Crypto World

Bitcoin Cash holds near $500 despite broader crypto market slump: check 2026 outlook

- Bitcoin Cash price held near $500 as bulls battled intraday sell-off pressure.

- The altcoin could retest key resistance levels amid Bitcoin’s gains.

- However, Standard Chartered forecasts BTC could drop to $50k, and BCH will likely mirror this.

Bitcoin Cash (BCH) price is demonstrating notable resilience, with bulls holding near the $500 mark as the broader cryptocurrency market downturn hits sentiment.

On February 12, 2026, the BCH price hovered between $496 and $523, down nearly 3% in the past 24 hours but still within range of this crucial level.

Bitcoin Cash price holds $500 amid BTC struggle

The resilience comes as the broader crypto market faces pressure, including from macroeconomic factors.

Sell-off across the sector has seen Bitcoin struggle to reclaim the $70,000 mark, and on Thursday, Standard Chartered analyst Geoff Kendrick highlighted the bank’s forecast for BTC in 2026.

Specifically, Standard Chartered has now slashed its 2026 target to $100,000 per Bitcoin, citing potential further pain before prices recover.

Amid downward pressure, the bank sees bears pushing BTC to support around $50,000.

Kendrick said in a note to clients that Ethereum will also likely drop to $1,400 before rebounding to highs of $4,000 in 2026.

While BCH remains near $500 and has held above the $450 support, this outlook for BTC and ETH suggests the coin could be at risk of further decline.

Negative sentiment will cascade to other Bitcoin-related tokens.

BCH price technical outlook and forecast for 2026

Bitcoin Cash price fell to around $468 on October 10, 2025, and to $454 on Feb. 5, 2026.

The two dates highlight the last two major sell-off events across the crypto market. If prices fall past this support base, a retest of June 2025 lows at $385 could follow.

Before this, Bitcoin Cash had rallied from $268 to $443 between April 9 and May 23.

From a technical perspective, BCH’s weekly chart indicates that the price currently hovers above a key horizontal support level.

The uptick between March and September 2025, and between November 2025 and early January 2026, also put prices above the middle line of a broader parallel channel.

The resistance level of this pattern lies near $700, while support is around $264.

Currently, BCH’s price hovers at the 50-day moving average of $597, which has acted as support since Oct. 10, 2025.

If the price drops below the 50-day SMA, bulls could be in trouble. The weekly RSI sits in the neutral 40-50 zone. However, it is likely to suggest potential bearish acceleration before a rebound.

Meanwhile, the MACD indicator shows strengthening bearish momentum after a bearish crossover in mid-January.

A weekly close above $510 could allow buyers a relief rally towards the channel resistance. However, if prices slip under $425, a revisit of $300-$260 could be next.

Crypto World

Espresso Token Launches at $275 Million Valuation

Launchpad buyers are down 30% with a 2-year vesting period ahead of them.

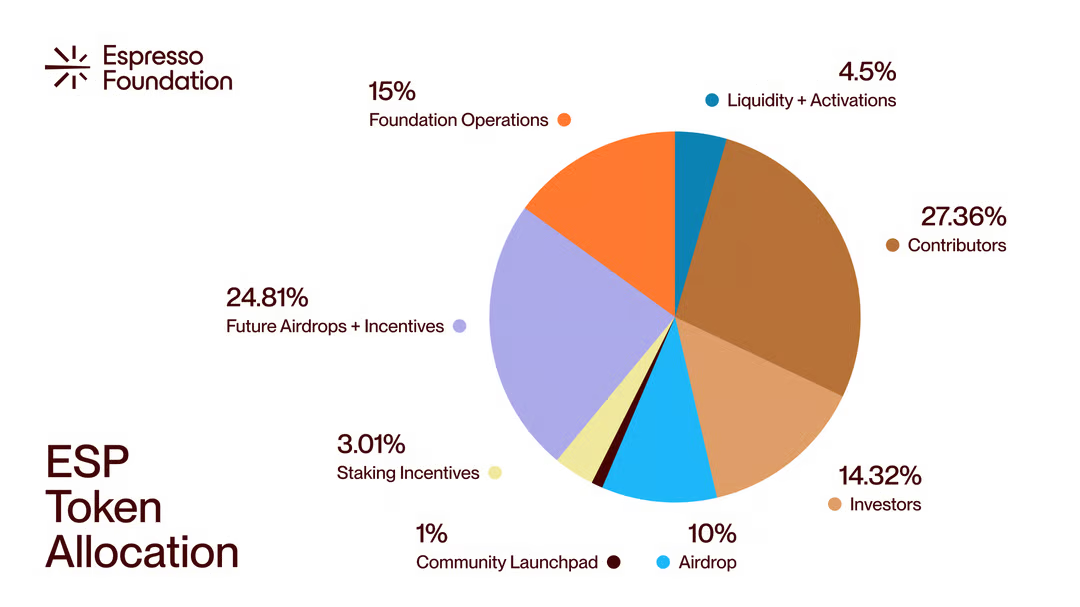

Espresso, a decentralized rollup base layer, launched its native ESP token this morning at a valuation of roughly $275 million following its token airdrop and distribution.

The token debuted at $0.072 before jumping up to $0.083 shortly after its launch and has reported $115 million in trading volume over its first 7 hours across CoinGecko-tracked platforms.

The protocol is designed to support rollups and appchains with everything they need from a base layer to ensure high performance, including finality, data availability, and real-time interoperability.

Today’s ESP token launch enables the network to transition to proof-of-stake, and the protocol has distributed 10% of the token supply in an airdrop to more than one million eligible addresses.

There was also a Kaito Launchpad sale in July 2025, which sold 1% of the supply at a $400 million valuation, leaving launchpad investors with a 31% loss at current prices.

The ESP token is the latest in a line of ICOs and token sales that are opening underwater, with Infinex and Aztec being two other recent examples.

Crypto World

Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

Coinbase (COIN) missed fourth-quarter earnings forecasts on Thursday, thanks to weaker trading activity and lower crypto asset prices.

The U.S.-based crypto exchange posted total revenue of $1.78 billion against estimates for $1.83 billion. Adjusted EPS of $0.66 was well lower than the consensus $0.86.

Total transaction revenue of $983 million was below forecasts for $1.02 billion and down from $1.046 billion in the third quarter and $1.556 billion in the fourth quarter one year ago.

Subscription revenue of $727.4 million was down from $746.7 million the previous quarter and up from $641.1 million a year earlier.

Through Feb. 10 of the first quarter, the company saw transaction revenue of about $420 million. It guided to full-quarter subscription revenue of $550-$630 million.

“We continue to be optimistic about the long-term trajectory of the crypto industry,” Coinbase said. “Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems. While asset prices can be volatile, under the surface an undercurrent of technological change and crypto product adoption continues.”

Shares are modestly higher in after-hours trading, but fell 7.9% during the regular session, extending year-to-date declines to 40%.

Crypto World

Vitalik Buterin Advocates for Decentralized Reform in Russia’s Governance

TLDR

- Vitalik Buterin condemned Russia’s invasion of Ukraine, calling it criminal aggression and not a situation of equal fault.

- He argued that lasting peace in Ukraine and Europe can only be achieved through internal change within Russia.

- Buterin proposed that decentralized governance could be the key to reforming Russia’s political system.

- He highlighted tools like quadratic voting and zero-knowledge systems as potential solutions for improving decision-making.

- Buterin emphasized the importance of involving more people in governance through platforms like pol.is to find societal compromises.

Vitalik Buterin, co-founder of Ethereum, shared his views on Russia’s future in a post published on February 12. In the post, originally written in Russian, Buterin called Russia’s invasion of Ukraine “criminal aggression.” He emphasized the need for structural reform within Russia to achieve long-term peace and security, advocating for a decentralized governance model.

Buterin Criticizes Russia’s War and Calls for Internal Change

In his recent post, Vitalik Buterin condemned Russia’s invasion of Ukraine, labeling it as “criminal aggression.” He strongly rejected the idea that both sides are equally at fault, which some have argued. Buterin clarified that peace in Europe and Ukraine could not be achieved through a simple ceasefire alone.

He suggested that the best path to stability in the region involves internal change within Russia itself. For Russia to secure lasting peace, Buterin proposed significant structural reforms. These reforms, according to him, should focus on decentralizing governance, moving away from centralized power.

Vitalik Buterin Advocates for Decentralized Governance

Vitalik Buterin emphasized the potential of decentralized governance to transform Russia. He mentioned specific tools that could help in building a new system, such as quadratic voting and zero-knowledge (ZK) systems. These tools, Buterin argued, could allow large groups of people to find common ground without relying on a small elite.

The Ethereum co-founder believes that decentralized governance could be key to building a more transparent and fair system. In his post, he also referenced platforms like pol.is, which allow for broader participation in decision-making. These digital tools, Buterin suggested, could provide a way for citizens to directly engage with governance.

New Leadership and Ideas for Russia’s Future

Buterin also discussed the importance of new leadership in Russia, highlighting the need for fresh ideas. He stressed that the Russian opposition should focus on involving more people in decision-making. This approach would help avoid the concentration of power in the hands of a few.

He pointed out that using platforms for online voting and discussions could allow people to reach societal compromises. These compromises could then be turned into official policies without the need for intermediaries. According to Buterin, achieving consensus in this manner is crucial for Russia’s long-term stability.

Crypto World

ETHZilla Launches Tokenized Jet Engine Leases Amid Ethereum Decline

TLDR

- ETHZilla has launched a tokenized investment opportunity in leased jet engines through its subsidiary ETHZilla Aerospace.

- The company acquired two CFM56 commercial jet engines worth $12.2 million and is offering equity in these assets via the Eurus Aero Token I.

- The tokens, available to accredited investors, are priced at $100 each, with a minimum investment of 10 tokens.

- ETHZilla aims to provide a targeted return of 11% for token holders if they hold through the lease term, ending in 2028.

- Cash flows from the leased engines will be distributed monthly to token holders via blockchain technology.

ETHZilla has expanded its operations into the tokenization sector, launching a new project focused on jet engine leases. The company, through its new subsidiary ETHZilla Aerospace, is offering tokenized equity in jet engines it recently acquired. This move comes as ETHZilla seeks to diversify its investments amid Ethereum prices continuing to decline.

ETHZilla Introduces Tokenized Engine Leases on Arbitrum

ETHZilla’s new venture centers around tokenizing a $12.2 million investment in two leased CFM56 commercial jet engines. These engines are leased to a major U.S. airline, though the company has not disclosed the airline’s identity due to confidentiality concerns. By launching the Eurus Aero Token I on the Arbitrum layer-2 network, ETHZilla offers tokenized equity in the engines, allowing investors to participate in this emerging market.

ETHZilla CEO McAndrew Rudisill commented on the project, stating, “Offering a token backed by engines leased to one of the largest and most profitable U.S. airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows.” The company believes that this move will help modernize fractional ownership of aviation assets, a market traditionally dominated by institutional investors and private equity firms.

Token Sale Details and Project Goals

The Eurus Aero Token I, available to accredited investors, will be sold through Liquidity.io’s token marketplace. Each token is priced at $100, with a minimum investment of $1,000, or 10 tokens. The project aims to offer a return of approximately 11% if token holders hold until the lease agreements conclude in 2028. However, a disclaimer notes that actual returns could differ based on various factors.

Cash flows from the leased engines will be distributed monthly to token holders through the blockchain. ETHZilla has structured the tokens with collateral consisting of the engines, related lease receivables, insurance proceeds, and other reserves. The company’s tokenization model ensures transparency and on-chain distribution, making it accessible to a broader group of investors.

ETHZilla’s expansion into tokenized aviation assets is part of a broader effort to pivot from its Ethereum holdings. The firm recently revealed a $250 million share buyback program, following a drop in the company’s market cap. ETHZilla’s share price has seen fluctuations, including a significant drop in recent months.

Crypto World

BitGo Expands Custody, Staking Partnership With 21Shares

BitGo Holdings and 21Shares said Thursday they have expanded their existing partnership to include custody and staking services supporting 21Shares’ crypto exchange-traded products (ETPs) for investors in the United States and Europe.

Under the agreement, BitGo will deliver qualified custody, trading and execution services and integrated staking infrastructure for 21Shares’ US exchange-traded funds and global ETPs. The arrangement also provides 21Shares with access to liquidity across electronic and over-the-counter markets, according to the announcement.

BitGo said the services will be delivered through its regulated entities in the US and Europe, including its federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and its MiCA-licensed operations authorized by Germany’s Federal Financial Supervisory Authority.

21Shares, a subsidiary of FalconX, is one of the largest crypto ETF issuers globally, with 59 exchange-traded products listed across 13 exchanges and more than $5.4 billion in assets under management as of Feb. 11, according to its website.

The move comes less than a month after BitGo, a digital asset infrastructure company based in Palo Alto, California, began trading on the New York Stock Exchange under the ticker BTGO.

Related: BitGo’s IPO pop turns volatile as shares slip below offer price

Staking moves deeper into regulated products

In recent months, institutional custody platforms have increasingly embedded staking services into their core offerings as investor demand grows for yield-generating crypto infrastructure.

In October, Coinbase expanded its integration with staking infrastructure provider Figment, allowing Coinbase Prime and Coinbase Custody clients to stake Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) directly from Coinbase custody.

About a month later, Anchorage Digital partnered with Figment to add staking for Hyperliquid (HYPE), offering the service through Anchorage Digital Bank and its Singapore entity, with access also available via its Porto self-custody wallet.

On Feb. 9, Ripple said it expanded its institutional custody platform through integrations with Securosys and Figment, adding hardware security module support that allows banks and custodians to offer crypto custody and staking services without running their own validator or key management infrastructure.

There has also been growing institutional interest in liquid staking, which allows investors to earn proof-of-stake rewards while receiving a tradable token that keeps their underlying assets liquid.

On Tuesday, Hong Kong-based custodian Hex Trust announced it has partnered with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping their SOL liquid and eligible for use as collateral in borrowing and lending through its markets platform.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Fiserv Launches US Dollar Settlement Platform for Digital Asset Companies

Fiserv, a major US payments and financial technology provider, has launched a new cash settlement platform for digital asset companies, a move that could strengthen fiat infrastructure for crypto players and improve access to liquidity.

On Thursday, Fiserv announced the debut of INDX, a real-time cash settlement system that operates 24 hours a day, 365 days a year. The platform allows digital asset companies to move US dollars instantly using a single custodial account, potentially improving how exchanges, trading desks and other crypto businesses manage fiat balances.

INDX will be made available to more than 1,100 insured financial institutions participating in the Fiserv Deposit Network. The account structure provides up to $25 million in Federal Deposit Insurance Corporation (FDIC) coverage, according to the company.

The launch is notable because many digital asset companies still rely on traditional banking rails that operate only during business hours or on onchain token transfers to move dollar value. By enabling round-the-clock US dollar settlement within the banking system, INDX offers functionality similar to blockchain-based settlement while remaining offchain.

Fiserv is one of the largest payments and financial services technology providers globally, offering core banking, merchant acquiring and transaction processing services. The company generated more than $21 billion in revenue in fiscal 2025.

Fiserv has also expanded its footprint in digital assets. As Cointelegraph reported in October, the company is involved in North Dakota’s state-backed stablecoin initiative, where it is providing payments and settlement infrastructure to support the project’s rollout.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

TradFi and digital assets continue to converge

INDX is the latest example of an established financial institution building infrastructure for the digital asset sector. For institutional clients, the platform offers a more familiar banking framework while introducing faster, always-on cash management capabilities.

The system could also position Fiserv ahead of legacy banking partners that still depend on batch-based processing for US dollar transfers. For crypto infrastructure providers, including exchanges, trading desks, stablecoin issuers and custodians, reliable, real-time dollar liquidity can provide a meaningful operational advantage.

The Milwaukee, Wisconsin company in December completed the acquisition of Stone Castle Cash Management, which provides banks liquidity, in a move widely seen as bolstering its FIUSD stablecoin, launched in June 2025

Beyond settlement speed, stablecoins are increasingly being viewed by traditional financial institutions as liquidity infrastructure. Always-on digital dollars can facilitate collateral movement, treasury operations and cross-border payments with fewer intermediaries and less settlement friction.

While INDX stands out for combining traditional bank settlement with continuous-dollar availability tailored to digital-asset companies, other companies have also prioritized real-time settlement.

For example, Sygnum operates a round-the-clock multi-asset network that enables instant settlement across fiat currencies, stablecoins and other digital assets for institutional clients.

Similarly, Fireblocks supports real-time settlement infrastructure for stablecoins and digital asset transfers, helping institutions streamline liquidity management.

Related: How TradFi banks are advancing new stablecoin models

Crypto World

Russia Plans Return to US Dollar Settlement as Strategic Cooperation Talks Emerge

TLDR:

- Russia and US combined oil production could reach 22.6 million barrels daily, reshaping global markets

- Moscow controls 44% of enriched uranium and 43% of palladium, critical for US industrial supply chains

- Russia-China trade hit $245B in 2024, spurring Moscow to diversify away from yuan-heavy dependence

- Russian reserves climbed to record $833B with over $400B in gold, providing negotiation leverage

Russia is reportedly planning to shift back toward US dollar settlement systems while exploring cooperation with the United States across multiple strategic sectors.

The discussions encompass fossil fuels, natural gas, offshore oil drilling, and critical raw materials. This development marks a potential reversal of Moscow’s decade-long effort to reduce dollar exposure.

The move could reshape global commodity markets and currency dynamics while altering geopolitical alliances between major powers.

Energy Cooperation Could Reshape Global Markets

According to analyst Bull Theory, shared on social media platform X, the cooperation framework would combine significant production capacity from both nations.

The United States currently produces 13.5 million barrels per day of oil, representing the highest output in American history.

Russia maintains production at 9.1 million barrels daily despite ongoing international sanctions. Combined influence over global oil supply would immediately shift pricing power and export leverage across international markets.

Natural gas represents another critical component of the potential partnership. Russia controls some of the world’s largest gas reserves, though many liquefied natural gas and pipeline projects remained frozen after the implementation.

Reopening investment channels and joint development initiatives would reintroduce substantial supply into global markets. This shift would directly affect European energy pricing and long-term gas market dynamics.

The timing carries particular weight given the current global energy transitions. Western nations have sought alternative suppliers since 2022, creating market volatility and price fluctuations.

Russian re-entry into Western-aligned energy frameworks could stabilize certain markets while disrupting others. Energy analysts note that infrastructure investments would require years to fully materialize.

Corporate participation represents a significant financial dimension. Western companies absorbed approximately $110 billion in losses when exiting Russian operations.

Re-entry opportunities in energy fields, gas infrastructure, mining projects, and Arctic drilling zones could enable American firms to resume resource extraction activities. This corporate angle extends beyond immediate profits to long-term strategic positioning.

Critical Minerals and Currency Realignment Take Center Stage

Russia controls substantial portions of strategic resources essential to modern manufacturing. The nation holds 44 percent of enriched uranium, 43 percent of palladium, 40 percent of industrial diamonds, 25 percent of titanium, and 20 percent of vanadium globally.

These materials form core components in semiconductors, defense systems, electric vehicle production, nuclear energy, and aerospace manufacturing. Partnership in this sector addresses American supply chain vulnerabilities while reducing Chinese dependency.

Moscow spent recent years building alternatives to Western settlement systems and reducing dollar reserves. Russia-China bilateral trade reached $245 billion by 2024, creating structural dependence on yuan liquidity and Chinese imports.

However, this pivot concentrated financial risk in Beijing-oriented frameworks. Reopening dollar settlement channels would diversify Russia’s financial positioning, balancing Eastern and Western exposure while re-anchoring portions of global trade.

Russia’s financial reserves recently climbed to a record $833 billion, with gold holdings exceeding $400 billion. This reserve strength provides Moscow with negotiating leverage for structuring long-term resource agreements.

The financial stability enables Russia to approach discussions from a position beyond immediate economic necessity.

The broader framework encompasses energy cooperation affecting global supply, mineral partnerships reshaping industrial resource access, corporate re-entry unlocking infrastructure projects, and currency realignment pulling Russia partially back into dollar systems.

Geopolitical leverage simultaneously shifts between Washington, Moscow, and Beijing. If finalized, observers suggest this could represent one of the largest structural resets in global economic alignment since Cold War conclusion.

Crypto World

BlackRock Brings $2.1B Tokenized Treasury Fund to Uniswap for DeFi

BlackRock has taken a significant step into the world of decentralized finance (DeFi) by bringing its $2.1 billion tokenized Treasury fund to Uniswap. This move marks the asset management giant’s first formal engagement with DeFi and offers institutions new avenues for on-chain investment. The announcement solidifies BlackRock’s growing interest in digital assets and blockchain technology.

The launch of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will enable institutional clients to trade tokenized securities on the Uniswap decentralized exchange. The fund’s listing represents a broader push to expand institutional access to the growing DeFi space. This venture also includes BlackRock acquiring an undisclosed amount of Uniswap’s governance token, UNI.

The listing will initially be available to a select group of institutional investors and market makers. As a part of the collaboration, Securitize, a tokenization company, facilitated the launch of BUIDL. The cooperation between Securitize and BlackRock strengthens the legitimacy of tokenized assets as viable investment products.

Tokenization Boosts DeFi and Institutional Access

Tokenized assets have seen increasing popularity as they allow real-world assets to be traded on blockchain networks. BlackRock’s foray into DeFi with BUIDL aims to provide institutions with access to tokenized money markets. These assets, backed by US Treasury securities, are designed to offer liquidity, security, and yield to investors.

Securitize CEO Carlos Domingo noted the importance of providing institutions with self-custody tools to trade tokenized real-world assets. He emphasized that this new product gives investors the flexibility to interact with decentralized finance while maintaining traditional investment characteristics. BUIDL is now the largest tokenized money market fund, with over $2.1 billion in total assets across multiple blockchains.

BUIDL is not the only fund seeking to expand access to tokenized money markets. Other major financial institutions like Goldman Sachs and BNY Mellon have entered the tokenization space, signaling wider industry acceptance. BlackRock’s partnership with Uniswap and Securitize further highlights the momentum behind blockchain technology in traditional finance.

Implications of Wall Street’s Adoption of Tokenized Assets

The rise of tokenized assets has been partly driven by the growing adoption of stablecoins and blockchain infrastructure. Financial institutions see tokenization as a way to adapt to shifting market dynamics, especially as stablecoin usage continues to rise. JPMorgan analysts have pointed out that tokenized money market funds could offer a counterbalance to the increasing use of stablecoins in the broader economy.

Tokenization could play a crucial role in mitigating potential liquidity shifts caused by the rapid expansion of stablecoins. According to JPMorgan strategist Teresa Ho, tokenized funds offer investors a way to post money market fund shares as collateral without losing yield. This feature could provide a valuable hedge against the growing dominance of stablecoins.

The regulatory landscape also plays a critical role in shaping the future of tokenized real-world assets. With the GENIUS Act expected to influence the stablecoin market, clearer regulations could encourage further adoption of blockchain technology. Solomon Tesfaye of Aptos Labs believes that stablecoin regulations may accelerate broader adoption of on-chain assets like tokenized money market funds.

Crypto World

21Shares Taps BitGo for Regulated Staking and Custody in US & Europe

BitGo Holdings and 21Shares have broadened their alliance to extend custody and staking services for 21Shares’ U.S. exchange-traded funds and global exchange-traded products. The expanded deal will see BitGo provide qualified custody, trading and execution capabilities, and a unified staking infrastructure for 21Shares’ US-listed ETFs and international ETPs. The press release notes that this arrangement gives 21Shares enhanced access to liquidity across electronic and over-the-counter markets as part of a broader strategy to scale regulated crypto yield solutions for institutional investors. The partnership is anchored in BitGo’s regulated framework in the United States and Europe, leveraging its OCC-regulated federally chartered trust bank and MiCA-licensed European operations. Announcement.

21Shares is a major crypto ETF issuer, with an established footprint across 13 exchanges and 59 listed products, supported by more than $5.4 billion in assets under management as of Feb. 11, according to its public materials. The collaboration follows BitGo’s own foray into the public markets earlier in the year, when the Palo Alto-based infrastructure provider began trading on the New York Stock Exchange under the ticker BTGO.

In recent months, custodial and staking services have become increasingly entwined as institutions seek yield-generating crypto infrastructure within regulated wrappers. The new BitGo–21Shares framework exemplifies this shift, allowing traditional and alternative asset managers to offer staking yields while maintaining compliant custody—an arrangement that can streamline onboarding for large-scale investors who require robust risk controls and auditability. The broader ecosystem has seen a spate of partnerships and integrations aimed at embedding staking deeper into regulated product lines, a trend that has accelerated as more institutions seek regulated exposure to proof-of-stake ecosystems.

Among the notable examples cited in the ecosystem: a Coinbase–Figment collaboration that broadened institutional staking for assets including Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) through Coinbase Custody. Separately, Anchorage Digital partnered with Figment to extend staking for Hyperliquid (HYPE), integrating these services via its banking and custody infrastructure. Ripple has also expanded its institutional custody stack with integrations that add hardware security module support to enable banks and custodians to offer custody and staking without building their own validator or key-management systems.

Beyond staking, the sector is witnessing growing interest in liquid staking—an approach that lets investors earn staking rewards while retaining a tradable token that preserves liquidity. Regulators in certain jurisdictions have signaled tolerance for specific liquid-staking activities, reinforcing the push toward regulated, yield-bearing structures. In another development, Hex Trust announced a collaboration with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping SOL liquid for use as collateral in borrowing and lending through its Markets platform. These moves collectively illustrate how custody providers are layering staking liquidity into regulated product lines to satisfy investor demand for yield without compromising risk controls.

In this evolving landscape, the BitGo–21Shares partnership stands out for its scope and regulatory alignment. By combining BitGo’s OCC-regulated custody framework with MiCA-licensed European operations, the alliance aims to unlock scalable staking and liquidity across major markets for a broad set of products, including US-listed ETFs and international ETPs. The collaboration signals a maturation in the ecosystem, where product issuers can offer regulated staking while maintaining robust custody and market access—an arrangement that may help attract institutions that previously shied away from crypto exposure due to compliance and operational concerns. For readers seeking a deeper dive into the breadth of the collaboration, a related press release details the global ETF-partnership expansion across staking and custody, highlighting the operational pathways BitGo will provide for 21Shares’ product lineup.

Video and media discussions surrounding the partnership can be explored through a related presentation linked to the announcement.

Market participants should watch how the integration affects liquidity profiles and trading costs for 21Shares’ ETF roster, as well as how it influences the pace at which other ETF issuers consider similar custody-and-staking models. The collaboration may also influence how global regulators view regulated staking within ETF wrappers, particularly as MiCA implementations take fuller effect across Europe and as U.S. authorities continue to refine guidelines for crypto custody and staking activities.

Key takeaways

- BitGo will deliver qualified custody, trading and execution services, plus integrated staking infrastructure for 21Shares’ US ETFs and global ETPs.

- The services will be provided through BitGo’s regulated entities in the US and Europe, leveraging an OCC-regulated trust bank and MiCA-licensed operations.

- 21Shares’ product slate includes 59 ETPs listed across 13 exchanges, with more than $5.4 billion in assets under management as of Feb. 11.

- The move aligns with a broader institutional push to embed staking within regulated custody offerings, following similar partnerships and integrations across the sector.

- The deal underscores BitGo’s ongoing expansion into ETF and regulated markets after its BTGO listing on the NYSE earlier this year.

Tickers mentioned: $BTGO, $AVAX, $APT, $SUI, $SOL

Market context: The collaboration arrives amid growing institutional interest in regulated staking and custody-enabled yield strategies, supported by clearer regulatory frameworks in the U.S. and Europe and expanding ETF liquidity across crypto assets.

Why it matters

The partnership between BitGo and 21Shares represents a meaningful step in bringing regulated staking and custody to a broader class of institutional investors. By coupling BitGo’s OCC-chartered custody capabilities with 21Shares’ diversified ETF lineup, the arrangement reduces operational friction for asset managers seeking compliant exposure to proof-of-stake ecosystems. This is particularly relevant as the crypto industry pushes toward scalable yield opportunities within regulated wrappers, a dynamic that could accelerate the adoption of staking across traditional finance channels.

For 21Shares, the deal broadens access to liquidity and trading venues for its US-listed ETFs and global ETPs. As the ETF issuer continues to grow—reporting 59 products and substantial AUM—partnerships like this can help sustain product velocity, improve execution quality, and offer investors more reliable ways to participate in staking rewards without directly managing keys or validator infrastructure.

From a regulatory perspective, the alignment with an OCC-regulated entity in the United States and MiCA-licensed operations in Europe signals a mature model for regulated crypto infrastructure. If these structures gain broader acceptance, more issuers may pursue similar multi-jurisdictional approaches, further integrating staking into mainstream investment products. In a market that remains sensitive to liquidity, risk controls, and operational risk, such collaborations could contribute to steadier capital inflows and more robust market-making activity around crypto ETPs.

What to watch next

- Rollouts of custody and staking services for 21Shares’ entire U.S. ETF lineup and broader international ETPs, with clear launch timelines.

- Regulatory updates from the OCC and updates to MiCA implementations that may affect how staking is offered within ETF wrappers.

- Potential expansion of BitGo–21Shares technology and service integrations to additional product lines or new markets.

- Continued ETF issuance activity by 21Shares and related liquidity improvements across electronic and OTC venues.

Sources & verification

- BitGo and 21Shares Accelerate Global ETF Partnership Across Staking and Custody — Business Wire press release (Feb 12, 2026).

- 21Shares product catalog and assets under management (as of Feb 11) published by 21Shares.

- BitGo IPO coverage and BTGO listing details (Cointelegraph gateway to BitGo stock information).

- FalconX acquisition of 21Shares (context for 21Shares’ corporate structure).

- Ripple expands institutional custody stack with staking and security integrations (industry context for custody-staking trends).

BitGo expands custody and staking for 21Shares across US and Europe

BitGo and 21Shares have formalized an expanded collaboration that integrates custody, trading, and staking services for 21Shares’ US ETFs and global ETPs. The arrangement will see BitGo operate through its regulated US and European entities, including a federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and MiCA-licensed European operations, providing a bridge between traditional custody controls and crypto-native staking yields. The underlying objective is to reduce friction for institutions seeking yield opportunities tied to major proof-of-stake ecosystems while maintaining stringent risk and compliance standards.

Within the scope of the agreement, 21Shares gains access to BitGo’s custody and execution frameworks, coupled with integrated staking infrastructure designed to support its ETF lineup. The collaboration underscores a broader trend in the market: custodians and wallet providers are increasingly embedding staking capabilities into regulated products to satisfy investors’ demand for yield, liquidity, and governance participation without sacrificing institutional-grade controls.

As a backdrop, the ecosystem has seen a series of institutional staking moves—ranging from Coinbase’s partnerships enabling direct staking for select assets, to Anchorage Digital’s collaborations that extend staking through regulated banking channels, and even Ripple’s expansion of its custody platform with security integrations. These developments collectively point to a maturation of the crypto infrastructure market, where regulated custody and staking go hand in hand to deliver scalable, compliant exposure to proof-of-stake networks. In this context, BitGo’s expanded alliance with 21Shares positions both firms to capture a larger slice of the ETF and ETP issuance market and to support a broader wave of institutional adoption.

Market participants will be watching how quickly the rollout unfolds and how liquidity improves across the involved products, particularly in the United States and Europe. The partnership could catalyze further collaborations between custodians and ETF issuers, as regulators continue to refine the boundaries of crypto custody and staking within regulated investment products.

Crypto World

SBET executives urge to look beyond recent price action

As institutional adoption of digital assets matures, a new corporate playbook is emerging: treat ether not just as an investment, but as productive financial infrastructure.

The shift comes amid sharp downward market volatility. SharpLink Gaming (SBET) — which saw its stock soar last May after adopting an ether treasury strategy — has since plunged (along with every other of 2025’s hastily-formed digital asset treasury companies). It’s a reminder of the turbulence that continues to define the asset class.

At a panel discussion at Consensus Hong Kong 2026 featuring Sharplink Chairman Joe Lubin and CEO Joseph Chalom, the two executives outlined how DATs are evolving into a distinct institutional strategy.

“I’ve never seen more of a moment of differentiation where the actual macro tailwinds for Ethereum have never been better in its 10-and-a-half-year history,” said Chalom, pointing to the growth of stablecoins and tokenization. “Listen to Larry Fink at Davos, when he’s telling you $14 trillion of BlackRock assets will be tokenized, and over 65% of that to date is happening on Ethereum.”

While recent ether price action and ETF flows have raised concerns, Chalom framed them as part of broader macro de-risking. “Bitcoin and ether were very easy to de-risk,” he said, adding that rotations out of liquid assets are typical during volatility. “The largest players in institutional finance are telling us out loud — they’re coming to ether.”

SharpLink’s strategy differs, he argued, because it deploys permanent capital. “An ETF is a great passive exposure vehicle, but it needs to provide daily liquidity…We own permanent capital,” he said. “The third stage — which is actually most important — is making your ETH productive.”

Lubin emphasized ether’s distinguishing feature: yield.

“Ether would be a much better asset… because it is a productive asset. It yields. It has a risk-free rate,” he said, referring to staking returns of roughly 3%. SharpLink has staked nearly all its holdings and plans to continue accumulating. “We’ll keep buying ether. We’ll keep staking ether and adding new yield to ether.”

Beyond staking, Chalom described what he called “good institutional DeFi,” using long-term locked capital to earn risk-adjusted returns rather than chasing venture-style upside. “We’re not looking for convex VC 10x outcomes — we’re looking for the best risk-adjusted yield for our investors. And we’re actually confident that by doing it, we’ll improve the DeFi ecosystem by raising its standards.”

For Lubin, the shift resembles the early internet era. “A long time ago…there were internet companies. Now every company is an internet company. Soon, every company is going to be a blockchain company,” he said, predicting firms will increasingly hold tokens on balance sheets and require sophisticated onchain treasury tools.

Read more: Ethereum treasury firm SharpLink stakes $170M ETH on Linea network

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports21 hours ago

Sports21 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World22 hours ago

Crypto World22 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video18 hours ago

Video18 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’