Crypto World

Bitcoin Analysts Forecast Prolonged BTC Price Consolidation

Fresh on-chain data from Glassnode suggests Bitcoin could be headed for another prolonged phase of range-bound trading unless critical support levels are reclaimed. The February edition of The Week On-chain highlights a price corridor anchored by the True Market Mean near $79,200 and a Realized Price around $55,000 — a setup that mirrors patterns seen in the first half of 2022. With overhead supply concentrated in higher price bands, the decisive question remains: will new buyers re-enter and lift BTC out of consolidation?

Key takeaways

- Bitcoin remains confined within a corridor defined by the True Market Mean (~$79,200) and the Realized Price (~$55,000), signaling a 2022-style consolidation unless key support is reclaimed.

- A breakout would require a decisive reclaim of the True Market Mean near $79,200 or a systemic dislocation that drives price below the Realized Price around $55,000, according to Glassnode.

- Overhead supply is structurally heavy, with large clusters positioned between roughly $82,000–$97,000 and then again from $100,000–$117,000, creating a potential sell-side overhang if prices move higher.

- Whales appear to be shifting risk posture, closing long positions and opening shorts relative to retail, reinforcing a cautious, range-bound outlook for the near term.

- Near-term price action remains pinned between support below $65,000 and resistance near $68,000, with a move above $72,000 needed to re-open upside traffic toward earlier momentum benchmarks.

Tickers mentioned: $BTC

Sentiment: Neutral

Market context: The on-chain view fits within a broader environment where liquidity and risk appetite are delicate, and buyers are waiting for a clearer catalyst. The mix of heavy overhead supply and patient accumulation suggests a market that could drift rather than surge without fresh demand catalysts.

Why it matters

The unfolding dynamics around Bitcoin’s price framework matter for traders and long-term holders alike. The analysis emphasizes the importance of on-chain metrics in gauging potential supply pressure that could cap rallies even if price action briefly turns bullish. If BTC can reclaim the high-end thresholds implied by the True Market Mean, the market could test higher moving averages and previously observed resistance zones. Conversely, persistent weakness around the Realized Price would imply additional downside risk, particularly for participants who bought into higher ranges and are still sitting on unrealized losses.

On-chain behavior paints a nuanced picture. The URPD (UTXO Realized Price Distribution) suggests that substantial portions of the supply were created at price levels well above current prices, reinforcing the argument that a meaningful number of coin-holders may have an emotional and financial stake in seeing a higher price if conditions permit. Yet these same clusters also form a potential overhang: if market momentum fades or risk sentiment deteriorates, concentrated gains from earlier periods could quickly turn into selling pressure as holders decide to cut losses or rebalance.

Added to this, the market environment features a tug-of-war between long-term holders and more speculative participants. Data from on-chain observers and market analytics firms indicates that larger players are tightening exposure, a signal that the restoration of upside momentum will likely require a catalyst capable of re-igniting fresh demand. In practical terms, that means price action could remain choppy until a clear breakout above major resistance or a decisive breach of critical support occurs, with every swing potentially attracting new entrants or sellers depending on the path taken.

What to watch next

- Watch whether Bitcoin clears the $68,000 resistance to aim for the $72,000 level again, a move that would re-energize momentum toward the 20-day EMA and beyond.

- Monitor for a true reclaim of the True Market Mean near $79,200, which Glassnode identifies as a potential sign of renewed structural strength.

- Be alert for a drop below the Realized Price around $55,000, which could trigger renewed capitulation or a shift in risk tolerance among holders.

- Track ongoing on-chain activity from major holders, particularly any notable increases in short positioning relative to retail, as it could presage further consolidation.

- Observe how overhead supply bands between $82,000 and $117,000 behave if price attempts to press higher, as the density of this supply hints at potential sell-side pressure that could cap rallies.

Sources & verification

- The Week On-chain by Glassnode (February 11 edition) detailing overhead supply and the True Market Mean vs Realized Price dynamics.

- Glassnode’s URPD data showing long-term supply clusters above $82,000 and related implications for unrealized losses.

- Commentary from Joao Wedson (Alphractal) on changing whale activity and the potential for a consolidation phase over the next month.

- CoinGlass liquidation heatmap illustrating liquidity distribution between bids and asks around the $69,000–$72,000 region.

- Cross-referenced price movement discussions noting the need to clear $72,000 to target higher moving averages.

Bitcoin price in focus: market dynamics and key levels

Bitcoin (CRYPTO: BTC) is currently trading within a defined corridor that mirrors a broader, on-chain narrative about when demand will re-enter after a period of subdued momentum. The framework rests on two pivotal on-chain markers: the True Market Mean, a measure of where the market’s “fair value” sits on a given day, and the Realized Price, which anchors the cost basis of coins currently in circulation. Glassnode’s recent analysis emphasizes that these markers have established a price range that, for now, resembles the patterns observed during the first half of 2022. In that period, BTC traded between the True Market Mean and the Realized Price before entering a protracted bear phase, with a low near $15,000 later that year. While the present setup does not predict a similar outcome, it underscores the challenge of surging higher without a fundamental catalyst that re-energizes buyers.

Overhead supply, a term that captures the concentration of coins that would require price appreciation to become fully realized profit, remains structurally heavy in higher price bands. The URPD data points to substantial clusters above $82,000, extending into the $97,000 and beyond $117,000 zones. These levels represent cohorts of coins that have historically faced unrealized losses; in a market where buyers are scarce, these zones can turn into latent sell-offs if volatility spikes or sentiment deteriorates. In practice, this translates to a potential ceiling on upside movements unless demand accelerates or supply dynamics shift decisively in favor of buyers.

Rounding out the on-chain narrative is visible activity from market participants described as “whales” — those holding large quantities of BTC. Recent posts from industry observers noted a shift: long positions are being closed while shorts are being opened relative to retail activity. This pattern aligns with a cautious stance, reinforcing a prevailing view that the market could continue to absorb supply rather than launch into a rapid uptrend. In other words, the current price action could persist within a narrow band as participants wait for a decisive trigger to reorient risk exposure.

From a practical standpoint, the price dynamics show BTC facing a barrier near $68,000 after a recent attempt to rebound from lows below $60,000. The next significant hurdle sits at around $72,000, a level that many analysts say must be cleared to re-engage the upward slope toward the 20-day exponential moving average near $76,000 and, beyond that, the 50-day moving average above $85,000. Until that sequence of resistance is breached, the market is more likely to remain in a phase of range-bound action with incremental gains or losses tied to short-term liquidity and the evolving appetite for risk across crypto markets.

In parallel, market observers highlight the current liquidity landscape as another critical factor. The liquidity framework, which shapes how quickly buyers or sellers can enter or exit positions, tends to tighten during uncertain macro periods. In such a regime, even modest shifts in sentiment can produce outsized price moves, particularly when the order book tightens around the major support and resistance thresholds described above. The absence of a clear catalyst makes the path of least resistance a continued drift, with occasional bursts as traders reposition around the pivotal levels identified by on-chain analysis.

https://platform.twitter.com/widgets.js

Crypto World

Vitalik Proposes ‘Decentralized Governance’ Model for Russia’s Future

The Ethereum co-founder condemned Russia’s invasion of Ukraine while saying the country could benefit from crypto principles like decentralization.

Vitalik Buterin shared in a long post on X on Feb. 12, originally written in Russian, his views on Russia’s war against Ukraine and what Russia’s future could look like under a “decentralized governance” model.

In the first half of the post, published ahead of the fourth anniversary of Russia’s invasion, the Ethereum co-founder called the war “criminal aggression,” not a “complicated situation” where both sides are equally at fault. He then argued that real, lasting security for Ukraine and Europe will not come from a temporary ceasefire alone, but from change inside Russia itself.

In his view, the strongest guarantee of peace would be for Russia to transform into a different kind of system. To do that, he said, the country would need deeper structural reform based on decentralized governance.

Buterin’s post underscores a broader trend of applying crypto ideas, especially decentralization and transparency, to geopolitics. As crypto adoption grows around the world, its core principles are increasingly being discussed as models for both financial and political systems.

“People often speak about ‘decentralized governance’ and ‘radical democracy’ in very abstract and idealistic terms, but far too rarely do they talk about what concrete problem it can actually solve,” Buterin wrote, via translation.

He listed ideas such as quadratic voting, zero-knowledge (ZK) systems and online discussion platforms like pol.is. These tools, he said, can help large groups find common ground instead of leaving decisions to a small, centralized elite.

“In the crypto industry, some people like to say that we need to move from ‘don’t be evil’ to ‘can’t be evil’. In human society, achieving this goal 100% is completely unrealistic, but achieving 25%? That would already be a very good result,” Buterin wrote in Russian.

He added that this point matters for two reasons: First, when building any new system, people must be clear about the real goal. Second, both ordinary Russians and members of the political elite who would need to “cooperate in order for there to be any success” must understand why these ideas are worth supporting.

In the final part of his essay, Buterin focused on decentralized governance as a process, highlighting digital tools and AI-driven discussion platforms. He argued that the Russian opposition needs new ideas and leaders, and that the best way to find them is to involve more people directly.

Instead of relying on a small group, he suggested using online systems like pol.is, where large numbers of citizens can post views and vote on proposals.

“This makes it possible to find societal compromises — or even consensus — directly, without intermediaries (such as elected representatives), so that officials are left only with the task of turning that compromise/consensus into an official document or law,” Buterin wrote.

He emphasized that “this is all long-term,” and that the Russian people need to think deeply about what happens after Putin. “Having a concrete roadmap — a plan that can convince a broad coalition, both ordinary people and politicians, both inside Russia and in other countries — is an important first step,” he concluded.

Crypto World

Hyperliquid-Based Ventuals’ Trading Volume Surges 100% in 17 Days

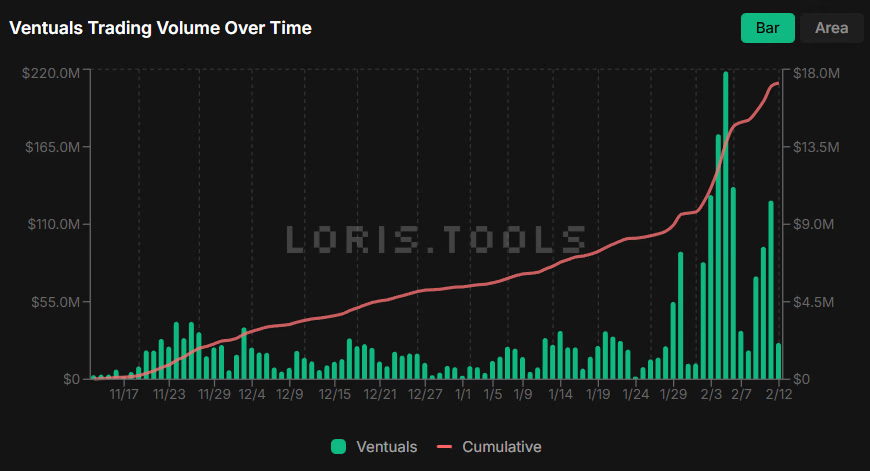

Cumulative trading volume on the tokenized private equity platform reached $200 million about four months after the protocol’s launch.

Ventuals, a protocol that lets users trade tokenized exposure to private and pre-IPO companies, has crossed $200 million in cumulative trading volume less than three months after launch, according to a Feb. 11 X post from the platform’s co-founder, Alvin Hsia.

The milestone was reached just 17 days after cumulative volume first hit $100 million, on Jan. 24, a level that took the platform 73 days to achieve, Hsia noted.

On-chain data from LorisTools, which tracks activity across Hyperliquid’s HIP-3 products, shows cumulative volume on Ventuals has climbed past $215 million by press time. The platform has recorded 5,342 unique traders and generated over $70,000 in fees since going live in October 2025.

Built on the Hyperliquid blockchain, Ventuals allows traders to take synthetic, leveraged positions tied to the valuations of private companies, including firms such as Anthropic and OpenAI.

The most actively traded product so far is MAG7 — a contract tracking the so-called “Magnificent Seven” U.S. tech companies, which includes Amazon, Apple and Microsoft — which has seen over $4 million in trading volume today, Feb. 12, the data shows.

Alongside the surge in activity, Ventuals’ liquid staking token vHYPE, which represents a claim on the underlying HYPE, Hyperliquid’s native token, rose about 20% to $30, according to CoinGecko data.

Crypto World

Bitcoin price could crash further, Standard Chartered slashes target

The Bitcoin price has already crashed by nearly 50% from its all-time high, and a top long-term bull believes there is more downside to come in the near term.

Summary

- Bitcoin price has slumped from the all-time high to $66,000.

- Standard Chartered warned that the coin may drop to $50k.

- Technical analysis suggests that the coin may fall before rebounding.

Bitcoin (BTC) retreated to $66,000 on Thursday, a few points above the year-to-date low of $60,000. This decline has persisted as its divergence from American stocks has widened, with leading indices such as the Dow Jones and the Nasdaq 100 hovering near their record highs.

Bitcoin’s price may have further downside in the near term, according to Standard Chartered, which warned that the coin may crash to $50,000.

The bank then lowered its Bitcoin price target for the year to $100,000, down from its previous estimate of $150,000. It was the second major downgrade as the bank had previously set the target price to $300,000.

Geoffrey Kendrick, the bank’s head of digital assets, predicts there will be more capitulation in the coming months. At the same time, he pointed to the ongoing Bitcoin ETF outflows, plunging futures open interest, and lack of a clear narrative.

“I think we are going to see more pain and a final capitulation period for digital asset prices in the next few months. The macro backdrop is unlikely to provide support until we near [Kevin] Warsh taking over at the Fed,” Kendrick told The Block. “On the downside I think this will see BTC to $50,000 or just below, ETH to $1,400.”

SoSoValue data shows that spot Bitcoin ETFs have shed over $282 million in assets this month. They have lost close to $6 billion in the last four months, a sign that investors are capitulating, with some moving their cash to the booming stock market.

Meanwhile, the futures open interest has tumbled to $44 billion from last year’s high of $96 billion. Falling open interest is a sign that investors are reducing their exposure to Bitcoin.

Bitcoin price technical analysis

The weekly chart shows that the BTC price has declined over the past few months and is now hovering near its lowest point of the year. It has already dropped below the 50-week and 100-week Exponential Moving Averages. Also, the Average Directional Index has jumped to 30, a sign that the downtrend is strengthening.

Therefore, the most likely outlook is bearish, with the initial target being at $60,000. A drop below that level will signal further downside to $50,000, as Standard Chartered predicts.

Crypto World

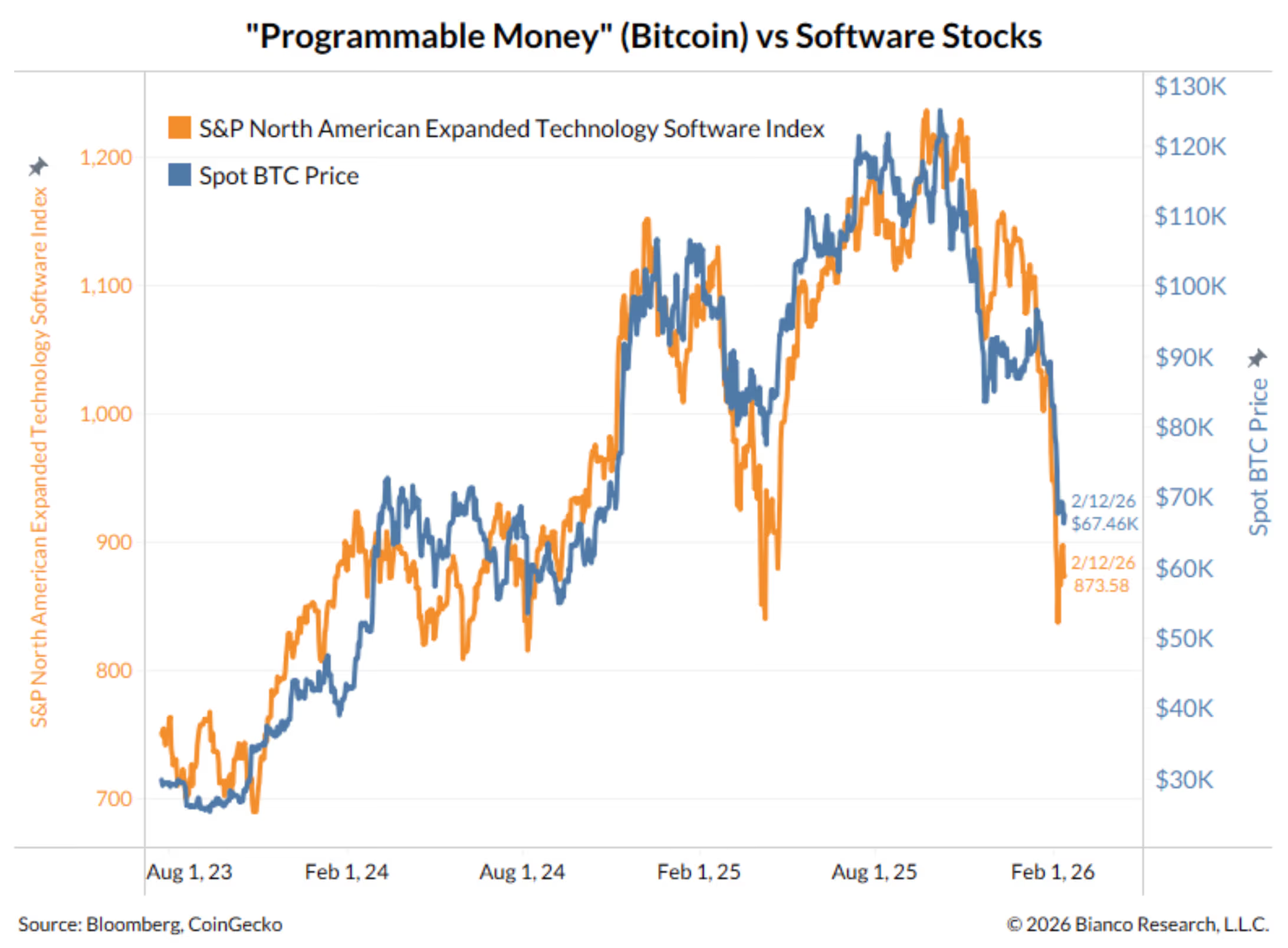

BTC falls back to $65,000 as software sector slides 3%

Bitcoin fell back toward last week’s lows, giving up nearly all of its recent gains above $70,000 and resuming its slide alongside weakness in the broader tech sector, as the crypto now trades back around $65,000.

Bitcoin was down 2% over the past 24 hours, with losses in ether and solana roughly tracking.

The decline mirrored broad price action in the Nasdaq, which fell 2% on Wednesday and more particularly in the software sector, where the iShares Expanded Tech-Software Sector ETF (IGV) tumbled 3%. The IGV is now down 21% year to date as investors question the sector’s pricey multiples in a world where the coding abilities of artificial intelligence agents appear to be rising exponentially.

“Software stocks are struggling again today,” wrote macro strategist Jim Bianco. “IGV is essentially back to last week’s panic lows.”

“Don’t forget there’s another type of software, ‘programmable money,’ crypto,” Bianco added. “They are the same thing.”

Precious metals not immune

Cruising along with modest gains through most of the day, gold and silver suffered quick, steep plunges in the mid-afternoon. Late in the session, silver was lower by 10.3% to $75.08 per ounce and gold was down 3.1% to $4,938.

Crypto World

Binance October 10 Backlash Hijacks Consensus Hong Kong

Binance Co-CEO Richard Teng has defended the exchange against claims that it was responsible for the October 10, 2025, “10/10” crypto crash, which saw roughly $19 billion in liquidations.

Speaking at CoinDesk’s Consensus Hong Kong conference on February 12, 2026, Teng argued the sell-off was driven by other factors besides any Binance-specific failures.

Sponsored

Sponsored

Richard Teng Gives Binance’s Side of the Story on October 10 Crash

The Binance co-CEO cited macroeconomic and geopolitical shocks between the US and China. Specifically, he cited:

- Fresh US tariff threats, including potential 100% duties on Chinese imports, and

- China’s imposition of rare-earth export controls.

The combination, he said, flipped global risk sentiment, triggering mass liquidations across all exchanges, centralized and decentralized alike.

“The US equity market plunged $1.5 trillion in value that day,” Teng said. “The US equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

The majority of liquidations (roughly 75%) occurred around 9:00 p.m. ET, coinciding with the release of macro news.

Teng acknowledged minor platform issues during the event, including a stablecoin depegging (USDe) and temporary slowness in asset transfers.

However, he stressed these were unrelated to the broader market collapse. He also emphasized that Binance supported affected users, including by compensating some of them.

Sponsored

Sponsored

“…trading data showed no evidence of a mass withdrawal from the platform,” he added.

Last year, Binance reportedly facilitated $34 trillion in trading volume and served over 300 million users.

It is worth noting that the October 10 crash has been a persistent cause of Binance FUD over the past several months. The exchange has faced criticism from far and wide, with the heaviest attacks coming from rival exchange OKX and its CEO, Star Xu.

Traders Reject Teng’s Macro Shock Explanation Amid $19 Billion 10/10 Liquidation

Despite Teng’s detailed defense, traders on social media have responded swiftly and critically. On X (Twitter), users accused Binance of locking APIs and engineering conditions that forced liquidations, only to deflect responsibility with the “macro shock” explanation.

Sponsored

Sponsored

“Blaming macro shocks is the new ‘it was a glitch.’ $19B liquidated and somehow nobody at Binance is responsible lol,” one user challenged.

Naysayers go further, with some users likening Teng’s claims to colloquial phrases in harsh criticism.

“‘It wasn’t us, it was the macro’ is the crypto exchange version of the dog ate my homework. $19B in liquidations and every platform just points at the guy next to them,” another said.

However, the majority of responses revolved around alleged fake API responses and questioned internal coordination at Binance. The general sentiment is that users feel the exchange is not fully transparent.

The backlash illustrates the ongoing tension between centralized exchanges and leveraged traders during high-volatility events.

While retail demand has cooled compared to previous years, Teng highlighted that institutional and corporate participation in crypto remains strong.

Sponsored

Sponsored

“Institutions are still entering the sector,” he said. “Meaning the smart money is deploying.”

Teng also framed the 10/10 event as part of a broader cyclical pattern in crypto markets. He argued that despite short-term turbulence, the sector’s underlying development continues, with institutional capital driving long-term confidence.

Still, the exchange faces a twofold challenge:

- It must defend its role during unprecedented market stress

- Binance must also restore trust with a skeptical trading community.

While the $19 billion liquidation wiped out positions across the market, the debate over who or what should be held accountable continues to simmer online. This is expected, given the fragility of confidence in high-leverage crypto trading.

Crypto World

Bitcoin risk-reward has shifted after recent selloff

Bitcoin’s recent price decline has prompted market analysts to assess whether a price floor is forming, with one prominent on-chain researcher stating the risk-reward profile has shifted following the selloff.

Summary

- “Checkmate” Check suggests Bitcoin has entered “deep value” territory.

- Recent selloff capitulation losses resemble those seen at 2022 cycle lows, indicating a potential market bottom forming with a 60% probability.

- Bitcoin’s price may be forming a bottom, but further declines are possible as market sentiment shifts.

James “Checkmate” Check, a former lead researcher at Glassnode and author of Check On Chain, told What Bitcoin Did host Danny Knowles that Bitcoin entered “deep value” territory across multiple mean-reversion frameworks when it dropped into recent price zones, according to statements made on the podcast. Check noted that capitulation-style losses spiked to levels last seen at the 2022 cycle lows.

Check stated that if Bitcoin is not trending toward zero, the statistical setup appears increasingly asymmetric after the selloff. The analyst said the current environment represents a time for market participants to pay attention rather than lose focus.

The researcher said he was focused on market structure rather than identifying a single forced seller behind the price movement.

Check offered a probabilistic assessment, stating that the odds of a bottom forming have increased significantly. He said the probability that the market has already set a meaningful low stands at more than 50%, likely around 60%, according to his analysis. The analyst assigned low odds to Bitcoin reaching a new all-time high within the year without a major macroeconomic shift or significant market event.

Regarding exchange-traded funds, Check cited billions in outflows during the drawdown, but characterized the situation as positioning unwinds rather than structural failure. He noted that at an earlier peak, approximately 62% of cumulative inflows were underwater, while ETF assets under management declined only in the mid-single digits. Check suggested earlier outflows aligned with CME open interest, consistent with basis-trade adjustments.

The analyst criticized reliance on the four-year halving cycle as a timing tool, calling it an “unnecessary bias.” Check said his approach prioritizes observing investor behavior over calendar-based predictions.

Even if the low has been established, Check said he expects the market to revisit it. He argued that bottoms typically form through multiple “capitulation wicks” followed by extended periods of reduced activity, where sustained uncertainty erodes confidence among late-cycle buyers. Check stated that formulating a bear case at current levels would be premature, framing the current zone as late-stage rather than early-stage in the move, while acknowledging prices could decline further.

The analyst described two failed all-time-high attempts in October followed by a sharp decline that likely resulted in significant losses for market participants. He referenced what he termed a “hodler’s wall” of invested wealth positioned above key levels, including a threshold he called the “bull’s last stand.” Check argued that once price broke below those levels, downside probability increased.

A key reference level cited by Check was the True Market Mean, described as a long-term center-of-gravity price that also overlapped with the ETF cost basis. He said that once that level broke, the psychological regime shifted to an acceptance phase where market participants began to believe a bear market had begun.

Check argued the market was subsequently pulled toward a prior high-volume consolidation zone where a significant portion of this cycle’s trading volume had occurred. He said the selloff likely involved leverage liquidations but framed that as secondary to a broader shift in market sentiment, where participants sell rallies during perceived downtrends.

The most significant bottoming signal emphasized by Check was the scale of realized losses during the recent decline. He said capitulation losses occurred at a very large daily rate, comparable to the 2022 bottom, with sellers concentrated among recent buyers from the late cycle and those who purchased during an earlier consolidation period. Check also noted that SOPR (Spent Output Profit Ratio) printed around minus one standard deviation, a reading that has historically appeared in only two contexts: as an early warning signal and near bottoming phases.

Check reiterated that bottoms form through a process involving multiple capitulation events followed by extended periods of reduced speculative interest, rather than a single definitive price point.

Crypto World

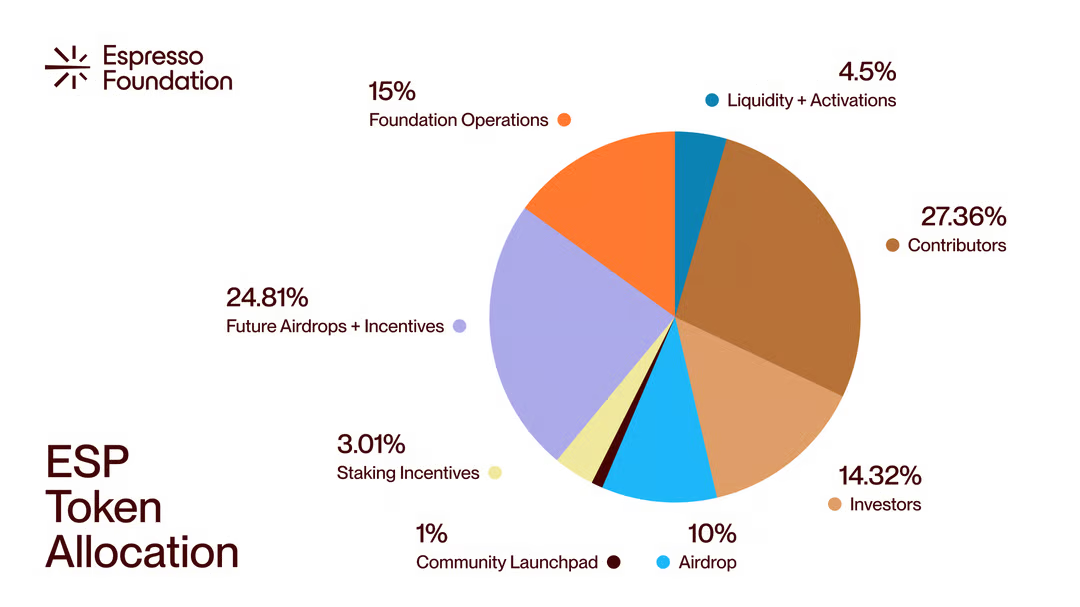

Espresso Token Launches at $275 Million Valuation

Launchpad buyers are down 30% with a 2-year vesting period ahead of them.

Espresso, a decentralized rollup base layer, launched its native ESP token this morning at a valuation of roughly $275 million following its token airdrop and distribution.

The token debuted at $0.072 before jumping up to $0.083 shortly after its launch and has reported $115 million in trading volume over its first 7 hours across CoinGecko-tracked platforms.

The protocol is designed to support rollups and appchains with everything they need from a base layer to ensure high performance, including finality, data availability, and real-time interoperability.

Today’s ESP token launch enables the network to transition to proof-of-stake, and the protocol has distributed 10% of the token supply in an airdrop to more than one million eligible addresses.

There was also a Kaito Launchpad sale in July 2025, which sold 1% of the supply at a $400 million valuation, leaving launchpad investors with a 31% loss at current prices.

The ESP token is the latest in a line of ICOs and token sales that are opening underwater, with Infinex and Aztec being two other recent examples.

Crypto World

Coinbase misses Q4 estimates as transaction revenue falls below $1 billion

Coinbase (COIN) missed fourth-quarter earnings forecasts on Thursday, thanks to weaker trading activity and lower crypto asset prices.

The U.S.-based crypto exchange posted total revenue of $1.78 billion against estimates for $1.83 billion. Adjusted EPS of $0.66 was well lower than the consensus $0.86.

Total transaction revenue of $983 million was below forecasts for $1.02 billion and down from $1.046 billion in the third quarter and $1.556 billion in the fourth quarter one year ago.

Subscription revenue of $727.4 million was down from $746.7 million the previous quarter and up from $641.1 million a year earlier.

Through Feb. 10 of the first quarter, the company saw transaction revenue of about $420 million. It guided to full-quarter subscription revenue of $550-$630 million.

“We continue to be optimistic about the long-term trajectory of the crypto industry,” Coinbase said. “Crypto is cyclical, and experience tells us it’s never as good, or as bad as it seems. While asset prices can be volatile, under the surface an undercurrent of technological change and crypto product adoption continues.”

Shares are modestly higher in after-hours trading, but fell 7.9% during the regular session, extending year-to-date declines to 40%.

Crypto World

Vitalik Buterin Advocates for Decentralized Reform in Russia’s Governance

TLDR

- Vitalik Buterin condemned Russia’s invasion of Ukraine, calling it criminal aggression and not a situation of equal fault.

- He argued that lasting peace in Ukraine and Europe can only be achieved through internal change within Russia.

- Buterin proposed that decentralized governance could be the key to reforming Russia’s political system.

- He highlighted tools like quadratic voting and zero-knowledge systems as potential solutions for improving decision-making.

- Buterin emphasized the importance of involving more people in governance through platforms like pol.is to find societal compromises.

Vitalik Buterin, co-founder of Ethereum, shared his views on Russia’s future in a post published on February 12. In the post, originally written in Russian, Buterin called Russia’s invasion of Ukraine “criminal aggression.” He emphasized the need for structural reform within Russia to achieve long-term peace and security, advocating for a decentralized governance model.

Buterin Criticizes Russia’s War and Calls for Internal Change

In his recent post, Vitalik Buterin condemned Russia’s invasion of Ukraine, labeling it as “criminal aggression.” He strongly rejected the idea that both sides are equally at fault, which some have argued. Buterin clarified that peace in Europe and Ukraine could not be achieved through a simple ceasefire alone.

He suggested that the best path to stability in the region involves internal change within Russia itself. For Russia to secure lasting peace, Buterin proposed significant structural reforms. These reforms, according to him, should focus on decentralizing governance, moving away from centralized power.

Vitalik Buterin Advocates for Decentralized Governance

Vitalik Buterin emphasized the potential of decentralized governance to transform Russia. He mentioned specific tools that could help in building a new system, such as quadratic voting and zero-knowledge (ZK) systems. These tools, Buterin argued, could allow large groups of people to find common ground without relying on a small elite.

The Ethereum co-founder believes that decentralized governance could be key to building a more transparent and fair system. In his post, he also referenced platforms like pol.is, which allow for broader participation in decision-making. These digital tools, Buterin suggested, could provide a way for citizens to directly engage with governance.

New Leadership and Ideas for Russia’s Future

Buterin also discussed the importance of new leadership in Russia, highlighting the need for fresh ideas. He stressed that the Russian opposition should focus on involving more people in decision-making. This approach would help avoid the concentration of power in the hands of a few.

He pointed out that using platforms for online voting and discussions could allow people to reach societal compromises. These compromises could then be turned into official policies without the need for intermediaries. According to Buterin, achieving consensus in this manner is crucial for Russia’s long-term stability.

Crypto World

ETHZilla Launches Tokenized Jet Engine Leases Amid Ethereum Decline

TLDR

- ETHZilla has launched a tokenized investment opportunity in leased jet engines through its subsidiary ETHZilla Aerospace.

- The company acquired two CFM56 commercial jet engines worth $12.2 million and is offering equity in these assets via the Eurus Aero Token I.

- The tokens, available to accredited investors, are priced at $100 each, with a minimum investment of 10 tokens.

- ETHZilla aims to provide a targeted return of 11% for token holders if they hold through the lease term, ending in 2028.

- Cash flows from the leased engines will be distributed monthly to token holders via blockchain technology.

ETHZilla has expanded its operations into the tokenization sector, launching a new project focused on jet engine leases. The company, through its new subsidiary ETHZilla Aerospace, is offering tokenized equity in jet engines it recently acquired. This move comes as ETHZilla seeks to diversify its investments amid Ethereum prices continuing to decline.

ETHZilla Introduces Tokenized Engine Leases on Arbitrum

ETHZilla’s new venture centers around tokenizing a $12.2 million investment in two leased CFM56 commercial jet engines. These engines are leased to a major U.S. airline, though the company has not disclosed the airline’s identity due to confidentiality concerns. By launching the Eurus Aero Token I on the Arbitrum layer-2 network, ETHZilla offers tokenized equity in the engines, allowing investors to participate in this emerging market.

ETHZilla CEO McAndrew Rudisill commented on the project, stating, “Offering a token backed by engines leased to one of the largest and most profitable U.S. airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows.” The company believes that this move will help modernize fractional ownership of aviation assets, a market traditionally dominated by institutional investors and private equity firms.

Token Sale Details and Project Goals

The Eurus Aero Token I, available to accredited investors, will be sold through Liquidity.io’s token marketplace. Each token is priced at $100, with a minimum investment of $1,000, or 10 tokens. The project aims to offer a return of approximately 11% if token holders hold until the lease agreements conclude in 2028. However, a disclaimer notes that actual returns could differ based on various factors.

Cash flows from the leased engines will be distributed monthly to token holders through the blockchain. ETHZilla has structured the tokens with collateral consisting of the engines, related lease receivables, insurance proceeds, and other reserves. The company’s tokenization model ensures transparency and on-chain distribution, making it accessible to a broader group of investors.

ETHZilla’s expansion into tokenized aviation assets is part of a broader effort to pivot from its Ethereum holdings. The firm recently revealed a $250 million share buyback program, following a drop in the company’s market cap. ETHZilla’s share price has seen fluctuations, including a significant drop in recent months.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports22 hours ago

Sports22 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports6 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World23 hours ago

Crypto World23 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video18 hours ago

Video18 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’