Crypto World

Tom Lee Says Ethereum Has Never Failed This Pattern and Expects Another V-Shaped Recovery

BitMine bought roughly $83 million in ETH this week, even as Ethereum struggles to reclaim $2,000-mark.

Ethereum has remained volatile since October, while the sell-off intensified over the last month. Fundstrat head of research Tom Lee said investor frustration around the leading altcoin’s recent weakness overlooks a long and consistent historical pattern of sharp declines followed by equally rapid recoveries.

In fact, he believes that the bottom is near.

Ethereum Near the Bottom?

While speaking at a conference in Hong Kong this week, Lee said that since 2018, Ethereum has experienced drops of more than 50% on eight different drawdowns, including a steep 64% fall between January and March last year. In every one of those instances, ETH formed a “V-shaped bottom,” recovering fully and doing so at roughly the same pace as its decline. From his perspective, this track record indicates that the current drawdown does not represent any change in Ethereum’s outlook, and he expects another V-shaped bottom to emerge following the latest sell-off.

Lee also cited BitMine market analyst Tom DeMark’s assessment, who believes Ethereum may need to revisit the $1,890 level to form a “perfected bottom.” Lee added that, based on BitMine’s assessment, ETH appears to be very close to such a bottom, as he drew parallels to previous downturns in late 2018, late 2022, and April 2025.

While Lee refrained from pinpointing the exact low, he argued that the magnitude of the decline itself is more important, and that investors should be thinking in terms of opportunity rather than offloading their stash.

“If you have already seen a decline, you should be thinking about opportunities here instead of selling.”

BitMine Is Buying

His comments came as Ether prices fell to $1,760 on February 6, as it approached the 2025 low of almost $1,400. So far, ETH has continued to struggle to reclaim the $2,000 level after a more than 36% drop over the past 30 days. As weakness in the market continues, BitMine, the ETH-focused treasury firm chaired by Lee, purchased roughly $83 million worth of ETH this week.

It executed two large buys of 20,000 ETH each via institutional platforms BitGo and FalconX, even as its existing holdings remained significantly underwater.

You may also like:

Meanwhile, the drawdown has already led to large-scale portfolio adjustments. For instance, Trend Research, a trading firm led by Liquid Capital founder Jack Yi, fully exited its Ethereum positions and closed what was once Asia’s largest ETH long. The firm had built roughly $2.1 billion in leveraged ETH exposure but ultimately realized losses of about $869 million after unwinding its positions despite Yi reiterating a bullish long-term outlook just days earlier.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

LTC & DOGE Holders Jump Ship to BlockDAG as Its Live Mainnet Beats Ethereum with 5,000 TPS!

The Litecoin price has taken a beating this week, with holders facing significant losses and key support near $50 under the spotlight. A dip below this level could push LTC down to $45, while resistance near $56.4 limits any immediate rebound.

Dogecoin is showing a similar bearish trend, with the latest Dogecoin price prediction pointing to further weakness as it trades below $0.13. Traders are watching the charts closely, trying to gauge whether these popular meme and altcoins can find their footing amid broader market pressure.

But in the middle of all these declines, BlockDAG (BDAG) is moving in a sharp upward pattern! Its Mainnet is now live, handling 5,000 transactions per second, far beyond what Ethereum can deliver. Plus, current buyers are eyeing 200× upside ahead of exchange listings on February 16.

This mix of speed, technology, and ROI potential is attracting serious attention from traders seeking top crypto coins, especially as big names like LTC and DOGE shift into defensive mode.

Litecoin Price Tests Critical $50 Support

Litecoin investors have faced heavy losses recently, with nearly $40 million booked over the weekend. Since the start of the year, LTC has shed about $1.81 billion in market value, leaving holders with an average loss of 40%. The coin is now approaching key support at $50, and a break below that could push the Litecoin price down to $45, its lowest since June 2022.

On the upside, Litecoin faces resistance near $56.4, with the 20-day EMA acting as the next hurdle if buyers step in. Technical indicators like the RSI and Stochastic Oscillator remain in bearish territory, signaling ongoing selling pressure. Traders tracking the litecoin price are closely monitoring these levels, as MVRV readings suggest a rebound may be possible if sentiment improves.

Dogecoin Price Prediction: Is DOGE Headed Lower?

The Dogecoin price prediction is turning bearish, as DOGE is slipping again. It is currently trading around $0.0909, down about 15% in the past week. After failing to stabilize, the coin has broken toward the lower end of its daily range, showing sellers still in control.

Over the past month, DOGE has lost more than a third of its value, and it’s slightly weaker against Bitcoin. This recent drop below the $0.13 Fibonacci extension raises questions for short-term traders.

On the weekly chart, the next key support sits near $0.0208 if current levels fail to hold. On the upside, DOGE faces resistance near $0.168–$0.198, meaning any bounce may be limited.

With the weekly RSI near oversold at 32, some see a buying opportunity, but technical pressure remains. Analysts are keeping a close eye on these zones for shaping the near-term Dogecoin price prediction.

BlockDAG Mainnet Outperforms Ethereum!

BlockDAG’s Mainnet is officially live and is processing an impressive 5,000 transactions per second; that’s 500 times faster than Ethereum! This move comes days ahead of its exchange listings, which are now expected to see even stronger demand as the market sees the network’s capabilities. On top of this, a final allocation is running, offering coins at $0.00025. Compared with the confirmed listing price of $0.05, this points to a potential 200× return.

The TGE is now live, and the Claim button for the free airdrop will be active within the next 24–48 hours. Users will be able to claim their BDAG allocations directly through the BlockDAG dashboard. Claiming is simple: connect the wallet used during the presale, select “Claim BDAG,” and confirm the transaction. No extra verification or forms are required. The claims are executed on-chain, and coins will be sent directly to the connected wallet.

Once claimed, BDAG coins will appear in the wallet and can be transferred, traded, or used according to vesting conditions. Network features and staking rewards will continue to roll out after this. The team has confirmed that staking is available only to BDAG holders, so missing this window means missing out on staking rewards.

This combination of record-breaking speed and the final allocation phase has attracted massive attention from traders tracking top crypto coins. Likewise, analysts suggest that acting now could make a real difference in potential gains later on. Ultimately, high ROI potential, transparency, and a live Mainnet outperforming some of crypto’s biggest names have made BDAG one of the most promising projects for the year ahead.

Which Is the Top Crypto Coin to Buy for 2026?

Litecoin and Dogecoin remain under clear pressure as sentiment across the market stays fragile. The Litecoin price is hovering near critical support, and unless buyers step in above key resistance, the risk of another drop toward $45 remains real.

At the same time, the latest Dogecoin price prediction reflects continued weakness, with DOGE struggling to reclaim lost ground and facing strong resistance on any bounce. For now, both assets sit in a defensive territory, leaving traders cautious as they reassess exposure.

Meanwhile, BlockDAG is telling a very different story. The Mainnet is already live, processing 5,000 transactions per second, and exchange listings are happening in four days.

And with the final allocation priced at $0.00025 and a confirmed $0.05 listing price, the potential 200× upside is basically guaranteed. For traders seeking top crypto coins to buy now, BlockDAG isn’t just competing with the market’s biggest players; it’s effectively outperforming them.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

Trump-Backed World Liberty Financial Launches World Swap Remittance Platform

World Liberty Financial has unveiled plans to introduce a new foreign exchange and remittance platform called World Swap. This platform aims to simplify global money transfers and reduce high transaction fees. The venture is backed by the family of former U.S. President Donald Trump, raising some ethical concerns. It is set to challenge traditional financial institutions and revolutionize cross-border transactions.

Revolutionizing the Remittance Market

The World Swap platform is designed to connect users directly to bank accounts and debit cards worldwide. It will allow users to complete foreign exchange and remittance transactions at a much lower cost than traditional financial institutions. Co-founder Zak Folkman highlighted that the platform is built around the company’s USD1 stablecoin, which was launched last year.

Folkman emphasized that over $7 trillion is currently moving across the globe in currency exchanges, and traditional financial institutions have been heavily taxing these transfers. With World Swap, the company aims to cut these fees significantly, offering a more efficient solution for global money transfers. The platform is poised to directly compete with services provided by banks and legacy money transfer operators.

Expanding into Decentralized Finance

In addition to its remittance platform, World Liberty Financial is expanding its footprint in decentralized finance. The firm recently launched its lending platform, World Liberty Markets, which has already facilitated $320 million in loans. It has also handled more than $200 million in borrowings since its inception just a few weeks ago.

World Liberty Financial’s broader goal is to carve out a significant role in the global payments and remittance ecosystem. This ecosystem is currently dominated by established financial players who charge high fees and have long settlement times. The firm’s stablecoin-based approach offers a potentially more affordable and faster alternative to traditional financial systems.

Ethics Scrutiny Amid Trump Family Ties

World Liberty Financial’s expansion has raised concerns among government ethics experts due to its ties to the Trump family business, the Trump Organization. The company’s activities have reportedly generated substantial revenue from foreign entities, fueling these concerns. The timing of the company’s growth, coupled with Donald Trump’s involvement in U.S. crypto policy, has led to discussions about potential conflicts of interest.

Despite these concerns, the White House has denied any conflicts of interest. The company has not yet disclosed a specific launch date for World Swap or detailed its pricing model. However, the announcement signals the company’s intent to disrupt the global remittance industry and take on incumbent players in the market.

Crypto World

Bitcoin Cash holds near $500 despite broader crypto market slump: check 2026 outlook

- Bitcoin Cash price held near $500 as bulls battled intraday sell-off pressure.

- The altcoin could retest key resistance levels amid Bitcoin’s gains.

- However, Standard Chartered forecasts BTC could drop to $50k, and BCH will likely mirror this.

Bitcoin Cash (BCH) price is demonstrating notable resilience, with bulls holding near the $500 mark as the broader cryptocurrency market downturn hits sentiment.

On February 12, 2026, the BCH price hovered between $496 and $523, down nearly 3% in the past 24 hours but still within range of this crucial level.

Bitcoin Cash price holds $500 amid BTC struggle

The resilience comes as the broader crypto market faces pressure, including from macroeconomic factors.

Sell-off across the sector has seen Bitcoin struggle to reclaim the $70,000 mark, and on Thursday, Standard Chartered analyst Geoff Kendrick highlighted the bank’s forecast for BTC in 2026.

Specifically, Standard Chartered has now slashed its 2026 target to $100,000 per Bitcoin, citing potential further pain before prices recover.

Amid downward pressure, the bank sees bears pushing BTC to support around $50,000.

Kendrick said in a note to clients that Ethereum will also likely drop to $1,400 before rebounding to highs of $4,000 in 2026.

While BCH remains near $500 and has held above the $450 support, this outlook for BTC and ETH suggests the coin could be at risk of further decline.

Negative sentiment will cascade to other Bitcoin-related tokens.

BCH price technical outlook and forecast for 2026

Bitcoin Cash price fell to around $468 on October 10, 2025, and to $454 on Feb. 5, 2026.

The two dates highlight the last two major sell-off events across the crypto market. If prices fall past this support base, a retest of June 2025 lows at $385 could follow.

Before this, Bitcoin Cash had rallied from $268 to $443 between April 9 and May 23.

From a technical perspective, BCH’s weekly chart indicates that the price currently hovers above a key horizontal support level.

The uptick between March and September 2025, and between November 2025 and early January 2026, also put prices above the middle line of a broader parallel channel.

The resistance level of this pattern lies near $700, while support is around $264.

Currently, BCH’s price hovers at the 50-day moving average of $597, which has acted as support since Oct. 10, 2025.

If the price drops below the 50-day SMA, bulls could be in trouble. The weekly RSI sits in the neutral 40-50 zone. However, it is likely to suggest potential bearish acceleration before a rebound.

Meanwhile, the MACD indicator shows strengthening bearish momentum after a bearish crossover in mid-January.

A weekly close above $510 could allow buyers a relief rally towards the channel resistance. However, if prices slip under $425, a revisit of $300-$260 could be next.

Crypto World

Zerebro founder Jeffy Yu has allegedly killed himself again

Jeffy Yu, the Zerebro founder who previously faked his own death before being sued by Burwick Law, has allegedly committed suicide for real.

On February 2, X account “alvennya” claimed that Yu had killed himself, pointing to a recent burial at the Roseville Cemetery, which lists the deceased as “Jeffy Zhenyu Yu” and claims he died on New Year’s Day.

The account also claimed to have police recordings taken from a scanner that contains audio of Roseville police discussing the scene before discovering his suicide.

This was shared along with unsubstantiated screenshots apparently from Roseville police that suggest Yu was suffering a “mental crisis” and was going door to door asking for help while armed.

Another X account, “Scooter,” shared these reports and also claimed that one of their followers visited Yu’s grave and took a photo.

Jeffy Yu staged his death to sell $1.4M in crypto

Yu staged his death last year after launching his own after-death-themed memecoin. He also faked his own obituary and scheduled posts to be released after his apparent death.

A writer for The San Francisco Standard, however, tracked Yu down and discovered him living with his parents in San Francisco.

After his supposed death, analysts spotted Yu selling $1.4 million worth of Zerebro tokens.

Read more: X Creators $1M prize winner exposed as memecoin pump-and-dumper

Given Yu’s history, online users are already skeptical about Alvennya’s claims and are starting to question the account’s credibility.

One user questioned if the police audio was AI-generated, and claims that Yu’s final video was made in San Francisco, not Roseville.

Others have noted that his X account and Telegram were deleted after his “death” and that there are also no local news reports on the apparent suicide.

The Alvennya account is also unusual. Despite being six years old, it’s only made 21 posts, all of which were posted this month and are dedicated to Yu’s suicide.

They’ve also limited the replies to their posts.

Jeffy Yu sued by Burwick Law

Legal firm Burwick Law filed a lawsuit against Yu on February 9, claiming that he misrepresented Zerebro as a legitimate long-term AI infrastructure.

They say that the project’s founders cashed out their Zerebro holdings as onlookers began to realise their lies, and that Yu staged his death to distract from the project’s collapse.

Read more: Zerebro’s ‘dead’ founder Jeffy Yu is still dumping tokens

Because of this, Scooter is now claiming that Burwick Law has somehow sued a dead man.

Scooter was named a defendant in another Burwick lawsuit against Pump Fun and Solana, and has since suggested that he would consider filing a counterdefamation claim against the firm.

It’s ultimately unlcear wether or not Yu has died. Protos has reached out to Alvennya, Roseville Police, Roseville Cemetery, and Burwick Law for comment and will update this piece should we hear back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Binance Completes $1B SAFU Fund Shift to Bitcoin

Binance converts $1 billion SAFU fund fully into Bitcoin, buying 4,545 BTC to finish its reserve overhaul.

Binance announced on Thursday that it has finished converting its $1 billion Secure Asset Fund for Users (SAFU) from stablecoins into Bitcoin, purchasing a final tranche of 4,545 BTC and bringing total holdings to 15,000 BTC.

The exchange’s decision to shift its emergency insurance reserve into BTC rather than a dollar-pegged asset reversed its position from April 2024 and placed roughly $1 billion of user protection funds directly into the cryptocurrency with the largest market cap.

Conversion Completed Within 30-Day Window

Binance executed the rebalancing in several separate purchases between February 2 and February 12, according to on-chain data monitored by Lookonchain. The final transaction of 4,545 BTC, valued at $304.5 million, brought the total worth of the holding to just over $1 billion based on Bitcoin’s current price around $67,000.

The exchange first announced the conversion plan on January 30, saying the process would conclude within 30 days. However, the completion fell nearly halfway through that window, with the SAFU wallet address, which Binance made public, now holding 15,000 BTC.

The Secure Asset Fund for Users was created in 2018 as an insurance pool to cover user losses in extreme events such as exchange hacks. In April 2024, Binance converted the fund entirely into USDC, describing the move at the time as a stability measure. The completion now marks a full reversal of that approach.

Binance said it views Bitcoin as “the premier long-term reserve asset” and framed the decision as aligning SAFU with that position. The firm also stated it will rebalance the fund if its value falls below $800 million due to price declines.

Market Context

Back when the move was announced, it drew immediate comment from market observers, with crypto commentator Garrett describing the conversion on X as “a direct capital injection into the market” and “what responsible builders do.”

You may also like:

The announcement arrived as CryptoQuant data showed Binance accounted for roughly 41% of spot trading volume among the top 10 exchanges in 2025. The exchange also maintains similarly high shares in Bitcoin perpetual futures and stablecoin reserves.

Meanwhile, at the market, the OG cryptocurrency was trading around the $67,300 level at the time of this writing, up slightly by about 0.5% in the last 24 hours, but in the red over seven days after suffering a nearly 5% dip per CoinGecko data.

The situation is the same across longer timeframes, with BTC shedding just under 24% of its value over the past fortnight and nearly 30% in the last month to keep its price more than 46% below its all-time high above $126,000 reached in October 2025.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Key Senate Democrat wants U.S. crypto bill to move, and SEC chief reveals danger of defeat

One way or another, the U.S. crypto industry is likely to receive official policy that defines which digital assets get what treatment from which federal agencies. The problem: It might not last.

Securities and Exchange Commission Chairman Paul Atkins is focused on reversing the “head in the sand” approach he accuses his predecessors of having on crypto policy, and he’s ready to issue rules that give the industry the regulatory clarity it craves. The catch, though, is that such rules won’t be locked down and can be erased by the same kind of commission vote that puts them in place. They won’t be backed by a targeted law that makes them unassailable by future administrations.

“We need a firm grounding in statute so we can’t have any backsliding in the future,” Atkins told the Senate Banking Committee in Thursday testimony. No matter how enthusiastic he is in giving the industry innovation-friendly rules, they’re not “future-proof.”

But the legislation in the U.S. Senate that would govern such things is floundering. Crypto executives and bankers haven’t been able to reach a compromise on one of the sticking points in stablecoin rewards programs. And Democratic lawmakers haven’t been offered answers to a number of their core concerns, including the full staffing of regulatory commissions and the danger of conflicts of interest when senior government officials have deep business ties to crypto (most obviously, in their view, President Donald Trump).

Senator Mark Warner, one of the leading Democratic negotiators on the Digital Asset Market Clarity Act, which still needs a hearing in the banking panel, said there’s still a big, bipartisan group working hard on the bill.

“We want to get this done,” he said, signalling that Democrats haven’t yet abandoned the talks. “It’s got to be done safely.”

His primary concern is decentralized finance (DeFi) and preventing bad actors from using it for illicit purposes. Warner’s views on this have, at times, shaken the industry and been seen as a threat to the future existence of DeFi projects. But the latest talks over the bill’s treatment of illicit finance haven’t yet settled on an approach.

“We’ve got to make sure that we don’t set up a regime that allows bad actors or carves out enforcement,” Warner said.

A Republican lawmaker, Senator Bernie Moreno, commiserated with the SEC chairman, saying, “Congress has failed miserably to give you laws.”

Atkins reiterated that his agency has “pretty broad authority” to write rules now that put crypto businesses on a clear regulatory foundation, as he’s been trying to execute with his “Project Crypto” agenda. But, he said, the rules would need to have legislation “undergird” them.

“We do need, I believe, a good law coming out of Congress,” Atkins said.

Read More: The big U.S. crypto bill is on the move. Here is what it means for everyday users

So far, a similar version of the Clarity Act already passed the House of Representatives last year. And just last month, another version cleared the Senate Agriculture Committee in a party-line vote. However, when it comes time for the full Senate to vote on a final market structure bill, the industry will need at least seven Democrats like Warner on board — and potentially more, if the Republicans aren’t unanimous.

While Senate Banking Committee Chairman Tim Scott sounded a hopeful note on Thursday about the Clarity Act, even industry leaders such as Coinbase CEO Brian Armstrong have shown a willingness to pull support if the policy doesn’t look right. And Treasury Secretary Scott Bessent called out crypto-industry “nihilists” who are ready to stand in the way, saying they should move to El Salvador if they don’t want vigorous regulation.

The girding that Atkins needs for the SEC’s pending rules remains uncertain, though the White House has directed negotiators to find common ground before the month is out. The clock is ticking, as House Financial Services Committee Chairman French Hill put it.

Read More: SEC’s Paul Atkins grilled on crypto enforcement pull-back, including with Justin Sun, Tron

Crypto World

Ethereum Price Struggles Below $2,000 Despite Entering Buy Zone

Ethereum price remains under pressure after a sharp decline that unsettled investors across the crypto market.

Although Ethereum appears to be entering a historically favorable accumulation zone, on-chain indicators reveal mixed conviction among different holder cohorts.

Sponsored

Sponsored

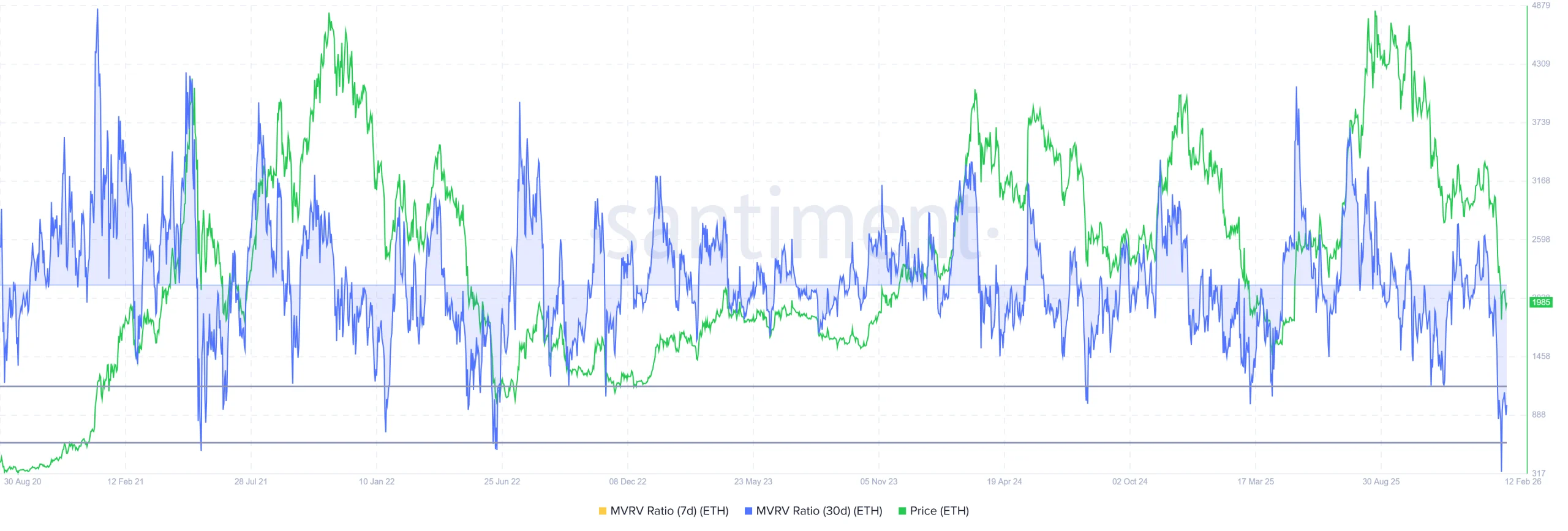

Ethereum Is In a Prime Accumulation Range

Ethereum’s Market Value to Realized Value, or MVRV, ratio indicates that ETH has entered what analysts describe as an “opportunity zone.” This range lies between negative 18% and negative 28%. Historically, when MVRV falls into this band, selling pressure approaches exhaustion.

Previous entries into this zone often preceded price reversals. Investors typically accumulate when unrealized losses deepen. Such behavior can stabilize the Ethereum price and initiate recovery phases. However, historical probability does not guarantee immediate upside.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Current macro conditions complicate the outlook. Liquidity constraints and cautious sentiment may delay accumulation. While MVRV suggests undervaluation relative to realized cost basis, broader market weakness could suppress momentum and extend consolidation before any meaningful rebound begins.

Ethereum Holders Are Leaning Differently

Short-term holders are regaining influence over Ethereum price action. The MVRV Long/Short Difference measures profitability between long-term and short-term holders. Deeply negative readings signal greater profitability among short-term holders compared to long-term investors.

Sponsored

Sponsored

Toward the end of January, the metric suggested profitability was shifting away from short-term traders. That trend hinted at an improving structure. However, the recent decline reversed that dynamic, restoring short-term holder profits. These investors typically sell quickly, increasing vulnerability to renewed downside pressure.

The HODLer net position change metric reveals another shift. Long-term holders previously exhibited steady accumulation. In recent days, the buying pressure has transitioned into distribution, reflecting reduced confidence among strategic investors.

Long-term holder selling adds structural risk. These participants often provide foundational support during downturns. Without renewed accumulation from this cohort, the Ethereum price may struggle to absorb supply. Current data shows limited evidence of strong counterbalancing demand.

ETH Price May Look At Consolidation

Ethereum price trades at $1,983 and remains above the $1,811 support level. Despite this stability, the altcoin recently marked a nine-month low at $1,743. Maintaining $1,811 is critical to prevent deeper technical deterioration.

Given ongoing selling from both short-term and long-term holders, recovery may face resistance near $2,238. Continued weakness could keep ETH trading closer to support rather than challenging overhead barriers. A confirmed breakdown below $1,811 may expose Ethereum to $1,571.

Alternatively, reduced selling from short-term holders could ease pressure. If long-term holders resume accumulation, Ethereum may attempt a stronger rebound. A decisive move above $2,238, followed by a rally past $2,509, would invalidate the bearish thesis and improve the medium-term outlook.

Crypto World

What is Zero Knowledge Proof (ZKP)? A $100M Self-Funded Layer-1 Powering Private AI and Driving Massive Growth

In recent years, millions of traders and crypto users have experienced what it feels like when personal data gets exposed. Exchange leaks, identity verification breaches, wallet tracking, and analytics tools have made privacy a growing concern in digital finance. Many blockchain networks record everything publicly, making transactions transparent but not always private. For users who value security, that model no longer feels enough.

This is where Zero Knowledge Proof (ZKP) enters the conversation. ZKP is a Layer-1 blockchain built around one clear principle: prove computation is correct without revealing the underlying data. Instead of exposing sensitive information, it validates results while protecting privacy. In a market where trust is often tested, Zero Knowledge Proof (ZKP) is gaining attention as the top crypto to buy today for those seeking a more secure blockchain foundation.

What is Zero Knowledge Proof (ZKP)?

Zero Knowledge Proof (ZKP) is a Layer-1 blockchain built to validate computation without revealing the underlying data. In simple terms, the network allows a result to be proven correct while keeping sensitive inputs private. This approach is central to zero-knowledge cryptography and is the foundation of the entire ZKP ecosystem.

The project was developed with a strong commitment to readiness. Before launching its presale, the team invested $100 million of self-funded capital into building the blockchain architecture, proof systems, and supporting infrastructure. This build-first model reduces risk and signals long-term focus.

Core features include:

- A privacy-focused Layer-1 blockchain

- Zero-knowledge validation of computation

- Architecture designed for secure AI workloads

- Integration with real hardware through Proof Pods

For newcomers exploring options in today’s market, ZKP stands apart because it already operates with infrastructure in place. This foundation strengthens its case as the top crypto buy today, especially for those looking beyond early hype and into practical execution.

Live Presale Auction: Stage 2 Momentum Builds

Zero Knowledge Proof (ZKP) is currently in a structured crypto presale auction that distributes coins in progressive stages. The presale has already raised $1.85 million, showing early traction. At present, Stage 2 is closing in 6 days, marking a critical point in the auction cycle.

Market observers and analysts have noted the pace of participation. Some experts project that if momentum continues, the ZKP presale auction could reach $1.7 billion, highlighting expectations around the project’s scale.

Below is the current auction snapshot:

| Category | Details |

| Current Stage | STAGE 2 : ROUND 4 |

| Total Raised | $1.85M |

| Yesterday’s Closing Price | $0.00007 USD |

| Auction Day | 77 / 450 |

The auction model allows price discovery across stages rather than through a fixed-price sale. This structured progression creates measurable entry points and encourages sustained participation. For those searching for the top crypto buy today, the combination of raised capital, staged structure, and projected growth gives ZKP a strong position within the current presale market.

Proof Pods: A Working Product Backed by $17M

Proof Pods represent the tangible layer of the Zero Knowledge Proof (ZKP) ecosystem. These physical devices are designed to generate verifiable computation for the network. Instead of relying solely on digital staking models, ZKP connects blockchain incentives to measurable hardware performance.

The project allocated $17 million specifically for Proof Pods creation, covering development, production, and logistics. This investment demonstrates that Proof Pods are not conceptual but operational components of the network’s design.

Key benefits of Proof Pods include:

- Real hardware participation in blockchain validation

- Generation of cryptographic proofs

- Decentralized distribution of computing power

- Accessibility for non-technical users

Proof Pods strengthen decentralization while tying network rewards to real activity. For presale participants, this working product provides tangible backing to the blockchain’s function.

When evaluating the top crypto buy today, projects with operational hardware and capital commitment often stand out. ZKP’s integration of Proof Pods shows that it is building a functioning ecosystem rather than relying purely on token demand.

Final Say

Zero Knowledge Proof (ZKP) combines three critical elements rarely seen together in early-stage blockchain projects: a fully developed Layer-1 architecture, a structured live presale auction, and a working hardware product in Proof Pods. With a $100 million self-funded development, $17 million allocated to hardware, and a presale that has already raised $1.85 million, ZKP demonstrates preparation and execution before scaling further.

As Stage 2 closes in 6 days and experts project the presale could reach $1.7 billion, the project continues to build measurable momentum. The staged auction structure provides transparency, while Proof Pods anchor the network in real-world computation.

For newcomers seeking the top crypto buy today, Zero Knowledge Proof (ZKP) presents a strong combination of privacy technology, financial commitment, and live participation mechanics. Rather than promising future development, ZKP enters the market with infrastructure already built and an ecosystem actively expanding.

Explore ZKP:

Website: https://zkp.com/

Buy: https://buy.zkp.com

Telegram: https://t.me/ZKPofficial

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor

Retail traders are dumping Bitcoin in panic mode right now. Fear is everywhere. The Fear and Greed Index is stuck at 12. That is extreme.

However, perpetual futures volume is actually spiking. That kind of divergence does not show up for no reason.

The market has wiped out nearly $800 billion in a month. Brutal. But the real question is this. Is smart money quietly positioning before the next major move.

Because when fear is loud and volume rises at the same time, something is about to break.

Key Takeaways

- JPMorgan maintains a bullish 2026 outlook despite the total market cap falling from $3.1T to $2.3T.

- The Crypto Fear & Greed Index is pinned at 12 (“Extreme Fear”), levels historically associated with bottom formation.

- Bitcoin is trading at $67,610, significantly below its estimated production cost of $77,000.

- Whale activity in perpetual markets suggests complex institutional hedging is dominant over spot selling.

Is This Institutional Hedging or Strategic Accumulation?

So let’s pause for a second.

Who is buying when the market feels this terrified? Bitcoin price is around $67,610 and Ether near $1,950, both down heavily this month.

Spot charts look rough and retail is clearly panicking. Yet, Perpetual futures volume is climbing fast, which usually signals sophisticated players stepping in with structured positions, not emotional longs.

This isn’t what speculative euphoria looks like. When retail piles in, funding spikes positive. Instead, BTC funding is nearly flat and ETH funding is negative.

There are only two real explanations here: institutional hedging… or strategic positioning ahead of a larger move.

Will Bitcoin Price $50K Floor Hold?

The charts look terrible right now, no doubt about it. However, fundamentals wise it might leaning bullish good long term.

JPMorgan estimates Bitcoin’s production cost sits around $77,000. BTC is trading well below that.

Historically, when price drops under production cost, it does not stay there long. Miners either shut off machines or pressure builds for a rebound.

Still, the downside risk is not gone. Chief equity strategist John Blank warned Bitcoin could slide to $40,000 within 6 to 8 months.

That would be a full blown capitulation scenario. All Traders are now locked on $60,000 as the key support to watchout for.

The post The Market Is Terrified, Institutions Aren’t. Analyzing the ‘Extreme Fear’ Floor appeared first on Cryptonews.

Crypto World

Stacks price retests $0.28: can STX go higher?

- Stacks price surged by 5% to test resistance near $0.28.

- Gains follow Bitcoin’s uptick to $67,500.

- STX could still dip to recent lows if the Bitcoin price falls to new lows.

Stacks’ STX token edged higher on the day as Bitcoin held above the $67,500 level following a roughly 2% intraday move.

Despite the modest gain, the Bitcoin layer-2 network’s native token continues to trade in volatile conditions, reflecting uncertainty across the broader cryptocurrency market.

A sustained pickup in momentum could lift STX toward levels last seen in May 2025.

However, ongoing market turbulence and expectations of further downside risk for Bitcoin suggest Stacks may remain under pressure.

Analysts point to $0.24 as a key support level that bulls will need to defend to prevent a deeper pullback.

Stacks price today

STX posted modest daily gains on February 12, 2026, trading around $0.27 at the time of writing with a 5% uptick.

But buyers are hovering at these levels after hitting resistance around $.028, a level reached after STX recovered from Feb.5, 2026, lows of $0.22.

Despite weekly losses having moderated to 2%, Stacks remains more than 32% down in the monthly time frame.

Meanwhile, gains on the day have also come amid reduced buyer interest, with daily trading volume down 6% to $13.2 million.

Notably, prices remain within the range that offers support at $0.24, with bulls revisiting the level on three occasions year-to-date.

Stacks price prediction

Stacks is among the top Bitcoin DeFi protocols looking to leverage a layer-2 network to enable smart contracts and yield opportunities directly on Bitcoin’s security.

The project has gained traction as the digital asset investment space broadens.

One of its landmark moves is the recent integration with Fireblocks, which could potentially expose over 2,400 institutional clients to STX for native Bitcoin DeFi participation.

“Bitcoiners want to earn yield without sacrificing security. They want their yield to be denominated in Bitcoin and ideally, with as few additional trust assumptions as possible,” the firms stated in their announcement.

Clients will be able to tap into Bitcoin-denominated rewards, BTC-yielding vaults, and BTC-backed loans.

This institutional gateway could significantly boost STX adoption, especially if Bitcoin prices spike.

Bulls could eye the $0.56-$0.60 range or higher, with the altcoin having reached highs of $1.05 in May 2025.

The technical picture supports this short-term outlook and targets.

On the daily chart, the Relative Strength Index (RSI) hovers at 34, but signals bullish divergence.

Charts also show the Moving Average Convergence Divergence (MACD) indicator pointing to a bullish crossover.

If Bitcoin faces intensified selling pressure, Stacks’ upside potential could suffer.

In this case, STX may find support in the $0.23-$0.20 area.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports18 hours ago

Sports18 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World19 hours ago

Crypto World19 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video15 hours ago

Video15 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat3 days ago

NewsBeat3 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’