Crypto World

ETHZilla Launches Tokenized Jet Engine Leases Amid Ethereum Decline

TLDR

- ETHZilla has launched a tokenized investment opportunity in leased jet engines through its subsidiary ETHZilla Aerospace.

- The company acquired two CFM56 commercial jet engines worth $12.2 million and is offering equity in these assets via the Eurus Aero Token I.

- The tokens, available to accredited investors, are priced at $100 each, with a minimum investment of 10 tokens.

- ETHZilla aims to provide a targeted return of 11% for token holders if they hold through the lease term, ending in 2028.

- Cash flows from the leased engines will be distributed monthly to token holders via blockchain technology.

ETHZilla has expanded its operations into the tokenization sector, launching a new project focused on jet engine leases. The company, through its new subsidiary ETHZilla Aerospace, is offering tokenized equity in jet engines it recently acquired. This move comes as ETHZilla seeks to diversify its investments amid Ethereum prices continuing to decline.

ETHZilla Introduces Tokenized Engine Leases on Arbitrum

ETHZilla’s new venture centers around tokenizing a $12.2 million investment in two leased CFM56 commercial jet engines. These engines are leased to a major U.S. airline, though the company has not disclosed the airline’s identity due to confidentiality concerns. By launching the Eurus Aero Token I on the Arbitrum layer-2 network, ETHZilla offers tokenized equity in the engines, allowing investors to participate in this emerging market.

ETHZilla CEO McAndrew Rudisill commented on the project, stating, “Offering a token backed by engines leased to one of the largest and most profitable U.S. airlines serves as a strong use case in applying blockchain infrastructure to aviation assets with contracted cash flows.” The company believes that this move will help modernize fractional ownership of aviation assets, a market traditionally dominated by institutional investors and private equity firms.

Token Sale Details and Project Goals

The Eurus Aero Token I, available to accredited investors, will be sold through Liquidity.io’s token marketplace. Each token is priced at $100, with a minimum investment of $1,000, or 10 tokens. The project aims to offer a return of approximately 11% if token holders hold until the lease agreements conclude in 2028. However, a disclaimer notes that actual returns could differ based on various factors.

Cash flows from the leased engines will be distributed monthly to token holders through the blockchain. ETHZilla has structured the tokens with collateral consisting of the engines, related lease receivables, insurance proceeds, and other reserves. The company’s tokenization model ensures transparency and on-chain distribution, making it accessible to a broader group of investors.

ETHZilla’s expansion into tokenized aviation assets is part of a broader effort to pivot from its Ethereum holdings. The firm recently revealed a $250 million share buyback program, following a drop in the company’s market cap. ETHZilla’s share price has seen fluctuations, including a significant drop in recent months.

Crypto World

Argentina Congress Blocks Right To Take Salary In Crypto

Argentine fintech groups had welcomed the possibility that, for the first time, workers could deposit their salaries into virtual wallets. However, lawmakers removed the provision, a move widely seen as favoring traditional banking interests.

During negotiations to secure broader support for the bill, President Javier Milei’s party agreed to exclude the article, despite polls indicating that a large majority of Argentines prefer the freedom to choose where their salaries are deposited.

Sponsored

Distrust In Banks Drives Wallet Adoption

Argentine law today stipulates that workers must deposit their salaries into traditional bank accounts. Despite that law, digital wallet adoption in Argentina has soared over the past few decades.

In part, that growth reflects limited access to banking. A 2022 Central Bank survey found that only 47% of Argentines had a bank account, a gap largely driven by longstanding distrust of traditional systems.

Decades of financial instability, including the 2001 “corralito” deposit freeze, persistent inflation, and repeated restrictions on access to funds, have eroded public trust in banks and accelerated a shift toward cash and dollar-denominated savings.

In response, fintech-run digital wallets, operated by non-bank payment service providers, have expanded access to financial services across Argentina.

Sponsored

Platforms such as Mercado Pago, Modo, Ualá, and Lemon now rank among the most widely used. Many users without access to traditional bank accounts rely on these apps as their first point of entry into the formal digital financial system.

That’s why fintech leaders welcomed a provision that would have allowed Argentines to deposit their salaries directly into virtual wallets. However, the article was cut out of the proposed labor reform before it was even debated in Congress.

“The exclusion of Article 35 from the labor reform eliminated the possibility for Argentinians to freely choose where to receive their salary. In practice, the obligation to channel salaries through traditional banks was maintained, following strong pressure from the sector,” Maximiliano Raimondi, CFO of Lemon told BeInCrypto. “Governing involves negotiation, but it’s paradoxical that in a context where economic freedom is a central tenet, there has been a setback on a point that expanded a concrete freedom.”

That setback followed an intense lobbying effort by Argentina’s banking sector, which moved quickly to block the proposal.

Sponsored

Political Trade Off Favors Banks

Banking associations sent letters to key senators this week outlining their objections to allowing salary deposits into digital wallets.

They argued that digital wallets lack adequate regulation, pose potential systemic risks, and could deepen financial exclusion.

“They do not have a regulatory, prudential or supervisory framework equivalent to that of banks and their approval would generate legal, financial, asset and systemic risks that would directly affect workers and the functioning of the financial system,” said Banco Provincia, a leading Argentine bank, in a statement.

Sponsored

Fintech organizations pushed back, arguing that these claims were false.

“All Payment Service Providers (PSPs) are regulated and supervised by the Central Bank of Argentina (BCRA)… digital wallets were the gateway to financial services for millions of people who were able to open a virtual account easily and free of charge, and access better financial solutions,” Lemon said in a statement.

A recent study by consulting firm Isonomía also found that 9 out of 10 Argentines wanted the option to choose where to deposit their salaries. The tendency was even stronger among independent workers and those who work in the informal sector. The report also revealed that 75% of Argentines already use digital wallets daily.

Ultimately, the banking sector prevailed before the bill reached a Senate vote. According to reports, the government removed the provision to avoid straining relations with banks and to improve the bill’s chances of securing final approval.

Crypto World

21Shares Partners with BitGo for Enhanced Crypto Custody and Staking

TLDR

- 21Shares has expanded its partnership with BitGo to include custody and staking services for its crypto ETPs.

- BitGo will offer regulated custody, trading, execution services, and integrated staking infrastructure for 21Shares’ products.

- The partnership will support 21Shares’ US exchange-traded funds and global crypto ETPs across both the US and Europe.

- BitGo’s services will be delivered through its OCC-approved trust bank in the US and MiCA-licensed operations in Europe.

- 21Shares manages over $5.4 billion in assets across 59 exchange-traded products listed on 13 global exchanges.

21Shares has announced an expansion of its partnership with BitGo to enhance its custody and staking services. The collaboration will support 21Shares’ crypto exchange-traded products (ETPs) across the United States and Europe. BitGo will provide regulated custody, trading, execution services, and integrated staking infrastructure for these products.

This agreement allows 21Shares to offer investors seamless access to its US exchange-traded funds (ETFs) and global ETPs. BitGo will also provide liquidity across various electronic and over-the-counter markets.

The services will be offered through BitGo’s regulated entities in both the US and Europe. This includes the federally chartered trust bank approved by the Office of the Comptroller of the Currency (OCC) and MiCA-licensed operations authorized by Germany’s Federal Financial Supervisory Authority.

BitGo to Support 21Shares’ US and Global ETPs

The expanded partnership will enable BitGo to offer a range of services that support 21Shares’ exchange-traded products. BitGo’s services will include both custody and staking solutions for 21Shares’ clients. With a presence in the US and Europe, BitGo’s platform offers strong compliance with regulatory standards. This includes its OCC-approved US trust bank and MiCA-licensed European operations.

21Shares, a subsidiary of FalconX, is one of the world’s largest crypto ETP issuers. As of February 11, the company manages over $5.4 billion in assets across 59 products listed on 13 exchanges. This move marks another milestone in BitGo’s ongoing efforts to provide institutional-grade services to crypto investors.

21Shares Benefits from BitGo’s Custody and Staking Infrastructure

The partnership will also enhance 21Shares’ ability to tap into the growing demand for yield-generating crypto infrastructure. Staking services have become a key feature for institutional investors seeking enhanced returns from their crypto holdings. BitGo’s fully regulated framework will offer these investors access to secure custody and staking services.

This move comes just weeks after BitGo began trading on the New York Stock Exchange under the ticker BTGO. The crypto industry has seen a rise in staking services, with platforms like Coinbase and Anchorage Digital also expanding their staking offerings. The growing interest in liquid staking, which allows users to stake while maintaining liquidity, further supports the demand for BitGo’s services.

Crypto World

SEC Under Fire: Paul Atkins Faces Questions on Crypto Regulation Pause

TLDR

- SEC Chair Paul Atkins is under scrutiny for pausing the case against Justin Sun.

- Democratic lawmakers question whether political ties influence the SEC’s enforcement decisions.

- The SEC’s overall legal actions dropped by 30% in 2025, with a 60% decline in crypto-related cases.

- Paul Atkins defends the SEC’s approach, emphasizing a balanced enforcement strategy.

- Lawmakers express concerns about the SEC’s decision to drop high-profile crypto cases like Binance and Ripple.

The U.S. Securities and Exchange Commission (SEC) Chair, Paul Atkins, is facing increased scrutiny from lawmakers regarding the agency’s shifting approach to cryptocurrency regulation. At a House Financial Services Committee hearing, lawmakers questioned his leadership as the SEC’s enforcement actions have slowed. The hearing focused on the SEC’s decision to pause the case against Tron founder Justin Sun, amid concerns about political connections and the agency’s declining crypto-related actions.

Paul Atkins Faces Lawmaker Scrutiny Over Enforcement Shifts

During the hearing, Democratic lawmakers voiced concerns about the SEC’s decision to pause the case against Justin Sun, founder of Tron. Representative Maxine Waters questioned whether industry ties to former President Donald Trump influenced the agency’s enforcement actions. She also pointed to the broader decline in enforcement efforts after Trump took office, and new leadership under Paul Atkins was appointed to the SEC in 2025.

Waters specifically referenced the SEC’s 2023 lawsuit against Sun. The lawsuit accused him of organizing the unregistered sale of crypto securities related to the TRX and BTT tokens and manipulating trading volumes. However, in February 2025, the SEC requested that a federal court pause the case. Since then, Sun has emerged as a prominent financial backer of Trump-affiliated crypto ventures.

SEC Chair Defends Reduced Enforcement in Cryptocurrency Cases

Atkins defended the SEC’s approach, asserting that the agency continues to pursue a robust enforcement effort. He emphasized that the SEC is still active in bringing cases against violators, but the total number of actions has dropped. According to Cornerstone Research, the SEC’s overall legal actions fell 30% in 2025, with crypto-related cases dropping by 60%.

When asked about the SEC’s leniency toward some high-profile crypto cases, including those involving Binance, Ripple, Coinbase, Kraken, and Robinhood, Atkins responded cautiously. He declined to discuss specific cases, citing confidentiality concerns. However, he did reiterate his commitment to a balanced approach in overseeing the cryptocurrency market.

Lawmakers Raise Concerns About SEC’s Crypto Enforcement Priorities

Lawmakers were quick to question the SEC’s decisions to drop several high-profile cases against major players in the crypto industry. The SEC dismissed its lawsuit against Binance in May 2025, which had accused the company of offering unlicensed services and misleading investors about its trading controls. The agency also ended litigation involving Ripple, Coinbase, and other firms linked to the crypto industry.

Representative Stephen Lynch expressed frustration, asking how such high-profile cases could end without any enforcement actions. He emphasized the reputational damage the SEC has suffered due to these decisions. Despite these concerns, Paul Atkins maintained that the agency’s overall strategy is focused on ensuring market integrity while maintaining flexibility in enforcement.

Crypto World

Coinbase Misses Expectations With $667M Loss in Q4

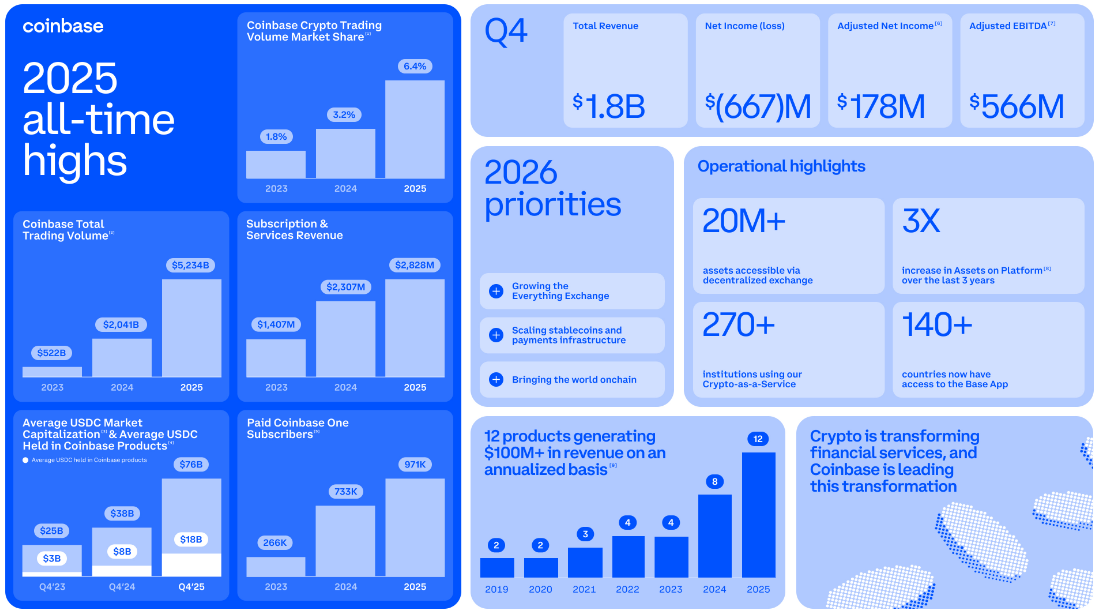

Coinbase reported a net loss of $667 million in the fourth quarter of 2025, snapping the crypto exchange’s eight-quarter straight streak of profitability.

In its Q4 earnings released on Thursday, Coinbase said its earnings per share came in at 66 cents, which missed analyst expectations of 92 cents per share by 26 cents.

The company said its net revenue fell 21.5% year-on-year to $1.78 billion, falling short of analyst expectations of $1.85 billion.

Transaction-related revenue dropped nearly 37% year-on-year to $982.7 million, while subscription and services revenue jumped more than 13% from the year prior to $727.4 million.

It’s the first net loss Coinbase has reported since the third quarter of 2023, and comes as the crypto market fell over the quarter, with Bitcoin (BTC) dropping nearly 30% from a high of $126,080 in early October to under $88,500 by Dec. 31.

Bitcoin has fallen 25.6% to $65,760 so far this year, having climbed from a crash to under $60,000 earlier this month.

Despite the earnings miss, shares in Coinbase (COIN) rose 2.9% in after-hours trading on Thursday to $145.18 after a 7.9% decline over the trading day to close at $141.1.

For its Q1 outlook, the crypto platform said that it had generated $420 million in transaction revenue as of Feb. 10 but expects its subscription and services revenue to fall from $727.4 million to the $550 million to $630 million range.

Coinbase added that 2025 was a “strong year” for the company, both operationally and financially, with its full-year 2025 revenues climbing 9.4% from 2024 to $6.88 billion.

Related: Coinbase unveils crypto wallets designed specifically for AI agents

“In 2025, more than 12% of all crypto in the world resided on Coinbase,” the company said. “We’re building and connecting more products to facilitate customers doing more with their assets.”

Coinbase chief financial officer, Aleshia Haas, told investors on an earnings call that the company plans to keep its tech, sales, and marketing expenses relatively flat in comparison in Q4.

“We are going to be nimble as we go through the year and look at the opportunities that we have ahead of ourselves versus our expenses,” she said.

Magazine: The critical reason you should never ask ChatGPT for legal advice

Crypto World

Crypto Lender BlockFills Temporarily Freezes Transfers as Liquidity Pressures Emerge

The company blamed it on the most recent violent correction in the crypto market.

Crypto lender BlockFills has temporarily suspended client deposits and withdrawals in response to recent market volatility and financial conditions, according to an official statement released by the firm.

The decision was taken last week as a protective measure for both clients and the company.

Suspending Client Transfers

According to the official announcement, BlockFills said that while transfers in and out of the platform are paused, clients have continued access to trading services, including the ability to open and close positions in spot and derivatives markets, as well as in select other circumstances outlined by the firm.

The suspension potentially affects around 2,000 institutional clients, such as asset managers and hedge funds. BlockFills operates exclusively with investors holding at least $10 million in crypto assets. These clients collectively generated more than $60 billion in trading volume on the platform in 2025.

BlockFills stated that its management team has been working closely with investors and clients to resolve the situation and restore platform liquidity.

“BlockFills is committed to transparency in its communications and to the protection of its clients. Management has been working hand in hand with investors and clients to bring this issue to a swift resolution and to restore liquidity to the platform. The firm has also been in active dialogue with our clients throughout this process, including information sessions and an opportunity to ask questions of senior management.”

Crypto Market Turmoil

The move comes amid a broader crypto market downturn and echoes previous periods of stress in the industry, including the 2022 collapse of FTX and other crypto lenders. Bitcoin prices began falling on October 10 following a social media post by US President Donald Trump on tariffs, which contributed to increased volatility and nearly $20 billion in liquidations across the market.

Bitcoin continued to decline in the months that followed, as it fell under $65,000, over 45% below its October highs, and reached a year-to-date low of $60,008 on February 5. Stalled US crypto legislation has also continued to weigh on market sentiment.

SECRET PARTNERSHIP BONUS for CryptoPotato readers: Use this link to register and unlock $1,500 in exclusive BingX Exchange rewards (limited time offer).

Crypto World

Asia leapfrogging the West in onchain retail use as regional hubs lead on stablecoin rules

Hong Kong — Asia is outpacing Western markets in the adoption of onchain financial services, driven by a focus on user utility and proactive regulation. While the West remains focused on institutional asset management, Asian markets are prioritizing high-frequency retail applications and cross-border trade.

During a panel discussion at Consensus Hong Kong, industry leaders highlighted how different regional dynamics shape blockchain growth. Suhan Zhao, head of APAC at Aptos Labs, noted a distinct shift toward real-world use cases. “In Asia, there is a high adoption of digital payment, and also there’s a high willingness to deploy new technology at scale,” Zhao said. She pointed to South Korea’s Lotte Group, which issued over 5 million mobile service vouchers on the Aptos network, reaching 1.3 million users in under three months.

Regulatory progress is a primary engine of this growth. Niki Ariyasinghe, vice president for Asia Pacific and Middle East at Chainlink Labs, identified Hong Kong and the United Arab Emirates as the most advanced markets for stablecoin regulation. He argued that stablecoin adoption in Asia often stems from a fundamental need for efficiency rather than speculation. “Ultimately, it’s a willingness to use a new form of payment because of the value it delivers. Ultimately, it’s cheaper, it’s quicker, or it’s more convenient at the end of the day,” Ariyasinghe said.

Small businesses engaged in international trade represent a key demographic for these digital assets. These firms use stablecoins to bypass a fragmented traditional payment infrastructure that often takes days to settle. Nick See Tong, APAC regional lead for Base, emphasized that local stablecoins remain essential for mass market penetration. “A merchant selling wonton mee on the side is not going to accept USDT, USDC or any USD stablecoin. They want Hong Kong dollars,” See Tong said.

Crypto World

ETHZilla starts offering tokenized jet engine leasing exposure through newly launched token

ETHZilla (ETHZ) has unveiled a tokenized aviation asset, marking a major step in its plan to bring income-producing real-world assets onto Ethereum.

The new offering, Eurus Aero Token I, gives accredited investors access to lease income from two commercial jet engines currently in use by a major U.S. airline, ETHZilla announced on Thursday.

The deal, run through ETHZilla’s newly formed ETHZilla Aerospace LLC subsidiary, turns a traditionally institutional asset, aircraft engine leasing, into fractional tokens.

Each $100 token represents a claim on monthly lease payments, with expected annual returns around 11%, according to the company. ETHZIlla acquired the jet engines for $12.2 million late last month.

The tokens are issued on Ethereum Layer 2s and distributed through Liquidity.io, a platform that ETHZilla has backed.

Various firms buy and lease jet engines to aircraft operators. The firms lease these engines as spares to ensure their operations can continue in case their primary engines fail. Firms including AerCap, Willis Lease, and SMBC Aero Engine Lease are involved in the business.

This marks a shift from ETHZilla’s prior focus as a crypto treasury. The company sold over $114 million in ETH last year and redirected its capital toward tokenized assets like home loans, car loans and now aerospace equipment. The firm still owns 69,802 ETH ($136.5 million).

The Eurus tokens are secured by the engines, lease contracts and insurance, with distribution built directly into the smart contracts.

The leases run through 2028 and include a buy-sell agreement that could return additional capital to investors at term’s end. ETHZilla plans to expand this model into other asset classes, the firm wrote.

Crypto World

Polymarket Starts 5-Minute Bitcoin Price Betting

Prediction platform Polymarket recently launched a new feature that lets users bet on cryptocurrency price movements every five minutes.

The event signals rising demand for real-time crypto sentiment data among traders and investors.

Sponsored

Sponsored

Real-Time Sentiment Drives Short-Term Contracts

For now, the new market is limited to Bitcoin, though support for major altcoins is expected to follow.

Price will update dynamically, in tune with market sentiment and immediate price reaction. All trades will be executed on-chain to ensure transparency and security.

The feature targets day traders and crypto enthusiasts looking for a fast-paced experience. With Bitcoin’s recent dip, price swings have grown increasingly erratic, amplifying short-term volatility.

The initiative builds on existing contracts with varying durations, ranging from 15-minute and hourly intervals to four-hour time frames. It also comes as prediction markets are seeing exponential growth in usage, with individual polls recording trading volumes in the hundreds of millions of dollars.

It also reflects growing concern that shifting attention toward these platforms could distort crypto’s core purpose and use cases.

Sponsored

Sponsored

Market Weakness Fuels Betting Activity

Among the wide range of polls offered by prediction platforms such as Polymarket and Kalshi, a significant share involves crypto bets. More specifically, many of these contracts focus on forecasting the future price of major digital assets.

Interest in these wagers has surged in recent months.

Tens of millions in trading volume have been directed toward Bitcoin’s February price alone, alongside heavily traded contracts linked to Ethereum, XRP, and Solana.

These forecasts have gained traction as the broader crypto market struggles to regain momentum. In this environment, volatility itself appears to be fueling participation, with traders using market weakness as an opportunity to place short-term bets.

While the proliferation of such polls has generated substantial trading activity, it is also drawing capital and attention away from underlying fundamentals.

Instead of sustained focus on integration or real-world use cases, crypto narratives risk shifting toward probabilities and crowd positioning.

Polymarket’s new five-minute betting feature further amplifies that dynamic.

If price-based wagering continues to attract more capital than long-term allocation, the market could increasingly revolve around price movements rather than durable value creation.

Crypto World

Crypto PAC Fairshake Targets Al Green in Texas Primary Campaign

TLDR

- Crypto PAC Fairshake has launched a $1.5 million ad campaign against Texas Democrat Al Green in the primary race.

- Fairshake is targeting Green due to his opposition to cryptocurrency policies and his critical stance on digital assets.

- The PAC aims to replace Green with Christian Menefee, who has a favorable position on blockchain technology.

- Fairshake has committed to supporting candidates who advocate for crypto-friendly legislation across both political parties.

- The PAC also plans to spend $5 million to support U.S. Representative Barry Moore in the Alabama Senate primary.

Crypto PAC Fairshake has launched a $1.5 million ad campaign against Texas Democrat Al Green. The PAC is seeking to influence Green’s bid for re-election, aiming to replace him with a candidate more favorable to cryptocurrency policies. Green, a senior Democrat on the House Financial Services Committee, has long criticized cryptocurrency’s potential risks to the financial system.

Fairshake Launches Attack Ads Against Green

Fairshake’s $1.5 million ad campaign against Al Green represents the PAC’s first major move in Texas this election cycle. Green, who represents a newly redrawn Texas district, has been vocal in opposing crypto legislation. The PAC, which has access to a $193 million war chest, intends to influence Green’s primary contest, which includes rising Democratic challenger Christian Menefee.

Green’s stance on cryptocurrency has earned him an “F” grade from Stand With Crypto, a group that tracks lawmakers’ positions on digital assets. The Texas representative has frequently warned of the potential dangers cryptocurrencies pose to investors and the broader economy. Fairshake aims to elect lawmakers more supportive of crypto by opposing incumbents like Green, who resist industry-friendly policy changes.

Protect Progress Super PAC Supports Menefee

Christian Menefee, Green’s primary challenger, has taken a more favorable stance on blockchain technology. His position has earned him an “A” grade from Stand With Crypto, which is supporting him as a pro-crypto candidate. Protect Progress, the super PAC affiliated with Fairshake, has voiced its commitment to backing candidates who support cryptocurrency innovation.

Menefee’s recent victory in a special election has put him in a strong position as he competes against Green for the newly drawn district seat. Texas’ primaries are scheduled for next month, setting the stage for a crucial race between Green and Menefee. Fairshake believes Menefee’s support for crypto will help drive economic growth in the state and beyond.

Fairshake’s involvement in congressional elections this cycle goes beyond the Green-Menefee race. The PAC has also pledged $5 million to support U.S. Representative Barry Moore of Alabama, a Republican who is pro-crypto. Moore faces a competitive Senate primary in Alabama, and Fairshake aims to boost his candidacy to further its cryptocurrency-friendly agenda.

The PAC’s strategy involves supporting candidates across both parties who are aligned with the crypto industry’s goals. Fairshake’s ads focus on broader political messages rather than crypto-specific policies, ensuring that they remain independent from candidates’ campaigns.

Crypto World

Coinbase Outage Affects Users, Halting Crypto Trades and Transfers

TLDR

- Coinbase users are currently unable to buy, sell, or transfer cryptocurrencies due to a significant service disruption.

- The outage has impacted essential trading and transaction functions, leaving many users unable to manage their crypto holdings.

- Coinbase confirmed that internal teams are investigating the issue and working to restore full service as quickly as possible.

- The disruption comes at a difficult time for Coinbase, with many users reporting failed transactions during active market conditions.

- Coinbase has advised users to monitor its official channels for real-time updates as the company works on resolving the issue.

Coinbase users are experiencing a major disruption that prevents them from buying, selling, or transferring cryptocurrencies. The issue has significantly impacted the platform’s ability to process essential transactions. The company confirmed that its internal teams are investigating the problem and working to restore full service as quickly as possible.

Coinbase Struggles with Trading and Transaction Failures

The service disruption has disrupted key functions, including the ability to place orders or move funds. Many users have reported failed transactions, restricting access to their accounts during active market conditions. This issue has led to a wave of complaints from users who are unable to manage their crypto holdings effectively.

“We are aware of the current issues affecting users’ ability to trade and transfer funds,” Coinbase said in a statement.

The company added that its technical team is investigating the root cause of the problem, and users are advised to stay updated through the platform’s official channels. Coinbase has not yet shared any specific technical details about what caused the disruption.

Ongoing Investigation and User Impact

As of now, the cause of the outage remains unclear. Coinbase has promised to resolve the issue, though no specific timeline has been provided for full restoration of services. The disruption comes at a challenging time for the company, with users actively trading in volatile market conditions.

This service failure has left many users unable to execute trades or manage their portfolios. During periods of heightened market activity, such interruptions can result in substantial inconvenience and financial loss for traders. Coinbase’s response will be closely scrutinized as it works to regain user trust.

Market and Company Impact

The timing of the outage also raises concerns about Coinbase’s operational reliability. The company is already under pressure due to the broader weakness in the digital asset market. This outage may further damage its reputation, especially among institutional investors who rely on reliable platforms for trading.

In the wake of the disruption, Coinbase has advised users to monitor its status page for updates. Although the company has not provided details on when the issue will be resolved, it remains committed to restoring services as soon as possible.

-

Politics4 days ago

Politics4 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business4 days ago

Business4 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat3 days ago

NewsBeat3 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech6 days ago

Tech6 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports24 hours ago

Sports24 hours agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business4 days ago

Business4 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat4 days ago

NewsBeat4 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports5 days ago

Former Viking Enters Hall of Fame

-

Politics4 days ago

Politics4 days agoThe Health Dangers Of Browning Your Food

-

Sports7 days ago

New and Huge Defender Enter Vikings’ Mock Draft Orbit

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat6 days ago

NewsBeat6 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World1 day ago

Crypto World1 day agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Video21 hours ago

Video21 hours agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Crypto World2 days ago

Crypto World2 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

![MILLI - SHOW ME THE MONEY 12 REACTION | SMTM12 [THAI SUB]](https://wordupnews.com/wp-content/uploads/2026/02/1770943312_maxresdefault-80x80.jpg)