Crypto World

CEO sentenced to 20 years for $200M Bitcoin Ponzi scheme

A U.S. federal court has sentenced the chief executive of a crypto trading and multi-level marketing firm to 20 years in prison for orchestrating a massive Bitcoin-based Ponzi scheme that defrauded tens of thousands of investors worldwide.

Summary

- Ramil Ventura Palafox, CEO of Praetorian Group International, was sentenced to 20 years in prison for running a $200 million Bitcoin Ponzi scheme.

- Prosecutors said the scheme defrauded more than 90,000 investors worldwide, promising daily returns of up to 3% through supposed crypto trading.

- The U.S. Department of Justice said investor funds were misused for personal expenses, with no legitimate trading activity backing the returns.

Bitcoin Ponzi scheme CEO sentenced to 20 years

Ramil Ventura Palafox, 61, former CEO and Chairman of Praetorian Group International (PGI), received the sentence Thursday after being convicted on multiple federal charges, including wire fraud and money laundering.

According to court documents, Palafox used PGI to lure more than 90,000 investors into a purported Bitcoin (BTC) trading program that promised daily returns of 0.5% to 3%.

Prosecutors said the program never engaged in genuine trading, instead, returns were paid with funds from new investors, a classic Bitcoin Ponzi scheme.

Victims from around the world collectively invested more than $200 million, with documented losses exceeding tens of millions for many individuals.

Government filings show Palafox made lavish personal purchases with investor money, which reportedly included luxury cars, high-end designer goods and real estate. Earlier reports in the case revealed that millions flowed into personal expenses rather than investment activity, exacerbating investors’ losses.

“He spent approximately $3 million on 20 luxury vehicles, including automobiles by Porsche, Lamborghini, McClaren, Ferrari, BMW, Bentley, and others. Palafox spent approximately $329,000 on penthouse suites at a luxury hotel chain and purchased four homes in Las Vegas and Los Angeles worth more than $6 million. Palafox spent another $3 million of investors’ money to buy clothing, watches, jewelry, and home furnishings at luxury retailers, including Louboutin, Neiman Marcus, Gucci, Versace, Ferragamo, Valentino, Cartier, Rolex, and Hermes, among others,” the DoJ statement said.

Palafox initially pleaded guilty in September 2025 to fraud and money laundering charges, acknowledging his role in the Bitcoin Ponzi scheme that operated between December 2019 and October 2021.

The FBI’s Washington Field Office and IRS Criminal Investigation Division assisted in the case, and some victims have already been granted restitution orders. Efforts continue to track down remaining assets to repay those defrauded.

Crypto World

PGI CEO Gets 20 Years Over $200M Crypto Investment Scheme

A US federal judge in Virginia sentenced the chief executive of Praetorian Group International to 20 years in prison for running a $200 million cryptocurrency investment scheme that defrauded tens of thousands of investors.

According to the Department of Justice, 61-year-old Ramil Ventura Palafox, a dual US and Philippine citizen, was convicted of wire fraud and money laundering for what prosecutors described as a Ponzi scheme that falsely promised daily returns of up to 3% from Bitcoin trading.

The US Attorney’s Office for the Eastern District of Virginia said investors poured over $201 million into PGI between December 2019 and October 2021, including at least 8,198 Bitcoin (BTC) valued at about $171.5 million at the time. According to prosecutors, victims suffered losses of at least $62.7 million.

The sentencing concludes the criminal case brought by the DOJ and follows a parallel civil action by the Securities and Exchange Commission, marking one of the larger crypto-related fraud cases in recent years by investor count and funds involved.

Fake trading claims and luxury spending

Court filings said Palafox told investors PGI was engaged in large-scale Bitcoin trading capable of generating consistent daily profits.

However, prosecutors said the company was not trading at a level sufficient to support the promised returns. Instead, new investor funds were used to pay earlier participants.

Authorities said Palafox operated an online portal that falsely displayed steady gains, giving investors the impression their accounts were growing. He also used a multilevel marketing structure, offering referral incentives to recruit new members.

The DOJ said Palafox spent millions in investor funds on personal expenses, including $3 million on luxury vehicles, over $6 million on homes in Las Vegas and Los Angeles, and hundreds of thousands of dollars on penthouse suites and high-end retail purchases.

Authorities said he also transferred at least $800,000 and 100 BTC to a family member.

Related: Sam Bankman-Fried claims Biden DOJ silenced witnesses during FTX trial

Civil charges and international reach

The scheme began to unravel as regulators scrutinized PGI’s trading claims and fund flows.

In April 2025, the Securities and Exchange Commission filed a civil complaint alleging that Palafox misrepresented PGI’s Bitcoin trading activity and used new investor money to pay earlier participants.

The complaint said PGI promoted an AI-powered trading platform and guaranteed daily returns despite lacking trading operations capable of generating those profits.

Federal prosecutors in the Eastern District of Virginia later unsealed criminal charges accusing Palafox of wire fraud and money laundering arising from the same conduct.

Authorities had seized the company’s website in 2021, and related operations were shut down in the United Kingdom, signaling cross-border enforcement scrutiny before the US criminal case advanced.

The DOJ said victims may be eligible for restitution and directed them to the US Attorney’s Office website for information on filing claims.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

Crypto World

Ark Invest buys $18 million of crypto stocks including 10th consecutive Bullish (BLSH) purchase

Ark Invest added another $18 million worth of crypto-adjacent stocks to its holdings on Thursday, including a $2 million purchase of shares in cryptocurrency exchange Bullish (BLSH).

The St. Petersburg, Florida-based company also bought $12 million worth of crypto-friendly trading platform Robinhood (HOOD) and $4 million worth of ether treasury firm Bitmine Immersion Technologies (BMNR), according to an emailed disclosure on Friday.

Ark’s investment in Bullish, the parent company of CoinDesk, extends its run of consecutive equity purchases in the crypto exchange to 10 days. Bullish shares fell 0.53% to $31.71 on Thursday.

BLSH shares have lifted from a trough of around $24 on Feb. 5 to trade either side of the $30 mark over the last week. They remain, however, more than 16% lower year-to-date.

HOOD shares fell 8.9% on Thursday, closing at $71.12 as U.S tech stocks sank, taking bitcoin with them.

Bitmine defied the broader market to rise 1.39% to $19.74.

Crypto World

Ramil Ventura Palafox gets 20 years sentence over $200 million bitcoin Ponzi scheme

The CEO of Praetorian Group International (PGI) was sentenced to 20 years in prison in the U.S. for running a global Ponzi scheme that falsely claimed to invest in bitcoin and foreign exchange trading.

Ramil Ventura Palafox, 61, promised daily returns of up to 3%, misleading more than 90,000 investors and draining over $62.7 million in funds, according to a Thursday statement from the U.S. Attorney’s Office for the Eastern District of Virginia.

PGI collected more than $201 million from investors between late 2019 and 2021, including over 8,000 bitcoin , according to court records. Instead of investing the money, prosecutors said Palafox used new investor funds to pay old ones while siphoning millions for himself.

To keep the illusion going, Palafox built an online portal where investors could track their supposed profits, with numbers that were entirely fabricated.

In reality, Palafox was buying Lamborghinis, luxury homes in Las Vegas and Los Angeles and penthouse suites at high-end hotels. Prosecutors say he spent $3 million on luxury cars and another $3 million on designer clothing, watches, and jewelry.

The case was investigated by the FBI and IRS. Victims may be eligible for restitution. The SEC is pursuing civil penalties, and Palafox remains banned from handling securities.

Crypto World

Will $2.3B options expiry jolt Ethereum price from key strike levels?

Ethereum price continues to lag its 2021 peak as institutions rotate cautiously into ETH exposure while weighing ETF flows, on-chain activity, and broader macro risk.

Summary

- BlackRock lifts its Bitmine stake 166% to $246M, doubling down on a levered Ethereum price proxy even as ETH trades ~60% below its peak and Bitmine stock is down ~70%.

- Vitalik Buterin and Stani Kulechov recently sold millions in ETH while BlackRock and Goldman Sachs add exposure via Bitmine and Ethereum ETFs, treating the drawdown as opportunity.

- BlackRock’s thesis leans on Ethereum’s dominance in tokenized real‑world assets, with Larry Fink calling tokenization “necessary” as BTC, ETH and SOL trade as high‑beta macro risk proxies.

BlackRock is leaning into the pain on Ethereum (ETH) price, quietly ramping up its exposure to Bitmine even as blue‑chip crypto names slide and prominent insiders head for the exits.

BlackRock’s leveraged Ethereum bet

According to a 13F‑HR filing collated by Fintel, BlackRock’s Bitmine stake jumped 166% in Q4 2025 to about $246 million, cementing the asset manager as a key backer of the Ethereum‑heavy treasury vehicle. Bitmine, the second‑largest digital asset treasury firm and a levered proxy on Ether, has seen its own stock price crater nearly 70% over six months to roughly $20 per share. The move drew an approving response from Bitmine chair Tom Lee, who has publicly floated a $250,000 price target for Ethereum and responded with clapping emojis to the disclosure in a post on X.

BlackRock’s buying spree lands as Ethereum trades just under $2,000, roughly 60% below its August peak, with Standard Chartered’s Geoffrey Kendrick warning the token could drop a further 25% toward $1,400. “The best investment opportunities in crypto have presented themselves after declines,” Lee said on Monday, after Bitmine added another $80 million of Ether to its already underwater position, which is sitting on at least $6.6 billion in paper losses.

Insiders sell, Wall Street buys

February has seen crypto pioneers unload sizable Ether positions, even as Wall Street leans in. Ethereum co‑founder Vitalik Buterin sold at least $7 million worth of ETH last week to fund new initiatives, while Aave founder Stani Kulechov offloaded more than $8 million. At the same time, Goldman Sachs disclosed holdings of just over $1 billion in Ethereum exchange‑traded funds, joining BlackRock in treating the drawdown as an entry point.

BlackRock’s conviction rests on tokenisation. In January, the firm said Ethereum will lead the tokenisation of real‑world assets, noting that around 66% of all tokenised instruments sit on Ethereum, compared with about 10% on BNB Chain, 5% on Solana, 4% on Arbitrum, 4% on Stellar, and 3% on Avalanche. CEO Larry Fink has called tokenisation “necessary,” arguing in Davos that the goal is to bring “the entire financial system on one common blockchain.”

Market backdrop and key levels

The broader tape remains fragile. Bitcoin is down about 0.7% over the past 24 hours, trading near $66,582, while Ethereum has slipped roughly 0.4% to around $1,955. Spot dashboards show Bitcoin changing hands close to $66,618 with roughly $44.9 billion in 24‑hour volume, as Ethereum hovers near $1,961 on about $20.1 billion traded. Solana, another high‑beta proxy for crypto risk, trades around $192, with leading centralized exchanges printing quotes in the $191–$193 band on heavy liquidity.

This parabolic move comes as digital assets continue to trade as the purest expression of macro risk appetite. Bitcoin (BTC) is hovering around $66,600, with a 24‑hour range roughly between $65,000 and $68,400, on more than $30 billion in dollar volumes. Ethereum (ETH) changes hands close to $1,960, with about $20 billion in 24‑hour turnover and spot quotes clustering just below the $2,000 mark. Solana (SOL) trades near $192, fractionally lower on the day, with leading venues reporting individual pairs clearing hundreds of millions in volume.

For now, BlackRock is treating the selloff as structural opportunity rather than terminal decline, aligning its Bitmine bet with a broader thesis that Ethereum’s role in real‑world asset rails will outlast this drawdown.

Crypto World

Bitcoin, ether little changed before U.S. inflation report: Crypto Markets Today

Bitcoin rose to test $67,000 early Friday and was quickly rebuffed, though it remains about 1% higher since midnight UTC with ether rising half as much. The derivatives market, too, is showing signs of positivity.

The CoinDesk 20 Index (CD20) is little changed, up just 0.7% in the period.

While the gains mark a recovery from yesterday’s U.S. trading, which saw the cryptocurrency market fall back toward last week’s lows, bitcoin is still on track for a fourth straight week of declines. That’s the longest falling streak since mid-November.

Meantime, a slowdown in trading and fading volatility are weighing on volumes.

It’s likely that traders are looking to the U.S. Consumer Price Index (CPI) print coming later today for hints on direction. A higher-than-forecast reading could lift bond yields and the dollar, putting additional pressure on risk assets. A lower reading might signal the easier conditions that are more conducive to risk-taking.

Even so, it will take quite a jump to push the bitcoin price to $85,000, a level that Deribiti’s chief commercial officer, Jean-David Péquignot, said would signal the largest cryptocurrency’s long-term rally is no longer “broken.”

Derivatives

- The market is showing signs of renewed life as open interest (OI) dropped to $15.5 billion, suggesting a cleanup of late-cycle leverage.

- Perpetual funding rates have flipped neutral to positive across all venues, now ranging between 0% and 8%. This broader optimism is being mirrored by institutions, as the three-month annualized basis spiked to just over 3%, signaling the first real uptick in professional conviction.

- The bitcoin options market shows returning call volume at 65%, even as the one-week 25-delta skew eased to 17.9%. Despite this “bottom-fishing” activity, the implied volatility (IV) term structure remains in short-term backwardation, confirming that traders are still paying a high “panic premium” for immediate downside protection.

- Coinglass data shows $256 million in 24-hour liquidations, split 69-31 between longs and shorts. Bitcoin ($112 million), ether ($52 million) and others ($16 million) were the leaders in terms of notional liquidations.

- The Binance liquidation heatmap indicates $68,800 as a core liquidation level to monitor in case of a price rise.

Token Talk

- PUMP, the token of Solana-based memecoin launchpad Pump.fun, is up more than 5% in the past 24 hours.

- The platform rolled out a new way for token communities to allocate fees directly through its mobile app with the inclusion of GitHub account integration.

- The integration offers a simpler way for creators to assign automatic payouts generated by a token’s community, and more social features are expected to be introduced in the future.

- In practice, this means communities can start supporting creators on GitHub through a portion of the fees generated. To receive the fees, creators will need to claim them through the platform’s mobile app.

- Pump.fun was largely behind a major memecoin trading frenzy early last year that saw its monthly trading volume surge past $11 billion. Volume has since plunged to $1 billion last month, according to DeFiLlama data.

Crypto World

Bitcoin ETFs bleed $410M amid $2.5B options expiry: is BTC facing deeper crash?

- Bitcoin saw spot ETF outflows of over $410 million as prices struggled.

- Over $2.5 billion in Bitcoin options expired on Friday.

- Analysts say “worst of downturn” likely over but market remains bearish.

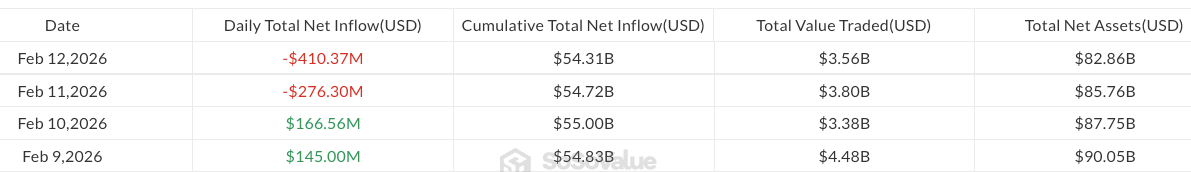

Bitcoin ETFs experienced a net outflow of over $410 million on February 12, as investors withdrew capital from the exchange-traded funds amid growing fears of a broader crypto market downturn.

And on Friday morning, Feb. 13, BTC price fluctuated near $66,800 as the market recorded a massive $2.5 billion Bitcoin options expiry.

Crypto analysts have shared their thoughts on what this could mean for the Bitcoin price in the short term.

Bitcoin ETF outflows and $2.5 billion options expiry

Data showed that on US spot Bitcoin ETFs recorded net outflows of over $410 million yesterday, with none of the 12 spot ETFs notching net inflows.

BlackRock’s IBIT led with nearly $158 million, Fidelity’s FBTC had $104 million, and Grayscale’s GBTC had over $59 million in exits.

This marked the second consecutive day of redemptions, following $276 million on February 11.

Institutional investors are pulling back amid Bitcoin’s struggles around the $67,500-$65,450 range.

The fresh ETF outflows coincide with a pivotal weekly options expiry at 08:00 UTC on Feb. 13.

Approximately 38,000 Bitcoin contracts worth $2.5 billion in notional value have expired, primarily on Deribit, with a put/call ratio of 0.72 and maximum pain near $74,000.

Ethereum also saw 215,000 ETH options worth $410 million expire, with a put/call ratio of 0.82 and a maximum pain point at $2,100.

These maximum pain points are at values well above spot BTC and ETH levels, and likely the driver of downward pressure as market makers look to hedge delta exposure on out-of-the-money calls.

February 13 Options Expiration Data

38,000 BTC options expired with a Put-Call Ratio of 0.71, maximum pain point at $74,000, and notional value of $2.5 billion.

215,000 ETH options expired with a Put-Call Ratio of 0.82, maximum pain point at $2,100, and notional value of $410… pic.twitter.com/07TKfJxmMi— Greeks.live (@GreeksLive) February 13, 2026

Bitcoin price prediction

The ETF outflows and broader market weakness hinder bulls, and sentiment is skewed bearish, analysts say.

“Today saw the expiration of options accounting for 9% of total open interest, totaling nearly $2.9 billion. This week, implied volatility for Bitcoin and Ethereum has declined, with BTC’s main-term IV at 50% and ETH’s at 70%. While the downward price trend has moderated, market confidence remains weak,” analysts at Greeks.live noted via X.

Despite this outlook, the market may have “the most violent leg of the downturn” behind it. If sentiment improves, prices could pick up an upside trajectory.

In this case, a relief rally to above the critical $70,000 mark is likely.

However, ETF bleeding and macroeconomic headwinds could greatly cap upside momentum.

On Thursday, Standard Chartered forecast Bitcoin price could retest $50k before rising to $100k by the end of 2026. The bank cites ETF outflows, macro pressures and broader risk asset sentiment as negative catalysts.

$410M outflows in a single day.

US spot Bitcoin ETFs just logged their 4th straight week of bleeding.

AUM down from $170B (Oct ‘25 peak) to ~ $80B.

At the same time, Standard Chartered cuts 2026 BTC target from $150K → $100K and warns of a possible $50K flush first.

ETH ETFs… pic.twitter.com/H9W8lmAvRq

— Dear Bitcoiner ⚡️ (@DearBitcoiner) February 13, 2026

Notably, BTC tested support at $60k this month, and the elevated implied volatility, coupled with ETF exits, signals aggressive downside protection.

If outflows continue amid other highlighted downside triggers, the $50k level could be the next target.

Crypto World

AVAX Eyes $147 Target as Elliott Wave Pattern Signals Multi-Year Recovery Phase

TLDR:

- AVAX completed Wave 1 between $8-$5, now entering Wave 2 recovery phase within descending channel

- CryptoPatel targets $33, $58, $97, and $147 representing potential 2,489% expansion from bottom

- Critical support at $5.50 must hold on weekly close to maintain bullish Elliott Wave structure

- Analysis suggests multi-year setup through 2026-2027 suited for spot accumulation and patience

AVAX traders are monitoring a technical analysis that suggests the token could target $147 in the coming years. Crypto analyst CryptoPatel has identified an Elliott Wave formation on the weekly chart, indicating a possible recovery phase after a 95% correction from the 2021 all-time high.

The analysis places AVAX at a critical inflection point, with the asset trading within a multi-year descending channel.

Price action currently hovers near $8.86, presenting what the analyst describes as a macro support accumulation zone.

Technical Structure Shows Wave Completion

The technical framework outlined by CryptoPatel centers on Elliott Wave theory applied to AVAX’s weekly timeframe. According to the analysis shared on X, Wave 1 completed between $8 and $5, marking a macro bottom for the current cycle.

The token now enters what the analyst labels as Wave 2, representing an early recovery phase from the previous correction.

The descending channel formation has contained price action since the 2021 peak. This pattern shows a bearish breakdown followed by a retest of the lower trendline, creating what technical analysts call a deviation setup.

Market structure at these levels suggests accumulation by institutional participants, though this remains speculative based on price behavior rather than confirmed data.

Support zones have formed between $8 and $7, coinciding with weekly demand areas. The liquidity sweep into these zones mirrors fractal patterns from previous market cycles.

Additionally, the compression phase resembles historical accumulation periods that preceded major rallies in past bull markets.

Price Targets Extend Beyond $100 Mark

CryptoPatel’s forecast includes four distinct targets as the Elliott Wave structure potentially unfolds through 2026 and 2027. The progression starts at $33, followed by $58, then $97, before reaching a final target of $147.

These levels correspond to the mid-channel resistance and eventual upper boundary of the descending formation. From the identified bottom to the highest target, the expansion measures approximately 2,489%.

The bullish scenario requires sustained weekly strength with expansion toward mid-channel resistance zones. Price must demonstrate momentum capable of breaking through overhead supply levels that accumulated during the extended correction. However, the analysis also establishes clear invalidation parameters to manage risk exposure.

The critical support level sits at $5.50, representing the Wave 1 low. A weekly close beneath this threshold would negate the Elliott Wave count and suggest further downside potential. This makes the $5.50 level essential for bulls to defend on higher timeframes.

The analyst characterizes this setup as appropriate for spot accumulation and long-term positioning rather than short-term trading.

The asymmetric risk-reward profile stems from proximity to identified support versus the distance to upside targets.

Patience remains necessary as weekly timeframe patterns develop over extended periods, typically spanning months or years rather than days or weeks.

Crypto World

Coinbase Reports $667M Q4 Loss as Crypto Market Downturn Hits Revenues

Coinbase earnings just broke its streak, and not in a good way. After eight straight winning quarters, it posted a brutal $667 million net loss in Q4 2025. That is a punch to the face.

As crypto prices slid from their yearly highs, the exchange completely missed Wall Street revenue expectations.

Revenue came in at $1.78 billion. Sounds big, but it was below the $1.85 billion analysts expected. Transaction revenue was the real damage. Down 37% to $982.7 million.

That tells you everything about trader activity right now.

Key Takeaways

- Coinbase reported a $667 million net loss, its first profit miss since Q3 2023.

- Revenue fell 21.5% YoY to $1.78 billion, missing analyst expectations.

- Transaction fees plummeted 37% as retail traders exited the market.

- Shares (COIN) dipped 7.9% intraday but rebounded nearly 3% after hours.

Is the Bull Market Officially Over? How Coinbase Can Survive It

That $667 million loss is not just a bad quarter. It screams deeper cycle weakness. A big chunk of it came from unrealized losses on Coinbase own crypto holdings after prices collapsed from the October 2025 highs.

When Bitcoin falls from nearly $126,000 to the mid $60k range, nobody walks away clean. Not even the exchanges.

This kind of volatility feels similar to the uncertainty during the FTX fallout days. Brian Armstrong is still calling this downturn psychological.

Retail traders are barely active. Transaction revenue, which is the core engine of the business, dried up as volume vanished.

Casual money is staying on the sidelines. And that is the last thing Coinbase needed.

Discover: The best crypto to diversify your portfolio

COIN Stock Resilience or Dead Cat Bounce?

Even after that ugly earnings report, COIN stock actually climbed 2.9% in after-hours, sitting near $145. Sounds crazy, right?

But the stock had already dropped 7.9% during the regular session. Traders probably priced in the disaster before the numbers even hit.

Still, the outlook is not exactly comforting. Subscription and services revenue was the only real bright spot, up 13% to $727.4 million.

That helped soften the blow. But management is already guiding lower for Q1 2026, expecting that figure to fall into the $550 to $630 million range. That is not small.

If even the so-called stable revenue starts shrinking, the safety cushion gets thin fast. And if that happens, a retest of the $139 zone, near the 52-week lows, would not be surprising at all.

Discover: What is the next crypto to explode?

The post Coinbase Reports $667M Q4 Loss as Crypto Market Downturn Hits Revenues appeared first on Cryptonews.

Crypto World

Bitcoin ETFs Post $410M Outflows As Early-Week Momentum Fades

US spot Bitcoin exchange-traded funds (ETFs) saw heightened selling on Thursday, with outflows accelerating the same day Standard Chartered lowered its 2026 Bitcoin forecast.

Spot Bitcoin (BTC) ETFs recorded $410.4 million in outflows, extending weekly losses to $375.1 million, according to SoSoValue data.

Unless Friday brings substantial inflows, the funds are on track for a fourth consecutive week of losses, with assets under management (AUM) nearing $80 billion, down from a peak of almost $170 billion in October 2025.

The selling coincided with Standard Chartered lowering its 2026 Bitcoin target from $150,000 to $100,000, warning that prices could fall to $50,000 before recovering.

“We expect further price capitulation over the next few months,” the bank said in a Thursday report shared with Cointelegraph, forecasting Bitcoin to drop to $50,000 and Ether (ETH) to $1,400.

“Once those lows are reached, we expect a price recovery for the remainder of the year,” Standard Chartered added, projecting year-end prices for BTC and ETH at $100,000 and $4,000, respectively.

Solana ETFs the only winners amid heavy crypto ETF outflows

Negative sentiment persisted across all 11 Bitcoin ETF products, with BlackRock’s iShares Bitcoin Trust ETF (IBIT) and the Fidelity Wise Origin Bitcoin Fund suffering the largest outflows of $157.6 million and $104.1 million, respectively, according to Farside.

Ether ETFs faced similar pressure, with $113.1 million in daily outflows dragging weekly outflows to $171.4 million, marking a potential fourth consecutive week of losses.

XRP (XRP) ETFs saw their first outflows of $6.4 million since Feb. 3, while Solana (SOL) ETFs bucked the trend, recording a minor $2.7 million in inflows.

Extreme bear phase not yet here as analysts expect $55,000 bottom

Standard Chartered’s latest Bitcoin forecast follows previous analyst forecasts that Bitcoin could dip below $60,000 before testing a recovery.

Crypto analytics platform CryptoQuant reiterated that realized price support remains at around $55,000 and has not yet been tested.

“Bitcoin’s ultimate bear market bottom is around $55,000 today,” CryptoQuant said in a weekly update shared with Cointelegraph.

“Market cycle indicators remain in the bear phase, not extreme bear phase,” CryptoQuant noted, adding: “Our Bull-Bear Market Cycle Indicator has not entered the Extreme Bear regime that historically marks the start of bottoming processes, which typically persist for several months.”

Related: Bernstein calls Bitcoin sell-off ‘weakest bear case’ on record, keeps $150K 2026 target

Bitcoin hovered around $66,000 on Thursday, briefly dipping to $65,250, according to CoinGecko data.

Despite ongoing selling pressure, long-term holder (LTH) behavior does not indicate capitulation, with holders currently selling around breakeven. “Historical bear market bottoms formed when LTHs endured 30–40% losses, indicating further downside may be required for a full reset,” CryptoQuant added.

Magazine: Bitcoin difficulty plunges, Buterin sells off Ethereum: Hodler’s Digest, Feb. 1 – 7

Crypto World

Aave Labs Seeks $50M Package in Revenue Shift Proposal

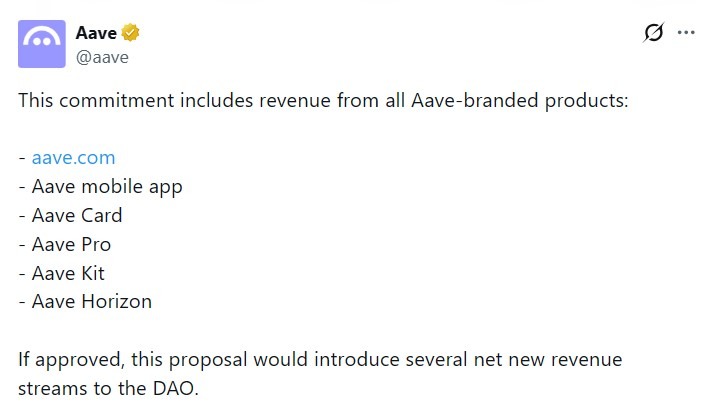

Aave Labs has asked tokenholders to approve a funding package worth about $50 million in exchange for redirecting all revenue from Aave-branded products to the Aave DAO treasury.

The proposal includes up to $42.5 million in stablecoins — $25 million as a primary grant and $17.5 million tied to product milestones. It also includes 75,000 Aave (AAVE) tokens, worth about $8 million at the time of writing. The stablecoin grants, if approved, will be streamed over time, and milestone payments will be released upon product launches.

In return, Aave Labs would route 100% of product-level revenue to the DAO. That includes fees generated by aave.com, the planned Aave App and Aave Card, Aave Pro, Aave Kit and Aave Horizon. The framework also asks tokenholders to ratify Aave V4 as the protocol’s long-term technical foundation and outlines plans to create a foundation to hold and steward the Aave brand.

The proposal would mark a shift in how Aave captures and distributes value. It would consolidate protocol and product revenue at the DAO level while shifting Aave Labs to a DAO-funded operating model after months of governance tension.

Governance concerns over voting power

The funding request drew scrutiny from some community members. Marc Zeller, founder of the Aave Chan Initiative, wrote that the $50 million package represents a significant portion of the DAO treasury.

He called for unbundling the vote into separate proposals covering revenue alignment, V4 ratification, foundation creation and funding.

Zeller also called for clearer definitions of “revenue” and independent verification of product income flowing to the DAO. He raised concerns over the 75,000 Aave token grant, noting that governance tokens carry voting power. He said entities receiving DAO tokens should disclose their wallet holdings.

Crypto commentator DefiIgnas described the proposal as a “big compromise” that AAVE holders “should like,” though he also said clearer disclosures around governance voting power tied to the 75,000 AAVE grant would be appropriate.

Aave Labs framed the proposal as a move toward a “token-centric” model that aligns value accrual with the DAO. Aave founder Stani Kulechov said on X that directing product revenue to the DAO would expand its capacity to fund growth and other initiatives.

“This would position the DAO to fund growth, increase buybacks, and pursue other opportunities as it sees fit,” Kulechov wrote.

Related: Vitalik draws line between ‘real DeFi’ and centralized yield stablecoins

Proposal follows rejected IP vote

The proposal follows another contentious governance episode recently. On Dec. 26, Aave tokenholders rejected a proposal to transfer control of the protocol’s brand assets to an entity under the DAO, with a majority voting against the measure.

On Jan. 3, Kulechov outlined a broader strategy to expand beyond decentralized finance (DeFi) lending and revisit how non-protocol revenue flows to token holders.

The current proposal formalizes elements of that vision, combining revenue consolidation, V4 ratification and a new foundation structure in a single strategic pitch.

The Temp Check, an initial signal vote to measure community support, was launched ahead of any binding onchain vote. If it advances, the proposal would move through additional governance stages before any funds are distributed.

Magazine: Hong Kong stablecoins in Q1, BitConnect kidnapping arrests: Asia Express

-

Politics5 days ago

Politics5 days agoWhy Israel is blocking foreign journalists from entering

-

Sports6 days ago

Sports6 days agoJD Vance booed as Team USA enters Winter Olympics opening ceremony

-

Business5 days ago

Business5 days agoLLP registrations cross 10,000 mark for first time in Jan

-

NewsBeat4 days ago

NewsBeat4 days agoMia Brookes misses out on Winter Olympics medal in snowboard big air

-

Tech7 days ago

Tech7 days agoFirst multi-coronavirus vaccine enters human testing, built on UW Medicine technology

-

Sports1 day ago

Sports1 day agoBig Tech enters cricket ecosystem as ICC partners Google ahead of T20 WC | T20 World Cup 2026

-

Business5 days ago

Business5 days agoCostco introduces fresh batch of new bakery and frozen foods: report

-

Tech2 days ago

Tech2 days agoSpaceX’s mighty Starship rocket enters final testing for 12th flight

-

NewsBeat5 days ago

NewsBeat5 days agoWinter Olympics 2026: Team GB’s Mia Brookes through to snowboard big air final, and curling pair beat Italy

-

Sports4 days ago

Sports4 days agoBenjamin Karl strips clothes celebrating snowboard gold medal at Olympics

-

Sports6 days ago

Former Viking Enters Hall of Fame

-

Politics5 days ago

Politics5 days agoThe Health Dangers Of Browning Your Food

-

Business5 days ago

Business5 days agoJulius Baer CEO calls for Swiss public register of rogue bankers to protect reputation

-

NewsBeat7 days ago

NewsBeat7 days agoSavannah Guthrie’s mother’s blood was found on porch of home, police confirm as search enters sixth day: Live

-

Crypto World2 days ago

Crypto World2 days agoPippin (PIPPIN) Enters Crypto’s Top 100 Club After Soaring 30% in a Day: More Room for Growth?

-

Crypto World3 days ago

Crypto World3 days agoBlockchain.com wins UK registration nearly four years after abandoning FCA process

-

NewsBeat4 days ago

NewsBeat4 days agoResidents say city high street with ‘boarded up’ shops ‘could be better’

-

Crypto World3 days ago

Crypto World3 days agoU.S. BTC ETFs register back-to-back inflows for first time in a month

-

Video1 day ago

Video1 day agoPrepare: We Are Entering Phase 3 Of The Investing Cycle

-

Sports4 days ago

Kirk Cousins Officially Enters the Vikings’ Offseason Puzzle

(@coinbase)

(@coinbase)