Angela Rayner called for relief on business rates and minimum wage pressures, while Andy Burnham says the tax system needs to adapt for hospitality venues

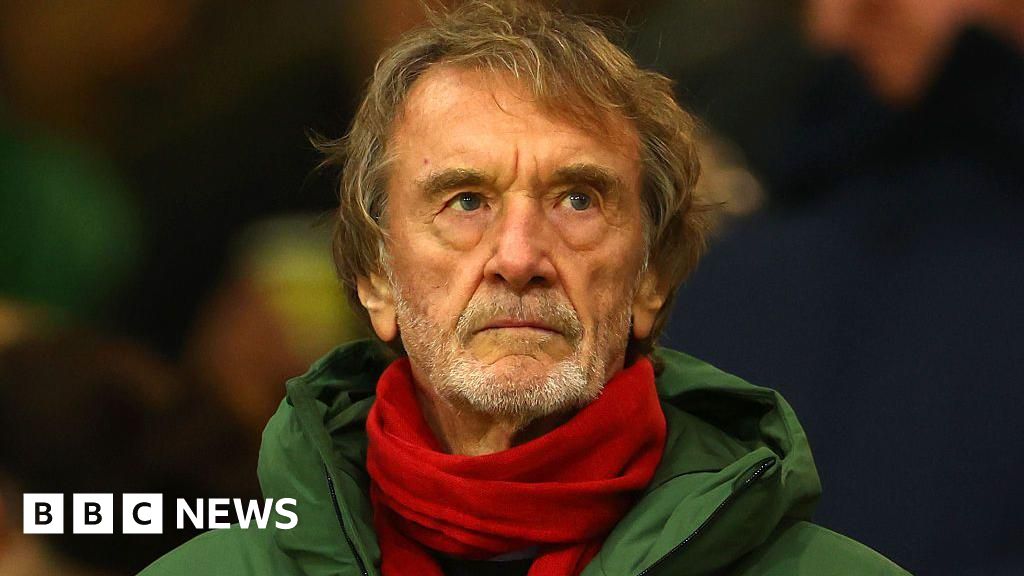

Two high-profile figures who could potentially challenge Sir Keir Starmer’s leadership have criticised the government’s tax system for placing significant strain on hospitality businesses, particularly pubs.

Angela Rayner acknowledged that the increase to the minimum wage has created difficulties for hospitality firms, and called on the government to “start relieving” pressure on the sector, as reported by City AM.

Speaking at a night-time economy conference, Starmer’s former deputy PM said: “I talked about the challenges of business rates, the challenges of VAT, the challenges, yes, of the minimum wage going up, and the living wage and the cost of energy.

“We’ve got to start looking at the intersectionality of all these challenges and start relieving some of them.”

After facing considerable criticism from the pub sector over punishing business rates, Rachel Reeves unveiled a £300m support package. However, the assistance excludes restaurants, hotels and retail businesses.

Rayner continued: “So we’ve talked about a review of business rates. We’ve got to put rocket boosters up what we promised at the election and start delivering.”

Meanwhile, Andy Burnham – whose attempt to return to Westminster was blocked by Labour – has argued that the UK’s tax regime needs to be adapted for the hospitality industry. The Mayor of Manchester said: “We need a planning and tax regime that recognises that value added to the UK economy. And I’m including the music industry in this and live venues.

“I know pubs have got their business rates exemption but it should be broader than that, I think it should be all hospitality venues because you want that mixed economy as well. It’s not one version of the night time economy.”

Shadow Business Secretary Andrew Griffith lambasted Rayner’s remarks, blaming the former deputy PM for the creation of the “Unemployment Rights Bill” in a post on X.

The senior Tory commented: “Today Angela Rayner has finally recognised the cumulative impact this Government’s anti-business policies have had on the economy.

“But these words ring hollow given she was the principal architect of the job-destroying (Un)Employment Rights Bill.

“Only the Conservatives have the team, the plan and the leadership to reverse the job-destroying elements of the Employment Rights Bill and get Britain working again.”