Crypto World

LTC & DOGE Holders Jump Ship to BlockDAG as Its Live Mainnet Beats Ethereum with 5,000 TPS!

The Litecoin price has taken a beating this week, with holders facing significant losses and key support near $50 under the spotlight. A dip below this level could push LTC down to $45, while resistance near $56.4 limits any immediate rebound.

Dogecoin is showing a similar bearish trend, with the latest Dogecoin price prediction pointing to further weakness as it trades below $0.13. Traders are watching the charts closely, trying to gauge whether these popular meme and altcoins can find their footing amid broader market pressure.

But in the middle of all these declines, BlockDAG (BDAG) is moving in a sharp upward pattern! Its Mainnet is now live, handling 5,000 transactions per second, far beyond what Ethereum can deliver. Plus, current buyers are eyeing 200× upside ahead of exchange listings on February 16.

This mix of speed, technology, and ROI potential is attracting serious attention from traders seeking top crypto coins, especially as big names like LTC and DOGE shift into defensive mode.

Litecoin Price Tests Critical $50 Support

Litecoin investors have faced heavy losses recently, with nearly $40 million booked over the weekend. Since the start of the year, LTC has shed about $1.81 billion in market value, leaving holders with an average loss of 40%. The coin is now approaching key support at $50, and a break below that could push the Litecoin price down to $45, its lowest since June 2022.

On the upside, Litecoin faces resistance near $56.4, with the 20-day EMA acting as the next hurdle if buyers step in. Technical indicators like the RSI and Stochastic Oscillator remain in bearish territory, signaling ongoing selling pressure. Traders tracking the litecoin price are closely monitoring these levels, as MVRV readings suggest a rebound may be possible if sentiment improves.

Dogecoin Price Prediction: Is DOGE Headed Lower?

The Dogecoin price prediction is turning bearish, as DOGE is slipping again. It is currently trading around $0.0909, down about 15% in the past week. After failing to stabilize, the coin has broken toward the lower end of its daily range, showing sellers still in control.

Over the past month, DOGE has lost more than a third of its value, and it’s slightly weaker against Bitcoin. This recent drop below the $0.13 Fibonacci extension raises questions for short-term traders.

On the weekly chart, the next key support sits near $0.0208 if current levels fail to hold. On the upside, DOGE faces resistance near $0.168–$0.198, meaning any bounce may be limited.

With the weekly RSI near oversold at 32, some see a buying opportunity, but technical pressure remains. Analysts are keeping a close eye on these zones for shaping the near-term Dogecoin price prediction.

BlockDAG Mainnet Outperforms Ethereum!

BlockDAG’s Mainnet is officially live and is processing an impressive 5,000 transactions per second; that’s 500 times faster than Ethereum! This move comes days ahead of its exchange listings, which are now expected to see even stronger demand as the market sees the network’s capabilities. On top of this, a final allocation is running, offering coins at $0.00025. Compared with the confirmed listing price of $0.05, this points to a potential 200× return.

The TGE is now live, and the Claim button for the free airdrop will be active within the next 24–48 hours. Users will be able to claim their BDAG allocations directly through the BlockDAG dashboard. Claiming is simple: connect the wallet used during the presale, select “Claim BDAG,” and confirm the transaction. No extra verification or forms are required. The claims are executed on-chain, and coins will be sent directly to the connected wallet.

Once claimed, BDAG coins will appear in the wallet and can be transferred, traded, or used according to vesting conditions. Network features and staking rewards will continue to roll out after this. The team has confirmed that staking is available only to BDAG holders, so missing this window means missing out on staking rewards.

This combination of record-breaking speed and the final allocation phase has attracted massive attention from traders tracking top crypto coins. Likewise, analysts suggest that acting now could make a real difference in potential gains later on. Ultimately, high ROI potential, transparency, and a live Mainnet outperforming some of crypto’s biggest names have made BDAG one of the most promising projects for the year ahead.

Which Is the Top Crypto Coin to Buy for 2026?

Litecoin and Dogecoin remain under clear pressure as sentiment across the market stays fragile. The Litecoin price is hovering near critical support, and unless buyers step in above key resistance, the risk of another drop toward $45 remains real.

At the same time, the latest Dogecoin price prediction reflects continued weakness, with DOGE struggling to reclaim lost ground and facing strong resistance on any bounce. For now, both assets sit in a defensive territory, leaving traders cautious as they reassess exposure.

Meanwhile, BlockDAG is telling a very different story. The Mainnet is already live, processing 5,000 transactions per second, and exchange listings are happening in four days.

And with the final allocation priced at $0.00025 and a confirmed $0.05 listing price, the potential 200× upside is basically guaranteed. For traders seeking top crypto coins to buy now, BlockDAG isn’t just competing with the market’s biggest players; it’s effectively outperforming them.

Private Sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Crypto World

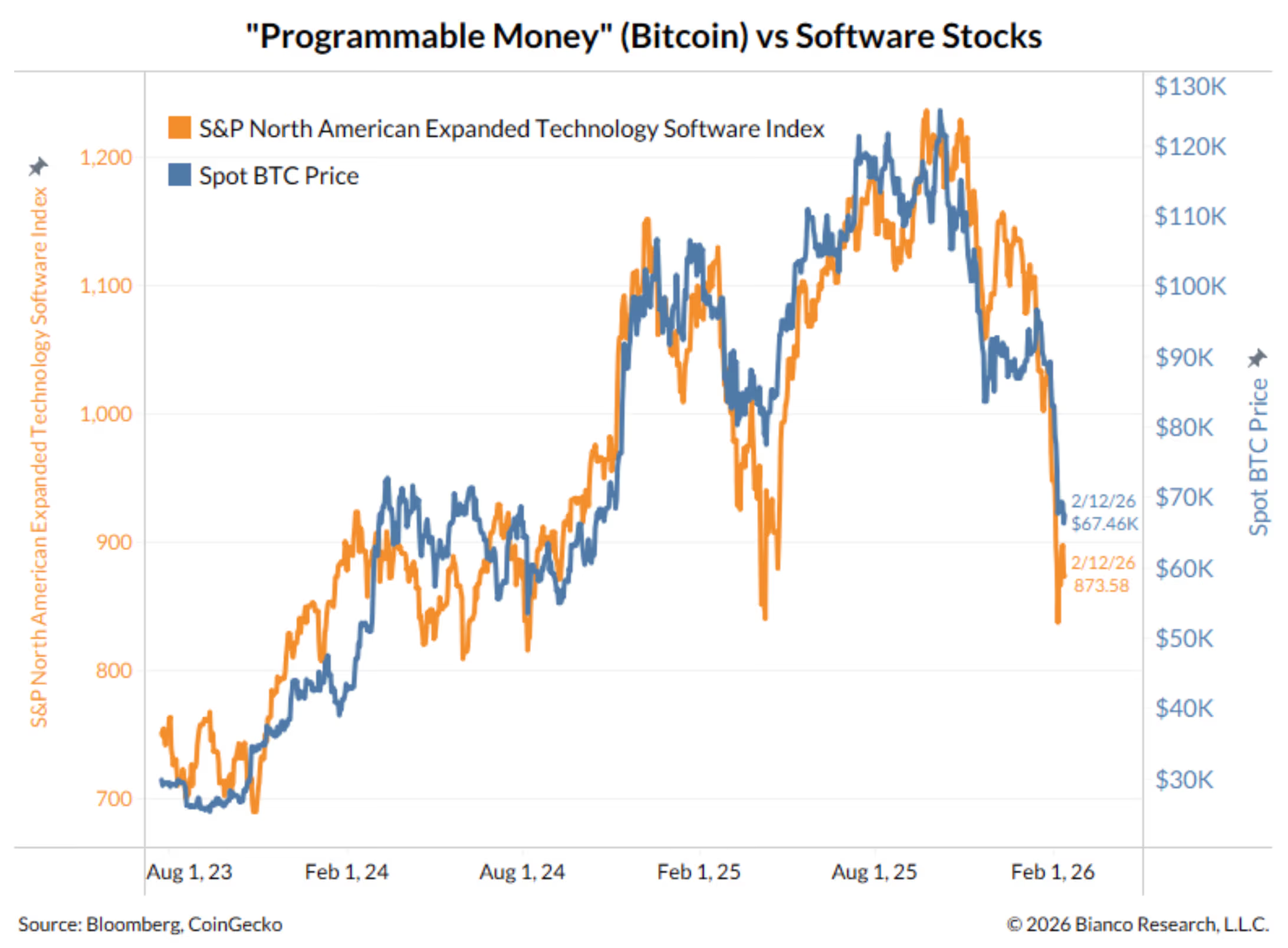

BTC falls back to $65,000 as software sector slides 3%

Bitcoin fell back toward last week’s lows, giving up nearly all of its recent gains above $70,000 and resuming its slide alongside weakness in the broader tech sector, as the crypto now trades back around $65,000.

Bitcoin was down 2% over the past 24 hours, with losses in ether and solana roughly tracking.

The decline mirrored broad price action in the Nasdaq, which fell 2% on Wednesday and more particularly in the software sector, where the iShares Expanded Tech-Software Sector ETF (IGV) tumbled 3%. The IGV is now down 21% year to date as investors question the sector’s pricey multiples in a world where the coding abilities of artificial intelligence agents appear to be rising exponentially.

“Software stocks are struggling again today,” wrote macro strategist Jim Bianco. “IGV is essentially back to last week’s panic lows.”

“Don’t forget there’s another type of software, ‘programmable money,’ crypto,” Bianco added. “They are the same thing.”

Precious metals not immune

Cruising along with modest gains through most of the day, gold and silver suffered quick, steep plunges in the mid-afternoon. Late in the session, silver was lower by 10.3% to $75.08 per ounce and gold was down 3.1% to $4,938.

Crypto World

Binance October 10 Backlash Hijacks Consensus Hong Kong

Binance Co-CEO Richard Teng has defended the exchange against claims that it was responsible for the October 10, 2025, “10/10” crypto crash, which saw roughly $19 billion in liquidations.

Speaking at CoinDesk’s Consensus Hong Kong conference on February 12, 2026, Teng argued the sell-off was driven by other factors besides any Binance-specific failures.

Sponsored

Sponsored

Richard Teng Gives Binance’s Side of the Story on October 10 Crash

The Binance co-CEO cited macroeconomic and geopolitical shocks between the US and China. Specifically, he cited:

- Fresh US tariff threats, including potential 100% duties on Chinese imports, and

- China’s imposition of rare-earth export controls.

The combination, he said, flipped global risk sentiment, triggering mass liquidations across all exchanges, centralized and decentralized alike.

“The US equity market plunged $1.5 trillion in value that day,” Teng said. “The US equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

The majority of liquidations (roughly 75%) occurred around 9:00 p.m. ET, coinciding with the release of macro news.

Teng acknowledged minor platform issues during the event, including a stablecoin depegging (USDe) and temporary slowness in asset transfers.

However, he stressed these were unrelated to the broader market collapse. He also emphasized that Binance supported affected users, including by compensating some of them.

Sponsored

Sponsored

“…trading data showed no evidence of a mass withdrawal from the platform,” he added.

Last year, Binance reportedly facilitated $34 trillion in trading volume and served over 300 million users.

It is worth noting that the October 10 crash has been a persistent cause of Binance FUD over the past several months. The exchange has faced criticism from far and wide, with the heaviest attacks coming from rival exchange OKX and its CEO, Star Xu.

Traders Reject Teng’s Macro Shock Explanation Amid $19 Billion 10/10 Liquidation

Despite Teng’s detailed defense, traders on social media have responded swiftly and critically. On X (Twitter), users accused Binance of locking APIs and engineering conditions that forced liquidations, only to deflect responsibility with the “macro shock” explanation.

Sponsored

Sponsored

“Blaming macro shocks is the new ‘it was a glitch.’ $19B liquidated and somehow nobody at Binance is responsible lol,” one user challenged.

Naysayers go further, with some users likening Teng’s claims to colloquial phrases in harsh criticism.

“‘It wasn’t us, it was the macro’ is the crypto exchange version of the dog ate my homework. $19B in liquidations and every platform just points at the guy next to them,” another said.

However, the majority of responses revolved around alleged fake API responses and questioned internal coordination at Binance. The general sentiment is that users feel the exchange is not fully transparent.

The backlash illustrates the ongoing tension between centralized exchanges and leveraged traders during high-volatility events.

While retail demand has cooled compared to previous years, Teng highlighted that institutional and corporate participation in crypto remains strong.

Sponsored

Sponsored

“Institutions are still entering the sector,” he said. “Meaning the smart money is deploying.”

Teng also framed the 10/10 event as part of a broader cyclical pattern in crypto markets. He argued that despite short-term turbulence, the sector’s underlying development continues, with institutional capital driving long-term confidence.

Still, the exchange faces a twofold challenge:

- It must defend its role during unprecedented market stress

- Binance must also restore trust with a skeptical trading community.

While the $19 billion liquidation wiped out positions across the market, the debate over who or what should be held accountable continues to simmer online. This is expected, given the fragility of confidence in high-leverage crypto trading.

Crypto World

Bitcoin risk-reward has shifted after recent selloff

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

Summary

- “Checkmate” Check suggests Bitcoin has entered “deep value” territory.

- Recent selloff capitulation losses resemble those seen at 2022 cycle lows, indicating a potential market bottom forming with a 60% probability.

- Bitcoin’s price may be forming a bottom, but further declines are possible as market sentiment shifts.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check noted that capitulation-style losses spiked to levels last seen at the 2022 cycle lows.

Check stated that if Bitcoin is not trending toward zero, the statistical setup appears increasingly asymmetric after the selloff. The analyst said the current environment represents a time for market participants to pay attention rather than lose focus.

The researcher said he was focused on market structure rather than identifying a single forced seller behind the price movement.

Check offered a probabilistic assessment, stating that the odds of a bottom forming have increased significantly. He said the probability that the market has already set a meaningful low stands at more than 50%, likely around 60%, according to his analysis. The analyst assigned low odds to Bitcoin reaching a new all-time high within the year without a major macroeconomic shift or significant market event.

Regarding exchange-traded funds, Check cited billions in outflows during the drawdown, but characterized the situation as positioning unwinds rather than structural failure. He noted that at an earlier peak, approximately 62% of cumulative inflows were underwater, while ETF assets under management declined only in the mid-single digits. Check suggested earlier outflows aligned with CME open interest, consistent with basis-trade adjustments.

The analyst criticized reliance on the four-year halving cycle as a timing tool, calling it an “unnecessary bias.” Check said his approach prioritizes observing investor behavior over calendar-based predictions.

Even if the low has been established, Check said he expects the market to revisit it. He argued that bottoms typically form through multiple “capitulation wicks” followed by extended periods of reduced activity, where sustained uncertainty erodes confidence among late-cycle buyers. Check stated that formulating a bear case at current levels would be premature, framing the current zone as late-stage rather than early-stage in the move, while acknowledging prices could decline further.

The analyst described two failed all-time-high attempts in October followed by a sharp decline that likely resulted in significant losses for market participants. He referenced what he termed a “hodler’s wall” of invested wealth positioned above key levels, including a threshold he called the “bull’s last stand.” Check argued that once price broke below those levels, downside probability increased.

A key reference level cited by Check was the True Market Mean, described as a long-term center-of-gravity price that also overlapped with the ETF cost basis. He said that once that level broke, the psychological regime shifted to an acceptance phase where market participants began to believe a bear market had begun.

Check argued the market was subsequently pulled toward a prior high-volume consolidation zone where a significant portion of this cycle’s trading volume had occurred. He said the selloff likely involved leverage liquidations but framed that as secondary to a broader shift in market sentiment, where participants sell rallies during perceived downtrends.

The most significant bottoming signal emphasized by Check was the scale of realized losses during the recent decline. He said capitulation losses occurred at a very large daily rate, comparable to the 2022 bottom, with sellers concentrated among recent buyers from the late cycle and those who purchased during an earlier consolidation period. Check also noted that SOPR (Spent Output Profit Ratio) printed around minus one standard deviation, a reading that has historically appeared in only two contexts: as an early warning signal and near bottoming phases.

Check reiterated that bottoms form through a process involving multiple capitulation events followed by extended periods of reduced speculative interest, rather than a single definitive price point.

Crypto World

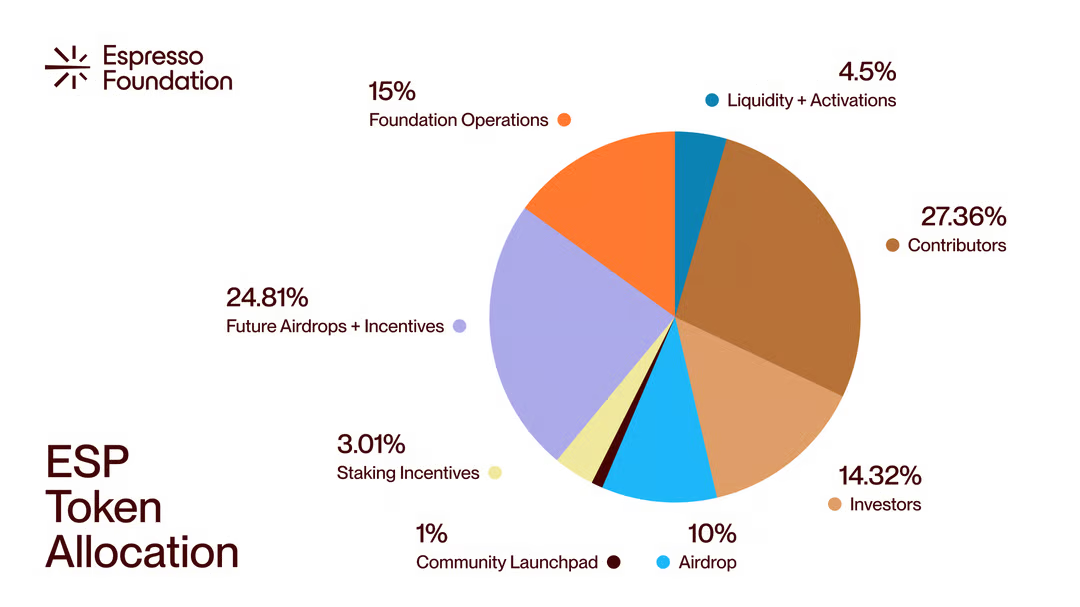

Espresso Token Launches at $275 Million Valuation

Launchpad buyers are down 30% with a 2-year vesting period ahead of them.

Espresso, a decentralized rollup base layer, launched its native ESP token this morning at a valuation of roughly $275 million following its token airdrop and distribution.

The token debuted at $0.072 before jumping up to $0.083 shortly after its launch and has reported $115 million in trading volume over its first 7 hours across CoinGecko-tracked platforms.

The protocol is designed to support rollups and appchains with everything they need from a base layer to ensure high performance, including finality, data availability, and real-time interoperability.

Today’s ESP token launch enables the network to transition to proof-of-stake, and the protocol has distributed 10% of the token supply in an airdrop to more than one million eligible addresses.

There was also a Kaito Launchpad sale in July 2025, which sold 1% of the supply at a $400 million valuation, leaving launchpad investors with a 31% loss at current prices.

The ESP token is the latest in a line of ICOs and token sales that are opening underwater, with Infinex and Aztec being two other recent examples.

Crypto World

Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

Coinbase (COIN) missed fourth-quarter earnings forecasts on Thursday, thanks to weaker trading activity and lower crypto asset prices.

The U.S.-based crypto exchange posted total revenue of $1.78 billion against estimates for $1.83 billion. Adjusted EPS of $0.66 was well lower than the consensus $0.86.

Total transaction revenue of $983 million was below forecasts for $1.02 billion and down from $1.046 billion in the third quarter and $1.556 billion in the fourth quarter one year ago.

Subscription revenue of $727.4 million was down from $746.7 million the previous quarter and up from $641.1 million a year earlier.

Through Feb. 10 of the first quarter, the company saw transaction revenue of about $420 million. It guided to full-quarter subscription revenue of $550-$630 million.

“We continue to be optimistic about the long-term trajectory of the crypto industry,” Coinbase said. “Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems. While asset prices can be volatile, under the surface an undercurrent of technological change and crypto product adoption continues.”

Shares are modestly higher in after-hours trading, but fell 7.9% during the regular session, extending year-to-date declines to 40%.

Crypto World

Vitalik Buterin Advocates for Decentralized Reform in Russia’s Governance

TLDR

- Vitalik Buterin condemned Russia’s invasion of Ukraine, calling it criminal aggression and not a situation of equal fault.

- He argued that lasting peace in Ukraine and Europe can only be achieved through internal change within Russia.

- Buterin proposed that decentralized governance could be the key to reforming Russia’s political system.

- He highlighted tools like quadratic voting and zero-knowledge systems as potential solutions for improving decision-making.

- Buterin emphasized the importance of involving more people in governance through platforms like pol.is to find societal compromises.

Vitalik Buterin, co-founder of Ethereum, shared his views on Russia’s future in a post published on February 12. In the post, originally written in Russian, Buterin called Russia’s invasion of Ukraine “criminal aggression.” He emphasized the need for structural reform within Russia to achieve long-term peace and security, advocating for a decentralized governance model.

Buterin Criticizes Russia’s War and Calls for Internal Change

In his recent post, Vitalik Buterin condemned Russia’s invasion of Ukraine, labeling it as “criminal aggression.” He strongly rejected the idea that both sides are equally at fault, which some have argued. Buterin clarified that peace in Europe and Ukraine could not be achieved through a simple ceasefire alone.

He suggested that the best path to stability in the region involves internal change within Russia itself. For Russia to secure lasting peace, Buterin proposed significant structural reforms. These reforms, according to him, should focus on decentralizing governance, moving away from centralized power.

Vitalik Buterin Advocates for Decentralized Governance

Vitalik Buterin emphasized the potential of decentralized governance to transform Russia. He mentioned specific tools that could help in building a new system, such as quadratic voting and zero-knowledge (ZK) systems. These tools, Buterin argued, could allow large groups of people to find common ground without relying on a small elite.

The Ethereum co-founder believes that decentralized governance could be key to building a more transparent and fair system. In his post, he also referenced platforms like pol.is, which allow for broader participation in decision-making. These digital tools, Buterin suggested, could provide a way for citizens to directly engage with governance.

New Leadership and Ideas for Russia’s Future

Buterin also discussed the importance of new leadership in Russia, highlighting the need for fresh ideas. He stressed that the Russian opposition should focus on involving more people in decision-making. This approach would help avoid the concentration of power in the hands of a few.

He pointed out that using platforms for online voting and discussions could allow people to reach societal compromises. These compromises could then be turned into official policies without the need for intermediaries. According to Buterin, achieving consensus in this manner is crucial for Russia’s long-term stability.

Crypto World

ETHZilla Launches Tokenized Jet Engine Leases Amid Ethereum Decline

TLDR

- ETHZilla has launched a tokenized investment opportunity in leased jet engines through its subsidiary ETHZilla Aerospace.

- The company acquired two CFM56 commercial jet engines worth $12.2 million and is offering equity in these assets via the Eurus Aero Token I.

- The tokens, available to accredited investors, are priced at $100 each, with a minimum investment of 10 tokens.

- ETHZilla aims to provide a targeted return of 11% for token holders if they hold through the lease term, ending in 2028.

- Cash flows from the leased engines will be distributed monthly to token holders via blockchain technology.

ETHZilla has expanded its operations into the tokenization sector, launching a new project focused on jet engine leases. The company, through its new subsidiary ETHZilla Aerospace, is offering tokenized equity in jet engines it recently acquired. This move comes as ETHZilla seeks to diversify its investments amid Ethereum prices continuing to decline.

ETHZilla Introduces Tokenized Engine Leases on Arbitrum

ETHZilla’s new venture centers around tokenizing a $12.2 million investment in two leased CFM56 commercial jet engines. These engines are leased to a major U.S. airline, though the company has not disclosed the airline’s identity due to confidentiality concerns. By launching the Eurus Aero Token I on the Arbitrum layer-2 network, ETHZilla offers tokenized equity in the engines, allowing investors to participate in this emerging market.

ETHZilla CEO McAndrew Rudisill commented on the project, stating, “Offering a token backed by engines leased to one of the largest and most profitable U.S. airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows.” The company believes that this move will help modernize fractional ownership of aviation assets, a market traditionally dominated by institutional investors and private equity firms.

Token Sale Details and Project Goals

The Eurus Aero Token I, available to accredited investors, will be sold through Liquidity.io’s token marketplace. Each token is priced at $100, with a minimum investment of $1,000, or 10 tokens. The project aims to offer a return of approximately 11% if token holders hold until the lease agreements conclude in 2028. However, a disclaimer notes that actual returns could differ based on various factors.

Cash flows from the leased engines will be distributed monthly to token holders through the blockchain. ETHZilla has structured the tokens with collateral consisting of the engines, related lease receivables, insurance proceeds, and other reserves. The company’s tokenization model ensures transparency and on-chain distribution, making it accessible to a broader group of investors.

ETHZilla’s expansion into tokenized aviation assets is part of a broader effort to pivot from its Ethereum holdings. The firm recently revealed a $250 million share buyback program, following a drop in the company’s market cap. ETHZilla’s share price has seen fluctuations, including a significant drop in recent months.

Crypto World

BitGo Expands Custody, Staking Partnership With 21Shares

BitGo Holdings and 21Shares said Thursday they have expanded their existing partnership to include custody and staking services supporting 21Shares’ crypto exchange-traded products (ETPs) for investors in the United States and Europe.

Under the agreement, BitGo will deliver qualified custody, trading and execution services and integrated staking infrastructure for 21Shares’ US exchange-traded funds and global ETPs. The arrangement also provides 21Shares with access to liquidity across electronic and over-the-counter markets, according to the announcement.

BitGo said the services will be delivered through its regulated entities in the US and Europe, including its federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and its MiCA-licensed operations authorized by Germany’s Federal Financial Supervisory Authority.

21Shares, a subsidiary of FalconX, is one of the largest crypto ETF issuers globally, with 59 exchange-traded products listed across 13 exchanges and more than $5.4 billion in assets under management as of Feb. 11, according to its website.

The move comes less than a month after BitGo, a digital asset infrastructure company based in Palo Alto, California, began trading on the New York Stock Exchange under the ticker BTGO.

Related: BitGo’s IPO pop turns volatile as shares slip below offer price

Staking moves deeper into regulated products

In recent months, institutional custody platforms have increasingly embedded staking services into their core offerings as investor demand grows for yield-generating crypto infrastructure.

In October, Coinbase expanded its integration with staking infrastructure provider Figment, allowing Coinbase Prime and Coinbase Custody clients to stake Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) directly from Coinbase custody.

About a month later, Anchorage Digital partnered with Figment to add staking for Hyperliquid (HYPE), offering the service through Anchorage Digital Bank and its Singapore entity, with access also available via its Porto self-custody wallet.

On Feb. 9, Ripple said it expanded its institutional custody platform through integrations with Securosys and Figment, adding hardware security module support that allows banks and custodians to offer crypto custody and staking services without running their own validator or key management infrastructure.

There has also been growing institutional interest in liquid staking, which allows investors to earn proof-of-stake rewards while receiving a tradable token that keeps their underlying assets liquid.

On Tuesday, Hong Kong-based custodian Hex Trust announced it has partnered with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping their SOL liquid and eligible for use as collateral in borrowing and lending through its markets platform.

Magazine: 6 weirdest devices people have used to mine Bitcoin and crypto

Crypto World

Fiserv Launches US Dollar Settlement Platform for Digital Asset Companies

Fiserv, a major US payments and financial technology provider, has launched a new cash settlement platform for digital asset companies, a move that could strengthen fiat infrastructure for crypto players and improve access to liquidity.

On Thursday, Fiserv announced the debut of INDX, a real-time cash settlement system that operates 24 hours a day, 365 days a year. The platform allows digital asset companies to move US dollars instantly using a single custodial account, potentially improving how exchanges, trading desks and other crypto businesses manage fiat balances.

INDX will be made available to more than 1,100 insured financial institutions participating in the Fiserv Deposit Network. The account structure provides up to $25 million in Federal Deposit Insurance Corporation (FDIC) coverage, according to the company.

The launch is notable because many digital asset companies still rely on traditional banking rails that operate only during business hours or on onchain token transfers to move dollar value. By enabling round-the-clock US dollar settlement within the banking system, INDX offers functionality similar to blockchain-based settlement while remaining offchain.

Fiserv is one of the largest payments and financial services technology providers globally, offering core banking, merchant acquiring and transaction processing services. The company generated more than $21 billion in revenue in fiscal 2025.

Fiserv has also expanded its footprint in digital assets. As Cointelegraph reported in October, the company is involved in North Dakota’s state-backed stablecoin initiative, where it is providing payments and settlement infrastructure to support the project’s rollout.

Related: Crypto’s 2026 investment playbook: Bitcoin, stablecoin infrastructure, tokenized assets

TradFi and digital assets continue to converge

INDX is the latest example of an established financial institution building infrastructure for the digital asset sector. For institutional clients, the platform offers a more familiar banking framework while introducing faster, always-on cash management capabilities.

The system could also position Fiserv ahead of legacy banking partners that still depend on batch-based processing for US dollar transfers. For crypto infrastructure providers, including exchanges, trading desks, stablecoin issuers and custodians, reliable, real-time dollar liquidity can provide a meaningful operational advantage.

The Milwaukee, Wisconsin company in December completed the acquisition of Stone Castle Cash Management, which provides banks liquidity, in a move widely seen as bolstering its FIUSD stablecoin, launched in June 2025

Beyond settlement speed, stablecoins are increasingly being viewed by traditional financial institutions as liquidity infrastructure. Always-on digital dollars can facilitate collateral movement, treasury operations and cross-border payments with fewer intermediaries and less settlement friction.

While INDX stands out for combining traditional bank settlement with continuous-dollar availability tailored to digital-asset companies, other companies have also prioritized real-time settlement.

For example, Sygnum operates a round-the-clock multi-asset network that enables instant settlement across fiat currencies, stablecoins and other digital assets for institutional clients.

Similarly, Fireblocks supports real-time settlement infrastructure for stablecoins and digital asset transfers, helping institutions streamline liquidity management.

Related: How TradFi banks are advancing new stablecoin models

Crypto World

Russia Plans Return to US Dollar Settlement as Strategic Cooperation Talks Emerge

TLDR:

- Russia and US combined oil production could reach 22.6 million barrels daily, reshaping global markets

- Moscow controls 44% of enriched uranium and 43% of palladium, critical for US industrial supply chains

- Russia-China trade hit $245B in 2024, spurring Moscow to diversify away from yuan-heavy dependence

- Russian reserves climbed to record $833B with over $400B in gold, providing negotiation leverage

Russia is reportedly planning to shift back toward US dollar settlement systems while exploring cooperation with the United States across multiple strategic sectors.

The discussions encompass fossil fuels, natural gas, offshore oil drilling, and critical raw materials. This development marks a potential reversal of Moscow’s decade-long effort to reduce dollar exposure.

The move could reshape global commodity markets and currency dynamics while altering geopolitical alliances between major powers.

Energy Cooperation Could Reshape Global Markets

According to analyst Bull Theory, shared on social media platform X, the cooperation framework would combine significant production capacity from both nations.

The United States currently produces 13.5 million barrels per day of oil, representing the highest output in American history.

Russia maintains production at 9.1 million barrels daily despite ongoing international sanctions. Combined influence over global oil supply would immediately shift pricing power and export leverage across international markets.

Natural gas represents another critical component of the potential partnership. Russia controls some of the world’s largest gas reserves, though many liquefied natural gas and pipeline projects remained frozen after the implementation.

Reopening investment channels and joint development initiatives would reintroduce substantial supply into global markets. This shift would directly affect European energy pricing and long-term gas market dynamics.

The timing carries particular weight given the current global energy transitions. Western nations have sought alternative suppliers since 2022, creating market volatility and price fluctuations.

Russian re-entry into Western-aligned energy frameworks could stabilize certain markets while disrupting others. Energy analysts note that infrastructure investments would require years to fully materialize.

Corporate participation represents a significant financial dimension. Western companies absorbed approximately $110 billion in losses when exiting Russian operations.

Re-entry opportunities in energy fields, gas infrastructure, mining projects, and Arctic drilling zones could enable American firms to resume resource extraction activities. This corporate angle extends beyond immediate profits to long-term strategic positioning.

Critical Minerals and Currency Realignment Take Center Stage

Russia controls substantial portions of strategic resources essential to modern manufacturing. The nation holds 44 percent of enriched uranium, 43 percent of palladium, 40 percent of industrial diamonds, 25 percent of titanium, and 20 percent of vanadium globally.

These materials form core components in semiconductors, defense systems, electric vehicle production, nuclear energy, and aerospace manufacturing. Partnership in this sector addresses American supply chain vulnerabilities while reducing Chinese dependency.

Moscow spent recent years building alternatives to Western settlement systems and reducing dollar reserves. Russia-China bilateral trade reached $245 billion by 2024, creating structural dependence on yuan liquidity and Chinese imports.

However, this pivot concentrated financial risk in Beijing-oriented frameworks. Reopening dollar settlement channels would diversify Russia’s financial positioning, balancing Eastern and Western exposure while re-anchoring portions of global trade.

Russia’s financial reserves recently climbed to a record $833 billion, with gold holdings exceeding $400 billion. This reserve strength provides Moscow with negotiating leverage for structuring long-term resource agreements.

The financial stability enables Russia to approach discussions from a position beyond immediate economic necessity.

The broader framework encompasses energy cooperation affecting global supply, mineral partnerships reshaping industrial resource access, corporate re-entry unlocking infrastructure projects, and currency realignment pulling Russia partially back into dollar systems.

Geopolitical leverage simultaneously shifts between Washington, Moscow, and Beijing. If finalized, observers suggest this could represent one of the largest structural resets in global economic alignment since Cold War conclusion.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports21 hours ago

Sports21 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World23 hours ago

Crypto World23 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video18 hours ago

Video18 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’