Crypto World

21Shares Taps BitGo for Regulated Staking and Custody in US & Europe

BitGo Holdings and 21Shares have broadened their alliance to extend custody and staking services for 21Shares’ U.S. exchange-traded funds and global exchange-traded products. The expanded deal will see BitGo provide qualified custody, trading and execution capabilities, and a unified staking infrastructure for 21Shares’ US-listed ETFs and international ETPs. The press release notes that this arrangement gives 21Shares enhanced access to liquidity across electronic and over-the-counter markets as part of a broader strategy to scale regulated crypto yield solutions for institutional investors. The partnership is anchored in BitGo’s regulated framework in the United States and Europe, leveraging its OCC-regulated federally chartered trust bank and MiCA-licensed European operations. Announcement.

21Shares is a major crypto ETF issuer, with an established footprint across 13 exchanges and 59 listed products, supported by more than $5.4 billion in assets under management as of Feb. 11, according to its public materials. The collaboration follows BitGo’s own foray into the public markets earlier in the year, when the Palo Alto-based infrastructure provider began trading on the New York Stock Exchange under the ticker BTGO.

In recent months, custodial and staking services have become increasingly entwined as institutions seek yield-generating crypto infrastructure within regulated wrappers. The new BitGo–21Shares framework exemplifies this shift, allowing traditional and alternative asset managers to offer staking yields while maintaining compliant custody—an arrangement that can streamline onboarding for large-scale investors who require robust risk controls and auditability. The broader ecosystem has seen a spate of partnerships and integrations aimed at embedding staking deeper into regulated product lines, a trend that has accelerated as more institutions seek regulated exposure to proof-of-stake ecosystems.

Among the notable examples cited in the ecosystem: a Coinbase–Figment collaboration that broadened institutional staking for assets including Avalanche (AVAX), Aptos (APT), Sui (SUI) and Solana (SOL) through Coinbase Custody. Separately, Anchorage Digital partnered with Figment to extend staking for Hyperliquid (HYPE), integrating these services via its banking and custody infrastructure. Ripple has also expanded its institutional custody stack with integrations that add hardware security module support to enable banks and custodians to offer custody and staking without building their own validator or key-management systems.

Beyond staking, the sector is witnessing growing interest in liquid staking—an approach that lets investors earn staking rewards while retaining a tradable token that preserves liquidity. Regulators in certain jurisdictions have signaled tolerance for specific liquid-staking activities, reinforcing the push toward regulated, yield-bearing structures. In another development, Hex Trust announced a collaboration with the Jito Foundation to integrate JitoSOL, a liquid staking token on the Solana blockchain, enabling clients to earn staking and MEV rewards while keeping SOL liquid for use as collateral in borrowing and lending through its Markets platform. These moves collectively illustrate how custody providers are layering staking liquidity into regulated product lines to satisfy investor demand for yield without compromising risk controls.

In this evolving landscape, the BitGo–21Shares partnership stands out for its scope and regulatory alignment. By combining BitGo’s OCC-regulated custody framework with MiCA-licensed European operations, the alliance aims to unlock scalable staking and liquidity across major markets for a broad set of products, including US-listed ETFs and international ETPs. The collaboration signals a maturation in the ecosystem, where product issuers can offer regulated staking while maintaining robust custody and market access—an arrangement that may help attract institutions that previously shied away from crypto exposure due to compliance and operational concerns. For readers seeking a deeper dive into the breadth of the collaboration, a related press release details the global ETF-partnership expansion across staking and custody, highlighting the operational pathways BitGo will provide for 21Shares’ product lineup.

Video and media discussions surrounding the partnership can be explored through a related presentation linked to the announcement.

Market participants should watch how the integration affects liquidity profiles and trading costs for 21Shares’ ETF roster, as well as how it influences the pace at which other ETF issuers consider similar custody-and-staking models. The collaboration may also influence how global regulators view regulated staking within ETF wrappers, particularly as MiCA implementations take fuller effect across Europe and as U.S. authorities continue to refine guidelines for crypto custody and staking activities.

Key takeaways

- BitGo will deliver qualified custody, trading and execution services, plus integrated staking infrastructure for 21Shares’ US ETFs and global ETPs.

- The services will be provided through BitGo’s regulated entities in the US and Europe, leveraging an OCC-regulated trust bank and MiCA-licensed operations.

- 21Shares’ product slate includes 59 ETPs listed across 13 exchanges, with more than $5.4 billion in assets under management as of Feb. 11.

- The move aligns with a broader institutional push to embed staking within regulated custody offerings, following similar partnerships and integrations across the sector.

- The deal underscores BitGo’s ongoing expansion into ETF and regulated markets after its BTGO listing on the NYSE earlier this year.

Tickers mentioned: $BTGO, $AVAX, $APT, $SUI, $SOL

Market context: The collaboration arrives amid growing institutional interest in regulated staking and custody-enabled yield strategies, supported by clearer regulatory frameworks in the U.S. and Europe and expanding ETF liquidity across crypto assets.

Why it matters

The partnership between BitGo and 21Shares represents a meaningful step in bringing regulated staking and custody to a broader class of institutional investors. By coupling BitGo’s OCC-chartered custody capabilities with 21Shares’ diversified ETF lineup, the arrangement reduces operational friction for asset managers seeking compliant exposure to proof-of-stake ecosystems. This is particularly relevant as the crypto industry pushes toward scalable yield opportunities within regulated wrappers, a dynamic that could accelerate the adoption of staking across traditional finance channels.

For 21Shares, the deal broadens access to liquidity and trading venues for its US-listed ETFs and global ETPs. As the ETF issuer continues to grow—reporting 59 products and substantial AUM—partnerships like this can help sustain product velocity, improve execution quality, and offer investors more reliable ways to participate in staking rewards without directly managing keys or validator infrastructure.

From a regulatory perspective, the alignment with an OCC-regulated entity in the United States and MiCA-licensed operations in Europe signals a mature model for regulated crypto infrastructure. If these structures gain broader acceptance, more issuers may pursue similar multi-jurisdictional approaches, further integrating staking into mainstream investment products. In a market that remains sensitive to liquidity, risk controls, and operational risk, such collaborations could contribute to steadier capital inflows and more robust market-making activity around crypto ETPs.

What to watch next

- Rollouts of custody and staking services for 21Shares’ entire U.S. ETF lineup and broader international ETPs, with clear launch timelines.

- Regulatory updates from the OCC and updates to MiCA implementations that may affect how staking is offered within ETF wrappers.

- Potential expansion of BitGo–21Shares technology and service integrations to additional product lines or new markets.

- Continued ETF issuance activity by 21Shares and related liquidity improvements across electronic and OTC venues.

Sources & verification

- BitGo and 21Shares Accelerate Global ETF Partnership Across Staking and Custody — Business Wire press release (Feb 12, 2026).

- 21Shares product catalog and assets under management (as of Feb 11) published by 21Shares.

- BitGo IPO coverage and BTGO listing details (Cointelegraph gateway to BitGo stock information).

- FalconX acquisition of 21Shares (context for 21Shares’ corporate structure).

- Ripple expands institutional custody stack with staking and security integrations (industry context for custody-staking trends).

BitGo expands custody and staking for 21Shares across US and Europe

BitGo and 21Shares have formalized an expanded collaboration that integrates custody, trading, and staking services for 21Shares’ US ETFs and global ETPs. The arrangement will see BitGo operate through its regulated US and European entities, including a federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and MiCA-licensed European operations, providing a bridge between traditional custody controls and crypto-native staking yields. The underlying objective is to reduce friction for institutions seeking yield opportunities tied to major proof-of-stake ecosystems while maintaining stringent risk and compliance standards.

Within the scope of the agreement, 21Shares gains access to BitGo’s custody and execution frameworks, coupled with integrated staking infrastructure designed to support its ETF lineup. The collaboration underscores a broader trend in the market: custodians and wallet providers are increasingly embedding staking capabilities into regulated products to satisfy investors’ demand for yield, liquidity, and governance participation without sacrificing institutional-grade controls.

As a backdrop, the ecosystem has seen a series of institutional staking moves—ranging from Coinbase’s partnerships enabling direct staking for select assets, to Anchorage Digital’s collaborations that extend staking through regulated banking channels, and even Ripple’s expansion of its custody platform with security integrations. These developments collectively point to a maturation of the crypto infrastructure market, where regulated custody and staking go hand in hand to deliver scalable, compliant exposure to proof-of-stake networks. In this context, BitGo’s expanded alliance with 21Shares positions both firms to capture a larger slice of the ETF and ETP issuance market and to support a broader wave of institutional adoption.

Market participants will be watching how quickly the rollout unfolds and how liquidity improves across the involved products, particularly in the United States and Europe. The partnership could catalyze further collaborations between custodians and ETF issuers, as regulators continue to refine the boundaries of crypto custody and staking within regulated investment products.

Crypto World

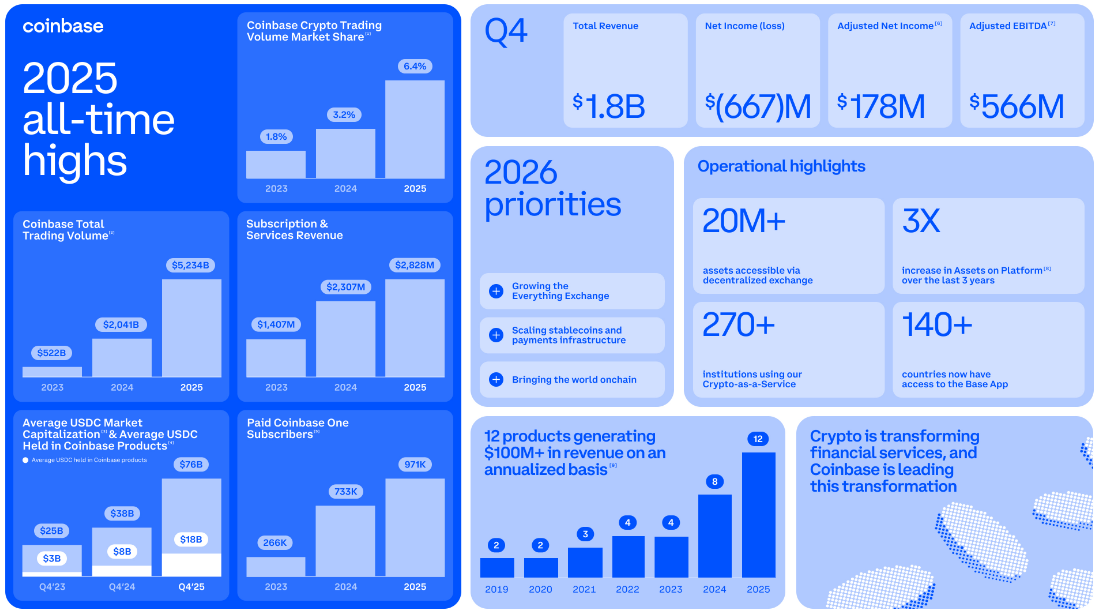

Coinbase Misses Expectations With $667M Loss in Q4

Coinbase reported a net loss of $667 million in the fourth quarter of 2025, snapping the crypto exchange’s eight-quarter straight streak of profitability.

In its Q4 earnings released on Thursday, Coinbase said its earnings per share came in at 66 cents, which missed analyst expectations of 92 cents per share by 26 cents.

The company said its net revenue fell 21.5% year-on-year to $1.78 billion, falling short of analyst expectations of $1.85 billion.

Transaction-related revenue dropped nearly 37% year-on-year to $982.7 million, while subscription and services revenue jumped more than 13% from the year prior to $727.4 million.

It’s the first net loss Coinbase has reported since the third quarter of 2023, and comes as the crypto market fell over the quarter, with Bitcoin (BTC) dropping nearly 30% from a high of $126,080 in early October to under $88,500 by Dec. 31.

Bitcoin has fallen 25.6% to $65,760 so far this year, having climbed from a crash to under $60,000 earlier this month.

Despite the earnings miss, shares in Coinbase (COIN) rose 2.9% in after-hours trading on Thursday to $145.18 after a 7.9% decline over the trading day to close at $141.1.

For its Q1 outlook, the crypto platform said that it had generated $420 million in transaction revenue as of Feb. 10 but expects its subscription and services revenue to fall from $727.4 million to the $550 million to $630 million range.

Coinbase added that 2025 was a “strong year” for the company, both operationally and financially, with its full-year 2025 revenues climbing 9.4% from 2024 to $6.88 billion.

Related: Coinbase unveils crypto wallets designed specifically for AI agents

“In 2025, more than 12% of all crypto in the world resided on Coinbase,” the company said. “We’re building and connecting more products to facilitate customers doing more with their assets.”

Coinbase chief financial officer, Aleshia Haas, told investors on an earnings call that the company plans to keep its tech, sales, and marketing expenses relatively flat in comparison in Q4.

“We are going to be nimble as we go through the year and look at the opportunities that we have ahead of ourselves versus our expenses,” she said.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Crypto Lender BlockFills Temporarily Freezes Transfers as Liquidity Pressures Emerge

The company blamed it on the most recent violent correction in the crypto market.

Crypto lender BlockFills has temporarily suspended client deposits and withdrawals in response to recent market volatility and financial conditions, according to an official statement released by the firm.

The decision was taken last week as a protective measure for both clients and the company.

Suspending Client Transfers

According to the official announcement, BlockFills said that while transfers in and out of the platform are paused, clients have continued access to trading services, including the ability to open and close positions in spot and derivatives markets, as well as in select other circumstances outlined by the firm.

The suspension potentially affects around 2,000 institutional clients, such as asset managers and hedge funds. BlockFills operates exclusively with investors holding at least $10 million in crypto assets. These clients collectively generated more than $60 billion in trading volume on the platform in 2025.

BlockFills stated that its management team has been working closely with investors and clients to resolve the situation and restore platform liquidity.

“BlockFills is committed to transparency in its communications and to the protection of its clients. Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform. The firm has also been in active dialogue with our clients throughout this process, including information sessions and an opportunity to ask questions of senior management.”

Crypto Market Turmoil

The move comes amid a broader crypto market downturn and echoes previous periods of stress in the industry, including the 2022 collapse of FTX and other crypto lenders. Bitcoin prices began falling on October 10 following a social media post by US President Donald Trump on tariffs, which contributed to increased volatility and nearly $20 billion in liquidations across the market.

Bitcoin continued to decline in the months that followed, as it fell under $65,000, over 45% below its October highs, and reached a year-to-date low of $60,008 on February 5. Stalled US crypto legislation has also continued to weigh on market sentiment.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Asia leapfrogging the West in onchain retail use as regional hubs lead on stablecoin rules

Hong Kong — Asia is outpacing Western markets in the adoption of onchain financial services, driven by a focus on user utility and proactive regulation. While the West remains focused on institutional asset management, Asian markets are prioritizing high-frequency retail applications and cross-border trade.

During a panel discussion at Consensus Hong Kong, industry leaders highlighted how different regional dynamics shape blockchain growth. Suhan Zhao, head of APAC at Aptos Labs, noted a distinct shift toward real-world use cases. “In Asia, there is a high adoption of digital payment, and also there’s a high willingness to deploy new technology at scale,” Zhao said. She pointed to South Korea’s Lotte Group, which issued over 5 million mobile service vouchers on the Aptos network, reaching 1.3 million users in under three months.

Regulatory progress is a primary engine of this growth. Niki Ariyasinghe, vice president for Asia Pacific and Middle East at Chainlink Labs, identified Hong Kong and the United Arab Emirates as the most advanced markets for stablecoin regulation. He argued that stablecoin adoption in Asia often stems from a fundamental need for efficiency rather than speculation. “Ultimately, it’s a willingness to use a new form of payment because of the value it delivers. Ultimately, it’s cheaper, it’s quicker, or it’s more convenient at the end of the day,” Ariyasinghe said.

Small businesses engaged in international trade represent a key demographic for these digital assets. These firms use stablecoins to bypass a fragmented traditional payment infrastructure that often takes days to settle. Nick See Tong, APAC regional lead for Base, emphasized that local stablecoins remain essential for mass market penetration. “A merchant selling wonton mee on the side is not going to accept USDT, USDC or any USD stablecoin. They want Hong Kong dollars,” See Tong said.

Crypto World

ETHZilla starts offering tokenized jet engine leasing exposure through newly launched token

ETHZilla (ETHZ) has unveiled a tokenized aviation asset, marking a major step in its plan to bring income-producing real-world assets onto Ethereum.

The new offering, Eurus Aero Token I, gives accredited investors access to lease income from two commercial jet engines currently in use by a major U.S. airline, ETHZilla announced on Thursday.

The deal, run through ETHZilla’s newly formed ETHZilla Aerospace LLC subsidiary, turns a traditionally institutional asset, aircraft engine leasing, into fractional tokens.

Each $100 token represents a claim on monthly lease payments, with expected annual returns around 11%, according to the company. ETHZIlla acquired the jet engines for $12.2 million late last month.

The tokens are issued on Ethereum Layer 2s and distributed through Liquidity.io, a platform that ETHZilla has backed.

Various firms buy and lease jet engines to aircraft operators. The firms lease these engines as spares to ensure their operations can continue in case their primary engines fail. Firms including AerCap, Willis Lease, and SMBC Aero Engine Lease are involved in the business.

This marks a shift from ETHZilla’s prior focus as a crypto treasury. The company sold over $114 million in ETH last year and redirected its capital toward tokenized assets like home loans, car loans and now aerospace equipment. The firm still owns 69,802 ETH ($136.5 million).

The Eurus tokens are secured by the engines, lease contracts and insurance, with distribution built directly into the smart contracts.

The leases run through 2028 and include a buy-sell agreement that could return additional capital to investors at term’s end. ETHZilla plans to expand this model into other asset classes, the firm wrote.

Crypto World

Polymarket Starts 5-Minute Bitcoin Price Betting

Prediction platform Polymarket recently launched a new feature that lets users bet on cryptocurrency price movements every five minutes.

The event signals rising demand for real-time crypto sentiment data among traders and investors.

Sponsored

Sponsored

Real-Time Sentiment Drives Short-Term Contracts

For now, the new market is limited to Bitcoin, though support for major altcoins is expected to follow.

Price will update dynamically, in tune with market sentiment and immediate price reaction. All trades will be executed on-chain to ensure transparency and security.

The feature targets day traders and crypto enthusiasts looking for a fast-paced experience. With Bitcoin’s recent dip, price swings have grown increasingly erratic, amplifying short-term volatility.

The initiative builds on existing contracts with varying durations, ranging from 15-minute and hourly intervals to four-hour time frames. It also comes as prediction markets are seeing exponential growth in usage, with individual polls recording trading volumes in the hundreds of millions of dollars.

It also reflects growing concern that shifting attention toward these platforms could distort crypto’s core purpose and use cases.

Sponsored

Sponsored

Market Weakness Fuels Betting Activity

Among the wide range of polls offered by prediction platforms such as Polymarket and Kalshi, a significant share involves crypto bets. More specifically, many of these contracts focus on forecasting the future price of major digital assets.

Interest in these wagers has surged in recent months.

Tens of millions in trading volume have been directed toward Bitcoin’s February price alone, alongside heavily traded contracts linked to Ethereum, XRP, and Solana.

These forecasts have gained traction as the broader crypto market struggles to regain momentum. In this environment, volatility itself appears to be fueling participation, with traders using market weakness as an opportunity to place short-term bets.

While the proliferation of such polls has generated substantial trading activity, it is also drawing capital and attention away from underlying fundamentals.

Instead of sustained focus on integration or real-world use cases, crypto narratives risk shifting toward probabilities and crowd positioning.

Polymarket’s new five-minute betting feature further amplifies that dynamic.

If price-based wagering continues to attract more capital than long-term allocation, the market could increasingly revolve around price movements rather than durable value creation.

Crypto World

Crypto PAC Fairshake Targets Al Green in Texas Primary Campaign

TLDR

- Crypto PAC Fairshake has launched a $1.5 million ad campaign against Texas Democrat Al Green in the primary race.

- Fairshake is targeting Green due to his opposition to cryptocurrency policies and his critical stance on digital assets.

- The PAC aims to replace Green with Christian Menefee, who has a favorable position on blockchain technology.

- Fairshake has committed to supporting candidates who advocate for crypto-friendly legislation across both political parties.

- The PAC also plans to spend $5 million to support U.S. Representative Barry Moore in the Alabama Senate primary.

Crypto PAC Fairshake has launched a $1.5 million ad campaign against Texas Democrat Al Green. The PAC is seeking to influence Green’s bid for re-election, aiming to replace him with a candidate more favorable to cryptocurrency policies. Green, a senior Democrat on the House Financial Services Committee, has long criticized cryptocurrency’s potential risks to the financial system.

Fairshake Launches Attack Ads Against Green

Fairshake’s $1.5 million ad campaign against Al Green represents the PAC’s first major move in Texas this election cycle. Green, who represents a newly redrawn Texas district, has been vocal in opposing crypto legislation. The PAC, which has access to a $193 million war chest, intends to influence Green’s primary contest, which includes rising Democratic challenger Christian Menefee.

Green’s stance on cryptocurrency has earned him an “F” grade from Stand With Crypto, a group that tracks lawmakers’ positions on digital assets. The Texas representative has frequently warned of the potential dangers cryptocurrencies pose to investors and the broader economy. Fairshake aims to elect lawmakers more supportive of crypto by opposing incumbents like Green, who resist industry-friendly policy changes.

Protect Progress Super PAC Supports Menefee

Christian Menefee, Green’s primary challenger, has taken a more favorable stance on blockchain technology. His position has earned him an “A” grade from Stand With Crypto, which is supporting him as a pro-crypto candidate. Protect Progress, the super PAC affiliated with Fairshake, has voiced its commitment to backing candidates who support cryptocurrency innovation.

Menefee’s recent victory in a special election has put him in a strong position as he competes against Green for the newly drawn district seat. Texas’ primaries are scheduled for next month, setting the stage for a crucial race between Green and Menefee. Fairshake believes Menefee’s support for crypto will help drive economic growth in the state and beyond.

Fairshake’s involvement in congressional elections this cycle goes beyond the Green-Menefee race. The PAC has also pledged $5 million to support U.S. Representative Barry Moore of Alabama, a Republican who is pro-crypto. Moore faces a competitive Senate primary in Alabama, and Fairshake aims to boost his candidacy to further its cryptocurrency-friendly agenda.

The PAC’s strategy involves supporting candidates across both parties who are aligned with the crypto industry’s goals. Fairshake’s ads focus on broader political messages rather than crypto-specific policies, ensuring that they remain independent from candidates’ campaigns.

Crypto World

Coinbase Outage Affects Users, Halting Crypto Trades and Transfers

TLDR

- Coinbase users are currently unable to buy, sell, or transfer cryptocurrencies due to a significant service disruption.

- The outage has impacted essential trading and transaction functions, leaving many users unable to manage their crypto holdings.

- Coinbase confirmed that internal teams are investigating the issue and working to restore full service as quickly as possible.

- The disruption comes at a difficult time for Coinbase, with many users reporting failed transactions during active market conditions.

- Coinbase has advised users to monitor its official channels for real-time updates as the company works on resolving the issue.

Coinbase users are experiencing a major disruption that prevents them from buying, selling, or transferring cryptocurrencies. The issue has significantly impacted the platform’s ability to process essential transactions. The company confirmed that its internal teams are investigating the problem and working to restore full service as quickly as possible.

Coinbase Struggles with Trading and Transaction Failures

The service disruption has disrupted key functions, including the ability to place orders or move funds. Many users have reported failed transactions, restricting access to their accounts during active market conditions. This issue has led to a wave of complaints from users who are unable to manage their crypto holdings effectively.

“We are aware of the current issues affecting users’ ability to trade and transfer funds,” Coinbase said in a statement.

The company added that its technical team is investigating the root cause of the problem, and users are advised to stay updated through the platform’s official channels. Coinbase has not yet shared any specific technical details about what caused the disruption.

Ongoing Investigation and User Impact

As of now, the cause of the outage remains unclear. Coinbase has promised to resolve the issue, though no specific timeline has been provided for full restoration of services. The disruption comes at a challenging time for the company, with users actively trading in volatile market conditions.

This service failure has left many users unable to execute trades or manage their portfolios. During periods of heightened market activity, such interruptions can result in substantial inconvenience and financial loss for traders. Coinbase’s response will be closely scrutinized as it works to regain user trust.

Market and Company Impact

The timing of the outage also raises concerns about Coinbase’s operational reliability. The company is already under pressure due to the broader weakness in the digital asset market. This outage may further damage its reputation, especially among institutional investors who rely on reliable platforms for trading.

In the wake of the disruption, Coinbase has advised users to monitor its status page for updates. Although the company has not provided details on when the issue will be resolved, it remains committed to restoring services as soon as possible.

Crypto World

Coinbase’s Armstrong, Ripple’s Garlinghouse among familiar crypto execs in U.S. CFTC advisory group

The U.S. Commodity Futures Trading Commission, which is set to be a leading regulator of the crypto markets, has named some of the crypto sector’s most prominent executives as members of its newly established Innovation Advisory Committee, including the CEOs of Coinbase, Ripple, Robinhood and Uniswap Labs.

The 35-member committee will steer the U.S. derivatives regulator on the needs of firms at the center of financial innovation, and to fill some of its number, the agency had repurposed a previous CEO council established at the end of last year before the arrival of CFTC Chairman Mike Selig.

“By bringing together participants from every corner of the marketplace, the IAC will be a major asset for the Commission as we work to modernize our rules and regulations for the innovations of today and tomorrow,” Selig said in a statement.

While the earlier group already included members such as Gemini CEO Tyler Winklevoss, Kraken Co-CEO Arjun Sethi and Polymarket CEO Shayne Coplan, the much larger committee adds several more crypto CEOs and the top executives of FanDuel and DraftKings. Additionally, the advisers will include the leaders of many of the more traditional companies and organizations, such as the chief executives of Nasdaq, CME Group, Cboe Global Markets, Futures Industry Association (FIA) and International Swaps and Derivatives Association (ISDA).

Other new names among the 35 are Chris Dixon of a16z Crypto, Anatoly Yakovenko of Solana Labs, Peter Mintzberg of Grayscale, Sergey Nazarov of Chainlink Labs and Alana Palmedo of Paradigm. Tom Farley, the CEO of Bullish, CoinDesk’s parent company, is also a member.

Selig recently announced a crypto agenda his agency is pursuing alongside the Securities and Exchange Commission, having formally joined with the SEC’s Project Crypto.

The CFTC’s advisory committee is listed below (* denotes earlier council membership):

- Hayden Adams, CEO, Uniswap Labs

- Brian Armstrong, CEO, Coinbase

- Andrej Bolkovic, CEO, Options Clearing Corporation

- Thomas Chippas, CEO, Rothera Markets

- Shayne Coplan, CEO, Polymarket *

- Professor Harry Crane, Representative

- Chris Dixon, General Partner, a16z Crypto

- Craig Donohue, CEO, Cboe Global Markets *

- Terry Duffy, Chair & CEO, CME Group *

- Tom Farley, CEO, Bullish *

- Adena Friedman, Chair & CEO, Nasdaq *

- Brad Garlinghouse, CEO, Ripple

- Christian Genetski, President, FanDuel

- Luke Hoersten, CEO, Bitnomial *

- Frank LaSalla, President & CEO, Depository Trust and Clearing Corporation

- Walt Lukken, CEO, FIA

- Tarek Mansour, CEO, Kalshi *

- Kris Marszalek, CEO, Crypto.com *

- Nathan McCauley, CEO, Anchorage Digital

- Peter Mintzberg, CEO, Grayscale

- Sergey Nazarov, CEO, Chainlink Labs

- Scott D. O’Malia, CEO, ISDA

- Alana Palmedo, Managing Partner, Paradigm

- Vivek Raman, CEO, Etherealize

- Professor Carla Reyes, Representative

- Jason Robins, CEO, DraftKings

- David Schwimmer, CEO, LSEG *

- Arjun Sethi, Co-CEO, Kraken *

- Peter Smith, CEO, Blockchain.com

- Vance Spencer, Co-founder, Framework Ventures

- Jeff Sprecher, CEO, Intercontinental Exchange *

- Vlad Tenev, CEO, Robinhood

- Don Wilson, CEO, DRW

- Tyler Winklevoss, CEO, Gemini *

- Anatoly Yakovenko, CEO, Solana Labs

Read More: CFTC to tap Tyler Winklevoss, other crypto CEOs as first members of innovation panel

Crypto World

Israeli Military Bets on Polymarket Trigger Indictments

Israel indicted two citizens for allegedly using classified information to place wagers on the prediction platform Polymarket, according to a statement made by authorities on Thursday.

The news renewed concern that prediction markets make it easier to engage in insider trading for profit.

Sponsored

Sponsored

Israeli Agencies Target Military Insider Betting Case

In a joint statement, the Israeli Defense Ministry, Israel Police, and the Shin Bet said the suspects — an army reservist and a civilian — were arrested on suspicion of placing bets on Polymarket about potential military operations.

“This was allegedly based on classified information to which the reservists were exposed through their military duties,” the statement said.

The announcement comes weeks after Israeli public broadcaster Kan News reported on the matter. The outlet said security agencies had opened an investigation into the suspected misuse of classified information within the defense establishment.

The report alleged that the information was used to place bets on Polymarket, including on the timing of Israel’s opening strike on Iran during the 12-day war in June 2025.

These platforms have seen a surge in wagers on geopolitics, crypto, politics, and sports. Although marketed as alternatives to traditional gambling, their structure closely mirrors conventional betting markets.

Users buy and sell shares tied to real-world outcomes, with prices ranging from $0.01 to $1.00 reflecting the market’s implied probability of each outcome.

Sponsored

Sponsored

Their accessibility, pseudonymity, and ease of use have also prompted concerns about potential insider trading and misconduct.

Are Prediction Markets Exploitable Profit Machines?

Since the start of the year, several incidents have emerged, raising questions about whether individuals with confidential information are using these platforms to generate substantial profits.

In early January, a cluster of newly created Polymarket accounts placed large, precisely timed wagers on contracts predicting Venezuelan strongman Nicolás Maduro would be removed from office.

These wallets netted more than $630,000 in combined profits just hours before reports of his capture broke.

A similar controversy emerged last December. A Polymarket user earned nearly $1 million by placing highly accurate bets on Google’s 2025 Year in Search rankings. The precision prompted speculation about possible insider access.

The wallet achieved an unusually high success rate, correctly predicting nearly all outcomes, including several low-probability results. However, there is no evidence confirming any internal connection.

Together, the incidents have intensified debate over the role of prediction markets. Critics question whether they function as efficient information aggregators or enable the monetization of privileged, non-public information.

Crypto World

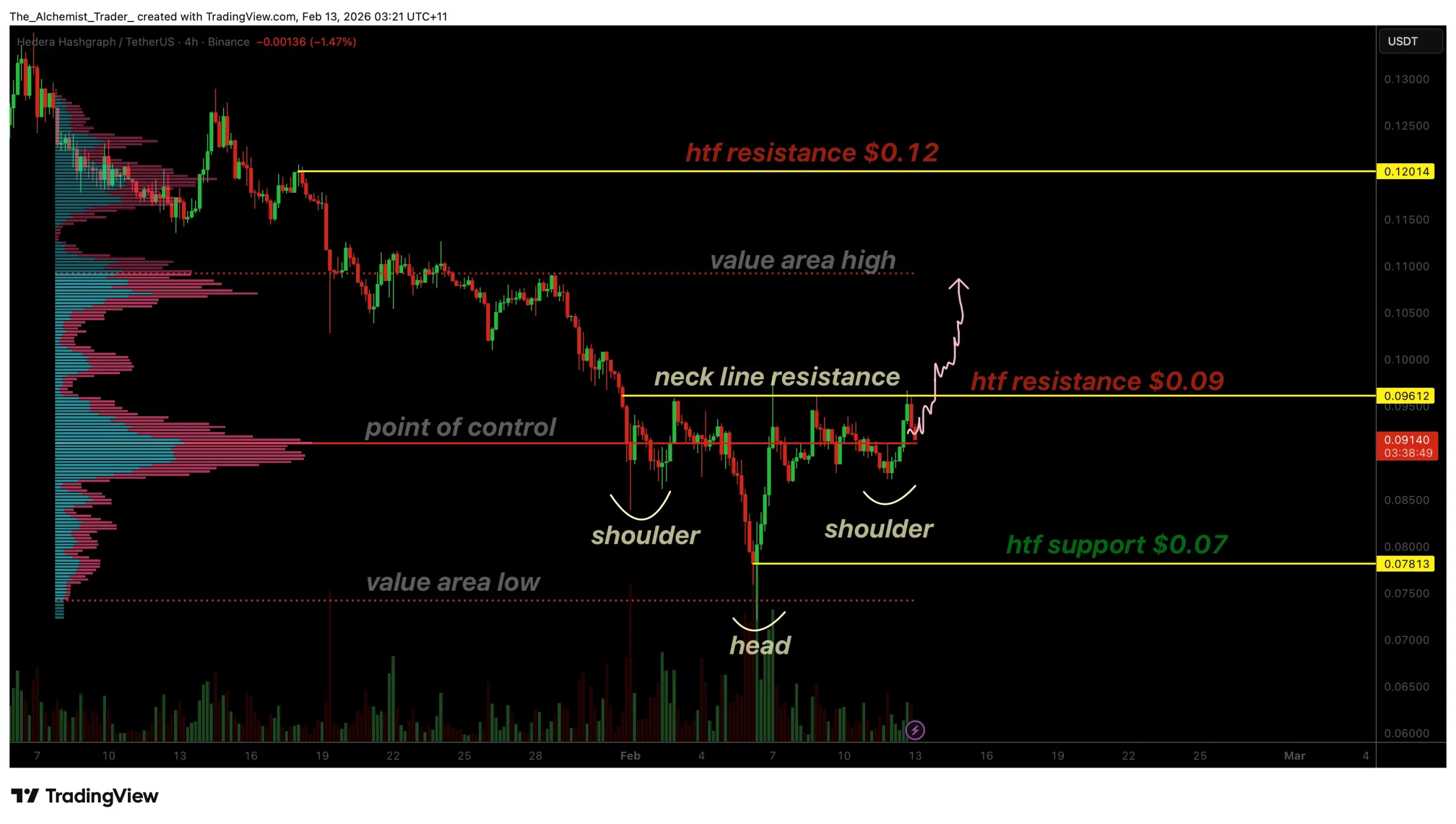

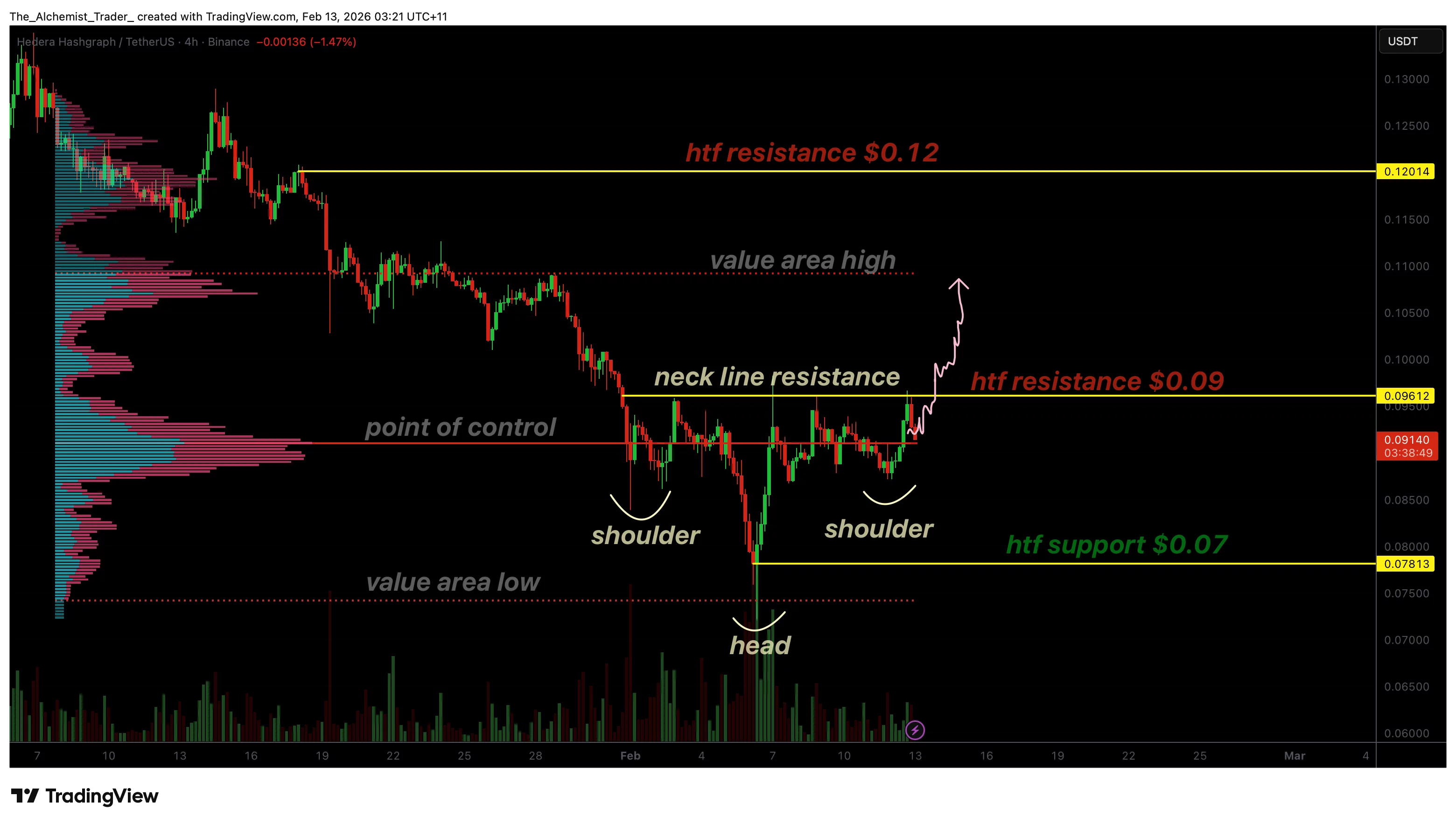

HBAR price nears breakout, inverse head and shoulders pattern forms

HBAR price is consolidating below key resistance as an inverse head and shoulders pattern develops, signaling a potential bullish breakout if the neckline resistance is cleared with volume.

Summary

- Inverse head and shoulders pattern developing, signaling trend reversal potential

- $0.09 neckline resistance is the key trigger for bullish confirmation

- Holding above the point of control supports a breakout toward higher targets

HBAR (HBAR) price action is showing increasingly constructive behavior as the market builds a classic bullish reversal structure on the higher timeframes. After an extended corrective phase, price has stabilized and begun forming an inverse head and shoulders pattern, a formation often associated with trend reversals when confirmed by a breakout above resistance.

This structure is developing just beneath a key high-timeframe resistance level, placing HBAR at a critical inflection point. With price holding above key value levels and volume remaining supportive, the technical setup suggests that bullish momentum may be building beneath the surface.

HBAR price key technical points

- Inverse head and shoulders pattern is forming, signaling potential trend reversal

- Neckline resistance sits near $0.09, a key high-timeframe level

- Price is holding above the point of control, supporting breakout conditions

HBAR’s recent price action has carved out a well-defined inverse head-and-shoulders pattern, consisting of a left shoulder, head, and right shoulder. This structure typically forms after sustained downside pressure and reflects a gradual shift in control from sellers to buyers.

The neckline of this pattern is clearly defined near the $0.09 level, which also aligns with a high-timeframe resistance zone. This confluence strengthens the importance of the level, as a breakout above the neckline would represent both a pattern confirmation and a structural shift.

Throughout the formation, price has respected higher lows, indicating that downside momentum is weakening and buyers are increasingly willing to step in earlier.

Volume and point of control support the setup

One of the more constructive aspects of HBAR’s setup is how volume behaves during consolidation. Price is currently trading above the point of control, where the highest concentration of traded volume has accumulated. Holding above this level suggests acceptance at higher prices and reinforces the bullish narrative.

In reversal structures, accumulation beneath resistance is often a precursor to expansion. The fact that volume has remained healthy, rather than declining, indicates sustained participation and reduces the risk of a false breakout.

Additionally, a key swing low has formed near the value area low, further supporting the idea that demand is building at higher levels rather than allowing price to rotate lower.

Breakout conditions and upside targets

For the bullish scenario to fully play out, HBAR must break above the neckline resistance near $0.09 with a clear bullish influx. A decisive close above this level, with expanding volume, would confirm the inverse head-and-shoulders pattern and signal a shift in market structure.

If confirmed, the next upside target would be the value area high, followed by the broader high-timeframe resistance around $0.12. These levels represent natural areas where price may pause or consolidate following a breakout.

Importantly, a breakout without volume confirmation would increase the risk of a failed move. As such, volume behavior remains a key variable to monitor.

What to expect in the coming price action

From a technical, price action, and market structure perspective, HBAR is approaching a pivotal moment. As long as price remains above the point of control and continues to build higher lows, the inverse head and shoulders pattern remains valid.

A successful breakout above $0.09 would likely trigger a bullish expansion toward higher resistance zones. Conversely, failure to break and hold above the neckline could result in extended consolidation or a rotation back toward lower value levels.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports23 hours ago

Sports23 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video20 hours ago

Video20 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’