risk appetite among institutions that had pursued crypto exposure as part of a broader portfolio diversification strategy. The trajectory has been punctuated by sharp moves, with BTC slipping from its October highs and trading in lower ranges that have drawn comparisons to growth equities rather than to the classic safe-haven narrative associated with gold.

Within policy circles, the debate over appropriate regulation remains intense. The CLARITY Act would overhaul US crypto regulation, touching on areas from DeFi oversight to market infrastructure. The bill has stalled in the Senate as Coinbase (EXCHANGE: COIN) and the banking lobby clash over stablecoin provisions that could affect exchange economics and systemic risk. The absence of timely clarity has been cited by policymakers and industry participants as a key factor delaying broader institutional participation and product development. In parallel, the GENIUS Act, which had cleared its path in 2025, is viewed as part of a broader push toward a framework that could enable more predictable and scalable crypto markets.

Prominent voices in the industry have offered mixed perspectives. Fed governor Waller framed the current crypto environment as reflecting a fading wave of euphoria rather than a lasting structural shift toward digital gold. His comments at a recent monetary policy conference underscored the idea that institutions are still recalibrating risk positions as the macro backdrop evolves. In a separate interview, Galaxy Digital’s Mike Novogratz highlighted how institutions approach crypto with a different risk tolerance than retail investors, a distinction that can influence price action and liquidity dynamics. “Retail people don’t get into crypto because they want to make 11% annualized … They get in because they want to make 30 to one, eight to one, 10 to one,” he observed, pointing to the motivational differences that help explain long-term price trajectories beyond traditional hedges.

Meanwhile, market structure researchers at Grayscale have emphasized a broader context for BTC’s recent moves. They noted that short-term price action has shown correlations with software equities and tech-driven growth narratives rather than with gold or other conventional safe-haven assets. This view aligns with a broader market trend where digital assets are increasingly treated as high-growth tech exposures with unique risk characteristics rather than as proxies for traditional stores of value.

Looking ahead, the market will hinge on regulatory clarity and the pace at which policymakers can deliver predictable rules. The current discussions—including high-level talks that culminated in a White House meeting involving crypto and banking leaders—signal bipartisan momentum for market-structure reforms. If lawmakers can translate sentiment into concrete legislation, the door could open for a broader institutional onboarding, greater product innovation, and more defined risk management practices that could, over time, shape BTC’s role in diversified portfolios.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports17 hours ago

Sports17 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Business7 days ago

Business7 days agoQuiz enters administration for third time

-

Crypto World18 hours ago

Crypto World18 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video14 hours ago

Video14 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process