Crypto World

Israeli soldier allegedly used military secrets to gamble on Polymarket

Israel is attempting to prosecute a reserve soldier who allegedly used military secrets to place bets on security operations via Polymarket.

Polymarket offers a multitude of markets on various military operations, from bets on the outcome of the Ukraine/Russia war, to more specific targeted missile strikes against various countries.

Israel’s Shin Bet security agency announced today that the soldier — who is facing court along with an alleged civilian accomplice — used “classified reports” accessed via their military role to help make bets that could threaten Israel’s national security.

The pair is charged with numerous security offences, as well as bribery and obstruction of justice. Several people were arrested, but only two have been charged so far.

A lawyer representing the soldier told Bloomberg that the indictment is “flawed,” adding that the charge of harm to national security has been dropped.

They added, however, that he’s still believed to have used confidential information without permission.

Pair might be connected to $150K Polymarket winnings on Israel-Iran strikes

It’s unknown which prediction markets the two bet on, or if they made any profits. There are suspicions, however, that they could be linked to the Polymarket account “ricosuave666.”

This account made over $150,000 betting on Israel’s strikes against Iran in 2025, and reportedly got each prediction correct across a war that lasted 12 days.

Israeli authorities then opened up an investigation into these bets.

Previous cases involving the leaking of military secrets led to an Israeli soldier reportedly being sentenced to 27 months in jail in 2023.

The individual passed on confidential information to users on social media so that they could gain credibility and popularity online.

Read more: Logan Paul fakes $1M Super Bowl bet on Polymarket

Every month, there seems to be another debate surrounding Polymarket and the use of insider information to make bets, but it’s unclear how capable the platform is of preventing these sorts of trades.

There were concerns over one account that made $437,000 betting on the exit of Venezuela’s former president Nicolás Maduro hours before the US captured him.

There were also concerns that someone was able to use insider information to bet on the Nobel Peace Prize before it was announced.

After the home of Polymarket’s CEO, Shayne Coplan, was raided by the FBI, a company spokesperson said, “We charge no fees, take no trading positions, and allow observers from around the world to analyze all market data as a public good.”

Protos has reached out to Polymarket for comment and will update this piece should we hear anything back.

Got a tip? Send us an email securely via Protos Leaks. For more informed news and investigations, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.

Crypto World

Israeli Military Bets on Polymarket Trigger Indictments

Israel indicted two citizens for allegedly using classified information to place wagers on the prediction platform Polymarket, according to a statement made by authorities on Thursday.

The news renewed concern that prediction markets make it easier to engage in insider trading for profit.

Sponsored

Sponsored

Israeli Agencies Target Military Insider Betting Case

In a joint statement, the Israeli Defense Ministry, Israel Police, and the Shin Bet said the suspects — an army reservist and a civilian — were arrested on suspicion of placing bets on Polymarket about potential military operations.

“This was allegedly based on classified information to which the reservists were exposed through their military duties,” the statement said.

The announcement comes weeks after Israeli public broadcaster Kan News reported on the matter. The outlet said security agencies had opened an investigation into the suspected misuse of classified information within the defense establishment.

The report alleged that the information was used to place bets on Polymarket, including on the timing of Israel’s opening strike on Iran during the 12-day war in June 2025.

These platforms have seen a surge in wagers on geopolitics, crypto, politics, and sports. Although marketed as alternatives to traditional gambling, their structure closely mirrors conventional betting markets.

Users buy and sell shares tied to real-world outcomes, with prices ranging from $0.01 to $1.00 reflecting the market’s implied probability of each outcome.

Sponsored

Sponsored

Their accessibility, pseudonymity, and ease of use have also prompted concerns about potential insider trading and misconduct.

Are Prediction Markets Exploitable Profit Machines?

Since the start of the year, several incidents have emerged, raising questions about whether individuals with confidential information are using these platforms to generate substantial profits.

In early January, a cluster of newly created Polymarket accounts placed large, precisely timed wagers on contracts predicting Venezuelan strongman Nicolás Maduro would be removed from office.

These wallets netted more than $630,000 in combined profits just hours before reports of his capture broke.

A similar controversy emerged last December. A Polymarket user earned nearly $1 million by placing highly accurate bets on Google’s 2025 Year in Search rankings. The precision prompted speculation about possible insider access.

The wallet achieved an unusually high success rate, correctly predicting nearly all outcomes, including several low-probability results. However, there is no evidence confirming any internal connection.

Together, the incidents have intensified debate over the role of prediction markets. Critics question whether they function as efficient information aggregators or enable the monetization of privileged, non-public information.

Crypto World

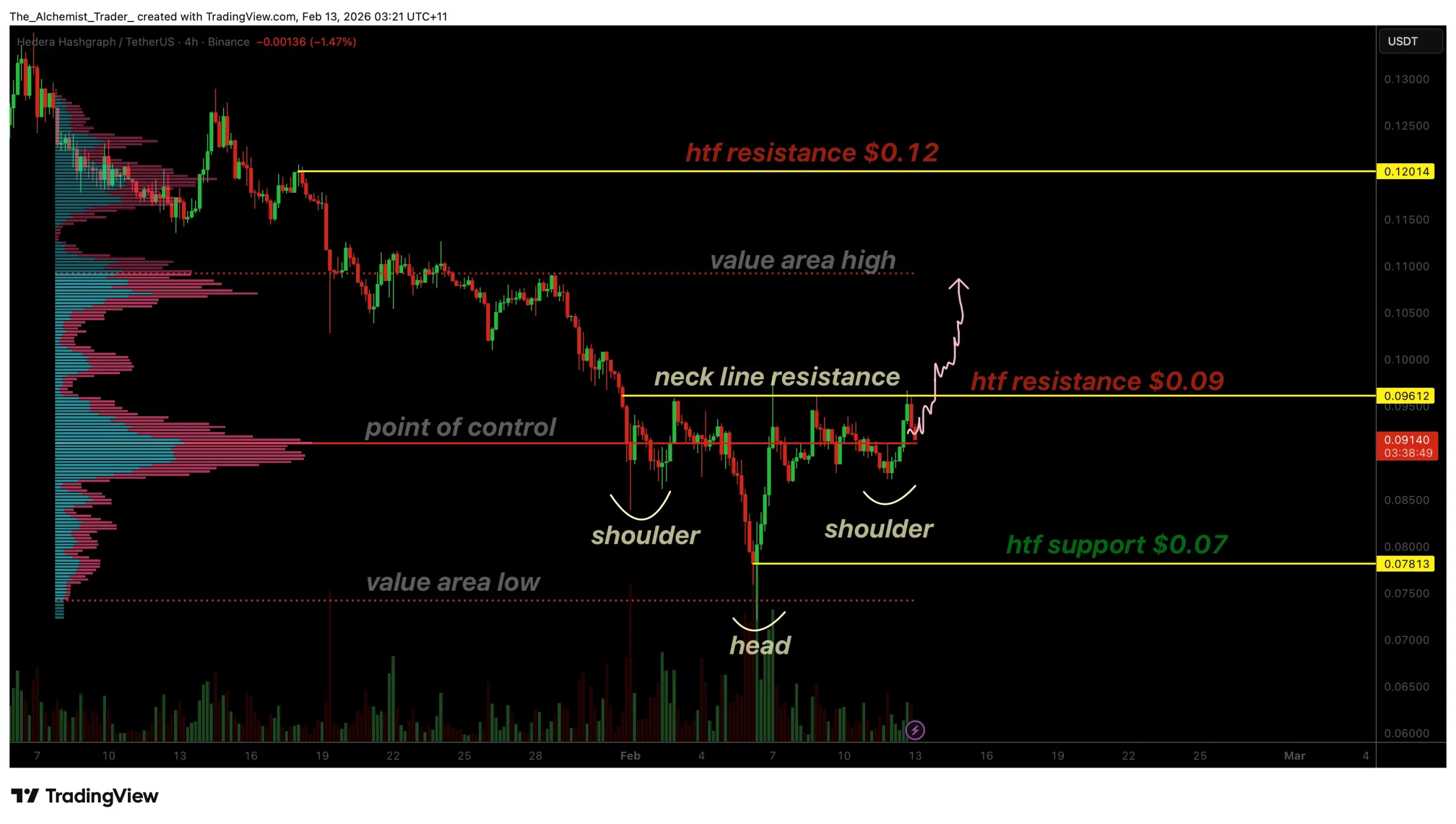

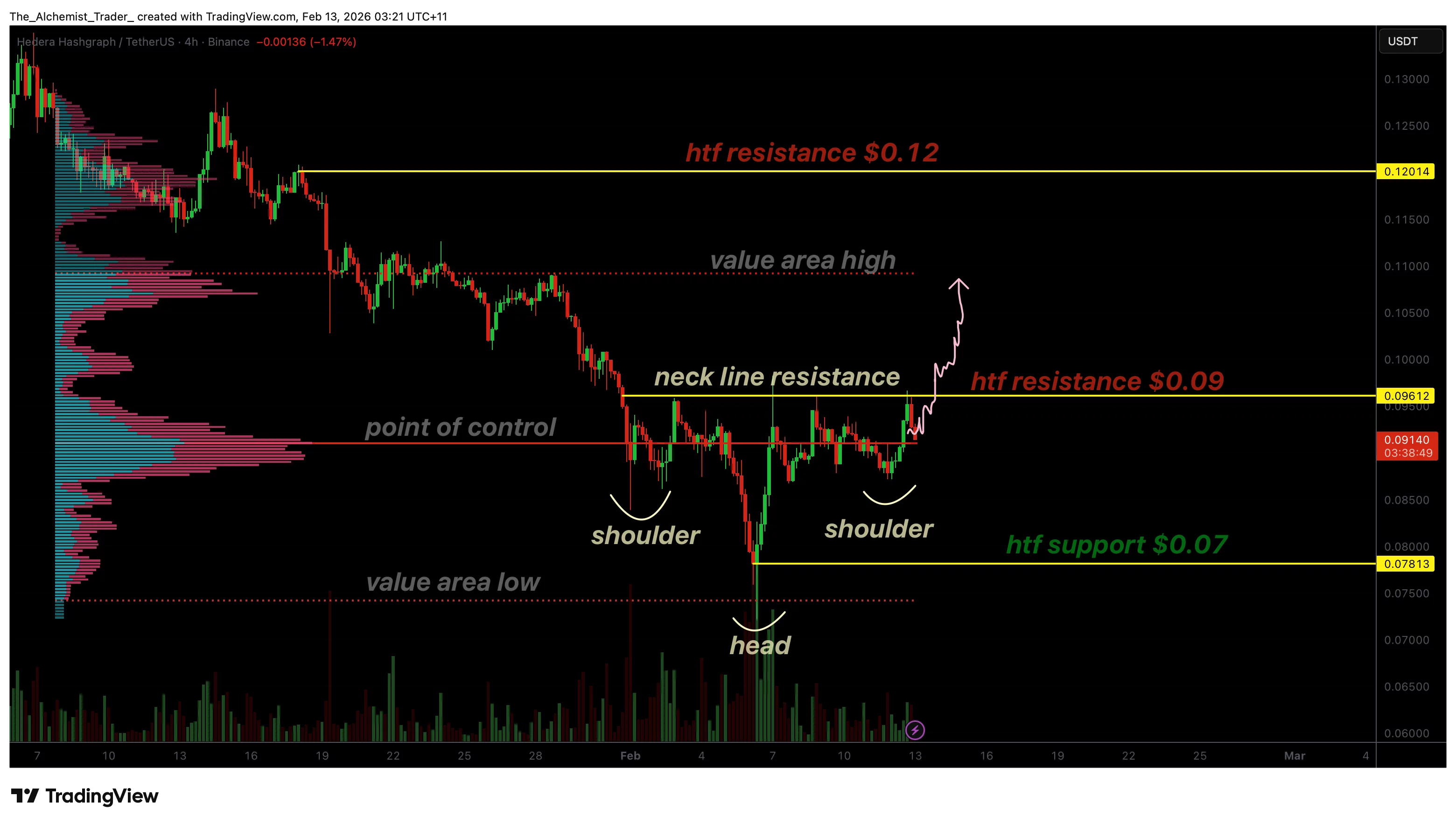

HBAR price nears breakout, inverse head and shoulders pattern forms

HBAR price is consolidating below key resistance as an inverse head and shoulders pattern develops, signaling a potential bullish breakout if the neckline resistance is cleared with volume.

Summary

- Inverse head and shoulders pattern developing, signaling trend reversal potential

- $0.09 neckline resistance is the key trigger for bullish confirmation

- Holding above the point of control supports a breakout toward higher targets

HBAR (HBAR) price action is showing increasingly constructive behavior as the market builds a classic bullish reversal structure on the higher timeframes. After an extended corrective phase, price has stabilized and begun forming an inverse head and shoulders pattern, a formation often associated with trend reversals when confirmed by a breakout above resistance.

This structure is developing just beneath a key high-timeframe resistance level, placing HBAR at a critical inflection point. With price holding above key value levels and volume remaining supportive, the technical setup suggests that bullish momentum may be building beneath the surface.

HBAR price key technical points

- Inverse head and shoulders pattern is forming, signaling potential trend reversal

- Neckline resistance sits near $0.09, a key high-timeframe level

- Price is holding above the point of control, supporting breakout conditions

HBAR’s recent price action has carved out a well-defined inverse head-and-shoulders pattern, consisting of a left shoulder, head, and right shoulder. This structure typically forms after sustained downside pressure and reflects a gradual shift in control from sellers to buyers.

The neckline of this pattern is clearly defined near the $0.09 level, which also aligns with a high-timeframe resistance zone. This confluence strengthens the importance of the level, as a breakout above the neckline would represent both a pattern confirmation and a structural shift.

Throughout the formation, price has respected higher lows, indicating that downside momentum is weakening and buyers are increasingly willing to step in earlier.

Volume and point of control support the setup

One of the more constructive aspects of HBAR’s setup is how volume behaves during consolidation. Price is currently trading above the point of control, where the highest concentration of traded volume has accumulated. Holding above this level suggests acceptance at higher prices and reinforces the bullish narrative.

In reversal structures, accumulation beneath resistance is often a precursor to expansion. The fact that volume has remained healthy, rather than declining, indicates sustained participation and reduces the risk of a false breakout.

Additionally, a key swing low has formed near the value area low, further supporting the idea that demand is building at higher levels rather than allowing price to rotate lower.

Breakout conditions and upside targets

For the bullish scenario to fully play out, HBAR must break above the neckline resistance near $0.09 with a clear bullish influx. A decisive close above this level, with expanding volume, would confirm the inverse head-and-shoulders pattern and signal a shift in market structure.

If confirmed, the next upside target would be the value area high, followed by the broader high-timeframe resistance around $0.12. These levels represent natural areas where price may pause or consolidate following a breakout.

Importantly, a breakout without volume confirmation would increase the risk of a failed move. As such, volume behavior remains a key variable to monitor.

What to expect in the coming price action

From a technical, price action, and market structure perspective, HBAR is approaching a pivotal moment. As long as price remains above the point of control and continues to build higher lows, the inverse head and shoulders pattern remains valid.

A successful breakout above $0.09 would likely trigger a bullish expansion toward higher resistance zones. Conversely, failure to break and hold above the neckline could result in extended consolidation or a rotation back toward lower value levels.

Crypto World

Russia Blocks WhatsApp to Push Surveillance App, Company Claims

WhatsApp, the messaging app owned by Meta, is at the center of a high-stakes regulatory clash as Moscow pushes a domestic alternative and tightens control over digital communication. In recent days, the company publicly accused the Russian government of attempting to block access for millions of users to steer them toward a state-owned substitute. The dispute unfolds as Russia advances a homegrown platform, Max, developed by VK, and seeks to entrench it as the official backbone for private messaging inside the country. The government’s aim is amplified by directives to pre-install Max on all smartphones sold in Russia, a move scheduled to take effect on Sept. 1, and by a broader push to curb reliance on Western platforms amid ongoing regulatory scrutiny.

Key takeaways

- WhatsApp alleges Russia is attempting to isolate over 100 million users from private and secure communication, describing the move as a setback to digital safety.

- Max, announced by VK and described as a state-backed alternative to WhatsApp and Telegram, began rolling out in March 2025 and is being mandated for pre-installation on new devices starting Sept. 1.

- Backlinko estimates Russia hosts about 72 million active monthly WhatsApp users, placing the country among the top markets for the app outside the usual leaders.

- Russian authorities have signaled that unblocking WhatsApp would require compliance with local laws and a willingness to negotiate, signaling a potential but uncertain path to access restoration.

- Beyond Russia, authorities in other countries have intermittently restricted messaging services during periods of conflict or political upheaval, highlighting a broader trend in digital sovereignty and governance.

Sentiment: Neutral

Market context: The episode sits at the intersection of tech policy and geopolitical risk, illustrating how regulatory actions aimed at domestic control of communications can ripple through the broader digital ecosystem, including networks that crypto services rely on for open, cross-border activity. It underscores a growing attention to data localization, interoperability, and platform sovereignty that could influence global tech and financial ecosystems.

Why it matters

The confrontation between WhatsApp and Russia’s state-backed messaging initiative underscores a fundamental tension between user safety, privacy, and state interests. By introducing Max as a domestically controlled alternative, Moscow is signaling that access to private communication platforms is not simply a consumer choice but a matter of national policy. The move could reshape how Russians communicate, store sensitive information, and interact with businesses, while also raising questions about data localization, resilience, and security in a landscape where private messaging has become a critical utility for personal and professional life.

For international platforms, the Russian example highlights the costs and friction of compliance in a regulated environment that prizes sovereign control over digital infrastructure. The push to pre-install Max on all devices introduces a form of interoperability risk and raises concerns about interoperability with foreign networks, encryption standards, and user consent. Companies that operate across borders must navigate a patchwork of rules, sometimes in real time, which can affect everything from customer support to data flows and incident response protocols. The situation also hints at potential regulatory spillovers to adjacent technologies, including decentralized and cross-border services that crypto projects rely on to maintain open access and censorship resistance.

From a safety and governance perspective, the Russian case illustrates why policymakers abroad are investing in formal mechanisms to manage online communications. The tension between allowing free, secure messaging and enforcing content or data requests from law enforcement creates a persistent policy dilemma. In markets where crypto and blockchain technologies are gaining traction, observers will be watching to see how such regulatory dynamics influence the development of compliant, privacy-preserving communication tools and infrastructure that can withstand political pressure while preserving user trust.

The broader pattern is not limited to Russia. Reports from other countries describe a spectrum of actions—from partial restrictions to complete takedown attempts—that governments have employed during moments of political contention. The dialogue around messaging sovereignty compounds existing concerns about censorship, access to information, and digital rights. For users, this can mean unpredictability in service availability, the need for alternative channels, or the adoption of independent or decentralized messaging solutions as a hedge against outages or coercive controls.

On the technical front, the unfolding dynamic may accelerate innovation in how platforms approach data localization, compliance tooling, and cross-border interoperability. It also raises practical questions for developers, such as how to design communication apps that can operate seamlessly across multiple legal regimes without compromising user safety or security. While the immediate focus is regional, the implications reverberate through any ecosystem that depends on reliable, private messaging as a backbone for collaboration, financial transactions, or sensitive communications—an area where crypto communities have long stressed the importance of resilient, permissionless networks even as regulators seek to impose order and accountability.

What to watch next

- Sept. 1, 2025 — Russia’s mandatory pre-installation of Max on all smartphones takes effect, elevating the platform’s installed base and potentially altering user behavior during the ongoing policy debate.

- End of 2026 — Official signals from Moscow suggest a possible complete blocking of WhatsApp if compliance with national laws does not align with the state’s terms.

- February 2026 — Public commentary and further reporting on whether WhatsApp remains accessible or experiences domain-level restrictions within Russia, including official statements from the presidential administration or regulatory bodies.

- Regulatory actions and negotiations — Any new statements from Russia’s negotiation channels or law-enforcement agencies that clarify the conditions under which foreign messaging services could regain access or be forced to alter operational practices.

- Comparative developments — Monitoring similar moves in other jurisdictions to assess how messaging sovereignty affects global platforms, user experience, and cross-border data flows.

Sources & verification

- Gazeta.ru: Russia reports that WhatsApp’s domain had been blocked and would require VPN or similar workaround to access. https://www.gazeta.ru/tech/news/2026/02/11/27830761.shtml

- TASS: Presidential press secretary Dmitry Peskov commented that unblocking WhatsApp would require the app to follow Russian laws and engage in negotiations. https://www.gazeta.ru/tech/news/2026/02/12/27832279.shtml?utm_source=chatgpt.com&utm_auth=false

- Backlinko: Estimates of Russia’s active WhatsApp user base, highlighting a sizable market. https://backlinko.com/whatsapp-users

- WhatsApp on X: Official status update from the messaging platform regarding Russia’s access measures. https://x.com/WhatsApp/status/2021749165835829485?s=20

- Related coverage and context: Afghanistan internet outage and blockchain decentralization discussion. https://cointelegraph.com/news/afghanistan-internet-outage-blockchain-centralized-web

Digital friction in Russia’s messaging ecosystem: implications for users and global platforms

The dispute over WhatsApp and the push for a state-backed alternative in Russia crystallizes how policy choices can redefine the digital landscape that users rely on every day. The government’s insistence on pre-installation and on maintaining control over messaging channels is rooted in a broader imperative to keep communications within national boundaries, a stance that has long resonated with policymakers across different regions and sectors, including finance and crypto. While the immediate stakes involve access to a popular app and the safety of private conversations, the longer arc concerns how digital infrastructure is governed, who bears responsibility for safeguarding data, and how open networks can survive attempts at centralization.

For users in Russia, the outcome may hinge on a balance between safety assurances and the practicality of maintaining private, secure conversations in a domestic environment. The presence of a government-backed platform could improve certain regulatory alignments but might also introduce new layers of surveillance or compliance expectations. In contrast, WhatsApp’s contention that the move would “isolate over 100 million users” emphasizes concerns about user autonomy and the resilience of cross-border communication in the face of coercive policy changes. The debate has implications that extend beyond messaging to how crypto ecosystems—built on permissionless networks that assume open access—are perceived when governments seek to exert tighter control over digital channels and data flows.

From a business and innovation standpoint, the Max initiative raises questions about interoperability and the economics of protocol choices in a regulatory environment. Domestic platforms can attract usage through convenience and policy compliance, but they may also risk fragmentation, reduced interoperability with global services, and increased costs for developers who must adapt to multiple rule sets. For the broader tech community, the gambit signals a need to design systems and user experiences that maintain robust privacy protections while meeting diverse regulatory requirements. The lessons learned from Russia’s approach could influence the development of new messaging tools, privacy-preserving features, and strategies to ensure user safety without sacrificing openness—an objective that remains central to many crypto advocates who champion secure, censorship-resistant networks.

Ultimately, the case highlights how control over digital communications remains a strategic frontier for governments and tech firms alike. It also serves as a reminder for users and investors to monitor regulatory trajectories and policy signals, as these can have spillover effects on adjacent sectors that depend on stable, accessible online infrastructure. Whether by design or accident, policy choices in one major market can catalyze shifts in how people communicate, how services are delivered, and how new technologies—such as decentralized tools or crypto-enabled platforms—are perceived and adopted in the years ahead.

What to watch next

- Sept. 1, 2025 — Max becomes the default pre-installed option on new smartphones in Russia, solidifying its installed base.

- End-2026 — Official statements or regulatory actions that could signal a complete blocking of WhatsApp if compliance terms are not met.

- February 2026 — Ongoing reporting on access to WhatsApp in Russia, including potential official clarifications or statements from Moscow.

- Regulatory updates — Any new measures that define how foreign messaging platforms must operate within Russia’s legal framework.

Crypto World

Bitcoin Faces Historic Capitulation Event with $3.2 Billion in Losses

TLDR

- Bitcoin experienced one of its largest capitulation events in history with $3.2 billion in realized losses on February 5, 2026.

- The massive sell-off led to significant losses for Bitcoin and Ethereum investors, marking one of the worst days in crypto history.

- Ethereum mirrored Bitcoin’s downturn, suffering a sharp price drop as the broader market faced extreme selling pressure.

- On-chain data showed that the market realized an average of $2.3 billion in daily losses over the past week.

- Experts warn that more pain could lie ahead for the crypto market, with predictions of further price declines for both Bitcoin and Ethereum.

The cryptocurrency market experienced one of its most intense capitulation events in history on February 5, 2026. Data from CryptoQuant revealed that investors faced a staggering $3.2 billion in realized losses in just 24 hours. This massive sell-off is among the largest recorded losses, placing the event in the top 3-5 worst loss events ever documented in crypto history.

Bitcoin Suffered a Major Blow

The February 2026 market crash was especially harsh on Bitcoin. According to CryptoQuant, the sell-offs during this period caused Bitcoin investors to lock in a massive loss. The on-chain data shows that Bitcoin holders faced severe financial pain, with billions in unrealized losses turning into realized losses in a single day.

Bitcoin’s price was significantly impacted, dropping to lower levels than many had not expected. The crypto asset saw one of its worst days, as the market faced an extreme level of selling pressure. Investors, many of whom had bought during higher price levels, were forced to sell at a loss.

Ethereum’s Struggles Mirror Bitcoin’s Downturn

Ethereum, too, faced a severe loss in the February 2026 sell-off. The second-largest cryptocurrency after Bitcoin suffered as the broader market crashed. Ethereum’s price dropped dramatically, as investors were forced to realize losses amid widespread capitulation in the market. Ethereum’s price moved in tandem with Bitcoin’s decline, showing similar patterns of pain for holders.

Despite Ethereum’s resilience in previous years, it did not escape the effects of this capitulation event. Like Bitcoin, Ethereum holders faced the harsh reality of the market’s volatility. With the pressure mounting, Ethereum’s losses became a symbol of the widespread distress in the market.

Is More Pain Ahead for Crypto?

Despite the harsh nature of the February 2026 crash, experts warn that more challenges could lie ahead for cryptocurrency holders. Standard Chartered issued a cautionary note, suggesting that the market is still at risk of further correction. Analysts predict Bitcoin could fall as low as $50,000, with Ethereum possibly reaching levels as low as $1,400.

The macroeconomic environment, coupled with potential ETF outflows, could continue to contribute to a downward trend. Cryptocurrency investors are bracing themselves for more uncertainty, as the market remains volatile and unpredictable.

Crypto World

Aptos-Incubated Decibel Launch Protocol-Native Stablecoin Pre-Mainnet

Decibel Foundation is moving to embed an on-chain stablecoin into its Aptos-native derivatives ecosystem. The protocol-native token, USDCBL, issued by Bridge, is set to back on-chain perpetual futures trading as Decibel gears up for its February mainnet launch. The dollar-denominated asset is designed to internalize reserve economics, reducing dependence on third-party stablecoin issuers and giving the protocol more control over collateral dynamics. Decibel, incubated by Aptos Labs, plans to debut in February with a fully on-chain perpetual futures venue that relies on a single cross-margin account. The platform’s December testnet reportedly attracted more than 650,000 unique accounts and exceeded 1 million daily trades, figures that have yet to be independently verified.

Key takeaways

- Decibel will launch a protocol-native stablecoin, USDCBL, issued via Bridge’s Open Issuance platform, ahead of its Aptos-based perpetual futures exchange mainnet.

- USDCBL reserves will be backed by a mix of cash and short-term U.S. Treasuries, with yield retained within the protocol to support on-chain economics.

- Onboarding flow converts deposits of USDC into USDCBL, enabling on-chain collateral for perpetual futures and reducing reliance on external stablecoin issuers.

- The project emphasizes that USDCBL is infrastructure for the exchange rather than a standalone retail token, signaling a broader push toward ecosystem-native stablecoins.

- The announcement situates Decibel within a wider trend toward native stablecoins across crypto and traditional finance, with examples like Hyperliquid’s USDH and institutional tokens from JPMorgan and PayPal.

- Bridge’s Open Issuance ties Decibel to a broader stablecoin issuance framework, underscored by Bridge’s acquisition by Stripe in late 2025.

Sentiment: Neutral

Market context: The emergence of ecosystem-native dollar tokens across crypto platforms and traditional finance mirrors a broader move toward internalized collateral and on-chain settlement. The trend includes initiatives such as Hyperliquid’s native stablecoin USDH, JPMorgan’s tokenized deposits with JPM Coin, and PayPal’s PYUSD, all highlighting a shift toward dollars inside networks rather than relying solely on external issuers. The regulatory environment is also evolving, with proposals for stablecoin licensing and oversight under consideration in the United States.

Why it matters

The Decibel initiative marks a meaningful shift in how on-chain derivatives ecosystems anchor liquidity and risk management. By issuing USDCBL through Bridge’s Open Issuance platform, the project creates a fully collateralized stablecoin designed to live entirely within the protocol’s rails. The approach aims to reduce counterparty risk and minimize dependence on third-party stablecoin issuers, potentially lowering external liquidity constraints for the exchange’s perpetual futures venue.

From a tech perspective, a cross-margin architecture on a fully on-chain perpetuals venue can streamline settlement and collateral management. The onboarding flow—deposit USDC and convert to USDCBL— ties user funds to a native collateral pool that is governed by on-chain rules and reserves that are auditable in real time. The reserve model anchors value in a mix of cash and short-term U.S. Treasuries, with yield returned to the protocol rather than shared with external issuers or custodians. That design could improve capital efficiency and enable more aggressive reinvestment into ecosystem development and product enhancements, provided risk controls remain robust.

Market observers note that the broader push toward ecosystem-native stablecoins is not limited to crypto-native platforms. In parallel, traditional financial players are deploying tokenized dollar instruments within their networks to support real-time settlements and liquidity optimization. The PayPal PYUSD program and JPM Coin’s deployment for institutional settlement illustrate how “inside-network” dollars can reshape flow dynamics across both crypto and conventional finance. In the case of PayPal, for example, a 2025 rewards program tied to PYUSD holdings further integrates the stablecoin into consumer and merchant ecosystems, signaling how stablecoins can extend beyond trading into everyday payments and incentives.

Hyperliquid’s USDH example underscores the potential of native stablecoins to serve as platform-wide collateral. USDH is minted on the platform’s HyperEVM layer and is designed to act as collateral across the exchange, aiming to reduce reliance on off-platform issuers. This demonstrates a broader appetite among developers to align stablecoins with the specific risk profiles and liquidity needs of their ecosystems, rather than “one-size-fits-all” stablecoins that depend on external issuers.

As the ecosystem experiments with native stablecoins, the role of issuance infrastructure becomes another critical variable. Bridge’s Open Issuance framework enables projects to create regulated, fully collateralized stablecoins with integrated on- and off-ramps, linking on-chain finance more tightly to real-world assets. Bridge’s acquisition by Stripe in late 2025 highlights how stablecoin tooling is increasingly intertwined with mainstream fintech infrastructure, potentially accelerating adoption and interoperability across networks.

In short, Decibel’s USDCBL blueprint reflects a broader thesis: native stablecoins embedded within a platform’s governance and risk framework can improve liquidity, reduce external dependencies, and enable more sustainable funding for ecosystem development. Whether such models gain traction will depend on risk controls, regulatory clarity, and the ability of on-chain venues to demonstrate durable, auditable reserve management while delivering reliable user experiences.

What to watch next

- February mainnet launch of the Aptos-based perpetual futures exchange and the onboarding flow for USDCBL.

- Details on reserve composition, collateralization ratios, and on-chain governance updates tied to USDCBL and Bridge’s issuance framework.

- Regulatory developments around stablecoin licensing and compliant issuance pathways, including mentions of licensing proposals in the U.S. context.

- User adoption metrics from the testnet and early mainnet phases, including net deposits into USDCBL and cross-margin activity.

Sources & verification

- Decibel Foundation’s announcement about USDCBL and its use as collateral for on-chain perpetual futures.

- Decibel’s X post detailing reserve backing and income retention within the protocol.

- Bridge’s Open Issuance platform and its role in issuing regulated, fully collateralized stablecoins; Bridge’s 2025 Stripe acquisition.

- December testnet performance metrics (650,000+ unique accounts; 1,000,000+ daily trades).

- Comparative examples of ecosystem-native stablecoins, including Hyperliquid’s USDH, JPM Coin, and PayPal’s PYUSD.

Decibel’s on-chain stablecoin aims to underpin Aptos perpetuals

The Decibel Foundation’s plan centers on USDCBL, a protocol-native stablecoin issued by Bridge, designed to operate as collateral for on-chain perpetual futures on Decibel’s upcoming Aptos-based exchange. Depositors will convert USDC (CRYPTO: USDC) into USDCBL (CRYPTO: USDCBL) as part of the onboarding flow, with USDCBL issued via Bridge’s Open Issuance platform. The intention is to create a fully collateralized, internal reserve mechanism that reduces exposure to external stablecoin issuers while maintaining familiar price stability for traders. Bridge, which had been acquired by Stripe in late 2025, serves as the issuance backbone for USDCBL, aiming to deliver a seamless on-ramp and off-ramp experience for users across the ecosystem.

At launch, the exchange will feature a single cross-margin account for on-chain perpetual futures, simplifying risk management for users who hold USDCBL as collateral. The December testnet reportedly attracted hundreds of thousands of users and a high level of trading activity, underscoring pent-up demand for on-chain derivatives experiences on Aptos. However, as with many new testnet figures, independent verification remains pending, so market participants will be watching the February mainnet rollout closely to assess real-world engagement and liquidity.

USDCBL reserves are described as a mix of cash and short-term U.S. Treasuries, with yield generated by those assets retained within the protocol. This approach could reduce the need to rely on trading fees or token incentives as primary revenue streams, freeing capital to be reinvested into ecosystem development and product enhancements. The foundation emphasized that USDCBL is not merely another stablecoin; rather, it is “core exchange infrastructure” intended to support the mechanics of a fully on-chain venue rather than serve as a broad retail token. This framing reflects a design choice that prioritizes platform integrity and reliability over standalone consumer use cases.

In the broader context, Decibel’s move sits alongside a wave of native-stablecoin experiments across both crypto-native projects and traditional financial institutions. Hyperliquid’s USDH, minted on the platform’s HyperEVM, illustrates how a platform-specific token can function across an exchange’s liquidity and collateral framework. The inclusion of widely discussed developments like JPM Coin (institutional tokenization for settlement) and PYUSD (PayPal’s dollar-backed token integrated into its payments network) further demonstrates the industry’s interest in dollars entrenched within networks rather than external issuers alone. Taken together, these examples depict a landscape where stablecoins are increasingly tailored to the governance and risk profiles of individual ecosystems, rather than deployed as generic, market-wide instruments.

Crypto World

Vitalik Proposes ‘Decentralized Governance’ Model for Russia’s Future

The Ethereum co-founder condemned Russia’s invasion of Ukraine while saying the country could benefit from crypto principles like decentralization.

Vitalik Buterin shared in a long post on X on Feb. 12, originally written in Russian, his views on Russia’s war against Ukraine and what Russia’s future could look like under a “decentralized governance” model.

In the first half of the post, published ahead of the fourth anniversary of Russia’s invasion, the Ethereum co-founder called the war “criminal aggression,” not a “complicated situation” where both sides are equally at fault. He then argued that real, lasting security for Ukraine and Europe will not come from a temporary ceasefire alone, but from change inside Russia itself.

In his view, the strongest guarantee of peace would be for Russia to transform into a different kind of system. To do that, he said, the country would need deeper structural reform based on decentralized governance.

Buterin’s post underscores a broader trend of applying crypto ideas, especially decentralization and transparency, to geopolitics. As crypto adoption grows around the world, its core principles are increasingly being discussed as models for both financial and political systems.

“People often speak about ‘decentralized governance’ and ‘radical democracy’ in very abstract and idealistic terms, but far too rarely do they talk about what concrete problem it can actually solve,” Buterin wrote, via translation.

He listed ideas such as quadratic voting, zero-knowledge (ZK) systems and online discussion platforms like pol.is. These tools, he said, can help large groups find common ground instead of leaving decisions to a small, centralized elite.

“In the crypto industry, some people like to say that we need to move from ‘don’t be evil’ to ‘can’t be evil’. In human society, achieving this goal 100% is completely unrealistic, but achieving 25%? That would already be a very good result,” Buterin wrote in Russian.

He added that this point matters for two reasons: First, when building any new system, people must be clear about the real goal. Second, both ordinary Russians and members of the political elite who would need to “cooperate in order for there to be any success” must understand why these ideas are worth supporting.

In the final part of his essay, Buterin focused on decentralized governance as a process, highlighting digital tools and AI-driven discussion platforms. He argued that the Russian opposition needs new ideas and leaders, and that the best way to find them is to involve more people directly.

Instead of relying on a small group, he suggested using online systems like pol.is, where large numbers of citizens can post views and vote on proposals.

“This makes it possible to find societal compromises — or even consensus — directly, without intermediaries (such as elected representatives), so that officials are left only with the task of turning that compromise/consensus into an official document or law,” Buterin wrote.

He emphasized that “this is all long-term,” and that the Russian people need to think deeply about what happens after Putin. “Having a concrete roadmap — a plan that can convince a broad coalition, both ordinary people and politicians, both inside Russia and in other countries — is an important first step,” he concluded.

Crypto World

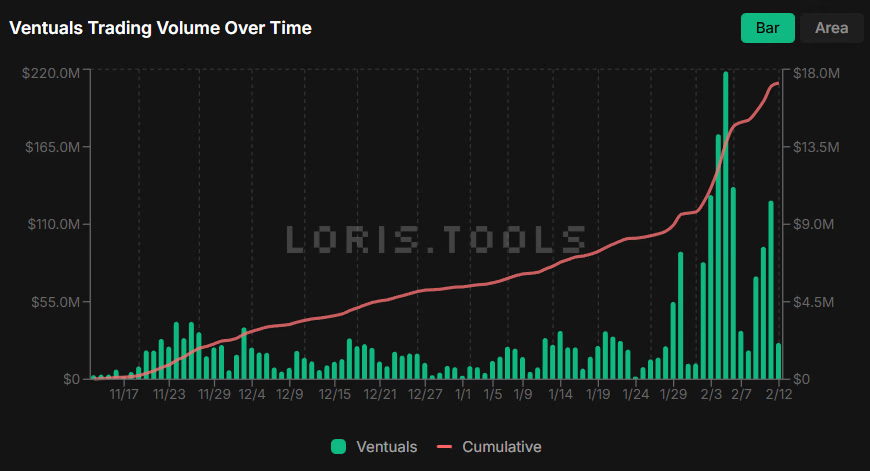

Hyperliquid-Based Ventuals’ Trading Volume Surges 100% in 17 Days

Cumulative trading volume on the tokenized private equity platform reached $200 million about four months after the protocol’s launch.

Ventuals, a protocol that lets users trade tokenized exposure to private and pre-IPO companies, has crossed $200 million in cumulative trading volume less than three months after launch, according to a Feb. 11 X post from the platform’s co-founder, Alvin Hsia.

The milestone was reached just 17 days after cumulative volume first hit $100 million, on Jan. 24, a level that took the platform 73 days to achieve, Hsia noted.

On-chain data from LorisTools, which tracks activity across Hyperliquid’s HIP-3 products, shows cumulative volume on Ventuals has climbed past $215 million by press time. The platform has recorded 5,342 unique traders and generated over $70,000 in fees since going live in October 2025.

Built on the Hyperliquid blockchain, Ventuals allows traders to take synthetic, leveraged positions tied to the valuations of private companies, including firms such as Anthropic and OpenAI.

The most actively traded product so far is MAG7 — a contract tracking the so-called “Magnificent Seven” U.S. tech companies, which includes Amazon, Apple and Microsoft — which has seen over $4 million in trading volume today, Feb. 12, the data shows.

Alongside the surge in activity, Ventuals’ liquid staking token vHYPE, which represents a claim on the underlying HYPE, Hyperliquid’s native token, rose about 20% to $30, according to CoinGecko data.

Crypto World

Bitcoin price could crash further, Standard Chartered slashes target

The Bitcoin price has already crashed by nearly 50% from its all-time high, and a top long-term bull believes there is more downside to come in the near term.

Summary

- Bitcoin price has slumped from the all-time high to $66,000.

- Standard Chartered warned that the coin may drop to $50k.

- Technical analysis suggests that the coin may fall before rebounding.

Bitcoin (BTC) retreated to $66,000 on Thursday, a few points above the year-to-date low of $60,000. This decline has persisted as its divergence from American stocks has widened, with leading indices such as the Dow Jones and the Nasdaq 100 hovering near their record highs.

Bitcoin’s price may have further downside in the near term, according to Standard Chartered, which warned that the coin may crash to $50,000.

The bank then lowered its Bitcoin price target for the year to $100,000, down from its previous estimate of $150,000. It was the second major downgrade as the bank had previously set the target price to $300,000.

Geoffrey Kendrick, the bank’s head of digital assets, predicts there will be more capitulation in the coming months. At the same time, he pointed to the ongoing Bitcoin ETF outflows, plunging futures open interest, and lack of a clear narrative.

“I think we are going to see more pain and a final capitulation period for digital asset prices in the next few months. The macro backdrop is unlikely to provide support until we near [Kevin] Warsh taking over at the Fed,” Kendrick told The Block. “On the downside I think this will see BTC to $50,000 or just below, ETH to $1,400.”

SoSoValue data shows that spot Bitcoin ETFs have shed over $282 million in assets this month. They have lost close to $6 billion in the last four months, a sign that investors are capitulating, with some moving their cash to the booming stock market.

Meanwhile, the futures open interest has tumbled to $44 billion from last year’s high of $96 billion. Falling open interest is a sign that investors are reducing their exposure to Bitcoin.

Bitcoin price technical analysis

The weekly chart shows that the BTC price has declined over the past few months and is now hovering near its lowest point of the year. It has already dropped below the 50-week and 100-week Exponential Moving Averages. Also, the Average Directional Index has jumped to 30, a sign that the downtrend is strengthening.

Therefore, the most likely outlook is bearish, with the initial target being at $60,000. A drop below that level will signal further downside to $50,000, as Standard Chartered predicts.

Crypto World

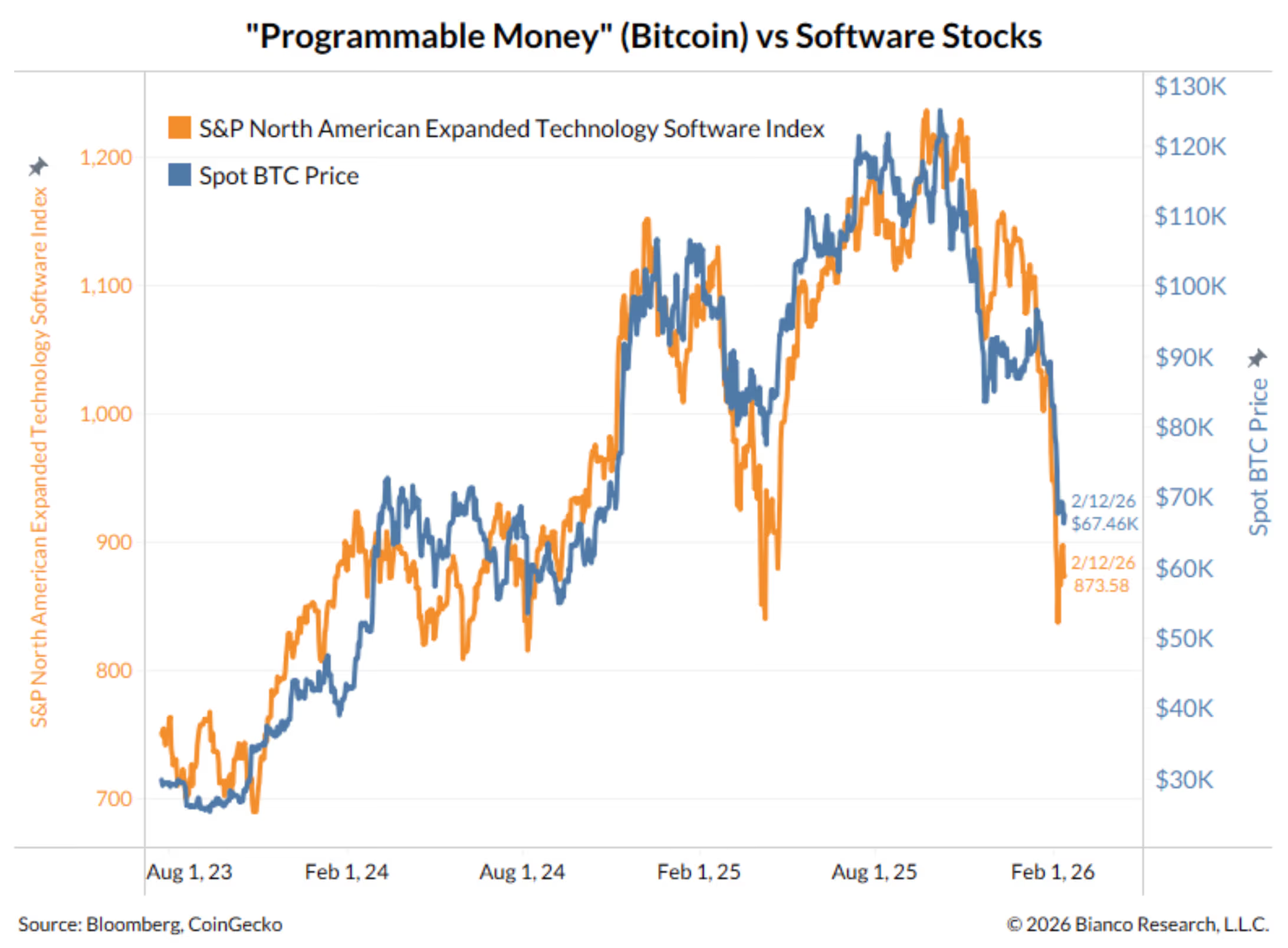

BTC falls back to $65,000 as software sector slides 3%

Bitcoin fell back toward last week’s lows, giving up nearly all of its recent gains above $70,000 and resuming its slide alongside weakness in the broader tech sector, as the crypto now trades back around $65,000.

Bitcoin was down 2% over the past 24 hours, with losses in ether and solana roughly tracking.

The decline mirrored broad price action in the Nasdaq, which fell 2% on Wednesday and more particularly in the software sector, where the iShares Expanded Tech-Software Sector ETF (IGV) tumbled 3%. The IGV is now down 21% year to date as investors question the sector’s pricey multiples in a world where the coding abilities of artificial intelligence agents appear to be rising exponentially.

“Software stocks are struggling again today,” wrote macro strategist Jim Bianco. “IGV is essentially back to last week’s panic lows.”

“Don’t forget there’s another type of software, ‘programmable money,’ crypto,” Bianco added. “They are the same thing.”

Precious metals not immune

Cruising along with modest gains through most of the day, gold and silver suffered quick, steep plunges in the mid-afternoon. Late in the session, silver was lower by 10.3% to $75.08 per ounce and gold was down 3.1% to $4,938.

Crypto World

Binance October 10 Backlash Hijacks Consensus Hong Kong

Binance Co-CEO Richard Teng has defended the exchange against claims that it was responsible for the October 10, 2025, “10/10” crypto crash, which saw roughly $19 billion in liquidations.

Speaking at CoinDesk’s Consensus Hong Kong conference on February 12, 2026, Teng argued the sell-off was driven by other factors besides any Binance-specific failures.

Sponsored

Sponsored

Richard Teng Gives Binance’s Side of the Story on October 10 Crash

The Binance co-CEO cited macroeconomic and geopolitical shocks between the US and China. Specifically, he cited:

- Fresh US tariff threats, including potential 100% duties on Chinese imports, and

- China’s imposition of rare-earth export controls.

The combination, he said, flipped global risk sentiment, triggering mass liquidations across all exchanges, centralized and decentralized alike.

“The US equity market plunged $1.5 trillion in value that day,” Teng said. “The US equity market alone saw $150 billion of liquidation. The crypto market is much smaller. It was about $19 billion. And the liquidation on crypto happened across all the exchanges.”

The majority of liquidations (roughly 75%) occurred around 9:00 p.m. ET, coinciding with the release of macro news.

Teng acknowledged minor platform issues during the event, including a stablecoin depegging (USDe) and temporary slowness in asset transfers.

However, he stressed these were unrelated to the broader market collapse. He also emphasized that Binance supported affected users, including by compensating some of them.

Sponsored

Sponsored

“…trading data showed no evidence of a mass withdrawal from the platform,” he added.

Last year, Binance reportedly facilitated $34 trillion in trading volume and served over 300 million users.

It is worth noting that the October 10 crash has been a persistent cause of Binance FUD over the past several months. The exchange has faced criticism from far and wide, with the heaviest attacks coming from rival exchange OKX and its CEO, Star Xu.

Traders Reject Teng’s Macro Shock Explanation Amid $19 Billion 10/10 Liquidation

Despite Teng’s detailed defense, traders on social media have responded swiftly and critically. On X (Twitter), users accused Binance of locking APIs and engineering conditions that forced liquidations, only to deflect responsibility with the “macro shock” explanation.

Sponsored

Sponsored

“Blaming macro shocks is the new ‘it was a glitch.’ $19B liquidated and somehow nobody at Binance is responsible lol,” one user challenged.

Naysayers go further, with some users likening Teng’s claims to colloquial phrases in harsh criticism.

“‘It wasn’t us, it was the macro’ is the crypto exchange version of the dog ate my homework. $19B in liquidations and every platform just points at the guy next to them,” another said.

However, the majority of responses revolved around alleged fake API responses and questioned internal coordination at Binance. The general sentiment is that users feel the exchange is not fully transparent.

The backlash illustrates the ongoing tension between centralized exchanges and leveraged traders during high-volatility events.

While retail demand has cooled compared to previous years, Teng highlighted that institutional and corporate participation in crypto remains strong.

Sponsored

Sponsored

“Institutions are still entering the sector,” he said. “Meaning the smart money is deploying.”

Teng also framed the 10/10 event as part of a broader cyclical pattern in crypto markets. He argued that despite short-term turbulence, the sector’s underlying development continues, with institutional capital driving long-term confidence.

Still, the exchange faces a twofold challenge:

- It must defend its role during unprecedented market stress

- Binance must also restore trust with a skeptical trading community.

While the $19 billion liquidation wiped out positions across the market, the debate over who or what should be held accountable continues to simmer online. This is expected, given the fragility of confidence in high-leverage crypto trading.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports22 hours ago

Sports22 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business4 days ago

Business4 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World24 hours ago

Crypto World24 hours agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video19 hours ago

Video19 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’